#HardFork

Explore tagged Tumblr posts

Text

Significance of Tonconnect for the TON Community and Its Importance

Significance of Tonconnect for the TON Community and Its ImportanceTonconnect is not just another fork; it represents a new era for the TON community, bringing unique advantages and opportunities that can shape the future of the entire ecosystem. Here’s why Tonconnect is highly significant and why it matters:1. First Fork of TON: A New BeginningTonconnect is the first hard fork of The Open Network (TON), marking a pivotal moment in its history. It introduces new possibilities, technology, and value propositions that can push the entire TON ecosystem to new heights. As the first fork, Tonconnect is pioneering innovation within the network, serving as a fresh platform for growth and exploration.2. Empowering the CommunityTonconnect is community-driven, designed to give power back to the users. It aims to create an open, inclusive, and supportive environment where community members have a say in the project’s future. By fostering a sense of ownership, Tonconnect brings people together, strengthening the TON community through shared goals and visions.3. Strategic Scarcity: A Catalyst for ValueWith a 50% token burn, Tonconnect introduces scarcity into the market, which can drive demand and enhance the value of TonC over time. This strategy creates a more sustainable ecosystem by controlling supply, aligning with the community’s interest in long-term growth and stability.4. Expanding the EcosystemTonconnect provides a new avenue for development within the TON ecosystem. Its launch creates opportunities for developers, influencers, and enthusiasts to participate in building decentralized applications (dApps), platforms, and services on top of the TonC network. This expansion is vital for diversifying use cases, strengthening TON’s position in the broader crypto market.5. Attracting New Users and Mass AdoptionBy targeting a community size of 30 to 300 million users, Tonconnect is driving mass adoption and mainstream interest in the TON ecosystem. Its innovative airdrop and referral program incentivize users to join, engage, and spread the word, accelerating TON’s visibility and growth globally.6. Creating Long-term PotentialTonconnect is not just about quick gains; it’s about building a solid foundation for the future. The strategic distribution of tokens, systematic burn plan, and long-term vision make Tonconnect a significant asset for those looking to invest in and contribute to the evolving TON landscape.Tonconnect is an essential part of the TON community’s future. It brings innovation, empowerment, scarcity, and growth to the ecosystem, providing a platform for mass adoption and long-term value creation. By involving the community at every step, Tonconnect is set to redefine what’s possible within the TON network, making it a project that every TON enthusiast should watch closely and engage with.Join the revolution. Join Tonconnect.WebsiteTwitterInstagramTelegram

0 notes

Text

ウィミックス財団は、暗号資産WEMIXの価値とエコシステムをさらに強化するための新しいトークノミクス「ブリオッシュハードフォーク」を2024年7月1日に実施します。この革新的なアップデートは、WEMIXのミンティング量を効果的に管理し、コミュニティ主導のエコシステムへと移行することを目的としています。

0 notes

Text

What Exactly is the VASIL Hard Fork: In Simple Terms (Part 1 of 2)

Read the original article HERE.

The Cardano community is abuzz with excitement for the upcoming VASIL Hardfork. But you may be reading this and wonder: what is VASIL? This post should help answer your question, even if you aren’t crypto-savvy.

What is a Hard Fork?

A hard fork in the crypto world is when the developers of a currency make a second branch (or “fork”) with the same basic code of the original currency. Hard forks usually bring significant changes to the efficiency, protocol, governance, or security of a currency. The VASIL hard-fork, in particular, is focused on improving the efficiency of the Cardano network.

Diffusion Pipelining

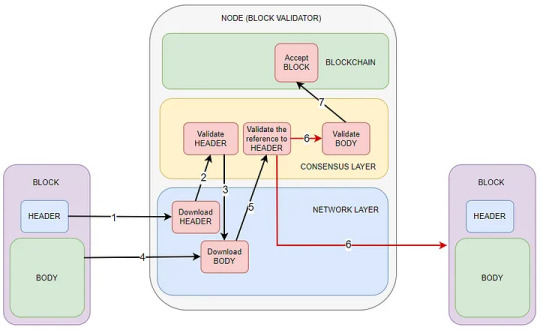

Diffusion means “the spreading of something more widely” and pipelining means “transportation by means of pipelines.” These definitions don’t explicitly help us here since diffusion pipelining is actually a computing term. Diffusion pipelining enhances the efficiency of a blockchain by allowing blocks (a place on the blockchain that stores information on the transactions inside and the blocks that it links to) to be distributed to other nodes (“users” on the blockchain) before it is validated. So nodes will be able to validate the reference to the header (summary of what's in the block) and then distribute that block while still validating the body of the block (shown by the red arrows in the diagram below).

This means that a block can be sent to 95% of the network while the block is also being validated, greatly improving the throughput of the network.

CIP-32

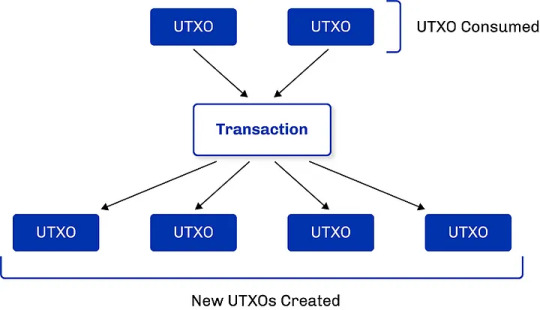

Cardano Improvement Proposal 32 (CIP-32) allows for the addition of inline Datums to a UTXO (an unspent transaction output, I highly recommend you read the Cardano documentation about UTXO-based blockchains). Datum is a piece of information about a UTXO’s owner and other timing details. Previously, the Datum is attached to a UTXO in the form of a hash, so the actual data that the hash represents can be accessed only if the UTXO is spent (when the unspent outputs are used as an input).

CIP-32, however, allows the Datum to be displayed on the UTXO instead of displaying the Datum’s hash (hashes were initially chosen because it was believed that hashes would take up less space, reducing the size of blocks). This will help dApp developers since they will be able to see the Datum without using any computational power to calculate hashes.

Now, you may have one question: what if the Datum is larger than the Datum’s hash? If the Datum is larger, this would take up more space in the block and reduce the efficiency of the network. The great thing about CIP-32 is it allows you to choose, either use the Datum itself or its hash. This way, we get the best of both worlds.

Part two will come out soon…

If you enjoyed reading this, consider following. It helps a lot!

ADA Crunch

2 notes

·

View notes

Text

4844 Data Challenge: Insights and Winners

In March 2024, the Ethereum network underwent a significant upgrade with the implementation of EIP-4844, an essential part of the Dencun hardfork, aimed at bolstering Ethereum’s role as a data availability layer. This upgrade introduced “blobs” of data, dramatically enhancing the scalability of Layer 2 solutions by increasing data availability by approximately 100 times. As with any major…

View On WordPress

0 notes

Text

I go in and out with 🔗🎙️Hardfork with Casey Newton and Kevin Roose. Topics aside the ‘out’ is often because they both have a habit of moving the tone of their voice up a couple of octaves which truly pierce’s my ear drums.

And just now I realized how much they also remind me of YouTuber 🔗📼 Ryan George — who can be very funny - and equally piercing.

0 notes

Text

Quotazione di Polkadot DOT/USDT in questo momento: Introduzione a Polkadot DOT Polkadot è un network che permette l'interconnessione di diverse blockchain, garantendo le transazioni non solo di token digitalizzati (e dunque anche tecnicamente di criptovaluta) ma anche di dati di altro tipo. È uno dei progetti più forti del momento e il suo token di riferimento, DOT, è oggi tra i primi 10 per capitalizzazione dell'intero comparto. Polkadot e il suo token sono però molto di più di un progetto di scambio di valori e dati: mirano ad assumere una posizione assolutamente centrale all'interno del mondo delle criptovalute e delle blockchain, cosa che stanno già riuscendo a fare, anche grazie alla spinta propulsiva dei progetti DeFi, ovvero di finanza decentralizzata. Un grande progetto - solido tecnicamente e con molte particolarità - al quale dedichiamo un approfondimento utile sia per chi vorrà investire su DOT, sia per chi invece vorrà comprenderne le caratteristiche tecniche. Principali informazioni su Polkadot Coin: ❓Nome:Polkadot📑Sigla:DOT👶Nascita:2016📈Previsioni:Previsioni Polkadot🔍Tecnologia:Interchain operability - Nominated PoS⚡Comprare:Come comprare Polkadot📱Wallet:Ledger X, Ledger S, Polkawallet, Polkadot.JSPolkadot – Tabella principali caratteristiche introduttive Polkadot: Capitalizzazione di mercato, statistiche prezzo DOT/USD Cos’è Polkadot (DOT) Polkadot è una blockchain scalabile, che garantisce l'interoperabilità tra diversi network nonché un protocollo sicuro per la connessione tra diverse chain. È un progetto di Web3, che punta a sviluppare infrastrutture informatiche per un web decentralizzato, al centro del quale, insieme ad altri progetti, si troverà proprio Polkadot. Siamo davanti ad un progetto monumentale, con obiettivi molto ambiziosi e che punta ad offrire anche una base importante per lo sviluppo di progetti autonomi e collaterali. - Blockchain scalabile Al nucleo del progetto c'è la sua scalabilità. Senza entrare in concetti troppo tecnici - che sarebbero inadeguati a questo punto del nostro approfondimento - l'obiettivo della scalabilità si traduce nella possibilità di ospitare sempre più progetti, garantire sempre maggiore connettività senza aumento di consumi e di costi e senza rallentamenti. La scalabilità è una delle caratteristiche principali di Polkadot - Interconnessione tra le blockchain In realtà ci sono diversi progetti che offrono infrastrutture informatiche per la connessione tra blockchain che altrimenti non potrebbero parlare tra di loro. La particolarità di Polkadot risiede nell'offrire interfacce che permettono di trasmettere anche dati raw, ovvero non tokenizzati. Questo può essere estremamente importante per i dati utili all'innesco di uno smart contract, che arrivano ad esempio dalle borse o da altri tipi di centri dati. Polkadot permette l'interazione completa tra diverse blockchain La soluzione offerta è già pienamente funzionante e ospita già progetti che si appoggiano sia all'una, sia all'altra versione di dati. Tokenizzati o meno, per intenderci. - Non serve hardfork E qui iniziamo ad entrare nel tecnico. I progetti blockchain di vecchia generazione per implementare novità significative all'interno del progetto dovevano sdoppiarsi, ovvero dividere l'albero e continuare sul progetto. Si tratta di una procedura lenta, costosa in termini di risorse e spesso confusionaria. Polkadot (DOT) è invece un progetto che permette di implementare novità in corsa, o meglio in produzione, senza che ci sia la necessità di sdoppiare l'albero e lasciarne un altro come dismesso. Una struttura di questo tipo, che è oggi in realtà comune a tantissime e diverse blockchain, rende Polkadot molto più utile nel caso in cui si volessero implementare delle novità che il mercato richiede. - Dai co-fondatori di Ethereum Importante, in questa fase iniziale, parlare anche dei fondatori che animano il progetto. Tra questi figura Gavin Wood, che i più appassionati di criptovalute ricorderanno essere uno dei fondatori di Ethereum. Personaggio di spessore all'interno della community delle criptovalute e inventore dei protocolli Proof of Authority e Whisper. Come funziona Polkadot DOT Prima di essere una criptovaluta (cosa che tecnicamente è DOT), Polkadot è un protocollo blockchain di ultima generazione, che ha come scopo principale quello di permettere l'interconnessione tra diverse chain, interne o esterne al progetto. Ci sono diverse caratteristiche che potremmo definire come uniche del progetto. - Scalabilità Le blockchain classiche possono performare soltanto un numero finito di operazioni e rapidamente possono diventare troppo esose in termini di costi di transazione o lente nel processare le informazioni. Polkadot invece ha un design shared multichain, il che vuol dire che può processare le informazioni e le transazioni appoggiandosi a diverse blockchain in parallelo. Questo permette di eliminare alla radice i fenomeni dei colli di bottiglia - che sono uno dei problemi principali delle blockchain di vecchia generazione - e di poter avere una scalabilità sulla carta infinita. - Flessibilità Un altro dei problemi tipici delle blockchain di vecchia generazione è che sono altamente incapaci di adattarsi ad usi diversi da quelli per cui erano concepiti. In Polkadot invece la flessibilità è by design. Si possono sviluppare parachain, ovvero delle blockchain sovrane ma integrate nel progetto principale, che possono operare secondo le proprie regole e adattarsi alle necessità del progetto. La sovranità dei progetti ospitati è un aspetto di grande impatto sull'apprezzamento di Polkadot Questo mette nelle mani degli sviluppatori un enorme potenziale, che permette la nascita di progetti che altri tipi di sistemi non avrebbero mai consentito. Il fatto di consentire la sovranità a progetti interni rende Polkadot cruciale all'interno della nuova ondata della finanza decentralizzata. Ovvero i sistemi che puntano ad offrire servizi simil-bancari su blockchain. Chi è a suo agio con i termini mutuati dall'informatica, potrebbe immaginare parachain e regole generali di Polkadot come delle librerie che possono essere facilmente inserite nei propri progetti. - Condivisione delle informazioni e delle funzionalità Proprio come se fossero dei software che condividono lo stesso sistema operativo. Una delle cose più importanti che possono essere condivise sono le validazioni delle transazioni. Polkadot è una sorta di autostrada agnostica delle informazioni Chi vuole sviluppare la propria App distribuita, può fare affidamento, dietro pagamenti in DOT, proprio sull'intero network che abbiamo appena descritto. La cruciale importanza di DOT è collegata, ma è un concetto che esprimeremo con maggiore dovizia di particolari più avanti, all'utilizzo che si fa della piattaforma. Quali sono le principali caratteristiche del progetto? Ci sono diverse caratteristiche degne di nota per il progetto, che andremo ad analizzare una per una, anche allo scopo di differenziare questo progetto dai tanti che potrebbero sembrare, almeno ad uno sguardo poco attento, simili. - Può integrare progetti nativi Polkadot nasce non soltanto con l'obiettivo di far comunicare blockchain già esistenti. Al suo interno, grazie anche a Substrate, permette di sviluppare progetti nativi, che sono naturalmente integrati con la blockchain centrale. Questo è un fattore di grandissima attrattiva per chiunque voglia avvicinarsi al progetto e sfruttarlo per il proprio sviluppo. - L'utilizzo del network è a pagamento Nel senso che ci sono dei costi coinvolti per approfittare dei nodi del network, della loro capacità di validazione e della loro sicurezza. Questo prezzo viene pagato in DOT, che rimane la criptovaluta gas all'interno dell'intero progetto. Per questo diciamo che il valore di DOT sarà direttamente collegato a quanto il progetto riuscirà a fare in termini di volumi di utilizzo. DOT è il gas del progetto, che utilizziamo per ottenere risorse dagli altri - Tantissime transazioni al secondo E parliamo di limiti che non sono teorici, ma effettivi. È stato già agilmente superato il limite di 1.000 transazioni al secondo, che per moltissime blockchain di vecchia generazione, pensiamo a Bitcoin ma anche a Litecoin, per nominare due dei progetti più anziani, sono numeri che almeno per il momento non possono essere raggiunti. - DOT non è un mezzo di scambio di valore Dal Whitepaper emerge chiaramente la volontà di fare di DOT un utility token Almeno nelle funzionalità del progetto originario, DOT non è utilizzato per pagare servizi o beni, ma soltanto all'interno della blockchain di Polkadot. Questo ovviamente non è un limite fisico, ma piuttosto l'intenzione di chi ha creato il progetto. I token DOT comunque continuano a guadagnare valore sulle principali piazze che offrono scambi in criptovaluta. - Polkadot non vuole rimpiazzare altre criptovalute Soprattutto tra quelle che hanno come funzione principale il pagamento per beni o servizi. Il progetto nato per permettere l'integrazione tra diverse blockchain, con un sistema molto complesso ma che non è nato per i pagamenti. Ovviamente nulla vieta a due parti private di mettersi d'accordo e pagarsi di DOT. Ma non è questa la funzionalità principale del progetto. - Staking All'interno di Polkadot si può fare anche staking, ottenendo anche delle ricompense. Vale la pena però di sottolineare, per chi dovesse interessarsi a questo scopo di DOT, che esistono delle tasse per i nodi che fanno staking e sono inattivi, che rendono lo stake and wait una pratica molto poco invitante almeno su questo network. L'obiettivo principale è quello di favorire la cooperazione, soprattutto tra i progetti che sono nati all'interno della chain e che fanno staking per assumerne almeno in parte la governance. - Un mondo di microstati Torniamo ancora una volta sul concetto di sovranità dei progetti che sono tecnicamente ospitati su Polkadot. Immaginiamo di avere il nostro piccolo stato, piccolissimo, grande anche un solo quartiere. Abbiamo la libertà di creare le nostre regole, di decidere come funzionano gli spostamenti e il passaggio di denaro. Tuttavia un microstato del genere avrebbe enormi problemi a mantenere polizia e forze dell'ordine, nonché ad avere un rigido apparato di controllo. Polkadot, passateci la metafora estremamente poco tecnica, si occupa proprio di offrire questi servizi di vigilanza. Allo stesso tempo, come se fosse un benefico ente sovrastatale, si occupa anche di mantenere le strade che permettono a queste micro-comunità sovrane di scambiarsi dati, ma anche token digitalizzati. Un progetto quasi unico in questo senso e una configurazione che permette grandissima libertà di creazione a chi vuole iniziare a sviluppare utilizzando DOT e Polkadot. Approfondimenti sul progetto Ci sono diversi approfondimenti che si possono fare sul progetto, per chi volesse comprendere come funziona effettivamente e quali tipi di applicazioni può far girare al suo interno. - WhitePaper È il paper che viene utilizzato da tutte le criptovalute per spiegare il funzionamento della propria blockchain e del proprio progetto. Una lettura molto impegnativa, che è adatta soltanto a chi ha una buona formazione sia informatica, sia invece sulle blockchain. Rimane comunque la fonte di informazioni più tecnica su questo specifico progetto. - La community Polkadot ha una community estremamente attiva, che pubblica con costanza contenuti sul sito ufficiale. Chi volesse degli esempi pratici di applicazione sul network, può sicuramente rivolgersi a quella che è una delle community più tranquille e ospitali del mondo delle crypto. Qual’è sarà il futuro di Polkadot? Polkadot, pur essendo un progetto già molto importante, è in realtà ancora nella fase embrionale e ha cominciato da relativamente poco ad essere così centrale nell'ecosistema delle criptovalute. Si può parlare in diversi modi del futuro di Polkadot, tenendo conto anche delle previsioni prezzo di Polkadot DOT - che riguardano più strettamente il valore del token che anima questa specifica blockchain. - Previsioni di prezzo su DOT Le previsioni su prezzo di DOT sono ormai ottimiste e rialziste da diverso tempo e vengono costantemente riviste al rialzo. Sul medio periodo, che tradizionalmente riguarda orizzonti a 24 mesi, si punta decisi intorno a quota 35$, che però il progetto ha già quasi raggiunto con i prezzi attuali. Il valore futuro di Polkadot è molto interessante per gli investitori Sul lungo periodo, che invece riguarderebbe uno spazio di circa 4 anni, le previsioni più attendibili e i target sui quali c'è maggiore consenso parlano di 100$, che sarebbe in forte rialzo rispetto al valore attuale, ma probabilmente anche in questo caso da rivedere al rialzo tra poco, almeno se questo dovesse rimanere il pattern di crescita del progetto. Su DOT e sul suo utilizzo all'interno della blockchain in questione, valgono gli approfondimenti che abbiamo fatto poco sopra e che spiegano in dettaglio le diverse funzionalità che questo token può rivestire. Il suo prezzo sarà, molto probabilmente, in funzione del grado di utilizzo del network, delle parachain e dei progetti che verranno sviluppati al suo interno. - Le previsioni sull'espansione futura del progetto Queste sono altrettanto importanti, anche per chi guarda a Polkadot soltanto come un progetto sul quale investire - e non come chain delle chain per lo sviluppo di progetti distribuiti. Perché come abbiamo detto poco sopra, in realtà il valore di DOT sarà ancorato all'ubiquità e al livello di utilizzo di questa infrastruttura. Crediamo - e siamo sicuramente i più ottimisti a riguardo - che in realtà Polkadot sia ancora in una fase, se vogliamo, embrionale. Questo vuol dire che anche se i volumi di utilizzo del progetto sono già importanti, dovrebbero essere poca cosa rispetto a quello che il progetto può effettivamente fare nel futuro. E con il crescere dell'adozione del progetto, crescerà anche il valore dei DOT. Le previsioni, sebbene al rialzo, oggi sono comunque conservatrici. Non è difficile immaginare che Polkadot riuscirà a fare molto di più anche rispetto alle più rosee previsioni. Leggi anche la guida: Come comprare Polkadot DOT Polkadot DOT Blockchain La "blockchain" di Polkadot è in realtà in quattro parti, quattro diversi strati che contribuiscono alle funzionalità che rendono il progetto unico. Andremo adesso a descriverle in breve, cercando di offrire ai nostri lettori anche meno esperti di tecnologia un quadro che renda effettivamente l'idea della funzionalità del progetto. - Relay Chain È il centro nevralgico della chain di Polkadot. Si occupa infatti della sicurezza, del consenso sul protocollo e della possibilità di avere operazioni tra diverse blockchain. - Parachain Sono delle blockchain che il progetto definisce sovrane, ovvero che hanno il loro token di riferimento e che possono funzionare secondo le proprie regole, interfacciandomi poi con il nodo centrale. - Parathread Hanno molti punti in comune con le parachain, anche se hanno un pricing model che è del pay as you use, ovvero a consumo. Offrono possibilità di sviluppo più economiche sul poderoso network di Polkadot e offrono barriere di ingresso più basse rispetto ad una parachain classica. - Bridges Sono i cosiddetti ponti, che permettono la comunicazione tra parachain e parathread. E anche verso progetti esterni come Ethereum e Bitcoin. - Come funziona il consenso dentro Polkadot IL consenso è gestito tramite quattro diversi ruoli, con una specializzazione molto stretta, che contribuisce in ciascun nodo al corretto funzionamento del network. NOMINATORS: hanno il compito di selezionare i validatori (dei quali parleremo tra pochissimo) che sono validi, contribuendo alla sicurezza dell'intero network. Hanno anche la responsabilità di selezionare gli staking dots VALIDATORS: si preoccupano di validare le proof of stake da parte dei collators e partecipano al ruolo di gestione del consenso con altri variatori. COLLATORS: si preoccupano di raccogliere e di mantenere le transazioni tra utenti e di produrre le cosiddette proof per i validator. FISHERMEN: hanno il ruolo di controllo del network, nel senso che sono adibiti a ripotare eventuali comportamenti errati da parte dei validator e degli altri ruoli che gestiscono il consenso. Anche i nodi completi delle parachain possono svolgere questo ruolo. - Non si tratta di un meccanismo Proof of Work Ovvero quello che abbiamo visto con Bitcoin e con tantissime criptovalute di primissima generazione. Siamo infatti davanti ad un sistema che è detto Nominated Proof of Stake, dove, per farla semplice, non si devono compiere calcoli complessi ed esosi sul piano energetico per validare le operazioni. Vengono attribuiti a diversi nodi i ruoli che abbiamo definito poco sopra, così da permettere al network di funzionare in modo più agile e, tecnicamente, scalabile all'infinito. Polkadot DOT Wallet Ci sono diversi wallet che sono specificatamente pensati proprio per Polkadot - e che in genere supportano tutti quelli che sono i token che girano nativamente all'interno del network in questione. I wallet di Polkadot: abbiamo tre macro-alternative - Polkawallet È un wallet da installare sul proprio smartphone e che è disponibile sia per AppStore e dunque per smartphone Apple, sia nel mondo Android, sia tramite Google Play, sia tramite APK installabile senza passare dallo store. Sono supportati i trasferimenti di DOT, anche tramite codice QR, un sistema smart per il recupero dell'accesso al wallet stesso e una buona interfaccia per controllare i propri token e soprattutto per accedere allo staking. - Polkadot.js Un wallet sicuramente sui generis per chi non è molto esperto di questo settore. Permette infatti di stockare i propri DOT sia su Firefox che su Chrome, ovvero all'interno del proprio browser. Rispetto a quello che abbiamo citato poco sopra, questo wallet però non è in grado di offrire tutte le funzionalità che sono utili in questo tipo di wallet. È utile però per interagire con le DApps nel browser che possono utilizzare Dot per il proprio funzionamento. - Ledger I wallet fisici o hardware Ledger supportano oggi le estensioni DOT. Acquistando uno di questi wallet potremo iniziare a tenere sia su Ledger Nano X che su Ledger Nano S i nostri DOT - e anche la maggior parte dei token che girano comunque all'interno di questa blockchain. Una soluzione che è decisamente più sicura, perché permette anche di tenere i propri DOT sganciati dalla rete e dunque al riparo da eventuali attacchi. Secondo molti, not your key, not your wallet, a testimoniare come nei fatti tenere i propri DOT o qualunque altro tipo di criptovaluta su portafogli tecnicamente altrui non sia una grande idea. - Exchange Tutti i migliori exchange di criptovalute che offrono la possibilità di comprare DOT offrono anche un wallet integrato, che permette di tenere, temporaneamente (soprattutto se si investono grandi somme) i token. È una soluzione ideale per chi acquista e vuole tenere questo tipo di criptovaluta in portafoglio per poco tempo o che vuole comunque intervenire con acquisti di capitale ridotto. Polkadot Mining Polkadot non utilizza un algoritmo Proof of Work, ma una algoritmo Nominated Proof of Stake che non prevede la possibilità di fare mining. Chi pensava di poter entrare sul mercato andando a utilizzare le proprie apparecchiature, oppure anche acquistando dei PC per il mining hardware è purtroppo destinato a rimanere deluso. Di contro si possono però ottenere le staking rewards - ovvero, per farla semplice, dei pagamenti di DOT per il ruolo che svolgiamo all'interno della rete. Non è necessaria comunque una grande potenza di calcolo e dunque i concetti classici del mining - validi per tutte o quasi le criptovalute di vecchia generazione - non sono validi. I miners - o quelli che vorrebbero diventarlo, dovranno guardare necessariamente ad altri progetti. Read the full article

0 notes

Text

0 notes

Text

Cardano Ecosystem Steps into Decentralised Governance Era with ‘Chang’: All Details | Daily Reports Online

The Cardano blockchain team is actively working toward self-sustainability. Recently, Cardano completed its Chang upgrade, propelling the network into the era of decentralized governance. Now, ADA token holders can actively participate in electing representatives and contribute to development discussions. The Chang hardfork was implemented on block 10,764,778, according to reports. Essentially,…

0 notes

Text

🌟 #Tonconnect: The Future of Blockchain with 1000x Potential! 🌟Built on the foundations of #TON, Tonconnect is poised to deliver massive growth! With the right momentum and a robust community strategy, we’re targeting a 1000x price increase – just like #Bitcoin Cash and Ethereum Classic during their early days. 🚀Here’s why we believe Tonconnect can achieve exponential growth:🔗 First Hard Fork of TON: Building on proven tech with advanced scalability and security.🎯 Massive #Airdrop: Millions of users onboarded, creating liquidity and community strength.💎 Locked Token Strategy: Minimized sell pressure ensures steady value growth.📈 1000x Growth Potential: Following the footsteps of successful hard forks like #BCH and #ETC!Early adopters stand to gain the most – don’t miss your chance with Tonconnect! 🌐

1 note

·

View note

Text

Cardano’s Vasil Hardfork to Fetch Major Performance Boost

The much-anticipated Vasil hard fork, a significant upgrade to the Cardano blockchain, has successfully completed its first phase, as announced by Cardano operator Input Output Global Hong Kong on Twitter. This backward-incompatible update to the main network is poised to enhance smart contract capabilities, chain throughput, and reduce costs.

Key among the upgrades is the introduction of Plutus v2, the second iteration of Cardano's smart contract language. Plutus serves as the foundation of Cardano, segregating off-chain, user-machine-run smart contract code from on-chain transaction validation. Scheduled for release on September 27, one epoch after the hard fork, Plutus v2 will enable scripting contracts utilizing inputs and UTXOs without actual expenditure, allowing access to blockchain-stored data without traditional spending and UTXO recreation steps.

Vasil's enhancements to the Cardano ledger address transaction processing delays caused by the size of transactions running reference scripts, streamlining how reference scripts are handled. Following Vasil, Cardano plans to implement "diffusion pipelining," a scaling technique aimed at boosting speed and scalability. This method compresses idle time by disseminating blocks ahead of their complete validation while still validating headers, ensuring swift propagation of newly created blocks across the network within five seconds of their inception.

0 notes

Text

Crypto Pulse: Navigating the Future of Finance - Weekly Insights

Dear Traders. The world of cryptocurrency never sleeps, and this past week has been particularly buzzing with major news and developments. From significant legal settlements to technological advancements, here's a roundup of the most recent happenings in the crypto sphere.

Weekly Crypto News Round-Up

Summary of the Week's Most Impactful News - Binance and DOJ: The U.S. Department of Justice argues that Binance's former CEO should remain free until sentencing, but only within the U.S. This development could have implications for the exchange's global operations. - Cosmos Hub Developments: The founder of Cosmos calls for a chain split, affecting the ATOM token and its ecosystem, demonstrating the dynamic nature of blockchain governance. - KyberSwap Hacked: KyberSwap, a decentralized exchange, was hacked for $48 million, a significant event raising concerns over DeFi security. - Do Kwon's Extradition: A Montenegro court has approved the extradition of Terra's Do Kwon, a decision that could have repercussions for the broader crypto market. - Binance Settles for $4B: Binance agreed to a $4 billion settlement in a U.S. criminal case, with CEO Changpeng Zhao resigning and pleading guilty. - Bitcoin Hashrate War Escalates: The competition between Antpool and Foundry intensified, highlighting the competitive nature of Bitcoin mining as the Bitcoin ETF nears. - Ethereum's Layer 2 Debate: The implementation of Layer 2 solutions in Ethereum spurred discussions about their impact on scalability and efficiency. - Bitcoin's Anti-Censorship Questioned: The acknowledgment of a 'filter' by the mining pool F2Pool brought Bitcoin's anti-censorship principles to the fore.

Technical Analysis: Bitcoin #BTC, Bitcoin Dominance #BTC.D, Ethereum #ETH, Solana #SOL, Ripple #XRP, ChainLink #LINK and Some Potential Coins Price Prediction

The exclusive content has been posted in our announcement section. You can quickly read it here. Bitcoin at the Crossroads: Hold or Sell? Plus, Exciting New Altcoin Updates Including SOL's 275% Rally! 🤑

Upcoming Crypto Events

Noteworthy Events in the Crypto World - Beldex TestNet Hardfork: Scheduled for November 27, 2023, Beldex announces a significant TestNet hardfork at block height 1251330. - Beldex iOS Wallet Update: A major update for Beldex's iOS wallet is set to release, marking a significant enhancement for users. - Qtum Mandatory Update: Qtum has announced a mandatory update for its mainnet, expected around 00:24 UTC on November 27, 2023. - Binance Japan Listing: Binance expands its reach with a new listing in Japan, adding to the platform's global presence. - Flux Major News: Flux teases substantial news regarding its Web3 interoperability efforts, an exciting development in the space. - USH Airdrop: An airdrop event is set for rewarding active community members involved in liquidity provision and $HTM staking. - Bad Idea AI Chatbot V3.0 Launch: The AI Chatbot for Telegram by Bad Idea AI gets an upgrade to V3.0, enhancing user interaction with advanced features. - WeSendit MEXC Listing: WeSendit will be listed on MEXC with the WSI/USDT pair, a new trading opportunity for the community. - Scribe Available to All: Previously limited to manually approved creator pool owners, Scribe is now accessible to all users. - Vertex Protocol Bitrue Listing: Vertex Protocol gets listed on Bitrue with the VRTX/USDT pair, widening its market accessibility. - Tenset Bitget Listing: Tenset will be listed on Bitget with the 10SET/USDT pair, offering a new trading avenue for investors. - AMA with Ciphers on Concordium Blockchain: An AMA session with Ciphers focuses on bridging real-world assets and NFTs on the Concordium blockchain. - Sonic Testnet Upgrade: The Sonic testnet is reopening, focusing on swap transactions and boasting over 2,000 TPS. - Abu Dhabi Finance Week: A significant event where global financial industry leaders discuss economic and technological opportunities and challenges. - AMA with Arbitrum: An AMA session with Arbitrum focuses on building and growing the ecosystem, scheduled for 12:00 PM (EST). - QPIP-4 Vote for Qredo: A crucial vote for Qredo's QPIP-4, which could lead to significant changes in the platform. Source: coinmarketcal.com

Free Crypto Signals Review

Last Week's Crypto Signals Performance In November 2023, the All In One Crypto App's crypto signals showcased the following performance: - Total Signals: 3 - Wins: 2 - Losses: 1 - Breakeven: 0 - Profit Percentage: 14.09% - Winrate: 66.67% These statistics reflect a solid performance with a majority of the signals resulting in wins. The winrate of over 66% and a profit percentage of 14.09% indicate the effectiveness of the signals provided by the platform for that month.

Accurate Crypto Market Prediction Review

In the last month, the All In One Crypto App's crypto signals have shown impressive results: - SOL Performance: A signal for SOL predicted a 90% potential gain, which played out well, underlining the accuracy and potential of these crypto signals. - Market Update and Gains: Another update highlighted coins with a potential gain of 250% and 90%, showcasing the depth of market analysis and the potential for significant returns. - Bitcoin Success: A signal pertaining to Bitcoin met all its targets, demonstrating the platform's ability to accurately predict market movements. Overall, these results paint a picture of a robust and reliable signal system, capable of navigating the complexities of the crypto market and providing users with actionable insights for profitable trading decisions.

All In One Crypto App Exclusive Features

Exploring the Revolutionary Trading Tools of the All In One Crypto App - AI-based Future Trading Bots: This innovative feature utilizes advanced AI and technical analysis to swiftly analyze market trends. By interpreting indicators and patterns, the AI-based bot executes trades free from human emotion, ensuring consistent, data-driven results. It's a step into the future of trading, offering an edge in rapidly changing markets. - DCA (Dollar-Cost Averaging) Trading Bots: These bots optimize crypto gains by automatically purchasing assets at set intervals. This strategy is ideal for investors at all experience levels, promoting smarter and more disciplined investing strategies. - Copy Trading Bots: For those who are either new to trading or too busy to manage their trades actively, the Copy Trading Bots provide a convenient solution. These bots mirror the moves of experienced analysts in real-time, enabling users to trade effortlessly while maintaining control over their investments.

Join Our Premium Community

Exclusive Benefits for Premium Subscribers Take your crypto journey to the next level by joining the All In One Crypto App Premium Community. As a premium subscriber, you'll unlock a wealth of in-depth insights, advanced trading signals, and personalized support to enhance your trading experience. Our premium community offers: - Advanced Trading Tools: Get access to sophisticated AI tools and algorithmic trading bots. - Expert Analysis: Receive detailed market analyses and predictions from experienced traders. - Exclusive Signals: Benefit from high-quality, premium-only trading signals. - Personalized Support: Enjoy dedicated customer service for all your trading queries. Don't miss out on these exclusive benefits. Sign up today and be part of a community that's dedicated to helping you succeed in the dynamic world of cryptocurrency trading.

Stay Connected

Follow Us on Social Media - Mobile app - Telegram Channel - Telegram Group - Twitter - Facebook - YouTube - Instagram Read the full article

0 notes

Link

Seasoned Ethereum (ETH) fanatic and investor Ryan Berckmans printed a thread to emphasize the principle alternatives unlocked by noncustodial bridge mechanisms between varied second-layer options. They're resilient to sudden hardforks and might be much more useful resource environment friendly.Inter-L2 bridges are extra dependable and cheaper than rivals from L1s, Ryan Berckmans saysBridges between completely different Ethereum-based L2 scalers have already established themselves as much less dangerous and extra gas-optimized techniques in comparison with cross-L1 bridges. In future, their supremacy is about to turn out to be much more apparent, Berckmans opined in his thread yesterday on X.Inter-L2 bridges are already higher than cross-L1 bridges and are assured to proceed bettering vs. cross-L1, with no analysis threat.Let me attempt to clarify why.It’s honest to say that in the present day’s L2s have heavy coaching wheels, together with safety councils and admin multisigs. Many…— Ryan Berckmans ryanb.eth🦇🔊 (@ryanberckmans) September 3, 2023As an illustration, as soon as the underlying L1 laborious forks, each L2s on its high and their bridges are robotically migrated. In the meantime, a bridge between two L1s want guide migration initiated. When a paternal L1 reorganizes, all of its L2s comply with; there’s no want for any extra motion. Additionally, techniques of interconnected L2 protocols might be extra gasoline environment friendly in comparison with bridges from earlier generations due to the mixing of zero-knowledge proofs (ZKPs):A 3rd profit is that inter-L2 bridges can have their messages bundled into the identical aggregated verification that powers the L2s themselves. For instance, bridging exercise might be included in the identical zk proof used to settle a zk L2’s inside exercise at no extra L1 gasoline price.Cross-L1 bridges might be thought-about immutable provided that we assume that each begin and goal L1 blockchains won't ever bear hardforks.Berckmans talked about Hop Protocol, Throughout, Connext and Socket apps among the many pioneering cross-L2 decentralized bridges.Arbitrum strengthens its dominance in L2 scene with Stylus launchedNonetheless, the groups of L2 bridges have plenty of work to do, Berckmans concluded. In future, they are going to be of paramount significance for the worldwide worth switch system:In brief, inter-L2 bridges are assured to be extra dependable and cheaper than cross-L1 bridges. That’s why the Ethereum Commerce Community would be the major automobile for the multichain community economic system.As of in the present day, 90% of Ethereum’s L2s ecosystem is managed by two blockchains, i.e., Arbitrum One (ARB) and Optimism (OP). As coated by U.Right now beforehand, Arbitrum launched Stylus, an instrument for programmers working in non-EVM languages.With Stylus, builders can run good contracts and tokens written in WASM languages (C, C++ and Rust) in EVM-compatible blockchains with out limitations.Supply: https://u.in the present day/ethereum-eth-investor-explains-three-benefits-of-inter-l2-bridges

0 notes

Text

zkEVM’s daily active addresses have declined. Uniswap submitted a proposal seeking a friendly hardfork on Polygon zkEVM. As reported earlier, Polygon [MATIC] zkEVM was expecting a new network upgrade that would add multiple new features. The latest tweet from Polygon revealed that the rollup successfully completed its Dragonfruit upgrade. Read Polygon’s [MATIC] Price Prediction 2023-24 With the update, zkEVM has become the only rollup that supports Ethereum’s PUSH0. Dragonfruit update is successful Polygon announced that it would push out the Dragonfruit upgrade on 20 September, which has now been successfully released. With the update, Polygon zkEVM Mainnet Beta became up to date with the latest version of Solidity, maintaining the rollup’s equivalence with the EVM by incorporating support for the latest EVM opcode PUSH0. Dragonfruit Upgrade: successful Polygon zkEVM Mainnet Beta upgrade + bridge operations have completed successfully. System resumes full activity. Devs, the list of EVM networks that support PUSH0 opcode: 1) Ethereum 2) Polygon zkEVM Mainnet Beta — Polygon (@0xPolygon) September 20, 2023 For the uninitiated, PUSH0 is the latest EVM opcode included in the Shanghai hard fork. The update could have resulted in a hike in zkEVM’s network activity, but that was not the case. Unfortunately, the Dragonfruit update also did not have a positive impact on the rollup as zkEVM’s key metrics remained low. For instance, in the recent past, zkEVM’s daily active addresses took a downturn. A similar trend was also noted in terms of its daily transactions. Source: Artemis Thanks to this, zkEVM’s daily gas use also declined. Polygonscan’s data revealed that after spiking in late August, the rollup’s daily gas usage has plummeted sharply, suggesting less activity on the network. The rollup’s captured value was also declining, which was evident from the dip in its TVL and fees. Nonetheless, the overall ecosystem seemed to have grown over the months as the total number of unique depositors continued to rise. Source: Polygonscan A new hardfork might be around the corner Amidst this, Uniswap [UNI] submitted a proposal for a friendly hardfork. For starters, a friendly fork refers to a situation in which a protocol is duplicated, creating a new version that maintains a positive and collaborative relationship with the original project. The newly submitted proposal aims to focus on the integration of Zero Protocol as a friendly fork of Uniswap on the Polygon zkEVM chain. A vote is now live, proposing a "friendly fork" between Uniswap DAO and Zero Protocol on Polygon zkEVM.@zero_zkevm will use Uniswap’s backend, while offering Uniswap a 10% token allocation and open R&D benefits. Details below. — Polygon DeFi | zkEVM Mainnet Beta (@0xPolygonDeFi) September 19, 2023 Is your portfolio green? Check out the MATIC Profit Calculator As per the official proposal, Uniswap can harness the advantages of Zero Protocol while ensuring that both projects benefit mutually and contribute to the evolving DeFi landscape. The proposal suggested a structured proposal timeline spanning three weeks to ensure transparency, community engagement, and thoughtful decision-making. Source

0 notes

Text

Quotazione di Polkadot DOT/USDT in questo momento: Polkadot è un network che permette l'interconnessione di diverse blockchain, garantendo le transazioni non solo di token digitalizzati (e dunque anche tecnicamente di criptovaluta) ma anche di dati di altro tipo. È uno dei progetti più forti del momento e il suo token di riferimento, DOT, è oggi tra i primi 10 per capitalizzazione dell'intero comparto. Polkadot e il suo token sono però molto di più di un progetto di scambio di valori e dati: mirano ad assumere una posizione assolutamente centrale all'interno del mondo delle criptovalute e delle blockchain, cosa che stanno già riuscendo a fare, anche grazie alla spinta propulsiva dei progetti DeFi, ovvero di finanza decentralizzata. Un grande progetto - solido tecnicamente e con molte particolarità - al quale dedichiamo un approfondimento utile sia per chi vorrà investire su DOT, sia per chi invece vorrà comprenderne le caratteristiche tecniche. Principali informazioni su Polkadot Coin: ❓Nome:Polkadot📑Sigla:DOT👶Nascita:2016📈Previsioni:Previsioni Polkadot🔍Tecnologia:Interchain operability - Nominated PoS⚡Comprare:Come comprare Polkadot📱Wallet:Ledger X, Ledger S, Polkawallet, Polkadot.JSPolkadot – Tabella principali caratteristiche introduttive Polkadot: Capitalizzazione di mercato, statistiche prezzo DOT/USD Cos’è Polkadot (DOT) Polkadot è una blockchain scalabile, che garantisce l'interoperabilità tra diversi network nonché un protocollo sicuro per la connessione tra diverse chain. È un progetto di Web3, che punta a sviluppare infrastrutture informatiche per un web decentralizzato, al centro del quale, insieme ad altri progetti, si troverà proprio Polkadot. Siamo davanti ad un progetto monumentale, con obiettivi molto ambiziosi e che punta ad offrire anche una base importante per lo sviluppo di progetti autonomi e collaterali. - Blockchain scalabile Al nucleo del progetto c'è la sua scalabilità. Senza entrare in concetti troppo tecnici - che sarebbero inadeguati a questo punto del nostro approfondimento - l'obiettivo della scalabilità si traduce nella possibilità di ospitare sempre più progetti, garantire sempre maggiore connettività senza aumento di consumi e di costi e senza rallentamenti. La scalabilità è una delle caratteristiche principali di Polkadot - Interconnessione tra le blockchain In realtà ci sono diversi progetti che offrono infrastrutture informatiche per la connessione tra blockchain che altrimenti non potrebbero parlare tra di loro. La particolarità di Polkadot risiede nell'offrire interfacce che permettono di trasmettere anche dati raw, ovvero non tokenizzati. Questo può essere estremamente importante per i dati utili all'innesco di uno smart contract, che arrivano ad esempio dalle borse o da altri tipi di centri dati. Polkadot permette l'interazione completa tra diverse blockchain La soluzione offerta è già pienamente funzionante e ospita già progetti che si appoggiano sia all'una, sia all'altra versione di dati. Tokenizzati o meno, per intenderci. - Non serve hardfork E qui iniziamo ad entrare nel tecnico. I progetti blockchain di vecchia generazione per implementare novità significative all'interno del progetto dovevano sdoppiarsi, ovvero dividere l'albero e continuare sul progetto. Si tratta di una procedura lenta, costosa in termini di risorse e spesso confusionaria. Polkadot (DOT) è invece un progetto che permette di implementare novità in corsa, o meglio in produzione, senza che ci sia la necessità di sdoppiare l'albero e lasciarne un altro come dismesso. Una struttura di questo tipo, che è oggi in realtà comune a tantissime e diverse blockchain, rende Polkadot molto più utile nel caso in cui si volessero implementare delle novità che il mercato richiede. - Dai co-fondatori di Ethereum Importante, in questa fase iniziale, parlare anche dei fondatori che animano il progetto. Tra questi figura Gavin Wood, che i più appassionati di criptovalute ricorderanno essere uno dei fondatori di Ethereum. Personaggio di spessore all'interno della community delle criptovalute e inventore dei protocolli Proof of Authority e Whisper. Come funziona Polkadot DOT Prima di essere una criptovaluta (cosa che tecnicamente è DOT), Polkadot è un protocollo blockchain di ultima generazione, che ha come scopo principale quello di permettere l'interconnessione tra diverse chain, interne o esterne al progetto. Ci sono diverse caratteristiche che potremmo definire come uniche del progetto. - Scalabilità Le blockchain classiche possono performare soltanto un numero finito di operazioni e rapidamente possono diventare troppo esose in termini di costi di transazione o lente nel processare le informazioni. Polkadot invece ha un design shared multichain, il che vuol dire che può processare le informazioni e le transazioni appoggiandosi a diverse blockchain in parallelo. Questo permette di eliminare alla radice i fenomeni dei colli di bottiglia - che sono uno dei problemi principali delle blockchain di vecchia generazione - e di poter avere una scalabilità sulla carta infinita. - Flessibilità Un altro dei problemi tipici delle blockchain di vecchia generazione è che sono altamente incapaci di adattarsi ad usi diversi da quelli per cui erano concepiti. In Polkadot invece la flessibilità è by design. Si possono sviluppare parachain, ovvero delle blockchain sovrane ma integrate nel progetto principale, che possono operare secondo le proprie regole e adattarsi alle necessità del progetto. La sovranità dei progetti ospitati è un aspetto di grande impatto sull'apprezzamento di Polkadot Questo mette nelle mani degli sviluppatori un enorme potenziale, che permette la nascita di progetti che altri tipi di sistemi non avrebbero mai consentito. Il fatto di consentire la sovranità a progetti interni rende Polkadot cruciale all'interno della nuova ondata della finanza decentralizzata. Ovvero i sistemi che puntano ad offrire servizi simil-bancari su blockchain. Chi è a suo agio con i termini mutuati dall'informatica, potrebbe immaginare parachain e regole generali di Polkadot come delle librerie che possono essere facilmente inserite nei propri progetti. - Condivisione delle informazioni e delle funzionalità Proprio come se fossero dei software che condividono lo stesso sistema operativo. Una delle cose più importanti che possono essere condivise sono le validazioni delle transazioni. Polkadot è una sorta di autostrada agnostica delle informazioni Chi vuole sviluppare la propria App distribuita, può fare affidamento, dietro pagamenti in DOT, proprio sull'intero network che abbiamo appena descritto. La cruciale importanza di DOT è collegata, ma è un concetto che esprimeremo con maggiore dovizia di particolari più avanti, all'utilizzo che si fa della piattaforma. Quali sono le principali caratteristiche del progetto? Ci sono diverse caratteristiche degne di nota per il progetto, che andremo ad analizzare una per una, anche allo scopo di differenziare questo progetto dai tanti che potrebbero sembrare, almeno ad uno sguardo poco attento, simili. - Può integrare progetti nativi Polkadot nasce non soltanto con l'obiettivo di far comunicare blockchain già esistenti. Al suo interno, grazie anche a Substrate, permette di sviluppare progetti nativi, che sono naturalmente integrati con la blockchain centrale. Questo è un fattore di grandissima attrattiva per chiunque voglia avvicinarsi al progetto e sfruttarlo per il proprio sviluppo. - L'utilizzo del network è a pagamento Nel senso che ci sono dei costi coinvolti per approfittare dei nodi del network, della loro capacità di validazione e della loro sicurezza. Questo prezzo viene pagato in DOT, che rimane la criptovaluta gas all'interno dell'intero progetto. Per questo diciamo che il valore di DOT sarà direttamente collegato a quanto il progetto riuscirà a fare in termini di volumi di utilizzo. DOT è il gas del progetto, che utilizziamo per ottenere risorse dagli altri - Tantissime transazioni al secondo E parliamo di limiti che non sono teorici, ma effettivi. È stato già agilmente superato il limite di 1.000 transazioni al secondo, che per moltissime blockchain di vecchia generazione, pensiamo a Bitcoin ma anche a Litecoin, per nominare due dei progetti più anziani, sono numeri che almeno per il momento non possono essere raggiunti. - DOT non è un mezzo di scambio di valore Dal Whitepaper emerge chiaramente la volontà di fare di DOT un utility token Almeno nelle funzionalità del progetto originario, DOT non è utilizzato per pagare servizi o beni, ma soltanto all'interno della blockchain di Polkadot. Questo ovviamente non è un limite fisico, ma piuttosto l'intenzione di chi ha creato il progetto. I token DOT comunque continuano a guadagnare valore sulle principali piazze che offrono scambi in criptovaluta. - Polkadot non vuole rimpiazzare altre criptovalute Soprattutto tra quelle che hanno come funzione principale il pagamento per beni o servizi. Il progetto nato per permettere l'integrazione tra diverse blockchain, con un sistema molto complesso ma che non è nato per i pagamenti. Ovviamente nulla vieta a due parti private di mettersi d'accordo e pagarsi di DOT. Ma non è questa la funzionalità principale del progetto. - Staking All'interno di Polkadot si può fare anche staking, ottenendo anche delle ricompense. Vale la pena però di sottolineare, per chi dovesse interessarsi a questo scopo di DOT, che esistono delle tasse per i nodi che fanno staking e sono inattivi, che rendono lo stake and wait una pratica molto poco invitante almeno su questo network. L'obiettivo principale è quello di favorire la cooperazione, soprattutto tra i progetti che sono nati all'interno della chain e che fanno staking per assumerne almeno in parte la governance. - Un mondo di microstati Torniamo ancora una volta sul concetto di sovranità dei progetti che sono tecnicamente ospitati su Polkadot. Immaginiamo di avere il nostro piccolo stato, piccolissimo, grande anche un solo quartiere. Abbiamo la libertà di creare le nostre regole, di decidere come funzionano gli spostamenti e il passaggio di denaro. Tuttavia un microstato del genere avrebbe enormi problemi a mantenere polizia e forze dell'ordine, nonché ad avere un rigido apparato di controllo. Polkadot, passateci la metafora estremamente poco tecnica, si occupa proprio di offrire questi servizi di vigilanza. Allo stesso tempo, come se fosse un benefico ente sovrastatale, si occupa anche di mantenere le strade che permettono a queste micro-comunità sovrane di scambiarsi dati, ma anche token digitalizzati. Un progetto quasi unico in questo senso e una configurazione che permette grandissima libertà di creazione a chi vuole iniziare a sviluppare utilizzando DOT e Polkadot. Approfondimenti sul progetto Ci sono diversi approfondimenti che si possono fare sul progetto, per chi volesse comprendere come funziona effettivamente e quali tipi di applicazioni può far girare al suo interno. - WhitePaper È il paper che viene utilizzato da tutte le criptovalute per spiegare il funzionamento della propria blockchain e del proprio progetto. Una lettura molto impegnativa, che è adatta soltanto a chi ha una buona formazione sia informatica, sia invece sulle blockchain. Rimane comunque la fonte di informazioni più tecnica su questo specifico progetto. - La community Polkadot ha una community estremamente attiva, che pubblica con costanza contenuti sul sito ufficiale. Chi volesse degli esempi pratici di applicazione sul network, può sicuramente rivolgersi a quella che è una delle community più tranquille e ospitali del mondo delle crypto. Qual’è sarà il futuro di Polkadot? Polkadot, pur essendo un progetto già molto importante, è in realtà ancora nella fase embrionale e ha cominciato da relativamente poco ad essere così centrale nell'ecosistema delle criptovalute. Si può parlare in diversi modi del futuro di Polkadot, tenendo conto anche delle previsioni prezzo di Polkadot DOT - che riguardano più strettamente il valore del token che anima questa specifica blockchain. - Previsioni di prezzo su DOT Le previsioni su prezzo di DOT sono ormai ottimiste e rialziste da diverso tempo e vengono costantemente riviste al rialzo. Sul medio periodo, che tradizionalmente riguarda orizzonti a 24 mesi, si punta decisi intorno a quota 35$, che però il progetto ha già quasi raggiunto con i prezzi attuali. Il valore futuro di Polkadot è molto interessante per gli investitori Sul lungo periodo, che invece riguarderebbe uno spazio di circa 4 anni, le previsioni più attendibili e i target sui quali c'è maggiore consenso parlano di 100$, che sarebbe in forte rialzo rispetto al valore attuale, ma probabilmente anche in questo caso da rivedere al rialzo tra poco, almeno se questo dovesse rimanere il pattern di crescita del progetto. Su DOT e sul suo utilizzo all'interno della blockchain in questione, valgono gli approfondimenti che abbiamo fatto poco sopra e che spiegano in dettaglio le diverse funzionalità che questo token può rivestire. Il suo prezzo sarà, molto probabilmente, in funzione del grado di utilizzo del network, delle parachain e dei progetti che verranno sviluppati al suo interno. - Le previsioni sull'espansione futura del progetto Queste sono altrettanto importanti, anche per chi guarda a Polkadot soltanto come un progetto sul quale investire - e non come chain delle chain per lo sviluppo di progetti distribuiti. Perché come abbiamo detto poco sopra, in realtà il valore di DOT sarà ancorato all'ubiquità e al livello di utilizzo di questa infrastruttura. Crediamo - e siamo sicuramente i più ottimisti a riguardo - che in realtà Polkadot sia ancora in una fase, se vogliamo, embrionale. Questo vuol dire che anche se i volumi di utilizzo del progetto sono già importanti, dovrebbero essere poca cosa rispetto a quello che il progetto può effettivamente fare nel futuro. E con il crescere dell'adozione del progetto, crescerà anche il valore dei DOT. Le previsioni, sebbene al rialzo, oggi sono comunque conservatrici. Non è difficile immaginare che Polkadot riuscirà a fare molto di più anche rispetto alle più rosee previsioni. Leggi anche la guida: Come comprare Polkadot DOT Polkadot DOT Blockchain La "blockchain" di Polkadot è in realtà in quattro parti, quattro diversi strati che contribuiscono alle funzionalità che rendono il progetto unico. Andremo adesso a descriverle in breve, cercando di offrire ai nostri lettori anche meno esperti di tecnologia un quadro che renda effettivamente l'idea della funzionalità del progetto. - Relay Chain È il centro nevralgico della chain di Polkadot. Si occupa infatti della sicurezza, del consenso sul protocollo e della possibilità di avere operazioni tra diverse blockchain. - Parachain Sono delle blockchain che il progetto definisce sovrane, ovvero che hanno il loro token di riferimento e che possono funzionare secondo le proprie regole, interfacciandomi poi con il nodo centrale. - Parathread Hanno molti punti in comune con le parachain, anche se hanno un pricing model che è del pay as you use, ovvero a consumo. Offrono possibilità di sviluppo più economiche sul poderoso network di Polkadot e offrono barriere di ingresso più basse rispetto ad una parachain classica. - Bridges Sono i cosiddetti ponti, che permettono la comunicazione tra parachain e parathread. E anche verso progetti esterni come Ethereum e Bitcoin. - Come funziona il consenso dentro Polkadot IL consenso è gestito tramite quattro diversi ruoli, con una specializzazione molto stretta, che contribuisce in ciascun nodo al corretto funzionamento del network. NOMINATORS: hanno il compito di selezionare i validatori (dei quali parleremo tra pochissimo) che sono validi, contribuendo alla sicurezza dell'intero network. Hanno anche la responsabilità di selezionare gli staking dots VALIDATORS: si preoccupano di validare le proof of stake da parte dei collators e partecipano al ruolo di gestione del consenso con altri variatori. COLLATORS: si preoccupano di raccogliere e di mantenere le transazioni tra utenti e di produrre le cosiddette proof per i validator. FISHERMEN: hanno il ruolo di controllo del network, nel senso che sono adibiti a ripotare eventuali comportamenti errati da parte dei validator e degli altri ruoli che gestiscono il consenso. Anche i nodi completi delle parachain possono svolgere questo ruolo. - Non si tratta di un meccanismo Proof of Work Ovvero quello che abbiamo visto con Bitcoin e con tantissime criptovalute di primissima generazione. Siamo infatti davanti ad un sistema che è detto Nominated Proof of Stake, dove, per farla semplice, non si devono compiere calcoli complessi ed esosi sul piano energetico per validare le operazioni. Vengono attribuiti a diversi nodi i ruoli che abbiamo definito poco sopra, così da permettere al network di funzionare in modo più agile e, tecnicamente, scalabile all'infinito. Polkadot DOT Wallet Ci sono diversi wallet che sono specificatamente pensati proprio per Polkadot - e che in genere supportano tutti quelli che sono i token che girano nativamente all'interno del network in questione. I wallet di Polkadot: abbiamo tre macro-alternative - Polkawallet È un wallet da installare sul proprio smartphone e che è disponibile sia per AppStore e dunque per smartphone Apple, sia nel mondo Android, sia tramite Google Play, sia tramite APK installabile senza passare dallo store. Sono supportati i trasferimenti di DOT, anche tramite codice QR, un sistema smart per il recupero dell'accesso al wallet stesso e una buona interfaccia per controllare i propri token e soprattutto per accedere allo staking. - Polkadot.js Un wallet sicuramente sui generis per chi non è molto esperto di questo settore. Permette infatti di stockare i propri DOT sia su Firefox che su Chrome, ovvero all'interno del proprio browser. Rispetto a quello che abbiamo citato poco sopra, questo wallet però non è in grado di offrire tutte le funzionalità che sono utili in questo tipo di wallet. È utile però per interagire con le DApps nel browser che possono utilizzare Dot per il proprio funzionamento. - Ledger I wallet fisici o hardware Ledger supportano oggi le estensioni DOT. Acquistando uno di questi wallet potremo iniziare a tenere sia su Ledger Nano X che su Ledger Nano S i nostri DOT - e anche la maggior parte dei token che girano comunque all'interno di questa blockchain. Una soluzione che è decisamente più sicura, perché permette anche di tenere i propri DOT sganciati dalla rete e dunque al riparo da eventuali attacchi. Secondo molti, not your key, not your wallet, a testimoniare come nei fatti tenere i propri DOT o qualunque altro tipo di criptovaluta su portafogli tecnicamente altrui non sia una grande idea. - Exchange Tutti i migliori exchange di criptovalute che offrono la possibilità di comprare DOT offrono anche un wallet integrato, che permette di tenere, temporaneamente (soprattutto se si investono grandi somme) i token. È una soluzione ideale per chi acquista e vuole tenere questo tipo di criptovaluta in portafoglio per poco tempo o che vuole comunque intervenire con acquisti di capitale ridotto. Polkadot Mining Polkadot non utilizza un algoritmo Proof of Work, ma una algoritmo Nominated Proof of Stake che non prevede la possibilità di fare mining. Chi pensava di poter entrare sul mercato andando a utilizzare le proprie apparecchiature, oppure anche acquistando dei PC per il mining hardware è purtroppo destinato a rimanere deluso. Di contro si possono però ottenere le staking rewards - ovvero, per farla semplice, dei pagamenti di DOT per il ruolo che svolgiamo all'interno della rete. Non è necessaria comunque una grande potenza di calcolo e dunque i concetti classici del mining - validi per tutte o quasi le criptovalute di vecchia generazione - non sono validi. I miners - o quelli che vorrebbero diventarlo, dovranno guardare necessariamente ad altri progetti. Read the full article

0 notes

Text

Kripto paralar için mevcut olan süratli dünyada, yaklaşan etkinlikler ve gelişmeler hakkında bilgi sahibi olmak yatırımcılar için çok kıymetli. İşte Bitcoin ve kripto para meraklılarının önümüzdeki hafta takip etmesi gereken kıymetli etkinlikler…Kripto paralar, bu hafta bu olaylara odaklanacak17 Temmuz Pazartesi günü Ethereum Topluluk Konferansı (EthCC) başlıyor ve 20 Temmuz’a kadar devam edecek. Bu aktiflik, Ethereum meraklıları ve uzmanlarının bir ortaya gelerek Ethereum ekosistemindeki son gelişmeleri ve gelecek beklentilerini tartışacakları heyecan verici bir toplantı olmayı vaat ediyor. 18 Temmuz Salı günüNuls (NULS) Mainnet V2.16.0 güncellemesinin bu gün yayınlanması planlanıyor. Güncelleme, NULS ağına kıymetli geliştirmeler getiriyor. Potansiyel olarak projenin performansını ve piyasa hassaslığını etkiliyor. Çarşamba, Temmuz 19’da ise Hyve (HYVE), HYVE platformunun yeni bir sürümünü tanıtan V2.5 güncellemesini başlatacak. Bu güncelleme, geliştirilmiş bir kullanıc�� arayüzü (UI) ve kullanıcı tecrübesi (UX), dördüncü bir işbirliği tekniği ve başka özellikleri içeriyor. Sürüm, HYVE kullanıcıları için daha akıcı ve verimli bir platform sağlamayı amaçlıyor.20 Temmuz Perşembe ise IoTeX (IOTX) V1.11.0 Hardfork sürümünü yayınlayacak. Bu güncellemenin IoTeX Blockchain ağına değerli iyileştirmeler ve geliştirmeler getirmesi ve projenin ekosistemini ve token performansını potansiyel olarak etkilemesi bekleniyor.Kritik makroekonomik olaylar neler?Kriptoya has olaylara ek olarak, kripto para üniteleri de dahil olmak üzere daha geniş finansal piyasaları etkileyecek değerli makroekonomik olaylar var. Örneğin 18 Temmuz Salı günü Saat 17:00’de, yatırımcılar ABD Merkez Bankası (FED) Kontrolden Sorumlu Komiser Yardımcısı Michael S. Barr’ı dinlemek isteyecekler. Barr’ın konuşmasında düzenleyici ortam ve bunun kripto para bölümü üzerindeki potansiyel tesiri hakkında bilgi vermesi beklenmekte.Çarşamba, 19 Temmuz’da piyasa gözlemcileri saat 12:00’de açıklanacak olan Avro Bölgesi Tüketici Fiyat Endeksi (TÜFE) Yıllık bilgilerini yakından takip edecek. Beklentinin yüzde 5,5 (bir evvelki %6,1’e kıyasla) olduğu TÜFE bilgileri, Avro Bölgesi’ndeki enflasyon eğilimlerine ait bilgi sağlayacak. Yatırımcılar, kripto para üniteleri de dahil olmak üzere daha geniş finansal piyasalar üzerindeki potansiyel etkiyi kıymetlendirecek.20 Temmuz Perşembe günü, Türkiye Cumhuriyet Merkez Bankası (TCMB) saat 14:00’te faiz kararını açıklayacak. Bu kararın Türkiye iktisadı üzerinde tesirleri olacak ve kripto para ünitelerine yönelik piyasa hassaslığını potansiyel olarak etkileyecektir. Özetle, hafta ilerledikçe kripto para yatırımcıları ve meraklıları hem kriptoya mahsus olayları hem de makroekonomik göstergeleri yakından izleyecek, potansiyel fırsatları arayacak ve piyasa üzerindeki tesirlerini değerlendirecektir. Bitcoin ve kripto paralar için dinamik dünyayı takipte kalmak gerekiyor.

0 notes