#Hundred Crore

Text

The Largest Real Estate Investment Opportunity Prime Location in Tolichowki, HyderabadEver Offered by Heera Luxury City

Introduction

owning a piece of prime real estate in one of Hyderabad most sought-after locations at a discounted price. Heera Luxury City, a part of the esteemed Heera Group led by CEO Dr. Nowhera Shaik, is offering an unprecedented investment opportunity. This article delves into the details of this remarkable offer, the strategic advantages of the land, and why this is a golden chance for investors.

Heera Luxury City: The Best Land in Business

Prime Location in Tolichowki, Hyderabad

Heera Luxury City boasts a prime piece of land located in Tolichowki, Hyderabad. Known for its strategic positioning and high market value, this land is one of the most valuable real estate assets in the area. The current market rate for this land reaches up to Rs. 3.04 lakh per square yard, driven by high demand and its premium location.

Special Discount for Heera Group Family

In a generous move, Heera Group is offering this land to its family members at a significantly discounted price. The total valuation of the land is estimated at Rs. 753,77,14,200 (Rupees Seven Hundred Fifty-Three Crore Seventy-Seven Lakh Fourteen Thousand Two Hundred Only). This offer not only provides an excellent opportunity to own prime real estate at a reduced rate but also leverages the geographical advantage and future potential of investing in this area.

youtube

Secure Your Investment with Heera Luxury City

Transparent and Secure Transactions

Dr. Nowhera Shaik has set specific price ranges for purchasing lands in Tolichowki, Hyderabad, from a minimum of Rs. 5 lakh to a maximum of Rs. 5 crore. This pricing strategy is designed to protect buyers from fraud and safeguard their interests. Heera Luxury City has taken control of the selling process to ensure transparency and protect buyers' interests.

Exact Location and Connectivity

The property is located in Town Survey Nos. 12, 13, 14, & 15/1, Block M, Ward No. 13, Tolichowki, Hyderabad, Telangana – 500 008. This area is well-connected, approximately 1 kilometer from the Tolichowki junction and 0.8 kilometers from the road towards Golconda Fort. The site is situated on a proposed 80′ road leading to the 7 Tombs, offering ease of access.

Land Details and Potential

The total land area under consideration is 33,060.15 square yards (27,642.50 square meters). Classified as residential and urban, this land is suitable for various types of development. Although currently selected for non-residential use, it holds potential for future commercial and residential projects. Key documents such as Sale Deed No. 5479 of 2015, Demarcation Report, and various utility bills have been reviewed to ensure the land's legitimacy.

youtube

Valuation and Legal Considerations

Current Valuation

Based on Sale Deed No. 5479 of 2015 and current market rates, the valuation of Heera Group’s property is Rs. 75,37,71,420 as of August 26, 2024. However, the property’s realizable value is estimated at Rs. 67,83,94,2780 (Rs. 678.39 Crores), reflecting its high demand and prime location.

Steps for Successful Development

To ensure the successful development of the property, it is crucial to:

Verify the legal status

Conduct a physical survey

Obtain all necessary certifications

Buyers should check for any legal issues or encroachments, confirm land measurements, and ensure clear road access to avoid any problems.

Big Praising to Dr. Nowhera Shaik

Dr. Nowhera Shaik, CEO of the Heera Group, is the cornerstone of the Heera Group family. Her dedication to Heera Group investors, whom she treats like family, is the reason for her continuous efforts and success. Investors trust Dr. Nowhera Shaik to protect their interests and make their investments fruitful in the long term. Her strong reputation for caring about her investors’ success and well-being makes every investment with the Heera Group rewarding.

"Investors trust Dr. Nowhera Shaik to protect their interests and make their investments fruitful in the long term."

For more information, contact us at:

(+91) 92810 26273/69

(+91) 91360 02818

(+91) 91360 04247

Heera Group Back Office

Conclusion

Dr. Nowhera Shaik’s primary focus is to settle investors’ claims. To facilitate this, Tolichowki land plots are being sold at a reduced price. This discounted rate aims to ensure smooth transactions and effectively resolve claims. After the Supreme Court’s approval to settle the claims through the sale of the Tolichowki property, it is confirmed that there are no disputes or legal obstacles preventing the sale. This guarantees that the process will proceed without any issues or encroachments.

Investing in Heera Luxury City is not just about owning prime real estate; it’s about securing a prosperous future under the trusted leadership of Dr. Nowhera Shaik. Don’t miss out on this unparalleled opportunity to invest in one of Hyderabad’s most valuable properties.

#heeraluxurycity#noweherashaik#realestateinvestment#hyderabadproperty#primeland#discountedproperty#heeragroup#tolichowki#investmentopportunity#secureinvestment#nowherashaik#tolichowk#landvaluation#residentialproperty#urbandevelopment#golcondafort#propertysale#heeragroupfamily#ceonoweherashaik#supremecourtapproval#investorclaims#transparentbuying#Youtube#heeragold

2 notes

·

View notes

Note

Same idiot here for information on what are like the culturally appropriate things to do for pujo in Bengal

(non Bengalis here's your guide to act native to pujo madness)

So, what IS pujo?

Following mahalaya, (if you don't know what that is, here's the infodump i did;)

Devispaksha begins. The goddess is returning home. There's a different side to this story however.

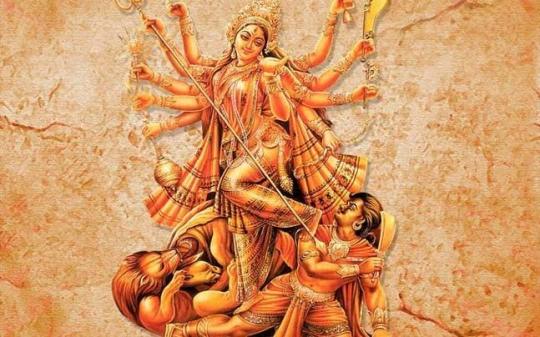

THE MYTHOLOGICAL SIDE AND WHAT THAT GREEN THING YOU SEE AT DURGA'S FEET IN EVERY PANDAL IS.

So, mahishasur was believed to be a monster. He one day decided to go into the depths of a jungle and sit for an intense tapasya. So he did. He prayed to lord brahma for months and months. He was covered in ivy and moss, Insects grew on him but he stayed firm. For months he prayed, without food or water. Brahma, impressed by his tenacity appeared before him. Mahishasur asked for the boon of immortality. Brahma granted him his wish. "You shall not be killed by any man in heaven, hell, or earth." Strengthened by his boon, Mahishasur attacked Indrapuri, The court of God Indra. He captured his throne. The gods turned to brahma for help. Brahma, on realising his mistake, went to consult with Lord Vishnu and Lord Shiva. the gods decided that as mahishasur couldn't be destroyed by any MAN, they needed to create a female source of power to end him. The gods gathered. They collected their powers and from the blinding lights, emerged the goddess of feminine power-Durga. She was bestowed with weapons; she was given strikingly beautiful features, And then, armed with a hundred hands and skilled in hundred different weapons, she went on the fight. Mahishasur, initially enthralled by her beauty, proposed to marry her; but she declared war. The battle went on for days. At the end, Durga's vahan, the lion pounced on the asur, Durga stepped on him and piercing her trishul through his heart, emerged victorious. The evil was dead. The power that laid within the flashing eyes of the goddess had won.

GOT IT. SO WHAT DO I DO DURING PUJAS?

Puja celebrations usually don't start in it's full-fledged glory till atleast the fifth day (panchami). it continues till the tenth day (Dashami).

If you live in kolkata during pujas, GO OUT. The whole city is bedazzled in lights, there are fairs through the city. Nobody sits at home; everybody is out on the roads sparkling and dressed to nines. Wear your best dresses and walk through the streets at night till the sun comes up. The most major part of pujas is pandal hopping. Thousands of pandals with budgets of crores are made at various spots in the city. These are pandals as huge as marketplaces; each with different themes. There are competitions every year between them, based on which pandal had the best durga idol, which had the best theme, which had the best structure, etc.

Pujas are the time when Kaash ful(the white flowers I clicked last year in the fourth picture) are in full bloom, there are lotuses in bloom in ponds; nature is bedecked in her best jewels.

Keeping in spirit with the goddess returning home, bengalis usually return home during pujas. it's a time to visit families, revsit old friends and have complete unabashed fun. It's time to gobble down on junk foods as much as you can. Oh and girls, on Ashtami(or the eighth day), make sure you put on your best sarees for arti and bedazzle the guys on the road;)

Despite the intense commercialization of the pujas that has happened in the last few years, it still remains an extremely core emotion for us bengalis. It's the time of homecoming, of taking a break and reconnecting to our roots every year. it's the time of visiting family, of recreating old memories, of re-living new and old romances. It's the whole world celebrating you coming home. It's the world celebrating the power that lays inside every woman- a mother, a sister, a wife.

@vellibandi @pinkpdf @dhuup

19 notes

·

View notes

Text

This is a serious question.

Why does our society suck in the choice of movies? I've seen movies produced with hundreds of crores and big superstars, tonnes of vfx and still they barely touch 7 on IMDb. But there are movies like Karwaan, 102 Not Out, Piku, Hindi Medium etc which have IMDb ratings around 7.5 or more but they still dont get the fame and recognition they deserve. And when someone talks about them, people are like "ye kaunsi movie hai? Naam to nahi suna kabhi. Kuch acha laga yaar"

14 notes

·

View notes

Text

Why Kris Gopalakrishnan Is Spending Hundreds Of Crores To Study The Human Brain - Forbes India

Human brain is enigma.it is seat of human consciousness,it has strange connectivity with the planets of the solar system.It has tremendous amount of. Memory storage not only of data but thoughts and feelings together. The memory in human brain is client server or totally inhouse nobody knows till date.

2 notes

·

View notes

Text

Been meaning to talk about this for a few days, but holy fuck, what a week for women's sport.

(Before we get started: INR 1 lakh is about £1,000. INR 1 crore is about £100,000)

The Board of Control for Cricket in India have finally got behind the growth in women's cricket and are launching the inaugural Women's Indian Premier League this year and the player's auction was held last Monday.

The 5 franchises were each given a salary cap of about £1.6m to build a squad of 15-18 players by buidding for their services. So £8m to be spread among around 90 players.

Reserve prices began at 10 lakh rupees and were capped at 50 and while some players didn't generate much interest (for example, Royal Challengers Bangalore got a big bargain by securing the Australian bowler, Megan Schutt at her reserve price of 40 lakh, and Alyssa Healy only went for 70 lakh) a few made bank.

Mandhana cost RCB 28% of their cap. No other player in either the men's or women's IPL takes up as much of their team's cap as her. It's also nearly 7 times the value of her central contract with the BCCI to play for India and vastly more than the £30k she gets playing in the gimmicky Hundred tournament in England.

It's a fresh tournament and the teams need stars to act as faces of the franchise. And so, in places they've mirrored the men's game. Mandhana, India's best batter and who wears 18, joined RCB, whose men's team have Virat Kohli, who also wears 18. (They also signed Ellyse Perry for 1.7 crore and the destructive Richa Ghosh for 1.9 crore). Harmanpreet Kaur, India's captain, got 1.8 crore from Mumbai, whose men's team feature Rohit Sharma, who is also India's captain.

These prices are for a tournament that begins on March 4 and ends on March 26. Three weeks. 8 to 10 games. Pro-rata, the top women are getting paid like footballers (and even those whose salaries are counted in lakh are getting healthy paydays).

This tournament will be successful. The BCCI wouldn't be doing it if it wasn't going to be. And it will grow. Lots of talented foreign players fell victim to squad building restrictions and went unsold. The league will expand. Maybe to 6 teams, before eventually ending up with 8.

All that's holding it back is how quickly talented Indian players are identified and their skills develop. The cash the BCCI generate from this will supercharge that search. The top players already have access to top coaches and training facilities, but for some, the 10 or 20 lakh they get from this tournament will help them build a future and lifestyle as professional cricketers and generate opportunities for others, which in turn will allow the BCCI to expand the tournament.

Within 10 years, I'd be surprised if the WIPL isn't the biggest women's sports league on the planet.

2 notes

·

View notes

Text

Top Property Management Software Options for Real Estate Investors in India

Managing a growing real estate portfolio in India can be a challenging task. For investors looking for streamlined solutions, property management software integrated with a robust real estate property portal like Look My Property is essential. This software enables efficient rental property management, tracking income, lease management, and other tasks across multiple properties. Look My Property is a comprehensive property management portal in India with a vast database of properties. It offers more than just listings – it provides essential features to aid in managing, buying, and renting properties.

Welcome to Look My Property

Look My Property provides access to over 10,000 listings in Hyderabad, making it a prime destination for those interested in real estate management in India. Whether you're looking for apartments, commercial properties, open plots, or luxury villas, this real estate property portal offers easy-to-navigate search options based on your budget, location, and preferences. Investors and homebuyers alike can browse various property types such as ready-to-move apartments, villas, and open plots. Look My Property is ideal for rental property management and discovering exclusive opportunities in Hyderabad's booming real estate market.

Explore Hyderabad's Real Estate Market

Hyderabad offers a thriving real estate market with properties ranging from luxury apartments to gated community villas. Through Look My Property, you can easily explore the best neighborhoods and investment options. Investors can also leverage the platform’s tools for real estate management and rental property management, ensuring seamless transactions and management processes.

Featured Property Listings

Look My Property features hundreds of premium listings, including ready-to-move apartments, villas, and open plots. Each listing comes with detailed information to help investors make well-informed decisions on this real estate property portal. Our database covers properties in prime locations like Shankarpalli, Kismatpur, and Medchal, making it easier to find the perfect investment. Whether you're searching for a luxurious 4 BHK villa in Shankarpalli or a modern apartment in Jubilee Hills, Look My Property provides essential details, aiding in seamless rental property management and long-term real estate management in India. With prices ranging from ₹1.41 crore to ₹6.5 crore, you can find the perfect balance between luxury and affordability on this property management portal in India.

Open Plots in Hyderabad

For those looking to invest in open plots, Look My Property lists more than 300 properties, including DTCP-approved plots in Medchal and Sangareddy. These plots offer an excellent opportunity for investors aiming for long-term returns or future development through smart real estate management in India. By leveraging the platform's real estate property portal, investors can access detailed data to assist in rental property management and land development. With top-notch features, this property management portal in India makes it easier to explore premium land deals, ensuring solid investment opportunities for the future.

Why Choose Look My Property?

Look My Property stands out as a leading real estate property portal in Hyderabad. Here’s why it’s the preferred choice for investors and homeowners: With over 10,000 properties, including apartments, commercial spaces, and villas, Look My Property is the go-to platform for finding the right property. The portal’s tools enable seamless rental property management, making it easy for investors to track tenants, rents, and other essential details. All listings on Look My Property come with RERA certification, ensuring that your investments are safe and verified.

Become a Channel Partner

If you're interested in expanding your real estate business, consider becoming a channel partner with Look My Property. Channel partners gain access to exclusive property listings and enjoy collaboration with one of the most trusted property management companies in India. With a channel partner program that enhances customer service and income opportunities, it's a great way to grow your portfolio.

Discover the Finest Properties with Look My Property

Look My Property is more than just a real estate property portal; it's a hub for discovering hidden gems in the Hyderabad real estate market. Whether you're looking for luxury villa plots in Kothur or ready-to-move apartments in Bachupally, this portal connects you with the best properties available. By combining advanced tools for real estate management in India with a curated selection of premium properties, Look My Property offers a unique platform for investors and homeowners alike.

0 notes

Text

Yarada Beach Andhra Pradesh - Visakhapatnam

Today we have to talk about Yarada Beach. This beach is located in Yarada on the west coast of the Bay of Bengal; Yarada Beach is located 15 kilometers from Visakhapatnam. The beach is located near Gangavaram Beach, Gangavaram Port, and Dolphin's Nose. The scientific study of the characteristics of soil deposited on Yarada Beach was conducted from May 2009 to May 2010. So let's get more information about this beach.

Yarada Beach is surrounded by rocky hills. This beach is ideal for going out of half the day of small groups in a completely different and natural environment. Water advice is not given on this beach, because water is much polluted with industrial waste. If you favor your luck, you can see the multicolor crabs rising on the rocks. This beach is probably the most clean and safe beach in Vizag area or even in India.

The whole area of Yarada Beach is covered with hundreds of banana and coconut plantations. Excluding some of the assets developed by the private sector, there is no infrastructure development in this field. Agrigold, who took part in the Yarada Beach lease from the government and did several landscaping and developed a garden inside, This beach is situated near Gangavaram Port.

This beach is actually safe to swim in comparison to the Rishikonda beach. To get to Yarada Beach, there is no bus facility available or alternatively, you can hire a cab to go here. This beach is a perfect place to stay away from all but it still needs some help before it can really be tourism-friendly.

This beach is in the process of bringing a new change and a little away from the city center, with a family and friends Offer a complete gateway. Even before reaching the shore of Yarada Beach, there is a glimpse of a beautiful coastline from the Dolphin Hill. Last year, the Andhra Pradesh Tourism Development Corporation started constructing a restaurant and beach shacks at Yarada at a cost of 1.5 crores.

There is a Durga temple in Yarada Beach, which is currently under construction. It is an open theater with floodlights for cultural activities, which is easily accessible during Durga Puja. This beach is the famous tourist destination in Visakhapatnam. Yarada Beach is a favorite place to burn stress and play in playful water activities. Tourists visit this beach and enjoy a good time with their favorite.

The beautiful landscape of Yarada Beach attracts tourists on a large scale. This lounge attracts enchanting views of sunsets on the beach. Known for experiencing the thrill of rock climbing near the rocks you can pay a visit to Yarada Beach at any time of the year.

Read More on Yarada Beach

1. Things To Do at Yarada Beach

Today we are going to go to Yarada Beach in South Goa and talk about what activities a tourist should do. So let us gather some information about Yarada beach.

This beach can relax the mind of the tourist in a place surrounded by natural beauty, serene atmosphere and unmistakable charm. Yarada Beach offers an exceptionally romantic and serene atmosphere to all couples tourists.

At Yarada Beach, tourists can enjoy activities such as soaking up the heat of the sun, staying under the shade, walking, enjoying a fun family picnic, capturing photographs with a die-to-fall background on the backdrop, and going on an evening bike ride.

2. Best Time To Visit Yarada Beach

Here we have to collect information about Best Time to Visit Yarada Beach. This is to collect information on where the visitor can visit Yarada beach. So let us know a little more about Yarada Beach.

Winter Season

The onset of winter on Yarada Beach lasts from November to February. The ideal time to pay a visit to this beach is for the tourist as the atmosphere is pleasant and enjoyable during this period. The climate of the winter season on Yarada Beach is pleasant and pleasant. During the winter season the temperature on this beach varies from 18-degree Celsius to 32-degree Celsius which makes Yarada Beach an excellent destination for tourists of all ages.

Summer Season

The summer season on Yarada Beach lasts from March to June. Tourists should avoid visiting this beach during the summer season. Humidity is quite high on Yarada Beach during the summer season. Temperatures on Yarada Beach this season have been rising to 42 degrees Celsius and above. This beach is unbearable to enjoy during the holiday during the summer season.

Monsoon Season

The beginning of the monsoon season on Yarada Beach lasts from July to September. The beach receives heavy rainfall during the monsoon season. Due to the heavy rainfall during this season on Yarada Beach, no tourist is allowed to enjoy water activities there.

3. How To Reach Yarada Beach

Here we are going to talk about How to Reach Yarada Beach. So let's gather information about how a tourist can visit Yarada Beach.

By Air

The nearest airport to reach Yarada Beach is Visakhapatnam International Airport. The airport is well served by various domestic and international flights such as Spice Jet, Air India, Alliance Air, Air Asia, Air Costa and Indigo. Tourists can easily reach Yarada Beach from this airport.

By Train

The nearest railway station for tourists to reach Yarada Beach is the Visakhapatnam railway station, about 12 km away. The railway station provides regular train services from famous Indian cities to Visakhapatnam and vice versa, including Mumbai, Hyderabad, Chennai, Bangalore, Kolkata and New Delhi. From Visakhapatnam Junction, tourists can choose a shared cab to go to Yarada Beach at their convenience.

By Road

The nearest bus station to Yarada Beach is Scindia. There are many private and state owned buses available to reach this beach. These buses run on routes that take tourists from South Indian metropolises like Vijayawada, Chennai, Bangalore and Hyderabad to Visakhapatnam. This type of road is very easy for tourists to reach this beach.

4. Top Places to Visit Around Yarada Beach

VMRDA INS Kursura Submarine Museum

Borra Caves

Rishikonda Beach

TU 142 Aircraft Museum

Ross Hill Church

Dolphin's Nose

Kailasagiri

Rama Krishna Beach

VUDA Park

Varaha Lakshmi Narasimha Temple

#yarada beach#yarada beach distance#yarada beach location#yarada beach andhra pradesh#yarada beach in vizag#yarada beach visakhapatnam#yarda beach

0 notes

Text

L Axis by Pharande Spaces 2, 3 & 4 BHK Homes at Spine Road Pimpri Chinchwad, Pune

Info & Visit +917020787851

✨Discover The All New L-Axis by Pharande Spaces:

A Landmark Address at Spine Road, Moshi

Welcome to L-Axis, a Premium Residential development by Pharande Spaces, ideally located on Spine Road in Moshi. This upscale project is crafted for those who seek the perfect blend of contemporary design, comfort, and a vibrant community living experience.

Configurations Available:

➡️ 2 BHK Apartments

⭐Sizes: 820 sq.ft. / 835 sq.ft.

💰 Price: Start From ₹98 Lakhs

➡️ 3 BHK Apartments

⭐ Sizes: 1122 sq.ft. / 1145 sq.ft./ 1224 sq.ft.

💰 Price: Start From ₹1.33 Crore

➡️ 4 BHK Apartments

⭐Size: 1479 sq.ft.

💰 Price: ₹1.81 Crore

Info & Visit +917020787851

✨Project Highlights:

28-Story Tower: Elevating your living experience with stunning views and spacious homes.

✨Premium Lifestyle Amenities:

🏊 Swimming Pool

🏏 Children’s Play Area

🏋️ Gymnasium

🎯 Indoor Games

🏀 Basketball Court

🎭 Amphitheatre

🧘 Senior Citizen Area

🎊 And Many More

Info & Visit +917020787851

L-Axis at Spine Road, Moshi, is not just a residence; it's a lifestyle. Whether you're a young professional, a growing family, or someone looking for a spacious abode, L-Axis offers homes that meet all your needs.

Experience luxury living with unparalleled amenities and make L-Axis your new address today!

Info & Visit +917020787851

Overview: The ultimate living experience awaits you at Pimpri-Chinchwad’s most premium destination! Spread across 11 acres of verdant greenery, explore spacious 2, 3 & 4 BHK flats in Pimpri-Chinchwad that cater to your sophisticated tastes. L-axis on Spine Road brings you a brand new dimension in luxury with masterfully crafted architecture, beautifully planned apartments and exclusive lifestyle amenities. Nestled in a serene neighbourhood, that offers great connectivity to PCMC and Pune’s prime locations. Enjoy access to some of the best social infrastructure in the vicinity. These flats in Pimpri Chinchwad bring comfort to your doorstep. This project happens to be Pimpri – Chinchwad’s most premium destination offering world-class amenities such as a fully equipped gymnasium, amphitheatre and more. Life at L-axis comes along with the finest of niceties. We offer a wide variety of amenities to introduce elegant living for a selected few. We’ve left no stone unturned to equip the development with a mélange of world-class amenities and contemporary features.

L-AXIS | Pharande Spaces L-AXIS PHARANDE SPACES, Spine Rd, PCNTDA, Sector No. 6, Moshi, Pimpri-Chinchwad, Maharashtra 412105

Info & Visit +917020787851

About Pharande Spaces:

Pharande Spaces has stamped their signature green imprints across several hundred acres of Pimpri-Chinchwad, from Moshi in the North-East to Ravet in the West, and in several sectors of Pradhikaran.

Pradhikaran is the Pimpri Chinchwad New Township Development Authority (PCNTDA). It was set up as the apex Town Planning body to ensure the systematic development of the residential zones of the predominantly industrial Pimpri-Chinchwad. Inspired by the Chandigarh model, it has transformed Pimpri-Chinchwad into a residential destination of choice.

Info & Visit +917020787851

Pharande Spaces is known for its unique and high-quality residential projects, including apartments, row houses and twin bungalows in PCMC and Pune. It has over 100 acres of new and upcoming residential and commercial complexes in PCMC and Pune. CERTIFICATIONS Pharande Promoters & Builders, the flagship company of Pharande Spaces, an ISO 9001-2000 certified company, is a pioneer in the PCMC area, offering a mixed bag of products catering mainly to the 42 sectors of Pradhikaran.

L-AXIS - 2, 3 & 4 BHK Homes at Spine Road Pimpri Chinchwad, Pune

Info & Visit +917020787851

#LAxis#SpineRoad#Moshi#PharandeSpaces#PimpriChinchwad#MoshiPradhikaran#Pradhikaran#Pimpri#Chinchwad#NashikRoad#Chakan#NashikPuneHighway#PuneNashikRoad#2BHK#3BHK#4BHK#2BHKHomes#3BHKHomes#4BHKHomes#LuxuryAbode#LuxuryHomes#LuxuryResidences#LuxuryFlats#LuxuryApartments#MoshiSpineRoad#MoshiChikhaliRoad#Chikhali#TataMotors#HinjawadiSpineRoad#MoshiHinjewadiRoad

0 notes

Text

Five hundred investors got arrested regarding Buds Act, handed over a memorandum to the Tehsildar regarding their demands in the name of the Prime Minister

In the district itself, 223 chit fund companies had invested 2 billion 17 crore 40 lakh 70027 rupees from 76215 investors and this amount was lost. The offices of most chit fund companies were closed but the investors did not get their money.

By Manoj Kumar Tiwari

Published Date: Mon, 23 Sep 2024 09:16:47 AM (IST)

Updated Date: Mon, 23 Sep 2024 09:16:47 AM (IST)

When the women and men involved…

0 notes

Text

Mercury EV-Tech Limited: Outcome of Board Meeting and Disclosure under SEBI Regulations

On September 13, 2024, Mercury EV-Tech Limited issued an official announcement to BSE Ltd., regarding the decisions made in its Board of Directors' meeting. This communication serves to disclose significant resolutions passed in compliance with Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

During this meeting, which took place from 07:00 p.m. to 08:50 p.m., the Board of Directors of Mercury EV-Tech Limited approved two major preferential issues, namely the issuance of equity shares and convertible warrants. Both decisions reflect the company's strategy to raise substantial capital, totaling hundreds of crores, and to strengthen its financial position while adhering to the necessary regulatory requirements.

Preferential Issue of Equity Shares

The Board of Directors has green-lighted the issuance of up to 1,57,41,000 equity shares, priced at ₹75 per share. Each share consists of a face value of ₹1 with a premium of ₹74, resulting in a total issue size of approximately ₹118.05 crores. These shares will be allotted to specific investors through a preferential issue as outlined under the Companies Act of 2013, SEBI's Issue of Capital and Disclosure Requirements (ICDR) Regulations of 2018, and other applicable regulations.

The company will seek approval from its shareholders, as well as other necessary regulatory authorities, to move forward with this issue. Once approved, the proposed allottees will be required to pay the entire amount upfront, ensuring 100% of the total issue size is realized. Details of the investors and allotment specifics are provided in Annexure I attached to the formal communication. The prominent investors include entities such as Shree Saibaba Exim Pvt Ltd, Raghuvir International Pvt Ltd, and Forbes EMF, with post-allotment holding percentages varying based on the number of shares subscribed.

Preferential Issue of Convertible Warrants

In addition to the equity shares, the Board also approved the issuance of up to 4,83,00,000 convertible warrants. These warrants are priced similarly at ₹75 per warrant, with each warrant being convertible into one fully paid equity share. The total amount to be raised from this warrant issuance will not exceed ₹362.25 crores.

The issuance follows the same legal framework as the equity shares, requiring shareholder and regulatory approval before the final issuance. Investors will be asked to pay 25% of the total issue size upfront, with the option to convert these warrants into equity shares within 18 months from the date of issue. The list of potential allottees, which includes entities like Nexpact Limited, Eminence Global Fund PCC, and North Star Opportunities Fund VCC, is detailed in Annexure II. Post-conversion, these investors will hold significant stakes in the company, with varying holding percentages depending on their level of participation.

Extra Ordinary General Meeting (EGM)

To facilitate the approval process for these issues, the company has scheduled an Extraordinary General Meeting (EGM) on Saturday, October 12, 2024, at 11:00 a.m. The meeting will be held through Video Conferencing (VC) or Other Audio-Visual Means (OAVM), in compliance with regulatory guidelines, to allow shareholders to vote on the proposed preferential issuances.

The formal communication, signed by Mr. Kavit J. Thakkar, Director and CEO of Mercury EV-Tech Limited, concludes with a request for BSE to take the necessary disclosures on record.

Mercury EV-Tech Limited’s decision to opt for these preferential issues reflects its proactive approach toward capital infusion, demonstrating confidence in its growth trajectory. These issuances are expected to play a crucial role in bolstering the company’s equity base and ensuring it is well-capitalized for future endeavors.

0 notes

Text

Heera Group's Latest Real Estate Development: Where Modern Living Meets Tranquility-Heera Luxury City /Dr.Nowhera Shaik

Introduction

Welcome to Heera Group's latest real estate development, a place where modern living meets tranquility. Nestled in the heart of Hyderabad, this project offers a perfect blend of nature and convenience, featuring well-planned plots and state-of-the-art infrastructure. Designed to cater to both residential and commercial needs, our development provides an ideal opportunity for families and investors alike.

Prime Location and Connectivity

The property is strategically located in Town Survey Nos. 12, 13, 14, & 15/1, Block M, Ward No. 13, Jubilee Hills, Film Nagar, Hyderabad, Telangana – 500 008. This prime location offers excellent connectivity:

Approximately 1 kilometer from Tolichowki junction

0.8 kilometers from the road towards Golconda Fort

Situated on a proposed 80' road leading to 7 Tombs

The ease of access makes this development a highly desirable option for those seeking a well-connected living space.

youtube

Land Insights and Property Details

Key Features:

Total land area: 33,060.15 square yards (27,642.50 square meters)

Classification: Residential and urban

Topography: Level land

Current use: Non-residential, with potential for future commercial & residential projects

The property's urban classification and level terrain make it suitable for various types of development. Its current non-residential status opens up possibilities for innovative commercial and residential projects.

Valuation and Investment Potential

A detailed valuation certificate issued by A. Madhusudan, a Government Registered Valuer specializing in immovable property, provides insight into the property's worth:

Valuation as of August 26, 2024: Rs. 75,37,71,420

Estimated realizable value: Rs. 67,83,94,2780 (Rs. 678.39 Crores)

This valuation reflects the property's high demand and prime location, making it an attractive investment opportunity.

Heera Luxury City: A Closer Look

The valuation process for Heera Luxury City takes into account current market rates in Hyderabad:

Interior locations: Approximately Rs. 1.52 lakh per square yard

Main road properties: Up to Rs. 3.04 lakh per square yard

Average rate used for this property: Rs. 2.28 lakh per square yard

Based on these rates, the total land value is calculated at Rs. 753,77,14,200 (Rupees Seven Hundred Fifty-Three Crore Seventy-Seven Lakh Fourteen Thousand Two Hundred Only).

The land's classification as residential and urban, combined with its level terrain and prime location, contributes to its positive market valuation. The absence of reported encroachments and final agreements further enhances its appeal to potential investors.

Pricing Strategy and Buyer Protection

Dr. Nowhera Shaik, CEO of Heera Group, has implemented a unique pricing strategy to protect buyers and maintain transparency:

Land prices range from a minimum of Rs. 5 lakh to a maximum of Rs. 5 crore

This pricing structure is designed to prevent fraud and safeguard buyers' interests

Heera Luxury City has taken control of the selling process to ensure transparent transactions

For more information on pricing and availability, contact:

(+91) 92810 26273/69

(+91) 91360 02818

(+91) 91360 04247

www.heeragroupbackoffice.biz

Steps for Successful Property Development

To ensure a smooth development process, potential buyers should:

Verify the legal status of the property

Conduct a physical survey of the land

Obtain all necessary certifications

Check for any legal issues or encroachments

Confirm land measurements

Ensure clear road access to the property

Following these steps will help avoid potential problems and ensure a successful investment.

Conclusion

Heera Group's latest real estate development in Hyderabad offers a unique opportunity to invest in a thriving community. With flexible plot sizes, affordable pricing, and easy access to essential amenities, this project is ideal for both residential and commercial purposes. The prime location, combined with the property's high valuation and potential for development, makes it an attractive investment option.

Explore a new way of living in a peaceful, secure, and prosperous environment with Heera Group. Book your plot today and start building your future with us!

Contact Heera Group to learn more about this exciting opportunity and take the first step towards owning your dream property in Hyderabad's most sought-after location.

#heeragroup#nowherashaikh#realestateinvestment#hyderabadproperty#interestfreetrade#affordablehousing#womenempowerment#supremecourtoversight#ethicalbusiness#telanganadevelopment#islamicfinance#landplots#heeradevelopers#economicgrowth#homeownership#financialindependence#investmentopportunities#indiarealestate#businessexpansion#communitydevelopment#Youtube

0 notes

Text

Income Tax Exemptions for Startups in 2024: Eligibility and Benefits

India's startup environment has been developing at an outstanding rate, turning into a key driver of innovation and financial increase. To guide this entrepreneurial surge, the government has brought numerous schemes and tax exemptions that purpose to lessen the financial burden on new corporations. Among these are particular income tax exemptions that startups can take advantage of.

In 2024, the landscape for tax exemptions maintains to adapt, providing critical alleviation for eligible companies. This article will delve into the maximum considerable income tax exemptions available to startups in 2024, consisting of eligibility criteria and the key blessings these exemptions provide to new organizations.

Overview of Income Tax Exemptions for Startups

Startups face several demanding situations all through their early tiers, such as coin flow troubles, operational expenses, and market uncertainties. Recognizing these hurdles, the Indian authorities give numerous profits tax exemptions to reduce the monetary burden and inspire more marketers to go into the market. One of the maximum distinguished projects is the Section 80-IAC tax exemption, introduced as a part of the Startup India scheme. This exemption aims to offer tax alleviation to eligible startups for the preliminary years in their operation, when they are most liable to economic pressures.

Key Income Tax Exemptions for Startups in India can enjoy the following primary income tax exemptions:

Section 80-IAC Tax Deduction

Exemption below Section 56 (Angel Tax Exemption)

Capital Gains Exemption under Section 54GB

Tax Benefits on ESOPs for Startups

Exemption from Tax on Long-Term Capital Gains beneath Section 54EE

1. Section 80-IAC Tax Deduction The most full-size earnings tax exemption for startups is provided below Section 80-IAC of the Income Tax Act. This segment lets in eligible startups to claim a a hundred% tax deduction on income for 3 consecutive monetary years inside their first ten years of incorporation.

Eligibility for Section 80-IAC

To qualify for the exemption beneath Section 80-IAC, startups ought to meet the following criteria:

Incorporation Date: The startup should be incorporated between April 1, 2016, and March 31, 2024. This provision has been extended in current years to house more modern corporations.

Nature of Business: The startup should be worried in innovation, development, deployment, or commercialization of new merchandise, offerings, or procedures pushed by using generation or intellectual assets.

Approval: The startup have to be licensed as eligible for tax advantages through the Department for Promotion of Industry and Internal Trade (DPIIT).

Turnover: The enterprise’s turnover need to not exceed INR 100 crore in any of the financial years for which the deduction is claimed.

Benefits of Section eighty-IAC:

Startups that qualify for the Section eighty-IAC tax deduction can avail of numerous blessings:

Complete Tax Relief: Eligible startups do not have to pay earnings tax on income for three consecutive monetary years. This facilitates them reinvesting their profits into increase and operations.

Increased Financial Stability: By saving on taxes, startups can enhance their cash go with the flow, which is essential for the duration of the early stages when capital necessities are excessive.

Flexibility in Choosing Years: Startups can choose any three consecutive years inside their first ten years of incorporation to say the exemption, presenting flexibility primarily based on the employer’s boom cycle.

2. Exemption below Section fifty-six (Angel Tax Exemption)

Angel investors frequently play a crucial role in presenting initial funding for startups. However, beneath Section fifty six(2)(viib) of the Income Tax Act, the "Angel Tax" used to use to startups receiving investments above the honest marketplace cost, growing great financial burdens. To assist the increase of startups, the authorities have exempted eligible organizations from this tax.

Eligibility for Angel Tax Exemption

The startup must be diagnosed via DPIIT.

The aggregate quantity of paid-up percentage capital and percentage top rate should not exceed INR 25 crore.

Investments made by listed groups with a net well worth of INR one hundred crore or turnover of INR 250 crore or extra are exempt.

Benefits of Angel Tax Exemption

This exemption lets in startups to stable investment from buyers without the worry of extra tax liabilities, making it easier for them to elevate capital during their increase segment.

3. Capital Gains Exemption under Section 54GB

Section 54GB of the Income Tax Act allows for the exemption of long-term capital gains on the sale of residential belongings if the proceeds are invested in eligible startups.

Eligibility for Section 54GB

The residential belongings ought to be bought, and the capital gains should be reinvested within the startup as fairness.

The startup should use those price ranges for purchasing new property (consisting of computers or plant and equipment) to grow its business.

The startup must be identified by means of the DPIIT.

Benefits of Section 54GB

This provision encourages funding in startups through allowing enterprise founders and traders to defer their tax liability on capital gains, which may be a massive benefit when securing a budget for commercial enterprise expansion.

4. Tax Benefits on ESOPs for Startups

Employee Stock Ownership Plans (ESOPs) are a popular tool for startups to draw and hold expertise. However, the tax treatment of ESOPs has historically been a challenge, as employees had been required to pay tax on the time of exercising, even supposing they didn’t sell the stocks.

Recent Tax Changes on ESOPs

To ease the financial burden, the authorities now allows deferred taxation on ESOPs for startups. Under this provision, personnel of DPIIT-diagnosed startups can defer the charge of tax on ESOPs for 5 years or till they go away the corporation or sell their stocks, whichever is earlier.

Benefits of ESOP Tax Deferral Attract and Retain Talent: By providing tax advantages on ESOPs, startups could make their reimbursement applications more attractive, supporting them entice pinnacle skills.

Deferred Tax Liability: Employees do not need to pay taxes prematurely while workout their ESOPs, giving them greater flexibility and reducing their instant tax burden.

5. Exemption from Tax on Long-Term Capital Gains beneath Section 54EE

Section 54EE allows an exemption from capital profits tax if the long-term capital gains from the sale of a capital asset are invested in the government-notified fund of budget for startups.

Eligibility for Section 54EE

The capital gains need to be invested within the eligible startup fund within six months of the sale of the unique asset.

The most quantity that may be invested and exempted under Section 54EE is INR 50 lakh.

Benefits of Section 54EE

This exemption gives investors a tax-efficient approach to supporting startups while deferring their capital profits tax, encouraging greater investments inside the startup ecosystem.

Conclusion:

The availability of income tax exemption for startups in India, especially in 2024, offers significant financial alleviation and promotes the growth of recent businesses. Whether it is through the Section 80-IAC deduction, capital gains exemptions, or deferred taxation on ESOPs, startups can get the right of entry to more than a few tax blessings that reduce their economic burden. By meeting the eligibility standards and taking advantage of those income tax exemptions, startups can channel their savings into enterprise boom, product improvement, and expansion efforts.

0 notes

Text

Cry for Ayushman Bharat services rocks Partab Park as patients seek Govt intervention Rehan Qayoom Mir Srinagar, Sep 05 (KNO): The recent suspension of Ayushman Bharat services by private hospitals in Jammu & Kashmir, effective September 01, has led to widespread calls for government intervention from hundreds of affected patients. The suspension has sparked serious concerns among patients who depend on these services for essential treatments. Today, a protest was held at Pratab Park, Lal Chowk, Srinagar, where patients and their family members from across J&K were seen shouting slogans and raising placards. Patients, speaking to the news agency—Kashmir News Observer (KNO), have urged the government to act swiftly to restore these crucial healthcare services. The halt in services stems from a financial dispute involving private hospitals, which have not received approximately Rs 200 crore in funds since March. A protester told KNO, “If the government doesn’t resume the Golden Card, how will we afford the treatment? We don’t have the money for private hospitals.” Another person, from Pulwama, said, “We want the government to restart the scheme; otherwise, we will lose our family members. It is not a matter of money, but life and death.” As already reported by KNO, in November of last year, IFFCO-TOKIO General Insurance Company, which provided insurance for Ayushman Bharat in J&K, notified the State Health Agency (SHA) of its decision not to renew the contract after its expiration on March 14, 2025. Previously managed by Bajaj Allianz GIC, IFFCO-TOKIO was introduced as the new insurer but has since sought to withdraw, citing financial losses. Despite the SHA’s requests for IFFCO-TOKIO to continue, the company refused. Additionally, the High Court recently directed IFFCO-TOKIO to continue the existing arrangement under the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana-SEHAT (AB-PMJAY-SEHAT) until the dispute is resolved by an arbitrator. However, the company has yet to comply, prompting authorities to file a contempt petition—(KNO)

Cry for Ayushman Bharat services rocks Partab Park as patients seek Govt intervention

Srinagar, Sep 05: The recent suspension of Ayushman Bharat services by private hospitals in Jammu & Kashmir, effective September 01, has led to widespread calls for government intervention from hundreds of affected patients.

The suspension has sparked serious concerns among patients who depend on these…

0 notes

Text

Congress alleges that Sebi chief Madhavi Puri Buch received Rs 16 crore salary from a private bank

Congress has accused SEBI chief Madhavi Puri Buch of taking Rs 16 crore as salary from a private bank.

In January last year, a report published by the US-based Hindenburg Research Institute revealed evidence that the Adani Group, which created fake companies abroad, engaged in secret transactions of hundreds of crores of rupees and committed corruption in the stock market. Also, Hindenburg had…

0 notes

Text

Modus operandi unraveled: How over Rs 600 crore were siphoned out of country

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

Delhi Police's Special Cell registered an FIR in October 2021 regarding a syndicate that channeled money obtained through various criminal activities out of the country. This included Proceeds of Crime ( POC) obtained through illegal Chinese loan apps, illegal online gamings and also illegal bettings.

The wide network of this syndicate can be gauged from the fact that the case was first taken over by Delhi Police in October 2021. It was later transferred to the Enforcement Directorate ( ED) that is probing the matter and recently made an arrest on July 13.

From the documents that have been accessed by Republic Digital, it is mentioned categorically how accused persons, the fraudulent companies created by them on the pretext of forged documents were involved in opening of bank accounts both within and outside country and have taken out funds to the tune of Rs 338 crore.

To begin with, fake identities like Aadhaar, PAN cards and Voter ID cards were used for creating shell firms and opening multiple bank accounts.

In continuation to this, shell firms were also opened in Hong Kong, China, UAE, Singapore and Malaysia. The money that was deposited in Indian bank accounts was then successfully routed through RTGS/ NEFT.

The probe in this case by the agencies led them to get hold of Ashish Kumar Verma. It was found that Ashish along with the accomplices were able to create 18 shell firms and multiple accounts not only in private but also public banks.

Investigations have also revealed that Ashish is one among many in this huge syndicate that was successfully taking out hundreds of crores from the country.

As per law enforcement officials the other major characters involved in this crime of money laundering included Praveen Kumar based in Dubai who was involved in creating fake firms abroad, and Vipin Batra who used to be in touch with Ashish and gave him directions on how the modus operandi had to be implemented. Vipin Batra was recently arrested by the ED on July 13. He is being interrogated.

The mastermind of this syndicate is said to be Pawan Thakur, a Dubai-based bookie and an international Hawala operator. As per law enforcement officials, he is the mastermind in incorporating entities within India as well in foreign countries for remitting funds from India and receiving such funds in foreign bank accounts.

Thakur used to provide forged documents to Vipin Batra who in turn used to send these documents to Ashish Kumar Verma for executing outward remittances. Thakur used to incorporate entities in foreign countries on the backing of passports of several Indian individuals.

The modus operandi proved to be so successful that the syndicate acquired foreign exchange to the tune of Rs 271 crore and successfully sent this amount to the foreign bank account of shell companies abroad in the garb of purported imports of services giving false declarations in turn to banks.

In this, 90 percent of the amount was sent to Dubai while 10 percent was sent to Singapore.

It did not just end here. During the investigations, it was further found that Pawan Thakur was working on a similar modus operandi and in connivance with people that have been identified as Rohit Sharma, Jatin Chopra, Anmol Srivastava, Deepak Kaushal and others for illegal outward remittances.

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

From this, funds to the tune of Rs 338 crore were channeled out to Hong Kong and Singapore. Some of the fake firms that were created are Perfect Solutions, Omega Technologies, RP investment and consultancy, Flappose Trade PVT ltd, Uniwide innovations.

Fake directors of these firms were created. Bank accounts of office boys were created by giving them Rs 15,000. On their names, SIM cards used to be bought from where banking transactions used to be done.

With some arrests made in this case so far, investigations are still on to get hold of major masterminds in this Hawala racket that has resulted in more than Rs 608 crore being siphoned off the country.

1 note

·

View note

Text

CONCEPT OF START-UP IN INDIA:

Startup India campaign is based totally on an action plan geared toward selling financial institution financing for start-up ventures to boost entrepreneurship and encourage start-united states of america with jobs advent. The marketing campaign was first introduced with the aid of our Prime Minister Shri. Narendra Modi on 15th August, 2015.

It is focused on to restrict the role of States in policy domain and to dispose of “License Raj” and hindrances like land permissions, overseas investment proposal and environmental clearances. It is organized by the Department of Industrial Policy and Promotion. The government has already launched PMMY, the MUDRA Bank, a brand new organisation set up for improvement and refinancing activities regarding micro units with a refinance fund of Rs. 2 hundred billion.

START-UP

A startup is an entity, personal, partnership or confined liability partnership (LLP) organization that is situated in India, which changed into opened much less than 5 years in the past and have an annual turnover less than Rs. 25 Crores.

To be eligible for thinking about as a startup, the entity must not be fashioned with the aid of splitting up or reconstruction and its turnover need to no longer have crossed Rs. 25 Crores at some stage in its life.

KEY ADVANTAGES :

Single Window Clearance regardless of the assistance of a cellular software.

10,000 Crores fund of finances

80% reduction in patent registration price

Modified and more friendly Bankruptcy Code to make sure 90-day go out window.

Freedom from mystifying inspections for 3 years.

Freedom from Capital Gain Tax for 3 years.

Freedom from tax in profits for three years.

Eliminating purple tape.

Self-certification compliance.

Innovation hub beneath Atal Innovation Mission.

Starting with five Lakh faculties to goal 10 Lakh children for the innovation programme.

New schemes to provide IPR protection to start-u.S.And new corporations.

Encourage entrepreneurship.

Stand India across the world as a start-up hub.

FUNDING

Venture capital finances from abroad and angel buyers are proving to be a massive boon for Indian startup stories. Indian startups including Flipkart, Olacabs, Snapdeal, Hike, Shopclues, Freecharge, Inmobi and many others. Receive numerous rounds of observe-on financing as well both from their current investors or from any new investor.

SoftBank, which is headquartered in Japan, has invested US$ 2.00 Billion into Indian startups. The Japanese company had pledged the overall investments at US$ 10.00 Billion. Google declared to launch a startup. Oracle on 12th February, 2016 introduced to set up 9 incubation facilities.

Under the Start-Up India Action Plan”, the Honourable Prime Minister has also introduced Rs. 10,000 Crores fund for new establishments, identical opportunity in government procurement, a Rs. 500 Crores credit assure scheme and simpler go out norms.

MERGERS 7 ACQUISITIONS

Apart from funding, mergers and acquisitions also are assisting these startup corporations to develop by way of obtaining new abilities immediately and expanding into the market percentage of the obtained corporation. The first-class instance of this will be shopping for Myntra, an app based totally buying portal by means of every other era massive Flipkart to gain the market percentage.

Snapdeal recently received Freecharge to develop into the region of cell price gateways, when you consider that cellular payments are a subsequent warm spot sensed through diverse startups offering immense possibilities for in addition penetration.

Not handiest in India but also across the world tech giants have used acquisition of companies as a way to preserve their function of marketplace chief and also as a way to enhance diversification. An instance of this can be acquisition of messaging app Whatsapp with the aid of any other large Facebook.

GOVERNMENT ROLE

The Ministry of Human Resource Development and the Department of Science and Technology have agreed to accomplice in an initiative to set up over seventy five startup help hubs in the National Institutes of Technology, the Indian Institutes of Information Technology, the Indian Institutes of Science Education and Research and National Institutes of Pharmaceutical Education and Research. Reserve Bank of India takes steps to assist improve the convenience of doing enterprise within the usa and contribute to an environment that is conducive for the increase of start-up businesses.

Indian authorities are likewise taking numerous steps to construct an environment that's suitable for startups, due to the fact small companies can play a very vital function to increase and enhance the Indian economic system inside the future. In the Union Budget of 2015, authorities have set up a procedure or a mechanism known as Self Employment and Talent Utilization to assist all the aspects of startups proper from their seed financing stage to their boom stage. It is also predicted that authorities may also roll out a Rs. 2,000 Crores fund to offer seed capital to startups associated with IT and biotechnology.

EDUCATIONAL INSTITUTION ALLIANCES

Under the scheme, a group of begin-u.S.A.Will acknowledge an MOU with the celebrated establishments and will also establish the begin-up centres within the campus. NIT-Silchar is one of the establishments of the US to have joined the program. IIT Madras is also related with this marketing campaign. The group has been efficiently dealing with seven study parks that have incubated many start-ups.

CONCLUSION

Hence, thinking of all the above traits, it could be concluded that indigenous startups will no longer simplest make the lives of the human beings less complicated thru their low cost and handy offerings but may also act as a prime booster for the development and the development of the Indian economic system.

FAQ’S

1.Which are the bodies and businesses that fall under the class of “Funding Bodies”?

Alternate Investment Funds, Venture Capital Funds, Angel Fund and Seed Funds registered with SEBI will be eligible for offering assistance to entities wherein now not much less than 20 percent equity is taken up by such finances.

2.If an entity does not now have a PAN. Would I be allowed to sign up my entity as a “Startup”?

Yes. An entity without a PAN can be registered as a Startup.

3.Can I provide mobile numbers within the registration form?

It is advised that best one mobile range of the legal consultant of the entity is supplied at the time of registration.

4.What files might qualify as a helping document to the application to check in as a “Startup”?

The software shall be followed with the aid of

a copy of Certificate of Incorporation or Registration, because the case may be, and

a write-up about the nature of business highlighting how it's far operating towards innovation, development or improvement of products or procedures or services, or its scalability in phrases of employment technology or wealth creation.

5.For how long would reputation as a “Startup” be valid?

An entity shall quit to be a Startup on final touch of ten years from the date of its incorporation/ registration or if its turnover for any previous year exceeds 100 crore rupees.

6.What are the elements that want to be reviewed before issuing help?

A new services or products or method; OR

A considerably stepped forward present services or products or manner so as to create or upload cost for customers or workflow.

7.What qualifies as a “Startup” for the purpose of Government schemes?

Upto a period of ten years from the date of incorporation/ registration, if it's far incorporated as a non-public confined employer (as described inside the Companies Act, 2013) or registered as a partnership firm (registered under phase fifty nine of the Partnership Act, 1932) or a constrained liability partnership (under the Limited Liability Partnership Act, 2008) in India.

8.Can a current entity check in itself as a “Startup” on the Startup India Portal and Mobile App?

Yes, an current entity that meets the standards as indicated in reaction to Question 1 can go to the Startup India portal and Mobile App and get itself identified for diverse advantages.

9.What is the timeframe for obtaining a certificate of reputation as a “Startup” in case an entity already exists?

The technique of registration in such cases shall be real time and the certificate of recognition would be issued straight away upon a hit submission of the utility.

10.do I need to print a software shape and put up the physical copy of the identical to complete the technique of Startup registration?

No. The utility needs to be submitted online most effectively.

0 notes