#ITZ2024PIX

Explore tagged Tumblr posts

Text

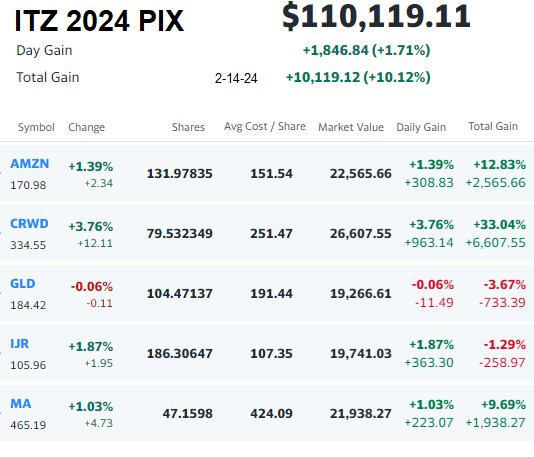

ITZ 2024 PIX Recap

WOW! what a year.... +27.76% BUY & HOLD Return... Amazing. The portfolio peaked December 16th at +35.17% but as with the market pulled back into year end. ITZ 2024 PIX finished the year +27.76%... beating the $SPX +23.31% return while just below the $COMPQ +28.64%. The IJR Small Cap etf didn't perform as expected, since lower interest rates are in question. Amazon was the best as did CrowdStrike, GLD & MA in line with the market.

0 notes

Text

ITZ 2024 PIX

YTD +32.55% Just edging out the Nasdaq

0 notes

Text

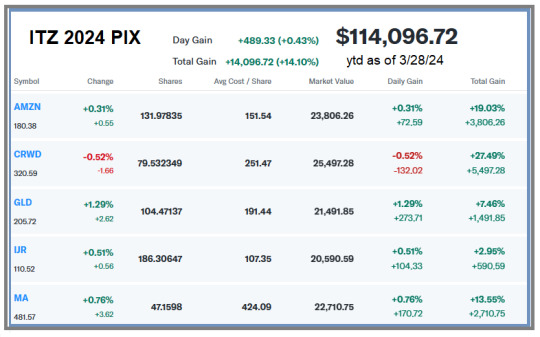

Frist Quarter return on Buy&Hold portfolio for 2024 +14.1%

0 notes

Text

ITZ 2024 PIX

Amazon (NASDAQ: AMZN) was the top pick in ITZ 2023 PIX with a 77.8% return. It will be in the 2024 ITZ PIX portfolio. The perennial concern about Amazon is its valuation. After the huge gains in 2023, the stock trades at nearly 40 times expected earnings. That's a higher level than any of the other FAANG stocks. However, there are a few key things to keep in mind.

First, Amazon's market dominance warrants a premium valuation, to some extent. The company has built impressive moats that make it one of the strongest businesses around.

Second, Amazon has historically channeled so much of its money into initiatives that fuel future growth. This makes earnings-based valuation metrics less applicable to the stock.

Third (and most importantly), Amazon's growth prospects are significant. For example, CEO Andy Jassy predicts that global IT spending in the cloud will soar by nine times or more over the next 10 to 15 years.

AWS should be a big beneficiary of this trend if he's right. A forward price-to-earnings ratio that only looks at where earnings might be one year in the future won't fully reflect this growth potential.

I think that Amazon's current valuation is quite reasonable, all things considered. Accordingly, I view the stock as a great pick for 2024 with a 26% upside. AMZN Yearend Price Target $190

CrowdStrike Holdings (NASDAQ:CRWD) CRWD is a global leader in next-generation endpoint protection, threat intelligence and cyberattack response services. The company is benefiting from the rising demand for cyber-security solutions due to the slew of data breaches and the increasing necessity for security and networking products amid the growing hybrid working trend. The continued digital transformation and cloud migration strategies adopted by organizations are key growth drivers.

In the latest reported financial results for the third quarter of fiscal 2024, the company’s revenues and non-GAAP earnings surged 35% and 105%, respectively, on a year-over-year basis. For fiscal 2024, CrowdStrike expects revenues between $3,046.8 million and $3,050.2 million. The Zacks Consensus Estimate for the same is pegged at $3.1billion, indicating growth of 36% year over year. CRWD Yearend Price Target $350

SPDR Gold Trust (GLD) There is almost no chance of a Fed rate hike this year. There is 84.8% chance of rates being the same in January and about 41.8% chance of rates remaining the same in March 2024, per CME FedWatch Tool. A decline in inflation has boosted the probability of a less-hawkish Fed. This would likely weaken the U.S. dollar and favor gold prices. Talks are rife that The Fed may even cut rates in latter part of 2024. ITZ has a 23% upside for 2024.

GLD Yearend Price Target $235

iShares Core S&P Small-Cap ETF (IJR). IJR is better than IWM because it tracks the performance of the S&P SmallCap 600 Index, a better group of smaller companies than the Russell 2000. Small-caps are still cheap from a valuation perspective. They have priced in a recession that has yet to materialize. ITZ sees 20%+ upside for 2024

IJR Yearend Price Target $130

Mastercard (NYSE:MA). 13.4% expected return. Analysts expect the payments firm to grow revenues by 12.1% and earnings per share by 17% in 2024 as lucrative cross-border transactions return. Credit losses are also expected to remain low — a winning combination for a credit card company

MA Yearend Price Target $480

0 notes