#India Paints & Coating market development

Explore tagged Tumblr posts

Text

Get the latest India Paints & Coating market report, including size, trends, share, and revenue for 2028. Stay ahead with market outlook and future insights.

#India Paints & Coating market research report#India Paints & Coating market report#India Paints & Coating market size#India Paints & Coating market trends#India Paints & Coating market share#India Paints & Coating market revenue#India Paints & Coating market outlook#India Paints & Coating future market#India Paints & Coating market insights#India Paints & Coating market forecast#India Paints & Coating market analysis#India Paints & Coating market top players#India Paints & Coating market major players#India Paints & Coating market leading players#India Paints & Coating market emerging players#India Paints & Coating market players#India Paints & Coating market competitors#India Paints & Coating market growth#India Paints & Coating market growth factors#India Paints & Coating market development#India Paints & Coating market challenges

0 notes

Text

Breathe New Life into Your Space: Budget-Friendly Design with MITS Work

Do you dream of a stunningly designed interior but worry about the cost? You're not alone! Creating a beautiful and functional space doesn't have to break the bank. At MITS Work, a leading interior design company in Noida and a trusted partner for homeowners across India, we believe everyone deserves a space that reflects their style and personality.

This article is packed with practical tips and design inspiration to help you transform your space without exceeding your budget. Whether you're searching for an interior decorator near you in Delhi, Patna, or any other city in India, MITS Work's expertise can guide you through the process. We'll show you how to achieve a high-end look using creative strategies and readily available resources.

Finding Inspiration on a Budget:

Embrace DIY Projects: Unleash your inner creativity! Upcycle old furniture with a fresh coat of paint or reupholster tired pieces with colorful fabrics. Explore online tutorials or attend local workshops to learn basic carpentry or craft skills.

Think Outside the Box: Explore thrift stores, flea markets, and vintage shops for unique treasures. You might find hidden gems like antique accent pieces, decorative mirrors, or even artwork at a fraction of the retail cost.

Harness the Power of Social Media: Platforms like Pinterest and Instagram are goldmines for design inspiration. Follow best interior designers in Delhi and other design professionals for trending ideas and budget-friendly hacks.

Maximizing Space with Smart Design:

Rearrange and Repurpose: Before buying new furniture, consider rearranging your existing pieces. A fresh layout can create a completely different feel. Repurpose furniture for multiple functions, like using an ottoman as a coffee table or a console table as a desk.

Embrace Multifunctional Furniture: Opt for furniture that serves multiple purposes. Foldable chairs, ottomans with storage compartments, and nesting tables can maximize space and functionality in smaller areas.

Let There Be Light: Natural light is a powerful design tool. Open curtains and blinds to brighten your space and create a more open feel. Consider strategically placing mirrors to reflect light and make the room feel more spacious.

Creating Impact with Affordable Decor:

The Power of Paint: A fresh coat of paint can dramatically transform a space. Choose bold colors for an accent wall or calming neutrals for a serene atmosphere. Explore affordable paint brands that offer high-quality options.

Accessorize with Intention: A few well-chosen accessories can add personality and style. Visit thrift stores or discount home decor stores for throw pillows, artwork, plants, or decorative vases.

Bring Nature Indoors: Houseplants not only add a touch of life to your space but also improve air quality. Opt for low-maintenance varieties like succulents or snake plants that require minimal care.

Why Choose MITS Work as Your Budget-Friendly Design Partner?

At MITS Work, we understand that budget-friendly design doesn't mean sacrificing quality or style. Our experienced interior design company in Delhi offers a range of services tailored to your needs and budget. We can help you:

Develop a budget plan and stick to it.

Find creative and affordable solutions for your design goals.

Guide you through the design process, ensuring a cohesive and stylish outcome.

Conclusion:

Creating a beautiful and functional interior doesn't require a hefty price tag. With a little creativity, resourcefulness, and the expert guidance of MITS Work, you can transform your space into a haven you love without breaking the bank.

Ready to get started? Contact MITS Work today for a free consultation and discover how we can help you achieve your dream space.

#bestinteriordesigncompany#interiordesigncompanyinnoida#interiordecoratornearme#bestinteriordesignersindelhi#bestinteriordesignerinpatna#interiordesign#interiordesigner#homedesign#interiordecor#moderndesign#homedesignideas#livingroomdesign#bedroomdesign#bathroomdesign#commercialdesign#sustainabledesign#homestyling#india#noida#delhi#patna#biharsharif#begusarai

3 notes

·

View notes

Text

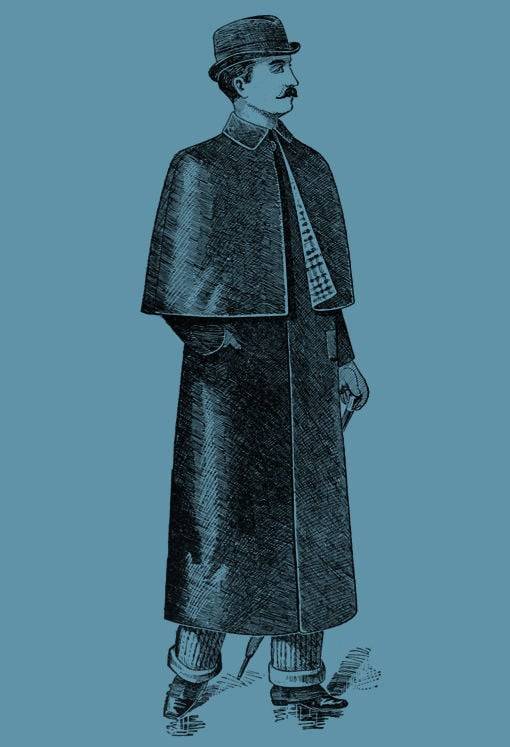

On June 17th 1823 Charles Macintosh patented the waterproof cloth he was using to make raincoats.

While he was trying to find uses for the waste products of gasworks, Charle discovered that coal-tar naphtha dissolved india rubber. He took wool cloth and painted one side with the dissolved rubber preparation and placed another layer of wool cloth on top.

This created the first practical waterproof fabric, but the fabric was not perfect. It was easy to puncture when it was seamed, the natural oil in wool caused the rubber cement to deteriorate. In cold weather the fabric became stiffer and in hot weather the fabric became sticky. When vulcanized rubber was invented in 1839, Macintosh's fabrics improved since the new rubber could withstand temperature changes.

Of course just because you patent something it does not mean you actually were the first to invent it, controversy has followed the invention of the telephone since Alexander Graham Bell patented it, other inventions were questioned, the tyre, the television and the bicycle, all connected to Scotland and all have earlier versions that were thought of, or made beforehand, the “Mac” is no different.

James Syme, a surgeon and chemist based in Edinburgh, had discovered a derivative of coal tar (naphtha) could dissolve rubber and published his findings in Thomson's Annals of Philosophy five years before Macintosh came up with his idea.

It was the same process used by Macintosh following his own chemistry experiments with waste from Glasgow’s coal-gas works, and it has been claimed that the inventor had read Syme’s work before developing it for his own uses.

While Syme, uninterested in commercial matters, failed to patent his valuable discovery and continued to build a noteworthy career in surgery, Macintosh stamped his name on the idea in 1823, had Syme done so you might be calling the coats Symes.....it doesn’t have the same ring does it? Syme’s paper had not detailed the crucial sandwich-type construction employed by Macintosh, although this too was not completely new.

Spanish scientists previously used the method to make leak-proof containers for mercury, and renowned British balloonist Charles Green made a balloon envelope that applied the same principle in 1821.

French scientists also made balloons gas-tight and impermeable by impregnating fabric with rubber dissolved in turpentine and the use of rubber to waterproof fabric dates back to the Aztecs, who used natural latex.

But what made Macintosh’s invention revolutionary was its ease of manufacture and wear, seeing him swiftly launching into the production of cloth to be converted into coats and other garments by tailors in Glasgow.

Some of you might have picked up on the different spelling of the names in the first two paragraphs? Others will now be scrolling back to see what I mean! Well when As news of his invention spread, the repeated misspelling of the inventor’s name is thought to have popularised the description of the resulting coat as a “Mackintosh” – a name that has stuck to the present day.

Macintosh was elected as a fellow of the Royal Society for his contributions to chemistry and enjoyed considerable success before his death in 1843, aged 76.

First sold in 1824, his coat remains on the market in numerous forms across the world, it is now primarily a luxury brand still bearing its inventor’s name, even though it is spelled wrong!

6 notes

·

View notes

Text

The Phosphate Conversion Coatings Market is projected to grow from USD 1878.6 million in 2024 to an estimated USD 2671.55million by 2032, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2032.The phosphate conversion coatings market has been witnessing steady growth in recent years, driven by its broad applications across industries such as automotive, aerospace, construction, and manufacturing. Phosphate conversion coatings, known for their excellent corrosion resistance, wear protection, and surface preparation qualities, play a crucial role in enhancing the performance and longevity of metal components. This article explores the key trends, growth drivers, challenges, and opportunities shaping the phosphate conversion coatings market.

Browse the full report at https://www.credenceresearch.com/report/phosphate-conversion-coatings-market

Market Overview

Phosphate conversion coatings are applied to metallic surfaces through a chemical reaction involving phosphoric acid and metal. These coatings create a thin, adherent layer of insoluble phosphate crystals, offering protection against corrosion and improving paint adhesion. Key types of phosphate coatings include iron, zinc, and manganese phosphate coatings, each tailored for specific applications.

Key Market Drivers

Demand from Automotive and Aerospace Industries The automotive and aerospace sectors are major consumers of phosphate conversion coatings. In these industries, the coatings are used for corrosion protection, surface preparation, and wear resistance. The rising demand for lightweight and fuel-efficient vehicles, along with advancements in aerospace engineering, is bolstering the adoption of phosphate conversion coatings.

Growth in Construction and Infrastructure Development With urbanization and infrastructure development on the rise, the demand for durable metal components has surged. Phosphate coatings enhance the durability of steel and other metals used in construction, making them indispensable for the industry.

Stringent Environmental Regulations Governments worldwide are implementing stringent environmental regulations to promote sustainable practices. Modern phosphate conversion coatings are being designed to comply with these regulations by reducing heavy metal content and minimizing environmental impact, which has boosted their adoption.

Emerging Trends

Eco-friendly Coating Solutions The market is witnessing a shift towards eco-friendly phosphate coatings that reduce hazardous chemical use. For instance, advancements in low-temperature processes and water-based formulations are gaining traction.

Technological Innovations Research and development in nanotechnology have opened new avenues for phosphate conversion coatings. Nanophosphate coatings provide superior performance in terms of adhesion, corrosion resistance, and mechanical strength.

Expansion in Emerging Economies Rapid industrialization in emerging economies such as India, China, and Brazil is creating significant opportunities for market players. The increasing demand for high-performance coatings in these regions is expected to drive market growth.

Challenges

Raw Material Price Volatility Fluctuations in the prices of raw materials such as phosphoric acid and zinc can impact the overall production cost of phosphate coatings, posing a challenge for manufacturers.

Environmental Concerns Despite advancements in eco-friendly solutions, phosphate conversion coatings still face criticism for their environmental impact. The disposal of waste generated during the coating process remains a significant issue.

Competition from Alternative Coatings The growing popularity of alternative coatings, such as ceramic and polymer-based coatings, presents stiff competition to phosphate conversion coatings. These alternatives often offer superior performance and lower environmental impact.

Opportunities

Innovations in Coating Technologies Continuous research in coating technologies presents opportunities for developing advanced phosphate coatings with enhanced properties. Innovations in application methods, such as electrochemical deposition and spray techniques, can further expand the market.

Collaborations and Partnerships Strategic collaborations among key market players and end-user industries can foster innovation and streamline supply chains, boosting the adoption of phosphate conversion coatings.

Focus on Green Manufacturing Embracing green manufacturing practices and developing sustainable coating solutions can help companies comply with environmental regulations and gain a competitive edge.

Key Player Analysis:

Henkel AG & Co. KGaA

PPG Industries

The Sherwin-Williams Company

Axalta Coating Systems LLC

Kansai Paint Co.

Chemetall GmbH

Nihon Parkerizing Co., Ltd.

Keystone Corporation

Freiborne Industries Inc.

Hubbard-Hall Inc.

Segmentations:

By Product Type:

Iron Phosphate Conversion Coating

Zinc Phosphate Conversion Coating

Manganese Phosphate Conversion Coating

By Substrate:

Steel

Cast Iron

Others (Magnesium, Aluminium, Titanium)

By End-use Industry:

Food & Beverages

Consumer Appliances

Automotive

Others (Chemical/ Petrochemical, Healthcare, Aerospace, etc.)

By Region:

North America

U.S.

Canada

Mexico

Europe

UK

France

Germany

Italy

Spain

Russia

Belgium

Netherlands

Austria

Sweden

Poland

Denmark

Switzerland

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Thailand

Indonesia

Vietnam

Malaysia

Philippines

Taiwan

Rest of Asia Pacific

Latin America

Brazil

Argentina

Peru

Chile

Colombia

Rest of Latin America

Middle East

UAE

KSA

Israel

Turkey

Iran

Rest of Middle East

Africa

Egypt

Nigeria

Algeria

Morocco

Rest of Africa

Browse the full report at https://www.credenceresearch.com/report/phosphate-conversion-coatings-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

Summer Cool Coat Powder Manufacturers in India: Keeping Buildings Cooler and Energy Efficient

India’s soaring summer temperatures have long been a challenge for homeowners, businesses, and industries alike. With the rising costs of energy and the growing need for sustainability, innovative solutions like summer cool coat powder have become increasingly popular. This advanced product, designed to keep buildings cooler by reflecting heat, has led to a surge in demand for summer cool coat powder manufacturers in India.

What Is Summer Cool Coat Powder?

Summer cool coat powder is a specially formulated coating material that reflects solar radiation and minimizes heat absorption. When applied to roofs and walls, it reduces surface temperatures significantly, making interiors cooler and more comfortable. The powder is mixed with water or other binding agents and applied like paint to achieve a reflective and insulating finish.

Benefits of Summer Cool Coat Powder

Reduces Indoor Temperatures: By reflecting sunlight and infrared radiation, summer cool coat powder helps maintain lower indoor temperatures, even in the peak of summer.

Energy Savings: Cooler interiors mean reduced reliance on air conditioning, leading to lower electricity bills and energy consumption.

Eco-Friendly Solution: By lowering energy use, summer cool coat powder contributes to reducing carbon emissions, aligning with global sustainability goals.

Protects Roofs and Walls: The reflective coating protects surfaces from UV radiation, preventing wear and tear while extending their lifespan.

Affordable and Easy to Apply: Compared to other cooling technologies, summer cool coat powder is cost-effective and straightforward to apply, making it accessible for residential and commercial use.

Why India Needs Summer Cool Coat Powder

India experiences some of the highest summer temperatures globally, particularly in states like Rajasthan, Gujarat, and Tamil Nadu. This extreme heat not only affects daily life but also places a significant burden on energy resources due to the widespread use of air conditioning. Urban areas, in particular, face the added challenge of the “urban heat island” effect, where densely developed areas retain more heat than rural surroundings.

Summer cool coat powder manufacturers in India are addressing these challenges by providing effective and affordable solutions that help combat the heat, reduce energy demands, and promote sustainable construction practices.

Leading Summer Cool Coat Powder Manufacturers in India

The increasing demand for summer cool coat powder has given rise to several manufacturers specializing in high-quality, energy-efficient products. Here are some of the top players in the Indian market:

Novota Thermotech Pvt. Ltd.: A leader in innovative cooling solutions, Novota Thermotech Pvt. Ltd. offers advanced summer cool coat powders that are durable, eco-friendly, and highly effective in reducing heat absorption.

Asian Paints: Known for their wide range of paints and coatings, Asian Paints has ventured into the summer cool coat segment, offering products that cater to India’s unique climatic challenges.

Nerolac Paints: Nerolac provides energy-efficient coatings, including summer cool coat powders, designed for both residential and commercial applications.

Berger Paints: With a focus on sustainability, Berger Paints offers high-performance cool coating products that deliver long-lasting results.

Applications of Summer Cool Coat Powder

Summer cool coat powder is versatile and can be applied in various settings, including:

Residential Buildings: Homeowners can use this coating on roofs and terraces to maintain cooler indoor environments and save on energy bills.

Commercial Buildings: Office complexes and retail spaces benefit from reduced cooling costs and improved indoor comfort.

Industrial Facilities: Warehouses and factories, often exposed to intense heat, can maintain safer working conditions with summer cool coat powder.

Public Infrastructure: Schools, hospitals, and government buildings can use this eco-friendly solution to create energy-efficient spaces.

Choosing the Right Summer Cool Coat Powder

With numerous options available in the market, it’s essential to select the right product to meet your needs. Here’s what to look for:

Reflective Properties: Check for high solar reflectance index (SRI) values to ensure optimal performance.

Durability: Choose a product that offers long-lasting protection against UV rays, weather changes, and general wear and tear.

Ease of Application: Opt for powders that mix easily and can be applied with standard tools.

Environmental Certifications: Look for eco-friendly certifications to ensure the product aligns with sustainability goals.

Cost and Warranty: Compare prices and check for warranties to ensure you’re getting value for money.

The Future of Summer Cool Coat Powders in India

As awareness of energy efficiency and sustainability grows, the demand for summer cool coat powders is expected to increase significantly. Government initiatives like the Energy Conservation Building Code (ECBC) and Smart Cities Mission are encouraging the adoption of energy-saving technologies, making cool coating solutions an integral part of modern construction practices.

In the coming years, summer cool coat powder manufacturers in India will likely continue innovating to offer products that are even more efficient, durable, and affordable. With the right policies and consumer awareness, these products can play a critical role in reducing India’s energy footprint and combating climate change.

Conclusion

In a country where the summer heat can be relentless, summer cool coat powder manufacturers in India are providing solutions that enhance comfort, reduce energy consumption, and promote sustainability. Companies like Novota Thermotech Pvt. Ltd. are leading the way with innovative products that cater to India’s diverse needs.

If you’re looking to beat the heat and save on energy costs, summer cool coat powder is an excellent investment. Explore the options available from trusted manufacturers and take a step towards a cooler, greener future.

0 notes

Text

Top 15 Market Players in Global Zinc Phosphate Corrosion Inhibitors Market

Top 15 Market Players in Global Zinc Phosphate Corrosion Inhibitors Market

The zinc phosphate corrosion inhibitors market is competitive, driven by demand from industries like construction, automotive, and marine. Here are the top 15 players shaping the global market:

Heubach GmbH A market leader in corrosion inhibitors, Heubach provides high-performance zinc phosphate products designed for protective coatings and paints.

W.R. Grace & Co. Grace’s innovative solutions include zinc phosphate additives that enhance corrosion resistance for industrial applications.

BASF SE BASF delivers advanced zinc phosphate corrosion inhibitors that are widely used in marine and automotive coatings.

Nubiola (Ferro Corporation) Nubiola, a subsidiary of Ferro Corporation, specializes in anti-corrosion pigments, including zinc phosphate solutions tailored for harsh environments.

SNCZ Known for its expertise in anti-corrosion additives, SNCZ produces a broad range of zinc phosphate variants for industrial coatings.

Kerala State Industrial Enterprises (KSIE) A key player in the Indian market, KSIE offers high-quality zinc phosphate for domestic and international clients.

Chemetall GmbH (BASF subsidiary) Chemetall focuses on metal surface treatment and provides zinc phosphate products with excellent anti-corrosion properties.

Vanchem Performance Chemicals Vanchem is a recognized supplier of zinc phosphate inhibitors used in surface coatings for industrial and construction sectors.

Noelson Chemicals Specializing in anti-corrosion and anti-rust additives, Noelson offers innovative zinc phosphate products to meet diverse market needs.

Jiangsu Xinruida Chemical Co., Ltd. This Chinese company focuses on the production of zinc phosphate corrosion inhibitors for coatings and paints used in heavy industries.

Hanchang Industries Co., Ltd. Hanchang supplies zinc phosphate inhibitors designed for long-term corrosion protection in automotive and marine applications.

Kobo Products, Inc. Kobo Products provides functional pigments, including zinc phosphate, catering to advanced industrial coatings.

Halox (ICL Advanced Additives) Halox offers corrosion inhibitors such as zinc phosphate to enhance the durability of paints and coatings in aggressive environments.

Shijiazhuang Xinsheng Chemical Co., Ltd. A leader in the Chinese market, Xinsheng manufactures high-quality zinc phosphate products with a strong export focus.

Pigmentan Ltd. Based in Israel, Pigmentan produces zinc phosphate corrosion inhibitors that are widely used in protective coatings worldwide.

Request report sample at https://datavagyanik.com/reports/global-zinc-phosphate-corrosion-inhibitors-market/

Top Winning Strategies in Zinc Phosphate Corrosion Inhibitors Market

Market leaders in zinc phosphate corrosion inhibitors employ strategic approaches to remain competitive and address the increasing demand for high-performance protective solutions. Below are the top strategies:

Innovation in Product Development Companies are investing in R&D to develop advanced zinc phosphate variants that enhance performance while being eco-friendly. For instance, BASF has introduced low-toxicity products catering to strict environmental regulations.

Sustainability Initiatives With rising demand for environmentally friendly solutions, companies like Heubach are focusing on developing non-toxic and sustainable zinc phosphate products.

Targeting Emerging Markets Players are expanding their presence in emerging economies such as India, Brazil, and Southeast Asia, where industrialization and infrastructure development drive demand.

Collaborations with End-User Industries Collaborating with industries such as automotive, construction, and marine helps manufacturers tailor their products to specific customer needs. Chemetall’s partnerships with automotive OEMs exemplify this strategy.

Global Distribution Networks Expanding distribution networks ensures market players can meet global demand efficiently. Noelson Chemicals, for example, has strengthened its export capabilities in North America and Europe.

Focus on High-Growth Segments Companies are targeting high-growth applications, such as powder coatings and waterborne paints, which increasingly rely on zinc phosphate corrosion inhibitors.

Acquisitions and Mergers Acquisitions of smaller players help market leaders enhance their product portfolio and expand their geographic presence. W.R. Grace’s acquisition of regional suppliers has bolstered its market share.

Digital Marketing and Branding Leveraging digital platforms to showcase product benefits and applications has become a key strategy for companies looking to attract industrial clients globally.

Cost Optimization in Production Implementing efficient production techniques and sourcing raw materials strategically helps companies reduce costs and remain competitive in price-sensitive markets.

Customizable Solutions Offering tailored zinc phosphate products for specific coatings and paints enhances customer satisfaction and loyalty. SNCZ excels in this approach with its industry-specific solutions.

Adapting to Regulatory Changes Ensuring compliance with global environmental and safety standards is critical. Companies like Vanchem are proactively reformulating products to meet evolving regulations.

Enhancing Supply Chain Efficiency Optimizing supply chains through regional manufacturing facilities and digital tools has helped companies like BASF improve delivery times and reduce costs.

Educational Initiatives Conducting workshops and training sessions for customers to highlight the application and benefits of zinc phosphate products builds trust and long-term partnerships.

Technological Integration Integrating advanced technologies like nanotechnology into product formulations enables companies to offer superior anti-corrosion performance. Halox has leveraged such innovations effectively.

Focus on Long-Term Performance Emphasizing the durability and extended lifecycle benefits of zinc phosphate corrosion inhibitors helps companies attract industries prioritizing cost-effective maintenance solutions.

These strategies are enabling market leaders to drive innovation, capture emerging opportunities, and address evolving customer needs in the zinc phosphate corrosion inhibitors market.

Request a free sample copy at https://datavagyanik.com/reports/global-zinc-phosphate-corrosion-inhibitors-market/

#Zinc Phosphate Corrosion Inhibitors Market#Zinc Phosphate Corrosion Inhibitors Production#market share#market growth#market players#market size#revenue#average price#top trends#competitive pricing strategies

0 notes

Text

Mixed Xylene Prices, News, Trend, Graph, Chart, Forecast and Historical

Mixed xylene is an important industrial solvent that plays a significant role in various industries, including chemical manufacturing, pharmaceuticals, paints, and coatings. As a crucial intermediate in the production of chemicals such as terephthalic acid (used in polyester production) and other petrochemicals, the price of mixed xylene is influenced by a variety of factors including supply and demand, production costs, raw material prices, and geopolitical events. Over the years, mixed xylene prices have experienced fluctuations due to the volatility in crude oil prices, as well as shifts in global production and consumption trends. This article delves into the factors impacting the mixed xylene market and provides an overview of its price trends.

The mixed xylene market is closely linked to the global oil industry since the primary feedstock for producing mixed xylene is derived from crude oil. The price of crude oil directly influences the cost of mixed xylene production. When crude oil prices rise, production costs for mixed xylene also tend to increase, which, in turn, raises the price of mixed xylene. On the other hand, when oil prices decline, the cost of production tends to decrease, often leading to a reduction in mixed xylene prices. Therefore, fluctuations in crude oil prices are one of the primary drivers of mixed xylene price trends. Moreover, economic cycles play a role in the demand for mixed xylene. During periods of economic expansion, demand for mixed xylene increases due to higher manufacturing activities in sectors such as automotive, construction, and textiles. Conversely, during economic slowdowns or recessions, demand decreases, resulting in lower prices.

Get Real time Prices for Mixed xylene: https://www.chemanalyst.com/Pricing-data/mixed-xylene-80

The mixed xylene market is also shaped by regional factors. In regions like North America, Europe, and Asia, industrial growth, as well as demand for solvents and petrochemicals, can significantly affect mixed xylene prices. For example, the Asia-Pacific region, particularly China and India, has seen substantial growth in industries such as textiles, automotive, and consumer goods, which in turn drives demand for mixed xylene. China, as one of the largest consumers of mixed xylene, influences global price trends. Any shifts in its domestic production or import policies can have a ripple effect on global pricing.

Additionally, production capacity and technological advancements in the manufacturing processes for mixed xylene contribute to the pricing dynamics. The introduction of more efficient and cost-effective production methods can lower manufacturing costs, potentially reducing the price of mixed xylene. Conversely, a lack of investment in technology or limited production capacity in key regions can lead to price hikes. For instance, disruptions in supply chains, plant shutdowns, or limitations in the refining capacity of mixed xylene can cause price spikes due to limited availability.

Another important aspect influencing mixed xylene prices is the shift towards more sustainable and eco-friendly alternatives in the market. As global awareness of environmental issues grows, industries are increasingly seeking solutions to reduce their carbon footprint and dependency on fossil fuels. This has led to a growing interest in bio-based solvents and alternative chemicals that can replace petroleum-derived solvents like mixed xylene. The development of such alternatives could dampen the demand for traditional mixed xylene, potentially exerting downward pressure on its prices in the long run.

The global regulatory environment also plays a role in shaping the mixed xylene market. Stricter regulations around the use of hazardous chemicals, including mixed xylene, can impact pricing dynamics. Governments worldwide are imposing regulations to reduce the environmental and health risks associated with the use of solvents. These regulations may necessitate investments in safer manufacturing processes, which could increase production costs. Additionally, restrictions on emissions and volatile organic compounds (VOCs) could influence the demand for mixed xylene, particularly in markets that prioritize environmental sustainability.

Furthermore, trade policies and international relations can have a significant effect on the pricing of mixed xylene. Tariffs, import/export restrictions, and trade agreements between countries affect the flow of mixed xylene across borders. Any changes in trade policies, such as the imposition of tariffs on key raw materials or products, can lead to price fluctuations. Geopolitical tensions or trade wars between major players in the mixed xylene market, such as the United States, China, and countries in the Middle East, can create uncertainty and influence market prices.

The mixed xylene market has also been impacted by shifts in consumer preferences. As demand for cleaner and more sustainable products grows, companies in industries like automotive and consumer goods are adopting greener alternatives to reduce their environmental impact. This has led to a shift in the types of solvents and chemicals used in manufacturing processes. Mixed xylene, being a petroleum-derived product, faces increasing competition from bio-based solvents, which are considered more environmentally friendly and sustainable. The growing trend towards sustainable solutions is likely to impact the demand for mixed xylene and may influence its pricing in the future.

In conclusion, the price of mixed xylene is driven by a complex interplay of factors including crude oil prices, global economic trends, production capacities, technological advancements, environmental regulations, and trade policies. As the world moves towards more sustainable practices, the market dynamics for mixed xylene may shift, potentially leading to changes in pricing structures. For businesses and industries reliant on mixed xylene, staying informed about these factors and anticipating changes in the market can help mitigate risks and take advantage of opportunities. Understanding the factors that influence mixed xylene prices is essential for stakeholders in the chemical, automotive, pharmaceutical, and other industries that rely on this important chemical solvent.

Get Real time Prices for Mixed xylene: https://www.chemanalyst.com/Pricing-data/mixed-xylene-80

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Mixed Xylene#Mixed Xylene Price#Mixed Xylene Prices#Mixed Xylene Pricing#india#united kingdom#united states#germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Waterborne Automobile Coating Market Outlook, Current and Future Industry Landscape Analysis by 2032

The global demand for waterborne automobile coatings is projected to surge, with an anticipated market value of USD 79 billion in 2022, and is expected to reach USD 141.5 billion by 2032, growing at a CAGR of 6% during the forecast period. This growth is largely attributed to the coatings’ ability to protect vehicles against UV radiation, acid rain, and adverse weather conditions.

Waterborne automobile coatings are eco-friendly solutions that use water as a solvent to disperse a resin. These coatings typically contain up to 80% water, with small quantities of other solvents such as glycol ethers. Their environment-friendly nature is underscored by regulations in the US and Europe, which mandate a VOC content of less than 3.5 pounds per gallon of water.

Key takeaways from the market include:

Environmental Benefits : Waterborne coatings significantly reduce volatile organic compound (VOC) emissions, aligning with stringent environmental regulations.

Market Growth : The market is driven by the increasing demand for eco-friendly products, high chemical resistance, and low-temperature processing.

Challenges : The longer drying and curing times compared to solvent-borne coatings and sensitivity to humidity and freezing conditions may hamper growth.

Source: https://www.plasticsnewsdirectory.com/company/910976/news/3556792/waterborne-automobile-coating-market-outlook-current-and-future-industry-landscape-analysis-by-2032

Regional Analysis

Asia-Pacific : This region is expected to dominate the waterborne automobile coatings market due to the rapid growth of the automobile industry and less stringent regulations. The surge in vehicle production, particularly in China and India, coupled with rising middle-class incomes, is propelling market growth.

North America : The US is poised to lead regional growth, with significant adoption of electrocoat processes. Electrocoat, an immersion painting technique, offers uniform and clean coating applications, making it popular among vehicle manufacturers. The demand for quick and efficient coating methods in US factories will further drive the adoption of electrocoating technologies.

Drivers of Market Growth

Several factors are driving the growth of the waterborne automobile coatings market:

Environmental Regulations : Stringent regulations in the US and Europe regarding VOC emissions have spurred the shift from solvent-borne to waterborne coatings.

Consumer Awareness : Growing awareness of the harmful effects of VOCs has increased demand for environmentally friendly coatings.

Industrial Applications : The rise in end-use industries and the development of eco-friendly coatings are contributing to market expansion.

Technological Advancements : Innovations in coating technologies, including improved formulations and application techniques, are enhancing product performance and market adoption.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware – 19713, USA T: +1-845-579-5705 For Sales Enquiries: [email protected] Website: https://www.futuremarketinsights.com LinkedIn| Twitter| Blogs | YouTube

0 notes

Text

The Importance Of Anti-Graffiti Coating: A Step Towards Clean And Protected Spaces

This is especially so given the high tempo of development, especially in the urban context of the Delhi NCR region where upkeep of the built form is a challenge. Although most people may appreciate graffiti as a form of art, few would love to see it painted on their walls, stations, or any business establishment. People have to spend a considerable amount of money to wipe off graffiti and a vast amount of time to repair and renovate surfaces, which makes it an ongoing battle for property owners as well as city authorities. Fortunately, the answer to this question is called anti-rubbing paint, a relatively recent method that not only combats graffiti but also saves the appearance of structures.

At Nivera Paints, we understand the need for effective protection against graffiti in Delhi NCR, and our innovative Anti Graffiti coating in Delhi NCR offers a reliable solution to combat this issue. In this article, we explore the benefits of anti-graffiti coating, its applications, and why Nivera Paints is the go-to choice for businesses and property owners in the region.

What is Anti-Graffiti Coating?

Anti-graffiti coatings as the name implies are a particular type of coatings intended to prevent surfaces from being vandalized through graffiti. These coatings form a real shield against other materials such as spray paints, markers, and other products that are used in graffiti. They offer a shield that can be washed without affecting the base material because it could be concrete, metal, glass, or even brick.

There are two primary types of anti-graffiti coatings:

Permanent Coatings – These coatings have a chemical adhesion to the surface and are tough. They afford long-lasting protection and they are least likely to be washed out thus needing to be reapplied.

Sacrificial Coatings – These types of coatings create a layer that has to be removed together with the graffiti. Sacrificial coatings if cleaned will require touch-up, but are well preferred, especially in the areas prone to vandalism.

These two types of anti-graffiti coating can be obtained from Nivera Paints, and they are individually formulated depending on the special needs of the buildings in Delhi NCR.

The Growing Problem of Graffiti in Delhi NCR

The Delhi NCR is among the most developing metropolitan areas in India which by all means also experiences some problems concerning the look and tidiness of urban areas. Vandalism is a common problem in schools, offices, public places and structures, buildings, railway stations, and other facilities which refers to writing on walls and other facilities with spray paint and markers. Some graffiti has aesthetic significance, but much of it is recognized as vandalism resulting in gradual degradation of the look of the structures and other areas of the community.

The effects of graffiti are felt beyond simple concerns about the appearance of properties. Graffiti has the profoundest impacts brought forth in this paper. Graffiti can also have a detrimental effect on an area by impacting the value of a property by its presence generally lowering the interest in the property by prospective buyers or tenants besides giving a general impression of an area being declined. Since competition is rife in the Delhi NCR real estate market, giving structures the facelift they need can help investors attract potential buyers customers, and visitors alike.

How Anti-Graffiti Coating Helps Protect Your Property

Some products are used to paint buildings to prevent graffiti from becoming rampant and consequently reaching a point of no return. The benefits of anti-graffiti coating include:

Effects – It can be easily removed – Speaking of the benefits of anti-graffiti coatings, one must include the fact that they can be removed easily provided no need for strong chemicals or long hours of work. This results in lesser maintenance costs as well as the time that will be needed to renovate the property.

Gum Protection – It is also noted that anti-graffiti coatings offer long-term protection to the surfaces, as the graffiti does not seem to get under the surface. One of the great benefits of having a coated surface is durability therefore does not easily wear out and therefore does not require frequent touch-ups or reapplications.

Greater Appearance – As opposed to allowing graffiti to build up on structures, anti-graffiti coatings maintain a property’s appearance. The same applies to commercial premises, common-use infrastructure, and residential structures in areas of high traffic.

Economical – Although applying anti-graffiti coatings may be capital intensive in the first instance, saving on the costs of washing, touch-up repainting, repairs, and subsequent recoating results in substantial savings, making it one of the most cost-effective ways of maintaining buildings.

Ecofriendly – Anti-graffiti coatings are normally water-borne systems free of solvents which makes it safer and environment friendly than using chemical solvents or washing to remove graffiti from the surface.

We do offer Nivera Paints fine Anti Graffiti Coating that has been developed to suit the environment and specific conditions of Delhi NCR. The products we provide will protect your property from graffiti and at the same time retain value.

Why Choose Nivera Paints for Anti-Graffiti Coating in Delhi NCR?

In choosing the form of anti-graffiti coating to use, quality should always come first on your list. Here at Nivera Paints, we aim to provide our clients with the best of what can be used to fight graffiti. Here’s why you should choose Nivera Paints for your anti-graffiti coating needs in Delhi NCR:

Coating Solutions – Nivera Paints has accrued experience for many years and knows the requirements of the clients in Delhi NCR. We pride ourselves in our skilled staff, who in consultation with the clients, identify the appropriate anti-graffiti coating system to be used on the client’s building.

Anti-Graffiti Coatings – Our packaging materials are Manufactured to elicit high performances when it comes to graffiti and other contaminant barriers. This means that whether you require a permanent or sacrificial coating our products can offer you great value.

Customized services – As business owners will appreciate, each property is individual. That is why we have developed programs of work to address surface type, environmental conditions, and individual characteristics of your facility. Currently, our coatings are developed to meet the demands of various surface types such as brick, concrete, metal, and glass.

Customer satisfaction – As a leading brand of quality paints, Nivera Paints fully acknowledges that our buyers are our topmost priority. Providing customers with excellent service from the first time they approach us to the time they hire our services to apply the anti-graffiti coating to their property is something we are proud of for our company. Our crew performs the work to the best of our ability and follows through until the coating remains an effective solution.

Eco-Friendly Products – for environmental consciousness, we have safe anti-graffiti coatings for people and the environment. These products are designed to exclude nasty chemicals, making them suitable for facilities in Delhi NCR where ecological issues matter.

The Application Process of Anti-Graffiti Coating

Graffiti protection coatings are relatively easy to apply in most cases, but care must be taken to do the job correctly. At Nivera Paints, we follow a step-by-step process to apply anti-graffiti coatings to your property:

Surfacing – Usually, the first process in the coating is to prepare the surface to obtain a good coating adhesion. The existing dirt, grime, or antisocial behavior graffiti is cleared before applying the coating.

Coating Application – After the manner described above, the anti-graffiti coating is then sprayed, rolled, or brushed on the surface depending and the type of the coating to be applied.

And final Coating – All coatings require some time to cure for them to achieve their expected performance. At this point, the coating forms a chemical bond with the substrate and forms a very good barrier to protection.

Inspection and Maintenance – Once the coating is dry, we assess for correctness of the application of the coating. We also advise our clients on how they can maintain it to ensure they continue to benefit from the coating in the future.

Conclusion

Anti Graffiti coating in Delhi NCR is an essential tool for property owners. who wish to protect their buildings from the damaging effects of graffiti. With Nivera Paints, you can rest assured that your property is in good hands. Our high-performance anti-graffiti coatings provide long-lasting protection, helping you maintain the aesthetic appeal and value of your property.

Nivera Paints has the best anti-graffiti coating solutions for every business person, property manager, or city authority in Delhi NCR. Visit or call us today to speak with one of our specialists and discover how we can ensure your property remains secure and visually appealing.

0 notes

Text

Analyzing the Aluminum Trihydrate (ATH) Market: Drivers, Opportunities, and Trends

The Aluminum Trihydrate (A.T.H.) Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the Aluminum Trihydrate (A.T.H.) Market:

The global Aluminum Trihydrate (A.T.H.) Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-aluminum-trihydrate-ath-market

Which are the top companies operating in the Aluminum Trihydrate (A.T.H.) Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Aluminum Trihydrate (A.T.H.) Market report provides the information of the Top Companies in Aluminum Trihydrate (A.T.H.) Market in the market their business strategy, financial situation etc.

Huber Group Holding SE (Germany), Alfa Aesar (U.S.), Thermo Fisher Scientific (U.S.), Sumitomo Chemical Co., Ltd. (Japan), Albemarle Corporation (U.S.), Showa Denko K.K. (Japan), Alcoa Corporation (U.S.), Aluminium Corporation of China Limited (China), Nabaltec AG (Germany), NALCO India (India), M.A.L. (Magyar Alumínium Termelo és Kereskedelmi Zrt (Hungary), Hindalco Industries Ltd (India), Magna International Inc. (Canada), Norsk Hydro ASA (Norway), Dubai Aluminium Company Ltd. (U.A.E.), KOBE STEEL LTD. (Japan), Rio Tinto (U.K.), Constellium (France), Eramet (France), RusAL (Russia), TALCO ALUMINIUM COMPANY (Tajikistan)

Report Scope and Market Segmentation

Which are the driving factors of the Aluminum Trihydrate (A.T.H.) Market?

The driving factors of the Aluminum Trihydrate (A.T.H.) Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Aluminum Trihydrate (A.T.H.) Market - Competitive and Segmentation Analysis:

**Segments**

- By End-Use Industry: The A.T.H. market is segmented into various end-use industries such as plastics, building and construction, paints and coatings, chemicals, and others. The building and construction segment is expected to witness significant growth due to the increasing demand for fire-retardant materials in infrastructure development projects. - By Grade: Based on grade, the A.T.H. market is categorized into standard grade A.T.H. and ultrafine grade A.T.H. The ultrafine grade A.T.H. segment is anticipated to experience high demand owing to its superior properties such as high whiteness and dispersibility. - By Application: In terms of application, the market is divided into flame retardants, fillers, coatings, and others. The flame retardants segment is projected to dominate the market as A.T.H. is extensively used as a flame retardant due to its effectiveness in reducing the flammability of materials.

**Market Players**

- Almatis GmbH - Nabaltec AG - Albemarle Corporation - Huber Engineered Materials - Almatis B.V. - Sumitomo Chemical Co., Ltd. - Showa Denko K.K. - Lkab Group - Alupre S.A. - Aluminium Corporation of China Limited

These key market players are actively involved in strategic initiatives such as mergers, acquisitions, collaborations, and product launches to strengthen their market position and expand their product portfolio. The competitive landscape of the A.T.H. market is highly fragmented with the presence of several regional and international players striving to gain a competitive edge.

The global Aluminum Trihydrate (A.T.H.) market is poised for significant growth by 2028, driven by the rising demand for fire-retardant materials across various end-use industries. The market is expected to witness substantial growth in the building and construction segment as stringent regulations regarding fire safety in buildings propel the adoption of A.T.H. as a key flame retardThe Aluminum Trihydrate (A.T.H.) market is poised for considerable growth in the coming years, primarily fueled by the escalating demand for fire-retardant materials in diverse end-use industries. The segmentation of the market into various end-use industries such as plastics, building and construction, paints and coatings, chemicals, among others, presents ample opportunities for market growth. Particularly, the building and construction segment is expected to witness substantial advancement owing to the increasing need for fire-retardant materials in infrastructure development projects. With stringent regulations emphasizing fire safety in buildings, the adoption of A.T.H. as a flame retardant is set to surge, further boosting market growth.

Moreover, the market segmentation based on grade into standard grade A.T.H. and ultrafine grade A.T.H. adds another dimension to the market dynamics. The ultrafine grade A.T.H. segment is anticipated to experience heightened demand due to its superior properties including high whiteness and dispersibility. This suggests that manufacturers and end-users are increasingly inclined towards high-quality products that offer enhanced performance characteristics. As a result, the ultrafine grade A.T.H. segment is likely to witness significant growth, driving overall market expansion.

In terms of applications, the A.T.H. market is divided into flame retardants, fillers, coatings, and others. Among these, the flame retardants segment is projected to dominate the market due to the widespread use of A.T.H. as an effective flame retardant. The inherent properties of A.T.H. make it a preferred choice for reducing flammability in various materials, thereby contributing to its extensive utilization in flame retardant applications. This dominance of the flame retardants segment indicates a strong market foothold for A.T.H. in ensuring fire safety across different industries.

The presence of key market players such as Almatis GmbH, Nabaltec AG, Albemarle Corporation, Huber Engineered Materials, and others underscores the competitive landscape of the A.T.H. market. These**Market Players**

- Almatis GmbH - Nabaltec AG - Albemarle Corporation - Huber Engineered Materials - Almatis B.V. - Sumitomo Chemical Co., Ltd. - Showa Denko K.K. - Lkab Group - Alupre S.A. - Aluminium Corporation of China Limited - Huber Group Holding SE (Germany) - Alfa Aesar (U.S.) - Thermo Fisher Scientific (U.S.) - Sumitomo Chemical Co., Ltd. (Japan) - Albemarle Corporation (U.S.) - Showa Denko K.K. (Japan) - Alcoa Corporation (U.S.) - Aluminium Corporation of China Limited (China) - Nabaltec AG (Germany) - NALCO India (India) - M.A.L. (Magyar Alumínium Termelo és Kereskedelmi Zrt (Hungary) - Hindalco Industries Ltd (India) - Magna International Inc. (Canada) - Norsk Hydro ASA (Norway) - Dubai Aluminium Company Ltd. (U.A.E.) - KOBE STEEL LTD. (Japan) - Rio Tinto (U.K.) - Constellium (France) - Eramet (France) - RusAL (Russia) - TALCO ALUMINIUM COMPANY (Tajikistan)

The Aluminum Trihydrate (A.T.H.) market is poised for significant growth

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Aluminum Trihydrate (A.T.H.) Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Aluminum Trihydrate (A.T.H.) Market, expected to exhibit impressive growth in CAGR from 2024 to 2028.

Explore Further Details about This Research Aluminum Trihydrate (A.T.H.) Market Report https://www.databridgemarketresearch.com/reports/global-aluminum-trihydrate-ath-market

Key Benefits for Industry Participants and Stakeholders: –

Industry drivers, trends, restraints, and opportunities are covered in the study.

Neutral perspective on the Aluminum Trihydrate (A.T.H.) Market scenario

Recent industry growth and new developments

Competitive landscape and strategies of key companies

The Historical, current, and estimated Aluminum Trihydrate (A.T.H.) Market size in terms of value and size

In-depth, comprehensive analysis and forecasting of the Aluminum Trihydrate (A.T.H.) Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Aluminum Trihydrate (A.T.H.) Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of Aluminum Trihydrate (A.T.H.) Market Insights and Forecast to 2028

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Aluminum Trihydrate (A.T.H.) Market Landscape

Part 05: Pipeline Analysis

Part 06: Aluminum Trihydrate (A.T.H.) Market Sizing

Part 07: Five Forces Analysis

Part 08: Aluminum Trihydrate (A.T.H.) Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Aluminum Trihydrate (A.T.H.) Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-aluminum-trihydrate-ath-market

China: https://www.databridgemarketresearch.com/zh/reports/global-aluminum-trihydrate-ath-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-aluminum-trihydrate-ath-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-aluminum-trihydrate-ath-market

German: https://www.databridgemarketresearch.com/de/reports/global-aluminum-trihydrate-ath-market

French: https://www.databridgemarketresearch.com/fr/reports/global-aluminum-trihydrate-ath-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-aluminum-trihydrate-ath-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-aluminum-trihydrate-ath-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-aluminum-trihydrate-ath-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1338

Email:- [email protected]

#Aluminum Trihydrate (ATH) Market Size#Aluminum Trihydrate (ATH) Market Shares#Aluminum Trihydrate (ATH) Market Forecast#Aluminum Trihydrate (ATH) Market Growth#Aluminum Trihydrate (ATH) Market Demand

0 notes

Text

Specialty Chemicals Manufacturers in Hyderabad

Hyderabad, often referred to as the pharmaceutical and industrial hub of India, is home to numerous companies specializing in cutting-edge chemical innovations. Among these, Sainor Labs has carved a niche as one of the leading specialty chemicals manufacturers in the region. Renowned for its commitment to quality, sustainability, and innovation, Sainor Labs serves a diverse array of industries, making it a trusted name in the specialty chemicals sector.

What Are Specialty Chemicals?

Specialty chemicals, also known as performance chemicals, are unique compounds tailored for specific applications. Unlike bulk chemicals, these products are produced in smaller volumes but offer high value due to their precise formulations and functionality. Specialty chemicals play a pivotal role in industries such as pharmaceuticals, agriculture, textiles, paints, adhesives, and personal care.

Why Choose Sainor Labs?

As a forward-thinking specialty chemicals manufacturer in Hyderabad, Sainor Labs focuses on meeting the evolving demands of the market with a customer-centric approach. Here's what sets them apart:

Wide Range of Products Sainor Labs boasts a diverse portfolio of specialty chemicals tailored for industries like healthcare, coatings, agrochemicals, and water treatment. Their innovative formulations ensure optimal performance and efficiency in applications.

State-of-the-Art Infrastructure The company operates with advanced manufacturing facilities equipped with modern technology to produce high-purity chemicals. Their stringent quality control processes ensure every product meets global standards.

Sustainable Practices Sustainability is a cornerstone of Sainor Labs' operations. The company adopts eco-friendly practices, minimizes waste, and uses green chemistry principles wherever possible.

R&D Capabilities With a strong emphasis on research and development, Sainor Labs consistently delivers innovative solutions. Their team of experts works on developing customized chemicals to address specific client requirements.

Customer-Centric Approach Sainor Labs believes in building long-term relationships with clients. Their ability to offer tailored solutions, technical support, and on-time delivery has made them a trusted partner for businesses across various sectors.

Applications of Specialty Chemicals

Specialty chemicals from Sainor Labs find applications in a variety of industries, such as:

Pharmaceuticals: Active ingredients and intermediates for drug manufacturing.

Agriculture: Fertilizers, crop protection chemicals, and soil enhancers.

Paints and Coatings: Additives for durability, color retention, and surface protection.

Textiles: Specialty dyes, coatings, and finishing agents for high-performance fabrics.

Water Treatment: Chemicals for purification and wastewater management.

Why Hyderabad Is a Hub for Specialty Chemicals

Hyderabad's robust infrastructure, skilled workforce, and favorable policies make it an ideal location for specialty chemicals manufacturing. The city provides access to a well-connected logistics network and a collaborative ecosystem of industries, research institutions, and regulatory bodies.

Partner with Sainor Labs for Excellence

When it comes to specialty chemicals, choosing a reliable manufacturer like Sainor Labs ensures you receive high-quality, innovative, and sustainable solutions tailored to your needs. With a proven track record and a dedication to excellence, Sainor Labs is your go-to partner for specialty chemical requirements.

If you're looking for advanced specialty chemicals to enhance your business operations, connect with Sainor Labs today and experience unmatched quality and service.

0 notes

Text

Why India is Emerging as a Hub for Top Ship Chandlers and Marine Services

India is long-standingly considered a powerhouse in the maritime sector thanks to its vast coastline and bustling ports. Recently, it has become an essential location for the top ship chandlers and marine services due to its strategically located location, skilled workforce and commitment to technological advancement. Companies like the Gujmar Group have led this development, providing top-quality marine services that serve the international shipping business.

Strategic Geographical Advantage

The location of India's geographical position is key to its growth as a hub for maritime commerce. The country is situated along important transportation routes to international ports; India's ports function as vital fueling and vessel provisioning points. This has led to the rise of ship chandlers who supply essential items ranging from water and food to technological equipment. Gujmar Group is one of the top ship chandlers from India, and Gujmar Group ensures that ships are fully stocked and prepared for their voyages.

Excellence in Ship Repair Services

One of the best characteristics of India's maritime abilities is its repair and maintenance services for ships. With its world-class dry docks and repair facilities, India is now a popular destination for vessels that require maintenance and upgrading. The availability of highly trained engineers and technicians ensures that vessels receive the best treatment, reducing downtime and increasing operational efficiency. Gujmar.com is a top-rated online retailer. Gujmar.com's emphasis on accuracy and prompt delivery has earned them a prestigious reputation in this industry.

Innovation in Marine Paints

India is also a leader in the need for superior-performance marine paints. These paints are essential to protect vessels from harsh marine environments while reducing maintenance costs and increasing fuel efficiency. Indian producers and distributors have adopted the latest technology to create environmentally friendly coatings that conform to internationally recognized standards. Gujmar Group provides access to some of the most effective marine paints, ensuring vessels are robust and safe to sail.

Comprehensive Marine Services

India's vast range of marine services makes it an all-in-one location for both ship operators and owners. From crew management and logistics to expert technical support, India offers an array of services designed to meet the needs of a variety of customers. Companies such as Gujmar Group prioritize customer satisfaction by providing cost-effective, reliable solutions based on the highest quality standards.

Driving Factors Behind India's Growth

Various factors are responsible for the rise of India as a significant maritime hub.

Government Support : Policies such as 'Make in India' and investments in port infrastructures have helped the shipping industry.

Cost-Effectiveness : Competitive pricing without compromising quality makes India a preferred choice.

Sustainability Focus : A growing focus on sustainable shipping practices aligns India with global trends.

India's potential as a significant hub for top ship chandlers and marine service is undisputed. Companies like the Gujmar Group are leading the way, and the country continues increasing its presence within the global maritime market. Explore India's marine excellence at Gujmar.com and discover how its services can benefit your operations.

0 notes

Text

Understanding the Role of Minerals in Advanced Manufacturing

China clay, also known as kaolin, is a versatile mineral with numerous industrial applications. Derived from naturally occurring clay deposits, it is prized for its fine particle size, chemical inertness, and unique physical properties. Many industries, such as ceramics, paper, rubber, and paint, rely heavily on high-quality china clay powder. Among the key players in this industry, India stands out as a leading producer and supplier of this essential raw material. The nation boasts a wealth of resources and a well-established network of China Clay Powder Manufacturers in India, catering to both domestic and international markets.

China clay powder is extensively used in the ceramics industry as a primary ingredient in the production of porcelain, sanitary ware, and decorative pottery. Its ability to enhance the whiteness, strength, and smoothness of finished products makes it indispensable for ceramic manufacturers. Beyond ceramics, the paper industry is another major consumer of china clay powder. It serves as a filler and coating agent, improving the texture, printability, and opacity of paper products. Similarly, the rubber industry values china clay for its reinforcing properties, which contribute to the durability and flexibility of rubber goods.

In the paint and coatings sector, china clay powder is widely utilized as an extender and pigment. It not only reduces production costs but also improves the consistency, gloss, and opacity of paints. Additionally, it finds applications in the cosmetics industry, where its fine texture and absorbent qualities make it ideal for skincare and makeup products. The versatility of china clay powder has also seen its use in agriculture, pharmaceuticals, and even as a component in certain types of adhesives and sealants.

The quality of china clay powder depends on several factors, including its mineral composition, particle size, and processing techniques. Indian manufacturers have invested significantly in advanced technologies to ensure the production of high-purity china clay powder that meets global standards. Rigorous quality control measures, coupled with sustainable mining practices, have positioned India as a reliable source of this mineral. Moreover, the competitive pricing offered by Indian manufacturers has further cemented their reputation in the global market.

Environmental sustainability is a growing concern in the mining and processing of china clay. Leading manufacturers in India are adopting eco-friendly practices to minimize the environmental impact of their operations. From reforestation efforts to waste management systems, these initiatives are aimed at preserving the natural ecosystem while maintaining production efficiency. The adoption of green technologies not only enhances the environmental credentials of manufacturers but also appeals to environmentally conscious consumers worldwide.

Innovation is another driving force in the china clay powder industry. Research and development efforts are focused on improving the functionality and application scope of this mineral. For instance, surface-modified china clay powders are being developed to meet the specific requirements of advanced industries like electronics and nanotechnology. These innovations are opening up new avenues for growth and diversification, further solidifying India’s position as a hub for high-quality china clay powder.

The future of the china clay powder industry in India looks promising, with increasing demand from various sectors and a strong emphasis on sustainable development. As industries continue to evolve, the role of china clay as a critical raw material is expected to grow, creating opportunities for manufacturers and exporters alike. The emphasis on quality, sustainability, and innovation ensures that Indian manufacturers remain competitive in the global marketplace.

One of the prominent names contributing to this growth is the Sudarshan Group. Known for its commitment to quality and customer satisfaction, the Sudarshan Group has carved a niche for itself in the competitive landscape of china clay powder manufacturing. With a focus on technological advancements and sustainable practices, the company has been at the forefront of delivering exceptional products to its clients. The Sudarshan Group’s dedication to excellence and innovation makes it a trusted partner for businesses seeking premium china clay powder solutions. By continually evolving and adapting to market demands, the Sudarshan Group is not just meeting but exceeding industry standards, reinforcing its position as a leader in this field.

0 notes

Text

Silicone Surfactant Market Growth Trends: Share, Size, and Industry Insights by 2031

Straits Research, a leading global market research firm, has released its latest research report on the silicone surfactant market, forecasting a steady growth trajectory in the coming years. The global silicone surfactant market was valued at USD 2.4 billion in 2023 and is expected to expand from USD 2.524 billion in 2024 to USD 4 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.1% during the forecast period (2024–2032).

Market Definition

Silicone surfactants are a class of surfactants that are derived from silicone, a synthetic material that is known for its unique chemical structure and properties. These surfactants are used in various industrial applications to reduce surface tension, improve stability, and enhance the performance of other products. They find wide applications in industries such as personal care, agriculture, construction, paints and coatings, and textiles due to their superior performance in enhancing wetting, foaming, emulsification, defoaming, and dispersing properties.

Get a Full PDF Sample Copy of the Report @ https://straitsresearch.com/report/silicone-surfactant-market/request-sample

Market Dynamics

The silicone surfactant market is experiencing steady growth driven by several trends, market drivers, and emerging opportunities:

Key Trends:

Growing Demand for Sustainable Products: There is an increasing focus on sustainability and the need for environmentally friendly surfactants. Silicone surfactants are considered a greener alternative to conventional surfactants, as they are biodegradable and non-toxic, meeting the growing demand for eco-friendly solutions. This trend is propelling the adoption of silicone surfactants in various industries.

Technological Advancements in Silicone Chemistry: Recent technological advancements in silicone chemistry have led to the development of innovative and high-performance silicone surfactants. These innovations are enhancing the efficiency and effectiveness of silicone surfactants in diverse applications, including personal care, paints, and coatings, driving the market's growth.

Key Market Drivers:

Rising Demand from the Personal Care Industry: Silicone surfactants are increasingly being used in personal care products, such as shampoos, conditioners, and skincare products, due to their ability to enhance product performance. They are prized for their ability to provide superior conditioning, smooth texture, and long-lasting effects, making them a preferred choice for cosmetic manufacturers.

Expanding Agricultural Applications: Silicone surfactants are increasingly utilized in agriculture, particularly in agrochemical formulations, to improve the wetting, spreading, and absorption of pesticides and fertilizers. The growing need for efficient agricultural practices to boost crop yield and reduce environmental impact is driving the demand for silicone surfactants in this sector.

Key Market Opportunities:

Expansion in Emerging Economies: As industries in emerging economies such as India, China, and Brazil continue to grow, there is increasing demand for silicone surfactants across various sectors, including agriculture, construction, and textiles. These regions present significant opportunities for market expansion, with rising industrialization and awareness of product performance.

Increased Adoption in Green Technologies: With the global shift toward sustainability and the adoption of green technologies, silicone surfactants are well-positioned to capitalize on this trend. Their eco-friendly properties make them ideal for use in applications that focus on reducing environmental impact, presenting substantial growth opportunities for manufacturers.

Market Segmentation

The silicone surfactant market is segmented by application, end-use industry, and geography. Below are the key segments:

By Application:

Wetting Agents

Foaming Agents

Emulsifiers

Defoaming Agents

Dispersants

Others

By End-Use Industry:

Agriculture

Paints and Coatings

Construction

Textile

Personal Care

Others

For a detailed breakdown of the market segmentation, visit https://straitsresearch.com/report/silicone-surfactant-market/segmentation

Key Players

The silicone surfactant market features several key players who are dominating the global landscape. These players are focusing on expanding their product portfolios, developing innovative solutions, and capitalizing on emerging market opportunities:

Dow Inc.

Innospec

Momentive

Elkem Silicones

Shin-Etsu Chemical Co.Ltd.

Evonik Industries AG

Andisil

Supreme Silicones