#GovReports BAS lodgement

Explore tagged Tumblr posts

Text

Conquer BAS Lodgement with GovReports: Lodge BAS online portal

GovReports makes it easier and faster for business owners to prepare and lodge your own BAS, STP, TPAR and other ATO reports directly. Lodge and reconcile Activity Statements and other ATO compliance reports all from one place. Take control and make your BAS and ATO compliance a breeze. please feel free to reachout to us for more info: https://www.govreports.com.au/business

GovReports empowers businesses and tax agents to submit their BAS electronically, saving time and minimizing errors. Here's how:

Effortless Data Entry: Forget the hassle of manual data entry. GovReports allows you to import data directly from popular accounting software, eliminating repetitive tasks.

Automated Calculations: No more spreadsheet struggles! GovReports automates all calculations, ensuring accuracy and reducing the risk of mistakes.

Seamless Lodgement: Once your data is entered, GovReports handles the secure electronic lodgement directly to the Australian Taxation Office (ATO). No more printing, mailing, or waiting in line.

Enhanced Compliance: Stay on top of your BAS obligations with GovReports. The platform offers reminders and notifications for upcoming deadlines, helping you avoid penalties.

Additional Benefits:

Integrated Features: GovReports seamlessly integrates with your existing workflows, allowing for a smooth transition to online BAS lodgement.

Secure Storage: Keep your BAS records safe and easily accessible with GovReports' secure online storage solution.

Expert Support: A dedicated support team is available within the platform to answer any questions and assist you with the lodgement process.

Start Streamlining Today:

Stop wasting time and resources on tedious BAS lodgement procedures. GovReports offers a user-friendly platform that simplifies the process, improves accuracy, and saves you valuable time. Sign up for a free trial today and experience the GovReports difference!

0 notes

Text

GovReports-Tax Software for Business

GovReports tax software for small business makes tax and BAS lodgments fast and easy. GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

The Way Forward With Single Touch Payroll

The commencement of Single Touch Payroll since July 2018 for businesses with more than 20 employees was the starting of the new reporting era for employers to submit information such as their employees’ salaries and wages, pay as you go withholding and super information to the Australian Tax Office (ATO) supposing from their payroll solution each time they pay their employees.

Small and micro businesses with less than 20 employees will have until July 2019 to get on board with this STP bandwagon.

According to the ATO, to date nearly 45,000 businesses have already opted in for STP of which 16,000 are considered as small business with less than 20 employees. And with the deadline looming around in few months, ATO has indicated low touch approach to STP compliance until the system settles in. How long until the STP system settles in, that is the question for many businesses that are not yet and perhaps reluctant to be on digital platform due to the nature of their business.

STP will be beneficial for younger generation employees who are tech savvy and love to be online. They will be able to view their year to date tax paid by their employer/s and super information online via myGov. With the same data collected, ATO will be able to assess whether or not employers are correctly reporting super obligations for and on behalf of their employees.

In the longer term, the ATO’s objective is to provide a consolidated and overview tax position to all tax payers from individual to business and or corporate in real time with a few clicks of the mouse.

Benefits for employers with Single Touch Payroll is that it will streamline the process of reporting to the ATO as reporting is completed along with their payroll information being submitted.

The information submitted will be prefilled on other reporting obligations ie W1 & W2 on the BAS for employers, eliminating potential errors and double handling of payroll data. Furthermore, PAYG payment summaries will no longer be required at end of the year now that employees can access their details online from myGov and auto prefilling for tax return from software or MyTax.

For businesses that are already using compliant payroll, generally nothing has changed with your normal payroll process. The additional to that routine is the extra step of ATO reporting of the pay run details and it could be part of the software features or extending to their bookkeeping or tax adviser to review and submit their STP reporting obligations from their own STP software.

Businesses not using compliant payroll software nor on the digital platform, can either upgrade their software or get an STP reporting software extension like GovReports where they can upload their payroll details in CSV or XML file formats to submit to ATO. This process can also be reviewed by their Bookkeeper or tax adviser and or lodged through their adviser’s GovReports STP reporting software account.

Businesses not using any software to date will now have option to buy new STP payroll software to comply. For micro and small businesses, ATO has reached out to software providers to make available low cost options for these businesses to get on board.

Over 31 software providers responded and agreed with the ATO’s proposal to participate in the STP rollout for micro and small businesses. They can choose to opt in for a well-known software brands that are willing to cut their price perhaps for first year or two and help these small business getting on board with STP.

GovReports STP reporting solution for micro and small business is the Interactive Accounts Manager (IAM) - with STP module or full featured IAM Business Ledger.

IAM is a simple application with direct lodgement capability and integrates with GovReports so tax practitioners can also lodge from their GovReports account as options for better client management and electronic filings of compliance reports including STP and or other compliance reporting forms.

IAM as STP reporting module comes with options to upload pay run events in CSV or manually enter payroll details for simple payroll calculation and of course direct lodgement to ATO.

IAM STP’s annual cost is $99 inclusive of GST and lodgement.

IAM Business Ledger is an easy to use business ledger built to meet micro and small business accounting and regulatory reporting needs. With options to upload data files for sales, expenses, payroll events, receipts and or invoices, bank statements...etc. to create financial and compliant reports ready for ATO lodgement. Reports available for lodgement include Activity Statement, Tax File Number Declaration, Single Touch Payroll and business tax return.

The annual cost for IAM Business Ledger is $149 GST and lodgement inclusive.

Both IAM STP and IAM Business Ledgers have available option for online engagement and interaction with their own tax or BAS agent to share and review your account and reports for lodgement if advice is required.

1 note

·

View note

Text

Jobkeeper Extension key dates | GovReports

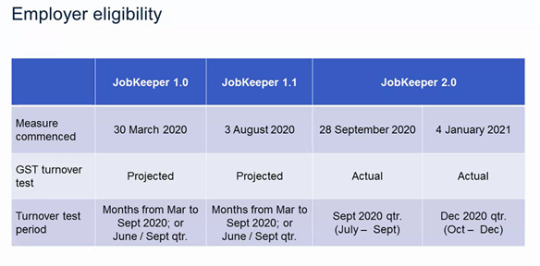

On 30 March, the Federal Government uncovered the JobKeeper Lodgement Program with an end goal to boost businesses to save laborers in work to the extent that this would be possible.

Preceding 28 September 2020, the JobKeeper Payment was $1,500 profit (before charge) per fortnight, paid to the business as an enhancement to help with the installment of pay and wages. The JobKeeper Lodgement plot has been stretched out from 28 September 2020 until 28 March 2021 and contains two separate augmentation periods. The pace of the JobKeeper installment in every expansion period will rely upon the number of hours a qualified worker works, or a qualified business member is effectively occupied with the business.

Expansion periods for JobKeeper 2.0

There are two separate augmentation periods for JobKeeper 2.0. For every expansion period, an extra real decrease in turnover test applies and the pace of the JobKeeper Lodgement installment is extraordinary.

The main quarter of the augmentation time frame runs from 28 September 2020 to 3 January 2021, containing 7 fortnights of:

Level 1: $1,200 per fortnight for those working 80 hours or more in any reference period; and

Level 2: $750 per fortnight for those working less than 80 hours in any reference period.

The second quarter of the augmentation time frame runs from 4 January 2021 to 28 March 2021, involving 6 fortnights of:

Level 1: $1,000 per fortnight for those working 80 hours or more in any reference period; and

Level 2: $650 per fortnight for those working less than 80 hours in any reference period.

N.B: Employers don't have to re-select to keep guaranteeing installments during the augmentation time frame in the event that they are now taken on JobKeeper.

Significant Dates

Jobkeeper 2.0 - Extension 1 period

28 September 2020: The JobKeeper expansion 1-period begins and the installment rates change for your qualified representatives. The principal augmentation covers the JobKeeper fortnights between 28 September 2020 and 3 January 2021. Organizations will be needed to reevaluate their qualification concerning their genuine GST turnover in the September quarter 2020 to be qualified for JobKeeper Payments from 28 September 2020 to 3 January 2021.

You'll additionally have to:

Show that your real GST turnover has declined in the September 2020 quarter comparative with a tantamount period (for the most part the relating quarter in 2019). See the real decrease in the turnover test.

Have fulfilled the first decrease in the turnover test. Notwithstanding, on the off chance that you were qualified to get a JobKeeper for fortnights before 28 September, you have just fulfilled the first decrease in the turnover test. In the event that you are taking on JobKeeper lodgement unexpectedly from 28 September 2020, on the off chance that you fulfill the genuine decrease in the turnover test, you will likewise fulfill the first decrease in the turnover test (with the exception of specific colleges). You can select on that premise.

Tell the ATO whether the level 1 (higher) or level 2 (lower) installment rate applies to each qualified representative, qualified business member, or qualified strict professional. In the event that you are now joined up with JobKeeper and qualified for the augmentation, you do this in your business month to month statement in November. You should likewise tell your qualified representatives, qualified business members, or qualified strict experts which installment rate applies to them within 7 days of advising the ATO of their installment rate.

30 September 2020: Enrolments close for September fortnights

To guarantee installments for the September JobKeeper fortnights, you should enlist by 30 September.

This should be possible through the accompanying stages:

ATO Business Portal. To utilize the Business Portal you will require a myGovID connected to your ABN in relationship Authorisation Manager (RAM). You can discover how to set this up at ato.gov.au/mygovid.

Online Services for Agents (for enrolled charge/BAS specialists). Your enlisted expense or BAS specialist can select, distinguish, and announce for JobKeeper for your sake.

Snap-on this connect to the pertinent page on the ATO site for a bit by bit guidelines on the most proficient method to select.

Somewhere in the range of 1 and 14 October 2020: Complete the October JobKeeper month to month business affirmation

You should distinguish your qualified workers, qualified business members, or qualified strict specialists every prior month making your business month to month presentation.

Make your business month to month announcement between the first and fourteenth of every month to guarantee JobKeeper installments for the earlier month. For instance, to be repaid for JobKeeper installments paid to your workers in August you should finish your announcement by 14 September.

Somewhere in the range of 1 and 31 October 2020: Check and present the business genuine decrease in turnover to the ATO

This should be possible online to be qualified for JobKeeper augmentation 1. It couldn't be any more obvious, the genuine decrease in the turnover test.

You have until 31 October 2020 to pay workers for JobKeeper fortnights finishing off with October

You need to tell the ATO the installment level being asserted for each qualified representative.

You should distinguish your qualified workers, qualified business members, or qualified strict professionals every prior month making your business month to month affirmation. You can do this utilizing the qualification report.

Make your business month to month presentation between the first and fourteenth of every month to guarantee JobKeeper installments for the earlier month. For instance, to be repaid for JobKeeper installments paid to your representatives in August you should finish your affirmation by 14 September.

Before you select to get JobKeeper installments, you need to tell each qualified representative that you mean to choose them as qualified workers under the JobKeeper Payment plot. You should tell those representatives that you have selected them as a qualified worker to guarantee the JobKeeper installment. They should consent to be named by you by finishing the JobKeeper worker selection notice.

#JobKeeperPayment#JobkeeperLodgement#GovReportsJobkeeperLodgement#JobkeeperExtension#JobkeeperExtensionPeriod

0 notes

Text

Tax software for bookkeepers - GovReports

GovReports tax software is a suite of integrated compliance, Empower your practice with our intelligent tax software for bookkeepers. Simplify complex tax calculations, job tracking, time/billing and e-signature apps with one client database that simplifies the production and management of your jobs, clients and team.

Manage multiple clients: Easily handle the tax returns of multiple clients within a single platform.

Automate calculations: Let GovReports handle the complex calculations, reducing the risk of errors.

Integrate with accounting software: Seamlessly connect GovReports with popular accounting software for streamlined data transfer.

Store documents securely: Safely store and access important documents related to tax returns.

Collaborate with clients: Easily share information and collaborate with clients throughout the tax preparation process.

0 notes

Text

Lodge BAS online portal - GovReports

Looking to simplify and expedite your BAS lodgement process? Look no further than GovReports! This user-friendly platform automates tasks to lodge BAS online quicker , GovReports enables taxpayers and tax practitioners to prepare, manage and lodge compliant reports including BAS, STP, TFND,TPAR, FBT, tax returns and more, Feel free to reachout to us for more exciting informations: https://www.govreports.com.au/bas-agent

0 notes

Text

GovReports-Tax Software for Business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services. GovReports Interactive Accounts Manager business ledger software is a great solution for small businesses

0 notes

Text

GovReports-Tax Software for Business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

GovReports-Tax Software for Business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

GovReports-Tax Software for Business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

GovReports-Tax Software for Business GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

GovReports-Tax Software for Business GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes

Text

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services. GovReports tax software for small business makes tax and BAS lodgments fast and easy.

0 notes

Text

tax software for small business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services. GovReports tax software for small business makes tax and BAS lodgments fast and easy.

0 notes

Text

GovReports-Tax Software for Business

GovReports offers a fully featured tax and BAS lodgment system for small business owners. Integrate with your accounting software or manually enter data and manage your lodgements with real time ATO online services.

0 notes