#I can understand what Charlie said about the edit because he cannot include everything and there is a storyline

Explore tagged Tumblr posts

Text

Charlie talking about the fan response to All Of Those Voices, and the new edit that's going to be streamed. And Louis commenting on Charlie's fashion choices.

All Of Those Voices IG live, 12 May 2023 x

#that is a very Louis comment#AOTV Global Screening#I can understand what Charlie said about the edit because he cannot include everything and there is a storyline#Charlie Lightening#Louis Tomlinson#people say thats Louis and Oli in the back but it's not far but that is def Chris Frewin#hope the beach scene isnt mentioned again because it gets funnier every time the natural and organic scene is mentioned#Louis twitter#Louis vid#Louis IG#12 May 2023#veeps#mine

36 notes

·

View notes

Text

21 Supernatural Questions

Thanks to @sammit-janet for helping me procrastinate tonight!

1. When did you start watching Supernatural?

Early December, 2014. I’d been sick for a month, already, and had run out of other shows I wanted to watch. I decided to watch that show that Misha Collins was on that my goddaughters used to watch. I got through 9.5 seasons by Christmas. That first hellatus was awful, and it’s how I got into the fandom. I needed more, found con videos, then fan fiction, and the rest is history!

2. Who is your favorite in TFW?

It depends on the day. I usually say I’m Winchester-sexual, angel-curious!

3. Who is your least favorite in TFW?

Ugh. I don’t dislike any of them (though I miss BAMF early-seasons Cas who didn’t bleed much and could do things regular hunters couldn’t like see demons’ faces). If I had to rank them, I probably obsess over Cas the least.

4. Tag your top 5 Supernatural blogs.

You’d ask me who my favorite children were, too, wouldn’t you? Not falling for that!

5. Who is your favorite character (not including TFW)?

You’re killing me. You’re really killing me. I CAN’T PICK. Chuck? Donna? Jody? Rowena? I love John and Mary, but I don’t get squishy when I watch them on the show. Charlie? I literally squealed and frightened my husband when we saw AU!Charlie the first time. Ellen? There are too many and you can’t make me pick!!

6. Who is your favorite woman in Supernatural?

Donna. She kicks ass and calls it butt.

7. John or Mary?

Gonna quote @sammit-janet directly, cuz she said it well: “Both. I know people hate one or the other, but you cannot look at these parents with real-world glasses. John had the mother of his children burned on the ceiling and he had no fucking clue about the Supernatural until then. Once he did, he was on a mission to find whatever killed his wife.

“Mary made a deal to save the man she loved. She would have stopped Azazel that night in the nursery too, but Michael erased her memory. Now that she’s come back, well, don’t you think it’s a little disorienting to spend 32 years in heavenly bliss and then get thrust back down to earth and find out her children are living the exact life she didn’t want them to?

“Also, don’t forget, EVERYTHING was stacked against them. Heaven made 100% sure that they got together just so Sam and Dean could be born and play out the apocalypse.”

8. What were your first opinions of Sam, Dean, Cas, and Jack?

Sam: Tall, but the hair, and he’s a baby, I feel like a pedophile.

Dean: Older, still tall, wiseass, heart of gold, if he loves pie, I’m a goner!

Cas: HOLY FUCK.

Jack: If he’s good, I will hold him and love him and squeeze him and call him George. If he’s evil, I will cut him down with the flames of a thousand burning suns.

9. What’s your favorite season?

I really don’t have one. I have seasons I love more, and seasons I love less, but none are my favorites. The writing in the beginning was tighter, and felt like there was an end coming, which made it more electric. But I really love watching the boys grow and change and make better, smarter decisions, or make stupid decisions for bigger, better reasons. I dislike the degradation of angel powers, though. I mean, remember when Cas could smite an entire diner of monsters or demons with just a bright light, but this season he was beaten to pulp by a demon gang? And now that Heaven’s gates are all open, can Cas fly, again? I mean, they couldn’t fly because the closed gates cut them off from Heaven, but now the gates are open, so LET CAS FLY, DAMMIT.

10. What’s your least favorite season?

Season 7, although that season does have an inordinate amount of things I like about it, so it makes no sense. Story-wise, I get it. They had to systematically take away everything the boys valued in order to leave Sam the destroyed mess he was when Dean and Cas disappeared. I don’t like it when my boys hurt, but I understand why they did it. On the other hand, season 7 gave us Charlie, and Frank, and Garth, and Kevin, and numerous dick jokes, and Sam tied to a bed, and Cas naked on Dean’s car covered in bees. So torn, but when I rewatch the series, I take a deep breath when I start season 7. (During my most recent rewatch, I also took a breath when Toni Bevell came onto my screen, so I guess I now put 12 in with 7.)

11. Opinions on Destiel?

Canon - Dean is straight. He’s said multiple times he doesn’t swing that way. I wouldn’t object if the writers decided to change that, but I respect Jensen and the writers in their decision not to go that way. There are more and more diverse characters on our screen every year, and I’m okay with letting Dean be a cis het white male who loves women of all kinds. I would love if they did a Human!Impala episode and the Impala turned out to be John Barrowman, though. On the other hand, Cas is completely unconcerned with gender and sexuality, so I wouldn’t mind seeing him have a romantic thing with a guy. Pretty sure that would break the fandom, though, so not holding my breath.

Fanon - Holy cheeseballs, that boy swings harder than an old-time saloon door, and I love reading about him being so open to everyone. Give me all the guys banging Dean like a screen door in a hurricane. Dean is all the door metaphors and memes, including the memes about Cas loving to destroy doors. Show me these two idiots falling in love any way you got it. They were roommates, you say? YES. There was only one bed, you say? SIGN ME THE FUCK UP. Dean’s a fireman and Cas is a nurse? ARE YOU TRYING TO KILL ME??? BRING IT.

12. Do you believe Supernatural queerbaits?

Not intentionally, or maliciously, but I can see why some folks might think that, sometimes. It’s a fine line the show writers have to balance on when it comes to scenes with Dean and Cas because of the fandom’s obsession with Destiel. They want to show the love between the two characters as brothers, but it can’t be too much love. (However, I sometimes wonder about certain things. I would love to sit down with Jensen, Jerry Wanek, and Robbie Thompson, show them certain moments, and ask why certain decisions were made regarding framing, editing, props, and such. If they weren’t thinking Destiel, what were they thinking??)

13. Seasons 1-7 or 8-14?

You’re asking me to pick my kids, again. 1-7 is Kripke writing, 8-11 is Robbie Thompson writing, NO NO NO YOU CAN’T MAKE ME DECIDE.

14. Favorite villain (plot wise)?

Crowley

15. Do you think they should end the Lucifer plot line?

YES. I’m cool with watching Nick progress into a big bad, but keep Lucifer in The Empty. (I just had a wild thought about The Empty, Lucifer, and The Shadow coming for Jack. Lord, I hope I’m wrong.)

16. Who do you think has gone through more trauma (Sam, Dean, or Cas)?

Quoting Sammit again: “Sam. He found out he had demon blood in him, was one of Azazel’s “chosen”, died by being stabbed in the back, went to hell for 100 years, lost his soul, was driven mad by Lucifer, almost died doing the trials, was possessed by Gadreel…did i leave anything out?”

Dean and Cas have also had their share, but if you want to quantify it, I think Sam has had more.

17. What’s your favorite Supernatural episode?

Baby, Dog Dean Afternoon, Don’t Call Me Shurley, most of the other episodes writing by Robbie Thompson, too.

18. Do you like case episodes?

They are a nice breather in between the episodes where I can’t sit back for moment.

19. Who do you relate most to in TFW?

I switch back and forth between Dean and Sam. I relate to Sam wanting to go to college to get away from his family, I relate to Dean’s eating habits, I understand why Sam’s done all the stupid shit he’s done, and I understand Dean not wanting to delve into things because it’s hard. Oh, and I say awesome almost as much as Dean. Cas, though, is a mystery to me. The only time I relate to him is when he’s confused by pop culture references.

20. Why do you like Supernatural?

The characters. They’re just so fucking interesting, you know? And (with some notable exceptions) the writers have managed to keep them from getting too far away from who they were in the pilot, while showing them growing and changing and improving. I love the world, I love the fantasy, and I love how universal they all are. I mean, if you took characters from another show and put them in a Beach AU, I wouldn’t be able to see it like I can with these characters. They’re awesome.

21. If you could bring back one character and kill off another who would they be?

Keep Lucifer dead, bring back Frank. I also want to see more of Linda Tran. Or Ellen, though I don’t know what they’d do with her with Mary around. I’d say Crowley, but I know that will never happen, and I understand why, so I’m letting him go.

Tag yourselves!

3 notes

·

View notes

Note

(The destiel ask thing) 6,9,48,49

6. What is/are your NOTP(s)?

Ahaha okay, I am prepared to lose followers for this! Let’s do this.

My number one NOTP is Megstiel. If you like it, good for you, but I just cannot see why. As you probably know by now, I am the type of person that needs lots of angst and buildup in order to ship something.

One of my main reasons for not shipping Megstiel, before I discuss the problematic aspect of their “relationship”, was that they were written like a typical, forced heterosexual pairing. I honestly felt like the kiss between Cas and Meg was a way to no-homo Cas (even though he doesn’t even have a gender). Before this point, he had never even remotely shown an interest in any woman. At this point in the show, people were already hardcore shipping Destiel, so the kiss felt so forced. There were about six seconds of buildup between the two that mostly included Meg calling Cas “Clarence” and making gross references to sex that Cas didn’t understand.

Second, in order to ship something I also need to genuinely like both characters and believe that they’d be good for each other. I’ve already mentioned that I absolutely despise Meg, and I have very important reasons for it. I’ve said it before and I’ll say it again: Meg forced herself on both Sam and Dean at different instances, she was the reason for the deaths of Ellen and Jo, and she tortured many people including her first vessel (and her second, though no one even gave a shit about the second vessel). She didn’t even have a real redemption arc—and yes, I know it was because Rachel had to leave the show for health reasons, but it could have been done much better. Meg didn’t actually do anything good and there were always other motives, particularly when it came to watching over Cas in the mental hospital. Castiel, on the other hand, is my absolute favourite character, and I am highly protective of him, so I cannot see him get taken advantage of by some demon when he deserves so much better.

Third, the “relationship” and the whole idea behind it is highly problematic. Meg textually stated that she needed Cas’s protection multiple times, which was why she even stayed to “take care of him” when he was in the mental hospital. She was clearly using him, and he was in a vulnerable state. He had never had any kind of experience when she kissed him, so he was experimenting in a way… It just didn’t work.

Anyway, one day I’m going to make a huge meta post about Megstiel and why I don’t ship it at all.

Other NOTPs include Wincest (I am so grossed out when people turn beautiful relationships between siblings into something incestuous, as though the only love that exists is romantic love), Samifer (abusive), and Cas x anyone (besides Dean, of course, due to my intense secondhand jealousy).

9. What was your favourite Destiel moment?

Well shit. I don’t know how to answer this because there were so many moments… You know what? I’ll name a few.

“I need you” and the broken connection

Purgatory and Dean praying to Cas every night

Cas as Dean’s Collette

“I love you. I love all of you.” (It was so blatant that Cas was talking to Dean first, and then to Sam and Mary when he said this.)

The fucking mixtape

Dean kneeling beside Cas’s body when he died at the end of 12x23 (or, just, all of 12x23) and then praying to God to bring him back in 13x01

48. What is a confession you have regarding the show?

Hmm… Ever since I watched the first episode of SPN, I am so much more critical of the other shows I watch. In fact, most of them now suck in my eyes no matter how much I loved them before I watched Supernatural. SPN is not perfect at all—there are a lot of problematic aspects such as representation and killing of female characters for manpain—but the thing that it’s best at, in my opinion, is the relationships between the characters. There is so much chemistry between the actors on the show that when I watch other shows, all I can think about is how their friendships and relationships between family members don’t work. Not the way SPN’s do.

I have also completely lost the desire to start any new shows, so there’s that.

49. If you could tell your favourite characters one thing, what would it be?

I would tell Sam: “Sam, thank you for always keeping the faith and for fighting no matter how hard things get. You are so strong because of the way you have handled everything you’ve been through. I admire the hell out of you.”

I would tell Dean: “Dean fucking Winchester, I am going to need you to stop what you are doing. Stop holding back from liking Taylor Swift music, LARPing, and both Daphne and Fred; stop thinking that there’s anything you need to change about who you really are; stop hating yourself. You deserve to be happy. You deserve your happy ending.”

I would tell Castiel: “You don’t hear this enough, but you’ve done so much good in the world, for your loved ones and for humanity as a whole. You are important. You are good enough just the way you are. You are loved.”

I would tell Charlie: “YOU ARE MY QUEEN. I WANT TO FANGIRL OVER THE HARRY POTTER BOOKS WITH YOU. ALSO PLEASE INFORM DEAN THAT HE IS BISEXUAL.”

Well damn. This was long. For my next ones, I’ll probably write a lot less. ¯\_(ツ)_/¯

Send me an ask from my Supernatural Ask Game (Destiel Edition).

8 notes

·

View notes

Text

Dear Taylor,

I’m not great with words. But I have so many words I need to say to you. I thought I’d give you a story of the first time I heard one of your songs, and how now reputation is coming out as I am nearing graduation from college. THAT. IS. CRAZY.

So I’ll try to tell you everything. Here goes.

I’m Isabelle! This is my mom and I:

I’m 20, a Christmas baby...people say that sucks ‘cause ‘no double presents’ but honestly i love having my birthday on Christmas ‘cause I love giving gifts. (ie..getting weirdly specifically funny gifts for my older brothers...!) I turn 21 this Christmas! (So down to drink with you whenever...)

I’m from Rockville, MD, basically right outside DC (kinda) but I’m currently in Chicago for school at Loyola University Chicago! I have 2 foolish yet incredibly smart brothers, my mom is my best friend in the whole world, and I live with my grandparents as well. I’ve played piano since age 3, I love to sing, I am OBSESSED with musical theatre, I love to make people laugh and, on that note, I love comedy-sketch, improv, stand up…you name it. I love puns a little too much…but CAN someone love puns too much? THE LIMIT DOES NOT EXIST. But I digress. There’s someone who has had a huge impact on my life who I’ve never met, and that someone is you.

2007. I’m in 5th (pretty sure) grade, and our school’s talent show is coming up. Basically, we had to audition to even perform at the talent show (a concept I did not understand but as I type this I’m realizing that is the premise of most music competition shows on TV? Good job, Isabelle. Nailed it.) I played piano, that was it, but an older student (maybe 7th grade at the time) auditioned with a song I hadn’t heard before…it was a song called Our Song. I quickly became obsessed with the song. We both got into the talent show, and she ended up performing A Place in this World in front of the school. I ended up playing my piano piece. Those two songs, not even sung by you the first times I heard them, started my love of your music.

Now...2009-2010. (TIME TRAVEL, RIGHT??) I am in 8th grade, going into high school (CRAZY) and tickets for a certain tour are on sale…the Fearless tour. You had one date in the summer of 2010 for DC at the Verizon Center, but it conflicted with my 8th grade graduation. THEN, because MIRACLES HAPPEN, there was a second date added for DC, the day before the original tour date! Unfortunately, the day before my actual graduation ceremony we had a “mandatory” pre-graduation dinner thing. Still a little bitter I couldn’t go to the Fearless tour, but I made up for it later with 3 other tours.

2011! Freshman year of high school? Life before I knew who I was gonna be...I’m honestly still not sure, as a senior in college. Anyways, freshman year of high school? Not awesome! I went to an all-girls Catholic high school, and I made a lot of friends, but those friendships didn’t really happen till sophomore year. Sophomore year is when I truly threw myself into my school’s performing arts department. I fell in love. I had actually done shows in the summer at my high school, but they were summer camp-y programs, so it was before I was a student there. The first show was Hairspray, follows by the spring production of You’re A Good Man, Charlie Brown. In between, I participated in an Improv Show and a dance concert. Ok. So. I cannot dance. I enjoy dancing, and especially now I still say I cannot dance, but I LOVE DANCING. I love dancing and looking 1000% foolish while doing so. I signed up for a class called “Intro to Modern Dance” thinking it meant modern music, like ‘at the moment’ music. WRONG.

Basically….I, a VERY pale short female with short brown hair and bangs, wore different pastel leotards that had flowy fabric attached to them and pranced across stage before doing what can ONLY be described as ‘birthing motions’.

...True story. Anyways, not the worst thing, but a funny thing.

So, summer 2011: I was an ensemble member in our summer production of Footloose. I also had successfully gotten (thank you Mom…) tickets to night 1 of the Speak Now World Tour in DC for August 2011. I went by myself, but my oldest brother, Jerry, dropped me off and made sure I was safely inside before he went to a Nationals game. He picked me up as well, and he ended up catching the final sounds of that concert from standing in the lobby after the game. I remember everything about that concert. I remember being awestruck when the incredibly touching intro to the album was spoken by you, and then awestruck by the smoke machine….leading to a powerful, young woman rising up from under a stage in a gold glittery dress. That alone blew me away. I took a few pictures at that show, but this one sticks out-partially because it is the least blurry one I took, and partially because I like that you see you on the big screen and onstage. You were so connected to the crowd. It was a truly magical night:

That night and the Speak Now album mean so much to me. It’s special because it was the first time I ever saw you perform live, Taylor, but also because the album has so many songs I hold dear. All your albums do.

Fearless has songs that reassure me, even at age 20, like Fifteen, and it has the song that is my mom’s favorite…The Best Day. It also has anthems that make my heart pound with a sort of fire…Change.

Speak Now, similarly, has songs that resonate with me and will continue to resonate with me forever. I can’t even talk about Never Grow Up on here or ever because it makes me cry thinking about how much I love my grandparents, brothers, and my marvelous mom. Enchanted is a song that I could quite possibly talk about for days and days and days. It so specifically illustrates all the emotions I feel when I truly “crush” on someone. It also is helpful, because the words you put to that song are lightyears more poignant than how I could describe how I put feelings into words. And you DID. THAT. Enchanted is a song that means so much to all of us, for obvious reasons. I have to say that “the words i held back” as well as the prologue to speak now really parallel all my worries about overthinking and being afraid to speak up. Thank you for those words.

It is 2012, my high school is doing The Wiz, and I am freaking out over RED. Red was a turning point for you, and again, it illustrated feelings in ways I couldn’t fathom: “all I feel in my stomach is butterflies, the beautiful kind, making up for lost time, taking flight…”, “everybody loves pretty, everybody loves cool..”–I was a junior in high school at this time, and I had experienced bullying and people talking behind my back constantly as well as some cyberbullying. It was not great. The theatre really helped me. My mom surprised me, in 2013, with tickets to night 1 of the Red tour in DC! I went by myself, but I got a text 15 minutes into being in my section from my mom that said “do you see the big Red sign?” …aka this:

…which was not lit (hehe…LIT) at the time my mom texted me. She ended up hearing from a friend that had extra box seats so she called up 2 other friends from work and they joined her in a completely different section from me in the Verizon Center! I just think it’s so funny!! This ended up being more meaningful than I’d thought because this show was the day before Mothers Day. The “surprise” B stage song was Never Grow Up, a song my mom and I adore. From the entrance to the light up drums to the music box to confetti galore, this was another night i’ll never forget.

My mom and I circa 1999. I love that photo, and, to me, I hear Never Grow Up AND The Best Day playing when I look at it.

I forgot to say another thing when talking about all your tours: I am obsessed with musical theatre, and something you never fail to include on tours is a theatrical feel. It’s always so beautifully done, with quirky “Stage direction” type things and costumes…thank you for that.

By this time…I’ve graduated high school and decided on a school in the midwest…the windy city itself, CHICAGO. Loyola University Chicago, in fact!

It is summer 2014, and I have had a tumblr for some time, mostly filled with photos of bunnies, you-related things/edits, SNL, Harry Potter, and puns. (The basics, you know…not much has changed!)

There have been videos by this time of elevator buttons and secrets about a LIVESTREAM. So, in the car with my mom on the way to move into my dorm (we stopped at Notre Dame on the way because it’s a LONG drive from where I live and most of my family has attended ND! I also worked at Notre Dame this past summer!) I was using a bunch of data to stream your livestream…and? 1989 is coming! I played Shake it Off a LOT on that car ride once I downloaded it. It was so cool because I tried to brush off the bullying I faced in high school and something you said about 1989 was this: “This is a story about coming into your own, and as a result…coming alive.” The album with that message brought me into my freshman year of college, a year filled with many ups and downs. I thank you for being there for me.

Summer 2015, I had the great honor of going to night 1 (JULY 13, yes 13…!!!) of the 1989 Tour in DC, this time at Nationals Park-outside, which was VERY exciting for me, with my godmother! Lorde was the surprise guest, and I am now happy to say I am seeing Lorde live in concert March 2018! The 1989concert was spectacular, it was clear you were taking charge of doing what YOU want and sticking to your genuine, full heart 24/7. I can’t thank you enough for the memories you’ve given me.

I love everyone on here, on tumblr, even though I do not know any of them–in real life. I hope to meet all of you guys, you’re hilarious on here, and I may not post as often as many of you, but I send you all love always.

Now, I am a senior in college. That is WEIRD AF. I turn 21 this Christmas, (I’m a Christmas baby!) I graduate in May, and after that I don’t have plans. I need to get a job, I know that, but uncertainty is AT AN ALL TIME HIGH right now.

reputation is coming out during my SENIOR year of college, a time with SO much uncertainty...definitely more uncertainty than freshman year. I cannot wait to be empowered and enlightened by this album and I can’t help but thank you for this new album and more encouragement to be myself, my best self.

reputation comes out in less than 1 month, and I cannot wait. From what I know so far, and what I know about your “Take no shit and spread so much love no matter what as a strong independent woman” attitude is that I will love this album FOR. SURE. I love you endlessly. I really, really, really hope to meet you someday, and I hope you know that you mean so much to me. Thank you for being a friend to me, even when all I needed was a high note, a funny post, a cat photo, photos of you with fans that make my heart burst, and the hope that someday I’ll meet you. I can’t wait for that day.

Thank you for your heart.

I love you so much, Tay.

Love,

Isabelle

@taylorswift

204 notes

·

View notes

Text

CHARLES MANSON, RIP

{NOTE: During his lifetime, Charles Manson was rarely allowed to speak on his own terms. At least not without being interrupted, edited, or interpreted in order to leave him sounding like a gibbering hippie lunatic spouting incoherent nonsense. That’s what we do to people whose ideas pose a viable potential threat to the status quo. Before anyone has a chance to hear directly what the likes of Manson or the Unabomber have to say, tell the mob it’s all incoherent gibberish, and no one will pay the slightest attention. Who has the time to waste listening to nonsense from a crazy person? Problem solved. With the passing of one of the most insightful and important thinkers of the 20th century, a man who had been mythologized nearly out of existence while being touted as the most Evil Bugaboo the World Has Ever Known, we would like to offer him the simple respect of letting him at last speak for himself. Below is the testimony Manson offered in his own defense during the Tate-LaBianca murder trial in 1970. It’s worth noting that the jury was ordered out of the courtroom when he took the stand, and so never heard any of the following.} There has been a lot of charges and a lot of things said about me and brought against the co-defendants in this case, of which a lot could be cleared up and clarified. . . . I never went to school, so I never growed up to read and write too good, so I have stayed in jail and I have stayed stupid, and I have stayed a child while I have watched your world grow up, and then I look at the things that you do and I don't understand. . . . You eat meat and you kill things that are better than you are, and then you say how bad, and even killers, your children are. You made your children what they are. . . . These children that come at you with knives. they are your children. You taught them. I didn't teach them. I just tried to help them stand up. . . . Most of the people at the ranch that you call the Family were just people that you did not want, people that were alongside the road, that their parents had kicked out, that did not want to go to Juvenile Hall. So I did the best I could and I took them up on my garbage dump and I told them this: that in love there is no wrong. . . . I told them that anything they do for their brothers and sisters is good if they do it with a good thought. . . . I was working at cleaning up my house, something that Nixon should have been doing. He should have been on the side of the road, picking up his children, but he wasn't. He was in the White House, sending them off to war. . . . I don't understand you, but I don't try. I don't try to judge nobody. I know that the only person I can judge is me . . . But I know this: that in your hearts and your own souls, you are as much responsible for the Vietnam war as I am for killing these people. . . . I can't judge any of you. I have no malice against you and no ribbons for you. But I think that it is high time that you all start looking at yourselves, and judging the lie that you live in. I can't dislike you, but I will say this to you: you haven't got long before you are all going to kill yourselves, because you are all crazy. And you can project it back at me . . . but I am only what lives inside each and every one of you. My father is the jailhouse. My father is your system. . . I am only what you made me. I am only a reflection of you. I have ate out of your garbage cans to stay out of jail. I have wore your second-hand clothes. . . I have done my best to get along in your world and now you want to kill me, and I look at you, and then I say to myself, You want to kill me? Ha! I'm already dead, have been all my life. I've spent twenty-three years in tombs that you built. Sometimes I think about giving it back to you; sometimes I think about just jumping on you and letting you shoot me . . . If I could, I would jerk this microphone off and beat your brains out with it, because that is what you deserve, that is what you deserve. . . . If I could get angry at you, I would try to kill everyone of you. If that's guilt, I accept it . . .These children, everything they done, they done for the love of their brother. . . . If I showed them that I would do anything for my brother--including giving my life for my brother on the battlefield--and then they pick up their banner, and they go off and do what they do, that is not my responsibility. I don't tell people what to do . . . .

These children were finding themselves. What they did, if they did whatever they did, is up to them. They will have to explain that to you. . . . It's all your fear. You look for something to project it on, and you pick out a little old scroungy nobody that eats out of a garbage can, and that nobody wants, that was kicked out of the penitentiary, that has been dragged through every hellhole that you can think of, and you drag him and put him in a courtroom. You expect to break me? Impossible! You broke me years ago. You killed me years ago. . . . I have killed no one and I have ordered no one to be killed. I may have implied on several different occasions to several different people that I may have been Jesus Christ, but I haven't decided yet what I am or who I am. In prison his name was a number. Some now want a sadistic fiend, and so they see him as that. So be it. Guilty. Not guilty. They are only words. You can do anything you want with me, but you cannot touch me because I am only my love. . . If you put me in the penitentiary, that means nothing because you kicked me out of the last one. I didn't ask to get released. I liked it in there because I like myself. Mr. Bugliosi is a hard-driving prosecutor, polished education, a master of words, semantics. He is a genius. He has got everything that every lawyer would want to have except one thing: a case. He doesn't have a case. Were I allowed to defend myself, I could have proven this to you. . .The evidence in this case is a gun. There was a gun that laid around the ranch. It belonged to everybody. Anybody could have picked that gun up and done anything they wanted to do with it. I don't deny having that gun. That gun has been in my possession many times. Like the rope was there because you need rope on a ranch. . . .It is really convenient that Mr. Baggot found those clothes. I imagine he got a little taste of money for that. . . .They put the hideous bodies on [photographic] display and they imply: If he gets out, see what will happen to you. . . .[Helter Skelter] means confusion, literally. It doesn't mean any war with anyone. It doesn't mean that some people are going to kill other people. . . Helter Skelter is confusion. Confusion is coming down around you fast. If you can't see the confusion coming down around you fast, you can call it what you wish. . Is it a conspiracy that the music is telling the youth to rise up against the establishment because the establishment is rapidly destroying things? Is that a conspiracy? The music speaks to you every day, but you are too deaf, dumb, and blind to even listen to the music. . . It is not my conspiracy. It is not my music. I hear what it relates. It says "Rise," it says "Kill." Why blame it on me? I didn't write the music. . . . Danny DeCarlo. . .said that I hate black men, and he said that we thought alike. . . But actually all I ever did with Danny DeCarlo or any other human being was reflect him back at himself. If he said he did not like the black man, I would say 'O.K.' So consequently he would drink another beer and walk off and say 'Charlie thinks like I do.' But actually he does not know how Charlie thinks because Charlie has never projected himself. I don't think like you people. You people put importance on your lives. Well, my life has never been important to anyone. . . . [Linda Kasabian] gets on the stand and she says when she looked in that man's eyes that was dying, she knew that it was my fault. She knew it was my fault because she couldn't face death. And if she can't face death, that is not my fault. I can face death. I have all the time. In the penitentiary you live with it, with constant fear of death, because it is a violent world in there, and you have to be on your toes constantly. . . . [I taught the Family] not to be weak and not to lean on me. . . .I told [Paul Watkins],"To be a man, boy, you have to stand up and be your own father." So he goes off to the desert and finds a father image in Paul Crockett. . . . I do feel some responsibility. I feel a responsibility for the pollution. I feel a responsibility for the whole thing. . . .To be honest with you, I don't recall ever saying "Get a knife and a change of clothes and go do what Tex says." Or I don't recall saying "Get a knife and go kill the sheriff." In fact, it makes me mad when someone kills snakes or dogs or cats or horses. I don't even like to eat meat-that is how much I am against killing. . . .

I haven't got any guilt about anything because I have never been able to see any wrong. . . I have always said: Do what your love tells you, and I do what my love tells me . . . Is it my fault that your children do what you do? What about your children? You say there are just a few? There are many, many more, coming in the same direction. They are running in the streets-and they are coming right at you!

by Jim Knipfel

5 notes

·

View notes

Text

the king arthur movie is SO BAD, guys.

imagine a baby and a kitten got together and tried to edit a movie with only the vaguest idea of arthurian legend based on the backs of the VHS of the disney version and also the lion king for some reason, and also the barest idea of how human brains can accept and understand editing and narrative. imagine a pretty good video game opening for 2001, but watched thru the haze of a really strenuous flu and it’s rented and ancient and was chewed up by at least two dogs so it’s glitching a lot. imagine a knight’s tale……………Reimagined™ (needlessly) by a team of randos who only speak italian and their ideas are being translated by jen from the IT crowd in that one episode where she pretends she can speak italian. imagine a movie with a budget of four dollars (except the budget was HUGE). imagine an opium dream within a dream of robert downey jr’s 2009 sherlock holmes where jude law becomes a boring, leathery king who has a bad habit of constantly sacrificing the silent women he supposedly loves to an undulating pile of lovecraftian horror water ladies that live in his shame toilet in his penis tower basement ONLY to super saiyan into a really bad DnD dude with a motorcycle-insignia-metal skull head and the torso of two The Rocks smashed together (sorry, The Rock) instead of (a much better) watson. imagine eragon, but somehow exceedingly, fremdschamenly, schadenfreudingly worse. not many things get both german expressions, in a gleefully terrible adverb form at that, but this movie——oh, THIS movie——-deserves them.

the letters of the opening credits roll (or creep?) across the screen. the kerning is bad. all the T’s have a phallic, buffylike, sword motif going on and it renders the names unreadable. the colors and the blurry shots look like something out of monty python. again, who hired this editor? who watched this movie, kissed their fingertips like an italian grandma, and gently set this eldritch horror adrift on the tides of eternity to be received with fear and loathing by millions of human eyes? the elephants from lord of the rings attack the bridge from legend of zelda, and that red flamey eye guy from eragon (mordred, for some reason, in a shake n bake wig) ?? or possibly from inkheart?? is defeated. remember, we know nothing about these characters. feel nothing for them. and the trend continues. katie mcgrath appears, of course, in her standard and splendid emerald green, and then immediately dies. none of the shots in the first 20 minutes of the movie match up, we go from scenes with several people to ultra close ups of faces—-it’s like the “mmmm whatcha say” SNL skit, but serious. the movie continues to not know if it’s playing itself seriously or if it knows how bad it truly is (how bad me be?)

finally we get ONE establishing shot of a sweeping wall (maybe? the camera never stays still enough to tell) and the audience (five people) grounds ourselves, sort of. we get a whip-fast, but not whip-smart, super evolution of arthur’s childhood, in which he shoves coins into a wall (see kids!!! if u just put YR COINS IN YR WALLS instead of BUYING GODDAMN AVOCADOS, U COULD HAVE A CASTLE!!!!) and hearkens back to his character in pacific rim, bc he’s just a scrappy, vaguely appropriative white guy that loves 2 fight stuff. oh, his mom is killed when he’s young ofc. charlie hunnam eventually fucks off to the island w the sword in the sort-of stone (none of the physics makes sense in this movie?? the sword in the stone dropped into a lake, but is now in a chasm on a different island which shows no sign of the ruins of arthur’s childhood town?? in the final fight scene, charlie hunnam is several floors up from scythe-y jude law, but then suddenly they’re fighting on the top of saruman’s tower scuse me at the whipping sea-level, then suddenly BACK IN THE TOWER bc i guess it wasn’t destroyed????? bc then it gets destroyed again??) of course, charlie hunnam is the One Man who can Grip the penis sword, even though in an interesting turn of events, They are Testing Everyone by shipping them in boats to the island (this seems like an egregious waste of resources). charlie hunnam got in this unfortch sitch bc i forgot, but the guy who put him on the boat chuckled darkly and said he was “”””getting on a different boat””””, but like, doesn’t everyone end up there?? it had the air of the DMV, on purpose, so why was this a threat? how did he avoid it for so long? are there that many people in the kingdom??? also, if i was him i’d straight up pretend i couldn’t lift it tbh and come back for it when They were getting donuts. oh, another inkheart thing—the BLONDE MOM SURVIVES (!!!??? somehow???? unexplained? she had a HOLE THRU HER BODY??) and maybe has memory loss or something and spends her days being somehow indispensable to jude law despite doing nothing but moving a plate.

i cannot explain the rest of the plot, because i do not understand it. charlie hunnam just EXPERIENCES things with a world-weary, almost kingly worldliness, despite flashing in between being an innocent farm boy who doesn’t wanna do anything and a self-assured wisecracking hustler. there are some good jokes about boring white dude names in a medieval setting, and no more humor forever is allowed in this movie or any movies ever again. a chris parnell lookalike with a hat says he can shoot 75 yards but not 175, then shoots 175 with absolutely no introduction/buildup/continuance/jokes and spends the rest of the film as robin hood. there are some other dudes?????? more women (the brothel ladies that rescue arthur from the river ((not unlike….the prince of egypt…..)) are killed to further manpain, including lucy, who is Special for an unexplained reason. jude law murders his daughter (i guess???), who has a russian name and a tendency to sit around and stroke birds and stare sappily out the window (i feel u, johanna). everyone is wearing medieval versions of suits. there are many iterations of snake, ranging from economy-sized snake to a Giant Fuckmaster Snake Mother. at least five cloaks are cast off. eric bana becomes a literal rock. everything has the vague, shuddering feeling of an improv show where everyone wants the final word/bit. there is grit, there is dirt, there is snake blood, and there is clanking. so much clanking. charlie hunnam is bravely hurling one-liners but no one is listening. what is the sound of only one hand on excalibur???? apparently not as powerful as…………T W O hands on excalibur.

the editing continues to be bizarre. they keep trying to do the inception thing where they talk about the plan while showing the plan, therefore (in inception, correctly) allowing us to get to the good parts, but there ARE NO GOOD PARTS or even parts at all and they don’t fully commit to the dang method anyway. the shining light of the film, an unnamed mage woman with good bone structure and sweet harem pants (and who COULD have at least been set up as morwen but was not) who can possess animals and also make a lot of dust fly around behind her, becomes charlie hunnam’s spiritual guide?? sort of?? maybe love interest??? she seems to have no interest in him or inhabiting the worldly narrative/plane of this movie. i do not blame her. anyway, she’s got the eagles from LOTR on her side. she dopes the shit out of charlie hunnam (again, why) with a literal snake and he solves his daddy/uncle issues (line @ jude law: “”””you created me”””””) in an incomprehensible nonlinear part of the narrative (she was captured, but i guess jude law let her go before hunnam got to the castle???? bc he’s Not So Bad After All? bc he was bored? eating a sandwich? fuck idk so she could have met him in the middle of fuck knows? i mean if they have medieval lyft or medieval twitter DMing or something??) also, he may or may not have gone to a ””””””DARK””””””””island, but he did NOT solve his daddy issues there. he did, however, fight some rodents of unusual size from the princess bride.

ok that is all the energy i have; this movie has sapped me, i am nothing in the great maw of its terribleness. other stuff happens. we have a happy ending, with 4/6ths of the Round Table built (literally and figuratively), and some Vikings conceding to charlie hunnam for no other reason than he’s a bro, i guess. line: how do u scam money out of a viking? u talk to them. SEE MILLENNIALS ALL U HAVE TO DO IS TALK AND PPL GIVE U MONEY or be born the true heir to the throne of (fake england).

the worst part is that i don’t understand how jude law, who is 44, looks the same the entire movie and watches as charlie hunnam, who is 37, grows up and eventually challenges him. eric bana, who is 48, doubtlessly had fictional charlie hunnam arthur at like 27-35, making jude law the same age in that fiction. i guess men can just ???? play any age????????? forever??????? honorable mentions: the soundtrack, jude law’s eyeshadow, and the preview for atomic blonde.

#long post#king arthur#i love arthurian legend okay#and honestly i loved this movie#from hate springs love

13 notes

·

View notes

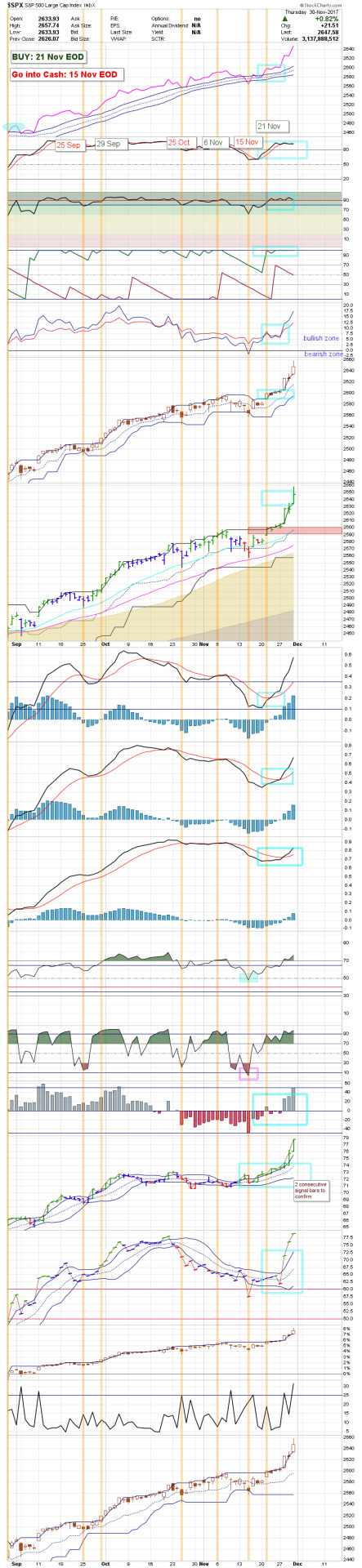

Photo

S&P 500: 30 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, HD.

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 8 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 5 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - S&P 500 Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

S&P 500 Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

S&P 500 Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily S&P 500 D-5 Indicator: Trending Bullish

Weekly S&P 500 D-5 Indicator: Trending Bullish

Monthly S&P 500 D-5 Indicator: Trending Bullish

Experiment #8 (New)

XLB - Bullish signal

XLE - Bullish signal

XLF - Bullish signal

XLI - Bullish signal

XLK - Bearish signal <------------

XLP - Bullish signal

XLU - Bullish signal

XLV - Bullish signal

XLY - Bullish signal

SPY - Bullish signal

RSP - Bullish signal

$XVG - Bullish signal

EQAL - Bullish signal

EQWS - Bullish signal

$VIX - Bearish signal <-------------

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“To make any kind of gain in life, ... you must place some of your material and/or emotional capital at risk. That is the law of the universe. Except by blind chance, it cannot be circumvented. There are no appeals. It is the law. - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

“I’ve learned many things from [George Soros] but perhaps the most significant is that it’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong. Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular. As far as Soros is concerned, when you’re right on something, you can’t own enough. It takes courage to ride a profit with huge leverage.” - Stanley Druckenmiller

“And then all that is required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past. It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.” - Charlie Munger

“The second piece, analytically, is bet size, which is once you have an edge, how much do you bet in your portfolio? That’s a second key component which is often overlooked.” - Michael Mauboussin

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Anonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Anonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“I only focus on what is black or white and kind of sift out the gray area in my investing style.” - Stanley Druckenmiller

(Editor: Why invest in anything which you are unsure about when there are other options that you are more sure about? This is simple “opportunity cost” thinking.)

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Text

Taylor, it’s midterms time, so naturally this long post happened

Taylor, what to say to you.

I gotta admit I’m horrible with words-I’m not a good writer, but on a smaller scale I could show you horrifyingly embarrassing messages to guys with my feelings typed out in a chaotic mess.

So I’ll try to tell you everything. Here goes.

I’m Isabelle! I’m from Rockville, MD, basically right outside DC (kinda) but I’m currently in Chicago for school at Loyola University Chicago! I have 2 foolish yet incredibly smart brothers, my mom is my best friend in the whole world, and I live with my grandparents as well. I’ve played piano since age 3, I love to sing, I am OBSESSED with musical theatre, I love to make people laugh and, on that note, I love comedy-sketch, improv, stand up...you name it. I love puns a little too much...but CAN someone love puns too much? THE LIMIT DOES NOT EXIST. But I digress. There’s someone who has had a huge impact on my life who I’ve never met, and that someone is you.

It’s 2007. I’m in 5th (pretty sure) grade, and our school’s talent show is coming up. Basically, we had to audition to even perform at the talent show (a concept I did not understand but as I type this I’m realizing that is the premise of most music competition shows on TV? Good job, Isabelle. Nailed it.) I played piano, that was it, but an older student (maybe 7th grade at the time) auditioned with a song I hadn't heard before...it was a song called Our Song. I quickly became obsessed with the song. We both got into the talent show, and she ended up performing A Place in this World in front of the school. I ended up playing my piano piece. Those two songs, not even sung by you the first times I heard them, started my love of your music.

Now, it’s 2009-2010. (TIME TRAVEL, RIGHT??) I am in 8th grade, going into high school (CRAZY) and tickets for a certain tour are on sale...the Fearless tour. You had one date in the summer of 2010 for DC at the Verizon Center, but it conflicted with my 8th grade graduation. THEN, because MIRACLES HAPPEN, there was a second date added for DC, the day before the original tour date! Unfortunately, the day before my actual graduation ceremony we had a “mandatory” pre-graduation dinner thing. Still a little bitter I couldn't go to the Fearless tour, but I made up for it later with 3 other tours.

The year is 2011! Freshman year of high school? Not awesome! I went to an all-girls Catholic high school, and I made a lot of friends, but those friendships didn't really happen till sophomore year. Sophomore year is when I truly threw myself into my school’s performing arts department. I fell in love. I had actually done shows in the summer at my high school, but they were summer camp-y programs, so it was before I was a student there. The first show was Hairspray, follows by the spring production of You’re A Good Man, Charlie Brown. In between, I participated in an Improv Show and a dance concert. Ok. So. I cannot dance. I enjoy dancing, and especially now I still say I cannot dance, but I LOVE DANCING. I love dancing and looking 1000% foolish while doing so. I signed up for a class called “Intro to Modern Dance” thinking it meant modern music, like ‘at the moment’ music. WRONG. You know what modern dance means, Taylor:

Basically....that. I, a VERY pale short female with short brown hair and bangs, wore different pastel leotards that had flowy fabric attached to them and pranced across stage before doing what can ONLY be described as ‘birthing motions’. I had to hairspray my bangs back, and when I would remove bobbi pins etc the bangs would STICK STRAIGHT UP...

True story. Anyways, not the worst thing, but a funny thing.

So, summer 2011 I was an ensemble member in our summer production of Footloose. I also had successfully gotten (thank you Mom...) tickets to night 1 of the Speak Now World Tour in DC for August 2011. I went by myself, but my oldest brother, Jerry, dropped me off and made sure I was safely inside before he went to a Nationals game. He picked me up as well, and he ended up catching the final sounds of that concert from standing in the lobby after the game. I remember everything about that concert. I remember being awestruck when the incredibly touching intro to the album was spoken by you, and then awestruck by the smoke machine....leading to a powerful, young woman rising up from under a stage in a gold glittery dress. That alone blew me away. I took a few pictures at that show, but this one sticks out-partially because it is the least blurry one I took, and partially because I like that you see you on the big screen and onstage:

That night and the Speak Now album mean so much to me. It’s special because it was the first time I ever saw you perform live, Taylor, but also because the album has so many songs I hold dear. All your albums do.

Fearless has songs that reassure me, even at age 20, like Fifteen, and it has the song that is my mom’s favorite...The Best Day. It also has anthems that make my heart pound with a sort of fire...Change.

Speak Now, similarly, has songs that resonate with me and will continue to resonate with me forever. I can't even talk about Never Grow Up on here or ever because it makes me cry thinking about how much I love my grandparents, brothers, and my marvelous mom. Enchanted is a song that I could quite possibly talk about for days and days and days. It so specifically illustrates all the emotions I feel when I truly “crush” on someone. It also is helpful, because the words you put to that song are lightyears more poignant than how I could describe how I put feelings into words. And you DID. THAT. Enchanted is a song that means so much to the whole fandom, for obvious reasons.

It is 2012, my high school is doing The Wiz, and I am freaking out over RED. Red was a turning point for you, and again, it illustrated feelings in ways I couldn't fathom: “all I feel in my stomach is butterflies, the beautiful kind, making up for lost time, taking flight...”, “everybody loves pretty, everybody loves cool..”--I was a junior in high school at this time, and I had experienced bullying and people talking behind my back constantly as well as some cyberbullying. It was not great. The theatre really helped me. My mom surprised me, in 2013, with tickets to night 1 of the Red tour in DC! I went by myself, but I got a text 15 minutes into being in my section from my mom that said “do you see the big Red sign?” ...aka this:

...which was not lit (hehe...LIT) at the time my mom texted me. She ended up hearing from a friend that had extra box seats so she called up 2 other friends from work and they joined her in a completely different section from me in the Verizon Center! I just think it’s so funny!! This ended up being more meaningful than I’d thought because this show was the day before Mothers Day. The “surprise” B stage song was Never Grow Up, a song my mom and I adore. From the entrance to the light up drums to the music box to confetti galore, this was another night i’ll never forget.

I forgot to say another thing when talking about all your tours: I am obsessed with musical theatre, and something you never fail to include on tours is a theatrical feel. It��s always so beautifully done, with quirky “Stage direction” type things and costumes...thank you for that.

By this time...I’ve graduated high school and decided on a school in the midwest...the windy city itself, CHICAGO. Loyola University Chicago, in fact!

It is summer 2014, and I have had a tumblr for some time, mostly filled with photos of bunnies, you-related things/edits, SNL, Harry Potter, and puns. (The basics, you know...not much has changed!)

There have been videos by this time of elevator buttons and secrets about a LIVESTREAM. So, in the car with my mom on the way to move into my dorm (we stopped at Notre Dame on the way because it’s a LONG drive from where I live and most of my family has attended ND! I also worked at Notre Dame this past summer!) I was using a bunch of data to stream your livestream...and? 1989 is coming! I played Shake it Off a LOT on that car ride once I downloaded it. It was so cool because I tried to brush off the bullying I faced in high school and something you said about 1989 was this: “This is a story about coming into your own, and as a result...coming alive.” The album with that message brought me into my freshman year of college, a year filled with many ups and downs. I thank you for being there for me.

Summer 2015, I had the great honor of going to night 1 (JULY 13, yes 13...!!!) of the 1989 Tour in DC, this time at Nationals Park-outside, which was VERY exciting for me, with my godmother! Lorde was the surprise guest, and I am now happy to say I am seeing Lorde live in concert March 2018! The 1989 concert was spectacular, it was clear you were taking charge of doing what YOU want and sticking to your genuine, full heart 24/7. I can’t thank you enough for the memories you’ve given me.

I love everyone on here, on tumblr, even though I do not know any of them--in real life. I hope to meet all of you guys, you’re hilarious on here, and I may not post as often as many of you, but I send you all love always.

Now, I am a senior in college. That is WEIRD AF. I turn 21 this Christmas, (I’m a Christmas baby!) I graduate in May, and after that I don't have plans. I need to get a job, I know that, but uncertainty is AT AN ALL TIME HIGH right now.

reputation comes out in less than 1 month, and I cannot wait. From what I know so far, and what I know about your “Take no shit and spread so much love no matter what as a strong independent woman” attitude is that I will love this album FOR. SURE. I love you endlessly. I really, really, really hope to meet you someday, and I hope you know that you mean so much to me. Thank you for being a friend to me, even when all I needed was a high note, a funny post, a cat photo, photos of you with fans that make my heart burst, and the hope that someday I’ll meet you. I can't wait for that day.

I love you so much, Tay.

Love,

Isabelle

56 notes

·

View notes

Photo

S&P 500: 29 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, HD. Stopped out of MA.

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 6 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily D-5 Indicator: Trending Bullish

Weekly D-5 Indicator: Trending Bullish

Monthly D-5 Indicator: Trending Bullish

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Annonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Annonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Photo

S&P 500: 28 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, MA, HD

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 7 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily D-5 Indicator: Trending Bullish

Weekly D-5 Indicator: Trending Bullish

Monthly D-5 Indicator: Trending Bullish

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“To make any kind of gain in life, … you must place some of your material and/or emotional capital at risk. That is the law of the universe. Except by blind chance, it cannot be circumvented. There are no appeals. It is the law. - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther