#Gold Smelting Market Sale

Explore tagged Tumblr posts

Text

Gold Smelting Market Set to Surpass USD 27.1 billion by 2031 - Latest report by TMR

The global gold smelting market was valued at an estimated USD 20.3 billion in 2023 and is projected to reach USD 27.1 billion by 2031, representing a CAGR of 3.9%. The gold smelting market plays a crucial role in extracting and purifying gold from various sources, transforming it into usable precious metal for diverse applications. This report examines the current state of the market, its key drivers, challenges, and future trends.

Gold smelting is the process of extracting gold from its ore through heating and chemical reactions to separate the precious metal from impurities. It is a critical step in the gold production chain, enabling the transformation of raw materials into high-purity gold bullion or ingots suitable for further processing or investment.

Don't miss out on the latest market intelligence. Download sample Copy today@https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1469

Growth Drivers and Opportunities:

• Focus on responsible sourcing: Growing emphasis on ethical sourcing and responsible supply chains in the gold industry creates opportunities for regulated and sustainable smelting practices. • Advancements in hydrometallurgy: Adoption of eco-friendly hydrometallurgical techniques for gold refining helps reduce environmental impact compared to traditional methods. • Integration of digital technologies: Utilization of blockchain technology and digital platforms can enhance transparency and traceability in the gold supply chain. • Rising demand for high-purity gold: Increasing demand for high-purity gold in electronics and certain industrial applications necessitates advanced refining techniques.

Market Growth:

This growth is driven by several factors: • Rising demand for refined gold: The increasing demand for gold from various industries, including jewelry, electronics, and investment, necessitates continuous refining of raw gold materials. • Growing recycling of gold: A significant portion of the gold supply comes from recycling, especially from end-of-life jewelry and electronics, contributing to the demand for gold smelting services. • Expansion of gold mining: Increased gold exploration and mining activities globally generate more raw gold material that requires refining before entering the market. • Technological advancements: Advancements in smelting technologies like hydrometallurgy and pyrometallurgy are improving efficiency, reducing environmental impact, and enabling the processing of complex gold-bearing materials.

Key Players:

The gold smelting market is dominated by established players, with some regional variations. Major players include: Chongjin Gold Corporation, Ronghua Industry Group Co. Ltd., Ohio precious metals LLC, Global Advanced Metals, Chenzhou Mining Group Co. Ltd., Johnson Matthey Ltd., Materion, Ohio precious metals LLC, Gannon and Scott, Aida Chemical Industries Co. Ltd., Yuyuan Tourist Mart Zijin Mining Group Co. Ltd., and OJSC Kolyma Refinery.

Request for Brochure@https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1469

Recent Developments:

• Focus on sustainability: Smelters are increasingly adopting environmentally friendly practices, such as reducing energy consumption and minimizing waste generation. • Growing demand for traceable gold: Consumers are demanding ethically sourced and traceable gold, prompting smelters to implement stringent sourcing practices and certification schemes. • Expansion into emerging markets: Established players are entering new markets with high growth potential, particularly in Asia Pacific and Africa.

Strategies for Market Players

• Technology Investment: Investment in R&D to develop and commercialize innovative smelting technologies with higher efficiency, lower emissions, and reduced environmental impact. • Market Diversification: Diversification of product and service offerings to target emerging markets such as small-scale mining operations, artisanal gold producers, and industrial end-users.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact Us:

Nikhil Sawlani Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Blog: https://tmrblog.com Email: [email protected]

#Gold Smelting Market#Gold Smelting Market Size#Gold Smelting Market Share#Gold Smelting Market Sale

0 notes

Text

Sell Gold in Delhi NCR - Cash for Gold in Delhi

If you want to sell gold for cash, here are some steps and tips to help you get the best value for your gold:

Determine the value of your gold:

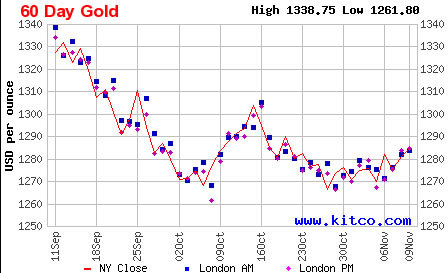

Weigh your gold: Use an accurate scale to measure the weight of your gold in grams or ounces. Check purity: Identify the carat (e.g. 10K, 14K, 18K, 24K) or fineness of your gold. Pure gold is 24 carats. Current Market Price: Find the current spot price of gold, which fluctuates daily based on market conditions. Websites like Kitco or GoldPrice.org can provide this information. Understanding the Types of Gold Buyers:

Jewelry Stores: Many jewelry stores buy gold, especially if it is in good condition and can be resold. Pawn Shops: These stores offer fast cash, but may not give you the best price.

Online gold buyers: Some companies operate online and offer postal gold delivery services. Examples are “Cash for Gold USA” or “Sell your gold”. Gold Refiners: They smelt gold and pay based on weight and purity, often offering better prices. Receive multiple offers:

Visit or contact multiple buyers to get offers. This will give you a better idea of fair market value. Check the buyer's reputation:

Check reviews and ratings on platforms like the Better Business Bureau (BBB) or Trustpilot. Make sure the buyer is licensed and follows fair practices. Negotiate:

Don't be afraid to negotiate the price. Some buyers may be willing to offer a better deal if they know you're buying. Complete the sale:

Once you agree on a price, you may be required to provide identification. Make sure you understand the terms and conditions of the sale, including fees and commissions.

Get a receipt for your records. By following these steps, you can maximize the value you receive when you sell your gold for cash.

Cash for gold in Delhi | Cash for gold in Preet Vihar Delhi

#cash for gold in delhi#cash for gold in gurgaon#cash for gold in preet vihar#cash for gold in noida ghaziabad#sell gold for cash#sell gold online#sell gold near me

1 note

·

View note

Text

Turn Christmas: Hidden in Finery

A Robert Townsend & Arielle Nathan story I was meant to publish awhile back but forgot about so happy late December 17th!!

The problem of forgetting you are trapped is when the trap twists itself around your ankle, and you dare to show your distress. At Rivington’s, she had forgotten about it all, the redcoats and the beatings from Captain Hennely’s wife. In the daze of candlelight and a humorous conversation, she forgot about the war outside her door. She forgot about her role as prisoner & friend, governess & respectable guest she forgot about all the titles given to her when James Rivington made a joke or John André mused a poem out loud.

Arielle forgot about her family being miles away in Philadelphia when Robert smiled at her.

That rare secret smiles that she tugged close to her chest. Robert Townsend had many ways of smiling- the polite line for drunk customers who ranted about everything and nothing, that reserved smile of amusement when Rivington would refer to him as “Robby Boy” or her favourite- well favourite two.

The sly one that would catch the glint in his eyes when something amused him- genuinely unrefined. It could be a joke or a complaint made by a person, or perhaps it was a thought that crossed his mind. Those rare melancholic free thoughts as he laughed to himself about a uniform three sizes too big on a young officer or the invisible ink debacle. Arielle liked those smiles.

The one she loved, was that gentle smile unaided by a raise of his eyebrows or a slant of his chin. No, instead it draped over his lips in momentary content. His witty smiles were regular affairs that fluttered her chest- these gentle ones; a rarer variety as if budgeted and allotted in his monthly account books—emerging when he felt in control when the world stopped spinning, when everything felt in order- as if Robert had not sacrificed all his prospects in a high stakes gamble. That of a spy; that of life and death.

When he first gave her that smile, her heart melted. She realised that the love she thought she had felt previously was nothing because she wanted to imprint this moment in her very being. She was longing for some reception, for some encouragement. Arielle could still recall the way his eyes softened when the coffeehouse was closing, and he glanced up from his books and smiled—not seeing her as out of place in this world of his but rather a comforting part of it, amongst the candles burning low and the day's numbers recorded.

This sense of belonging was not here tonight. Andre was away at dinner and Rivington was entertaining a table of ladies. The one man she did care about was tending to his wares—streets away which at this table felt like oceans away.

Bitterness coursed her chest, gripped at her tongue, forcing her to taste anxiety in her bones and the resentment of this cage. This cage that had deceived her so well until the cards were laid in front of her. Numbers racked up in debt, the men around her smelt like gin and rum, like a pulsing wound under bandages. Toxic and jaundiced.

Captain Hennely, the fool, was in debt and racking it up fast as he insisted on another betting coin. Arielle watched him with abject horror- leading him to snap at her “Shut your damn eyes constantly!” “Judas of a woman!” the two alternating every two minutes. When he lost a round, he slammed his fist down in front of her. If he chose not to bring it down on the table, he could quickly bring it down on her, to her stomach and thighs, causing her heart to patter in her throat.

Arielle could not just leave, to find another table even when she longed for anyone else's company. For if she tried to move he would snap about having to keep an eye on her. That someone should see his victory should learn the value of coin over-etching it out in budget plans.

The man he gambled against was a wolf of a man. Conniving and greedy for anything that glittered. Rivington once told her that he got violent with anyone who tried to cheat him. Oft, dragging them to the nearest alleyway to crash bone against bone. Townsend’s nod told Arielle this wasn't just James’s typical exaggerations. This man focused his gaze on her neck, on her necklace like a fox upon a goose.

Upon the pearl and aquamarine choker, a gift from her parents, the first necklace of significance she was allowed to own; Not to share the diamonds and pearls with her sister or mother from the family safe. Not the gold chains of girlhood. This necklace was her sixteenth birthday present, a present that told her she was now allowed her safekeeping items. The pearls were small white river pearls that circles her neck in singular role while in the center was a cushion-cut aquamarine secured in gold plated brass while hanging from it was a baroque seawater pearl, with its pear shape, that felt like a tear, the size of her thumbnail- small, delicate yet strong.

This necklace may not have been the most costly, but it had sentimental value, it demonstrated when Arielle has first trusted with value herself and now this man wanted it. Hennley failed his bet and had no money to give. Taking the opportunity, the man demanded her necklace to settle all debt- so he could play another night again.

She began to refuse, this was not his to give it was hers- it was her possession. “I apologise sir but this is mine, it is not for sale”. It was then she realised she was still entrapped that she was the property of the crown, that a last-minute cry saying it belonged to her father meant nothing.

He slammed his hand in front of her, the same way Hennley did. Demanding it outright or else that captain would be no longer, and she wouldn’t want that. Oh, see how I care Arielle thought spitefully, at first. Drag him by his guts for all I care this is mine. Her barred teeth in a snarl meant nothing. For every time, her emotions began to get out of check, that another guest may notice- this same captain pinched her hand. “It doesn't belong to you, it belong to the Crown and as you’re exchequer I demand you hand it over”

Protests died on Arielle’s lips as tears pricked her eyes. Her neck felt cold as her possession was stored safely in the man’s hand. “It will fetch for a fair price” he murmured as he passed her. Straight to the market. Away from her hands. Standing sharpley she demanded a coin- a carriage she was going home. Henley handed her a coin reluctantly “be prudent with your travel” he had such a nerve.

No one met her eye, Rivington continued chatting, Andre was still gone and Robert was far away while she was left feeling like a bartered whore- none of her possessions bound to her by ownership let alone honor. Her anxiety fretted- what else will they take from her?

The accounts were in check, the stock for the Christmastide sales was prepared. When Robert Townsend came back to Rivington’s the following day everything felt alright. He was prepared for last minute officers trying to barter the price of rum. He had everything from second hand goods to newer ones. Abraham often critiqued him for his loyalty to his business. Accusing him of not engaging with the Ring fully in order to save his own income. Fool.

That was the only answer Robert would give to it. It is not like he spent nights awake pondering if there was any merit in his words.

There was one thing out of place, however, Miss Nathan’s regular expression of glee, often smiling with some wit on her tongue. Her choleric rants. Her general ability to hold court in the room. That is what made her and Rivington work so well. He would work one half of the room and her th either. Yet while James was intentional- Robert thought it was just Arielle’s nature to challenge, twist, debate and laugh.

Instead she appeared late; strange. Her dress plainer than her regular vibrant colours or patterns. No jewellery around her neck. The most telling was the way she sulked around the room. Eyes dark refuting anyone who came near her. Watery and untrusting. Perhaps that was what concerned him, Arielle was as volatile as he was. One minute light hearted next minute serious, melancholic then temperamental. While he was private however; her face was a stage informing everyone of her mood. Robert didnt know how he felt about the twisting in his chest when he caught her eye.

It felt strange not to have a presence by his elbow, peering down at whatever he was working on. It was all very strange indeed.

Yet; Mr Townsend could not go and talk to her. Risk showing the world their closeness. No instead he would have to make inquiries. The hint came when Captain Hennley- he never bothered to catch his first name, scoffed past her and she scowled, teeth bare like a fox disturbed.

Pouring a glass of port, he delicately placed it next to the man.

“Gambling good, sir?”

“Could be better,”

“is that so?”

“Aye, some wolf like bastard bet me out of my money” Robert cringed but continued.

“I hope you found a way to remedy it” He tried to sound neutral, not generally given to inquiries.

“Oh I did- he wanted the girl’s necklace, she has been in a wicked temper ever since, the King doesn’t pay me enough for this”

Over the next couple of days, Arielle felt herself go from bad to worse. It was not the material object of the gif that mattered. It was this idea of not having any grounding of being trapped. She suddenly became more aware of her limits, of her confinements. Of how much she missed her family. The necklace was a symbol.

Who was her ally?

The bustle of officers, actresses and curious traders made for decent observing; they were like headless chickens on the 24th. Arielle failed to take notice of the man behind her. His hand dropped to her shoulder, startling her with a squeak. “Hush now” came Mr Townsend’s voice “Do not startle all of York City.”

Even now, she felt herself chuckling. “Come”. He was gesturing to the cellar. Leaving first; curious Arielle disappeared from the crowd into the back. Two seconds later, he held out his arm. “Where are you escorting me to, Mr Townsend?” “You will see.”

Robert guided her to his room and with the wit she had left she turned “Now this is not very proper”.

“Look what is on the bed.”

There was a small brown paper package wrapped neatly in twine. It was not very thick, and she could tell there was cloth under it. “Am I to open it” “Well it is a gift, I believe that is what you do with them” Too curious to retort Arielle undid the tie and noted underneath one of his handkerchiefs- the one subtly embroidered with white cross-stitch. Unfolding it, she felt something cold. By God, it was impossible.

Sparkling back at her was her necklace.

“It is not a replica; it is the same one...I traced down Captain Hennley’s contact and made some inquiries the man he sold it to is in debt to me for sharing stock so in exchange for settling our debts I got it back” Robert explained, each word gave her this urge to embrace the living daylights out of him and never let go.

“Before you ask why you were far too miserable for this establishment and I could not have it affecting business” “business? What one?” “the one of my mental state.”

So he was concerned about her. She had an ally.

“I suppose it is a Christmas present.”

“Don’t tell any of the other Quakers” Robert cooed with an amused expression.

“Now, let me put that on for you” gently moving her hair out of the way he clasped it around her neck, his breath warm against it. If Arielle could have melted, she would have. Then he knelt down placing an intense, warm kiss to the back of her neck.

The gesture made her think of customs. In Sephardi culture, a groom as a sign of engagement would gift anything of value, a coin, a ring or a necklace. It was a sign of the marriage that he could support them. It was not limited to the Ashkenazi ring or coin. It could be earrings, or it could be the hunting down of the string of pearls around her neck.

“I won’t tell the Quakers if you won’t tell the Jews.”

With a grin, she added “or else we might be engaged.”

Startled, Robert sharply inhaled before laughing “I think I could think of worse things.”

“Run along, go light up the room again.”

Instead of moving, Arielle sprung up and embraced him. Her head in his shoulder, arms tight around him. Robert’s arms were soon around her. A quiet, warm embrace. Murmuring a thank you, she caught the sight of him.

Robert Townsend was smiling, gentle and unaided.

#12 days of turn#12 days of christmas#turn: washington's spies#turn amc#Robert Townsend#gifts#Arielle Nathan#𝐫𝐨𝐛𝐞𝐫𝐭 𝐭𝐨𝐰𝐧𝐬𝐞𝐧𝐝#𝐚𝐫𝐢𝐞𝐥𝐥𝐞 𝐧𝐚𝐭𝐡𝐚𝐧#𝐦𝐲 𝐨𝐧𝐥𝐲 𝐰𝐡𝐨𝐥𝐞𝐬𝐨𝐦𝐞 𝐜𝐨𝐮𝐩𝐥𝐞#𝐚𝐫𝐢𝐞𝐥𝐥𝐞 𝐧𝐚𝐭𝐡𝐚𝐧 & 𝐫𝐨𝐛𝐞𝐫𝐭 𝐭𝐨𝐰𝐧𝐬𝐞𝐧𝐝

16 notes

·

View notes

Text

The Role of Women In Traditional African Societies

One area where the traditional societies were well advanced than their Western counterparts was in the area of women’s rights. Women in non-Western traditional societies were long “liberated” before those in the West. In fact, the Western feminist movement drew a lot of inspiration from the role women played in traditional Iroquois society. According to Jacobsen (2009),

An aspect of Native American life that alternately intrigued, perplexed, and sometimes alarmed European and European-American observers, most of whom were male, during the 17th and 18th centuries, was the influential role of women. In many cases they hold pivotal positions in Native political systems. Iroquois women, for example, nominate men to positions of leadership and can “dehorn,” or impeach, them for misconduct. Women often have veto power over men’s plans for war. In a matrilineal society — and nearly all the confederacies that bordered the colonies were matrilineal — women owned all household goods except the men’s clothes, weapons, and hunting implements. They also were the primary conduits of culture from generation to generation.

The role of women in Iroquois society inspired some of the most influential advocates of modern feminism in the United States. The Iroquois example figures importantly in a seminal book in what Sally R. Wagner calls “the first wave of feminism,” Matilda Joslyn Gage’s Woman, Church, and State (1893). In that book, Gage acknowledges, according to Wagner’s research, that “the modern world [is] indebted [to the Iroquois] for its first conception of inherent rights, natural equality of condition, and the establishment of a civilized government upon this basis.”

Gage was one of the 19th century’s three most influential American feminists, with Elizabeth Cady Stanton and Susan B. Anthony. Gage herself was admitted to the Iroquois Council of Matrons and was adopted into the Wolf Clan, with the name Karonienhawi, “she who holds [up] the sky.” (Jacobsen, 2009).

It is not just in the Iroquois nation that women held important political positions. As we have shown above, most traditional societies have Clan or Queen Mothers with the power to appoint and depose a chief. Her role is to scold, reprimand and rebuke an erring chief since a bad chief brings shame to the royal family. If the chief continues in his errant ways, the Queen Mother has the power to recall and depose the chief.

In other traditional; systems, women even played a more visible political role:

· Women ruled the Mongol Empire (Weatherford, 2005).

· Quen Nzinga of the Mbundu people of Angola put up a ferocious resistance against Portuguese colonial rule (http://www.blackpast.org/?q=gah/queen-nzinga-1583-1663).

· The kings of Dahomey were assisted by a cabinet which consisted of the migan (prime minister); the meu (finance minister) created by Tegbesu; yovo-gan (viceroy of Whydah); the to-no-num (the chief eunuch and minister in charge of protocol); the tokpo (minister of agriculture); the agan (general of the army); and the adjaho (minister of the king's palace and the chief of police). The most interesting and unique feature of the cabinet was that each of these posts had a female counterpart who complemented him but reported independently to the king (Ayittey, 2006: 243).

· During his reign, Gezo increased the number of the full-time soldiers from about 5,000 in 1840 to 12,000 by 1845. This army consisted not only of men but also of women, the famous Amazons `devoted to the person of the king and valorous in war.' This unique female section was created and organized by Gezo and consisted of 2,500 female soldiers divided into three brigades. Commanders of this army were also top cabinet ministers in charge of the central government thus enhancing the position of the army in decision making (Boahen, 1986; p.86).

· In the Yoruba Kingdom (Nigeria) in early times it was not necessarily a male who was chosen as ruler, and the traditions of Oyo, Sabe, Ondo, and Ilesa record the reigns of female oba (kings) (Smith, 1969: 13).

· In Asante, the British captured and exiled the king to Sierra Leone in January 1897. But to the Asante, it was the golden stool, not the king, was the symbol and soul of their nation. When the British made a vain attempt to capture the golden stool in April 1900, they met a stiff and humiliating defeat at the hands of an Asante woman, Yaa Asantewa, the Queen Mother of Edweso. Though this rebellion was finally crushed, the British never gained possession of the golden stool. Of course, British historians rarely mention this defeat, much less at the hands of a woman!

Needless to say, there were bad women rulers too. One was Dode Akabi, whose accession to power constituted the first major female figure in Gá, and indeed Gold Coast. But in her long reign, 1610-1635, she cast aside the practice of rule by consensus and issued a series of brutal decrees which displeased her people. She was f killed after she had ordered her subjects to sink a well at a place called Akabikenke (Ayittey, 2006: 232)

Women In The Traditional Economic System

With the exception of Islamic countries in the Middle East, women also played a much more visible and important role in the traditional economy – especially in agriculture and market trading. Most traditional societies practice sexual division of labor. In early times, activities considered dangerous and physically strenuous such as waging wars, hunting, fishing, manufacturing (cloth weaving, pottery, leatherworks, iron smelting, sculpturing, etc) and building were male occupations. Food cultivation and processing were traditionally reserved for women. Since the family's entire needs could not be produced on the farm, a surplus was necessary to exchange for those items. It was only natural that trade in foodstuffs and vending came to be handled by women and for market governance to lie in their hands. Indeed in many localities, market rules were generally laid down and enforced by "Market Queens", usually selected from the women traders.

Women still play this role today since agriculture continues to account for a higher share of the Gross Domestic Product (GDP) of developing countries. For example, three out of four Africans are engaged in agriculture, with women making the most significant contribution. They perform “some 90 percent of the work of food processing, 80 percent of food storage tasks, 90 percent of hoeing and weeding, and 60 percent of harvesting and marketing, besides load carrying and transport services” (FAO, 1985, Chapter 7).[i] Rural markets and trade are also largely handled by women. Local farm produce ‑ either cash crops or food crops ‑ are marketed at the local market, almost invariably by women.

In West Africa, for example, market activity has been dominated by women for centuries:

· In 1879, Governor Rowe of Sierra Leone expressed his admiration of these women: “The genius of the Sierra Leone people is commercial; from babyhood the Aku girl is a trader, and as she grows up she carries her small wares wherever she can go with safety. The further she goes from the European trading depots the better is her market” (White, 1987; p.27).

· The market in every Ga town is run entirely by women. No trading, except that initiated by foreigners is ever carried on by men...Many of the women are very shrewd and ingenious in their trading. One day when good catches of fish were coming in I saw a woman, who had no fishing men‑folk, exchange a bowlful of fried akpiti cakes for a panful of fresh fish, and then hastily sell the fish to a `stranger' who was trying to make up a load to take away. The sale of the fish brought her three shillings and four pence. The sale of the cakes would have brought her one and sixpence. The materials out of which she made the cakes probably cost less than sixpence (Field, 1940: 64).

· The market place among the Akan of Ghana is largely a woman's world. Except for the small percentage of traders who are men, the processes of trade are said to be mysteries to men. Men often seem uncomfortable in the market; they prefer to send a woman or a child to make purchases for them, and avoid entering it if possible. For women, the market place is not only a place of business but of leisure as well. Sales are sometimes slow and women chat and josh with each other” (McCall, 1962).

· In South Dahomey, commercial gains are a woman's own property and she spends her money free of all control...Trade gives to women a partial economic independence and if their business is profitable they might even be able to lend some money ‑ a few thousand francs ‑ to their husbands against their future crops (Tardits and Tardits, 1962).

The object in trading was to make a profit. The Yoruba women "trade for profit, bargaining with both the producer and the consumer in order to obtain as large a margin of profit as possible" (Bascom, 1984; p.26). And profits made from trading were kept by the women in almost all of the West African countries.

Though the amount of profit was often small by today’s standards, many women traders were able to accumulate enough for a variety of purposes: to reinvest and expand their trading activities, to cover domestic and personal expenses since spouses have to keep the house in good condition, to replace old cooking utensils, to buy their own clothes and to educate their children. The case of Abi Jones was earlier cited where profits from her trading were used to educate her sons. Indeed, many of the post‑colonial leaders of Africa were similarly educated ‑ with funds accumulated from trading profits.

Another important use of trade profits was the financing of political activity. As Herskovits and Harwitz (1964) put it: "Support for the nationalist movements that were the instruments of political independence came in considerable measure from the donations of the market women" (p.7).

To start trading, women often looked to their husbands for support or borrowed from the extended family pot. For example,

As soon as he is married the Ga husband is expected to set his wife up in trade (`ewo le dzra' ‑ he puts her in the market). It is part of every woman's normal occupation to engage in some sort of trade and every reasonable husband is expected to start her off...When she is unlucky in her trading and loses her capital her husband is expected to set her up again, but if she loses her capital three times she is a bad manager and he has no further obligation in the matter (Field, 1940:55).

Market trading generally made African women economically independent. Chatting at the market place also provided an important social release for pent‑up emotions. Of course, today, much of this market activity has spilled over into the informal sector, where women still play an important role in food-related activities, such as, food vending by the roadside.

[i] Perhaps this gender characteristic explains why Africa’s agriculture revolution never materialized. In many countries, it was crafted with the help of Western agricultural experts who tended to prescribe “mechanization” with the importation of male-driven agricultural machinery.

References Ayittey, George B.N. (2006) Indigenous African Institutions. Dobbs Ferry, NY: Transnational Publishers.

Bascom, William (1984). The Yoruba Of Southwestern Nigeria. Prospect Heights: Waveland Press, Inc.

Boahen, A.A. (1986). Topics in West African History. New York: Longman.

Bohannan, Paul and George Dalton eds. (1962). Markets In Africa. Evanston: Northwestern University Press.

Field, M. J. (1940). Social Organization of the Ga People. Accra: Government of the Gold Coast Printing

Herskovits, M.J. and Harwitz, M. eds. (1964). Economic Transition In Africa. Evanston: Northwestern University Press.

Jacobsen, E. (2009) The Iroquois Constitutionhttps://ca01001129.schoolwires.net/cms/lib7/ca01001129/centricity/domain/221/the_iroquois_constitution.pdf

Johansen, Bruce E. (1990). “Native American Societies and the Evolution of Democracy in

America, 1600-1800,” Ethnohistory, Vol. 37, No. 3 (Summer, 1990): pp. 279-290.

______________ “Native American Ideas of Governance and U.S. Constitution

http://www.america.gov/st/peopleplace-english/2009/June/20090617110824wrybakcuh0.5986096.html

McCall, Daniel F. (1962). "The Koforidua Market," in Bohannan and Dalton, eds. (1962).

Smith, Robert S. (1969). Kingdoms of The Yoruba. London: Methuen & Co. Ltd

Tardits Claudine and Claude (1962). "Traditional Market Economy in South Dahomey" in Bohannan and Dalton (1962).

Weatherford, Jack (1989). Indian Givers: How the Indians of the Americas transformed the World. New York: Ballantine, 1989.

_______"The Women Who Ruled the Mongol Empire", Globalist Document - Global History, June 20, 2005

White, E. Frances (1987). Sierra Leone's Settler Women Traders. Ann Arbor: University of Michigan Press.

2 notes

·

View notes

Text

Queen Material - Chapter 2

Synopsis: It’s your day off and you just want to spend the day alone, doing one of your favourite things but things don’t always work out the way we want especially if the king is involved

Pairing: Valkyrie x Asgardian!fem!reader

Words: 2.7k+

TRIGGER WARNING - Alcohol use/reference

The conversation may be lingering in your brain but you didn't put much thought into her actual words. They were merely just the ramblings of a very drunk newly appointed king. Even if you did take her seriously, you had no clue what she actually meant anyway and you weren't likely to ask for clarification. You wondered if she told everyone her actual name when she was drunk. Was that even her name? It seemed rather odd that she would just blurt it out to a random barkeeper but they say being intoxicating effects one's filter. Thankfully today you were taking some time off so you wouldn't have to face the awkwardness of seeing the king in your bar. That was Kyle's problem today. You were gracing the local Asgardian markets with your presence instead. Enjoying the warm sun that peaked through the clouds in the sky as you browse the multicoloured stalls. You loved coming here; so much so that most of the venders knew you by name. You would also make a game out of spotting Midgardians among the people. They were always the ones making fools of themselves. For some reason, first-time visitors always came with the notion that Asgardians can't speak the same language so they usually go around shouting simplified English. You could also tell by the way some judged what they saw, Midgardians have a bit of a nasty streak but so does every race of people. They deem themselves as greater which wasn't true but nobody ever fought them on the matter. You check your list as you hunt down the final ingredients you needed for your dinner tonight. You liked to make your meals from scratch using fresh local ingredients. That hadn't changed since Asgard. "Good day, Mrs Pearson. How are you doing?"

Mrs Pearson was an older woman with a heart of gold. She was always trying to help out those in need and you highly respected her for it. She also grew some of the best veggies around.

"I'm doing pretty well, thank you for asking Y/N. What are you after today?"

Your lips curl into a smile as your eyes drift over the assortment of products for sale. "I'll take a bunch of celery and just two garlic cloves, please."

"What are you making today?" She wonders as she collects the ingredients and puts them into small clear bags.

"A lasagna," You answer, taking the items from her and adding them to the satchel resting on your hip. "I've never made one before but the recipe seems easy enough." You shrug. Can't be any harder than the food you made back in Asgard, right? Although back then you never really spent much time in the kitchen. Your love for cooking hadn't come until you found yourself looking for things to do on Midgard to occupy your free time. At first, you mainly made the popular dishes of your people but before too long you branched out when you bought your first Midgardian cookbook. The recipes were easy enough to follow. "It's a simple pasta dish with mince and vegetables."

"Can't say I've ever tried it but it sounds delicious," She wore a soft smile as you hand over the money. "I hope you enjoy."

"If all goes well, I'll be sure to make it for you and your husband sometime." You suggest.

"That would be lovely"

One last glance over her wears, you notice an array of jars. Reaching over to grab the one filled with red. Inspecting the label. "Since when did you sell... jam?"

"I thought I'd try my hand at making it, Roger said it tasted great. You're free to have one if you like; consider it a gift."

You roll the jar between your palms for a few seconds before shaking your head. "No, I don't mind paying," Rooting through your pocket in search of loose change, you hand it over. "Have a nice day, Mrs Pearson, say hi to Mr Pearson for me."

"I will Enjoy your lasagna." With a gentle smile, you turn on your heel and walk away. Pulling out the crumpled up checklist, you make sure you have every ingredient before heading home.

It was around mid-afternoon when you finally slumped through the door to your humble abode. it was a relatively small one-bedroom bungalow. Hanging up your jacket on the rack by the door and slipping off your shoes before marching straight into the kitchen. The book said this should take at least two hours to cook, you were rapidly losing daylight and you hadn't even started yet. Rushing around the kitchen, you follow the step by step instructions to ensure your dish is perfect before setting it in the oven. The sun had already set by the time you fall onto the couch to wait for the meal to cook. The next few hours are spent flicking through the channels on them until you find a show that's even a little bit interesting. Interrupted by the sound of the chicken timer you spring into action more than ready to devour whatever came out; good or bad. At least it smelt great. It has to be around nine when you finally settle down at the kitchen table with a big chunk of lasagna sat on your plate. About to dig in when your phone vibrates against the table. You're surprised to see Kyle's name pop up on the screen and a groan leaves your lips.

"This better be good, Kyle?"

"Hey, Y/N. You remember how you said I could close up early today?"

"Yes, you have some family thing or something. What's the problem?" You wonder. The business was in good standing so closing early wouldn't make much of a difference but you had already said yes, why was he asking again?

"It's just... I can't get the last person to leave. They're just hunched over the bar, refusing to leave." That's it? That's his big problem? This isn't the first time this happened, definitely isn't the last but it's not exactly an emergency. Kyle has worked with you long enough to know what to do.

"Seriously? You should be used to this by now."

"This is different."

"Different how? Just get them out." You shrug, leaning back in your seat. Eyes flickering to the food just waiting to be eaten.

"I can't just kick them out," he urges and you can't help but roll your eyes.

"Why?"

"Because it's the king. I don't think I'm allowed to just tell her what to do." You sigh loudly. Of course, it was the King. Why couldn't things just be simple? "Hello? Y/N?"

"Can you stay until I get there?" You question quietly.

"Yeah."

"Then I'll be there in five," You hang up on him before he gets a chance to respond. Taking a forkful of lasagna into your mouth, you push the plate aside. Guess it'll have to wait until later. It did taste good though, worth the wait. You grab your jacket, slip back into your shoes and walk to your bar. Luckily, you didn't live that far away so it wasn't a long walk. You push the door but when it doesn't open you knock a few times and wait for the door to swing open to see Kyle staring back.

"Where is she?" You ask quietly as you barge past him spotting the woman slumped over the bar. It was a sad sight. The king of Asgard so drunk she's on the edge of consciousness. In all this time you don't think you've ever seen her like this. She had a high tolerance so this is very out of character, "Is she asleep?" You turn back to him.

"I don't know,"

Leaning in close, you inspecting her carefully. She reeked of the alcohol she'd probably been drinking all day. You lay your hand on her shoulder. "Are you okay, my king?" You watch her arms shake as she tries to push herself up off the bar with a low deep groan. You're not sure what to do with her. You can't exactly leave her here all night fermenting in her own juices. The palace which was pathetic in comparison to the golden palace it used to be - it was more like a pretty big house - was pretty far from here. That only really left one option that didn't take her to the inn. "Can you walk?" You ask softly backing away from her. The brunette nods, slowly standing up from her seat. Stumbling in the processes, you leap forward to catch her. She was heavier than expected but you could support her. "You can go home, Kyle. I got this."

"Okay," he disappears behind the bar. "What are you gonna do with her?"

"She's not gonna get far like this so maybe take her back to my place," You suggest. Kyle reappears, backpack slung over her shoulder.

"Shouldn't you take her back to her place?" He argues, heading for the door. "Doesn't she have like guards or people who'll be looking for her? She is the king after all."

You didn't really know what to say to that so you just dismiss him with a wave of your hand. He was right. Shouldn't she have people with her? Someone whose supposed to keep an eye on her or at least guards to protect her? She was always alone when you saw her at least until she finds someone to bed. Valkyrie mumbles something incoherent as you basically drag her out of your establishment; wishing she'd actually carry some of her own weight because it felt like she was putting it all on you. In the end, you do take her back home with you, dropping her down on your bed. She snuggles into your pillow as you throw a blanket over her, making sure she's laying on her side; you bend down so you're stood eye level. "Are you going to be okay? You want some water?"

"Mhmm." Collecting her water, you return to a passed out woman drooling on your pillow. You leave the glass on the bedside table and watch her for a moment. For some reason, you felt on edge having her here like this was a huge mistake. You hardly even knew the woman so what right did you have to take her home? This was basically kidnapping. You imagine this won't be the first time she wakes up in a strangers bed though. And it wasn't like she was all that capable of actually walking home. Would she be mad that you brought here? It was your duty as one of her subjects to help. With a heavy sigh, you collect a blanket and some pillows. It was only right that you spend the night on the couch. You warm up your dinner, check on her one last time before settling in for the night.

You awake to beams of sunlight streaming through the blinds. An ache in your neck which you imagine came from your makeshift bed. For a second the entire world is at peace but then you remember the woman asleep in your bed. Throwing off the blanket, you make your way to the bedroom. Opening the door a crack to peer inside. It was dark and filled with gentle snores. It was sweet seeing her so calm. Not shoving glass after glass down her throat. It dawned upon you that you've probably never interacted with a sober Valkyrie. Leaving her to sleep, you get ready for the day and make yourself an omelette for breakfast. Time moves pretty quickly and as you're placing the ceramic plate on the drying rack a loud thud hits your ears. It came from the bedroom. Panic set in as you barging in unannounced no less. "Are you alright, my king?"

She's... gone? Your brows furrow as you walk further into the room only to discover the woman lying face down on the floor. With wide eyes, you rush to her side. "What happened? Are you hurt?"

"Where... am I?" Her voice is low and heavy with sleep. She rubs both eyes gently and follows up with a yawn; which in turn makes you yawn.

"My house," You reply softly. The woman meets your eyes but remains silent. You can't figure out what's going on in her head but you imagine she's trying to process what brought her to this moment. That's what you'd be doing.

"Did we...?" Your brow knits together before realisation dawns across your face.

"What? No. I- I uh... slept on the couch." You explain quickly. "You practically passed out in my bar so I brought you back here and you immediately fell asleep. Nothing else, I can assure you."

You expect a joke. A cheesy remark but her face remains blank as she scrambled to her feet. "Well, Thanks then I guess."

"Uhm it was no trouble at all. I was happy to help," you plaster on a smile to accompany your unconvincing words. "Would you like something to eat? It's lunchtime so I can make you- I dunno, A grilled cheese? I can make a great grilled cheese" You ramble. "The key is the bread you use and then you mix in like a couple of different che-"

"Yeah, I don't care, make whatever."

You purse your lips before turning on your heel. "Okay I didn't know if you wanted to shower but I left some towels on the dresser and a change of clothes just in case. Oh and if you need painkillers or anything they're in the cabinet above the sink. Just come out whenever you ready."

You leave her alone. Going off to prepare the grilled cheese you had so expertly described. By how long it was taking her she either took you up on the offer to shower or she had passed out again. Hopefully, the first one because you had to leave for work soon. When she finally emerges, she had changed into the clothes you left out and she's pressing a towel to the ends of her hair.

"For you, my king," You place the grilled cheese down on top of the dining room table. It smelt so good you regret not making another one for yourself but you don't have time to start now. You begin to clean the kitchen utensils you used as silence settles in the room. "If you'd like something to drink, I have a variety of juices I can offer or water if you'd prefer?"

"This is really good." You face the other woman and can't help but smile at the compliment. The best thing about cooking was cooking for others. You didn't have a lot of friends and you spent most of your time working so you hardly ever got the chance.

"Thank you."

"Do you like cooking?" Valkyrie asks with a mouth full of cheese.

"Sure," you shrug, turning back to the dishes. Swirling the sponge around the already clean plate. "It helps me relax, I guess. I don't really get a lot of free time but when I do I like to try out new recipes and ideas. I purchase cookbooks online, I think the amazon maybe my favourite thing about Midgard."

As you finish up, you watch a very spaced out Valkyrie for a few seconds before disappearing to collect your things for work. She's still sat there when you return but with an empty plate this time.

"So, I kinda have to head to work now. I hope that's okay?" You don't know why you're asking. It just felt rude to rush out when you have the king sat at your dining table.

"Right- I didn't mean to impose." Valkyrie spins in her chair to face you. You give her an unsure smile.

"Not at all, it was a pleasure to have you." You semi lie. "I just have to, you know, work for a living."

Valkyrie collects her things from the bedroom as you wait by the door. It's weird. Almost feels like you've upset her by kicking her out. But you try not to dwell on it as you shift your weight from one foot to the other. What is taking so long? She emerges from the bedroom, ready to go. "Uh... You're the barkeep right?"

You nod. Did she just not remember your name or was barkeep just what she wanted to call you? After a flurry of confusion crosses her face you come to the conclusion that she just doesn't remember. "Y/N."

"Right- I knew that. Thanks for food and clothes, Y/N."

She leaves first and you follow after, making sure to lock the door on the way out. With a final goodbye, Valkyrie turns right while you turn left.

PREV // NEXT

Tagging per request: @iconicwlw

#valkyrie#valkyrie x reader#brunnhilde#brunnhilde x reader#thor ragnarok#valkyrie x you#brunnhilde x you#endgame

91 notes

·

View notes

Text

How Suddenly-precious Cobalt that Powers ‘Teslas and iPhones’ also Fuels ‘Child Labor’ in Africa & Armed Heists in Europe

An artisanal miner carries raw ore at Tilwizembe, a former industrial copper-cobalt mine, outside of Kolwezi, the capital city of Lualaba Province in the south of the Democratic Republic of the Congo

It’s an unwanted side-effect of the world’s growing desire for environmentally friendly vehicles: rare metals that are key components of electric cars are becoming prime targets for criminals, as demand sends their values soaring.

How to steal $10 million

On a sunny July weekend in Rotterdam last year, a gang of men pull up in trucks at an unremarkable bonded warehouse situated among an industrial landscape of cranes, shipping containers and depots that sprawls 25 miles along the banks of Europe’s biggest port.

Having purloined the secure codes that give them access through the warehouse’s main gates, they make their way inside and head first to the building’s security unit, punch in the number that disables the alarms and quickly remove the recording unit for the cameras that are aimed at the doors and windows.

Satisfied they are no longer being spied on, they head to a section towards the back of the warehouse and cut the padlock on its sliding door to reveal hundreds of orange and blue drums piled four-high on pallets. All are stuffed full with the prize the men are after: cobalt, a formerly obscure, unwanted metal that, thanks to the electric vehicle revolution, has become a highly desirable commodity nicknamed “blue gold”.

Five or six hours later, the last of the pallets stowed on board their trucks, the gang drives away with 112 tonnes of cobalt, worth around US$10 million. The Dutch police who will investigate when the heist is discovered on the Monday morning spend months failing to catch anyone for the crime or recover any of the stolen goods.

A conveyor belt carries chunks of Raw cobalt after a first transformation at a plant in Lubumbash

Electrifying demand

Cobalt has become of particular interest to organised crime since its price rocketed by 250 percent between 2016 and 2018 (from about US$26,000 a tonne to more than US$90,000) thanks to demand from electric car manufacturers such as Tesla, Volvo, Ford and Volkswagen, and smartphone makers like Apple.

Its unique qualities prevent lithium-ion batteries in mobiles and electric cars from overheating and going up in flames. More than 50 percent of all cobalt demand is now for battery use, and the EU and the US both class it as a critical raw material.

As electric vehicle production gears up - manufacturers worldwide are investing US$300 billion over the next few years so as to build 35 million electric cars and trucks annually by 2030 - experts believe that the price of cobalt will rise again and make it even more attractive to criminals. According to the prediction of one American cobalt investor: “A wave of demand for copper, nickel, lithium and cobalt is coming that almost no one - miner, investor or banker alike - has anticipated or planned for.”

‘The new gasoline’ fuels abuse

The value of cobalt, which takes its name from the German kobold, or “goblin”, derives from its novel properties and relatively short supply. It is an element that does not occur in a "free" form, but is gathered during the mining of copper or nickel and needs to be chemically prised from them using acids and heat.

For hundreds of years, it was used to impart a distinctive blue tint to glass or ceramics, but in the 20th century scientists discovered it to have qualities crucial to our most advanced technologies. Combined with other metals, it produces alloys that are extremely strong, stable under high temperatures and anti-corrosive for use in aircraft engines, rockets, nuclear power stations, turbines and cutting tools.

However, it is the demand created by its critical role in batteries for electric cars that is not only producing the unwanted attention of criminals, but is also fuelling a human rights crisis involving exploited child labour in one of the world’s poorest countries in Africa.

Around 70 percent of the world’s supplies come from the Democratic Republic of Congo (DRC), which has been beset by decades of war, corruption and unrest. The country is described as being to cobalt what Saudia Arabia is to oil - Goldman Sachs, the merchant bank, has called cobalt “the new gasoline".

Every day, tens of thousands of desperate Congolese, including children as young as four, illegally mine cobalt by hand in horrendous conditions. Unicef estimates that there are 40,000 children working in mines across southern DRC, earning as little as 8p a day to crawl through discarded mines, some more than 100 meters deep, to scavenge for rocks containing cobalt in the discarded by-products.

Reports from Amnesty International and others catalogue frequent injuries and deaths, prompting television and newspaper reports detailing the dreadful human cost. One headline in a British newspaper states: “Child miners aged four living a hell on Earth so you can drive an electric car.”

Campaigners estimate that hundreds of miners die every year or have their health seriously damaged. The hazards include mine collapses such as the one in June this year that killed more than 40 miners working illegally on a site in Lualaba province in south-east DR; asphyxiation due to inadequate ventilation; and illnesses such as the respiratory disease cobalt lung, a pneumonia which can cause permanent incapacity or death.

A man digs through some mine waste searching for left over cobalt in a mine between Lubumbashi and Kolwezi

It’s feared that thousands more children will be sucked into the hellish trade, particularly now that many countries have pledged to ban the sale of new petrol and diesel cars between 2025 and 2040.

Such damaging reports and headlines have forced companies like Apple, Tesla, Volkswagen and Volvo to try to find ways to ensure that the metal they buy is not “conflict cobalt” produced using child labour. One avenue being explored is the use of blockchain technology, the cryptographic tech behind digital currencies like Bitcoin, to ensure traceability.

Thriving black market

It may be difficult to enforce. The rocks that the children find are sold on cheaply to traders, mostly Chinese middle-men who, in turn, ship the cobalt back to their country to be made untraceable; it is smelted down before joining the supply chain that feeds the needs of giant multinationals, and whets the appetite of organised crime gangs in Europe.

Another cobalt heist occurred in 2012 down the coast in Antwerp. Three containers of cobalt had been shipped to a warehouse at the Belgian port. When truckers arrived to pick them up, they discovered that two had already been “collected”; thieves had once again somehow obtained the access codes used for deliveries.

Experts believe that the robberies are being carried out by organised crime gangs who not only know the docks well, but have extensive knowledge of the metal and understand the market for it. “Cobalt is not as fungible a commodity as many believe – this makes it a difficult product to ‘fence’ without a knowledgeable middleman with routes to market,” says George Heppel, a senior cobalt analyst at London-based CRU group, which offers business intelligence on the metals and mining industries.

So what happens to the stolen cobalt? “It is highly unlikely to have made its way into the battery supply chain,” Heppel says. “My best guess is that it was probably sold into the alloy scrap and revert sector to be used in superalloys, speciality steels or diamond tools. It’s more likely to be in a jet engine than a smartphone.”

But whatever the use the black market that exists for scarce and valuable metals like cobalt is thriving. Jan Struijs, the chairman of the Dutch police union and the former head of a criminal investigation squad in Rotterdam, told the business channel Bloomberg that the warehouse robbery there was simply “the tip of the iceberg".

David Weight, the president of the UK-based Cobalt Institute, says: “If something is valuable then it becomes a target. You saw it with copper: when its price was high, people were stealing manhole covers and pulling up electrical cables from the ground - and some were killing themselves doing it. When the price is high, people do the most extraordinary things.”

— By Richard Ellis, freelance journalist in the UK, December 9, 2019

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

— RT

2 notes

·

View notes

Text

Where are the vulnerabilities in the gold supply chain?

Many of the vulnerabilities within the gold industry lie within the gold supply chain. The journey of gold, from production to consumer and investor, consists of several stages — the beginning of which is either mining or recycling. Each stage of the gold supply chain offers an opportunity for bad actors to either disrupt or integrate.

Mining: Gold mining happens at large, medium, and small scales all over the world. Large and medium scale mining encompasses extraction using industrial and mechanized methods all of which are susceptible to corruption, theft, and fraud. Informal or semi-formal, small scale mining accounts for 12% of the global mine supply. Illegally mined gold from these types of operations gets sold on the black market or smuggled into other jurisdictions to enter the supply chain for refining.

Recycling: About a third of the new gold introduced to the market each year comes from gold recycling. The supply of recycled gold comes, in part, from cash-for-gold businesses that are susceptible to the risks outlined above.

Refining: Mined and recycled gold enters the refining process referred to as smelting. As previously mentioned, illegally mined gold can get smelted along with legally sourced gold. Additionally, organized crime can misrepresent or fraudulently obtain records associated with transactions.

Retailing: The sale of gold for retail represents a significant market internationally and introduces a large opportunity for fraud and exploitation from the misrepresentation of the origin of gold, to identity fraud, to complex scams involving purchase history and receipts. Additionally, organized crime can exploit arbitrage opportunities by sourcing illegal payments in one jurisdiction that get misunderstood or misperceived in another as legitimate.

Investing: Gold is a popular and valuable financial instrument and therefore subject to the same vulnerabilities of any traded asset. Because traders and recipients of gold can transact without the physical exchange of gold (in the futures market), there is ample opportunity for fraud, identity theft, and other risks.

HeraSoft’s next generation software offers a variety of products and services to improve enterprise logistics management and cybersecurity.

HeraVault™ offers distributed cloud storage with built-in replication, error correction and restoration capabilities.

HeraFlow™, is an AI-Powered threat analysis system for fast and accurate threat data monitoring perfect for high-volume workloads and enterprise security-level SOC’s.

HeraPass™, with inherently fraud proof design, helps businesses innovate user management in IoT environments by achieving the anonymization and encryption of highly-sensitive data.

HeraStamp™ proof-stamps mission critical data to permanent data stores and can help with data integrity in, for example, ecommerce settings.

0 notes

Text

A Complete Buying Guide for Laboratory Muffle Furnaces

Laboratory Muffle Furnaces are high-temperature furnaces that can be used for various applications. They have been developed and manufactured for over 40 years to meet the needs of several markets, including medicine, research, and food production.

There are many different types of furnaces on the market, so it's important to know what you want before shopping. These muffle furnaces are widely used, from science labs to industries. However, while many muffle furnaces are available in the market, not all of them are built the same.

You need to find a perfect furnace that best matches your requirements. However, there are a few things you can look for while buying a muffle furnace for your laboratory. This guide will tell you everything you need to know before buying a Laboratory Muffle Furnace.

An Introduction to Muffle Furnaces

Muffle Furnaces For Sale are designed to heat or smelt a wide range of materials from glass and gold to steel, graphite and silicon. While several types of furnaces are on the market, laboratory furnaces are most widely used nowadays. This type of furnace has two distinct elements: the chamber and the infrared radiation source, which heat materials.

A muffle furnace emits infrared radiation through conduction and convection. So, it involves heating material with radiation and transferring heat by conduction between chambers. Only one chamber is used in most cases because it's easier to work with one chamber than with two separate ones.

Factors To Consider While Buying Muffle Furnaces

Selecting an ideal muffle furnace is an important task for a scientist or a lab engineer. However, there are a few factors that you need to consider. For instance, the requirements are different from one industry to another. So, it's vital to note down all the details your lab requires. Here are a few factors that you should consider before buying a muffle furnace for your lab:

1. Number of Chambers

First of all, you need to decide how many chambers you want. Most laboratories use only one chamber because it offers better control and efficiency than two separate chambers. This is particularly useful in the case of mixed chemistry experiments where it is difficult to maintain uniform temperature without using two chambers.

2. Size Of The Chamber

The size of the chambers is another essential issue to consider. In most cases, the size of most muffle furnaces can range from a few inches to 25-30 inches in diameter. However, this has a tremendous effect on the furnace's cost, efficiency, and overall performance.

3. Size Of The Radiation Source

You need to decide if your chamber should be built using infrared radiation or radiant heat transfer technology. For instance, an infrared radiation-based furnace will require a larger source than an ordinary radiant heat transfer furnace. You should also consider other features such as convection and conduction between two chambers if you opt for a ceramic chamber or an additional chamber that uses radiant heat transfer technology.

4. Temperature Control

The temperature range is another critical aspect that you need to consider. You should ensure that your chamber can control different temperatures across different parts of the heating chamber. Some furnaces can get temperatures as high as 3500° C, so you should look at this feature before making a final decision.

5. Operating Cost

The operating cost is an essential factor in most cases. These muffle furnaces are used in industries where most of the operations are performed around heating equipment and not laboratory analysis. That's why such a furnace can be more expensive than normal muffle furnaces used in laboratories.

6. Safety Features

Every laboratory furnace is designed for the safe use of personnel. Therefore, you need to ensure that your muffle furnace is safe enough to use in your laboratory environment. Additionally, the furnace's output is another essential aspect that you need to verify before buying a furnace. The higher the furnace's output, the more heat it can radiate and transfer simultaneously over a wider range of temperatures.

Most manufacturers provide a lab purchase restriction on their furnaces that ensures they can only be used in laboratories or research facilities. So next time when you are out there looking for muffle furnaces, then make sure to consider these tips.

Final Words

Since most muffle furnaces being sold to laboratories contain only one chamber, consider it an important factor before making a final decision. Other factors like size and amount of chambers are also important to consider. Additionally, it is crucial to check the temperature range produced by your furnace and safety features for safe operation.

Original Source:

https://mazingus.com/a-complete-buying-guide-for-laboratory-muffle-furnaces/

0 notes

Text

Oxalic Acid Market Insights, Deep Analysis of Key Vendor in the Industry 2019-2029

Oxalic acid is a colorless, crystalline substance with sharp, sour taste. Oxalic acid is at high concentration can be a dangerous poison. It’s a part of carboxylic acid family.Oxalic acid is soluble in water, alcohol and ether. Oxalic acid is widely used as bleaching or cleaning agent. Oxalic acid is used as a mordant in dying process. Oxalic acid is used in pharmaceutical to purification or dilution purpose.Another important application of oxalic acid is to smelt rare earth. Oxalic acid is used as bleaching agent in textile and wood industry. Oxalic acid plays a vital role as rust-remover for metal treatment industry as well as water treatment. The estimated oxalic acid consumption was about 190 million metric tons at the end of 2009.

Oxalic Acid Market: Drivers and restraints

The exponential growth in pharmaceutical and rare earths industry, is the major contributor to the growth of Oxalic Acid Market. The use of Oxalic Acid in bleaching and cleaning purpose at various industrial/household application is a positive indicator in the expected growth of oxalic acid market. The growing concern towards sterilization in industry also drive the demand of oxalic acid market.

On the other hand, due to its toxic and corrosive nature, industrial as well as household use and handling might create restrain in the demand of Oxalic acid.

Visit For Sample>>https://www.futuremarketinsights.com/reports/sample/rep-gb-1267

Oxalic Acid Market: Segmentation

On the basis of application, global Oxalic Acid Marketis segmented into:

Rare earth Industry

Pharmaceuticals

Textile

Other (Cleaning, Surface Dust Removal.)

On the basis of manufacturing process, the global Oxalic Acid Marketis segmented into:

Nitric Acid Oxidation Process

Sodium Formate Dehydrogenation Process

Dialkyl Oxalate Hydrolysis Process

For any queries linked with the report, ask an analyst >>https://www.futuremarketinsights.com/ask-question/rep-gb-1267

Oxalic Acid Market: Region Wise Outlook

Asia is estimated to be the largest consumer of oxalic acid in the world by volume .Especially China is a major consumer, producer as well as exporter of oxalic acid. The exponential growth in rare earth industry, pharmaceutical as well as textiles are the major factors behind the rise of oxalic acid consumption in Asian countries. Europe is estimated to be one of the fastest growing market for oxalic acid. USA due to its growth in application sector is also indicating positive prospect to the demand in oxalic acid consumption.

Oxalic Acid Market: Key market Players

Some of the market producers of the global oxalic acid market are Shanxi Province Yuanping Chemicals Co., Ltd., Ube industries, ltd., Oxaquim S.A. ,Tongliao Jinmei Chemicals Co.,Ltd, Indian Oxalate Ltd. and others

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, types and applications.

Regional analysis includes:

North America (U.S., Canada)

Latin America (Mexico. Brazil)

Western Europe (Germany, Italy, France, U.K, Spain, Nordic countries, Belgium, Netherlands, Luxembourg)

Eastern Europe (Poland, Russia)

Asia Pacific (China, India, ASEAN, Australia & New Zealand)

Japan

Middle East and Africa (GCC, S. Africa, N. Africa)

Buy Report >>https://www.futuremarketinsights.com/checkout/1267

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Report Highlights:

Detailed overview of parent market

Changing market dynamics in the industry

In-depth market segmentation

Historical, current and projected market size in terms of volume and value

Recent industry trends and developments

Competitive landscape

Strategies of key players and products offered

Potential and niche segments, geographical regions exhibiting promising growth

A neutral perspective on market performance

Must-have information for market players to sustain and enhance their market footprint

About FMI

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in Dubai, the global financial capital, and has delivery centers in the U.S. and India. FMI's latest market research reports and industry analysis help businesses navigate challenges and make critical decisions with confidence and clarity amidst breakneck competition. Our customized and syndicated market research reports deliver actionable insights that drive sustainable growth. A team of expert-led analysts at FMI continuously tracks emerging trends and events in a broad range of industries to ensure that our clients prepare for the evolving needs of their consumers.

Contact

Mr. Abhishek Budholiya

Unit No: AU-01-H Gold Tower (AU), Plot No: JLT-PH1-I3A,

Jumeirah Lakes Towers, Dubai,

United Arab Emirates

MARKET ACCESS DMCC Initiative

For Sales Enquiries: [email protected]

For Media Enquiries: [email protected]

0 notes

Text

When I first got into this business gold was selling for around $300 an ounce. Gold went as high as $1900 an ounce and today gold is selling for over $1,200 an ounce and experts forecast it to go higher – much higher! I have seen forecasts by reliable writers that Gold could reach as high as $5000 an ounce in coming years.

The United States is the largest jewelry market in the world and millions of Americans have old, broken or just out-of-fashion pieces of jewelry sitting in their jewelry boxes. Just last week my wife came across a single 18K gold erring. She lost the other earring in the set about ten years ago and the remaining earring has just been sitting in her jewelry box since then. I put the earring on my gold scale and it weighed 8 grams. At today’s prices that one earring was worth over $300 –which is more than she paid for the pair ten years ago.

There is literally a fortune in gold –billions of dollars worth, sitting around collecting dust. But the high price of gold today is bringing it out of the woodwork. And all you have to do to get your piece of the pie is to ask.

You might be wondering how long this business can last. I recently spoke with the owner of a large gold refining company and I asked him how long this business could continue. He said:

“Every year all the refining companies in the US combined refine less than one percent of all the scrap gold jewelry in the country. And new jewelry sales grow over five percent a year. So there is pretty much an endless supply. We have been in this business for 33 years and we expect to be doing this for at least another 33 years.”

How much can I make buying gold?

Unscrupulous gold dealers like the ones that advertise on radio and TV ask you to mail your gold in to them. They typically pay between 10% and 20% of the value of gold. Most pawnshops pay about 30% to 35%.

Legitimate dealers pay between 40% and 65%. 40% to 65% may seem low to you, but remember, the gold you buy has to be smelted, refined, assayed and poured into ingots before it can be resold. Refiners who do this will pay you between 85% and 92% of the spot price of gold.

Lets look at a typical sale. The average person tends to bring in three or four items that altogether weigh about 2 ounces. Most items people bring me are 14K gold which is 58% pure gold and the rest is alloys to lend gold its color and hardness.

Two ounces at 58% works out to 1.16 ounces of pure gold. Lets say for example you pay that person 50%, which is typical of most legitimate gold dealers. At $1400 an ounce, that comes out to $812. Now you send the gold to a refiner who will pay you 95% of the spot price. I will let you do the math, but this works out to a very nice profit from just one transaction. Many experts predict that gold will go as high as $5000 an ounce. I don’t know if that will happen, but imagine how profitable this business will be if it does.

Do that 3 or 4 times a week and you are looking at some real money! And it’s 100% legal.

Skip McGrath’s book on gold buying is amazing. He also has extremely good one on one support. He cares about his customers. Thanks Skip! ~ Michael

Where do you find people with Gold to sell?

I live in a small town of about 12,000 people. I was driving to the supermarket on a recent Saturday and saw several signs that said: “Cash for Gold and Silver Today at the Majestic Hotel.” After I left the market, I drove over to the Majestic Hotel to see what was going on.

There was a gentleman in one of the meeting rooms off of the lobby with a table, a scale and calculator and a cash box. He was meeting with a lady while two more people waited their turn. I didn’t want to bother him, but the lady who works at the reception desk is a friend of mine, so I asked her how he was doing. She told me he has had a steady stream of customers all day. Imagine if each person brought in just one ounce of gold and he saw 20 or 30 people that day. That is a huge amount of money

There are two factors driving the gold business today:

A recovering, but still tough economy with millions of people out of work

Relatively high prices for gold and silver

The gold business has always been a good business, but nothing like it has been since 2008 when gold prices started rising as the economy began the downturn. These two facts have combined to bring millions of people out of the woodwork with gold to sell. Either they need cash, or they just want to take advantage of today’s high prices.

It is very easy to find these people. You can set up in a hotel room like the person in the example above. You can advertise in local papers or even on radio. You can also advertise for free on sites such as Craigslist. Another popular method is using door hangars. You can get them made for about 2-cents each and hire school kids to hang them for you. But none of these methods work as well as one simple, low cost advertising method I am going to show you in one of your free bonuses.

Do you like to travel? A couple of years ago I met an older gentleman and his wife who roam the country in an RV, buying gold at every town they stop in. They even have a sign on the side of their RV that they buy gold and people come up to them in the RV parks.

Gold Parties are a booming business

One of the things I show you how to do with my system is throw gold parties. You have all heard of home parties for Tupperware, cosmetics or cooking gadgets. Well at those parties people spend money. When people attend a gold party they make money! If you can get 10 people to a gold party you can buy several ounces of gold, -potential profit of up to 45% on each ounce And the hostess, who put on the party, will get 10% of what you make. Now that’s what I call a “win-win.”

My system includes complete instructions on hosting a gold party of your own and how to market gold parties to others. Besides the instructions I have also included flyers, brochures, ads and invitations. All of these are in simple Word docs, so all you have to do is add your contact information an

0 notes

Text

Global Oxalic Acid Market Market By System Type, By End User, By Region, Industry Analysis and Forecast, 2019 – 2029

Oxalic acid is a colorless, crystalline substance with sharp, sour taste. Oxalic acid is at high concentration can be a dangerous poison. It’s a part of carboxylic acid family.Oxalic acid is soluble in water, alcohol and ether. Oxalic acid is widely used as bleaching or cleaning agent. Oxalic acid is used as a mordant in dying process. Oxalic acid is used in pharmaceutical to purification or dilution purpose.Another important application of oxalic acid is to smelt rare earth. Oxalic acid is used as bleaching agent in textile and wood industry. Oxalic acid plays a vital role as rust-remover for metal treatment industry as well as water treatment. The estimated oxalic acid consumption was about 190 million metric tons at the end of 2009.

Oxalic Acid Market: Drivers and restraints