#IRELAND INVESTOR PROGRAM

Explore tagged Tumblr posts

Text

Ireland Investor Visa Process

Apply for an Ireland Visa from India for and Ireland invester visa and get settled in one of the most lovely and wealthy country in Western Europe, noted for its attractive beauty and fresh air. 80 percent of the island is covered in grasslands and pastures. It is located west of England and is surrounded by the Atlantic Ocean. The official language of is English. Ireland is one of Europe’s fastest expanding economies and is also one of the world’s wealthiest countries. Many multinational corporations seek access to Europe and North America because of its geographic proximity, cheap rate, and participation in the EU and Eurozone.

Thousands of the world’s best research and innovation businesses, including Apple, Google, Huawei, Intel, Microsoft, and Dell, have established European headquarters in Ireland. Following the relaxation of immigration policy Ireland Investor Visa can get you citizenship by applying for an Ireland Visa from India and experience the top quality of life and better education for your children, as well as enjoy the friendly business environment and outstanding investment prospects, this is what is more attractive to people.

#TUDY VISA#WORK VISA#STUDENT VISA#STUDY ABROAD#WORK ABROAD#STUDY CONSULTANT#IMMIGRATION#VISA#IMMIGRATION SERVICES#VISA REQUIREMENTS#IRELAND INVESTOR VISA#IRELAND INVESTMENT VISA#IRELAND INVESTOR PROCESS#IRELAND INVESTMENT PROCESS#IRELAND INVESTOR PROGRAM#INVESTOR VISA#IRELAND INVESTOR

0 notes

Text

Ireland Immigrant Investor Program

Apply for an Ireland Visa from India for and Ireland invester visa and get settled in one of the most lovely and wealthy country in Western Europe, noted for its attractive beauty and fresh air. 80 percent of the island is covered in grasslands and pastures. It is located west of England and is surrounded by the Atlantic Ocean. The official language of is English. Ireland is one of Europe’s fastest expanding economies and is also one of the world’s wealthiest countries. Many multinational corporations seek access to Europe and North America because of its geographic proximity, cheap rate, and participation in the EU and Eurozone Thousands of the world’s best research and innovation businesses, including Apple, Google, Huawei, Intel, Microsoft, and Dell, have established European headquarters in Ireland..VJC Overseas immigration consultant in Hyderabad

0 notes

Text

Ireland residency by investment

Ireland is a lovely place to live, and its citizens are well-known for their great sense of humor and carefree attitude toward life. The employment and health benefits are excellent, and the quality of life is remarkable. It is a good idea if you intend to live in Ireland, and the nation provides the Immigrant Investor Programme (IIP), an investment program that enables people of non-EU (European Economic Area) countries to become residents of Ireland. All they need to do is make a big economic contribution to Ireland.

Why Opt for Us? By investing in EU Citizen, you can fulfill your desire of becoming an Irish citizen through residency by investing in real estate. We will guide you through each of the challenging procedures and use open and honest channels of contact to update you at every turn. Take advantage of pre-approval checks with EU Citizens to minimize the chance of delays when moving to Ireland. You will be able to expedite the processing of your application and speed up the approval procedure by following our advice and ideas.

0 notes

Text

Scott Dylan - Best Business Ideas for 2024

Scott Dylan is a renowned entrepreneur, investor, business strategist, and philanthropist based between the UK, Ireland and Spain. Scott is one of the Co-Founders here at Inc & Co, and since its inception he has played a pivotal role in the company’s growth and success. Here are some of the best business ideas shared by Scott Dylan for 2024:

Sustainable and Eco-Friendly Products

Reusable Products: Items like reusable bags, water bottles, and straws.

Eco-Friendly Packaging: Offering sustainable packaging solutions for businesses.

Green Cleaning Products: Non-toxic, biodegradable cleaning supplies.

Health and Wellness

Telehealth Services: Online medical consultations and healthcare services.

Fitness Apps and Wearables: Personalized workout programs and fitness tracking devices.

Mental Health Services: Online therapy, mindfulness apps, and wellness retreats.

Technology and Innovation

AI and Machine Learning Solutions: Developing AI-driven applications for various industries.

Cybersecurity: Providing services to protect businesses from cyber threats.

Smart Home Devices: Creating devices that enhance home automation and security.

Remote Work Solutions

Coworking Spaces: Offering flexible workspaces for remote workers and small businesses.

Productivity Software: Developing tools to help teams collaborate and manage projects remotely.

Virtual Event Platforms: Platforms for hosting online conferences, workshops, and networking events.

E-Commerce and Online Services

Niche Marketplaces: Specialized online stores catering to specific interests or demographics.

Subscription Boxes: Curated boxes for hobbies, health, beauty, and more.

Digital Marketing Services: Helping businesses with SEO, social media, and online advertising.

Education and E-Learning

Online Courses and Tutoring: Platforms for teaching skills and providing educational content.

EdTech Tools: Developing software and apps to enhance the learning experience.

Language Learning Apps: Interactive apps for learning new languages.

Renewable Energy

Solar Panel Installation: Providing solar energy solutions for homes and businesses.

Electric Vehicle Charging Stations: Setting up charging infrastructure for EVs.

Energy Efficiency Consulting: Helping businesses and homeowners reduce energy consumption.

Food and Beverage

Plant-Based Foods: Creating and selling vegan and vegetarian products.

Ghost Kitchens: Delivery-only restaurant models focusing on online orders.

Health Foods: Offering organic, gluten-free, and health-conscious food options.

Real Estate and Property Management

Short-Term Rentals: Managing properties for Airbnb and similar platforms.

Real Estate Technology: Tools for property management, virtual tours, and investment analysis.

Senior Living Communities: Developing and managing housing for the elderly.

Personal Services

Personal Finance Advisors: Offering financial planning and investment advice.

Home Improvement Services: Renovation, repair, and landscaping businesses.

Pet Services: Pet grooming, boarding, and training.

These ideas leverage current trends and market demands, offering potential for growth and success in 2024.

Follow Scott Dylan for more such posts!

0 notes

Text

What are the Impacts of ISO 37001 Certification in Ireland

ISO 37001 Certification in Ireland

ISO 37001 Certification in Ireland, which specializes in Anti-Bribery Management Systems (ABMS), may want to have a big and vast-ranging impact on businesses in Ireland. These impact growth past compliance, influencing the company’s way of life, stakeholder relationships, and operational effectiveness.

Here are the key implications of ISO 37001 certification in Ireland:

Enhanced Corporate Governance

Reinforced Governance Framework: ISO 37001 certification in Ireland promotes strong management structures, ensuring that anti-bribery guidelines and techniques are incorporated into the commercial enterprise employer’s governance framework.

Top Management Commitment: Encourages control and willpower from top control to uphold and implement anti-bribery measures, leading to a more ethically driven enterprise business enterprise.

Improved Legal and Regulatory Compliance

Legal Protection: ISO 37001 certification in Ireland Helps corporations look at Irish anti-bribery jail hints and worldwide tips, decreasing the danger of prison effects, fines, and sanctions.

Regulatory Confidence: ISO 37001 certification in Ireland Builds self-notion amongst regulators that the corporation is devoted to stopping bribery and corruption.

Enhanced Reputation and Trust

Public Trust: Enhances the organization’s recognition among clients, partners, investors, and the overall public by demonstrating a dedication to moral practices.

Demand Positioning: Positions the employer as a pacesetter in moral business practices, attracting clients and industrial enterprise possibilities, and prioritizing integrity and compliance.

Operational Efficiency and Risk Management

Risk Reduction: ISO 37001 certification in Ireland Implements a systematic technique to identify and mitigate bribery dangers, mainly to enhance powerful chance manipulation.

Efficient Processes: Streamlines strategies and controls related to anti-bribery measures, reducing the functionality of corruption and operational disruptions.

Employee Morale and Engagement

Ethical Culture: Fosters a culture of integrity and ethical behaviour, number one to better worker morale and engagement.

Training and Awareness: Provides ongoing schooling and attention programs, ensuring employees understand anti-bribery policies and strategies.

Enhanced Business Relationships

Partner and Supplier Confidence: ISO 37001 certification in Ireland Strengthens relationships with companions and carriers by ensuring they adhere to anti-bribery requirements, reducing the threat of being related to unethical practices.

Transparency and Accountability: Promotes transparency and obligation in agency dealings, essential to more honest and reliable company relationships.

Continuous Progress and Adaptability

Monitoring and Evaluation: This coverage encourages regular monitoring and evaluation of anti-bribery measures, ensuring the business enterprise can adapt to new risks and regulatory modifications.

Feedback Mechanisms: Incorporates remarks mechanisms concerning employees and stakeholders in continuously improving anti-bribery practices.

Economic and Social Impacts

Economic Stability: Contributes to economic stability by selling sincere business corporation practices and decreasing corruption, which could enhance the general organization environment in Ireland.

Social Responsibility: ISO 37001 certification in Ireland This employer demonstrates corporate social obligation by committing to moral enterprise practices and contributing to the fight against social corruption.

Key Uses of ISO 37001 Certification in Ireland

Enhancing Ethical Practices

Bribery Prevention: Establishes techniques and controls to prevent, encounter, and reply to bribery.

Promoting Integrity: Fosters a way of life of integrity and ethical behavior inside the employer.

Regulatory Compliance

Meeting Legal Requirements: Helps corporations look at Irish and worldwide anti-bribery criminal hints and rules, lowering the danger of prison consequences and sanctions.

Avoiding Legal Risks: ISO 37001 certification in Ireland Provides a scientific approach to handling criminal dangers related to bribery and corruption.

Building Trust and Reputation

Stakeholder Confidence: Demonstrates the enterprise’s determination to anti-bribery practices and complements its reputation among customers, companions, customers, and regulators.

Market Differentiation: Differentiates the business employer as a pacesetter in moral employer practices, attracting customers and business corporation possibilities.

Improving Business Relationships

Supplier and Partner Integrity: ISO 37001 certification in Ireland Ensures that companies and partners adhere to anti-bribery necessities, decreasing the chance of being related to unethical practices.

Trustworthy Collaborations: Facilitates sincere and obvious collaborations with business organization companions.

Operational Efficiency and Risk Management

Risk Assessment: Implements a primarily based method to figure and identify dangers, of which are important to higher threat manipulation.

Internal Management: Enhances internal controls and approaches, decreasing the risk of bribery incidents and functional disruptions.

Continuous Progress

Ongoing Monitoring: This coverage promotes regular monitoring and development of anti-bribery measures, ensuring that the agency adapts to evolving risks and regulatory adjustments.

Employee Involvement: Encourages worker involvement in anti-bribery tasks, fostering a culture of non-stop development and shared duty.

Global Business Facilitation

International Standards Compliance: ISO 37001 certification in Ireland Aligns with global anti-bribery necessities, facilitating smoother interactions with global clients and partners.

Cross-Border Transactions: Supports moral practices in skip-border transactions, lowering the threat of bribery in global operations.

Industry-Specific Impacts

Financial Services: Enhances compliance with anti-bribery policies, builds receive as proper with customers, and decreases the hazard of financial crimes.

Construction and Real Estate: Reduces the danger of bribery in procurement and challenges approvals, ensuring honest and obvious techniques.

Healthcare and Pharmaceuticals: Ensures ethical practices in procurement, clinical trials, and interactions with regulators, ensuring affected men or women receive actual protection.

Public Sector: Improves transparency and obligation in public procurement and control, reducing corruption and strengthening public get hold of as real with.

Technology and Telecommunications: Protects in the direction of bribery dangers in supply chain control, sales, and employer development, as well as selling moral boom.

Strategic Business Impacts

Competitive Advantage: ISO 37001 certification in Ireland Provides an aggressive component by differentiating the enterprise as a pacesetter in anti-bribery practices, attracting ethically aware clients and partners.

Investor Confidence: Increases investor self-perception through demonstrating sturdy anti-bribery measures fundamental to potential funding opportunities.

Sustainability: Contributes to the business corporation’s long-term sustainability by promoting moral practices and decreasing the chance of bribery-related disruptions.

Reputation Management: Helps control and shield the organization’s popularity and reduces the impact of capability bribery incidents at the emblem.

Conclusion

ISO 37001 certification in Ireland spherically impacts corporation governance, legal compliance, popularity, operational performance, and agency relationships in Ireland. By adopting ISO 37001 certification in Ireland necessities, Irish corporations can save bribery and corruption and beautify their famous moral standards, primarily to sustainable boom and superior stakeholder acceptance. This certification is a powerful device for promoting integrity, transparency, and obligation in the non-public and public sectors, contributing to a more shaped and ethical organization in Ireland.

Why Factocert for ISO 37001 Certification in Ireland

We provide the best ISO consultants Who are knowledgeable and provide the best solution. And to know how to get ISO certification. Kindly reach us at [email protected]. work according to ISO standards and help organizations implement ISO certification in Ireland with proper documentation.

For more information, visit ISO 37001 Certification in Ireland.

Related links :

ISO 21001 Certification in Ireland

ISO 22301 Certification in Ireland

ISO 37001 Certification in Ireland

ISO 27701 Certification in Ireland

ISO 26000 Certification in Ireland

ISO 20000-1 Certification in Ireland

ISO 50001 Certification in Ireland

HALAL Certification in Ireland

Related Articles

What are the Impacts ISO 37001 Certification in Ireland

0 notes

Text

Stock Market News: Intel and Uber Gain, Kraft Heinz and MGM Decline

Intel (INTC) stock went up by 2.4% after announcing plans to build a semiconductor factory in Ireland with a $2 billion equity investment. Cisco (CSCO) also experienced a 1.3% increase ahead of its earnings announcement. However, Boeing (BA) saw a 0.6% decrease in its stock, making it the worst-performing stock on the index. Johnson & Johnson (JNJ) and Apple (AAPL) also dropped by 0.5%. On the positive side, Uber (UBER) surged by 14.7% after revealing its first-ever $7 billion share buyback program. 💼📈

In the biotech sector, IQVIA (IQV) shares rose by 13.1% following better-than-expected quarterly earnings. Peers Charles River Laboratories (CRL) and Illumina (ILMN) also saw gains, with CRL rising by 11.3% and ILMN by 5.2%. However, Akamai Technologies (AKAM) disappointed investors with its quarterly results, leading to an 8.2% decline in its stock. MGM Resorts (MGM) reported a contraction in margins at its Las Vegas and Detroit operations due to higher employment costs, resulting in a 6.2% decrease. 🧪💰

CrowdStrike Holdings (CRWD) had a positive day, jumping by 3.8% after HSBC and KeyBanc raised their price targets for the cybersecurity stock. On the other hand, Kraft Heinz (KHC) saw a 5.5% drop in its stock due to declining sales in the fourth quarter. Despite beating Wall Street's expectations, Airbnb (ABNB) slipped by 1.7% as it warned of slowing growth. 💻🛒

Overall, investors have been focusing on the "Magnificent Seven" stocks, which have seen increased valuations and contributed to record highs in major indexes. However, Deutsche Bank analysts have highlighted the risks involved in such concentrated market activity. Kraft Heinz (KHC) reported lower sales, partly affected by cuts in the federal Supplemental Nutrition Assistance Program (SNAP), while Uber (UBER) announced its first-ever share repurchase program, reflecting confidence in its financial performance. The rise of Bitcoin has also impacted the market, driving up shares of cryptocurrency-adjacent companies. 📊📉

Intel Cisco Boeing Johnson & Johnson Read the original article

0 notes

Text

How ISO 9001 certification in Ireland lays the premise for lengthy-term business enterprise achievement

How ISO 9001 certification in Ireland lays the premise for lengthy-term business enterprise achievement

ISO 9001 certification in Ireland can help to create the basis for long-time period business enterprise practices in Ireland, supporting boom, efficiency, and lengthy-term viability. The following are some of the processes that ISO 9001 certification promotes sustainable enterprise:

Increased Productivity:

Simplifying strategies, improving workflows, and slicing waste are commonplace components of placing ISO 9001 requirements into workout. Businesses can also help sustainability thru lowering resource use, slicing energy use, and raising productivity through operational optimization.

Enhanced Management of Quality:

The aim of ISO 9001 is to assure everyday product and carrier fantastic thru pleasant manage structures. Improved first-class lowers waste, remodel, and mistakes, which improves client satisfaction and makes use of fewer assets. Because glad customers are likelier to paste around, there is less want for aggressive advertising and the environmental damage that consists of bringing in new industrial agencies.

Compliance and Risk Management:

Businesses are advocated with the aid of ISO 9001 to discover and decrease dangers nicely. Companies can avoid problems that would otherwise result in environmental harm or fines for non-compliance via way of following regulatory suggestions and detecting potential dangers in their operations.

Optimization of Resources:

Businesses also can limit their environmental effect, generate an awful lot less waste, and use substances extra efficiently via operating closer to better resource manage. Utilizing strength-green technologies, reducing back on the use of raw materials, and placing recycling applications in location are a few examples of this optimization.

Constant Enhancement:

A subculture of continual development is encouraged thru ISO 9001. Companies can find possibilities for innovation and sustainability upgrades, with a view to power lengthy-time period fulfillment, by the usage of routinely studying and upgrading their methods.

Supplier Connections:

An extra sustainable delivery chain may be ensured with the aid of taking part with providers who adhere to ISO 9001 or comparable requirements. In the deliver chain, providers that positioned sustainability and exceptional control first can help upholding moral ideas and uniformity.

Stakeholder Self-Assurance:

An ISO 9001 certification indicates a willpower to high-quality and customer pleasure. Establishing trust amongst stakeholders, along side investors, customers, and regulators, can foster enduring connections and business organization partnerships.

Accountability for the Environment:

Although the main goal of ISO 9001 is fantastic control, following its suggestions often consequences in more ecologically pleasant operations. Businesses help environmental sustainability not directly with the resource of cutting again on waste, strength use, and emissions.

Businesses in Ireland can provide a robust foundation for sustainable operations and be a part of financial achievement with social and environmental obligation via manner of implementing and upholding ISO 9001 standards.

What makes Factocert Ireland the pinnacle enterprise of ISO 9001 certification?

Our Ireland professionals for ISO 9001 Certification constantly supply first-rate effects. The corporation can operate with out the automatic call representations of each way leader. On a technique map, operations usually proceed on this way.

Dublin, Belfast, Cork, Derry, and Limericokay are just a few Irish cities in which ISO 9001 Consultants in Ireland Ltd specializes in imparting superb ISO 9001 consulting services. Audit registration, software program training, and different ISO Standards like ISO 22000, 17025, and 45001 are also furnished. Among different topics, the ones offerings cope with ISO 9001 requirements ranging from ISO 27001 to ISO 14001.

Ireland's ISO 9001 experts can gift fresh development opportunities. Factocert currently presents a free certification fee estimate.

For More Information, go to ISO 9001 certification in Ireland,

Related links:

ISO 13485 Certification in Ireland

CE MARK Certification Ireland

ISO 14001 Certification in Ireland

ISO 22000 Certification in Ireland

ISO 27001 Certification in Ireland

ISO 45001 Certification in Ireland

HALAL Certification in Ireland

ISO Certification in Ireland

ISO 9001 Certification in Ireland

0 notes

Text

Hollywood actors strike reaches 100th day

LOS ANGELES

While screenwriters are busy back at work, film and TV actors remain on picket lines, with the longest strike in their history set to hit 100 days on Saturday after talks broke off with studios. Here's a look at where things stand, how their stretched-out standoff compares to past strikes, and what happens next.

Hopes were high and leaders of the Screen Actors Guild-American Federation of Television and Radio Artists were cautiously optimistic when they resumed negotiations on Oct. 2 for the first time since the strike began 2 1/2 months earlier.

The same group of chief executives from the biggest studios had made a major deal just over a week earlier with striking writers, whose leaders celebrated their gains on many issues actors are also fighting for: long-term pay, consistency of employment and control over the use of artificial intelligence.

But the actors' talks were tepid, with days off between sessions and no reports of progress. Then studios abruptly ended them on Oct. 11, saying the actors' demands were exorbitantly expensive and the two sides were too far apart to continue.

“We only met with them a couple of times, Monday, half a day Wednesday, half a day Friday. That was what they were available for," SAG-AFTRA President Fran Drescher told The Associated Press soon after the talks broke off. "Then this past week, it was Monday and a half a day on Wednesday. And then “Bye bye. I’ve never really met people that actually don’t understand what negotiations mean. Why are you walking away from the table?"

The reasons, according to the Alliance of Motion Picture and Television Producers, included a union demand for a fee for each subscriber to streaming services.

“SAG-AFTRA gave the member companies an ultimatum: either agree to a proposal for a tax on subscribers as well as all other open items, or else the strike would continue," the AMPTP said in a statement to the AP. "The member companies responded to SAG-AFTRA’s ultimatum that unfortunately, the tax on subscribers poses an untenable economic burden.”

Netflix co-CEO Ted Sarandos, one of the executives in on the bargaining sessions, told investors on an earnings call Wednesday that “This really broke our momentum unfortunately."

SAG-AFTRA leaders said it was ridiculous to frame this demand as as though it were a tax on customers, and said it was the executives themselves who wanted to shift from a model based on a show's popularity to one based on number of subscribers.

“We made big moves in their direction that have just been ignored and not responded to,” Duncan Crabtree-Ireland, SAG-AFTRA's national executive director and chief negotiator, told the AP. "We made changes to our AI proposal. We made dramatic changes to what used to be our streaming revenue share proposal," Crabtree-Ireland said.

The studios said just after the talks broke off that the per-subscriber charge would cost them $800 million annually, a figure SAG-AFTRA said was a vast overestimate.

The AMPTP later responded that the number was based on a union request for $1 per customer per year, which was lowered to 57 cents after SAG-AFTRA changed its evaluation to cut out non-relevant programming like news and sports.

The actors are in unscripted territory, with no end in sight. Their union has never been on a strike this long, nor been on strike at all since before many of its members were born. Not even its veteran leaders, like Crabtree-Ireland, with the union for 20 years, have found themselves in quite these circumstances.

As they did for months before the talks broke off, members and leaders will rally, picket and speak out publicly until the studios signal a willingness to talk again. No one knows how long that will take. SAG-AFTRA says it is willing to resume at any time, but that won't change its demands.

“I think that they think that we’re going to cower,” Drescher said. “But that’s never going to happen because this is a crossroads and we must stay on course.”

The writers did have their own false start with studios that may give some reason for optimism. Their union attempted to restart negotiations with studios in mid-August, more than three months into their strike. Those talks went nowhere, breaking off after a few days. A month later, the studio alliance came calling again. Those talks took off, with most of their demands being met after five marathon days that resulted in a tentative deal that its members would vote to approve almost unanimously.

Hollywood actors strikes have been less frequent and shorter than those by writers. The Screen Actors Guild (they added the “AFTRA” in a 2011 merger) has gone on strike against film and TV studios only three times in its history.

In each case, emerging technology fueled the dispute. In 1960 — the only previous time actors and writers struck simultaneously — the central issue was actors seeking pay for when their work in film was aired on television, compensation the industry calls residuals. The union, headed by future U.S. President Ronald Reagan, was a smaller and much less formal entity then. The vote to strike took place in the home of actors Tony Curtis and Janet Leigh, the parents of current SAG-AFTRA member and vocal striker Jamie Lee Curtis.

Mid-strike, the actors and studios called a truce so all could attend the Academy Awards — a move forbidden under today’s union rules. Host Bob Hope called the gathering “Hollywood’s most glamorous strike meeting.”

In the end, a compromise was reached where SAG dropped demands for residuals from past films in exchange for a donation to their pension fund, along with a formula for payment when future films aired on TV. Their 42-day work stoppage began and ended all within the span of the much longer writers strike.

A 1980 strike would be the actors' longest for film and television until this year. That time, they were seeking payment for their work appearing on home video cassettes and cable TV, along with significant hikes in minimum compensation for roles. A tentative deal was reached with significant gains but major compromises in both areas. Union leadership declared the strike over after 67 days, but many members were unhappy and balked at returning to work. It was nearly a month before leaders could rally enough votes to ratify the deal.

This time, it was the Emmy Awards that fell in the middle of the strike. The Television Academy held a ceremony, but after a boycott was called, only one acting winner, Powers Boothe, was there to accept his trophy.

Other segments of the actors union have gone on strike too, including several long standoffs over the TV commercials contract. A 2016-2017 strike by the union's video game voice actors lasted a whopping 11 months. That segment of the union could strike again soon if a new contract deal isn't reached.

The return of writers has gotten the Hollywood production machine churning again, with rooms full of scribes penning new seasons of shows that had been suspended and film writers finishing scripts. But the finished product will await the end of actors strike, and production will remain suspended many TV shows and dozens of films, including “Wicked,” “Deadpool 3” and “Mission Impossible — Dead Reckoning Part 2.”

The Emmys, whose nominations were announced the same day the actors strike was called, opted to wait for the stars this time and move their ceremony from September to January, though that date could be threatened too.

The Oscars are a long way off in March, but the campaigns to win them are usually well underway by now. With some exceptions — non-studio productions approved by the union — performers are prohibited from promoting their films at press junkets or on red carpets. Director Martin Scorsese has been giving interviews about his new Oscar contender “ Killers of the Flower Moon.” Star and SAG-AFTRA member Leonardo DiCaprio hasn't.

0 notes

Text

What is Ireland Golden Visa Program?

Ireland introduced the idea of the Ireland Investment Immigration Programme in 2012 to allow non-EU/EEA people and their family members to get Irish citizenship. To get citizenship, one must make a sizable financial investment in Irish companies. This project aids in expanding employment opportunities and the Irish economy.

According to official documentation, investing in Ireland does not automatically bestow citizenship. Long-term residence in Ireland is provided, which is used to support citizenship applications in accordance with national naturalization laws through the best immigration lawyer in Ireland. Ireland Golden Visa is the name given to the investment visa for Ireland. Ireland citizenship through investment is only feasible through the acquisition of an Ireland Golden Visa.To qualify for the Irish Investment visa, a person must have a lawfully accumulated minimum net worth of € 2 million, or around Rs 14, 62, 40,100. The applicant must also be of excellent moral character and have no prior convictions or criminal histories elsewhere in the globe in order to qualify for a visa. Rules on whether investments are eligible for the Ireland Investment Program and who may apply for or obtain an Ireland Investment Visa are determined by the Irish Naturalization and Immigration Service (INIS) in conjunction with an evaluation committee.

Investment strategies that qualify a person for residency in Ireland will be certified by the Irish Immigrant Investor Program. According to the best immigration lawyer in Ireland, these permissible investments include:

Investment in Irish businesses for at least three years totaling at least €1 million.

An approved investment fund must have at least €1 million invested for at least three years.

Real estate investment trust: At least €2 million invested for at least three years in one or more qualifying REITs.

Donate at least €500,000 to a qualifying charity initiative in the fields of the arts, sports, health, culture, or education to establish an endowment.

Process for the Immigrant Investor Program in Ireland

Step 1: Locate a licensed immigration attorney in Ireland.

Step 2: Consult with a lawyer about citizenship and immigration alternatives in Ireland.

Step 3: Help your Irish immigration attorney collect all necessary supporting documentation.

Step 4: Submit an application to the Irish immigration authorities together with the necessary supporting materials, choosing one of the four investment alternatives. The application cost for the applicant and any accompanying family members, if any, is €1,500 and is non-refundable. Only during official intake "windows"—which happen five times a year and last around 25 days each—are applications accepted.

Step 5: Obtain the Immigration Ireland evaluation committee's acceptance of your application for an Ireland Golden Visa. The committee has been given permission to suggest that the Minister for Justice and Equality approve investment visa requests.

Step 6: The applicant must make the suggested investment and submit documentation of it when the Minister for Justice and Equality approves the proposal.

Step 7: Show proof of enough private health insurance.

Step 8: The Irish lawyer's submission of a certificate of good character. The police's declaration of good character in the original application is not the same as this criterion.

Step 9: Following formal confirmation of the investment, the applicant will be issued a two-year first resident permit in Ireland.

Ireland Long-Term Residency

Depending on the investment option they choose, investors can renew their residency permit after two years by providing proof that their investment has been kept up for the required holding time. The residency visa may be renewed for a further three years provided the investor's investment is still eligible, they are financially secure, of high moral character, and no charges of criminal behavior have been brought against them.

Citizenship through Investment in Ireland

The Ireland Immigrant Investor scheme was not a citizenship scheme; it was once a residence program. However, under the same conditions, one may petition for Irish citizenship. Immigrant investors may use the resident permit to assist them fulfil the residency requirements for Irish citizenship. The immigrant investors must have resided in Ireland for at least a year immediately prior to the application date and for four of the five years immediately prior to the application date in order to be eligible to apply for Irish citizenship by investment. "Residency" in this context refers to real physical presence in the nation. However, if a person travels outside the nation for both business and pleasure, they are still regarded as residents.

0 notes

Text

Ireland Investor Visa

Nationals from the non-EEA countries who want to make an approved investment in Ireland can apply for secure resident status in Ireland through the Immigrant Investor Programme for them and their families. Apply for an Ireland Visa from India under the Programmed Investment, with a minimum of €1,000,000 and this must be held or invested for a minimum of three years in either a single Irish business or a group of businesses.

The Advantages of applying for the most sought Ireland Visa from India in the investment program in Ireland you can gain citizenship for the main applicant and their families. in 2012, Ireland launched its first investment visa programme. It was improvised in 2013, and now applicants from outside the European Union can deposit a minimum of €2.0 million in an Approved Investment Fund and get an Irish residency by the sole means of investment is to secure a “Golden Visa” through the Irish Immigrant Investor Program. Investors must have a good reputation, a net worth of at least €2 million, and a spotless track record.

#STUDY VISA#WORK VISA#STUDENT VISA#STUDY ABROAD#WORK ABROAD#STUDY CONSULTANT#IMMIGRATION#VISA#IMMIGRATION SERVICES#VISA REQUIREMENTS#IRELAND INVESTOR VISA#IRELAND VISA#INVESTOR VISA#IRELAND INVESTMENT PROGRAM#IRELAND INVESTMENT VISA

0 notes

Text

The U.S. Debt Ceiling and Its Global Implications

Every country’s financial structure houses various integral concepts that dictate its economic narrative. One such pivotal yet complex concept is the ‘debt ceiling.’ Frequently appearing in U.S. financial news, the term ‘debt ceiling’ refers to the maximum limit set by Congress on the amount of national debt that the U.S. government can accrue to meet its financial obligations. The term ‘ceiling’ signifies a limit beyond which the national debt cannot extend.

What is the Debt Ceiling

The debt ceiling functions as a regulatory limit on the amount of national debt the U.S. Treasury can accrue to pay for the expenditures that Congress has already approved. It acts as a checkpoint to monitor and control government spending.

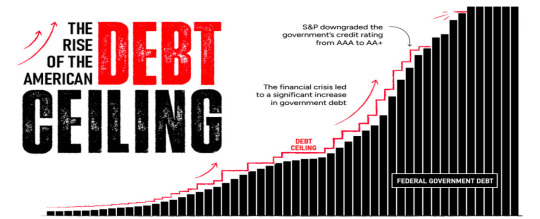

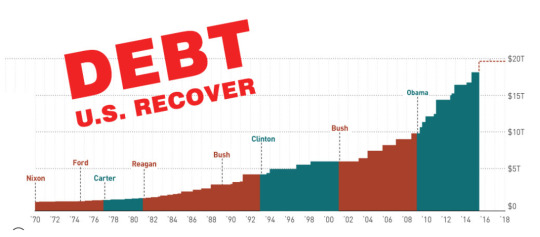

Over the past century, the debt ceiling has been raised or suspended multiple times, each change reflecting the evolving realities and necessities of government spending and borrowing. It’s an interesting dance between policy, spending, and repayment, and an essential cog in the wheel of U.S. financial mechanisms.

Why is the U.S. in Debt and Unable to Repay It?

Over the years, the U.S. has built up a colossal national debt, a daunting figure that’s largely the outcome of varied factors such as heavy government spending, enduring economic crises like the 2008 financial meltdown, the COVID-19 pandemic, and certain tax policies that have influenced the debt scenario.

The complex challenge of repaying this debt is deeply intertwined with the global economic structure’s complexities. While it’s easy to assume that the trade deficit, characterized by a higher import volume than export, contributes to the debt, it doesn’t directly add to the national debt. However, it does play a role in influencing the overall economic health of the nation and indirectly impacts the debt situation.

But, what are the reasons that the U.S. has hit the debt ceiling and is not able to overcome it?

Government Spending: The U.S. government spends substantially on various programs such as defence, healthcare, social security, and interest payments on the national debt. This spending often exceeds the government’s revenues, resulting in a deficit that adds to the national debt.

Economic Crises: Economic downturns often necessitate increased government spending to stimulate the economy and provide relief.

Tax Policies: Tax policies also play a role in the debt scenario. Tax cuts, while potentially stimulating economic growth, can decrease government revenue, thus increasing the deficit if not accompanied by corresponding reductions in government spending.

Interest Payments: As the national debt grows, so does the interest the government must pay on that debt. These interest payments can become a significant part of the budget, leaving less room for other spending priorities and creating a cycle that can cause the debt to grow even further.

Managing and repaying the U.S. debt is a complex issue that involves a careful balance of government spending and revenue, fiscal policy decisions, and managing the country’s economy in the context of a global economic system.

The Size and Scope of U.S. Debt

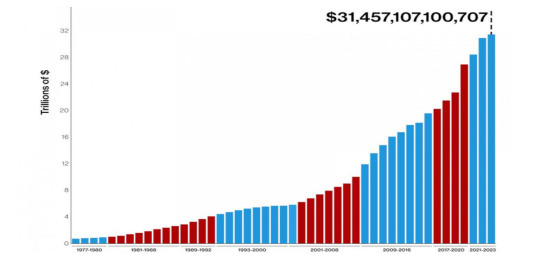

As of 2023, the U.S. national debt stands at a staggering $31.4 trillion, earning the country the status of being the world’s largest debtor.

Where Does the U.S. Borrow From?

The United States acquires debt by issuing Treasury securities like Treasury bonds, notes, and bills. These financial instruments are bought by a wide array of investors, including individuals, corporations, and foreign governments.

Who Are Its Biggest Lenders?

The U.S.’s most substantial debt holders on the international front are Japan and China. Other countries, including the United Kingdom, Brazil, and Ireland, also hold significant portions of U.S. debt. The United States owes Japan approximately $1.28 trillion, while China holds around $1.06 trillion of U.S. debt. The amounts owed to other lenders vary, typically falling into the range of billions of dollars.

Consequences of Hitting the Debt Ceiling

The U.S. hitting its debt ceiling can have significant global implications due to the interconnectedness of today’s global economy.

Here are some potential global consequences:

Impact on Global Markets: The U.S. Treasury market is the largest and most liquid bond market in the world. If the U.S. defaults on its debt obligations, it could cause widespread volatility in global markets. Investors, both domestic and foreign, might start doubting the creditworthiness of the U.S., causing a sell-off of U.S. Treasury securities that could disrupt financial markets worldwide.

Currency Fluctuations: The U.S. dollar is the world’s primary reserve currency, meaning many countries hold it in large quantities to carry out international trade. A U.S. debt default could weaken the dollar, leading to currency fluctuations and economic instability globally.

Global Economic Slowdown: The U.S. economy plays a vital role in driving global growth. Any economic disruption in the U.S., like a recession triggered by a debt default, could have a domino effect on the world economy, potentially leading to a global economic slowdown or recession.

Impact on Foreign Debt Holders: Countries like China and Japan, which hold significant amounts of U.S. debt, could face losses if the U.S. were to default. This could impact their economic stability.

Reduced Confidence in Global Financial System: The U.S. is seen as a global economic leader, and its debt is considered one of the safest investments. A debt default could shake confidence in the global financial system, leading to economic uncertainty and reduced investment.

Potential for Increased Borrowing Costs: If a U.S. default leads to a downgrade in its credit rating, borrowing costs for the U.S. could increase, which could then impact borrowing costs globally. This could make it more expensive for governments, businesses, and individuals worldwide to borrow money.

Here are some potential individual consequences:

In short, the U.S. hitting its debt ceiling and potentially defaulting on its debt repayments could have serious, far-reaching consequences for the global economy. It highlights the need for prudent fiscal policy not only for the U.S. but for economies around the globe. But, what will the citizens of the U.S. face because of hitting its debt ceiling?

The wrangling over the debt ceiling can create economic uncertainty, negatively impacting consumer and business confidence. This can lead to reduced business investments, job cuts, and slower economic growth.

The government might have to make tough choices about which bills to pay. This could put programs like Social Security, Medicare, and military pensions at risk, directly affecting the citizens dependent on these programs.

The uncertainty and the potential for increased government borrowing costs can trickle down to the public in the form of higher interest rates for mortgages, auto loans, student loans, and credit cards.

The debate and uncertainty surrounding the debt ceiling often lead to stock market volatility. This can affect the retirement savings and investment portfolios of everyday Americans.

The Domino Effect: Recession and Layoffs

The repercussions of the U.S. hitting its debt ceiling can go far beyond its own borders, owing to the country’s significant role in the global economy. A notable concern is the potential for a worldwide economic recession and the dreaded consequence – mass layoffs.

As the keystone of global markets, the U.S. economy’s health directly influences financial currents worldwide.

Imagine this: the U.S., unable to lift its debt ceiling, defaults on its debt. This scenario would unsettle financial markets and could seriously undermine investors’ confidence. The ensuing decline in investments can ripple through economies, leading businesses to scale back or shut down, manifesting the dire reality of layoffs.

A U.S. default could also send shockwaves through economies heavily reliant on exporting to the U.S. A debt default could trigger a contraction in the U.S. economy, causing a slump in demand for imports. As a result, these export-dependent economies may see their growth slow down, potentially leading to job cuts in various sectors.

A U.S. debt default could create a ripple effect in global interest rates. As investors’ confidence shakes, they may demand higher returns to compensate for the increased risk, causing a surge in global interest rates. This increase in borrowing costs can hurt businesses and households, leading to a decline in spending, further slowing economic growth, and potentially driving more layoffs.

How Will the U.S. Recover from This Debt?

Recovering from such an overwhelming amount of debt is a long-term and complex process. It requires the implementation of severe cost-cutting measures, comprehensive tax reforms, and strategies to stimulate economic growth.

An integral part of this process is maintaining fiscal discipline to prevent uncontrolled debt accumulation. However, these measures must be carefully balanced to ensure that they don’t hinder economic growth or place an unfair burden on the nation’s citizens.

Read more at: https://dsb.edu.in/the-us-debt-ceiling-and-its-global-implications/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+us+debt

#USDebtCeiling#GlobalImplications#EconomicImpact#FinancialMarkets#USFiscalPolicy#DebtCrisis#EconomicOutlook#FinancialStability#GovernmentShutdown#GlobalEconomy#USDollar#TradeTensions#MonetaryPolicy#BudgetDeficit#EconomicForecast#india#fintech#jobs#banking#education#google#ai#blockchain

0 notes

Text

What are the programs under Ireland Business Visa?

Ireland Business Immigration is a mélange of excellent business pathways that caters to all business people. The visa has a popular investor visa, startup visa, and a unique Critical skills visa for entrepreneurs. With long-term residency, the applicant can opt for permanent residency by meeting residency requirements.

0 notes

Text

Starting Your Own Business in Ireland: The Sherpha Success Story

Starting your own business is an exhilarating venture that requires careful planning, determination, and adaptability. In this blog post, we will explore the inspiring success story of Sherpha, an innovative startup that made waves in Ireland's business landscape. From understanding the Irish startup ecosystem to overcoming challenges and achieving growth, Sherpha's journey offers valuable insights for aspiring entrepreneurs looking to launch their own business in the Emerald Isle.

1. The Irish Startup Ecosystem

Ireland has emerged as a thriving hub for startups, offering a conducive environment for entrepreneurs. With its strong economy, skilled workforce, supportive government policies, and access to the European Union market, Ireland presents a myriad of opportunities for those looking to transform their business ideas into reality. Understanding the local ecosystem is crucial for setting the right foundation for your startup, just as Sherpha did.

2. Introducing Sherpha: The Idea That Took Flight

Sherpha, a brainchild of Jane O'Malley and Michael Byrne, was born out of a passion for revolutionizing education. They envisioned a technology-driven platform that would provide personalized online learning experiences to students of all ages. Their ambition was to make quality education accessible to every learner, and thus, Sherpha was born.

3. Research and Planning

Like any successful startup, Sherpha began with extensive research and planning. Market analysis, competitor research, and identifying their unique selling proposition were among the key elements that shaped their business model. This stage laid the groundwork for a solid business strategy and helped them navigate potential challenges.

4. The Power of Networking

Building a network of like-minded entrepreneurs, mentors, and industry experts can prove invaluable for any startup. Sherpha actively participated in local startup events, networking meetups, and accelerator programs, allowing them to gain insights, seek guidance, and form collaborations that accelerated their growth.

5. Securing Funding and Resources

Starting a business often requires capital investment. Sherpha diligently explored various funding options, such as government grants, angel investors, and venture capital. By showcasing a strong business plan and the potential impact of their educational platform, they successfully secured the necessary funding to kickstart their venture.

6. Navigating Regulatory and Legal Matters

Complying with legal and regulatory requirements is essential for any startup to operate smoothly. Sherpha ensured they had all the necessary licenses and registrations in place, enabling them to focus on their core business activities without legal hurdles.

7. Embracing Innovation and Technology

As an ed-tech startup, Sherpha understood the transformative power of technology. They constantly innovated their platform, leveraging the latest advancements in online learning to provide a seamless experience to their users. Embracing technology not only enhanced their offerings but also positioned them as industry leaders.

8. Marketing and Branding

Effective marketing and branding are critical for gaining visibility and attracting customers. Sherpha invested in building a strong brand identity and executed targeted marketing campaigns to reach their target audience. They utilized social media, content marketing, and word-of-mouth referrals to create a buzz around their platform.

9. Overcoming Challenges

No startup journey is without challenges. Sherpha encountered obstacles such as scaling their operations, managing cash flow, and dealing with competitors. However, they remained resilient and adaptable, learning from each hurdle and emerging stronger.

10. Scaling Up and Going Global

Sherpha's commitment to excellence and continuous improvement earned them a loyal user base in Ireland and beyond. With a scalable business model and a solid reputation, they successfully expanded their operations to reach a global audience, making a significant impact on the international education scene.

Starting your own business in Ireland can be a rewarding experience, especially when armed with a compelling idea, dedication, and a willingness to embrace challenges. Sherpha's journey from a startup to an influential ed-tech company demonstrates the potential for success in Ireland's vibrant startup ecosystem. By learning from their experience and applying the right strategies, you too can embark on a remarkable entrepreneurial journey, just like Sherpha. So, take the plunge, chase your dreams, and make a mark in the thriving business landscape of Ireland.

1 note

·

View note

Text

India and 159 Other Nations Lose Their Ability to Enter Indonesia without a Visa

In a significant policy change, travelers planning a visit to Indonesia will now be required to obtain a visa. The Indonesian government has recently suspended the visa-free entry privilege for 159 countries, including India, as a measure to ensure public order and mitigate the risk of disease transmission from non-WHO-certified nations.

Visa-Free Travel Suspended for 159 Countries, Including India

The Ministry of Law and Human Rights, in accordance with concerns over public order disruptions and the potential health risks, has issued an order to halt visa-free travel to Indonesia. This decision aims to address the need for strict regulation and control over incoming visitors. Consequently, the number of policy recipients has been reset to align with this new regulation.

Exceptions for ASEAN Member Nations

It's important to note that the ASEAN member nations, which include Brunei, the Philippines, Cambodia, Laos, Malaysia, Myanmar, Singapore, Thailand, Timor-Leste, and Vietnam, are exempt from this visa requirement. Nationals from these countries only need a valid passport and a confirmed flight out of Indonesia to enjoy a stay of up to 30 days. However, should they wish to extend their stay, they have the option of selecting from the various immigration visas available, such as e-VOA (Electronic Visa on Arrival), Visit Visa, or Limited Stay Visa, as reported by Bali Times.

Visa Application Process for Non-ASEAN Nations

For travelers hailing from the 159 countries not exempt from the visa requirement, a visa application is mandatory before their arrival in Indonesia. These countries, as listed by Kompas.com, include Albania, Algeria, Andorra, Angola, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bhutan, Bolivia, Botswana, Brazil, Bulgaria, Burkina Faso, Burundi, Czech Republic, Chad, Chile, Denmark, Dominica, Ecuador, Estonia, Fiji, Finland, Gabon, Gambia, Georgia, Ghana, Grenada, Guatemala, Guyana, Haiti, Honduras, Hungary, Hong Kong, India, Ireland, Iceland, and many more.

Exploring the Beauty of Indonesia

Despite the changes in visa requirements, Indonesia remains a welcoming destination for travelers from all over the world, offering an abundance of stunning islands to explore. Whether it's a romantic honeymoon in Bali or the bustling urban experience in Jakarta and Yogyakarta, Southeast Asia has much to offer.

Visas for Digital Nomads and Property Investors

Indonesia also caters to digital nomads seeking to establish a residence in Bali. Additionally, the government has announced a golden visa program designed for individuals interested in investing in the country through property ownership. This program provides an opportunity for those who wish to contribute to Indonesia's growth and development through long-term investments.

Conclusion

With the recent visa policy changes, it is essential for travelers to familiarize themselves with the new regulations before planning a visit to Indonesia. While the visa-free entry privilege has been suspended for most nations, including India, the country continues to welcome visitors from around the world, offering diverse experiences and opportunities to explore its natural beauty and cultural heritage.

For more information visit @ https://satgurutravel.com/india-and-159-other-nations-lose-their-ability-to-enter-indonesia-without-a-visa/

0 notes

Text

The Federal Reserve Hold Treasury Bonds

The general populace holds over $22 trillion of the national debt. A substantial amount of the public debt is held by foreign governments. In contrast, the balance is held by American banks and investors, the Federal Reserve, state and local governments, mutual funds, pension funds, insurance companies, and holders of savings bonds. In a quarterly Treasury bulletin, the Treasury breaks down who owns how much of the public debt. According to its September 2021 bulletin, which comprised statistics through March 2021, foreign and international investors held almost $7 trillion. $1.17 trillion was held by state and local governments, whereas $3.6 trillion was held by mutual funds. Other holders of public debt include individuals, government-sponsored companies, brokers and dealers, banks, bank personal trusts and estates, corporate and non-corporate firms, and other investors.

The Federal Reserve Hold Treasury Bonds

Note that the public's share of the national debt is made up of more than Treasury bills, notes, and bonds. Treasury Inflation-Protected Securities, as well as certain State and local government series securities, contain it. When you add Social Security debt to all the retirement and pension accounts, you'll find that about half of the US Treasury debt is held in trust for retirement. If the United States defaulted on its debt, current and future pensioners would be the hardest hit.

As the country's central bank, the Federal Reserve is in control of the country's credit. It has no financial need to hold Treasury bills. So, why does it do it? Between 2007 and 2014, the Federal Reserve's assets more than tripled. In response to the financial crisis of 2008, the Fed increased open market operations by purchasing bank-owned mortgage-backed securities. In 2009, the Fed began buying US Treasury bonds. By 2011, it had amassed $1.6 trillion in assets, reaching a peak of $2.5 trillion in 2014. Quantitative easing (QE) boosted the economy by lowering interest rates and flooding the financial markets with cash. It ensured that firms could continue to borrow at low rates for operations and expansion. The Fed used to credit it generated out of thin air to buy Treasurys from its member banks. It had the same impact as if money had been printed. By keeping interest rates low, the Fed assisted the government in avoiding the high-interest rate penalty that would have been imposed if it had taken on too much debt. Important: In October 2014, the Federal Reserve announced the conclusion of its quantitative easing program. As a result, 10-year Treasury note interest rates jumped from a 200-year low of 1.43 percent in July 2012 to roughly 2.17 percent by the end of 2014. In 2017, the Federal Open Market Committee (FOMC) announced that the Fed would begin to reduce its Treasury holdings. It did, however, buy Treasurys again a few years later. The Federal Reserve stated on March 15, 2020, that it would buy $500 billion in US Treasury bonds and $200 billion in mortgage-backed securities over the next few months. On March 23, 2020, the FOMC increased QE purchases to an unlimited amount. By May 2021, its financial sheet had expanded to $8.76 trillion. Foreign ownership of US debt is currently at an all-time high. In July 2021, Japan held $1.32 trillion in US Treasury bonds, making it the country's largest foreign debt holder. China is the second-largest holder, with $1.07 trillion in US debt. Both Japan and China want the dollar to remain higher in value than their own currencies. This allows them to keep their exports to the United States affordable, allowing their economies to thrive. When China boosted its holdings to $699 billion in 2006, it surpassed the United Kingdom as the second-largest foreign holder. With $579.8 billion, the United Kingdom is the third-largest holder. As the effects of Brexit continue to wreak havoc on the country's economy, its holdings have risen in rank. Ireland is next, with $324.3 billion in its coffers. The top ten include Luxembourg, Switzerland, the Cayman Islands, Brazil, Taiwan, and France.

The total public debt held by other countries, the Federal Reserve, mutual funds, and other businesses and individuals, as well as intragovernmental holdings held by Social Security, the Military Retirement Fund, Medicare, and other retirement funds, makes up the US national debt. Many people believe that much of the US national debt is owed to foreign countries such as China and Japan, but the truth is that the majority of it is owed to US Social Security and pension systems. This means that Americans own the majority of the national debt.Economists and legislators routinely discuss the optimal level of the national debt. Most people agree that some debt is important to drive economic growth and that debt can become a problem at some point, but they disagree about where that point is. If the debt grows too large, government programs will be eliminated, taxes will be raised, and the economy will suffer.

The national debt and the deficit are inextricably linked. A budget deficit occurs when the federal government spends more money than it receives in tax revenues. This imbalance must be filled by borrowing additional money, which adds to the debt.

Andrew Jackson paid off the nation's interest-bearing debt in 1835. He is the first and only president to accomplish so.

0 notes

Text

Farmland Is Valuable, But Shopping For It's Tricky For Fund Buyers The Brand New York Times

It is made up of cooperative banksand associations who present credit score to individuals and businesses all through the United States. The FCS assists the rural neighborhood and organizations of all kinds and sizes, ranging from small household farms to firms with world operations. Golden State Farm Credit has a Funds Held account program, which is an interest-bearing trust held funds account that offers a market-competitive cash administration option for debtors. By establishing a Funds Held account, you can hold your money liquid on your agriculture working needs while additionally incomes a market rate of return.

When determining the ERP components, analysis was carried out to guarantee that payments don't exceed obtainable funding and, in combination throughout all producers, don't exceed 90 percent of losses, as required by the Extending Government Funding and Delivering Emergency Assistance Act. The distinction between the ERP payment issue for crop insurance and NAP is due to variations in the out there coverage ranges. Crop insurance is out there on the catastrophic coverage level funds held and buy-up coverage ranges . NAP is limited by regulation to a most of sixty five p.c buy-up coverage. For both NAP and crop insurance, the ERP fee issue for the catastrophic and maximum buy-up ranges are 75 p.c and 95 % respectively, with the ERP elements stair-stepping for the buy-up choices in-between as proven within the tables above. Payment limits and different reductions will cut back ERP payments, further reducing the % of losses lined.

Farm Credit debtors turn into homeowners of their native Farm Credit establishment, which supplies them the proper to elect peers that can represent their interests as board members. It means borrowers have a personal stake not merely in their own loan, but within the System. We consider this contributes to accountable stewardship of the System's resources. The Farm Credit System doesn't ag funds held concern an ESG report right now. The System formed an ESG Work Group in 2021 to coordinate alignment across Farm Credit System committees, to research and suggest ESG measurement and modeling methodologies, and to make sure broad awareness of ESG actions throughout the Farm Credit System. The progress and findings of this work group will assist us determine the potential for a consolidated, Systemwide ESG report.

We handle agriculture investments to attain key priorities of our sustainability and responsible investing program, sustainably managing the sources entrusted to us and supporting climate change mitigation across our farmland. Agriculture investments have a protracted historical past of generating strong monetary results. The low correlation of farmland returns with the returns of different courses implies that farmland can provide diversification benefits within investor portfolios. Farmland investments may offer moderate inflation protection. Each of those umbrella entities has been approved in Ireland as a UCITS Fund and certain Funds have been licensed for public sale in certain jurisdictions throughout the European Economic Area (“EEA”), United Kingdom and Switzerland. No Fund is currently or is predicted to be approved for public sale in some other jurisdiction, and thus could solely be sold under applicable private placement rules.

Sustainable production practices contain a wide range of approaches. Specific methods must bear in mind topography, soil characteristics, local weather, pests, native availability of inputs and the individual grower's goals. Making the transition to sustainable agriculture is a process. The 2014 Farm Bill created ACEP by combining WRP, FRPP, and GRP, which Congress first approved within the 1990, 1996, and 2002 Farm Bills, respectively.The 2018 Farm Bill retained ACEP with only a few policy modifications and largely restored funds reduce within the 2014 Farm Bill. For grasslands of particular environmental significance, NRCS may contribute as a lot as seventy five percent of the truthful market worth of the easement.

0 notes