#Import Data of Indonesia

Explore tagged Tumblr posts

Text

Indonesia Import & Export Data Analysis: Trends for 2024-2025

Indonesia stands as one of Southeast Asia’s largest economies, and its import-export activities play a crucial role in shaping the nation’s economic landscape. For businesses, investors, and analysts looking to understand market trends, having access to Indonesia import data and Indonesia export and import statistics is essential for making informed decisions. The country’s import-export sector is driven by various factors, such as natural resources, manufactured goods, and trade agreements. In this article, we will explore the Indonesia import export data for the year 2024-2025, focusing on trends, key sectors, and future forecasts.

Understanding Indonesia's Import and Export Data

1. Indonesia Import Data for 2024-2025

Indonesia’s import sector continues to evolve as demand for raw materials, machinery, and consumer goods remains high. As the nation moves towards industrialization and urbanization, key imports include:

Machinery and Equipment: These are essential for the expansion of Indonesia’s manufacturing and industrial sectors. With a growing demand for infrastructure development, machinery imports, particularly for construction, electrical equipment, and automotive sectors, are expected to rise significantly in 2024-2025.

Chemical Products: Indonesia relies on chemicals for its manufacturing processes, including the production of pharmaceuticals, textiles, and food products. The demand for chemicals is anticipated to grow as various industries require advanced chemical solutions.

Petroleum Products: Despite Indonesia’s significant oil reserves, it still imports refined petroleum products to meet domestic consumption, especially as demand for energy continues to rise.

Consumer Goods: Indonesia’s middle class is expanding, and with this demographic growth, the demand for consumer goods such as electronics, vehicles, and food products is projected to continue increasing in the coming years.

2. Indonesia Export and Import Statistics for 2024-2025

Indonesia’s exports are primarily driven by natural resources, including palm oil, coal, petroleum, and rubber. According to Indonesia export and import statistics, several key commodities are expected to dominate in 2024-2025:

Mineral Fuels: Coal remains one of Indonesia’s top exports, with significant shipments to countries like China and India. Due to the global demand for energy, the coal export market is expected to remain strong throughout 2024-2025.

Palm Oil: As one of the world’s largest producers, Indonesia continues to lead in palm oil production. This product is primarily exported to countries like India, China, and the European Union. The growth in palm oil exports is expected to be stable in the coming years.

Electrical and Electronics: As technology advances, exports in electrical machinery and electronics are forecast to grow. Indonesia is increasingly exporting smartphones, computers, and related components, particularly to neighboring Asian markets.

Automobiles and Parts: Indonesia has become a significant exporter of vehicles and automobile parts, especially to ASEAN nations. As the automotive sector expands, the export of cars and auto components will likely show positive growth in 2024-2025.

3. Import Data of Indonesia: Key Trading Partners

The Import Data of Indonesia reveals that the country’s primary trading partners include China, Japan, the United States, and Singapore. These nations supply a wide range of goods to Indonesia, which are critical to maintaining its industrial growth and meeting domestic demand.

China: As Indonesia’s largest import partner, China supplies a significant portion of machinery, electronics, and chemicals. With ongoing infrastructure projects in Indonesia, Chinese products, particularly in construction and telecommunications, are expected to see continued import demand.

Japan: Japan exports high-quality machinery, vehicles, and chemicals to Indonesia. As Indonesia focuses on expanding its manufacturing capabilities, imports from Japan are expected to remain integral to its industrialization efforts.

United States: The U.S. exports agricultural products, industrial machinery, and high-tech equipment to Indonesia. The ongoing economic cooperation between the two nations will likely continue to drive trade in the upcoming years.

Singapore: As a key regional hub, Singapore is a significant source of refined petroleum products, chemicals, and electronic goods. Indonesia imports a wide variety of products from Singapore, supporting its growing sectors in energy, technology, and manufacturing.

4. Trends in Indonesia’s Import-Export Data for 2024-2025

Trade Balance and Currency Impact: In 2024-2025, Indonesia is likely to face challenges related to its trade balance. A higher import bill driven by industrial demand may outpace the growth in exports, potentially affecting the country's currency and trade balance. However, with the government’s focus on boosting export industries, this trend could shift over time.

Regional Trade Agreements: Indonesia's participation in various trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), is expected to open new export opportunities, particularly in agricultural and manufacturing sectors. This will also allow Indonesia to access more affordable imports, which could boost domestic industries.

Sustainability Focus: As global markets increasingly prioritize sustainability, Indonesia’s exports, especially in palm oil, coal, and other natural resources, may face greater scrutiny. The country will need to adapt by embracing sustainable practices in agriculture and manufacturing to remain competitive in the international market.

5. Indonesia's Import-Export Data Forecast for 2024-2025

Looking forward to the next few years, Indonesia’s import-export data indicates the country will continue to see growth in trade activities. Imports will be driven by industrialization, energy demands, and consumer goods. Meanwhile, exports will likely remain strong in natural resources, technology, and automotive sectors.

Conclusion

The Indonesia import export data for 2024-2025 paints a picture of a dynamic and evolving trade environment. With its robust import needs and competitive export markets, Indonesia is poised for continued economic growth. By focusing on infrastructure, industrial development, and regional trade partnerships, Indonesia can overcome challenges and capitalize on opportunities in both its import and export sectors. Tracking Indonesia import and export statistics will be crucial for understanding how the nation's trade landscape will unfold in the coming years, offering valuable insights for businesses and investors alike.

#Indonesia export data#Indonesia export statistics#Export Data of Indonesia#Indonesia trade data#Indonesia import data#Indonesia export and import statistics#Indonesia import export data#Import Data of Indonesia#global trade data#international trade#trade data

0 notes

Text

Australia's Imports from Indonesia: Key Insights & Essential Questions

1. What Are the Primary Products That Australia Imports from Indonesia?

Australia imports a variety of products from Indonesia, including refined petroleum, electronics, and manufactured goods. These imports are essential for various sectors within the Australian economy.

2. How Significant Are Indonesia's Exports to Australia in the Context of Australia's Total Imports?

Indonesia plays a crucial role as a trading partner, supplying a range of products that are integral to Australia's import portfolio. The exact significance can be understood by analyzing trade data and statistics.

3. Can You Provide Examples of Australia's Import Data by HS Code?

Certainly. Australia's import data by HS code offers detailed insights into specific products imported. For instance, the Department of Foreign Affairs and Trade provides pivot tables presenting total Australian imports using the Harmonized Tariff Item Stat-key Classification (HTISC) at various digit levels, offering a comprehensive view of import statistics.

4. Which Sectors Dominate Australia's Imports from Indonesia?

Key sectors dominating Australia's imports from Indonesia include energy commodities like refined petroleum, electronics such as video displays, and various manufactured goods. These sectors represent a significant portion of the trade volume between the two nations.

5. How Does the Australia-Indonesia Free Trade Agreement Impact Imports?

The Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA) aims to enhance trade by reducing tariffs and promoting economic cooperation. This agreement facilitates easier access to each other's markets, potentially increasing the volume and variety of imports from Indonesia to Australia.

6. What Is the Trend of Australia's Imports from Indonesia Over Recent Years?

Analyzing recent trade data reveals trends in import volumes and values, highlighting growth areas and potential sectors where imports have increased or decreased over time. This analysis helps in understanding the evolving trade relationship between the two countries.

7. How Are Imported Goods from Indonesia Classified Upon Entry into Australia?

Imported goods are classified using the Harmonized System (HS) codes, which standardize the identification of products. This classification aids in applying tariffs, monitoring trade statistics, and enforcing regulations.

8. What Are the Compliance Requirements for Importing Goods from Indonesia to Australia?

Importers must adhere to Australian regulations, including biosecurity measures, quality standards, and labeling requirements. Ensuring compliance is crucial to facilitate smooth customs clearance and avoid penalties.

9. Are There Any Tariffs or Duties Imposed on Imports from Indonesia?

Under IA-CEPA, many tariffs on Indonesian imports have been reduced or eliminated. However, specific duties may still apply depending on the product category and compliance with rules of origin.

10. How Can Businesses Leverage Australia's Import Data for Strategic Decisions?

Businesses can analyze import data to identify market trends, assess competition, and explore opportunities for sourcing products. Understanding import patterns aids in making informed decisions regarding supply chain management and market entry strategies.

Conclusion

The trade relationship between Australia and Indonesia is marked by a dynamic exchange of goods, with Indonesia playing a pivotal role as a key supplier for various products. Understanding the nuances of Australia's import data, including the classification by HS codes and the impact of trade agreements, is essential for stakeholders aiming to navigate and capitalize on this bilateral trade landscape.

#australia import from indonesia#australia import#australia import data#australia import data by hs code#australia import products#import from indonesia to australia#australia biggest import#australia import list#importing goods into australia

0 notes

Text

Discover valuable global trade data by country with Seair Exim Solutions. Gain insights into market trends, import-export volumes, and optimize your business decisions.

#US Import Data#US Importer Data#ukraine import export data#Indonesia import export data#Bangladesh export import data

0 notes

Text

https://www.tradeimex.in/blogs/find-buyers-suppliers-indonesia-customs-data

Get accurate Indonesia import data and Indonesia export data to track trade trends, find reliable suppliers in Indonesia, and make informed business decisions with real-time trade insights.

#tradeimex#indonesia import and exporter#buyers in Indonesia#Indonesia impoters#suppliers in Indonesia#indonesia export data#indonesia import data

0 notes

Text

Discover Indonesia's top exports, including palm oil, textiles, coffee, and natural gas. Learn about Indonesia's export performance in 2024 and explore the diverse commodities driving its economy. Access detailed export data with Seair Exim Solutions.

#Indonesia top exports#major exports of Indonesia#indonesia export products list#indonesia total exports#indonesia trade data#Indonesia export data#indonesia imports and exports#indonesia export

0 notes

Text

How to export rubber products from India to Indonesia

India leads global rubber industry, targeting Indonesia's market. Learn essential steps for successful rubber export ventures.

0 notes

Text

Indonesia Import Export, Trade and Customs Data - Eximpedia

List of Indonesia Importers: Database of Indonesia Trade and Import Data by product & HS Code. Access the Detailed Indonesia Customs Export Data by Country & Shipment information to help you make informed business decisions.

0 notes

Text

"The coral reefs of south Sulawesi are some of the most diverse, colorful and vibrant in the world. At least, they used to be, until they were decimated by dynamite fishing in the 1990s.

As part of a team of coral reef ecologists based in Indonesia and the UK, we study the reefs around Pulau Bontosua, a small Indonesian island in south Sulawesi...

In many places around the world, damage like this might be described as irreparable. But at Pulau Bontosua, the story is different. Here, efforts by the Mars coral restoration program have brought back the coral and important ecosystem functions, as outlined by our new study, published in Current Biology. We found that within just four years, restored reefs grow at the same rate as nearby healthy reefs.

Speedy recovery

The transplanted corals grow remarkably quickly. Within a year, fragments have developed into proper colonies. After two years, they interlock branches with their neighbors. After just four years, they completely overgrow the reef star structures and restoration sites are barely distinguishable from nearby healthy reefs.

The combined growth of many corals generates a complex limestone (calcium carbonate) framework. This provides a habitat for marine life and protects nearby shorelines from storm damage by absorbing up to 97% of coastal wave energy.

We measured the overall growth of the reef framework by calculating its carbonate budget. That's the balance between limestone production (by calcifying corals and coralline algae) and erosion (by grazing sea urchins and fishes, for example). A healthy reef produces up to 20kg of reef structure per square meter per year, while a degraded reef is shrinking rather than growing as erosion exceeds limestone production. Therefore, overall reef growth gives an indication of reef health.

At Pulau Bontosua, our survey data shows that in the years following restoration, coral cover, coral colony sizes, and carbonate production rates tripled. Within four years, restored reefs were growing at the same speed as healthy reefs, and thereby provided the same important ecosystem functions...

Outcomes of any reef restoration project will depend on environmental conditions, natural coral larvae supply, restoration techniques and the effort invested in maintaining the project. This Indonesian project shows that when conditions are right and efforts are well placed, success is possible. Hopefully, this inspires further global efforts to restore functioning coral reefs and to recreate a climate in which they can thrive."

-via Phys.org, March 11, 2024

#coral#coral reef#marine life#marine biology#sea creatures#aquatic#environment#ecology#environmental news#environmental science#climate action#climate hope#ecosystem#conservation#endangered species#indonesia#sulawesi#good news#hope#overfishing#hopepunk#hope posting

6K notes

·

View notes

Text

Math, grade 7, Ratios and Proportional Relationships 7.RP.A.3: Use proportional relationships to solve multistep ratio and percent problems. Examples: simple interest, tax, markups and markdowns, gratuities and commissions, fees, percent increase and decrease, percent error.

Essential Question: How can basic calculations of percent change influence major world events?

Do Now: Calculate the percent increase or decrease in each of the following equations. x = (28 - 17.9)/28 x = (41.5 - 57.7)/57.7

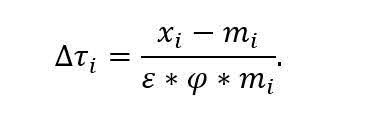

Class Discussion: Remind students about how to perform basic calculations of increase/decrease factors. Ask them whether this calculation would be more complicated if the quantities were dollars instead of just numbers (answer: no). Ask them whether this calculation would be more complicated if the quantities were billions of dollars instead of just dollars (answer: no). Show students that they just performed the exact same calculations that Donald Trump did in order to decide what tariffs should be put upon Indonesia and Thailand, respectively.

Finally, ask students whether important global trade decisions should be calculated with 7th grade math skills, or if perhaps this is insufficient given the severe consequences that could arise from such a dunning-kruger error.

Direct Instruction: Explain what a Dunning-Kruger error is, if for no other reason than to communicate how absolutely maddening has it is for legitimate experts who have dedicated their lives to nudging fiscal policy in the right direction and then watch as their president makes the worst decision possible on purpose.

Take a moment to explain the difference between an import and an export, so that students understand what these billions of dollars actually mean in the real world. Feel free to call out anyone who has ever questioned whether or not they would ever use this kind of math in the real world. Show them that it's happening right now, and make sure they understand how terrifying that is.

Acknowledge the variables: x: total exports from US to country i m: total imports to US from country i tau (τ): calculated % tariff on all imports to US from country i epsilon (ε): elasticity phi (φ): passthrough

Ask students what they think elasticity and passthrough mean, then show students this passage from ustr.gov:

Parameter Selection To calculate reciprocal tariffs, import and export data from the U.S. Census Bureau for 2024. Parameter values for ε and φ were selected. The price elasticity of import demand, ε, was set at 4. Recent evidence suggests the elasticity is near 2 in the long run (Boehm et al., 2023), but estimates of the elasticity vary. To be conservative, studies that find higher elasticities near 3-4 (e.g., Broda and Weinstein 2006; Simonovska and Waugh 2014; Soderbery 2018) were drawn on. The elasticity of import prices with respect to tariffs, φ, is 0.25. The recent experience with U.S. tariffs on China has demonstrated that tariff passthrough to retail prices was low (Cavallo et al, 2021).

Ask students if this clarified anything about what elasticity and passthrough mean. Most will say "no", but if anyone points out that multiplying 4 by 0.25 cancels them both out, reward them. That student is correct, because elasticity and passthrough have been arbitrarily assigned so as to make this calculation so simple that even Donald Trump can understand it.

Modeled Learning: Show how to apply these tariffs to popular imports such as raw coffee beans. For example, the USDA report of coffee imports from 2024 (page 6) shows that the vast majority of raw coffee is imported from Brazil.

A simple search with Perplexity.ai tells us that in 2024, imports (m) = $42.3 billion and exports (x) = $49.7 billion, so the reciprocal tariff would be (x-m)/m = (49.7-42.3)/42.3 = 17.5%.

Thus, all coffee imports from Brazil will automatically be 17.5% more expensive.

Be sure to highlight that this is happening to every country in the world, even those with total populations less than 1000.

Higher Order Learning:

Students should consider the following facts:

There is very little territory within the United States that can grow coffee.

Almost all coffee in the world is grown within what is called "The Global South", where the climate is warm and the labor is cheap.

The US exports significantly more (sometimes vastly more) to countries in the Global South than we import from them.

Students should then answer the following questions:

What will this universal tariff calculation do to the price of coffee?

Is there any way that US coffee companies can import the same amount of coffee as before without passing on the cost to consumers? Why or why not?

Do you think this tariff program will equalize imports and exports between the US and other countries? What other impacts could it have, good or bad, across the world?

#lesson plan#math#grade 7#trump tariffs#teachblr#I really should be devoting my time to other‚ more important things‚ but... I just had to do this today.#It's so obviously stupid#dunning kruger#Not even queueing this‚ just post.

57 notes

·

View notes

Text

A Banggai cardinalfish swims in Indonesia’s tropical waters. Photo: Jens Petersen (CC BY-SA 3.0)

Excerpt from this story from The Revelator:

Nothing fascinates Monica Biondo more than the animals often referred to as the ocean’s “living jewels” — the vividly colored little fishes who dance around in its waters.

Biondo, a Swiss marine biologist, became enamored with ocean life as a child after spending many summers snorkeling along the Italian coastline. Nowadays you’re more likely to find her deep-diving into trade records than marine waters. As the head of research and conservation at Fondation Franz Weber, she has spent the past decade searching through data on the marine ornamental fish trade.

These are the colorful fish you see in home aquariums or for sale at pet stores; Biondo wants to know where they came from, how they got there, and what happened to them along the way.

Compared to the clear waters around the coral reefs she’s explored, the records on these fish are frustratingly murky. Wading through them has though provided her with clarity on her calling: shining a light on the aquarium trade’s vast exploitation of these glamorous ocean dwellers.

Her entry into the fray came in the form of a Banggai cardinalfish, a striking little fish endemic to an archipelago in Indonesia that first became known to science in the 1930s. A scientist redescribed the species in 1994, kickstarting a tragic surge in the fish’s popularity for aquariums. Within less than a decade, 90% of the population had disappeared, Biondo says.

After witnessing that rapid decline, along with the failure of countries to subsequently regulate global trade in the species, Biondo was hooked. “That really pushed me into looking into this trade,” she says.

In her search for information she has pored over paperwork in the Swiss Federal Food Safety and Veterinary Office’s records warehouse. She and her colleagues at Pro Coral Fish have also spent years rifling through a European Union-wide electronic database called the Trade Control and Expert System (TRACES), which collects information on animal imports.

Although the datasets varied, the questions have remained the same. How many marine ornamental fish are being imported? What species are they? Where did they originate?

These straightforward questions are hard to answer to because the trade — despite being worth billions annually — has no mandatory data-collection requirements. As a result, information gathered about trade in these fishes tends to be opaque and haphazard compared to information on live organisms like farmed food animals.

53 notes

·

View notes

Text

Understanding Suppliers and Buyers in Indonesia: Insights from Trade Data

Indonesia's dynamic economy is deeply intertwined with global markets, making it essential to understand the roles of suppliers and buyers within the country. By analyzing Indonesia's import and export data, businesses can identify opportunities and navigate the complexities of international trade. This article addresses key questions to shed light on Indonesia's trade landscape.

Who Are the Key Suppliers in Indonesia?

Indonesia boasts a diverse range of suppliers across various sectors. Key industries include:

Agriculture: As a leading producer of palm oil, rubber, and cocoa, Indonesia's agricultural sector supplies these commodities globally.

Manufacturing: The country has a robust manufacturing base, producing textiles, footwear, and electronics for international markets.

Mining: Indonesia is rich in natural resources, supplying coal, tin, and nickel to various countries.

How Can One Identify Reliable Suppliers in Indonesia?

To find trustworthy suppliers in Indonesia:

Utilize Trade Directories: Platforms like Indonesia Trade Data provide comprehensive lists of suppliers, including shipment records and product details.

Attend Trade Fairs: Participating in events such as the Trade Expo Indonesia offers direct engagement with potential suppliers.

Consult Industry Associations: Organizations like the Indonesian Chamber of Commerce and Industry (KADIN) can provide verified supplier information.

Who Are the Prominent Buyers in Indonesia?

Indonesia's growing consumer base and industrial sector make it a significant market for various products. Prominent buyers include:

Manufacturing Companies: Importing machinery, raw materials, and components to support production.

Retail Chains: Sourcing consumer goods, electronics, and apparel for domestic distribution.

Government Agencies: Procuring infrastructure development materials and defense equipment.

How Can Businesses Connect with Buyers in Indonesia?

To engage with buyers in Indonesia:

Leverage Import Data: Analyzing import records can reveal active buyers and their purchasing patterns.

Network Through Chambers: Joining organizations like KADIN facilitates connections with potential buyers.

Participate in Trade Missions: Collaborating with trade promotion agencies can open doors to Indonesian markets.

What Does Indonesia's Import Data Reveal About Its Market?

Indonesia's import data offers insights into market demand and economic trends:

Major Imports: In 2023, mineral fuels and mineral oils were among the top imports, highlighting the country's energy needs.

Leading Suppliers: China, Singapore, and Japan are significant exporters to Indonesia, reflecting strong trade relationships.

Import Growth: The country's imports totaled USD 170.7 billion in 2019, ranking 30th globally.

How Does Indonesia's Export Data Reflect Its Economic Strengths?

Export data showcases Indonesia's competitive sectors:

Total Exports: In 2024, exports reached US$24.41 billion in October, marking a 10.69% increase from the previous month.

Top Export Goods: Products like motor vehicles and parts, rubber, and chemical products are among the top exports.

Trade Surplus: A positive trade balance of $54.53 billion underscores the country's export capabilities.

What Are the Trends in Indonesia's Import and Export Statistics?

Recent trends indicate:

Export Growth: Exports in May 2024 reached US$22.33 billion, a 13.82% increase compared to April 2024.

Import Patterns: Imports in May 2024 amounted to US$19.40 billion, up 14.82% compared to April 2024.

Commodity Focus: Oil and mineral fuels remain top export goods, reflecting Indonesia's resource-rich economy.

How Does Indonesia's Trade Data Compare Globally?

Indonesia's trade data in a global context shows:

Export Ranking: The country ranks 32nd globally in exports, with a total of USD 167.4 billion in 2019.

Import Ranking: With imports totaling USD 170.7 billion in 2019, Indonesia holds the 30th position globally.

Trade Growth: The trade growth rate stands at 13.50%, surpassing the world average of 5.34%.

What Are the Implications of Indonesia's Trade Data for Businesses?

Understanding Indonesia's trade data helps businesses:

Identify Opportunities: Recognize sectors with high demand or supply potential.

Assess Risks: Monitor economic indicators to anticipate market fluctuations.

Strategize Market Entry: Align products and services with current trade trends.

How Can One Access Detailed Indonesia Import and Export Data?

To access comprehensive trade data:

Government Portals: Indonesia's official statistics agency publishes regular trade reports.

International Databases: Platforms like the World Bank's World Integrated Trade Solution (WITS) offer detailed statistics.

#suppliers in indonesia#Buyers in indonesia#indonesia import data#indonesia trade data#indonesia export data#indonesia import export data#indonesia export and import statistics#indonesia import and export data

0 notes

Text

Seair Exim Solutions provides reliable Indonesia import data to help you analyze trade trends and opportunities. Access detailed shipment records, import statistics, and market insights to enhance your business decisions. Empower your trade strategy with accurate and up-to-date data.

#Import Data Indonesia#indonesia import data#indonesia trade data#indonesia import and export data#Indonesia Shipment data#indonesia import export data#indonesia export and import statistics

0 notes

Text

Soybean Export from India: Trends, Data, & Market Outlook for 2025

India's agricultural exports continue to gain momentum, with soybean standing as a key contributor. Known for its high nutritional value and diverse industrial applications, soybeans play a pivotal role in the global agri-commodity market. As the world’s demand for plant-based proteins and sustainable oils increases, India's position as a significant player in soybean exports strengthens. This article delves into the current trends in soybean export from India, examines soybean export data, highlights key soybean exporters in India, and explores major soybean-exporting countries for 2024-2025.

The Landscape of Soybean Export from India

India has emerged as a prominent exporter of soybeans, contributing significantly to global trade. Factors such as robust agricultural policies, advancements in farming techniques, and a focus on export-oriented production have bolstered India's soybean export capabilities.

In the 2024-2025 period, soybean exports from India are expected to grow due to increasing international demand. Indian soybeans are sought after for their quality, competitive pricing, and adherence to international standards. The primary export destinations for Indian soybeans include Southeast Asia, the Middle East, and European countries.

Soybean Export Data for 2024-2025

Tracking soybean export data reveals significant insights into India’s performance in the global market.

Volume and Value of Exports: India exported approximately 2.5 million metric tons of soybeans in the fiscal year 2023-2024, generating over $1.2 billion in revenue. The 2024-2025 projections suggest a 10-12% growth, driven by increasing demand from new and existing markets.

Major Importers of Indian Soybeans:

Indonesia and Vietnam: These countries use Indian soybeans primarily for feed and food processing industries.

United Arab Emirates (UAE): A significant importer due to its booming food industry and demand for plant-based products.

European Union (EU): Particularly Germany and the Netherlands, where soybeans are used for biofuels and plant-based protein products.

Export Growth Drivers:

India’s strategic position in Asia ensures shorter shipping times to key markets.

Increased global preference for non-GMO soybeans, a segment where India has an advantage.

Key Soybean Exporters in India

India’s soybean export industry is supported by numerous stakeholders, including farmers, processing companies, and export houses top soybean exporters in India are.

SOPA (Soybean Processors Association of India): SOPA plays a vital role in promoting soybean exports from India. It ensures the quality and branding of Indian soybeans, making them competitive in global markets.

Major Exporting Companies:

ITC Limited: Known for its robust supply chain and adherence to quality standards.

Adani Wilmar: A significant player in agri-exports, including soybeans and soy-derived products.

Ruchi Soya Industries: One of India's largest exporters, supplying non-GMO soybeans globally.

Emerging Players: Smaller exporters and agri-tech startups have also entered the market, leveraging technology to enhance productivity and streamline exports.

India’s Position Among Soybean Exporting Countries

Globally, India ranks among the top 10 soybean exporting countries. However, countries like Brazil, the United States, and Argentina dominate the export landscape.

Global Competitors:

Brazil: The world’s largest soybean exporter, primarily supplying China.

United States: A major exporter with advanced farming technology and extensive trade networks.

Argentina: Known for its high-quality soymeal exports.

India’s Competitive Edge:

Organic and non-GMO soybeans.

Competitive pricing compared to Western exporters.

Proximity to Asian and Middle Eastern markets.

Challenges in Competing Globally: While India has advantages, challenges such as inconsistent yield, fluctuating prices, and logistical issues need addressing to solidify its global standing.

Emerging Trends and Opportunities in Soybean Export

The soybean industry is undergoing transformation due to changing consumer preferences and technological advancements. Key trends for 2024-2025 include:

Shift to Plant-Based Diets: The rise of veganism and plant-based diets globally is driving demand for soy products, including tofu, soy milk, and soy protein isolates.

Sustainability and Traceability: Exporters focusing on sustainable farming and traceability in supply chains will have a competitive edge in international markets.

Government Support: Initiatives such as export incentives, enhanced logistics, and trade agreements are expected to boost soybean exports.

Value-Added Soy Products: Diversifying into soy-derived products like soymeal, soy oil, and soy protein can open new revenue streams for Indian exporters.

Challenges Facing Soybean Export from India

Despite its growth potential, the industry faces several hurdles:

Climate Change: Unpredictable weather patterns can impact crop yields.

Infrastructure Bottlenecks: Limited storage and transportation facilities hinder efficient exports.

Price Volatility: Global soybean prices are influenced by geopolitical and economic factors, impacting Indian exports.

Addressing these challenges through policy reforms and industry collaboration will be critical for sustained growth.

Future Outlook for Soybean Export from India

The future of soybean exports from India looks promising. With the global demand for soybeans expected to rise by 15-20% in the next decade, India has the opportunity to enhance its market share. Key strategies for growth include:

Investing in sustainable farming practices.

Strengthening trade relations with emerging markets like Africa and Latin America.

Promoting value-added soy products through branding and innovation.

Conclusion

Soybean export from India are poised for remarkable growth in the 2024-2025 period. By leveraging its strengths in quality production and strategic geographic positioning, India can expand its footprint in the global soybean market. However, addressing challenges like climate change, infrastructure, and price volatility will be essential for realizing its full potential. With the concerted efforts of farmers, exporters, and policymakers, India is set to cement its position as a leading player in the global soybean trade.

#soybean export from India#soybean export data#soybean exporters in India#soybean exporting countries#trade data#global trade data#international trade

2 notes

·

View notes

Text

Chapter 211 Trivia

Try not to choke, dear Ryusui…

Going by the map and the several smaller islands, the KoS seems to have landed in South Kalimantan on the island of Borneo. The mountains in the background could be the Meratus mountains.

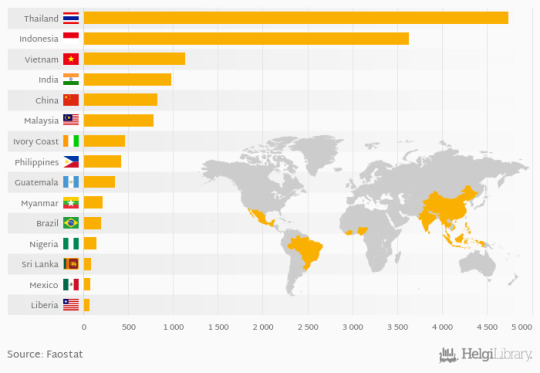

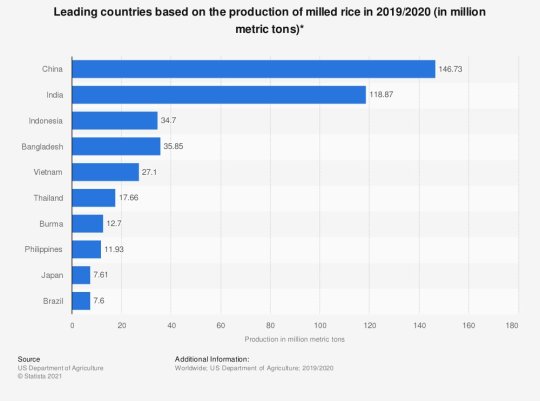

Indonesia is the world's second largest producer of rubber. The largest is Thailand which, geographically, isn't that far away, but it produces much less rice. This is probably why Indonesia was chosen for Rubber City instead.

It's been 10 years since the KoS began the world tour: -September 5741, Perseus completed -January 5742, ground zero ~February, petrified for 7.5 years -October 5750, arrive in India -April 5751, arrive in Indonesia -120 days for rice to grow, so it's around July/August.

It's a shame we didn't see traditional Australian dishes such as Vegemite, fairy bread, kangaroo meat…

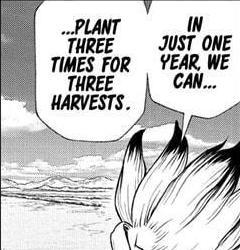

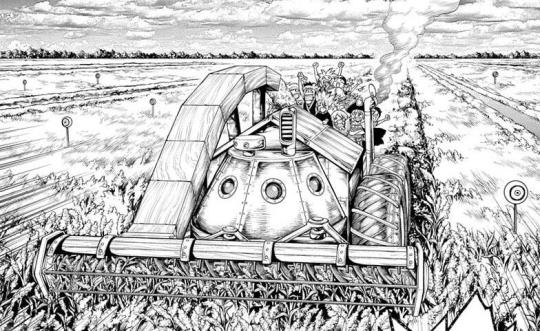

Rice grows from seed to harvest in ~120 days, so Indonesia can have 3 growing seasons. The most important one is the wet season from October to December, which is harvested in March & April. This is ~45% of total rice production for the year, which is the one the KoS harvested.

Character development.

(Gen finally tied up his cloak to stop it getting wet.)

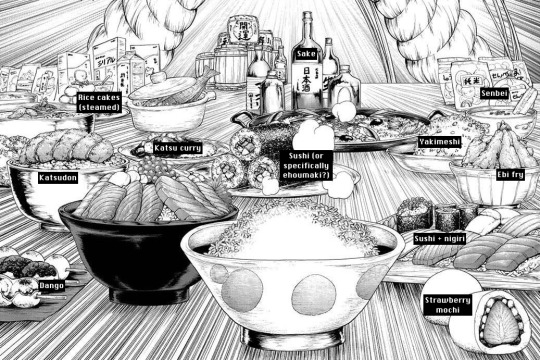

There's a lot of rice-based food in this image, so here's a few I've identified in case you need ideas for dinner.

Chrome and Suika are surveying the land, presumably plotting (rice) paddies. Chrome is using a theodolite, which is used to measure angles on the horizon. Suika is probably measuring distance with the rope as extra data for their calculations.

Sai's lesson seems to be proving Heron's formula using Pythagoras' theorem.

We can also see that Chrome's handwriting has improved since the last time he had to calculate the properties of triangles!

The device Kaseki built is an Archimedes' screw, which can be used to lift liquids or sand-like mediums upwards onto higher levels. In this case, it's being used to fill the rice paddies.

The mobile lab is truly one of the most valuable and hardworking members of the Kingdom of Science.

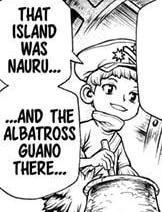

Nauru is one of the three great phosphorite islands in the Pacific Ocean, though thanks to too much mining in the last hundred years, the resource is almost completely depleted.

The prevalence of phosphorite is due to the albatross droppings, as Ukyo said.

When Yo said they took a pit stop, this is likely the route they took.

Fertilizer has 3 primary nutrients that help most plants to grow: -Nitrogen, from the nitric acid -Phosphorus, from the phosphorite -Potassium, from the wood ash (this also has calcium carbonate, which, as we all know, has at least 4 uses.)

Rice has many different variants such as Japonica ("from Japan") and Indica ("from India"). Indica rice tends to be thinner and longer, and includes basmati and jasmine.

Amylopectin is a component of starch, and is what allows rice to stick to itself (necessary to make onigiri).

13 notes

·

View notes

Text

my personal Rhythm Heaven headcanons

•at the moment i started typing this i had no electricity (12/4/2023 15:29) but ok lol

-DJ Yellow is very good at practically all subjects at school, except for math. he sleeps most of the year, so he has to intensify his grades in 2 weeks before the school year ends, and math is a pain. so while he studies, he asks Blue for help with "Whatever an ecuation is..." (still learning stuff from high school because he never intensified his math grades that much)

-J.J and Cecil live together in an apartment in Tokyo, while DJ Yellow and Blue live together in another apartment somewhere 40 minutes away from Tokyo. this makes both DJs wake up earlier to catch the train to get to school, which is a hard task for Yellow. this man either goes to sleep at 6am or doesn't sleeps at all. how do you want him to be at the train station at 6:10am to catch the train, travel for 40 minutes, get to Tokyo at 6:50am and walk to school to get there at 7:15am? think again mister, that's not a possible action on this dude. better wait until the update comes. /lh

-DJ Yellow dresses up with whatever he wants. this includes skirts, dresses, all kinds of feminine clothes. because why not? it's his gender expression, let him be, brother. don't be surprised if he shows up at a convention dressed up as Rui Kamishiro and in day 2 he is cosplaying Hatsune Miku NT. while he's happy then it's okay, isn't it?

-important headcanon: the school everyone in Rhythm Heaven +my RH ocs go to is an all-in-one school. from primary school to college, university, everything. so yeah, they're technically adults, young adults, that even if they have a job they go to school to learn basics such as math, history, etc, BUT with rhythm. there's an interesting story about this school that is located in, SURPRISE, Tokyo (not really. all fictional), but today is not the day or time to talk about it (my 4g data is limited and so is my battery- plz electricity come back quick)

-DJ Yellow's favourite music artists, groups and bands are: More!More!Jump!, Wonderlands x Showtime, Steampianist, Hello, Happy World!; RAISE A SUILEN, Raychell, Skrillex, Mitchie M, Pastel*Palettes, Nightcord at 25:00, MARETU, DECO*27, Eve, Vivid BAD Squad, Alan Walker, all of the D4DJ groups but specially Happy Around!, all of the Heathers Musical songs, Kawaii Sprite, GHOST And Pals, Banshee, RudyWade, Goreshit and, most importantly, an 80% of remixes of the Monster song (you look up Monster remix and you tell me when you know what i'm talking about)

-Blue's favourites: Cuarteto de Nos, GHOST And Pals, Daisuke-P, Omoi, Kikuo, Jakeneutron, KairikiBear, Roselia, Steampianist, Nayutailen, TOPHAMHAT-KYO, Lemon Demon, FAKE TYPE., girl in red and The Living Tombstone

-J.J and Cecil have similar taste in music, such as last note., wowaka, Wind Rose, Lemon Demon, Afterglow, Roselia, Leo/Need, The GazettE, GOLDEN BOMBER, HACHI... but Cecil is a bit different on his playlists, since he has Bluey music added such as Keepy Uppy and Lollipop Yum Yum Yum, and maybe some Imagination Movers music

-everyone speaks japanese and english, buuuuuut: Yellow speaks spanish (Spanish, Mexican, Colombian, neutral, Chilenian and Argentine accent), he's learning French and is interested in Hawaiian. Blue speaks Indonesian more fluently than Japanese or English, since he was born and raised his first 7 years of life in Indonesia. J.J speaks Italian, which is his 'original' language (?). and Cecil knows a bit of French and Hawaiian. super convenient for Yellow, but he's not talking with "one of those guys". yeaaaah the Rockers vs DJs conflict has been going on for a while now

thats all i can share as for now. i really wish my electricity comes back soon, i cannot live with 4g and less than 80% of battery for a week. remember all of these are headcanons and theres NO NEED to attack or negatively criticize them if you don't like em. tenkius :P

#rhythm tengoku#rhythm heaven#rizumu tengoku#リズム天国#watashime slug#rockers#rhythm heaven ds#dj school#dj yellow#dj blue#dj student#headcanon#headcanons#my headcanons#hc#wxs#l/n#25 ji nightcord de#niigo#nightcord at 25:00#raise a suilen#hello happy world#hhw#ras#mmj#please i need my electricity back#la concha de la lora#lcdtm edesur#edesur

14 notes

·

View notes