#Indian automobile market forecast

Explore tagged Tumblr posts

Text

Navigating the Indian Automobile Industry: Trends, Opportunities, and Challenges

Introduction

The automobile industry in India is projected to be valued at approximately USD 126.67 billion in 2024, with expectations to reach USD 187.85 billion by 2029. This represents a compound annual growth rate (CAGR) of 8.20% during the forecast period from 2024 to 2029.

The Indian automobile industry is one of the largest and most dynamic sectors in the world, playing a pivotal role in the nation’s economic growth. With a diverse range of vehicles produced, from two-wheelers to heavy trucks, the industry has shown remarkable resilience and adaptability. As of 2023, the market is undergoing significant transformations driven by technological advancements, changing consumer preferences, and a push toward sustainability. This blog explores key trends, opportunities, challenges, and the future outlook for the Indian automobile industry.

Current Market Landscape

Market Size and Growth

As of 2023, the Indian automobile market is estimated to be valued at over USD 150 billion, making it the fourth largest in the world. The sector contributes around 7.1% to the national GDP and accounts for approximately 49% of the manufacturing output. The market is poised for further growth, with projections indicating a compound annual growth rate (CAGR) of around 10% over the next five years.

Key Trends Shaping the Industry

Electrification of Vehicles The push for electric vehicles (EVs) is gaining momentum in India, driven by government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme. With increasing investments in charging infrastructure and incentives for EV manufacturers, the market for electric two-wheelers, cars, and buses is expected to expand significantly.

Connected Vehicles The integration of technology in vehicles is on the rise. From advanced driver-assistance systems (ADAS) to connected car features, automakers are focusing on enhancing safety, convenience, and overall driving experience. This trend is supported by the increasing demand for smart features among consumers.

Sustainability and Green Practices There is a growing emphasis on sustainable manufacturing practices. Companies are adopting eco-friendly processes, using recyclable materials, and focusing on reducing their carbon footprints to align with global sustainability goals. The introduction of stringent emission norms is also prompting manufacturers to innovate.

Shift in Consumer Preferences Indian consumers are increasingly favoring personal mobility solutions, especially in the wake of the pandemic. There is a noticeable shift toward SUVs and compact vehicles, as they offer versatility and comfort. Additionally, young consumers are showing a preference for digital experiences, influencing the way companies market and sell vehicles.

Digital Transformation The automotive sector is embracing digital tools across various functions, from manufacturing to sales. Virtual showrooms, online booking systems, and enhanced customer engagement through social media are becoming commonplace, reshaping the customer journey.

Challenges Facing the Industry

Despite its growth potential, the Indian automobile industry faces several challenges:

Regulatory Hurdles: Navigating complex regulations and compliance requirements can be daunting for manufacturers, particularly with the introduction of new emission standards and safety regulations.

Supply Chain Disruptions: The global supply chain issues, exacerbated by the COVID-19 pandemic, have impacted the availability of critical components, such as semiconductors, affecting production schedules.

Infrastructure Constraints: Insufficient charging infrastructure for electric vehicles and inadequate road conditions in certain regions can hinder the growth of new automotive segments.

Future Outlook

The future of the Indian automobile industry is bright, with several factors poised to drive growth:

Government Initiatives: Continued government support for electric mobility and sustainable practices will bolster the industry. Policies promoting manufacturing and exports, such as the Production-Linked Incentive (PLI) scheme, will also encourage investment.

Innovation and R&D: As automakers invest in research and development, breakthroughs in technology, such as autonomous driving and advanced battery systems, will reshape the market landscape.

Emerging Markets: With a large and growing middle class, the demand for automobiles in India is expected to increase. Expanding into rural and semi-urban markets will present new opportunities for manufacturers.

Conclusion

The Indian automobile industry is at a crossroads, balancing traditional manufacturing with innovative, sustainable practices. As it embraces electrification, digital transformation, and evolving consumer preferences, the industry is set to redefine mobility in India. Stakeholders must navigate challenges and leverage opportunities to thrive in this dynamic environment, ensuring that the sector continues to contribute significantly to the nation’s economy and development.

In summary, the Indian automobile industry is not just a vital economic driver but also a reflection of changing lifestyles and technological advancements. By focusing on innovation, sustainability, and consumer-centric strategies, the sector can pave the way for a prosperous future.

#Indian automobile market trends#Indian automobile market size#Indian automobile market share#Indian automobile market analysis#Indian automobile market forecast#Indian automobile market demand

0 notes

Text

Why Are Indian Students Choosing Germany For Study Abroad

Germany has rather emerged as one of the forecast favorite destinations for most Indian students in quest of better education and good jobs. Boasting being home to some of the best universities in the globe, a comprehensive research-oriented curriculum, and a strong economy, Germany has much to offer students when it comes to academic challenges diverse cultures, and job opportunities around the globe. This guide helps to understand the reasons that make Germans so attractive to Indian students who are willing to continue their education abroad.

1. High-Quality Education and Prestigious Institutions

Germany has some of the best universities and technical colleges in the world, and of these institutions, many have performed well on the international education tables. Numerous German higher learning institutions are effective, especially the Technical University of Munich, the University of Heidelberg, and the Ludwig Maximilian University of Munich, and major in engineering IT science, and other related field.

Moreover, the majority of German Universities offer research-oriented, new degree programs which focus, on professional competencies and academic theories. This approach finds a lot of favor with students from India as they prefer institutions that provide a competitive environment in their academic learning. Different from many other countries, the emphasis on techniques and experience base of German education ensures students' readiness for the international job market.

2. Affordable Tuition Fees and Cost of Living

The first and considered by many to be the absolute major reason why students from India prefer Germany is that the country is quite cheap. Since most of the universities are publicly funded, tuition fees are relatively low or free for international students something, which is rare among the competing countries for International students. The benefit associated with this is that the Indian students have the opportunity to access quality education from international standard education providers without having to borrow extremely large sums of money in order to do so.

As for the cost of living, it is quite moderate for the Germans compared to the level in such countries as the United States or the United Kingdom. Currently, cities like Berlin and Munich, as well as Frankfurt, help students as they provide cheap accommodation, cheaper fares for public transportation, and other incentives for student prices for necessities for the Indians to handle their living expenses by comparing the degree.

3. Opportunities for Scholarships

Many scholarships in Germany cover all the expenses of international students. For the Indian students DAAD (German Academic Exchange Service), Deutschlandstipendium, and Erasmus+ are the few scholarships that offer ample financial support for studying in Germany. These scholarships allow students to relieve some of their financial stress and provide opportunities solely based on merit, to students who may not be able to afford to study abroad.

These Scholarships sometimes include living expenses, travel expenses, and the cost of health insurance making Germany really a viable option for students from India belonging to various strata of society.

4. Focus on Engineering, Technology, and Innovation

Germany has been famous all over the world for their development, particularly in manufacturing engineering, automobile, and several industries. Since research forms a central part of academic progress, most German universities have affiliations with premium industries and research centers, thereby providing students with technological facilities, instruments, and industrial experiences.

Students especially from India believe that the German environment acquires value additions that are much sought after in the current technology-dominated world, especially for engineers. Features of programs embrace internships and practical training in the best practices of companies or organizations – the chance to undertake paid work experiences and advance relationships with companies before graduating.

5. Strong Post-Graduation Job Market and Work Opportunities

Cohort 1 The German economy is strong and as such international graduates stand a good chance of employment in the country. The country is in urgent need of experienced human resources in various sectors, especially engineering, IT, and health, meaning the right graduation qualifications in the market will be in high demand. From this demand, Indian students are likely to benefit because they are now eligible for the EU Blue Card that enables them to live and work in Germany and other EU countries.

In addition, upon graduation, Germany permits foreign students to stay and look for a job for up to 18 months if it is related to the course they took. This period brings time to Indian graduates to secure a good job and easily fit within the German job market.

6. Safe, Welcoming, and Multicultural Environment

Germany is considered to be a safe, liberal, and diverse country that warmly embraces internationals. Diversity in this country makes Indian students feel comfortable and at the same time makes them able to communicate with students and professionals from other parts of the globe. Germany's largest cities would include Berlin with its multinational population, prominent food cultures, and well-organized festivities alongside Hamburg and Frankfurt.

Germany embraces diversity and tolerance as many student associations, cultural clubs, and social activities involving students as well as community activities meant to welcome and encourage international learners. These resources enable Indian students to find their way in the new environment and get people who will assist them academically and socially.

7. English-Taught Programs with a Growing Emphasis on German Language Proficiency

However, as the globalization process continues, more and more programs in universities throughout Germany are taught in English while Germans still use their native language, German. Due to this factor, most Indian students interested in studying abroad choose Germany because they can get a quality education in English without the need to learn the German language at first instance.

But on the positive side, I think it will be useful for Indian students since it will enable them to get jobs in Germany and fit into German society. Most academic institutions can provide tuition-free or low-cost German language classes so that international learners can achieve the working knowledge and fluency that is desirable for most practical life and for career purposes.

8. Ease of Visa and Residence Permits

Compared to other locations for studies, the process of acquiring a student visa in Germany is very simple. On admission to a university, Indian students can apply for a student visa and since its validation necessitates the production of valid financial documents and records of the student's academic achievements, most students applying for this vise get it.

Permanent residence there is also possible after graduation, students are allowed to stay and look for a job in the country according to the course they have studied. Furthermore, Germany’s EU Blue Card channel allows Indian students to gain residency and long-term employment within Germany and continues to strengthen the argument of the country as a preferred study destination for students who intend to build their long-term European careers.

9. Networking Opportunities and Global Career Connections

Universities of Germany have huge connections with industries and universities almost in every corner of the world. What this means for Indian students is the ability to tap into these professional networks which will prove very useful to students as they seek to forge links that can weigh heavily in determining their success in their chosen fields later in their lives.

Almost all universities provide opportunities for students to directly engage with external professionals within their respective fields through career fairs, network meetings, and training in the form of workshops and seminars. The exposure received not only enlarges their horizon but also avails them of employment opportunities after the completion of their study.

10. Cultural Enrichment and Travel Opportunities

Living in Germany also provides Indian students a chance to start appreciating an enriched culture in terms of historical monuments, sculptures, music festivals, and many more. The convenient geographical position of Germany in the center of Europe allows students to easily and cheaply travel all across the European continent.

Concerning the benefits that students derive from the incremental eve exposure to other cultures and ways of doing things arouses in students a worldview, versatility, and catholicity of reception that is very traceable in the present Global Village.

Conclusion

Germany was ranked higher in the education index by Indian students owing to the quality, inexpensive education, and the perfect job market. Being formally more research-oriented, and up-to-date with industrial experience and skill development, Germany offers a very professional education system that prepares Indian students to carve a niche in their fields.

The country provides hospitality to the immigrants, multiculturalism, and is zealous for invention thus making it desirable to study, work, and develop. The decision to study in Germany can hardly be more beneficial for Indian students seeking quality education at a reasonable cost associated with excellent career prospects which can hardly be matched by the demanding majority of other countries.

Are you looking for the best study abroad consultants in kochi

#study abroad#study in australia#study abroad consultants#study in uk#study in germany#study in ireland#study blog

0 notes

Text

Internal Combustion Engines: A Comprehensive Guide

Internal combustion engines (ICEs) have been the driving force behind technological advancements for over a century. The Indian Internal Combustion Engines Market is projected to reach USD 8.3 billion by 2026, growing at a CAGR of 7.6% during the forecast period (2020–2026). This growth is primarily driven by the increasing demand for vehicles, construction equipment, and power generation solutions in the country that uses ICEs.

Basic Components of an Internal Combustion Engine

An ICE consists of several interconnected components that work together to produce power:

Combustion Chamber: The space where the fuel-air mixture is ignited and combustion occurs.

Piston: A movable component that reciprocates within the cylinder, converting the combustion energy into mechanical energy.

Connecting Rod: A component that connects the piston to the crankshaft, transmitting the mechanical energy.

Crankshaft: A rotating shaft that converts the reciprocating motion of the piston into rotary motion.

Valves: Devices that control the flow of fuel-air mixture into and out of the combustion chamber.

Fuel System: Delivers fuel to the engine for combustion.

Ignition System: Ignites the fuel-air mixture in the combustion chamber.

Cooling System: Removes excess heat from the engine to prevent overheating.

Exhaust System: Directs the exhaust gases from the engine to the atmosphere.

How an Internal Combustion Engine Works

ICEs typically operate on either a four-stroke or a two-stroke cycle.

Four-Stroke Cycle:

Intake Stroke: The intake valve opens, allowing a mixture of fuel and air to enter the cylinder.

Compression Stroke: The intake valve closes, and the piston compresses the fuel-air mixture.

Power Stroke: The spark plug ignites the compressed mixture, causing a power stroke that pushes the piston downward.

Exhaust Stroke: The exhaust valve opens, and the piston pushes the exhaust gases out of the cylinder.

Two-Stroke Cycle:

Intake and Compression Stroke: The piston moves downward, creating a vacuum that draws in a fresh charge of fuel and air.

Power and Exhaust Stroke: As the piston moves upward, the compressed mixture is ignited, generating power and forcing the exhaust gases out through the exhaust port.

Types of Internal Combustion Engines

ICEs can be classified based on several factors:

Fuel Type:

Gasoline engines

Diesel engines

Natural gas engines

Number of Cylinders:

Single-cylinder engines

Multi-cylinder engines (V-engines, inline engines, etc.)

Cooling System:

Air-cooled engines

Liquid-cooled engines

Ignition System:

Spark-ignition engines (gasoline engines)

Compression-ignition engines (diesel engines)

Applications of Internal Combustion Engines

ICEs are used in a wide range of applications, including:

Automobiles Passenger & Commercial Vehicles: Cars, trucks, and SUVs

Motorcycles Two & Three Wheelers: Bikes, scooters, passenger & goods carriers

Construction Equipment: Excavators, bulldozers, and cranes

Marine Engines: Boats and ships

Power Generators: Providing electricity for various purposes

Advantages and Disadvantages of Internal Combustion Engines

ICEs offer several advantages:

Efficiency: They can convert a significant portion of the fuel’s energy into mechanical work.

Power Output: ICEs can produce substantial power, making them suitable for heavy-duty applications.

Versatility: They can be adapted to fit various applications and sizes.

However, ICEs also have some disadvantages:

Pollution: The combustion process produces harmful emissions that contribute to air pollution.

Noise: ICEs can be noisy, especially when operating at high speeds.

Fuel Consumption: The consumption of fossil fuels can contribute to climate change.

The Future of Internal Combustion Engines

With increasing environmental concerns and stringent fuel efficiency regulations, the future of Internal Combustion Engines (ICEs) is evolving. While there is a growing emphasis on alternative power sources like electric vehicles, ICEs are still a dominant force in many industries.

At Greaves Engineering, we are committed to driving innovation in ICE technology to ensure their continued relevance. Our focus on research and development has led to significant advancements in:

Fuel Efficiency: We have developed engines that deliver exceptional fuel economy, reducing carbon emissions and operating costs.

Emission Reduction: Our engineers have implemented cutting-edge technologies to minimise harmful emissions, ensuring compliance with stringent environmental regulations.

Performance Optimization: We continuously strive to enhance the power output and performance of our ICEs, making them suitable for a wide range of applications.

Greaves Engineering’s Role in Shaping the Future of ICEs

Greaves Engineering is actively contributing to the future of ICEs by:

Developing Sustainable Solutions: Our focus on fuel-agnostic engines and alternative fuel options demonstrates our commitment to a sustainable future.

Investing in Research and Development: We invest heavily in research and development to explore new technologies and improve the efficiency and performance of our ICEs.

Collaborating with Industry Partners: We collaborate with industry leaders to develop innovative solutions and drive the adoption of advanced ICE technology.

While the transition to electric vehicles is gaining momentum, ICEs will likely remain a crucial part of the transportation landscape for many years to come. Greaves Engineering is at the forefront of this evolution, ensuring that our ICEs continue to meet the demands of a changing world.

0 notes

Text

India 2-Wheeler Market : Current Analysis and Forecast (2024-2032)

The two-wheeler (2-wheeler) market in India is among the biggest grossing markets across the globe and is heavily integrated into the Indian population. Affordable, convenient, and fuel-efficient, two-wheelers account for a dominant share of the number of vehicles owned by Indians. From the masses transport region to the countryside the need for motorcycles and scooters remains high. According to industry reports, India two-wheeler market size was over 150 million units in 2022 and hence, depicts the massive demand for such vehicles in Indian transportation. As consumers go for different products and services, various technologies being unveiled and the ever-shifting policies and regulations, the market is set to expand.

Market Overview and Key Drivers:

Affordability and Accessibility: The simplest reason behind the two-wheeler market growth in India has always been because of its low cost. Compared to cars, two-wheelers are cheaper, and thus available in the market for the broad population group. Besides, motorcycles are used by individuals living in rural regions as transport since access to public transport in such regions with harsh terrains is a challenge. In urban areas, people use scooters and bikes to move within the traffic-congested areas with ease. Much as they posed a financial strain when they were first imported require little money to own compared to other transport means, and have low maintenance requirements, two-wheelers have now become part of India’s transport systems.

Urbanization and Growing Middle Class: The use of two-wheelers has been on the rise in India primarily due to the increasing rate of urbanization and the increase in the size of middle-income earners. that as more people go into the cities for employment and other facilities such as education then more demand will result in personal transport. There are many users of scooters and other two-wheelers because they are easy to maneuver and economical in traffic-prone areas. Also, a higher disposable income packed on the middle-class buyer in India has resulted in early conversion and upgrade to the more upscale two-wheeler variants.

Fuel Efficiency and Environmental Impact: In a situation where fuel prices remain unpredictable in the country, two-wheelers are more fuel efficient as compared to four-wheelers. Scare awareness of the environment and its sustainability is leading to the increasing popularity of electric two-wheelers (E2-Wheelers). Recent measures for greener automobiles, specifically subsidies and incentives for electric vehicles (EVs) are making Indians consider E2-Wheelers. The shift towards electric mobility in the world and India especially in the two-wheelers has opened a great chance of development in each market particularly as the charging infrastructure is developed.

Government Initiatives and Regulations: The Indian government has implemented various policies to boost the automotive sector, including the two-wheeler market. Initiatives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, tax benefits, and subsidies for EV purchases have been pivotal in promoting electric two-wheelers. Furthermore, stricter emission norms, such as the Bharat Stage (BS) VI regulations, have pushed manufacturers to innovate and produce cleaner, more efficient vehicles.

Market Segmentation

Motorcycles vs. Scooters: The motorcycle segment remains the most popular in India among all two-wheelers and commands more than 60% of the market share. There is a healthy market for motorcycles in rural areas because these vehicles are strong, and they can move in the rough terrains that are common in rural areas. On the other hand, scooters have particularly transformed and gained recognition within the urban setting due to factors such as flexibility of use, low costs of maintenance, and use of automatic transmission. Honda and TVS are the leading scooter makers while Bajaj Auto and Royal Enfield have premium and sports bike segments.

Electric Two-Wheelers (E2-Wheelers): Electric two-wheelers are also quickly gaining ground in the Indian market. With environmental worries and the drive for more sustainable means of transport, people are gradually transitioning from conventional ICE automobiles to electric ones. Ather Energy and Ola Electric have recently launched new generation electric scooters with powerful batteries at reasonable prices and the latest Bajaj electric scooter has a significantly higher range than its domestic competitors. Other factors that have boosted the sales of electric two-wheelers in India include battery swapping stations, government policies, and reduced cost of lithium-ion batteries.

Rural vs. Urban Demand: Another segment that looks large for the motorcycle industry in India is the rural markets which constitute 55% of two-wheeler sales. In these areas, there is heavy dependency on two-wheelers for traveling to and fro the workplace or for carrying goods. While in urban regions scooters are more in demand because of convenience and traffic conditions. The fact that the consumption pattern varies geographically makes it possible for manufacturers to provide for the two segments using different products.

Issues Affecting the Two-Wheeler Market

Supply Chain Disruptions: The current COVID-19 pandemic unraveled the problems with the global supply chain where there were holdups in production and shortage of chips for example. What this did for the two-wheeler industry was that it enhanced the duration of waiting for consumers and elevated the cost to the manufacturers. Despite this, there has been continuity within the market and disruptions including disruptions of supply chains for global trades and shortages of the materials that affect the two-wheelers’ supplies and costs.

Rising Competition in the Electric Segment: The increased usage of electric two-wheelers has attracted new entrants, hence additional competition in the industry. Players that earlier used to provide traditional two-wheelers are now facing competition from new-age startups and technology companies that are progressing rapidly in the e-mobility segment. The complexity with the established brands is to innovate on fuel-burning vehicles while at the same time investing in electric mobility solutions.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=3654

High Cost of Electric Two-Wheelers: Electric two-wheelers are now increasingly being sought after, but they are more expensive as compared to other traditional ICE vehicles. Even with government subsidies, affordability remains a major issue for consumers, and this has been well illustrated as far as rural consumers are concerned. Also, sentiments such as concern for battery capacity and lack of access to charging facilities in semi-urban and even rural areas affect the uptake of the product.

Stricter Emission Regulations: There are also well-intentioned actions such as tighter emission standards as the shift to BS VI has raised the price of two-wheelers because of increased costs of revamping engines and technologies.

Opportunities and Future Outlook

Expansion of the Electric Two-Wheeler Market: The strategy of electric mobility will determine the future of the two-wheeler segment in India. The government has been very sensitive to its emission reduction goals and the adoption of EVs in the country and therefore this sector of the electric two-wheelers market is expected to grow very soon. They provide infrastructure, battery, and charging technology, and research and development associated companies will be other major beneficiaries of the growth. Smart technologies consisting of IoT connection, digital displays, and enhanced, and connective services make these electric two-wheelers more attractive to consumers.

Innovation in Financing Options: Manufacturers have had to look for ways of further unlocking the two-wheeler market through employing strategies like low down payment, long-term loans, and ‘use and subscribe’. These options coupled with an extension of micro-financing facilities in rural areas can create demand, especially the electric two-wheelers. Such partnerships between the manufacturing firms and the institutions and the fintech have played the role of a funnel of providing affordable prices to consumers across different income levels.

Conclusion

India's two-wheeler market is a cornerstone of the country's transportation ecosystem, driven by affordability, convenience, and rising urbanization. The increasing focus on electric two-wheelers, government initiatives, and the continued growth of both rural and urban demand point to a promising future. While the industry faces challenges like supply chain disruptions and the high cost of electric vehicles, innovations in technology and financing will help drive further growth. As the market evolves, India’s two-wheeler industry is set to play a crucial role in the transition towards sustainable and accessible mobility.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

India Car And Bike Care Products Market To Reach $435.9 Million By 2030

The India car and bike care products market size is anticipated to reach USD 435.9 million by 2030 and is anticipated to expand at a CAGR of 4.7% during the forecast period, according to a new report by Grand View Research, Inc. The market growth in India is directly proportional to the growth of the Indian automotive industry. Increasing penetration of electric cars and the development of autonomous cars are expected to drive the growth of the automotive industry, thereby boosting the demand for premium car & bike care products. In addition, rising demand for car-sharing services in urban cities is expected to drive automotive sales, thereby boosting the demand for car & bike care products to maintain the vehicle appearance.

India is witnessing significant growth in automotive production and sales. High investments in the country’s manufacturing sector and favorable government policies for the industrial sector are expected to positively impact automotive production in the country, which is anticipated to propel the demand for car and bike care products over the forecast period.

The use of bike & car care products for the maintenance and repair of vehicles is gaining popularity on account of growing awareness regarding their advantages among end users. With increasing disposable income and spending power, several younger population groups are inclined to buy cars & bikes to maintain their lifestyle and status. This is expected to positively impact the demand for premium car care products over the forecast period.

The closing down of wholesale and retail shops turned users to online platforms, which offered a wider product. In India, this trend was significantly accelerated by the pandemic, as users stayed at home and had time and resources to invest in car & bike care. The change in consumer behavior during the pandemic has led to an increased demand for DIY products and the usage of e-commerce to purchase these products. For personal users focusing on DIY, e-commerce platforms became an easier alternative to understand the alternatives and make informed purchases depending upon their needs.

Recent years have seen an increase in interest and importance of aesthetics in automobiles, especially private vehicles. Moreover, the COVID-19 pandemic gave a boost to this interest as users stayed at home and had time and resources to make their vehicles aesthetically pleasing. The change in consumer behavior during the pandemic has led to an increased demand for DIY products and the usage of e-commerce for purchasing products. In addition, on account of the continuous growth of the automotive industry, the need for the repair and maintenance of vehicles is expected to rise. This, in turn, is expected to propel the demand for car & bike cleaning products over the forecast period.

Request a free sample copy or view report summary: India Car And Bike Care Products Market Report

India Car And Bike Care Products Market Report Highlights

Based on products, the car cleaning products segment dominated the market in 2023, accounting for a revenue share of 28.4%. Shampoo and detergent are frequently used to clean the metal surfaces of cars. These products safely remove dirt, grease, oil stains, and other contaminants from the vehicle. These products are cost-effective and commonly used, and therefore, are leading the market.

Based on packaging volume, the 501 - 999 ml segment contributed the largest market share in terms of revenue, accounting for 39.2% of the market in 2023, owing to its suitability for individuals and commercial use. This segment is driven by the rising demand for medium-sized car care products by individuals, small workshops, and independent repair shops.

Based on end use, the do-it-for-me (DIFM) segment dominated the market in 2023, accounting for a revenue share of 69.7%. This segment is anticipated to grow at a slower pace compared to the DIY segment owing to high service costs and limited product availability at professional service stores.

Based on product type, the bike cleaning products segment accounted for the largest revenue share of 61.1% in 2023 and is expected to grow at the fastest CAGR over the coming years. This is owing to their wide use for removing contaminants and residues from the exterior surface of bikes.

The DIYM segment dominated the bike care products market in 2023 owing to the convenience and expertise offered by the DIYM specialists. These service providers handle routine maintenance tasks, such as chain cleaning & lubrication, bike washing, and polishing, using high-quality products.

India Car And Bike Care Products Market Segmentation

Grand View Research has segmented the India car & bike care products market based on products, end use, distribution channel, and packaging volume:

India Car Care Products Outlook (Revenue, USD Million, 2018 - 2030)

Car Cleaning Products

Car Polish

Car Wax

Wheel & Tire Cleaners

Glass Cleaners

Interior Cleaners

Accessories

Others

India Car Care Products Packaging Volume Outlook (Revenue, USD Million, 2018 - 2030)

Less than 250 ml

251 - 500 ml

501 - 999 ml

1 L - 5 L

Above 5 L

India Car Care Products End-use Outlook (Revenue, USD Million, 2018 - 2030)

Do-It-Yourself (DIY)

Do-It-For-Me (DIFM)

India Car Care Products Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

E-commerce

Retail Chains

Car Detailing Stores

India Bike Care Products Outlook (Revenue, USD Million, 2018 - 2030)

Bike Cleaning Products

Bike Polish

Bike Chain Cleaners & Lubricants

India Bike Care Products End Use Outlook (Revenue, USD Million, 2018 - 2030)

Do-It-Yourself (DIY)

Do-It-For-Me (DIFM)

List of Key Players in the India Car And Bike Care Products Market

3M

Motul

Pidilite Industries Ltd.

Formula 1 Wax (West Drive)

Turtle Wax, Inc.

Vista Auto Care (Resil Chemicals)

Würth India

The Waxpol Industries Limited

Shell Plc

Miracle

Auto Bros

SONAX Gmbh

Chemical Guys

Sheeba India Pvt. Ltd.

PROKLEAR

GreenZ Car Care

Niks

Abro

WaveX (Jangra Chemicals Private Limited)

0 notes

Text

India Thermoplastic Polymer Composites Market Trends, Growth, Forecast 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the India Thermoplastic Polymer Composites Market size by value at USD 2.79 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the India Thermoplastic Polymer Composites Market size to expand at a CAGR of 6.22% reaching a value of USD 4.01 billion by 2030. The Thermoplastic Polymer Composites Market in India is propelled by the increasing interest in thermoplastic polymer composites, which is attributed to their numerous benefits including high-volume processability, recyclability, excellent damage resistance, fracture toughness, and the capacity to form intricate shapes. These advanced materials are increasingly being utilized across various transportation sectors, ranging from automobiles to subway systems.

By volume, BlueWeave estimated the India Thermoplastic Polymer Composites Market size at 386.16 thousand tons in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the India Thermoplastic Polymer Composites Market size by volume is projected to grow at a CAGR of 6.09% reaching the volume of 427.36 thousand tons by 2030. Long-fiber thermoplastics (LFTs) are gaining traction in the transportation industry due to their superior performance characteristics. In the automotive sector, high fuel prices have had a significant impact, prompting manufacturers to adopt thermoplastic composites to reduce vehicle weight. It is particularly important as stringent emission regulations push for lower carbon dioxide emissions. By decreasing vehicle mass, thermoplastic composites contribute to improved fuel efficiency and reduced emissions.

Sample Request @ https://www.blueweaveconsulting.com/report/india-thermoplastic-polymer-composites-market/report-sample

Impact of Escalating Geopolitical Tensions on India Thermoplastic Polymer Composites Market

Geopolitical tensions can have a multifaceted impact on the India Thermoplastic Polymer Composites Market by disrupting supply chains and increasing raw material costs. Political instability can lead to sanctions, trade restrictions, and heightened tariffs, affecting the import of critical composite materials and advanced manufacturing technologies. These challenges result in production delays and increased expenses for Indian manufacturers, potentially stifling market growth. Furthermore, global trade uncertainties compel companies to seek local alternatives or invest in domestic production capabilities, which can initially inflate costs and hinder the market's expansion. Stabilizing geopolitical landscapes is crucial for fostering sustainable growth in the India Thermoplastic Polymer Composites Market.

India Thermoplastic Polymer Composites Market

Segmental Coverage

India Thermoplastic Polymer Composites Market – By End User

Based on end user, the India Thermoplastic Polymer Composites Market is divided into Automotive, Aerospace, Electrical & Electronics, Construction, Consumer Goods, and Healthcare segments. The automotive segment holds the highest share in the India Thermoplastic Polymer Composites Market by end user. It is primarily due to the nation's transportation sector contributing significantly to its GDP, approximately 6.3%. The automotive sector, primarily reliant on road infrastructure, manages over 50% of freight and 90% of passenger traffic. Government initiatives and private investments, along with a flourishing FMCG sector, drive the need for efficient connectivity solutions. Liberalization programs and FDI norms further encourage market competition and affordability. Moreover, there's a heightened focus on reducing carbon emissions and enhancing fuel efficiency within the automotive industry. This fuels the demand for thermoplastic composites, particularly continuous fiber-reinforced variants, offering lightweight solutions aligned with sustainability goals and automotive standards.

Competitive Landscape

The India Thermoplastic Polymer Composites Market is fragmented, with numerous players serving the market. The key players dominating the India Thermoplastic Polymer Composites Market include Reliance Industries Limited, Jushi India Fiberglass Co Pvt Ltd, Advanced Composites Pvt Ltd, SGL Carbon India Pvt Ltd, Tata AutoComp Systems Ltd, SABIC Innovative Plastics India Pvt Ltd, Owens Corning India Pvt Ltd, Tufropes Pvt Ltd, RTP Company, and 3B-the fibreglass company (India) Pvt Ltd. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge in the overall market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Electric Kick Scooter Market to Exceed USD 8,021.5 Million by 2033

The global Electric Kick Scooter Market is projected to grow at a CAGR of 11.7% during the forecast period. The sales of electric kick scooters are anticipated to surpass USD 2.7 Billion in 2023. The value of the electric kick scooter market is anticipated to reach a high of USD 8.2 Billion, by the year 2033.

A key aspect surging the sales of electric kick scooters is the growing carbon emissions from fuel-powered automobiles that have been a major source of concern for governments around the globe. Electric transportation choices such as electric scooters are likely to grow more popular as regulatory authorities focus on smart city development, but at a slower rate than passenger vehicles/buses. These scooters are ultra-quiet, which makes them a great alternative for towns looking for answers to the mounting issue of noise pollution.

Request For a Sample of Market Research: https://www.futuremarketinsights.com/reports/sample/rep-gb-13574

While customers in Latin America, the Middle East, Africa, and Asia Pacific regard electric kick scooters as a mode of short-distance transportation, consumers in North America and Europe see them as a lifestyle choice.

To keep consumers, vendors emphasize features such as longevity, low maintenance costs, and performance. As a result, suppliers concentrate on developing technologically superior cars that consider design/style, range, and speed parameters. OEMs are likely to be able to extend their income stream and geographical footprint as governments throughout the world invest in charging infrastructure and give customer incentives.

Owing to their compact size and simplicity of transportation, electric kick scooters are in high demand globally. As a result, rising traffic congestion throughout the world is increasing market demand for electric scooter-sharing services. As of February 2021, the Irish Minister of Transport, Eamon Ryan, has legalized the use of electric kick scooters on public roadways in Ireland without the requirement of a tax, insurance, or a driver's license.

Furthermore, governments throughout the world are offering tax breaks and incentives to encourage the use of electric kick scooters and ecologically friendly autos. For instance, the Indian government announced in June 2019 a plan to decrease the goods and services tax (GST) on electric cars from 12 to 5% to stimulate faster adoption.

However, one of the issues likely to hinder the growth of the electric scooter-sharing industry is the demand for batteries with extended range, rapid charging, and long lifespan. Improvements in riding range can be made feasible by introducing advancements in battery technology, which is anticipated to raise the production cost of electric motors, providing a hurdle to their acceptance.

Key Takeaways from the Electric Kick Scooter Market:

During the forecast period, the U.S. is estimated to account for a significant share of the global electric kick scooter market. This is attributed to the high demand for electric kick scooters amongst American consumers which are engineered to be the most durable and powerful form of mobility.

During the forecast period, the Asia Pacific electric kick scooter market is expected to have the highest share, led by China and Japan. This is owing to the regional players representing a culmination of continual product development and user experience and providing stylish, practical, and economical transportation. These scooters are therefore available in a range of body shapes, sizes, and colors to accommodate every rider.

Owing to its ability to minimize pollution and transportation congestion, along with its portability, the "two-wheeled" product type is expected to hold the greatest revenue, through the forecast period.

As it does not need to be serviced frequently and has a charging capability of up to 70W with a short charging time, the "lithium-ion” battery type, accounts for a significant share and is the most lucrative segment for key players.

Who is Winning?

Owing to the existence of both international and local players, the global electric Kick scooter market is fragmented. Many manufacturers hold a significant market share in their respective areas. Organic advances, such as product approvals and novel electric kick scooter services, are typically extensively embraced by large organizations. These factors are expected to increase the global electric kick scooter market size.

Key Players:

Micro Mobility Systems AG

Golabs Inc.

Bird Rides Inc.

Segway Inc.

IconBIT Limited

GOVECS AG

Razor LLC

Xiaomi Corporation

YADEA Technology Group Co. Ltd.

AKTIVO Scooter

0 notes

Text

Global Coil Coatings Market Assessment, Opportunities, and Forecast, 2016-2030F

Global Coil Coatings Market size was valued at USD 3.82 billion in 2022, which is expected to grow to USD 5.56 billion in 2030 with a CAGR of 4.8% during the forecast period between 2023 and 2030. The coil coating market is primarily driven by the robust growth of the construction and infrastructure sectors, particularly in emerging economies such as India, China, and Brazil. Strong construction sector development fuels the demand for coil coatings, providing protective, aesthetic, and functional benefits to metal surfaces used in buildings and constructions. Additionally, the increasing emphasis on energy efficiency and sustainability drives the adoption of coil coatings, especially those that contribute to cool roofing and energy conservation in roofing systems. Regulatory compliance and the need for corrosion protection in the construction and automotive industries further spur the demand for high-quality coil coatings.

Coil coatings are extensively used for vehicle exteriors and components to enhance aesthetics, durability, and corrosion resistance. As the automotive sector grows with increasing production and sales, the demand for high-quality coil coatings is expected to rise accordingly. Moreover, the industrial and manufacturing sectors utilize coil coatings for various purposes such as durability in machinery, equipment, storage tanks, and more. Rising demand for electrical appliance contribute to the increased need for protective and functional coatings, further raising coil coating demand.

Sample report- https://www.marketsandata.com/industry-reports/coil-coatings-market

Huge Construction Projects to Drive the Demand for Coil Coating

Coil coatings protect and enhance metal surfaces used in residential, commercial, and industrial buildings. Coil Coatings provide essential features like corrosion resistance, durability, and aesthetic appeal. Modern architectural trends often integrate metal-coated surfaces, further driving the need for coil coatings to meet sustainability and durability requirements. Compliance with sustainability norms, and energy efficiency mandates are additional factors contributing to the growing demand for coil coatings in the construction industry.

For instance, the Magnolia Mixed-Use Complex in Texas is a project with an estimated value of USD 1,000 million and is anticipated to reach completion in the first quarter of 2025. Saudi Arabia has been actively undertaking numerous significant infrastructure endeavors. These encompass major initiatives such as NEOM, the Red Sea Project, Qiddiya, King Salman Energy Park, Jeddah Tower, and Riyadh Metro. Additionally, the Minamikoiwa 6-Chome District Type One Urban Redevelopment project in Tokyo, Japan, is on track for completion in 2026. These Large-scale construction projects around the globe will drive the demand for Coil Coating due to the increased requirement for efficient roofing and protection for metal surface.

Strong Performance from automotive sector to raise the Usage of Coil Coating

The automotive industry stands as a substantial consumer of coil coatings as it is utilized for diverse applications encompassing vehicle exteriors, parts, and accessories. With the steady rise in global automobile production and sales, the demand for high quality coatings has surged correspondingly. Coil coatings play a pivotal role in enhancing the aesthetic appeal of vehicles, ensuring durability, corrosion resistance, and longevity of automotive components. As automakers prioritize the use of high-quality coatings to meet consumer expectations for visually appealing and durable vehicles, the demand for advanced coil coatings is anticipated to further escalate in the automotive sector.

For instance, the Society of Indian Automobile Manufacturers reported notable growth in various segments. Specifically, sales of passenger cars increased from 1,467,039 to 1,747,376 units, utility vehicles saw a surge from 1,489,219 to 2,003,718 units, and van sales rose from 113,265 to 139,020 units in comparison to the fiscal year of 2022.

Stringent Environmental Regulations and Sustainability Initiatives to Increase Coil Coating Demand

Coil coated metals compared to post-painted metals have demonstrated a notable reduction in environmental impact through reduced water consumption and recycling. One of the key areas where coil coated metals exhibit a positive environmental footprint is in the reduced water consumption compared to post coating metals. The process of pre-painting typically has low energy and labour cost, reduced environmental impact and decreased water usage compared to the traditional post-painting methods.

For instance, According to European Coil Coating Association, the impact of coil coated aluminum and steel on human are just 24% and 25% of the impact of post painted metals. Since coil coating offers sustainability and abets safety standards compared to post painted metals, the consumer sentiments towards coil coating improved.

Impact of COVID-19

The COVID-19 pandemic significantly disrupted global supply chains, impacting the production and distribution of coil coatings and their raw materials. Delays and shortages were witnessed in the supply chain for coil coating and substrates such as steel and aluminium primarily due to factory closures and transportation restrictions. The pandemic-induced lockdowns and economic slowdowns led to a notable decrease in demand across various sectors such as construction and automotive, which weakened the demand for coil coatings during the pandemic. Finally, the coil coating market faced price fluctuations during the pandemic, driven by supply and demand dynamics disruptions.

Impact of Russia-Ukraine War

The Russia-Ukraine conflict had a notable impact on the coil coating market, particularly because Russia is a major supplier of aluminium substrate to various countries, especially in Europe. The conflict prompted several European nations to enforce import bans on Russian products, including aluminium. This restriction significantly tightened the supply of coil coated metals in these markets. Consequently, production costs for coil coating increased in these countries, reducing procurement activities. The war reduced construction and automotive activities in the affected region further weakening the demand for coil coatings.

Global Coil Coatings Market: Report Scope

“Coil Coatings Market Assessment, Opportunities and Forecast, 2016-2030F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative & quantitative assessment of the current state of Coil Coatings Market globally, industry dynamics and challenges. The report includes market size, segmental shares, growth trends, COVID-19 and Russia-Ukraine war impact, opportunities and forecast between 2023 and 2030. Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/coil-coatings-market

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

0 notes

Text

Tire Aftermarket, Tire Replacement Market: A Competing Shift

A flat tire is among the several inconveniences vehicle owners aim to avoid. Whether due to valve system damage or blowout due to over-inflation, the absence of a proper tire can severely damage the wheel and trigger tire replacement. This drawback has instigated several tire producers to invest in R&D to develop high-performance, fuel-efficient tires, opening avenues for the global tire aftermarket, tire replacement market.

Additionally, integrating systems like anti-lock braking systems, electronic power control, and tire pressure monitoring systems has upheaved the demand for tire aftermarket services. Our estimates have gathered that the global market is set to gain revenue worth $93.38 billion by 2028, rising at a CAGR of 4.43% during the forecast years 2022-2028.

Developments in Aftermarket Services

Wait, did you say airless tires? Instead of air, tires are now integrated with a network of spokes that keeps the wheels rigid while giving them a see-through appearance. Each year, around 20% of tires are trashed due to puncture or uneven wear, stimulating manufacturers like Michelin to launch UPTIS airless automobile tire design that results in lower raw material and waste consumption. In this regard, the company has teamed up with GM to introduce UPTIS by 2024.

Besides, the tires’ ability to bear high weight and absorb shocks is anticipated to support the growth of the 16-18-inch rim size category. Numerous players have opted for this size since it offers additional grip, braking performance, and ride comfort, a major driving force for the tire aftermarket, tire replacement market.

The Green Initiative: With the average crude oil price rising from $39.68 in 2020 to $97.64 in 2022 and the rising carbon footprint, the demand for energy-efficient tires has boosted the tire replacement market. Besides, advances in tire energy efficiency can decrease global fuel consumption by around 5% in passenger vehicles, per the International Council on Clean Transportation. This has led low rolling resistance tires to gain immense traction among consumers to lower their total carbon footprint.

Considering this trend, in January 2023, Goodyear revealed a demonstration tire made of 90% sustainable materials, including carbon black and soybean oil. While it stated the need for further collaboration to bring 90% sustainable tires into the market, the company plans to sell them with 70% sustainable material in 2023. Our analysis indicates that the radial tire type captures the highest share in the market as it has lower rolling resistance, achieving greater fuel efficiency.

Labeling Culture: Labeling has emerged as a viable solution to differentiate products from packaging to tires. However, governments are striving to implement standards to eliminate redundant performance classes from the scale. For instance, the label design will be changed in the US with snow and ice grip symbols. The European Commission also introduced Euro 7 standards for particle emission from tires and brakes to ensure cleaner vehicular movement and air quality across the region.

Other than this, the Indian government mandated new standards in 2021 to enhance fuel efficiency and braking impact on wet roads. Earlier in 2022, Michelin became the first tire brand to receive a 4-star rating by the Bureau of Energy Efficiency, India, under the new star labeling program. Such steps by government bodies to promote sustainability are set to be a growth enabler for the Asia-Pacific tire aftermarket, tire replacement market.

Electric Vehicle: Revving Up the Ride

Over the course of a decade, electric vehicle sales soared to reach around 7 million units in 2021. Fueled by the falling costs of lithium-ion batteries, the rising EV sales have revolutionized the automotive industry and the tire sector. Furthermore, since the additional weight of batteries in EVs lead to enhanced stiffness, the demand for cutting-edge tires has accelerated. As a result, companies like Bridgestone have unveiled ENLITEN Technology that decreases tire rolling resistance by 30% and weight by 20% to expand EV driving range and reduce environmental impact. Therefore, the EV industry is attractive for expanding the tire aftermarket, tire replacement market.

FAQs:

Q1) What are the types of tires in the aftermarket, tire replacement market?

There are two major types of tires, namely, radial and bias, in the tire aftermarket, tire replacement market.

Q2) Which region will witness the fastest growth during the forecast period?

Asia-Pacific tire aftermarket, tire replacement is anticipated to witness the fastest growth, attaining a CAGR of 5.09% during the forecast period 2022-2028.

#Tire Aftermarket#Tire Replacement Market#Automotive & Transportation#Automotive Components#triton market research#market research reports

0 notes

Text

Global Top 5 Companies Accounted for 71% of total Sandalwood Extract market (QYResearch, 2021)

Sandalwood is a class of woods from trees in the genus Santalum. The woods are heavy, yellow, and fine-grained, and unlike many other aromatic woods, they retain their fragrance for decades. Indian Sandalwood Oil (Santalum Album) is extracted from the woods for use. Sandalwood is the second most expensive wood in the world, after African blackwood. Both the wood and the oil produce a distinctive fragrance that has been highly valued for centuries. Consequently, species of these slow-growing trees have suffered over-harvesting in the past century.

Most Sandalwood species are semi-parasitic and several produce a highly aromatic wood. The most common species are Indian sandalwood (Santalum album) and Australian sandalwood (Santalum spicatum), although other species are used for their scent as well.

The oil that distilled from eucarya spicata species, amyris and so on is not belonging to the Sandalwood Oil.

Different sandalwood species are indigenous to India, Indonesia, Sri Lanka, Bangladesh (S. album), and Australia (S. spicatum and S. lanceolatum), as well as to several Pacific Islands such as Hawaii (S. ellipticum), Fiji and Tonga (S. yasi), Papua New Guinea (S. macgregorii), Vanuatu and New Caledonia (S. austrocaledonicum) and French Polynesia (S. insulare).

Traditionally, sandalwood is wild-harvested, since cultivation is difficult. Because of over- and illegal harvesting, supplies of sandalwood, especially Indian sandalwood, have decreased considerably over the last 10-15 years. Consequently, efforts to cultivate sandalwood have increased; Australia now has several plantations of Indian sandalwood trees.

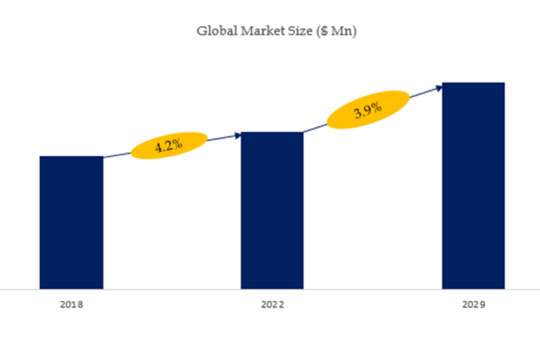

According to the new market research report “Global Sandalwood Extract Market Report 2023-2029”, published by QYResearch, the global Sandalwood Extract market size is projected to reach USD 0.16 billion by 2029, at a CAGR of 3.9% during the forecast period.

Figure. Global Sandalwood Extract Market Size (US$ Million), 2018-2029

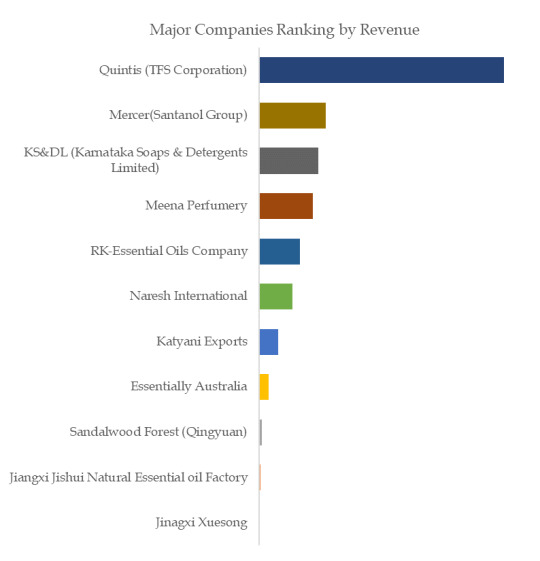

Figure. Global Sandalwood Extract Top 11 Players Ranking and Market Share(Based on data of 2021, Continually updated)

The global key manufacturers of Sandalwood Extract include Quintis (TFS Corporation), Mercer(Santanol Group), KS&DL (Karnataka Soaps & Detergents Limited), Meena Perfumery, RK-Essential Oils Company, Naresh International, Katyani Exports, Essentially Australia, Sandalwood Forest (Qingyuan), Jiangxi Jishui Natural Essential oil Factory, etc. In 2020, the global top five players had a share approximately 71.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

India Steel Industry: A Growing Giant in Global Markets

The India steel industry has emerged as a critical player in the global steel market, driven by rapid industrialization, urbanization, and robust infrastructure development.

The India Steel Market Size is projected to have a size of 135.81 million tons in 2024 and is expected to grow to 209.93 million tons by 2029, with a compound annual growth rate (CAGR) of 9.18% during the forecast period from 2024 to 2029.

Market Overview and Growth Drivers

India’s steel market is projected to witness substantial growth in the coming years, with both domestic demand and exports playing vital roles in its expansion. The Indian steel market is expected to grow at a healthy rate, owing to multiple factors:

1. Infrastructure Development

India is experiencing a construction boom driven by government initiatives like "Make in India," and large-scale infrastructure projects such as Smart Cities Mission, affordable housing, and expansion of railways. These projects are boosting demand for steel across sectors like real estate, transportation, and manufacturing, positioning India as a major consumer of steel.

2. Automobile and Manufacturing Industries

The rise in demand for steel from the automotive and manufacturing industries is another critical factor fueling growth. The steel sector serves as the backbone for automobile production, contributing to vehicle body construction, engine components, and other essential parts. With India being one of the fastest-growing automobile markets globally, the demand for quality steel is expected to remain strong.

3. Urbanization and Industrialization

As more people migrate to urban areas and industries expand, the demand for residential and commercial construction has surged. Steel, being a core material for structural applications, is experiencing heightened consumption in urban development, industrial buildings, and infrastructure projects.

4. Government Policies and Investments

India’s steel industry has benefited from supportive government policies aimed at enhancing production capacity and boosting exports. Initiatives like the National Steel Policy (NSP) 2017, which aims to achieve 300 million tons of steel production capacity by 2030, underscore the government’s commitment to making India a global steel leader. Furthermore, the Production Linked Incentive (PLI) scheme for specialty steel is expected to encourage more investments and technological upgrades in the sector.

Key Trends in the India Steel Market

1. Green Steel and Sustainability Efforts

With growing concerns about climate change and environmental impact, the Indian steel industry is increasingly focusing on sustainability. Companies are investing in green steel production, reducing carbon emissions, and adopting energy-efficient technologies. The push toward electric arc furnaces (EAF) and the use of scrap metal as raw material is part of a broader effort to transition to cleaner, eco-friendly steel manufacturing processes.

2. Growth of Specialty Steel

The demand for specialty steel, used in high-end applications such as aerospace, defense, and high-performance automotive components, is rising. Indian steel manufacturers are focusing on producing value-added steel products to cater to these advanced industries. This is in line with the government's PLI scheme for specialty steel, which aims to reduce India’s dependence on imports of high-grade steel products.

3. Export Market Opportunities

India has become one of the largest exporters of steel, driven by its competitive pricing and rising production capabilities. Indian steel manufacturers are tapping into new markets in Southeast Asia, Africa, and Europe. The global steel market is expected to remain strong, providing Indian producers with further opportunities for export growth, especially with other nations moving towards protectionist measures or supply disruptions from traditional steel producers.

Challenges in the Indian Steel Industry

Despite its growth trajectory, the Indian steel industry faces several challenges:

1. High Input Costs

One of the major concerns for steel producers is the rising cost of raw materials, especially iron ore and coking coal. While India is rich in iron ore, the reliance on imported coal has created price fluctuations that impact production costs. The industry is working toward finding cost-effective alternatives and increasing domestic coal production to mitigate this issue.

2. Environmental Regulations

As India moves toward a more sustainable future, stricter environmental regulations are being implemented for industries, including steel. Compliance with these regulations, while necessary, could raise production costs, especially for older plants that need significant upgrades.

3. Technological Modernization

Many steel plants in India still operate with outdated technologies that result in lower productivity and higher energy consumption. The adoption of newer, more efficient technologies, such as automation, digitization, and smart manufacturing, is essential for the industry’s modernization and competitiveness on a global scale.

Conclusion

The India steel industry is poised for continued expansion, benefiting from supportive government policies, rising domestic demand, and a growing export market. While challenges such as rising input costs and environmental regulations need to be addressed, the sector's commitment to sustainability and modernization will shape its future success. As India solidifies its position as a global steel powerhouse, the industry will play a crucial role in driving economic progress, infrastructure development, and job creation.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/india-steel-market

#india steel market#india steel market size#india steel market share#india steel market trends#india steel market analysis#india steel market forecast

0 notes

Text

India used car loan market size at USD 7.72 billion in 2021. And BlueWeave expects India used car loan market size to grow at a CAGR of 12.1% during the forecast period (2021–2028), reaching the value of USD 17.2 billion by 2028.In India, the second hand automobile market has been gaining traction in recent years. The ratio of used to new cars is currently approximately 1.3 in the country. The expansion of the organized and semi-organized sectors can be ascribed to the evolution of the country's used automobiles market. In addition, the reduction in the GST rate on used cars from 28% to 12–18% is driving the market. As the Indian auto industry transitions to BS-VI in April 2020, the value proposition of a used automobile is expected to improve, as new cars are expected to become more expensive due to increased technology expenditures. Major automobile manufacturers are also steadily focusing on reducing diesel car production.

India Used Car Loan Market - Technology Advancements

Unless there is a backlash against diesel automobiles, it is also expected to raise demand for compact diesel cars in the used car market (because of their higher mileage estimates). Mahindra First Choice Wheels Limited invested in CarandBike.com, a renowned Indian automobile website, in January 2020. Cars24 concluded a series D equity financing of roughly USD 100 million in October 2019 from new and existing investors. Maruti Suzuki India relaunched its True Value brand in February 2019 with a new identity and incentives. OLX has been a market leader in this area. In 2019, OLX partnered with the Frontier Group to open used automobile dealerships on the ground (Cash my Car). Cash my Car locations are now available in ten cities. OLX intended to further expand its. Over the forecast period, major players’ plan to develop offline outlets is expected to grow the market for unorganized used car sales.

Rising Demand for Pre-Owned Cars

The Indian pre-owned car market is expanding as demand for premium vehicles continues to rise. The sales of second hand premium cars have increased by 20%. The market's expected expansion can be linked to rising disposable income and an increase in the number of people who buy used cars. Used car loans are available for a variety of automobiles, including hatchbacks, SUVs, and premium sedans. They are dominating the used car loan market by giving loans up to 95% of the used car value, flexible EMI repayment options, swift loan disbursement, flexible tenure, and low paperwork.

With easier access to financing alternatives, annual maintenance contracts, and cheaper entry pricing, the India Used Car Loan industry is becoming more organized.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/india-used-car-loan-market/report-sample

0 notes

Text

Exploring Market Trends and Opportunities in the Global Epoxy Resins Paints Industry: A Comprehensive Market Research Study

Epoxy Resins Paints Market poised to grow at highest pace owing to rapid industrialization Epoxy resins paints are durable, water and chemical resistant coatings finding wide application across industries like construction, automotive and manufacturing due to their advantages. These paints provide excellent adhesion to non-porous substrates and resistance to humidity, moisture, chemicals and corrosion. They form a protective barrier and are increasingly used for automotive OEM coatings, floor coatings, concrete primers and protective coatings. The global epoxy resins paints market is estimated to be valued at US$ 13.62 Bn in 2024 and is expected to exhibit a CAGR of 5.6% over the forecast period 2024 to 2031 owing to rapid industrialization. The Global epoxy resins paints Market is estimated to be valued at US$ 13.62 Bn in 2024 and is expected to exhibit a CAGR of 5.6% over the forecast period 2024 to 2031. Key players operating in the epoxy resins paints are Momentive Performance Materials, Kukdo Chemical, Huntsman Corporation, The Dow Chemical Company, Atul Ltd, Sika AG, Cytec Industries Incorporation, DuPont, 3M, BASF SE, Aditya Birla Chemicals Ltd, NAMA Chemicals, LEUNA-Harze GmbH, and Spolchemie A.S. Key Takeaways Key players operating in the epoxy resins paints are Momentive Performance Materials, Kukdo Chemical, Huntsman Corporation, The Dow Chemical Company, Atul Ltd, Sika AG, Cytec Industries Incorporation, DuPont, 3M, BASF SE, Aditya Birla Chemicals Ltd, NAMA Chemicals, LEUNA-Harze GmbH, and Spolchemie A.S. The rapidly growing construction industry coupled increasing automobile production is fueling the demand for epoxy resins paints. Technological advancements are focused on developing low volatile organic compound and bio-based epoxy resins paints. The construction industry has been growing at a strong pace backed by rapid urbanization and industrialization in emerging economies of Asia Pacific and Middle East countries. Epoxy resins paints find extensive application in flooring, primers, protective and marine coatings in construction sector. The rapidly growing automobile production driven by rising vehicle ownership particularly in developing countries has increased the uptake of these paints in automotive OEM coatings and auto-refinish paints. Recent technological developments are focused on developing advanced epoxy resins paints with properties like low volatile organic compound (VOC) content, bio-based formulations and UV resistant coatings to suit varied end-use applications. These innovations are aimed at meeting stringent environmental norms along with improving product performance. Market Trends Some of the key trends in the global epoxy resins paints market include shift towards bio-based formulations driven by sustainability concerns and growing demand for low VOC content paints to meet environmental regulations. Another trend gaining momentum is development of UV resistant and high performance protective coatings for infrastructure and industrial applications like pipe coatings, machinery coatings etc. Rapid adoption of powder coatings for industrial use due to their advantages over liquid coatings is another major trend. Market Opportunities Rising investments in infrastructure development across developing nations provide significant growth opportunities. The Indian government's investments of USD 1.4 trillion in infrastructure till 2024 will boost adhesive demand. Another major opportunity lies in developing water-based and environment-friendly epoxy resins paints that can replace solvent-borne varieties to comply with stringent norms.

0 notes

Text

Market Size and Share: Global Instrument Cluster Market Analysis

The instrument cluster market, the overall market is estimated to be worth USD 9.02 Billion in 2018 and is expected to reach USD 10.72 Billion by 2023, at a CAGR of 3.5% between 2018 and 2023.

Increasing vehicle production worldwide and stringent government regulations for vehicle and passenger safety across the globe are the major drivers for the growth of the instrument cluster market.

Major players profiled in the instrument cluster market report are Continental (Germany), DENSO (Japan), Visteon (US), Nippon Seiki (Japan), Magneti Marelli (Italy), Aptiv (UK), Calsonic Kansei (Japan), Pricol (India), Robert Bosch (Germany), and Yazaki (Japan). The report also includes profiles of companies such as Alpine Electronics (Japan).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=255415383

Hybrid instrument cluster expected to hold a major share during the forecast period

Hybrid instrument cluster led the market in 2017. Hybrid instrument clusters are used in various vehicles, such as two-wheelers, passenger cars, buses and coaches, among others. The increasing adoption of hybrid instrument clusters for passenger cars and commercial vehicles is expected to drive the market during the forecast period. The increasing sales of passenger and commercial vehicles will simultaneously increase the demand for hybrid instrument clusters.

Two-wheeler expected to grow at a high CAGR between 2018 and 2023