#Hard Money Lender Rates in Baltimore

Explore tagged Tumblr posts

Text

7 Steps to Buying a House in Baltimore, Maryland

If you want to know how We Buy Houses Baltimore, Maryland, you've come to the right place!

When you begin thinking about buying a home, it’s not hard to let your emotions get the best of you. In a matter of seconds, you’re stalking homes on your home-browsing app, changing your route to work to do drive-bys on those houses you like, and even looking up some interesting mortgage options that are going to get you into that home with little to nothing down.

It can be incredibly easy to get yourself into a home that you can't really afford, and that is the number one cause of people not being able to build that long term wealth. This is why knowing the steps of the home-buying process can help you make some smart decisions when buying your next home.

Let’s be honest. Buying a home can be a confusing and frustrating process. Do you ever ask yourself, “What do I need to do to buy a home in Baltimore, Maryland?” or “Who will give me a home loan in Baltimore, Maryland?” Great News! You've found the answer with Moreira Team! We are mortgage brokers in Baltimore, Maryland.

That is why we have made it our purpose, for more than a decade, to provide our clients with the best mortgage experience possible. We have the home-buying know-how to make the home buying process a “done-for-you” experience. Getting a mortgage with us is actually a lot easier than you might think, and we have programs available for every situation. We shop your loan with over 22 different lenders and banks to make sure we deliver on our promise to get you the best deal. That means you save money, get a lower rate, and spend less money out of pocket. Our guarantee is to provide you with a transparent and easy home buying experience, and our promise is to find you the best deal.

Here are 7 easy steps to get you started on your home purchase:

Step 1 Get Your Finances In Order Buying your first home, or your next home is a HUGE deal! You absolutely have to know how much you can afford and how much you may need to save to get into your next house. Step 2 Get Preapproved for Your Mortgage In a quick conversation with you about your income, credit and down payment, a mortgage advisor will be able to pre-qualify you for your mortgage right on the spot. Call 800-599-1563 to talk to a licensed mortgage advisor to get a custom strategy on how to make your home purchase a reality. Get Your Quick QuoteGet Pre-Approved Step 3 Find the Right Real Estate Agent Starting your home buying journey online is a great place to start. But having a local expert in the feild is a must. We can help connect you with a local, Baltimore, Maryland Real Estate Agent who can help you find your next home. Step 4 Go House Hunting Your finances are solid, you've been preapproved and you have an expert on your side. It's time to go house hunting! Try making some lists, doing some research and asking questions. Step 5 Submit an Offer Once you’ve found the right home, it’s time to get serious! That means submitting an offer and signing a contract agreement with the sellers. Step 6 Get a Home Inspection and Appraisal If you've made it this far, you are officially unde contract! But now that you're under contract there is still some things to take care of, like a home inspection, appraisal and final mortgage approval. Step 7 Close on Your House This is it! All your hard work is done and now you have to sign the papers, take care of any payments and the keys are yours!

1 note

·

View note

Text

just look at it !!!

I'm half-white... white enough to experience xenophobia instead of its ugly cousin, racism. My brother isn't –– he looks more like my mom. Despite only being four years apart, we had very different experiences with teachers and peers growing up, and it was because of the color of his skin. I know that racism is real, not a faded chapter of a history book or a dying ideology in remote parts of the South. It's physical; it takes up space in a room. I can see it in my brother's self-surveillance and his obsession with formal language. He's afraid to be mean and afraid to be stupid. Our mother pours out mere drops of cultural knowledge, and it slips through the space between our fingers because we're too clumsy to catch it when it falls. Growing up the child of an immigrant is asking how to cook a traditional dish over the phone, your mother sifting through aged memories as you scribble what she says haphazardly into your notes app.

If we zoom out, racism can be explored with eyes, ears, hands, tongue, and nose. You can see neglected schoolrooms devoid of the proper supplies and a neighborhood's general lack of access to a store stocked with healthy foods. You can hear the noise pollution of a highway built through a neighborhood. You can taste the hard metals leaching into a water supply. You can smell the air too close to a locally unwanted land use (landfill, concentrated animal feeding operation, etc.). The victims are almost always the inhabitants of a historically black and brown neighborhood, disproportionately impacted by a myriad of health maladies and dying to them at rates higher than their white counterparts (1).

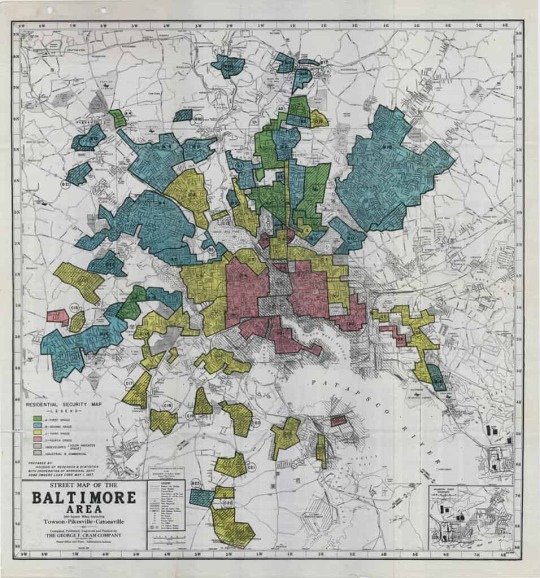

Baltimore is the nation's favorite example when discussing the detrimental effects of redlining. The racially discriminatory policy allowed mortgage lenders and banks to exclude racial minorities from obtaining housing in certain neighborhoods (2). It was used to carve swathes of segregated neighborhoods, keeping black and white separate and disturbingly unequal. Despite being outlawed in 1968, the practice continued under different names like "blockbusting" and "exclusionary zoning" (3). Explicitly racist policy ensured the uneven development of neighborhoods. For example, schools are funded by local property taxes. If the local property value is low, the school with be underfunded, too. Children are left without the proper supplies, faculty, and curriculum to succeed, posing another social obstacle on the path to a high quality of life. Redlining, among many other things, heavily contributed to the racial wealth gap. The purchase of a house is oftentimes the largest investment a person will make in their lifetime. Being denied a loan to purchase property that will rise in value over the years is being denied the boon of that investment. While white families were able to invest, prosper and pass this wealth down to their children through multiple generations, black and brown families were systemically denied this same privilege. Instead, they were isolated into neighborhoods that received little to no public investment and suffered from discriminatory policy like where locally unwanted land uses are chosen to be built, whether schools should be funded at the state level or the federal level, and over-policing. Just to put it into perspective, in the 1930s black households comprised 20% of the population but were confined to 2% of Baltimore city (4). Their property value stayed low or decreased, making it almost impossible to simply sell the property and move somewhere "nicer." With what money? This was deliberate impoverishment.

Poorly enacted forms of reinvestment often lead to gentrification (a new housing issue seen as early as the 1960s) (5). Wealthy outsiders move into neighborhoods benefiting from the fruit of well-intentioned policy, raising the price of goods and services, and ultimately pushing out the people who were originally supposed to be the benefactors back into neglected neighborhoods. The cycle continues, all so racially linked.

I assume most Baltimoreans know about the Black Butterfly and the White L. If you're not from Baltimore, though, or if you don't know, it's in reference to the shape of the "area around the Inner Harbor and stretching straight North to the wealthy neighborhoods of Homeland and Guilford, with the low-income, majority Black neighborhoods that make up large swaths of East and West Baltimore" (6). Our campus is on the edge of a historic dividing line –– York Road. Property was sold to black families on the East side of York, and property was sold to white families on the West side of York. The difference is stark. It's obvious. Just go look at it.

0 notes

Text

we buy houses for cash Baltimore - Real Estate Investing

youtube

Homes for Sale, Mortgage Rates, Virtual Tours & Rentals ...

Search confidently with your trusted source of homes for sale or rent

Far From the Bright Lights of Big Cities, These Are America's Hottest...

Robin Williams� Former Home in Tiburon Is Listed Again, With Price Cu...

�The Golden Girls� House Sells for $1 Million Over Ask

3 Reasons Millennial Buyers Love VA Loans

Find a lender who can offer competitive mortgage rates and help you with pre-approval.

Does it have pet-friendly rentals? What are the crime rates? How are the schools? Get important

local information on the area you're most interested in.

Find out how the NAR works for consumers and REALTORS�

Learn About N.A.R

For Homeowners

For REALTORS�

https://www.realtor.com/

Owning commercial property can really boost your profile in multiple ways, but always be very cautious when attempting to either buy or sell any type of commercial real estate. It can come back to bite you in a bad way. You may want to pay attention to this article full of commercial real estate tips.

On the real estate market both buyers and sellers are well advised to remain open until a potential deal is well and truly sealed. It is tempting to commit to a particular offer or home when the sale process is just starting. There is a great distance between an interest expressed and money changing hands; homeowners who commit themselves to a deal too early risk getting taken advantage of.

When you begin to advertise your real estate through a website, you must understand that you have a very short amount of time to catch your visitors attention. If your content is not focused, you will instantly lose thousands of potential buyers. Make sure your site is focused if you want to get customers.

Buying a commercial property is a process that takes much longer than purchasing a single family home. It is going to take more time to prepare the property so keep that in mind. Do not try to rush and do things too fast because you may end up making bad decisions as a result.

One tip to being a good landlord is to make sure you check the references of anyone you would like as a tenant. Sometimes people can put on a good show and seem like they would be good tenants when in reality they would create a lot of problems for you. Better to be safe than sorry.

Make sure all details are finalized. After you have signed a real estate contract, be sure to stay in touch with your lender and real estate agent. A good realtor will go through everything that you need to have in place before settlement. Make sure that you have proper insurance and have figured out whether your real estate tax will be included in the mortgage payment, or you if you need to pay it separately.

The most successful commercial real estate investors are the ones who can find a good deal and know when to walk away from it. Develop an exit strategy and know how to calculate your minimum acceptable levels for payoff, returns, and projected cash flows. No matter how appealing the property may seem, do not hesitate to drop it if it will not perform to your expectations.

It has been a long hard road, but you are now the proud owner of a commercial property. By now, you certainly have decided what or who will be using the piece of real estate. Go ahead, celebrate. Celebrate the fact that you have accomplished a major goal.

I'm just very interested by sell house fast maryland and I hope you appreciated the new entry. Liked our post? Please share it. Help other people locate it. We love reading our article about sell house fast maryland. we buy houses for cash Baltimore - Real Estate Investing we buy houses Baltimore buy houses Baltimore we buy houses in Baltimore we buy houses fast Baltimore we buy houses for cash Baltimore buy house Baltimore

0 notes

Text

How Much Is Too Much for a Cannabis Business Loans?

If opening a business were as easy as coming up with a great idea, more people would do it. The truth is, starting any type of business will require hard work and dedication – when you add to that starting a business in a new and emerging market, you may find yourself with even more questions about how to get started.

As with most businesses, one of the most important factors to consider before you get started is where you will get your capital. Specifically when it comes to starting a cannabis business, obtaining financing won’t be as simple as walking into your neighborhood bank and applying for a business loan. Luckily, a reputable commercial lender is a great option for obtaining cannabis business loans in Oregon.

Factors to Consider When Applying for Cannabis Business Loans in Oregon

When applying for cannabis business loans in Oregon, it’s important to consider the capital that will be required for different factors of the business. The amount of money you’ll need for your cannabis business loan will depend on your circumstances, but you’ll want to budget for things like:

Licensing fees: Oregon has several types of licenses, which we’ll discuss in more detail below, ranging in prices from $1,000 to over $5,000

Registering your business with the Oregon Division of Corporations

Legal fees (it’s very helpful to have an attorney guide you through the varying state and local regulations applicable to operating a cannabis business in Oregon)

Real estate

Product and marketing

Obtaining a Cannabis Business License in Oregon

Oregon has several categories of business licenses to offer in the cannabis industry, ranging from producer/grower, wholesaler, retailer, and laboratory services, in addition to processing or researching. Oregon also offers a separate business license for hemp. Your cannabis business may hold multiple license types, depending on your focus. To acquire a cannabis business license in Oregon, you must be over 21 years of age, and have secured a building for your business, appropriate security for that building, and meet other required measures. Although you can apply for your license before these measures are in place, your application will not be approved until these requirements are finalized.

Why Commercial Lenders are Necessary for Cannabis Business Loans in Oregon

While many states have legalized the sale and use of both recreational and medical marijuana, cannabis is still considered illegal on the federal level. Therefore, banks, which are regulated and backed by the FDIC, cannot provide capital to the operator of a cannabis business. To do so would be considered money laundering.

Since obtaining a loan from a bank isn’t an option, it’s important to find a reputable commercial lender that is experienced in cannabis business loans in Oregon.

When researching cannabis business loans in Oregon, beware of the many predatory lenders that take advantage of cannabis business owners’ need for start-up capital. These unscrupulous businesses have been known to charge interest rates of up to 50 percent on their loans. A reputable lender will require lots of documentation from you to make sure that loaning you money doesn’t present a risk for them. You’ll likely be asked for balance sheets, income statements, and bank statements, along with your credit risk profile and your capital needs.

The Bottom Line: How Much Do You Need to Borrow?

Depending on the type and scale of cannabis business you’re looking to open, startup fees can range from $150,000 to $2 million. Your cost will depend partially on your location, and partially on the type of operation you run. Staffing can make up a huge portion of the startup fees, so if you have a small operation, this cost will be lower. Similarly, rent is another big chunk of capital which can fluctuate depending on your location and circumstances. It’s important to flesh out your business plan, and then find a reputable lender who will help you obtain your cannabis business loan in Oregon.

The post How Much Is Too Much for a Cannabis Business Loans? appeared first on Baltimore News Journal.

from Baltimore News Journal https://ift.tt/2YtQWJd via IFTTT

0 notes

Text

Mariner Finance Personal Loan Review

What is Mariner Finance?

Originally associated with 1st Mariner Bank in Baltimore, Md., Mariner Finance is now an independent financial services organization which issues personal loans, auto loans, mortgages and home refinancing options. The company claims to be growing quickly, with over 450 branches across 22 states, and the ability to issue personal loans in 23 states.

Launched in 2002, Mariner Finance is unique in that it has no minimum credit score requirements, making its personal loans available to a wider spectrum of borrowers — especially those who may have trouble getting approved for a personal loan elsewhere. That flexibility comes with a price, though, as reflected in the APR offerings.

Mariner Finance personal loan highlights No prepayment penalties: Mariner Finances does not charge any prepayment penalties, allowing you to reduce the amount of interest you incur by paying off your loan at a faster clip. No minimum credit score requirement. By not setting a minimum credit score requirement, Mariner Finance opens its doors to all who may need a personal loan. This is a big deal as many times, those who could benefit most from a personal loan are shut out of the system. High APR. Just because you can get a personal loan doesn’t mean it will be affordable. With a negative credit history, you’re more likely to end up with an offer at the high end of Mariner Finance’s APR range — 36.00%. While this is a cheaper alternative to a payday loan, it’s still going to be an expensive way to borrow money. Terms: 12 to 60 months

Mariner Finance Personal Loan Details

Terms Fees and Penalties Term lengths: 12 to 60 months APR: up to 36.00% Loan amounts: $1,000–$25,000 Time to funding: As soon as 2 days after loan approval. Credit check: A Soft Pull will be performed when you check your offers, which will not affect your credit score. If you decide to follow up on that offer and file an application, a hard pull will be performed, which may have a negative impact on your credit score. Origination fee: Varies Prepayment fee: None Late payment fee: Not specified Other fees: Not specified

Mariner Finance product details

Loans between $1,500 and $7,000 can be completed online. When you complete a loan online, it can be funded in as little as two days after you have submitted your final paperwork. Loans in amounts less than $1,500 or greater than $7,000 can be initiated online, but must be completed at one of Mariner Finance’s physical locations. These loans may take a little longer to turn around.

Mariner Finance’s personal loans come with a 15-day guarantee. What that means is if you change your mind about your loan within the first 15 days and would like to return it, you can do so without penalty, repaying all the money and receiving a full refund for any finance charges you may have paid.

Eligibility requirements Minimum credit score: No minimum credit score Minimum credit history: Not specified Maximum debt-to-income ratio: Not specified

Mariner Finance is licensed to issue personal loans to residents of the following states: Alabama, California, Delaware, Florida, Georgia, Indiana, Illinois, Kentucky, Louisiana, Maryland, Mississippi, Missouri, New Jersey, New York, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin. Qualified residents of these states will be U.S. citizens, U.S. residents or foreign residents.

When you apply, you will need a government-issued photo ID and proof of income. If you apply for a loan greater than $7,000 or less than $1,500, you will need to complete the application process at one of Mariner Finance’s physical locations. In these instances, you will also need to provide your Social Security card and proof of residence.

Mariner Finance is very lenient in its qualification requirements. In fact, it even accepts applicants who have filed for bankruptcy. Bear in mind that while you may qualify for a loan, the more negative line items there are on your credit report, the more likely you are to get an APR offer in the top end of Mariner Finance’s range. This is an expensive way to borrow money, though it is still better than a payday loan.

Applying for a personal loan from Mariner Finance

The first step in getting a personal loan from Mariner Finance is checking your offers. You will be asked to provide information such as your name, citizenship or residency status, address, phone number, email, date of birth, employment status, employer information, income, Social Security number, loan amount and loan purpose. While your Social Security number will be ran to get an overview of your credit history, this will be a soft pull. Soft pulls do not affect your credit score.

After you have received an offer, you can move forward if you so choose. At this point in the application process, you will need to provide supporting documentation such as your government-issued ID and proof of income. If you are applying for a loan of less than $1,500 or more than $7,000, this documentation will need to be submitted in person. In these instances, you’ll also need to provide your Social Security card and proof of residence. At this point, a hard pull will be done on your credit. This may lower your credit score, but it’s a standard part of the lending process regardless of which financial institution you work with.

If you complete the process online, your loan could be funded as soon as two days after completing the application process. Loans which require an in-person meeting at a physical Mariner Finance location may take longer.

Either way, you have 15 days after your loan has been issued to reconsider your options. If you end up wishing you hadn’t taken out the loan, you can return the money within this timeframe with no questions asked. You will also receive a refund for any financing charges you may have paid.

Pros and Cons of a Mariner Finance Personal Loan

Pros Cons Lenient lending requirements: Mariner Finance lends to those with lower credit scores, and has no minimum credit score requirement. It’s even possible to get a personal loan with a bankruptcy on your credit report, but all of that leniency comes at a price. No prepayment penalty: No prepayment penalty means you can pay off your loan faster, cutting down on the amount of interest you pay over the life of your loan. Low minimum loan amounts: Loans of $1,500 are fairly low for the personal loan space, and you can get loans for even less if you are willing to visit an in-person location. Smaller loans mean that you’re not borrowing — and more importantly, paying interest on — more money than you need. High APR offerings: Mariner Finance offers higher rates. Ostensibly, that’s because it needs to make up for he credit risk it’s taking on by being so lenient with borrower requirements. It also means you should shop around to see if you can get lower rates elsewhere. Longer process for larger or smaller loans: Loans outside the $1,500-$7,000 range will require visiting a Mariner Finance location. This adds another step to the process, and can add time, too. State residency requirements. Mariner Finance is only licensed to issue personal loans in 23 states. Even if you think its personal loans might be a good match for your situation, you’ll be out of luck if you live in one of the other 27.

Who’s the best fit for a Mariner Finance personal loan?

If you’ve had trouble getting a personal loan elsewhere, Mariner Finance can be a good alternative to payday lenders. Its APR offerings are high compared to much of the competition, but the flip side of high APR offerings is a very lenient acceptance policy with no hard and fast minimum credit score requirement and a willingness to consider giving you another chance even if you’ve filed for bankruptcy in the past.

That said, you can only take advantage of the low credit requirements if you live in one of the 23 states in which Mariner Finance is licensed to lend. If you live in one of the other 27, have good credit or need access to loan funding ASAP, this lender likely isn’t the right match for you.

Alternative personal loan options Discover Personal Loans APR range: 6.99% to 24.99% Credit requirements: Minimum 660 credit score Terms: 36 to 84 months Origination fee: No origination fee

Discover offers personal loans with flexible repayment terms and No origination fee. The lender claims you may get a decision on your loan application in the same day you apply. Even better, if you have a change of heart, you can return your loan funds within 30 days without paying interest.

OneMain Financial APR range: 16.05%–35.99% Credit requirements: 0 Terms: 24 to 60 months Origination fee: Varies

OneMain Financial has similar rates to Mariner Finance, but you can get access to your funds a lot more quickly — sometimes as soon as the same day. OneMain Financial does have physical locations if face-to-face interaction is important to you during the loan application process. These branches are spread across 44 states, which is nearly twice as many as Mariner Finance.

Affinity Federal Credit Union APR: Starting at 9.75% Credit requirements: 525 Terms: Up to 60 months Origination fee: No origination fee

The fact that Affinity Federal Credit Union accepts those with credit scores as low as 525 is pretty incredible. On top of the low credit requirements, your APR, which could potentially start at 9.75%, is likely to be much lower than what Mariner Finance will offer you, even if you qualify by the skin of your teeth.

Interested in a personal loan? Here are the top personal loan lenders of 2019!

LenderAPR RangeLoan Amount 1 Includes AutoPay discount. Important Disclosures for SoFi. SoFi Disclosures Fixed rates from 5.990% APR to 16.490% APR (with AutoPay). Variable rates from 5.74% APR to 14.60% APR (with AutoPay). SoFi rate ranges are current as of February 15, 2019 and are subject to change without notice. Not all rates and amounts available in all states. See Personal Loan eligibility details. Not all applicants qualify for the lowest rate. If approved for a loan, to qualify for the lowest rate, you must have a responsible financial history and meet other conditions. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your credit worthiness, years of professional experience, income and other factors. See APR examples and terms. Interest rates on variable rate loans are capped at 14.95%. Lowest variable rate of 5.74% APR assumes current 1-month LIBOR rate of 2.51% plus 4.28% margin minus 0.25% AutoPay discount. For the SoFi variable rate loan, the 1-month LIBOR index will adjust monthly and the loan payment will be re-amortized and may change monthly. APRs for variable rate loans may increase after origination if the LIBOR index increases. The SoFi 0.25% AutoPay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. To check the rates and terms you qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull. See Consumer Licenses. Minimum Credit Score: Not all applicants who meet SoFi’s minimum credit score requirements are approved for a personal loan. In addition to meeting SoFi’s minimum eligibility criteria, applicants must also meet other credit and underwriting requirements to qualify. SoFi Personal Loans are not available to residents of MS. Maximum interest rate on loans for residents of AK and WY is 9.99% APR, for residents of IL with loans over $40,000 is 8.99% APR, for residents of TX is 9.99% APR on terms greater than 5 years, for residents of CO, CT, HI, VA, SC is 11.99% APR, and for residents of ME is 12.24% APR. Personal loans not available to residents of MI who already have a student loan with SoFi. Personal Loans minimum loan amount is $5,000. Residents of AZ, MA, and NH have a minimum loan amount of $10,001. Residents of KY have a minimum loan amount of $15,001. Residents of PA have a minimum loan amount of $25,001. Variable rates not available to residents of AK, TX, VA, WY, or for residents of IL for loans greater than $40,000. Terms and Conditions Apply: SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or permanent resident in an eligible state and meet SoFi’s underwriting requirements. Not all borrowers receive the lowest rate. To qualify for the lowest rate, you must have a responsible financial history and meet other conditions. If approved, your actual rate will be within the range of rates listed above and will depend on a variety of factors, including term of loan, a responsible financial history, years of experience, income and other factors. Rates and Terms are subject to change at anytime without notice and are subject to state restrictions. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as Income Based Repayment or Income Contingent Repayment or PAYE. Licensed by the Department of Business Oversight under the California Financing Law License No. 6054612. SoFi loans are originated by SoFi Lending Corp., NMLS # 1121636. (www.nmlsconsumeraccess.org) 2 Includes AutoPay discount. Important Disclosures for Payoff. Payoff Disclosures All loans are subject to credit review and approval. Your actual rate depends upon credit score, loan amount, loan term, credit usage and history. Currently loans are not offered in: MA, MS, NE, NV, OH, and WV. 3 Important Disclosures for FreedomPlus. FreedomPlus Disclosures All loans available through FreedomPlus.com are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. All loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, and credit usage and history. Eligibility for a loan is not guaranteed. Loans are not available to residents of all states – please call a FreedomPlus representative for further details. The following limitations, in addition to others, shall apply: FreedomPlus does not arrange loans in: (i) Arizona under $10,500; (ii) Massachusetts under $6,500, (iii) Ohio under $5,500, and (iv) Georgia under $3,500. Repayment periods range from 24 to 60 months. The range of APRs on loans made available through FreedomPlus is 5.99% to a maximum of 29.99%. APR. The APR calculation includes all applicable fees, including the loan origination fee. For Example, a four year $20,000 loan with an interest rate of 15.49% and corresponding APR of 18.34% would have an estimated monthly payment of $561.60 and a total cost payable of $7,948.13. To qualify for a 5.99% APR loan, a borrower will need excellent credit on a loan for an amount less than $12,000.00, and with a term equal to 24 months. Adding a co-borrower with sufficient income; using at least eighty-five percent (85%) of the loan proceeds to directly pay off qualifying existing debt; or showing proof of sufficient retirement savings, could help you also qualify for the lowest rate available. 4 Important Disclosures for Citizens Bank. Citizens Bank Disclosures Personal Loan Rate Disclosure: Fixed interest rates from 6.79% – 20.89% (6.79% – 20.89% APR) based on applicable terms. Lowest rates range from 5.99%-18.99% (5.99%-18.99% APR), are for eligible applicants, require a 3-year repayment term, and include our Loyalty and Automatic Payment Discounts of 0.25 percentage points each, as outlined in the Loyalty Discount and Automatic Payment Discount disclosures. Subject to additional terms and conditions, and rates are subject to change at any time without notice. Such changes will only apply to applications taken after the effective date of change. Loyalty Discount: The borrower will be eligible for a 0.25 percentage point interest rate reduction on their loan if the borrower has a qualifying account in existence with us at the time the borrower has submitted a completed application authorizing us to review their credit request for the loan. The following are qualifying accounts: any checking account, savings account, money market account, certificate of deposit, automobile loan, home equity loan, home equity line of credit, mortgage, credit card account, student loans or other personal loans owned by Citizens Bank, N.A. Please note, our checking and savings account options are only available in the following states: CT, DE, MA, MI, NH, NJ, NY, OH, PA, RI and VT. This discount will be reflected in the interest rate and Annual Percentage Rate (APR) disclosed in the Truth-In-Lending Disclosure that will be provided to the borrower once the loan is approved. Limit of one Loyalty Discount per loan, and discount will not be applied to prior loans. The Loyalty Discount will remain in effect for the life of the loan. Automatic Payment Discount: Borrowers will be eligible to receive a 0.25 percentage point interest rate reduction on their Citizens Bank Personal Loan during such time as payments are required to be made and our loan servicer is authorized to automatically deduct payments each month from any bank account the borrower designates. If our loan servicer is unable to successfully withdraw the automatic deductions from the designated account two or more times within any 12-month period, the borrower will no longer be eligible for this discount. 5 Important Disclosures for LendingPoint. LendingPoint Disclosures Loan approval is not guaranteed. Actual loan offers and loan amounts, terms and annual percentage rates (“APR”) may vary based upon LendingPoint’s proprietary scoring and underwriting system’s review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees from 0% to 6% may apply depending upon your state of residence. Upon LendingPoint’s final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. LendingPoint makes loan offers from $2,000 to $25,000, at rates ranging from a low of 9.99% APR to a high of 35.99% APR, with terms from 24 to 48 months. The loan offer(s) shown reflect a 28 day payment cycle which is being offered as a courtesy as many of our customers are paid on a biweekly schedule and thus this may better align the loan payment dates with your actual income receipt schedule. 6 Important Disclosures for LendingClub. LendingClub Disclosures

All loans made by WebBank, Member FDIC. Your actual rate depends upon credit score, loan amount, loan term, and credit usage & history. The APR ranges from 6.95% to 35.89%*. The origination fee ranges from 1% to 6% of the original principal balance and is deducted from your loan proceeds. For example, you could receive a loan of $6,000 with an interest rate of 7.99% and a 5.00% origination fee of $300 for an APR of 11.51%. In this example, you will receive $5,700 and will make 36 monthly payments of $187.99. The total amount repayable will be $6,767.64. Your APR will be determined based on your credit at the time of application. The average origination fee is 5.49% as of Q1 2017. In Georgia, the minimum loan amount is $3,025. In Massachusetts, the minimum loan amount is $6,025 if your APR is greater than 12%. There is no down payment and there is never a prepayment penalty. Closing of your loan is contingent upon your agreement of all the required agreements and disclosures on the www.lendingclub.com website. All loans via LendingClub have a minimum repayment term of 36 months. Borrower must be a U.S. citizen, permanent resident or be in the United States on a valid long term visa and at least 18 years old. Valid bank account and Social Security number are required. Equal Housing Lender. All loans are subject to credit approval. LendingClub’s physical address is: LendingClub, 71 Stevenson Street, Suite 1000, San Francisco, CA 94105.

†Per reviews collected and authenticated by Bazaarvoice in compliance with the Bazaarvoice Authentication Requirements, supported by anti-fraud technology and human analysis. All reviews can be reviewed at reviews.lendingclub.com

**Based on approximately 60% of borrowers who received offers through LendingClub’s marketing partners between January 1, 2018 to July 20,2018. The time it will take to fund your loan may vary.

7 Important Disclosures for Earnest. Earnest Disclosures Earnest does not lend in Alabama, Delaware, Kentucky, Nevada, or Rhode Island. 8 Important Disclosures for Avant. Avant Disclosures

* The actual rate and loan amount that a customer qualifies for may vary based on credit determination and other factors. Funds are generally deposited via ACH for delivery next business day if approved by 4:30pm CT Monday-Friday. Avant branded credit products are issued by WebBank, member FDIC.

** Example: A $5,700 loan with an administration fee of 4.75% and an amount financed of $5,429.25, repayable in 36 monthly installments, would have an APR of 29.95% and monthly payments of $230.33

* Important Disclosures for Upgrade Bank. Upgrade Bank Disclosures

* Your loan terms are not guaranteed and are subject to our verification and review process. You may be asked to provide additional documents to enable us to verify your income and your identity. This rate includes an Autopay APR reduction of 0.5%. By enrolling in Autopay your payments will be automatically deducted from you bank account. Selecting Autopay is optional. Annual Percentage Rate is inclusive of a loan origination fee, which is deducted from the loan proceeds. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. All loans made by WebBank, member FDIC. Please refer to Upgrade’s Terms of Use and Borrower Agreement for all terms, conditions and requirements.

** Accept your loan offer and your funds will be sent to your bank via ACH within one (1) business day of clearing necessary verifications. Availability of the funds is dependent on how quickly your bank processes this transaction. From the time of approval, funds should be available within four (4) business days.

8.09% – 35.99%$1,000 - $50,000

Visit Upstart

5.74% – 16.49%1$5,000 - $100,000

Visit SoFi

7.99% – 35.89%*$1,000 - $50,000

Visit Upgrade

5.99% – 24.99%2$5,000 - $35,000

Visit Payoff

5.99% – 29.99%3$7,500 - $40,000

Visit FreedomPlus

6.79% – 20.89%4$5,000 - $50,000

Visit Citizens

9.99% – 35.99%5$2,000 - $25,000

Visit LendingPoint

6.95% – 35.89%6$1,000 - $40,000

Visit LendingClub

6.99% – 18.24%7$5,000 - $75,000

Visit Earnest

9.95% – 35.99%8$2,000 - $35,000

Visit Avant

Our team at Student Loan Hero works hard to find and recommend products and services that we believe are of high quality and will make a positive impact in your life. We sometimes earn a sales commission or advertising fee when recommending various products and services to you. Similar to when you are being sold any product or service, be sure to read the fine print understand what you are buying, and consult a licensed professional if you have any concerns. Student Loan Hero is not a lender or investment advisor. We are not involved in the loan approval or investment process, nor do we make credit or investment related decisions. The rates and terms listed on our website are estimates and are subject to change at any time. Please do your homework and let us know if you have any questions or concerns.

The post Mariner Finance Personal Loan Review appeared first on Student Loan Hero.

from Updates About Loans https://studentloanhero.com/featured/mariner-finance-personal-loan-review/

0 notes

Text

Mariner Finance Personal Loan Review

What is Mariner Finance?

Originally associated with 1st Mariner Bank in Baltimore, Md., Mariner Finance is now an independent financial services organization which issues personal loans, auto loans, mortgages and home refinancing options. The company claims to be growing quickly, with over 450 branches across 22 states, and the ability to issue personal loans in 23 states.

Launched in 2002, Mariner Finance is unique in that it has no minimum credit score requirements, making its personal loans available to a wider spectrum of borrowers — especially those who may have trouble getting approved for a personal loan elsewhere. That flexibility comes with a price, though, as reflected in the APR offerings.

Mariner Finance personal loan highlights No prepayment penalties: Mariner Finances does not charge any prepayment penalties, allowing you to reduce the amount of interest you incur by paying off your loan at a faster clip. No minimum credit score requirement. By not setting a minimum credit score requirement, Mariner Finance opens its doors to all who may need a personal loan. This is a big deal as many times, those who could benefit most from a personal loan are shut out of the system. High APR. Just because you can get a personal loan doesn’t mean it will be affordable. With a negative credit history, you’re more likely to end up with an offer at the high end of Mariner Finance’s APR range — 36.00%. While this is a cheaper alternative to a payday loan, it’s still going to be an expensive way to borrow money. Terms: 12 to 60 months

Mariner Finance Personal Loan Details

Terms Fees and Penalties Term lengths: 12 to 60 months APR: up to 36.00% Loan amounts: $1,000–$25,000 Time to funding: As soon as 2 days after loan approval. Credit check: A Soft Pull will be performed when you check your offers, which will not affect your credit score. If you decide to follow up on that offer and file an application, a hard pull will be performed, which may have a negative impact on your credit score. Origination fee: Varies Prepayment fee: None Late payment fee: Not specified Other fees: Not specified

Mariner Finance product details

Loans between $1,500 and $7,000 can be completed online. When you complete a loan online, it can be funded in as little as two days after you have submitted your final paperwork. Loans in amounts less than $1,500 or greater than $7,000 can be initiated online, but must be completed at one of Mariner Finance’s physical locations. These loans may take a little longer to turn around.

Mariner Finance’s personal loans come with a 15-day guarantee. What that means is if you change your mind about your loan within the first 15 days and would like to return it, you can do so without penalty, repaying all the money and receiving a full refund for any finance charges you may have paid.

Eligibility requirements Minimum credit score: No minimum credit score Minimum credit history: Not specified Maximum debt-to-income ratio: Not specified

Mariner Finance is licensed to issue personal loans to residents of the following states: Alabama, California, Delaware, Florida, Georgia, Indiana, Illinois, Kentucky, Louisiana, Maryland, Mississippi, Missouri, New Jersey, New York, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin. Qualified residents of these states will be U.S. citizens, U.S. residents or foreign residents.

When you apply, you will need a government-issued photo ID and proof of income. If you apply for a loan greater than $7,000 or less than $1,500, you will need to complete the application process at one of Mariner Finance’s physical locations. In these instances, you will also need to provide your Social Security card and proof of residence.

Mariner Finance is very lenient in its qualification requirements. In fact, it even accepts applicants who have filed for bankruptcy. Bear in mind that while you may qualify for a loan, the more negative line items there are on your credit report, the more likely you are to get an APR offer in the top end of Mariner Finance’s range. This is an expensive way to borrow money, though it is still better than a payday loan.

Applying for a personal loan from Mariner Finance

The first step in getting a personal loan from Mariner Finance is checking your offers. You will be asked to provide information such as your name, citizenship or residency status, address, phone number, email, date of birth, employment status, employer information, income, Social Security number, loan amount and loan purpose. While your Social Security number will be ran to get an overview of your credit history, this will be a soft pull. Soft pulls do not affect your credit score.

After you have received an offer, you can move forward if you so choose. At this point in the application process, you will need to provide supporting documentation such as your government-issued ID and proof of income. If you are applying for a loan of less than $1,500 or more than $7,000, this documentation will need to be submitted in person. In these instances, you’ll also need to provide your Social Security card and proof of residence. At this point, a hard pull will be done on your credit. This may lower your credit score, but it’s a standard part of the lending process regardless of which financial institution you work with.

If you complete the process online, your loan could be funded as soon as two days after completing the application process. Loans which require an in-person meeting at a physical Mariner Finance location may take longer.

Either way, you have 15 days after your loan has been issued to reconsider your options. If you end up wishing you hadn’t taken out the loan, you can return the money within this timeframe with no questions asked. You will also receive a refund for any financing charges you may have paid.

Pros and Cons of a Mariner Finance Personal Loan

Pros Cons Lenient lending requirements: Mariner Finance lends to those with lower credit scores, and has no minimum credit score requirement. It’s even possible to get a personal loan with a bankruptcy on your credit report, but all of that leniency comes at a price. No prepayment penalty: No prepayment penalty means you can pay off your loan faster, cutting down on the amount of interest you pay over the life of your loan. Low minimum loan amounts: Loans of $1,500 are fairly low for the personal loan space, and you can get loans for even less if you are willing to visit an in-person location. Smaller loans mean that you’re not borrowing — and more importantly, paying interest on — more money than you need. High APR offerings: Mariner Finance offers higher rates. Ostensibly, that’s because it needs to make up for he credit risk it’s taking on by being so lenient with borrower requirements. It also means you should shop around to see if you can get lower rates elsewhere. Longer process for larger or smaller loans: Loans outside the $1,500-$7,000 range will require visiting a Mariner Finance location. This adds another step to the process, and can add time, too. State residency requirements. Mariner Finance is only licensed to issue personal loans in 23 states. Even if you think its personal loans might be a good match for your situation, you’ll be out of luck if you live in one of the other 27.

Who’s the best fit for a Mariner Finance personal loan?

If you’ve had trouble getting a personal loan elsewhere, Mariner Finance can be a good alternative to payday lenders. Its APR offerings are high compared to much of the competition, but the flip side of high APR offerings is a very lenient acceptance policy with no hard and fast minimum credit score requirement and a willingness to consider giving you another chance even if you’ve filed for bankruptcy in the past.

That said, you can only take advantage of the low credit requirements if you live in one of the 23 states in which Mariner Finance is licensed to lend. If you live in one of the other 27, have good credit or need access to loan funding ASAP, this lender likely isn’t the right match for you.

Alternative personal loan options Discover Personal Loans APR range: 6.99% to 24.99% Credit requirements: Minimum 660 credit score Terms: 36 to 84 months Origination fee: No origination fee

Discover offers personal loans with flexible repayment terms and No origination fee. The lender claims you may get a decision on your loan application in the same day you apply. Even better, if you have a change of heart, you can return your loan funds within 30 days without paying interest.

OneMain Financial APR range: 16.05%–35.99% Credit requirements: 0 Terms: 24 to 60 months Origination fee: Varies

OneMain Financial has similar rates to Mariner Finance, but you can get access to your funds a lot more quickly — sometimes as soon as the same day. OneMain Financial does have physical locations if face-to-face interaction is important to you during the loan application process. These branches are spread across 44 states, which is nearly twice as many as Mariner Finance.

Affinity Federal Credit Union APR: Starting at 9.75% Credit requirements: 525 Terms: Up to 60 months Origination fee: No origination fee

The fact that Affinity Federal Credit Union accepts those with credit scores as low as 525 is pretty incredible. On top of the low credit requirements, your APR, which could potentially start at 9.75%, is likely to be much lower than what Mariner Finance will offer you, even if you qualify by the skin of your teeth.

Interested in a personal loan? Here are the top personal loan lenders of 2019!

LenderAPR RangeLoan Amount 1 Includes AutoPay discount. Important Disclosures for SoFi. SoFi Disclosures Fixed rates from 5.990% APR to 16.490% APR (with AutoPay). Variable rates from 5.74% APR to 14.60% APR (with AutoPay). SoFi rate ranges are current as of February 15, 2019 and are subject to change without notice. Not all rates and amounts available in all states. See Personal Loan eligibility details. Not all applicants qualify for the lowest rate. If approved for a loan, to qualify for the lowest rate, you must have a responsible financial history and meet other conditions. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your credit worthiness, years of professional experience, income and other factors. See APR examples and terms. Interest rates on variable rate loans are capped at 14.95%. Lowest variable rate of 5.74% APR assumes current 1-month LIBOR rate of 2.51% plus 4.28% margin minus 0.25% AutoPay discount. For the SoFi variable rate loan, the 1-month LIBOR index will adjust monthly and the loan payment will be re-amortized and may change monthly. APRs for variable rate loans may increase after origination if the LIBOR index increases. The SoFi 0.25% AutoPay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. To check the rates and terms you qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull. See Consumer Licenses. Minimum Credit Score: Not all applicants who meet SoFi’s minimum credit score requirements are approved for a personal loan. In addition to meeting SoFi’s minimum eligibility criteria, applicants must also meet other credit and underwriting requirements to qualify. SoFi Personal Loans are not available to residents of MS. Maximum interest rate on loans for residents of AK and WY is 9.99% APR, for residents of IL with loans over $40,000 is 8.99% APR, for residents of TX is 9.99% APR on terms greater than 5 years, for residents of CO, CT, HI, VA, SC is 11.99% APR, and for residents of ME is 12.24% APR. Personal loans not available to residents of MI who already have a student loan with SoFi. Personal Loans minimum loan amount is $5,000. Residents of AZ, MA, and NH have a minimum loan amount of $10,001. Residents of KY have a minimum loan amount of $15,001. Residents of PA have a minimum loan amount of $25,001. Variable rates not available to residents of AK, TX, VA, WY, or for residents of IL for loans greater than $40,000. Terms and Conditions Apply: SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or permanent resident in an eligible state and meet SoFi’s underwriting requirements. Not all borrowers receive the lowest rate. To qualify for the lowest rate, you must have a responsible financial history and meet other conditions. If approved, your actual rate will be within the range of rates listed above and will depend on a variety of factors, including term of loan, a responsible financial history, years of experience, income and other factors. Rates and Terms are subject to change at anytime without notice and are subject to state restrictions. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as Income Based Repayment or Income Contingent Repayment or PAYE. Licensed by the Department of Business Oversight under the California Financing Law License No. 6054612. SoFi loans are originated by SoFi Lending Corp., NMLS # 1121636. (www.nmlsconsumeraccess.org) 2 Includes AutoPay discount. Important Disclosures for Payoff. Payoff Disclosures All loans are subject to credit review and approval. Your actual rate depends upon credit score, loan amount, loan term, credit usage and history. Currently loans are not offered in: MA, MS, NE, NV, OH, and WV. 3 Important Disclosures for FreedomPlus. FreedomPlus Disclosures All loans available through FreedomPlus.com are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. All loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, and credit usage and history. Eligibility for a loan is not guaranteed. Loans are not available to residents of all states – please call a FreedomPlus representative for further details. The following limitations, in addition to others, shall apply: FreedomPlus does not arrange loans in: (i) Arizona under $10,500; (ii) Massachusetts under $6,500, (iii) Ohio under $5,500, and (iv) Georgia under $3,500. Repayment periods range from 24 to 60 months. The range of APRs on loans made available through FreedomPlus is 5.99% to a maximum of 29.99%. APR. The APR calculation includes all applicable fees, including the loan origination fee. For Example, a four year $20,000 loan with an interest rate of 15.49% and corresponding APR of 18.34% would have an estimated monthly payment of $561.60 and a total cost payable of $7,948.13. To qualify for a 5.99% APR loan, a borrower will need excellent credit on a loan for an amount less than $12,000.00, and with a term equal to 24 months. Adding a co-borrower with sufficient income; using at least eighty-five percent (85%) of the loan proceeds to directly pay off qualifying existing debt; or showing proof of sufficient retirement savings, could help you also qualify for the lowest rate available. 4 Important Disclosures for Citizens Bank. Citizens Bank Disclosures Personal Loan Rate Disclosure: Fixed interest rates from 6.79% – 20.89% (6.79% – 20.89% APR) based on applicable terms. Lowest rates range from 5.99%-18.99% (5.99%-18.99% APR), are for eligible applicants, require a 3-year repayment term, and include our Loyalty and Automatic Payment Discounts of 0.25 percentage points each, as outlined in the Loyalty Discount and Automatic Payment Discount disclosures. Subject to additional terms and conditions, and rates are subject to change at any time without notice. Such changes will only apply to applications taken after the effective date of change. Loyalty Discount: The borrower will be eligible for a 0.25 percentage point interest rate reduction on their loan if the borrower has a qualifying account in existence with us at the time the borrower has submitted a completed application authorizing us to review their credit request for the loan. The following are qualifying accounts: any checking account, savings account, money market account, certificate of deposit, automobile loan, home equity loan, home equity line of credit, mortgage, credit card account, student loans or other personal loans owned by Citizens Bank, N.A. Please note, our checking and savings account options are only available in the following states: CT, DE, MA, MI, NH, NJ, NY, OH, PA, RI and VT. This discount will be reflected in the interest rate and Annual Percentage Rate (APR) disclosed in the Truth-In-Lending Disclosure that will be provided to the borrower once the loan is approved. Limit of one Loyalty Discount per loan, and discount will not be applied to prior loans. The Loyalty Discount will remain in effect for the life of the loan. Automatic Payment Discount: Borrowers will be eligible to receive a 0.25 percentage point interest rate reduction on their Citizens Bank Personal Loan during such time as payments are required to be made and our loan servicer is authorized to automatically deduct payments each month from any bank account the borrower designates. If our loan servicer is unable to successfully withdraw the automatic deductions from the designated account two or more times within any 12-month period, the borrower will no longer be eligible for this discount. 5 Important Disclosures for LendingPoint. LendingPoint Disclosures Loan approval is not guaranteed. Actual loan offers and loan amounts, terms and annual percentage rates (“APR”) may vary based upon LendingPoint’s proprietary scoring and underwriting system’s review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees from 0% to 6% may apply depending upon your state of residence. Upon LendingPoint’s final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. LendingPoint makes loan offers from $2,000 to $25,000, at rates ranging from a low of 9.99% APR to a high of 35.99% APR, with terms from 24 to 48 months. The loan offer(s) shown reflect a 28 day payment cycle which is being offered as a courtesy as many of our customers are paid on a biweekly schedule and thus this may better align the loan payment dates with your actual income receipt schedule. 6 Important Disclosures for LendingClub. LendingClub Disclosures

All loans made by WebBank, Member FDIC. Your actual rate depends upon credit score, loan amount, loan term, and credit usage & history. The APR ranges from 6.95% to 35.89%*. The origination fee ranges from 1% to 6% of the original principal balance and is deducted from your loan proceeds. For example, you could receive a loan of $6,000 with an interest rate of 7.99% and a 5.00% origination fee of $300 for an APR of 11.51%. In this example, you will receive $5,700 and will make 36 monthly payments of $187.99. The total amount repayable will be $6,767.64. Your APR will be determined based on your credit at the time of application. The average origination fee is 5.49% as of Q1 2017. In Georgia, the minimum loan amount is $3,025. In Massachusetts, the minimum loan amount is $6,025 if your APR is greater than 12%. There is no down payment and there is never a prepayment penalty. Closing of your loan is contingent upon your agreement of all the required agreements and disclosures on the www.lendingclub.com website. All loans via LendingClub have a minimum repayment term of 36 months. Borrower must be a U.S. citizen, permanent resident or be in the United States on a valid long term visa and at least 18 years old. Valid bank account and Social Security number are required. Equal Housing Lender. All loans are subject to credit approval. LendingClub’s physical address is: LendingClub, 71 Stevenson Street, Suite 1000, San Francisco, CA 94105.

†Per reviews collected and authenticated by Bazaarvoice in compliance with the Bazaarvoice Authentication Requirements, supported by anti-fraud technology and human analysis. All reviews can be reviewed at reviews.lendingclub.com

**Based on approximately 60% of borrowers who received offers through LendingClub’s marketing partners between January 1, 2018 to July 20,2018. The time it will take to fund your loan may vary.

7 Important Disclosures for Earnest. Earnest Disclosures Earnest does not lend in Alabama, Delaware, Kentucky, Nevada, or Rhode Island. 8 Important Disclosures for Avant. Avant Disclosures

* The actual rate and loan amount that a customer qualifies for may vary based on credit determination and other factors. Funds are generally deposited via ACH for delivery next business day if approved by 4:30pm CT Monday-Friday. Avant branded credit products are issued by WebBank, member FDIC.

** Example: A $5,700 loan with an administration fee of 4.75% and an amount financed of $5,429.25, repayable in 36 monthly installments, would have an APR of 29.95% and monthly payments of $230.33

* Important Disclosures for Upgrade Bank. Upgrade Bank Disclosures

* Your loan terms are not guaranteed and are subject to our verification and review process. You may be asked to provide additional documents to enable us to verify your income and your identity. This rate includes an Autopay APR reduction of 0.5%. By enrolling in Autopay your payments will be automatically deducted from you bank account. Selecting Autopay is optional. Annual Percentage Rate is inclusive of a loan origination fee, which is deducted from the loan proceeds. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. All loans made by WebBank, member FDIC. Please refer to Upgrade’s Terms of Use and Borrower Agreement for all terms, conditions and requirements.

** Accept your loan offer and your funds will be sent to your bank via ACH within one (1) business day of clearing necessary verifications. Availability of the funds is dependent on how quickly your bank processes this transaction. From the time of approval, funds should be available within four (4) business days.

8.09% – 35.99%$1,000 - $50,000

Visit Upstart

5.74% – 16.49%1$5,000 - $100,000

Visit SoFi

7.99% – 35.89%*$1,000 - $50,000

Visit Upgrade

5.99% – 24.99%2$5,000 - $35,000

Visit Payoff

5.99% – 29.99%3$7,500 - $40,000

Visit FreedomPlus

6.79% – 20.89%4$5,000 - $50,000

Visit Citizens

9.99% – 35.99%5$2,000 - $25,000

Visit LendingPoint

6.95% – 35.89%6$1,000 - $40,000

Visit LendingClub

6.99% – 18.24%7$5,000 - $75,000

Visit Earnest

9.95% – 35.99%8$2,000 - $35,000

Visit Avant

Our team at Student Loan Hero works hard to find and recommend products and services that we believe are of high quality and will make a positive impact in your life. We sometimes earn a sales commission or advertising fee when recommending various products and services to you. Similar to when you are being sold any product or service, be sure to read the fine print understand what you are buying, and consult a licensed professional if you have any concerns. Student Loan Hero is not a lender or investment advisor. We are not involved in the loan approval or investment process, nor do we make credit or investment related decisions. The rates and terms listed on our website are estimates and are subject to change at any time. Please do your homework and let us know if you have any questions or concerns.

The post Mariner Finance Personal Loan Review appeared first on Student Loan Hero.

from Updates About Loans https://studentloanhero.com/featured/mariner-finance-personal-loan-review/

0 notes

Text

Mariner Finance Personal Loan Review

What is Mariner Finance?

Originally associated with 1st Mariner Bank in Baltimore, Md., Mariner Finance is now an independent financial services organization which issues personal loans, auto loans, mortgages and home refinancing options. The company claims to be growing quickly, with over 450 branches across 22 states, and the ability to issue personal loans in 23 states.

Launched in 2002, Mariner Finance is unique in that it has no minimum credit score requirements, making its personal loans available to a wider spectrum of borrowers — especially those who may have trouble getting approved for a personal loan elsewhere. That flexibility comes with a price, though, as reflected in the APR offerings.

Mariner Finance personal loan highlights No prepayment penalties: Mariner Finances does not charge any prepayment penalties, allowing you to reduce the amount of interest you incur by paying off your loan at a faster clip. No minimum credit score requirement. By not setting a minimum credit score requirement, Mariner Finance opens its doors to all who may need a personal loan. This is a big deal as many times, those who could benefit most from a personal loan are shut out of the system. High APR. Just because you can get a personal loan doesn’t mean it will be affordable. With a negative credit history, you’re more likely to end up with an offer at the high end of Mariner Finance’s APR range — 36.00%. While this is a cheaper alternative to a payday loan, it’s still going to be an expensive way to borrow money. Terms: 12 to 60 months

Mariner Finance Personal Loan Details

Terms Fees and Penalties Term lengths: 12 to 60 months APR: up to 36.00% Loan amounts: $1,000–$25,000 Time to funding: As soon as 2 days after loan approval. Credit check: A Soft Pull will be performed when you check your offers, which will not affect your credit score. If you decide to follow up on that offer and file an application, a hard pull will be performed, which may have a negative impact on your credit score. Origination fee: Varies Prepayment fee: None Late payment fee: Not specified Other fees: Not specified

Mariner Finance product details

Loans between $1,500 and $7,000 can be completed online. When you complete a loan online, it can be funded in as little as two days after you have submitted your final paperwork. Loans in amounts less than $1,500 or greater than $7,000 can be initiated online, but must be completed at one of Mariner Finance’s physical locations. These loans may take a little longer to turn around.

Mariner Finance’s personal loans come with a 15-day guarantee. What that means is if you change your mind about your loan within the first 15 days and would like to return it, you can do so without penalty, repaying all the money and receiving a full refund for any finance charges you may have paid.

Eligibility requirements Minimum credit score: No minimum credit score Minimum credit history: Not specified Maximum debt-to-income ratio: Not specified

Mariner Finance is licensed to issue personal loans to residents of the following states: Alabama, California, Delaware, Florida, Georgia, Indiana, Illinois, Kentucky, Louisiana, Maryland, Mississippi, Missouri, New Jersey, New York, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin. Qualified residents of these states will be U.S. citizens, U.S. residents or foreign residents.

When you apply, you will need a government-issued photo ID and proof of income. If you apply for a loan greater than $7,000 or less than $1,500, you will need to complete the application process at one of Mariner Finance’s physical locations. In these instances, you will also need to provide your Social Security card and proof of residence.

Mariner Finance is very lenient in its qualification requirements. In fact, it even accepts applicants who have filed for bankruptcy. Bear in mind that while you may qualify for a loan, the more negative line items there are on your credit report, the more likely you are to get an APR offer in the top end of Mariner Finance’s range. This is an expensive way to borrow money, though it is still better than a payday loan.

Applying for a personal loan from Mariner Finance

The first step in getting a personal loan from Mariner Finance is checking your offers. You will be asked to provide information such as your name, citizenship or residency status, address, phone number, email, date of birth, employment status, employer information, income, Social Security number, loan amount and loan purpose. While your Social Security number will be ran to get an overview of your credit history, this will be a soft pull. Soft pulls do not affect your credit score.

After you have received an offer, you can move forward if you so choose. At this point in the application process, you will need to provide supporting documentation such as your government-issued ID and proof of income. If you are applying for a loan of less than $1,500 or more than $7,000, this documentation will need to be submitted in person. In these instances, you’ll also need to provide your Social Security card and proof of residence. At this point, a hard pull will be done on your credit. This may lower your credit score, but it’s a standard part of the lending process regardless of which financial institution you work with.

If you complete the process online, your loan could be funded as soon as two days after completing the application process. Loans which require an in-person meeting at a physical Mariner Finance location may take longer.

Either way, you have 15 days after your loan has been issued to reconsider your options. If you end up wishing you hadn’t taken out the loan, you can return the money within this timeframe with no questions asked. You will also receive a refund for any financing charges you may have paid.

Pros and Cons of a Mariner Finance Personal Loan

Pros Cons Lenient lending requirements: Mariner Finance lends to those with lower credit scores, and has no minimum credit score requirement. It’s even possible to get a personal loan with a bankruptcy on your credit report, but all of that leniency comes at a price. No prepayment penalty: No prepayment penalty means you can pay off your loan faster, cutting down on the amount of interest you pay over the life of your loan. Low minimum loan amounts: Loans of $1,500 are fairly low for the personal loan space, and you can get loans for even less if you are willing to visit an in-person location. Smaller loans mean that you’re not borrowing — and more importantly, paying interest on — more money than you need. High APR offerings: Mariner Finance offers higher rates. Ostensibly, that’s because it needs to make up for he credit risk it’s taking on by being so lenient with borrower requirements. It also means you should shop around to see if you can get lower rates elsewhere. Longer process for larger or smaller loans: Loans outside the $1,500-$7,000 range will require visiting a Mariner Finance location. This adds another step to the process, and can add time, too. State residency requirements. Mariner Finance is only licensed to issue personal loans in 23 states. Even if you think its personal loans might be a good match for your situation, you’ll be out of luck if you live in one of the other 27.

Who’s the best fit for a Mariner Finance personal loan?

If you’ve had trouble getting a personal loan elsewhere, Mariner Finance can be a good alternative to payday lenders. Its APR offerings are high compared to much of the competition, but the flip side of high APR offerings is a very lenient acceptance policy with no hard and fast minimum credit score requirement and a willingness to consider giving you another chance even if you’ve filed for bankruptcy in the past.

That said, you can only take advantage of the low credit requirements if you live in one of the 23 states in which Mariner Finance is licensed to lend. If you live in one of the other 27, have good credit or need access to loan funding ASAP, this lender likely isn’t the right match for you.

Alternative personal loan options Discover Personal Loans APR range: 6.99% to 24.99% Credit requirements: Minimum 660 credit score Terms: 36 to 84 months Origination fee: No origination fee

Discover offers personal loans with flexible repayment terms and No origination fee. The lender claims you may get a decision on your loan application in the same day you apply. Even better, if you have a change of heart, you can return your loan funds within 30 days without paying interest.

OneMain Financial APR range: 16.05%–35.99% Credit requirements: 0 Terms: 24 to 60 months Origination fee: Varies

OneMain Financial has similar rates to Mariner Finance, but you can get access to your funds a lot more quickly — sometimes as soon as the same day. OneMain Financial does have physical locations if face-to-face interaction is important to you during the loan application process. These branches are spread across 44 states, which is nearly twice as many as Mariner Finance.

Affinity Federal Credit Union APR: Starting at 9.75% Credit requirements: 525 Terms: Up to 60 months Origination fee: No origination fee

The fact that Affinity Federal Credit Union accepts those with credit scores as low as 525 is pretty incredible. On top of the low credit requirements, your APR, which could potentially start at 9.75%, is likely to be much lower than what Mariner Finance will offer you, even if you qualify by the skin of your teeth.

Interested in a personal loan? Here are the top personal loan lenders of 2019!