#ICICI Bank Coral Credit Card

Explore tagged Tumblr posts

Text

0 notes

Text

Discover the key benefits of the ICICI Coral Credit Card, including reward points, dining discounts, complimentary lounge access, insurance coverage, and annual fee waiver. Enjoy exclusive perks on shopping, travel, and entertainment while managing your expenses effectively. Maximize your lifestyle with this versatile and rewarding credit card.

0 notes

Text

Best ICICI Credit Cards With No Annual Fee Benefits

Looking for a credit card that offers amazing benefits without any annual fee? ICICI Bank has some of the best options for you! These cards combine savings with exclusive rewards, making them a perfect choice for budget-conscious users. Explore the best ICICI credit cards with no annual fee to maximize your savings.

The ICICI Platinum Chip Credit Card is a standout option. It not only comes with zero annual fees but also offers exciting reward points on every transaction, ensuring your spending always brings something back. Another great choice is the ICICI Amazon Pay Credit Card, ideal for online shoppers. With this card, you can enjoy cashback on Amazon purchases and earn rewards on other spends, all without worrying about an annual fee.

For those who love dining out, the ICICI Coral Credit Card offers attractive dining discounts along with other lifestyle privileges. Additionally, these cards come with features like contactless payments, robust security, and access to ICICI's excellent customer service.

Say goodbye to annual charges and hello to smart savings! Explore ICICI’s no annual fee credit cards today and make every transaction rewarding.

0 notes

Text

Top ICICI Bank Credit Cards: A Complete Guide

Looking for the best ICICI Bank credit cards? Our comprehensive guide has you covered! ICICI Bank offers a wide range of credit cards tailored to different needs, including shopping, travel, dining, and more. Whether you’re a frequent traveler, an online shopper, or someone who loves dining out, there’s an ICICI credit card for you.

ICICI Bank credit cards come packed with exciting benefits like cashback, reward points, travel perks, and exclusive discounts. For instance, the ICICI Coral Credit Card is perfect for everyday needs, offering great discounts on dining and movies. Meanwhile, the ICICI Sapphiro Credit Card is ideal for premium customers seeking luxury benefits like travel insurance, airport lounge access, and global offers.

Choosing the right ICICI Bank credit card can help you maximize savings and enjoy unmatched perks. Explore options that fit your lifestyle and make the most of what ICICI Bank has to offer. Start your journey with the perfect ICICI Bank credit card today and enjoy a rewarding financial experience!

0 notes

Text

Top 5 Best ICICI Bank Credit Cards of 2024 Ultimate Guide & Benefits

Explore the Top 5 Best ICICI Bank Credit Cards of 2024, each offering a range of rewards and exclusive benefits. The ICICI Bank Coral Credit Card provides rewards on daily spending, lounge access, and dining discounts. The Platinum Chip Credit Card is a great lifetime-free option, offering simple rewards and fuel savings. For luxury travelers, the Sapphiro Credit Card includes premium perks like international lounge access and concierge services. Frequent Amazon shoppers can benefit from up to 5% cashback with the Amazon Pay Credit Card. Lastly, the Rubyx Credit Card offers premium rewards, airport lounge access, and entertainment deals.

These Top 5 Best ICICI Bank Credit Cards provide options for every lifestyle, from essential benefits to high-end perks. Choose the one that best fits your needs for maximum financial rewards and savings.

0 notes

Text

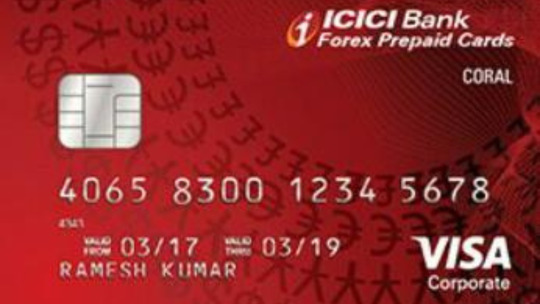

ICICI Bank Coral Prepaid Forex Card

The ICICI Bank Coral Prepaid Forex Card is a versatile financial instrument designed to satisfy the needs of international visitors. Whether you're a traveller seeing new locations or a business person who frequently travels overseas, this prepaid card offers a straightforward and secure way to manage your foreign exchange spending. The Coral Prepaid Forex Card allows you to load a variety of foreign currencies, eliminating the need to carry cash or traveler's checks. It provides users with access to a huge worldwide network of ATMs and retail establishments, making it the perfect travelling companion. Check

Main Points

Multi-Currency Load: You can load multiple foreign currencies onto a single card, allowing you to avoid the hassle of carrying different currencies or traveler's cheques.

Global Acceptance: The card is widely accepted at ATMs, merchant establishments, and online platforms around the world, providing you with easy access to your funds wherever you go.

Security: The card comes with a PIN-based security feature, ensuring that your funds are safe and protected from unauthorized use. In case of loss or theft, you can also report it and get a replacement card.

Emergency Assistance: Many Coral Prepaid Forex Cards offer emergency assistance services, including card replacement and emergency cash disbursement, in case you run into unforeseen financial troubles while abroad.

Travel Insurance: Some versions of this card offer complimentary travel insurance, covering aspects like medical emergencies, lost baggage, trip cancellations, and more, providing you with added peace of mind during your travels.

Exclusive Discounts: Cardholders often enjoy exclusive discounts and offers on dining, shopping, and travel-related services, helping you save money while abroad.

Online Access: You can easily track your transactions and manage your card online, allowing you to monitor your expenses and balance in real-time.

Reloadable: The card is reloadable, meaning you can add more funds to it as needed, making it a convenient and reusable financial tool for multiple trips.

Currency Conversion: The card typically offers competitive exchange rates, saving you money on currency conversion fees compared to exchanging cash at airports or currency exchange offices.

Customizable: Depending on your needs, you can choose the initial currencies you want to load onto the card. This customization ensures that you have the right mix of currencies for your travel destinations.

24/7 Customer Support: ICICI Bank usually provides round-the-clock customer support, so you can seek assistance or report issues at any time during your journey.

Cashless Transactions: Enjoy the convenience of cashless transactions, whether you're dining, shopping, or booking hotels and flights during your travels.

No Foreign Transaction Fees: With a prepaid forex card, you often avoid foreign transaction fees that are typically associated with using a regular credit or debit card abroad.

Conclusion

The ICICI Bank Coral Prepaid Forex Card, in conclusion, is an invaluable financial instrument for both business and leisure tourists abroad. It offers comfort and security while travelling due to its ability to load a variety of currencies, wide acceptance, and strong security measures. The added benefits, including emergency assistance, travel insurance, and exclusive discounts, make it more appealing to consumers who frequently go abroad. Whether you're a traveller exploring new locations or a business professional managing abroad spending, this card streamlines your financial transactions and ensures you make the most of your travels. Consider the ICICI Bank Coral Prepaid Forex Card if you're seeking for a quick and inexpensive way to send money abroad.

0 notes

Text

NRI, or Non-Resident Indian, credit cards are designed to cater to the needs of Indians living abroad. These cards offer various benefits and rewards programs, including cashback rewards, to provide value and convenience to NRI customers. Cashback rewards credit cards allow users to earn a percentage of their spending back as cash, which can be a great way to save money and maximize your credit card usage.

Main Points

HDFC Bank NRI Superia Credit Card:

Cashback Rewards: Earn cashback on various spending categories, including dining, shopping, travel, and more. The cashback percentage varies depending on the category.

Additional Benefits: Enjoy airport lounge access, travel privileges like discounted airfares and hotel bookings, and exclusive discounts on partner merchants.

Annual Fee: The annual fee for this card may apply, and it varies based on the bank's terms and conditions.

ICICI Bank NRI Coral Credit Card: Cashback Rewards: Earn cashback on a range of spending categories, such as grocery shopping, bill payments, dining, and fuel expenses. The cashback rates may vary for different categories.

Additional Benefits: Avail complimentary airport lounge access, travel insurance coverage, and lifestyle perks like discounts on dining, shopping, and entertainment.

Annual Fee: The annual fee for this card may be applicable, subject to the bank's policies.

Axis Bank Miles & More World Credit Card:

Cashback Rewards: Instead of direct cashback, this card offers miles as rewards. Earn miles on your spending, which can be redeemed for flight tickets, upgrades, and other travel-related expenses with Lufthansa and its partner airlines.

Additional Benefits: Enjoy airport lounge access, travel insurance coverage, and exclusive offers on travel bookings.

Annual Fee: The card may have an annual fee, depending on the bank's terms and conditions.

SBI Signature NRI Credit Card: Cashback Rewards: Earn cashback on various spending categories, including international transactions, dining, and departmental store purchases. The cashback rates may vary based on the category.

Additional Benefits: Access airport lounges worldwide, receive complimentary movie tickets, avail concierge services, and enjoy lifestyle privileges like dining discounts.

Annual Fee: The card may have an annual fee, which can vary based on the bank's policies.

Citibank IndianOil Platinum NRI Credit Card:

Cashback Rewards: This card focuses on cashback rewards for fuel purchases at IndianOil outlets. Earn cashback on fuel expenses and save on your refueling costs.

Additional Benefits: Enjoy accelerated rewards on other categories, dining discounts at partner restaurants, and exclusive offers on travel bookings.

Annual Fee: The card may have an annual fee, subject to the bank's terms and conditions.

Conclusion

These credit cards are designed to cater to the needs of NRIs and offer attractive cashback rewards, making them a valuable choice for maximizing savings and benefits. It's important to review the specific terms, conditions, and eligibility requirements set by each bank before applying for any credit card.

0 notes

Text

ICICI Coral Credit Card: Top Benefits and Exclusive Offers

The ICICI Coral Credit Card is packed with benefits that make it a great choice for anyone looking to enhance their shopping, dining, and travel experiences. This premium credit card offers rewarding features, such as earning 2 reward points for every ₹100 spent on purchases, and 4 points on select categories like dining and groceries. Plus, new cardholders get a joining bonus of 1,000 reward points!

One of the standout features of the ICICI Coral Credit Card is the annual fee waiver if you spend ₹1,50,000 or more in a year. The card also offers exclusive discounts at partner restaurants, with up to 20% off on dining bills. For travel enthusiasts, it provides complimentary access to airport lounges and travel insurance coverage.

ICICI Coral Credit Cardholders can also benefit from special discounts on movie tickets and enjoy cashback offers from top brands. Managing the card is easy with ICICI’s mobile banking app, which allows you to track your rewards, transactions, and bills on the go.

With a range of exclusive perks and a flexible payment option, the ICICI Coral Credit Card is a valuable addition to your financial toolkit.

0 notes

Text

The Ultimate Guide to the Top 10 Fuel Credit Cards in India

Here’s a concise guide to the top 10 fuel credit cards in India, tailored for those looking to save on fuel expenses. These cards offer significant benefits such as cashback, reward points, and fuel surcharge waivers, helping you reduce the cost of your daily commute or long journeys. The IndianOil Citi Credit Card, BPCL SBI Credit Card, and HDFC Bharat Cashback Credit Card lead the pack with their impressive rewards on fuel purchases. Other notable options include the ICICI HPCL Coral Credit Card, Standard Chartered Super Value Titanium Credit Card, and Axis Bank IndianOil Credit Card, each providing unique advantages at various fuel stations. The Kotak Essentia Platinum Credit Card, YES BANK Prosperity Rewards Plus Credit Card, American Express Membership Rewards Credit Card, and RBL Bank Platinum Maxima Credit Card also stand out with their combined benefits on fuel and other categories. These fuel credit cards in India are essential for anyone looking to optimize fuel spending while enjoying additional perks.

0 notes

Text

Top ICICI Bank Credit Cards: Benefits, Features & Rewards

ICICI Bank offers a diverse range of credit cards catering to various lifestyles. Top ICICI Bank Credit Cards include the Coral, Sapphiro, Platinum Chip, and Rubyx, each designed to provide exceptional benefits and rewards. The Coral Credit Card offers 2 PAYBACK points per ₹100 spent and complimentary airport lounge access, making it ideal for frequent shoppers. The Sapphiro Credit Card is tailored for luxury seekers, providing global lounge access, complimentary golf sessions, and 24/7 concierge services. The Platinum Chip Credit Card is a no-fee card with basic rewards and enhanced security through chip-and-PIN technology. The Rubyx Credit Card offers double reward points on international transactions and exclusive entertainment perks like buy-one-get-one-free movie tickets. These cards not only provide excellent travel, dining, and entertainment benefits but also cater to diverse financial needs, ensuring there's an ICICI Bank card for every type of spender.

0 notes

Video

youtube

ICICI Bank Coral Credit card Apply Live demo in Tamil @Tech and Technics

0 notes

Link

You can earn reward points when you shop with your ICICI Bank Coral Credit Card and redeem them easily for attractive options from a range of categories like travel, premium merchandise, and much more. Read on to know more about ICICI Bank Coral Credit Card offers.

#ICICI Bank Coral Credit Card#online Credit Card#ICICI Bank Coral Credit Card limit#ICICI Bank Coral Credit Card fee and charges#get credit card online#credit card instant approval#apply for new credit card

0 notes

Link

Yes, you can get credit cards with no credit score. If you haven’t borrowed any loan in past credit history then your credit score will be zero. But it doesn’t mean you can’t have a credit card. You can apply for secured credit cards to get the monthly expenses managed. Read the article and know how to get credit cards with no credit history in India.

#Credit Cards with No Credit#ICICI Bank Coral Credit Card#Axis Bank Insta Easy Credit Card#Credit Card

0 notes

Photo

ICICI Bank Coral Credit Card

ICICI Bank Coral Credit Card is a way of life type Mastercard. 2X Cash prizes on eating, food, and grocery stores. Free motion pictures and air terminal parlor visits. Acquire PAYBACK focuses while shopping. Get add-on cards for your relatives.

Reference

https://www.creditmantri.com/icici-bank-coral-credit-card/

0 notes

Text

ICICI Coral credit card is tailored to meet the needs of frequent online shoppers. The card comes loaded with features such as reward points, cash back, and gift vouchers that not only make shopping a fun experience but also add up to significant savings in the long run. A customer can avail of this credit card either as a VISA or MasterCard version. Users become eligible for additional benefits such as lounge access, discounts on movie tickets and shopping, and cashback on travel tickets.

0 notes

Text

The ICICI Coral credit card offers enticing promotions in the areas of travel and lifestyle. This card is a part of the "gemstone collection," a line of high-end credit cards from ICICI that also includes the Rubyx, Sapphiro, and other cards. This card has an implanted microchip that increases security along with tempting discounts, promotions, and access to premium lounges.

0 notes