#Global investments

Explore tagged Tumblr posts

Text

Indian Economy Shows Growth and Expansion

Private credit is becoming more popular for Indian projects as entrepreneurs prefer short-term debt over giving up ownership. This is happening because new private equity (PE) investments are decreasing, and many PEs are leaving through public markets.

Several companies are planning to enter capital markets soon to provide money to PE fund investors.

"Private credit demand is going up. Big credit funds are investing lots of money in Indian companies, both struggling and doing well," says Bhavin Shah, a partner at PwC India.

PE firms offer private credit at slightly higher rates than shared loans and also provide global expertise to entrepreneurs.

Tax uncertainty worries PEs in India, with many still getting income-tax notices despite efforts to clarify the system," Shah notes.

"This is India's decade, with global PE investors planning big investments," says Eric Janson, global head of private equity at PwC.

In 2021, India saw record private investments, leading to record exits for early investors. In 2023, there were also record exits through public market sales.

Global PE funds usually hold their investments for 6-7 years and make returns of 3.5x–4.5x on their original investment in CY22 and CY23.

M&A activity increased in Q1 2024, with 455 deals worth $25.6 billion, a 24% increase from Q4CY23, showing a market change.

Dinesh Arora, a partner at PwC India, says: "Amid opportunities, the Indian economy is doing well. Q1 2024 is the best in six quarters, showing growth and a desire for expansion."

While M&A average deal sizes stayed the same, PE deal sizes fell 39%, with most deals under $50 million, especially in the lower- and mid-market segments.

The biggest deal was in media and entertainment, with Reliance Industries and Walt Disney forming a joint venture.

#indian economy#indian economy 2024#indian project#indian entrepreneurs#global investments#finance#investment#indian government

0 notes

Text

✌China's Global Investments - Congress Original Document✌

https://berndpulch.org/2024/02/23/%e2%9c%8cchinas-global-investments-congress-original-document%e2%9c%8c/

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

IRENA: Investments in renewable energies must quadruple to meet climate target

The global energy transition is off-track, aggravated by the effects of global crises. Introduced by IRENA’s Director-General Francesco La Camera at the Berlin Energy Transition Dialogue (BETD) today, the World Energy Transitions Outlook 2023 Preview calls for a fundamental course correction in the energy transition. A successful energy transition demands bold, transformative measures reflecting…

View On WordPress

#energy transition technologies#Global investments#Investments#IRENA#meet climate target#renewable energies#the International Renewable Energy Agency#the Paris climate accord

0 notes

Text

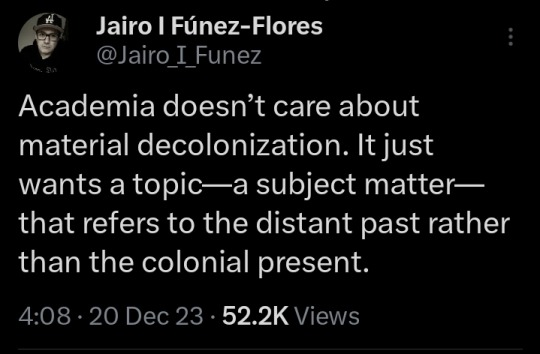

#so many people I know in decolonial studies have been appalled by the silence and indifference#by their colleagues in the field#i'm just surprised they thought whiteys go into studying black and brown people with honest intentions#or any kind of investment in the lived reality of colonized people in the present day#they're in it to exploit global south suffering for clout#like every other white and western grifter#institutionalized academia is one of the pillars of white supremacy#white supremacy#racism#anti blackness#free palestine#free sudan#free congo#western imperialism#western hypocrisy#decolonization#colonization#colonialism#white academia#islamophobia#knee of huss

25 notes

·

View notes

Text

Why was the world’s richest man

@elonmusk not invited to Labour’s UK investment summit?

#Elon Musk#World's richest man#Labour Party#UK investment summit#Tesla#SpaceX#Elon Musk and politics#Musk and UK relations#Musk's business ventures#Space exploration#Electric vehicles#Clean energy#Renewable energy#Musk and government policy#Musk's influence on tech#Tech industry leaders#Labour Party's investment strategy#Elon Musk's wealth#Musk and international relations#UK politics#Musk's public appearances#Musk's global reach#Labour and big business#Innovation#Tech entrepreneurship#Billionaires in politics#US-UK business relations#Elon Musk and Twitter (X)#Musk’s space ventures#Tesla's global expansion

3 notes

·

View notes

Text

#1. Global Politics#“2024 US Election”#“Russia Ukraine conflict”#“China Taiwan tensions”#“Israel Palestine ceasefire”#“NATO expansion”#2. Technology & Innovation#“AI advancements”#“Quantum computing breakthroughs”#“ChatGPT updates”#“5G technology”#“Electric vehicles news”#3. Climate & Environment#“Climate change summit”#“Carbon capture technology”#“Wildfires 2024”#“Renewable energy news”#“Green energy investments”#4. Business & Economy#“Stock market news”#“Global inflation rates”#“Cryptocurrency market trends”#“Tech IPOs 2024”#“Supply chain disruptions”#5. Health & Wellness#“COVID-19 variants”#“Mental health awareness”#“Vaccine development”#“Obesity treatment breakthroughs”#“Telemedicine growth”

2 notes

·

View notes

Text

beginning to see american "if you dont vote for the blue warmongerers then you are personally responsible for the red warmongerers getting into power"

#it is so frustrating seeing americans play morals about what party is “harm reduction” when you know sure as hell#that both of them do the same shit#both parties destroy the stability and peace of global south nations for profit. both parties invest so much in global north countries#to encourage allyship and reliance so to never break that allyship. biden is FUNDING GENOCIDE RIGHT NOW.#both parties kill kids. both parties support modern day slavery. both parties pollute our earth and blame it on india and china#and (cus i know your average white american lib doesnt care about the rest of the world)#both parties make the usa a living hell for marginalized ppl. look at how badly indigenous and lgbt rights have been eroded over these 4 yr#look at what is happening at the us/mexico border. look at student loans. look at poverty.#they sat there and did nothing as roe vs wade was destroyed in front of their eyes.#its not harm reduction when both parties are doing the same harm but one of them is just being nicer about it#it is chickens voting for their butcher

13 notes

·

View notes

Text

#- **HTX**#- **Huobi**#- **Crypto Trading**#- **Bitcoin**#- **Ethereum**#- **Cryptocurrency Exchange**#- **Blockchain**#- **Secure Platform**#- **Global Users**#- **Investing**

2 notes

·

View notes

Text

.

#I really don't mind whether you vote or not in the US elections#as stated multiple times both democrats and republicans see the global south as fodder for their ambitions#but it is heartbreaking that USamericans are celebrating Kamala as if she's a slaying queen#even if her domestic policies are decent (and I know nothing about that tbh) she would still be the leader of the US#and your foreign policy isn't gonna change#and that's partially because the population doesn't care about the rest of the world enough to push for change - you're benefiting#so why bother really#oh yeah you're anti-war and think military expenses could be instead channeled to better purposes#but how much of your country's unparalleled GDP is sustained - directly or not - by exploring the global south and financing wars?#do you think wars (yes proxy ones too) are not seen as investment by your government?#get real you're benefiting and the problem is not voting for Kamala but comfortably watching the global south go up in flames to ensure tha#yes ESPECIALLY Palestine and the middle east

2 notes

·

View notes

Text

Bri's Lookbook 2/? ᠂ ⚘ ˚

modern aesthetic: G. Label by Goop Cardigan $595, / Reiss cotton t-shirt, $60 / Hermès Birkin 35, $28,000 (gifted from mom) / G. Label by Goop Trouser $595 / Gionvito Rossi pumps, $795 x 2 / Cartier watch, $11,500 / Hermès scarf (gifted) / Victoria Beckham dress, $1,290 / Chanel Rouge Allure Lip Color, $48 / Yves San Laurent Desk Agenda, $550 (gifted)

#(( another silly clothing edit of her normal wear#bri comes from old money. her mother is a french real estate heiress. her father's side runs a global investment firm#and she makes a lot of money#gross 1%er wealth#while she is a minimalist (compared to her relatives) all her possessions are luxury brand. she just buys no thought to price#at the same time she has these things for a very long time. been using the same YSL planner for years (just buys refill pages)#a lot are nice gifts from family. the birkin was her mom's prior#+ any pop of color (reds primarily-can you guess why?) are via her scarves ))#( aes & isms ) .#( my edits ) .#v ( modern ) .

5 notes

·

View notes

Text

The Future of Wheat Farming in Kenya: The Economic Benefits of Israeli-Kenyan Wheat Farming Partnerships

���Explore the potential transformation of Kenya’s wheat farming through Israeli investment, focusing on innovative technologies and private partnerships to boost production and create jobs.” “Learn how Israeli investors are set to revolutionize wheat farming in Kenya, enhancing food security and leveraging advanced agricultural technologies in private-sector partnerships.” “Discover the future of…

#agricultural growth#agricultural investment#agricultural modernization#agricultural partnerships#arable land#drone farming#farming innovation#Farming technology#food prices#Food security#global wheat supply#Israeli investors#Israeli technology#job creation#Kenya Agriculture#Kenya food production.#Kenya wheat farming#Kenya-Israel collaboration#precision agriculture#private partnerships#private sector investment#sustainable farming#wheat farming#wheat production#wheat supply chain

2 notes

·

View notes

Text

[Monday August 5th] The Global Market Crash: What Just Happened?

In recent weeks, the world’s financial markets took a huge hit, causing a lot of panic and confusion. This big drop, or "crash," has people worried about what it means for their money and the economy. So, what caused this, and what should we know about it?

What Caused the Crash? Rising Interest Rates: Central banks, like the Federal Reserve in the U.S., have been increasing interest rates to control inflation. Inflation is when prices for things like food and gas go up a lot. Higher interest rates make borrowing money more expensive, so people and businesses spend less. This decrease in spending can slow down the economy, leading to drops in stock prices.

Geopolitical Issues: Ongoing conflicts between countries and trade wars have made the global economy unstable. When countries impose sanctions or stop trading with each other, it can mess up supply chains and make investors nervous. Nervous investors often pull their money out of stocks, causing prices to fall even more.

Economic Slowdown: Lately, some of the world’s biggest economies, like the U.S. and China, have shown signs of slowing down. When the economy slows, businesses earn less money, and this often causes their stock prices to drop.

Tech Stocks Falling: Tech companies have been super popular with investors, but their stock prices got really high—maybe too high. When interest rates started going up, people began to worry that these companies might not be worth as much as they thought, leading to a big sell-off in tech stocks.

What Does This Mean? The market crash has caused a lot of people to lose money, especially those who have investments in stocks. While it’s normal to feel worried, it’s important to remember that markets have ups and downs. Some experts think this might just be a temporary setback, while others are more cautious and think the downturn could last a while.

For anyone investing, this crash is a reminder of how important it is to not put all your money in one place. Diversifying, or spreading out your investments, can help protect you from big losses. Even though it’s tempting to chase after the hottest stocks, having a balanced portfolio is usually a smarter move.

In the end, while this market crash is unsettling, it’s part of the natural cycle of the economy. Markets tend to recover over time, so staying calm and thinking long-term is the best strategy.

2 notes

·

View notes

Text

What Are The Major Factors Driving Retinal Biologics Market Growth?

The Retinal Biologics Market is experiencing a surge in demand, fueled by advancements in eye disease treatments and a growing emphasis on vision health. According to a recent analysis by Future Market Insights (FMI), a leading market research firm, the market is currently valued at an impressive US$22.25 billion in 2022. Looking ahead, the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 11.1% over the next six years. This translates to a staggering market valuation of US$41.92 billion by 2028, highlighting the significant potential of retinal biologics in revolutionizing eye care.The remarkable expansion of the Global Retinal Biologics sector is fueled by advancements in technology, innovative research, and a growing demand for cutting-edge treatments. As the industry continues to evolve, it presents unprecedented opportunities for stakeholders, investors, and healthcare professionals alike.Key Retinal Biologics Market Insights:

Rising Prevalence of Diabetes-related Eye Disorders and Age-related Macular Degeneration (AMD) The prevalence of diabetes-related eye disorders and age-related macular degeneration is on the rise, underscoring the growing need for innovative solutions within the Retinal Biologics Industry.Substantial Investment in R&D for Biologics in Retinal Disorders The industry is witnessing a significant influx of research and development resources, aimed at advancing biologics for both infectious and non-infectious retinal disorders. This investment underscores the commitment to addressing unmet medical needs.

Emergence of Specific Biologic Molecules as Therapeutic Targets Specific biologic molecules are gaining prominence as highly promising therapeutic targets, offering new hope for patients with retinal conditions.Gene Therapy as a Solution for Monogenic Retinal Illnesses With a growing number of monogenic retinal illnesses, gene therapy is emerging as a pivotal component of the Retinal Biologics Market, presenting innovative solutions for these challenging conditions.

Request a Sample Copy of This Report Now.https://www.futuremarketinsights.com/reports/sample/rep-gb-8663

#The Retinal Biologics Market is experiencing a surge in demand#fueled by advancements in eye disease treatments and a growing emphasis on vision health. According to a recent analysis by Future Market I#a leading market research firm#the market is currently valued at an impressive US$22.25 billion in 2022. Looking ahead#the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 11.1% over the next six years. This translates to a s#highlighting the significant potential of retinal biologics in revolutionizing eye care.The remarkable expansion of the Global Retinal Biol#innovative research#and a growing demand for cutting-edge treatments. As the industry continues to evolve#it presents unprecedented opportunities for stakeholders#investors#and healthcare professionals alike.Key Retinal Biologics Market Insights:Rising Prevalence of Diabetes-related Eye Disorders and Age-relate#underscoring the growing need for innovative solutions within the Retinal Biologics Industry.Substantial Investment in R&D for Biologics in#aimed at advancing biologics for both infectious and non-infectious retinal disorders. This investment underscores the commitment to addres#offering new hope for patients with retinal conditions.Gene Therapy as a Solution for Monogenic Retinal Illnesses With a growing number of#gene therapy is emerging as a pivotal component of the Retinal Biologics Market#presenting innovative solutions for these challenging conditions.Request a Sample Copy of This Report Now.https://www.futuremarketinsights.#institutional sales in the Retinal Biologics Industry#where Retinal Biologics are supplied in speciality clinics and hospitals#will generate higher revenues. In 2018#hospital sales accounted for more than 35% of market revenue.According to the report#retail sales of Retinal Biologics will generate comparable revenues to hospital sales and will expand at an 11.9% annual rate in 2019. Reta#with retail pharmacies generating more money than their counterparts in the future years.Penetration in North America Higher#APEJ’s Attractiveness to IncreaseNorth America continues to be the market leader in Retinal Biologics revenue. According to FMI estimates#North America accounted for more than 46% of global Retinal Biologics Industry revenues in 2018. Revenues in North America are predicted to#continuous growth in the healthcare infrastructure#and a favourable reimbursement scenario.Europe accounted for about one-fourth of the Retinal Biologics market#with Western European countries such as Germany#the United Kingdom#France#Italy

2 notes

·

View notes

Text

/ Apparently on an official h.onkai s.tar r.ail stream it was mentioned how they will have a sort of interview with N.ASU- I'm going to be honest and say that I kind of doubt they would add a character from f.go to h.sr or the other way around (someone mentioned that it could just be a CE or light cone) BUT- if they do end up adding something, whatever it is, I might actually download it again

#;ooc#ooc#i was only on h.sr for w.elt#and the protagonist i liked them but like in general;; i didnt really get invested in the story nor other charas#plus it became too overwhelming to try to absorb another entirely new lore and I was lazy so yeet#my dream is that one day they make a p.c version of f.go like the arcade one (delusional)#but also i dont want the 😬type of fandom g.enshin has so its the prize to pay#im sorry; i love g.enshin soo much but the fa.ndom is- certainly something!#of course f.ate also has its stuff like any fandom but#things that get too popular globally tend to gather odd peeps#gaslighting gatekeeping f.go ORTIEOTUEIRI#;dl

4 notes

·

View notes

Text

India's FDI Policies Demystified: What You Need to Know Before Investing

Foreign Direct Investment (FDI) has played a pivotal role in shaping India's economic landscape, driving growth, innovation, and global integration. With its vast market potential, skilled workforce, and supportive government policies, India has emerged as a preferred destination for international investors seeking expansion opportunities. In this blog, we will demystify India's FDI policies, explore the significance of FDI to India's economy, and provide insights for foreign investors looking to capitalize on India's growth story.

Understanding FDI:

Foreign Direct Investment (FDI) refers to the investment made by foreign entities, such as multinational corporations or private individuals, in domestic companies and assets of a nation. Unlike other forms of investment, FDI involves a significant level of ownership or control over the invested firm, facilitating long-term strategic partnerships and collaboration.

Significance of FDI to India's Economic Development:

FDI in India plays a crucial role in driving economic growth and development across various dimensions:

1. Economic Growth: FDI injects capital into diverse industries, stimulating production, creating job opportunities, and contributing to GDP growth.

2. Technological Advancement: Foreign investors bring innovative ideas, best practices, and advanced technologies, fostering technological modernization across industries.

3. Export Promotion: Foreign companies often produce goods for export, enhancing India's export competitiveness and improving its balance of payments.

4. Infrastructure Development: FDI inflows frequently target infrastructure projects, enhancing India's transportation, telecommunications, and energy infrastructure.

5. Global Integration: FDI promotes trade and investment ties, facilitating India's integration into the global economy and enhancing its competitiveness on the international stage.

India's Appeal to FDI:

Several factors contribute to India's attractiveness as a destination for FDI:

1. Huge Market: With over 1.3 billion consumers and a growing middle class, India offers a vast market potential for foreign investors seeking growth opportunities.

2. Skilled Labor Force: India boasts a highly educated and skilled workforce, particularly in sectors such as IT, engineering, and medicine, providing a talent pool for innovation and productivity.

3. Government Initiatives: Programs like "Make in India" and "Digital India" streamline business operations and offer incentives to foreign investors, signaling the government's commitment to facilitating investment.

4. Infrastructure Growth: India is undergoing rapid industrialization and infrastructure development, offering opportunities for investment in sectors such as transportation, energy, and telecommunications.

5. Abundant Resources: India's rich natural resources present opportunities for investment in sectors like mining, agriculture, and renewable energy, catering to the growing demand for sustainable solutions.

6. Investor Protection: Bilateral investment agreements ensure the protection of foreign investors' rights, providing a secure investment environment and fostering trust and confidence among investors.

Current Scenario and Future Outlook:

India remains a popular destination for international investors, with FDI inflows expected to continue strengthening in the coming years. As India undergoes further economic reforms and policy changes, the importance of FDI in driving growth and development is likely to increase, positioning India as a top investment destination for foreign investors seeking opportunities in a vibrant and dynamic economy.

Key Considerations for Foreign Investors:

Before investing in India, foreign investors should consider the following factors:

1. Market Analysis: Conduct a thorough analysis of India's market potential, consumer demographics, and competitive landscape to identify investment opportunities aligned with your business objectives.

2. Regulatory Environment: Familiarize yourself with India's FDI policies, regulations, and legal framework governing foreign investment to ensure compliance and mitigate risks.

3. Sectoral Opportunities: Explore specific sectors such as technology, healthcare, manufacturing, and renewable energy that offer growth prospects and align with your expertise and investment strategy.

4. Partnerships and Collaborations: Seek strategic partnerships and collaborations with local stakeholders, industry associations, and government agencies to navigate the market landscape and leverage local expertise.

5. Risk Management: Assess and mitigate risks associated with currency fluctuations, political instability, regulatory changes, and market volatility to safeguard your investment portfolio and ensure long-term sustainability.

Foreign Direct Investment (FDI) has emerged as a cornerstone of India's economic growth story, catalyzing development, innovation, and global integration. As we delve deeper into India's FDI policies and their implications for foreign investors, it becomes evident that the nation offers a compelling blend of opportunities, challenges, and potential rewards.

India's journey towards becoming a preferred destination for FDI has been marked by concerted efforts from policymakers, industry stakeholders, and investors alike. Through progressive policy reforms, initiatives such as "Make in India" and "Digital India," and a commitment to fostering a conducive business environment, India has positioned itself as an attractive investment destination on the global stage.

The significance of FDI to India's economic development cannot be overstated. FDI inflows have played a pivotal role in driving economic growth, stimulating production, creating job opportunities, and fostering technological advancement. Moreover, foreign investors have contributed to India's export promotion efforts, infrastructure development, and global integration, thereby bolstering the nation's competitiveness and resilience in the international arena.

India's appeal to foreign investors lies in its diverse market potential, abundant resources, skilled labor force, and supportive regulatory framework. With over 1.3 billion consumers and a burgeoning middle class, India offers a vast and dynamic market for businesses seeking growth opportunities. Additionally, India's highly educated workforce, particularly in sectors such as IT, engineering, and medicine, provides a talent pool for innovation and entrepreneurship.

The government's proactive stance towards attracting FDI, coupled with initiatives to streamline business operations and offer incentives to foreign investors, has bolstered investor confidence and fostered a conducive investment climate. Furthermore, bilateral investment agreements ensure the protection of foreign investors' rights, providing a secure and predictable investment environment that encourages long-term capital inflows.

Looking ahead, India's trajectory as a top investment destination for foreign investors appears promising. As the nation continues to embark on its path of economic reform and modernization, the role of FDI in driving growth and development is expected to become even more pronounced. With ongoing efforts to enhance ease of doing business, promote innovation and entrepreneurship, and strengthen infrastructure and connectivity, India is poised to unlock new avenues for investment and collaboration across diverse sectors.

For foreign investors looking to capitalize on India's growth story, it is imperative to conduct thorough market analysis, familiarize themselves with India's regulatory environment, and identify sectoral opportunities aligned with their business objectives and expertise. Strategic partnerships, collaborations with local stakeholders, and robust risk management strategies are essential elements for navigating the complexities of investing in India and maximizing returns on investment.

In conclusion, India's FDI policies offer a gateway to a world of opportunities for foreign investors seeking to participate in the nation's dynamic and evolving economy. By understanding the nuances of India's regulatory framework, leveraging its market potential, and forging strategic partnerships, foreign investors can position themselves to reap the benefits of India's growth trajectory while contributing to the nation's journey towards prosperity and inclusive development. As India continues to chart its course as a global economic powerhouse, the role of FDI will remain pivotal in shaping its future trajectory and fostering sustainable growth and prosperity for all stakeholders involved.

References

This post was originally published on: Foxnangel

#indias fdi#fdi investment in india#foreign direct investment in india#foreign invest in india#fdi in india#international investors#foreign investors#global economy#fdi india policy#foxnangel#invest in india

2 notes

·

View notes