#IPO 2019

Explore tagged Tumblr posts

Text

No, Uber's (still) not profitable

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Bezzle (n): 1. "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it" (JK Gabraith) 2. Uber.

Uber was, is, and always will be a bezzle. There are just intrinsic limitations to the profits available to operating a taxi fleet, even if you can misclassify your employees as contractors and steal their wages, even as you force them to bear the cost of buying and maintaining your taxis.

The magic of early Uber – when taxi rides were incredibly cheap, and there were always cars available, and drivers made generous livings behind the wheel – wasn't magic at all. It was just predatory pricing.

Uber lost $0.41 on every dollar they brought in, lighting $33b of its investors' cash on fire. Most of that money came from the Saudi royals, funneled through Softbank, who brought you such bezzles as WeWork – a boring real-estate company masquerading as a high-growth tech company, just as Uber was a boring taxi company masquerading as a tech company.

Predatory pricing used to be illegal, but Chicago School economists convinced judges to stop enforcing the law on the grounds that predatory pricing was impossible because no rational actor would choose to lose money. They (willfully) ignored the obvious possibility that a VC fund could invest in a money-losing business and use predatory pricing to convince retail investors that a pile of shit of sufficient size must have a pony under it somewhere.

This venture predation let investors – like Prince Bone Saw – cash out to suckers, leaving behind a money-losing business that had to invent ever-sweatier accounting tricks and implausible narratives to keep the suckers on the line while they blew town. A bezzle, in other words:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

Uber is a true bezzle innovator, coming up with all kinds of fairy tales and sci-fi gimmicks to explain how they would convert their money-loser into a profitable business. They spent $2.5b on self-driving cars, producing a vehicle whose mean distance between fatal crashes was half a mile. Then they paid another company $400 million to take this self-licking ice-cream cone off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Amazingly, self-driving cars were among the more plausible of Uber's plans. They pissed away hundreds of millions on California's Proposition 22 to institutionalize worker misclassification, only to have the rule struck down because they couldn't be bothered to draft it properly. Then they did it again in Massachusetts:

https://pluralistic.net/2022/06/15/simple-as-abc/#a-big-ask

Remember when Uber was going to plug the holes in its balance sheet with flying cars? Flying cars! Maybe they were just trying to soften us up for their IPO, where they advised investors that the only way they'd ever be profitable is if they could replace every train, bus and tram ride in the world:

https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

Honestly, the only way that seems remotely plausible is when it's put next to flying cars for comparison. I guess we can be grateful that they never promised us jetpacks, or, you know, teleportation. Just imagine the market opportunity they could have ascribed to astral projection!

Narrative capitalism has its limits. Once Uber went public, it had to produce financial disclosures that showed the line going up, lest the bezzle come to an end. These balance-sheet tricks were as varied as they were transparent, but the financial press kept falling for them, serving as dutiful stenographers for a string of triumphant press-releases announcing Uber's long-delayed entry into the league of companies that don't lose more money every single day.

One person Uber has never fooled is Hubert Horan, a transportation analyst with decades of experience who's had Uber's number since the very start, and who has done yeoman service puncturing every one of these financial "disclosures," methodically sifting through the pile of shit to prove that there is no pony hiding in it.

In 2021, Horan showed how Uber had burned through nearly all of its cash reserves, signaling an end to its subsidy for drivers and rides, which would also inevitably end the bezzle:

https://pluralistic.net/2021/08/10/unter/#bezzle-no-more

In mid, 2022, Horan showed how the "profit" Uber trumpeted came from selling off failed companies it had acquired to other dying rideshare companies, which paid in their own grossly inflated stock:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

At the end of 2022, Horan showed how Uber invented a made-up, nonstandard metric, called "EBITDA profitability," which allowed them to lose billions and still declare themselves to be profitable, a lie that would have been obvious if they'd reported their earnings using Generally Accepted Accounting Principles (GAAP):

https://pluralistic.net/2022/02/11/bezzlers-gonna-bezzle/#gryft

Like clockwork, Uber has just announced – once again – that it is profitable, and once again, the press has credulously repeated the claim. So once again, Horan has published one of his magisterial debunkings on Naked Capitalism:

https://www.nakedcapitalism.com/2023/08/hubert-horan-can-uber-ever-deliver-part-thirty-three-uber-isnt-really-profitable-yet-but-is-getting-closer-the-antitrust-case-against-uber.html

Uber's $394m gains this quarter come from paper gains to untradable shares in its loss-making rivals – Didi, Grab, Aurora – who swapped stock with Uber in exchange for Uber's own loss-making overseas divisions. Yes, it's that stupid: Uber holds shares in dying companies that no one wants to buy. It declared those shares to have gained value, and on that basis, reported a profit.

Truly, any big number multiplied by an imaginary number can be turned into an even bigger number.

Now, Uber also reported "margin improvements" – that is, it says that it loses less on every journey. But it didn't explain how it made those improvements. But we know how the company did it: they made rides more expensive and cut the pay to their drivers. A 2.9m ride in Manhattan is now $50 – if you get a bargain! The base price is more like $70:

https://www.wired.com/story/uber-ceo-will-always-say-his-company-sucks/

The number of Uber drivers on the road has a direct relationship to the pay Uber offers those drivers. But that pay has been steeply declining, and with it, the availability of Ubers. A couple weeks ago, I found myself at the Burbank train station unable to get an Uber at all, with the app timing out repeatedly and announcing "no drivers available."

Normally, you can get a yellow taxi at the station, but years of Uber's predatory pricing has caused a drawdown of the local taxi-fleet, so there were no taxis available at the cab-rank or by dispatch. It took me an hour to get a cab home. Uber's bezzle destroyed local taxis and local transit – and replaced them with worse taxis that cost more.

Uber won't say why its margins are improving, but it can't be coming from scale. Before the pandemic, Uber had far more rides, and worse margins. Uber has diseconomies of scale: when you lose money on every ride, adding more rides increases your losses, not your profits.

Meanwhile, Lyft – Uber's also-ran competitor – saw its margins worsen over the same period. Lyft has always been worse at lying about it finances than Uber, but it is in essentially the exact same business (right down to the drivers and cars – many drivers have both apps on their phones). So Lyft's financials offer a good peek at Uber's true earnings picture.

Lyft is actually slightly better off than Uber overall. It spent less money on expensive props for its long con – flying cars, robotaxis, scooters, overseas clones – and abandoned them before Uber did. Lyft also fired 24% of its staff at the end of 2022, which should have improved its margins by cutting its costs.

Uber pays its drivers less. Like Lyft, Uber practices algorithmic wage discrimination, Veena Dubal's term describing the illegal practice of offering workers different payouts for the same work. Uber's algorithm seeks out "pickers" who are choosy about which rides they take, and converts them to "ants" (who take every ride offered) by paying them more for the same job, until they drop all their other gigs, whereupon the algorithm cuts their pay back to the rates paid to ants:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

All told, wage theft and wage cuts by Uber transferred $1b/quarter from labor to Uber's shareholders. Historically, Uber linked fares to driver pay – think of surge pricing, where Uber charged riders more for peak times and passed some of that premium onto drivers. But now Uber trumpets a custom pricing algorithm that is the inverse of its driver payment system, calculating riders' willingness to pay and repricing every ride based on how desperate they think you are.

This pricing is a per se antitrust violation of Section 2 of the Sherman Act, America's original antitrust law. That's important because Sherman 2 is one of the few antitrust laws that we never stopped enforcing, unlike the laws banning predator pricing:

https://ilr.law.uiowa.edu/sites/ilr.law.uiowa.edu/files/2023-02/Woodcock.pdf

Uber claims an 11% margin improvement. 6-7% of that comes from algorithmic price discrimination and service cutbacks, letting it take 29% of every dollar the driver earns (up from 22%). Uber CEO Dara Khosrowshahi himself says that this is as high as the take can get – over 30%, and drivers will delete the app.

Uber's food delivery service – a baling wire-and-spit Frankenstein's monster of several food apps it bought and glued together – is a loser even by the standards of the sector, which is unprofitable as a whole and experiencing an unbroken slide of declining demand.

Put it all together and you get a picture of the kind of taxi company Uber really is: one that charges more than traditional cabs, pays drivers less, and has fewer cars on the road at times of peak demand, especially in the neighborhoods that traditional taxis had always underserved. In other words, Uber has broken every one of its promises.

We replaced the "evil taxi cartel" with an "evil taxi monopolist." And it's still losing money.

Even if Lyft goes under – as seems inevitable – Uber can't attain real profitability by scooping up its passengers and drivers. When you're losing money on every ride, you just can't make it up in volume.

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

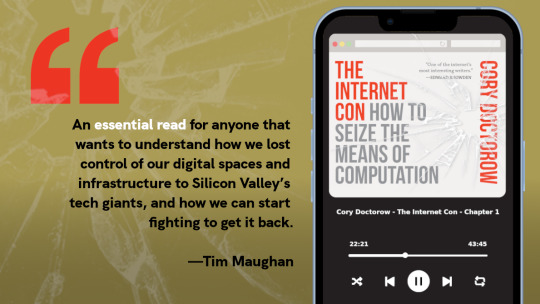

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#bezzles#hubert horan#uber#rideshare#accounting tricks#financial engineering#late-stage capitalism#narrative capitalism#lyft#transit#uber eats#venture predation#algorithmic wage discrimination

1K notes

·

View notes

Text

Introducing MJS 🩷🧡🤎

I go by M here. I’m a 33 year old female who is married to my Boss. We still work together and live a very comfortable lifestyle. I am of German-Scottish decent 5’4” and thin but with beautiful DD breasts and an ass that brings the boys to the yard 🍑. I love to cook and workout but I also have fears that fill my head. Is it too late to start a family? Am I missing out on life being an introvert? Do I look fat in this?

My first love is my husband J. He is 42 and gorgeous. 6’0” Irish-German heritage with a beautiful man body and a tight little ass that I can’t help from trying to stick my finger in when I walk by (girls you know.) When I say J is the boss I mean he is also A BOSS. In the working world he is a cut-throat shark who takes companies and prepares them for IPOs. We first met in 2019 as he was joining my company. We hit off right away but tried for months to be good…but by the time COVID hit it became unbearable. So we fucked. And we fucked. And we fucked. And we realized something about one another. In the office we are the opposite of what we are in the bedroom. At work I am at the bottom…while in bed I am in charge. At work he is “Mr J” in designer suits and a Rolex watch…while in bed he’s my bottom. He loves to be pegged, restrained, locked, humiliated and more…which leads us to S.

S is 36 and is my Second love. And by Second love I don’t mean I love him less than my husband. We fell in love about a year ago after J and I met him at a bar in Manhattan. He’s 6’3 African American with massive hands and cock that literally made me spit my drink the first time I saw it. He has the most beautiful eyes I’ve ever seen and pierced nipples 🤤. He’s also bi-sexual. S spent 6 months in jail at 19 and the experience made him realize an attraction to other men. Submissive men. Which is exactly what J is. S quit his job last October and moved from New York to live with us. Because of J’s unique career, S does odd jobs like driver, security and personal trainer for both of us.

I started this blog initially to meet other couples or singles in our home state of Massachusetts, but after talking to my therapist, decided this would be a good place to journal and express myself. 🩷🧡🤎

2 notes

·

View notes

Note

What are your thoughts on BTS's future and TK's future with BTS? I have a gut feeling BTS aren't going to reconvene in 2025. Especially with Bang's uncertainty shown in the press conference.

Maybe TK aren't re-signing? Idk what to think

Ok this ask has been in my drafts for nearly a fortnight. Firstly, I wanted to apoligise to the original sender that it took me this long to get sorted. Last week was busy with work and I've also had to deal with a tonne of asks too. So apologies.

This post is also F.A.O. @nonalisa @lullaby-of-taekook @taekookgotjamz who asked about my thoughts so to you and the rest of you...

First, I'll give a bit of context and then my thoughts on what might be happening now and could happen in the future....

First, the context:

This will be broken up into 3 parts...

2018 & the 2020 contract

Fake Rumours about contracts and lack of support

What HYBE are saying

2018 & the New 2020 contract.

We can't talk about the future without looking back to the previous renegotiation.

In 2017, BTS were close to breaking point and in early 2018 contemplating disbandment. Under this cloud BigHit initiated negotiations with BTS, over several months the boys renegotitated there second phase contract, due to start in June 2020, and most likely an adjustment to the then current contract.

I have speculated that BTS, and in particular Taekook, used Dispatch to hint at them being a couple as form of contract negotiation.

Whatever happened BTS re-signed.

It should be noted that BH suggested that BTS use their own lawyers and even to consult with their parents about the contract proposals.

I feel the new contract afforded BTS a lot more autonomy and control over their futures, content and lives. First indications of this was the two-month break in 2019.

It's clear from June 2020 there is a stark change in how the boys are presented and how they interact both in front and behind the camera.

Most reports indicated that the new contract was until 2026

Major news outlets would not report that date unless it came directly from BH.

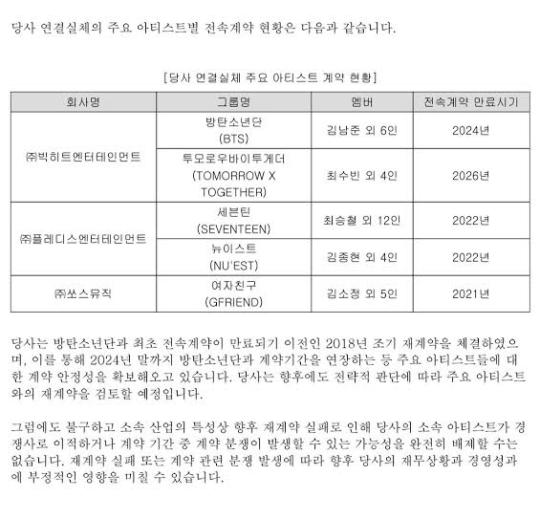

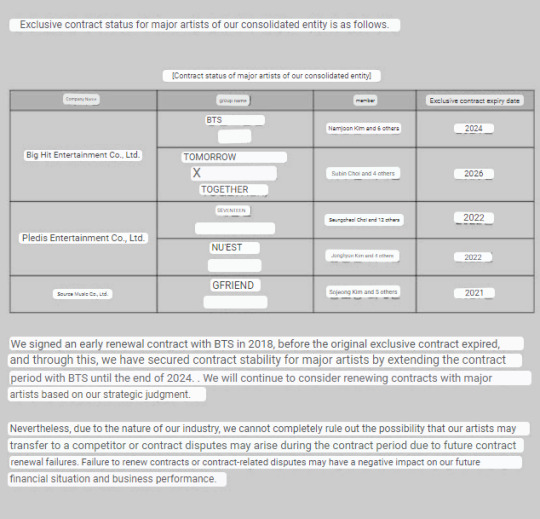

Then in 2020 during the IPO of BH on the Korean Stock Market, this came out...

So why the two dates? My initial thought was a 5 year contract with an option to extent for 2 years. However, I now think the answer is a lot simpler, BTS signed a 5 year deal which factored in 2 year time out for military enlistment, so there would be an automatic extension to 2026, hence why nearly all news outlets in 2018 mention this obvious press release date.

The Fake Rumour(s) about Contracts

Between June 2020 and now amongst some Taekookers and solo stans there is a perception that HYBE is sideling and not supporting Tae and JK.

Then, in Jan 2023, a Taekook twitter account started circulating a "blind item" claiming to be from October 2020 about how 5 members of BTS had re-signed/extended their contract, but 1 member hadn't, and another was supportive of them (despite there being not a single shred of evidence of such a blind item existing back in 2020)...

Then BANG! on 11th February, on the well-known blind item website CrazyDaysCrazyNights, the exact same blind item resurfaced but with 2023 twist that set out to villainise HYBE and Scooter Braun...

My guess, because people can submit gossip to CDCN, someone did this recently for this blind.

Following it's posting, it was clear that some Taekookers and Solo JK/Tae Stans used this blind as justification for their fav's perceived lack of support from the company (despite that not exactly being the case) and ongoing assumption that Taekook were the only ones who hadn't re-signed, and will not enlist and would leave BH after 2024. Obviously forgetting that not a few days earlier they claimed this all happened back in 2020. Odd that isn't it....

These rumours were initially compounded by JK's Lives on Weverse, where he talks about not working on his album that he's not doing much. Then within days, we hear about Tae's work and promotion of it, as well as JK going to work and rumours of a BA with Calvin Klein.

HYBE, BigHit and Band PD....

As the speculation grew - within the fandom about how supposedly some of the members, particularly Taekook weren't getting the same level of support from the company - we suddenly start seeing statements and interviews, reiterating that the company supports all members in their solo projects.

In particular, Bang PD does an interview and conference where he talks about the future of K-Pop. He specifically mentioned BTS and that they are currently in contract renewal talks with BH. So unlike the blind all the members are currently negotiating their new contract, but it's likely nothing will resolve until BTS return from enlistment.

My thoughts...

I'll break this down into BTS as a whole and what might be the key points in the contract talks, then look briefly at Taekook.

BTS

BTS back in 2018 decided to renegotiate together as 1 and got a new contract as a collective. That contract I think gave them a lot more freedom, control and opportunities for solo activities until 2024/26 from June 2020.

During this new contract negotiation, which likely started last year, it's clear they're doing the same thing. We know this because RM stated it in his Live the other day. I think the catch up with Jin last week, whilst was about catching up with him it was also about the new contract. RM also stated it would be resolved until they all return from the military.

I think the new contract is about allowing BTS to create music and go on tours together every few years and in between allow them to grow as soloists too. As well as, giving them even more control over their time and music.

This is where a new BTS Label, separate from BigHit and HYBE, could come into play. It will be like what Apple Records was like for the Beatles. However, this may be the biggest sticking point for HYBE, it would be predominantly owned by BTS, with HYBE as a minority shareholder. I also wonder if BTS want their Masters, as this would increase their control. I think HYBE want to retain as much control/profit as the can from BTS, but obviously the boys want more of that for themselves too. So, I think a compromise will be reached.

I do think HYBE will give them most of the control and freedom they want and possibly more control/ownership over their Masters.

Taekook

There is a perception in certain quarters that Tae and JK are victims and are just riding out their contract until 2024. That doesn't tally with what they and the other members have said. I definitely think all 7 re-sign with BH/HYBE in some way. But I wonder if Taekook want some specific for them included too. I could see them asking for no "fanservice" moments, but that's small fry. Could they want a managed (sort of) coming out plan? That's possible. In light of recent events, could they want HYBE to support them officially moving in together as flatmates?

These are all interesting questions and thoughts I currently have.

Final thought:

What is clear though to me, is that BTS will be re-signing with HYBE in some way, and we'll possibly get that announcement shortly after the last members return from the military.

#my asks#taekook#jungkook#taehyung#jeon jungkook#kim taehyung#bighit#hybe#bts contract renewal#bts#bts military enlistment

26 notes

·

View notes

Text

its very funny to see people calling tumblr "VC-based social media".

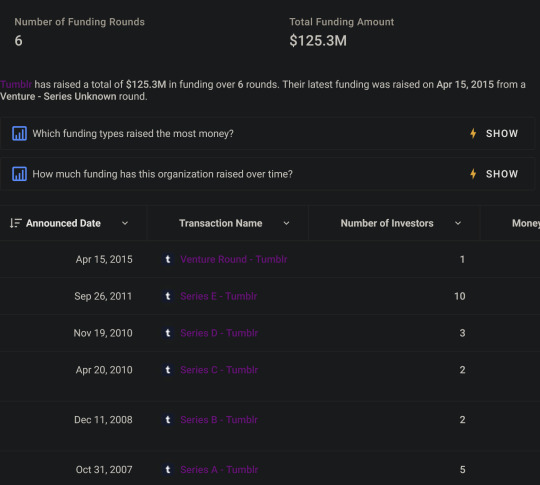

look, here's all the venture capital rounds Tumblr has ever been involved in:

after the 2011 venture round, Tumblr was purchased by Yahoo for 1.1 billion in 2013.

The 2015 venture round refers to some manner of mistaken reporting. At that time Menlo Ventures put out a press release that they were interested in funding the "next Uber or Tumblr" but did not actually invest any more money for Tumblr with Verizon - business records show that Menlo Ventures was in fact a venture investor with Tumblr and Uber in 2011 funding rounds though.

Anyway, after that you have Yahoo including Tumblr but not including Yahoo's stake in Alibaba being sold to Verizon for ~$4 billion in 2017.

And then in 2019 Verizon sold Tumblr to Automattic as part of how Verizon'd been getting rid of its AOL and Yahoo assets.

So Tumblr received its last venture capital investment over 12 years ago now, and essentially all the venture investors got paid off in 2013 by Yahoo as part of the purchase deal. That's what venture investors are usually looking for after all - sell the company they invested in to an existing enterprise that will pay big bucks, or get it to the stock market with an IPO, either way they get paid for the shares they took in the company as a condition of their venture investment.

3 notes

·

View notes

Text

Silicon Valley, despite being a supposed hub of innovation, one separated from the garish demands of regular industries, has culturally grown to resemble an open-air private equity firm where companies are incubated like animals bred for slaughter.

While I’m not saying the Valley is entirely bereft of innovation, the modern tech ecosystem has become an alternative asset market built to enrich the very same people it once claimed to reject. Fred Wilson, the co-founder of Union Square Ventures, said in 2016 that startups that took corporate money were “doing business with the devil,” yet the only remaining difference between the current state of venture capital and private equity appears to be how willing they are to say the quiet part (“we need to make money off of this investment”) out loud.

Silicon Valley’s key differentiator was that it was theoretically the place where venture capital took risks on interesting and innovative technology, yet the best-funded startups remain siloed in whatever industry venture capital believes will be “big,” even if they haven’t got any true path to profitability.

It may also be a result of the different incentives that bring people to the Bay Area and the tech industry in general. A decade ago, engineers made an average base salary of $92,648 versus $139,729 in 2023. The software industry has created 82 new billionaires since 2010, and the 2019 tech IPO rush created an estimated 5000 new millionaires across eight tech companies. In 2013, there were 39 unicorns (tech companies worth a billion dollars or more). According to CBInsights, there are now over a thousand of them. And because Andreessen and his fellow venture stooges forced so many lossy, unprofitable companies to go public, many of them are underwater (and they have been for some time), with the top 50 Tech IPOs since 2020 losing 59% of their market capitalization as of May 13 2023.

As a result, the Valley is left with the avaricious culture of the finance industry without any of the stability. Venture capital’s elite turned startups into alternative investments, fattened them up to sell, and, when the market dropped out in 2022 and 2023, shrugged their shoulders and blamed the workers. They, along with tech’s leaders, derided a culture of “entitlement” that they themselves created. Oh, workers want food at the office? They want a gym? They want a place to nap? Then why didn’t you fucking complain when companies started offering this shit back in 2015?

Because tech’s elite hates labor, and hoarding talent was a necessity to pump valuations. The tech industry — by which I mean the Valley’s powerful venture arm — spent a decade convincing software engineers that they were an elevated class, promising them the world and oftentimes delivering it without requiring them to build something that improved the world in any way. And the second the party ended — the moment that the economy stopped endlessly providing growth to every single company in the market, and when money stopped being free — tech was ready to eject tens of thousands of workers, and tech’s venture capitalists were ready to stop signing checks and start requiring “hard numbers” for the first time in years.

And the problem with an industry that is led and powered by venture capital is that it doesn’t build any real culture. “Startup culture” is a vague shibboleth that exists to justify labor abuse in exchange for a theoretical massive payday in the future, with the hollow premise that there is something more noble about writing code or “working at an early-stage company” than there is any other job. While there are people doing cool, weird or societally-beneficial shit, they are endlessly drowned out by a combination of founders trying to build “the next big thing,” with “big” referring to how much they can sell it for, and “thing” being “whatever is going to sell to someone.”

2 notes

·

View notes

Text

Mengenal Politikus Muda (21/08/23)

Rian Ernest Tanudjaja, SH, MPA

Lahir di berlin, jerman pada tanggal 24 oktober 1987 (35 tahun) merupakan seorang politikus yang dikenal sebagai mantan staf alhi hukum Gubernur DKI Jakarta Basuki Tjahaja Purnama. Jelang Pemilu 2019 Rian Ernest merupakan calon Legislatif (Caleg) untuk DPR RI yang diusung oleh Partai Solidaritas Indonesia, dengan daerah pemilihan DKI Jakarta I. Rian Ernest mulai dikenal Masyarakat saat mendampingi Basuki Tjahaja Purnama saat mengajukan gugatan atas aturan pilkada di Mahkamah Konstitusi (MK). Namun, Rian Ernest telah mengundurkan diri dari Partai Solidaritas Indonesia (PSI) pada 15 desember 2000. Dengan menempati posisi terakhir adalah sebagai Dewan Pemimpin Pusat PSI. Kemudian, Pada bulan Januari 2023 Rian Ernest resmi menjadi Ketua Biro Pemuda Partai Golkar DKI Jakarta.

Pendidikan & Karir

Rian Ernest memulai pendidikan sekolah dasar di SD Maria Fransiska, Bekasi dan lulus tahun 1999, lalu Rian Ernest melanjutkan pendidikannya pada SMP Marsdirini Bekasi yang kemudian lulus pada tahun 2002, kemudian melanjutkan sekolahnya lagi pada Sekolah Menengah Atas Negeri 82 Jakarta lulus pada tahun 2005. Selanjutnya, Rian Ernest menyelesaikan Pendidikan sarjananya di Fakultas Hukum, Universitas Indonesia, Tepatnya pada bidang hukum bisnis.

Sebelum terjun ke dalam dunia politik dan pemerintahan, di tahun 2013-2015, Rian merupakan Associate untuk firma hukum Hadiputranto, Hadinoto & Partners, bagian dari firma hukum global Baker & McKenzie. Ia juga menjadi Junior Associate bagi Melli Darsa & Co pada kurun waktu 2009-2013. Sebagai konsultan hukum, dia fokus dalam pemberian advis dan analisa tentang investasi, jual beli perusahaan, menyiapkan IPO serta audit dari sisi hukum.

Saat bekerja di firma hukum, Rian pernah membantu Anies Baswedan dalam tim transisi Presiden-Wakil Presiden Terpilih 2014, dalam mensinkronkan kebijakan dalam bidang pendidikan agar sesuai dengan janji kampanye. Ia juga alumni Indonesia Mengajar pada tahun 2011-2012 dan menjadi guru kelas 5 SD atas 28 murid di Pulau Rote, Nusa Tenggara Timur (NTT) selama setahun penuh.

Karena terpanggil ke dunia politik dan pemerintahan, Rian lalu meninggalkan praktek hukum swasta untuk menjadi staf hukum bagi Basuki Tjahaja Purnama, Gubernur DKI Jakarta saat itu. Kemudian Rian meneruskan pendidikan dan bergelar Master Public Administration di Lee Kuan Yew School of Public Policy, Singapura, atas beasiswa penuh. Rian sempat bekerja sebagai Asisten Staf Khusus Presiden bidang hukum, sebelum akhirnya mengundurkan diri di Desember 2021 untuk aktif di DPP PSI hingga Desember 2022, saat dia mengumumkan keluar dari partai tersebut. Di Januari 2023, Rian resmi diperkenalkan sebagai Ketua Biro Pemuda Partai Golkar DKI Jakarta di kantor DPD Golkar Jakarta.

2 notes

·

View notes

Text

3 Things Smart Investors Know About Chevy

chewer (choice -1.64%, He has had an eventful journey in his relatively short life. It was established in 2011 as an online retailer for pet food and other pet related products. It was then acquired by PetSmart in 2017, launched an online pet pharmacy the following year, and spun off in an IPO in 2019. Chevy has impressed investors since its public debut. Between 2019 and 2022, its revenue grew…

View On WordPress

2 notes

·

View notes

Text

Deutsche Telekom Stock Review

Deutsche Telekom is a Germany-based company that provides integrated telecommunication services. It operates through five segments: Germany, United States, Europe, Systems Solutions, and Group Development. The Germany segment provides fixed-network and mobile telecommunications services to consumers and business customers. The United States segment provides telecommunications services in the United States market; and the Europe segment offers fixed-network and mobile operations of the national companies in Greece, Romania, Hungary, Poland, the Czech Republic, Croatia, Slovakia, and Austria.

IPO

A major turning point in the world of telecommunications took place in November 1996, when Deutsche Telekom went public. It was the largest IPO in history and the capstone of years of intense effort by Goldman Sachs to establish a presence in the German market.

The company's offering marked a significant step in the development of an Anglo-Saxon shareholder culture. It was also the first telecommunications company to be listed on the Frankfurt and New York stock exchanges, as well as the Tokyo Stock Exchange.

It was the largest ever IPO and it was oversubscribed five times. Shares traded at nearly 20 percent above the issue price on their first day of trading.

In addition to its traditional services in Germany, the company provides telecommunications services throughout the rest of Europe and the United States. Its businesses include fixed network and broadband, mobile telephony, and information technology services.

Today, the company is one of the world's leading telecommunications companies with operations in more than 50 countries and a broad range of products and services. It has a worldwide network of around 248 million wireless and 26 million wireline customers.

The company has been in the forefront of telecommunications innovation, investing extensively in digital technologies to develop innovative new products and services for its customers. Examples include the Internet of Things, 5G technology, video conferencing, and artificial intelligence.

For a company like Deutsche Telekom, it is important to have a diverse product portfolio that appeals to different kinds of users. The company is also known for acquiring and selling companies to generate growth and streamline operations.

Despite its success, the company has faced several challenges in the past few years. It has lost customers to larger rivals, including AT&T and Verizon Communications Inc VZ.N, and it has also experienced a drop in revenue and profits.

However, the company's management has made efforts to turn its fortunes around, launching new business models and making strategic acquisitions. It is a leader in the telecommunications industry and it continues to seek ways to grow its business and create value for shareholders.

Mergers and Acquisitions

Deutsche Telekom is a diversified telecommunications company with a strong position in Europe and a booming US business. It operates in a number of different sectors, such as payments and commercial real estate tech.

In the US, the company is primarily focused on mobile services. Its subsidiary T-Mobile USA has an excellent record of growth and is a significant competitor to AT&T and Verizon. In addition, it owns Sprint (NYSE:S), which is set to become a major player in the U.S. telecom industry once the merger is complete in 2019.

The company has not made many major acquisitions, but it has done a few small ones over time. These smaller deals, such as the purchase of a Romanian carrier, the sale of T-Mobile Netherlands and its acquisition of Austria’s Telecom Austria, have improved its market position and scale.

Its US telco operations, T-Mobile USA and T-Mobile International, have been growing at very strong rates. These companies have a large customer base and are expected to continue expanding.

T-Mobile US is the second largest wireless service provider in the United States with a customer base of 120 million, behind Verizon. It has a very competitive pricing model and a great reputation in the industry.

However, the stock has not performed well in recent months. This is largely due to the fact that many investors are not aware of the fact that the German government owns 57 percent of the company. It has been criticized by a few legislators who think that the government should reduce its holding before the deal can be completed.

As a result, the stock has been down with other European stocks. If the Euro continues to weaken, this would likely help the stock and also its U.S. assets, which have been irrationally punished by European investors because they are included in a European stock.

To counter this, the company has been increasing its dividend and repurchasing some of its own shares, which are now trading at about a 50% discount to their value. These dividend increases and the repurchases should allow for further growth.

Shareholders

One of the largest shareholders in deutsche telekom stock is the German government and its agency, Kreditanstalt fuer Wiederaufbau (KfW). KfW owns 17.3 percent of the company's shares. It has been buying more shares and reducing its stake in a series of transactions.

Another large shareholder is the United States investment group Blackstone. It purchased 4.5 percent of deutsche telekom stock for $3.3 billion. It is hoping that the purchase will help the company achieve its long-term financial goals and boost shareholder value, according to the company's announcement.

It also plans to use the money to fund future dividend increases. The dividends are a key part of the company's plan to reinvest in new technologies and networks.

The company also recently rolled out an overhaul of its corporate strategy to focus on digitalization and adapting its business models to the changing needs of customers. The changes will make it a software company that sells telecommunication services, rather than just a hardware manufacturer.

This is a big shift from the days when telecommunications networks were made up of monolithic blocks of network elements. Today, companies like DT are disaggregating their technology and moving it into the cloud. This allows them to connect with third-party networks and use their infrastructure to provide telecommunications services.

In the case of telecommunications, this involves billing-software and other backend systems. These backend systems are responsible for collecting and analyzing customer data to make pricing decisions.

If these systems are not able to comply with GDPR, will they be subjected to enforcement action or sanctions by U.S., EU, or German authorities? If not, will they be the target of new private actions for fraud and/or breach of contract?

To protect its data, deutsche telekom stock has "binding corporate rules" that it has promised to abide by. These rules are "binding" on all of the company's subsidiaries and any of its other companies that can be required to comply with them or have already adopted them on a voluntary basis.

But what if deutsche telekom stock's subsidiary T-Mobile USA doesn't subscribe to these "binding" corporate privacy rules? Does it still have to comply with the "binding" rules, or is there something in the corporate law that prevents it from doing so?

Dividends

One of the coolest perks of being a shareholder of this German company is the opportunity to participate in its annual dividend payout. The company pays out an impressively large sum each year, and it has a long and distinguished history of making its shareholders happy. Despite its size, the company manages to stay on top of its game thanks to some innovative corporate strategies and a healthy dose of luck. In a nutshell, there's a reason why this stock has been a KfW staple for so long. The company is also one of the few surviving German telecoms. If you're on the hunt for a good value telecommunications stock, deutsche telekom should be at the top of your list. You'll be rewarded with top-notch service and competitive paycheques, not to mention a hefty chunk of the local economy.

After all, it's not every day that you get a free piece of the country's largest phone company, let alone one of the most innovative and coveted German telecommunications companies in the business.

2 notes

·

View notes

Text

201112 WSJ Magazine

Why BTS Runs the World

The South Korean pop group has reached the top of the U.S. charts, united millions of fans around the world into a self-styled ARMY, shattered online viewing records and been part of a major IPO. Now BTS is preparing to release a new album.

It’s been a really long time since we had a face-to-face interview like this.” Rapper j-hope, 26, a member of the South Korean group BTS, jumps into conversation while waiting for his bandmates to settle in. The coronavirus pandemic put a hard stop to the group’s world tour, which would have taken them across 17 cities on three continents this year. But it hasn’t made them any less busy as they look ahead to the release of a new album.

In early September, all seven members of BTS—short for their Korean name Bangtan Sonyeondan, which they alter in English to “Beyond the Scene”—were camped out in Seoul’s artsy Yeonnam neighborhood, just weeks after their latest catchy hit, “Dynamite,” topped global charts and became the most downloaded song of 2020 in the United States. Decked in monochrome outfits, rappers RM, SUGA and j-hope and vocalists Jung Kook, Jin, V and Jimin—as they are known by their stage names—shuttled between interviews and the WSJ. photoshoot inside a house-turned–chic cafe. Clearing security to meet them involved surprisingly little hassle: a name check, temperature screening and Covid-19 health form followed by a short walk to the entrance where security personnel quickly glanced at name tags.

In July, BTS broke the Guinness World Record for staging the biggest virtually attended livestream music performance, which attracted fans from over 100 countries. They miss the real thing, though. “That feeling [of being onstage] is really the best thrill I probably get in life. Even if I leave one day, I think I’ll be back for this,” says Jin, 27, of being onstage in front of BTS’s devoted fans, officially dubbed ARMY. The name stands for “Adorable Representative M.C. for Youth,” though the demographics of the band’s fan base now extend well beyond that age group.

In part thanks to the ardor of the ARMY—which one count estimates as high as 48 million, based on online commentary by unique authors—the band is often called “the Beatles of the 21st century.” The group has exploded the familiar boy band recipe, taking the concept of fandom into new territory and developing the South Korean genre known as K-pop into a global force. A voluntary census conducted by fans between July and September gathered over 400,000 responses from surveys translated into 46 languages, according to University of Nevada, Las Vegas, graduate student Nicole Santero, who led the effort with two others under the Twitter handle @ResearchBTS. The data, which is still being analyzed, is pointing toward the demographic and geographic diversity of BTS fans.

BTS has topped Billboard’s song chart, released one of America’s bestselling albums of 2020 and performed at the Grammys with Lil Nas X. They sold out London’s Wembley Stadium in 2019, won four MTV Video Music Awards this year and smashed the record for the most views on YouTube in a 24-hour period (over 100 million)—all while singing almost entirely in Korean. They have also collaborated with musical stars such as Ed Sheeran, Sia, Nicki Minaj, Halsey, Charli XCX and Charlie Puth.

Their impact has extended beyond music. In June, the band donated $1 million to Black Lives Matter, a sum that was matched by fans across the world in just over a day. The group also used its clout to launch Connect, BTS, a public art project showcasing works this spring by the likes of Antony Gormley and Tomás Saraceno in New York, Berlin, London, Buenos Aires and Seoul. In October, the band’s management company, Big Hit Entertainment Co. , went public on the South Korean stock exchange. The company raised about $840 million through its initial public offering with a valuation of about $4 billion, which leapt to $7.6 billion by the end of trading on the first day, October 15, before sliding over the next few days to $5.9 billion. (By way of comparison, in early June, Warner Music’s IPO resulted in a $15 billion valuation, which has since dropped slightly to a $14.36 billion market cap.) Big Hit’s stock debut put the equity holdings of Bang Si-hyuk—the 48-year-old founder and co-CEO of Big Hit and the mastermind behind BTS who owns nearly 35 percent of the business—at a value of around $2.8 billion. BTS is Big Hit’s largest asset, and Bang has given each band member 68,385 of his personal shares, worth over $15 million to each on the day of the IPO. BTS’s global success has powered Big Hit, which is only 15 years old, to revenues high enough to bump one of South Korea’s traditionally entrenched “Big Three” entertainment companies from the top rankings.

“These guys have achieved gradual growth by putting their voices into music,” Bang said by email. “BTS’s music that sings of the emotions and experiences of youth first resonated among their peers. Then it resonated among the contemporary global citizens. And that sentiment transcended borders and reached to the peripheries of the world. That’s how the group got to receive so much love and support. This enables BTS to be connected to their fans wherever they are, and is what makes the seven boys special.”

The latest single, “Dynamite,” is their first group song recorded entirely in English, and their first track to truly break on American Top 40 radio. The track is their first song to get to No. 1 on the Billboard Hot 100. It was quickly followed by their second U.S. chart-topper, a remix of Jason Derulo and Jawsh 685’s TikTok hit “Savage Love (Laxed—Siren Beat).” Their fifth album, BE (Deluxe Edition), is out this month, and the members of BTS say they’re trying to keep their focus on their music. “We’re preparing our next album now, [and I] think it’d be great if all our songs make it into Billboard’s Hot 100,” says Jimin, 25. “Another performance at the Grammys would be great.” A few seats away, Suga, 27, teases, “Just say you’d like to receive the award.”

Who are BTS? And how did they get so famous? The questions have persisted even as the world has become mesmerized by BTS’s irresistible hooks, Technicolor production and high-flying choreography.

Boy bands have long been one of pop music’s most consistent and reliable constructs. Though we now look back at the Beatles fully aware of their world-changing musical and cultural innovations, when they appeared in the early ’60s, more attention was paid to their haircuts than to their songwriting. The Fab Four also established the blueprint of distilling members to one characteristic—The Quiet One or The Cute One—and having fans identify with a favorite.

These patterns reappeared a few years later with a couple of family groups with ear-candy hooks and elaborate dance moves: the Jackson 5 and the Osmonds. The structure became formalized in the ’80s—enhanced with a sprinkling of light hip-hop—with New Edition (a teen spin on R&B groups with multiple vocalists like the Temptations) and New Kids on the Block, who sold more than 70 million albums worldwide. Puerto Rico–based band Menudo reinforced the genre’s formulaic reputation by replacing members when they reached the age of 16.

Meanwhile, pop music in South Korea was also establishing a lane for groups of singing and dancing teenagers. As far back as 1962, a single released by a Korean girl group called the Kim Sisters even cracked the Top 10 of the U.S. Billboard charts. But contemporary K-pop is generally seen as starting with the ’90s trio Seo Taiji and Boys, who synthesized Korean music and style with gleaming highlights taken from Western pop and were propelled to stardom on a TV talent show. One of the Seo Taiji and Boys members, Yang Hyun-suk, then founded YG Entertainment in 1996; it is now one of Korea’s “Big Three” entertainment companies, and has spawned its own bands, including girl group Blackpink.

In the U.S., boy bands went nuclear at the turn of the century with the notorious manager Lou Pearlman’s Florida pop factory, which assembled both the Backstreet Boys and NSYNC, and dominated the charts for years. Pearlman tried to repeat history with O-Town and LFO, while other groups like 98 Degrees followed a similar model. At the same time, in the Asian music industry, groups such as the Taiwanese band F4 and the Japanese group Arashi were logging huge hits, with g.o.d. setting the pace in South Korea.

Inevitably, there was a backlash, and then inevitably—because there’s always a new generation of teenagers coming of age—about a decade later, the pendulum swung back. One Direction, constructed by British music producer Simon Cowell in 2010, mixed in some rock and EDM elements to the usual pop confection and became the biggest U.K. phenomenon since the Beatles. (Atypically, they spun off successful solo careers for all five members after the group began its extended hiatus in 2016.)

In South Korea, though, K-pop continued to become more popular and more formalized, as it became part of an international phenomenon called Hallyu, or “the Korean Wave.” BoA and Wonder Girls were among the acts who attempted to crack the Western market but stalled, while Psy’s 2012 hit “Gangnam Style” was the first YouTube video to reach a billion views. But it still came as a surprise to many when seven Korean guys married the simmering global appeal of K-pop and the resilience of the boy band—amplified by social media—and started storming the charts.

BTS debuted on June 13, 2013, but their first release, “No More Dream’’ (a rap-heavy song that begins with “Hey, what’s your dream?”), hardly made a dent in the K-pop scene, which was dominated by established acts and rising groups such as EXO and Apink at the time. From the start, Big Hit’s Bang was looking to create a hip-hop group that could produce their own songs with messages that would resonate with their audience. In a 2011 lecture at his alma mater, Seoul National University, Bang predicted the coming of “wholesome idols” who could “sing and dance, act for sure and even play instruments and compose.” By then, he was well underway crafting K-pop’s next-generation of superstars.

His first pick was RM (given name Kim Nam-jun, now 26), in 2010. At the time, RM was performing in South Korea’s underground hip-hop scene under the stage name Runch Randa. The next to join, that same year, was Suga (Min Yun-ki), who was performing and producing under the name Gloss, after he placed second in a rap audition organized by Big Hit. J-Hope (Jeong Ho-seok) was part of a dance crew called Neuron before signing on as a Big Hit trainee, as performers in an apprenticeship period with Korean entertainment companies are often called.

Jung Kook (Jeon Jeong-guk), now 23, joined as a trainee after participating in a local televised singing audition program. He received offers from multiple agencies but chose Big Hit after seeing RM. Jin (Kim Seok-jin) was a college student on his way to school when an official at Big Hit approached him to audition. V (Kim Tae-hyung), 24, was discovered at a closed-door audition held at a dance academy. Jimin (Park Ji-min) was the last to join. He was a dance student at the Busan High School of Arts when he auditioned for Big Hit at the suggestion of his teacher. The members have each carved out strong identities for themselves within the group—j-hope is considered the star dancer; RM is seen as the main spokesperson, especially in the U.S., as he speaks English; Jung Kook is the “golden maknae” (meaning the youngest in Korean)—but they have all contributed their songwriting and composing skills to hits such as “Boy With Luv,” “On,” “DNA,” “Run” and “Idol.” j-hope describes his approach as research-heavy. “I first study the topic and think about what story I need to tell and what kind of content it should encompass,” he says. “Sometimes the type of stories I’m dealing with are light, but sometimes they aren’t, so it’s important that I’m knowledgeable about what I’m working on.”

SUGA says he comes across ideas for his songs from the books he reads. “I tend to think a lot about the meaning behind words,” he says. “We deal a lot with emotions so I spend a lot of time thinking about how words can be construed differently.”

RM, who has credits on many of BTS’s biggest songs, will dwell on a line from a movie or a passing scene, sometimes for years, before starting to work it into his lyrics. “[Writing songs] takes a long time for me,” says RM. “So it hurts, body and soul, when I have to throw one away.”

In recent years, pop music—generally associated with bubblegum, upbeat dance songs—has been getting more serious and introspective. From the Weeknd to Selena Gomez, teen idols have increasingly been writing and singing about mental and emotional health, anxiety and loss. (A 2018 study at the University of California Irvine examined hundreds of thousands of English-language pop songs and confirmed that sadness was on the rise.) Though a casual glance at their intricate choreography may not make it obvious, BTS is celebrated by their fans for touching on psychological and social issues in their songs.

“I don’t like talking about my dark side,” says Jin. “I’m in the camp that believes idols should always show their bright and positive side.” Still, a conversation with Bang inspired Jin’s 2018 solo ballad “Epiphany,” which focuses on self-acceptance. V, who contributed to the neo-soul “Stigma”—which includes lines like “The pain is never soothed”—recently received a phone call from producer Bang on a song he was writing. “Could you tone down this a little?” Bang asked.

“How come he never says things like that to me?” SUGA jumps in.

RM responds. “Because that’s (your) personality.”

j-hope chimes in, laughing, “I’m a bit envious of [SUGA’s] expressions.”

“I’m the type that speaks out first, and then thinks about it,” SUGA explains.

Pdogg, Big Hit’s chief producer, who has provided musical direction for BTS’s albums from the start, says it’s the band members who decide on the message (like their album title Love Yourself) they want to send through their music. “The most important thing for BTS as a team is the message that members want to convey,” he says. Musically, the band’s initial heavy lean into hip-hop has become fused with genres like Brit rock, EDM and future house over the years.

The music “still has a footing in hip-hop sound, but when it comes to genre, we’re in the process of expanding the parameters to create a hybrid sound,” said Pdogg in late September, a few days after he had completed production for BTS’s upcoming album. “We’re in the process of perfecting BTS’s unique hue.”

For their new album, BTS members had made separate bids to feature melodies they had written as the album’s lead song. Jimin describes that process as “painstaking and tearful.” Jung Kook points out that the members weren’t just competing against each other, but against other composers who also submitted attempts to Bang. Jin alone sent him three different melodies. SUGA made it to the finals. RM, though, chose to sit this one out. “The competition was too fierce,” he says.

The seven members of BTS spent their childhoods in different parts of South Korea. Jung Kook and Jimin were born in Busan, a southern port city. Jung Kook grew up in a creative household, with an older brother who’s a talented illustrator and parents who like to sing. As a child, Jimin learned kendo (a Japanese martial art using bamboo swords) and thought of becoming a policeman but changed his mind after starting to dance in middle school. His father used to say he should become a prosecutor.

V wanted to be a singer since his childhood, possibly influenced by his father, who had dreamed of becoming a star himself. (“Tae-hyung’s father is super-talented,” Jin says, referring to V by his real name.) Jin grew up in an entrepreneurial household. “My family is all in business, so they’re all good speakers,” he says, and V jumps in to note, “You’ve got your mom’s way with words.”

j-hope was born in Gwangju and raised by his father, a literature teacher, and a “strong-willed” mother who once ran an internet cafe. “I used to wonder how I could dance,” he says, referring to how no one in his family danced or sang. (“His dad’s quite strict,” Jin adds.) SUGA was born in Daegu to a family that he describes as “far from having anything to do with the arts and entertainment,” though his mother picked up drawing in her 60s. As a kid, he thought of becoming a fireman, and at one point his father tried to persuade him to study journalism. He composed his first song when he was 13. He’s since lost the recording but says, “I remember it—I’ll use it one day.”

RM, who once considered studying journalism in college, wrote his first song in 2007. He describes it as a disaster but he held onto it anyway. “I can’t even tell if the lyrics are Korean,” he says.

Social media has overturned the rules of the music industry and elevated the power of the fan, with BTS’s ARMY leading the way. For years, the group has had the most social engagement of any act in the world. Many avid fans take it as their personal responsibility to stream new BTS songs and videos through as many devices as possible as many times as possible, helping to juice the band’s chart positions. The sense of intimacy provided by constant social media contact also leads to an intensity and identification with the BTS members that simply wouldn’t have been imaginable for previous bands. (ARMY is a tightly knit collective. Many fans declare “I’m ARMY,” or “I’m an ARMY,” when describing their devotion to the band.)

“BTS knows how to engage fans between their big video drops with a steady stream of content,” said Lyor Cohen, global head of YouTube Music, by email. When the band released their single “Dynamite” in September, they had also uploaded over a dozen additional clips related to the song, Cohen says, including individual videos of each member singing the song, a reaction video, footage from their choreography rehearsals and a “B-side” clip of their music video showing the band from different camera angles.

The efforts pay off. When “Dynamite” premiered on YouTube, it instantly drew three million viewers, according to Cohen. (At press time in early October, it had nearly 500 million views.) “They are truly a global act with a legion of loyal fans from around the world.” Over 90 percent of BTS clip views this year have come from outside South Korea, including the United States, Mexico, Brazil, Japan and India.

The group has several ongoing video series on YouTube, including Bangtan Bomb (short behind-the-scenes clips), with over 600 episodes and counting, and Episode (longer videos of BTS at photo or music-video shoots). There’s also Run BTS!, a near-weekly entertainment program showing the seven stars involved in games or other activities, which is released on South Korean livestreaming service V Live and on Weverse, Big Hit’s own online platform, which offers exclusive content as well as premium paid memberships. This is in addition to the usual music videos, vlogs, interview clips and reality TV shows in which the band appears.

Randy Suh, a K-pop critic in Canada, says BTS’s success has highlighted the importance and strength of new media in the music industry. From their early days, BTS used to put out three or four clips on YouTube every week and release mixtapes on blogs, she says. “That gave them an approachable image as singers, and it came at a time when people started preferring [social media] influencers who felt closer than some pop singer far away.”

The content empire that BTS produces is so vast that even fans can’t keep up. When “Dynamite” launched, Michelle Tack, 47, a cosmetics stores manager from Chicopee, Massachusetts, requested a day off work to stream the music video on YouTube. “I streamed all day,” Tack says. She made sure to watch other clips on the platform in between her streaming so that her views would count toward the grand total of views. (YouTube says it has systems in place to eliminate videos viewed by computer programs, which can skew the measure of a video’s overall popularity.)

“It feels like I’m part of this family that wants BTS to succeed, and we want to do everything we can do to help them,” says Tack. She says BTS has made her life “more fulfilled” and brought her closer to her two daughters, 12 and 14. The younger one introduced her to the band two years ago.

If feels like I’m part of this family that wants BTS to succeed, and we want to do everything we can do to help them.— Michelle Tack, BTS fan

Fifteen-year-old Abbey Hammond, who lives in Falmouth, Massachusetts, recalls her reaction when she first watched a BTS video in seventh grade. “Their vocals were amazing; they were rapping, dancing, plus they do a lot of acting in the videos—I just thought they were all-around talented, and then looking at the lyrics, they were really meaningful,” says Hammond. The language barrier was never an obstacle. “I don’t think you have to understand what they’re saying to understand what emotions they’re putting out there,” she says. “A lot of it comes from their performance. Words aren’t the only thing you need in order to get them.”

“The best K-pop utilizes storytelling in really innovative ways,” says Colette Balmain, 58, a senior lecturer in film and media and communications at London’s Kingston University, who organized a BTS academic conference in January 2020, at which 200 papers were submitted. She also examines “Bangtan Universe,” an ever-evolving narrative around BTS that is told through multiple mediums, including music videos, online blog posts and social media postings where Big Hit discloses clues or story pieces. The storyline of Bangtan Universe, in which the seven members adopt fictional personas, isn’t revealed in chronological order. Some avid fans take part by writing and changing the stories based on different clues dropped by Big Hit.

“We had albums that have themes in the West, but a story across albums is unusual,” says Balmain. “What Big Hit is doing with BTS is innovating not just the Korean entertainment business, but also the U.S. entertainment business.”

Lee Ji-young, a philosophy professor at Sejong University in Seoul, a self-proclaimed ARMY and author of BTS, Art Revolution, says BTS’s success in the American music industry holds historical significance. “This shouldn’t be seen as just a victory for South Korean singers, but a paradigm shift in America’s racial and linguistic hegemony.”

Lee says BTS’s innovations are also reflected in how ARMY is redefining pop group fan bases. “This is an extremely active community,” she says, pointing to a Twitter account operated by BTS fans to organize charity fundraising projects (@oneinanarmy), free tutoring services within the ARMY community and an academic journal, The Rhizomatic Revolution Review, for which she is an advisory board member. It publishes peer-reviewed papers on “the art, fandom, economic effects and sociocultural forces generated by BTS and ARMY.”

The band, which signed a new seven-year contract with Big Hit in 2018, has other hoops to jump through looking ahead, including starting mandatory military duties for roughly two years by age 28. That means enlisting next year for Jin, 27, the band’s eldest member. Calls for exempting the members from service (a legal option for high-performing athletes and award-winning classical musicians) have been on the rise, though no precedent exists for K-pop stars. So far Big Hit has been silent on the issue.

The stars of BTS say there are still more things yet to achieve. “In the past, we had clear goals and a thirst. We had to do well—we were desperate,” says Jung Kook. “I still have a similar mindset. It’s the achievements we’ve made every step of the way that are prompting me to want to challenge myself more.”

“Before, we were all just fixated on looking for the camera when the red light came on,” says Jimin. “Now we feel more relaxed.”

Source: WSJ

3 notes

·

View notes

Text

After less than two years in the role, John Koryl has stepped down as CEO of The RealReal, the prominent online luxury consignment platform. The company announced this leadership change on Monday, naming Rati Sahi Levesque as the new chief executive officer, effective immediately. Levesque, a co-founder of The RealReal since its inception in 2011, has been instrumental in shaping the company’s trajectory, holding various leadership positions in areas such as sales, merchandising, and marketing. Levesque's appointment comes during a critical time for The RealReal, as the company is working to stabilize its operations and improve financial performance after facing significant challenges in the luxury resale market. Under her leadership alongside former CFO Robert Julian as interim co-CEOs, the company began implementing major changes aimed at achieving profitability. These reforms included revisions to the commission structure that now favour higher-value items, like jewelry and iconic bags from brands such as Hermès. The move to hire Koryl in early 2023 was intended to bolster these efforts, as he brought experience from Neiman Marcus to help navigate the company's financial struggles. His tenure included efforts to refine customer service offerings and further adapt the commission structures. Notably, The RealReal achieved EBITDA profitability for the first time since its IPO in 2019 during the fourth quarter of 2023, a milestone that reflects the effectiveness of these strategic changes. For fiscal 2024, The RealReal forecasts adjusted EBITDA between $4.5 million to $7.5 million, a dramatic turnaround from the adjusted EBITDA losses of $55 million in 2023 and $112 million in 2022. However, this journey toward profitability has not been without its downsides. The company’s gross merchandise value (GMV) fell by 5% year-over-year in 2023, dropping to $1.7 billion. Looking ahead, The RealReal expects to reach a GMV of about $1.8 billion for 2024. The board’s confidence in Levesque is palpable. Karen Katz, chairperson of the board, expressed strong support for the new leadership, emphasizing that Rati and her team are positioned to advance the business effectively. Koryl’s departure was framed positively, with the board wishing him the best as he focuses on family matters. Despite the favorable financial developments, challenges remain. Many consignors have expressed dissatisfaction with the platform, feeling that reselling luxury items is not as financially rewarding as it once was. This sentiment threatens to impact the inventory and variety of items available on the platform, which is crucial for a resale business reliant on consignors willing to list their items for sale. Levesque's rich experience within The RealReal makes her an ideal candidate to address these issues head-on. As the first employee of the company, she has witnessed the evolution of the current landscape of luxury resale. Her understanding of the business, coupled with her previous leadership roles, uniquely positions her to better align offerings with the interests and needs of consignors while staying committed to increasing profitability. The RealReal's trajectory highlights a critical phase in the luxury resale market. As consumers continue to seek sustainable and cost-effective shopping options, platforms like The RealReal must navigate the fine line between profitability and attractiveness to sellers. In conclusion, Rati Sahi Levesque's ascension to the CEO role showcases a deep-rooted commitment to reinvigoration and understanding of the luxury resale landscape. Her leadership will likely influence the company's ability to foster relationships with both buyers and sellers, ensuring that The RealReal remains a significant player in the luxury commerce space. The ongoing evolution within the company will be closely watched by industry experts and consumers alike as it unfolds in the upcoming fiscal year.

#Fashion#AbercrombieRetailTrendsConsumerBehaviorStockMarketBusinessSuccess#AesopRetailDevelopmentCareerGrowthEmployeeEngagementLuxurySkincare#BFCCarolineRushFashionLeadershipBritishFashionFashionIndustry#resale#TheRealReal

0 notes

Text

ACE Holdings Bhd: RM814 Million Scam

In April 2019, the Securities Commission Malaysia (SC) told the public that ACE Holdings Bhd had issued corrective disclosures on 1 April 2019 after the sections the watchdog had issued on 11 December 2018.

As a result, ACE Holdings Bhd aka ACE Group had to issue an unconditional redemption offer to all investors who had placed private investments between PPM 2015 and 2018.

—— Start of Notice—–

DMCA Notice by ACE Holdings BHD, aka ACE Group

It seems ACE Holdings BHD has hired the services of a Reputation Agency to try and suppress this page. Yesterday, they filed a Copyright Notice with Google to take down this link from Google’s search engines.

You can see the notice at – https://lumendatabase.org/notices/28231736

Since this is a critical review and a newsworthy story, ACE Holdings is not aware that this falls under the fair usage policy of the copyright law. Appropriate counter notice has been submitted with our contacts at Google and we’ve been told that this article will be reinstated with Google within 7 business days.

Due to this attempt by Internet Removals Pte Ltd on behalf of ACE Holdings, we’re now looking deeper into this shady company and will soon be publishing our latest findings on Gripeo, and our other network sites plus a handful of friendly portals and media houses. We intend to bring the facts and maximum exposure to potential customers (and victims) of ACE Group.

—— End of Notice—–

Note that ACE Holdings Bhd aka ACE Group had raised RM814 million during this period and now had to return the entire sum to the investors.

The Securities Commission Malaysia released a notification about this matter on 4 April 2019 for the investors. At the time, they had 21 days to submit their application to get the refund.

Also, SC had recommended the investors to seek professional financial advice in case they had any doubt or confusion regarding the matter.

Why Did ACE Holdings BHD (ACE Group) Get Sanctioned?

The SC had sanctioned the private investment firm for using false and misleading statements while promoting its fund-raising projects.

For example, the company used to market one of its fund-raising projects as “ACE Credit Sdn Bhd offers potential subscribers a stable investment in the consumer credit industry with security dividends from an increasing cash flow.”

Their promotion also claimed that it had a business model which generates recurring income with constant growth and a “rising standard of living”.

ACE Holdings Bhd aka ACE Group modified it to “AHB provides investors with a unique investment opportunity in the consumer credit industry”.

ACE Holdings Bhd had been trying to acquire Apex Equity in 2018-19 and in February 2019, the SC granted a conditional approval for the proposed merger between Mercury Securities Sdn Bhd and Apex Equity.

What was the condition for this approval? The SC wanted ACE Investment Bank Ltd to exit the deal. It was a subsidiary of ACE Holdings Bhd which is now popular as ACE Group.

Furthermore, ACE Investment Bank Ltd didn’t agree to these terms. It was unclear if the SC had explained the reason why they imposed such a specific condition onto the deal.

The Aftermath:

Apart from the changes I mentioned above, ACE Holding Berhad also disclosed that its present authorized and paid up share capital was at 50 million ordinary shares of RM1 each. Prior to the sanctions, they used to claim the figure was 100 million ordinary shares of RM1 each.

Also, the company changed a statement for PPM 2018 to reflect the raising of funds exceeding RM250 million under PPM 2016.

Furthermore, they used to claim that they had raised funds for investment in Islamic financial products such as Islamic capital market activities, Islamic pre-IPO investments and the Islamic credit industry.

In reality, they used RM142.47 million for shares, RM64.7 million for internal financing, RM33.72 million for property, RM79.95 million for retail financing and RM423.42 million for corporate financing.

They didn’t use the funds for what they had raised them.

At the time, ACE Holdings Berhad had shares in

OCR Group Bhd

ConnectCounty Holdings Bhd

Sanchem Holdings Bhd

Apex Equity Holdings Bhd

Technodex Bhd

People Behind ACE Holdings Berhad: Board of Directors and Owner:

The Group Managing Director and ACE Group CEO is Annie Chang aka Chang Al Nee. She is also the founder of the company.

Similarly, Choong Chee Meng, Calvin is the Group Executive director. And Yeo Wee Sun, Sunny is the Group Director, Group Managing Director Office.

The Group Chairman of ACE Holdings Bhd is Ybhg. Tan Sri Dato’ Seri Dr Ting. Also, Tuan Yang Terutama Tun Dato’ Seri Utama Ahmad Fuzi Bin Haji Abdul Razak is the Eminent Shareholder of ACE Group.

Conclusion: Should You Invest with ACE Holdings Bhd (ACE Group)?

After seeing how ACE Holdings Bhd lied to its investors in the past, it’s very difficult to recommend this company. They have faced reprimands from the SC Malaysia and had to return millions.

Certainly, it’s no small matter.

Seeing the history of the company, it would be best for investors to steer clear of this investment firm. There are plenty of better and more reliable investment companies in Malaysia. You don’t have to choose the one with a terrible past.

0 notes

Text

This day in history

I'm in TARTU, ESTONIA! AI, copyright and creative workers' labor rights (TOMORROW, May 10, 8AM: Science Fiction Research Association talk, Institute of Foreign Languages and Cultures building, Lossi 3, lobby). A talk for hackers on seizing the means of computation (TOMORROW, May 10, 3PM, University of Tartu Delta Centre, Narva 18, room 1037).

#20yrsago Japan jails academic for writing P2P app https://web.archive.org/web/20040512194433/http://straitstimes.asia1.com.sg/latest/story/0,4390,250207,00.html

#20yrsago Blogger redesign notes https://stopdesign.com/journal/2004/05/09/blogger.html

#20yrsago TheyRule: applying information design to corporate directorships https://theyrule.net

#20yrsago Don’t just protect the unconceived: protect the inanimate! https://fafblog.blogspot.com/2004_05_02_fafblog_archive.html#108411098508640046

#15yrsago Brit MP saw undercover cops egging crowd to riot at G20 https://www.theguardian.com/politics/2009/may/10/g20-policing-agent-provacateurs

#15yrsago Elsevier has an entire division dedicated to publishing fake advertorial “peer-reviewed” journals https://science.slashdot.org/story/09/05/09/1514235/more-fake-journals-from-elsevier

#10yrsago Against the instrumental argument for surveillance https://www.theguardian.com/technology/blog/2014/may/09/cybersecurity-begins-with-integrity-not-surveillance

#10yrsago Congressmen ask ad companies to pretend SOPA is law, violate antitrust https://www.eff.org/deeplinks/2014/05/pols-ad-networks-pretend-we-passed-sopa-and-never-mind-about-antitrust

#10yrsago Japanese man arrested for 3D printing and firing guns https://kotaku.com/japanese-man-arrested-for-having-guns-made-with-a-3d-pr-1573358490

#5yrsago Americans with diabetes are forming caravans to buy Canadian insulin at 90% off https://www.cbc.ca/news/canada/nova-scotia/americans-diabetes-cross-canada-border-insulin-1.5125988

#5yrsago Big Tech is deleting evidence needed to prosecute war crimes, and governments want them to do more of it https://www.theatlantic.com/ideas/archive/2019/05/facebook-algorithms-are-making-it-harder/588931/

#5yrsago Buried in Uber’s IPO, an aggressive plan to destroy all public transit https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

#1yrago KPMG audits the nursing homes it advises on how to beat audits https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

7 notes

·

View notes

Text

How Is The WeWork Founder Still Rich

How Is The WeWork Founder Still Rich https://www.youtube.com/watch?v=F5VaFX2lxIM Adam Neumann, the co-founder of WeWork, remains a millionaire despite the company's dramatic decline. Founded in 2010 with Miguel McKelvey, WeWork aimed to revolutionize office spaces with dynamic, community-driven environments. The company experienced rapid growth and high valuations, reaching $20 billion by 2017. However, its IPO filing in 2019 exposed inefficiencies and led to Neumann's ousting. Neumann, despite the company's failings and his controversial tactics, leveraged WeWork shares and received substantial financial settlements upon his departure. He invested $350 million in his new venture, Flow, which is valued at over $1 billion. Flow focuses on the rental housing market and aims to create community-driven living spaces. Neumann's ability to secure investment post-WeWork highlights the venture capital industry's tendency to reward charisma and vision, sometimes at the expense of tangible results. The story of WeWork and Neumann underscores the volatile nature of startup success and the complex dynamics of venture capital, where charm and ambitious vision can lead to significant financial gains even after setbacks. via Contrarian Perspectives https://www.youtube.com/channel/UC8j1vtxBoUVRmJ-G2at4-bA September 24, 2024 at 01:00AM

#techwonders#beyondimaginationai#futuretechmagic#aiapplications#mindblowntech#innovativeai#ai#productivity#aitools#timemanagement

0 notes

Text

Week Eleven

Final Hand-in Meeting

Rewrite IPO - mark clearly which is the final

Lecture - Eugene and Jenny

Outer Nebular Drifter

Adrian McCleland, the Dowse Christchurch Art Gallery

telecom prospect 2004, national film archive

audio-visual performance vjRex with Kaleb Bennett

Port replicator, 2003, City gallery, vjRex with Keri Whaiti and Kaleb Bennett

Greembelt Video Suburb, 2006

one of a series of multimedia installation exploring relationship between environmental and sunburn anxiety

sci Fi and western script written by Eugene

Horror script, Greenbelt Video Suburb, Enjoy Gallery, multi media installation

Transposition of a mountain, 2006, the physics room, Christchurch, collaborative performance and installation

it's a lovely daze, 2007, ocular lab gallery, extended audio-visual performance

insidious pop 2 (drift), 2007, National film archive, installation and audio-visual performance, with Daniel Agnihotri, Jenny Gillam, Paul Faris, Richard Reddaway, Steve Rowe, Daniel Shaw, Gemma Syme, Eugene Hansen.

Another lovely daze, 2008, installation and one-off performance with Daniel Agnihotri

Future calls the dawn chorus, 2013, Dr Kron and Danial Shaw, video and installation

Transposition of a river, 2018, with Motoko Kikkawa and Murdabike, Blue Oyster Art Project Space, vinyl cut wall drawing with a video projector of the tukituki river, group exhibition Not standing Still curated by Raewyn Martyn, remixed the video live on opening night, streamed over the internet back home (live but not present)

Outer Nebular Drifter, 2019, Adrian McCleland, video performance