#ICO Listing and Campaigning Services

Explore tagged Tumblr posts

Text

ICO Listing - Standing Out in the Crypto World

Initial Coin Offerings (ICOs) have become a popular way for startups to raise funds and build a community of supporters. However, navigating the complexities of an ICO listing and campaign can be difficult for even the most experienced entrepreneurs. In this article, we explore the importance of ICO listings and how Nadcab Labs can help your blockchain project succeed.

What is ICO Listing?

ICO listing is the process of listing an initial coin offering on various crypto exchanges, platforms, and markets. This important step will allow investors to purchase newly issued cryptocurrencies and contribute to the growth and development of the project. An effective ICO listing Services is critical to the success of a blockchain project, as it exposes the project to a wider audience and increases the likelihood of attracting investors.

Why is ICO Listing Important?

Listing your ICO is important for several reasons:

Increased visibility:

Listing your ICO on a reputable platform increases visibility, allowing your project to reach a wider audience and You can attract more investors.

Increased credibility:

A successful ICO listing increases the credibility of your project and demonstrates your commitment to transparency and regulatory compliance.

Improved Market Access:

Listing your ICO gives you access to a wider market, allowing you to trade your cryptocurrencies on a variety of exchanges and platforms.

Increased liquidity:

A properly listed ICO increases liquidity, making it easier for investors to buy and sell cryptocurrencies.

How Can Nadcab Labs Help with ICO Listing Services?

Nadcab Labs provides comprehensive ICO listing Services and Campaign services designed to help blockchain startups succeed. Our team of experts has extensive experience in the blockchain industry and will ensure your project receives the attention it deserves.

Some of the services we offer are:

ICO Listing Strategies:

Our team can create an ICO customized to the specific needs and goals of your project. Develop a listing strategy. \ n \ n ICO Campaign Management: \ n We manage your ICO campaign and ensure that your project is effectively promoted through various channels.

ICO Marketing Services:

Our marketing experts create engaging content, social media campaigns, and email marketing strategies to attract investors and promote his ICO.

Compliance with ICO regulations:

We ensure that your ICO complies with relevant regulations, ensuring a smooth and successful listing process.

Benefits of Working with Nadcab Labs

By partnering with Nadcab Labs, you can expect the following benefits:

Expert advice:

Our team of experts will advise you on the ICO listing process and ensure your project gets listed. I'll make it.

Increased Visibility:

We help you increase the visibility of your project and thereby attract the attention of more investors and the blockchain community.

Increased credibility:

Our services increase the credibility of your projects and demonstrate your commitment to transparency and regulatory compliance.

Improved Market Access:

Listing your ICO with us gives you access to a broader market, allowing you to trade your cryptocurrencies on a variety of exchanges and platforms.

Conclusion

ICO Listing and Campaigning Services is an important step for the success of a blockchain project. Understanding the importance of an ICO listing and partnering with a reputable service provider like Nadcab Labs can increase your project's visibility, increase credibility, and improve market access. With comprehensive ICO listing and campaign services, you can ensure your ICO is a success and take your blockchain project to the next level.

Author Profile

Nadcab Labs - A Leading Blockchain Developers With over 8+ years of experience in, Custom Blockchain Development, Smart Contract Development, Crypto Exchange Development, Token Creation and Many More Services.

Twitter — twitter.com/nadcablabs

LinkedIn — linkedin.com/company/nadcablabs

Facebook — facebook.com/nadcablabs

Instagram — instagram.com/nadcablabs

Spotify — spotify.com/nadcablabs

YouTube — www.youtube.com/@nadcablabs

#nadcablabs#blockchain#nadcab labs services#blockchain technology#ICO LISTING#ICO Listing and Campaigning Services#ICO Listing Partners

0 notes

Text

The Legal Framework Surrounding Token Sales

In the rapidly evolving world of cryptocurrency, understanding the legal framework surrounding token sales is essential for both investors and developers. As token sale methods such as Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), and airdrops gain popularity, navigating the regulatory landscape has become increasingly complex. This blog delves into the legal considerations involved in these token sale methods, emphasizing the importance of compliance in the dynamic cryptocurrency environment.

What Are Token Sales?

Token sales are fundraising mechanisms used by cryptocurrency projects to raise capital by issuing tokens in exchange for cryptocurrencies or fiat money. These tokens often represent various utilities, such as access to services or voting rights in governance.

The legal treatment of tokens depends on their classification as either utility tokens or security tokens:

Utility Tokens: Typically used to access a specific service or product within a project.

Security Tokens: Represent ownership or investment contracts, often subject to stringent securities regulations.

ICOs: Navigating Regulatory Compliance

Initial Coin Offerings (ICOs) were among the first methods for raising funds in the crypto space. However, their popularity led to increased regulatory scrutiny.

Legal Challenges: Many jurisdictions, including the United States, classify ICO tokens as securities. Consequently, ICOs must either register with regulatory bodies like the Securities and Exchange Commission (SEC) or qualify for an exemption.

Jurisdictional Shifts: Projects often seek jurisdictions with favorable regulatory frameworks to conduct their ICOs.

Staying Informed: Monitoring the ICO calendar and exploring upcoming ICO lists help investors identify compliant projects and minimize risks.

IDOs: Decentralized Token Launches

Initial DEX Offerings (IDOs) have emerged as an alternative to traditional ICOs. IDOs enable projects to launch tokens directly on decentralized exchanges (DEXs), offering greater accessibility and liquidity.

Regulatory Considerations: Projects launching IDOs must adhere to regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements to mitigate potential legal risks.

IDO Tracking: Investors can use IDO launch schedules to identify opportunities while staying aware of associated regulatory obligations.

Airdrops: Free Tokens, But Not Without Rules

Airdrops are widely used as promotional tools or rewards for community engagement, distributing tokens free of charge to users.

Compliance Challenges: While airdrops offer incentives, they must comply with local tax and securities laws.

Tracking Opportunities: Following a crypto airdrop calendar ensures participants can access the latest and upcoming airdrop campaigns while staying within legal boundaries.

Crypto Launchpads: Simplifying Compliance

Crypto launchpads facilitate token sales, providing platforms for projects to conduct ICOs or IDOs.

Compliance Support: Many reputable launchpads have established compliance protocols, assisting projects in navigating the regulatory landscape.

Investor Trust: Participating in token sales through the best crypto launchpads ensures engagement with vetted and reputable projects.

Why Legal Compliance Matters

Failure to adhere to legal frameworks can result in:

Project Shutdowns: Regulatory violations may lead to the cessation of operations.

Investor Risks: Non-compliant projects may expose investors to financial and legal risks.

Market Trust Issues: A lack of compliance can undermine confidence in a project and the broader cryptocurrency ecosystem.

Conclusion

The legal framework surrounding token sales is critical for the sustainable growth of the cryptocurrency space. By understanding the regulations related to ICOs, IDOs, and airdrops, participants can navigate this complex environment more effectively.

Engaging in cryptocurrency research and staying updated on trending projects will empower investors to make informed decisions while minimizing legal risks. As the crypto landscape continues to evolve, compliance will remain the cornerstone of successful and sustainable token sales.

0 notes

Text

The Legal Framework Surrounding Token Sales

In the rapidly evolving world of cryptocurrency, understanding the legal framework surrounding token sales is essential for both investors and developers. As token sale methods such as Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), and airdrops gain popularity, navigating the regulatory landscape has become increasingly complex. This blog delves into the legal considerations involved in these token sale methods, emphasizing the importance of compliance in the dynamic cryptocurrency environment.

What Are Token Sales?

Token sales are fundraising mechanisms used by cryptocurrency projects to raise capital by issuing tokens in exchange for cryptocurrencies or fiat money. These tokens often represent various utilities, such as access to services or voting rights in governance.

The legal treatment of tokens depends on their classification as either utility tokens or security tokens:

Utility Tokens: Typically used to access a specific service or product within a project.

Security Tokens: Represent ownership or investment contracts, often subject to stringent securities regulations.

ICOs: Navigating Regulatory Compliance

Initial Coin Offerings (ICOs) were among the first methods for raising funds in the crypto space. However, their popularity led to increased regulatory scrutiny.

Legal Challenges: Many jurisdictions, including the United States, classify ICO tokens as securities. Consequently, ICOs must either register with regulatory bodies like the Securities and Exchange Commission (SEC) or qualify for an exemption.

Jurisdictional Shifts: Projects often seek jurisdictions with favorable regulatory frameworks to conduct their ICOs.

Staying Informed: Monitoring the ICO calendar and exploring upcoming ICO lists help investors identify compliant projects and minimize risks.

IDOs: Decentralized Token Launches

Initial DEX Offerings (IDOs) have emerged as an alternative to traditional ICOs. IDOs enable projects to launch tokens directly on decentralized exchanges (DEXs), offering greater accessibility and liquidity.

Regulatory Considerations: Projects launching IDOs must adhere to regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements to mitigate potential legal risks.

IDO Tracking: Investors can use IDO launch schedules to identify opportunities while staying aware of associated regulatory obligations.

Airdrops: Free Tokens, But Not Without Rules

Airdrops are widely used as promotional tools or rewards for community engagement, distributing tokens free of charge to users.

Compliance Challenges: While airdrops offer incentives, they must comply with local tax and securities laws.

Tracking Opportunities: Following a crypto airdrop calendar ensures participants can access the latest and upcoming airdrop campaigns while staying within legal boundaries.

Crypto Launchpads: Simplifying Compliance

Crypto launchpads facilitate token sales, providing platforms for projects to conduct ICOs or IDOs.

Compliance Support: Many reputable launchpads have established compliance protocols, assisting projects in navigating the regulatory landscape.

Investor Trust: Participating in token sales through the best crypto launchpads ensures engagement with vetted and reputable projects.

Why Legal Compliance Matters

Failure to adhere to legal frameworks can result in:

Project Shutdowns: Regulatory violations may lead to the cessation of operations.

Investor Risks: Non-compliant projects may expose investors to financial and legal risks.

Market Trust Issues: A lack of compliance can undermine confidence in a project and the broader cryptocurrency ecosystem.

Conclusion

The legal framework surrounding token sales is critical for the sustainable growth of the cryptocurrency space. By understanding the regulations related to ICOs, IDOs, and airdrops, participants can navigate this complex environment more effectively.

Engaging in cryptocurrency research and staying updated on trending projects will empower investors to make informed decisions while minimizing legal risks. As the crypto landscape continues to evolve, compliance will remain the cornerstone of successful and sustainable token sales.

0 notes

Text

The Legal Framework Surrounding Token Sales

In the rapidly evolving world of cryptocurrency, understanding the legal framework surrounding token sales is essential for both investors and developers. As token sale methods such as Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), and airdrops gain popularity, navigating the regulatory landscape has become increasingly complex. This blog delves into the legal considerations involved in these token sale methods, emphasizing the importance of compliance in the dynamic cryptocurrency environment.

What Are Token Sales?

Token sales are fundraising mechanisms used by cryptocurrency projects to raise capital by issuing tokens in exchange for cryptocurrencies or fiat money. These tokens often represent various utilities, such as access to services or voting rights in governance.

The legal treatment of tokens depends on their classification as either utility tokens or security tokens:

Utility Tokens: Typically used to access a specific service or product within a project.

Security Tokens: Represent ownership or investment contracts, often subject to stringent securities regulations.

ICOs: Navigating Regulatory Compliance

Initial Coin Offerings (ICOs) were among the first methods for raising funds in the crypto space. However, their popularity led to increased regulatory scrutiny.

Legal Challenges: Many jurisdictions, including the United States, classify ICO tokens as securities. Consequently, ICOs must either register with regulatory bodies like the Securities and Exchange Commission (SEC) or qualify for an exemption.

Jurisdictional Shifts: Projects often seek jurisdictions with favorable regulatory frameworks to conduct their ICOs.

Staying Informed: Monitoring the ICO calendar and exploring upcoming ICO lists help investors identify compliant projects and minimize risks.

IDOs: Decentralized Token Launches

Initial DEX Offerings (IDOs) have emerged as an alternative to traditional ICOs. IDOs enable projects to launch tokens directly on decentralized exchanges (DEXs), offering greater accessibility and liquidity.

Regulatory Considerations: Projects launching IDOs must adhere to regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements to mitigate potential legal risks.

IDO Tracking: Investors can use IDO launch schedules to identify opportunities while staying aware of associated regulatory obligations.

Airdrops: Free Tokens, But Not Without Rules

Airdrops are widely used as promotional tools or rewards for community engagement, distributing tokens free of charge to users.

Compliance Challenges: While airdrops offer incentives, they must comply with local tax and securities laws.

Tracking Opportunities: Following a crypto airdrop calendar ensures participants can access the latest and upcoming airdrop campaigns while staying within legal boundaries.

Crypto Launchpads: Simplifying Compliance

Crypto launchpads facilitate token sales, providing platforms for projects to conduct ICOs or IDOs.

Compliance Support: Many reputable launchpads have established compliance protocols, assisting projects in navigating the regulatory landscape.

Investor Trust: Participating in token sales through the best crypto launchpads ensures engagement with vetted and reputable projects.

Why Legal Compliance Matters

Failure to adhere to legal frameworks can result in:

Project Shutdowns: Regulatory violations may lead to the cessation of operations.

Investor Risks: Non-compliant projects may expose investors to financial and legal risks.

Market Trust Issues: A lack of compliance can undermine confidence in a project and the broader cryptocurrency ecosystem.

Conclusion

The legal framework surrounding token sales is critical for the sustainable growth of the cryptocurrency space. By understanding the regulations related to ICOs, IDOs, and airdrops, participants can navigate this complex environment more effectively.

Engaging in cryptocurrency research and staying updated on trending projects will empower investors to make informed decisions while minimizing legal risks. As the crypto landscape continues to evolve, compliance will remain the cornerstone of successful and sustainable token sales.

0 notes

Text

The Legal Framework Surrounding Token Sales

In the rapidly evolving world of cryptocurrency, understanding the legal framework surrounding token sales is essential for both investors and developers. As token sale methods such as Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), and airdrops gain popularity, navigating the regulatory landscape has become increasingly complex. This blog delves into the legal considerations involved in these token sale methods, emphasizing the importance of compliance in the dynamic cryptocurrency environment.

What Are Token Sales?

Token sales are fundraising mechanisms used by cryptocurrency projects to raise capital by issuing tokens in exchange for cryptocurrencies or fiat money. These tokens often represent various utilities, such as access to services or voting rights in governance.

The legal treatment of tokens depends on their classification as either utility tokens or security tokens:

Utility Tokens: Typically used to access a specific service or product within a project.

Security Tokens: Represent ownership or investment contracts, often subject to stringent securities regulations.

ICOs: Navigating Regulatory Compliance

Initial Coin Offerings (ICOs) were among the first methods for raising funds in the crypto space. However, their popularity led to increased regulatory scrutiny.

Legal Challenges: Many jurisdictions, including the United States, classify ICO tokens as securities. Consequently, ICOs must either register with regulatory bodies like the Securities and Exchange Commission (SEC) or qualify for an exemption.

Jurisdictional Shifts: Projects often seek jurisdictions with favorable regulatory frameworks to conduct their ICOs.

Staying Informed: Monitoring the ICO calendar and exploring upcoming ICO lists help investors identify compliant projects and minimize risks.

IDOs: Decentralized Token Launches

Initial DEX Offerings (IDOs) have emerged as an alternative to traditional ICOs. IDOs enable projects to launch tokens directly on decentralized exchanges (DEXs), offering greater accessibility and liquidity.

Regulatory Considerations: Projects launching IDOs must adhere to regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements to mitigate potential legal risks.

IDO Tracking: Investors can use IDO launch schedules to identify opportunities while staying aware of associated regulatory obligations.

Airdrops: Free Tokens, But Not Without Rules

Airdrops are widely used as promotional tools or rewards for community engagement, distributing tokens free of charge to users.

Compliance Challenges: While airdrops offer incentives, they must comply with local tax and securities laws.

Tracking Opportunities: Following a crypto airdrop calendar ensures participants can access the latest and upcoming airdrop campaigns while staying within legal boundaries.

Crypto Launchpads: Simplifying Compliance

Crypto launchpads facilitate token sales, providing platforms for projects to conduct ICOs or IDOs.

Compliance Support: Many reputable launchpads have established compliance protocols, assisting projects in navigating the regulatory landscape.

Investor Trust: Participating in token sales through the best crypto launchpads ensures engagement with vetted and reputable projects.

Why Legal Compliance Matters

Failure to adhere to legal frameworks can result in:

Project Shutdowns: Regulatory violations may lead to the cessation of operations.

Investor Risks: Non-compliant projects may expose investors to financial and legal risks.

Market Trust Issues: A lack of compliance can undermine confidence in a project and the broader cryptocurrency ecosystem.

Conclusion

The legal framework surrounding token sales is critical for the sustainable growth of the cryptocurrency space. By understanding the regulations related to ICOs, IDOs, and airdrops, participants can navigate this complex environment more effectively.

Engaging in cryptocurrency research and staying updated on trending projects will empower investors to make informed decisions while minimizing legal risks. As the crypto landscape continues to evolve, compliance will remain the cornerstone of successful and sustainable token sales.

0 notes

Text

Top 5 Blockchain Marketing Agencies in 2025

In the rapidly evolving world of blockchain, effective marketing is key to standing out in an increasingly crowded marketplace. As we move into 2025, the demand for specialized blockchain marketing agencies is at an all-time high. These agencies possess the expertise and strategies to help blockchain startups and established companies drive engagement, grow their communities, and enhance their market presence.

Here are the top 5 blockchain marketing agencies in 2025 that are making waves with their innovative approaches and exceptional services.

1. Bizvertex – The Trailblazer in Blockchain Marketing

Taking the top spot is Bizvertex, a cutting-edge agency that has redefined how blockchain companies approach marketing. With a strong focus on data-driven strategies, Bizvertex combines creativity with technology to deliver powerful results. Known for their comprehensive marketing campaigns, they offer everything from influencer marketing and social media management to content creation, PR, and community building.

What sets Bizvertex apart is their ability to integrate AI and blockchain technology into their marketing tools, allowing clients to target the right audience with precision. Their in-depth industry knowledge and innovative solutions make them the go-to agency for brands looking to disrupt the blockchain space. If you're looking to boost your project’s visibility and create lasting impact, Bizvertex should be your first choice.

2. Blockchainmarketing.io – A Trusted Name in the Blockchain Ecosystem

Coming in at second place, Blockchainmarketing.io has cemented itself as a leading player in blockchain marketing. Specializing in ICO (Initial Coin Offering) and IDO (Initial DEX Offering) promotions, they have successfully launched numerous campaigns that have raised millions for blockchain startups. With an experienced team of blockchain experts, Blockchainmarketing.io offers end-to-end marketing services including SEO, content marketing, community management, and tokenomics consultancy.

What makes Blockchainmarketing.io stand out is their vast network of media contacts and their ability to secure high-impact press coverage for their clients. Their campaigns are meticulously crafted to drive engagement, create buzz, and attract investors, making them a top choice for blockchain projects seeking a proven marketing partner.

3. NinjaPromo.io – Experts in Social Media and Branding

At number three, NinjaPromo.io is a powerhouse in social media marketing, branding, and community management. Their approach focuses on creating authentic, engaging content that resonates with audiences across multiple platforms. From Facebook to LinkedIn, Telegram to Twitter, NinjaPromo.io has helped numerous blockchain projects grow their social media presence and build loyal communities.

With a knack for viral campaigns and an eye for creativity, NinjaPromo.io is particularly well-known for its influencer marketing strategies. They have an extensive network of blockchain influencers that can promote projects to the right audiences. Whether you’re launching a new blockchain service or looking to rebrand, NinjaPromo.io has the tools and talent to bring your vision to life.

4. Icoda.io – Blockchain Marketing Specialists

Fourth on our list is Icoda.io, a marketing agency specializing in blockchain and cryptocurrency promotion. Icoda.io is best known for its analytical approach, offering clients data-driven insights to optimize their marketing efforts. Their expertise spans ICO/IEO marketing, content creation, media outreach, and influencer collaborations, with a particular focus on driving conversion through targeted campaigns.

Icoda.io also offers tailored solutions for NFT projects, helping creators and platforms gain traction in the competitive NFT market. Their multi-channel marketing strategies have helped blockchain companies reach global audiences and achieve their fundraising goals, solidifying Icoda.io as a reliable partner for blockchain marketing in 2025.

5. Coinbound.io – Marketing to the Crypto Community

Rounding out our top five is Coinbound.io, a leading agency that has been at the forefront of crypto marketing for years. Coinbound.io specializes in helping blockchain brands connect with crypto enthusiasts through influencer marketing, podcast advertising, and social media campaigns. They have a keen understanding of the crypto community, which allows them to craft highly effective marketing strategies that drive both awareness and engagement.

Coinbound.io’s deep roots in the blockchain ecosystem give them access to some of the most influential voices in the industry, making them a great choice for projects looking to tap into the power of crypto influencers. Their services also include SEO, content marketing, and community management, ensuring a holistic approach to marketing.

conclusion

Whether you're launching a new token, looking to grow your blockchain community, or aiming to stand out in a crowded market, these top 5 blockchain marketing agencies in 2025 have the expertise, tools, and networks to help you succeed. From the technological innovation of Bizvertex to the influencer prowess of Coinbound.io, each of these agencies brings something unique to the table, ensuring your project achieves its marketing goals in the blockchain world

Book a free consultation With us

Website : https://www.bizvertex.com/blockchain-marketing-agency

Email : [email protected]

Call / Whatsapp : +918807211121

Telegram : https://t.me/bizvertex

Skype : skype:live:.cid.3ed07beb81ad2399

#Blockchain Marketing Agency#Blockchain Marketing Company#Blockchain Marketing Services#business#entrepreneur

0 notes

Text

Drive Your STO to Success with BlockWoods – Your Trusted Marketing Partner

At BlockWoods, we are industry veterans committed to uplifting the value of your project. From the pre-STO stage to listing your tokens on top platforms, we cover all aspects of the process. Our mission is to help your project soar by providing comprehensive, end-to-end marketing solutions.

Why Choose BlockWoods?

We are a team of seasoned professionals with deep expertise in both the crypto and digital marketing landscapes. In a market flooded with new projects, we stand out by creating tailored growth strategies that help blockchain initiatives succeed. With us, you gain a trusted partner dedicated to:

Analyzing the latest trends and competitors

Crafting a strategic roadmap for your project

Offering real-time monitoring and ongoing optimization of campaigns

Measuring success with data-driven insights and KPIs

Providing periodic reports to help scale your project

Our Comprehensive STO Services

Launching a Security Token Offering (STO) requires consistent effort and a deep understanding of the crypto landscape. At BlockWoods, we offer a full suite of services designed to guide your STO to success:

Pre-STO Consulting: We'll help you craft a comprehensive whitepaper and set clear goals and objectives for your launch.

STO Marketing Strategy: From PR strategies and content creation to exchange listings, our team manages every step of your campaign.

Ongoing Support: Our team is available 24/7 to address your queries and provide live status updates on your project.

Additional Services: We also offer mobile app development, website development, and other essential crypto marketing services.

Why BlockWoods?

Our core values set us apart: trustworthiness, transparency, and results-driven strategies. We don’t rely on guesswork – all our decisions are backed by data. We understand that each project is unique, so we create customized marketing solutions for every client. From onboarding to execution, our goal is simple: to maximize your return on investment (ROI).

STO Marketing for the Future

A Security Token Offering (STO) represents a real-world asset, such as stocks, bonds, or even gold, powered by blockchain technology. Unlike ICOs, which issue fungible tokens, STOs offer investors a stake in a regulated asset. STO marketing is essential to raise awareness, drive token sales, and meet your fundraising goals.

When you partner with BlockWoods, you’re choosing a team with a proven track record in crafting successful marketing strategies for the crypto and blockchain space. Our tailored solutions ensure your STO captures the attention of your target audience, helping you achieve visibility and profitability in a competitive environment.

Let's Work Together

Connect with BlockWoods to get a foolproof STO marketing strategy that aligns with your goals. Schedule a meeting with one of our experts at your convenience to discuss your objectives, and we'll take it from there. Our team will handle everything from content creation to campaign execution, leaving you free to focus on what matters most: growing your business.

0 notes

Text

ICO Development Services: Building the Foundation for Your Tokenized Future

Initial Coin Offerings (ICOs) have revolutionized the way startups and businesses raise capital. By leveraging blockchain technology, ICOs enable projects to access global investors and raise funds through the sale of digital tokens. For many organizations, ICOs represent the gateway to a tokenized future, allowing them to create decentralized ecosystems that drive innovation and growth.

However, launching a successful ICO requires more than just an idea and a token—it requires the right strategy, legal compliance, technical expertise, and a solid marketing plan. This blog will explore how ICO development services can build the foundation for your tokenized future, ensuring that your ICO launch is both successful and sustainable.

What Are ICO Development Services?

ICO development services provide end-to-end solutions for businesses and startups looking to launch a token sale. These services encompass everything from ideation and smart contract development to legal compliance and marketing strategy. By partnering with professional ICO developers, you can streamline the entire process, ensuring that your project meets industry standards and regulatory requirements.

Key services offered by ICO development providers include:

Whitepaper Creation: Drafting a comprehensive whitepaper that details the project’s objectives, technical features, tokenomics, and roadmap.

Token Development: Creating custom tokens on blockchain platforms such as Ethereum (ERC-20), Binance Smart Chain (BEP-20), or Solana.

Smart Contract Development: Building and auditing secure smart contracts to automate the token sale process.

Website & Dashboard Development: Designing a professional ICO website and token sale dashboard for investors to easily purchase tokens.

KYC/AML Solutions: Implementing compliance measures such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Marketing & Community Building: Executing marketing campaigns to attract investors and build a vibrant community around your project.

The Benefits of ICO Development Services

Engaging with professional ICO development services can significantly enhance the chances of a successful token launch. Here are some of the key benefits of using these services:

1. Comprehensive Support from Start to Finish

Launching an ICO involves many moving parts, including token development, legal compliance, smart contracts, and marketing. ICO development services provide a holistic solution, guiding you through each phase of the process. From drafting the initial whitepaper to listing the token on exchanges post-ICO, you’ll have expert support at every stage.

2. Regulatory Compliance

One of the major challenges of launching an ICO is navigating the complex regulatory environment. Different jurisdictions have different rules regarding token sales, and failure to comply with these regulations can result in fines, penalties, or even project shutdowns. ICO development services help ensure your project adheres to KYC, AML, and securities laws, minimizing legal risks.

3. Custom Token Development

A well-designed token can be the cornerstone of your project’s ecosystem. ICO developers can create customized tokens tailored to your project’s needs, ensuring they integrate seamlessly with your platform. Whether you need a utility token for an application or a governance token for a decentralized organization, ICO development services can deliver the perfect solution.

4. Security Audits and Smart Contract Development

Smart contracts are the backbone of ICOs, handling everything from token distribution to investor contributions. However, poorly coded smart contracts can expose your ICO to hacking or other vulnerabilities. ICO development services include thorough security audits to identify and fix any potential issues before launching the ICO. This ensures the integrity of your project and builds investor trust.

5. Marketing and Investor Outreach

Even the most innovative project can fail without the right exposure. ICO development services often include marketing strategies that can help you reach a global audience. By leveraging social media, content marketing, and influencer partnerships, you can build a strong community and attract early investors who are critical to the success of your ICO.

Steps to Building Your Tokenized Future with ICO Development Services

Launching an ICO is a significant undertaking, but with the right partner, the process becomes much smoother. Below are the essential steps ICO development services can guide you through, ensuring that your tokenized future is built on a solid foundation.

1. Project Ideation and Market Research

Every successful ICO starts with a compelling idea. Before development begins, you’ll need to clearly define the purpose of your project, its objectives, and how blockchain technology fits into your solution. ICO development services can help refine your idea and conduct market research to ensure there’s demand for your product or service.

Define your project's vision and goals.

Identify the problem your project solves.

Research competitors and market opportunities.

2. Whitepaper Development and Tokenomics

The whitepaper is the foundation of your ICO, providing potential investors with in-depth information about your project. It should include details about the problem you’re solving, your solution, the technology behind it, and how your token will function within the ecosystem.

Tokenomics refers to the economic model of your token, including its supply, distribution, and utility within the platform. ICO development services assist with drafting the whitepaper and designing a sustainable token economy.

Outline your project’s technical details and roadmap.

Define token supply, distribution, and use cases.

Include incentives for token holders, such as staking or governance rights.

3. Token Development and Smart Contracts

Once your tokenomics are finalized, the next step is to develop your custom token. ICO development services create tokens based on standards like ERC-20 (Ethereum) or BEP-20 (Binance Smart Chain), ensuring they meet industry requirements.

Smart contracts handle the automation of your ICO, from processing token purchases to distributing tokens to investors. These contracts must be carefully coded and thoroughly audited to prevent vulnerabilities.

Create and test custom tokens on your chosen blockchain.

Develop secure smart contracts to govern the token sale.

Conduct security audits to detect and fix any vulnerabilities.

4. Regulatory Compliance and KYC/AML Implementation

ICOs must adhere to a range of regulatory requirements, especially concerning Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. Failure to comply with these regulations can result in severe penalties. ICO development services ensure that your token sale meets the necessary legal requirements, protecting both you and your investors.

Implement KYC and AML checks for participants.

Ensure compliance with local and international regulations.

Work with legal experts to navigate the evolving regulatory landscape.

5. Website and Dashboard Creation

Your ICO website is the face of your project and plays a critical role in building investor trust. A professional, secure, and user-friendly website allows potential investors to learn about your project and participate in the token sale.

Design a compelling and informative landing page.

Create a secure investor dashboard for seamless token purchases.

Ensure website security with encryption and anti-DDoS measures.

6. Marketing and Community Building

A successful ICO relies on building a strong community of supporters and investors. ICO development services often include marketing strategies to help your project gain visibility across social media, forums, and industry platforms.

Launch targeted marketing campaigns across social media.

Engage with the crypto community through channels like Telegram and Reddit.

Partner with influencers to boost awareness and credibility.

7. Post-ICO Support

Once your ICO concludes, the next phase begins—developing your platform and delivering on your promises to investors. ICO development services provide post-ICO support, from listing your token on exchanges to ongoing technical maintenance.

List your token on reputable cryptocurrency exchanges.

Continue engaging with your community and investors.

Provide regular updates on project progress and milestones.

Conclusion

ICO development services play an essential role in laying the groundwork for a successful tokenized future. From project ideation and token development to regulatory compliance and post-ICO support, these services ensure that your ICO meets industry standards, regulatory requirements, and investor expectations.

Partnering with experienced ICO development teams enables you to focus on your vision while leaving the technical, legal, and marketing aspects to professionals. By building a solid foundation, you can confidently launch your ICO and set your project on the path to long-term success.

Ready to build the foundation for your tokenized future? Partner with expert ICO development services to bring your vision to life today!

0 notes

Text

In 2024, the landscape of digital finance continues to evolve, and creating your own cryptocurrency token has never been more accessible or advantageous. Whether you’re a startup, an established business, or an individual with a visionary idea, having your own token can unlock new opportunities for fundraising, customer engagement, and technological innovation. At Hyipco.com, we offer comprehensive services to help you create and manage cryptocurrency tokens across all major networks. Here’s a guide to getting started.

Why Create a Cryptocurrency Token?

Fundraising: Tokens can be used in Initial Coin Offerings (ICOs) or Security Token Offerings (STOs) to raise capital.

Community Building: Tokens can incentivize and reward community participation, fostering loyalty and engagement.

Decentralized Applications (DApps): Tokens are integral to the functioning of DApps, providing utility and governance functions.

Market Expansion: Creating a token can open up new markets and customer segments, enhancing your brand’s reach and appeal.

Steps to Create Your Own Token

Define Your Purpose and Tokenomics

Purpose: What problem does your token solve? Is it for payments, access to services, or governance?

Tokenomics: Decide on the total supply, distribution method, and any incentives for holding or using the token.

Choose the Right Blockchain Network

Ethereum: The most popular choice, known for its robust smart contract capabilities.

Binance Smart Chain (BSC): Offers lower transaction fees and faster processing times.

Polygon (Matic): A layer-2 solution that provides scalability and lower costs.

Solana: Known for high throughput and low fees.

Others: Depending on your specific needs, other networks like Avalanche, Cardano, or Polkadot might be suitable.

Token Development and Smart Contracts

At Hyipco.com, we handle the technical aspects of token creation. Our experts will write and deploy smart contracts to ensure your token functions as intended.

Token Audit

Security is paramount. We conduct thorough audits of your token’s code to identify and fix vulnerabilities, ensuring it’s safe from malicious attacks.

Token Deployment

Once audited, your token is deployed on the chosen blockchain network. We provide end-to-end support during this critical phase.

Updating Token Information

As your project evolves, so might your token’s parameters. We offer services to update your token’s information, keeping your community informed and engaged.

Post-Creation Services

Marketing and Community Building: Launching a successful token requires effective marketing and a strong community. We can assist with strategic marketing campaigns and community engagement initiatives.

Exchange Listings: Getting your token listed on popular exchanges increases liquidity and accessibility. We help navigate the complexities of the listing process.

Ongoing Support: Our relationship doesn’t end at deployment. We provide continuous support to ensure your token thrives in the competitive crypto landscape.

Why Choose Hyipco.com?

Expertise: Our team consists of blockchain experts with extensive experience in token creation and management.

Customization: We tailor our services to meet your unique needs and goals.

Security: We prioritize the security of your token with comprehensive audits and best practices.

Customer Support: Our dedicated support team is always ready to assist you through every stage of your token’s lifecycle.

Creating your own cryptocurrency token in 2024 is a strategic move that can propel your project to new heights. With Hyipco.com, you have a trusted partner to guide you through the complexities of token creation and management. Visit our website to learn more and start your journey in the world of cryptocurrency today.

We can also create token for you, contact us on

Email: [email protected]

Telegram: https://t.me/Btchyipc

0 notes

Text

How Can a Cryptocurrency Development Company Help with ICO Launches?

Initial Coin Offerings (ICOs) have revolutionized the way startups raise capital, allowing them to bypass traditional funding routes and connect directly with a global pool of investors. However, launching a successful ICO requires careful planning, execution, and compliance with regulatory requirements. This is where a cryptocurrency development company can play a crucial role. Let's explore how these companies can help startups navigate the complexities of launching an ICO.

1. Smart Contract Development:

One of the key components of an ICO is the smart contract that governs the token sale. A cryptocurrency development company can help create a secure and efficient smart contract that meets the specific requirements of the ICO. This includes defining the tokenomics, distribution model, and any additional features such as vesting schedules or bonus structures.

2. Token Development:

Creating a custom token that aligns with the project's goals and vision is essential for a successful ICO. A cryptocurrency development company can assist in designing and developing the token, ensuring it complies with relevant standards (e.g., ERC-20, ERC-721) and is compatible with popular wallets and exchanges.

3. ICO Website Development:

An attractive and informative website is crucial for attracting potential investors to an ICO. A cryptocurrency development company can design and develop a user-friendly website that showcases the project's whitepaper, team, roadmap, and token sale details. They can also integrate KYC/AML verification processes to comply with regulatory requirements.

4. Marketing and PR:

Building awareness and generating hype around an ICO is essential for its success. A cryptocurrency development company can help create a comprehensive marketing and PR strategy that includes social media campaigns, influencer outreach, and community engagement. They can also assist in creating compelling content such as blog posts, videos, and infographics to educate investors about the project.

5. Legal Compliance:

Navigating the legal landscape surrounding ICOs can be challenging, with regulations varying significantly from country to country. A cryptocurrency development company can help ensure that the ICO complies with relevant laws and regulations, including KYC/AML requirements, securities laws, and tax obligations.

6. Security Audits:

Security is paramount in the world of cryptocurrency, and ICOs are no exception. A cryptocurrency development company can conduct thorough security audits of the smart contract and website to identify and mitigate potential vulnerabilities. This helps protect investors' funds and maintain the project's credibility.

7. Post-ICO Support:

The end of the ICO is just the beginning of the journey for a cryptocurrency project. A development company can provide ongoing support for the token post-ICO, including listing on exchanges, implementing governance mechanisms, and maintaining the smart contract.

8. Technical Expertise:

Launching an ICO requires a deep understanding of blockchain technology and the cryptocurrency ecosystem. A cryptocurrency development company brings technical expertise and industry knowledge to the table, helping ensure the ICO is executed smoothly and efficiently.

Conclusion

A cryptocurrency development company can be a valuable partner for startups looking to launch an ICO. From smart contract development to marketing and legal compliance, these companies offer a range of services that can help navigate the complexities of the ICO process. By leveraging their expertise, startups can increase their chances of a successful ICO and lay the foundation for a successful blockchain project.

#Cryptocurrency Development Company#Cryptocurrency Development#Cryptocurrency#Crypto#Crypto Development Company#blockchain#blockchain technology

0 notes

Text

Know Everything About the Minting Program of AXMachine!

Welcome to the AXMachine DeFi Referral Minting Program, an initiative planned and announced to bring together an innovative group of developers and creators. You can effectively collaborate on building and introducing a wide range of cutting-edge earning products/applications within the decentralized finance ecosystem. For cooperative effects and success of Defi applications, the team has innovated the AXMint project boasting an incentivised referral system on the blockchain.

Being an early active participant, you can grab this opportunity to earn rewards for the periodical minting of AXM Tokens [native asset to AXMachine ecosystem]. This is a new yet crucial minting platform with an intention to foster community growth and make engagement effective while bringing in a decentralized network to benefit all its community members.

AXMachine project and team are ready to generate a high-volume market cap with AXM coin appreciation of 1800% in the next 5 years. So, the agenda is high-end, you can positively join the bandwagon to explore the best markets with the AXMachine universe along with a diverse array of upcoming earning opportunities being a part of this network.

AXMint Program

AXMint program is an active earning campaign posed by South Africa and United Kingdom-based company AXMachine Blockchain Services Private LTD. This program will allow you to operate the minting bots on a blockchain server and in fact, earn AXM Tokens daily. This campaign is loaded with additional income boosters such as referrals, kinds of leadership rewards, and binary incentive rewards. The AXMint minting program is a crypto project where you can win maximum profits by using the network protocols.

You can also invite others while participating in the program and in return earn commissions from the different referrals’ minting activities. This campaign is powered by the AXMachine blockchain [decentralized platform] to enjoy fast, safe, and scalable transactions. It claims to be a convenient and profitable way for enthusiasts, investors, users, and interested candidates alike to mine virtual assets.

AXMint Business Plan

· User can purchase and activate any of the minting packages.

· Every minting bot will run for around 365 days and mint new tokens eventually.

· Minted new assets are tradeable on listed exchanges.

· You can utilize the affiliate and other booster programs to grab tons of AXM tokens.

Minting Program Bots Packages

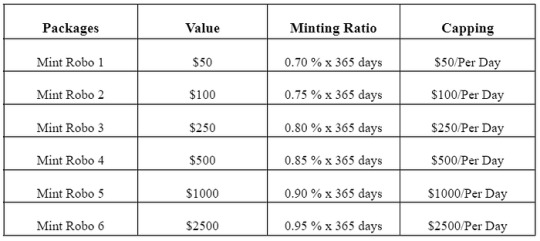

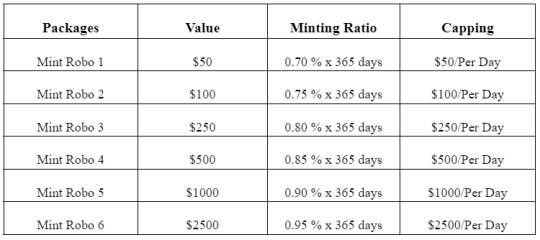

To participate in the minting program, you initially should create a user account with Axmint.io to get eligible to enjoy all perks and events while making a purchase of the minting bot package. The packages come in a wide range pattern from $100 — $10,000, and each package is designed with a different minting capacity as well as duration. Make sure that the higher its package, the more rewards you have the chance to earn.

When you choose a package and get activated, a new node is generated in the network.

The nodes act as minting algorithms to mint new tokens as per the hash power.

The higher your package, the higher you get the hash power, hence; minting benefits for more tokens.

What is Minting Income in Tokens?

“Minting income in tokens” phrase relates to the process of two words “minting” which means the creation of cryptocurrency tokens and then earning income from created tokens. Check out the exact process working:

1. Token Creation or Minting

Minting is done by creating a new set of cryptocurrency tokens usually on blockchain platforms such as Ethereum or Binance Smart Chain where assets can be digital currencies even owned within a specific project.

2. Initial Creation or ICO

In a few scenarios, assets are generated through an Initial Coin Offering or say Initial Token Offering where assets are sold to investors in return for established digital assets like Bitcoin/Ethereum.

3. Yield Farming or Staking

Once tokens are generated and in use, you as a holder can eventually earn income via yield farming or staking. This process refers to offering liquidity to DEXs or any lending platforms in return for interest/rewards in the form of cryptocurrencies. Whereas, staking terms specify to lock up a certain amount of assets in a blockchain network while incorporating a staking mechanism. In exchange, you will get rewards/interest in the form of extra tokens.

4. Liquidity Provision

Some of you mint assets and then offer liquidity to DEXs by depositing cryptocurrencies into liquidity pools, hence; earning certain fees from trading on the platform.

5. Governance and Voting

Some of the ecosystems give holders advocated rights to earn income by joining in governance activities where you can freely vote on proposals/decisions regarding the project’s development. As a result, you earn assets as rewards for the active participation.

6. NFT Minting

In some scenarios, the term “minting” can also relate to the creation of non-fungible tokens where artists and creators are allowed to feasibly mint NFTs such as digital art, collectables, or any sort of unique items and in exchange earn income from the sale made.

7. Risks and Considerations

We all believe that minting income in cryptocurrencies seems profitable, still, the process carries vulnerable risks. As cryptocurrency markets are volatile, hence; the value of cryptocurrencies might fluctuate at any time barging with the market trends. So, we recommend every user to perform the mandatory research and get known with the underlying technology, the specific token project, along its potential risks prior to getting involved. Also, be aware of the tax implications of earning income in cryptocurrency, as tax laws also depend on and vary by jurisdiction.

8. Diversification

Diversifying your virtual holdings is often associated with managing risk rather than putting all your earnings into a single token, you should spread and explore other investments across various projects.

9. Legal and Regulatory Compliance

While you decide to mint cryptocurrencies, you should always consider compliance with local and international regulations and then think about earning income in the cryptocurrency space. Make sure you understand all applicable laws and regulations.

Henceforth, AXMint brings you the golden opportunity to earn minting income in tokens and freely participate by being a part of the growing cryptocurrency ecosystem. However, work with caution, understand the basic and associated risks; and then conduct your research prior to making any investment using all sorts of resources.

For more information and details, you can log in to the official portal to get recent updates: https://www.axmint.io/.

Twitter: https://twitter.com/AxmintDefi

Telegram: https://t.me/AxMintChat

Medium: https://medium.com/@Axmintdefi/

Reddit: https://www.reddit.com/user/Axmint

0 notes

Text

Know Everything About the Minting Program of AXMachine!

Welcome to the AXMachine DeFi Referral Minting Program, an initiative planned and announced to bring together an innovative group of developers and creators. You can effectively collaborate on building and introducing a wide range of cutting-edge earning products/applications within the decentralized finance ecosystem. For cooperative effects and success of Defi applications, the team has innovated the AXMint project boasting an incentivised referral system on the blockchain.

Being an early active participant, you can grab this opportunity to earn rewards for the periodical minting of AXM Tokens [native asset to AXMachine ecosystem]. This is a new yet crucial minting platform with an intention to foster community growth and make engagement effective while bringing in a decentralized network to benefit all its community members.

AXMachine project and team are ready to generate a high-volume market cap with AXM coin appreciation of 1800% in the next 5 years. So, the agenda is high-end, you can positively join the bandwagon to explore the best markets with the AXMachine universe along with a diverse array of upcoming earning opportunities being a part of this network.

AXMint Program

AXMint program is an active earning campaign posed by South Africa and United Kingdom-based company AXMachine Blockchain Services Private LTD. This program will allow you to operate the minting bots on a blockchain server and in fact, earn AXM Tokens daily. This campaign is loaded with additional income boosters such as referrals, kinds of leadership rewards, and binary incentive rewards. The AXMint minting program is a crypto project where you can win maximum profits by using the network protocols.

You can also invite others while participating in the program and in return earn commissions from the different referrals’ minting activities. This campaign is powered by the AXMachine blockchain [decentralized platform] to enjoy fast, safe, and scalable transactions. It claims to be a convenient and profitable way for enthusiasts, investors, users, and interested candidates alike to mine virtual assets.

AXMint Business Plan

· User can purchase and activate any of the minting packages.

· Every minting bot will run for around 365 days and mint new tokens eventually.

· Minted new assets are tradeable on listed exchanges.

· You can utilize the affiliate and other booster programs to grab tons of AXM tokens.

Minting Program Bots Packages

To participate in the minting program, you initially should create a user account with Axmint.io to get eligible to enjoy all perks and events while making a purchase of the minting bot package. The packages come in a wide range pattern from $100 — $10,000, and each package is designed with a different minting capacity as well as duration. Make sure that the higher its package, the more rewards you have the chance to earn.

When you choose a package and get activated, a new node is generated in the network.

The nodes act as minting algorithms to mint new tokens as per the hash power.

The higher your package, the higher you get the hash power, hence; minting benefits for more tokens.

What is Minting Income in Tokens?

“Minting income in tokens” phrase relates to the process of two words “minting” which means the creation of cryptocurrency tokens and then earning income from created tokens. Check out the exact process working:

1. Token Creation or Minting

Minting is done by creating a new set of cryptocurrency tokens usually on blockchain platforms such as Ethereum or Binance Smart Chain where assets can be digital currencies even owned within a specific project.

2. Initial Creation or ICO

In a few scenarios, assets are generated through an Initial Coin Offering or say Initial Token Offering where assets are sold to investors in return for established digital assets like Bitcoin/Ethereum.

3. Yield Farming or Staking

Once tokens are generated and in use, you as a holder can eventually earn income via yield farming or staking. This process refers to offering liquidity to DEXs or any lending platforms in return for interest/rewards in the form of cryptocurrencies. Whereas, staking terms specify to lock up a certain amount of assets in a blockchain network while incorporating a staking mechanism. In exchange, you will get rewards/interest in the form of extra tokens.

4. Liquidity Provision

Some of you mint assets and then offer liquidity to DEXs by depositing cryptocurrencies into liquidity pools, hence; earning certain fees from trading on the platform.

5. Governance and Voting

Some of the ecosystems give holders advocated rights to earn income by joining in governance activities where you can freely vote on proposals/decisions regarding the project’s development. As a result, you earn assets as rewards for the active participation.

6. NFT Minting

In some scenarios, the term “minting” can also relate to the creation of non-fungible tokens where artists and creators are allowed to feasibly mint NFTs such as digital art, collectables, or any sort of unique items and in exchange earn income from the sale made.

7. Risks and Considerations

We all believe that minting income in cryptocurrencies seems profitable, still, the process carries vulnerable risks. As cryptocurrency markets are volatile, hence; the value of cryptocurrencies might fluctuate at any time barging with the market trends. So, we recommend every user to perform the mandatory research and get known with the underlying technology, the specific token project, along its potential risks prior to getting involved. Also, be aware of the tax implications of earning income in cryptocurrency, as tax laws also depend on and vary by jurisdiction.

8. Diversification

Diversifying your virtual holdings is often associated with managing risk rather than putting all your earnings into a single token, you should spread and explore other investments across various projects.

9. Legal and Regulatory Compliance

While you decide to mint cryptocurrencies, you should always consider compliance with local and international regulations and then think about earning income in the cryptocurrency space. Make sure you understand all applicable laws and regulations.

Henceforth, AXMint brings you the golden opportunity to earn minting income in tokens and freely participate by being a part of the growing cryptocurrency ecosystem. However, work with caution, understand the basic and associated risks; and then conduct your research prior to making any investment using all sorts of resources.

For more information and details, you can log in to the official portal to get recent updates: https://www.axmint.io/.

Twitter: https://twitter.com/AxMachine

Telegram: https://t.me/AxMintChat

Reddit: https://www.reddit.com/user/AxMachineDeFI

0 notes

Text

Global Trade Dynamics and Their Impact on Cryptocurrency

As global connections deepen and trade dynamics evolve, cryptocurrency has emerged as a transformative force in the world of commerce. The rise of digital currencies is reshaping how businesses and individuals participate in global trade, presenting both opportunities and challenges. This blog explores how these changes are impacting the cryptocurrency space, focusing on the latest trends and developments.

The Intersection of Global Trade and Cryptocurrency

Cryptocurrency is revolutionizing traditional financial systems, especially in the realm of international trade. Digital currencies such as Bitcoin and Ethereum provide a decentralized, fast, and cost-effective means of transaction, particularly for cross-border payments.

Key Benefits:

Reduced Transaction Costs: Cryptocurrencies eliminate the need for intermediaries, reducing fees associated with traditional banking systems.

Faster Payments: Blockchain technology ensures near-instantaneous transfers, enhancing trade efficiency.

Inclusive Access: Emerging markets with limited access to traditional banking systems benefit significantly from cryptocurrency adoption.

As businesses seek to optimize their operations, adopting cryptocurrency as a payment method is becoming increasingly common.

Staying Informed: Cryptocurrency Information and Research

Understanding the evolving cryptocurrency landscape is essential for businesses and investors alike.

Inflation Hedge: Cryptocurrencies often serve as a safeguard against inflation and currency devaluation, particularly in economies experiencing instability.

Strategic Investments: Researching the best cryptocurrencies for trade helps investors and businesses make informed decisions.

Ongoing cryptocurrency research sheds light on how digital assets can transform trade practices, making it crucial to stay updated on the latest trends.

Trending Cryptocurrency Projects

The cryptocurrency space is buzzing with innovation, with several projects gaining traction globally:

Decentralized Finance (DeFi): DeFi platforms are revolutionizing traditional financial services, enabling decentralized borrowing, lending, and trading.

Non-Fungible Tokens (NFTs): NFTs are transforming how value is exchanged, particularly in the art, gaming, and entertainment industries.

Additionally, Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) are paving the way for new projects to enter the market. By tracking upcoming ICO lists and top ICOs, investors can uncover promising opportunities in this vibrant ecosystem.

The Role of ICOs and Token Sales

ICOs have become a popular method for raising funds in the cryptocurrency sector.

Why ICOs Matter:

They offer innovative solutions to existing industry challenges.

Investors gain early access to promising projects with potential for high returns.

Platforms providing ICO calendars and insights into upcoming token sales help investors stay ahead in identifying lucrative ventures. Similarly, IDOs are gaining momentum, offering decentralized alternatives for token launches.

Airdrops: Opportunities for Investors

Crypto airdrops provide free tokens to users, often as part of promotional campaigns for new projects.

Benefits of Airdrops:

Free entry into emerging projects.

Potential for significant returns as the project gains value.

By staying informed about the latest crypto airdrops and upcoming airdrop opportunities, investors can reap rewards while diversifying their portfolios.

Crypto Launchpads: Empowering New Projects

Crypto launchpads are essential for the success of new cryptocurrency ventures.

How Launchpads Help:

Provide resources and exposure for new projects.

Streamline token launch processes.

Connect developers with potential investors.

The best crypto launchpads ensure smooth token launches, offering investors access to high-quality projects while supporting innovation in the cryptocurrency space.

Conclusion

The evolving dynamics of global trade are having a profound impact on the cryptocurrency landscape. By integrating digital assets into trade practices, businesses and individuals can enjoy enhanced efficiency, reduced costs, and greater inclusivity.

To thrive in this dynamic ecosystem, it’s vital to stay informed about:

Cryptocurrency research and trends.

Prominent projects, ICOs, IDOs, and airdrops.

Opportunities offered by crypto launchpads.

By embracing these innovations, investors and businesses can effectively navigate the intersection of global trade and cryptocurrency, unlocking new avenues for growth and success in an increasingly connected world.

0 notes

Text

Global Trade Dynamics and Their Impact on Cryptocurrency

As global connections deepen and trade dynamics evolve, cryptocurrency has emerged as a transformative force in the world of commerce. The rise of digital currencies is reshaping how businesses and individuals participate in global trade, presenting both opportunities and challenges. This blog explores how these changes are impacting the cryptocurrency space, focusing on the latest trends and developments.

The Intersection of Global Trade and Cryptocurrency

Cryptocurrency is revolutionizing traditional financial systems, especially in the realm of international trade. Digital currencies such as Bitcoin and Ethereum provide a decentralized, fast, and cost-effective means of transaction, particularly for cross-border payments.

Key Benefits:

Reduced Transaction Costs: Cryptocurrencies eliminate the need for intermediaries, reducing fees associated with traditional banking systems.

Faster Payments: Blockchain technology ensures near-instantaneous transfers, enhancing trade efficiency.

Inclusive Access: Emerging markets with limited access to traditional banking systems benefit significantly from cryptocurrency adoption.

As businesses seek to optimize their operations, adopting cryptocurrency as a payment method is becoming increasingly common.

Staying Informed: Cryptocurrency Information and Research

Understanding the evolving cryptocurrency landscape is essential for businesses and investors alike.

Inflation Hedge: Cryptocurrencies often serve as a safeguard against inflation and currency devaluation, particularly in economies experiencing instability.

Strategic Investments: Researching the best cryptocurrencies for trade helps investors and businesses make informed decisions.

Ongoing cryptocurrency research sheds light on how digital assets can transform trade practices, making it crucial to stay updated on the latest trends.

Trending Cryptocurrency Projects

The cryptocurrency space is buzzing with innovation, with several projects gaining traction globally:

Decentralized Finance (DeFi): DeFi platforms are revolutionizing traditional financial services, enabling decentralized borrowing, lending, and trading.

Non-Fungible Tokens (NFTs): NFTs are transforming how value is exchanged, particularly in the art, gaming, and entertainment industries.

Additionally, Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) are paving the way for new projects to enter the market. By tracking upcoming ICO lists and top ICOs, investors can uncover promising opportunities in this vibrant ecosystem.

The Role of ICOs and Token Sales

ICOs have become a popular method for raising funds in the cryptocurrency sector.

Why ICOs Matter:

They offer innovative solutions to existing industry challenges.

Investors gain early access to promising projects with potential for high returns.

Platforms providing ICO calendars and insights into upcoming token sales help investors stay ahead in identifying lucrative ventures. Similarly, IDOs are gaining momentum, offering decentralized alternatives for token launches.

Airdrops: Opportunities for Investors

Crypto airdrops provide free tokens to users, often as part of promotional campaigns for new projects.

Benefits of Airdrops:

Free entry into emerging projects.

Potential for significant returns as the project gains value.

By staying informed about the latest crypto airdrops and upcoming airdrop opportunities, investors can reap rewards while diversifying their portfolios.

Crypto Launchpads: Empowering New Projects

Crypto launchpads are essential for the success of new cryptocurrency ventures.

How Launchpads Help:

Provide resources and exposure for new projects.

Streamline token launch processes.

Connect developers with potential investors.

The best crypto launchpads ensure smooth token launches, offering investors access to high-quality projects while supporting innovation in the cryptocurrency space.

Conclusion

The evolving dynamics of global trade are having a profound impact on the cryptocurrency landscape. By integrating digital assets into trade practices, businesses and individuals can enjoy enhanced efficiency, reduced costs, and greater inclusivity.

To thrive in this dynamic ecosystem, it’s vital to stay informed about:

Cryptocurrency research and trends.

Prominent projects, ICOs, IDOs, and airdrops.

Opportunities offered by crypto launchpads.

By embracing these innovations, investors and businesses can effectively navigate the intersection of global trade and cryptocurrency, unlocking new avenues for growth and success in an increasingly connected world.

0 notes

Text

Global Trade Dynamics and Their Impact on Cryptocurrency

As global connections deepen and trade dynamics evolve, cryptocurrency has emerged as a transformative force in the world of commerce. The rise of digital currencies is reshaping how businesses and individuals participate in global trade, presenting both opportunities and challenges. This blog explores how these changes are impacting the cryptocurrency space, focusing on the latest trends and developments.

The Intersection of Global Trade and Cryptocurrency

Cryptocurrency is revolutionizing traditional financial systems, especially in the realm of international trade. Digital currencies such as Bitcoin and Ethereum provide a decentralized, fast, and cost-effective means of transaction, particularly for cross-border payments.

Key Benefits:

Reduced Transaction Costs: Cryptocurrencies eliminate the need for intermediaries, reducing fees associated with traditional banking systems.

Faster Payments: Blockchain technology ensures near-instantaneous transfers, enhancing trade efficiency.

Inclusive Access: Emerging markets with limited access to traditional banking systems benefit significantly from cryptocurrency adoption.

As businesses seek to optimize their operations, adopting cryptocurrency as a payment method is becoming increasingly common.

Staying Informed: Cryptocurrency Information and Research

Understanding the evolving cryptocurrency landscape is essential for businesses and investors alike.

Inflation Hedge: Cryptocurrencies often serve as a safeguard against inflation and currency devaluation, particularly in economies experiencing instability.

Strategic Investments: Researching the best cryptocurrencies for trade helps investors and businesses make informed decisions.

Ongoing cryptocurrency research sheds light on how digital assets can transform trade practices, making it crucial to stay updated on the latest trends.

Trending Cryptocurrency Projects

The cryptocurrency space is buzzing with innovation, with several projects gaining traction globally:

Decentralized Finance (DeFi): DeFi platforms are revolutionizing traditional financial services, enabling decentralized borrowing, lending, and trading.

Non-Fungible Tokens (NFTs): NFTs are transforming how value is exchanged, particularly in the art, gaming, and entertainment industries.

Additionally, Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) are paving the way for new projects to enter the market. By tracking upcoming ICO lists and top ICOs, investors can uncover promising opportunities in this vibrant ecosystem.

The Role of ICOs and Token Sales

ICOs have become a popular method for raising funds in the cryptocurrency sector.

Why ICOs Matter:

They offer innovative solutions to existing industry challenges.

Investors gain early access to promising projects with potential for high returns.

Platforms providing ICO calendars and insights into upcoming token sales help investors stay ahead in identifying lucrative ventures. Similarly, IDOs are gaining momentum, offering decentralized alternatives for token launches.

Airdrops: Opportunities for Investors

Crypto airdrops provide free tokens to users, often as part of promotional campaigns for new projects.

Benefits of Airdrops:

Free entry into emerging projects.

Potential for significant returns as the project gains value.

By staying informed about the latest crypto airdrops and upcoming airdrop opportunities, investors can reap rewards while diversifying their portfolios.

Crypto Launchpads: Empowering New Projects

Crypto launchpads are essential for the success of new cryptocurrency ventures.

How Launchpads Help:

Provide resources and exposure for new projects.

Streamline token launch processes.

Connect developers with potential investors.

The best crypto launchpads ensure smooth token launches, offering investors access to high-quality projects while supporting innovation in the cryptocurrency space.

Conclusion

The evolving dynamics of global trade are having a profound impact on the cryptocurrency landscape. By integrating digital assets into trade practices, businesses and individuals can enjoy enhanced efficiency, reduced costs, and greater inclusivity.

To thrive in this dynamic ecosystem, it’s vital to stay informed about:

Cryptocurrency research and trends.

Prominent projects, ICOs, IDOs, and airdrops.

Opportunities offered by crypto launchpads.

By embracing these innovations, investors and businesses can effectively navigate the intersection of global trade and cryptocurrency, unlocking new avenues for growth and success in an increasingly connected world.

0 notes

Text

Global Trade Dynamics and Their Impact on Cryptocurrency

As global connections deepen and trade dynamics evolve, cryptocurrency has emerged as a transformative force in the world of commerce. The rise of digital currencies is reshaping how businesses and individuals participate in global trade, presenting both opportunities and challenges. This blog explores how these changes are impacting the cryptocurrency space, focusing on the latest trends and developments.

The Intersection of Global Trade and Cryptocurrency

Cryptocurrency is revolutionizing traditional financial systems, especially in the realm of international trade. Digital currencies such as Bitcoin and Ethereum provide a decentralized, fast, and cost-effective means of transaction, particularly for cross-border payments.

Key Benefits:

Reduced Transaction Costs: Cryptocurrencies eliminate the need for intermediaries, reducing fees associated with traditional banking systems.

Faster Payments: Blockchain technology ensures near-instantaneous transfers, enhancing trade efficiency.

Inclusive Access: Emerging markets with limited access to traditional banking systems benefit significantly from cryptocurrency adoption.

As businesses seek to optimize their operations, adopting cryptocurrency as a payment method is becoming increasingly common.

Staying Informed: Cryptocurrency Information and Research

Understanding the evolving cryptocurrency landscape is essential for businesses and investors alike.