#Gary the Watchdog

Explore tagged Tumblr posts

Text

Incorrect Quotes: SKULLSHIP EDITION

#wander over yonder#The Skullship#watchdogs#andy the watchdog#Tim The watchdog#Gary the Watchdog#Jerry the watchdog#lord hater#commander peepers#ambdgtag

5 notes

·

View notes

Text

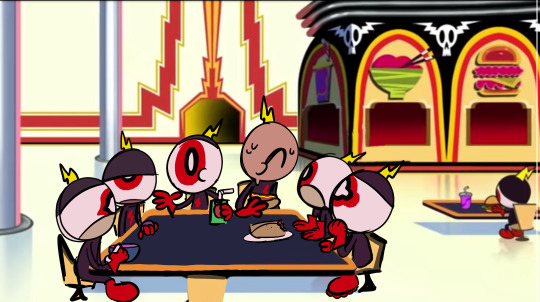

Me and friends watchdogs !!

@silllyyyyy @punk-angel

#in order its ty charles gary and buck#wander over yonder#woy#ocs#friends ocs#woy watchdogs#watchdog oc#fezzart#save woy#wander over yonder fanart#digital art#wander#commander peepers

42 notes

·

View notes

Text

REQUEST MASTERLIST! (REDONE)

✦ . ⁺ . ✦ . ⁺ . ✦ . ⁺ . ✦ . ⁺ . ✦ ⁺ . ✦

What fandoms I will write for;

-Lego Monkie Kid

-One Piece

-One Punch Man

-Assassination Classroom (limited characters)

-COD (call of duty, any game)

-ATSV (across the spiderverse)

-TADC (the amazing digital circus)

-Dandy’s World

-Pressure (only like three characters I’ll write for💔)

-Regretevator

-Cookie Run

-Arcane

What fandoms i won’t write for;

-Genshin Impact/Honkai impact

-Seven Deadly Sins

-Obey Me/Obey Me nightbringer

-FNF (Friday night funkin)

-MHA (my hero academia)

-Hazbin Hotel/Helluva boss

-other fandoms that have problematic backgrounds

WHAT I WILL WRITE!!!

-platonic

-light angst

-fluff

-slightly suggestive content (will have a warning)

-slightly suggestive content (not full on nfsw)

-childhood romance (no suggestive stuff)

-teen romance (no suggestive stuff)

-Reader x character

-character x character (very rarely)

-character x Reader x character

-polycules/polyamory (multiple characters x reader)

-T4T (trans for trans relationships)

-F4F (femme for femme relationship)

-M4M (masc for masc relationship)

-F4TF (femme for trans femme)

-F4TM (femme for trans masc)

-F4TNB (femme for trans non binary)

-F4A (femme for any)

-M4TF (masc for trans femme)

-M4TM (masc for trans masc)

-M4TNB (masc for trans non binary)

-M4A (masc for any)

-LGBTQ content

-Yandere Content (not extreme)

WHAT I WILL NOT WRITE!!!

- major nsfw

-r@pe/noncon/dubcon

-cnc (consensual non-consent)

-child x adult

-abusive scenarios

-anything to do with children involved in anything sexual

-racism

-ableism

-unsanitary fetishes (i.e. scat, wound f*cking, etc)

-severe angst

-s*icide & s*lf h*rm

- extreme Yandere stuff (r@pe, cannibalism, etc)

CHARACTER’S I’LL BE WRITING FOR

ARCANE

- Viktor

- Jayce Talis

- Vi

- Jinx

- Sevika

- Caitlyn Kiraaman

- Mel Medarda

- Ambessa Medarda

- Salo

- Lest

- Vander

- Silco

- Ekko

LEGO MONKIE KID

- MK (Qi Xioatian)

-Mei Dragon

-Redson

-Sun Wukong

-Six Eared Macaque

-Ao Lie

-Lady Bone Demon

-The Mayor

-Yin & Jin

-Tang

-Pigsy (mostly platonic)

-Sandy (mostly platonic)

-Nezha (platonic)

-Bai He (platonic)

ONE PIECE

- Monkey D. Luffy

-Vinsmoke Sanji

-Roronora Zoro

-Usopp

-Nico Robin

-Franky

-Chopper (platonic)

-Nami

-Jinbei

-Donquixte Doflamingo

-Donquixte Rosiante

-Boa Hancock

-Dracule Mihawk

-Crocodile

-Shanks

-Rayleigh

-Portgaz D. Ace

-Marco

-Thatch

-Izou

-Edward Newgate, Whitebeard (mostly platonic)

-Eustass Kidd

-Jewelry Bonney

-Killer

-Sabo

-Trafalgar Law

-Buggy

-Smoker

-Rob Luci

-Kalifa

-Yamato

-Perona

-Shaci

-Penguin

-Bepo (platonic)

ONE PUNCH MAN

-Saitama

-Genos

-Garou

-King

-Child Emporer (platonic)

-Metal Bat

-Speed O’ Sound Sonic

-Mumen Rider

-Watchdog Man (mostly platonic)

-Fubuki

-Atomic Samurai

-Lord Boros

-Bang

-Zombieman

-Flashy Flash

-Sweet Mask

-Charanko

COD - CALL OF DUTY (MW2/3)

-Simon “Ghost” Riley

-John “Soap” MacTavish

-John “Captain” Price

-Horangi (Hong-Jin)

-König

-Nikolai

-Valeria Garza/El Sin Nombre (F4F/NB/AFAB)

-Alejandro Vargas

-Phillip Graves

-Farah Karim

-Kyle “Gaz” Garrick

-Kate Laswell (F4F)

-Gary “Roach” Sanderson

ATSV - ACROSS THE SPIDERVERSE

-Miles Morales (platonic/fluff)

-Gwen Stacy (Platonic/Fluff)

-Pavitr Prabhakar (platonic/fluff)

-Prowler Miles (platonic/fuff)

-Peter B. Parker

-Jess Drew

-Miguel O’Hara

-Hobie Brown

TADC - THE AMAZING DIGITAL CIRCUS

-Pomni

-Jax

-Zooble

-Kaufmo

-Ragatha

-Gangle

-Caine

-Kinger

Dandy’s World

- Dandy

- Astro

- Vee

- Shelly

- Sprout

- Pebble (platonic)

- Glisten

- Flutter (platonic)

- Toodles (platonic)

- Rodger

- Teagan

- Brightney

- Scraps

- Goob

- Boxten

- Poppy

-Cosmo

- Finn

- Razzle & Dazzle (can be semi-poly)

- Shrimpo

COOKIE RUN

- Hollyberry Cookie

- Dark Cacao Cookie

- White Lily Cookie

- Golden Cheese Cookie

- Pure Vanilla Cookie

- Pitaya Dragon Cookie

- Burning Spice Cookie

- Shadow Milk Cookie

- Wind Archer Cookie

- Moonlight Cookie

- Sea Fairy Cookie

- Black Pearl Cookie

- Frost Queen Cookie

- Stormbringer Cookie

- Elder Faerie Cookie

- Crimson Coral Cookie

- Shining Glitter Cookie

- Stardust Cookie

- Clotted Cream Cookie

- Nutmeg Tiger Cookie

- Street Urchin Cookie

- Rebel Cookie

- Mozzarella Cookie

- Burnt Cheese Cookie

- Smoked Cheese Cookie

- Captain Caviar Cookie

- Financier Cookie

- Crunchy Chip Cookie

- Wildberry Cookie

- Affogato Cookie

- Tea Knight Cookie

- Lilac Cookie

- Red Velvet Cookie

- Almond Cookie

- Black Raisin Cookie

- Latte Cookie

- Kumiho Cookie

- Milk Cookie

- Werewolf Cookie

- Vampire Cookie

(There’s just a lot)

✦ . ⁺ . ✦ . ⁺ . ✦ . ⁺ . ✦ . ⁺ . ✦ ⁺ . ✦

IF YOU DON’T SEE ANY CHARACTERS OF INTERESTS YOU CAN (in dms if you prefer) ASK IF I’LL WRITE THEM! ^^

please as well reread the will/won’t write section if you’re feeling unsure!

#what i will write#writing#fandom#fandom writing#multiple fandoms#writing requests#request page#request#lmk#cod mw2#assassination classroom#one punch man#one piece#across the spiderverse#the amazing digital circus#underverse#undertale au#this took way too long

196 notes

·

View notes

Text

the gay watchdogs!! (they're on a triple date)

charles and gary belong to @panchikzo

ty and roman belong to @silllyyyyy

#art#digital art#my art#wander over yonder#woy#woy fanart#woy watchdogs#ocs#others ocs#friends ocs#save woy#craig mccracken

87 notes

·

View notes

Text

Totally didn’t change the color palette for watchdogs right after a character sheet!! That’d be really stupid!!! (I’m kinda stupid)

I drew @punk-angel and @panchikzo ‘s characters in the first one! The order goes: Charles, Ty, Roman, Andre, Buck, and Gary!! (Honorable mention: @chara-supercool ‘s “baby peepers” with those stupid big red boots 😭)

LOVE YOU GUYS (platonic) RAHHHHHH 👹👹

#wander over yonder#woy#save woy#cartoon#my art#my art <3#my artwork#watchdog oc#woy watchdogs#others ocs#mutuals

68 notes

·

View notes

Text

Elon Musk had no business sending Twitter employees an email giving them 24 hours to click "yes" to keep their jobs or else voluntarily resign during his takeover in 2022, an Irish workplace watchdog ruled Monday.

Not only did the email not provide staff with enough notice, the labor court ruled, but also any employee's failure to click "yes" could in no way constitute a legal act of resignation. Instead, the court reviewed evidence alleging that the email appeared designed to either get employees to agree to new employment terms, sight unseen, or else push employees to volunteer for dismissal during a time of mass layoffs across Twitter.

"Going forward, to build a breakthrough Twitter 2.0 and succeed in an increasingly competitive world, we will need to be extremely hardcore," Musk wrote in the all-staff email. "This will mean working long hours at high intensity. Only exceptional performance will constitute a passing grade."

With the subject line, "A Fork in the Road," the email urged staff, "if you are sure that you want to be part of the new Twitter, please click yes on the link below. Anyone who has not done so by 5pm ET tomorrow (Thursday) will receive three months of severance. Whatever decision you make, thank you for your efforts to make Twitter successful."

In a 73-page ruling, an adjudication officer for the Irish Workplace Relations Commission (WRC), Michael MacNamee, ruled that Twitter's abrupt dismissal of an Ireland-based senior executive, Gary Rooney, was unfair, the Irish public service broadcaster RTÉ reported. Rooney had argued that his contract clearly stated that his resignation must be provided in writing, not by refraining to fill out a form.

18 notes

·

View notes

Text

This day in history

#10yrsago DHS watchdog: DHS can search all your devices within 100 mi of US border https://www.wired.com/2013/02/electronics-border-seizures/

#10yrsago Confessions of a fifth grade punk https://thisishangingrockcomics.tumblr.com/post/42546243887/actual-diary-entry-from-when-i-was-in-5th-grade-oh

#1yrago Gators and Amazon tag-team small sellers https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#gator-ade

#1yrago Neuromancer today https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#radar-angels

#1ytago SEC vs private equity ripoffs https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#gary-gensler

#1yrago Welcome to the Palmerverse https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#terra-ignota

2 notes

·

View notes

Text

Lawmakers demand answers from top Michigan official over suspected pro-Democrat electioneering

Rep. Roger Williams, R-Texas

EXCLUSIVE: The entire Michigan House GOP delegation — plus a major committee chair — is demanding answers from a top state official regarding the potential use of federal taxpayer dollars for pro-Democratic Party electioneering.

Rep. Roger Williams, R-Texas, led a letter to Michigan Secretary of State Jocelyn Benson calling for a probe into whether public funds for a federal agency-linked voter registration push may have been "weaponized" to "aid and abet President Biden's reelection campaign."

The demands followed Williams' May subpoena to the Small Business Administration for records relating to actions in a memo forged between the SBA and Benson’s department.

The memo utilized a 2021 Biden executive order on "promoting access to voting" as its keystone and provided various directives relating to registering voters, according to the letter.

EXCLUSIVE: HOUSE COMMITTEE DEMANDS BIDEN AGENCY REVEAL STAFF TRAVEL HISTORIES AMID ELECTIONEERING CLAIMS

Williams, head of the House Small Business Committee, and the co-signers seek to determine whether there is documentation reflecting allegations the voter registration work done under the memo strategically favors Democrats.

The letter claims 39 of 52 scheduled small business outreach events in Michigan take place in "counties with the highest populations of demographics targeted by the Democratic National Committee.

"Additionally, 100 percent of the visits to Michigan from the SBA Administrator and Deputy Administrator have taken place in counties with the highest populations of DNC target demographics."

Williams and co-signers, including Rep. Lisa McClain, R-Mich., questioned the proclivity of efforts occurring in places valued by the Biden administration and campaign.

"The United States is built upon the principle of free and fair elections, but the Biden administration seems to not care about upholding our democracy," McClain said Tuesday.

WATCHDOG GROUP SUES FEDS FOR RECORDS AS LAWMAKER CALLS VOTER REGISTRATION EFFORTS A ‘SLAP IN THE FACE’

"Instead, they’re using the taxpayer-funded SBA to coordinate voter registration with Michigan’s Secretary of State."

She called that alleged behavior an "abuse of power" that risks future election integrity.

"I will not rest until I get to the bottom of [this]," McClain said.

Williams added that evidence shows the SBA "has the ability to indirectly campaign" for Biden in a must-win state.

"This is a ridiculous — and likely illegal — use of taxpayer resources. I thank my Michigan colleagues for joining me in this effort, and we will not stop until the SBA is completely and totally forthcoming," Williams said.

The letter cited a covertly recorded April video released by self-described "guerrilla journalist" James O’Keefe, which shows an SBA official claiming Small Business Administrator Isabel Casillas Guzman's travel is at times purposefully targeted to "indirectly campaign" for Biden.

In the video, a Guzman visit to vulnerable Sen. Jon Tester’s, D-Mont., home state is cited. The SBA official in the video notes Tester’s seat is a must-win for a continuing Democratic majority in the upper chamber.

Citing that context, the letter demanded Benson turn over all documents and communications between her department, SBA officials and external contractors relating to Michigan voter registration.

NEW TRUMP VOTER FRAUD SQUADS BEGIN GEARING UP FOR 'ELECTION INTEGRITY' FIGHT

It also demanded memo-related expense documentation, sources of the expense payments and the name of the state official designated as Benson's liaison with the SBA.

Benson was also asked to turn over lists of relevant events in Republican House districts with notations about whether that GOP member as well as the state’s two Democratic senators, Gary Peters and Deborah Stabenow, were invited.

"If either of the two senators were invited but a Republican member of Congress was not, please detail the reasoning behind the lack of invitation," Williams wrote.

In response to past criticisms of the Michigan Department of State’s (MDOS) work under the memo, spokeswoman Angela Benander said the agency enjoys being part of a "first-in-the-nation effort" with the small business community to "play an active role in our democracy."

"Allegations that this program is being used to drive large amounts of voter activity in a partisan manner are patently false," Benander said, adding, unsolicited, that criticisms of the voter registration web portal are unfounded due to its minimal use.

Critics, however, have suggested the attention given by a Biden administration agency to a key swing state in this way continues to draw suspicion.

Previously, Guzman said in a statement heralding the memo that it is meant to promote civic engagement and fulfill a Biden administration promise to protect and strengthen democracy.

"Small businesses are busy working on and in their businesses, and by meeting them where they are — on our website and at our small business outreach events — we can help facilitate voter registration and civic engagement so their voices are heard," Guzman said.

An SBA representative declined to respond to a question about the veracity of O'Keefe's video.

0 notes

Text

0 notes

Text

SEC Approves Bitcoin ETFs, Making Bitcoin Investing Accessible to Main Street Investors

The US Securities and Exchange Commission (SEC) has given approval for certain investment companies to offer "spot bitcoin" exchange-traded funds (ETFs), making bitcoin investing more accessible to Main Street investors. This move will allow investors to participate in the bitcoin market without directly owning the digital asset. While the approval is seen as a positive development, SEC Chair Gary Gensler has warned investors to remain cautious about the risks associated with bitcoin and crypto-related products.

The SEC had a deadline to make a decision on 11 firms that had applied to offer bitcoin ETFs. Despite an initial false start announcement on Tuesday, the SEC granted approval to all 11 of them on Wednesday. This decision by the regulatory agency is expected to have a significant impact on the market, as it opens the door for more traditional financial institutions to offer bitcoin investment vehicles.

The price of bitcoin has been highly volatile in recent history. It reached an all-time high of nearly $69,000 in November 2021 but experienced a significant drop to below $17,000 during the "crypto winter" of 2022. Currently, it has been trading at around $45,000 leading up to the SEC's decision. Following the news of the approval, the price of bitcoin saw a slight increase of 0.3%.

Despite the approval of bitcoin ETFs, concerns remain among some financial advisors and investor watchdog groups about the risks associated with the crypto industry. They argue that the industry has a history of fraudulent activities, such as artificially inflated trading volumes. Better Markets, a prominent investor watchdog group, strongly opposed the SEC's decision to approve bitcoin ETFs, stating that it will enable the mass marketing of a volatile and fraud-filled financial product to everyday American investors.

Read the original article on CNN

Tags: Bitcoin, Cryptocurrency, Investment, SEC

0 notes

Text

An aerial view of An Illegal Gold Mine in Triangulo de Telembi, Colombia. Photograph: Daniel Munoz/AFP/Getty

Environmental Crime Money Easy to Stash in US Due to Loopholes, Report Finds

Secrecy and lax oversight mean illegal loggers and miners in Amazon can park billions in real estate and other assets

— Jonathan Watts | Thursday 26 October 2023

Secrecy and lax oversight have made the US a hiding place for dirty money accrued by environmental criminals in the Amazon rainforest, a report says.

Illegal loggers and miners are parking sums ranging from millions to billions of dollars in US real estate and other assets, says the report, which calls on Congress and the White House to close loopholes in financial regulations that it says are contributing to the destruction of the world’s biggest tropical forest.

“We are trying to show that the US is the easiest place to hide dirty money, which is a major problem not just in terms of national security, drug trafficking and kleptocratic corruption but also environmental crime,” said Ian Gary, the executive director of the Financial Accountability and Corporate Transparency (Fact) Coalition, which produced the report.

For the first time in 2021, the US came top in the world financial secrecy index released by the Tax Justice Networks, as a result of money laundering and gaps in its financial transparency laws.

The study by Fact draws attention to the impact this has on environmental crime in the Amazon, a region of global importance due to its impact on the climate. The report lists six case studies of links between forest destruction and companies in the US.

Florida, which has strong cultural and linguistic connections to South America, was found to be a hotspot. The report cites the case of Goldex, formerly the second biggest gold exporter in Colombia, which supplied more than 45 tonnes of gold, worth $1.4bn, to two US refineries, including Republic Metals Corp (RMC) in Miami.

Colombian prosecutors later alleged that the gold was illegally mined, transferred through shell companies and ultimately used to launder money for organised crime groups. The company was hit with sanctions by the Colombia government and one of its suppliers was extradited to the US to face charges of drug trafficking and money laundering. After an investigation by the US attorney’s office, RMC agreed to tighten its internal money laundering guidelines. Goldex has since filed for bankruptcy.

A still more lucrative case linking Miami with Amazon nations was that of NTR Metals, which pleaded guilty to charges that it failed to maintain an adequate anti-money-laundering programme after revelations that it dealt with $3.6bn (£3bn) of illegal gold and fake ingots from Peru.

Peru’s Former President Alejandro Toledo allegedly bought properties to hide and launder $1.2m he received in bribes. Photograph: AP

The problem was not isolated to Florida. In Maryland, the former Peruvian president Alejandro Toledo allegedly bought properties to hide and launder $1.2m he received in bribes from the Brazilian construction company Odebrecht for a contract to build the cross-Amazon interoceanic highway and other projects. Odebrecht has admitted paying bribes and a US court has ordered funds to be sent back to Peru. Toledo denies any wrongdoing.

Other case studies linked a Nevada firm to purchases of illegal timber from the Loreto region of the Peruvian Amazon, and a Connecticut company to forest clearance for a palm oil plantation in indigenous land.

Government regulators and watchdog groups in Peru said it was common for their investigations into environmental crime to run into a dead end with shell companies in the US. “We have had cases where we can directly trace the dirty money route to US company involvement,” Daniel Linares Ruesta, the director of Peru’s financial intelligence unit, was quoted as saying.

Illegal mining settlements along the interoceanic highway which connects Peru’s Pacific ports to Brazil. Photograph: Dan Collyns/The Guardian

The report identifies two principal flaws in the US regulation of financial flows from other countries: permissive rules on identification that allow the use of anonymous shell companies; and gaping holes in the anti-money-laundering framework that enable estate agents and refineries to accept payments without checking and disclosing the origin of funds.

Earlier this year, the Igarapé Institute estimated that environmental crime in the Amazon generated annual profits of between $110bn and $281bn, though it has been a relatively low priority for financial authorities in Latin America. Investigations by the Insight Crime website suggest the problem may be growing as links build between environmental crime, narco-trafficking and money-laundering networks in Brazil, Colombia, Peru and Ecuador.

The Fact report urges the US to take more responsibility because it is the primary destination for illegal funds, followed by the UK and its crown dependencies such as the Cayman Islands.

Among its recommendations are for the US administration to establish anti-money-laundering obligations in the real estate market, to provide support for Amazon nations to improve financial oversight, and to implement the Corporate Transparency Act, which would establish a database of true “beneficial” owners of all companies. It also calls on the US Congress to pass the Forest Act, which would add illegal deforestation to the US money-laundering statute.

Gary said he was encouraged that the Biden administration had called out the threat posed by corruption. Now, he said, it needed to act.

“The US needs to step up,” Gary said. “Our report shows the importance of the US cleaning up its own financial secrecy house and the need to collaborate with law enforcement partners in the Amazon region to combat illegal financial flows … for the US to have such financial secrecy is a problem for the whole world.”

#Amazon Rainforest | Americas | US News | Deforestation#Logging and Land-Clearing | Environment | World news#Florida | Gold | Organised Crime | Colombia 🇨🇴 | Peru 🇵🇪#Brazil 🇧🇷 | Ecuador 🇪🇨 | Article | News | Jonathan Watts | Guardian USA

0 notes

Text

All of @punk-angel mine and @silllyyyyy 's watchdog ocs !!!!

From left to right its,

andre, buck, gary, Charles, ty, and roman

#fezzart#wander over yonder#woy#wander over yonder fanart#watchdog oc#woy watchdogs#friends ocs#woy wander#digital art#save woy#craig mccracken#cartoon

107 notes

·

View notes

Text

Wall Street Watchdog Says AI Will Cause 'Unavoidable' Economic Collapse

https://gizmodo.com/gary-gensler-ai-to-cause-unavoidable-economic-collapse-1850929797

View On WordPress

0 notes

Text

TL;DR US lawyer John E Deaton observed a possible shift within the SEC’s stance in the direction of the cryptocurrency trade, particularly after not leveraging the current pretend BTC ETF information to criticize the sector. Beforehand, SEC’s Chairman Gary Gensler ceaselessly related crypto with destructive actions. Deaton suggests Gensler’s conduct could also be influenced by main establishments’ opinions. Regardless of a rumor that the SEC authorised BlackRock’s BTC ETF software inflicting a value surge, the approval was false. Deaton expressed extra belief in judges overseeing the SEC than within the company itself. The SEC Appears Completely different John E Deaton – a US lawyer representing hundreds of Ripple buyers within the lawsuit towards Ripple – assumed that the US Securities and Alternate Fee (SEC) may need modified its stance in the direction of the cryptocurrency trade. He based mostly his idea on the truth that the company didn't use the pretend BTC ETF information that circulated the house earlier this week as a possibility to bash the digital asset sector. Deaton reminded this was not the case prior to now when the SEC’s Chairman Gary Gensler used to criticize crypto and hyperlink it to terrorism funding and prison exercise each time he had this feature. “I could possibly be flawed, however I attribute it to the Court docket loss coupled with the Larry Fink have an effect on. Gensler solely cares about what the foremost incumbent donors, I imply establishments suppose.” The lawyer’s opinion in regards to the SEC’s softened strategy coincides with the one shared by Scott Melker, higher often called “The Wolf of All Streets.” The latter argued in a current X (Twitter) submit that the approval of a spot Bitcoin ETF is simply across the nook since “the language and tone have modified.” Deaton’s Earlier Response to the SEC The breaking stories from October 16 that America’s securities regulator has lastly authorised BlackRock’s software to introduce a spot BTC ETF within the States infused enthusiasm within the crypto house whereas the complete market flashed inexperienced. The value of the first digital asset, for one, surged by over 10% in a matter of minutes to as excessive as $29,500 (per CoinGecko). Nonetheless, the jolly was short-lived because it turned out that there was no such official approval. The SEC additionally chipped in, saying individuals mustn't belief all the things they learn on the Web and confirm data with authentic sources. Deaton disagreed with the assertion, sustaining that impartial judges who oversee the watchdog are extra reliable than the company itself. Subsequently, he claimed that an Appellate Court docket discovered the SEC to be “arbitrary and capricious:” “Lastly, a federal decide within the SDNY known as the SEC legal professionals hypocrites and acknowledged they lacked devoted allegiance to the legislation. So, in terms of the SEC, I select to take heed to judges. And man, are they talking loudly.” SPECIAL OFFER (Sponsored) Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Supply: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Text

Kumanan Ramanathan who worked for a legal firm consulting for Sam Bankman-Fried’s crypto exchange was able to safeguard up to $500 million of customer funds on the day hackers attacked FTX. Amid bizarre transactions out of FTX wallets on Nov. 11, Zach Dexter, chief executive of FTX subsidiary LedgerX rallied former employees on a Google Meet call to brainstorm how they might protect vulnerable user assets. Ramanathan, advising FTX from Alvarez & Marshall, volunteered to create a new wallet on his Ledger Nano and transfer the funds there, according to a Wired investigative report. Ledger Nano is a hardware wallet used for self-custody of cryptocurrencies. Also on the call was Gary Wang, former chief technology officer at FTX and Alameda, and currently witness for the prosecution in Bankman-Fried’s criminal trial. Wang reportedly aided the effort to transfer around half a billion of customer assets to Ramanathan’s personal hard wallet. As CTO, Wang had backdoor keys to FTX’s systems. He and SBF would later use this access to send $400 million to the Bahamas Securities watchdog hours before SBF filed Chapter 11 and declared his crypto exchange bankrupt. On Nov. 12, Ramanathan, joined by FTX general counsel Ryne Miller, transferred $500 million in customer crypto from a USB device to crypto custodian BitGo, whom Dexter had called earlier to set up cold storage wallets for the rescue mission. He’s a total boss. It’s my pretty strong feeling that if we hadn’t pulled this Ledger stunt, we would have lost significantly more money. An anonymous FTX employee told Wired Opting to tap a personal ledger wallet during this tumultuous period at FTX proved helpful. However, the unidentified FTX exploiter managed to siphon over $400 million from the platform before staffers could ferry all the assets to safety. crypto.news reported that the hacker transferred some of the loot to cross-chain protocols like Thorchain and Railgun in a bid to cover their tracks while laundering stolen FTX crypto. In related news, the FTX estate under CEO John Ray III has recovered $7 billion in assets at press time while BitGo holds about $1.1 billion for the company. Along with FTX 2.0 relaunch plans and further clawbacks to repay customers, the bankrupt exchange is also suing SBF’s parents, Joseph Bankman and Barbara Fried. FTX’s founder could face decades behind bars if convicted, as Ray’s administrators piece together assets for billions in repayments to users and creditors.

0 notes

Text

Crypto Exchange Bittrex Settles With SEC — Agrees to Pay $24 Million

Bittrex Settles With SEC The U.S. Securities and Exchange Commission (SEC) announced Thursday that crypto trading platform Bittrex Inc., its co-founder and former CEO William Shihara, and Bittrex’s foreign entity Bittrex Global GmbH have reached a settlement with the regulator. The SEC charged Bittrex entities and Shihara in April. Specifically, the SEC explained that Bittrex and Shihara “agreed to settle charges that they operated an unregistered national securities exchange, broker, and clearing agency.” Meanwhile, Bittrex Global “agreed to settle charges that it failed to register as a national securities exchange.” The securities watchdog stated that as part of the settlement, subject to court approval, the defendants consented to be permanently enjoined from violating the securities laws. Moreover, the SEC detailed: Bittrex and Bittrex Global agreed to pay, on a joint and several basis, disgorgement of $14.4 million, prejudgment interest of $4 million, and a civil penalty of $5.6 million, for a total monetary payment of $24 million. Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, commented: “For years, Bittrex worked with token issuers to ‘scrub’ their online statements of any indicia that they were investment contracts — all in an effort to evade the federal securities laws. They failed.” The SEC has taken several enforcement actions against major crypto firms this year, including and Coinbase (Nasdaq: COIN). The Nasdaq-listed crypto exchange Coinbase, which attempted to have the charges against it dismissed last week, claimed that the SEC “overstepped” its statutory authority. The regulator reportedly asked Coinbase to delist all crypto tokens except bitcoin in order to comply with securities laws. SEC Chairman Gary Gensler, who has been slammed for his enforcement-centric approach to regulating the crypto industry, believes that all crypto tokens except bitcoin are securities. He also said that crypto is a highly speculative field that is rife with fraud. The SEC has also revealed its plan to appeal the Ripple decision made by District Judge Analisa Torres regarding XRP. The securities watchdog believes that some parts of the Ripple ruling are “wrongly decided,” according to Gensler. What do you think about Bittrex settling charges with the SEC? Let us know in the comments section below. Read the full article

0 notes