#Inertial Navigation System Market Size

Explore tagged Tumblr posts

Text

Understanding About the Uses of Inertial Navigation Systems

Whether, you are traveling in a commercial aircraft, military transport or even a self-driving car, there are good chances that an inertial navigation system will have an important role to play in the journey from one point to the other. The contemporary inertial navigation systems are tremendously reliable and affordable for a number of emerging applications What Exactly is INS? An INS has an…

View On WordPress

#Inertial Navigation System Market#Inertial Navigation System Market Growth#Inertial Navigation System Market Outlook#Inertial Navigation System Market Research Report#Inertial Navigation System Market Share#Inertial Navigation System Market Size#Inertial Navigation System Market Trends

0 notes

Text

North America Is Dominating Inertial Navigation System Market

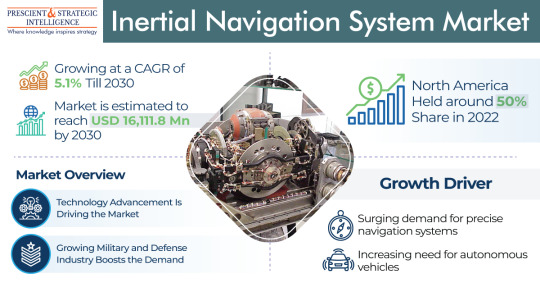

The inertial navigation system market generated revenue of USD 10,812.8 million in the past, which is expected to reach USD 16,111.8 million by 2030, advancing at a CAGR of 5.1%.

The market for inertial navigation systems is significantly driven by the defense industry. For precise navigation, location, and aiming in several defense applications, such as aircraft, submarines, missiles, and unmanned vehicles, INS technology is essential.

Many industries, including precision agriculture, geodesy, surveying, and geophysics, need accurate positioning and timing data. These applications benefit from the high accuracy and dependability provided by inertial navigation systems, which helps drive their expansion.

Accuracy, dependability, weight, power, size, cost-effectiveness, and other elements of such systems may all be improved, which will help a variety of industries like aerospace, military, and defense, among others. Microelectromechanical systems (MEMS) technical breakthroughs are also contributing to the market's growth. Manufacturers have developed more affordable, compact, low-power, and economical solutions thanks to the use of MEMS.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/inertial-navigation-system-market/report-sample

Additionally, the integration of several sensors, including barometers, magnetometers, and GPS, boosts the system's precision and dependability and results in more precise and secure navigation. Additionally, with the aid of modern MEMS-based sensors, enhanced sensor fusion algorithms, fiber optic gyroscopes, GNSS, and hybrid navigation systems, the competency and performance of inertial navigation systems are improving.

The forecast period is expected to have the biggest growth in the APAC market. This can be attributed to the expanding aviation sector in the area. Growing middle-class populations' preference for air travel has increased the demand for airplanes, which has increased the demand for inertial navigation systems in APAC.

Several APAC nations, including China, India, South Korea, and Japan, are raising their defense spending levels and modernizing their armed services. Military applications like armored vehicles, missiles, submarines, and precision-guided bombs rely heavily on inertial navigation systems. The APAC region's expanding defense capabilities and modernization initiatives have increased demand for INS.

#Inertial Navigation System Market#Size of Inertial Navigation System Market#Demand for Inertial Navigation System Market#Trends in Inertial Navigation System Market

0 notes

Text

Airborne Light Detection and Ranging System Market Size, Share, Overview Competitive Landscape by 2032

The airborne Light Detection and Ranging (LiDAR) system market size will grow at a notable rate on the back of rising penetration of exploration, corridor mapping and Advanced Driver Assistance Systems (ADAS) systems. Surging investments in driverless cars and heightened awareness about LiDAR systems will encourage stakeholders to expand their geographical presence.

Fortune Business Insights™ has delved into these inputs in an upcoming research report, titled, “Airborne Light Detection and Ranging (LiDAR) System Market, 2024-2032.”

Informational Source:

Some of the Leading Companies Profiled in the Market:

RIEGL USA Inc, Inc. (The U.S.)

Velodyne LiDAR, Inc (The U.S.)

Trimble Navigation Limited (The U.S.)

Leica Geosystems Holdings AG (Switzerland)

Faro Technologies Inc. (The U.S.)

3D Laser Mapping (The U.K.)

Hexagon AB (Sweden)

Phoenix LiDAR Systems (The U.S.)

Teledyne Technologies (The U.S.)

Segments:

In terms of product type, the market is segmented into mobile, airborne, terrestrial and UAV. Based on component, the industry is segregated into Navigation Inertial Measurement Unit (IMU) devices, laser scanners, GPS component and others. With respect to application, the market is fragmented into exploration, corridor mapping, environment, Advanced Driver Assistance Systems (ADAS) and others. On the basis of geography, the industry includes Europe, North America, Asia Pacific and the Rest of the World.

Report Coverage:

The research report offers insights into industry dynamics redefining the global landscape. The report delves into drivers, opportunities, restraints and trends to provide a holistic market view. Along with qualitative and quantitative analyses, the report has been prepared through primary sources, including interviews with application developers, directors and executives. The report also provides secondary resources, such as press releases, annual reports, white papers and journals.

Drivers and Restraints:

Surging Demand for 3D Images to Foster Industry Growth

Leading players are likely to cash in on the prevalence of 3D images in a host of applications, including topographical surveys, military and defense, corridor mapping and civil engineering. The airborne Light Detection and Ranging (LiDAR) system market share will witness a notable uptick on the back of expanding footfall of corridor mapping, city planning and 3D mapping. Expanding applications of UAVs could add fillip to LiDAR-based mapping systems. With rising traction for improved safety features, autonomous cars are likely to be equipped with LiDAR systems for navigation and GPS. LiDAR systems will increasingly be mounted on unmanned vehicles to provide versatility and portability. However, the prevalence of lightweight and low-cost photogrammetry systems could dent the growth prospect.

Regional Insights:

North America to Witness Investments Galore with Rising Investments in Driverless Cars

Stakeholders expect the U.S., Canada, and Mexico to emerge as lucrative destinations following the rising footfall of driverless cars. Moreover, the ADAS has become trendier across the region, encouraging leading companies to boost North America market revenue. Technological advancements will be pronounced with expanding mapping and surveying applications. Modernization of GPS components and increasing exploration activities will boost regional growth.

Asia Pacific airborne Light Detection and Ranging (LiDAR) system market growth will be noticeable owing to rising infrastructure development. With LiDAR modernization programs gaining an uptick across China, Australia and India, stakeholders are likely to foster their footprint. Expanding automotive sector and the soaring popularity of UAV systems could provide impetus to the regional market.

Competitive Landscape:

Stakeholders Focus on Product Launches to Bolster Portfolios

Leading companies are likely to invest in technological advancements, product rollouts, and R&D activities to expand their geographical presence. With soaring investments in innovation and advanced design, stakeholders could inject funds into mergers and acquisitions.

February 2021: Phoenix LiDAR Systems announced its collaboration with Nordic Unmanned Systems to provide a customer-focused solution.

0 notes

Text

𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐨𝐟 𝐭𝐡𝐞 𝐔𝐧𝐦𝐚𝐧𝐧𝐞𝐝 𝐀𝐞𝐫𝐢𝐚𝐥 𝐕𝐞𝐡𝐢𝐜𝐥𝐞 (𝐔𝐀𝐕) 𝐌𝐚𝐫𝐤𝐞𝐭-IndustryARC™

The Unmanned Aerial Vehicle Market size is estimated to reach $69.9 billion by 2030, growing at a CAGR of 11.2% during the forecast period 2024-2030.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞

A UAV navigation system is a system that enables unmanned aerial vehicles (UAVs) to navigate autonomously or with remote control. UAV navigation systems use a variety of components, including GPS systems, Inertial measurement units (IMUs), Sensors. UAV navigation systems are used in a variety of sectors, including: defense, agriculture, logistics, surveying, and infrastructure inspection. UAVs are also known as unmanned aircraft systems (UAS) or remotely piloted aircraft systems (RPAS).

𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐒𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐔𝐀𝐕 𝐌𝐚𝐫𝐤𝐞𝐭

𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐢𝐧 𝐭𝐡𝐞 𝐃𝐞𝐟𝐞𝐧𝐬𝐞 𝐒𝐞𝐜𝐭𝐨𝐫: The defense industry remains the largest consumer of UAVs, utilizing them for surveillance, reconnaissance, and tactical operations. The integration of artificial intelligence (AI) and machine learning into UAVs has significantly enhanced their capabilities, allowing autonomous decision-making and target identification.

𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐑𝐨𝐥𝐞 𝐢𝐧 𝐀𝐠𝐫𝐢𝐜𝐮𝐥𝐭𝐮𝐫𝐞: Precision agriculture is a major growth area for UAVs. Equipped with advanced sensors and imaging technologies, drones are used for crop health monitoring, irrigation management, and pesticide spraying. This reduces waste and maximizes yield, driving sustainable farming practices.

𝐑𝐢𝐬𝐞 𝐨𝐟 𝐃𝐫𝐨𝐧𝐞 𝐃𝐞𝐥𝐢𝐯𝐞𝐫𝐢𝐞𝐬: E-commerce giants and logistics providers are leveraging drones for last-mile deliveries. UAVs offer faster delivery times, reduced costs, and the ability to reach remote areas. This trend is accelerating with advancements in payload capacity and navigation systems.

𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 𝐰𝐢𝐭𝐡 𝟓𝐆 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲:The adoption of 5G networks is enhancing UAV operations, providing high-speed data transfer and real-time communication.

0 notes

Text

0 notes

Text

0 notes

Text

The global inertial navigation system market size reached US$ 11.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 18.9 Billion by 2032, exhibiting a growth rate (CAGR) of 5.6% during 2024-2032.

0 notes

Text

Sensors Market: Navigating the Landscape of Smart Sensing

The Sensors Market is today's rapidly evolving technological landscape, sensors play a pivotal role in enabling smarter, more efficient devices and systems.

In an increasingly interconnected world, sensors are the backbone of various industries, playing a crucial role in data collection, monitoring, and automation. As technology continues to advance, the sensors market has seen significant growth, marked by a projected increase in market size from $2.20 billion in 2023 to $3.90 billion by 2030, with a CAGR of 7.10%. This blog delves into the current state of the sensors market, key players, types of sensors, applications, and regional dynamics.

Current Market Overview

Market Size and Growth Projections

The sensors market is projected to grow from $2.20 billion in 2023 to $2.40 billion in 2024. The substantial growth trajectory reflects an increasing demand for advanced sensors across various sectors, including industrial automation, automotive, healthcare, and consumer electronics. By 2030, the market is expected to reach $3.90 billion, driven by innovations in technology and the proliferation of the Internet of Things (IoT).

Key Growth Drivers

Several factors contribute to the growth of the sensors market:

Technological Advancements: Innovations in sensor technology, including miniaturization, improved accuracy, and integration with AI and machine learning, are enhancing their application potential.

IoT and Automation: The rise of IoT applications is creating a significant demand for sensors, enabling real-time data collection and analysis across various industries.

Increased Safety and Efficiency: In sectors such as automotive and industrial manufacturing, sensors are vital for improving safety, efficiency, and operational effectiveness.

Healthcare Innovation: The demand for advanced healthcare monitoring devices, including wearables and remote patient monitoring systems, is fueling growth in the medical sensors segment.

Key Market Players

The sensors market comprises numerous established players, each contributing to the sector's growth through innovation and strategic partnerships. Some of the key players include:

Broadcom Ltd.

Fitbit, Inc.

Koninklijke Philips N.V.

Texas Instruments Inc.

STMicroelectronics NV

Garmin Ltd.

NXP Semiconductors

Analog Devices

Honeywell

Sensata Technologies

Northrop Grumman

Siemens

Ametek Incorporated

Autoliv Incorporated

Avago Technologies

Banner Engineering

Boeing

Continental

Danaher Corporation

Delphi Automotive

Eaton Corporation

Emerson Electric

Abbott Laboratories

General Electric

Heraeus Holding

Schneider Electric

Johnson Controls

L- Communications

Measurement Specialties

Nagano Keiki Company

These companies are at the forefront of sensor innovation, consistently developing new products to meet the evolving needs of various industries.

Key Segments in the Sensors Market

By Type

The sensors market is segmented based on the type of sensors, which include:

Temperature Sensors: Used to measure temperature in various applications, from HVAC systems to industrial processes.

Pressure Sensors: Vital for monitoring pressure levels in automotive, industrial, and healthcare applications.

Position Sensors: Essential for determining the position of objects in automation and robotics.

Oxygen Sensors: Widely used in medical applications, automotive systems, and industrial processes.

NOx Sensors: Important for environmental monitoring and automotive emissions control.

Speed Sensors: Crucial for automotive applications, providing data on vehicle speed and performance.

Inertial Sensors: Utilized in consumer electronics and automotive applications to detect motion and orientation.

Image Sensors: Key components in cameras and imaging systems, facilitating visual data capture.

Others: This category encompasses various specialized sensors catering to niche applications.

By Applications

Sensors are employed across multiple sectors, including:

Industrial: Automation and process control in manufacturing and production facilities.

Vehicles: Advanced driver-assistance systems (ADAS) and vehicle dynamics monitoring.

Military/Aerospace: Navigation, surveillance, and monitoring systems for defense applications.

Medical: Patient monitoring, diagnostic devices, and therapeutic equipment.

Consumer Electronics: Smart devices, wearables, and home automation systems.

Information Technology: Data centers and IT infrastructure monitoring.

Others: This includes various specialized applications across different industries.

Regional Dynamics

North America

North America holds a significant share of the sensors market, driven by technological advancements and the presence of key players. The region's robust industrial base and high adoption of IoT technologies further bolster market growth.

Europe

Europe is characterized by stringent regulations and a focus on environmental sustainability, which drives the demand for sensors in automotive and industrial applications. The presence of leading manufacturers also contributes to the region's market growth.

Asia Pacific

The Asia Pacific region is expected to witness the highest growth rate in the sensors market, fueled by rapid industrialization, increasing automation, and rising consumer electronics demand. Countries like China, Japan, and India are at the forefront of this growth.

Latin America

Latin America is gradually adopting advanced sensor technologies, particularly in industrial and automotive applications. The region's growth is supported by investments in infrastructure and manufacturing.

Middle East & Africa

The sensors market in the Middle East and Africa is emerging, with growing investments in industrial automation and smart city initiatives driving demand for various sensor types.

Challenges and Opportunities

Challenges

Despite the promising growth, the sensors market faces several challenges:

Data Security: As sensors collect vast amounts of data, ensuring data security and privacy is a growing concern.

Integration Complexity: Integrating sensors with existing systems and technologies can be complex and costly.

Market Competition: The market is highly competitive, with numerous players vying for market share, which can lead to price wars and reduced profit margins.

Opportunities

However, the sensors market also presents significant opportunities:

Emerging Technologies: The advent of AI, machine learning, and advanced analytics opens new avenues for sensor applications and innovations.

Sustainability Initiatives: The growing emphasis on environmental sustainability presents opportunities for sensors in renewable energy and waste management applications.

Healthcare Advancements: The increasing demand for remote patient monitoring and telehealth solutions offers substantial growth potential in the medical sensors segment.

Conclusion

The sensors market is poised for significant growth in the coming years, driven by technological advancements, the rise of IoT, and the increasing demand for automation across various sectors. With a projected market size reaching $3.90 billion by 2030, stakeholders in the sensors industry must navigate challenges while capitalizing on emerging opportunities. The collaboration between key players, continued innovation, and an emphasis on sustainability will be critical in shaping the future of the sensors market.

As industries continue to evolve and embrace digital transformation, sensors will remain integral in driving efficiencies, improving safety, and enhancing the overall quality of life in our increasingly connected world.

Browse More:

Sesame Seeds Market Overview

Silica Sand Market Trends

Smart Building Market Analysis

Smart Home Installation Service Market 2024

0 notes

Text

0 notes

Text

MEMS Gyroscopes Market Strategies and Resources to Grow Your Company, 2032

MEMS (Micro-Electro-Mechanical Systems) Gyroscopes are advanced sensors that measure angular velocity and rotational motion with high precision. Utilizing microfabrication technology, MEMS Gyroscopes are compact and highly accurate, making them essential components in various applications. These gyroscopes are widely used in consumer electronics, automotive systems, and aerospace for applications requiring precise motion sensing and stabilization. By providing accurate orientation and rotational data, MEMS Gyroscopes enhance the performance and functionality of modern devices and systems.

The MEMS Gyroscopes Market valued at USD 2.71 billion in 2023, is projected to reach USD 5.88 billion by 2032, growing at a CAGR of 9% during the forecast period of 2024-2032.

Future Scope:

The future of MEMS Gyroscopes is marked by advancements in sensitivity, accuracy, and integration with other sensors. Innovations in microfabrication techniques and materials are expected to improve the performance and reduce the size of MEMS Gyroscopes. The integration of MEMS Gyroscopes with other MEMS sensors, such as accelerometers and magnetometers, will enable more comprehensive motion sensing and navigation solutions. Additionally, developments in low-power and high-frequency gyroscopes will support the growing demand for precise motion sensing in portable and wearable devices.

Trends:

Current trends in MEMS Gyroscopes include the development of higher sensitivity and accuracy sensors for improved motion detection and stabilization. There is a growing focus on integrating MEMS Gyroscopes with other sensor technologies to provide more detailed and reliable data. The market is also seeing advancements in low-power and miniaturized gyroscopes that cater to portable and wearable applications. Additionally, the use of MEMS Gyroscopes in emerging fields such as autonomous vehicles and drones is driving innovation and development.

Applications:

MEMS Gyroscopes are used in a diverse range of applications, including consumer electronics such as smartphones, tablets, and wearable devices for motion tracking and orientation. In automotive systems, they are employed for vehicle stability control and navigation. Aerospace applications utilize MEMS Gyroscopes for inertial navigation and attitude control in aircraft and spacecraft. The technology is also critical in robotics and drones for precise motion control and stabilization.

Solutions and Services:

Solutions related to MEMS Gyroscopes include custom sensor design and integration for specific applications, performance optimization, and system integration. Manufacturers offer calibration, maintenance, and technical support to ensure optimal sensor performance. Additionally, consultancy services are available to help organizations select and implement MEMS Gyroscope solutions that meet their motion sensing requirements.

Key Points:

Measures angular velocity and rotational motion with high precision.

Enhances performance and functionality in consumer electronics, automotive systems, and aerospace.

Future advancements focus on sensitivity, integration with other sensors, and low-power designs.

Trends include higher sensitivity, miniaturization, and use in autonomous vehicles and drones.

Applications span smartphones, vehicle stability, inertial navigation, and robotics.

Solutions include custom design, performance optimization, calibration, and technical support.

Read More Details: https://www.snsinsider.com/reports/mems-gyroscopes-market-4263

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

#MEMS Gyroscopes Market#MEMS Gyroscopes Market Size#MEMS Gyroscopes Market Share#MEMS Gyroscopes Market Report#MEMS Gyroscopes Market Analysis

0 notes

Text

0 notes

Text

The search, detection and navigation instruments market is projected to witness substantial growth, with its value expected to surge from USD 298,422.51 million in 2024 to USD 505,127.32 million by 2032, reflecting a notable CAGR of 6.8%. The Search, Detection, and Navigation Instruments Market encompasses a diverse range of devices and systems designed to locate, identify, and guide various objects and entities. These instruments are pivotal in sectors such as defense, aviation, maritime, space exploration, and even in consumer electronics. This article delves into the current state, driving factors, and future prospects of this dynamic market.

Browse the full report at https://www.credenceresearch.com/report/search-detection-and-navigation-instruments-market

Market Overview

The global search, detection, and navigation instruments market is experiencing robust growth, driven by technological advancements and increasing demand across multiple sectors. These instruments include radar systems, sonar devices, Global Positioning Systems (GPS), and various other sensors and navigation aids.

Key Market Drivers

1. Technological Advancements: Continuous innovations in sensor technology, artificial intelligence (AI), and machine learning (ML) are significantly enhancing the capabilities of search, detection, and navigation instruments. Advanced radar and sonar systems offer higher accuracy and better resolution, while AI and ML enable more efficient data processing and analysis.

2. Military and Defense Needs: The defense sector remains one of the largest consumers of search, detection, and navigation instruments. Nations worldwide are investing heavily in upgrading their defense systems, including sophisticated radar and GPS technologies, to enhance national security and surveillance capabilities.

3. Aviation and Maritime Applications: In aviation, these instruments are crucial for air traffic management, navigation, and ensuring flight safety. Similarly, in the maritime sector, they play a vital role in navigation, collision avoidance, and underwater exploration.

4. Space Exploration: The increasing number of space missions and satellite launches necessitates advanced navigation and detection instruments. These tools are essential for tracking space debris, guiding spacecraft, and ensuring successful mission outcomes.

5. Consumer Electronics: The integration of GPS and other navigation technologies in smartphones, wearable devices, and automobiles has expanded the market. The growing demand for location-based services and applications is further propelling this segment.

Market Segmentation

The search, detection, and navigation instruments market can be segmented based on technology, application, and geography.

1. By Technology: - Radar Systems: Utilized extensively in defense, aviation, and meteorology for detecting and tracking objects. - Sonar Systems: Predominantly used in maritime applications for underwater detection and navigation. - GPS and GNSS: Essential for navigation in aviation, maritime, automotive, and consumer electronics. - Inertial Navigation Systems (INS): Used where GPS signals are weak or unavailable, such as in submarines and spacecraft.

2. By Application: - Defense and Military - Aviation - Maritime - Space Exploration - Automotive - Consumer Electronics

3. By Geography: - North America: Leading the market due to significant defense expenditure and technological advancements. - Europe: Strong presence in aviation and maritime sectors. - Asia-Pacific: Rapid growth driven by increasing defense budgets and advancements in consumer electronics. - Rest of the World: Steady growth with a focus on improving defense and navigation infrastructure.

Market Challenges

Despite the positive growth trajectory, the market faces several challenges:

1. High Costs: The development and deployment of advanced search, detection, and navigation instruments involve substantial costs, which can be a barrier for smaller organizations and emerging economies.

2. Regulatory Hurdles: Strict regulations and compliance requirements in different regions can impede market growth and innovation.

3. Technological Limitations: While advancements are ongoing, certain technological limitations, such as signal interference and data accuracy issues, still pose challenges.

4. Cybersecurity Threats: With the increasing reliance on digital and connected systems, the threat of cyber-attacks on navigation and detection instruments is a growing concern.

Future Outlook

The future of the search, detection, and navigation instruments market looks promising, with several trends set to shape its growth:

1. Integration of AI and ML: The use of AI and ML for data processing, predictive analysis, and autonomous navigation is expected to revolutionize the market.

2. Miniaturization and Portability: Advances in microelectronics are leading to smaller, more portable instruments, broadening their application scope.

3. Collaborations and Partnerships: Increased collaborations between private companies, governments, and research institutions will drive innovation and development.

4. Sustainability Initiatives: Growing focus on sustainable technologies and practices will influence the design and manufacturing of these instruments.

Key Players

BAE Systems PLC

Leonardo S.p.A

Raytheon

Thales Group

United Technologies Corp.

Agilent Technologies

Honeywell International Inc.

Northrop Grumman Corporation

Moog Inc.

Garmin International Inc.

Group North America Inc.

Smiths

Ultra Electronics Holdings PLC

Elbit Systems Ltd.

NovAtel Inc.

Kratos Defense & Security Solutions Inc.

Segments:

By Type:

Compasses

Aeronautical and Space Navigation Instruments

Nautical Navigation Instruments

Radio Navigational Aid Apparatus

By Technology:

Radio Frequency Identification based (RFID)

Cellular

Network

Bluetooth

Remote Sensing Services

Real Time Kinetic

Other Technologies

By Application

Marine

Aviation

Military

Other Applications

By Region

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Rest of Asia Pacific

Latin America, the Middle East, and Africa

Middle East

Africa

South America

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

Inertial Navigation System Market Size, Share, Exclusive Industry Report Insights by 2030

The global inertial navigation system market size was valued at USD 11.61 billion in 2022. The market is projected to grow from USD 12.29 billion in 2023 to USD 22.15 billion by 2030, exhibiting a CAGR of 8.77% during 2023-2030.

The Inertial Navigation System (INS) measures the relative position of a reference system point. These systems determine the location, attitude, and location of vehicles and other equipment. The INS market is expected to grow significantly during the forecast period owing to the increasing demand for miniaturized accelerometers and gyroscope sensors, emphasizing the development of next-generation navigation devices.

Fortune Business Insights™ mentioned this in a report titled "Inertial Navigation System Market, 2023-2030."

Informational Source:

Russia-Ukraine War Impact

Advanced Navigation Systems Prove Crucial in Wartime, Offering Precision and Flexibility

During wartime situations, there is a growing need for technologically advanced airborne systems, space-based navigation technology for enemy positioning precision, and the acquisition of Ship Inertial Navigation Systems (SINS). These conflicts have underscored the importance of multi-platform navigation solutions that disrupt accurate location data, with modern technology-based solutions providing lightweight, compact, and cost-effective systems suitable for both UAVs and vehicles, serving both aerial and ground applications.

List of Key Players Profiled in the Report:

General Electric Company (U.S.)

Gladiator Technologies (U.S)

Honeywell International Inc. (U.S.)

iXblue SAS (France)

Northrop Grumman Corporation (U.S.)

Parker Hannifin Corporation (U.S.)

Raytheon Technologies Corporation (U.S.)

Safran S.A (France)

Teledyne Technologies Incorporated (U.S.)

Thales Group (France)

Trimble Inc. (U.S.)

VectroNav Technologies LLC. (U.S.)

Segments:

Gyroscope Segment’s Augmented Growth due to Increased Demand for Compact and Efficient Devices

By component, the market is segmented into accelerometers, gyroscopes, and others. Due to the increasing demand for gyroscopes owing to its development of compact, cost-effective, and efficient devices, the gyroscope segment is expected to be the fastest-growing segment during the forecast period.

MEMS Segment Growth Driven by Increasing Demand for Compact and Intelligent Systems

By technology, the market is divided into mechanical gyro, ring laser gyro, fiber optics gyro, MEMS, and others. The MEMS segment is estimated to witness the fastest growth during the forecast period, owing to the rising demand for compact, intelligent, and efficient systems.

Airborne Segment Soars as Demand for Navigation Tech Rises

By platform, the market is classified into airborne, ground maritime, and space. The airborne segment is expected to experience the fastest growth during the forecast period, owing to the rising demand for navigation technology for airborne platform products.

Commercial Segment Takes Off with Growing Demand for Navigation Solutions

By end-user, the market is divided into commercial and military. The commercial segment is expected to grow significantly during the forecast period. The segment's growth is attributed to the navigation solutions’ growing demand in commercial platforms, including vehicles, helicopters, and aircraft.

Geographically, the market is studied across North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage

The report offers:

Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

Comprehensive insights into regional developments.

List of major industry players.

Key strategies adopted by the market players.

The latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints

INS Market Thrives on Technological Advancements and Growing Satellite Navigation Use

The growing technological developments in Micro-Electro-Mechanical-Systems (MEMS) and the rising use of satellite navigation are expected to drive market growth during the forecast period. The increasing availability of solid and minor components, navigation device developments, and aerospace businesses is estimated to drive the inertial navigation system market growth.

These systems require regular maintenance, leading to high procurement, maintenance cost, and operation and may hamper market growth during the forecast period.

Regional Insights

North America Dominates INS Market, Fueled by Military Investment and Tech Developers

North America held the largest inertial navigation system market share in 2022. The growth is attributed to the rising spending on advanced systems procurement for military solutions and the presence of several hardware and software developers across North America.

Europe is estimated to witness the fastest growth during the forecast period owing to the significant opportunities created by the Russia-Ukraine war for navigation devices.

Competitive Landscape

Major Players Drive Growth through Strategic Partnerships and Acquisitions

The inertial navigation system market has several players with strong brand and product portfolios. The rising adoption of different partnerships and acquisition strategies by major market players is expected to drive market growth during the forecast period.

Key Industry Development

March 2023 – The Inertial Labs GPS-Aided Inertial Navigation System launched INS-DM. It is an IP68-rated version of a new-generation, super-ruggedized, fully integrated system shielded from electromagnetic compatibility and electromagnetic interference (EMC/EMI). It combines an Inertial Navigation System (INS) with an Air Data Computer (ADC) to provide high-performance strapdown capabilities, enabling it to determine velocity, position, and absolute orientation.

0 notes

Text

0 notes

Text

0 notes

Text

Military Aviation Sensors & Switches Market: A Comprehensive Overview

The global defense industry is witnessing a transformative era driven by rapid technological advancements and evolving security challenges. Within this landscape, military aviation stands at the forefront, demanding sophisticated sensor and switch technologies to ensure operational superiority and mission success. According to a study by Next Move Strategy Consulting, the global Military Aviation Sensors & Switches Market size is predicted to reach USD 268.61 million with a CAGR of 3.6% by 2030. This comprehensive overview explores the critical role of sensors and switches in military aviation, their evolving technologies, market trends, challenges, and future prospects.

Request for a sample, here: https://www.nextmsc.com/military-aviation-sensors-switches-market/request-sample

Evolution of Military Aviation Sensors and Switches

The evolution of military aviation sensors and switches is deeply intertwined with the development of aerial warfare. From the early days of aviation, sensors such as altimeters, airspeed indicators, and compasses were fundamental to pilot navigation and aircraft control. As aircraft technology advanced, sensors evolved to include radar systems for air defense, electronic warfare sensors for threat detection, and infrared sensors for targeting and navigation in low-visibility conditions.

Switches, on the other hand, have been pivotal in enabling pilots to control various aircraft systems. Mechanical switches have given way to more advanced digital interfaces, allowing for precise and rapid adjustments to flight controls, weapon systems, and communication devices. The integration of fly-by-wire technology further revolutionized cockpit interfaces, relying heavily on electronic switches for flight control inputs.

Key Technologies in Military Aviation Sensors

Radar Systems: Radars are essential for detecting and tracking objects in the air, on the ground, and at sea. Military aircraft employ radar systems for reconnaissance, surveillance, and targeting purposes, enabling pilots to identify threats and navigate through complex airspace.

Infrared Sensors: Infrared sensors detect heat signatures emitted by objects, making them invaluable for targeting enemy aircraft, ground vehicles, and personnel. Infrared technology also aids in night vision and enhances situational awareness in challenging environments.

Electronic Warfare Systems: Military aircraft use electronic warfare systems to detect, identify, and counter hostile radar and communications signals. These systems include electronic support measures (ESM) for passive threat detection and electronic countermeasures (ECM) for active jamming and deception.

Navigation Systems: Modern navigation systems combine GPS technology with inertial measurement units (IMUs) and other sensors to provide accurate position, velocity, and attitude information. These systems are critical for precision strike missions and safe navigation in all weather conditions.

Market Trends and Growth Drivers

The military aviation sensors and switches market is experiencing significant growth propelled by several key factors:

Increased UAV Adoption: The proliferation of unmanned aerial vehicles (UAVs) across military operations has fueled demand for miniaturized sensors and switches capable of supporting autonomous flight and mission execution.

Defense Modernization Programs: Countries worldwide are investing heavily in defense modernization, focusing on upgrading existing fleets and acquiring advanced aircraft equipped with state-of-the-art sensor and switch technologies.

Technological Advancements: Innovations in materials science, miniaturization, and data processing have led to the development of more robust, efficient, and reliable sensor and switch solutions for military applications.

Geopolitical Tensions: Rising geopolitical tensions and evolving security threats are prompting nations to bolster their military capabilities, driving demand for cutting-edge aviation technologies.

Interoperability and Integration: The push for greater interoperability and network-centric warfare capabilities is spurring investments in sensors and switches that can seamlessly integrate with other defense systems.

Inquire before buying, here: https://www.nextmsc.com/military-aviation-sensors-switches-market/inquire-before-buying

Challenges and Considerations

Despite the promising outlook, the military aviation sensors and switches market faces several challenges:

Regulatory Compliance: Strict regulatory frameworks govern the development and deployment of defense technologies, requiring manufacturers to adhere to stringent quality and safety standards.

Cybersecurity Vulnerabilities: Connected aircraft systems are susceptible to cyber threats, necessitating robust cybersecurity measures to safeguard sensitive data and ensure mission integrity.

Complex Supply Chain: The integration of multiple sensors and switches within sophisticated avionics systems demands a complex and reliable supply chain to meet production and maintenance requirements.

Cost Pressures: Budget constraints and cost considerations pose challenges for defense organizations seeking to procure advanced sensor and switch technologies without compromising quality or performance.

Future Outlook and Opportunities

Looking ahead, the military aviation sensors and switches market is poised for continued growth and innovation:

Emerging Technologies: Advancements in artificial intelligence (AI), machine learning, and sensor fusion will enhance the capabilities of military aviation systems, enabling autonomous operations and real-time decision-making.

Focus on Sustainability: Defense contractors are exploring sustainable materials and manufacturing processes to reduce environmental impact and ensure the longevity of sensor and switch technologies.

Global Collaboration: Increased collaboration between defense agencies, industry stakeholders, and research institutions will drive cross-border innovation and knowledge-sharing in sensor and switch development.

Human-Machine Interface: The evolution of human-machine interface technologies will redefine cockpit design, optimizing pilot interaction with sensor and switch interfaces for enhanced mission effectiveness.

Data Integration and Analytics: As sensor technology continues to advance, there will be a growing emphasis on data integration and analytics capabilities. Military aviation systems will leverage big data analytics and cloud computing to process vast amounts of sensor data in real-time, extracting actionable insights to support mission planning, decision-making, and post-mission analysis.

Autonomous Systems: The integration of artificial intelligence and autonomous technologies will enable the development of unmanned combat aerial vehicles (UCAVs) equipped with sophisticated sensor and switch systems. These autonomous platforms will revolutionize aerial warfare, offering enhanced situational awareness, agility, and mission flexibility while reducing the risk to human pilots.

Electromagnetic Spectrum Management: With the proliferation of electronic warfare threats, there will be a growing focus on electromagnetic spectrum management. Military aviation sensors and switches will incorporate advanced spectrum monitoring and management capabilities to counter jamming, interference, and cyber threats, ensuring the integrity and effectiveness of communications and sensor systems.

Environmental Adaptability: Military aviation operations often take place in harsh and unpredictable environments, from extreme temperatures to high-altitude conditions. Future sensor and switch technologies will prioritize environmental adaptability, incorporating ruggedized designs, temperature-resistant materials, and advanced cooling systems to ensure reliable performance in any operational scenario.

In conclusion, the military aviation sensors and switches market is characterized by continuous innovation, driven by the imperative to enhance operational capabilities and maintain strategic advantage in an increasingly complex security environment. By harnessing the power of advanced sensor and switch technologies, defense organizations can optimize mission outcomes and ensure the safety and effectiveness of military aviation operations.

#military aviation#aerospace#defence#sensors#switches#technology#innovations#market research#market trends#business insights

0 notes