#How Banks Assist with Estate Planning

Text

How Banks Assist with Estate Planning

How Banks Assist with Estate Planning

Estate planning is a crucial part of managing your finances and ensuring that your assets are distributed according to your wishes after your death. While many people think of estate planning as something only for the wealthy, it's actually important for anyone who wants to protect their loved ones and their legacy. Banks can play a significant role in estate planning by offering a range of services and expertise. Let's explore how banks can assist with estate planning and why it's beneficial to include them in your planning process.

ALSO READ - Advocate Ayush Garg

1. Providing Trust Services

One of the primary ways banks assist with estate planning is by offering trust services. Trusts are legal arrangements that allow you to place assets under the management of a trustee, who then manages these assets according to the terms you set. Banks can act as professional trustees, managing the trust’s assets on behalf of the beneficiaries. This can be particularly useful for complex estates or when there is a need to ensure that assets are managed prudently over a long period.

Banks have the expertise and resources to handle the various responsibilities of a trustee, such as investing the trust assets, managing real estate, paying bills, and distributing assets to beneficiaries according to the trust's terms. By serving as a trustee, banks provide a level of professionalism and impartiality that might be difficult for a family member or friend to offer.

ALSO READ- Ayush Garg High Court Advocate

2. Offering Estate Planning Advice and Guidance

Banks often have a wealth management division staffed with financial advisors and estate planning specialists. These professionals can provide valuable advice on how to structure your estate to minimize taxes, avoid probate, and ensure that your assets are distributed according to your wishes. They can help you understand the different types of trusts, the benefits of a will, and how to set up power of attorney and health care directives.

By working with a bank's estate planning experts, you can gain a clearer understanding of your financial situation and develop a comprehensive estate plan that meets your goals. They can also work in conjunction with your attorney and accountant to create a coordinated plan that covers all aspects of your estate.

ALSO READ- Ayush Garg

3. Managing Investment Accounts

Part of estate planning involves ensuring that your investments are managed effectively to grow your wealth and provide for your loved ones after you're gone. Banks can help with this by managing investment accounts and providing financial planning services. This includes developing an investment strategy that aligns with your estate planning goals and adjusting the strategy as needed to reflect changes in your circumstances or market conditions.

Banks can also manage specialized investment accounts like Individual Retirement Accounts (IRAs) or 401(k)s, which have specific rules regarding inheritance and distribution. By working with a bank, you can ensure that these accounts are managed properly and that your beneficiaries receive the maximum benefit.

ALSO READ- Cyber Crime Advocate

4. Offering Safe Deposit Boxes and Digital Vaults

A key component of estate planning is ensuring that important documents, such as wills, trusts, insurance policies, and deeds, are stored safely and can be easily accessed by your executor or trustee when needed. Banks offer safe deposit boxes that provide a secure location for storing these documents and other valuable items.

In addition to physical safe deposit boxes, many banks now offer digital vaults. These are secure online storage solutions where you can store digital copies of important documents. Digital vaults are particularly useful because they allow your executor or trustee to access necessary documents from anywhere, making it easier to manage your estate.

5. Assisting with the Probate Process

After someone passes away, their estate often goes through a legal process called probate, where the deceased's assets are distributed according to their will or state law. Banks can assist with the probate process by providing executor services. An executor is responsible for managing the estate, paying off debts, and distributing assets to beneficiaries.

Banks can act as executors, offering a professional and impartial approach to managing the estate. This can be especially helpful if the estate is complex or if there are family disputes that might complicate the distribution of assets. By acting as an executor, the bank ensures that the estate is handled according to the law and the wishes of the deceased.

ALSO READ- High Court Advocate

6. Minimizing Estate Taxes

Estate taxes can significantly reduce the value of your estate if not properly planned for. Banks can help minimize estate taxes by advising on various strategies, such as setting up trusts, making charitable donations, or gifting assets during your lifetime. These strategies can reduce the taxable value of your estate, ensuring that more of your wealth is passed on to your beneficiaries.

Banks' estate planning experts can work closely with your attorney and accountant to develop a tax-efficient estate plan. They can help identify opportunities to reduce taxes and ensure that all legal requirements are met to avoid any issues with the IRS.

7. Supporting Charitable Giving

If you wish to include charitable giving in your estate plan, banks can help facilitate this process. They can set up charitable trusts or donor-advised funds, which allow you to donate assets to charity while also receiving tax benefits. Banks can also manage these charitable funds, ensuring that your donations are used according to your wishes.

By working with a bank, you can create a charitable giving plan that reflects your values and provides ongoing support to the causes you care about. This not only helps you leave a lasting legacy but also offers potential tax advantages for your estate.

8. Providing Financial Education for Beneficiaries

In addition to managing your estate, banks can provide financial education for your beneficiaries. This can include guidance on how to manage inherited wealth, investment strategies, and financial planning. By educating your beneficiaries, banks can help them make informed decisions about their inheritance and ensure that the wealth you leave behind is used wisely.

Financial education is particularly important for younger beneficiaries who may not have experience managing significant assets. Banks can offer resources and support to help them understand their financial options and make smart choices for the future.

Conclusion

Banks offer a wide range of services that can greatly assist with estate planning. From acting as a trustee or executor to providing investment management and financial education, banks bring a level of expertise and professionalism that can help ensure your estate is managed according to your wishes. By incorporating a bank into your estate planning process, you can gain peace of mind knowing that your assets will be handled with care and that your loved ones will be well taken care of.

FAQs

What is the role of a bank in estate planning?

Banks can act as trustees, executors, provide investment management, and offer financial planning and tax advice as part of estate planning.

How can banks help minimize estate taxes?

Banks can advise on strategies like setting up trusts, making charitable donations, or gifting assets to reduce the taxable value of your estate.

What are trust services, and how do banks provide them?

Trust services involve managing assets placed in a trust according to the terms set by the trustor. Banks can act as professional trustees, managing these assets for the benefit of the beneficiaries.

Why use a bank as an executor for an estate?

A bank offers professional and impartial management of an estate, which can be particularly useful for complex estates or in situations where family disputes may arise.

Can banks help with charitable giving in estate planning?

Yes, banks can assist in setting up charitable trusts or donor-advised funds to facilitate charitable giving and provide tax benefits.

0 notes

Text

(unplanned) productive weekend dito sa apartment, part I

short zoom meeting with my Sunlife FA, na sobrang na-happy ako after.

i was planning kasi na iwithdraw na funds ko at ilagay sa bank muna kung wala pa naman pag gagamitan. na confuse kasi ako na continous payment pala yung policy ko until mag 80y/o ako. dba?? ayaw ko mag bayad ng insurance hanggang umabot sa age na yon but after talking to her i realized na mas magiging beneficial for me na iretain yon or maybe withdraw it some later time.

not that she made me change *my mind, inexplain lang nya yung mga dating hindi ko gets and na refresh ako about my policy since I had it at only 20, kakasimula ko lang mag work. it was just my mom's idea initially tapos pinsan ko pa FA ko (bago na yung ngayon ksi nag venture into real estate si kuya) kumbaga all trust na ako at di ko na binusisi fully mga naka saad sa contract.

dami ko gusto ishare about this kaso baka TMI or what. hingi nalang ako mg insights niyo sana into getting an insurance? like kelan ba dapat? and kung ayaw ninyo bakit?

kasi when I got mine, di naman yun with full conviction. hindi ko pa plano pero naisip ko "sige ipon naman" and "akin din naman mapupunta". andon din yung part na gusto ko makampante mom ko na from the start ng pag ttrabaho ko makakpag save ako.

si Miss Mia, hindi siya hard-selling. sabi nga nya she understands yung circumstances ng mga tao kung bakit gugustuhin o aayaw sila to have themselves insured, how soon o kung later pa. and if i decided right there and then na mag withdraw, she would assist me all the way.

another thing na naiiisip ko though, if ever mag kakaron ako mg kid/s at dumating yung time na magkakatrabaho na sila hindi ko gagawin yung katulad ng akin especially aa unang year of working nila, unless personally ready at gustong gusto nilang kumuha. sa isip ko, mas gusto kong ienjoy nila mga unang sahod sa paraan na gusto nila as long as hindi makakasama sa kanila, and to be able to do that dapat wala din akong financial hang ups. not that I woul tend na umasa sa kanila pero yun bang maipasa ko yung mga takot ko for their future eh dapat mas mag focus sila sa present lalo at age 20s. ayuuun.

20 notes

·

View notes

Text

Unlocking the UAE's Golden Visa Maze: Insider Tips for Success

Welcome, aspiring adventurers, to the exciting world of Golden Visas Services in the UAE! If you've ever dreamt of unlocking new opportunities, exploring vibrant cultures, or building a brighter future in one of the world's most dynamic hubs, then you're in the right place. In this guide, we'll be your compass, navigating the Golden Visa maze with insider tips and expert advice to ensure your journey is not just successful but also fulfilling. So, grab your map, pack your enthusiasm, and let's set sail on this exhilarating voyage towards your Golden Visa dream!

1. Understanding Golden Visa Eligibility Criteria

Before setting sail, ensure you're eligible. The UAE offers Golden Visas to investors, entrepreneurs, talented professionals, and retirees. Each category has specific criteria, like investment thresholds or retirement fund requirements. Check your eligibility based on your profile and aspirations.

2. Gathering the Required Documents

Assemble your crew of documents for the journey. Common documents include passport copies, proof of investment, bank statements, and a clean criminal record certificate. For investors, additional documents like business plans, trade licenses, and property ownership deeds may be required. Double-check the specific document checklist based on your chosen Golden Visa category.

3. Plotting Your Investment Strategy

Choosing the right investment is crucial. Opt for real estate, business ventures, or innovation projects that align with UAE regulations and contribute to the economy. Research thriving industries, consult with financial advisors, and consider long-term sustainability when crafting your investment strategy.

4. Crafting a Stellar Business Plan

A well-crafted business plan is your treasure map to Golden Visa approval. Highlight your business concept, market analysis, financial projections, and growth strategies. Emphasize how your venture will create jobs, drive innovation, or enhance the UAE's economic landscape. Tailor your business plan to showcase value, feasibility, and alignment with UAE's vision for growth and development.

5. Navigating the Golden Visa Application Process

Embark on your Golden Visa application journey through the relevant government authority, such as the Federal Authority for Identity and Citizenship (ICA), the Ministry of Economy, or local immigration departments. Follow the online application portal or engage with authorized representatives for a smooth submission process. Timing, transparency, and professional assistance are key for success.

6. Insider Tips for Smooth Sailing

Apply During Economic Stability: Submit your application during periods of economic growth and stability for higher chances of approval.

Engage Legal or Immigration Consultants: Consider hiring legal or immigration consultants for expert guidance and assistance throughout the application process.

Be Transparent and Consistent: Disclose accurate information and ensure consistency across all documents to avoid delays or rejections.

Showcase Long-Term Commitment: Highlight your commitment to long-term engagement in the UAE through investment diversification or strategic partnerships.

As we reach the shores of our Golden Visa adventure, it's time to reflect on the invaluable insights and strategies we've uncovered. From understanding eligibility criteria to crafting stellar business plans and navigating the application process, you've gained the tools and knowledge needed to steer your course towards success.

Remember, patience and preparation are your steadfast companions in this journey. Keep abreast of UAE's visa policies, adapt your strategies as needed, and stay committed to your long-term goals. Whether you're an investor, entrepreneur, or talented professional, the UAE's Golden Visa offers a gateway to new horizons and endless possibilities.

#GoldenVisa#GoldenVisaServices#MainlandGoldenVisa#LongTermResidencyVisa#InvestorVisa#GoldenVisaServicesUAE#365proservices#proservices#uaevisaservices#uaeconsultancy#businesssetupdubai

4 notes

·

View notes

Text

In 2008, Supreme Court Justice Clarence Thomas decided to send his teenage grandnephew to Hidden Lake Academy, a private boarding school in the foothills of northern Georgia. The boy, Mark Martin, was far from home. For the previous decade, he had lived with the Justice and his wife in the suburbs of Washington, D.C. Thomas had taken legal custody of Martin when he was 6 years old and had recently told an interviewer he was “raising him as a son.”

Tuition at the boarding school ran more than $6,000 a month. But Thomas did not cover the bill. A bank statement for the school from July 2009, buried in unrelated court filings, shows the source of Martin’s tuition payment for that month: the company of billionaire real estate magnate Harlan Crow.

The payments extended beyond that month, according to Christopher Grimwood, a former administrator at the school. Crow paid Martin’s tuition the entire time he was a student there, which was about a year, Grimwood told ProPublica.

“Harlan picked up the tab,” said Grimwood, who got to know Crow and the Thomases and had access to school financial information through his work as an administrator.

Before and after his time at Hidden Lake, Martin attended a second boarding school, Randolph-Macon Academy in Virginia. “Harlan said he was paying for the tuition at Randolph-Macon Academy as well,” Grimwood said, recalling a conversation he had with Crow during a visit to the billionaire’s Adirondacks estate.

ProPublica interviewed Martin, his former classmates and former staff at both schools. The exact total Crow paid for Martin’s education over the years remains unclear. If he paid for all four years at the two schools, the price tag could have exceeded $150,000, according to public records of tuition rates at the schools.

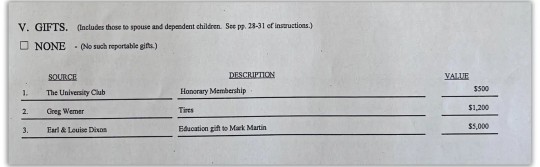

Thomas did not report the tuition payments from Crow on his annual financial disclosures. Several years earlier, Thomas disclosed a gift of $5,000 for Martin’s education from another friend. It is not clear why he reported that payment but not Crow’s.

The tuition payments add to the picture of how the Republican megadonor has helped fund the lives of Thomas and his family.

“You can’t be having secret financial arrangements,” said Mark W. Bennett, a retired federal judge appointed by President Bill Clinton. Bennett said he was friendly with Thomas and declined to comment for the record about the specifics of Thomas’ actions. But he said that when he was on the bench, he wouldn’t let his lawyer friends buy him lunch.

Thomas did not respond to questions. In response to previous ProPublica reporting on gifts of luxury travel, he said that the Crows “are among our dearest friends” and that he understood he didn’t have to disclose the trips.

ProPublica sent Crow a detailed list of questions and his office responded with a statement that did not dispute the facts presented in this story.

“Harlan Crow has long been passionate about the importance of quality education and giving back to those less fortunate, especially at-risk youth,” the statement said. “It’s disappointing that those with partisan political interests would try to turn helping at-risk youth with tuition assistance into something nefarious or political.” The statement added that Crow and his wife have “supported many young Americans” at a “variety of schools, including his alma mater.” Crow went to Randolph-Macon Academy.

GET IN TOUCH

ProPublica plans to continue reporting on the Supreme Court. If you have information we should know, please get in touch. Josh Kaplan can be reached by email at [email protected] and by Signal or WhatsApp at 734-834-9383. Justin Elliott can be reached by email at [email protected] or by Signal or WhatsApp at 774-826-6240.

Crow did not address a question about how much he paid in total for Martin’s tuition. Asked if Thomas had requested the support for either school, Crow’s office responded, “No.”

Last month, ProPublica reported that Thomas accepted luxury travel from Crow virtually every year for decades, including international superyacht cruises and private jet flights around the world. Crow also paid money to Thomas and his relatives in an undisclosed real estate deal, ProPublica found. After he purchased the house where Thomas’ mother lives, Crow poured tens of thousands of dollars into improving the property. And roughly 15 years ago, Crow donated much of the budget of a political group founded by Thomas’ wife, which paid her a $120,000 salary.

“This is way outside the norm. This is way in excess of anything I’ve seen,” said Richard Painter, former chief White House ethics lawyer for President George W. Bush, referring to the cascade of gifts over the years.

Painter said that when he was at the White House, an official who’d taken what Thomas had would have been fired: “This amount of undisclosed gifts? You’d want to get them out of the government.”

A federal law passed after Watergate requires Justices and other officials to publicly report most gifts. Ethics law experts told ProPublica they believed Thomas was required by law to disclose the tuition payments because they appear to be a gift to him.

Justices also must report many gifts to their spouses and dependent children. The law’s definition of dependent child is narrow, however, and likely would not apply to Martin since Thomas was his legal guardian, not his parent. The best case for not disclosing Crow’s tuition payments would be to argue the gifts were to Martin, not Thomas, experts said.

But that argument was far-fetched, experts said, because minor children rarely pay their own tuition. Typically, the legal guardian is responsible for the child’s education.

“The most reasonable interpretation of the statute is that this was a gift to Thomas and thus had to be reported. It’s common sense,” said Kathleen Clark, an ethics law expert at Washington University in St. Louis. “It’s all to the financial benefit of Clarence Thomas.”

Martin, now in his 30s, told ProPublica he was not aware that Crow paid his tuition. But he defended Thomas and Crow, saying he believed there was no ulterior motive behind the real estate magnate’s largesse over the decades. “I think his intentions behind everything is just a friend and just a good person,” Martin said.

Crow has long been an influential figure in pro-business conservative politics. He has given millions to efforts to move the law and the judiciary to the right and serves on the boards of think tanks that publish scholarship advancing conservative legal theories.

Crow has denied trying to influence the Justice but has said he extended hospitality to him just as he has to other dear friends. From the start, their relationship has intertwined expensive gifts and conservative politics. In a recent interview with The Dallas Morning News, Crow recounted how he first met Thomas. In 1996, the Justice was scheduled to give a speech in Dallas for an anti-regulation think tank. Crow offered to fly him there on his private jet. “During that flight, we found out we were kind of simpatico,” the billionaire said.

The following year, the Thomases began to discuss taking custody of Martin. His father, Thomas’ nephew, had been imprisoned in connection with a drug case. Thomas has written that Martin’s situation held deep resonance for him because his own father was absent and his grandparents had taken him in “under very similar circumstances.”

Thomas had an adult son from a previous marriage, but he and wife, Ginni, didn’t have children of their own. They pitched Martin’s parents on taking the boy in.

“Thomas explained that the boy would have the best of everything — his own room, a private school education, lots of extracurricular activities,” journalists Kevin Merida and Michael Fletcher reported in their biography of Thomas.

Thomas gained legal custody of Martin and became his legal guardian around January 1998, according to court records.

Martin, who had been living in Georgia with his mother and siblings, moved to Virginia, where he lived with the Justice from the ages of 6 to 19, he said.

Living with the Thomases came with an unusual perk: lavish travel with Crow and his family. Martin told ProPublica that he and Thomas vacationed with the Crows “at least once a year” throughout his childhood.

That included visits to Camp Topridge, Crow’s private resort in the Adirondacks, and two cruises on Crow’s superyacht, Martin said. On a trip in the Caribbean, Martin recalled riding jet skis off the side of the billionaire’s yacht.

Roughly 20 years ago, Martin, Thomas and the Crows went on a cruise on the yacht in Russia and the Baltics, according to Martin and two other people familiar with the trip. The group toured St. Petersburg in a rented helicopter and visited the Yusupov Palace, the site of Rasputin’s murder, said one of the people. They were joined by Chris DeMuth, then the president of the conservative think tank the American Enterprise Institute. (Thomas’ trips with Crow to the Baltics and the Caribbean have not previously been reported.)

Thomas reconfigured his life to balance the demands of raising a child with serving on the high court. He began going to the Supreme Court before 6 a.m. so he could leave in time to pick Martin up after class and help him with his homework. By 2001, the justice had moved Martin to private school out of frustration with the Fairfax County public school system’s lax schedule, The American Lawyer magazine reported.

For high school, Thomas sent Martin to Randolph-Macon Academy, a military boarding school 75 miles west of Washington, D.C., where he was in the class of 2010. The school, which sits on a 135-acre campus in the Shenandoah Valley, charged between $25,000 to $30,000 a year. Martin played football and basketball, and the Justice sometimes visited for games.

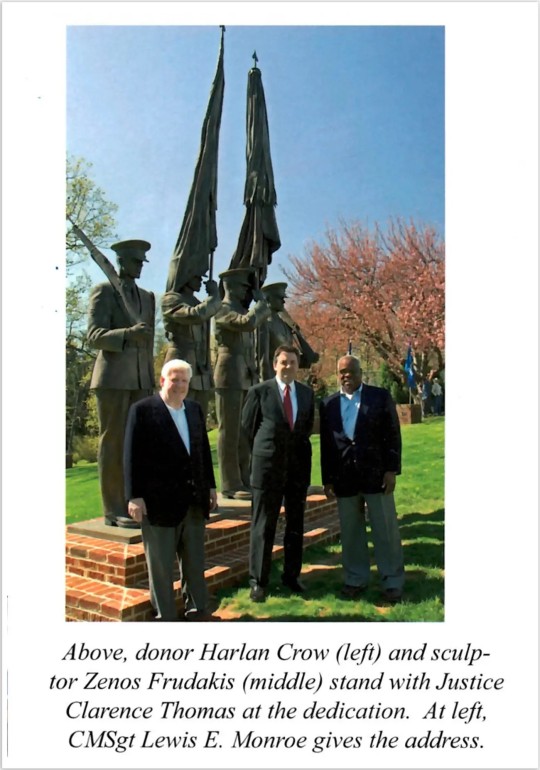

Randolph-Macon was also Crow’s alma mater. Thomas and Crow visited the campus in April 2007 for the dedication of an imposing bronze sculpture of the Air Force Honor Guard, according to the school magazine. Crow donated the piece to Randolph-Macon, where it is a short walk from Crow Hall, a classroom building named after the Dallas billionaire’s family.

Martin sometimes chafed at the strictures of military school, according to people at Randolph-Macon at the time, and he spent his junior year at Hidden Lake Academy, a therapeutic boarding school in Georgia. Hidden Lake boasted one teacher for every 10 students and activities ranging from horseback riding to canoeing. Those services came at an added cost. At the time, a year of tuition was roughly $73,000, plus fees.

The July 2009 bank statement from Hidden Lake was filed in a bankruptcy case for the school, which later went under. The document shows that Crow Holdings LLC wired $6,200 to the school that month, the exact cost of the month’s tuition. The wire is marked “Mark Martin” in the ledger.

Crow’s office said in its statement that Crow’s funding of students’ tuition has “always been paid solely from personal funds, sometimes held at and paid through the family business.”

Grimwood, the administrator at Hidden Lake, told ProPublica that Crow wired the school money once a month to pay Martin’s tuition fees. Grimwood had multiple roles on the campus, including overseeing an affiliated wilderness program. He said he was speaking about the payments because he felt the public should know about outside financial support for Supreme Court Justices. Martin returned to Randolph-Macon his senior year.

Thomas has long been one of the less wealthy members of the Supreme Court. Still, when Martin was in high school, he and Ginni Thomas had income that put them comfortably in the top echelon of Americans.

In 2006 for example, the Thomases brought in more than $500,000 in income. The following year, they made more than $850,000 from Clarence Thomas’ salary from the Court, Ginni Thomas’ pay from the Heritage Foundation and book payments for the Justice’s memoir.

It appears that at some point in Martin’s childhood, Thomas was paying for private school himself. Martin told ProPublica that Thomas sold his Corvette — “his most prized car” — to pay for a year of tuition, although he didn’t remember when that occurred.

In 2002, a friend of Thomas’ from the RV community who owned a Florida pest control company, Earl Dixon, offered Thomas $5,000 to help defray the costs of Martin’s education. Thomas’ disclosure of that earlier gift, several experts said, could be viewed as evidence that the Justice himself understood he was required to report tuition aid from friends.

“At first, Thomas was worried about the propriety of the donation,” Thomas biographers Merida and Fletcher recounted. “He agreed to accept it if the contribution was deposited directly into a special trust for Mark.” In his annual filing, Thomas reported the money as an “education gift to Mark Martin.”

Do you have any tips on the Supreme Court or the judiciary? Josh Kaplan can be reached by email at [email protected] and by Signal or WhatsApp at 734-834-9383. Justin Elliott can be reached by email at [email protected] or by Signal or WhatsApp at 774-826-6240.

#us politics#news#ProPublica#2023#us supreme court#ethics rules#ethics violations#supreme court ethics violations#scotus#justice clarence thomas#ginni thomas#harlan crow#Mark Martin#Christopher Grimwood#Randolph-Macon Academy#Hidden Lake Academy#Mark W. Bennett#Richard Painter#Kathleen Clark#The Dallas Morning News#Kevin Merida#Michael Fletcher#Camp Topridge#Adirondacks#superyacht#russia#Chris DeMuth#The American Lawyer#Crow Holdings LLC#heritage foundation

23 notes

·

View notes

Text

Driving Mr. Tovar

Chapter 1 - Don't Get Comfortable

Description: We’re introduced to Reader, as you drive out of the city to meet the reclusive billionaire Samuel Rose, hoping to go to work for him at his estate.

Author’s Note: I chose to make reader in her 40’s because I wanted her to have history to bring to the table. This is a slow burn romance but will feature no pregnancies/babies.

Rating: Mature 18+ONLY

Warnings: Pero x female reader, cursing, slight angst, Pero being mildly threatening.

Word count: 3231 (335 words added)

Masterlist (this story)

Author’s Masterlist

You were never late. That was a fact of your existence. You always started too early, just in case, and your mind was always ten steps ahead, to make sure you didn’t miss anything.

This morning, you’d gotten up at 4 am, to have time to do your yoga, go for your run, have breakfast, shower and get ready, and manage the hour-long drive from your apartment to the estate, all before 7 am.

In truth, you hated getting up early, and you absolutely despised morning workouts. It took time for your body to wake up properly, which made it feel a bit like trying to run whilst drunk. Nothing responded the way it was supposed to, and that put you off balance and made your body feel heavy and sluggish.

You’d started the pre-run yoga routine in order to make sure your body was at least moderately awake by the time your feet hit the pavement, and it did help, but you really didn’t enjoy it.

So, why go through all that trouble?

Because you thrived on discipline and descended into complete disarray without it. You might have hated it, but you needed it to stay sane. And quite possibly, alive.

You’d spent many long years making your way through the workweeks on caffeine and little else, and over time, it had worn you down to the point where your health had become an issue at just 40 years old.

Your doctor had urged you to make some changes to your life, starting with your job, to get your internal stress under control, and he was also the one who had suggested you force your body into new routines.

You’d always been good at taking orders, as well as organizing and planning (as long as it wasn’t for yourself), so when he’d made it clear that if you wanted to live past 60, his admonishments shouldn’t be considered suggestions, you’d obeyed.

You’d been a personal assistant to the owner of a bank for the better part of a decade, and she’d come to rely on you to keep her life outside of work on track. So much so, that her teenage children had been heartbroken to find out that you’d quit.

You’d practically raised them.

But you did want to live to see retirement one day, and you’d begun to search for other jobs, trying to find something you might be good at that wouldn’t require you to keep another person’s entire life under minute control, whilst burying and disregarding your own.

And that was how you’d ended up driving to an interview at the crack of dawn, in the middle of nowhere.

The application had been for a live-in driver but didn’t specify any more than that.

But it was way out in the country, a lone estate on a huge property owned by a tech-genius, and you were a good driver, even if you’d never contemplated doing it for a living before.

You arrived at the huge, locked gates, nestled into the twenty-foot-high stonewalls that surrounded the main property, fifteen minutes early, and you were about to park the car a bit to the side while you waited for your appointed time. But just moments after you got there, the gates begun to swing open.

No one was there to ask for ID or check your car for anything dangerous, you were just silently invited to enter.

This made you wonder two things: firstly, what piece of advanced technology had already determined your identification, and where was it? And second, what type of weaponry was being aimed at you, right now?

You drove inside, and the massive iron gates closed behind you, and you couldn’t help but feel a bit like a mouse in a trap. But then, that was probably the point.

A sharply dressed man was standing by the foot of the front steps to the main house, directing you to park right in front of him, before opening the door for you as soon as you came to a stop.

“Good morning, miss,” he greeted politely.

He was probably in his mid-fifties, tall and just a bit plump, with an air about him that suggested he was at least somewhat trained as a butler, although he seemed more like someone that had been groomed by life, than school.

“Good morning, sir,” you answered. “I’m a bit early.”

“That’s fine. Mr. Rose appreciates the respectfulness and consideration for his time. He’s having breakfast at the moment, but he won’t mind starting the meeting early.

I’ll show you to him. My name is Coulson.”

You gave him your name in return and thanked him as he led you up the stairs and held the front door for you.

The main house was… huge. Some twenty rooms, you guessed. And while the outside design of it gave the impression that it was old but perfectly reconditioned, you knew that Mr. Rose had had the place built just ten years earlier, and the inside of it clearly reflected that.

The entry-hall was massive, with a large black granite staircase winding its way up to the second floor, taking up most of the rear half of the hall. And the placement of the rooms, the size and shape of them, all indicated that a modern designer had been involved with the architecture. It was efficiently designed and tailored to fit the needs of its owner. And most of the materials were modern and sustainable.

It was beautiful.

Coulson led you through the left side of the house, past what appeared to be a smaller ballroom, and then a dining room that connected to the kitchen, in which Mr. Rose was indeed sitting, having breakfast and reading a newspaper.

He was younger than you, mid-thirties, and average built but with an impeccable posture to help him carry the tailored suit he wore. His skin was almond colored, and his black hair was cropped short, simple and efficient, and the only jewelry he wore was a watch of a brand you didn’t recognize.

“Your seven-o-clock appointment, sir,” the butler announced while gesturing for you to approach.

“Thank you, Coulson,” Mr. Rose replied to him.

The butler just nodded and left, the same way you’d come in, and Mr. Rose gestured to a chair opposite him at his small breakfast-table.

“Welcome. How was the drive from the city?” he asked, sounding genuinely interested even in such a bland subject.

“It was good, thank you,” you answered, before trying to find a more rewarding reply. “I had plenty of time to go over just how many ways to screw up an interview, so if I still do, I’ll really have to kick myself.”

He chuckled a little and folded the newspaper away.

“I’m sure you have some questions. Feel free to ask them.”

“Um, well… When your assistant called me to set the meeting, I kind of expected to get some more information on what the job really is, but she said that I’d have to ask you about that.”

“First off, I don’t have an assistant, the woman you spoke to is my housekeeper, Laura. You’ll meet her later,” he explained, making you wonder why he would introduce you to the staff before even hiring you.

“Secondly, the application was quite vague,” he carried on, “but that was intentional. I didn’t want to narrow the applicants too much.

I’ve learned that merits on paper do very little to tell you which person is going to fit any given position, so I like to keep the options open.

Also, this job is going to be… challenging. I doubt that any previous merits would do anyone much good with this, although I suppose it doesn’t hurt to have some experience with assisting… shall we say demanding individuals.”

“That’s pretty much all I’ve ever done,” you conceded. “But I get the feeling we’re not talking about you, here?”

“No. But before we get to that, I’d like to talk a little more about you," he redirected, and you were instantly self-conscious. "From your records, I can see that you’ve been a very diligent worker your entire adult life. There’s nothing but praise for you from your previous employers. In fact, most of them cited you as being irreplaceable.

So, why the sudden change?”

“Because it turns out that I’ve been a little too diligent. Sacrificing not just my personal time and social life to my jobs, but my health as well,” you explained. “I need a change of pace and if it comes with a change of scenery too, that’s probably just for the better.”

“I see,” he said after a brief pause. “What about family?”

“I have a sister, but we’re not close, we never really have been.”

He stayed quiet and just studied you for a few beats, before he spoke again.

“Okay, any other questions?” he asked, making you mentally start preparing for the end of this conversation, since that was what it sounded like you were heading for, and no three-minute interview had ever landed you a job before.

“Just about the security of this place,” you shrugged, “but I doubt you’d wanna share that with me until you’ve decided if I’m hired or not.”

“Oh, you are,” he said without pause, as if it was completely obvious. “Assuming you’ll still want the job once you’ve learned what it really is.”

You stared dumbly at him, feeling quite confused, since you’d just dismissed your own chances completely.

“I-I am…?”

“That surprises you?” he asked, looking somewhat bemused.

“Well, yeah. I mean, I assumed you’d have other applicants, other interviews to do before you made up your mind.

Holy shit…” you breathed, truly staggered at this turn of events, while the billionaire across from you merely smiled softly and shook his head slowly a couple of times.

“It’s rare that I like a person on paper. Even rarer that I continue to like them after thoroughly researching them, and downright unique that my interest in them only grows as I meet them.

You weren’t the only applicant, but you are the only one being interviewed,” he explained calmly.

“Oh,” you said, genuinely struggling to find any actual words to offer in return. “Sorry, I don’t know how to respond to that.”

“That’s okay,” he said with a small chuckle. “And about the security, there’s plenty of it, but it’s specifically designed not to be easily detectable, so you’ll have to forgive me if I don’t share the details of it.

But, sufficed to say, I knew exactly what time you’d be arriving.”

“I assumed so. And I also assume I was allowed onto the premises without any obvious screening, because there are security measures in place that wouldn’t have allowed me to escape, had I come here with malicious intent?” you shared your observations, and that earned you a fuller smile from him.

“Exactly right. You’re gonna fit right in here, if you chose to stay.”

“You don’t seem very confident that I’ll want to…” you prodded, and his smile went from mildly impressed, to a bit annoyed.

Affectionate, but annoyed.

“Yes, well I suppose I can’t put it off much longer,” he sighed. “Come with me, and I’ll show you.”

He got up and led you back to the front entrance, and outside where he walked along the right side of the house, around the corner and onto a gravel path that led to a smaller side-building, nestled in between four big old oak-trees.

It was small compared to the main building, but it was still a full-sized house. One floor, probably four or five rooms, plus the kitchen, and a big porch at the back.

Mr. Rose knocked on the door, and a muffled male voice called for him to enter. He nodded at you to follow him inside, and then started chatting as he walked into the kitchen.

“Morning, Tov. How’s your hand?”

You stepped into the hall, and just a few feet in, the living room opened up to your left, while the kitchen was a little further in, to the right, past the coat-hangers and closets in the hall.

You stopped to admire the beautifully furnished living room, with a big fireplace taking center stage, while the tv was surpassed to the right wall.

There were positively packed bookcases as well as glass cabinets filled with movies and LP-records, on every wall of the room, and the sofa and the two pulpy-looking armchairs just screamed leisurely comfort.

“Fine. Don’t tell me you came down so early to check on a few cuts, jefe.”

The grumpy, deep voice, with a thick Spanish accent, snapped you out of your reverie, and you quickly followed the sound over to the kitchen.

You came into view behind Mr. Rose just as the unknown man turned from the kitchen counter, grasping a coffee-mug and bringing it to his mouth.

“No, I came to introduce you to your driver,” Mr. Rose declared.

The mug froze a few inches from the man’s lips as he saw you, and when he heard his boss declare who you were, his arm dropped all the way down to his waist, and a downright scary looking scowl came over his scarred face.

“Hijo de puta…” the man spat between tight jaws.

“Tov, we talked about this.”

“And I told you: I don’t need help,” the man snapped, getting angrier by the second, but Mr. Rose took it in stride.

“Since you refuse to get a driver’s license, you need a driver, you know that. I can’t keep sparing people from other positions to help you run errands.”

“Errands? I do not run errands, I do what must be done.”

“As do I,” Mr. Rose returned, and there was suddenly an authority to his voice that made the other man hold his tongue. “This is not a debate, Tov. I’m your boss and I’m telling you – this woman is your driver from now on.”

He gave the grumpy man your name, at which point he turned away from you, as though he could make you disappear if he just couldn’t see you.

Mr. Rose seemed to stifle an eyeroll as he angled himself more towards you.

“I apologize for this man’s less than polite behavior, but if it’s of any comfort to you, he treats everyone like this.

His name is Pero Tovar, and he’s what you might call the manager of this estate.

His primary function is to take care of my horses, but he seems to just generally know everything that goes on here, from who the gardener’s dating, to which one of the housekeeper’s granddaughters just took up ballet.”

Mr. Tovar was busying himself with needlessly rearranging and fiddling with the things on his counter, anything to not have to turn around and acknowledge your presence.

“I have eyes and ears. This is all it takes,” he grumbled, but his employer just huffed at him.

“Honestly, I haven’t ruled out the possibility that he’s some form of sorcerer. But he’s also a skilled fighter, and his attitude of just not giving a shit if people like him, makes him good at weeding out bullshit. Which is just one of the reasons why I like to bring him along as my personal security from time to time.

Now, since he doesn’t trust anyone else to tend to the horses, he’s in charge of making sure they have everything they need, which means weekly trips into town to restock on their feeds, treats and anything else he feels that they are lacking.

And since he meddles in all other aspects of this estate as well, he usually ends up running errands for Coulson, the gardener, the cook and the housekeeper too.”

Mr. Tovar still had his back to you, and he grumbled something you couldn’t interpret, but Mr. Rose just ignored him and kept going.

“The problem is that he keeps borrowing people from my security team in order to run said errands, which was fine a year ago when I didn’t have that much need for them, but my circumstances have gotten more delicate, and I need them where they are.

Obviously, that’s where you come in. And just so we’re clear: Tov is one of very few people I trust, and that makes him invaluable to me.

So, in addition to driving him anywhere he wants to go, I’m expecting you to look after him, however much he protests, since he’s hopeless at taking care of himself.

I have a room ready for you here, and I’d prefer it if you lived here while you work for me, even if it does mean sharing house with a brute.”

Right. Okay. This was so not what you’d expected.

But, despite his gruffness, the Spaniard had something appealing about him. He was scarred and troubled, and inherently distrustful, as well as surprisingly easily offended for someone who was obviously held in the very highest regard by his employer.

Still, he clearly took great pride in his work, and that was something that you understood, and respected.

You squared your shoulders.

“Thank you for your trust, Mr. Rose. I won’t let you down.”

He seemed relieved that you didn’t just turn around and run away, making you wonder if there had been others that had.

He thanked you in return, and told you to take the day to get familiar with everything, before he said something in Spanish to his friend, and then excused himself to get started on his workday.

Allowing you and the brute a chance to hash it out.

“Just to be clear, Mr. Tovar; I won’t expect or ask you to like me, only that you respect that I have a strong work-ethic, just like you.

I like to earn my keep, and I’m not afraid of hard work.”

He scoffed as he finally turned back towards you, to thoroughly look you over, head to toe and back again.

“A woman as soft as you, has not known hard work.”

“How would you know how soft I am?” you challenged.

“Your hands,” he replied with a sneer. “They are smooth, not used to toiling, no dirt under your nails. You are soft. No probado.”

Oh, was that how it was gonna be? Fine. You could play this game too.

“I might not have any battle-scars that you can see, but there’s more than one way to know hardship.

You know nothing more about me than I do about you, so how about we get the pissing contest over with: Since you’re the only dick present, you’re automatically the biggest one.

I am in no conceivable way any threat to you, so just let me work, okay?”

He just glared at you, still with something conniving in the depths of his eyes.

“Would you at least show me which room is mine, so I don’t wander into yours uninvited?” you asked with a mildly exasperated sigh.

He finally sipped his coffee, then pushed off the kitchen counter and headed off towards the bedrooms.

He led you to the last room in the hall, and then just leaned against the doorframe while you walked inside and looked around. It was almost bigger than your whole apartment.

“Don’t get comfortable, blando. You won’t be staying.”

>>>>>>>>>> <<<<<<<<<<

Link to Chapter 2

Thank you for reading, and if you enjoyed this, please consider reblogging. I would dearly appreciate it <3

@tacticalsparkles

@tanzthompson

@sarahjkl82-blog

@marydjarin

@idreamofboobear

@annathewitch

@agingerindenial

@tiffanyleen

@winter-fox-queen

@elegantduckturtle

@lovefreylove

@shadowolf993

@callsigncatfish

@hounding-around

@cannedsoupsucks

@startrekkingaroundasgard

@thisshipwillsail316

@ellie-darling

@likes-good-reblogs-even-better

@nakhudanyx

@dihra-vesa

@tobealostwanderer

@ophelialoveshandsomemen

@deadhumourist

@spideysimpossiblegirl

@toomanystoriessolittletime

@tintinn16

@prostitute-robot-from-the-future

@nolanell

#driving mr. tovar#driving mr. tovar series#pero tovar x female reader#pero tovar x fem!reader#pero x reader#pero tovar x ofc#modern!pero#modern!au#the great wall modern au#the great wall fanfiction#pero tovar fanfiction#pedro pascal fanfiction#pedro pascal characters#sirowsky stories

56 notes

·

View notes

Text

The Man from Black Water, Chapter 4

A/N As promised, here in a pre-Christmas installment of my crossover fic. In it, we see Jamie find a place for himself at Netherton, despite hostilities on all sides. He and Claire are finally formally introduced, and we learn a bit more about Claire’s plans for her future.

Previous chapters and a character mapping to the Man from Snowy River universe can be found on my AO3 page.

Merry Christmas to all who celebrate, and a safe and happy holiday to all!

From his imposing stature to his iceberg gaze, Dougal Mackenzie would have been the epitome of a Highland warrior, had he been born two hundred years earlier. As it was, he’d grown up in the industrial slums on the south banks of the Clyde, going to work in the textile mills at the age of twelve. Being on the winning side of a knife fight several years later saw him fleeing the city in search of less hostile horizons. Brawn made him a desirable labourer. An ability to keep difficult men in line with his ominous reputation made him an adept foreman. He’d risen through the ranks to become the chief overseer of Netherton’s agricultural holdings over the past twenty years.

“He’s a hard worker, that one,” the estate’s chief cook remarked to Dougal as they crossed paths in the kailyard one afternoon. She gestured towards Jamie, who toiled nearby, splitting firewood for the kitchen stoves with admirable economy. The August sun stared down from an azure sky, and he occasionally paused to wipe sweat from his eyes and take a swig of water from a tin canteen sitting in the shade of an ornamental rosebush. Rollo lay nearby, his pink tongue afurl in the hot air.

“Aye, seems willing enough,” Dougal said a bit begrudgingly. He hadn’t been consulted about the hiring of this latest labourer, which rankled him. There was a long list of cronies he would sooner have assisted.

“I canna understand why the master hired him,” the stout woman continued in a lower tone. “He comes from the Highlands.” This last word was pronounced as though it was a communicable disease. Despite being in the shadow of the Grampian mountains, Netherton had always been staffed by Lowland Scots, even if, like Dougal himself, they were only a couple generations removed from their Gaelic roots.

Dougal had entertained similar thoughts himself, but he wasn’t about to stand about and gossip with the house staff about them.

“Twas a long time ago,” he said instead. “Good day, Mrs. Crook.”

Walking past the woodpile, he called out.

“Fraser, when ye’re done here, ye can muck out the stables.”

“Yes, sir.”

Despite a dark blue smear of sweat across the back of his cambric shirt, the young man seemed cheerfully willing to work without pause. He wasn’t even breathing hard. Dougal stalked back to his quarters in a foul mood.

***

Netherton’s stables were more luxurious than any croft Jamie had ever set foot in, with two long rows of stalls bisected by a stone alleyway that funneled the mountain breeze in summer and absorbed the anemic sunlight in winter. Still, horse shite was horse shite, no matter how pampered the beast that produced it.

Most of the animals were away from their stalls, either grazing in the paddock near the river where the grass was the sweetest or serving as mounts to Netherton’s large workforce. This made Jamie’s job easier, but he missed the opportunity to gaze into their limpid brown eyes and admire their glossy coats. He was on his sixth stall when two familiar pests stopped to watch him.

“Lookit than, Rupe. The teuchter’s shovellin’ shite. Pretty canny fer a teuchter, usin’ the flat end o’ the shovel an’ everything.”

This was Angus, a dark wiry stockhand who was perpetually spoiling for a fight. His companion, Rupert, was a soft-bellied lout who followed Angus around like a sheepdog, laughing obligingly at his jokes. Jamie had met men like them before and did his best to ignore them.

“They eat a lot of neeps an’ tatties in the Highlands, Rupe. Are ye diggin’ fer yer supper, laddie boy?”

Jamie unbent to his full height, well over a head taller than Angus. The smaller man stepped back but made a show of lighting a cigarette with casual indifference.

“Have they given ye the day off, Angus?” Jamie asked.

“I’m studyin’ tae be supervisor,” Angus declared with no little arrogance.

Staring Jamie directly in the eye, he let the still-burning match drop into the dry straw at his feet. A tiny curl of smoke immediately rose. Jamie casually hefted a shovelful of moist excrement onto the growing flame. It was an advertent error that saw some of the load land on Angus’ well-polished leather boots. The bully’s fists went up. Rollo let out a low growl of warning. Jamie tossed his shovel to the side in preparation for the altercation.

“What have you been up to, Kip?”

Claire Beauchamp’s precise elocution acted like a bucket of cold water and all three men scrambled to appear innocuous. Angus was quick to offer his assistance saddling her usual mount. When she refused, he and Rupert left the stables on the pretense of having work to accomplish elsewhere, which was doubtful.

For his part, Jamie went back to mucking stalls while still surreptitiously observing his employer’s daughter. She was carrying on a one-sided conversation with her horse as he was wont to do himself when he was alone. Her luxurious curls were tied back behind her ears but cascaded over her shoulders. She was at least wearing a riding frock today, although she appeared to be preparing to ride without supervision.

“Can I help ye?” he asked, when he noticed she was struggling with the gray mare’s halter.

“No, I’m fine,” she replied without so much as glancing his way.

Out of the corner of his eye, Jamie watched her stubbornly endeavour to repair the halter for another few minutes. Rather than offer his assistance again, he merely fashioned a halter and lead from a nearby coil of rope using a knot his father had taught him as a lad.

“Oh,” the young lady remarked as he slipped the harness over the docile mare’s ears. “How did you do that?”

Eager to show off his competency at something other than mucking stalls or chopping firewood, Jamie demonstrated the technique behind the Tom Fool’s knot, enjoying the way the lass’ golden eyes narrowed in concentration as she followed each movement of his hands. No matter how hard she tried, she couldn’t duplicate his efforts, and they both ended up chuckling at her ineptitude.

“You’re the boy from the train station,” she realized after they had finished tacking up her horse together. Jamie wasn’t certain whether to be pleased she remembered him or not. Certainly, the use of the word ‘boy’ wasn’t flattering.

“Aye,” he acknowledged. “James Fraser, mistress,” he introduced himself while politely removing his cap.

“I’m afraid I wasn’t very courteous that day,” she half-apologized with a subtle grimace. “A constitutional failing, I’m told.”

Sticking out her gloved hand, she introduced herself, as though he wasn’t aware to whom he’d been speaking all along. “Claire Elizabeth Beauchamp.”

He’d never shook a woman’s hand before and was uncertain as to the appropriate response. He wasn’t some titled suitor who might kiss her knuckles, even if they weren’t encased in leather. A firm shake such as he’d been taught seemed equally unsuitable. He was saved from having to hold her dainty grip indefinitely by her father riding into the stables. They both dropped the other’s hand as though the contact suddenly burned.

“Fraser, cool off this horse and stable him,” the cattle baron commanded.

“Aye, sir.”

Jamie was walking away when he heard the man release an exasperated sigh.

***

“Why aren’t you at your lessons?”

It was always a tender balance, deciding how much leeway to give his headstrong daughter, and when to rein her in. Lately, his attempts to argue that more feminine propriety was required if she was to secure a husband were met with greater and greater resistance.

“One of the broodmares is about to foal,” Claire replied. “I want to be there to help her.”

“The men are quite capable of handling it,” he argued, drawing his unwilling daughter back towards the manor house with a firm arm around her shoulder.

“I can do it better. If I’m to be a veterinarian, I shall need as much firsthand experience as I can obtain.”

This fixation with attending the Royal Veterinary College in Edinburgh was one matter in which he’d indulged his daughter for too long. He’d been certain she’d outgrow the notion as she emerged into womanhood.

“You should be concerning yourself with marriage, child rearing,” he explained for the hundredth time.

“The gentleman cattle breeder has a breeding program for his daughter as well,” Claire retorted, demonstrating the independent spirit and sharp wit that made him despair of ever finding her a husband.

“You’ll spend the afternoon at the manor with your Aunt Rosemary,” he decreed, feeling his face grow hot in frustration. “And Mister Randall will come to call on you this Saturday. I don’t,” he forestalled her protest with a raised hand, “want to hear another word about it. You are my daughter, and you will obey me.”

Watching her skirts swish angrily across the courtyard as she hastened away, Henry Beauchamp wondered how his only child could so resemble a mother she’d never met.

32 notes

·

View notes

Text

Get Fast Cash with Direct Lender's Short-Term Loans UK for Debit Cards

Short term loans UK direct lender make it simple and timely to acquire financial aid. All you have to do is provide the lender with your debit card. You can receive financial aid with this loan and avoid the burden of additional papers. Unexpected costs can blow your budget, but with these debit card loans, you can acquire immediate cash and take care of your demands right now. Key characteristics of loans without debit cards with the help of this financial plan, loans between £100 and £2,500 can be obtained for duration of 14 to 30 days. Debit card loans are the sole prerequisite for these 12-month payday loans; no other requirements apply.

It is not necessary for you to give the lender any of your pricey assets or real estate. Furthermore, those with a poor credit history—default, late payments, insolvency, CCJs, etc.—can also apply for short term loans UK direct lender financial aid. Since there is no credit check involved, poor credit history is not a problem. Who is eligible to benefit from this scheme? The following requirements must be met by the borrowers in order to receive financial assistance from these loans:

1. The applicant must be an adult who is at least eighteen years old and a permanent resident of the United Kingdom.

2. He should have a long-term, UK-based bank account in his name that is no older than six months.

3. The borrower must also have been a regular employee of the same company for the last six months.

4. To be able to return the loan amount on schedule, he must make the required salary of at least £1,000 each month.

5. He ought to reside permanently in the United Kingdom. How is the plan applied for?

Applying for this short term cash loans is simple. All you have to do is provide some information (name, address, loan amount, account number, etc.) on an online application form. All you need for this online service is a PC and an internet connection. After approval, the money is sent into your account in less than a day. You can avoid waiting in line or going to the lender's office by using this service.

You are under no obligation to use any other form of identification in place of your debit card. Thus, those who are renters, non-homeowners, etc., can apply for short term loans direct lenders with ease. Debit card not used. Additionally, the loan amount helps you to pay for other little expenses such as unexpected auto repairs, school fees, medical bills, the purchase of new appliances, and other household necessities. In light of this, this financial plan is quite helpful for obtaining financial assistance during difficult times.

A short term loans UK can also refer to an advance of funds obtained through an ATM or bank transaction using an existing credit card. This sum typically maxes out at less than £1000 and is typically a fixed portion of the borrower's credit limit. As long as the amount you withdraw stays below your cash advance limit, this option is typically less expensive than a loan and offers greater flexibility.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Even as the international community coordinates global climate action through the Paris Agreement and the U.S. government makes strides through major bills such as the Inflation Reduction Act, there is plenty that cities must still do on their own to clean up their economies and built environments. One of the most frequent approaches are decarbonization plans, which are often nested within larger climate action plans. Decarbonization plans outline specific steps cities will take to eliminate greenhouse gas (GHG) emissions from their electricity systems, buildings, transportation networks, and related sectors.

Last September, we evaluated the implementation potential of decarbonization plans from 50 of the country’s largest cities. What we found was concerning: While most cities took some steps toward reducing GHG emissions, their plans often lacked the details necessary to meet aspirational goals. That was especially the case for funding and finance issues—meaning how cities plan to pay for needed infrastructure improvements and other actions to reduce GHG emissions. With larger cities requiring billions of dollars to retrofit their building stock, construct new transit lines, or modernize local electricity distribution systems, being realistic about how to fund all these investments is an essential step to decarbonization.

Cities frequently fell short across four different criteria in our analysis. First, while every city should thoroughly spell out details on funding and financing, only 70% of cities integrated these concerns into their decarbonization strategies, and second, only 66% identified existing funding sources. Third, only 54% proposed specific, innovative, consistent, and/or long-term funding sources or financing mechanisms, and finally, just 34% estimated the financial impacts of each decarbonization strategy. Only eight cities—Cincinnati; Denver; Memphis, Tenn.; Nashville, Tenn.; New York City; Sacramento, Calif.; San Francisco; and San Jose, Calif.—satisfied all four of these funding and financing criteria in our original evaluation. Sound funding and financing strategies are the exception when it comes to decarbonization planning in American cities.

Lackluster aggregate scores tell one part of the story, but they also obscure the experimentation and innovation currently taking place as cities work to fund ambitious decarbonization efforts. Based on our detailed scan of 50 large U.S. cities, we encountered a range of funding and financing policies that formally commit to investing real money to decarbonize their local built environments, including real estate, electricity systems, and transportation networks.

This report summarizes specific funding and financing policies found in these 50 cities to provide a glimpse into the variety and scale of local climate finance innovations. Adopted before the passage of the Inflation Reduction Act (IRA), these strategies focus on locally driven efforts and innovations rather than new federal funding streams. Still, in the context of increased federal investment, strong local institutions and policies are even more important. For example, the IRA’s $27 billion Greenhouse Gas Reduction Fund can directly fund local green banks and provide the technical and financial assistance necessary to establish new green banks or similar institutions. While not comprehensive, the examples in this piece offer a kind of early roadmap for any city looking to commit to genuine climate action and make the most of coming federal climate investments.

Some cities, such as Portland, Ore. and Denver, have the kind of climate-friendly support among voters that lends itself toward sweeping actions like dedicating new taxes to fund climate action. Where enabling state and local legislation exists, financial tools such as property assessed clean energy programs are helping cities address specific climate challenges like retrofitting old buildings. Other cities have built off their relationship with local utilities or adapted existing funding streams to have a more explicit climate focus. While there’s no one-size-fits-all approach to paying for decarbonization efforts, these examples offer lessons for how political environments, staff knowledge, and complementary laws can influence decarbonization investments.

Two cities’ efforts to raise dedicated climate funds through taxes

Our analysis identified two cities as standout leaders in establishing long-term, flexible funding to address climate change: Portland, Ore. and Denver. Both cities passed ballot measures to establish dedicated climate funds by raising a large business tax and sales tax, respectively. In each case, grassroots efforts led the ballot measures to success, and the funds provide a landmark sustainable funding source. Accompanying innovations (e.g., the use of five-year fund planning cycles and the creation of new competitive award programs prioritizing underserved communities) transformed each city’s approach to action-oriented planning and equity-focused implementation.

In November 2018, 65% of Portland voters passed the Clean Energy Community Benefits Fund Initiative (Ballot Measure 26-201). The measure requires large retailers to pay a 1% Clean Energy Surcharge on “gross revenues from retail sales in Portland, excluding basic groceries, medicines, and health care services.” The resulting funding—which the coalition supporting the ballot measure memorably referred to as “1% from the 1%”—is placed in the city’s new Portland Clean Energy Community Benefits Fund (PCEF) and spent via competitive awards on climate action projects. While originally projected to raise between $44 million and $61 million annually, the fund has outperformed expectations, with new revenue projections reaching $90 million annually. As of October 2022, funded projects and actions totaled $130 million, including a range of workforce programs such as the Green Janitor Education Program; agriculture and resilience projects such as NAYA Neerchokikoo Food Sovereignty Project; and energy efficiency projects such as the Deep Energy Retrofit Project.

Shaped by years of BIPOC-lead organizing and campaigning, the Portland measure included a bold commitment to environmental justice from its start, with city staff prioritizing awards that benefit people with low incomes, communities of color, and workers facing discrimination. In response to recommendations from the program’s recent audit, 2022 updates added a requirement that the city produce five-year Climate Investment Plans, which will then be used to ensure funds contribute to the city’s broader climate strategy. This shift toward investment-focused climate planning—wherein planned strategies are already funded, and thus much more likely to be implemented—will allow the city to continue its journey toward a more grounded, strategic approach to connecting climate planning to decarbonization action.

Denver’s Climate Protection Fund follows a similar story. In 2019, local environmental advocates collected signatures for an energy use tax. While the local advocacy group Resilient Denver was unable to get the measure on the ballot in its original form, it caught the attention of the Denver City Council and the mayor, who created a citizen Climate Action Task Force to “[engage] Denver’s communities in defining goals, gaps, solutions, and investment opportunities.” The task force—with participants ranging from community members to Xcel Energy representatives—recommended a 0.25% sales tax increase to replace the energy use tax, and the city council put Measure 2A on the ballot for November 2020.

Measure 2A passed with the support of 62% of Denver voters, and was projected to generate between $30 million and $40 million annually to fund climate action—50% of which would go toward equity-focused projects. One year later, the city’s Office of Climate Action, Sustainability, and Resiliency, which manages the fund, produced its first Climate Protection Fund Five-Year Plan. The plan set forth strategies to manage, spend, and track the fund’s impact and alignment with allowable funding routes (staff positions, agreements with other city agencies, and competitively awarded contracts with external partners), allowable uses (workforce development, renewable energy, buildings and homes, sustainable transportation, adaptation and resiliency, and environmental justice) and equity values. The fund’s 2021 annual report found actual revenues ($41 million) outperformed initial projections ($37 million) for the year. Within its first year, the fund committed nearly $57.7 million dollars to projects ranging from e-bike libraries for essential workers to workforce development for green jobs and community solar installations.

These two ballot measures show the potential of strong grassroots organizing—combined with new institutional structures—as a strategy to raise sustainable, flexible capital for equity-centered climate action. The creation of Portland’s Clean Energy Community Benefits Fund and Denver’s Climate Protection Fund have not only provided each city with the ability to fund their existing decarbonization planning efforts, but have also introduced new levels of engagement, transparency, and oversight into local climate governance. Originating from resident-led coalitions, these funds also formalize monetary and procedural commitments to equity, whereas unfunded climate plans often offer only words.

Property assessed clean energy: A popular tool for climate investments

Passing a citywide tax increase to fund climate action is a rare achievement, so cities beyond Portland and Denver are coming up with other creative methods to fund their climate action priorities. One of the more common financial strategies is the use of property assessed clean energy (PACE) programs to incentivize building efficiency upgrades. PACE programs allow commercial (C-PACE) and sometimes residential (R-PACE) property owners to make energy efficiency improvements to their properties by fully financing all upfront costs. (See PACENation for a list of approved capital providers by state.) These costs are then attached to property tax assessments and paid off over an extended period, often up to 20 years. Over the course of repayment, property owners often save enough on energy efficiency to more than cover the cost of the improvements.

Enabled by state-level legislation, PACE programs are currently allowed in 39 states. All but eight of these states have active PACE programs, meaning that at least one local government in the state has passed a municipal ordinance establishing a local PACE program. This strategy is growing in popularity; several plans analyzed in our original report cited the success of their local PACE programs, while others laid out strategies to bring new PACE programs to their city. These include:

Atlanta: Atlanta’s 2016 Climate Action Plan implicates PACE as a key financing strategy for its building energy efficiency goals. The city’s C-PACE program is managed by Ygrene Energy Fund. The local economic development authority, Invest Atlanta, authorized $500 million in bond issuances for the program.

Cincinnati: The 2018 Green Cincinnati Plan includes a goal to increase the number of PACE projects completed in the city. Ohio PACE, which manages the city’s Energy Special Improvement District’s PACE program, reports nearly $20.6 million in total principal.

Columbus, Ohio: The 2021 Columbus Climate Action Plan emphasizes the success of their PACE program to date, targets $250 million in annual PACE investments by 2030, and aims to pair those investments with the establishment of a green bank by 2025.

Dallas: The 2020 Dallas Comprehensive Environmental and Climate Action Plan commits to developing a landing page and “comprehensive educational program” for building owners and tenants to learn about energy efficiency programs, including the city’s PACE program. The program is available to commercial, industrial, and multifamily residential property owners in Dallas, and is administered by the Texas PACE Authority. As of August 2022, the program invested over $73 million dollars and completed nine PACE projects.

Kansas City, Mo.: The 2022 Short-Term Implementation Plan for Kansas City’s Climate Protection and Resiliency Plan includes PACE as a planned financing strategy for grid stability, resilience, and residential energy efficiency.

Orlando, Fla.: The 2018 Community Action Plan celebrated $500 million in financing in the PACE program’s first two years. The plan also highlights Orlando’s utilization of $17.5 million in green bonds to improve energy efficiency in 55 municipal buildings.

Our research found several other cities aspiring to bring PACE programs to their communities, either through the passage of enabling legislation, starting up a program in an area where it is already permitted, or increasing awareness and participation in existing programs. But despite its growing adoption, PACE programs are far from a financial panacea; they are limited to the building sector, and some critics are concerned about consumer protections, particularly around the potential for predatory practices and oversight challenges in residential PACE programs. The National Consumer Law Center has identified troubling cases of contractors pushing unneeded improvements (sometimes with little associated energy savings) on vulnerable homeowners who have not been properly screened for their ability to pay. In response to new requirements in the 2018 Economic Growth, Regulatory Relief, and Consumer Protection Act, in 2019, the Consumer Financial Protection Bureau issued advanced notice of a new rule requiring PACE programs to follow existing ability-to-repay regulations.

Other emerging strategies for decarbonization financing

Besides those listed above, cities are using a variety of other financial strategies to pay for decarbonization activities. Below are promising practices highlighted in other decarbonization plans we analyzed:

Local financing authorities

Boston: The 2019 City of Boston Climate Action Plan cites Renew Boston Trust as the city’s current and future vehicle to “invest in energy efficiency and renewable energy generation in municipal buildings.” Originally established in 2017, the Trust has already invested $10 million in energy savings performance contracting—a process in which upgrades are financed through future energy savings. The plan commits to $35 million in additional investments through the Trust.

New York: New York City’s 2019 “A Livable Climate” plan commits to growing the Green Housing Preservation Program for low- and no-interest energy efficiency loans. The city also plays an important role in broader climate finance systems through strategic investment of its pension funds.

Washington, D.C.: The 2018 Sustainable DC 2.0 Plan committed to establishing a green bank by 2020—a goal that was met in less than a year. The DC Green Bank now serves as a central access point for several innovative local climate finance programs, including the District’s PACE program, an Affordable Housing Retrofit Accelerator, a Clean Energy Advantage Program, a Community Impact Initiative, a Commercial Loan for Energy Efficiency and Renewables program, a Navigator Pre-Development Loan program, and an open solicitation for innovative clean energy financing proposals. In 2022, the DC Green Bank committed over $26 million in capital.

Funding partnerships

Los Angeles: The 2019 Green New Deal Sustainability City Plan proposes stormwater capture actions funded by the Safe Clean Water Program (Measure W, a 2018 ballot measure), which collects an estimated $300 million annually through a 2.5-cent tax per square foot of impervious surface on private parcels in the Los Angeles County Flood Control District.

San Diego: The 2022 City of San Diego Climate Action Plan celebrates the $4.8 million Climate Equity Fund, founded in 2021 and financed in part through the city’s energy franchise agreement with the electric utility SDG&E. Such franchise agreements are an emerging financial strategy for localities and energy providers to collaborate on cleaner energy and other climate outcomes.

One-time investments

Chicago The city’s 2022 Climate Action Plan includes an analysis of climate-related Recovery Plan investments, which total $188 million.

Sacramento, Calif.: The 2022 City of Sacramento Preliminary Climate Action and Adaptation Plan begins by noting a one-time budget allocation of $4.5 million to fund the plan’s implementation. While not yet implemented, a diverse and comprehensive set of financing options are explored in Appendix D of the plan.

Funding and financing are often the biggest barriers to local decarbonization efforts. That reality is borne out through the overall lack of detail and clarity we found when analyzing decarbonization plans from 50 of the country’s largest cities. But many cities have found creative strategies to address vexing problems such as the high upfront cost of building retrofits and the compounding environmental and social inequalities vulnerable neighborhoods face. As climate challenges mount, such strategies will be essential in securing the necessary investments for making our cities resilient and sustainable for decades to come.

For more case studies on innovative local approaches to fund and finance decarbonization, see the Department of Energy’s State and Local Solution Center, the National Association of State Energy Officials’ energy financing resources, and the Atlas’ local government case studies.