#Hybrid Vehicles Market Analysis

Explore tagged Tumblr posts

Text

Ilana Berger at MMFA:

In a new analysis of electric vehicle-related content on Facebook, Media Matters found that negative stories made up the vast majority of content, particularly on right-leaning and politically nonaligned U.S. news and political pages, a trend which does not align with the optimistic outlook of EV adoption and technological advancements. Since 2021, the Biden administration has allocated billions of dollars toward meeting the ambitious goal of making half of all new cars sold electric or hybrid over the next few years. Provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act have provided tax credits and other incentives to jump start electric vehicle sales and infrastructure such as charging stations, domestic battery manufacturing, critical mineral acquisition, in addition to preparing the automotive industry workforce for the transition.

In March, an Environmental Protection Agency rule setting strict limits on pollution from new gas-powered cars primed automakers for success in meeting these goals. Biden’s EV push will continue to play an important role in the upcoming presidential election. Former president and current GOP candidate Donald Trump has insisted that Biden’s policies benefit China, which makes up the largest share of the global EV market. In March, while talking about the current state of the auto industry, Trump declared, “If I don’t get elected, it’s going to be a bloodbath for the whole — that’s going to be the least of it. It’s going to be a bloodbath for the country.” Economists disagree.

The comment tracks with years of outrage and opposition from Republican politicians, right-wing media, and fossil fuel industry surrogates, who have often disparaged the new technology and related policy and misleadingly framed the EV push as a threat to American jobs and national security. Constant attacks on EVs from the right have helped fuel a politically divided market, where people who identify as Democrats are now much more likely to buy them or consider buying them, while nearly 70% of Republican respondents to a recent poll said they “would not buy” an EV. So far in 2024, headline after headline announced EV sales slumps and proclaimed that “EV euphoria is dead,'' despite reports of “robust” growth. In February, CNN changed a headline about EV sales on its website from a success story to a failure. Despite the positive long term outlook for EVs based on indicators like sales and government investments, the discourse around electric vehicles is often pessimistic.

[...] Right-wing media have been driving anti-EV sentiment (with help from fossil fuel industry allies) since the start of Biden’s term. This trend was clearly reflected in Media Matters’ analysis. Out of the top 100 posts related to EVs on right-leaning pages, 95% were negative, earning over a million interactions in 2024 so far. But on Facebook, politically nonaligned pages fed into this trend as well. Nearly three quarters (74%) of EV related top posts on nonaligned pages had a negative framing. These posts generated 83% of all interactions on EV-related top posts from nonaligned pages.

On non-aligned and right-wing Facebook pages, anti-electric vehicle content-- likely fueled by a mix of climate crisis denial and culture war resentments-- draws lots of reliable engagement, in contrast to the reality of increased EV adoption in recent years.

#Electric Vehicles#Culture Wars#Automobiles#Climate Change#Facebook#CHIPS Act#Inflation Reduction Act#Infrastructure Investment and Jobs Act#Biden Administration#Joe Biden#EV Charging Stations

9 notes

·

View notes

Text

The Impact of Electric Vehicles on Auto Transport Market Perception

For city dwellers, the 2023 Kia Rio and Hyundai Elantra Hybrid emerge as commendable choices. The Kia Rio, recognized for its compact size and excellent fuel economy, offers straightforward functionality without compromising on reliability, making it an ideal option for navigating urban landscapes. Its affordability and low maintenance costs add to its appeal for budget-conscious consumers.

On the other hand, the Hyundai Elantra Hybrid stands out with its impressive fuel efficiency and a suite of standard driver-assistance features, catering to those who prioritize environmental friendliness and advanced technology. The hybrid's performance in stop-and-go traffic and quick acceleration capabilities make it a top contender for urban driving.

Additionally, for those requiring more space without sacrificing maneuverability, the 2023 Mazda CX-30 and Hyundai Kona are recommended. These subcompact SUVs provide the necessary room while maintaining the ease of driving required in tight city spaces. The Mazda CX-30 is praised for its sporty handling and premium interior, offering a luxurious feel at a more accessible price point.

Strategies for Maximizing Auto Resale Value

In conclusion, when making a vehicle purchase, especially for city driving, it is imperative to align the choice with personal preferences, lifestyle needs, and long-term financial considerations. Whether opting for a luxury or an affordable model, the decision should reflect a balance of comfort, efficiency, and practicality, ensuring a satisfying and sustainable driving experience.

Through the exploration of both luxury and affordable vehicles ideal for urban landscapes, our comparative analysis has offered a deep dive into how each fit into the bustling life of city driving. The discussion illuminated the nuanced differences between them, highlighting the importance of considering factors such as size, fuel efficiency, and technological features when making a purchasing decision.

Luxury vehicles, with their high-end amenities and superior performance, cater to those seeking an elevated driving experience and status symbol, while affordable models present a practical, cost-effective solution without sacrificing comfort or the latest technology.

This balance between indulgence and functionality underscores the diverse needs and preferences of urban drivers, inviting a carefully weighed choice that resonates with individual lifestyle demands and financial considerations.

Final Recommendations

Choosing the right vehicle for city driving also entails considering the logistics of owning and maintaining such a prized possession in urban realms, including the necessity of safe and reliable auto transport for those needing to relocate their vehicles.

For peace of mind during transportation, entrusting your valuable car to a service like www.luckystarautotransport.com ensures that it is handled with the utmost care and professionalism.

As you navigate through the myriads of options, from plush sedans designed for maximum comfort to compact cars engineered for the hustle of city life, remember that the ultimate choice reflects a harmony of personal needs, environmental considerations, and the pure joy of driving.

youtube

6 notes

·

View notes

Text

Golden State drivers purchased a record number of new electric cars in 2023, achieving a 29 percent jump over the previous year, a new report has found.

Californians bought 446,961 new light-duty zero-emissions vehicles in 2023 — a significant increase from the 345,818 they purchased in 2022 and the 250,279 in 2021, according to a new analysis from the nonprofit Veloz and the California Energy Commission.

The data showed that such cars — which include battery-electric, plug-in hybrid and fuel cell powered vehicles — held a 25 percent share of the light-duty automotive market, which generally includes passenger cars and lightweight trucks.

In comparison, these types of zero-emissions vehicles only made up an 18.84 percent share of that market in 2022 and a 12.41 percent share in 2021, per the data.

Despite industry-wide concerns about a decline in the public’s appetite for light-duty zero-emissions vehicles, 2023 proved to be a record-breaking year for these sales both in California and on a national level, the analysis noted.

The nation wide effort, lead by California to switch over to zero-emissions electric cars is one of those hopeful climate stories. California announced in 2022 that by 2035 all new cars and light trucks sold in the state will be electric and having already made it to 25% in 2023 they're well on their way. Last year the Biden administration laid out a plan for 50% of all new vehicles (including heavy trucks) would be electric by 2030 nation wide

#California#climate change#climate crisis#climate action#electric vehicles#electric cars#global warming#Joe Biden#good news

4 notes

·

View notes

Text

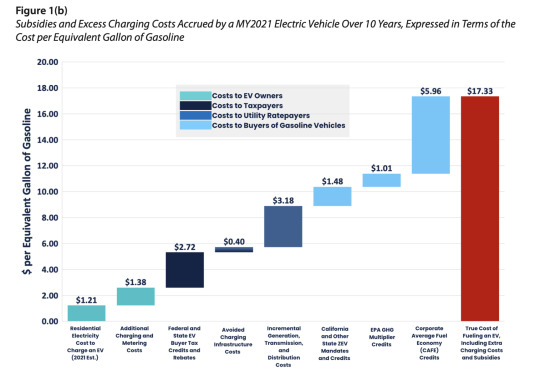

Study: Cost of ‘fueling’ an electric vehicle is equivalent to $17.33 per gallon

By Kenneth Schrupp | The Center Square

(The Center Square) – The complete costs of "fueling" an electric vehicle for 10 years are $17.33 per equivalent gallon of gasoline, a new analysis from the Texas Public Policy Foundation says.

The study authors say the $1.21 cost-per-gallon equivalent of charging a car cited by EV advocates excludes the real costs born by taxpayers for subsidies, utility ratepayers for energy investments, and non-electric vehicle owners for mandate-and-environmental-credit-driven higher vehicle costs, which they say total $48,698 per EV. Those costs must be included when comparing fueling costs of EVs and traditional gas-powered vehicles, TPPF maintains.

“The market would be driving towards hybrids if not for this market manipulation from the federal government. We’d be reducing emissions and improving fuel economy at the same time on a much greater scale,” study author Jason Isaac told The Center Square in an interview. He then cited Toyota estimates that the batteries from one EV can power 90 hybrids and reduce emissions 37 times more than that one EV.

The study adds up the costs of direct subsidies to buyers of the car and chargers; indirect subsidies in the form of avoided fuel taxes and fees, as well as electric grid generation, transmission, distribution, and overhead costs for utilities; and regulatory mandates that include fuel economy standards, EPA greenhouse gas credits, and zero-emission mandates.

Image courtesy of the Texas Public Policy CenterTexas Public Policy Center

The study also assumes EVs will be driven for 10 years and 120,000 miles, which the authors claim is a generous estimate. According to J.D. Power, EVs lose 2.3% of their range each year due to battery degradation, in part driving EVs to lose value faster than internal combustion cars.

With Ford losing an estimated $70,000 per EV and subsidies reaching $50,000 per EV, Isaac says the real cost of a vehicle such as a Ford Lightning is over $150,000, and those costs are carried by everyone, including non-EV owners and even Americans without cars.

“The real cost of a Ford Lightning is closer to $172,00 and no one would buy them at that. I know their sales have tanked. The [electric] Silverado sold 18 electric trucks last quarter,” Isaac said. “Buying a car is more expensive today and people don’t understand why that is. I’m trying to help them understand if they buy a gas or diesel car they’re paying for an electric vehicle for a wealthy EV owner.”

To reach the $17.73 per gallon equivalent figure, the authors created categories for costs borne by EV owners, taxpayers, utility ratepayers, and buyers of electric vehicles. For reference, the cost per gallon equivalent is computed by dividing the number of miles over a car’s ten year lifetime by the average new vehicle's fuel efficiency of 36 miles per gallon equivalent, and using that number to divide the total cost presented.

EV owners only pay $1.21 for the cost of residential electricity and $1.38 for charging and metering costs per equivalent gallon, which makes charging still cheaper than gasoline in terms of costs paid by EV owners. However, taxpayers pay $2.72 per gallon in federal and state EV buyer tax credits and rebates ($8,984 over a vehicle lifetime), a cost of $0.40 per gallon ($1,318 over a vehicle lifetime) in avoided charging infrastructure costs split between taxpayers and utility ratepayers. Utility ratepayers then pay $3.18 per gallon ($10,515 over a vehicle lifetime) in increased costs to enable the grid to charge electric vehicles at mass scale through increased power generation, transmission and distribution. Lastly, buyers of non-electric vehicles face increased vehicle costs equating to $1.48 per gallon equivalent ($4,881 over a vehicle lifetime) due to requirements in many states that manufacturers sell a certain number of often money-losing EVs to continue selling other cars, $1.01 per gallon equivalent ($3,322 over a vehicle lifetime) due to EPA GHG emissions standards, while Corporate Average Fuel Economy Credits add a whopping $5.96 per gallon equivalent ($19,678 over a vehicle lifetime).

CAFE standards are the single largest externalized cost of EVs, a cost that researchers attribute to the fact that automakers whose fleets do not meet the necessary average fuel economy must purchase credits from automakers with excess credits, with these credit markets worth billions of dollars per year and contributing $1.78 billion to Tesla’s bottom line in 2022. The average fuel economy of an average EV with a 300 mile range in 2021 was estimated to be 113 miles per gallon equivalent, making automakers strongly incentivized to build these often money-losing cars to meet CAFE goals. To increase the adoption of cars that don’t use diesel or gasoline, the federal government created a 667% multiplier in MPGe for vehicles that use alternative power. With a fleetwide CAFE standard of 37 MPG for 2021 and a 2021 EV rated at 113 MPGE, an EV is worth 507 MPG worth of credits, or more than what Ford loses directly on its EVs.

2 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market���s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Usage-Based Insurance Market Soaring to $288.4B by 2030 with Pay-As-You-Drive Models

The Usage-Based Insurance market is experiencing explosive growth, poised to transform how insurance is delivered and consumed. With a value of USD 49.4 billion in 2023, this innovative market is expected to surge to USD 288.4 billion by 2030, achieving an impressive compound annual growth rate (CAGR) of 28.7%. Let's explore the key aspects driving this evolution, its applications, benefits, and challenges.

What is Usage-Based Insurance?

Usage-Based Insurance, also known as telematics insurance, is a model where premiums are determined by real-time driving behavior, mileage, or other individual usage metrics. By integrating technology like GPS trackers, onboard diagnostics, and mobile apps, insurers can assess risk profiles more accurately, offering customers customized premiums.

Download Sample Report @ https://intentmarketresearch.com/request-sample/usage-based-insurance-market-3090.html

Key Drivers of UBI Market Growth

Advancements in Telematics Technology With connected devices and telematics becoming mainstream, insurers have unprecedented access to data that aids in analyzing driver behavior and risk.

Growing Demand for Personalized Policies Traditional insurance models often fail to accommodate individual driving habits. UBI fills this gap by offering tailored premiums, leading to increased customer satisfaction.

Increased Adoption of Connected Vehicles As smart vehicles become more common, they provide a perfect platform for seamless integration of usage-based insurance systems.

Rising Focus on Cost Savings UBI rewards safe drivers with lower premiums, appealing to customers keen on reducing their insurance costs.

Applications of Usage-Based Insurance

Pay-As-You-Drive (PAYD) This model charges drivers based on the number of miles driven, ideal for those who travel infrequently.

Pay-How-You-Drive (PHYD) Focused on driving behavior, this type evaluates metrics such as speed, acceleration, and braking patterns to determine premiums.

Manage-How-You-Drive (MHYD) A hybrid approach, this model offers additional features like real-time coaching, alerts for risky behaviors, and maintenance recommendations.

Benefits of Usage-Based Insurance

Fair Pricing UBI aligns insurance costs with actual usage, ensuring fairer pricing compared to traditional policies.

Encouragement of Safer Driving With incentives for good driving habits, UBI promotes road safety and reduces accident rates.

Enhanced Transparency Customers gain clarity on how their premiums are calculated, building trust with insurance providers.

Cost Efficiency for Providers Insurers benefit from improved risk assessment and reduced claim fraud through detailed data collection.

Access Full Report @ https://intentmarketresearch.com/latest-reports/usage-based-insurance-market-3090.html

Challenges Facing the UBI Market

Data Privacy Concerns The collection and analysis of real-time driving data raise issues about personal privacy and data security.

High Initial Investment Setting up the necessary infrastructure for telematics integration can be costly for insurers.

Regulatory Hurdles Regulations regarding data usage, storage, and transparency can vary across regions, creating implementation challenges.

Customer Skepticism Some customers may resist adopting UBI due to distrust in how their driving data will be utilized.

The Road Ahead: Future of UBI

With the rise of electric and autonomous vehicles, the UBI market has vast potential for expansion. Collaboration between automakers and insurers is likely to intensify, driving innovation in insurance models. Emerging technologies like AI and big data analytics will further refine risk assessment, creating even more tailored solutions.

By 2030, UBI could become the standard for motor insurance, especially in developed markets where digital adoption is high.

FAQs

What is the projected market size of UBI by 2030? The UBI market is expected to reach USD 288.4 billion by 2030, growing at a CAGR of 28.7%.

What technologies enable UBI? UBI relies on telematics, GPS, mobile apps, and connected vehicle platforms to collect and analyze data.

How does UBI benefit drivers? UBI offers fairer premiums, promotes safer driving habits, and provides transparency in insurance pricing.

What are the primary challenges for UBI adoption? Key challenges include data privacy concerns, high setup costs, and varying regional regulations.

Is UBI suitable for all types of drivers? UBI is particularly beneficial for low-mileage and safe drivers seeking cost-efficient and personalized insurance solutions.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

0 notes

Text

Car Brake Pads Market Trends, Future Growth and Comprehensive Analysis to 2030

The Car Brake Pads market is expected to grow from USD 4.71 Billion in 2024 to USD 6.38 Billion by 2030, at a CAGR of 5.20% during the forecast period.

The Car Brake Pads Market has experienced significant growth and transformation over recent years, fueled by advancements in automotive technology, increasing safety concerns, and the global shift toward more sustainable and efficient vehicle components. Brake pads, an essential part of the braking system, play a critical role in vehicle safety by providing friction against brake rotors to stop or slow down a car effectively. The market's expansion is driven by a growing automotive sector, stringent safety regulations, and the rising adoption of electric vehicles (EVs) globally.

The demand for car brake pads has been bolstered by the surge in vehicle production and sales, particularly in emerging economies. Consumers are increasingly prioritizing vehicle safety and performance, prompting manufacturers to invest in high-quality, durable, and efficient brake pad materials. Innovations in material technology, such as ceramic, metallic, and organic compounds, are reshaping the market. Ceramic brake pads, for instance, are gaining popularity for their durability, low noise levels, and minimal dust production, catering to the growing demand for eco-friendly automotive components.

For More Insights into the Market, Request a Sample of this Report https://www.reportprime.com/enquiry/sample-report/19887

Key Market Players

Federal Mogul, Akebono, ZF TRW Automotive Holdings Corp, MAT Holdings, BOSCH, Nisshinbo Group Company, Delphi Automotive, ATE, ITT Corporation, BREMBO, Brake Parts Inc, Sumitomo, Acdelco, Fras-le, Knorr-Bremse AG, ADVICS, Meritor, Sangsin Brake, Hitachi Chemical, Double Link, Hawk Performance, EBC Brakes, ABS Friction, MK Kashiyama, Hunan Boyun Automobile Brake Materials, FBK SYSTEMS SDN BHD

Market Segmentations

By Type: Non-asbestos Organic Brake Pads, Low Metallic NAO Brake Pads, Semi Metallic Brake Pads, Ceramic Brake Pads

By Applications: Car OEM Industry, Car Aftermarket Industry

Geographically, the car brake pads market exhibits significant regional variations. North America and Europe are leading markets, driven by stringent safety and emission regulations and the widespread adoption of advanced braking systems such as Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC). In these regions, a strong focus on premium and luxury vehicles further fuels the demand for high-performance brake pads. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization, increasing vehicle ownership, and the booming automotive manufacturing industry in countries like China, India, and Japan.

Get Full Access of This Premium Report https://www.reportprime.com/checkout?id=19887&price=3590

The transition to electric and hybrid vehicles is reshaping the dynamics of the brake pads market. EVs and hybrids, which require less frequent braking system maintenance due to regenerative braking, have prompted manufacturers to innovate and develop specialized brake pads tailored to these vehicles' unique requirements. Additionally, the focus on noise, vibration, and harshness (NVH) reduction in EVs has led to the development of quieter and more efficient brake pad solutions.

The competitive landscape of the car brake pads market is characterized by the presence of global and regional players vying for market share through product innovation, mergers and acquisitions, and strategic partnerships. Companies such as Brembo, Bosch, Akebono Brake Corporation, and Nisshinbo Holdings are at the forefront of innovation, introducing cutting-edge products that enhance vehicle safety and performance while meeting evolving regulatory standards.

0 notes

Text

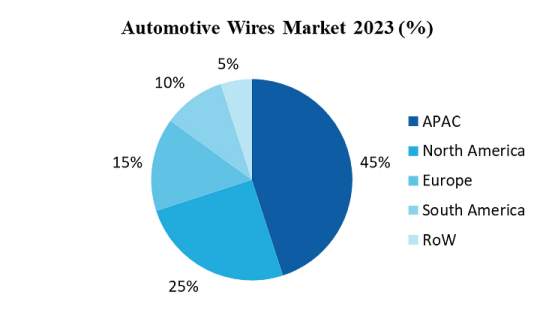

Automotive Wires Market-Industry Forecast, 2024–2030

Automotive Wires Market Overview:

Request Sample :

Automotive wire demand is expected to rise due to the growing trend of lightweight passenger automobiles as a means of reducing carbon emissions. In response to stringent regulations aimed at reducing carbon emissions from automobiles, manufactures will concentrate on producing aluminium automotive wires to reduce the vehicle’s overall weight. This is going to help in achieving the new regulations criteria. The rising focus on enhancing the standards for automotive wire will give opportunities for market expansion. For instance, according to US Auto Outlook 2024, light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Additionally, the demand for automotive wires is expected to rise in parallel with the volume of vehicles being produced and the increasing demand from customers for better comfort, safety, and convenience.

Market Snapshot:

Automotives Wires Market — Report Coverage:

The “Automotive Wires Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Automotives Wires Market.

AttributeSegment

By Material

· Copper

· Aluminium

· Others

By Vehicle Type

· Passenger Vehicles

· Light Commercial Vehicles

· Heavy Commercial Vehicles

By Propulsion

· ICE Vehicles

· Hybrid Vehicles

· Pure Electric Vehicles

By Transmission Type

· Electric wiring

· Data Transmission

By Application

· Engine wires

· Chassis wires

· Body and Lighting wires

· HVAC wires

· Dashboard / Cabin wires

· Battery wires

· Sensor wires

· Others

By End User

· OEM

· Aftermarket

By Geography

· North America (U.S., Canada and Mexico)

· Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

· Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

· South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

· Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted global supply chains, leading to delays in production and sales of automobiles which led to decrease in automotive wire manufacturing. Governments worldwide imposed lockdowns and restrictions, which led to shut down of mines, factories, and transportation networks, thus disrupting the supply of raw materials such as copper and aluminum, that are used in making automotive wires.

The Russia-Ukraine war had a huge impact on the global automotive wires market. Ukraine is a major manufacturer of copper, a material used as an automotive wiring component. The war has led to mining disruptions, which in turn has caused the shortages and increase in prices globally.

Key Takeaways:

Copper wires segment is Leading the Market

Copper wires segment holds the largest share in the automotive wires market with respect to market segmentation by material. Electrification will be the biggest driver to copper demand for vehicles. Copper is used throughout electric vehicle powertrains, from foils in each cell of the battery to the windings of an electric motor. In total, each electric vehicle can generate over 30kg of additional copper demand. According to a report by IDTechEx, the demand for copper from the automotive industry was just over 3MT in 2023 but is set to increase to 5MT in 2034. Because of its electrical and chemical characteristics, copper is used in every part of the battery. There are lot of tiny cells in the battery, and each one has a copper foil to carry electricity out of the cell. Large copper bars placed throughout the battery also convey the energy from each cell to the high-voltage connections, which in turn power the motor and electronics. Such parts and components with the copper are driving the market growth of copper wires in automotive wires market.

Inquiry Before Buying :

Passenger Vehicles are Leading the Market

Passenger Vehicles segment is leading the Automotive Wires Market by Application. The passenger vehicle category is currently holding the largest share in the automotive wires market because of a combination of factors including large production volumes, a wide range of wiring requirements, technological developments, and the increasing adoption of electric vehicles. For instance, according to Global and EU Auto industry 2023 report by The European Automobile Manufacturers’ Association (ACEA), European car production grew substantially, reaching nearly 15 million units, marking a significant year-on-year improvement of 12.6%. The growing popularity of electric vehicles (EVs) is also contributing to the growth of the passenger vehicle segment in the automotive wires market. EVs have more complex wiring systems due to the integration of batteries, motors, and charging infrastructure.

Integration of Smart Systems in Automobiles

Global demand for automotive wires is primarily driven by the integration of smart systems in automobiles. Modern automobiles have more wires because electronic control units (ECUs) are becoming more and more popular. Each ECU has been connected to a variety of sensors, actuators, and other ECUs through a complex network of connections. Automotive manufacturers are using sophisticated wiring solutions, such as light-weight harnesses, insulated cables and high-temperature-resistant wires to manage the rising number of connections and ensure reliable performance. For instance, In July 2024, Compal Electronics Inc, a leading contract electronics manufacturer from Taiwan, announced plans to build its first European factory in Poland. The company intends to invest more than $15.4 million to target automotive electronics clients. This strategic move marks Compal’s expansion into the European market. The need for complex and more advanced wiring solutions will continue to grow as automobiles become more technologically advanced, fueling the worldwide automotive wires market’s expansion.

Schedule A Call :

Fluctuating cost of materials to hamper the market

The market for automotive wires is significantly impacted by the price fluctuations of raw materials, particularly copper and aluminum. These materials are necessary for making automobile wires, and the market’s ability to expand may be severely hindered by their price instability. For instance, vehicle automation requires multiple sensors, as well as additional on-board computers. A standard autonomous system, with 12 cameras, seven Light Detection and Ranging sensors (LiDARs), eight radars and one automated driving control unit, will all depend on copper connections to function safely and reliably.

Buy Now :

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Automotive Wires Market. The top 10 companies in this industry are listed below:

Aptiv plc

Yazaki Corporation

Furukawa Electric Co., Ltd

Sumitomo wiring systems

Nexans SA

Fujikura Ltd

Samvardhana Motherson International Ltd

Leoni AG

Lear Corporation

THB Electronics

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.7%

Market Size in 2030

$ 6.8 Billion

Segments Covered

By Material, By Vehicle Type, By Propulsion, By Transmission Type, By Application, By End User and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Aptiv plc

2. Yazaki Corporation

3. Furukawa Electric Co., Ltd

4. Sumitomo wiring systems

5. Nexans SA

6. Fujikura Ltd

7. Samvardhana Motherson International Ltd

8. Leoni AG

9. Lear Corporation

10. THB Electronics

For more Automotive Market reports, please click here

0 notes

Text

Automotive Semiconductor Market In-Depth Analysis with Booming Trends Supporting Growth and Forecast 2023-2033

The demand for automotive semiconductor market is predicted to grow at a consistent growth rate of 7%. It is projected that the worldwide automotive semiconductor market is likely to be worth approximately US$ 58,770.1 million in the year 2023 and is expected to increase to a value of US$ 115,609.68 million by the year 2033.

Innovations in the automotive sector are proceeding at a breakneck pace.

When an error occurs in the vehicle, such as with the accelerator, the anti-lock brake interface, or the lights, a semiconductor is used to control the fail-safe system, manage the electrical control unit’s functions, and implement automotive fault tolerant systems, which alert the microcontrollers and safety systems installed in all vehicles. By way of illustration, consider the situation in which a vehicle loses traction on icy roads; this would call attention to the system’s ability to tolerate and recover from failure.

When the driver applies the brakes, the anti-lock braking system is activated because the sensors and semiconductor devices have detected an incident. As a result, semiconductors play a crucial role in the automotive sector, and the industry’s rapid expansion is anticipated to boost the automotive semiconductor market’s growth over the forecast period.

Demand for improved vehicle safety features continues to rise.

As the number of traffic accidents grows, so does the need for safety features like parking aids, collision avoidance systems, lane departure warnings, traction control, electronic stability control, tire pressure monitors, airbags, and telematics. Numerous ADAS technologies rely heavily on automotive semiconductors, which improve the systems’ functionality and enable them to detect and classify objects in the path of the vehicle, alerting the driver to changes in the environment and the state of the road as necessary.

Furthermore, these systems can use semiconductors and associated components to automatically apply the brakes or bring the vehicle to a stop, depending on the road conditions. In recent years, there has been a dramatic rise in the number of people losing their lives in traffic accidents, making it one of the leading causes of death worldwide.

According to a 2021 report by the World Health Organization, for instance, nearly 1.3 million people worldwide lose their lives in traffic-related incidents annually. Teenagers also have a higher rate of fatal road traffic injuries. Due to these causes, there has been an uptick in interest in car safety features. Businesses in the auto industry are working to address consumers’ concerns by designing and releasing new products with enhanced safety functions. For instance, HELLA (a company that makes advanced lighting and electronics components) is expected to begin mass producing their newest 77 GHz radar system soon.

Key Takeaways

The automotive semiconductor market is expected to experience significant growth in the coming years due to increased demand for electric and hybrid vehicles.

Advancements in ADAS technology are driving the demand for semiconductors that enable these features.

The development of autonomous vehicles is driving the need for more advanced semiconductor technology, such as LiDAR, radar, and camera systems.

The rise of connected car technology is driving demand for advanced semiconductor components that can support features like telematics, infotainment, and vehicle-to-vehicle communication.

The adoption of Industry 4.0 technology is driving demand for more advanced semiconductor technology that can support IoT and AI systems.

The United States is currently the largest market for automotive semiconductors due to its robust automotive industry and investment in emerging technologies.

The Asia-Pacific region is expected to experience significant growth in the automotive semiconductor market due to its growing automotive industry and increasing demand for electric and hybrid vehicles.

Competitive Landscape

The competitive landscape in the automotive semiconductor market is highly fragmented and characterized by intense competition among key players. There are several global players, including NXP Semiconductors N.V., Infineon Technologies AG, and Texas Instruments Incorporated, who are investing heavily in research and development to improve the performance and functionality of their semiconductor products. These companies are also expanding their product portfolios through strategic partnerships, mergers and acquisitions, and collaborations with other companies in the value chain.

The automotive semiconductor market is seeing increased competition from new entrants and startups that are developing innovative semiconductor products to cater to the evolving needs of the automotive industry. These companies are leveraging emerging technologies like IoT, AI, and cloud computing to develop cutting-edge semiconductor solutions that enhance the functionality and performance of automobiles.

Key Segments

Automotive Semiconductor Market by Component:

Micro Components (Processors)

Memory Devices

Logic

Optical & Sensors

Analog ICs

Discrete Devices

Automotive Semiconductor Market by Vehicle Type:

Automotive Semiconductors for Passenger Vehicles

Automotive Semiconductors for Light Commercial Vehicles

Automotive Semiconductors for Heavy Commercial Vehicles

Automotive Semiconductor Market by Application:

Body

Safety

Telematics & Infotainment

Power Trains

Chassis

0 notes

Text

Regional Market Share Analysis: North America’s Dominance in Rocket Propulsion

The Rocket Propulsion Market is witnessing transformative growth as the global appetite for space exploration and satellite deployment intensifies. Valued at USD 4.23 billion in 2018, the market is expected to reach USD 6.36 billion by 2023, reflecting a robust CAGR of 8.50%. This growth is propelled by increased satellite launch services, advancements in reusable launch vehicles, and the budding concept of space tourism.

The rocket propulsion market comprises technologies that enable launch vehicles to propel payloads, such as satellites and spacecraft, into orbit or beyond. Innovations in propulsion systems, such as hybrid propulsion and reusable rockets, are reshaping this dynamic industry. With applications spanning military, government, and commercial sectors, the market stands at the forefront of the new space race.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=131843671

Key Drivers of the Rocket Propulsion Market

One of the pivotal forces behind the growth of the rocket propulsion market is the surging demand for space launch services. These services cater to a variety of applications, including placing satellites in low Earth orbit (LEO) and medium Earth orbit (MEO), as well as carrying human spacecraft to the International Space Station (ISS). Additionally, space exploration missions and space tourism are emerging as key drivers. The introduction of private spaceflight companies offering suborbital and orbital experiences is fueling interest in advanced rocket propulsion systems.

Reusable launch vehicles are revolutionizing the industry, reducing costs associated with space travel and expanding the scope of rocket propulsion applications. Companies like SpaceX have demonstrated the economic and environmental benefits of reusing rocket engines and components, which significantly lower the cost per launch.

Another significant driver is the rise in military and government investments in space-based technologies. Defense organizations rely on satellites for surveillance, communication, and navigation, contributing to the demand for reliable and efficient rocket propulsion systems.

Segments of the Rocket Propulsion Market

The rocket propulsion market is categorized by type, propulsion system, orbit, launch vehicle type, and end user.

The rocket engine segment is projected to experience the highest growth during the forecast period. This growth is fueled by the increasing number of private and government launch service providers, the falling costs of launches, and the demand for reusable engines. Rocket engines are essential for heavy payload delivery, deep space exploration, and tourism missions.

In terms of propulsion type, hybrid propulsion systems are leading the charge. Combining the benefits of solid and liquid propulsion systems, hybrid propulsion offers enhanced control, safety, and efficiency. This system is particularly suited for payload delivery to LEO, MEO, and geostationary Earth orbit (GEO).

The unmanned launch vehicle segment is gaining prominence, with a higher CAGR expected during the forecast period. These vehicles, used primarily for satellite deployment and cargo delivery, are becoming increasingly sophisticated as investments in automation and robotics grow.

Regional Dynamics in the Rocket Propulsion Market

The rocket propulsion market exhibits varying growth dynamics across regions. In 2018, North America led the market, primarily due to the presence of key industry players and a surge in space-related investments. The region’s focus on space exploration, satellite launches, and space tourism drives its dominance. The U.S., in particular, is at the epicenter of innovation, with companies like SpaceX, Blue Origin, and Aerojet Rocketdyne leading advancements in propulsion technologies.

Meanwhile, the Asia-Pacific region is poised for the fastest growth, with increasing investments in space programs and launch services. Countries like China, India, and Japan are bolstering their capabilities in satellite deployment and deep-space exploration. The Indian Space Research Organisation (ISRO) and Mitsubishi Heavy Industries are examples of regional entities advancing rocket propulsion technologies.

Ask for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=131843671

Opportunities and Challenges

Opportunities abound in the rocket propulsion market, with the ongoing development of reusable technologies and hybrid propulsion systems. Reusable rockets are significantly reducing the cost of access to space, opening doors for more frequent and varied missions. Additionally, innovations in propellants and engine designs are enhancing payload capacities and efficiency.

However, challenges persist, particularly regarding the high costs associated with developing cutting-edge technologies. Investment in research and development for next-generation propulsion systems is capital-intensive and requires collaboration between governments, private entities, and academia.

Another hurdle is the infrastructure required to support the growing number of launches. Launch sites, ground control systems, and manufacturing facilities must be scaled to meet demand while maintaining safety and efficiency.

The Role of Key Players

Several key companies dominate the rocket propulsion market. SpaceX has set new benchmarks with its Falcon and Starship series, emphasizing reusability and affordability. Aerojet Rocketdyne, known for its RS-25 and RL10 engines, provides propulsion solutions for both government and commercial missions. Orbital ATK specializes in solid rocket motors, contributing to defense and space programs. In Asia, Antrix Corporation, the commercial arm of ISRO, and Mitsubishi Heavy Industries play pivotal roles in satellite launches and space exploration missions.

These companies are shaping the industry through strategic partnerships, technological innovation, and sustainable practices. Their efforts are not only advancing rocket propulsion but also enabling new frontiers in space exploration and commercialization.

The Future of Rocket Propulsion

As the demand for satellite launches and space exploration grows, the rocket propulsion market will continue to evolve. Innovations in propulsion systems, such as electric and nuclear propulsion, are on the horizon, promising to revolutionize space travel and deep-space exploration. The integration of artificial intelligence and machine learning into launch vehicle systems is expected to enhance performance, safety, and reliability.

Space tourism is another burgeoning area with the potential to redefine the rocket propulsion landscape. Companies are actively working on vehicles designed specifically for human spaceflight, blending cutting-edge technology with commercial viability.

The rocket propulsion market is not merely a technological endeavor but a reflection of humanity’s aspirations to explore and inhabit the cosmos. Its growth signals a new era of collaboration, innovation, and discovery.

To Gain Deeper Insights Into This Dynamic Market, Speak to Our Analyst Here: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=131843671

FAQs

What is the current size of the rocket propulsion market?

The rocket propulsion market was valued at USD 4.23 billion in 2018 and is projected to grow to USD 6.36 billion by 2023, at a CAGR of 8.50%.

What factors are driving the growth of the rocket propulsion market?

Key drivers include increased demand for satellite launch services, advancements in reusable rocket technology, and the emerging space tourism industry.

Which region dominates the rocket propulsion market?

North America is the leading region, with significant investments in space exploration, satellite deployment, and tourism. The Asia-Pacific region is expected to grow at the highest CAGR during the forecast period.

What are the challenges facing the rocket propulsion market?

The primary challenges include high development costs, the need for advanced infrastructure, and regulatory complexities.

Which companies are key players in the rocket propulsion market?

Prominent companies include SpaceX, Aerojet Rocketdyne, Orbital ATK, Antrix Corporation, and Mitsubishi Heavy Industries.

#rocket propulsion market#rocket engines#space launch services#space tourism#hybrid propulsion#satellite launch

0 notes

Text

Global Used Car Market: Comprehensive Market Insights

Global Used Car Market: Comprehensive Market Insights

The global used car market represents a dynamic and rapidly expanding segment of the automotive industry. According to Straits Research, the market was valued at USD 1747.95 billion in 2024 and is expected to grow dramatically, reaching USD 4338.97 billion by 2033 with a robust CAGR of 10.63% during the forecast period. A used car is defined as a previously driven vehicle that remains functional and is intended for resale, offering an affordable alternative to new car purchases.

Download Free Sample Report: https://straitsresearch.com/report/used-car-market/request-sample

Market Categorization

Vehicle Type Segmentation

Hatchback

Sedan

SUV

Fuel Type Breakdown

Petrol: Dominates the market due to lower maintenance costs and better initial acceleration

Diesel

Others (Electric, Hybrid)

Distribution Channels

Franchised Dealers

Independent Dealers

Private Sales

Online Platforms

Offline Marketplaces

Market Segmentation: https://straitsresearch.com/report/used-car-market/segmentation

Geographic Market Overview

Regional Market Trends

RegionDominant CountriesKey CharacteristicsNorth AmericaUnited States, CanadaHigh adoption of online used car platformsAsia-PacificIndia, China, JapanGrowing millennial preference for affordable vehiclesEuropeGermany, UK, FranceStrong emphasis on certified pre-owned vehiclesMiddle East & AfricaUAE, South AfricaEmerging market with increasing used car demand

Top Market Players

Asbury Automotive Group Inc

Autonation Inc.

Big Boy Toyz Ltd.

Carmax Business Services LLC

Cars24 Services Private Limited

Group1 Automotive Inc.

Hendrick Automotive Group

Lithia Motors Inc.

Mahindra First Choice Wheels Ltd

Truecar Inc.

Key Operational Factors Driving Market Growth

Consumer Dynamics

Millennial Preference: Younger generations are more inclined to purchase pre-owned vehicles to reduce expenses

Economic Constraints: Rising new car prices push consumers towards used car markets

Technological Advancements: Online platforms making used car transactions more transparent and convenient

Market Influencers

COVID-19 Impact: Pandemic disrupted new car supply chains, increasing used car demand

Remote Work Trends: Changing lifestyle patterns affecting vehicle purchasing decisions

Affordable Mobility: Used cars providing cost-effective transportation solutions

Buy Full Report: https://straitsresearch.com/buy-now/used-car-market

About Straits Research

Comprehensive Insights

Detailed Market Segmentation

Global and Regional Analysis

Extensive Competitive Landscape

Future Growth Projections

Technological and Consumer Trend Evaluation

The used car market continues to demonstrate remarkable resilience and growth potential, driven by economic factors, changing consumer preferences, and technological innovations. As affordability and flexibility become increasingly important, the market is poised for significant expansion in the coming years.

0 notes

Text

Happy Hanakwanza Everybody! As this strange and bewildering sphere rotates on it's axis around Sun , I can't help but feeling slightly apprehensive about letting loose and enjoying the spirit of festivus. Climate scientists recently released projections on ice melting at the north pole and the findings from the analysis were alarming, to say the least. If the current environmental conditions persist at their present rate than we could be living on an earth without ice at it's Northern most pole by the year 2030.

The influx of sea water on our oceans would cause untold seasonal fluctuations & weather anomolies unseen before. What's worse are the biom destructions that desimate whole food chains all to feed mankind's endless lust for consumption.ere are some simple, practical tips on how to shrink your carbon footprint:

At Home:

Reduce energy consumption: Turn off lights and electronics when not in use, unplug chargers, and consider switching to energy-efficient appliances.

Adjust your thermostat: Lower the heat in winter and raise it in summer. Even a few degrees can make a difference.

Conserve water: Take shorter showers, fix leaks, and consider installing low-flow showerheads and toilets.

Reduce waste: Recycle, compost, and avoid single-use plastics.

Eat less meat: Animal agriculture is a significant contributor to greenhouse gas emissions. Try incorporating more plant-based meals into your diet.

Buy less stuff: Consider whether you really need something before you buy it. Choose durable, long-lasting products and repair things instead of replacing them.

Transportation:

Walk, bike, or take public transportation: Whenever possible, choose these options over driving.

Drive efficiently: If you must drive, combine errands, avoid aggressive driving, and keep your tires properly inflated.

Consider a more fuel-efficient vehicle: If you're in the market for a new car, consider a hybrid or electric vehicle.

Food:

Eat local and seasonal food: This reduces the emissions associated with transporting food over long distances.

Reduce food waste: Plan your meals, store food properly, and compost food scraps.

Other:

Offset your carbon footprint: Consider purchasing carbon offsets to balance out your unavoidable emissions.

Advocate for change: Support policies and businesses that are working to reduce carbon emissions.

1 note

·

View note

Text

Brakes Market Overview, Trends, and Future Prospects to 2030

The Brakes market is expected to grow from USD 52.57 Billion in 2023 to USD 69.65 Billion by 2030, at a CAGR of 4.80% during the forecast period.

The brakes market is a critical segment of the global automotive industry, driven by the increasing demand for safety, advanced vehicle technologies, and stringent regulatory standards. Brakes are essential components designed to slow down or stop vehicles by converting kinetic energy into heat through friction or other means. The market encompasses a wide range of braking systems, including disc brakes, drum brakes, regenerative braking systems, and advanced electronic braking solutions like Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC).

For More Insights into the Market, Request a Sample of this Report https://www.reportprime.com/enquiry/sample-report/19880

Market Dynamics

Rising Emphasis on Safety Regulations: Governments and regulatory bodies worldwide are mandating safety features in vehicles, such as ABS and ESC, to reduce accidents and enhance road safety. This has significantly boosted the adoption of advanced braking technologies in passenger cars and commercial vehicles.

Technological Advancements: Innovations in braking technology, such as regenerative braking systems for electric vehicles (EVs) and autonomous emergency braking (AEB) systems, are shaping the market. These systems not only improve vehicle efficiency but also contribute to sustainability by reducing energy loss.

Electric and Hybrid Vehicle Adoption: The rapid shift toward EVs and hybrid vehicles has spurred demand for specialized braking systems, such as regenerative braking, which recovers energy during deceleration and improves overall vehicle efficiency.

Growing Vehicle Production and Fleet Expansion: The expansion of automotive manufacturing, particularly in emerging economies like China, India, and Brazil, has driven demand for braking systems. Increasing vehicle ownership and fleet expansion in logistics and transportation sectors further fuel market growth.

Rising Popularity of Performance and Luxury Vehicles: High-performance and luxury vehicles demand sophisticated braking systems, such as carbon-ceramic brakes, which offer superior performance, heat resistance, and durability. This trend is contributing to the growth of premium braking solutions.

Market Segmentations

By Type: Brake Pads, Brake Shoes, Brake Lining, Brake Rotor, Brake Drum

By Applications: Passenger Cars, Commercial Cars

Get Full Access of This Premium Report https://www.reportprime.com/checkout?id=19880&price=3590

Regional Analysis

North America serves as a critical market for advanced braking systems, propelled by stringent safety regulations and widespread adoption of ABS and ESC in both passenger and commercial vehicles. The region’s growing focus on autonomous vehicles and electric vehicles (EVs) further accelerates market growth. Europe stands as a prominent market, driven by strict safety standards, a high penetration of EVs, and the presence of leading automotive manufacturers. Nations such as Germany, France, and the UK lead the way in adopting cutting-edge braking technologies. Meanwhile, Asia-Pacific emerges as the largest and fastest-growing market for braking systems, with China and India at the forefront. The region’s thriving automotive industry, rising vehicle ownership, and substantial investments in EV infrastructure are fueling demand for both conventional and advanced braking solutions.

Competitive Landscape

The brakes market is highly competitive, with key players focusing on innovation, partnerships, and strategic acquisitions to strengthen their market position. Major companies include: Federal-Mogul, Aisin-Seiki, Robert Bosch, Brembo, Continental, Delphi Automotive, Nisshinbo, SGL Carbon AG, TRW, Tenneco, Akebono Brake Industry, Bendix, Sangsin, Longji Machinery, MIBA AG, BPW, Hongma, Gold Phoenix, Klasik, Boyun.

These companies are investing in R&D to develop advanced braking systems that meet the evolving demands of automakers and end-users. For example, Brembo S.p.A. has introduced "Sensify," an intelligent braking system that integrates software and AI to provide enhanced control and safety.

Future Outlook

The global brakes market is projected to grow at a compound annual growth rate (CAGR) of 5%-7% from 2024 to 2030, driven by technological advancements, increasing EV adoption, and growing awareness about vehicle safety. However, challenges such as fluctuating raw material prices and high costs of advanced braking systems may pose constraints.

Nonetheless, the shift toward autonomous vehicles, the integration of IoT in braking systems, and the emphasis on sustainability are expected to unlock new growth opportunities. Manufacturers focusing on innovation, eco-friendly solutions, and customer-centric strategies will be well-positioned to capitalize on the evolving demands of the brakes market.

0 notes

Text

Global Automotive Turbocharger Market: Driving Innovation in Engine Technology.

Our Latest Report covers The Global Automotive Turbocharger Market involves the development and use of turbochargers in vehicles to enhance engine performance by forcing more air into the combustion chamber, which increases power output and fuel efficiency. Turbochargers are becoming increasingly popular in both gasoline and diesel engines due to their ability to improve vehicle performance while reducing emissions. The market is driven by demand for more fuel-efficient and environmentally friendly vehicles, as well as advancements in turbocharging technology.

Get More Insights:

Key Matrix for Latest Report Update Base Year: 2023, Estimated Year: 2024, CAGR: 2024 to 2030

Key Players In The Automotive Turbocharger Market:

HONEYWELL, CONTINENTAL AG, DELPHI TECHNOLOGIES, TEL, ABB, CUMMINS, BMTS TECHNOLOGY, IHI, MITSUBISHI HEAVY INDUSTRIES, and BORGWARNER

Market segmentation:

Global Automotive Turbocharger Market is segmented into fuel type such as Gasoline, Diesel, and Others, by vehicle type such as passenger vehicles, Heavy Commercial Vehicles, and Light Commercial Vehicles. Further, market is segmented into Sales Channel such as OEM, and Replacement/ Aftermarket.

Automotive Turbocharger Market Segment by Fuel Type:

Gasoline Diesel Others

Automotive Turbocharger Market Segment by Vehicle Type:

Passenger vehicles Heavy Commercial Vehicles Light Commercial Vehicles

Regional Analysis for Outbreak- Automotive Turbocharger Market:

APAC (Japan, China, South Korea, Australia, India, and Rest of APAC)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

North America (U.S., Canada, and Mexico)

South America (Brazil, Chile, Argentina, Rest of South America)

MEA (Saudi Arabia, UAE, South Africa)

Key Features:

Turbochargers increase the engine's power output without significantly increasing fuel consumption, helping to reduce overall fuel costs.

Turbochargers boost engine power by forcing more air into the combustion chamber, which results in better acceleration and overall performance.

Turbocharging can help reduce engine emissions by enabling more complete combustion, which leads to lower levels of harmful pollutants.

Modern turbochargers are more compact and lighter, making them ideal for use in smaller engines while maintaining high performance.

As consumers and manufacturers focus on sustainability, turbochargers are being integrated into more vehicles to improve efficiency and meet stricter emission standards.

Even with the rise of electric vehicles, turbochargers are still in demand for hybrid vehicles to balance performance and fuel efficiency.

Get Sample Report:

About Us:

QualiKet Research is a leading Market Research and Competitive Intelligence partner helping leaders across the world to develop robust strategy and stay ahead for evolution by providing actionable insights about ever changing market scenario, competition and customers.

QualiKet Research is dedicated to enhancing the ability of faster decision making by providing timely and scalable intelligence.

QualiKet Research strive hard to simplify strategic decisions enabling you to make right choice. We use different intelligence tools to come up with evidence that showcases the threats and opportunities which helps our clients outperform their competition. Our experts provide deep insights which is not available publicly that enables you to take bold steps.

Contact Us:

6060 N Central Expy #500 TX 75204, U.S.A

+1 214 660 5449

1201, City Avenue, Shankar Kalat Nagar,

Wakad, Pune 411057, Maharashtra, India

+91 9284752585

Sharjah Media City , Al Messaned, Sharjah, UAE.

+971568464312

0 notes

Text

Automotive Acoustic Material Market

Automotive Acoustic Material Market Comprehensive Analysis Forecast by 2032

Global Market Insights

The global Automotive Acoustic Material Market was valued at USD 4.98 billion in 2023 and is anticipated to grow to USD 7.41 billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 4.52% from 2024 to 2032. This growth highlights the increasing emphasis on enhanced vehicle soundproofing and noise reduction technologies.

Download Free Sample Report with Complimentary Analyst Consultation: https://straitsresearch.com/report/automotive-acoustic-material-market/request-sample

Market Trends Driving Growth

Rising Consumer Demand for Comfort: Automotive consumers increasingly prioritize noise-free cabin environments, driving demand for advanced acoustic materials.

Stringent Regulatory Standards: Governments worldwide are implementing strict noise pollution regulations, compelling automakers to adopt innovative acoustic solutions.

Technological Advancements: Developments in lightweight and high-performing materials, such as polyurethane and fiberglass, are revolutionizing acoustic solutions.

Driving Factors

Growing Automotive Production: The expansion of global vehicle production is fueling demand for acoustic materials across both passenger and commercial vehicle segments.

Electric Vehicle Adoption: The quieter operation of electric vehicles (EVs) necessitates enhanced acoustic materials to suppress other ambient noises.

Sustainability Initiatives: Increasing focus on eco-friendly materials drives innovation in acoustic solutions that are both effective and environmentally conscious.

Opportunities in the Market

Integration with EV Platforms: The burgeoning EV market presents lucrative opportunities for acoustic material manufacturers to provide tailored solutions for electric and hybrid vehicles.

Customization and Innovation: Advances in material science enable manufacturers to design bespoke acoustic solutions for specific vehicle models and applications.

Expansion in Emerging Markets: Rapid urbanization and automotive growth in regions like Asia-Pacific and Latin America offer untapped potential for market players.

Market Segmentation

By Material Type:

Polyurethane

Textile

Fiberglass

Others

By Vehicle Type:

Passenger Cars

Commercial Vehicles

By Application Type:

Bonnet Liner

Door Trim

Others

Market Segmentation: https://straitsresearch.com/report/automotive-acoustic-material-market/segmentation

Key Players in the Automotive Acoustic Material Market

The competitive landscape features prominent players driving innovation and market expansion:

Dow Chemicals

3M Acoustics

BASF SE

Covestro

Henkel Adhesive Technologies

LyondellBasell

Sumitomo Riko

Sika

Toray Industries

Huntsman

Freudenberg Group

Buy Full Report (Exclusive Insights): https://straitsresearch.com/buy-now/automotive-acoustic-material-market

0 notes

Text

Electric Vehicle Component Market: A Comprehensive Analysis

Countries around the world have set targets to reduce vehicle emissions by 2035. They have started promoting the development and sales of EVs and related charging infrastructure. For instance, according to the Natural Resources Defense Council, automotive companies in the US have announced US 210 billion in investments in the EV industry to promote EV infrastructure such as charging stations. Several governments are providing various incentives, such as low or zero registration fees and exemptions from import taxes, purchase taxes, and road taxes for the adoption of EVs. This will grow the electric vehicle components market in the future.

New entrants and major automobile manufacturers are investing heavily in electrification. EVs are being launched across the spectrum from compact cars to luxury SUVs and commercial vehicles. The competitive landscape encourages fast steps in performance, range, and affordability, and EVs are increasingly becoming an option for consumers worldwide.

Recent Trends in the Electric Vehicle Component Market

An electric vehicle, driven by one or more electric motors, draws upon stored energy in rechargeable batteries. Private and public charging infrastructure allows these vehicles to be charged. The four primary types of electric vehicles include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs). Electric vehicle components are core parts that make electric vehicles operational. Major electric vehicle components include battery cells and packs, on-board chargers, motors, power control units, battery management systems, fuel cell stacks, and power conditioners. A few major players in the market include Tesla (US), BYD (China), Suzuki Motor Corporation (Japan), and BMW (Germany), among others.

Electric Vehicle Component Market Dynamics

The primary drivers for the electric vehicle and related components are the governmental initiatives for emissions reduction and efforts towards sustainable transport. More adoption of electric vehicles implies more demand for electric vehicle components. Growing prices of fossil fuels and more concern for the environment are leading consumers to EVs, thereby enhancing market growth. In addition, advancements in battery technology and development in charging infrastructure have increased the performance and accessibility of electric vehicles, which has consequently improved its appeal among consumers. Another factor is that the growing production of various types of electric models, including commercial and public transport, is raising high demand for all such electric vehicle components and boosting the market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=44595663

End user of the Electric Vehicle Component Market

The end users of the electric vehicle component market include private and commercial fleets. The private use of electric passenger cars is on the rise, and this trend has been fueled by consumers' increased interest in the environment, cost, and new technologies that their vehicle purchases offer. The clean alternative of EVs, with zero tailpipe emissions and a much lower carbon footprint for personal transport, is an essential driver for many concerned buyers regarding climate change and air quality. Besides, EVs operate at cheaper operating costs with electricity-based fueling and lower maintenance expenses as the number of moving parts is relatively more minor. In commercial space, companies are increasingly turning to EVs to achieve cost savings, meet. It includes sustainability goals and harsher environmental regulations. Some examples of commerce industries in commercial space are logistics, public transportation, utilities, and the retail sector.

0 notes