#Industrial Rubber Products Market volume

Explore tagged Tumblr posts

Text

British presence in the Straits Settlements […] (Penang, Singapore and Melaka) as a whole opened the way […]. Governor Andrew Clarke [...] clearly intended that economic botany should follow the quest for tin. Hardly three months after the [signing of the treaty legitimising British control in Malaya] [...] the Governor pressed Lord Carnarvon, Secretary of State for the Colonies, himself a keen botanist and collector, for the services of a ‘scientific botanist’. [...] Intimate plant knowledge among local [people] [...] assisted the discovery of many [plants valuable to European empire] [...] and the absorption of a number of vernacular names such as kempas (Koompassia), pandan (Pandanus) and nipah (Nypa) into scientific nomenclature. Equally, indigenous names for timbers, pre-eminently meranti and cengal, attained the status of trade names on the international market. Malay knowledge [...] proved also invaluable for commerce and [...] industries.

The Great Exhibition of 1851 at the Crystal Palace in Hyde Park, which displayed representative samples of colonial resources, was a microcosm of empire. Empire [...] co-sponsored the surveying, mapping and inventorying of people, lands and products for the ends of imperial power. Tropical nature, once a source [...] of wonderment, was brought to the domestic market place.

High on the imperial economic agenda were the Malayan territories, the source of gutta percha (from Palaquium gutta). Ingeniously adapted by the Malays [...], the plastic qualities of gutta percha were investigated for medical and industrial use by the [English East India] Company surgeons, T. Mongtomerie (1819-43) and T. Oxley (1846-57). [...] At the same time Oxley successfully pioneered the use of gutta percha for plastering fractures and preserving vaccine, the latter hitherto unable to be kept even for a few days. When a Prussian artillery Officer [...] then perfected its use for insulating telegraph cables, the product immediately gained strategic importance for the empire. Similar adaptations of other indigenous uses of plants paid dividends to industry and agriculture. [...]

---

The emergence of Hevea rubber in the Peninsula, superseding gutta percha as an industrial product was, again, the result of scientific exchange within the close-knit colonial botanical network [...] [following] [t]he illegal exportation by Kew [Royal Botanic Gardens in London] of the seedlings from South America to Ceylon and the Singapore Botanic Gardens [...]. Out of the seedlings sent in 1877 to Singapore, seven were planted by Hugh Low in the Perak Residency Garden. These and those raised in the Botanic Gardens furnished the seeds for the first plantations.

Though an introduced species, indigenous knowledge [...] of a wide variety of gums and exudates [...] benefited the plantation industry.

This [...] scored a major triumph for the colonial plantation industry. [...]

Large areas of Melaka had already been laid to waste by [...] a fast-growing variety of Brazilian cassava introduced in 1886 by Cantley.

The same cultivators soon turned the Imperata grasslands to rubber, but its rapid spread meant that a number of native plant species either became very rare or were entirely exterminated. The wild ancestor of the domestic mangosteen (Garcinia mangostana) is a likely example. [...] During his visit to Singapore in 1854 Wallace identified, within just a square mile, some 700 species of beetles [...].

---

All text above by: Jeyamalar Kathirithamby-Wells. "Peninsular Malaysia in the context of natural history and colonial science." New Zealand Journal of Asian Studies Volume 11 Number 1. 2009. [Bold emphasis and some paragraph breaks/contractions added by me. Presented here for commentary, teaching, criticism purposes.]

#abolition#ecology#plantations#imperial#colonial#tidalectics#extinction#archipelagic thinking#victorian and edwardian popular culture#intimacies of four continents#malaya plantations

64 notes

·

View notes

Text

Prices were collapsing worldwide on the brink of the Great Depression, and this induced a price war among the major oil companies. Like the other leading oil companies, AIOC had two options: compete to win new markets for investment or set up joint ventures with other companies and divide markets among them. In response, AIOC actively pursued a parallel policy on world oil production, prices, and synthetic fuel technology. In August 1928, during the same period as his meeting with Iranian government officials in Switzerland, [John Cadman, chairman of AIOC] traveled to Achnacarry, Scotland, and agreed with the heads of the major international oil companies such as Standard Oil of New Jersey, Royal Dutch / Shell, Gulf Oil, and Standard Oil of Indiana to enter into a “Pool Association” or “As-Is” agreement. This monopoly arrangement was designed to manage the glut of oil supplies by establishing a uniform selling price so that participants would not have to worry about price competition. The group agreed to control world oil production as well, enabling the companies to increase their output above volumes indicated by their market quotas, but only so long as the extra production was sold to the other pool members.

The “As-Is” agreement additionally formed part of a much larger “hydrocarbon cartel” concerning not just oil but the chemical and coal industries. The goal was to control the chemical industry and block the coal industry from accessing the patented use of a hydrogenation technology known as the Bergius process that could be used to convert coal into oil and develop synthetic fuels. The agreement ensured that chemical firms were blocked from using the new technologies to make chemicals, synthetic rubbers, and fuels from the conversion of coal into synthetic oil. Such arrangements would help maintain a particular economy of oil through the construction of an artificial system of scarcity.

Katayoun Shafiee, Machineries of Oil: An Infrastructural History of BP in Iran, 2018

2 notes

·

View notes

Text

Features, Applications and Advantages of PTFE Gaskets and Sheets in Industrial Applications

Polytetrafluoroethylene (PTFE) stands as an exceptional material because industries select it extensively for its notable industrial properties. Experts consistently praise PTFE gaskets and sheets for their chemical resistance, temperature endurance, and versatility. This article explores six key advantages of PTFE gaskets and sheets and their significant role in industrial processes.

1-Exceptional Chemical Resistance

One of the primary reasons industries rely on PTFE gaskets and sheets is their unparalleled chemical resistance. PTFE maintains its chemical stability when it comes in contact with extreme acids, bases and solvents. PTFE stands out because it does not weaken or change poorly in extreme chemical situations thus providing chemical processing industries with durable and efficient components.

2-High-Temperature Resistance

PTFE proves suitable for metallurgy and food processing as well as chemical manufacturing because it withstands very high temperatures. The temperature threshold of PTFE allows it to withstand heat levels reaching 260°C (500��F). PTFE presents an excellent material solution because its thermal stability allows usage in hot fluid applications that exceed typical material tolerances.

3-Versatility for Diverse Applications

PTFE gaskets and sheets are available in a wide range of compositions and manufacturing variations. Specific operational needs drive customization of the material which provides different thicknesses alongside fillers and allows production of compressed sheets and silicone variations. Additionally, PTFE gaskets can be tailored for various pipe sizes and flange connections, ensuring their adaptability across industries.

4-Non-Corrosive and Non-Contaminating Properties

Institutions which manage difficult chemical substances must address corrosion as their main operational challenge particularly in pharmaceutical settings and chemical processing facilities. PTFE exhibits complete resistance to corrosion along with waterproof properties and it acts as a non-damaging material in sealing applications because of its non-contaminating properties. First class sealing performance is achieved through its non-wetting nature that diminishes leaks and safeguards process stability.

5-Superior Electrical and Thermal Insulation

The insulating properties of PTFE matter most in use cases that need stable electrical behavior and resistance to heat. Unlike conventional materials, PTFE gaskets do not absorb heat easily, making them suitable for high-temperature industrial processes. Specialized PTFE gaskets and sheets can be further engineered to meet higher insulation demands, offering enhanced protection and efficiency.

6-Easy Availability and Customization

PTFE materials exist in ample volumes throughout the market allowing industries to acquire personalized gaskets and sheets according to their particular needs. Users now can send exact requirements to manufacturing firms who make customized PTFE parts based on application needs with modern manufacturing procedures. PTFE offers straightforward custom ability options which has made it an adaptable solution for industrial use.

PTFE Envelope Gaskets: Features and Applications

The design of a PTFE envelope gasket involves surrounding an inner inlay material with PTFE material. The combined structure of PTFE material enables effective use in the sealing of enamel flanges beside plastic pipes and rubber or steel flanges. The selection of inlay materials within PTFE envelope gaskets determines how well the gaskets perform in industrial sealing instances.

Properties of PTFE Envelope Gaskets

The material stands up against chemical decay during aggressive environmental exposures because of its corrosion-resistant properties.

PTFE envelope gaskets demonstrate extended lifespan because they naturally age slowly and protect their structural composition over lengthy usage durations.

The envelope gasket demonstrates superior ability to handle high pressure because it works with low surface pressure.

PTFE envelope gaskets possess the ability to alter their shape through molding so users can create customized gaskets for specific requirements.

The sealing material simplifies the operations involved in handling since its installation occurs easily and its transportation and dismantling requirements are streamlined.

Contamination Prevention: Ensures product purity, essential for pharmaceutical and food applications.

The material shows excellent performance as an insulator because it maintains temperature stability along with electrical insulation properties.

This material enables adequate flexibility alongside efficient sealing performance during conditions of change.

Applications of PTFE Envelope Gaskets

PTFE Envelope Gaskets use Gas and Liquid Sealing capabilities which create a low leakage rate suitable for gaseous and liquid element sealing applications.

The material fits high-temperature as well as high-pressure industrial settings which require materials that deal well with intense conditions.

The food-grade approval from the FDA has established PTFE Envelope Gaskets as an optimal choice for applications within food and pharmaceutical sectors.

Compatibility with Various Flanges: Works well with rubber, plastic, and enamel flanges.

This material serves well in applications that need high chemical corrosion resistance.

The material creates a cleanroom and hygienic environment which maintains safety through contamination prevention and meets both hygiene requirements.

Tension-sensitive flanges work best to meet requirements that need flexible and responsive sealing functions.

Conclusion

PTFE gaskets and sheets provide unparalleled benefits, from chemical and temperature resistance to versatility and ease of customization. Business operations that need superior sealing capabilities combined with resistance to contamination along with high durability continue to use PTFE materials as their principal operational component. Whether using standard PTFE gaskets or specialized PTFE envelope gaskets, businesses can ensure efficiency, safety, and reliability in their processes.

0 notes

Text

Barite Market: Key Challenges and Opportunities in the Industry

The global barite market size is expected to reach USD 2.13 billion by 2030, expanding at a CAGR of 5.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is projected to be driven by the growing investments in the oil & gas sector and rising demand from industries, such as paints & coating, chemicals, cosmetics, plastics, cement, and rubber. The flourishing oil & gas industry directly fuels the demand for barite, which finds use as a weighting agent in drilling mud formulations. Energy demand worldwide has increased abruptly owing to the growing global population. The rising population has led governments to invest increasingly in enhancing their energy generation capacity, which in turn, is boosting investments in onshore and offshore oil & gas exploration activities to cater to the growing global energy demand. A rise in drilling activities is eventually expected to augment barite consumption.

Furthermore, the product is also used in medical applications, power plants, laboratories, and pharmaceutical units. It is used in special X-ray tests wherein it acts as a shielding material. It is also employed for carrying out different medical tests, such as CT scans. Growing expenditure on healthcare is expected to positively influence market growth. For instance, the U.S. healthcare expenditure rose by around 30% from 2017 to 2022.Market players are adopting strategic initiatives, such as mergers & acquisitions, to expand their presence and capacity. To meet the new rising demand, key players are focusing on R&D for innovations, technologies, and recognition. For instance, in October 2021, The Nigerian Ministry of Mines and Steel Development introduced made-in-Nigeria barite. The product remains largely untapped in the region, and its production will save the country from importing it and also put Nigeria on the radar of the global mining communities

Gather more insights about the market drivers, restrains and growth of the Barite Market

Barite Market Report Highlights

• Based on application, the chemicals segment is expected to grow at the fastest CAGR of 5.4%, in terms of revenue, over the forecast period. The growth is attributed to its unique properties that include low oil absorption, chemical inertness, and insolubility

• The oil & gas segment accounted for the largest revenue share of over 76.0% in 2023. Barite is used as a weighting agent in fluids for drilling mud

• North America dominated the market with a revenue share of more than 40.0% in 2023. Growing investments in oil & gas exploration activities in the U.S. are propelling product demand

• Middle East & Africa is expected to register a CAGR of 4.3%, in terms of revenue, over the forecast period. It is one of the key oil & gas producers in the world, which makes barite demand high in the region

Barite Market Segmentation

Grand View Research has segmented the global barite market based on application, and region:

Barite Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Oil & Gas

• Chemicals

• Fillers

• Others

Barite Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o Russia

o Turkey

• Asia Pacific

o China

o Japan

o India

o South Korea

• Central & South America

o Brazil

o Colombia

o Argentina

o Venezuela

• Middle East & Africa

o Saudi Arabia

o Morocco

Order a free sample PDF of the Barite Market Intelligence Study, published by Grand View Research.

0 notes

Text

Zinc Oxide Market Elasticity Factors Impacting Demand, Supply, Pricing, and Growth Prospects Worldwide

The zinc oxide market plays a vital role in industries such as rubber, cosmetics, pharmaceuticals, and electronics. The elasticity of this market is influenced by various factors, including demand-supply dynamics, raw material costs, technological innovations, and regulatory frameworks. Understanding these elasticity factors helps businesses and investors anticipate market shifts and optimize their strategies for profitability.

1. Demand-Supply Dynamics

Market elasticity is significantly shaped by demand-supply imbalances. Zinc oxide is widely used in rubber manufacturing, personal care products, and coatings, leading to fluctuations in demand across different sectors. Key factors influencing demand include:

Growth in the automotive industry, increasing the need for ZnO in tire production.

Expansion of the cosmetics and skincare market, driving demand for zinc oxide in sunscreens and ointments.

Technological advancements in electronics, where ZnO is used in semiconductors and sensors.

On the supply side, disruptions in zinc ore mining, geopolitical factors, and trade policies affect the availability of zinc oxide, leading to price volatility.

2. Price Sensitivity and Raw Material Costs

Price elasticity of zinc oxide depends on raw material availability and production costs. Since zinc oxide is derived from zinc ore, fluctuations in zinc prices directly impact ZnO pricing. Factors affecting price elasticity include:

Mining regulations and environmental policies, restricting zinc ore extraction.

Energy and labor costs, influencing manufacturing expenses.

Alternative materials replacing ZnO in certain applications, affecting market stability.

Higher production costs make ZnO less elastic, meaning price increases may reduce demand in cost-sensitive industries.

3. Technological Innovations and Substitutes

Advancements in nanotechnology and eco-friendly ZnO production methods have made the market more adaptable. However, the availability of substitutes like titanium dioxide (TiO2) in cosmetics and silica in rubber production impacts the demand for ZnO. Factors affecting elasticity in this domain include:

Research on high-performance ZnO nanoparticles, expanding its use in electronics and healthcare.

Development of synthetic alternatives, reducing dependency on natural zinc oxide.

Sustainability concerns, leading to innovations in greener production methods.

4. Regulatory Policies and Trade Restrictions

Government regulations on zinc mining, emissions, and product safety standards also affect market elasticity. Stringent environmental laws can limit production, while tariffs and trade restrictions can impact international supply chains. Key influences include:

REACH regulations in Europe, controlling ZnO usage in consumer goods.

US and China trade policies, affecting import-export volumes.

Sustainable production incentives, encouraging the use of recycled zinc.

5. Macroeconomic Trends and Global Market Conditions

Macroeconomic factors like inflation, economic downturns, and currency fluctuations influence purchasing power and industrial production, thereby affecting ZnO market elasticity. Some key economic factors include:

Recession risks, leading to reduced industrial activity and lower ZnO consumption.

Currency exchange rates, impacting global trade and pricing strategies.

Infrastructure development, increasing ZnO demand in coatings and construction materials.

Conclusion

The elasticity of the zinc oxide market is driven by multiple interdependent factors, including supply chain constraints, price volatility, technological innovations, regulatory frameworks, and economic conditions. A thorough understanding of these factors is crucial for businesses and investors aiming to navigate market fluctuations and capitalize on emerging opportunities.

0 notes

Text

Custom Recycling Solutions for Tire Manufacturers

The tire manufacturing industry faces a dual challenge: meeting the growing demand for high-quality tires while managing the environmental impact of tire production and disposal. As global awareness of sustainability continues to rise, the importance of effective tire recycling solutions has never been greater. Recycling services designed to adapt to the unique needs of tire manufacturers can play a critical role in achieving both environmental and business goals.

We will explore how custom recycling solutions can meet the diverse requirements of tire manufacturers, ensuring efficient, sustainable, and cost-effective waste management practices.

The Importance of Tire Recycling

Tires are made from a combination of rubber, steel, and synthetic materials, which can pose significant environmental challenges when discarded improperly. Millions of tires end up in landfills annually, contributing to pollution, fire hazards, and long-term environmental degradation. By implementing tailored tire recycling solutions, manufacturers can:

Minimize their environmental footprint.

Comply with regulatory requirements.

Recover valuable materials for reuse.

Enhance their brand reputation as eco-conscious businesses.

Challenges Faced by Tire Manufacturers in Recycling

Every tire manufacturer operates differently, with specific production methods, material compositions, and waste generation patterns. As a result, standard recycling programs often fall short of addressing their unique needs. Some common challenges include:

Complex Material Composition: Tires contain multiple materials like rubber, steel, and textiles that require specialized recycling processes.

Volume Variability: Recycling needs may fluctuate based on production cycles, making it essential to have scalable solutions.

Logistics Management: Transporting large quantities of scrap tires can be logistically challenging and expensive.

Regulatory Compliance: Different regions have varying recycling and waste disposal regulations that manufacturers must adhere to.

Custom recycling solutions are designed to tackle these challenges by offering flexibility and innovation tailored to the specific needs of each manufacturer.

Key Features of Custom Recycling Solutions

Material Recovery Optimization

Custom recycling services focus on maximizing the recovery of valuable materials like rubber and steel from scrap tires. Advanced technologies, such as cryogenic grinding and devulcanization, can be employed to break down materials for reuse in new products, reducing waste and cutting costs for manufacturers.

Scalable Recycling Programs

Tire recycling solutions can be tailored to accommodate varying production volumes. Whether a manufacturer generates a steady flow of scrap tires or experiences seasonal spikes, scalable recycling programs ensure consistent and efficient waste management.

On-Site Recycling Facilities

For large-scale manufacturers, setting up on-site recycling units can streamline operations and reduce transportation costs. Custom solutions can include the design and implementation of on-site facilities that process scrap tires into reusable materials directly at the manufacturing plant.

Sustainable End-Product Development

Recycled tire materials can be transformed into a variety of sustainable products, including:

Rubberized asphalt for road construction.

Playground surfaces and sports tracks.

Industrial mats and flooring.

Automotive components.

Recycling providers work closely with manufacturers to identify and develop end products that align with their business goals and market needs.

Regulatory Compliance Support

Custom recycling solutions also include assistance in navigating complex regulatory landscapes. Service providers help manufacturers stay compliant with local, national, and international recycling and waste management laws, reducing the risk of penalties and legal issues.

Efficient Logistics Management

Tailored logistics plans ensure that scrap tires are collected, transported, and processed efficiently. Recycling providers often use data-driven strategies to optimize routes, reduce costs, and minimize carbon emissions associated with transportation.

Benefits of Custom Recycling Solutions for Tire Manufacturers

By investing in customized tire recycling solutions, manufacturers can unlock numerous benefits:

Cost Savings: Recovering valuable materials from scrap tires reduces the need for raw materials, cutting production costs.

Environmental Impact: Diverting tires from landfills and repurposing them into new products minimizes pollution and conserves natural resources.

Operational Efficiency: Streamlined recycling processes reduce waste handling times and improve overall operational efficiency.

Enhanced Reputation: Demonstrating a commitment to sustainability boosts a manufacturer’s brand image and strengthens relationships with environmentally conscious customers and partners.

Long-Term Sustainability: By adopting circular economy practices, manufacturers can future-proof their operations and stay competitive in an increasingly eco-focused market.

Partnering with the Right Recycling Provider

Choosing the right partner is essential for implementing effective tire recycling solutions. Look for a recycling provider that offers:

Experience and Expertise: A proven track record in handling complex tire recycling projects.

Customized Services: Tailored programs that address your unique production and waste management needs.

Advanced Technology: Access to innovative recycling techniques and equipment.

Sustainability Focus: A commitment to eco-friendly practices and sustainable product development.

Comprehensive Support: End-to-end services, including logistics, compliance assistance, and material recovery. By partnering with the right recycling provider, manufacturers can not only address their unique challenges but also create a positive impact on the planet.

0 notes

Text

Combating Fire Risks: Analyzing the Global Flame Retardant Market

The global flame retardant market size is expected to reach USD 14.90 billion by 2030, registering a CAGR of 7.1% during the forecast period, according to a new report by Grand View Research, Inc. This growth can be attributed to the growing application scope in key end-use industries including automotive, electrical & electronics, transportation, construction, and others. In addition, increasing demand for these products in applications, such as polyolefin, Engineering Thermoplastics (ETP), epoxy resins, Polyvinyl Chloride (PVC), and rubber, coupled with the presence of favorable government regulations, especially in Asia Pacific, North, America, and Europe, will drive the market in the coming years.

Halogenated products, including brominated, chlorinated, phosphate-based, and antimony trioxide-based, are widely used in various applications, such as printed wiring boards, wires & cables, floorings, flexible polyurethane foams, polyolefins, polyamides, wall sheeting, refrigeration, and others. The demand for environmentally friendly products, such as non-halogenated flame retardants, is growing at a rapid pace. The Asia Pacific, North America, and Europe regions have emerged as the largest consumers owing to the presence of stringent environmental sustainability policies and the rising awareness about fire safety among consumers.

Phosphorus-based flame retardants, both chlorinated and non-halogenated, are extensively used in flexible and rigid polyurethane foams and the demand is anticipated to augment in the coming years. They have wide application prospects, and it is a vital part of inorganic flame retardants. These products can be divided into inorganic and organic phosphorous products. Asia Pacific holds a substantially high share owing to the increasing product penetration in the end-use industries including automotive, electrical & electronics, construction, and others. The markets in Asia Pacific are witnessing high production, especially in countries, such as India, China, Japan, and South Korea, owing to the growing emphasis on eco-labeled fire resistance products.

The COVID-19 pandemic has highly impacted the growth of the automotive and construction, sectors. The halting of manufacturing activities, slowing down of construction projects, and ongoing labor shortages owing to travel restrictions are expected to affect the demand for the products and their derivatives in construction applications over the forecast period. The global market is highly competitive due to the presence of a large number of multinationals that are engaged in constant R&D activities. Companies, such as BASF SE, Clariant, DuPont, DSM, Albemarle Corp., and LANXESS have a global presence and dominate the market due to a wide range of products for each application market. A majority of these companies have integrated their business operations across the value chain.

Flame Retardant Market Report Highlights

Asia Pacific was the dominant regional market in 2022 owing to the increased investments in the end-use industries, such as transportation and construction, especially in developing countries like India

The U.S. accounted for the largest share of the North America regional market in 2022 due to the large-scale production and rapid growth of the electrical & electronics, automotive, and construction sectors in the U.S.

The non-halogenated product segment accounted for the highest revenue as well as volume share in 2022 owing to increased environmental concerns and stringent government regulations

By application, Polyolefins segment accounted for the largest revenue share in 2022. Due to the growing use of polyolefins as plastics in numerous applications.

Flame Retardant Market Segmentation

Grand View Research has segmented the global flame retardant market based on product, application, end-use, and region:

Flame Retardant Product Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Halogenated

Brominated

Chlorinated Phosphates

Antimony Trioxide

Others

Non-Halogenated

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorus Based

Others

Flame Retardant Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Polyolefins

Epoxy Resins

UPE

PVC

ETP

Rubber

Styrenics

Others

Flame Retardant End-use Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Construction

Transportation

Electrical & Electronics

Others

Flame Retardant Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Norway

Asia Pacific

China

Japan

India

South Korea

Central & South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

South Africa

List of Key Players

Albemarle Corporation

ICL

LANXESS

CLARIANT

Italmatch Chemicals S.p.A

Huber Engineered Materials

BASF SE

THOR

DSM

FRX Innovations

DuPont

Order a free sample PDF of the Flame Retardant Market Intelligence Study, published by Grand View Research.

0 notes

Text

Global 2-Mercaptoethanol Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2030

2-Mercaptoethanol (also ß-mercaptoethanol, BME, 2BME, 2-ME or ß-met) is the chemical compound with the formula HOCH2CH2SH. 2-ME is a colorless liquid, with an amine-like odor. It is flammable and soluble in water and various organic solvents. 2-ME can be used as the intermediate in the production of PVC stabilizer, crop protection, pharmaceuticals, photographic chemicals, solvent and stabilizer, initial product for chemical syntheses, water treatment and corrosion inhibitor. According to our (Global Info Research) latest study, the global 2-Mercaptoethanol market size was valued at USD 81 million in 2022 and is forecast to a readjusted size of USD 99.1 million by 2030 with a CAGR of 2.9% during review period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes. Chevron Phillips Chemical, BASF and Sunion Chemical & Plastics are the top 3 players of 2-Mercaptoethanol, with about 96% market shares. 2-Mercaptoethanol can be divided into <99% type and ≥ 99% type, ≥ 99% type accounts for nearly 98%. The applications of 2-Mercaptoethanol are Consumer & Industrial Applications, Agrochemicals, Polymers and Rubber Applications, Water Treatment Applications and others. the market is mainly driven by growing demand for Polymers and Rubber Applications, accounts for nearly 39%.

Sample Plan: https://www.reportsintellect.com/sample-request/2911758 This report is a detailed and comprehensive analysis for global 2-Mercaptoethanol market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided. Key Features: Global 2-Mercaptoethanol market size and forecasts, in consumption value ($ Million), sales quantity (MT), and average selling prices (USD/MT), 2018-2030 Global 2-Mercaptoethanol market size and forecasts by region and country, in consumption value ($ Million), sales quantity (MT), and average selling prices (USD/MT), 2018-2030 Global 2-Mercaptoethanol market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (MT), and average selling prices (USD/MT), 2018-2030 Global 2-Mercaptoethanol market shares of main players, shipments in revenue ($ Million), sales quantity (MT), and ASP (USD/MT), 2018-2025

Inquire Plan: https://www.reportsintellect.com/discount-request/2911758 The Primary Objectives in This Report Are: To determine the size of the total market opportunity of global and key countries To assess the growth potential for 2-Mercaptoethanol To forecast future growth in each product and end-use market To assess competitive factors affecting the marketplace This report profiles key players in the global 2-Mercaptoethanol market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments. Key companies covered as a part of this study include Chevron Phillips Chemical, BASF and Sunion Chemical & Plastics. etc. This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence. Market Segmentation 2-Mercaptoethanol market is split by Type and by Application. For the period 2018-2030, the growth among segments provides accurate calculations and forecasts for consumption value by Type, and by Application in terms of volume and value. This analysis can help you expand your business by targeting qualified niche markets. Market segment by Type Below 99% Above 99% Market segment by Application Consumer & Industrial Agrochemicals Polymers and Rubber Water Treatment Others Major players covered Chevron Phillips Chemical BASF Sunion Chemical & Plastics Market segment by region, regional analysis covers North America (United States, Canada and Mexico) Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe) Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia) South America (Brazil, Argentina, Colombia, and Rest of South America) Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

0 notes

Text

Japan Tyre Market Report 2031

The Japan tyre market was worth USD 13.05 billion in FY2022 and is further projected to reach USD 20.68 billion by the year FY2030, growing at a CAGR of 5.9% during the forecast period. Increasing production and demand for vehicles, escalation in vehicle ownerships, increased tyre manufacturer competitiveness, and technological advancements contributed to the growth of the Japan tyre market. In addition, the increasing population, rapid urbanization, transition to the nuclear family structure, and better purchasing power of the consumers also contributed to shaping the market growth. Post COVID-19, in many emerging industries and e-commerce businesses, companies are now offering to provide home delivery and transportation solutions to its customers and clients, which has in turn increased the production of commercial vehicles like trucks, tractors and trailers, and therefore, boosting the revenues of tyre companies in Japan.

Japan’s vehicle manufacturing capacity is constantly rising. The Japanese consumers understand that having the right vehicle tyre can enhance the fuel efficiency, handling and overall safety. The price, total life (in kilometres), safety & grip, ruggedness, and fuel efficiency offered by the tyre are some of the key factors that the customers consider while making purchasing decision. The government of Japan has set some standards for production with the aim of an efficient and sustainable environment. It encourages the public to buy more efficient and eco-friendly tyres for their vehicles.

However, factors such as fluctuating raw material prices and rising demand for tyre remoulding are anticipated to restrain the market’s expansion. Additionally, it is anticipated that improvements in the technology, fuel economy, and the growing popularity of electric cars would open a wide range of opportunities for the market growth.

Passenger Car Tyre Dominates the Japan Tyre Market

With the growing interest in small passenger cars by the Japanese population, the passenger car tyres has been experiencing significant growth with the largest market share in volumes across vehicle types. In the year FY2022, the tyre sales of passenger cars were at around 79791 thousands units, followed by light truck tyres and truck & bus tyres.

Replacement Tyres Have Significantly Contributed to the Market Growth

Due to their dense population, most of the Japanese cities provide significant challenges for drivers in terms of traffic and parking. Given the huge base of vehicle parc as Japan has traditionally been a matured automobile market with high vehicle ownership for several decades; the replacement tyre segment is the highest contributor holding 66.8% share in the total tyre market in terms of volume in FY2022.

Impact of COVID-19 on the Japan Tyre Market

Due to the outbreak of COVID-19 pandemic, the automotive sector witnessed several setbacks. The economic slowdown, lockdown and social distancing norms limiting public movement and stress on the business and employment sector had a negative impact on the disposable income of consumers which led to a major downturn in Japanese automobile and tyre industry. With the temporary shortage of raw materials in, operational challenges in production, manufacturing, supply chains, and testing caused decline in the Japan tyre market in 2020. Following the removal of COVID-19 restrictions in second half of 2020 and 2021, Japan’s automotive and tyre industry recorded a smart recovery.

Impact of Russia-Ukraine War on Japan Tyre Market

Russia and Ukraine war had triggered the slowdown in Japan tyre market, due to future uncertainties and ongoing supply chain issues. Japanese tyre manufacturer Bridgestone Corp., Ltd. had taken an exit from Russia. In March 2022, Bridgestone made the decision to halt all manufacturing operations and new investments in Russia. Along with Bridgestone, Michelin Group, and The Yokohama Rubber Company Limited have stopped their production in Russia.

Report Scope

“Japan Tyre Market Assessment, Opportunities and Forecast, 2016-2030F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative & quantitative assessment of the current state of the tyre market in Japan, industry dynamics and challenges. The report includes market size, segmental shares, growth trends, COVID-19 and Russia-Ukraine war impact, opportunities, and forecasts (2023-2030). Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

click here for full report- https://www.marketsandata.com/industry-reports/japan-tyre-market

Latest reports-

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

0 notes

Text

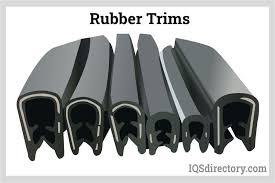

What Are The Key Advantages Of Rubber Extrusion Profiles?

Regarding manufacturing and engineering. Rubber extrusion profilesare gaining popularity. Many industries show interest in them. They are especially common in the automotive and construction sectors. These profiles have unique benefits.

In this article, we delve into the advantages of rubber extrusion profiles. We will explore why they’re favored in manufacturing. We will discuss how they are beneficial for your projects.

What Are Rubber Extrusion Profiles?

Let’s first clarify what these profiles are. The process involves forcing rubber material through a die. This creates continuous shapes. Shapes possess specific cross-sections. This is what the rubber extrusion process achieves. It allows manufacturers to produce

various products. These include seals and gaskets. They also make tubing and custom shapes. Shapes are tailored to specific needs.

Key Features of Rubber Extrusion Profiles

Customizability: One standout feature is their ability to be customized. Manufacturers can create custom profile extrusions. They meet precise specifications for different applications.

Diversity in Materials: Various types of rubber can be used in the extrusion process. This includes natural rubber and silicone. Also, neoprene and more. This diversity allows for tailored properties. Properties such as temperature resistance and flexibility. Also durability.

The Incredible Benefits of Rubber Extrusion Profiles

Design Flexibility That Defies Imagination

The most exceptional advantage is almost limitless design potential. Manufacturers can create custom-designed rubber components. These would be impossible or very expensive through other manufacturing methods whether a complex seal with multiple inner channels is needed. Or a unique profile with differing wall thicknesses. Extrusion makes it achievable.

Picture yourself designing a rubber seal that needs to fit perfectly. It should fit into an automotive engine compartment. This seal should have precise curves. Also, tight tolerances. Specialized functional features must be included. Custom rubber extrusionallows engineers to bring these designs to life. They can do so with remarkable accuracy.

Cost-Effectiveness at Scale

Large-volume production is the domain of rubber extrusion. It becomes incredibly economical. Initial die creation is necessary. After that, producing thousands, maybe even millions, of rubber profiles becomes cost-effective. The continuous nature of the extrusion process eliminates material waste. Rapid production speeds become possible.

For businesses that seek to create specialized components, cost-effectiveness means lower per-unit costs. Faster time-to-market becomes a reality. It’s almost like having a rubber profile production superhighway. It’s efficient. It’s quick. It’s precise.

Material Versatility

Rubber isn’t uniform. Extrusion technology grasps this perfectly. Different rubber compounds feature in this understanding. These range from natural rubber to specialized synthetic elastomers. They all can play a role in the extrusion process. This allows manufacturers to choose materials with specific properties. These properties include the following:

High-temperature resistance

Chemical compatibility

UV resistance

Flexibility across different environmental conditions

Specific durometer (hardness) requirements

Exceptional Consistency and Quality Control

Some production processes display substantial variations across production runs. This is not the case with rubber extrusion. This process delivers astonishing uniformity. Today’s extrusion lines boast state-of-the-art sensors and checks. This technology ensures that each profile meets precise requirements.

This process is akin to a master chef. This chef crafts identical pastries, batch after batch. Just like the chef, each rubber profile emerges from the line. It looks and functions like its predecessor. This uniformity is essential in critical sectors. Sectors such as aerospace medical devices and auto manufacturing. Where exactness is key.

Complex Cross-Sectional Geometries

One of the most impressive benefits of these profiles is the ability to create complex

cross-sectional shapes. Other manufacturing methods might find it challenging or impossible to do. They include:

Hollow sections

Multi-layered profiles

Profiles with internal channels

Intricate sealing lips

Profiles with varying wall thicknesses

Rapid Prototyping and Development

New rubber parts are developed much faster and cheaper now due to advancements in extrusion technologies. Techniques of computer-aided design (CAD) and cutting-edge

die-making methods are used. Engineers can now change from mere concept to the creation of a finished product with much more ease.

For companies that require custom extrusions, it means that innovation cycles speed up. These companies now have the ability to adapt promptly to market demands. They can also respond quickly to complex engineering issues.

Enhanced Performance Characteristics

Rubber extrusion is not only about forming a shape. It is about scientifically crafting a performance. Through the careful selection of compounds, manufacturers can create rubber components with:

Superior sealing capabilities

Reduced friction

Enhanced wear resistance

Improved thermal stability

Specific compression and rebound characteristics

Real-World Applications

Appreciation of these profiles is better by understanding their advantages. Let’s delve into some intriguing real-world applications.

Automotive Industry: Weather stripping, window seals, engine gaskets

Medical Devices: Specialized tubing, precision seals

Construction: Expansion joint seals, window and door weatherproofing

Electronics: Protective gaskets, vibration dampening components

Aerospace: Specialized sealing solutions for extreme environments

Conclusion

Rubber extrusion profiles encapsulate a merging of material science engineering accuracy and production innovation. These profiles tackle intricate design hurdles. Simultaneously they bring about remarkable adaptability, evenness, and efficiency.

In the next instance, you encounter a precisely engineered rubber component. Pause for a moment. Consider the astonishing technology associated with its genesis, whether it’s the smartphone within your grasp. Or the vehicle you operate, it is likely you reap benefits from the wonder of rubber extrusion. We are Custom Rubber Extrusions. Today. Reach out today. Call our expert team. Dial at (647) 294-5240. Alternatively, send us an email. Our email address is [email protected].

#advantages-of-rubber-extrusion-profiles#rubber-extrusion-profiles#custom-profile-extrusions#custom-rubber-extrusion

0 notes

Text

Vikas Lifecare Limited Expands Horizons with a New Manufacturing Facility Under Rajasthan Investment Promotion Scheme

Vikas Lifecare Limited (VLL), a name synonymous with innovation and sustainable growth, has taken a significant leap forward with the establishment of a cutting-edge manufacturing facility in Shahjahanpur RIICO Industrial Area, Rajasthan. This new development reflects the company's strategic vision and commitment to leveraging government-backed initiatives for sustainable expansion and regional development.

The manufacturing facility, sprawling across 20,000 square feet, is set to commence operations by the end of December 2024. Specializing in advanced commodity compounds such as EVA, ATH, Thermoplastic Rubber, and Thermoplastic Elastomer, the unit will have a production capacity of 5,000 MTPA. This state-of-the-art facility is expected to generate an additional INR 400-500 million in annual revenue, significantly enhancing VLL’s market presence and competitive edge.

The initiative aligns seamlessly with the Rajasthan Investment Promotion Scheme (RIPS), a progressive government program designed to stimulate industrial growth within the state. RIPS offers a spectrum of fiscal benefits, including a 9% SGST refund for products manufactured and sold within Rajasthan. Moreover, companies availing RIPS incentives enjoy additional perks such as employment-linked subsidies, exemptions from electricity duty and land tax, as well as potential capital investment and interest subsidies. By leveraging these incentives, Vikas Lifecare not only aims to boost profitability but also contribute meaningfully to the socio-economic upliftment of the region.

About Vikas Lifecare Limited Vikas Lifecare Limited, listed on both NSE and BSE, has earned its reputation as an ISO 9001:2015 certified entity dedicated to manufacturing and trading polymer and rubber compounds, as well as specialty additives for plastics and synthetic rubber. The company is a forerunner in environmental stewardship, producing upcycled compounds from industrial and post-consumer waste materials. These initiatives align with India's sustainability goals, particularly the Extended Producer Responsibility (EPR) obligations mandated for industries consuming large volumes of plastic products.

VLL’s innovation extends beyond polymers and rubber. Its subsidiary, Genesis Gas Solutions Pvt. Ltd. (GGSPL), commands approximately 20% of India's domestic gas metering market, supplying smart gas meters to major gas distribution companies. Genesis is also collaborating with Indraprastha Gas Limited (IGL) under the joint venture IGL Genesis Technologies Limited, which aims to manufacture advanced gas meters with cutting-edge LORA WAN technology. This joint venture underscores VLL’s commitment to technological advancement and indigenous manufacturing, with operations for the new plant set to begin in FY 2024-25.

Expanding Horizons In a dynamic pivot, Vikas Lifecare has diversified its portfolio beyond B2B raw material production, venturing into the B2C space with an array of consumer products spanning FMCG, agriculture, and infrastructure. These strategic moves, coupled with acquisitions, joint ventures, and partnerships, underscore the company’s ambition for aggressive growth.

Notably, Vikas Lifecare has also forayed into the entertainment industry, announcing its venture into film production. This bold step highlights the company's adaptability and creative vision, as it seeks to deliver compelling cinematic content to audiences globally.

A Vision for the Future As Vikas Lifecare continues to expand across diverse industries, it remains steadfast in its commitment to innovation, sustainability, and value creation for stakeholders. The establishment of the new manufacturing facility in Rajasthan marks another milestone in its journey toward achieving long-term business growth. By blending expertise in industrial manufacturing with forward-looking strategies, VLL is carving a path toward a brighter, more sustainable future for its operations and the communities it serves.

With its robust foundation and clear vision, Vikas Lifecare Limited is poised to redefine its industry footprint, delivering unparalleled value and shaping the future with creativity and innovation.

0 notes

Text

Rubber Engineering Factory in Malaysia: A Hub of Quality and Innovation

When it comes to the world of rubber manufacturing, KENNWU, a premier Rubber Engineering Factory in Malaysia, stands out as a trusted name in the industry. With years of expertise, advanced technology, and a commitment to excellence, KENNWU has carved a niche for itself, providing high-quality rubber components tailored to various industries.

Why Choose Malaysia for Rubber Engineering?

Malaysia is globally recognized as one of the largest producers of natural rubber. Its robust infrastructure and access to raw materials make it an ideal hub for rubber engineering factories. KENNWU leverages this strategic advantage to provide cost-effective and high-performing rubber products for local and international markets.

KENNWU: Leading the Rubber Engineering Industry

At KENNWU, we specialize in the manufacturing and engineering of precision rubber components. Our expertise spans across various industries, including automotive, construction, healthcare, and electronics. As a leading Rubber Engineering Factory in Malaysia, we ensure every product meets stringent quality standards.

State-of-the-Art Facilities

Our factory is equipped with cutting-edge machinery and technology, enabling us to produce a diverse range of rubber products. Whether it’s custom molds or high-volume production, our facilities are designed to handle projects of any size and complexity.

Comprehensive Rubber Solutions

KENNWU offers a wide array of services, making us a one-stop solution for all rubber engineering needs:

Custom Rubber Molding: Tailored solutions for unique industrial requirements.

Rubber Extrusion: High-precision components for various applications.

Rubber-to-Metal Bonding: Advanced techniques for enhanced durability.

Material Development: Innovative formulations to meet specific performance criteria.

Sustainability and Eco-Friendly Practices

At KENNWU, we take our environmental responsibilities seriously. As a forward-thinking Rubber Engineering Factory in Malaysia, we incorporate eco-friendly practices into our manufacturing processes. From reducing waste to using sustainable materials, we are committed to minimizing our ecological footprint.

Industries We Serve

Our products cater to a wide range of industries, showcasing the versatility and quality of our rubber engineering expertise:

Automotive: Rubber gaskets, seals, and vibration dampeners.

Healthcare: Medical-grade rubber components.

Electronics: Insulation and protective materials.

Construction: Durable and weather-resistant rubber solutions.

Commitment to Quality

KENNWU takes pride in delivering products that exceed customer expectations. Our quality assurance team ensures that each product undergoes rigorous testing, guaranteeing reliability and performance. As a trusted Rubber Engineering Factory in Malaysia, we adhere to international standards, making us a preferred partner for clients worldwide.

Partner with KENNWU Today

If you’re looking for a dependable Rubber Engineering Factory in Malaysia, KENNWU is your go-to solution. With a proven track record, state-of-the-art facilities, and an unwavering commitment to quality, we are equipped to handle all your rubber manufacturing needs.

0 notes

Text

U.S. Carbon Dioxide Market: Key Trends and Innovations Driving Industry Growth

The U.S. carbon dioxide market size is expected to reach USD 6.59 billion by 2030, registering a CAGR of 8.4% over the forecast period, according to a new report by Grand View Research, Inc. Increasing usage of carbon dioxide for Enhanced Oil Recovery (EOR) in oil & gas plants is anticipated to result in the growth of the market. In terms of revenue, the hydrogen segment accounted for a significant share in 2021. The growth of this segment can be attributed to the presence of leading hydrogen-producing companies in the country that have CO2 manufactured as a byproduct during hydrogen production.

Substitute Natural Gas (SNG) is expected to be one of the major sources of the production of CO2 in the U.S. This is due to a rise in the discovery of natural gas reserves in the U.S. with the deployment of shale technology. The oil & gas application segment accounted for a significant share in 2021 owing to the application of carbon dioxide-based EOR in oil fields of the U.S. for efficient and effective oil production. Moreover, the usage of CO2 in the food & beverages and medical industries is anticipated to increase in the U.S. over the forecast period.

The growth of this segment can be attributed to the presence of a large base of food and beverage manufacturing facilities in the country, which is projected to expand further over the forecast period. The spread of COVID-19 hindered the growth of the market in 2020 and 2021 owing to the factors, such as the reduction in demand for CO2 in the country owing to lockdowns. However, an increase in demand for CO2 from the manufacturers of pharmaceuticals and essential commodities, such as fire safety products, has been witnessed in the U.S., as well as across the world.

Gather more insights about the market drivers, restrains and growth of the U.S. Carbon Dioxide Market

U.S. Carbon Dioxide Market Report Highlights

• In terms of revenue, the food & beverages application segment dominated the global market in 2021

• The hydrogen source segment accounted for the second-largest share of the global market revenue in 2021

• The growth of this segment can be attributed to the presence of leading hydrogen-producing companies in the country that have CO2 manufactured as a byproduct

• In terms of revenue, the SNG segment accounted for the maximum revenue share in 2021. SNG is derived from the gasification of coal and emits byproducts, such as CO2, hydrogen, carbon monoxide, and methane

• The rubber industry uses CO2 to clean the rubber molds and to remove flash from rubber objects by tumbling them with crushed dry ice in a rotating drum

U.S. Carbon Dioxide Market Segmentation

Grand View Research has segmented the U.S. carbon dioxide market based on source, application:

U.S. CO2 Source Outlook (Volume, Million Tons; Revenue, USD Million, 2019 - 2030)

• Hydrogen

• Ethyl Alcohol

• Ethylene Oxide

• Substituted Natural Gas

• Others

U.S. CO2 Application Outlook (Volume, Million Tons; Revenue, USD Million, 2019 - 2030)

• Food & Beverages

• Oil & Gas

• Medical

• Rubber

• Fire Fighting

• Others

Order a free sample PDF of the U.S. Carbon Dioxide Market Intelligence Study, published by Grand View Research.

#U.S. Carbon Dioxide Market#U.S. Carbon Dioxide Market Size#U.S. Carbon Dioxide Market Share#U.S. Carbon Dioxide Market Analysis#U.S. Carbon Dioxide Market Growth

0 notes

Text

Di-Ter-Butyl Phenol Prices Trend | Pricing | News | Database | Chart

North America

In Q3 2024, the Di-tert-butyl Phenol (DTBP) market in North America displayed price stability, underpinned by a balance between supply and demand. This steadiness stemmed from several key factors. A primary influence was the subdued demand from downstream industries such as plastics, coatings, and solvents—sectors that typically consume significant volumes of DTBP. Additionally, trading activities remained sluggish as market participants adopted a cautious stance amidst broader economic uncertainties. The price of Phenol, the primary feedstock for DTBP, also stayed weak in the American market, helping to maintain low production costs and supporting overall price stability. While some improvements were noted in the construction and solvent-related industries, the demand for DTBP continued to be restrained. Market participants relied on existing inventories to meet domestic requirements, avoiding overstocking and excessive purchases. This cautious approach contributed to the steady pricing of DTBP throughout the quarter, reflecting a balanced supply-demand dynamic. Overall, DTBP prices in North America remained stable, fluctuating within a narrow range due to these market conditions.

APAC

In Q3 2024, the Di-tert-butyl Phenol (DTBP) market in the APAC region witnessed a notable price surge driven by strong demand from key industrial sectors, including plastics, rubber, coatings, and adhesives. The market faced supply constraints, exacerbating the supply-demand imbalance and fueling the price uptrend. India, in particular, experienced significant price increases due to heightened demand across multiple sectors, compounded by seasonal factors and robust industrial activity. Elevated raw material costs further contributed to the upward pricing pressure. The synchronization of price trends across the APAC region was evident, with India serving as a key driver. Despite challenges such as plant shutdowns [specific plant names could be mentioned if available], the region's pricing environment remained bullish. By the end of the quarter, the price of 2,6 Di-tert-butyl Phenol CFR JNPT in India reached USD 1879/MT, marking a steady progression in price increases throughout the period.

Get Real time Prices for Di-tert-butyl Phenol (DTBP): https://www.chemanalyst.com/Pricing-data/di-ter-butyl-phenol-1566

Europe

In Q3 2024, the European market for 2,6 Di-tert-butyl Phenol experienced a significant price decline, driven by a combination of logistical and geopolitical challenges. Escalating global logistics costs, particularly due to disruptions in the Red Sea region, played a central role. Conflicts in the area led to severe port congestion, equipment shortages, and increased operational expenses, creating cascading effects across supply chains. These logistical hurdles constrained the availability of 2,6 Di-tert-butyl Phenol, further complicating the market dynamics. Additionally, supply stability concerns weighed on market sentiment, contributing to fluctuating prices. Manufacturers faced difficulties in managing production schedules amidst these challenges, resulting in a bearish outlook for the European market. This interplay of geopolitical instability and logistical disruptions drove down prices during Q3 2024, highlighting the intricate dependencies within global supply chains that influence regional pricing trends.

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Di-Ter-Butyl Phenol#Di-Ter-Butyl Phenol Prices#Di-Ter-Butyl Phenol Price#Di-Ter-Butyl Phenol News#Di-Ter-Butyl Phenol Monitor

0 notes

Text

Disposable Gloves Market to Hit $18.94 Million by 2032

The global Disposable Gloves Market was valued at USD 12.62 Million in 2024 and it is estimated to garner USD 18.94 Million by 2032 with a registered CAGR of 5.2% during the forecast period 2024 to 2032.

Are you looking for the Disposable Gloves Market Research Report? You are at the right place. If you desire to find out more data about the report or want customization, Contact us. If you want any unique requirements, please allow us to customize and we will offer you the report as you want.

The global Disposable Gloves Market can be segmented on the basis of product type, Applications, distribution channel, market value, volume, and region [North America, Europe, Asia Pacific, Latin America, Middle East, and Africa]. The Disposable Gloves Industry 2024 report provides a comprehensive overview of critical elements of the industry including drivers, restraints, and management scenarios.

Download Sample PDF: @ https://www.vantagemarketresearch.com/disposable-gloves-market-1625/request-sample

Top Players

Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Unigloves (U.K.) Limited, The Glove Company, Superior Gloves, MAPA Professional, Adenna LLC, MCR Safety, Atlantic Safety Products Inc., Globus (Shetland) Ltd., Supermax Corporation Berhad, Kossan Rubber Industries BHD, Ammex Corporation, Kimberly-Clark Corporation, Sempermed USA Inc., Halyard Health Inc., Corporativo DL S.A. de C.V., Medline Industries Inc., Mölnlycke Health Care AB and others.

Trending 2024: Disposable Gloves Market Report Highlights:

A comprehensive assessment of the parent Industry

Development of key aspects of the business

A study of industry-wide market segments

Evaluation of market value and volume in past, present, and future years

Evaluation of market share

Tactical approaches of market leaders

Innovative strategies that help companies to improve their position in the market

You Can Buy This Report From Here: https://www.vantagemarketresearch.com/buy-now/disposable-gloves-market-1625/0

Analysis Of The Top Companies, Product Types, and Applications In The Market Report:

This report provides sales, revenue growth rate, and verified information about the major players. Also includes a regional analysis and a labor cost analysis, tables, and figures. It also highlights characteristics such as technological growth. The product type segment is expected to continue to maintain its leading position in the future and capture a significant market share based on sales. This report provides analysis, discussion, forecast, and debate on key industry trends, market share estimates, Industry size, and other information. This report also discusses drivers, risks, and opportunities.

Global Disposable Gloves Market report contains detailed data and analysis on the Disposable Gloves Market drivers, restraints, and opportunities. Experts with market and industry knowledge as well as research experience from regional experts validate the report. The Disposable Gloves Market report provides forecast, historical and current revenue for each industry, region, and end-user segment.

Regions Included

-North America [United States, Canada, Mexico]

-South America [Brazil, Argentina, Columbia, Chile, Peru]

-Europe [Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

-Middle East & Africa [GCC, North Africa, South Africa]

-Asia-Pacific [China, Southeast Asia, India, Japan, Korea, Western Asia]

Global Disposable Gloves Market report data will help you make more informed decisions. For example, in relation to prices, distribution channels are means of marketing or identifying opportunities to introduce a new product or service. These results will also help you make more informed decisions about your existing operations and activities.

Read Full Research Report with [TOC] @ https://www.vantagemarketresearch.com/industry-report/disposable-gloves-market-1625

You Can Use The Disposable Gloves Market Report To Answer The Following Questions:

What are the growth prospects of the Disposable Gloves Market business?

Who are the key manufacturers in the Disposable Gloves Market space?

What Forecast Period for Global Disposable Gloves Industry Report?

What are the main segments of the global Disposable Gloves Market?

What are the key metrics like opportunities and market drivers?

The Disposable Gloves Market Insights

Product Development/Innovation: Detailed Information On Upcoming Technologies, R&D Activities, And Product Launches In The Market.

Competitive Assessment: In-Depth Assessment Of Market Strategies, Geographic And Business Segments Of Key Market Players.

Market Development: Comprehensive Information On Emerging Markets. This Report Analyzes The Market For Different Segments In Different Regions.

Market Diversification: Comprehensive Information On New Products, Untapped Regions, Latest Developments, And Investments In The Disposable Gloves Market.

Check Out More Reports

Global Prescription Drugs Market: Report Forecast by 2032

Global Optoelectronic Components Market: Report Forecast by 2032

Global Beeswax Food Wrapping Paper Market: Report Forecast by 2032

Global 3D TSV Packages Market: Report Forecast by 2032

Global DC Circuit Breaker Market: Report Forecast by 2032

#Disposable Gloves Market#Disposable Gloves Market 2024#Global Disposable Gloves Market#Disposable Gloves Market outlook#Disposable Gloves Market Trend#Disposable Gloves Market Size & Share#Disposable Gloves Market Forecast#Disposable Gloves Market Demand#Disposable Gloves Market sales & price

0 notes

Text

Butadiene Market - Forecast(2024 - 2030)

Butadiene Market Overview

The Butadiene Market size is estimated at 12.11 million tons in 2023, and is expected to reach 15.94 million tons by 2030, growing at a CAGR of 3.71% during the forecast period (2024–2030). Butadiene is colorless and has a highly reactive nature with a monoisotopic mass of 54.046g/mol and is majorly used in petrochemical, rubber, automotive tires, latexes, coatings, gloves, and others. It is produced as a by-product from propylene and ethylene manufacturing, along with aromatic hydrocarbons, and is useful in the synthesis of cycloalkanes and cycloalkenes, through diels-alder reactions. The excellent properties such as strength, heat resistance, and high performance make it the best option for application in the automotive, electronics, construction, and medical industry Butadiene serves as a crucial component in the production of synthetic rubbers and elastomers, notably including polybutadiene rubber (PBR), styrene-butadiene rubber (SBR), nitrile rubber (NR), and polychloroprene (Neoprene). These materials find extensive applications across various industries, with PBR and SBR prominently used in tire manufacturing, while Neoprene and nitrile rubber are favored for producing a wide range of products such as gloves, seals, gaskets, hoses, wetsuits, and foams. Additionally, styrene-butadiene (SB) latex is utilized in the production of carpet and paper coatings. Polybutadiene rubber (BR, PBR), known for its cost-effectiveness and high volume production, often serves as a substitute for natural rubber (NR). Its synthesis typically involves anionic polymerization or coordination polymerization of 1,3-butadiene in non-polar solvents, favored for its ability to tightly control molecular weight (MW) and ensure high stereoregularity, making it a preferred method in the industry.

Request Sample :

The report: “Butadiene Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Barium Sulphate Industry. Market.

By Production Process: Steam Cracking, Foundry Process, Oxo-D Process.

By Product: Styrene butadiene rubber, Acrylonitrile butadiene styrene, Polybutadiene rubber, Nitrile rubber, and Others

By Application: Synthetic Rubber, Thermoplastic Rubber, Latexes, Conveyor Belt, Surgical Gloves, Golf Ball, Tires, and Others

By End-Use Industry: Automotive Industry (Commercial Vehicles, Passenger Vehicles, Automotive Components, and Others), Electronics Industry (Electronic Enclosures, Home Appliances, Computer, and Others), Chemical Industry, Construction, and Others.

By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Middle East (Saudi Arabia, UAE, Israel, Rest of the Middle East) and Africa (South Africa, Nigeria, Rest of Africa).

Key Takeaway

• The growth in the automotive production and construction industry in the Asia-Pacific region will create a drive in the butadiene market, due to the high demand for butadiene-derived products such as polybutadiene rubber, synthetic rubbers, styrene-butadiene latex, and others.

• The styrene butadiene rubber holds a major share in the butadiene industry, owing to its application in high-performance tires, automotive components, belts, gaskets, and others.

• The rising awareness regarding environmental and health concerns, along with increasing prices of crude oil is estimated to create a hindrance in the growth of the butadiene market.

Butadiene Market Segment Analysis — By Production Process

The demand for synthetic rubbers, and consequently the butadiene market, is heavily influenced by the automotive industry, while its supply relies on the ethylene industry due to its essential role in the steam cracking process. Consequently, fluctuations in supply and demand in other markets exert significant impacts on the butadiene industry. Factors such as the advancement of environmentally-friendly methods for polymer emulsion production, increasing demand for water-based solvents and coatings, and the expansion of industrial sectors such as automotive and consumer durables contribute to the global market’s growth trajectory. Furthermore, the consumption is estimated to reach 1.2 million by 2025 in India. Thus, the growth and demand for butadiene derived rubber and major applications in automotive will boost the steam cracking manufacturing process segment in the forecast period.

Inquiry Before Buying :

Butadiene Market Segment Analysis — By Product

By product, the styrene butadiene rubber segment is expected to have the largest share in the forecast period and is expected to grow at a CAGR of over 7.5%. It contains 23% styrene and 77% butadiene and is used as the primary material to make tires, shoe soles, and plastic materials. The SBR-1500 is a high molecular weight combining good extrusion and avoiding product degradation. The styrene-butadiene rubber has various applications such as automotive, consumer products, footwear, electronics, molded rubber products, and others. The automotive industry makes major use of styrene butadiene rubber due to its increasing dominance for automotive tires, belts, and other automotive components in the forecast period. China is the largest textile-producing and exporting country in the world. With its rapid growth over the last two decades, the Chinese textile industry has become one of the main pillars of the country’s economy. In February 2022, the Chinese textile export reached an all-time high of USD 24741 million.

Butadiene Market Segment Analysis — By Application

By application, the synthetic rubber segment is expected to have the largest growth share of over 48% in 2023 due to its application in the automotive industry and is expected to dominate the butadiene market size in the coming years. The butadiene is used as a major material for producing rubber and tires for various vehicles. Synthetic rubber has its application in industrial rubber, wires, belts, footwear, airplane tires, and surgical gloves. synthetic rubber segment. In the first three months of 2023, there was a positive and optimistic attitude in the Chinese market. After the Lunar New Year holidays, people began buying stocks again, leading to an increase in the prices of butadiene in China. There was a consistent demand for butadiene from industries that use it to make polymers and synthetic rubber in the Asian market.

Butadiene Market Segment Analysis- By End-Use Industry

Butadiene serves as a primary ingredient in the production of various synthetic rubbers and elastomers, including polybutadiene rubber (PBR), nitrile rubber (NR), styrene-butadiene rubber (SBR), and polychloroprene (Neoprene). These materials are integral in the manufacturing of a diverse range of goods and raw materials. Notably, in the production of acrylonitrile-butadiene-styrene (ABS) resin, which finds extensive applications in plastics manufacturing, butadiene-based rubber plays a pivotal role as a key component.

Schedule a Call :

Polybutadiene, in particular, is a commonly utilized material in tire manufacturing, with its production accounting for over 70% of tires manufactured globally. Its predominant use in tires is attributed to its effectiveness in sidewall construction, where it helps mitigate strain induced by continuous bending during operation. Consequently, the demand for butadiene in the automotive sector is projected to witness a notable increase in the foreseeable future.

By Geography — Segment Analysis

The Asia Pacific holds the largest share of around 48% in the butadiene market size, due to the major end-use industry in the region for the year 2023 and is expected to grow during the forecast period. The demand for butadiene is high in APAC nations due to rising automotive, construction, healthcare, and electronic applications. Butadiene products such as styrene butadiene rubber, polybutadiene, and others are majorly used in tires, automotive exhausts, conveyor belts, and others.The increasing demand for butadiene and its derivatives is likely to boost the growth in the market. Furthermore, China is emerging to dominate the butadiene market share owing to increased ethylene manufacturing preference in this region. Thus, the butadiene products will see a major growth owing to their rising dominance and application in various end-use industries, thereby creating a traction for the butadiene market in the forecast period. The Asia-Pacific region dominated the butadiene market. The downstream market in Asia-Pacific witnessed a huge spur in the past few years, owing to which the demand for butadiene has rapidly increased. China is one of the largest chemical manufacturing hubs in the world, with a wide range of industries. The Chinese butadiene market is expected to witness significant growth due to the presence of a large number of indigenous players.

For More Details on This Report — Request for Sample

Drivers — Butadiene Market

An increase in Automotive productions in the forecast period is driving the demand for the Butadiene Market.