#ISO 26262 development

Explore tagged Tumblr posts

Text

Technoscripts: The Best Embedded Systems Training Institute in Pune

When it comes to mastering embedded systems, Technoscripts stands out as the Best embedded institute in Pune, a city renowned for its technological and educational advancements. Established in 2005, Technoscripts has earned a stellar reputation for delivering industry-focused, hands-on training in embedded systems, automotive electronics, and IoT. With a proven track record of transforming students into job-ready professionals, Technoscripts is the go-to choice for aspiring engineers. Here’s why Technoscripts is widely regarded as the best embedded systems training institute in Pune.

Comprehensive and Industry-Aligned Curriculum

Technoscripts offers a well-structured curriculum designed to meet the demands of the rapidly evolving embedded systems industry. Their flagship programs, such as the Embedded Course in Pune with Placements and the Automotive Embedded Course, cover essential topics like:

Microcontroller Programming: In-depth training on 8051, AVR, PIC, ARM, and STM32 microcontrollers.

Embedded C and C++: Core programming skills for developing efficient, real-time applications.

Real-Time Operating Systems (RTOS): Practical exposure to FreeRTOS and other RTOS frameworks.

Automotive Standards: Training on ISO 26262, MISRA, and CAN protocol for automotive applications.

IoT and Embedded Linux: Cutting-edge skills in IoT device development and Linux-based embedded systems.

The curriculum is regularly updated to align with industry trends, ensuring students are equipped with the latest tools and technologies used in companies like Bosch, NXP, and Texas Instruments.

Hands-On Learning with Live Projects

At Technoscripts, the focus is on practical, hands-on learning. Students work on live projects that simulate real-world challenges, such as designing embedded systems for automotive applications or IoT devices. The institute’s state-of-the-art labs are equipped with industry-standard tools like Keil, MPLAB, and hardware kits, allowing students to gain practical experience in:

Hardware interfacing and debugging

PCB design and prototyping

Sensor integration and communication protocols (I2C, SPI, UART)

This practical approach bridges the gap between theoretical knowledge and industry requirements, making graduates highly employable.

Expert Faculty with Industry Experience

Technoscripts boasts a team of experienced trainers with over a decade of industry expertise. These professionals bring real-world insights into the classroom, sharing practical knowledge and best practices. Their mentorship ensures that students not only understand concepts but also learn how to apply them in professional settings. Regular doubt-clearing sessions and personalized guidance further enhance the learning experience.

Unparalleled Placement Support

One of Technoscripts’ standout features is its 100% placement support. The institute has strong tie-ups with leading companies in the embedded systems and automotive sectors, including:

Tata Elxsi

KPIT Technologies

L&T Technology Services

Robert Bosch

The dedicated placement cell offers comprehensive support, including:

Resume Building: Guidance on crafting professional resumes tailored to industry standards.

Mock Interviews: Simulated interview sessions to boost confidence and communication skills.

Job Referrals: Direct connections to top recruiters through campus placements and job fairs.

Technoscripts’ placement record speaks for itself, with thousands of students securing roles as embedded systems engineers, firmware developers, and IoT specialists in top-tier companies.

Certifications and Recognition

Technoscripts is a NASSCOM-certified institute, adding credibility to its training programs. Upon course completion, students receive industry-recognized certificates that enhance their employability. The institute also offers NSDC-affiliated certifications, further validating the quality of training and aligning with national skill development standards.

Flexible Learning Options

Understanding the needs of students and working professionals, Technoscripts provides flexible learning modes, including:

Classroom Training: Interactive, in-person sessions at their Pune facility.

Online Training: Live, instructor-led virtual classes for remote learners.

Weekend Batches: Tailored for professionals balancing work and learning.

This flexibility ensures that anyone, from fresh graduates to experienced engineers, can upskill at their convenience.

Student-Centric Approach

Technoscripts prioritizes student success through a holistic approach. Beyond technical training, the institute offers:

Soft Skills Training: Sessions on communication, teamwork, and leadership to prepare students for corporate environments.

Career Counseling: Guidance on career paths and specialization choices in embedded systems.

Lifetime Support: Access to resources, alumni networks, and job assistance even after course completion.

Why Choose Technoscripts?

Technoscripts’ combination of a cutting-edge curriculum, hands-on training, expert faculty, and exceptional placement support sets it apart as the best embedded systems training institute in Pune. Whether you’re a fresh engineering graduate or a professional looking to upskill, Technoscripts equips you with the knowledge, skills, and opportunities to thrive in the competitive embedded systems industry.

Conclusion

For anyone aspiring to build a successful career in embedded systems, Technoscripts is the ultimate destination. With its industry-aligned training, practical approach, and unmatched placement support, the institute empowers students to turn their passion for technology into rewarding careers. Enroll at Technoscripts today, attend a demo class, and take the first step toward becoming an embedded systems expert!

0 notes

Text

Model-Based Design Using MATLAB and Simulink Overview

Model-Based Design (MBD) using MATLAB and Simulink is a transformative engineering methodology that leverages graphical modeling, simulation, and code generation to design and validate complex systems. Widely adopted in industries like automotive, aerospace, and robotics, MBD streamlines development by replacing physical prototyping with virtual models. MATLAB provides powerful computational tools, while Simulink offers a block-diagram environment for dynamic system simulation. This 800-word overview explores the principles, applications, benefits, challenges, and future trends of MBD using MATLAB and Simulink.

Principles of Model-Based Design with MATLAB and Simulink

MBD with MATLAB and Simulink follows a structured workflow to design and validate systems:

System Modeling: Simulink’s graphical interface allows engineers to create block-diagram models representing system dynamics, such as mechanical, electrical, or control systems. MATLAB scripts enhance model customization and parameter tuning.

Simulation and Analysis: Simulink simulates models under various conditions, analyzing responses like stability, performance, or energy efficiency. MATLAB’s computational capabilities support data analysis and visualization, refining model accuracy.

Automatic Code Generation: Tools like Simulink Coder and Embedded Coder generate C, C++, or HDL code directly from models, ensuring consistency between design and implementation on embedded hardware.

Verification and Validation: MBD supports automated testing, including Software-in-the-Loop (SIL) and Hardware-in-the-Loop (HIL), to verify system behavior against requirements, ensuring compliance with standards like ISO 26262.

Hardware Integration: Simulink interfaces with hardware platforms like microcontrollers or FPGAs, enabling real-time testing and deployment of control algorithms.

Iterative Refinement: MBD’s iterative approach uses simulation results to refine models, optimizing designs before physical implementation, reducing errors and development time.

Applications of MBD with MATLAB and Simulink

MBD using MATLAB and Simulink is applied across diverse industries:

Automotive: MBD designs engine control units (ECUs), advanced driver-assistance systems (ADAS), and electric vehicle powertrains. Simulink simulates vehicle dynamics, while MATLAB optimizes control algorithms for fuel efficiency and safety.

Aerospace: It develops flight control systems, avionics, and satellite controllers. Simulink models aerodynamic behavior, and MATLAB ensures compliance with safety standards like DO-178C through rigorous testing.

Robotics: MBD creates control algorithms for robotic arms, drones, and autonomous vehicles. Simulink’s Robotics System Toolbox supports motion planning and sensor integration.

Industrial Automation: MATLAB and Simulink design programmable logic controllers (PLCs) and robotic systems, optimizing manufacturing processes and enabling predictive maintenance in smart factories.

Renewable Energy: MBD models wind turbines, solar inverters, and battery management systems, using Simulink to simulate energy flows and MATLAB to optimize grid integration.

Medical Devices: MBD validates control systems for devices like insulin pumps or ventilators, ensuring precision and safety through simulation and HIL testing.

Benefits of MBD with MATLAB and Simulink

MBD using MATLAB and Simulink offers significant advantages:

Reduced Development Time: Virtual prototyping in Simulink eliminates multiple physical prototypes, accelerating design iterations and reducing time-to-market by up to 30%, per industry studies.

Cost Efficiency: Simulation and automated code generation reduce hardware testing and manual coding costs, minimizing development expenses and material waste.

Enhanced Reliability: Early detection of design flaws through Simulink simulations ensures robust systems, reducing risks in safety-critical applications like automotive or aerospace.

Seamless Integration: MATLAB and Simulink’s unified environment supports cross-disciplinary collaboration, enabling mechanical, electrical, and software engineers to work cohesively.

Standards Compliance: Automated verification tools ensure compliance with standards like ISO 26262 (automotive) and DO-178C (aerospace), simplifying certification processes.

Scalability: MBD supports systems of varying complexity, from simple control loops to multidomain models, making it versatile for diverse projects.

Challenges in MBD Implementation

Despite its benefits, MBD with MATLAB and Simulink faces challenges:

High Initial Costs: Licenses for MATLAB, Simulink, and toolboxes like Embedded Coder are expensive, posing barriers for small organizations or startups.

Learning Curve: Mastering Simulink’s block-diagram interface and MATLAB scripting requires training, particularly for engineers new to model-based workflows.

Model Complexity: Developing high-fidelity models for complex systems, like autonomous vehicles, demands expertise in system dynamics and control theory, increasing development time.

Computational Demands: Simulating large models or real-time HIL testing requires powerful hardware, raising costs and potentially slowing processes.

Interoperability: Integrating MATLAB and Simulink with third-party tools or legacy systems can be complex, requiring custom interfaces or additional software.

Future Trends in MBD with MATLAB and Simulink

MBD is evolving to meet modern engineering demands:

AI and Machine Learning: MATLAB’s Deep Learning Toolbox integrates AI into Simulink models, enabling adaptive control and predictive maintenance for robotics and automotive systems.

Cloud-Based MBD: MATLAB Online and Simulink Online support remote simulation and collaboration, reducing hardware costs and enabling global team workflows.

Digital Twins: MBD creates digital twins for real-time monitoring and optimization, enhancing system lifecycle management in industries like manufacturing and energy.

Cybersecurity Testing: As embedded systems become connected, MBD will incorporate cybersecurity simulations to ensure resilience against cyberattacks.

Sustainability Focus: MATLAB and Simulink are optimizing energy-efficient designs, such as electric vehicles and renewable energy systems, aligning with global sustainability goals.

Conclusion

Model-Based Design using MATLAB and Simulink revolutionizes engineering by enabling virtual modeling, simulation, and validation of complex systems. Its graphical interface, robust toolboxes, and automated code generation streamline development, reduce costs, and ensure reliability in automotive, aerospace, and robotics applications. Despite challenges like high costs and model complexity, advancements in AI, cloud computing, and digital twins are expanding MBD’s capabilities. As industries demand smarter, safer, and more sustainable solutions, MATLAB and Simulink will remain indispensable, driving innovation and precision in system design.

0 notes

Text

Integration of ADAS features into VCUs

Introduction

Modern cars must now feature Integration of ADAS features into VCUs to increase efficiency, comfort, and safety. These systems need to be completely integrated into Vehicle Control Units (VCUs), the centralized “brains” of advanced and electric cars, in order to reach their full potential. The end-to-end integration process is covered in length in this piece, along with important factors, software and hardware tactics, industry best practices, and upcoming difficulties.

1. Describe a VCU and Explain Its Significance for ADAS

Similar to a computer CPU, a Vehicle Control Unit (VCU) is a high-performance embedded system that coordinates vital vehicle operations, including energy distribution, motor control, diagnostics, and safety features. It incorporates data from the Motor Controller, Thermal Management, Battery Management System (BMS), ADAS modules, and other sources in electric vehicles.

High-speed data flow, real-time control algorithms, and seamless interface with several sensors and ECUs are all requirements for a modern VCU. The job of the VCU becomes more crucial and intricate as ADAS technologies evolve, adding components like autonomous parking, collision avoidance, and lane centring.

2. Feature Scoping and Requirements Analysis

Determining which Integration of ADAS features into VCUs the car will support is the first step towards effective integration. Examples include:

Adaptive Cruise Control (ACC)

LDW/LKA: Lane Departure Warning/Assist

Automatic Emergency Braking (AEB)

Cross-traffic and blind-spot alerts

Automated Parking and Parking Assistance

CACC, or cooperative adaptive cruise control, uses V2X communication.

The choice of sensors, actuators, VCU computational needs, and communication interfaces is influenced by this scoping process. In addition, it directs adherence to regional rules, AUTOSAR middleware, and safety standards like as ISO 26262 (ASIL requirements).

3. Integration and Calibration of Sensors

A variety of sensor types are necessary for a strong ADAS:

Cameras to identify objects or lanes

Radar for distance and speed, both short- and long-range

Using LiDAR for accurate 3D mapping

Ultrasonic sensors for environments with low speeds

To ensure seamless fusion and dependability, these sensors must be connected via high-speed buses (such as CAN, Ethernet) and carefully calibrated — physically aligned and time-synchronized.

4. Environment Modelling & Sensors Integration

Inputs are combined using sensor fusion to provide a coherent picture of the vehicle environment. Included in this multi-layered data process are:

Pre-processing includes timestamp alignment, distortion correction, and noise filtering.

Tracking and object detection: recognize cars, people, and lane markings

Fusion algorithms are AI-driven or probabilistic techniques that integrate sensor data.

Environmental modeling: make a map of dynamic things in real time

Using perception to inform decision-making, apply alerts or active controls.

Reliance on numerous sensors enhances system durability, and accurate fusion is particularly important in bad weather or low light.

5. Development of Algorithms and Real-Time Control

ADAS algorithms must adhere to stringent real-time performance requirements for operations including lane-keeping, braking, acceleration, and parking. Usually, VCUs execute code that:

Responds with a millisecond lag to sensor inputs

carries out control procedures, such as model predictive control and PID loops.

controls the dynamics of the vehicle to prevent oscillations and guarantee string stability, which is (crucial for CACC.)

Additionally, emergency shutdown procedures, sensor cross-validation, and fallback techniques are necessary for robust control.

6. VCU Architecture & Hardware Selection

Selecting or creating the right VCU hardware is essential. Some items to consider are:

Processing power and SoCs: For modular expansion, tiered ADAS frequently depends on scalable technologies such as Mobileye’s EyeQ6H-based ECUs.

Power and thermal management: VCUs need to be able to control heat production, fit into limited spaces, and keep power levels constant.

Interfaces: Interfaces include a real-time clock, watchdog systems, ADC/DAC channels, and several CAN, LIN, and gigabit Ethernet interfaces.

Memory & Storage: Sufficient RAM and storage to enable middleware, ML models, logs, and diagnostic information to function.

Redundancy: Standby cores and hardware fault tolerance, particularly for safety-critical ADAS tasks

According to industry observations by TomTom and Mobileye, centralized ADAS domain controllers — capable of combining data and making intricate decisions — are increasingly replacing dispersed ECUs.

7. Middleware & Software Integration

Rarely does VCU software architecture run on bare metal. Instead, to handle necessary services, manufacturers frequently use on frameworks like AUTOSAR Adaptive/Classic:

OS scheduling for activities in real time

CAN/LIN/Ethernet/IP protocols make up the networking stack.

OTA updates, logging, and diagnostics

Security procedures, state management, and memory protection

In addition, modularity, reusability, and scalability are ensured by using standardized APIs, which are essential for adding new ADAS capabilities and adhering to legal requirements.

8. Integration of ADAS features into VCUs with Onboard Systems

The VCU and other ECUs must communicate seamlessly for ADAS capabilities to function:

Command flow to steering, throttle, and brake systems via CAN/LIN buses

Ethernet: used for LiDAR or high-data-rate cameras

V2X and C-V2X stacks are necessary for smart traffic integration and CACC.

Additionally, the VCU serves as a gateway, combining vehicle data for telematics, OTA, or diagnostics.

9. Simulation, Validation, and Testing

Extensive verification is essential:

Simulate sensor data and vehicle dynamics using hardware-in-the-loop (HIL) and software-in-the-loop (SIL).

Closed-course testing: adjust ECUs and sensor performance in a controlled environment

Real-world testing: a variety of weather, traffic, illumination, and road conditions

Safety testing using scenarios: edge situations, false positives and negatives, and emergency response

Standards like ISO 26262, ASPICE, and legal requirements (like Euro NCAP) must all be followed when testing.

10. Functional Safety & Cybersecurity

The two pillars of security and safety are:

Hazard analysis, risk assessment (ASIL ratings), problem identification, and diagnostics in accordance with ISO 26262

Intrusion detection, encrypted communication, secure boot, and OTA security countermeasures are examples of security measures.

Therefore, the safety and integrity of the VCU and ADAS modules are guaranteed by a robust, standards-based design.

11. Lifecycle Management & OTA Updates

In order to implement new features, changes, and repairs without requiring physical service, modern VCUs must be able to offer Over-the-Air updates (OTA).

OTA platforms guarantee:

Delivery of updates in a secure, verified manner

The ability to revert if issues arise

As a result, this enables feature upgrades, extends product lifecycles, and supports ongoing safety enhancements.

12. Standardization & Regulatory Compliance

In fact, regulatory agencies in Europe, the US, and Asia are gradually requiring several ADAS features, such as AEB, LDW, and Attention Warning.

Integration of VCU/ADAS must meet:

Functional safety (ASIL D for critical systems, ISO 26262)

Standards for software processes (ASPICE)

AUTOSAR, or interoperability

Vehicle communications, or V2X, data standards

As a result, these frameworks guarantee dependability, market acceptance, and legal conformity.

13. Expenses, intricacy, and user psychology

Trade-offs are introduced when ADAS is integrated into VCUs:

Increased expenses for hardware and development (sensors, software developers, validation infrastructure)

Added complexity: calibration, maintenance, calibration drift, and fault diagnosis

Driver conduct: excessive dependence that results in complacency or annoyance due to erroneous cues

Environmental restrictions: Rain, fog, snow, and glare might affect ADAS sensors.

For a successful implementation, it is essential to strike a balance between strong HMI tactics, continuous driver education, and technical robustness. Moreover, each of these elements must complement the others to ensure a seamless and effective user experience

14. Outlook & Future Trends

VCU-embedded ADAS’s development suggests:

Domain controllers using multi-SoC, high-bandwidth architectures in place of several smaller ECUs

Mobileye’s EyeQ6H and Arm’s automotive-enhanced processors are examples of machine learning and vision-first SoCs that enable quicker perception and decision-making (mobileye.com).

For example, CACC, V2X infrastructure integration, and vehicle-to-vehicle data sharing illustrate connected ecosystems.

Road to autonomy: SAE Level 3/4 functionality is based on ADAS, and some OEMs anticipate commercial Level 3 functionality soon.

15. Conclusion: Toward Safer, Smarter Mobility

It is now essential — not optional — to Integration of ADAS features into VCUs — it’s critical. When seamlessly integrated, ADAS brings:

⚠️ Enhanced safety via proactive intervention

👁️ Real-time situational awareness

🚗 Improved ride comfort and stress-free driving

🌱 Better fuel/energy efficiency and traffic flow

🔒 Future-proofed architecture addressing autonomy, OTA, and standards

However, increased complexity, expense, and security and dependability requirements accompany this advancement. Co-designing hardware and software, adhering to standards, functional safety, cybersecurity, and human-centered engagement are all balanced in a successful integration.

VCU-based ADAS integration is, in essence, a multidisciplinary undertaking. Deep knowledge of algorithms, software engineering, safety engineering, embedded hardware, and systems integration are necessary. However, with the correct strategy, automakers and Tier-1 suppliers can produce cars that are not just safer but also more intelligent, responsive, and prepared for the future.

If you’d like to explore cutting-edge VCUs or EV software solutions , Engineering Staffing Solutions visit our website or reach out at [email protected]. We’d love to partner with you on your ADAS journey.

#ADAS#VCU#AutomotiveInnovation#EVSoftware#SmartMobility#Dorleco#SafetyTech#AUTOSAR#ISO26262#MobilitySolutions#EngineeringServices

0 notes

Text

Global Automotive Cockpit Domain Control Unit (DCU) Market : Trends, Growth, Strategies, Opportunities, Top Companies, and Forecast

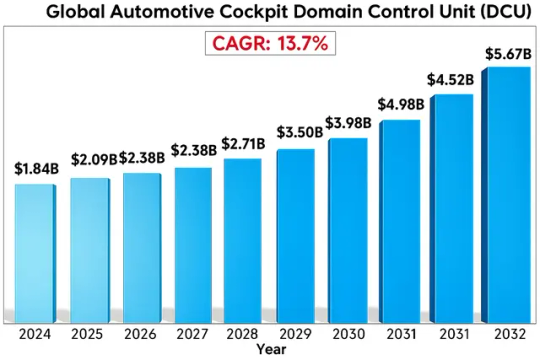

Global Automotive Cockpit Domain Control Unit (DCU) Market size was valued at US$ 1.84 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 13.7% during the forecast period 2025-2032. This robust growth is fueled by increasing vehicle electrification, rising demand for advanced driver assistance systems (ADAS), and consumer preference for connected infotainment solutions.

Automotive Cockpit DCUs serve as centralized computing platforms that integrate multiple vehicle functions including digital instrument clusters, head-up displays, infotainment systems, and climate controls. These high-performance electronic control units (ECUs) leverage powerful system-on-chip (SoC) processors to manage growing software complexity while reducing wiring harness weight by up to 30%. Leading solutions incorporate hypervisor technology to safely run multiple operating systems simultaneously, ensuring functional safety compliance with ISO 26262 ASIL-D requirements.

The market expansion is primarily driven by three key factors: the transition to software-defined vehicles, regulatory mandates for enhanced safety features, and premiumization trends in emerging economies. Recent developments include Continental’s 2024 launch of its next-generation Cockpit High Performance Computer with 5G connectivity, while Harman introduced its Ready Display solution featuring 48-inch panoramic screens. Asia-Pacific dominates the market with 42% revenue share in 2023, owing to rapid EV adoption in China where domestic suppliers like Neusoft Reach captured 18% market share.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-automotive-cockpit-domain-control-unit-dcu-market/

Segment Analysis:

By Type

Infotainment Segment Leads Due to Increasing Demand for Connected Vehicle Technologies

The market is segmented based on type into:

Powertrain/Chassis

Infotainment

Body Control

Advanced Driver Assistance Systems (ADAS)

By Application

Passenger Vehicle Segment Dominates Owing to Higher Production Volumes Globally

The market is segmented based on application into:

Passenger Vehicle

Commercial Vehicle

Electric Vehicles

By Vehicle Class

Luxury Vehicles Show Strong Adoption Rate for Advanced Cockpit Solutions

The market is segmented based on vehicle class into:

Economy Vehicles

Mid-range Vehicles

Luxury Vehicles

By Distribution Channel

OEM Segment Accounts for Major Share as DCUs are Typically Factory-installed

The market is segmented based on distribution channel into:

OEM

Aftermarket

Regional Analysis: Global Automotive Cockpit Domain Control Unit (DCU) Market

North America The North American Automotive Cockpit DCU market is characterized by high technological adoption and stringent automotive safety regulations. With major OEMs like General Motors and Ford investing heavily in smart cockpit technologies, the region is witnessing significant growth in integrated DCU solutions. The U.S. market alone is expected to account for over 35% of regional revenue by 2025, driven by consumer demand for advanced infotainment systems and ADAS integration. However, supply chain disruptions and semiconductor shortages have recently challenged production timelines. Cybersecurity concerns in connected vehicle systems are prompting stricter standards, influencing DCU architecture designs across passenger and commercial vehicle segments.

Europe Europe leads in regulatory-driven cockpit innovation, with EU mandates pushing for standardized HMI interfaces and driver monitoring systems. Germany’s automotive manufacturers are pioneering modular DCU platforms that consolidate powertrain, body control, and infotainment functions into single domain controllers. The region’s focus on premium vehicles has accelerated adoption of dual-chip DCU architectures, with market leaders like Continental and Bosch introducing AI-powered cockpit solutions. While labor costs and energy price fluctuations present challenges, the growing EV market is creating new opportunities for next-generation cockpit designs, particularly in Scandinavian markets where connected car penetration exceeds 70%.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific dominates DCU adoption with China accounting for nearly 50% of regional demand. Local manufacturers like Neusoft Reach and Desay SV are gaining market share through cost-optimized solutions tailored for high-volume production. Japan’s automotive electronics ecosystem supports sophisticated DCU development, while India’s expanding middle class is driving demand for mid-range cockpit systems. The region faces unique challenges including price sensitivity in emerging markets and fragmented safety standards across countries. However, government initiatives like China’s “Intelligent Connected Vehicle Innovation Development Strategy” are accelerating technology adoption, with DCUs becoming standard even in entry-level vehicles by 2026.

South America The South American market shows gradual but inconsistent growth in cockpit DCU adoption. Brazil represents the largest market, where economic stabilization efforts are renewing automotive industry investments. While budget constraints limit advanced feature penetration, regional automakers are implementing basic DCU functionalities in premium segments. The lack of localized semiconductor production creates supply chain vulnerabilities, causing dependence on imports from Asia and North America. Despite these challenges, the growing used car refurbishment market is creating secondary demand for aftermarket cockpit upgrades, particularly in Argentina and Colombia where vehicle electrification rates are slowly increasing.

Middle East & Africa This emerging market presents long-term potential with near-term limitations. Gulf Cooperation Council countries lead in luxury vehicle adoption, creating demand for high-end DCU systems, while African markets remain largely untapped due to economic constraints. The UAE’s focus on smart city development is driving pilot projects for autonomous vehicle cockpits. Infrastructure challenges and low new vehicle sales in most African nations restrict market growth, though South Africa’s established automotive sector shows promising DCU integration in locally assembled vehicles. Opportunities exist for affordable, ruggedized cockpit solutions that can withstand harsh operating conditions prevalent across the region.

MARKET OPPORTUNITIES

Transition to Zonal Architectures Creates New Integration Possibilities

Automakers’ shift toward zonal vehicle architectures presents significant opportunities for cockpit DCU suppliers. These new architectures consolidate functions traditionally handled by dozens of ECUs into regional domain controllers, with the cockpit unit serving as the primary human-machine interface. This transition enables suppliers to offer comprehensive solutions that combine infotainment, instrument cluster, HUD, and advanced driver monitoring functionalities. Early adopters of this approach are seeing 30-40% reductions in wiring harness complexity while gaining greater flexibility for software updates and feature expansion.

AUTOMOTIVE COCKPIT DOMAIN CONTROL UNIT (DCU) MARKET TRENDS

Integration of Advanced HMI and ADAS Features Driving Market Growth

The automotive cockpit domain control unit (DCU) market is experiencing significant transformation due to the rising demand for advanced human-machine interface (HMI) solutions and advanced driver-assistance systems (ADAS). Modern vehicles increasingly incorporate digital instrument clusters, heads-up displays (HUDs), and infotainment systems, all of which rely on high-performance DCUs. The global DCU market is projected to grow at a CAGR of approximately 10.2% from 2023 to 2030, driven by automakers’ focus on enhancing user experience and safety. Furthermore, the shift toward centralized domain architectures, replacing traditional distributed electronic control units (ECUs), is accelerating adoption as OEMs seek streamlined software management and reduced wiring complexity.

Other Trends

Electrification and Autonomous Driving

Electric vehicles (EVs) and autonomous driving technologies are reshaping cockpit DCU requirements, fostering innovations in power efficiency and processing capabilities. With over 26 million EVs expected to be sold annually by 2030, DCUs must support energy-efficient designs while handling vast data streams from sensors and cameras. Autonomous vehicles, in particular, demand high-redundancy, fail-safe DCUs capable of real-time decision-making. This trend is pushing semiconductor manufacturers to develop system-on-chip (SoC) solutions that integrate AI accelerators for faster image processing and predictive analytics, thereby enhancing both functionality and safety.

Software-Defined Vehicles and Over-the-Air (OTA) Updates

The rise of software-defined vehicles (SDVs) is another pivotal trend, with DCUs serving as the backbone for seamless OTA updates and cloud connectivity. Automakers are prioritizing modular software platforms, such as Android Automotive OS and QNX Hypervisor, to enable feature upgrades without hardware changes. By 2025, nearly 70% of new vehicles are expected to support OTA capabilities, reducing recall costs and extending vehicle lifecycle value. Partnerships between automotive OEMs and tech firms—like BMW’s collaboration with Qualcomm for scalable DCU platforms—underline the industry’s shift toward software-centric cockpits. These developments are further supported by 5G integration, ensuring low-latency communication between DCUs and external systems.

COMPETITIVE LANDSCAPE

Key Industry Players

Automotive Cockpit DCU Market Witnesses Intensified Competition as OEMs Prioritize Advanced HMI Solutions

The global automotive cockpit domain control unit (DCU) market exhibits a semi-consolidated competitive structure, with a mix of established automotive electronics providers and emerging tech-focused players. According to recent industry reports, Robert Bosch GmbH commands approximately 22% of the market share as of 2023, owing to its comprehensive in-vehicle computing platforms and strategic partnerships with major automakers across Europe and Asia.

Visteon Corporation follows closely with its next-generation SmartCore™ integrated cockpit controllers, having secured design wins with several Chinese EV manufacturers. Meanwhile, Continental AG has been gaining traction through its scalable cockpit high-performance computers (HPCs), particularly in premium vehicle segments. These three players collectively account for nearly 58% of the global DCU market revenue.

Chinese players like Neusoft Reach and Desay SV are rapidly expanding their market footprint through cost-competitive solutions tailored for domestic OEMs. For instance, Desay SV’s latest cockpit DCU platform supports up to 12 displays and 6 operating systems, making it particularly attractive for emerging market applications.

The competitive intensity is further amplified by recent technological developments:

Bosch’s 2023 launch of its integrated vehicle computers combining cockpit and ADAS functionalities

HARMAN’s acquisition of specialist AI firm Apostera to enhance its digital cockpit capabilities

Visteon’s $350 million investment in cockpit electronics R&D announced in Q2 2023

List of Key Automotive Cockpit DCU Manufacturers Profiled

Robert Bosch GmbH (Germany)

Visteon Corporation (U.S.)

Neusoft Reach (China)

Cookoo (China)

Desay SV Automotive (China)

Continental AG (Germany)

HARMAN International (U.S.)

Aptiv PLC (Ireland)

Marelli Holdings Co., Ltd. (Japan)

Learn more about Competitive Analysis, and Forecast of Global Automotive Cockpit DCU Market : https://semiconductorinsight.com/download-sample-report/?product_id=95799

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Automotive Cockpit DCU Market?

-> The Global Automotive Cockpit Domain Control Unit (DCU) Market size was valued at US$ 1.84 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 13.7% during the forecast period 2025-2032.

Which key companies operate in Global Automotive Cockpit DCU Market?

-> Key players include Bosch, Continental, Visteon, HARMAN, Desay SV, Neusoft Reach, and Cookoo among others.

What are the key growth drivers?

-> Key growth drivers include rising demand for connected vehicles, increasing vehicle electrification, and consumer preference for advanced infotainment systems.

Which region dominates the market?

-> Asia-Pacific holds the largest market share (42% in 2023), driven by automotive production in China, Japan and South Korea.

What are the emerging trends?

-> Emerging trends include integration of AI assistants, augmented reality HUDs, and multi-domain controller architectures in next-generation cockpits.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Automotive Cockpit Domain Control Unit (DCU) Market : Regional Insights and Market Dynamics 2025–2032

Global Automotive Cockpit Domain Control Unit (DCU) Market Research Report 2025(Status and Outlook)

Automotive Cockpit Domain Control Unit (DCU) Market size was valued at US$ 1.84 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 13.7% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95799

MARKET INSIGHTS

The global Automotive Cockpit Domain Control Unit (DCU) Market size was valued at US$ 1.84 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 13.7% during the forecast period 2025-2032. This robust growth is fueled by increasing vehicle electrification, rising demand for advanced driver assistance systems (ADAS), and consumer preference for connected infotainment solutions.

Automotive Cockpit DCUs serve as centralized computing platforms that integrate multiple vehicle functions including digital instrument clusters, head-up displays, infotainment systems, and climate controls. These high-performance electronic control units (ECUs) leverage powerful system-on-chip (SoC) processors to manage growing software complexity while reducing wiring harness weight by up to 30%. Leading solutions incorporate hypervisor technology to safely run multiple operating systems simultaneously, ensuring functional safety compliance with ISO 26262 ASIL-D requirements.

The market expansion is primarily driven by three key factors: the transition to software-defined vehicles, regulatory mandates for enhanced safety features, and premiumization trends in emerging economies. Recent developments include Continental’s 2024 launch of its next-generation Cockpit High Performance Computer with 5G connectivity, while Harman introduced its Ready Display solution featuring 48-inch panoramic screens. Asia-Pacific dominates the market with 42% revenue share in 2023, owing to rapid EV adoption in China where domestic suppliers like Neusoft Reach captured 18% market share.

List of Key Automotive Cockpit DCU Manufacturers Profiled

Robert Bosch GmbH (Germany)

Visteon Corporation (U.S.)

Neusoft Reach (China)

Cookoo (China)

Desay SV Automotive (China)

Continental AG (Germany)

HARMAN International (U.S.)

Aptiv PLC (Ireland)

Marelli Holdings Co., Ltd. (Japan)

Segment Analysis:

By Type

Infotainment Segment Leads Due to Increasing Demand for Connected Vehicle Technologies

The market is segmented based on type into:

Powertrain/Chassis

Infotainment

Body Control

Advanced Driver Assistance Systems (ADAS)

By Application

Passenger Vehicle Segment Dominates Owing to Higher Production Volumes Globally

The market is segmented based on application into:

Passenger Vehicle

Commercial Vehicle

Electric Vehicles

By Vehicle Class

Luxury Vehicles Show Strong Adoption Rate for Advanced Cockpit Solutions

The market is segmented based on vehicle class into:

Economy Vehicles

Mid-range Vehicles

Luxury Vehicles

By Distribution Channel

OEM Segment Accounts for Major Share as DCUs are Typically Factory-installed

The market is segmented based on distribution channel into:

OEM

Aftermarket

Regional Analysis: Global Automotive Cockpit Domain Control Unit (DCU) Market

North America The North American Automotive Cockpit DCU market is characterized by high technological adoption and stringent automotive safety regulations. With major OEMs like General Motors and Ford investing heavily in smart cockpit technologies, the region is witnessing significant growth in integrated DCU solutions. The U.S. market alone is expected to account for over 35% of regional revenue by 2025, driven by consumer demand for advanced infotainment systems and ADAS integration. However, supply chain disruptions and semiconductor shortages have recently challenged production timelines. Cybersecurity concerns in connected vehicle systems are prompting stricter standards, influencing DCU architecture designs across passenger and commercial vehicle segments.

Europe Europe leads in regulatory-driven cockpit innovation, with EU mandates pushing for standardized HMI interfaces and driver monitoring systems. Germany’s automotive manufacturers are pioneering modular DCU platforms that consolidate powertrain, body control, and infotainment functions into single domain controllers. The region’s focus on premium vehicles has accelerated adoption of dual-chip DCU architectures, with market leaders like Continental and Bosch introducing AI-powered cockpit solutions. While labor costs and energy price fluctuations present challenges, the growing EV market is creating new opportunities for next-generation cockpit designs, particularly in Scandinavian markets where connected car penetration exceeds 70%.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific dominates DCU adoption with China accounting for nearly 50% of regional demand. Local manufacturers like Neusoft Reach and Desay SV are gaining market share through cost-optimized solutions tailored for high-volume production. Japan’s automotive electronics ecosystem supports sophisticated DCU development, while India’s expanding middle class is driving demand for mid-range cockpit systems. The region faces unique challenges including price sensitivity in emerging markets and fragmented safety standards across countries. However, government initiatives like China’s “Intelligent Connected Vehicle Innovation Development Strategy” are accelerating technology adoption, with DCUs becoming standard even in entry-level vehicles by 2026.

South America The South American market shows gradual but inconsistent growth in cockpit DCU adoption. Brazil represents the largest market, where economic stabilization efforts are renewing automotive industry investments. While budget constraints limit advanced feature penetration, regional automakers are implementing basic DCU functionalities in premium segments. The lack of localized semiconductor production creates supply chain vulnerabilities, causing dependence on imports from Asia and North America. Despite these challenges, the growing used car refurbishment market is creating secondary demand for aftermarket cockpit upgrades, particularly in Argentina and Colombia where vehicle electrification rates are slowly increasing.

Middle East & Africa This emerging market presents long-term potential with near-term limitations. Gulf Cooperation Council countries lead in luxury vehicle adoption, creating demand for high-end DCU systems, while African markets remain largely untapped due to economic constraints. The UAE’s focus on smart city development is driving pilot projects for autonomous vehicle cockpits. Infrastructure challenges and low new vehicle sales in most African nations restrict market growth, though South Africa’s established automotive sector shows promising DCU integration in locally assembled vehicles. Opportunities exist for affordable, ruggedized cockpit solutions that can withstand harsh operating conditions prevalent across the region.

MARKET DYNAMICS

s cockpit systems evolve into full-fledged computing platforms, the software validation process has become exponentially more complex. OEMs now face the challenge of certifying integrated systems that combine safety-critical functions with consumer electronics features, each with different development cycles. The automotive industry’s traditional 5-7 year product development timelines often conflict with the rapid iteration pace of consumer technology, creating compatibility challenges. Current estimates suggest validation and testing now account for nearly 40% of total development costs for advanced cockpit systems.

The automotive industry continues facing challenges from semiconductor shortages, particularly for the high-performance system-on-chips (SoCs) required in modern cockpit DCUs. These specialized components often have lead times exceeding 12 months, forcing automakers to make difficult trade-offs between features and production volumes. The situation is exacerbated by increasing competition from consumer electronics companies for advanced semiconductor nodes. Some Tier 1 suppliers report that chip availability remains the primary limiting factor preventing faster rollout of next-generation cockpit systems.

Automakers’ shift toward zonal vehicle architectures presents significant opportunities for cockpit DCU suppliers. These new architectures consolidate functions traditionally handled by dozens of ECUs into regional domain controllers, with the cockpit unit serving as the primary human-machine interface. This transition enables suppliers to offer comprehensive solutions that combine infotainment, instrument cluster, HUD, and advanced driver monitoring functionalities. Early adopters of this approach are seeing 30-40% reductions in wiring harness complexity while gaining greater flexibility for software updates and feature expansion.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95799

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Automotive Cockpit DCU Market?

Which key companies operate in Global Automotive Cockpit DCU Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv_2.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-industrial-force-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-smart-temperature-monitoring.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-non-tactile-membrane-switches.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-semiconductor-alcohol-sensors.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-healthcare-biometric-systems.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-class-d-audio-power-amplifiers.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-usb-31-flash-drive-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-optical-fiber-development-tools.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-chips-3d-ic-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-acoustic-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wired-network-connectivity-3d.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-lens-antenna-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-millimeter-wave-antennas-and.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

New Product Development Management SoftwareNew Product Development Management Software

Omnex's New Product Development (NPD) Management Software is a comprehensive and robust platform intended for organizing and improving the entire product development lifecycle. Established on verified methods such as APQP (Advanced Product Quality Planning) and the Stage Gate and Lean methodologies, the software strengthens and organizes the project process from concept to launch. It provides the ability to manage product requirements, schedules, risk, resources, and cost all in one central cloud-based management system.Omnex's NPD Management Software gets every product developer in one platform across departments by incorporating engineering, quality, manufacturing, and supply chain teams into one managed project solution. It provides a real-time dashboard with alerts, relevant KPI scores, and productivity metrics, enabling every stakeholder to have visibility of the status live while managing projects and make data-based decisions. Managed risk and change processes are incorporated in the software to allow potential issues to be discovered early in the development cycle, allowing better quality outcomes and faster product launch planning.Omnex's NPD system is designed with compliance in mind, and directly correlates to, established industry references such as IATF 16949, ISO 9001 and ISO 26262. Thus, the Omnex NPD Management Software is intended for organizations in sectors that include automotive, aerospace, industrial manufacturing, etc. The modular design also provides the ability to meet selected organizational needs while still facilitating worldwide collaboration. Ultimately, Omnex's New Product Development Management Software simplifies and improves processes related to product innovation, operational efficiencies, and time-to-market for new products.

For more info visit us https://www.omnexsystems.com/platforms/npd-apqp-software

0 notes

Link

#adaptiveinterfaces#automotiveAI#collaborativeR&D#displayecosystems#HMIevolution#innovationconvergence#RegionalTechStrategies#smartmobility

0 notes

Text

Exploring the Future of Hardware in the Loop: $1,784.4 million by 2030

The hardware in the loop market is estimated to be valued at USD 1,100.8 million in 2025 and is projected to reach USD 1,784.4 million by 2030, growing at a CAGR of 10.1% from 2025 to 2030.

As electric and autonomous vehicle usage continues to rise, there is a growing demand for more sophisticated, real-time HIL systems capable of simulating high-voltage powertrains and complex sensor environments. Cutting-edge technologies, such as AI-driven test automation and digital twins, are transforming HIL testing by providing greater simulation accuracy and reducing development time. With new regulatory requirements related to functional safety (ISO 26262) and cybersecurity emerging, companies are seeking solution providers with advanced validation capabilities. These factors are expected to cause significant disruption in the HIL market and act as catalysts for innovation and broader use across industries.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=11343527

The closed loop testing segment is expected to grow to the highest CAGR during the forecast period. Closed-loop HIL reduces time spent testing fatigue while allowing for a more accurate validation and testing of safety-critical systems. One of the most significant opportunities for growth is in the automotive industry, as closed-loop HIL is critical for validating ADAS, sensor fusion capabilities, and high-voltage powertrain components in realistic processing environments. Additionally, development in digital twin technologies and artificial intelligence has created opportunities to improve the performance and reliability of a product. Strict global safety and functional compliance regulations like ISO 26262 continue to increase the need for closed-loop systems to ensure stringent validation rigor. Meanwhile, modernization in the aerospace and defense sector has created demands for more advanced simulation platforms to facilitate the testing of avionics and unmanned systems in a dynamic, high-risk environment. This creates opportunities for market participants to partner and invest in platforms with scalable, real-time simulation or testing capabilities.

The power electronics segment is expected to grow at the highest CAGR during the forecast period. Power electronics have the advantage of modulating electric current and voltages by controlling the switching cycles of transistors. Power electronic devices are prominently used for electric applications, such as power grids, PV cells, wind turbines, generators, battery energy storage systems, traction motors, electric drives, electric vehicles, and industrial machinery. Hardware in the loop testing helps in testing power electronic devices, such as electric motors and converters, by simulating the load connected to them. This helps with faster and reliable testing of these devices. The electric vehicle (EV) sector offers a significant growth opportunity with the immediate need to test powertrain components, regenerative braking systems, and onboard chargers in the most accurate way possible. The renewable energy sector, particularly solar and wind, also requires advanced HIL platforms to simulate interactions with the grid, energy storage, and control algorithms in smart inverters. Solid-state transformers and wide-bandgap semiconductors (SiC, GaN, etc.) are also emerging as new opportunities that need fast, high-fidelity HIL simulations for optimization and reliability testing. Participants in this market can take advantage of these areas of growth by designing custom HIL systems that are fast, FPGA-based, and can simulate fast, switching transients while integrating control interfaces in real-time. They could work with original equipment manufacturers (OEMs) in the EV sector, renewable energy companies, and power semiconductor vendors to design customized solutions in specific applications. By aligning with and/or developing solutions to address emerging technology applications, vendors will have a reasonable role in the move to a more electrified, efficient, and sustainable future.

The Hardware-in-the-Loop (HIL) market has significant prospects in areas such as electric vehicles (EVs), autonomous systems, renewable energy, and industrial automation. To develop the market's potential, players can build high-performance, real-time HIL systems that meet customer-defined requirements in some key focus areas, including advanced driver-assistance systems (ADAS), power electronics, and smart grids. In addition, participant companies should partner with leaders in the automotive, aerospace, and energy industries and work with them to provide solutions to the next generation of technology. Lastly, the use of artificial intelligence (AI) and digital twin technologies incorporated into HIL frameworks can provide the capability of intelligent, adaptive testing to improve simulation accuracy and efficiency.

In North America, the US is expected to dominate the market during the forecast period. The hardware-in-the-loop (HIL) industry is undergoing tremendous growth in the US due to the rapidly evolving automotive and aerospace sectors, overall electrification, and automation trend. The US has a lot of prominent automotive manufacturers, aerospace companies, and technology innovators that are now using HIL systems to validate embedded systems in real time, save development time, and ensure safety and compliance. As vehicles become more software-based and digital (i.e., advanced driver-assistance systems (ADAS), autonomous vehicles, electric/drivetrain), the ability to test HIL for accuracy, scalability, and efficiency is becoming increasingly important. One of the biggest enablers of growth in HIL is the transition towards electric vehicles (EVs) and autonomous driving. Companies, from traditional manufacturing and tier-1 suppliers to complementary startups, are investing heavily in R&D for EV development. HIL systems serve an increasingly pivotal role in stakeholders validating battery management systems, motor controller systems, and charging systems. The ability to test high-voltage and safety-critical components means that real-time testing via HIL is becoming an increasingly important aspect of the validation cycle. As the trend continues in the aerospace and defense sectors, with both established players and new entrants, HIL simulation is an essential part of the development cycle as reliability and regulatory compliance are critical to complete certification processes.

0 notes

Text

Future Growth Trends and Innovations in the Global Embedded Hypervisor Market to 2030

As embedded systems evolve from isolated controllers into networked, multifunctional platforms, the demand for efficient, secure, and flexible software environments continues to grow. At the center of this evolution is the embedded hypervisor a technology that is quietly reshaping industries ranging from automotive to defense, industrial automation, and beyond.

What is an Embedded Hypervisor?

An embedded hypervisor is a type of virtualization layer specifically designed for resource-constrained embedded systems. Unlike traditional hypervisors used in data centers or enterprise IT environments, embedded hypervisors must be lightweight, deterministic, and highly secure. Their primary role is to allow multiple operating systems or real-time operating systems (RTOS) to run concurrently on a single hardware platform, each in its own isolated virtual machine (VM).

This capability enables system designers to consolidate hardware, reduce costs, improve reliability, and enhance security through isolation. For example, a single board in a connected car might run the infotainment system on Linux, vehicle control on an RTOS, and cybersecurity software in a third partition all managed by an embedded hypervisor.

Market Dynamics

The embedded hypervisor market is poised for robust growth. As of 2024, estimates suggest the market is valued in the low hundreds of millions, but it is expected to expand at a compound annual growth rate (CAGR) of over 7% through 2030. Several factors are driving this growth.

First, the increasing complexity of embedded systems in critical industries is pushing demand. In the automotive sector, the move toward electric vehicles (EVs) and autonomous driving features requires a new level of software orchestration and separation of critical systems. Regulations such as ISO 26262 for automotive functional safety are encouraging the use of hypervisors to ensure system integrity.

Second, the proliferation of IoT devices has created new use cases where different software environments must coexist securely on the same hardware. From smart home hubs to industrial controllers, manufacturers are embracing virtualization to streamline development, reduce hardware footprint, and enhance security.

Third, the rise of 5G and edge computing is opening new frontiers for embedded systems. As edge devices handle more real-time data processing, they require increasingly sophisticated system architectures an area where embedded hypervisors excel.

Key Players and Innovation Trends

The market is populated by both niche specialists and larger companies extending their reach into embedded virtualization. Notable players include:

Wind River Systems, with its Helix Virtualization Platform, which supports safety-critical applications.

SYSGO, known for PikeOS, a real-time operating system with built-in hypervisor capabilities.

Green Hills Software, which offers the INTEGRITY Multivisor for safety and security-focused applications.

Siemens (via Mentor Graphics) and Arm are also active, leveraging their hardware and software expertise.

A notable trend is the integration of hypervisor technology directly into real-time operating systems, blurring the lines between OS and hypervisor. There’s also growing adoption of type 1 hypervisors—those that run directly on hardware for enhanced performance and security in safety-critical systems.

Another emerging trend is the use of containerization in embedded systems, sometimes in combination with hypervisors. This layered approach offers even greater flexibility, enabling mixed-criticality workloads without compromising safety or real-time performance.

Challenges Ahead

Despite its promise, the embedded hypervisor market faces several challenges. Performance overhead remains a concern in ultra-constrained devices, although newer architectures and optimized designs are mitigating this. Additionally, integration complexity and certification costs for safety-critical applications can be significant barriers, particularly in regulated sectors like aviation and healthcare.

Security is both a driver and a challenge. While hypervisors can enhance system isolation, they also introduce a new layer that must be protected against vulnerabilities and supply chain risks.

The Road Ahead

As embedded systems continue their transformation into intelligent, connected platforms, the embedded hypervisor will play a pivotal role. By enabling flexible, secure, and efficient software architectures, hypervisors are helping industries reimagine what’s possible at the edge.

The next few years will be critical, with advances in processor architectures, software frameworks, and development tools shaping the future of this market. Companies that can balance performance, security, and compliance will be best positioned to lead in this evolving landscape.

0 notes

Text

#Infineon Technologies#precision#powertrain#XENSIV#ASILB#AutomotiveSafety#MagneticSwitches#ADAS#ChassisControl#PowertrainTech#AutoInnovation#FunctionalSafety#SmartSensors#electronicsnews#technologynews

0 notes

Text

Top 5 Embedded Systems Training Institutes in Pune with Placements

Pune, a hub for technology and education, is home to several premier institutes offering embedded systems training with strong placement support. Embedded systems, the backbone of modern devices from smartphones to automotive systems, are in high demand, making quality training essential for aspiring engineers. Below is a curated list of the top five embedded systems training institutes in Pune, known for their comprehensive curricula, hands-on learning, and excellent placement records.

1. Technoscripts

Technoscripts, established in 2005, is a leading name in embedded Course in Pune, renowned for its career-oriented courses and robust placement support. Their programs, such as the Advanced Career Track in Embedded Systems and Automotive Embedded Course with Placements, cover critical topics like microcontroller programming, embedded C, RTOS, and automotive safety standards (e.g., ISO 26262). With a focus on practical learning, students work on live projects and gain hands-on experience with industry-standard tools. Technoscripts boasts a 100% placement support record, with tie-ups to top companies, mock interviews, and resume-building sessions to ensure job readiness. Their NASSCOM certification and flexible online/offline classes make them a top embedded institute in Pune for freshers and professionals alike.

2. Sofcon Training

Sofcon Training, an ISO 9001:2015-certified institute, offers comprehensive embedded systems training tailored to industry needs. Their curriculum spans basic electronics, embedded C, microcontroller families (8051, AVR, PIC), and PCB designing. With over 20 years of experience, Sofcon has trained over 70,000 engineers, achieving a 95% placement rate. Their smart labs, equipped with modern hardware, and expert trainers with 10+ years of industry experience ensure practical exposure. Sofcon provides NSDC-affiliated certificates, personality development sessions, and unlimited interview opportunities, making it a strong contender for career-focused training.

3. Emertxe

Emertxe, primarily based in Bangalore but accessible to Pune students through online courses, is a top choice for embedded systems training. Their curriculum emphasizes 70% hands-on learning, covering C/C++, microcontrollers, Linux internals, and RTOS. Students work on 10–15 industry-grade projects, ensuring job readiness. Emertxe’s placement record is impressive, with over 1,500 companies, including MNCs like Harman International, hiring their graduates. Their NSDC certification and dedicated Learning Management System enhance the learning experience, making it ideal for those seeking flexible, high-quality training.

4. ACTE

ACTE is a well-regarded institute offering job Hospitable environment, practical training, and placement support. Their embedded systems course covers microcontroller programming, hardware interfacing, and advanced concepts like RTOS and communication protocols. With a focus on real-world projects, ACTE ensures students gain practical skills. They claim partnerships with over 700 MNCs, including SAP, Oracle, and Amazon, and have placed over 3,500 students globally. ACTE’s job-oriented training, mock interviews, and certification support make it a solid option for career starters.

5. VLSI Design & Research Centre (COEP)

Located at the College of Engineering Pune (COEP), the VLSI Design & Research Centre offers a specialized embedded systems course with a blend of theoretical and practical training. The curriculum focuses on hardware design, programming, and real-time applications, delivered by experienced faculty. With COEP’s strong industry connections, the institute provides placement assistance, including campus interviews and career counseling. The course is particularly suited for BTech graduates seeking in-depth knowledge and job opportunities in embedded systems and related fields.

Conclusion

Pune’s embedded systems training institutes, such as Technoscripts, Sofcon, Emertxe, ACTE, and VLSI Design & Research Centre, offer robust programs combining theoretical knowledge, hands-on projects, and strong placement support. Whether you’re a fresher or a working professional, these institutes provide the skills and opportunities needed to excel in the fast-growing embedded systems industry. Research their offerings, attend demo classes, and choose the one that aligns with your career goals to kickstart your journey in this exciting field

0 notes

Text

Model-Based Design Tools: Revolutionizing Engineering Development

Model-Based Design (MBD) tools are transforming how engineers and developers approach system design, especially for complex embedded systems in industries like automotive, aerospace, industrial automation, and consumer electronics. These tools provide a structured and highly visual development methodology that allows teams to simulate, test, and validate system behavior long before physical prototypes are built. The result is faster development cycles, reduced errors, and a more efficient path from concept to deployment.

What Is Model-Based Design?

Model-Based Design is a design methodology that uses models to represent system behavior and functionality. These models are often built using tools like MATLAB® and Simulink®, where engineers can graphically design algorithms and simulate how systems will behave under various conditions. Unlike traditional code-first approaches, MBD starts with system modeling and then automatically generates production-quality code from those models.

At the core of MBD is the simulation-based approach, which means engineers can analyze and optimize system performance early in the design process. This approach is especially beneficial in industries where safety, reliability, and performance are critical.

Key Components of Model-Based Design Tools

Model-Based Design tools typically include several integrated components that work together to provide a full development workflow:

System Modeling: Visual blocks and diagrams are used to represent system logic, dynamics, and control behavior. This makes it easier to conceptualize the system as a whole and ensure different subsystems interact correctly.

Simulation and Analysis: Engineers can simulate system performance under real-world conditions. This includes testing various input conditions, disturbances, and failure scenarios without physical hardware.

Automatic Code Generation: Once the model is validated, the tool can generate optimized C/C++ code for embedded deployment. This saves time and ensures that the code reflects the verified model exactly.

Verification and Validation: Formal testing, including Hardware-in-the-Loop (HIL) and Software-in-the-Loop (SIL), can be done within the model environment to catch errors early. Requirements tracing and test case generation also become more structured.

Integration with Hardware: MBD tools support integration with real-time hardware platforms, enabling rapid prototyping, testing, and eventual system deployment.

Benefits of Model-Based Design Tools

The use of Model-Based Design tools offers several distinct advantages across the product development life cycle:

1. Reduced Development Time

Because MBD allows for early testing, design iterations happen faster. Changes can be made in the model and immediately validated, without the need to rewrite code or rebuild hardware.

2. Improved Design Quality

Simulation and early validation help detect design errors and inconsistencies before they escalate. This reduces the risk of failure in real-world scenarios and improves the overall quality of the final product.

3. Cost Efficiency

By catching issues early and reducing the need for physical prototypes, MBD significantly reduces development costs. Automatic code generation further minimizes the effort and time required for coding.

4. Team Collaboration

Model-Based Design tools offer a common visual language for system engineers, control engineers, and software developers. This shared platform improves collaboration and reduces misunderstandings in multi-disciplinary teams.

5. Easier Compliance and Documentation

Many industries require rigorous documentation and compliance with standards such as ISO 26262 (automotive) or DO-178C (aerospace). MBD tools help with automated report generation, model traceability, and structured testing, all of which support regulatory requirements.

Applications Across Industries

Automotive

Model-Based Design is extensively used in the automotive sector for developing advanced driver assistance systems (ADAS), powertrain control, and electric vehicle (EV) management systems. Real-time simulation and automatic code generation help meet safety and performance benchmarks.

Aerospace

In aerospace, MBD is used for flight control systems, navigation, and avionics. The ability to simulate conditions like turbulence or sensor failure in a virtual environment is invaluable.

Industrial Automation

Industrial control systems such as robotic arms, conveyor systems, and CNC machines benefit from the rapid prototyping and optimization that MBD offers.

Medical Devices

Medical equipment such as infusion pumps and diagnostic machines can be modeled to ensure accuracy, reliability, and regulatory compliance before real-world testing.

Popular Model-Based Design Tools

Some of the most widely used tools in the MBD ecosystem include:

MATLAB®/Simulink®: Industry-standard tools for modeling, simulation, and automatic code generation.

Stateflow®: Used for modeling and simulating decision logic based on state machines and flow charts.

dSPACE® and NI VeriStand: Platforms for Hardware-in-the-Loop simulation and rapid control prototyping.

LabVIEW: Offers graphical programming and dataflow-based design for engineering systems.

Challenges and Considerations

While Model-Based Design tools offer substantial advantages, they also come with a learning curve. Teams must be trained in how to use the tools effectively and understand modeling principles. Also, highly complex systems can result in large, difficult-to-maintain models if not properly managed.

Another consideration is model fidelity—ensuring that the simulated model accurately represents real-world behavior. This often requires detailed system knowledge and careful calibration of the model parameters.

The Future of Model-Based Design

As systems become more complex and interdisciplinary, Model-Based Design will play an even more central role. Integration with AI and machine learning, cloud-based simulation environments, and enhanced real-time collaboration tools are likely to shape the next generation of MBD platforms.

Furthermore, the rise of digital twins—virtual replicas of physical systems—relies heavily on model-based methodologies. As industries continue to move toward intelligent automation and cyber-physical systems, the use of Model-Based Design tools will only increase.

Conclusion

Model-Based Design tools by Servotechinc are a game-changer for modern engineering. They streamline development, enhance collaboration, reduce costs, and ensure a higher quality of products across various industries. By embracing MBD, companies position themselves at the forefront of innovation, equipped to tackle the challenges of complex systems with confidence and efficiency.

0 notes

Text

#Infineon#magneticswitch#functionalsafety in#automotive#sensors#stability#industry#powerelectronics#powermanagement#powersemiconductor

0 notes

Text

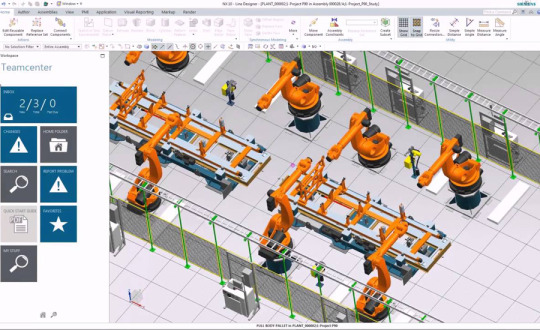

Teamcenter for Automotive Industry: Key Benefits, Features, and Applications

In the ever changing automotive sector, effectively managing intricate product lifecycles is essential. Siemens’s top Product Lifecycle Management (PLM)tool, Teamcenter, assists automakers in optimizing their engineering, design, and production procedures.

Key Benefits of Teamcenter in Automotive Industry

Enhanced Collaboration — Connects global teams, suppliers, and stakeholders for seamless data sharing.

Improved Efficiency — Automates workflows, reducing errors and rework.

Regulatory Compliance — Ensures adherence to industry standards like ISO 26262 and IATF 16949.

Cost Reduction — Minimizes design changes and accelerates time-to-market.

Better Change Management — Tracks and implements engineering changes effectively

Key Features of Teamcenter

BOM Management — Manages complex Bill of Materials across product variants.

CAD Data Integration — Supports multiple CAD systems for unified design management.

Digital Twin & Simulation — Enables virtual validation of automotive components.

Document & Workflow Management — Organizes critical documents and automates approvals.

Supplier Collaboration — Enhances transparency and coordination with vendors.

Applications in the Automotive Industry

Vehicle Development — Supports design, testing, and production planning.

Manufacturing Process Management — Optimizes production and quality control.

Aftermarket Services — Improves spare parts management and maintenance tracking.

Conclusion

Teamcenter empowers automotive manufacturers with a centralized PLM solution, improving efficiency, compliance, and product innovation. By streamlining operations, it accelerates vehicle development while maintaining quality and cost-effectiveness, making it a vital tool for the industry’s future.

0 notes

Text

Automotive Isolated Amplifier Market: CAGR, Revenue, and Market Share by Segment 2025–2032

MARKET INSIGHTS

The global Automotive Isolated Amplifier Market size was valued at US$ 345.6 million in 2024 and is projected to reach US$ 567.8 million by 2032, at a CAGR of 6.4% during the forecast period 2025-2032. This growth trajectory aligns with increasing vehicle electrification trends, where isolated amplifiers play a critical role in noise-sensitive automotive applications.

Automotive isolated amplifiers are specialized electronic components designed to amplify low-level signals while preventing ground loops and protecting sensitive circuits from high-voltage transients. These devices find extensive application in electric vehicles (EVs), hybrid vehicles, and automotive battery management systems. Key variants include optoelectronic isolated amplifiers, capacitor isolated amplifiers, and transformer isolated amplifiers, each offering distinct advantages in terms of isolation voltage and signal integrity.

The market expansion is driven by several critical factors: the global push towards vehicle electrification, stringent automotive safety regulations, and growing demand for advanced driver-assistance systems (ADAS). Asia-Pacific currently dominates the market, accounting for 48% of global demand in 2024, primarily due to China's leadership in EV production. Major players like ADI, TI, and ROHM are actively developing next-generation isolated amplifiers with higher integration and improved electromagnetic compatibility to meet evolving automotive requirements.

MARKET DYNAMICS

MARKET DRIVERS

Accelerating Shift Towards Electric and Hybrid Vehicles Fuels Demand for Isolated Amplifiers