#India Post Payments Bank

Explore tagged Tumblr posts

Text

Current Affairs- 3 September 2024

1. Namibia Syllabus: GS 1/PlacesSource: Indian Express Places in News Namibia is facing its worst drought in a century, worsened by El Niño. Status Food availability is critically low. Staple crops and livestock have perished. Approximately 1.2 million people face high levels of acute food insecurity. The government plans to cull 723 wild animals (including elephants, hippos, buffaloes,…

View On WordPress

0 notes

Text

SMS Banking of India Post Payments Bank Launched | Know Balance & 5 Transaction

Like many other banks, India Post Payments Bank has also launched their SMS Banking Service. Recently SMS Banking of India Post Payments Bank has been announced it on their X (Twitter) Handle. In this service India Post Payments Bank will provide the customers, their account information. Post Bank provides a helpline number on which you can call and get your query solved. On this number you…

View On WordPress

#India Post Payments Bank#SMS Banking#SMS Banking of India Post Payments Bank#the SMS Banking number of IPPB

0 notes

Text

IPPB Executive Recruitment 2023 Out for 132 Posts; Apply Online

IPPB Executive Recruitment 2023 Out for 132 Posts @ippbonline.com; Apply Online

IPPB Executive Recruitment 2023 Out for 132 Vacancies Apply Online India Post Payments Bank Application Form: IPPB Online Executive 2023-24 Recruitment Details: Here are the latest Current Openings in IPPB for Graduates in the age group of 21-35 years. India Post Payments Bank Ltd has released an advertisement for the recruitment of 132 Executives on contract basis posts. Interested & eligible contestants can apply online via the IPPB official website for India Post Payments Bank Executive Vacancy.

View More

#latest govt jobs#govt jobs#government jobs#bank jobs#latest bank jobs in india#latest bank jobs#banking jobs#executive jobs#bank executive jobs#recruitment#career#bank career#ippb recruitment#ippb executive recruitment#ippb executive jobs#ippbonline.com#ippb#india post payments bank

1 note

·

View note

Text

Doorstep Service for Hassle-Free Life Certificates

The Department of Posts, via India Post Payments Bank (IPPB), has introduced a new doorstep service to help pensioners submit their Digital Life Certificates (DLC). This service aims to make the process easy and convenient. Paperless and Hassle-Free Process: The DLC submission process is now completely paperless, seamless, and hassle-free. Pensioners are not required to send the acknowledgment…

0 notes

Text

इंडिया पोस्ट पेमेंट्स बैंक भर्ती 2023 - 43 आईटी अधिकारी पदों के लिए ऑनलाइन आवेदन करें

इंडिया पोस्ट पेमेंट्स बैंक भर्ती 2023 – 43 आईटी अधिकारी पदों के लिए ऑनलाइन आवेदन करें इंडियन पोस्ट पेमेंट बैंक (आईपीपीबी) ने अनुबंध के आधार पर सूचना प्रौद्योगिकी अधिकारी (कार्यकारी) रिक्ति की भर्ती के लिए एक अधिसूचना की घोषणा की है। वे उम्मीदवार जो रिक्ति विवरण में रुचि रखते हैं और सभी पात्रता मानदंड पूरे करते हैं, वे अधिसूचना पढ़ सकते हैं और ऑनलाइन आवेदन कर सकते हैं | आवेदन शुल्क अन्य सभी के…

View On WordPress

0 notes

Text

This is an in-progress community library project looking to get funds for providing anti caste books, resources and library amenities. They are seeking donations via GP*y or net banking. Their library will be located in Nagpur, in the office space of the anti caste publication house Panther's Paw. Please donate generously if you can, and if you are living in India. Click on this ⬇️⬇️⬇️

instagram

You can support them by buying a book bundle, by direct d0nation or simply by spreading the word. Payment links and details are in the post caption. Please share this.

#resources#india#casteism#dalit rights#dalit literature#intersectionality#mutual aid#library#community library#indie press#ambedkar#br ambedkar#Instagram

103 notes

·

View notes

Text

The thoroughly Technocratic “Digital Public Infrastructure” (DPI) originally slid in on the back of the global warming hoax. Unaccountable and unelected Bill Gates is rebranding the effort with his Modular Open-Source Identity Platform (MOSIP).

On 1-3 October, the Global DPI Summit 2024 was held in Cairo, Egypt. The principal sponsor was a NGO called Co-Develop Fund, who promised to,

… bring together key stakeholders from the public, private, and civil society sectors, including:

Countries: Countries that are seeking best-in-class approaches to digitization.

Bilateral and multilateral institutions: Institutions that support country governments in their digitization efforts.

Open-source digital public good providers: Providers of scalable digital solutions that can be used by countries to implement DPI.

Private sector companies: Companies with the expertise and capacity to help governments implement digital solutions at a population scale.

Civil society actors: Actors who are working to ensure that DPI is implemented in a way that is inclusive and protects the rights of all citizens.

Global DPI thought leaders: Experts on DPI who can provide valuable insights and guidance to countries on their DPI implementation journeys.

Domain-focused actors: Actors who are working to implement DPI solutions in specific sectors, such as education, healthcare, and agriculture.

⁃ Patrick Wood, Editor.

Microsoft co-founder Bill Gates is pushing governments to adopt the new global system for digital cash and ID that is backed by the World Economic Forum (WEF).

Gates and his foundation are doubling down on support for s digital public infrastructure (DPI).

DPI supports both digital IDs and payments and is backed by the WEF, the European Union (EU), and the United Nations (UN).

Gates is now pressuring governments around the world to begin incorporating DPI as the globalist groups push for payments and IDs to switch to a fully digital system on a global level.

The billionaire laid out his vision for global DPI in a new blog post.

The Silicon Valley oligarch is once again attempting to establish his reputation as a visionary on these matters.

Gates praised several third-world “developing countries” for allowing DPI to be tested on their citizens.

He revealed that the system has already been “trialed for the rest of the world” in India, Kenya, Brazil, and Togo.

One of the major criticisms leveled at digital IDs and payments is that they will lead to “enhanced,” digital government surveillance, and subsequent disenfranchisement of people.

Many have also raised concerns about the rush to usher in the technology.

Globalists have been pushing for DPI to be rolled out globally for large-scale adoption by 2030, ostensibly to fight “climate change.”

However, Gates does not share these concerns about the technology and is heavily pushing for DPI to be rolled out for the general public.

According to Gates, citizens should not be concerned about government surveillance because “a properly designed” DPI will in fact “enhance” privacy.

He claims DPI includes “safeguards” which he didn’t elaborate on.

Gates also touches on what he says are the benefits of using Modular Open-Source Identity Platform (MOSIP).

MOSIP is a global digital ID tool backed by the Gates Foundation.

However, MOSIP is yet another point of contention from the privacy standpoint.

But MOSIP featured as a key participant during the recent Global DPI Summit 2024 held in Egypt.

At the event, those behind MOSIP, as well as the World Bank, the UN’s development agency UNDP, and the globalist Tony Blair Institute all took part.

The event provided another opportunity for these organizations to push for global adoption of DPI by 2030.

In addition, the organizations pledged to work on accelerating this process.

MOSIP demonstrated its identity platform at the summit.

At the same time, it stressed that the goal of digital ID and payments is to improve accessibility of identification, “particularly for developing nations.”

The platform is already in use in Ethiopia, Morocco, and Sri Lanka.

Meanwhile, the World Bank announced that it is about to launch its own global Digital Public Infrastructure (DPI) program.

Read full story here…

3 notes

·

View notes

Text

Need a reliable, affordable, and convenient ride? Look no further! RideBoom is now available in India, bringing you a seamless transportation experience like never before.

📱 With our user-friendly mobile app, you can easily book a ride with just a few taps on your smartphone. Whether you're heading to work, exploring the city, or meeting friends, RideBoom has got you covered!

✅ Here's why you'll love RideBoom: 1️⃣ Safe and Trusted Drivers: Our drivers undergo thorough background checks and are fully licensed, ensuring your safety and peace of mind. 2️⃣ Affordable Fares: Say goodbye to overpriced rides! RideBoom offers competitive rates that won't break the bank. 3️⃣ Ride Options: Choose from a range of vehicles to suit your needs, from economical options to luxury cars. 4️⃣ Real-Time Tracking: Track your ride in real-time, so you know exactly when your driver will arrive. 5️⃣ Cashless Payments: Enjoy the convenience of cashless transactions through our secure and easy-to-use payment system.

🌟 Download the RideBoom app now and get ready for a smooth and enjoyable journey across India. Experience the future of transportation at your fingertips!

📲 Download the app here: [Insert App Store/Play Store links]

🔁 Help us spread the word! Share this post with your friends and family who could benefit from RideBoom's services. Let's make transportation hassle-free for everyone in India! 🙌

RideBoomIndia #TransportationRevolution #ConvenientRides #DownloadTheApp

18 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 4, 2024

HEATHER COX RICHARDSON

JAN 5, 2024

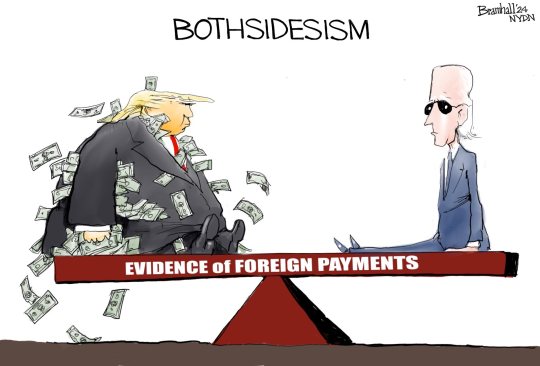

The Democrats on the House Oversight Committee today released a 156-page report showing that when he was in the presidency, Trump received at least $7.8 million from 20 different governments, including those of China, Saudi Arabia, United Arab Emirates, Qatar, Kuwait, and Malaysia, through businesses he owned.

The Democrats brought receipts.

According to the report—and the documents from Trump’s former accounting firm Mazars that are attached to it—the People’s Republic of China and companies substantially controlled by the PRC government paid at least $5,572,548 to Trump-owned properties while Trump was in office; Saudi Arabia paid at least $615,422; Qatar paid at least $465,744; Kuwait paid at least $300,000; India paid at least $282,764; Malaysia paid at least $248,962; Afghanistan paid at least $154,750; the Philippines paid at least $74,810; the United Arab Emirates paid at least $65,225. The list went on and on.

The committee Democrats explained that these payments were likely only a fraction of the actual money exchanged, since they cover only four of more than 500 entities Trump owned at the time. When the Republicans took control of the House of Representatives in January 2023, Oversight Committee chair James Comer (R-KY) stopped the investigation before Mazars had produced the documents the committee had asked for when Democrats were in charge of it. Those records included documents relating to Russia, South Korea, South Africa, and Brazil.

Trump fought hard against the production of these documents, dragging out the court fight until September 2022. The committee worked on them for just four months before voters put Republicans in charge of the House and the investigation stopped.

These are the first hard numbers that show how foreign governments funneled money to the president while policies involving their countries were in front of him. The report notes, for example, that Trump refused to impose sanctions on Chinese banks that were helping the North Korean government; one of those banks was paying him close to $2 million in rent annually for commercial office space in Trump Tower.

The first article of the U.S. Constitution reads: “[N]o Person holding any Office of Profit or Trust under [the United States], shall, without the Consent of the Congress, accept of any present, Emolument [that is, salary, fee, or profit], Office, or Title, of any kind whatever, from any King, Prince, or foreign State.”

The report also contrasted powerfully with the attempt of Republicans on the Oversight Committee, led by Comer, to argue that Democratic Joe Biden has corruptly profited from the presidency.

In the Washington Post on December 26, 2023, Philip Bump noted that just after voters elected a Republican majority, Comer told the Washington Post that as soon as he was in charge of the Oversight Committee, he would use his power to “determine if this president and this White House are compromised because of the millions of dollars that his family has received from our adversaries in China, Russia and Ukraine.”

For the past year, while he and the committee have made a number of highly misleading statements to make it sound as if there are Biden family businesses involving the president (there are not) and the president was involved in them (he was not), their claims were never backed by any evidence. Bump noted in a piece on December 14, 2023, for example, that Comer told Fox News Channel personality Maria Bartiromo that “the Bidens” have “taken in” more than $24 million. In fact, Bump explained, Biden’s son Hunter and his business partners did receive such payments, but most of the money went to the business partners. About $7.5 million of it went to Hunter Biden. There is no evidence that any of it went to Joe Biden.

All of the committee’s claims have similar reality checks. Jonathan Yerushalmy of The Guardian wrote that after nearly 40,000 pages of bank records and dozens of hours of testimony, “no evidence has emerged that Biden acted corruptly or accepted bribes in his current or previous role.”

Still, the constant hyping of their claims on right-wing media led then–House speaker Kevin McCarthy (R-CA) to authorize an impeachment inquiry in mid-September, and in mid-December, Republicans in the House formalized the inquiry.

There is more behind the attack on Biden than simply trying to even the score between him and Trump—who remains angry at his impeachments and has demanded Republicans retaliate—or to smear Biden through an “investigation,” which has been a standard technique of the Republicans since the mid-1990s.

Claiming that Biden is as corrupt as Trump undermines faith in our democracy. After all, if everyone is a crook, why does it matter which one is in office? And what makes American democracy any different from the authoritarian systems of Russia or Hungary or Venezuela, where leaders grab what they can for themselves and their followers?

Democracies are different from authoritarian governments because they have laws to prevent the corruption in which it appears Trump engaged. The fact that Republicans refuse to hold their own party members accountable to those laws while smearing their opponents says far more about them than it does about the nature of democracy.

It does, though, highlight that our democracy is in danger.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

17 notes

·

View notes

Text

History of Finance in India

The Evolution of Financial Management in India and Its Impact on the Economy

India’s financial management history is a fascinating journey that has significantly shaped its economy. Let’s explore this evolution in simple terms.

Early Beginnings

Financial management in India has ancient roots. Historically, India was known for its rich in nature trade and commerce. Ancient texts like the Arthashastra, written by Chanakya, provide insights into early financial practices, including taxation and statecraft.

Colonial Era

The British colonial period brought significant changes. The establishment of the Reserve Bank of India (RBI) in Kolkata 1935 marked a pivotal moment. The RBI became the sole central authority for regulating the country’s currency and credit systems. However, the financial system was primarily designed to serve colonial interests, focusing on trade and revenue and tax collection.

Post-Independence Reforms

After gaining independence in 1947, India faced the challenge of building a robust financial system. The government nationalized 13 major banks in 1969 to ensure financial inclusion and support economic development. This move aimed to extend banking services to rural areas and promote savings and investments.

Liberalization in the 1990s

The 1991 marked a turning point with economic liberalization. The government introduced reforms to open up the economy, reduce state control, and encourage private sector participation. The Multi National Companies across the globe were invited, encouraged to set up their businesses in India for cheap labour. To initiate this government also provided tax benefits to these companies.

These reforms led to significant growth in the financial sector. The stock market expanded, and new financial instruments like mutual funds and insurance products became popular. The liberalization era also saw the establishment of regulatory bodies like the Securities and Exchange Board of India (SEBI) to oversee the capital markets.

Digital Revolution

In recent years, digital technology has revolutionized financial management in India. Initiatives like the Pradhan Mantri Jan Dhan Yojana aimed to provide banking services to every household. The introduction of UPI or Unified Interface payments made transaction so quick and safe that today India is the largest country with the most number of online P2P and P2M transactions.

Impact on the Economy

The evolution of financial management has had a profound impact on the Indian economy:

Economic Growth: Financial reforms have fueled economic growth by attracting investments and promoting entrepreneurship.

Financial Inclusion: Nationalization of banks and digital initiatives have improved financial inclusion. The number of users of credit cards, online payments, loans and Bank account holders has increased significantly.

Stability and Regulation: The establishment of regulatory bodies like the RBI and SEBI has ensured stability and transparency in the financial system.

Innovation: The digital revolution has spurred innovation in financial services. Mobile Banking, Digital loans and Online Serices has made the work easier and efficient.

Conclusion

The history of financial management in India is a story of transformation and resilience. From ancient practices to modern digital innovations, each phase has contributed to shaping the economy. As India continues to evolve, its financial system will play a crucial role in driving sustainable growth and development.

2 notes

·

View notes

Note

i'm trying to sign up for your patreen but i can't get my card to process the payment. is there something we have to do to make it work? i've been trying for a couple days 😭

Hi hon! There are a lot of banks that don't like to work with Patreon and it also depends on where you live in the world. For example people in India have issues with their banks not allowing them to pay anything to Patreon.

However! I do have another way to give you my masterlist outside of patreon. I'd just have you pay me directly (we can discuss this part privately in dms). It's set up in Google Docs with links to everything I've written. Take a look at the link and you'll see everything there I've posted is what I've got on Patreon. You won't be able to open up any links within the masterlist (I would set permission for you to view everything after you pay via an email address) but this gives you an idea of what to expect.

If you're interested dm me @gurugirlsideb

xoxo

2 notes

·

View notes

Text

I've been meaning to write some posts explaining basic accounting principles for curious laypeople. I've finally started!

The Fundamental Law of Debit and Credit

Equity

The fundamental laws of any field of study often seem unrelated to the final result. To discover why mixing baking soda and vinegar makes bubbles, you must learn atomic theory. To understand why a map never needs five colors, you must study triangles. To read a 10-K, you must know what the word "equity" means.

If you've heard the word "equity" (in a context where it doesn't mean "being equal"), you have probably heard of home equity loan—a way of obtaining cash based on the value of your house, assuming you could somehow afford one.

Home equity is quite simple; it's the difference between the current value of your house and the amount you owe to the bank. In a sense, it's the amount of house you own.

Assets, Liabilities, and Equity

Imagine that you are not only rich enough to own a house, but rich enough to own two houses. You took out a separate bank loan for the new house, but that's fine—you're ready to become a landlord, and rent payments are going to exceed loan payments.

This second house is essentially a small business. The house is a resource for which you expect to receive a future benefit, or in business terms, an asset. The loan is an obligation to fork over assets (specifically cash) in the future, or a liability. And the difference between them, as with your actual home, is your equity.

Houses don't literally just sit there and print money. You might take out a smaller loan to add a swimming pool to the lot, for instance. Or you might build a tree house, or realize you forgot to pay your handyman's fees. This complicates the situation slightly, but not by that much.

Total Equity = Total Assets - Total Liabilities

A real estate corporation managing hundreds of houses and loans, plus a bank account and salaries it hasn't paid yet and so on, its ownership split among dozens of shareholders, follows this same equation. But stating it like this isn't helpful for most accounting purposes; more commonly, you'll see it stated like this:

Total Assets = Total Liabilities + Total Equity

This highlights another perspective on what liabilities and equity represent. Liabilities are, in a sense, the portion of the company owned by (or at least owed to) its creditors, while equity is the portion of the company owned by its owners.

If you only own one or two houses, the exact numbers don't matter much. As long as you make enough money to pay all the bills, you're doing fine. But a big company has obligations to dozens of people—its owners, its creditors, possibly the SEC and similar agencies. A company needs to keep careful track of its assets and liabilities.

Double-Entry Bookkeeping

The origin of the most fundamental accounting technique has been lost to the sands of time. Some say it was invented in Israel under the early Roman Empire, or in Korea during the 11th century, or in Italy during the 13th century, or in India during a century not listed on Wikipedia.

It wouldn't surprise me if it was invented more than once, because the basic concept is dead simple. Your page has two columns. Write assets on the left, write liabilities on the right. Equity goes on the right, too, or something equivalent.

Modern accounting has a lot more rules. But they're all about what you write in each column; this structure has remained constant for almost as long as we have detailed accounting records that haven't crumbled to dust.

The Balance of Debit and Credit

Debits and credits are just the name we give to entries in those books. Increases to assets are called "debits"; increases to liabilities and equity are called "credits". But decreases to assets are credits, and decreases to liabilities or equity are debits.

Speaking very loosely: Debits are things the company wants, while credits are what it pays to get those things.

Remember that equation I showed you earlier? Assets equal liabilities plus equity? If an asset increases, one of three other things happened: Another asset shrank, or a liability or equity grew. If you acquire a new liability, you got rid of another, lost equity, or gained an asset. And so on.

This is the immutable axiom of accounting. 1 × a = a, ΔU = Q - W, debit equals credit. Or to put it another way:

Every transaction must have an equal balance of debit and credit.

What's up with the cards?

Might as well explain this real quick.

From a bank's perspective, your savings account is literally a liability. When you deposit your paycheck, the bank recognizes both cash and an obligation to return that cash. When you withdraw money, the bank reduces its cash, and also your account. Reducing your bank account is a debit, and that's true whether you're withdrawing physical cash or using a plastic card to pay for groceries electronically. It's a card that debits your account.

As for credit cards...well, that's just a case of one word having multiple meanings. "Credit" has its accounting definition, and also the definition of "letting someone borrow money". They're not unrelated—a business borrowing money credits some liability to represent that debt—but credit cards aren't related to accounting credits.

4 notes

·

View notes

Text

IPPB Recruitment 2023 − 132 Executive Posts; Apply Onlline

✅ IPPB Recruitment 2023:

India Post Payments Bank (IPPB) has released an official notification on its official website for the positions of Executive. According to the IPPB Recruitment 2023 Notification a total of 132 vacancies are available. This article gives all the important information about the recruitment process, how you can apply, the age limit, age relaxation, applicaion fee & qualifications needed. If you want to apply for these jobs, it is highly recommended to read this article….. Read More.

✅ IPPB Vacancy 2023 Details

Organization Name: India Post Payments Bank

Name of Post: Executive

Total No of Posts: 132 Posts

✅ IPPB Recruitment 2023 Eligibility Criteria

Educational Qualification: As per the official IPPB notification, candidates are required to possess a Graduation degree from a recognized board or university as their educational qualification.

Age Limit: According to the India Post Payments Bank Recruitment Notification, candidates must meet the following age criteria:

The minimum age should be 21 years.

The maximum age should not exceed 35 years as of 01-Jun-2023.

Age Relaxation: The Age Relaxation for different categories of candidates is as follows:

OBC (NCL) Candidates: 03 Years

SC/ST Candidates: 05 Years

PWD (UR) Candidates: 10 Years

PWD [OBC (NCL)] Candidates: 13 Years

PWD (SC/ST) Candidates: 15 Years

✅ IPPB Executive Recruitment Selection Process & Other Essential Details

IPPB Vacancy 2023: Salary Details

The IPPB Recruitment 2023 offers a well-paying salary to selected candidates. The organization will provide a monthly salary of Rs. 30,000

India Post Payments Bank (IPPB) Executive Recruitment 2023: Probation Period

For the IPPB Executive Recruitment 2023, the probation period will initially be for 1 year. Afterward, the contract may be extended to 2 years. If the selected candidate demonstrates satisfactory performance, the contract period may be further extended. The maximum duration for this post could be up to 3 years.

IPPB Recruitment 2023: Selection Process

IPPB Recruitment 2023 for the executive post has a three-stage selection process:

First: The first stage is an online test.

Second: The second stage involves a group discussion.

Third: The final stage is a personal interview.

IPPB will shortlist candidates based on their performance in these stages, as well as their qualifications and experience. A list of shortlisted candidates will be created by IPPB after evaluating all the stages of the selection process.

- If you want to apply for these jobs, it is highly recommended to read our full article.

➤ Apply Link: Click Here

#india post#india#JOBALERT#Jobopening#jobsearch#vacancyjob#vacancy#recruitment#jobs#creativityindia#jobseekers#government#jobopportunity#government jobs#careergrowth#assamcareer#indian

2 notes

·

View notes

Text

Doorstep Service for Hassle-Free Life Certificates

The Department of Posts, via India Post Payments Bank (IPPB), has introduced a new doorstep service to help pensioners submit their Digital Life Certificates (DLC). This service aims to make the process easy and convenient. Paperless and Hassle-Free Process: The DLC submission process is now completely paperless, seamless, and hassle-free. Pensioners are not required to send the acknowledgment…

0 notes

Text

Online Company Registration Process in Andhra Pradesh

Introduction

Registering a company is a crucial step in establishing a business in India, and Andhra Pradesh offers a supportive environment for entrepreneurs. This guide provides a comprehensive overview of Company Registration in Andhra Pradesh, from the initial steps to post-registration compliance.

1. Understanding Company Registration

Company registration is the legal process of forming a new business entity, such as a private limited company, public limited company, or a limited liability partnership (LLP). Registering your company grants it a distinct legal identity and provides several advantages, including limited liability, access to funding, and credibility with clients and suppliers.

2. Choose the Right Business Structure

Before registering your company, decide on the type of business entity that suits your needs. Familiar structures in Andhra Pradesh include:

Private Limited Company: Suitable for small to medium-sized businesses with limited liability and a separate legal identity.

Public Limited Company: Ideal for larger businesses looking to raise capital through public shares.

Limited Liability Partnership (LLP): Combines the benefits of a partnership with limited liability.

3. Name Reservation

Select a unique and meaningful name for your company. The name must not be identical or similar to existing companies and should comply with the Ministry of Corporate Affairs (MCA) guidelines. You can check name availability using the MCA's online name search tool.

4. Obtain a Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) is required for filing documents online. DSCs are issued by certifying authorities and are used to authenticate electronic documents. Ensure that the DSC is obtained for all directors and authorised signatories of the company.

5. Apply for Director Identification Number (DIN)

Directors of the company must obtain a Director Identification Number (DIN). DIN is a unique identification number for individuals appointed as directors. It can be obtained by submitting Form DIR-3 on the MCA portal along with the required documents.

6. Prepare the Required Documents

The following documents are typically required for company registration:

Memorandum of Association (MOA): Describes the company's objectives and scope.

Articles of Association (AOA): Outlines the company's internal rules and regulations.

Proof of Address: For the registered office of the company.

Identity and Address Proof: For all directors and shareholders.

7. File the Incorporation Documents

Submit the incorporation documents to the Registrar of Companies (ROC) in Andhra Pradesh through the MCA portal. The primary forms include:

Form INC-32: Simplified Proforma for Incorporating Company electronically.

Form INC-33: e-Memorandum of Association.

Form INC-34: e-Articles of Association.

The necessary documents and DSC should accompany these forms.

8. Pay the Registration Fees

The registration fees vary depending on the type and size of the company. Fees can be paid online through the MCA portal. To avoid delays in the registration process, ensure that all required payments are made.

9. Receive the Certificate of Incorporation

Once the documents are reviewed and approved, the ROC will issue a Certificate of Incorporation. This certificate proves that your company is officially registered and legally exists.

10. Post-Registration Compliance

After registration, your company must adhere to various compliance requirements:

Obtain a PAN and TAN: Essential for tax purposes and to comply with Income Tax regulations.

Register for GST: GST registration is mandatory if your company's turnover exceeds the threshold limit.

Open a Bank Account In the company's name for financial transactions.

Maintain Statutory Registers: Keep records of shareholders, directors, and other important company documents.

11. Regular Filings and Annual Compliance

Ensure timely filing of annual returns and financial statements with the ROC. Companies must also conduct regular board meetings, maintain statutory records, and comply with other regulatory requirements.

Conclusion

Company Registration in Andhra Pradesh involves several steps, but understanding the process can make it much smoother. By following this guide and complying with legal requirements, you can successfully establish and grow your business in Andhra Pradesh.

0 notes

Text

From letters to logistics: With 1.5 Lakhs rural post offices, FM announces in Budget

Finance minister Nirmala Sitharaman Saturday announced the govt’s plan to transform India Post into a large logistics organisation with 1.5 lakh rural post offices.In her Budget speech, Sitharaman said India Post’s rural post offices will emerge as a catalyst for the rural economy. “India Post with 1.5 lakh rural post offices, complemented by the India Post Payment Bank and a vast network of 2.4…

0 notes