#India Rental Housing Market

Explore tagged Tumblr posts

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

5 notes

·

View notes

Text

Puri Real Estate Market: A Smart Investment for Your Dream Home

Puri, the spiritual capital of Odisha and home to the famous Jagannath Temple, is fast emerging as a real estate hotspot. Known for its pristine beaches, cultural heritage, and growing infrastructure, Puri's housing market presents a golden opportunity for homebuyers and investors alike. Whether you’re looking for affordable 1 BHK sea-view flats in Puri or luxury 2 BHK furnished apartments near Puri beach, there’s a property for every budget and lifestyle.

One of the most talked-about residential projects in this region is Bivab Yashila, offering modern flats in Puri with world-class amenities. If you’re considering investing in Puri real estate, now is the perfect time!

Why is Puri’s Real Estate Market Booming?

1. Coastal Living at Its Best

The demand for sea-view apartments in Puri is at an all-time high. Living near the ocean not only offers a serene lifestyle but also ensures higher property appreciation over time. Luxury apartments in Puri with modern amenities and stunning beach views are attracting buyers from across India.

2. Spiritual and Cultural Significance

Puri is one of the Char Dham pilgrimage sites, making it a preferred location for spiritual seekers and retirees. Real estate trends in Odisha indicate that properties near religious and heritage sites tend to have long-term value appreciation.

3. Rapid Infrastructure Development

With improvements in road connectivity, better urban planning, and upcoming residential projects, Puri’s housing market is evolving. The current property rates in Bhubaneswar and Puri reflect a steady increase, making investment opportunities in Puri’s real estate market highly attractive.

4. Ideal for Vacation Homes and Rentals

Being a major tourist hub, Puri Real Estate offers excellent rental returns. Many investors purchase furnished apartments in Puri as holiday homes or Airbnb rentals to generate passive income. Puri property prices remain competitive compared to other beach destinations, making it a profitable long-term investment.

Types of Properties Available in Puri

1. Affordable Housing in Puri

For budget-conscious buyers, there are affordable 1 BHK sea-view flats in Puri and modern flats in Puri that offer excellent amenities without a hefty price tag.

2. Luxury Apartments in Puri

For those seeking an opulent lifestyle, luxury 2 BHK furnished apartments near Puri Beach come equipped with state-of-the-art facilities like swimming pools, landscaped gardens, and smart home features. Luxury living experiences in Puri’s beachfront properties are gaining popularity among NRIs and high-net-worth individuals.

3. Villas and Independent Houses

If you prefer privacy, independent villas near Puri Beach offer spacious living with premium features. Many upcoming residential projects in Puri focus on villa-style developments, catering to those who seek exclusivity.

4. Commercial Properties

With the rise of tourism and retail businesses, commercial real estate in Puri is also witnessing growth. From beachfront resorts to retail spaces near Jagannath Temple, the opportunities are diverse.

Best Locations to Buy Property in Puri

1. Sea Beach Road

The most sought-after area, offering sea-view apartments in Puri and high rental demand.

2. Baliapanda

Close to the beach and well-connected, this area is perfect for modern flats in Puri and luxury projects like Bivab Yashila.

3. VIP Road

A developing area with promising future value, attracting both residential and commercial projects.

4. Grand Road (Bada Danda)

If you want to stay near the Jagannath Temple, this location is ideal.

Future Prospects of Real Estate Investments in Puri

Increasing Tourist Influx – As one of India’s most visited pilgrimage and beach destinations, the demand for housing and rentals will continue to rise.

Government Development Initiatives – Projects like improved coastal roads, tourism infrastructure, and smart city plans are set to boost Puri’s real estate market further.

Steady Appreciation of Property Values – The current property rates in Bhubaneswar and Puri indicate a growing trend, making now the perfect time to invest.

Key Considerations Before Buying Property in Puri

Compare 1 BHK and 2 BHK Apartments in Puri – Choose a configuration that fits your lifestyle and budget. Check Legal Approvals – Ensure the property has all necessary permits and RERA approvals. Analyze Rental Potential – Opt for areas near the beach or temple if investing in rental income. Future-Proof Your Investment – Look for properties in developing areas to maximize future returns.

Conclusion: Is Puri the Right Investment Choice?

Absolutely! Whether you’re a homebuyer looking for a peaceful sea-facing flat or an investor seeking high returns in Puri’s housing market, the opportunities are abundant. Puri is an ideal destination for real estate investments with its spiritual significance, thriving tourism, and growing infrastructure.

Now is the perfect time to invest in Puri real estate before prices surge further!

#developers in puri#developers in odisha#developers in Bhubaneswar#builders in puri#builders in Bhubaneswar

2 notes

·

View notes

Text

Moving to Electronic City: Embrace the Tech and Culture

Moving to a new place with the help of Packers and Movers Lucknow to Bangalore or by yourself is an exciting adventure, especially when you are moving to Electronic City. This dynamic tech hub is home to numerous IT parks, start-ups and a diverse community. The city is blessed with incredible weather and clean air. The electronic city welcomes people from all over India. In this blog, we will discuss things you should consider before making the transition.

1. Understanding the Locale

Electronic City is divided into three phases. The Phase 1 is the most developed. So, it's important to familiarize yourself with the area, as each phase has its own unique characteristics and amenities.

2. Connectivity

One of the biggest advantages of living in an Electronic City is its connectivity. The area is well-connected to main parts of Bangalore via the NICE Road and the Outer Ring Road. Public transport options include buses and the upcoming metro extension, making commuting easier.

3. Cost of Living

The cost of living in Electronic City can be different based on your lifestyle and housing choice. Housing is generally more affordable than in central Bangalore, but prices can differ significantly between phases. Be sure to research and compare rental options.

4. Housing Options

From apartments to gated communities, Electronic City offers a range of housing options. There are some factors you should consider before choosing the options, like proximity to your workplace, safety, and other amenities. There are some popular residential areas as well, such as Ayyappa Nagar and Neeladri Nagar.

5. Employment Opportunities

Electronic City is a major IT hub, hosting companies like Infosys, Wipro, and Tech Mahindra. If you're in the tech industry, you'll find ample job opportunities in this city. Networking events and meetups are common, so take advantage of these to expand your professional circle.

6. Lifestyle and Amenities

The area has a variety of amenities, including shopping malls, restaurants, and recreational facilities. The nearby Forum Mall and other local markets can easily fulfil your shopping needs. For food lovers, there's a mix of local eateries and international cuisine options as well.

7. Education and Healthcare

Electronic City is home to several reputable schools and colleges, making it suitable for families. Healthcare facilities are also easily accessible, with hospitals like Narayana Hrudayalaya and Columbia Asia nearby.

8. Cultural Diversity

It has a blend of professionals from different parts of India and the world; Electronic City offers a rich cultural experience. Engage in local festivals, events, and community gatherings to connect with new people.

9. Weather and Environment

Bangalore has a moderate climate, but Electronic City can be warmer due to urban heat. Ensure your living space has adequate ventilation and cooling systems. Green spaces and parks, like the nearby Electronic City Park, provide a nice escape from the hustle and bustle.

10. Safety and Security

Electronic City is relatively safe, but it's wise to be aware of your surroundings. You can take suggestions from your friends or Packers and Movers in Electronic City, as they have complete knowledge of the local area. It will help you in choosing residential areas with good security measures and stay informed about local news and community updates.

Conclusion

Moving to Electronic City can be a rewarding experience, especially for those in the tech industry. By understanding the local environment, amenities, and lifestyle, you can make a smooth moving and enjoy everything this dynamic area has to offer.

#Packers and Movers Electronic City#Packers and Movers Lucknow to Bangalore#thepackersmovers#Movers and Packers#Moving Companies

2 notes

·

View notes

Text

Investing in Real Estate in Mumbai: Is Now the Right Time?

Deciding if now is the right time to invest in Mumbai real estate depends on your individual goals and risk tolerance. By carefully weighing the pros and cons and doing your due diligence, you can make an informed decision about whether investing in Mumbai real estate is the right step for you right now.

The current state of the Mumbai real estate market

Mumbai's real estate market appears to be on a positive trajectory in 2024. There are reports of significant growth in the first quarter of 2024, with rising demand for both residential and commercial properties. The demand for high-end apartments remains high, with developers catering to this segment with new projects. overall, Mumbai continues to be an attractive destination for investors, both domestic and foreign

The potential for future growth in the Mumbai real estate market

India's economic recovery is expected to continue, which will likely boost demand for housing and office space in Mumbai as a financial hub. Ongoing infrastructure projects, like new metro lines, are creating new areas for development and improving connectivity within the city, making these areas more attractive for residents and businesses. The potential for future growth seems significant. However, It's important to stay informed about economic trends and government policies that could influence the market.

Things to consider before investing in real estate in Mumbai

Market Knowledge: Deep dive into current market trends, property price movements, rental yields in different areas, and overall market health.

Area Expertise: Focus on specific neighborhoods that align with your goals. Understand their growth trajectories, demographics, infrastructure plans, and rental potential

Strategic Selection: Consider not just current amenities but also future infrastructure projects and development plans in the area. This can significantly impact property value

Accessibility Matters: Choose a location with good connectivity to public transport, schools, hospitals, and workplaces, depending on your target demographic (families, young professionals etc.)

Investment Strategy: Align your property choice with your goals. If rental income is your focus, prioritize high-yield areas. For capital appreciation, consider up-and-coming neighborhoods.

Tips for successful real estate investment in Mumbai

Stay informed about current market trends, property prices, and future projections.

Real estate is a long-term investment. Think about your future needs and if the property aligns with them.

Consider the amenities offered by the property and the surrounding area that enhance your investment's value.

#realestate#sunblonderealty#mumbai#realestateprojects#reality#mumbairealestate#dreamhome#propertyfinder#maharera#luxuryliving#Mumbai Residential Properties#Right Time To Invest In Real estate#Invest In Mumbai Real estate#Invest in real estate#real estate investing#mumbai Properties

3 notes

·

View notes

Text

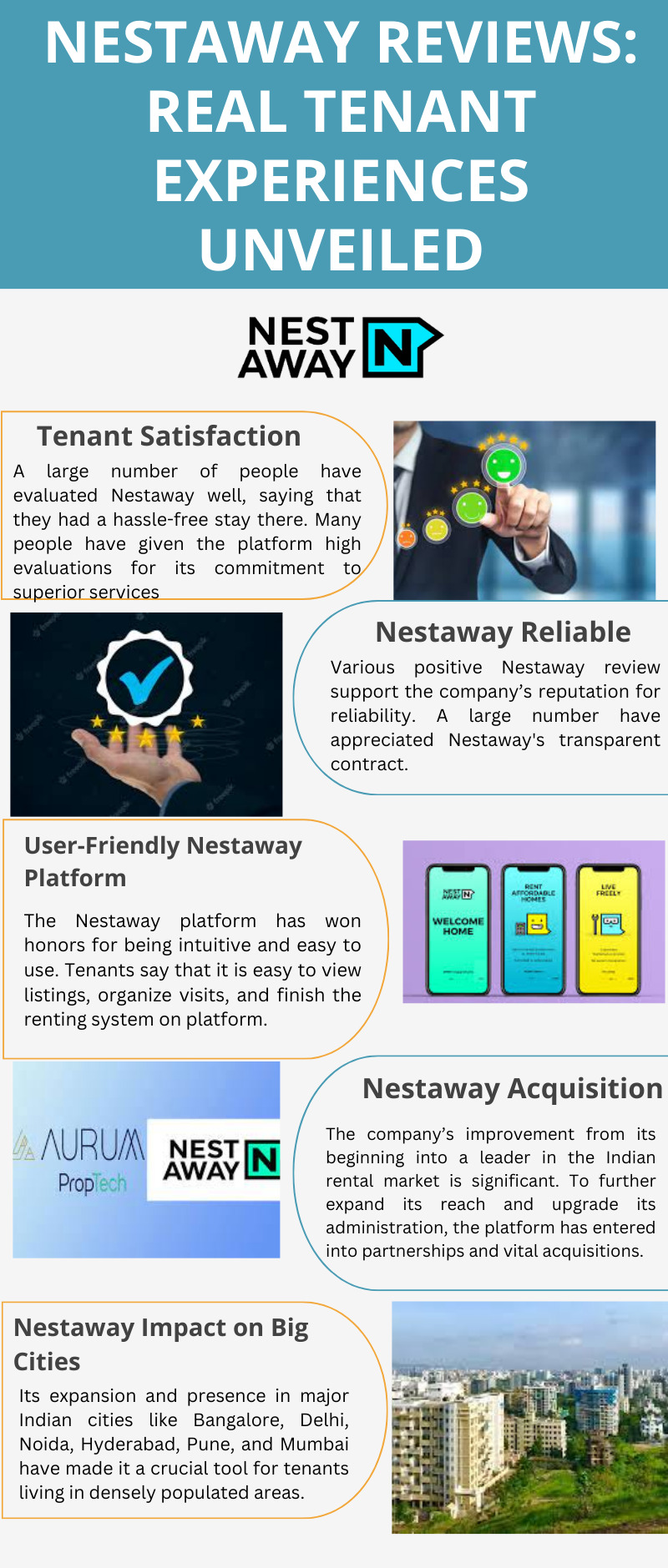

Nestaway Reviews: Real Tenant Experiences UnveiledThe rental housing market in India has experienced substantial expansion and change recently, with new businesses joining the market to meet tenants' changing needs. Among them, Nestaway has become a key participant, providing a distinctive platform that links tenants with suitable rental properties. This blog examines the reliability of the platform and its effects on several cities, including Bangalore, Gurgaon, Delhi, Noida, Hyderabad, Pune, and Mumbai. It also examines the company's evaluations and tenant experiences.

#nestaway#nestawayreview#nestaway ratings#nestawaygood#nestaway platform#nestaway reliable#nestaway reviews#nestaway good#nestawaypune#nestaway review

2 notes

·

View notes

Text

Nestaway Ratings: A Window into Tenant Satisfaction and Security

Nestaway has become a significant player in India's constantly changing rental housing market. With the goal of giving urban residents rental living spaces, the Nestaway platform has attracted a lot of interest and trust from tenants. In this blog, we will discuss Nestaway’s reputation as a trustworthy platform across major Indian cities such as Bangalore, Gurgaon, Hyderabad, Pune, and Mumbai.

A Quick Overview

Let's take a quick look at the company and how it has become a household name for many tenants in India. Using cutting-edge technology, the company connects landlords with renters looking for housing. It was established in 2015, and since then, it has expanded significantly and attracted much attention.

Nestaway Ratings: The Pulse of Tenant Satisfaction

Tenant evaluations and ratings are crucial factors to consider when selecting a rental property. Prospective tenants frequently look to the testimonials of former tenants to determine the caliber of the rental and the dependability of the platform. The company has made keeping an open feedback system a top priority after realizing this. The positive Nestaway ratings are a testament to the company’s commitment to providing affordable rentals.

An intuitive platform: The user-friendly Nestaway good platform is one of the main factors in its popularity. The entire renting procedure is quick and simple because of the ease with which tenants can browse for properties, schedule visits, and submit paperwork online.

A Wide Range of Rental Alternatives: The company offers a variety of rental alternatives, from single rooms to completely furnished apartments, to meet the various needs of city dwellers.

Tenant-Centric Approach: The company prioritizes its tenants in all aspects of its business. The customer service of Nestaway Pune is frequently recognized for its promptness in responding to tenant problems.

Security: The security and safety of Nestaway's renters is a top priority. The platform lists accommodations with security measures, and the company has strict verification procedures in place for both tenants and property owners. This feature is well-reflected in the positive Nestaway review.

City-Wide Presence: The company provides rental alternatives to a sizable urban population through its presence in important cities like Bangalore, Gurgaon, Delhi, Noida, Hyderabad, Pune, Mumbai, and many more.

Nestaway's Reliability

The Nestaway platform has established itself as a reliable platform that acts as a bridge between tenants and property owners. Strong verification procedures on the platform and commitment to tenant satisfaction have been important factors that have positioned Nestaway reliable platform as a top choice of tenants.

Acquisition and Expansion

The company has achieved great success on its path to dominating the Indian rental market. Through calculated action, the company was able to further streamline its business processes and improve the entire renting experience for tenants through the highly successful Nestaway Acquisition. The Nestaway sold out properties demonstrate how well the company matches tenants with property owners.

Nestaway Across India

The presence of the company includes numerous Indian cities, each with distinctive rental market dynamics.

Nestaway Bangalore: As one of the first places where the company marked its presence, Bangalore has a sizable selection of rental houses available on the platform. Reviews of Nestaway Bangalore point out how easy it is to locate suitable lodging in the busy regions of the city.

Nestaway Gurgaon witnesses a steady stream of professionals looking for rental homes. Due to its large property listings and trustworthy services, Nestaway Gurgaon has become a popular option for many.

Nestaway Delhi and Noida: There are numerous rental choices in Delhi and nearby places like Noida. The National Capital Region's (NCR) booming rental housing market has been made easier to navigate by Nestaway's presence in these locations.

Nestaway Hyderabad: The demand for rental homes has also increased in Hyderabad, the City of Pearls. The Nestaway Hyderabad offers choices for individuals on a tight budget as well as those looking for luxurious lodging.

Nestaway Pune, with its growing IT industry and educational institutions, has a broad rental market. With a variety of options, Nestaway Pune serves families, professionals, and students alike.

Nestaway Mumbai: Positive Nestaway Reviews praises the website for making the difficult task of locating a suitable rental property in this metropolis more smooth and manageable.

Conclusion:

The rising presence of Nestaway in significant Indian cities demonstrates the company's dedication to tenant security and pleasure. It is a dependable option for anyone looking for rental properties because of its user-friendly platform, varied listings, and emphasis on safety. Additionally, the company's commitment to resolving tenant issues promptly distinguishes it as a respected player in the Indian rental housing sector.

The Nestaway Platform is crucial in streamlining the renting process and giving tenants in India safe, high-quality living spaces as urbanization expands. The company is likely to keep its position as a top name in the Indian rental housing market by focusing on its customers and striving for improvement.

#nestaway delhi#nestawayratings#nestawayreliable#nestawayreview#nestaway good#nestaway#nestawayacquisition#nestawayplatform#nestawaysoldout

2 notes

·

View notes

Text

Real Estate Evolution In India!

Real estate, a constantly changing market, has a rich history and complex evolution. Although understanding its journey is challenging due to numerous factors, I will attempt to provide a simplified overview of the real estate sector in India. Let's explore its fascinating evolution without further ado!

Early years:

The real estate sector in India underwent significant transformations during the post-independence period. The government played a crucial role by implementing policies and undertaking various projects to meet the housing demands of the population. Special residential houses and colonies were constructed to cater specifically to government employees, equipped with essential amenities like schools, parks, and hospitals.

Another noteworthy development during this era was the introduction of public housing projects. As there was a shortage of residential spaces in major cities, the government initiated these projects, which greatly improved the living conditions for people. Additionally, land reforms were implemented in the 1950s and 1960s to benefit farmers and enhance rural life. These reforms included land allocation to landless farmers.

In summary, the post-independence period in India witnessed the establishment of government housing for employees, public housing projects, and land reforms aimed at improving housing conditions and supporting agricultural communities.

Urban Planning and Infrastructure:

During the post-independence period in India, there was a strong emphasis on the development and modernization of cities, which involved the implementation of infrastructure plans. These plans included the construction of bridges, ports, improved road networks, and other initiatives aimed at enhancing transportation and connectivity across the country. As a result, urban centers emerged, and the improved infrastructure contributed to the overall economic growth of India. Additionally, these developments created new employment opportunities in cities.

Basically, from the 1950s to the 1970s, the Indian government primarily focused on public housing as a key priority. However, in the subsequent years, there were significant shifts in priorities and approaches to the real estate sector.

1980s-1990s:

The 1980s to 1990s marked a significant shift in the Indian real estate sector. It witnessed the rise of private housing, attracting prominent businesses and entrepreneurs to the market. This era also saw the diversification of real estate into different sectors, including commercial and luxury properties. People began to view real estate as an investment opportunity, prioritizing their comfort and luxury.

During this time, several benefits of investing in real estate became evident:

Value Appreciation: Real estate investments had the potential for value appreciation over time, making it a favorable asset compared to other investment options.

Long-Term Security: Real estate provides stability and long-term security, offering a reliable and protected investment option.

Multiple Income Sources: Real estate investments could generate additional income through rental properties. The emergence of companies like Getsethome's 'Xtra Income Homes’, allowed property owners to earn rental income, with returns as high as 7%.

The 1980s to 1990s were transformative for the real estate industry in India, shaping the perception of real estate as an investment avenue and offering various advantages to investors. Let's now explore further developments in the subsequent years in the real estate realm.

Liberalization in the 1990s brought significant changes to the Indian real estate industry.

The government implemented measures to remove restrictive regulations, leading to rapid expansion and growth. This resulted in the emergence of large-scale real estate projects like IT parks, shopping malls, and commercial developments. The real estate landscape underwent a transformative shift, creating new avenues for development and prosperity.

Digitization has also played a crucial role in reshaping the real estate industry. Online platforms have made property search, buying, and selling more convenient and streamlined. Buyers can now easily access information about properties and make informed decisions.

The Real Estate (Regulation and Development) Act (RERA), introduced in 2016, has had a significant impact on the real estate sector. It aims to protect the rights of buyers and sellers and promote transparency in the industry.

The Covid-19 pandemic presented challenges to the real estate industry, but it also brought about unexpected positive outcomes. The experience of the pandemic shifted people's mindset towards the importance of homeownership, leading to increased interest in real estate investment. As a result, the industry quickly rebounded in 2022.

In conclusion, the real estate market is dynamic and continuously evolving. Real estate investment remains a reliable and secure option. If you are considering investing in real estate, it is advisable to take prompt action and secure your own property in this diverse and ever-changing industry.

#investment#investors#property investing#real estate#property#evolution#financial markets and investing

3 notes

·

View notes

Text

Best Property in Joka Kolkata: Unleashing Potential

Kolkata, the cultural capital of India, is a city steeped in history, art, and a vibrant spirit. As the city continues to grow and expand, new areas are emerging as promising hubs for real estate investments. Among these, Joka in Kolkata has captured the attention of property in Joka Kolkata enthusiasts and investors, offering a multitude of opportunities and untapped potential. Located in the southwestern part of the city, Joka stands at the threshold of transformation, poised to become a thriving real estate destination.

With its strategic location, excellent connectivity, and ongoing infrastructure development, Joka has all the ingredients necessary for a flourishing market of property in Joka Kolkata. The area enjoys proximity to key neighborhoods like Behala, Alipore, and New Alipore, making it well-connected to the rest of Kolkata through major roads and upcoming metro lines. This accessibility not only ensures convenience in daily commuting but also provides easy access to essential amenities, educational institutions, healthcare facilities, and entertainment zones.

One of the standout features of Joka is its status as an educational hub, boasting prestigious institutions, and esteemed engineering and management colleges. This concentration of educational institutions not only attracts students but also creates a demand for rental properties, making Joka an excellent investment opportunity.

Moreover, Joka offers a range of affordable housing options, making it an attractive destination for first-time homebuyers and investors alike. With a mix of apartments, villas, and plots, the area caters to diverse budget ranges and preferences, ensuring that there is something for everyone.

Some Interesting features of the best property in Joka Kolkata

1. Strategic Location: Situated in the southwestern part of Kolkata, Joka enjoys proximity to key areas such as Behala, Alipore, and New Alipore. It is well-connected to the rest of the city through major roads, including the Diamond Harbour Road and the upcoming Joka-BBD Bagh flat near joka metro line. The area's accessibility makes it convenient for daily commuting and provides easy access to essential amenities, educational institutions, healthcare facilities, and entertainment zones.

2. Educational Hub: Joka is renowned for being an educational hub, housing prestigious institutions, and several renowned engineering and management colleges. The presence of these esteemed institutions not only attracts students but also creates a demand for rental flats in Joka, making it an excellent investment opportunity.

3. Affordable Housing Options: Compared to other prime locations in Kolkata, Joka offers relatively affordable housing options. The area features a mix of apartments, villas, and plots, catering to various budget ranges. Whether you are a first-time homebuyer or an investor looking for long-term capital appreciation, Joka provides a range of options that suit diverse requirements.

4. Future Growth Potential: Joka's real estate market is poised for significant growth in the coming years. The area's proximity to the upcoming Joka-Airport Metro line proposed IT hubs and commercial developments indicates a promising future. As more infrastructure projects materialize and economic activities flourish, property in Joka Kolkata prices are likely to appreciate, ensuring attractive returns on investments.

5. Green Spaces and Serene Environment: Joka offers a peaceful and green environment, away from the bustling cityscape. The area is surrounded by lush greenery, with parks and open spaces providing a refreshing escape from the urban chaos. The presence of serene surroundings adds value to residential properties in Kolkata, providing a serene and healthy lifestyle for residents.

6. Upcoming Commercial and Retail Developments: Joka is witnessing the emergence of commercial and retail developments, making it an ideal location for businesses and entrepreneurs. The growing presence of shopping complexes, office spaces, and commercial hubs creates opportunities for entrepreneurs to establish their ventures and cater to the needs of the expanding residential population.

7. Cultural and Artistic Significance: Kolkata is known for its rich cultural heritage, and Joka is no exception. The area is home to the Alipore Mint and the famed Sabarna Roy Choudhury family's ancestral estate, known as the "Sabarna Sangrahashala." This cultural significance enhances the overall appeal of Joka, attracting individuals who appreciate history and arts.

8. Well-Planned Residential Complexes: Real estate developers in Joka are focused on creating well-planned residential complexes that offer modern amenities and a comfortable living experience. These complexes often include facilities such as swimming pools, gyms, community halls, landscaped gardens, and 24/7 security, providing a convenient and luxurious lifestyle for residents.

9. Growth in Rental Demand: Joka's proximity to educational institutions and employment hubs has led to a growing demand for rental properties. Investors have the opportunity to earn a steady rental income by investing in 1, 2, and 3 BHK flats in Joka. The demand from students, working professionals, and young families seeking affordable housing options ensure a consistent rental market.

10. Infrastructure Development: Joka has witnessed substantial infrastructure development in recent years, attracting attention from real estate developers and investors. The area boasts well-planned residential complexes, modern commercial spaces, and upcoming shopping malls. The expansion of the Joka-BBD Bagh Metro line and the proposed flat near joka metro line will further enhance connectivity, making Joka a preferred choice for homebuyers and investors alike.

Conclusion:

With its strategic location, infrastructure development, affordability, educational institutions, and future growth potential, Joka, Kolkata offers an enticing landscape for investment for property in Joka Kolkata. The area's green surroundings, upcoming commercial developments, cultural significance, and well-planned residential complexes make it an attractive destination for individuals and families looking for a thriving community to call home.

Whether you are an investor seeking returns or a homebuyer searching for a comfortable and affordable lifestyle, Joka has the potential to exceed your expectations. Embrace the possibilities and explore the real estate opportunities that await you in Joka, Kolkata!

#property in joka#property in joka kolkata#flats in joka#flat near joka metro#properties in kolkata#1 bhk flat in joka#2bhk flats in joka

2 notes

·

View notes

Text

How does Income Tax on Rental Income affect property Investors?

Thinking about diversifying your portfolio and becoming a landlord? Renting out a property can be a worthwhile strategy especially if you have a well-built home in a sought-after area. If this appeals to you, you might want to explore finding a house for sale in Coimbatore Kovaipudur, where the rental market tends to be strong. Be sure to look at current villa projects offered by established builders.

However, before you embark on your property search, it’s also important to understand how income tax applies to rental income in India. This article will walk you through the essential aspects of income tax on rental income and how it affects property investors like yourself.

How taxes work on rental income in India

When you earn money from renting out your property, it's categorised as 'Income From House Property' for tax purposes. Here’s the process to figure out how much of that rental income you'll actually pay taxes on:

Start with the gross annual value (which is essentially the total rent you collect in a year).

Subtract the municipal taxes you paid to the local municipality.

Take as standard deduction. You're allowed to deduct 30% of the remaining amount for property maintenance regardless of your actual maintenance expenses.

If you have a home loan on the property, you can deduct the interest you paid on that loan.

The amount left after these deductions is the income that will be taxed according to your personal income tax slab.

A house for sale in Coimbatore Kovaipudur can be a profitable venture. But when you own a rental home, it’s important to fulfil your property tax obligations to relevant authorities to avoid penalties and ensure compliance. Local tax rates and the property’s assessed value will determine your obligations. Thankfully, property taxes on rental properties are usually tax-deductible — this means you can subtract them from your gross rental income when calculating your taxable income, effectively lowering your overall tax burden.

Start by investing in the right property.

JRD Realtorss can help you get started if you want to invest in a rental property. Find a house for sale in Coimbatore Kovaipudur from their ongoing projects — including JRD Harmony Villas, Imperial Garden Villas, and JRD Vistara Green Villas. You can learn more about their properties by downloading their app. You may also call +91 81899-99999 or +91 60339-33333 to speak directly with one of their experts.

0 notes

Text

Where Can I List My House for Sale Online in India Without an Agent on the Best Property Listing Sites?

In today’s digital era, selling your house online has become easier than ever. Whether you're looking to sell property online quickly or find the right buyer without involving an agent, choosing the right real estate listing website is crucial. If you want to post property online for free and maximize visibility, this guide will help you list your property on the best real estate website in India and attract potential buyers effortlessly.

Why Sell Property Online?

Selling a house online comes with multiple benefits:

Wider Reach: Your listing can attract buyers from across India, increasing the chances of a quick sale.

Cost-Effective: Avoid hefty agent commissions and list property for free on reliable platforms.

Convenience: Manage your listing, upload images, and connect with buyers anytime, anywhere.

Faster Sales: Many platforms provide instant inquiries, helping you sell house fast online.

Best Property Listing Sites in India

Here are some top real estate portals in India where you can buy property online, sell property online, or rent property online effortlessly:

1. 77pillar.com – The Ultimate Property Listing Platform

77pillar.com is a trusted property listing site that allows you to post property online for free. Whether you're selling a residential home, commercial property for sale, or rental space, 77pillar.com ensures maximum exposure and seamless transactions.

2. MagicBricks

One of the leading real estate listing websites, MagicBricks offers paid and free property listings with excellent buyer engagement.

3. 99acres

Another major property listing site, 99acres provides a user-friendly interface to list and manage properties effectively.

4. Housing.com

Ideal for both buying and renting, Housing.com helps users buy house online or rent property online hassle-free.

5. NoBroker

A commission-free platform that connects sellers directly with buyers, making it perfect for those looking to avoid agent fees.

How to List Your Property for Free on 77pillar.com?

Listing your property on 77pillar.com is simple and free. Follow these easy steps:

Visit www.77pillar.com and sign up for an account.

Select the type of property you want to list: residential, commercial property for sale, or rental.

Upload high-quality images and detailed descriptions of your property.

Set your price and contact details to allow potential buyers to connect easily.

Publish your listing and share it on social media for greater reach.

Tips to Sell Your House Fast Online

Use High-Quality Photos: A picture speaks a thousand words, so ensure your images are clear and attractive.

Write a Compelling Description: Highlight key features and amenities to grab buyers' attention.

Set a Competitive Price: Research market rates to attract more inquiries.

Engage with Buyers Promptly: Quick responses can speed up the selling process.

Leverage Social Media: Share your listing on platforms like Facebook and Instagram to reach more potential buyers.

Conclusion

If you’re looking to buy house online, sell property online, or simply list property for free, choosing the right real estate listing website is crucial. 77pillar.com is the perfect platform to post property online and connect with serious buyers without agent intervention. Start your listing today and sell your house faster than ever!

Visit www.77pillar.com and list your property today!

#real estate investing#real estate agent#Buy property online#Sell property online#Best real estate website in India#List property for free#Post property online#Property listing site#Real estate listing website#Top real estate portals in India#Buy house online#Sell house fast online#Rent property online#Commercial property for sale

0 notes

Text

How to Finance Your Flat Purchase in Gurgaon: Loan Tips and Options

In Gurgaon’s ever-evolving real estate market, buying a flat demands a significant financial investment. This is where home loans in Gurgaon play a crucial role, offering the financial backing needed to turn homeownership aspirations into reality. This detailed guide explores everything you need to know about home loan eligibility, interest rates, and the application process in Gurgaon, ensuring a smooth and informed borrowing experience.

Reasons to Buy a Flat in Gurgaon

With a strong job market, modern infrastructure, and plenty of housing options, Gurgaon is a great place to buy a home. Getting a home loan in Gurgaon can make it easier to own property in this fast-growing city, offering both convenience and long-term value.

World-Class Infrastructure

Gurgaon offers excellent connectivity with well-maintained roads, an extensive metro network, and the Rapid Metro, making daily commutes smooth and hassle-free. The city also boasts popular recreational spots like Leisure Valley Park and Aravali Biodiversity Park, perfect for relaxation amidst nature. With ongoing Smart City initiatives, Gurgaon continues to evolve as a prime real estate destination. If you're looking to buy a home in this thriving hub, a home loan in Gurgaon can make property ownership more accessible in this fast-growing market.

Diverse Residential Options

Gurgaon offers a wide range of housing options, from budget-friendly apartments to high-end luxury residences with top-notch amenities like swimming pools, clubhouses, and landscaped gardens. With flexible home loan options available, buying a home in Gurgaon becomes more accessible, allowing you to enjoy a premium lifestyle in one of the fastest-growing real estate hubs in India.

Proximity to Recreational & Entertainment Hubs

Recreational hubs, shopping malls, and entertainment destinations are within easy reach, elevating the convenience and lifestyle of the city. With vibrant spots for dining, shopping, and entertainment like Ambience Mall, Cyber Hub, and Kingdom of Dreams, residents enjoy a rich and diverse lifestyle experience that perfectly blends leisure and convenience.

Thriving Job Market

Gurgaon stands out as a prime destination for professionals, offering a dynamic job market, top-tier infrastructure, and premium residential options. With thriving industries like IT, financial services, e-commerce, and real estate, the demand for housing continues to rise. The presence of leading MNCs has transformed Gurgaon into a real estate hotspot, attracting homebuyers and investors looking for convenience, luxury, and proximity to workplaces.

Future Growth Potential

With an average rental income of ₹42,696 per month, investing in a flat here offers a steady and lucrative return. The strong demand from professionals and expats ensures consistent occupancy and high rental yields, making it a smart choice for long-term financial growth. As demand continues to rise, both rental returns and property value are expected to appreciate, maximizing your investment potential.

Connectivity

Gurgaon boasts exceptional connectivity with a robust road network, including NH-48 (Delhi-Gurgaon Expressway), Golf Course Road, Dwarka Expressway, and Sohna Road, ensuring hassle-free commuting. The city's metro system enhances accessibility, with key stations like Sikanderpur, IFFCO Chowk, and Millennium City Centre Gurugram providing seamless intra-city travel. Additionally, upcoming metro extensions and the Delhi-Alwar Rapid Rail Transit System (RRTS) are set to further enhance connectivity, making Gurgaon an even more attractive destination for residents and businesses.

A Comprehensive Guide to Home Loans for Flat Purchase in Gurgaon

A home loan is a convenient financing option that enables individuals to purchase residential properties by borrowing from banks or housing finance companies. In Gurgaon, where property prices continue to rise, securing a home loan can make owning a flat more affordable and achievable. With flexible repayment options and competitive interest rates, home loans in Gurgaon provide a practical solution for homebuyers looking to invest in one of the fastest-growing real estate markets.

Home Loan Process in Gurgaon: A Step-by-Step Guide

Securing a home loan in Gurgaon is a seamless process, tailored to meet the needs of homebuyers in this rapidly growing real estate market. Here’s how it works:

Eligibility Check: Lenders assess your income, employment stability, credit score, and other financial factors to determine your loan eligibility. A good CIBIL score increases your chances of approval.

Document Submission: Once eligible, applicants must provide KYC documents, income proof, bank statements, and property-related papers for verification.

Loan Processing & Approval: The lender thoroughly verifies the documents, conducts a property valuation, and approves the loan based on compliance with lending criteria.

Disbursement of Funds: The loan amount is released in stages for under-construction properties or as a lump sum for ready-to-move-in homes.

With competitive home loan interest rates in Gurgaon and various financing options, buying a property has never been more accessible.

Eligibility Criteria for Home Loans in Gurgaon

Before applying for a home loan in Gurgaon, it's crucial to understand the eligibility criteria set by lenders. Meeting these requirements increases your chances of home loan approval and ensures a smooth borrowing experience. Here’s what you need to qualify:

1. Purpose of the Loan

The loan must be used exclusively for purchasing a residential property in Gurgaon, as per the lender’s guidelines.

2. Age Criteria

Applicants should be between 18 and 75 years old, ensuring a stable earning period for timely home loan repayment.

3. Residency Requirement

Only Indian residents are eligible to apply for a home loan in Gurgaon.

4. Employment Status

Both salaried professionals and self-employed individuals can apply. If you are a salaried applicant, you must provide a valid Employee ID as proof of employment.

5. Income Requirements

Salaried Professionals: Must provide multiple payslips as proof of stable income.

Self-Employed Individuals: Need to demonstrate consistent business operations and earnings through valid financial documents.

6. Essential Documents for Home Loan Application

A. Age Proof (Any one of the following):

Passport

Voter ID

PAN Card

Driving Licence

B. Address Proof (Any one of the following):

Driving Licence

PAN Card

Passport

Voter ID

C. Income Proof (Based on Employment Type):

7. Documents Required for Salaried Professionals

Last three months' salary slips

Bank statements for the past six months

Form 16 and Income Tax Returns (ITR) for the last three years

8. Documents Required for Self-Employed Individuals

Income Tax Returns (ITR) for the past three years

Profit & Loss Statements and Balance Sheets for the last three years

Business bank account statements for the last 12 months

9. Credit Score Criteria

To qualify for a home loan in Gurgaon, applicants must maintain a minimum credit score of 725. A higher credit score enhances loan eligibility, improves approval chances, and helps secure better interest rates. Lenders assess creditworthiness based on financial discipline, past repayment history, and outstanding liabilities.

Having all the necessary documents and a strong credit profile increases your chances of hassle-free loan approval in Gurgaon’s competitive real estate market.

Steps to Apply for a Home Loan

Buying a home in Gurgaon is a significant investment, and securing a home loan is a crucial step in this journey. To simplify the process, this guide walks you through everything—from checking your eligibility to loan disbursement—ensuring a seamless experience.

1. Check Your Eligibility

Before applying, assess your eligibility based on key factors like income, age, employment status, and credit score. A good credit score (750 or above) increases your chances of approval and helps you secure lower interest rates. Use an EMI calculator to estimate monthly repayments and plan your finances accordingly.

2. Determine the Loan Amount

Decide how much you need to borrow by considering the property cost, down payment capacity, and loan-to-value ratio (LTV). Banks usually finance up to 80-90% of the property value, while the rest must be paid up front. Evaluating these aspects will help you choose the best home loan option.

3. Compare Interest Rates

Choosing between a fixed or floating interest rate impacts your EMIs:

Fixed Interest Rate: Remains the same throughout the loan tenure, ensuring predictable monthly payments.

Floating Interest Rate: Fluctuates based on market conditions, potentially reducing your EMI if rates decrease.

Compare rates from different lenders to secure the most affordable home loan in Gurgaon.

4. Choose the Right Lender

Research and compare home loan providers, including:

Public sector banks: SBI, Bank of Baroda, PNB

Private banks: HDFC, ICICI Bank, Axis Bank

Housing finance companies: LIC Housing Finance, Indiabulls Housing Finance

Consider factors like interest rates, loan tenure, processing fees, and repayment flexibility before finalizing your lender.

5. Prepare the Required Documents

Having the necessary documents ready speeds up the application process. Commonly required documents include:

Identity proof: Aadhaar card, PAN card

Address proof: Voter ID, utility bills

Income proof: Salary slips, bank statements, ITR

Property documents: Sale agreement, title deed

6. Apply for the Loan

Fill out the loan application form, attach the required documents, and pay the processing fee (0.5% to 1% of the loan amount). Some lenders also allow online applications for faster processing.

7. Loan Processing & Approval

The lender verifies your documents, assesses your repayment capacity, and conducts a background check. This process may take a few days to weeks. A higher credit score and stable income can speed up approval.

8. Loan Sanction & Disbursement

Once approved, the lender issues a sanction letter outlining the loan amount, tenure, interest rate, and terms. After signing the agreement, the funds are disbursed, either in full or in stages, directly to the property seller or builder.

9. Signing the Loan Agreement

Carefully review the loan agreement before signing to ensure you understand all terms and conditions. This step legally finalizes the home loan process, securing your funds for the property purchase.

10. Loan Disbursement

For Ready-to-Move-in Flats: The entire loan amount is disbursed in one go, allowing for quick property acquisition.

For Under-Construction Flats: The loan is released in phases, aligned with the construction progress and the builder’s payment schedule. This ensures funds are distributed as per project milestones.

Factors to Consider Before Choosing a Home Loan

For first-time homebuyers in Gurgaon, selecting the right home loan requires careful evaluation. Here are essential factors to consider:

Choosing the Right Loan Tenure

A longer tenure results in lower EMIs, but you end up paying more in interest over time.

A shorter tenure increases your monthly EMI, but significantly reduces the overall loan cost.

Comparing Home Loan Offers from Different Lenders

Evaluate multiple banks and NBFCs to compare interest rates, processing fees, and loan terms.

Choosing the best home loan in Gurgaon can help reduce costs and improve financial flexibility.

Understanding Prepayment Options and Charges

Making prepayments can help reduce interest costs and shorten the loan tenure.

Some lenders impose prepayment penalties, so check these details before finalizing the loan agreement.

Tips to Improve Home Loan Eligibility

Securing a home loan in Gurgaon is easier with the right approach. Follow these key strategies to improve approval chances and get better loan terms:

Improve Credit Score & Reduce Debt – Maintain a score of 750+ by paying off debts and keeping a low debt-to-income ratio.

Increase & Declare All Income – Show all earnings, including side income, to strengthen your financial profile.

Make a Higher Down Payment – Paying 20-25% upfront lowers the loan amount and improves approval chances.

Apply with a Co-applicant – A co-applicant with a strong credit and income profile can increase loan eligibility.

Choose Pre-Approved Properties & Longer Tenure – RERA-approved homes simplify processing, while longer tenures reduce EMIs, making the loan more affordable.

CONCLUSION

Securing a home loan in Gurgaon requires careful planning, thorough research, and a clear understanding of eligibility criteria, interest rates, and legal requirements. This guide has outlined the key aspects to help you navigate the process with confidence.

By comparing lenders, assessing financial readiness, and exploring government-backed schemes, homebuyers can make well-informed decisions. With the right approach, first-time buyers can streamline their journey to homeownership in Gurgaon, ensuring a smooth and hassle-free experience.

#investmentopportunities#realestate#realestatemarket#realestategurgoan#properties in gurgaon#propertyinvestment#dwarka expressway#gurgaon#dwarkaexpressway#luxury homes

0 notes

Text

The Future of Real Estate Post-Budget 2025: A Look at Infrastructure Development and Urban Planning

The Union Budget 2025 has set the stage for transformative growth in India’s real estate sector, addressing long-standing demands and introducing new incentives for homebuyers, investors, and developers. With a strong focus on affordable housing, rental market reforms, infrastructure development, and tax benefits, this budget is expected to accelerate real estate expansion across urban and semi-urban areas.

For Sheth Realty, recognized as a top builder in Mumbai, these reforms present exciting opportunities for buyers and investors. Let’s explore how the latest budget will shape the industry and redefine real estate investment in India.

Major Tax Benefits for Homebuyers

One of the most anticipated announcements in Budget 2025 was the increase in tax deductions for home loans.

Key Takeaways:

Higher Deductions Under Section 80C & 24(b): • Taxpayers can now claim higher deductions on home loan principal and interest repayments, making housing more affordable. • The limit under Section 80C has been increased to accommodate larger principal repayments. • Interest deduction under Section 24(b) has been raised, reducing the overall tax burden for homeowners.

Tax Benefits on Second Homes: • Earlier, tax benefits were applicable only to one self-occupied property. Now, homebuyers can claim tax benefits on two self-occupied houses, encouraging investments in secondary properties.

Capital Gains Tax Adjustments: • Reduction in the long-term capital gains tax holding period from 3 years to 2 years will make real estate a more liquid and attractive investment option.

Impact on Homebuyers & Investors: These tax relaxations will boost housing demand, especially among salaried professionals and first-time homebuyers. With lower EMIs and increased affordability, more people will be encouraged to invest in property rather than rent.

Boost to Affordable Housing & PMAY Scheme

The government has reinforced its commitment to affordable housing by expanding the Pradhan Mantri Awas Yojana (PMAY) and introducing new incentives for developers building budget-friendly homes.

Key Takeaways:

Higher Allocation for PMAY • A 30% increase in the PMAY budget will speed up the construction of affordable homes. • The government aims to complete 30 lakh new houses in the next two years.

Interest Subsidy on Home Loans for EWS & LIG • First-time homebuyers in the Economically Weaker Section (EWS) and Low-Income Group (LIG) will benefit from lower home loan interest rates through government subsidies.

Tax Holidays for Affordable Housing Developers • Builders focusing on affordable projects will enjoy extended tax benefits, encouraging more housing supply in Tier 2 & Tier 3 cities.

Impact on Homebuyers & Developers: • Middle-class and lower-income families will find it easier to buy homes with subsidized interest rates. • Developers will be incentivized to focus on affordable projects, leading to faster urban expansion and new housing inventories.

Rental Housing & REITs: A Step Towards a Stronger Rental Market

With increasing migration to cities, rental housing reforms were a major focus in Budget 2025.

Key Takeaways:

New Incentives for Rental Housing • Tax exemptions for rental income up to a certain threshold. • Encouragement for institutional investors to build co-living spaces and managed rental properties.

Simplification of Real Estate Investment Trusts (REITs) Taxation • Elimination of double taxation on dividends received by REIT unitholders. • Lower tax rates on rental REITs, making them an attractive option for passive investors.

Impact on Investors & Tenants: • These reforms will boost the supply of quality rental properties, making renting easier for professionals and students. • More investors may consider REITs as a viable investment option, leading to better rental housing infrastructure.

Infrastructure Development & Smart Cities: Real Estate Growth Accelerators

A robust infrastructure push is set to improve connectivity and create new real estate hotspots.

Key Takeaways:

Urban Infrastructure Boost • ₹1 lakh crore allocated for smart city expansion, modern public transport, and metro networks. • New expressways, metro corridors, and highways will drive real estate appreciation in peripheral cities.

Industrial & Commercial Growth • New Special Economic Zones (SEZs) and IT parks announced in key metros. • Government incentives for green and sustainable commercial projects.

Expansion of Tier 2 & 3 Cities • Airport, rail, and road connectivity upgrades in smaller cities. • More affordable and mid-range housing options expected in emerging cities like Indore, Jaipur, Lucknow, and Coimbatore.

Impact on Investors & Homebuyers: • Real estate demand will increase in newly connected regions. • Commercial properties will attract more corporate investments, leading to higher rental yields.

Simplification of GST & Stamp Duty Reforms

One of the biggest hurdles in real estate has been high taxation. The budget introduced some relief measures to ease the burden on buyers and developers.

Key Takeaways:

Reduction in GST on Under-Construction Properties • Lower GST rates for buyers of under-construction homes, encouraging early-stage investments.

Stamp Duty Reduction in Key States • Incentives for state governments to reduce stamp duty, making home buying cheaper.

Single-Window Clearance for Real Estate Approvals • Faster approvals for new projects, reducing delays and boosting supply.

Impact on Buyers & Developers: • Homebuyers will save significantly on upfront costs. • Developers will benefit from faster project launches, improving housing availability.

Conclusion: A Bright Future for Indian Real Estate

Union Budget 2025 has laid a strong foundation for the real estate sector’s growth by addressing taxation, infrastructure, housing supply, and rental reforms. These changes will make buying homes more affordable, attract investment in commercial spaces, and boost rental housing.

For homebuyers, this is the best time to invest in real estate with lower tax burdens and better financing options. For investors, new opportunities in REITs, rental properties, and commercial real estate will ensure long-term gains.

This article is also posted on : - https://medium.com/@hardikpawar922/the-future-of-real-estate-post-budget-2025-a-look-at-infrastructure-development-and-urban-planning-659d42af11d0

0 notes

Text

Know More About Return On Investment In Real Estate

ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay. According to a report by CRISIL (Credit Rating Information Services of India Limited), the average house price in India has risen by about 6% annually over the past two decades.

Mumbai's real estate market has shown consistent growth in property values. Recent reports indicate that the city's residential segment has experienced a steady annual appreciation rate of 7-10%. Now from the perspective of investor, calculation of ROI needed in purpose to check stability of profit or loss from their Investments.

ROI Calculation

How to calculate return on investment for real estate.

If you are an investor, the ROI shows you the profitability of your investments. Calculate the return on investment using the formula: ROI = Net Profit / Cost of the investment * 100.

Key financial metrics.

Cap Rate: Reflects return potential and property value based on income.

Net Return: Measures annual income over the cash invested. & Compares property price to gross rental income.

Operating Expense Ratio: Portion of income spent on operating expenses. ie. Maintenance of Property, Taxation & Rennovations.

#ROI#return on investment#ROI Real estate#real estate investment#real estate india#realestateprojects#mumbairealestate#mumbai#sunblonderealty#luxuryliving#propertyfinder

2 notes

·

View notes

Text

Nestaway Reviews: Real Tenant Experiences Unveiled

The rental housing market in India has experienced substantial expansion and change recently, with new businesses joining the market to meet tenants' changing needs. Among them, Nestaway has become a key participant, providing a distinctive platform that links tenants with suitable rental properties. This blog examines the reliability of the platform and its effects on several cities, including Bangalore, Gurgaon, Delhi, Noida, Hyderabad, Pune, and Mumbai. It also examines the company's evaluations and tenant experiences.

#nestaway#nestaway ratings#nestawayreview#nestawaygood#nestaway platform#nestaway reviews#nestaway reliable#nestawaypune#nestaway review

2 notes

·

View notes

Text

Finding the perfect place to call home is a pursuit close to everyone's heart. It means more than walls and roofs; home is comfort, convenience, and belongingness. Nestaway, the trendsetter in the home rental and management space, understands this sentiment like no one else can. With its commitment towards customized comforts, the Nestaway good platform has revolutionized India’s rental housing market. The platform initiated its journey with a vision to bridge the gap between traditional renting and the pivotal requirements of modern urban dwellers. The mission was simple yet profound: to make every home feel 'just right' for tenants, offering a sense of warmth, security, and convenience.

2 notes

·

View notes

Text

Book Cab Online — Indian Travel House

How to Choose the Right Car Rental Service in Delhi: A Complete Guide

Delhi, the capital of India, is a bustling metropolis with a mix of historical landmarks, corporate hubs, and vibrant markets. Whether you are a tourist exploring its rich heritage or a business traveler needing reliable transportation, choosing the right car rental service in Delhi is crucial for a smooth and comfortable journey. Here’s a complete guide to help you make the best choice.

1. Identify Your Travel Needs

Before selecting a car rental service, determine your specific requirements:

Self-drive vs. Chauffeur-driven: Decide if you prefer driving yourself or need a professional driver.

Short-term vs. Long-term rental: Some rentals cater to hourly, daily, or long-term leasing.

Type of vehicle: Depending on your group size and luggage needs, you may need a sedan, SUV, luxury car, or tempo traveler.

2. Research and Compare Options

Delhi offers a wide range of car rental services, from local operators to international brands. Compare the following aspects:

Pricing and transparency: Check for hidden charges, fuel policies, and deposit requirements.

Fleet variety: Ensure the rental company provides well-maintained cars that suit your budget and comfort.

Customer reviews and ratings: Look for feedback on Google, social media, or travel forums to gauge reliability.

3. Check for Licensing and Insurance

Always choose a legally registered car rental service that provides insurance coverage for passengers and vehicles. This ensures safety and compliance with Delhi’s transport regulations.

4. Verify Fuel and Mileage Policies

Different rental services have varying fuel and mileage policies:

Full-to-full policy: Renters receive a full tank and must return the car with a full tank.

Limited vs. unlimited mileage: Choose a plan based on your travel distance to avoid additional costs.

5. Inspect the Car Before Booking

If possible, inspect the car for:

Physical condition: Scratches, dents, and overall cleanliness.

Functionality: Ensure brakes, air conditioning, GPS, and other features work properly.

Safety measures: Check airbags, seat belts, and emergency kits.

6. Understand the Terms and Conditions

Read the rental agreement carefully, paying attention to:

Cancellation and refund policies

Late return fees

Driver’s age and license requirements

7. Look for Added Benefits

Some rental services offer extra perks such as:

24/7 roadside assistance

GPS navigation systems

Corporate discounts or loyalty programs

8. Book in Advance for the Best Deals

Booking your rental car in advance can help you secure better rates, especially during peak seasons like festivals or business conferences in Delhi.

Final Thoughts

Choosing the right car rental service in Delhi can make a huge difference in your travel experience. Prioritize safety, reliability, and affordability while considering your specific needs. Whether it’s for a city tour, an outstation trip, or a corporate visit, the right rental service will ensure a hassle-free journey.

By following this guide, you can navigate Delhi’s roads with confidence and convenience with Indian Travel House

Instagram — https://www.instagram.com/indian_travel_house/

Facebook — https://www.facebook.com/IndTravelHouse/

#car booking#car booking in delhi#car rental#car on rent#car rental in delhi#indian travel house#car rental services

0 notes