#InternationalPayments

Explore tagged Tumblr posts

Text

💸 Looking for low-cost international money transfers? Wise offers transparent fees and great exchange rates! 🌍 Send money worldwide with ease and no hidden charges. 🚀 Join millions who trust Wise for fast and secure transfers today!

#Wise#moneytransfers#InternationalPayments#send money#finance#GlobalBanking#WiseTransfers#moneymatters#low fees#exchange rates

1 note

·

View note

Text

Simplify international payments service.

Learn more: https://zil.us/international-payments/

0 notes

Text

Effortless Global Money Transfers | Send Money Abroad with ZenithForexOnline

Effortless Global Money Transfers – Send Money Abroad with ZenithForexOnline! Experience a seamless and secure international money transfer service designed to make your transactions smooth, fast, and reliable. With competitive rates and transparent fees, you can send money worldwide for personal needs or business transactions confidently.

Fast & Reliable

Transparent Fees

Competitive Exchange Rates

Secure Transactions

24/7 Customer Support

Visit our nearest store or contact us: 🌐 https://shorturl.at/IjWF2 📱 +91 8448289666

#ZenithForexOnline#GlobalMoneyTransfers#FastTransfers#ReliableService#SecureTransactions#InternationalPayments#moneytransfer

0 notes

Text

#datanimbus#InternationalPayments#RegulatoryCompliance#FinTech#CrossBorderPayments#PaymentRegulations

0 notes

Text

Exploring the Benefits of a Forex Payment Gateway

Payments Clarity’s Forex Payment Gateway is your solution for seamless international transactions. Our gateway is built to handle the complexities of cross-border payments, providing you with a smooth and reliable experience. With features like real-time currency conversion and advanced security protocols, you can trust us to manage your forex payments efficiently. Focus on your business growth while we take care of your payment needs.

0 notes

Text

The Ultimate Travel Companion: Understanding Travel Forex Cards

Introduction: In today's interconnected world, travel has evolved from a luxury to a lifestyle for many. Whether you're embarking on a backpacking journey through Southeast Asia, exploring the cultural wonders of Europe, or embarking on a business trip halfway across the world, one thing remains constant – the need for seamless and convenient access to your finances. Enter the travel forex card, a versatile and indispensable tool that revolutionizes the way we manage money abroad. In this comprehensive guide, we'll explore everything you need to know about travel forex cards and why they're the ultimate companion for modern-day globetrotters.

1: Understanding Travel Forex Cards In this chapter, we'll delve into the fundamentals of travel forex cards. We'll explore how these cards work, their benefits compared to traditional payment methods, and the various types of travel forex cards available in the market. From single-currency cards to multi-currency variants, we'll unravel the complexities and demystify the intricacies of these financial instruments.

2: The Convenience Factor Travel forex cards offer unparalleled convenience, allowing travelers to load multiple currencies onto a single card. We'll discuss the ease of managing funds, checking balances, and making transactions on the go. Whether you're navigating bustling city streets or remote countryside, your travel forex card ensures that you're always prepared for your financial needs.

3: Safety and Security Safety is paramount when it comes to managing money abroad, and travel forex cards provide peace of mind with robust security features. From chip-and-PIN technology to biometric authentication, we'll explore the layers of protection that safeguard your funds against theft, fraud, and unauthorized access. Additionally, we'll discuss the importance of backup options and contingency plans in case of emergencies.

4: Cost-Efficiency Traditional payment methods often come with hidden fees and unfavorable exchange rates, eating into your travel budget. Travel forex cards offer cost-effective solutions with competitive exchange rates and minimal or zero transaction fees. We'll analyze the potential savings compared to alternatives like cash, credit cards, and traveler's checks, empowering you to make informed financial decisions that maximize value.

5: Global Acceptance and Accessibility Whether you're traversing bustling metropolises or remote off-the-beaten-path destinations, your travel forex card ensures universal acceptance and accessibility. We'll explore the extensive network of merchants, ATMs, and financial institutions that honor these cards worldwide, providing unparalleled convenience and flexibility wherever your adventures take you.

6: 24/7 Support and Assistance Lost your card? Encountering technical issues? Fear not – help is just a phone call away. In this chapter, we'll highlight the importance of reliable customer support and assistance offered by travel forex card providers. From round-the-clock helplines to emergency card replacement services, we'll discuss the peace of mind that comes with knowing that help is readily available whenever you need it most.

Conclusion: Empowering Your Global Journey In conclusion, travel forex cards represent more than just a financial tool – they're a gateway to unparalleled convenience, security, and peace of mind for travelers worldwide. Whether you're embarking on a solo adventure, a family vacation, or a business trip, equipping yourself with a travel forex card ensures that you're prepared for whatever the world throws your way. So, before you set off on your next journey, make sure to arm yourself with the ultimate companion for global adventures – a travel forex card that unlocks the world at your fingertips.

#TravelForexCard#GlobalFinance#CurrencyManagement#TravelTips#InternationalPayments#FinancialFreedom#TravelSmart#MoneyManagement#BudgetTravel#SecureTransactions#ConvenientPayments#TravelEssentials#TravelPreparation#FinancialPlanning#ExploreWithEase

0 notes

Link

Great news for Indian globetrotters! PhonePe, a leading digital payments platform in India, has joined forces with Dubai-based Mashreq Bank to revolutionize how Indian tourists pay in the United Arab Emirates (UAE). This innovative partnership brings the convenience of PhonePe's Unified Payments Interface (UPI) to the UAE, allowing Indian visitors to ditch their international debit cards and make seamless payments using their smartphones. PhonePe Makes Payments a Breeze A Boon for Travelers: Seamless Payments with PhonePe UPI in the UAE This collaboration marks a significant step forward for both PhonePe and UPI. Here's a closer look at how it benefits Indian travelers: Effortless Transactions: Say goodbye to fumbling with foreign currency or international transaction fees. With PhonePe UPI, Indian tourists can simply scan QR codes at Neopay terminals, conveniently located across retail stores, restaurants, and tourist attractions in the UAE. Real-Time Currency Conversion: No more confusion or hidden charges. PhonePe displays the exchange rate during the transaction, ensuring you know exactly how much you're paying in Indian Rupees (INR). Enhanced Security: PhonePe leverages the robust security features of UPI, providing peace of mind for your financial transactions during your UAE trip. A Partnership for Progress: PhonePe and Mashreq Bank Join Forces The success of this initiative hinges on the collaboration between PhonePe and Mashreq Bank. PhonePe, a dominant player in India's digital payments landscape, brings its user-friendly UPI platform to the UAE. Mashreq Bank, a leading financial institution in the UAE, provides its extensive network of Neopay terminals for seamless transactions. This partnership not only benefits Indian travelers but also aligns with the Indian government's vision of expanding UPI's reach beyond national borders. Beyond Payments: PhonePe's Vision for Streamlined Remittances PhonePe's vision extends beyond simplifying payments for travelers. The company plans to introduce inward remittance services in the UAE, leveraging UPI's infrastructure. This service, once activated, will allow Indian expats in the UAE to send money home to India more conveniently. By eliminating the need for lengthy bank account details and IFSC codes, PhonePe aims to streamline the remittance process, making it faster and more user-friendly. PhonePe's Global Expansion: Paving the Way for a UPI-Powered Future The integration of PhonePe UPI in the UAE isn't an isolated event. PhonePe has already established a presence in various international markets, including Singapore, Canada, Oman, Saudi Arabia, France, Sri Lanka, and Nepal. These efforts showcase PhonePe's commitment to expanding its services globally and contributing to the wider adoption of UPI as a secure and efficient digital payment method. FAQs Q: How can Indian travelers in the UAE use PhonePe UPI for payments? A: Indian travelers can use PhonePe UPI in the UAE by scanning QR codes displayed at Neopay terminals located in various retail stores, restaurants, and tourist attractions. Q: Does PhonePe UPI work with local UAE currency (AED)? A: While transactions occur using PhonePe UPI, the exchange rate is displayed during the process, and the final debit amount is reflected in Indian Rupees (INR) within your PhonePe app. Q: Can I use PhonePe UPI in the UAE to send money back to India? A: As of now, the inward remittance service using PhonePe UPI in the UAE is not yet active. However, PhonePe plans to introduce this service soon, allowing Indian expats in the UAE to send money home more easily.

#digitalpayments#GlobalExpansion#Indiantravelers#internationalpayments#MashreqBank#Neopayterminals#PhonePe#PhonePeMakesPaymentsaBreeze#remittanceservices#UAE#UPI

0 notes

Text

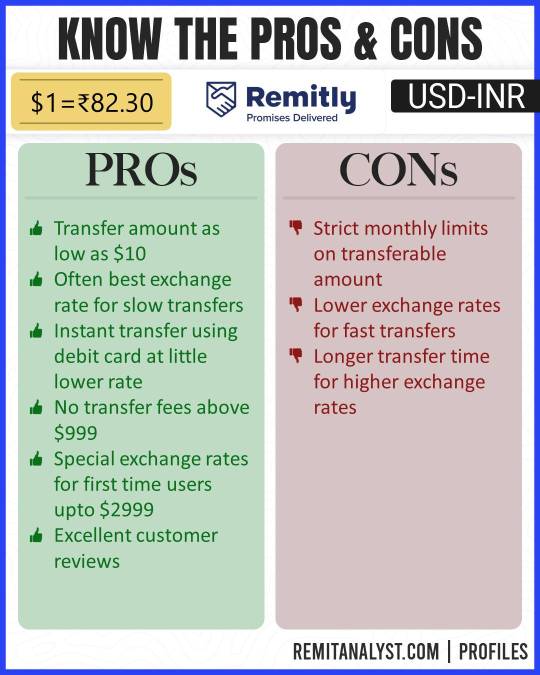

Remitly, a leading remittance service provider, offers a seamless

Remitly, a leading remittance service provider, offers a seamless, secure, and cost-effective solution for transferring money globally. With its user-friendly mobile app, Remitly simplifies the online money transfer process, eliminating the hassles associated with traditional methods, such as paperwork, complex codes, intermediaries, delays, and hidden fees. Headquartered in Seattle, Remitly extends its reach with offices in London, the Philippines, and Nicaragua, serving a vast network of more than 40 countries worldwide.

For those of Indian origin residing in the United States, Remitly specializes in facilitating money transfers to India. With Remitly, you can effortlessly send up to $30,000 from the United States to India in a single transaction. Enjoy the peace of mind that comes with fast deposits and guaranteed on-time delivery. Remitly consistently offers competitive exchange rates for currency conversion, ensuring that your money goes further. Plus, for transactions exceeding $1,000 USD, there are no transfer fees to worry about. Opt for their express money transfer service, and your funds will be available within a mere 4 banking hours.

Choose Remitly for your online remittance needs, and experience a hassle-free, secure, and cost-effective way to send money to your loved ones across the globe.

#Remitly#MoneyTransfer#SendMoney#CurrencyExchange#OnlineRemittance#FinancialServices#SecureTransfers#GlobalMoneyTransfer#CostEffectiveRemittance#TransparentTransfers#Fintech#DigitalPayments#Banking#CrossBorderPayments#NoTransferFees#ExchangeRates#FinancialFreedom#MobileApp#InternationalPayments#FastDeposits

0 notes

Text

The Future of International Payments: Emerging Technologies and Trends

In our interconnected world, international payments serve as the lifeblood of global commerce, facilitating the exchange of goods, services, and capital across borders. These transactions underpin multinational trade, fuel economic growth, and empower businesses and individuals to participate in the global market.

The systems facilitating payments have continually evolved from bartering goods and gold coins to checks, credit cards, and now digital currencies. This change has gained unprecedented momentum in recent years due to the rapid advancement of technology, changing consumer behavior, and evolving business needs.

The Current State of International Payments

Traditional methods like wire transfers, SWIFT payments, and bank drafts have served us for decades, ensuring security and traceability. However, they are often criticized for their speed, cost, and lack of transparency, which is critical in today's fast-paced and digital world.

With high transaction costs, slow processing times, and limited transparency on exchange rates and fees, traditional payment systems have been unable to keep up with the rising demands of instantaneous, cost-effective, and transparent transactions.

Emerging Technologies Reshaping International Payments

Fintech, a blend of 'financial technology,' is revolutionizing how we interact with money. It's dismantling age-old financial infrastructures and replacing them with streamlined, digital-first solutions that offer better user experiences and lower costs.

Real-Time Payments (RTP): A real-time payment is a transfer of funds that occurs immediately. This technology can eliminate one of the biggest challenges in international payments - delays.

Mobile Payments and Digital Wallets: Mobile and digital wallets are ushering in a new era of convenience and accessibility, allowing users to transact anywhere, anytime, with just a few taps on their smartphones.

Exploring Real-Time Payments (RTP)

RTP Explained: Real-Time Payments (RTP) are transfers that are processed instantly, 24/7, providing immediate availability of funds to the recipient. This immediacy is a game-changer in international payments, removing time barriers and enhancing business efficiency.

The Impact of RTP on International Trade: By facilitating instantaneous transactions, RTP can streamline international trade, enabling businesses to optimize their cash flows and reduce the risks associated with currency fluctuations.

Real-Time Settlements: While RTP brings many benefits, implementing it globally presents challenges. Issues such as different time zones, varying regulations, and interoperability need to be addressed for seamless global RTP.

Mobile Payments and Digital Wallets

Rise of Mobile Payments: A Global Perspective The ubiquity of smartphones and internet connectivity has fueled the surge of mobile payments. This growth trend is visible worldwide, providing a convenient and contactless mode of transaction that users appreciate.

Role of Digital Wallets in Enhancing User Experience: Digital wallets enable mobile payments and enhance the user experience by integrating loyalty programs, providing personalized offers, and offering advanced security features.

Regulatory Factors Impacting International Payments

Regulations play a crucial role in shaping the international payments landscape. From central banks to local governments, various entities create rules that dictate how money can be moved across borders.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations are integral to preventing financial crime. However, they also complicate international payments, requiring businesses to undertake due diligence and comply with stringent identification procedures.

Future of International Payments: Trends to Watch

The Increasing Role of AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) are set to further revolutionize international payments by automating processes, predicting trends, identifying fraud, and personalizing customer experiences.

The Future of Cross-Border Payments: The future belongs to integrated payment systems that can offer seamless experiences to users, regardless of their location. These platforms will cater to all transaction needs, combining different payment methods, currencies, and technologies.

The Environmental Impact: As the world becomes increasingly conscious of environmental impacts, the demand for 'green' or 'sustainable' technologies in payment systems will grow. This trend is expected to influence future innovations in the international payments landscape.

The future of international payments is undeniably exciting. As we look ahead, it's clear that technology will continue to drive innovation, pushing the boundaries of what's possible and transforming how we move money around the world.

In this dynamic landscape, embracing change and innovation will be key. Businesses, financial institutions, and individuals must be ready to adapt to these evolving technologies and trends to thrive in the future of international payments.

1 note

·

View note

Text

Understanding Wire Transfers: A Detailed Dive

What is a Wire Transfer?

Wire transfers are electronic funds from one individual or entity to another. Wire transfers have evolved into a digital service that allows instant movement of funds between bank accounts worldwide. The transaction is completed via a network through telecommunication wire networks or digital infrastructures such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). With wire transfers, the transaction can be completed in a matter of minutes or hours and is safe.

International and domestic wire transfer are highly dependable, even though wire transfers have high fees.

How Does It Work?

The process begins when a person sends money from their bank account to another individual's or company's bank account. The sender provides the recipient's name, bank account number, and bank routing number. In the case of international transfers, additional information such as the SWIFT or IBAN (International Bank Account Number) codes of the recipient's bank is required.

Once the details are confirmed, the sender's bank sends a message to the recipient's bank through a secure system, requesting the transfer of funds according to the sender's instructions. Upon the recipient's bank's approval, the funds are debited from the sender's account and credited to the recipient's account. This process can take several hours to a few days, depending on the banks and countries involved.

When to Use a Wire Transfer?

Wire transfers are often used when quick, secure, and direct transfer of funds is necessary. They are especially useful for large and time-sensitive transactions, as they can typically be completed within the same day domestically or one to five business days internationally. Examples of when to use a wire transfer include purchasing a home, sending money to family or friends abroad, paying for an international business transaction, or funding an investment account.

Benefits of Wire Transfer

Wire transfers provide a fast and secure method of transferring funds. They are a preferred method for large transactions as they allow for the immediate availability of funds, which can be crucial in time-sensitive purchases like real estate. They also offer a level of security and reliability, as both sender and receiver must have legitimate bank accounts that have undergone bank verification processes.

Risks Involved While Making a Wire Transfer

Despite their benefits, wire transfers carry some risks. They are often irreversible once the recipient's bank accepts the transfer, making them a common target for fraudsters. If a wire transfer is sent to the wrong account, it can be challenging to retrieve the funds. Also, personal information shared during the process could be at risk if it falls into the wrong hands. Hence, it's vital to double-check all details and only wire money to trusted recipients.

Difference Between Wire Transfer and Bank Transfer

While wire transfers and bank transfers involve moving funds from one account to another, key differences exist. Wire transfers are more immediate, secure, and reliable for large transactions, but they often come with fees, especially for international transfers. On the other hand, regular bank transfers, including ACH (Automated Clearing House) transfers, might take longer but usually come with lower or no fees.

In conclusion, wire transfers are convenient for quickly and securely transferring funds, especially for large amounts or international transactions. However, it's important to use this service wisely, be aware of potential risks, and understand how it differs from other types of bank transfers.

0 notes

Text

online payment, virtual payment, couponglobal.com, https://www.facebook.com/couponglobal

#globalpaying#globalpayment#internationalpaying#internationalpayment#payingglobal#paymentglobal#payinginternational#paymentinternational#onlinepaying#onlinepayment#virtualpaying#virtualpayment#payingonline#paymentonline#payingvirtual#paymentvirtual#globalpayee#globalpayer#internationalpayee#internationalpayer#payeeglobal#payerglobal#payeeinternational#payerinternational#virtualpayee#onlinepayee#payeevirtual#payeeonline#virtualpayer#onlinepayer

1 note

·

View note

Text

With Zil.US, handling International Payments is simple and secure. Track and reconcile your global transactions from anywhere. Learn more: https://zil.us/international-payments/

0 notes

Text

How to Send Money Abroad from India Online

Learn how to send money abroad easily with Zenith Forex Online. Explore methods like SWIFT, SEPA, wire transfers, and e-wallets to transfer funds securely at low fees. Our services support hassle-free outward remittances, ensuring fast delivery and protection. Ideal for personal and corporate needs, you can manage transactions digitally and efficiently. Check exchange rates, fees, and required documents for a seamless experience.

Track your transfer in real-time.

Get personalized support.

Enjoy competitive exchange rates.

Secure your data with advanced measures.

Choose a method based on urgency.

Visit our nearest store or contact us: 🌐 https://blog.zenithforexonline.com/how-to-send-money-abroad-from-india/ 📱 +91 8448289666

#ZenithForexOnline#GlobalMoneyTransfers#FastTransfers#ReliableService#SecureTransactions#InternationalPayments#MoneyTransfer#GlobalFinance#EffortlessTransfers

0 notes

Text

The Value and Role of Bitcoin in International Payments

Bitcoin has gained popularity worldwide as people see its potential for appreciation and its unique features. However, without additional drivers, the value of bitcoin would be fragile and rely solely on the shared illusion of its worth. This would make it susceptible to becoming a financial bubble like Beanie Babies or tulips.

But bitcoin's true value lies in its ability to enable cross-border payments between different countries and geopolitical clusters. Traditional currencies like the yuan and the dollar pose challenges when it comes to international transactions. Bitcoin provides a solution by serving as a neutral and mutually trusted asset, eliminating the need for intermediaries.

Bitcoin's decentralized nature and blockchain technology allow for secure and transparent transactions. It also offers faster and cheaper cross-border transfers compared to traditional methods. Additionally, bitcoin's divisibility and digital nature make it a convenient option for everyday purchases and large international trade deals.

In conclusion, bitcoin's design makes it well-suited for facilitating international payments. Its neutrality, trustworthiness, and technological advantages position it as a potential alternative to traditional currencies in global transactions.

Read the original article here

Related: #bitcoin, #cryptocurrency, #internationalpayments, #blockchain

0 notes

Video

youtube

Best Cheap Web Hosting Services For WordPress🔥 Interserver $2.5 Deal Review 🌐 Check out this Perfect Money Review on Raqmedia! 💸 Learn how to make secure online transactions with low fees and no worries about chargebacks. 🚀 Perfect for international payments! 🌍 Follow the link for the full scoop: https://bit.ly/perfctmny 🔒 Don’t forget to follow and like Raqmedia for more trending articles! #raqmedia #onlinepayments #PerfectMoney #SecureTransactions #DigitalCurrency #MoneyManagement #InternationalPayments #FinancialFreedom

0 notes

Text

Fast Selling Products On Amazon.com for Q4 2021

Introduction

In e-commerce, we divide the market into four sections -

1. Quarter 1 - January - March

2. Quarter 2 - April - June

3. Quarter 3 - July - September

4. Quarter 4 - Oct - December

Businesses work according to this bifurcated calendar. It gives better insights into various perspectives to push a particular range of products/services during certain quarters.

For instance, I am an e-commerce seller on Amazon selling clothing, accessories, gifts, electronics, and household things.

As I prepare my e-commerce site for Q4 (October - December), I will check the trends and see what products will be in demand.

Apart from taking help from data, a seasonal perspective would also give an idea about what range of products shall be in demand.

For instance, Q4 in India means winter. It is the time where air purifiers, heaters, geysers, blankets, gloves, face shields (holiday season means traveling), and many more would face a surge.

7 Expert Tips for a Profitable Q4 on Amazon

Try not to go out of stock!

For instance, your e-commerce sites sell the best of the clothing range for millennials, and the fur coat and Valentino boots score most of the sales on your site. You must keep them in stock always when you know that the demand is going to peak.

Therefore, load the essentials in needed amounts.

Tip: December is busy for the right sellers because the season hovers around Christmas and New year. Similarly, January can also be a busy month because shoppers would avail Amazon gift cards to make more purchases.

Q4 does not end in December. Period

Even though October - December is accounted as Q4, you should always consider January.

Stephen Smotherman, the top Amazon Seller, believes that November to January is the happening for Amazon sellers. Also, Amazon sellers must prepare themselves for a busy November and don’t bother much if the October sales graph goes a bit lean.

Let not the sales ranking fool you!

Every quarter has different dynamics, and they work differently.

For instance, in Q3 (July - September), the sales for toys and confectioneries were less, and they ranked at an average level.

The sales ranking of Q3 cannot determine the product flow for Q4. If I move according to the sales ranking of Q3 and don't bother to spend much on toys and confectionery, my business would be at a loss.

The reasons are - Diwali, Dussehra, Christmas, New Year, Durga Puja, etc, fall between October - January.

Stock at the right time

Stocking at the right time doesn't mean stocking during peak hours. Instead, stock when the demand is least, which means if you are stocking up for Diwali then, don't wait until October to refill the reserves.

If you stock non-perishable products such as

1. Home decor related things

2. Paints

3. Diyas and candles

4. Gifts

5. Toys

6. Festive clothes

And other things, at least a couple of months before the festive season, you can provide the customers with products that other stores can't because they ran out of supply.

Scan through the sales trend in Q4 and understand the emerging trends

This stage needs patience and quality research. Look for the following things while scanning through the Q4 trends:

1. Is there a pattern?

2. What are the rankings of different product categories (maximum and minimum)?

3. What are the emerging product categories for Q4 in the Indian and international markets (if you have a global footprint)?

4. What are the variations followed by your competitors?

5. Can a new category or product be portrayed as a necessity during Q4?

6. Can your e-commerce site be a trendsetter?

7. What is the pricing cycle? How does it create an impact on traction and sales?

8. What should be the ideal pricing?

Reach the one-time shoppers

There is no guarantee that the one who shopped for ₹5000 would trail back to your e-commerce site again. There could be many reasons such as:

1. Flashy sale/offer

2. Unavailability at other e-commerce sites

3. First-time customer

4. Good service

5. Tried upon recommendation

6. Have no other resort

However, there would be numerous reasons why the existing customers are not returning to the site, such as - high prices, payment limitations, checkout crisis, etc.

To sort this crisis, you should address their objection reasons and curate practical responses that will assist the customers in dissolving the barrier and making the purchase.

Therefore, you should get back to them always with luring offers or molding the messages that derive necessity and need rather than product/service endorsement.

Buck up your marketing tactics

Q4 is the stage where the seller expects to close the best possible deals and gain good sales. To reap impactful sales, you should conduct outstanding marketing.

By outstanding marketing, none are asking you to spend millions on advertising. Just follows these points to craft good marketing:

1. Frame it as a need/necessity (how will they benefit?)

2. Intertwine that expensive necessity with captivating offers

3. Offers could range from coupons, discounts, free goodies, and referral codes (coupons might encourage shoppers to shop again)

4. Offer better payment solutions (if international the feasible cross-border payment solutions)

5. Use influencer marketing or testimonial marketing (adds personal and authentic touch)

6. The benefits for customers should be loud and clear.

7. Add qualitative materials, such as - how-to videos, testimonials, feedback, images, etc.

The product combined with good marketing results in a sales spike, never forget. Therefore, these were the few effective measures to use to reap a successful Q4 sales.

How was 2020 for Amazon India?

We are aware of the catastrophic year 2020, but it wasn't a stressful 12 months for all.

Facts!

According to the reports submitted by Amazon India:

1. Over 4,152 sellers turned into millionaires as their online business on Amazon crossed ₹ 1 crore in sales.

2. It means the tally of millionaire sellers escalated by 29% year-on-year (YoY).

3. Apart from this, Amazon India witnessed a surge where 1.5 lakh new sellers enrolled themselves and more than 50,000 sellers registering in Hindi and Tamil.

4. Despite COVID19 employment and economic crunch, Amazon grew by 85% YOY in sales.

5. Amazon Global Selling witnessed more than 70,000 exporters crossing $2 billion in cumulative e-commerce exports and over 1 lakh developers from India building for Alexa globally.

Trending Products of Amazon India - 2020

COVID19 Mandates!

From 2020, face shields sales have soared up, making it one of the necessities along with N95 masks, masks, PPE kit (travel majorly), disinfectants, and sanitizers.

Pet beds

India has witnessed a surge in pet adoption. With mental health becoming a mandate and social media posing pet-owning as a sane and mandate deed, people are becoming proud pet owners.

Fact!

As per the reports, the pet furniture market predicts to register a CAGR of 5.8% during the forecast period (2021-2026).

Home Gyming Equipment

Due to the closing of the gym for a prolonged period, many gym freaks have started home gyming. Apart from the regular gyming souls, the latest fitness nerds have also joined the cult.

This section in the society has raised the demand for gym-friendly clothing, running shoes, yoga mats, protein shakes, shakers, and other gym equipment.

Groceries

Due to complete lockdown, people had to shift their offline grocery purchase to online stores. While a few were already using online stores for groceries, a whole new bunch of offline audience enjoyed the lavish digital shopping for veggies and fruits.

This also includes buying other household things – soaps, brushes, snacks, beauty care products, other food items, etc.

They understood the hassle-free, convenient, time saving, and secure method of shopping and have adopted online as the new shopping station.

Electronics

Not only shopping, even education took a dramatic shift from offline to online pushing parents to purchase smartphones and laptops for their kids.

It also resulted in the rise of routers, fibre cables, dongles, earphones, etc.

With the closing of cinema halls, a lot of people shifted from TV to OTT platforms. Therefore, to surf on OTT platforms you either need TV or mobile. Hence, the electronics category witnessed a rise in demand than the regular.

Home and kitchen appliances are also a part of them.

Trending product categories to sell on Amazon in Q4 2021

Electronics: Mobile, smart watches, voice assistant tools (Amazon & Google), earphones (wire and wireless).

Lightweight mesh shoes: People are opting more for this because it’s comfortable for everyday use and exercise-friendly.

Home and Kitchen Appliances: People are becoming more concerned about their décor, transforming their home and kitchen with urban touch.

People are utilizing Covid phase as the time to cater their mental health and improvise lifestyle.

Fitness Equipment: As we said, people are investing more time on themselves and family well-being. A major reason that is pushing them to adopt fitness as their priority is – social media.

Equipment like – plates, bars, weights, dumbbells, etc.

Toys & Games: Gifts for kids during festivals and games for teens (boys preferably). Apart from them, India has witnessed a spike in newborn children, so if you are visiting you will not go empty handed, we believe.

Fact!

In 2020, Amazon India witnessed a 30% growth in indoor games.

Clothing, Accessories & Skin Care: This combo never fades. Festive clothes, office-friendly clothes (as offices are re-opening), wedding season, complimenting accessories, etc.

Work From Home accessories

Camera accessories

Laptop Accessories - adjustable laptop stand, adjustable armrest, orthopaedic backrest cushion, etc.

Gaming accessories - RGB gaming mouse pad, game controller with cooling fan, etc.

COVID19 Essentials - PPE kit, digital pulse oximeter, vapor steamer, etc

Cleaning Appliances - kitchen and bathroom cleaning tools, spray mop, etc

These are the few product categories that you could sell in the Q4 stage.

1 note

·

View note