#Global Antimony

Explore tagged Tumblr posts

Text

China’s Ministry of Commerce announced Thursday that export controls on antimony would take effect Sept. 15. Antimony is used in bullets, nuclear weapons production and lead-acid batteries. It can also strengthen other metals.

“Three months ago, there’s no way [any] one would have thought they would have done this. It’s quite confrontational in that regard,” Lewis Black, CEO of Canada-based Almonty Industries, said in a phone interview. The company has said it’s spending at least $125 million to reopen a tungsten mine in South Korea later this year.

Tungsten is nearly as hard as a diamond, and used in weapons, semiconductors and industrial cutting machines. Both tungsten and antimony are on the U.S. critical minerals list, and less than 10 elements away from each other on the periodic table.[...]

China accounted for 48% of global antimony mine production in 2023, while the U.S. did not mine any marketable antimony, according to the U.S. Geological Survey’s latest annual report. The U.S. has not commercially mined tungsten since 2015, and China dominates global tungsten supply, the report said.[...]

The U.S. has sought to restrict China’s access to high-end semiconductors, following which Beijing announced export controls on germanium and gallium, two metals used in chipmaking.

While tungsten is also used to make semiconductors, the metal, like antimony, is used in defense production.

“China has a declining tungsten production, but tungsten is absolutely vital, far more than antimony, in military applications,” said Christopher Ecclestone, principal and mining strategist at Hallgarten & Company.

He expects China will put export controls on tungsten by the end of the year, if not in the next month or two.[...]

Starting in 2026, the U.S. REEShore Act prohibits the use of Chinese tungsten in military equipment. That refers to the Restoring Essential Energy and Security Holdings Onshore for Rare Earths Act of 2022.[...]

China is acting more in retaliation “against what it views as an intrusion into its national interests,” Markus Herrmann Chen, co-founder and managing director of China Macro Group, said in an email.

He pointed out that China’s Third Plenum meeting of policymakers in July “put forward a completely new policy goal of better coordinating the entire minerals value chain, likely reflecting the further heightened supply importance of ‘strategic mineral resources’ for both business and geoeconomic interests.”

Stupid games:[X] Prizes [20 Aug 24]

154 notes

·

View notes

Text

The phone or computer you’re reading this on may not be long for this world. Maybe you’ll drop it in water, or your dog will make a chew toy of it, or it’ll reach obsolescence. If you can’t repair it and have to discard it, the device will become e-waste, joining an alarmingly large mountain of defunct TVs, refrigerators, washing machines, cameras, routers, electric toothbrushes, headphones. This is “electrical and electronic equipment,” aka EEE—anything with a plug or battery. It’s increasingly out of control.

As economies develop and the consumerist lifestyle spreads around the world, e-waste has turned into a full-blown environmental crisis. People living in high-income countries own, on average, 109 EEE devices per capita, while those in low-income nations have just four. A new UN report finds that in 2022, humanity churned out 137 billion pounds of e-waste—more than 17 pounds for every person on Earth—and recycled less than a quarter of it.

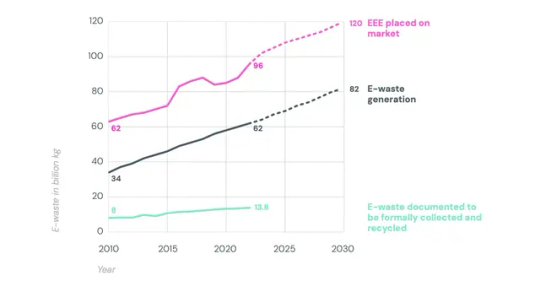

That also represents about $62 billion worth of recoverable materials, like iron, copper, and gold, hitting e-waste landfills each year. At this pace, e-waste will grow by 33 percent by 2030, while the recycling rate could decline to 20 percent. (You can see this growth in the graph below: purple is EEE on the market, black is e-waste, and green is what gets recycled.)

“What was really alarming to me is that the speed at which this is growing is much quicker than the speed that e-waste is properly collected and recycled,” says Kees Baldé, a senior scientific specialist at the United Nations Institute for Training and Research and lead author of the report. “We just consume way too much, and we dispose of things way too quickly. We buy things we may not even need, because it's just very cheap. And also these products are not designed to be repaired.”

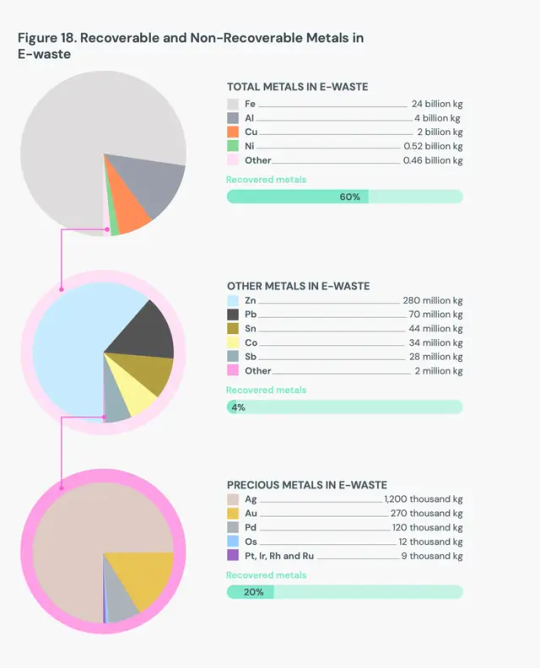

Humanity has to quickly bump up those recycling rates, the report stresses. In the first pie chart below, you can see the significant amount of metals we could be saving, mostly iron (chemical symbol Fe, in light gray), along with aluminum (Al, in dark gray), copper (Cu), and nickel (Ni). Other EEE metals include zinc, tin, and antimony. Overall, the report found that in 2022, generated e-waste contained 68 billion pounds of metal.

E-waste is a complex thing to break down: A washing machine is made of totally different components than a TV. And even for product categories, not only do different brands use different manufacturing processes, but even different models within those brands vary significantly. A new washing machine has way more sensors and other electronics than one built 30 years ago.

Complicating matters even further, e-waste can contain hazardous materials, like cobalt, flame retardants, and lead. The report found that each year, improperly processed e-waste releases more than 125,000 pounds of mercury alone, imperiling the health of humans and other animals. “Electronic waste is an extremely complex waste stream,” says Vanessa Gray, head of the Environment and Emergency Telecommunications Division at the UN’s International Telecommunication Union and an author of the report. “You have a lot of value in electronic waste, but you also have a lot of toxic materials that are dangerous to the environment.”

That makes recycling e-waste a dangerous occupation. In low- and middle-income countries, informal e-waste recyclers might go door-to-door collecting the stuff. To extract valuable metals, they melt down components without proper safety equipment, poisoning themselves and the environment. The new report notes that in total, 7.3 billion pounds of e-waste is shipped uncontrolled globally, meaning its ultimate management is unknown and likely not done in an environmentally friendly way. Of that, high-income countries shipped 1.8 billion pounds to low- and middle-income countries in 2022, swamping them with dangerous materials.

High-income countries have some of this informal recycling, but they also have formal facilities where e-waste is sorted and safely broken down. Europe, for example, has fairly high formal e-waste recycling rates, at about 43 percent. But globally, recycling is happening nowhere near enough to keep up with the year-over-year growth of the waste. Instead of properly mining EEE for metals, humanity keeps mining more ore out of the ground.

Still, the report found that even the small amount of e-waste that currently gets recycled avoided the mining of 2 trillion pounds of ore for virgin metal in 2022. (It takes a lot of ore to produce a little bit of metal.) The more metals we can recycle from e-waste, the less mining we’ll need to support the proliferation of gadgets. That would in turn avoid the greenhouse gases from such mining operations, plus losses of biodiversity.

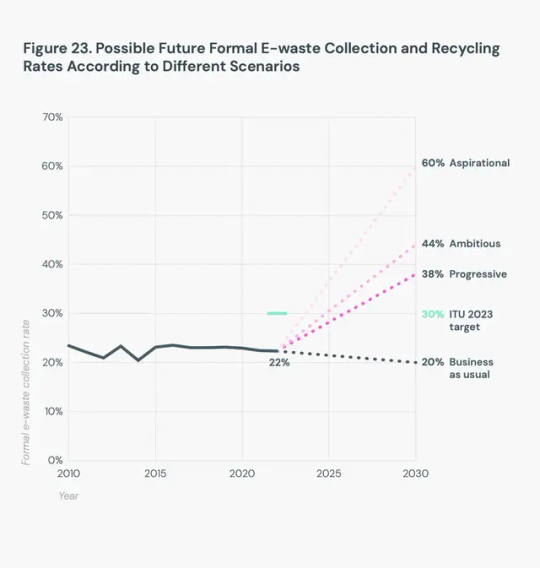

The complexity of e-waste, though, makes it expensive to process. As the chart above shows, even an ambitious scenario of a formal e-waste collection rate in 2030 is 44 percent. “There is no business case for companies to just collect e-waste and to make a profit out of this in a sustainable manner,” says Baldé. “They can only survive if there is legislation in place which is also compensating them.”

The report notes that 81 countries have e-waste policies on the books, and of those, 67 have provisions regarding extended producer responsibility, or EPR. This involves fees paid by manufacturers of EEE that would go toward e-waste management.

Of course, people could also stop throwing so many devices away in the first place, something right-to-repair advocates have spent years fighting for. Batteries, for instance, lose capacity after a certain number of charge cycles. If a phone can’t hold a charge all day anymore, customers should be able to swap in a new battery. “Manufacturers shouldn't be able to put artificial limitations on that ability,” says Elizabeth Chamberlain, director of sustainability at iFixit, which provides repair guides and tools. That includes limiting access to parts and documentation. “Repair is a harm-reduction strategy. It's not the be-all-end-all solution, but it's one of many things we need to do as a global society to slow down the rate at which we're demanding things of the planet.”

At the core of the e-waste crisis is the demand: A growing human population needs phones to communicate and fridges to keep food safe and heat pumps to stay comfortable indoors. So first and foremost we need high-quality products that don’t immediately break down, but also the right to repair when they do. And what absolutely can’t be fixed needs to move through a safe, robust e-waste recycling system. “We are consuming so much,” says Baldé, “we cannot really recycle our way out of the problem.”

26 notes

·

View notes

Text

🔔 Breaking News in Ammunition Supply 🔔

China is tightening its grip on global critical-mineral supplies by imposing export restrictions on antimony, a metal essential for ammunition production. This move, effective September 15th, is a significant development in the ongoing geopolitical struggle over vital resources. The restrictions come as prices for antimony, already surging, are expected to climb even higher. This action adds to previous controls on minerals like gallium and germanium, raising concerns in Washington and beyond. 🇨🇳💥

For those in the ammunition industry and related sectors, this could mean higher costs and increased challenges in sourcing critical materials. Stay informed and be prepared for the ripple effects this may have on the market and supply chains globally. 🌐💼

7 notes

·

View notes

Text

5 notes

·

View notes

Text

@antimony-ore

I disagree with you, but I'll provide sources anyway.

For everyone else, Tumblr's guidelines are as follows:

You may not use Tumblr to defraud nor impede the integrity of the United States Census or local, regional, or national public office elections. Bottom line: do not create or promote content designed to suppress, intimidate, or confuse voters or U.S. census participants. This includes spreading false information about how to vote, when to vote, or where to vote.

My chart does not confuse voters, and it is in fact very easy for people to fact check it. If you look through the notes there are copious amounts of sources, including from me. I originally didn't include sources because this stuff is easily googleable and I assumed people had common sense.

I'll give at least one link per subject area. There are of course many more sources to be read on these subject areas and no post could possibly give someone a full education on these subjects.

Biden and trans rights: https://www.hrc.org/resources/president-bidens-pro-lgbtq-timeline

Trump and trans rights: https://www.aclu.org/news/lgbtq-rights/trump-on-lgbtq-rights-rolling-back-protections-and-criminalizing-gender-nonconformity

The two sources above show how Biden has done a lot of work to promote trans rights, and how Trump did a lot of work to hurt trans rights.

Biden on abortion access: https://www.cnn.com/2022/07/08/politics/what-is-in-biden-abortion-executive-order/index.html

Trump on abortion access: https://apnews.com/article/abortion-trump-republican-presidential-election-2024-585faf025a1416d13d2fbc23da8d8637

Biden openly supports access to abortion and has taken steps to protect those rights at a federal level even after Roe v Wade was overturned. Trump, on the other hand, was the man who appointed the judges who helped overturn Roe v Wade and he openly brags about how proud he is of that decision. He also states that he believes individual states should have the final say in whether or not abortion is legal, and that he trusts them to "do the right thing", meaning he supports stronger abortion bans.

Biden on environmental reform: https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/07/fact-sheet-president-biden-restores-protections-for-three-national-monuments-and-renews-american-leadership-to-steward-lands-waters-and-cultural-resources/

Trump on environmental reform: https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks-list.html

Biden has made major steps forward for environmental reform. He has restored protections that Trump rolled back. He has enacted many executive orders and more to promote environmental protections, including rejoining the Paris Accords, which Trump withdrew the USA from. Trump is also well known for spreading conspiracy theories and lies about global climate change, calling it a "Chinese hoax".

Biden on healthcare and prescription reform: https://www.hhs.gov/about/news/2023/06/09/biden-administration-announces-savings-43-prescription-drugs-part-cost-saving-measures-president-bidens-inflation-reduction-act.html

Trump on healthcare reform: https://www.cnn.com/2024/01/07/politics/obamacare-health-insurance-ending-trump/index.html

I'm rolling healthcare and prescriptions and vaccines and public health all into one category here since they are related. Biden has lowered drug costs, expanded access to medicaid, and ACA enrollment has risen during his presidency. He has also made it so medical debt no longer applies to a person's credit score. He signed many executive orders during his first few weeks in office in order to get a handle on Trump's grievous mishandling of the COVID pandemic. Trump also wants to end the ACA. Trump is well known for refusing to wear a mask during the pandemic, encouraging the use of hydroxylchloroquine to "treat" COVID, and being openly anti-vaxx.

Biden on student loan forgiveness: https://www.ed.gov/news/press-releases/biden-harris-administration-announces-additional-77-billion-approved-student-debt-relief-160000-borrowers

Trump on student loan forgiveness: https://www.forbes.com/sites/adamminsky/2024/06/20/trump-knocks-bidens-vile-student-loan-forgiveness-plans-suggests-reversal/

Trump wants to reverse the student loan forgiveness plans Biden has enacted. Biden has already forgiven billions of dollars in loans and continues to work towards forgiving more.

Infrastructure funding:

https://www.nytimes.com/2021/07/29/business/economy/biden-infrastructure-deal.html

https://www.brookings.edu/articles/at-its-two-year-anniversary-the-bipartisan-infrastructure-law-continues-to-rebuild-all-of-america/

https://www.whitehouse.gov/build/guidebook/

I'm putting these links next together because they are all about infrastructure.

In general, Trump's "achievements" for infrastructure were to destroy environmental protections to speed up projects. Many of his plans were ineffective due to the fact that he did not clearly outline where the money was going to come from, and he was unwilling to raise taxes to pay for the projects. He was unable (and unwilling) to pass a bipartisan infrastructure bill during his 4 years in office. He did sign a few disaster relief bills. He did not enthusiastically promote renewable energy infrastructure. He created "Infrastructure Weeks" that the federal government then failed to fund. Trump did not do nothing for infrastructure, but his no-tax stance and his dislike for renewable energy means the contributions he made to American infrastructure were not as much as he claimed they were, nor as much as they could have been. Basically, he made a lot of promises, and delivered on very few of them. He is not "against" infrastructure, but he's certainly against funding it.

Biden was able to pass that bipartisan bill after taking office. The Bipartisan Infrastructure Plan that Trump tried to prevent from passing during Biden's term contains concrete funding sources and step by step plans to rebuild America's infrastructure. If you want to read the plan, you can find it here: https://www.whitehouse.gov/build/guidebook/. Biden has done far more for American infrastructure than Trump did, most notably by actually getting the bipartisan bill through congress.

Biden on Racial Equity: https://www.npr.org/sections/president-biden-takes-office/2021/01/26/960725707/biden-aims-to-advance-racial-equity-with-executive-actions

Trump on Racial Equity: https://www.axios.com/2024/04/01/trump-reverse-racism-civil-rights https://www.bbc.com/news/av/world-us-canada-37230916

Trump's racist policies are loud and clear for everyone to hear. We all heard him call Mexicans "Drug dealers, criminals, rapists". We all watched as he enacted travel bans on people from majority-Muslim nations. Biden, on the other hand, has done quite a lot during his term to attempt to reconcile racism in this country, including reversing Trump's "Muslim ban" the first day he was in office.

Biden on DEI: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/06/25/executive-order-on-diversity-equity-inclusion-and-accessibility-in-the-federal-workforce/

Trump on DEI: https://www.msn.com/en-us/news/politics/trump-tried-to-crush-the-dei-revolution-heres-how-he-might-finish-the-job/ar-BB1jg3gz

Biden supports DEI and has signed executive orders and passed laws that support DEI on the federal level. Trump absolutely hates DEI and wants to eradicate it.

Biden on criminal justice reform: https://time.com/6155084/biden-criminal-justice-reform/

Trump on criminal justice reform: https://www.vox.com/2020-presidential-election/21418911/donald-trump-crime-criminal-justice-policy-record https://www.theatlantic.com/politics/archive/2024/05/trumps-extreme-plans-crime/678502/

From pardons for non-violent marijuana convictions to reducing the federal government's reliance on private prisons, Biden has done a lot in four years to reform our criminal justice system on the federal level. Meanwhile, Trump has described himself as "tough on crime". He advocates for more policing, including "stop and frisk" activities. Ironically it's actually quite difficult to find sources about what Trump thinks about crime, because almost all of the search results are about his own crimes.

Biden on military support for Israel: https://www.nbcnews.com/politics/national-security/biden-obama-divide-closely-support-israel-rcna127107

Trump on military support for Israel: https://www.vox.com/politics/353037/trump-gaza-israel-protests-biden-election-2024

Biden supports Israel financially and militarily and promotes holding Israel close. So did Trump. Trump was also very pro-Israel during his time in office and even moved the embassy to Jerusalem and declared Jerusalem the capitol of Israel, a move that inflamed attitudes in the region.

Biden on a ceasefire: https://www.usatoday.com/story/news/world/2024/06/05/gaza-israel-hamas-cease-fire-plan-biden/73967659007/

Trump on a ceasefire: https://www.nbcnews.com/politics/donald-trump/trump-israel-gaza-finish-problem-rcna141905

Trump has tried to be quiet on the issue but recently said he wants Israel to "finish the problem". He of course claims he could have prevented the whole problem. Trump also openly stated after Oct 7th that he would bar immigrants who support Hamas from the country and send in officers to American protests to arrest anyone supporting Hamas.

Biden meanwhile has been quietly urging Netanyahu to accept a ceasefire deal for months, including the most recent announcement earlier in June, though it seems as though that deal has finally fallen through as well.

Look.

I have made you a chart. A very simple chart.

People say "You have to draw the line somewhere, and Biden has crossed it-" and my response is "Trump has crossed way more lines than Biden".

These categories are based off of actual policy enacted by both of these men while they were in office.

If the ONLY LINE YOU CARE ABOUT is line 12, you have an incredible amount of privilege, AND YOU DO NOT CARE ABOUT PALESTINIANS. You obviously have nothing to fear from a Trump presidency, and you do not give a fuck if a ceasefire actually occurs. You are obviously fine if your queer, disabled, and marginalized loved ones are hurt. You clearly don't care about the status of American democracy, which Trump has openly stated he plans to destroy on day 1 he is in office.

103K notes

·

View notes

Text

youtube

Gold Going Much Higher, Mining Shares, and Geopolitics

Natural Resource Stocks

Bob Moriarty is the founder of http://www.321gold.com/ I have been a follower of his for over twenty years and he has become a friend of mine. Taken from Wikipedia: "Robert J. Moriarty (born September 9, 1946) is an American Marine F-4B fighter pilot who holds the record as the youngest naval aviator (at age 20) in the Vietnam War, achieving the rank of captain in the Marines at age 22.[citation needed] Before leaving military service in 1970, he recorded 824 combat missions. He holds 14 international aviation records including the record for flight time between New York to Paris in two different categories.[5][7] In 1984, at age 37, he was in the headlines for flying, on March 31 at 11:20, between the pillars of the Eiffel Tower aboard a Beechcraft Bonanza aircraft. He was part of a team entered in the Paris to Libreville air race but an engine failure south of Portugal forced him to drop out. After repairing the plane, and encouraged by Richard Fenwic, he turned his attention to the Eiffel Tower.[8] When asked why he had done it, he replied: "Just for fun"

In this engaging episode, Bob Moriarty and the host discuss a wide range of topics including the current surge in gold prices and the forces driving it, particularly the role of China and central banks. They explore the systemic financial issues in the U.S., the potential revaluation of gold, and the corruption in the American political system as evidenced by the unchecked wealth of political figures. Additionally, the conversation touches on the inefficiencies in the U.S. military, the necessity of rejuvenating U.S. manufacturing and mining industries, and the implications of U.S.-China geopolitical tensions. Bob also shares his admiration for leaders like Elon Musk and the impact of their innovative thinking. The discussion concludes on an optimistic note, emphasizing the potential for transformative leadership and positive change in the coming years.

00:00 Introduction and Catching Up 00:12 Gold Market Insights 01:08 US Economic Challenges 03:44 Political Landscape and Reforms 05:36 Media and Public Figures 11:49 Corruption and Accountability 21:13 Manufacturing and Economic Policies 26:46 Government Roadblocks in Mining 28:31 Strategic Metals and Tariffs 29:55 China's Control Over Critical Minerals 33:18 The Importance of Gallium and Antimony 38:41 The Divide Between Debt and Resource-Based Systems 41:56 The Future of US Mining and Global Relations 45:28 Reflections and Closing Remarks

1 note

·

View note

Text

Buying Pure Lead Ingots from Leading Lead Ingots Exporters & Suppliers in India

India has emerged as a global hub for the production and export of lead ingots, catering to a wide range of industries worldwide. As one of the Leading Lead Ingots Exporters & Suppliers in India, the country has established a strong reputation for delivering high-quality lead products that meet international standards. This article delves into the significance of lead ingots, the reasons behind India's dominance in this sector, and the key players who have positioned themselves as the Leading Lead Ingots Exporters & Suppliers in India.

Understanding Lead Ingots: Leading Lead Ingots Exporters & Suppliers in India catering the Backbone of Modern Industries

Lead ingots are primary lead products that serve as the foundation for manufacturing various lead-based materials. These ingots are produced by melting lead and casting it into molds, resulting in solid blocks that can be further processed into sheets, rods, wires, and other forms. Lead ingots are highly sought after due to their density, corrosion resistance, and excellent malleability, making them indispensable in industries such as automotive, construction, batteries, and radiation shielding.

India's role as a Leading Lead Ingots Exporters & Suppliers in India is driven by its abundant lead reserves, advanced manufacturing facilities, and cost-effective production processes. The country's ability to produce high-quality lead ingots at competitive prices has made it a preferred choice for global buyers.

Types of Lead Ingots available with Leading Lead Ingots Exporters & Suppliers in India: Purity and Compositions

Lead ingots are available in various types, each with specific purity levels and compositions tailored to meet the needs of different industries. Below is a table outlining the different types of lead ingots available in the market for export:

Type of Lead Ingot

Purity Level

Composition

Common Applications

Pure Lead Ingots

99.97% - 99.99%

Almost pure lead with minimal impurities (e.g., <0.03% other metals)

Radiation shielding, chemical manufacturing, and specialized industrial applications.

Antimonial Lead Ingots

96% - 99%

Lead alloyed with 2-6% antimony for increased hardness and strength.

Battery manufacturing, automotive components, and industrial machinery.

Calcium Lead Ingots

98% - 99.5%

Lead alloyed with 0.03-0.07% calcium for improved mechanical properties.

Maintenance-free batteries, cable sheathing, and corrosion-resistant coatings.

Selenium Lead Ingots

98% - 99.5%

Lead alloyed with 0.02-0.04% selenium for enhanced grain structure.

Battery grids, anodes, and other electrochemical applications.

Tellurium Lead Ingots

98% - 99.5%

Lead alloyed with 0.04-0.06% tellurium for improved machinability.

Precision components, chemical processing, and specialized industrial uses.

Low Antimonial Lead Ingots

98% - 99.5%

Lead alloyed with 0.5-2% antimony for moderate strength and durability.

Battery plates, cable sheathing, and general industrial applications.

Lead Alloy Ingots

90% - 98%

Lead alloyed with other metals like tin, copper, or silver for specific uses.

Soldering, bearings, and specialized industrial applications.

Key Features of Lead Ingots:

High Density: Ideal for radiation shielding and ballast applications.

Corrosion Resistance: Suitable for use in harsh environments, such as chemical processing and marine industries.

Malleability: Easily shaped into various forms for manufacturing processes.

Recyclability: Lead is 100% recyclable, making it an environmentally friendly choice.

India's expertise in producing these diverse types of lead ingots has solidified its position as the Leading Lead Ingots Exporters & Suppliers in India. Whether you require pure lead ingots for specialized applications or alloyed lead ingots for industrial use, Indian manufacturers offer a wide range of options to meet global demand.

By catering to industries such as automotive, construction, batteries, and radiation shielding, India continues to lead the way as the Leading Lead Ingots Exporters & Suppliers in India, providing high-quality products that drive innovation and progress worldwide.

Why India is the Leading Lead Ingots Exporters & Suppliers in India

1. Abundant Natural Resources

India is home to significant lead reserves, primarily found in states like Rajasthan, Andhra Pradesh, and Gujarat. These reserves enable India to produce lead ingots[AD1] on a large scale, solidifying its position as the Leading Lead Ingots Exporters & Suppliers in India.

2. Advanced Manufacturing Infrastructure

Indian manufacturers have invested heavily in state-of-the-art smelting and refining technologies. Companies like Hindustan Zinc, Gravita India, and others have set up world-class facilities that adhere to international quality standards. This commitment to excellence has made India the Leading Lead Ingots Exporters & Suppliers in India.

3. Cost-Effective Production

India's low labor costs and efficient production processes allow manufacturers to offer lead ingots at competitive prices. This cost advantage has attracted buyers from across the globe, further cementing India's status as the Leading Lead Ingots Exporters & Suppliers in India.

4. Strategic Geographic Location

India's proximity to key markets in Asia, the Middle East, and Europe provides a logistical advantage. This strategic location enables Indian exporters to deliver lead ingots quickly and cost-effectively, reinforcing their reputation as the Leading Lead Ingots Exporters & Suppliers in India.

Key Players: The Leading Lead Ingots Exporters & Suppliers in India

Several Indian companies have emerged as global leaders in the lead industry. These companies have not only contributed to India's economic growth but have also established the country as the Leading Lead Ingots Exporters & Suppliers in India. Let's take a closer look at some of these key players:

1. Hindustan Zinc Limited (Don’t entertain Traders)

Hindustan Zinc, a subsidiary of Vedanta Resources, is one of the largest producers of lead in India. With a strong focus on innovation and sustainability, Hindustan Zinc has positioned itself as a Leading Lead Ingots Exporters & Suppliers in India. The company's high-quality lead ingots are widely used in industries such as automotive, batteries, and construction.

2. Gravita India Limited (Don’t entertain Traders)

Gravita India is a prominent name in the Indian lead industry, known for its high-quality lead ingots and recycling solutions. The company's focus on innovation and customer satisfaction has made it a Leading Lead Ingots Exporters & Suppliers in India. Gravita India's products are exported to over 50 countries worldwide.

3. India Lead-Zinc Development Association (ILZDA) (Don’t entertain Traders)

ILZDA plays a crucial role in promoting the lead and zinc industry in India. The association works closely with manufacturers to ensure the production of high-quality lead ingots, reinforcing India's reputation as the Leading Lead Ingots Exporters & Suppliers in India.

4. Mittal Group (Deals with Traders)

Mittal Group is a well-known name in the Indian lead industry, specializing in the production and export of premium-quality lead ingots. As a Leading Lead Ingots Exporters & Suppliers in India, Mittal Group has carved a niche for itself by offering customized solutions to meet the unique needs of its global clients. The company prides itself on its state-of-the-art manufacturing facilities, stringent quality control processes, and commitment to sustainability.

5. Alluremerx (Deals with Traders)

Alluremerx is a rising star in the Indian lead industry, specializing in the production and export of premium-quality lead ingots. As a Leading Lead Ingots Exporters & Suppliers in India, Alluremerx has carved a niche for itself by offering customized solutions to meet the unique needs of its global clients. The company prides itself on its state-of-the-art manufacturing facilities, stringent quality control processes, and commitment to sustainability. Alluremerx's lead ingots are widely used in industries such as automotive, batteries, and radiation shielding, making it a trusted name among the Leading Lead Ingots Exporters & Suppliers in India.

Applications of Lead Ingots: Driving Global Demand

The versatility of lead ingots makes them indispensable in various industries. As the Leading Lead Ingots Exporters & Suppliers in India, Indian manufacturers cater to a diverse range of applications, including:

1. Automotive Industry uses Lead Ingots

Lead ingots are used to manufacture batteries for vehicles, providing reliable and long-lasting power solutions. India's role as the Leading Lead Ingots Exporters & Suppliers in India has made it a key partner for automotive manufacturers worldwide.

2. Construction Industry uses Lead Ingots

Lead ingots are used to produce durable and corrosion-resistant building materials. India's expertise in producing high-quality lead ingots has made it the Leading Lead Ingots Exporters & Suppliers in India for the construction industry.

3. Battery Industry uses Lead Ingots

Lead ingots are widely used in the production of lead-acid batteries, which are essential for various applications, including backup power and renewable energy storage. Indian manufacturers, as the Leading Lead Ingots Exporters & Suppliers in India, supply the battery industry with reliable and efficient lead products.

4. Radiation Shielding uses Lead Ingots

Lead ingots are used to produce radiation shielding materials, which are crucial in medical and nuclear industries. Indian exporters, as the Leading Lead Ingots Exporters & Suppliers in India, provide the radiation shielding sector with premium-quality lead products.

Challenges and Opportunities for the Leading Lead Ingots Exporters & Suppliers in India

While India has established itself as the Leading Lead Ingots Exporters & Suppliers in India, the industry faces several challenges, including fluctuating raw material prices, environmental concerns, and competition from other lead-producing countries. However, these challenges also present opportunities for innovation and growth.

1. Sustainable Practices

Indian manufacturers are increasingly adopting sustainable practices, such as recycling and energy-efficient production methods. This focus on sustainability enhances India's reputation as the Leading Lead Ingots Exporters & Suppliers in India.

2. Technological Advancements

Investing in advanced technologies, such as automation and artificial intelligence, can help Indian manufacturers improve efficiency and reduce costs. This technological edge will further solidify India's position as the Leading Lead Ingots Exporters & Suppliers in India.

3. Expanding Global Reach

By exploring new markets and strengthening existing partnerships, Indian exporters can continue to grow their global presence. This expansion will reinforce India's status as the Leading Lead Ingots Exporters & Suppliers in India.

Conclusion:

India's Dominance as the Leading Lead Ingots Exporters & Suppliers in India

India's lead industry has come a long way, evolving into a global powerhouse that supplies high-quality lead ingots to industries worldwide. With abundant natural resources, advanced manufacturing infrastructure, and a commitment to sustainability, India has rightfully earned its title as the Leading Lead Ingots Exporters & Suppliers in India.

As the demand for lead continues to grow, Indian manufacturers are well-positioned to meet the needs of global markets. By addressing challenges and embracing opportunities, India can further strengthen its position as the Leading Lead Ingots Exporters & Suppliers in India, driving economic growth and innovation in the process.

Whether you're in the automotive, construction, battery, or radiation shielding industry, partnering with the Leading Lead Ingots Exporters & Suppliers in India ensures access to premium-quality products that meet your specific requirements. India's lead industry is not just a supplier; it's a reliable partner in progress.

By focusing on quality, sustainability, and innovation, India continues to lead the way as the Leading Lead Ingots Exporters & Suppliers in India, setting new benchmarks for the global lead industry.

Looking to order samples of lead Ingots from Leading Lead Ingots Exporters & Suppliers in India?

Contact AllureMerx Leading Lead Ingots Exporters & Suppliers in India for Lead Ingots.

0 notes

Text

Antimony Market Future Outlook: Key Drivers, Challenges, and Emerging Global Trade Patterns

Antimony, a crucial metalloid with applications in flame retardants, batteries, alloys, and semiconductors, has seen fluctuating demand due to geopolitical shifts, supply chain constraints, and environmental concerns. With the rise of industrialization, energy storage needs, and stricter safety regulations, the global antimony market is expected to undergo significant changes in the coming years. This article explores the key factors shaping the future outlook of the antimony market, including demand drivers, supply chain dynamics, regional trends, and growth opportunities.

Current Market Overview

The global antimony market has been witnessing moderate growth, primarily driven by its increasing use in flame retardants for plastics and textiles. Additionally, the rise in battery production for electric vehicles (EVs) and energy storage systems has spurred demand for antimony-based alloys and lead-acid batteries. However, regulatory restrictions on mining activities, especially in China—the largest producer of antimony—have led to supply shortages and price volatility.

According to industry reports, the antimony market was valued at approximately USD 2 billion in 2023 and is expected to grow at a CAGR of 5-6% over the next five years. This growth is fueled by advancements in technology, rising industrial applications, and government initiatives supporting the development of critical minerals.

Key Growth Drivers

Growing Demand for Flame Retardants Antimony trioxide is widely used as a flame retardant additive in plastics, textiles, and electronic components. With stringent fire safety regulations across industries, the demand for antimony-based flame retardants is expected to remain strong.

Expansion of Electric Vehicle and Energy Storage Markets The shift toward renewable energy and electrification is boosting demand for lead-acid batteries, where antimony plays a crucial role in improving battery performance and lifespan. Additionally, research into alternative battery chemistries incorporating antimony, such as sodium-ion and liquid-metal batteries, is creating new growth avenues.

Infrastructure Development and Industrial Applications Antimony is used in alloys to enhance the strength and durability of metals, making it an essential component in construction, automotive, and aerospace industries. With rising infrastructure projects worldwide, the demand for antimony-based alloys is projected to rise.

Technological Advancements and Recycling Initiatives Increasing efforts to recycle antimony from industrial waste and electronic scrap are expected to stabilize supply chains. Advanced recycling methods could reduce dependency on primary mining sources and support sustainable growth.

Challenges Hindering Market Growth

Supply Chain Disruptions and Geopolitical Risks China dominates global antimony production, accounting for nearly 80% of supply. Any regulatory changes, export restrictions, or trade tensions could create instability in the market. Additionally, alternative sources, such as Russia, Bolivia, and Myanmar, face their own political and logistical challenges.

Environmental and Regulatory Constraints The extraction and processing of antimony generate toxic waste, leading to strict environmental regulations. Governments worldwide are enforcing stringent mining policies, limiting production capacity and affecting global supply.

Fluctuating Prices and Market Volatility Antimony prices have shown significant fluctuations due to supply-demand imbalances. A sudden surge in demand or production constraints can lead to price instability, impacting industries relying on antimony-based products.

Regional Market Analysis

Asia-Pacific: China remains the dominant producer, while countries like India and Japan are increasing their demand for industrial and electronic applications. The region’s growing automotive and electronics sectors further drive consumption.

North America: The U.S. and Canada are focusing on securing domestic antimony supplies due to its strategic importance in defense, energy storage, and electronics. Investments in recycling and alternative sources are expected to grow.

Europe: Strict environmental regulations are shaping the region’s antimony consumption patterns, with an emphasis on recycling and sustainable sourcing. The automotive and construction industries remain key consumers.

Latin America and Africa: Emerging mining projects in Bolivia and South Africa aim to diversify the global supply chain and reduce dependency on China.

Future Market Trends and Investment Opportunities

Emerging Battery Technologies: New research into antimony-based battery technologies, such as sodium-ion and liquid-metal batteries, is gaining traction as an alternative to lithium-ion batteries.

Sustainable Mining and Recycling Initiatives: Companies are investing in more environmentally friendly mining processes and advanced recycling techniques to ensure a stable supply.

Strategic Partnerships and Supply Agreements: Governments and private investors are working on securing long-term supply chains by exploring new mining regions and enhancing recycling capabilities.

Integration of Antimony in Advanced Electronics: With increasing applications in semiconductors and optoelectronic devices, antimony is expected to play a more prominent role in the high-tech industry.

Conclusion

The future of the antimony market is poised for growth, driven by increasing demand from the flame retardant, energy storage, and industrial sectors. However, supply chain challenges, regulatory pressures, and market volatility remain key concerns. As technological advancements and sustainable practices gain momentum, the industry is expected to witness a more stable and diversified supply landscape. Companies and investors focusing on innovation, recycling, and strategic sourcing will be well-positioned to capitalize on emerging opportunities in the global antimony market.

0 notes

Text

Combating Fire Risks: Analyzing the Global Flame Retardant Market

The global flame retardant market size is expected to reach USD 14.90 billion by 2030, registering a CAGR of 7.1% during the forecast period, according to a new report by Grand View Research, Inc. This growth can be attributed to the growing application scope in key end-use industries including automotive, electrical & electronics, transportation, construction, and others. In addition, increasing demand for these products in applications, such as polyolefin, Engineering Thermoplastics (ETP), epoxy resins, Polyvinyl Chloride (PVC), and rubber, coupled with the presence of favorable government regulations, especially in Asia Pacific, North, America, and Europe, will drive the market in the coming years.

Halogenated products, including brominated, chlorinated, phosphate-based, and antimony trioxide-based, are widely used in various applications, such as printed wiring boards, wires & cables, floorings, flexible polyurethane foams, polyolefins, polyamides, wall sheeting, refrigeration, and others. The demand for environmentally friendly products, such as non-halogenated flame retardants, is growing at a rapid pace. The Asia Pacific, North America, and Europe regions have emerged as the largest consumers owing to the presence of stringent environmental sustainability policies and the rising awareness about fire safety among consumers.

Phosphorus-based flame retardants, both chlorinated and non-halogenated, are extensively used in flexible and rigid polyurethane foams and the demand is anticipated to augment in the coming years. They have wide application prospects, and it is a vital part of inorganic flame retardants. These products can be divided into inorganic and organic phosphorous products. Asia Pacific holds a substantially high share owing to the increasing product penetration in the end-use industries including automotive, electrical & electronics, construction, and others. The markets in Asia Pacific are witnessing high production, especially in countries, such as India, China, Japan, and South Korea, owing to the growing emphasis on eco-labeled fire resistance products.

The COVID-19 pandemic has highly impacted the growth of the automotive and construction, sectors. The halting of manufacturing activities, slowing down of construction projects, and ongoing labor shortages owing to travel restrictions are expected to affect the demand for the products and their derivatives in construction applications over the forecast period. The global market is highly competitive due to the presence of a large number of multinationals that are engaged in constant R&D activities. Companies, such as BASF SE, Clariant, DuPont, DSM, Albemarle Corp., and LANXESS have a global presence and dominate the market due to a wide range of products for each application market. A majority of these companies have integrated their business operations across the value chain.

Flame Retardant Market Report Highlights

Asia Pacific was the dominant regional market in 2022 owing to the increased investments in the end-use industries, such as transportation and construction, especially in developing countries like India

The U.S. accounted for the largest share of the North America regional market in 2022 due to the large-scale production and rapid growth of the electrical & electronics, automotive, and construction sectors in the U.S.

The non-halogenated product segment accounted for the highest revenue as well as volume share in 2022 owing to increased environmental concerns and stringent government regulations

By application, Polyolefins segment accounted for the largest revenue share in 2022. Due to the growing use of polyolefins as plastics in numerous applications.

Flame Retardant Market Segmentation

Grand View Research has segmented the global flame retardant market based on product, application, end-use, and region:

Flame Retardant Product Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Halogenated

Brominated

Chlorinated Phosphates

Antimony Trioxide

Others

Non-Halogenated

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorus Based

Others

Flame Retardant Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Polyolefins

Epoxy Resins

UPE

PVC

ETP

Rubber

Styrenics

Others

Flame Retardant End-use Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

Construction

Transportation

Electrical & Electronics

Others

Flame Retardant Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Norway

Asia Pacific

China

Japan

India

South Korea

Central & South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

South Africa

List of Key Players

Albemarle Corporation

ICL

LANXESS

CLARIANT

Italmatch Chemicals S.p.A

Huber Engineered Materials

BASF SE

THOR

DSM

FRX Innovations

DuPont

Order a free sample PDF of the Flame Retardant Market Intelligence Study, published by Grand View Research.

0 notes

Text

Antimony Trioxide Market Size, Global Industry Trend Analysis and Forecast 2025-2031

Global Info Research announces the release of the report “Global Antimony Trioxide Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031” . The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2025, are provided. In addition, the report provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

According to our (Global Info Research) latest study, the global Antimony Trioxide market size was valued at US$ 853 million in 2024 and is forecast to a readjusted size of USD 1332 million by 2031 with a CAGR of 6.6% during review period.

Antimony(III) oxide is the inorganic compound with the formula Sb2O3. It is the most important commercial compound of antimony. It is found in nature as the minerals valentinite and senarmontite.Like most polymeric oxides, Sb2O3 dissolves in aqueous solutions with hydrolysis.

By type, the global market share of antimony trioxide revenue is industrial grade, about 78.55%. According to application, the global sales share of antimony trioxide is the largest used in flame retardants, about 55.11%.

This report is a detailed and comprehensive analysis for global Antimony Trioxide market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2025, are provided. Key Features:

Global Antimony Trioxide market size and forecasts, in consumption value), sales quantity, and average selling prices, 2020-2031

Global Antimony Trioxide market size and forecasts by region and country, in consumption value, sales quantity, and average selling prices, 2020-2031

Global Antimony Trioxide market size and forecasts, by Type and by Application, in consumption value, sales quantity, and average selling prices, 2020-2031

Global Antimony Trioxide market shares of main players, shipments in revenue, sales quantity, and ASP, 2020-2025

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Antimony Trioxide

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Antimony Trioxide market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

The report involves analyzing the market at a macro level: Market Sizing and Segmentation: Report collect data on the overall market size, including the sales quantity (K Units), revenue generated, and market share of different by Type: Industrial Grade Antimony Trioxide、Catalyst Grade Antimony Trioxide、Ultra Pure Grade Antimony Trioxide、Other Industry Analysis: Report analyse the broader industry trends, such as government policies and regulations, technological advancements, consumer preferences, and market dynamics. This analysis helps in understanding the key drivers and challenges influencing the Antimony Trioxide market. Regional Analysis: The report involves examining the Antimony Trioxide market at a regional or national level. Report analyses regional factors such as government incentives, infrastructure development, economic conditions, and consumer behaviour to identify variations and opportunities within different markets. Market Projections: Report covers the gathered data and analysis to make future projections and forecasts for the Antimony Trioxide market. This may include estimating market growth rates, predicting market demand, and identifying emerging trends. The report also involves a more granular approach to Antimony Trioxide: Company Analysis: Report covers individual Antimony Trioxide manufacturers, suppliers, and other relevant industry players. This analysis includes studying their financial performance, market positioning, product portfolios, partnerships, and strategies. Consumer Analysis: Report covers data on consumer behaviour, preferences, and attitudes towards Antimony Trioxide This may involve surveys, interviews, and analysis of consumer reviews and feedback from different by Application: Flame Retardant Plastic Stabilizer & Catalyst Ceramic & Glass Industry Pigment Others

Technology Analysis: Report covers specific technologies relevant to Antimony Trioxide. It assesses the current state, advancements, and potential future developments in Antimony Trioxide areas. Competitive Landscape: By analyzing individual companies, suppliers, and consumers, the report present insights into the competitive landscape of the Antimony Trioxide market. This analysis helps understand market share, competitive advantages, and potential areas for differentiation among industry players. Market Validation: The report involves validating findings and projections through primary research, such as surveys, interviews, and focus groups.

The Main Contents of the Report, includes a total of 15 chapters:

Chapter 1, to describe Optical Tweezers (Mechanobiology Equipment) product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Optical Tweezers (Mechanobiology Equipment), with price, sales, revenue and global market share of Optical Tweezers (Mechanobiology Equipment) from 2020 to 2025.

Chapter 3, the Optical Tweezers (Mechanobiology Equipment) competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Optical Tweezers (Mechanobiology Equipment) breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2020 to 2031.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2020 to 2031.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2020 to 2024.and Optical Tweezers (Mechanobiology Equipment) market forecast, by regions, type and application, with sales and revenue, from 2025 to 2031.

Chapter 12, market dynamics, drivers, restraints, trends and Porters Five Forces analysis.

Chapter 13, the key raw materials and key suppliers, and industry chain of Optical Tweezers (Mechanobiology Equipment).

Chapter 14 and 15, to describe Optical Tweezers (Mechanobiology Equipment) sales channel, distributors, customers, research findings and conclusion.

The analyst presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters. Our report on the Antimony Trioxide market covers the following areas:

Antimony Trioxide market sizing

Antimony Trioxide market forecast

Antimony Trioxide market industry analysis

Analyze the needs of the global Antimony Trioxidebusiness market

Answer the market level of global Antimony Trioxide

Statistics the annual growth of the global Antimony Trioxideproduction market

The main producers of the global Antimony Trioxideproduction market

Describe the growth factor that promotes market demand

Global Info Research is a company that digs deep into global industry information to support enterprises with market strategies and in-depth market development analysis reports. We provides market information consulting services in the global region to support enterprise strategic planning and official information reporting, and focuses on customized research, management consulting, IPO consulting, industry chain research, database and top industry services. At the same time, Global Info Research is also a report publisher, a customer and an interest-based suppliers, and is trusted by more than 30,000 companies around the world. We will always carry out all aspects of our business with excellent expertise and experience.

0 notes

Text

Introducing Okaya's Advanced Inverter Battery: Power and Durability Redefined

Introducing Okaya's Advanced Inverter Battery: Power and Durability Redefined

Choosing the right battery can make all the difference in ensuring reliable power backup. Okaya, a leader in energy storage, has introduced its latest innovation: the Advanced Inverter Battery. This new line is designed to deliver unmatched performance and durability, setting a new standard in power backup for both residential and commercial applications.

The Strength of Advanced Tubular Technology

At the core of Okaya's Advanced Inverter Battery is Advanced Tubular Technology. This feature ensures consistent power during outages, making it a versatile choice for applications ranging from home inverters to corporate buildings, telecommunications, and more. With this advanced technology, you can trust Okaya to meet your energy needs with peace of mind and reliability.

Introducing the SJT (Super Jumbo Tubular) Inverter Battery

The Okaya SJT Inverter Battery is a groundbreaking addition to the energy storage field. With a compact design ideal for tight spaces, the SJT battery features a 6x1 layout with water inlets conveniently on one side, simplifying maintenance and enhancing safety. Taller tubular plates in the SJT battery improve performance, enabling faster recharge times and extended backup duration. With 15% faster charging than traditional batteries, the SJT battery ensures your power backup is ready whenever you need it most.

The TT (Tall Tubular) Advanced Inverter Battery

Another remarkable option, the TT Advanced Inverter Battery by Okaya, is engineered to withstand the demands of both home and commercial use. Known for its reliability and durability, the TT battery builds upon Okaya’s trusted technology to provide long-lasting, robust power backup solutions.

Key Features of Okaya's Advanced Inverter Batteries

Okaya's Advanced Inverter Batteries come with features that distinguish them from the competition:

Rugged Body Design: The sturdy construction includes terminal protectors, enhancing safety and ensuring secure connections.

Advanced Electrolyte Management: The unique CWLI system reduces spills, simplifying maintenance and allowing efficient electrolyte regulation.

Spill-Free Water Topping: The float design enables quick and mess-free water topping, reducing maintenance hassles.

Xtra Backup Design (XBD): Okaya’s XBD feature provides an additional 15-20% backup, so your power needs are always covered.

Certified Backup Hour (CBH): Okaya’s batteries are globally the first to feature a Certified Backup Hour, offering reliable performance tested under the Urban Metro Heavy Duty (UMHD) load cycle.

Ultra-Low Maintenance: The low Antimony alloy minimizes maintenance needs, ensuring a long-lasting battery with minimal upkeep.

Faster Recharge: Okaya’s quick recharge feature reduces downtime, keeping your battery ready when you need it.

For a more detailed overview of Okaya's latest battery features, check out our article on Introducing Okaya's Advanced Inverter Battery: Unleashing Power and Durability.

Conclusion

Okaya's Advanced Inverter Batteries represent a commitment to innovation, quality, and user satisfaction. Whether for your home, office, or critical equipment, Okaya’s Advanced Inverter Batteries provide top-notch performance and durability, ensuring uninterrupted power whenever needed. Choose Okaya to experience the future of energy storage solutions.

#Okaya Battery#Okaya Advanced inverter Battery#Inverter Battery#Inverter Battery for Home#Best Inverter Battery#Tubular Inverter Battery#Best Inverter#SJT Inverter Battery#Super Jumbo Inverter Battery

0 notes

Text

���� China Strikes Back: Gallium and Germanium Export Ban Escalates Global Tensions 🚨

China has banned exports of gallium, germanium, and tightened controls on antimony to the U.S., intensifying the ongoing tech trade war. These materials are essential for semiconductors, solar panels, and defense technologies, putting pressure on global supply chains.

Key Impacts of the Ban

1️⃣ Semiconductors: Gallium and germanium are critical for advanced chips used in AI and telecommunications. 2️⃣ Defense Industry: Antimony controls could disrupt production of night-vision systems and military hardware. 3️⃣ Renewable Energy: Solar panels relying on gallium may face rising costs and delays.

Experts warn this move highlights the fragility of global supply chains and the high stakes of the U.S.-China tech rivalry.

📖 Read more about how this ban could reshape global trade and innovation

0 notes

Text

In the summer of 1941, the United States sought to leverage its economic dominance over Japan by imposing a full oil embargo on its increasingly threatening rival. The idea was to use overwhelming economic might to avoid a shooting war; in the end, of course, U.S. economic sanctions backed Tokyo into a corner whose only apparent escape was the attack on Pearl Harbor. Boomerangs aren’t the only weapons that can rebound.

Stephanie Baker, a veteran Bloomberg reporter who has spent decades covering Russia, has written a masterful account of recent U.S. and Western efforts to leverage their financial and technological dominance to bend a revanchist Russia to their will. It has not gone entirely to plan. Two and a half years into Russian President Vladimir Putin’s war in Ukraine, Russia’s energy revenues are still humming along, feeding a war machine that finds access to high-tech war materiel, including from the United States. Efforts to pry Putin’s oligarchs away from him have driven them closer. Moscow has faced plenty of setbacks, most recently by losing control of a chunk of its own territory near Kursk, but devastating sanctions have not been one of them.

Punishing Putin: Inside the Global Economic War to Bring Down Russia is first and foremost a flat-out rollicking read, the kind of book you press on friends and family with proselytizing zeal. Baker draws on decades of experience and shoe-leather reporting to craft the best account of the Western sanctions campaign yet. Her book is chock-full of larger-than-life characters, sanctioned superyachts, dodgy Cypriot enablers, shadow fleets, and pre-dawn raids.

More than a good tale, it is a clinical analysis of the very tricky balancing acts that lie behind deploying what has become Washington’s go-to weapon. The risky decision just after the invasion to freeze over $300 billion in central bank holdings and cut off the Russian banking system hurt Moscow, sure. But even Deputy National Security Advisor Daleep Singh, one of the architects of the Biden administration’s response, told National Security Advisor Jake Sullivan that he feared the sanctions’ “catastrophic success” could blow up global financial markets. And that was before the West decided to take aim at Russia’s massive oil and gas exports, which it did with a series of half-hearted measures beginning later that year.

The bigger reason to cherish Punishing Putin is that it offers a glimpse into the world to come as great-power competition resurges with a vengeance. The U.S. rivalry with China plays out, for now, in fights over duties, semiconductors, and antimony. As Singh tells Baker, “We don’t want that conflict to play out through military channels, so it’s more likely to play out through the weaponization of economic tools—sanctions, export controls, tariffs, price caps, investment restrictions.”

The weaponization of economic tools, as Baker writes, may have started more than a millennium ago when another economic empire was faced with problematic upstarts. In 432 B.C., Athens, the Greek power and trading state supreme, levied a strict trade embargo on the city-state of Megara, an ally of Sparta—a move that, according to some scholars, sparked the Peloponnesian War. (Athens couldn’t break the habit: Not long after, it again bigfooted a neighbor, telling Melos that the “strong do what they can, and the weak suffer what they must.”) The irony of course is that Athens, the naval superpower, eventually lost the war to its main rival thanks to a maritime embargo.

It can be tempting to leverage economic tools, but it is difficult to turn them into a precision weapon, or even avoid them becoming counterproductive. The British empire’s 19th-century naval stranglehold and love of blockades helped bring down Napoleon but started a small war with the United States in the process.

Britain was never shy about using its naval and financial might to throw its weight around, but even the pound sterling never acquired the centrality that the U.S. dollar has today in a much bigger, much more integrated system of global trade and finance. That “exorbitant privilege,” in the words of French statesman Giscard D’Estaing, enabled the post-World War II United States to take both charitable (the Marshall Plan, for starters) and punitive economic statecraft to new heights.

The embargoes on Communist Cuba or revolutionary Iran were just opening acts, it turned out, for a turbocharged U.S. approach to leveraging its financial hegemony that finally flourished with the so-called war on terror and rogue states, a story well-told in books such as Juan Zarate’s Treasury Goes to War or Richard Nephew’s The Art of Sanctions.

Osama bin Laden is dead, Kabul is lost, Cuba’s still communist, and a Kim still runs North Korea, but the love of sanctions has never waned in Washington. If anything, given an aversion to casualties and a perennial quest for low-cost ways to impose its will, Washington has grown even fonder of using economic sticks with abandon. The use of sanctions rose under President Barack Obama, and again under Donald Trump; the Biden administration has not only orchestrated the unprecedented suite of sanctions on Putin’s Russia, but also taken Trump’s trade war with China even further.

Despite U.S. sanctions’ mixed record, the almighty dollar can certainly strike fear in countries that are forced to toe a punitive line they might otherwise try to skirt. Banks in third countries—say, a big French lender—could be forced to uphold Washington’s sanctions on Iran regardless of what French policy might dictate. Those so-called secondary sanctions raise hackles at times in places such as Paris and Berlin, prompting periodic calls for “financial sovereignty” from the tyranny of the greenback. But little has changed. Countries that want to continue having functioning banks have little choice but to act as the enforcers of Washington’s will.

What is genuinely surprising, as Baker chronicles, is that the growth of sanctions as the premier tool of U.S. foreign policy has not been matched by a commensurate growth in the corps of people charged with drafting and enforcing them. The Office of Foreign Assets Control, the Treasury Department’s main sanctions arm, is overworked and understaffed. A lesser-known but equally important branch, the Commerce Department’s Bureau of Industry and Security, struggles to vet a vast array of export controls and restrictions with a stagnant staff and stillborn budget. Post-Brexit Britain has faced even steeper challenges in leaping onto the Western sanctions bandwagon, having to recreate in the past few years a new body almost from scratch to enforce novel economic punishments.

Punishing Putin is not, despite the book’s subtitle, about an effort to “bring down” Russia. The sanctions—ranging from individual travel and financial bans on Kremlin oligarchs to asset forfeiture to sweeping measures intended to kneecap the ruble and drain Moscow’s coffers—are ultimately meant to weaken Putin’s ability to continue terrorizing his neighbor. In that sense, they are not working.

One of the strengths of Punishing Putin is Baker’s seeming ability to have spoken with nearly everybody important on those economic frontlines. She details the spadework that took place in Washington, London, and Brussels even before Russian tanks and missiles flew across Ukraine’s borders in February 2022, and especially in the fraught days and weeks afterward. It takes a special gift to make technocrats into action heroes.

The bulk of Baker’s wonderful book centers on the fight to sanction and undermine the oligarchs loyal to Putin who have helped prop up his kleptocracy. Perhaps, as Baker suggests, Western thinking was that whacking the oligarchs would lead to a palace coup against Putin. There was a coup, but not from the oligarchs—and it ended first with a whimper and then a mid-air bang.

There are a couple of problems with that approach, as Baker lays out in entertaining chronicles of hunts for superyachts and Jersey Island holding companies. First, it’s tricky to actually seize much of the ill-gotten billions in oligarch hands; the U.S. government is spending millions of dollars on upkeep for frozen superyachts, for example, but can’t yet turn them into money for Ukraine. And second, the offensive has not split the oligarchs from Putin: To the contrary, a Kremlin source tells Baker, “his power is much stronger because now they’re in his hands.”

At any rate, while the hunt for $60 billion or so in gaudy loot is fun to read about, the real sanctions fight is over Russia’s frozen central bank reserves—two-thirds of which are in the European Union—and the ongoing efforts to strangle its energy revenues without killing the global economy. Baker is outstanding on these big issues, whether that’s with a Present at the Creation-esque story of the fight over Russia’s reserves and the ensuing battle to seize them, or an explanation of the fiendishly complicated details of the “oil price cap” that hasn’t managed to cap Russian oil revenues much at all. More on those bigger fights would have made a remarkable book a downright stunner.

The Western sanctions on Russia, as sweeping and unprecedented as they are, have not ended Putin’s ability to prosecute the war. They have made life more difficult for ordinary Russians and brought down Russia’s energy export revenues, but they have not yet severed the sinews of war. “But, in fact, the West didn’t hit Russia with the kitchen sink,” Baker writes. Greater enforcement of sanctions, especially on energy, will be crucial to ratchet up the pressure and start to actually punish Putin, she argues. The one thing that is unlikely is that the sanctions battle will end anytime soon—not with Putin’s Russia, and not with other revisionist great powers such as China, whose one potential weakness is the asymmetric might of U.S. money.

“As long as Putin is sitting in the Kremlin,” Baker concludes, “the economic war will continue.”

5 notes

·

View notes

Video

youtube

China Bans Key Exports to US: Trade War Heats Up

In a bold move, China has announced a ban on exports of critical high-tech materials—gallium, germanium, and antimony—to the United States. This action comes as a direct response to escalating U.S. sanctions targeting Chinese semiconductor companies. With China being the world’s largest supplier of these essential minerals, this trade conflict could significantly impact the tech industry and national security for both nations. In this video, we break down the implications of this ban, the diplomatic tensions involved, and what it means for global supply chains. Stay tuned to find out how this trade war is heating up! Don't forget to like and share this video! #ChinaExportBan #TradeWar #Semiconductors #Gallium #Germanium #Antimony #USChinaRelations

0 notes

Text

[ad_1] Trade tensions between the United States and China escalated dramatically on Tuesday as Beijing imposed a ban on the export of critical minerals, signaling a sharp response to Washington’s tightening grip on China’s semiconductor industry. The decision, announced by China’s Ministry of Commerce, halts shipments of gallium, germanium, and antimony to the US, citing national security concerns. These minerals, essential for advanced technologies including semiconductors, fiber optics, and solar panels, are now classified as “dual-use” items, meaning they hold both civilian and military applications. In addition, China has ramped up scrutiny of graphite exports, requiring detailed declarations of their intended use and end recipients. China’s control over the global supply of these materials makes the ban a significant move. As the world’s leading producer, China accounts for the bulk of global production—providing 94% of gallium and 83% of germanium. These elements play a pivotal role in high-tech manufacturing, and the ban is expected to challenge the US’s ability to maintain steady supply chains. The ban follows Washington’s announcement on Monday of expanded export restrictions targeting China’s semiconductor industry. These measures, aimed at limiting Beijing’s access to advanced technologies, included restrictions on the sale of high-bandwidth memory chips used in artificial intelligence and chip-making tools from allies like Japan and the Netherlands. The new US sanctions list names 140 Chinese entities, including major chipmakers like Naura Technology Group and Piotech, marking the third round of tech-related restrictions against China in as many years. China’s Ministry of Commerce condemned the US measures as “unilateral bullying actions,” accusing Washington of weaponizing export controls under the guise of national security. Click here for Latest Fact Checked News On NewsMobile WhatsApp Channel For viral videos and Latest trends subscribe to NewsMobile YouTube Channel and Follow us on Instagram [ad_2] Source link

0 notes

Text

[ad_1] Trade tensions between the United States and China escalated dramatically on Tuesday as Beijing imposed a ban on the export of critical minerals, signaling a sharp response to Washington’s tightening grip on China’s semiconductor industry. The decision, announced by China’s Ministry of Commerce, halts shipments of gallium, germanium, and antimony to the US, citing national security concerns. These minerals, essential for advanced technologies including semiconductors, fiber optics, and solar panels, are now classified as “dual-use” items, meaning they hold both civilian and military applications. In addition, China has ramped up scrutiny of graphite exports, requiring detailed declarations of their intended use and end recipients. China’s control over the global supply of these materials makes the ban a significant move. As the world’s leading producer, China accounts for the bulk of global production—providing 94% of gallium and 83% of germanium. These elements play a pivotal role in high-tech manufacturing, and the ban is expected to challenge the US’s ability to maintain steady supply chains. The ban follows Washington’s announcement on Monday of expanded export restrictions targeting China’s semiconductor industry. These measures, aimed at limiting Beijing’s access to advanced technologies, included restrictions on the sale of high-bandwidth memory chips used in artificial intelligence and chip-making tools from allies like Japan and the Netherlands. The new US sanctions list names 140 Chinese entities, including major chipmakers like Naura Technology Group and Piotech, marking the third round of tech-related restrictions against China in as many years. China’s Ministry of Commerce condemned the US measures as “unilateral bullying actions,” accusing Washington of weaponizing export controls under the guise of national security. Click here for Latest Fact Checked News On NewsMobile WhatsApp Channel For viral videos and Latest trends subscribe to NewsMobile YouTube Channel and Follow us on Instagram [ad_2] Source link

0 notes