#High Purity Alumina Market

Explore tagged Tumblr posts

Text

High Purity Alumina Market Insights: Driving Forces Shaping the Global HPAL Landscape

High Purity Alumina Market Definition: High Purity Alumina (HPA) refers to a specialized form of aluminum oxide with a purity level exceeding 99.99%. It is primarily derived from aluminum hydroxide through a complex refining process that eliminates impurities, resulting in a high-performance material with numerous applications across various industries.

Market Overview: The global High Purity Alumina market has been experiencing significant growth in recent years, driven by its exceptional properties and versatile applications. HPA's remarkable purity, high-temperature resistance, and excellent electrical insulating properties make it a sought-after material in industries such as electronics, energy, optics, and more. This market has evolved from being a niche segment to a crucial component in cutting-edge technologies.

Market Growth: The High Purity Alumina market has witnessed robust growth due to several factors. Increased demand for LED lighting, electric vehicles, and advanced electronic devices has fueled the need for high-performance materials like HPA. Additionally, HPA's critical role in lithium-ion batteries and its potential applications in next-generation semiconductors have further boosted its market growth. As industries continue to innovate and demand superior materials, the HPA market is expected to expand steadily.

Market Industry: The High Purity Alumina industry encompasses a wide range of applications. In the electronics sector, HPA is utilized in the production of sapphire substrates for LED manufacturing and as a dielectric material in the semiconductor industry. Its high thermal conductivity and electrical insulation properties also make it valuable in the energy sector, where it is used in plasma screens and high-intensity discharge lamps.

In the optics industry, HPA's exceptional transparency and scratch resistance make it ideal for producing lenses, windows, and protective covers. Furthermore, HPA is gaining prominence in the medical field for its biocompatibility, making it a preferred material for medical implants and instruments. As new applications continue to emerge, the HPA industry remains dynamic and adaptable.

Market Trends: Several high purity alumina market trends have emerged in the industry. One significant trend is the growing emphasis on sustainability and eco-friendly production methods. Manufacturers are exploring cleaner and more energy-efficient processes to meet the rising demand for HPA while minimizing environmental impacts.

Another trend is the increasing investment in research and development to enhance HPA's properties, expand its application areas, and reduce production costs. Additionally, the market is witnessing a surge in strategic partnerships and collaborations among industry players to leverage each other's expertise and address the evolving demands of various sectors.

In conclusion, the High Purity Alumina market has evolved into a pivotal industry due to its exceptional properties and diverse applications. With a focus on innovation, sustainability, and collaboration, this market is poised for continued growth and adaptation to meet the evolving needs of modern industries.

0 notes

Text

High Purity Alumina Market Dominance: HCL Leaching Strategies

The HCL leaching high purity alumina (HPA) market involves the production of ultra-high purity aluminium oxide or alumina through hydrochloric acid leaching. HPA is utilized in numerous industrial applications owing to its unique properties such as high brightness, exceptional corrosion resistance and durability. It finds widespread usage in the production of LEDs, smartphone sapphire glass, lithium-ion batteries and semiconductors. HPA is commonly synthesized through the Bayer process, which involves multiple steps of purification and consumes huge amounts of energy. However, HCL leaching offers a cost-effective and environment-friendly production route for HPA. It involves dissolving aluminum hydroxide in hydrochloric acid to extract alumina in a more purified form. The process significantly reduces energy consumption and lowers production costs compared to traditional techniques. The Global HCL Leaching High Purity Alumina Market is estimated to be valued at US$ 2.4 Bn in 2024 and is expected to exhibit a CAGR of 13.% over the forecast period 2023 to 2030. Key players operating in the HCL leaching high purity alumina market are Alcoa Inc., Bukowski, Orbite Technologies Inc., Altech Chemicals Limited, Sumitomo Chemical Co., Xuancheng Jingrui New Material Co., Ltd., Nippon Light Metal Company Ltd., Dalian Hiland Photoelectric Material Co., Ltd., Sasol, and Rusal. Key Takeaways Key players: Key players Alcoa Inc., Bukowski, Orbite Technologies Inc., Altech Chemicals Limited, and Sumitomo Chemical Co. are the top manufacturers and suppliers of HCL leaching HPA globally. Growing demand: There is a massive rise in demand for HPA from the LED industry for manufacturing LED chips and screens. The exponential growth of the LED sector is directly influencing the HCL leaching HPA market. Global expansion: Leading HPA producers are investing heavily in capacity expansions to cater to the ballooning global demand. Several new production plants are being set up across Asia Pacific, Europe and North America. Market Key Trends

One of the key trends driving the HCL leaching high purity alumina market is the rising adoption of LED lighting solutions. LED lights consume 5-10 times less energy and last 25 times longer than traditional incandescent bulbs. With governments worldwide banning incandescent bulbs, the LED manufacturing industry is witnessing skyrocketing growth. This in turn is propelling the demand for HCL leaching HPA which is used to produce LED chips with high efficiency and brightness. The growth of applications such as Li-ion batteries, semiconductors, and sapphire glass for smartphones is further fueling the HCL leaching high purity alumina market.

Porter's Analysis

Threat of new entrants: New players requires high capital to build processing facilities and achieve economies of scale. Bargaining power of buyers: Buyers have moderate bargaining power given the specialized nature of HPA product with limited alternatives. Bargaining power of suppliers: Suppliers of key raw materials like bauxite have less bargaining power due to availability of substitutes. Threat of new substitutes: Substitutes like sapphire and silicon currently have limited capabilities compared to HPA in specialized applications. Competitive rivalry: Intense competition exists among existing players to gain market share and achieve cost leadership. Geographical Regions

The Asia Pacific region accounts for the major share of the global HCL leaching HPA market in terms of value due to presence of large aluminum refiners and growing demand from end-use industries in countries like China and Japan. The HCL leaching HPA market in North America is expected to witness the fastest growth during the forecast period supported by rising semiconductor manufacturing and innovations in Li-ion batteries industries across the United States and Canada.

#HCL Leaching High Purity Alumina Market Growth#HCL Leaching High Purity Alumina Market Size#HCL Leaching High Purity Alumina Market Share

0 notes

Text

HCL Leaching High Purity Alumina Market Dynamics: A Deep Dive into Influencing Factors

High purity alumina (HPA) is a refined form of aluminum oxide or alumina containing at least 99.99% of alumina or Al2O3. HPA finds wide applications in LED lights, semiconductors, smartphone sapphire glass, and others owing to its purity, hardness, and corrosion resistance properties. The HCL leaching process involves leaching bauxite or aluminum ores with hydrochloric acid to extract alumina in the form of aluminum chloride, which is then purified through a series of steps to produce high purity alumina. The HCL leaching technology offers advantages such as lower capital and production costs as compared to other production methods. The global HCL Leaching High Purity Alumina Market is estimated to be valued at US$ 3.5 billion in 2023 and is expected to exhibit a CAGR of 13% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Opportunity: The rising demand for high purity alumina from the semiconductor industry is estimated to drive the growth of the HCL leaching high purity alumina market during the forecast period. High purity alumina finds increasing usage in applications such as LED lights and semiconductors. The semiconductor industry has been witnessing rapid growth facilitated by the proliferation of smart devices along with increasing penetration of technologies such as 5G, internet of things, and artificial intelligence. This rising demand for semiconductors is estimated to further augment the demand for high purity alumina, thereby propelling the growth of the HCL leaching high purity alumina market over the forecast period. Porter’s Analysis Threat of new entrants: The HCL leaching high purity alumina market requires high capital and has strong economies of scale. Therefore threat of new entrants is moderate. Bargaining power of buyers: Buyers have moderate bargaining power in this market as there are several established players. Bargaining power of suppliers: Bauxite is the key raw material and suppliers have moderate bargaining power due to availability of substitutes. Threat of new substitutes: Threat of new substitutes is low as HCL leaching process has advantages over other production methods. Competitive rivalry: The market is consolidated with top players having significant market share. SWOT Analysis Strength: HCL leaching process offers high purity alumina at low cost. Established players have strong production capabilities and economies of scale. Weakness: The process requires sophisticated technology and high capital expenditure. Regulations regarding carbon emissions are becoming stricter. Opportunity: Growing demand for LEDs, lithium-ion batteries and other end-use industries driving the need for high purity alumina. Developing regions offer new growth avenues. Threats: Volatility in raw material prices and trade disputes can impact project feasibility. Stringent environmental norms pose compliance challenges. Key Takeaways The global HCL leaching high purity alumina market is expected to witness high growth during the forecast period owing to increasing use of alumina in various end-use industries.

The Asia Pacific region currently dominates the market and is expected to maintain its leading position over the coming years. China has a strong production base while countries like India are emerging as fast growing markets. Key players operating in the HCL leaching high purity alumina market are Alcoa Corporation, Norsk Hydro ASA, Sumitomo Chemical Co Ltd, Alumina Ltd, Orbite Technologies Inc. Growing downstream demand has spurred capacity expansions by major players. However, compliance to emission norms remains a key challenge.

#HCL Leaching High Purity Alumina Market Share#HCL Leaching High Purity Alumina Market Growth#HCL Leaching High Purity Alumina Market Demand#HCL Leaching High Purity Alumina Market Trend

0 notes

Text

HCL Leaching High Purity Alumina Market Potential: Exploring Untapped Opportunities

High purity alumina or HPA is an aluminium oxide product with a minimum purity level of 99.99%. It is used as a key component in LED bulbs due to its properties such as high brightness and energy efficiency. HPA finds major application in LED bulbs, smartphone sapphire glass, and semiconductors.

The HCL Leaching High Purity Alumina market is estimated for 2023-2030 for the forecast period, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The growing demand for HPA from the LED industry is estimated to drive the growth of the market during the forecast period. LED bulbs use HPA as a base material which helps boost light emission and provides energy efficiency. Additionally, increasing consumer preference towards LED lighting over traditional lighting owing to various benefits such as high brightness, durability, and low energy consumption is also expected to support the market growth. Furthermore, rapid urbanization along with increasing disposable income in developing countries is surging the demand for smartphones and other consumer electronics which utilize sapphire glass made from HPA. This is further expected to fuel the HCL leaching high purity alumina market growth over the forecast period.

#HCL Leaching High Purity Alumina Market Share#HCL Leaching High Purity Alumina Market Growth#HCL Leaching High Purity Alumina Market Demand

0 notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Impact Minerals Reaches Key Milestones with Maiden Resource Estimate and R&D Funding for Lake Hope HPA Project

Impact Minerals Limited (ASX: IPT) ("Impact Minerals" or "the Company") has achieved two pivotal milestones as it advances its position in the high-purity alumina (HPA) market. The company announced its Maiden Measured Resource Estimate alongside securing essential R&D funding for its flagship Lake Hope Project in Western Australia, located approximately 500 kilometres east of Perth.

The Maiden Measured Resource Estimate revealed 730,000 tonnes of lake clay at 25.8% alumina, translating to 189,000 tonnes of alumina (Al₂O₃). This robust resource base is projected to sustain at least 15 years of production, significantly reducing project risks and improving its long-term economic viability.

In addition to this, Impact Minerals received a $512,000 R&D tax rebate under the Australian Government’s Research and Development Tax Incentive program. This funding builds on the recent $2.87 million CRC-P grant awarded by the Federal Government, further bolstering the development of the Lake Hope Project and strengthening its financial foundation.

These milestones underscore Impact Minerals’ progress in establishing itself as a key contender in the growing HPA sector.

0 notes

Text

0 notes

Text

Hcl Leaching High Purity Alumina Market Unlock the Potential of the Worldwide Market

Hydrochloric acid (HCl) leaching is a process used to extract high purity alumina from bauxite ore. Bauxite is a type of rock that contains a high amount of aluminum hydroxide (Al2O3·3H2O), which is the precursor to high purity alumina. In the HCl leaching process, bauxite ore is treated with hydrochloric acid, which dissolves the aluminum hydroxide and leaves behind impurities such as iron and silica. The solution is then filtered and processed to recover the high purity alumina. This process is commonly used in the production of aluminum and other high-tech applications where high purity alumina is required.

Hcl Leaching High Purity Alumina Market

The market for Hcl Leaching high purity alumina Market is growing due to increasing demand from various industries such as electronics, aerospace, and automobile manufacturing. High purity alumina is used in a variety of applications as a key component in the production of advanced materials, ceramics, and other high-tech products. This increasing demand is driving growth in the market for HCl leaching-based high purity alumina production.

Additionally, the development of new technologies for the production of high purity alumina is expected to further drive the growth of the market. This includes the use of new leaching agents, improved filtration methods, and better refining processes, which are all aimed at improving the efficiency and economics of the HCl leaching process.

Some of the major companies operating in the global HCL leaching high purity alumina industry are Alcoa Inc., Bukowski, Orbite Technologies Inc., Altech Chemicals Limited, Sumitomo Chemical Co., Xuancheng Jingrui New Material Co., Ltd., Nippon Light Metal Company Ltd., Dalian Hiland Photoelectric Material Co., Ltd., Sasol, and Rusal.

However, factors such as the high cost of production, environmental regulations, and competition from alternative methods may limit the growth of the market. Despite these challenges, the market for high purity alumina produced through HCl leaching is expected to continue to grow in the coming years, driven by increasing demand from various industries and technological advancements.

The market for high purity alumina produced through HCl leaching is characterized by the following trends:

Increased demand: The demand for high purity alumina is growing due to its widespread use in various high-tech industries such as electronics, aerospace, and automobile manufacturing.

Technological advancements: There has been a continued effort to improve the efficiency and economics of the HCl leaching process, resulting in the development of new technologies such as the use of new leaching agents and improved filtration methods.

Environmental regulations: The HCl leaching process can have negative environmental impacts, leading to regulations aimed at reducing its environmental footprint. Companies in the industry are focusing on developing more sustainable and environmentally friendly processes.

Cost competitiveness: The high cost of production associated with HCl leaching is a challenge for the industry, and companies are focusing on reducing costs through the optimization of production processes and the use of cost-effective raw materials.

Competition from alternative methods: The market for high purity alumina produced through HCl leaching faces competition from other methods of alumina production, such as the Bayer process, which is also used to produce high purity alumina.

In summary, the market for high purity alumina produced through HCl leaching is expected to continue to grow, driven by increasing demand and technological advancements, while facing challenges such as environmental regulations, cost competitiveness, and competition from alternative methods.

To Know More Click @ https://www.coherentmarketinsights.com/insight/request-sample/282

#Hcl Leaching High Purity Alumina Market#Hcl Leaching High Purity Alumina Market Growth#Hcl Leaching High Purity Alumina Market Trends

0 notes

Text

0 notes

Text

HCL Leaching High Purity Alumina Market Momentum: Riding the Wave of Progress

High purity alumina (HPA) is a refined form of aluminum oxide or alumina containing at least 99.99% of alumina or Al2O3. HPA finds wide applications in LED lights, semiconductors, smartphone sapphire glass, and others owing to its purity, hardness, and corrosion resistance properties. The HCL leaching process involves leaching bauxite or aluminum ores with hydrochloric acid to extract alumina in the form of aluminum chloride, which is then purified through a series of steps to produce high purity alumina. The HCL leaching technology offers advantages such as lower capital and production costs as compared to other production methods. The global HCL Leaching High Purity Alumina Market is estimated to be valued at US$ 3.5 billion in 2023 and is expected to exhibit a CAGR of 13% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Opportunity: The rising demand for high purity alumina from the semiconductor industry is estimated to drive the growth of the HCL leaching high purity alumina market during the forecast period. High purity alumina finds increasing usage in applications such as LED lights and semiconductors. The semiconductor industry has been witnessing rapid growth facilitated by the proliferation of smart devices along with increasing penetration of technologies such as 5G, internet of things, and artificial intelligence. This rising demand for semiconductors is estimated to further augment the demand for high purity alumina, thereby propelling the growth of the HCL leaching high purity alumina market over the forecast period. Porter’s Analysis Threat of new entrants: The HCL leaching high purity alumina market requires high capital and has strong economies of scale. Therefore threat of new entrants is moderate. Bargaining power of buyers: Buyers have moderate bargaining power in this market as there are several established players. Bargaining power of suppliers: Bauxite is the key raw material and suppliers have moderate bargaining power due to availability of substitutes. Threat of new substitutes: Threat of new substitutes is low as HCL leaching process has advantages over other production methods. Competitive rivalry: The market is consolidated with top players having significant market share. SWOT Analysis Strength: HCL leaching process offers high purity alumina at low cost. Established players have strong production capabilities and economies of scale. Weakness: The process requires sophisticated technology and high capital expenditure. Regulations regarding carbon emissions are becoming stricter. Opportunity: Growing demand for LEDs, lithium-ion batteries and other end-use industries driving the need for high purity alumina. Developing regions offer new growth avenues. Threats: Volatility in raw material prices and trade disputes can impact project feasibility. Stringent environmental norms pose compliance challenges. Key Takeaways The global HCL leaching high purity alumina market is expected to witness high growth during the forecast period owing to increasing use of alumina in various end-use industries.

The Asia Pacific region currently dominates the market and is expected to maintain its leading position over the coming years. China has a strong production base while countries like India are emerging as fast growing markets. Key players operating in the HCL leaching high purity alumina market are Alcoa Corporation, Norsk Hydro ASA, Sumitomo Chemical Co Ltd, Alumina Ltd, Orbite Technologies Inc. Growing downstream demand has spurred capacity expansions by major players. However, compliance to emission norms remains a key challenge.

#HCL Leaching High Purity Alumina Market Share#HCL Leaching High Purity Alumina Market Growth#HCL Leaching High Purity Alumina Market Demand#HCL Leaching High Purity Alumina Market Trend

0 notes

Text

Oxyde d'aluminium calciné, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 16 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Oxyde d'aluminium calciné 2024-2030”, publié par QYResearch, la taille du marché mondial de Oxyde d'aluminium calciné devrait atteindre 3780 millions de dollars d'ici 2030, à un TCAC de 0.3% au cours de la période de prévision.

Figure 1. Taille du marché mondial de Oxyde d'aluminium calciné (en millions de dollars américains), 2019-2030

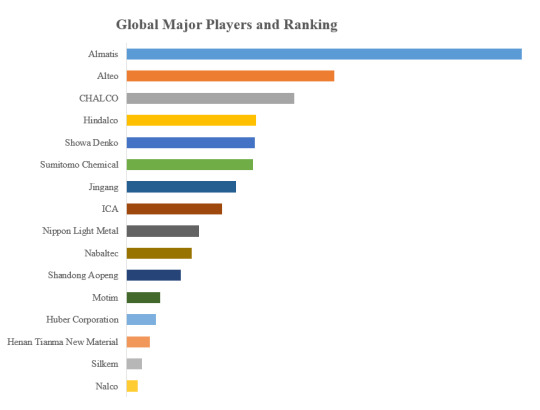

Selon QYResearch, les principaux fabricants mondiaux de Oxyde d'aluminium calciné comprennent Almatis, Alteo, CHALCO, Hindalco, Showa Denko, Sumitomo Chemical, Jingang, ICA, Nippon Light Metal, Nabaltec, etc. En 2023, les dix premiers acteurs mondiaux détenaient une part d'environ 48.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 16 premiers acteurs mondiaux de Oxyde d'aluminium calciné (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The market for calcined aluminum oxide, also known as alumina, is influenced by various factors that drive demand and supply dynamics within the industry. Here are some key drivers that impact the calcined aluminum oxide market:

1. Growing Demand in the Ceramics Industry: Calcined aluminum oxide is a crucial raw material in the ceramics industry, where it is used in the production of high-quality ceramics, refractories, and abrasives. The demand for calcined alumina in the ceramics sector is driven by infrastructure development, increased construction activities, and the growing need for advanced ceramic materials in various applications.

2. Increasing Demand in the Abrasives Industry: Calcined aluminum oxide is widely used as an abrasive material in applications such as grinding wheels, sandpaper, and polishing. The abrasives industry's growth, driven by diverse sectors like manufacturing, automotive, construction, and metalworking, contributes significantly to the demand for calcined alumina.

3. Growing Demand in Refractories: Calcined aluminum oxide plays a crucial role in the production of refractory materials used in high-temperature applications like steelmaking, glass production, and cement manufacturing. The demand for refractories in industries such as metallurgy and construction influences the market for calcined alumina.

4. Increasing Demand in the Electronics Industry: The electronics industry uses calcined aluminum oxide in various applications such as insulating components, electronic packaging, and substrates for semiconductor production. The growth of the electronics sector, including developments in semiconductors, LEDs, and electronic components, drives the demand for high-purity calcined alumina.

5. Automotive and Aerospace Applications: Calcined aluminum oxide is used in automotive and aerospace applications for components requiring high strength, wear resistance, and thermal stability. As these industries continue to innovate and demand high-performance materials, the need for calcined alumina as a key component in advanced materials grows.

6. Environmental Regulations and Sustainability: Increasing focus on environmental regulations and sustainability practices is driving the demand for eco-friendly materials in various industries. Calcined alumina produced using sustainable practices and meeting stringent environmental standards can attract environmentally conscious consumers and industries.

7. Research and Development: Advancements in manufacturing processes, product quality, and new applications for calcined aluminum oxide can drive market growth. Continuous research and development efforts to improve the properties and applications of calcined alumina can open up new market opportunities.

8. Global Economic Trends: Macroeconomic factors like industrial output, GDP growth, infrastructure development, and global trade impact the demand for calcined aluminum oxide. Market fluctuations, currency exchange rates, and geopolitical factors can also influence the market dynamics for calcined alumina.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes

Text

0 notes

Text

0 notes