#Honus Wagner Baseball Card Value

Explore tagged Tumblr posts

Text

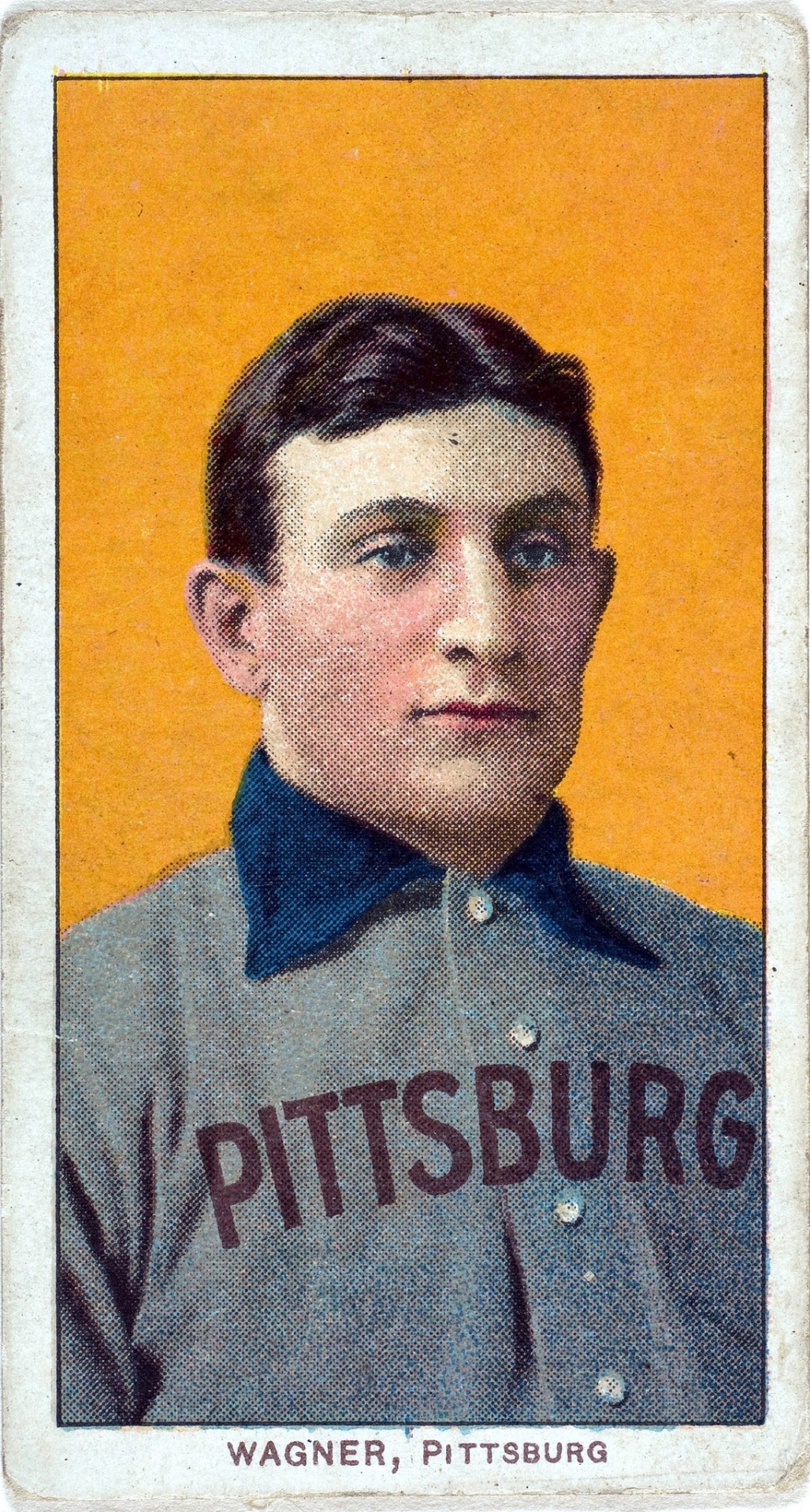

Honus Wagner

Honus Wagner Johannes Peter ” Honus ” Wagner, also known as Hans Wagner, was a German-American baseball shortstop who played for the Pittsburgh Pirates for 21 seasons from 1897 to 1917. In 1911, Wagner won his eighth (and final) batting title, setting a record in the National League that still stands today and has only been matched once, in 1997, by Tony Gwynn. He also led the league in slugging…

View On WordPress

#honus wagner#Honus Wagner And Ty Cobb#Honus Wagner Baseball Card Value#Honus Wagner Card#Honus Wagner Card Worth#Honus Wagner Cards In Existence#Honus Wagner Career Statistics#Honus Wagner Early Life#Honus Wagner Hall Of Fame#Honus Wagner Images#Honus Wagner Injury#Honus Wagner Records#Honus Wagner Rookie Year#Honus Wagner Salary#Honus Wagner Stats#Honus Wagner Statue#Honus Wagner T206#Honus Wagner Teams#Honus Wagner Tobacco Card#Honus Wagner World Series Stats

6 notes

·

View notes

Text

Are there any other millennials with the collective memory of your school teaching you about that one wildly expensive Honus Wagner baseball card? More than one teacher covered this at my school.

And they basically talked about it like it was the Black Lotus of baseball cards?

Hey, so why did they teach us about the high value of this one card? It wasn’t even a baseball card unit. It would just be kinda thrown in as a “did you know”.

Do schools now talk about the rarity of holographic first edition Charizards now or what?

Or was that a thing that was just our school district? Because again. More than one teacher impressed upon us that this card was rare and expensive. I want to say it was covered while talking about a book/movie we covered a couple of times.

And no. We are not a state known for baseball.

#Pokemon#magic the gathering#tcg#baseball cards#baseball#honus wagner#mtg#millennial#millenials#school#MLB

2 notes

·

View notes

Link

Check out this listing I just added to my Poshmark closet: Vintage Baseball Cards - Reprints with description of originals - Lot of 5.

0 notes

Text

Honus Wagner

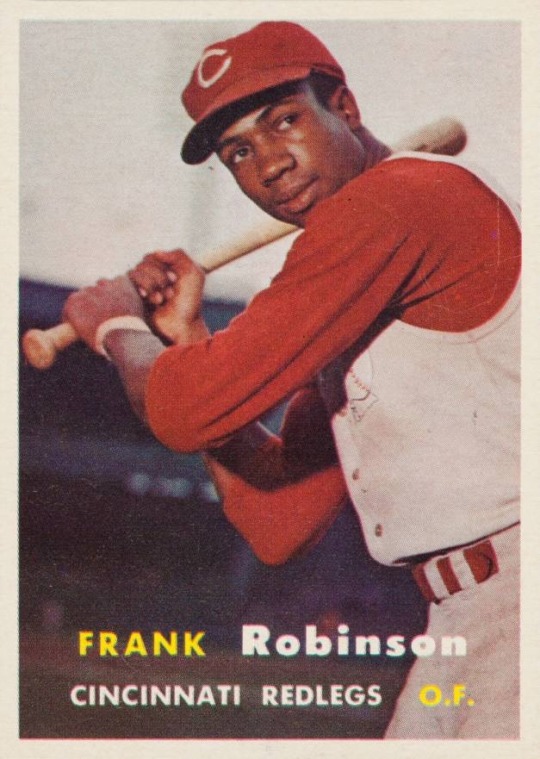

Honus Wagner, a Hall of Fame baseball player, is featured in the American Tobacco Company's T206 series, a set of baseball cards produced between 1909 and 1911.

Wagner reportedly requested to halt production of the card, leading to its rarity, with estimates of only around 50-200 cards known to exist.

Values for high-grade Wagner T206 cards can range into millions of dollars.

1 note

·

View note

Text

In the world of sports memorabilia, few items hold as much fascination as baseball cards. From the iconic Honus Wagner card to the valuable finds from the 80s and 90s, these pieces of cardboard can sometimes be worth a fortune. But what makes a baseball card valuable? Let's delve into the world of baseball cards and uncover the factors that can make them worth money. Baseball Playing cards The Rarity Factor One of the most significant factors that contribute to a baseball card's value is its rarity. The Honus Wagner card, for instance, is one of the most sought-after cards in the world, largely due to its scarcity. Wagner, a legendary shortstop for the Pittsburgh Pirates, was one of the greatest players of his era. However, his card became particularly valuable because it was pulled from production early, resulting in a limited number of copies. "The fewer the copies of a card, the higher its value. This is why the Honus Wagner card is so valuable. It's not just about the player, it's about the rarity of the card." - SportyConnect.com Native Card Store The Era of the Card The era in which a card was produced can also significantly impact its value. Cards from the 80s and 90s, for example, are often highly sought after by collectors. This is due to a combination of factors, including the popularity of baseball during these decades, the players featured on the cards, and the quality of the cards themselves. You can learn more about the value of cards from these eras in our articles on baseball cards worth money from the 80s and baseball cards worth money from the 90s. White Border Honus Wagner The Player on the Card The player featured on the card is another crucial factor in determining its value. Cards featuring legendary players like Michael Jordan or Zion Williamson can be worth a lot of money, especially if they are rookie cards or have been autographed. Mickey Mantle The Condition of the Card The condition of the card is also essential. Cards that are in mint or near-mint condition are typically worth more than cards that have been damaged or show signs of wear. It's always a good idea to keep your cards in a safe place to preserve their condition and potentially increase their value over time. Babe Ruth M101-4 Determining the Value of Your Baseball Cards After understanding the factors that contribute to a baseball card's value, the next step is to determine the value of your own cards. This process can be quite complex, as it involves a careful evaluation of the card's condition, rarity, and the player it features. Grading Your Cards One of the most reliable ways to determine the value of a baseball card is to have it professionally graded. Companies like PSA and Beckett offer grading services, which involve a thorough examination of the card's condition and authenticity. A card in 'mint' or 'gem mint' condition can fetch a significantly higher price than one that's merely in 'good' condition. "Grading your cards can significantly increase their value. A card in 'mint' condition is often worth several times more than the same card in 'good' condition." - SportyConnect.com Checking Sold Listings Another effective way to gauge the value of your baseball cards is to check the prices of similar cards that have recently sold on auction websites. This can give you a realistic idea of what collectors are currently willing to pay for cards like yours. Consulting Price Guides Price guides can also be a useful tool for determining the value of your cards. These guides provide estimated values for different cards based on their condition, rarity, and the player they feature. However, it's important to remember that these are just estimates, and the actual value of a card can vary based on the current market. Where to Sell Your Valuable Baseball Cards Once you've determined the value of your baseball cards, you might be wondering where to sell them. Auction

houses are often a good choice for extremely valuable cards, as they can attract serious collectors willing to pay top dollar. Online marketplaces can also be a good option, especially for cards that are less rare or in lower condition. Preserving the Value of Your Baseball Cards After determining the value of your baseball cards and possibly selling some, it's crucial to understand how to maintain and even increase the value of your remaining collection. Here are some tips to help you preserve your valuable baseball cards. Proper Storage Proper storage is key to preserving the condition of your baseball cards. They should be kept in a cool, dry place away from direct sunlight, which can cause colors to fade. Consider using protective sleeves, top loaders, or even specially designed baseball card storage boxes. "Proper storage is essential for maintaining the condition and value of your baseball cards. Keep them in a cool, dry place and consider using protective sleeves or boxes." - SportyConnect.com Handling with Care When handling your baseball cards, be sure to have clean hands to avoid transferring oils or dirt onto the cards. It's also advisable to hold them by the edges to prevent any damage to the surface. Insurance If your collection has a high overall value, you might want to consider getting it insured. This can protect you financially in case of damage or theft. Regular Appraisals The sports memorabilia market can fluctuate, so it's a good idea to have your collection appraised regularly. This can help you keep up to date with its current value and make informed decisions about buying or selling cards. In conclusion, collecting baseball cards can be a rewarding hobby, especially when you find out that some of your cards are worth money. By understanding the factors that contribute to a card's value, knowing how to determine the value of your own cards, and learning how to preserve their condition, you can truly make the most of this fascinating pastime. For more insights into sports memorabilia and the latest sports news, keep visiting SportyConnect.com. Check out our article on what factors make the Honus Wagner card so valuable? to delve deeper into the world of valuable baseball cards. #SportyConnect

0 notes

Text

Hard to find Baseball Cards - Collect Tradition

Everybody knows that collecting baseball cards is often a hobby that lots of people enjoy in this life. For collectors there isn't nearly anything exciting to to discover a card they will don't yet have inside their collection. The harder desired cards for baseball collections will be the more rare or vintage cards. These cards have a higher monetary value, obviously. Most of the "old" baseball cards you will see today are reproductions of the originals. You'll find, however, still a number of the original cards in circulation. Often you will find lower than 100 cards left of your given player and year. Sought after demand because of these cards has pushed the prices up, sometimes to thousands. The actual price range is dependent upon demand, condition, and the variety of cards available. Many rare baseball cards are the ones of very recognizable players that have spectacular as well as historical baseball careers. Cards of players like Babe Ruth, Mickey Mantle as well as Honus Wagner are among this group. Prepaid credit cards were collectibles in the time these players were enjoying the sport and are more valuable today. Many rare baseball cards show wear on the edges and corners, and some need creases about the card itself. Much of this wear is caused by the skinny and inferior quality cardboard that companies used to print cards for sure players. Another excuse for the wear is always that many collectors were children who collected they only for the romance in the game, and they also didn't take measures to maintain them in perfect condition.

Now unless there is a large amount of harm to the cards, these rare baseball cards have ale causing a lot of excitement whenever they can be found in public. The main reason because of this being the not enough cards that exist by baseball collectors. For that reason when one of these simple rare baseball cards that way of the T206 Honus Wagner card surfaces collectors and wealthy fans are getting ready for any high stakes bidding. Topps and baseball cards work together. Every time a trader thinks baseball card they are of Topps. Topps first produced card takes hold 1951 this set was oriented for the game also it would have been a Red and black set. It had been in 1952 in the event the modern trading card was exposed to life. This card set is among the most revered of sets. Collectors marvel with the 1952 sets history. From the time the period, Topps can produced its famous baseball card sets. Today, Topps comes with an established tradition of producing high-quality baseball cards. Topps has also added new technology for the cards in addition to their packaging, now sports many other brands that help it remain the nation's leading baseball card issuer. Many collectors, even serious ones, do not have the way to supply Wagners and Ruths. In recent years, MLB cards through the '70s are actually a smart investment for that common collector. Cards of Mike Schmidt, Carlton Fisk, Steve Garvey, Dusty Baker, along with other greats through the era have demostrated a marked rise in value. Although their value will continue to increase, any given strength training still manage to buy MLB cards from your 1970s. Probably the most valuable cards are available for less than $300. Collecting baseball cards being a hobby is fairly liked by many people. Collectors think it is exciting and frequently very profitable, particularly if they can locate genuine vintage cards. Most old baseball cards are copies, but originals are out there. Unless a card may be significantly damaged, rare baseball cards result in a great deal of excitement whenever they appear in public. More info about tom glavine rookie please visit website: visit here.

1 note

·

View note

Text

Buzzwords, De-buzzed: 10 Other Ways to Say Derek Jeter rookie cards

Derek Jeter was signed up due to the New york city Yankees with the sixth overall choice in the 1st round of the 1992 MBL Draft.He is without a doubt and also away looked at among the best well-liked players ever to use the Yankees Pin Lines if certainly not one of the most well-known of perpetuity (Infant Ruth and also Mickey Mantle could have one thing to mention concerning that).

The Leader, Mr. Nov, Leader Link-- whatever you would like to refer to as Derek Jeter, he is among the absolute most important sportsmens of his age group and one of the greatest baseball gamers of perpetuity.

Our Top Derek Jeter Rookie Card Picks

Greatest Derek Jeter Rookie Cards So, Derek Jeter has the numbers, the background, and also the future on his side. It's one of the trademark baseball cards of its entire creation as well as arguably, Derek Jeter's best rookie card.The art depicts Jeter hustling to make a play against a fantastic aluminum foil background.As a top-tier investment, this card possesses additional than doubled in value over the past 5 years, with optimals at three-way value.NY Yankee Future All-Star? Get Jasson Dominguez Rookie Cards If you require to possess the absolute best Derek Jeter memory cards on the market, this memory card possesses to be in your portfolio.This must-have Jeter novice memory card click here is actually an absolute jewel coming from top to bottom.

The craft, including a younger, eager Derek Jeter makes this an excellent display part for the severe, but a soft-sell real estate investor. It's unsubstantiated just how youthful Jeter looks here, however that is actually part of the attraction.

This card is traditional in every the correct methods and also will certainly enhance your collection both fiscally and aesthetically. Derek Jeter Little Sunshine High College Vehicle Autograph Novice RC

This card features a Derek Jeter therefore younger, he looks very likely to strike your doorbell and run than to strike home runs, however it's an outstanding assets. "Along with only 250 authorized copies of this particular memory card, it is actually rather rare, especially in best situation" exciting woodgrain trend behind Jeter additionally makes this memory card a noteworthy show piece, as there are really few like it.1993 Derek Jeter Coliseum Nightclub Murphy Novice Memory Card # 117.

CONTRIBUTE TO pushcart Derek Jeter arena club novice memory card Coliseum Club memory card had a more restricted release than most of the various other Jeter rookie memory cards, thus this has actually strengthened in worth especially effectively.

Along with refined gold lettering as well as neighboring at the bottom, yet no side perimeter, the card is actually both attractive and also challenging to locate in great problem.

For those who perform discover a top-quality version, this card will certainly be a sound expenditure for years to happen. As the gold aluminum foil model of among Derek Jeter's most preferred newbie cards, this is a staple assets for Jeter supporters and also intelligent financiers alike. The art here is actually definitely symbolic as a younger Derek Jeter rises towards his bright future. When this card was actually imprinted, no person had any clue they were looking at a newbie whose title would certainly be in debates along with Honus Wagner and Cal Ripken Jr

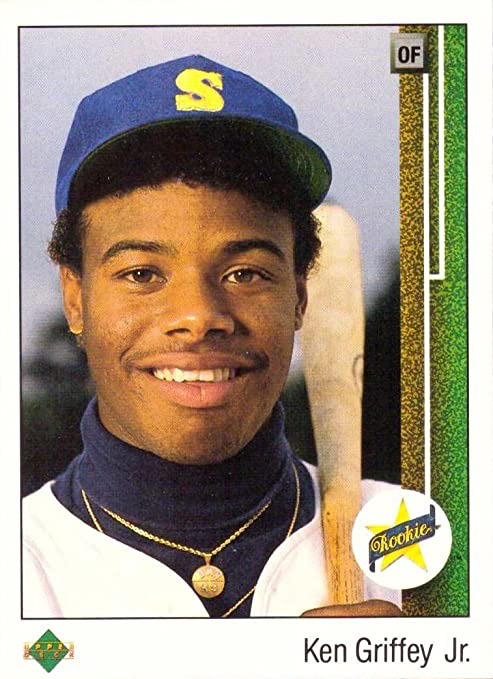

. The 1993 Derek Jeter Bowman Novice Memory Card can have incredibly easily been in our top 5 and also costs an expenditure at much higher grades. The 1993 Epitome Derek Jeter Novice Card is one more one that rarely missed out on out on the leading 5 ... our team like the close-up appearance together with the smug smile Jeter carries his skin ... the card rather advises our team of some of the greatest novice cards ever published in the 1989 Ken Griffey Jr. Upper Deck Rookie Card.1992 Derek Jeter Front Row Gold RC # 55.

You will definitely certainly not, I repeat will certainly not locate this card very commonly on ebay.com public auctions. You may locate it up on eBay acquire right now for an extremely high rate however finding it on eBay public auctions is like locating a needle in a haystack.However, if you carry out see the 1992 Front end Row Gold Derek Jeter RC up on eBay public auctions our company recommend trying (and also email our team at [email protected] as well as allow our team know).

Why Acquire Derek Jeter Newbie Cards?

Our experts'll respond to those inquiries and also additional in this thorough Derek Jeter Expenditure Report. Significant aspect that makes Derek Jeter a fantastic expenditure is his affiliation with the Yankees." Derek Jeter Novice Cards are some of the ideal expenditures in the activity ... in certain the 1993 SP Jeter RC" Jeter invested even more than a decade as the Yankee's group Leader as well as led the team to 5 Globe Series Championships in that span.

Sustained effectiveness in such a high-profile placement made Jeter a somebody, even for people that recognize absolutely nothing else about baseball.Also, playing in the huge The big apple City media market aided Derek Jeter connect with an astoundingly big reader as both an athlete and also media individuality.

1 note

·

View note

Text

Jose Canseco's car? A 'Happy Gilmore' VHS tape? A Betty White signed baseball? Auctions aren't just for T206 Honus Wagner cards

Jose Canseco’s car? A ‘Happy Gilmore’ VHS tape? A Betty White signed baseball? Auctions aren’t just for T206 Honus Wagner cards

Not every piece of sports memorabilia that sells at auction is the highly sought-after rookie card or the PSA 10 that has skyrocketed in value. There are a number of collectors looking for unique, odd or off the beaten path items. Auction houses are regularly selling items that you don’t come across every day, so here is a look at some recent sales from unique memorabilia pieces across the sports…

View On WordPress

0 notes

Link

NBA Top Shot customers can't get their money out. Experts are confounded Dapper Labs, the $7.5 billion company behind NBA Top Shot, has struggled to deal with a massive influx of new buyers and sellers on its platform. After a month of stunning growth (Dapper Labs says NBA Top Shot has 100 times as many users since the beginning of the year) The site has frequently been down for maintenance, and customers have flooded Twitter and Dapper Lab’s official Discord channel with complaints about being unable to withdraw their money. “I just wanna get my money out man,” complained user “Harry” in the “#vent” channel of the NBA Top Shot Discord. Withdrawal delays are purposeful, to an extent, Dapper Labs says: Its identity verification and anti-money-laundering procedures necessitate a wait period to avoid fraud. But the company acknowledges that it has been overwhelmed by the massive influx of sales, and it is looking to hire people and beef up its nascent compliance team. For customers waiting to withdraw their money from Top Shot, the excuses are infuriating. Michael, a 32-year-old digital advertiser in Los Angeles, who asked CNN Business not to publish his last name out of concern that his account could be shut down, said that since joining NBA Top Shot in January, he’s been unable to access the roughly $40,000 sitting in his account. He recently filed a complaint with the Consumer Financial Protection Bureau. “I’m just really worried that I’m not going to be able to get my money,” said Michael. The waiting period Dapper Labs is trying to persuade angry customers that the delays are actually a benefit to buyers and sellers: The company touts the fact that — unlike most other NFT marketplaces — it has some fraud protections in place. Buyers and sellers must go through multiple processes to gain the ability to access the money sitting in their accounts. The first is an identity verification measure, known in the industry as a “know-your-customer” process that involves taking a photo of your driver’s license and submitting your Social Security number. A spokesperson for Dapper Labs told CNN Business that there is “no backlog” for their KYC verification, and that the procedures are performed automatically with any failed verifications being reviewed within a 48-hour period. The next process is a six-to-eight-week period during which Dapper Labs monitors accounts for possible signs of fraud. Dapper Labs claims the delay — which was extended from an initial 30-day period — is essential to spot fraudsters. In a blog post that Dapper Labs shared with CNN Business, the company claims the waiting period is designed to prevent people from buying and selling Moments and then issuing credit card chargebacks. However, even after customers finally access the ability to make withdrawals, there are still lengthy delays before money actually ends up in their bank accounts. Firstly, Dapper Labs has placed caps on how much money can be withdrawn, starting at $1,000, and wire transfers — which carry a $25 fee — take a substantial amount of time to complete. On its website, Dapper Labs says that “most withdrawals are processed within 21 days but others may take 40 days or more.” In practice, the amount of time varies wildly from customer to customer. Some customers are receiving withdrawal payments in days, while others have been waiting for much longer. Vincent Diciglio, a 32-year-old data analyst for Microsoft, told CNN Business that he’s been waiting weeks for his wire transfer to go through. “There’s no reason that a company should be worth billions of dollars and can’t cover these withdrawals or even have the employees to help move this process along,” said Diciglio. “It just doesn’t make sense.” Dapper Labs told CNN Business that the withdrawal caps are meant to protect customers in the event their account is compromised and to “limit other liabilities.” The lengthy period for wire transfers even after the six-to-eight-week fraud monitoring period “just doesn’t make sense,” said Rakhi Talwar, an anti-money-laundering compliance consultant for artwork based in the UK. “Isn’t the whole point of these crypto transactions to be instant?” ‘You don’t really know what something is truly worth’ Dapper Labs has big ambitions. By teaming up with the NBA and creating a marketplace that allows for NFT purchases with a credit card (most other NFT sites require a cryptocurrency wallet) Dapper Labs has positioned itself as the bridge between the high-tech world of cryptocurrency and traditional collecting — NFTs for the regular joe. But the ease and convenience that Dapper Labs offers has come at a cost. Because NBA Top Shot is an all-in-one-marketplace, one that is minting NFTs, converting user’s payments into Dapper Labs’ proprietary FLOW cryptocurrency, and then converting those coins back into cash, they’ve had to deal with the added complications that come with each step. Dapper Labs has good reason to be concerned about potential misuse of its platform, experts say. Because the value of NFTs are both volatile and difficult to calculate — unlike say, a Picasso painting or a Honus Wagner baseball card, there is little precedent to compare an NFTs value to — they are prime targets for money launderers looking to legitimize ill-gotten gains. “You don’t really know what something is truly worth,” cautioned Professor Moyara Ruehsen, the Director of the Financial Crime Management Program at the Middlebury Institute of International Studies. “Given that the value of NFTs can change in seconds in the NBA Top Shot Marketplace (sometimes significantly) and given the frantic and heated 24-7 Top Shot Marketplace, there exists no baseline,” wrote former SEC investigator John Reed Stark in a blistering essay cautioning about the how NBA Top Shot could be exploited by money launderers. “Thus, even the most profitable, erratic or lopsided trading activity could appear ordinary, bona-fide or typical. But it is not hard to find suspicious activity on Dapper Lab’s platform even with its lengthy fraudulent activity monitoring. For example, a Moment of Fred VanVleet — the scrappy Toronto Raptors starting guard — hitting a 3-pointer against the Knicks was minted around 15,000 times. Up until recently, its highest sale was for $1,599 in February. But on April 14, one of the Moments with a high serial number (meaning its value should be low) sold for an astounding $140,090. To Ruehsen, the transaction is suspicious. “Hopefully the compliance folks are filing suspicious activity reports (SARs) on cases where the the winning bid is wildly out of proportion with comparable sales of that type of NFT,” said Ruehsen, who noted that while it is Dapper Lab’s responsibly to report suspicious activity to regulators, ultimately it falls on law enforcement to determine if any illegal activity has occurred. Dapper Labs did not respond to questions about what actions they might have taken to investigate the Fred VanVleet transaction, or whether they have ever filed a SAR with regulators. However, in a recent interview with Sports Illustrated, Dapper Labs CEO Roham Gharegozlou said he cannot recall ever filing SARs. While Dapper Labs says they still technically in “beta” mode and are enabling withdrawals as fast as they can — the company told CNN that as of April 23 “more than half” of customers have access to withdrawals — some of the users who have been waiting to gain access to their money have given to despair. “I haven’t gotten the money, I don’t think I’ll ever get the money,” said Vincent Diciglio. “I’ve accepted that I’ll never see it.” Source link Orbem News #confounded #customers #experts #investing #Money #NBA #NBATopShotcustomerscan'tgettheirmoneyout.Expertsareconfounded-CNN #shot #Top

0 notes

Text

NBA Top Shot customers can't get their money out. Experts are confounded

New Post has been published on https://appradab.com/nba-top-shot-customers-cant-get-their-money-out-experts-are-confounded/

NBA Top Shot customers can't get their money out. Experts are confounded

Dapper Labs, the $7.5 billion company behind NBA Top Shot, has struggled to deal with a massive influx of new buyers and sellers on its platform. After a month of stunning growth (Dapper Labs says NBA Top Shot has 100 times as many users since the beginning of the year) The site has frequently been down for maintenance, and customers have flooded Twitter and Dapper Lab’s official Discord channel with complaints about being unable to withdraw their money.

“I just wanna get my money out man,” complained user “Harry” in the “#vent” channel of the NBA Top Shot Discord.

Withdrawal delays are purposeful, to an extent, Dapper Labs says: Its identity verification and anti-money-laundering procedures necessitate a wait period to avoid fraud. But the company acknowledges that it has been overwhelmed by the massive influx of sales, and it is looking to hire people and beef up its nascent compliance team.

For customers waiting to withdraw their money from Top Shot, the excuses are infuriating.

Michael, a 32-year-old digital advertiser in Los Angeles, who asked Appradab Business not to publish his last name out of concern that his account could be shut down, said that since joining NBA Top Shot in January, he’s been unable to access the roughly $40,000 sitting in his account. He recently filed a complaint with the Consumer Financial Protection Bureau.

“I’m just really worried that I’m not going to be able to get my money,” said Michael.

The waiting period

Dapper Labs is trying to persuade angry customers that the delays are actually a benefit to buyers and sellers: The company touts the fact that — unlike most other NFT marketplaces — it has some fraud protections in place.

Buyers and sellers must go through multiple processes to gain the ability to access the money sitting in their accounts.

The first is an identity verification measure, known in the industry as a “know-your-customer” process that involves taking a photo of your driver’s license and submitting your Social Security number. A spokesperson for Dapper Labs told Appradab Business that there is “no backlog” for their KYC verification, and that the procedures are performed automatically with any failed verifications being reviewed within a 48-hour period.

The next process is a six-to-eight-week period during which Dapper Labs monitors accounts for possible signs of fraud. Dapper Labs claims the delay — which was extended from an initial 30-day period — is essential to spot fraudsters.

In a blog post that Dapper Labs shared with Appradab Business, the company claims the waiting period is designed to prevent people from buying and selling Moments and then issuing credit card chargebacks.

However, even after customers finally access the ability to make withdrawals, there are still lengthy delays before money actually ends up in their bank accounts.

Firstly, Dapper Labs has placed caps on how much money can be withdrawn. However, the company places a cap on each withdrawal payment, starting at $1,000, and those wire transfers — which carry a $25 fee — take a substantial amount of time to complete. On its website, Dapper Labs says that “most withdrawals are processed within 21 days but others may take 40 days or more.”

In practice, the amount of time varies wildly from customer to customer. Some customers are receiving withdrawal payments in days, while others have been waiting for much longer.

Vincent Diciglio, a 32-year-old data analyst for Microsoft, told Appradab Business that he’s been waiting weeks for his wire transfer to go through.

“There’s no reason that a company should be worth billions of dollars and can’t cover these withdrawals or even have the employees to help move this process along,” said Diciglio. “It just doesn’t make sense.”

Dapper Labs told Appradab Business that the withdrawal caps are meant to protect customers in the event their account is compromised and to “limit other liabilities.”

The lengthy period for wire transfers even after the six-to-eight-week fraud monitoring period “just doesn’t make sense,” said Rakhi Talwar, an anti-money-laundering compliance consultant for artwork based in the UK. “Isn’t the whole point of these crypto transactions to be instant?”

‘You don’t really know what something is truly worth’

Dapper Labs has big ambitions. By teaming up with the NBA and creating a marketplace that allows for NFT purchases with a credit card (most other NFT sites require a cryptocurrency wallet) Dapper Labs has positioned itself as the bridge between the high-tech world of cryptocurrency and traditional collecting — NFTs for the regular joe.

But the ease and convenience that Dapper Labs offers has come at a cost. Because NBA Top Shot is an all-in-one-marketplace, one that is minting NFTs, converting user’s payments into Dapper Labs’ proprietary FLOW cryptocurrency, and then converting those coins back into cash, they’ve had to deal with the added complications that come with each step.

Dapper Labs has good reason to be concerned about potential misuse of its platform, experts say. Because the value of NFTs are both volatile and difficult to calculate — unlike say, a Picasso painting or a Honus Wagner baseball card, there is little precedent to compare an NFTs value to — they are prime targets for money launderers looking to legitimize ill-gotten gains.

“You don’t really know what something is truly worth,” cautioned Professor Moyara Ruehsen, the Director of the Financial Crime Management Program at the Middlebury Institute of International Studies.

“Given that the value of NFTs can change in seconds in the NBA Top Shot Marketplace (sometimes significantly) and given the frantic and heated 24-7 Top Shot Marketplace, there exists no baseline,” wrote former SEC investigator John Reed Stark in a blistering essay cautioning about the how NBA Top Shot could be exploited by money launderers. “Thus, even the most profitable, erratic or lopsided trading activity could appear ordinary, bona-fide or typical.

But it is not hard to find suspicious activity on Dapper Lab’s platform even with its lengthy fraudulent activity monitoring.

For example, a Moment of Fred VanVleet — the scrappy Toronto Raptors starting guard — hitting a 3-pointer against the Knicks was minted around 15,000 times. Up until recently, its highest sale was for $1,599 in February. But on April 14, one of the Moments with a high serial number (meaning its value should be low) sold for an astounding $140,090.

To Ruehsen, the transaction is suspicious.

“Hopefully the compliance folks are filing suspicious activity reports (SARs) on cases where the the winning bid is wildly out of proportion with comparable sales of that type of NFT,” said Ruehsen, who noted that while it is Dapper Lab’s responsibly to report suspicious activity to regulators, ultimately it falls on law enforcement to determine if any illegal activity has occurred.

Dapper Labs did not respond to a questions about what actions they might have taken to investigate the Fred VanVleet transaction, or whether they have ever filed a SARs with regulator. However, in a recent interview with Sports Illustrated, Dapper Labs CEO Roham Gharegozlou said he cannot recall ever filing SARs.

While Dapper Labs says they still technically in “beta” mode and are enabling withdrawals as fast as they can — the company told Appradab that as of April 23 “more than half” of customers have access to withdrawals — some of the users who have been waiting to gain access to their money have given to despair.

“I haven’t gotten the money, I don’t think I’ll ever get the money,” said Vincent Diciglio. “I’ve accepted that I’ll never see it.”

0 notes

Text

The NFT Avalanche

By: Brian Zwerner

Non-Fungible Tokens (NFTs) are all over the place these days. The NBA partnered with Dapper Labs for a product called NBA Top Shot, where they sell single play video highlights called Moments to collectors. This is Dapper Labs second big product, the first was even weirder, a digital cat collectible called CryptoKitties. Top Shot has racked up over $200 Million in sales in a matter of weeks, you can read more about the product in this Forbes article. The artist Beeple sold a piece of digital art last week for an eye popping price of $69 Million, more on that here. Twitter CEO Jack Dorsey has created a digital art version of his first ever Tweet and is auctioning it now, pricing is above $2.5 Million already, more here. Is this a genius collectible for early buyers or lunacy? Great question, short answer is that I’m not sure yet.

Let’s get some of the basics out of the way. What is an NFT? Wikipedia defines an NFT as a digital file whose unique identity and ownership is verified on a blockchain (a digital ledger). Basically, an NFT is a piece or art, a video, a picture, a meme, a Tweet, or really anything that is individually numbered and sold to collectors. Your ownership is validated on a blockchain ledger, and NFTs are usually purchased with a cryptocurrency like Ethereum.

Some items are one of a kind, like the Beeple item listed above, and others can have thousands of items created, like NBA Top Shot. NBA Top Shot is more closely associated with a pack of baseball or basketball cards. They create a limited quantity of a collectible highlight, typically 1,000 up to 25,000 or more. Each one is unique and carries a number in a series. The #1 sells at a vastly higher price than #24,322. The difference can be $100,000 for the first item in a series all the way down to $50 for #24,322.

So the first question everyone asks about NFTs is the obvious one – “why would I pay for something I can get for free on YouTube or the internet?” This is a legit question, one I wrestle with. My favorite explanation came from Marc Andreessen on a recent Clubhouse conversation on the topic. He basically said that the paper and ink from the famous Honus Wagner baseball card is worth a few dollars, but the card sold for $3.25 Million a few years ago. The value of the card is in the scarcity and the belief of collectors that the card is desirable. Like I tell my wife when she asks what our house is worth, “it’s worth what someone is willing to pay for it.” Yes, you can find the same highlights on YouTube or Twitter, but you can’t own a licensed, numbered copy that you can later sell to someone else, hopefully at a higher price.

Right now, you have big influencers talking up the value of NFTs. If you look at Gary Vaynerchuk’s podcast episode list right now, the last six posts all have NFT in the title. Gary Vee is a big buyer of sports cards, and he is going all-in on NFTs now. Mark Cuban is a big fan of NFTs as well. He has turned a few of his Tweets into NFTs that have sold for thousands of dollars. NBA players like Terry Rozier and Josh Hart are very publicly buying their own Moments on Top Shot. I’m personally dipping my toe in the water on NBA Top Shot. I bought five moments in their marketplace a month ago. One Zion Williamson highlight I bought for $20 then I was able to flip for $189 today, a fantastic 7X return, albeit on low dollar amount. Top Shot also releases new packs of highlights, much like buying a pack of traditional basketball cards, which is a lot of fun.

But let’s get back to the original question, why do people even buy these things in the first place? Well if you read my prior post on the Metaverse, you know I believe this will be big. Like everyone on the planet big. I see a future where people have digital homes on the Metaverse, maybe 5-10 years from now. In those digital homes, we will want to display our digital collectibles. Maybe a piece of art in my digital living room or dining room, and maybe a cool sports highlight in my digital man cave. Could I just put up a free copy from the web on the walls? Sure I could, but that’s going to be seen as lame. I don’t have a fake Van Gogh on my walls, and I won’t want a fake highlight up on my digital walls. Right now all these NFT have limited utility, you can basically show them off on your social channels, but in the future the utility might be sky high. Will every NFT work like this in the Metaverse? Who the heck knows, but possibly.

One major note of caution, some NFTs will get bid up in a crazy frenzy and later be worth absolutely nothing. Which ones will have this fate? I don’t have a clue. CryptoKitties was red hot for a minute, then not so much. So were physical collectibles like Cabbage Patch Kids. As discussed above, collectibles have limited intrinsic value, they are all about what people are willing to pay so be cautious. It is probably OK to dabble and have some fun in the sector, but I am not putting my nest egg into NFTs any time soon. I expect that I’ll have more to share on NFTs in the future so stay tuned.

See prior posts here

Sign up for the Weekly Drop newsletter

0 notes

Text

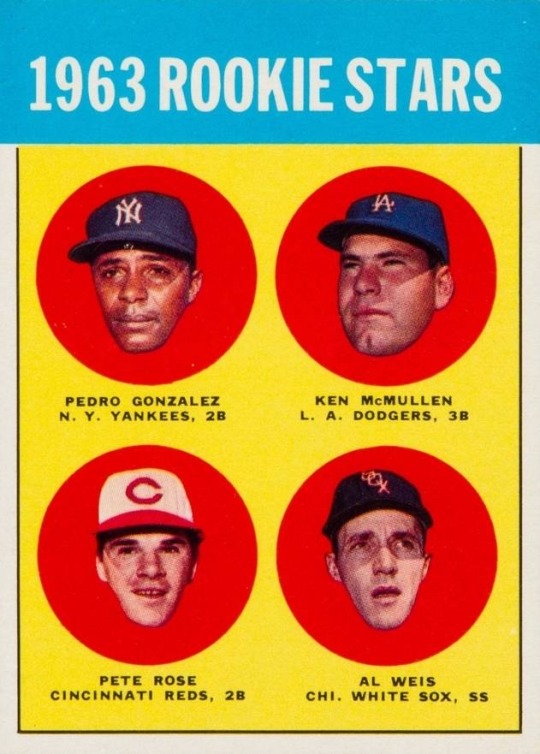

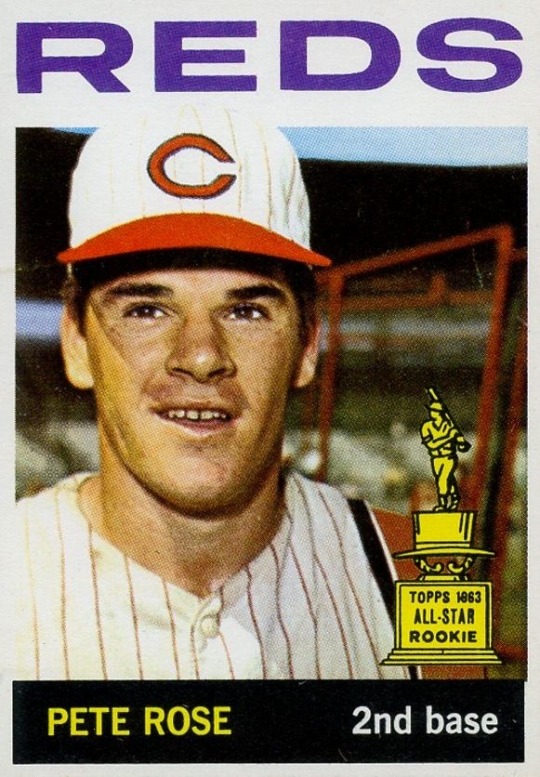

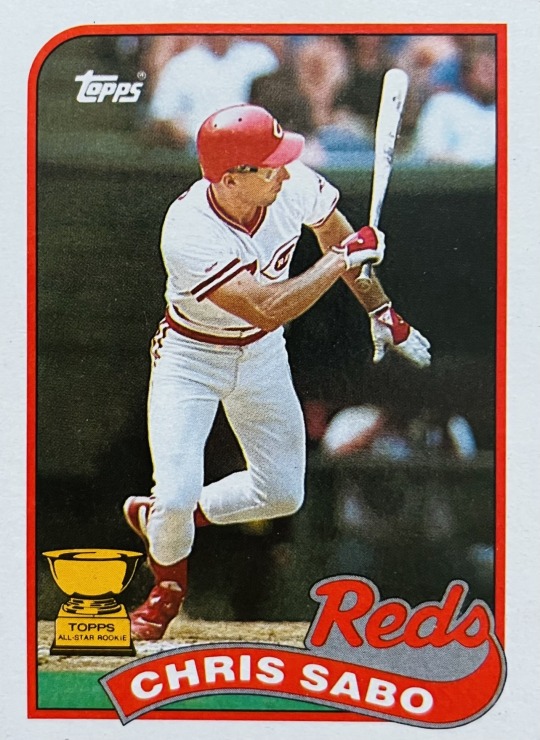

For the record, there is zero knowledge on the value of these baseball cards, this is all just my random observation. That being said, I want to thank Deans Cards and Beckett for the images on this article. There are countless articles, magazines, websites, etc. on the value of baseball cards. I have never seen anything about the most popular Cincinnati Reds baseball cards.

I don’t have a Mount Rushmore of baseball cards. My two favorites on that list is Honus Wagner’s T206 and Junior Griffey’s 89 Upper Deck rookie card.

I would love to hear other opinions of some great Reds cards. I do have countless crap baseball cards, but I do have this occasionally fantastic Sabo rookie card!

0 notes

Photo

Mike Trout's (@miketrout) rookie baseball card sold for a record US$3.93M at auction. It is the most valuable trading card ever, topping the value of the T206 Honus Wagner card. Mike Trout has blossomed into one of the best players of his era, so it should come as no surprise that the Angels' star's memorabilia sells for a pretty penny. — view on Instagram https://ift.tt/3hNvUfS

0 notes

Text

CJ current events - St Paddy’s Day 2020

Somewhat amusing Fifth Amendment cartoon.

***************

Somewhat amusing story of 20 y/o Benny Ramos stealing a Honus Wagner baseball card belonging to Charlie Sheen and selling it for $18,000. He served his time, married, had kids, worked hard, and Pres Obama eventually pardoned him as he prepared to leave office.

https://www.si.com/sports-illustrated/2020/02/26/all-star-cafe-heist

*****************

FOR IMMEDIATE RELEASE Tuesday, March 17, 2020

Iranian National Extradited to the Western District of Texas for Illegally Exporting Military Sensitive Items from the U.S. to Iran

On Saturday, 38-year-old Merdad Ansari who is an Iranian citizen and a resident of the United Arab Emirates was extradited from Georgia and arrived Saturday evening in San Antonio to face federal charges in connection with a scheme to obtain military sensitive parts for Iran in violation of the Iranian Trade Embargo, announced Assistant Attorney General for National Security John C. Demers, U.S. Attorney****

Ansari, and his co-defendant Mehrdad Foomanie (aka Frank Foomanie) of Iran, are charged in a federal grand jury indictment returned in June 2012 with conspiracy to violate the Iranian Transactions Regulations (ITR), conspiracy to launder money and conspiracy to commit wire fraud. Foomanie remains a fugitive in this case. In October 2012, a third co-defendant, Susan Yip (aka Susan Yeh), a citizen of Taiwan, was sentenced to two years in federal prison after pleading guilty to conspiring to violate the ITR by acting as a broker and conduit for Foomanie to buy items in the U.S. and have them unlawfully shipped to Iran.

According to the indictment, Foomanie also bought or attempted to buy items in the U.S. and arranged to have them unlawfully shipped to Iran through his companies in Iran (Morvarid Shargh Co. Ltd.); in Hong Kong (Panda Semiconductor and Foang Tech Inc., aka Ofogh Electronics Co.); and, in China (Ninehead Bird Semiconductor). The indictment also alleges that Ansari attempted to transship and transshipped cargo obtained from the U.S. by Yip and Foomanie using Ansari’s company, Gulf Gate Sea Cargo L.L.C., located in Dubai, United Arab Emirates. In her guilty plea, Yip admitted to primarily using her companies in Taiwan (Hivocal Technology Company, Ltd.; Enrich Ever Technologies Co., Ltd.; and, Kuang-Su Corporation) and in Hong Kong (Infinity Wise Technology; Well Smart (HK) Technology; Pinky Trading Co., Ltd.; and, Wise Smart (HK) Electronics Limited) to carry out the fraudulent scheme.

From Oct. 9, 2007, to June 15, 2011, the defendants obtained or attempted to obtain from companies worldwide over 105,000 parts valued at approximately $2,630,800 involving more than 1,250 transactions. The defendants conducted 599 transactions with 63 different U.S. companies where they obtained or attempted to obtain parts from U.S. companies without notifying the U.S. companies these parts were being shipped to Iran or getting the required U.S. Government license to ship these parts to Iran.***

https://www.justice.gov/opa/pr/iranian-national-extradited-western-district-texas-illegally-exporting-military-sensitive

0 notes

Link

When Karl Kissner’s aunt died in Defiance, Ohio in 2011, she had given her one-hundred-one year-dilapidated family dwelling to Karl and his cousins as an inheritance. The house’s exterior was in shambles and inside clutter crammed the rooms as if it had never been cleaned in a century. On the other hand, the frequent dwelling couldn’t finish Karl and Karla, one other family member, from wanting by it in consequence of his aunt had left him a gift that they “would accumulate things that (they) never knew existed.” (Fox TV Alternate Network, “Extraordinary Inheritance”). After cleansing out many of the inner, the attic was the rest dwelling Karl and Karla needed to rummage by. However this attic was numerous from the comfort of the house in consequence of it held many of the dilapidated family heirlooms and keys to doable family secrets and tactics. It was not unless they’d cleared about a of the objects heaped on top of one one other up to the rafters that they uncovered a cramped, grime-covered field that lay in opposition to the support wall. When they opened it they stumbled on over 700 cramped photos of some 30 famed baseball players from the early twentieth century tied in string. These photos integrated such big participant esteem Ty Cobb, Cy Young, Honus Wagner, Christy Mathewson and Connie Mack, actual to name about a. Amongst the sizable horde, every participant had roughly 12 to 16 more equivalent cards. Even supposing Karl believed none of them had been actual baseball cards since none resembled current cards which encompass participant’s stats, dates, and the name of the firm who manufactured them. Karl blueprint the collection aside unless they completed going by the comfort of the attic. Karl’s aunt, Jeanne Hench was the daughter of Carl Hench who had migrated from Germany and lived the American dream as a pleasant meat marketer and shop owner. He died in the 1940’s and left most of his assets in family dwelling’s attic, alongside with the mysterious field of irregular cards in mint situation. Mr. Hench’s grandson believed he obtained the cards as promotional objects from a candy retailer. Later, Karl opened the sphere and examined every person. He went on-line and researched every of the 30 players represented in the collection. The more he searched, the more he imagined sizable greenback indicators flying into his bank account. Karl knew the next logical step was to procure all 700 professionally authenticated. He called Peter Calderon, a baseball card expert in Dallas, Texas, and despatched him samples from the collection. After examining every card, Calderon nearly hit the ceiling when he realized that the cards had been extraordinarily rare traditional originals in pristine situation. Each was continuously known as a “E98” series of cards from 1910. Karl instructed him he had many more and despatched them to Calderon. Calderon straight notified Karl that his cards had been qualified and extraordinarily treasured. After necessary jubilation, Calderon blueprint them up with Heritage Public sale in uncover to promote a share of the cards as a replace of the total lot, in consequence of advertising the 700 altogether would flood the dilapidated baseball cards collectors’ market, that are in a neighborhood to nick the values of the baseball card multimillion greenback alternate. Over a time-frame, the Heritage Public sale Dwelling sold the partial lot for a filled with over $ 1,800,000. The rest was disbursed equally amongst twenty of Karl’s cousins to invent with as they happy. Pointless to speak, Karl and every of his cousins may well well well also without problems retire by auctioning the comfort of the cards, and that is what exactly they’re going to invent, but regularly so as not to damage the baseball card alternate. The rest of the collection has been estimated to promote for $ 3 million. The collection Karl stumbled on earned the name the “Dusky Swamp Procure” to hyperlink the geographical and historic northwestern Ohio dwelling so as to add notoriety to the sizable collection of about a of the oldest and rarest baseball card collection. HOME PLOG Related ProductsLoading products..

0 notes

Text

Graded Baseball Cards

Every Little Thing Regarding The Pricey Graded Baseball Cards

Collecting of Graded Baseball Cards starts just as a hobby. But later we look out for distinct alternatives, to maintain our interest higher in them and to offer our interest some value. The value of a card is determined by different aspects just like the year in which they may be made, player featured around the card as well as the number inside the set.

A number of essentially the most pricey Baseball cards:

1909-11 T206 “Jumbo” Honus Wagner

It realized about $3.two million in September 2016. It earned the value as a result of the mis-cut which created it of huge size and so it really is named.

1909 11 Gretzky T206 Honus Wagner

It realized $2.eight million in April 2015. This can be also named as Jumbo but not around the basis of mis cut of shape.

1952 Topps #311 Mickey Mantle

It realized $ 1,135,250. It really is scarce card as a fewer larger number of cards have been printed on this number.

1915-16 Sporting News M101-5 Babe Ruth

It realized $717000. It really is useful not since it is actually a Rookie card, but since it shows him as a player on Boston Red Sox.

1909 American Caramel E90-1 Joe Jackson.

It realized $667189. Joe Jackson was banned from baseball following the “Black Sox”, a significant league baseball fixing incident. So the cards have been fewer in quantity and this improved the demand for Rookie cards.

Cards value guide:

Baseball card for sales value is depending on several criteria aside from players more than it. Other aspects like scarcity, condition, errors, and value variation impacts the value too as Worth.

All these situations are causes for ups and downs in rates which we must contemplate although picking the cards. These value guides offer you the thorough information over the baseball cards.

youtube

0 notes