#GTS Mining Consultancy

Explore tagged Tumblr posts

Text

GTS Mining Consultant Providing Effective Mining Solutions

GTS Mining Consultancy specializes in Mining Consultancy Service and GTS Mining Solution, offering reliable Mining consultant expertise for optimized projects.

https://gts-india.com/mining-consultancy-services.php

0 notes

Text

GTS Mining Solution: Trusted Mining Consultancy Service

Explore GTS Mining Solution and Consultancy Service. Expert Mining Consultant providing tailored solutions for your mining needs.

https://gts-india.com/mining-consultancy-services.php

0 notes

Text

Expert Mining Engineering & Technical Services | GTS Solutions

GTS Solutions provides expert mining consultancy and technical services, covering every project phase from mineral exploration to design and engineering.

#Mining Engineering Services#Mining Consultancy#Corporate Advisory for Mining#Operational Mining Solutions

1 note

·

View note

Text

Review OBORTECH (OBOT)

OBORTECH - Smart logistics hub

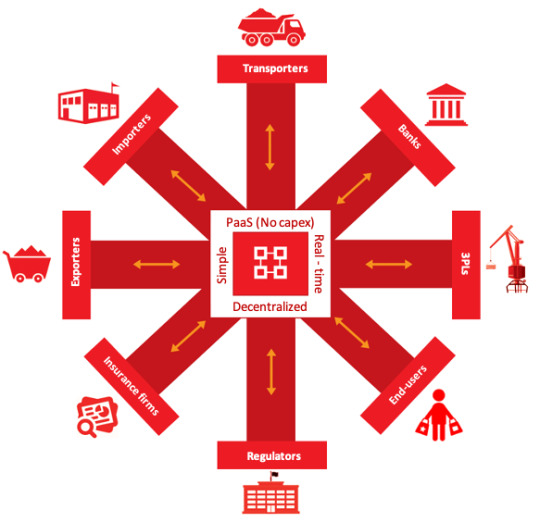

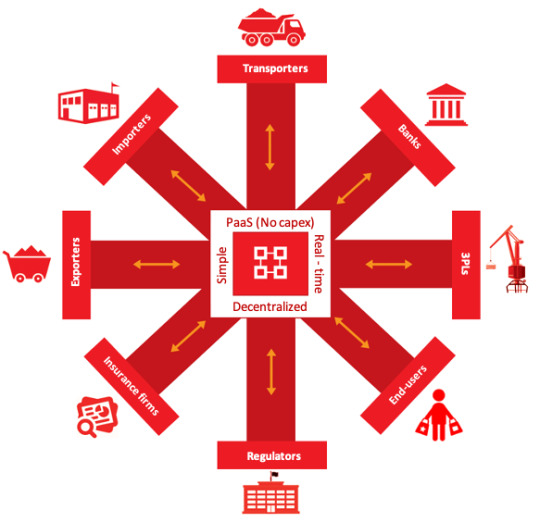

A FULLY DIGITAL ECOSYSTEM FOR YOUR SUPPLY CHAIN

OBORTECH aims to increase the performance and efficiency of current logistics services with the power of Blockchain and IoT. OBOT token serves as a bridge between DeFi and digital supply chain solution offered by OBORTECH called Smart Hub.

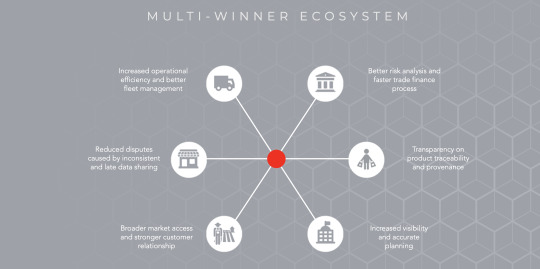

MULTI-WINNER ECOSYSTEM

Better risk analysis and faster trade finance process

Increased operational efficiency and better fleet management

Reduced disputes caused by inconsistent and late data sharing

Transparency on product traceability and provenance

Broader market access and stronger customer relationship

Increased visibility and accurate planning

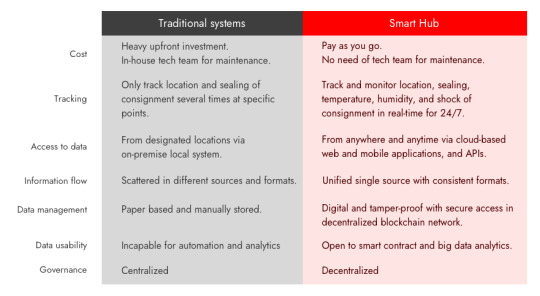

OBORTECH's Smart Hub VS Traditional systems

THE SMART HUB OFFERS

Blockchain and cloud powered communication hub

Accessible via easy to use web and mobile user interfaces, and an open API, the Smart Hub brings together supply chain actors, and enable their supply chains to share information, collaborate, conduct data analysis, and validate product traceability in real-time on a trusted platform.

Tamper-proof, unified and online document exchange

The Smart Hub allows secure sharing and exchange of documents with supply chain partners using blockchain powered version control. Authorized parties to any shipment can immediately see when changes have been made, and by whom, along a shipment journey.

IoT based real-time visibility and tracking

IoT sensors are installed on containers/trucks and transmit data to the Smart Hub dashboard to track valuable shipments, monitor their key physical measurements, and protect high-value products against theft. A client gets positioning data for shipment in real-time, irrespective of the shipping carrier they choose.

Open and decentralized networking marketplace

Based on the blockchain based trusted network established among the Smart Hub participants, the marketplace ecosystem will enable verification and scoring of stakeholders in supply chain without the need for third-party credentials. Moreover, the marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the users.

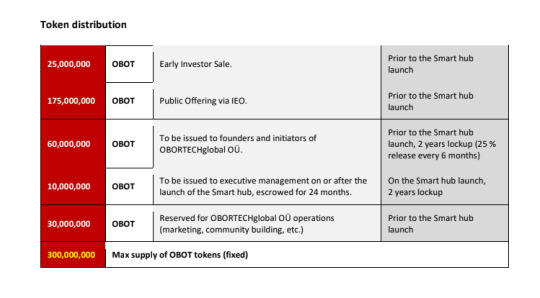

OBOT DEFI

FOR DIGITAL SUPPLY CHAIN

Smart Hub transaction fee

OBOT token will be used for paying Transaction fee of bundled services offered by the Smart Hub. Every transaction revenue received by OBOT is split in the following way: 5% for token burns, 20% for marketing & community building, 5% for Non-Profit activities, and 70% for Network Admin fee.

Contract bonus

OBOT token can be used for promoting contract performances between the Smart Hub users. Users collaborating via the Smart Hub can convert some portion of their contract funding into OBOT tokens and allocate them in Escrow Contract as a bonus payment.

Crowdfunding

Members of the Smart Hub can launch crowdfunding activities to OBOT token holders in the Smart Hub Marketplace. It will be done either by lending with algorithmic interest rate protocol based on calculation of member score/rating or by pledging (similar to Kickstarter) between creators and backers based on Escrow Contract and performance tracking in the Smart Hub’s blockchain network.

Exchanging services

OBOT token will be used in the Smart Hub Marketplace when its users exchange services among them. The Smart Hub Marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the Smart Hub users.

Member rewarding

The Smart Hub members will be rewarded by OBOT tokens based on their score/rating in the Marketplace. Members will be scored/rated by various ways based on blockchain data and performance histories in the Smart Hub network.

Governance

OBOT token allows holders to participate in Governance decisions of the Smart Hub Marketplace. They can exercise voting rights on policies of member enrollment, service exchanges, and crowdfunding activities of the Marketplace.

With OBOT tokens, the Smart Hub users can enjoy rewards like express delivery and extra care of products during shipments via the Smart Hub network. Get your OBOT tokens today by participating in our IEO

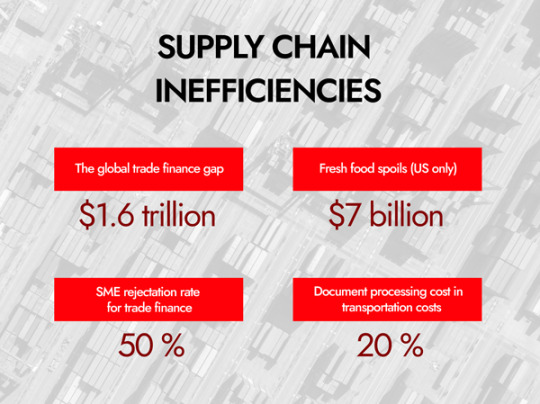

The manual and paper based processes often used in Supply Chain Industries are time consuming and also result in a lot of extra maintenance costs.

IEO starts on Probit from 10th March 2021

Starting price: ETH 0.000015

Invest upto 1 ETH, get 50% more bonus OBOT tokens

Invest between 1ETH - 2 ETH, get 100% more bonus OBOT token

Invest more than 2 ETH, get 200% more bonus OBOT tokens

ROAD MAP

TEAM

Tamir Baasanjav: CEO and Founder

He is specialized in project management and strategic communication. He had worked in managerial and expert positions of prestigious international development, government and business organizations such as an agency funded by Government of the United States for transportation and energy efficiency fields, Knowledge Hub project of Swiss Agency for Development and Cooperation on sustainable mining, and the biggest corporate bank of Mongolia. He also has 10 years of experience in UX and product designs. He won the global product design contest held by Adidas.

He designed the Smart Hub concept and its business strategy. He manages the project and leads the product design and marketing/communication.

Enkhbat Dorjsuren: Logistics Lead and Co-founder

He has 20 years of experience in logistics and transportation sector. He is a CEO of Mongolian Express LLC, one of the largest inland transport and logistic companies in Mongolia. He has extensive network in Mongolian transportation and logistics sector.

He established the project’s partnerships in the transportation sector and leads partnership development in Mongolia and Euro-Asia

Tungalag Sukhbat: CFO

She is a finance and investment professional more than 20 years of experience. She has worked in different domains including strategic and financial consulting, central banking, corporate banking, asset management, and multilateral development programs in managerial and expert positions. She achieved CFA Charter in the UK and is a member of the CFA Institute. Moreover, she is a Certified Business Appraiser of Mongolia.

She developed the business plan as well as financial modelling and analysis of the project. She leads financial management and analysis of the project.

Zoljargal Dashnyam: Chief Counsel

She has extensive experience in corporate law and private equity. Her portfolio of clients includes investment banks, multinationals, mining companies, and investment funds. She graduated Harvard Law School in Master of Laws. She was ranked as a top-tier lawyer in Mongolia for 9 years. She is a Senior Partner of the leading law firm in Mongolia, DB>S.

She is in charge of the governance model development of the Smart Hub and legal activities of the project.

Alok Gupta: Blockchain Architect

He is a certified blockchain developer with over 12 years of experience in application development and deep knowledge of Hyperledger Fabric architecture and functionalities. He was in top 5% of Blockchain Architecture Design course conducted by IBM and IIT, a top technology institute in India. He developed various blockchain projects and applications in supply chain, real estate registry, health insurance, etc.

He developed the blockchain architecture and application of the prototype system. He leads the blockchain (Hyperledger) architecture and application development of the project.

Maxim Prishchepo: Blockchain Architect

He is a blockchain architect with more than 6 years of experience in blockchain development and 20 years of experience in architecture designs of complex financial IT systems. He is a qualified analyst in crypto banking & finance. He worked as a core blockchain developer and architect for Energi, 0chain, and Wagerr projects. His main areas of specialization are Bitcoin, Ethereum, PIVX, ZCash and other open-source based blockchain solutions.

He developed the Ethereum smart contract of the project. He leads the token payment system and Ethereum blockchain development of the project.

Mauro Andriotto: Adviser

He is internationally recognized as one of the leaders in blockchain and Security Token Offering (STO). He is a professor of Corporate Finance and University of Geneve – UBIS. He is an Independent Expert at the European Commission for Horizon 2020 where he approves public grants for startups. He is also the former quantitative leader at EY for the South Europe area.

He advises the project on European market and fundraising

Garry Pinder: Adviser

He is a Managing Director of Intermodal Solutions Group (ISG). ISG is a global company supplying container rotation systems for the mining, grain and ship loading industries. It operates in 12 countries and wide network of client base in South American region.

He advises the project on South American market of containerized transportation of agricultural and mining products.

Ulf Henning Richter: Adviser

He specialized in logistics and infrastructure technologies of Europe, China, and Africa regions. He is a member of China Highway & Transportation Society. He is also a Chairman of LUKOIL, Hong Kong branch.

He advises the project in partnership development in China.

For more information, please follow the links below:

Website: https://www.obortech.io/

WHITEPAPER: https://drive.google.com/file/d/1a9vax2925irEnR5yUVx8ZAGo84ISLEre/view

Telegram: https://t.me/OBORTECH

Twitter: https://twitter.com/OBORTECHhub

Facebook: https://www.facebook.com/OBORTECH

Linkedin: https://www.linkedin.com/company/obortech

Medium: https://blog.obortech.io/

Youtube: https://www.youtube.com/channel/UCQxPIavuaCHfdpGsT8_hFkw

AUTHOR:

Bitcointalk Username: Manuel Akanji

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

Telegram Username: @Manuelakanji777

ETH Address: 0x176a48a2Eb8FF8dfa46e58741E4A7b642C90F512

1 note

·

View note

Text

Fulminant hepatic failure induced by antipsychotic drugs (a case report)

Introduction

Fulminant hepatitis is a rare condition but has a very poor prognosis in the absence of liver transplantation. It is important to identify the cause as soon as possible to start the etiological treatment, which may be drug poisoning, viral hepatitis, or alcoholic ... [1-3]. N-acetylcysteine (NAC), a glutathione precursor, was first used as a treatment for paracetamol overdose in 1979. Since then, it has been firmly established as an effective and safe treatment for paracetamol induced IHC prevention. NAC has also been shown to be effective outside paracetamol intoxication. It has been evaluated as an option for acute IHC other than paracetamol in adults and children. In a randomized clinical trial comparing NAC with placebo in adults with paracetamol-free IHC, NAC was associated with a marked improvement in survival without liver transplantation [4]. NAC has also been evaluated for non-hepatic clinical conditions, these indications include its use in lung diseases (COPD and pulmonary fibrosis), in the prevention of contrast-induced nephrotoxicity and for the treatment of certain cardiac diseases [3,5]. In this article, we report the case of a neuroleptic overdose in a 16-year-old who has rapidly progressed to fulminant hepatitis. The oral administration of N-acetylcysteine has allowed a dramatic improvement [3].

Observation

A 16-year-old man consulted at the emergency reception service (j1) for asthenia, disabling diffuse myalgia and uncontrollable vomiting, in the context of cutaneous-mucous jaundice, which had appeared for 4 days. Her antecedents included herpetic keratitis since the age of 3 years and chronic epigastralgia for 4 years. In the emergency department, the clinical examination found a sleepy, sleepy patient, a conjunctival subitem, muscle pain with manual pressure. The temperature was 37.8°C, and blood glucose was 2.2mmol/l. The blood pressure was 85/38 mmHg, the heart rate was 104 beats per minute and 95% saturation in the air. The biochemical assessment was very disturbed, with: an inflammatory syndrome (C-reactive protein at 150 mg/L, fibrinogen at 6.6g/L), renal insufficiency (urea at 14.4mmol/L, creatinine at 159 , 12mmol/L), cytolysis (ASAT: 10454 IU/L, ALA at 4408 IU/L), cholestasis (conjugated bilirubinemia at 151mmol/L, gamma GT at 489 IU / L, PAL at 657 IU/L ) and a disturbance of its hemostasis (TP <15%, a TCA at 96.4 s and a very collapsed factor V). The hemogram showed the following: white blood cells at 9210mm-3, platelets at 159 000mm-3 and hemoglobin at 11.2g/dl.

On the diagnosis side

The patient was admitted to intensive care (1st day). Etiologically, an infectious hypothesis has been ruled out by the negativity of his liver serologies (anti-HVA Ab, anti-HBV Ab and HBs antigen and anti-HCV antibodies) as well as the serology of CMV, the abdominal ultrasound was without particularities, blood ceruloplasmin level was normal, anti-smooth muscle and antimitochondrial antibodies were achieved returning normal. The preferred toxic hypothesis was a neuroleptic overdose because the interview reported a prescription of 3 different neuroleptics, by his doctor for his chronic epigastralgia of psychogenic origin (Olanzapine, Mainspring and Metoclopramide). Supported: Symptomatic treatment consisted of stopping neuroleptics, infusion of fresh frozen plasma, vitamin K, laxatives and ciprofloxacin were initiated associated with administration of N-acetylcysteine with a dose of oral load of 140mg/kg followed by a dose of 70mg/kg/day maintenance for 48 hours.

Evolution

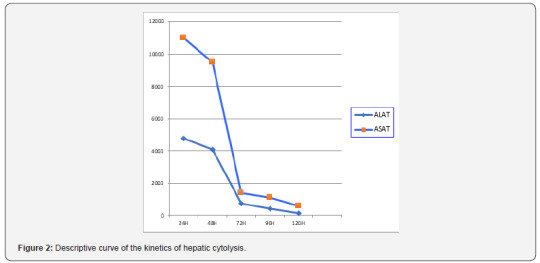

The evolution was quickly favorable. Hyper-bilirubinemia was divided by five in three days, the state of consciousness improved rapidly with appearance of an asterixis, the correction of the hemostasis disorder was more progressive with normalization towards the 4th day (Figure 1), a dramatic improvement in hepatic transaminases was observed as early as the second day (Figure 2). The patient left the intensive care unit to the gastric department on day 6. The symptomatic treatment was continued until day 10, the PBH was performed on day 11 without abnormality then he left the hospital on day 17.

Discussion

IHA is defined as a sudden failure of liver function in a patient with no history of liver disease. The cardinal signs of hepatic failure include coagulopathies and hepatic encephalopathy of any grade in the context of acute liver injury [4]. Currently, there is no scientifically proven beneficial treatment in the treatment of IHC, apart from liver transplantation Lee [5]. More than 1000 drugs have been listed as being responsible of hepatic side effects; 16% of these agents were neuropsychiatric drugs. Antidepressant drugs (tricyclic agents or SSRI), mood stabilizing agents and neuroleptic drugs have been implicated in biological or/and clinical hepatotoxicity. For these reasons, some psychotropic agents have been withdrawn of the pharmaceutical, On the contrary, in case of clinical hepatotoxicity, challenge or maintenance is absolutely inadvisable. Mechanism of the hepatic troubles: precise mechanisms of the hepatotoxicity remain unclear. Contrary to phenothiazine drugs, no information is available on the respective rule of the agents and their metabolites. Hypersensitivity syndrome or eosinophilia has been reported, suggesting a possible immuno-allergic mechanism. Presence of risk factors: risk factors have been retrieved, in some observations, like high daily dosage, high plasmatic concentration, age, alcoholism, obesity or antecedent of hepatic disorders like Gilbert syndrome. [6] Special care is advisable with these patients. As hepatotoxicity has been observed after surd Osage (or suicide attempt), a hepatic check-up has to be performed in these clinical situations [7]. Co-medication with hepatotoxic drugs may increase the risk as it has been suggested. Acetylcysteine is a precursor of glutathione. It is well known as an antidote for acetaminophen overdose due to its ability to increase glutathione levels, which inactivates the toxic metabolite of acetaminophen [8]. N-acetyl-pbenzoquinone mine. Glutathione is a major antioxidant that can serve as a scavenger for free radicals; therefore, acetylcysteine may increase glutathione stock during periods of oxidative stress, increase nitric oxide production, which causes vasodilation and therefore tissue oxygenation, and may also have an antiinflammatory effect. by inhibition of pro-inflammatory factors (TNF alfa and IL8) [9,10]. The majority of studies evaluated the use of NAC in acute IHC secondary to acetaminophen poisoning. There is little research on the use of NAC in IHC secondary to other causes. Hu [8]. evaluated the efficacy of NAC in patients with non-acetaminophen-overdosed IHC (safety and efficacy of NAC in patients with ALF not caused by acetaminophen overdose), in a meta-analysis, which consisted of analyzing four assays prospective clinical trials evaluating NAC versus placebo in the treatment of non-acetaminophen-induced IHC[3].

Conclusion

NAC is a beneficial treatment in the context of nonparacetamol induced IHC, it can prolong the survival of patients with or without liver transplantation and survival after transplantation, but it cannot improve overall survival. Therefore, due to the lack of available scientific evidence, current data is unable to conclusively determine the role of NAC in patients with IHC without paracetamol. Thus, they are unable to make recommendations for clinical practice.

1 note

·

View note

Text

GTS Mining Consultancy: Your Go-To Mining Consultancy Service

Unlock success with GTS Mining Consultancy. Our GTS Mining Solutions and mining consultant expertise drive efficient mining consultancy services.

0 notes

Text

Innovative Mining Consultancy | GTS Solutions

Drive innovation with GTS Solutions' mining consultancy services. Our experts deliver cutting-edge solutions tailored to your mining needs.

0 notes

Text

Global Smartwatch Market 2021: Top Industry Players, Growth Report to 2027

The global smartwatch market is anticipated to grow at a considerable CAGR of 19.6% during the forecast period (2021-2027). As the medical equipment are getting vanished from the markets due to their scarcity in the current situation of COVID-19, smartwatches are taking their place with multiple advantages from a single device. These devices are now equipped with SpO2 sensors to track the oxygen level of blood with the addition of heartbeat trackers. Few market players had equipped these devices with temperature sensors to monitor the body temperature of the user.

(Get 15% Discount on Buying this Report)

Get Report Sample Copy @ https://www.omrglobal.com/request-sample/smartwatch-market

The Amazfit GTS 2e of Huami is a recently launched product that has all the features mentioned above with the aesthetic look of the aluminum frame. Similarly, Apple Watch Series 6, Samsung Galaxy Watch 3, OnePlus Watch, Realme Watch S, Oppo Band Style, Fitbit Charger 4, Garmin vivosmart 4, and Honor Band 5i are a few of the smartwatches that can check the oxygen level of blood with SpO2 sensors.

A Full Report of Global Smartwatch Market is Available at: https://www.omrglobal.com/industry-reports/smartwatch-market

The smartwatches had already started fulfilling the health and fitness monitoring needs far before the COVID-19 pandemic had started. According to the survey conducted by Rock Health in 2019, the adaptation of wearable devices for health monitoring is increased from 24% in 2018 to 33% in 2019. According to the Clutch report, 61% of people use smartwatches as a wearable device while 27% use fitness trackers. 70% of people using wearable devices use it to track their health and fitness, 61% of people check the time on it and around 52% of people use it for communication purposes. These data show that humans had started using these devices far before the COVID-19, however, the evolution of this disease had added new features to this device. Now, these smartwatches are capable to detected COVID-19 infection 70% times correctly before the actual diagnosis test according to the study of Snyder's group.

Global Smartwatch Market Report Segment

By Product

Classic Smartwatch

Fitness Band Smartwatch

Standalone Smartwatch

By Operating Systems

Android

iOS

Windows

Others

By Applications

Medical/Health

Personal Assistance

Sports

Other

Global Smartwatch Market Report Segment by Region

North America

United States

Canada

Europe

UK

Germany

Italy

Spain

France

Rest of Europe

Asia-Pacific

China

India

Japan

South Korea

Rest of Asia-Pacific

Rest of the World

Reasons to Buying From us –

1. We cover more than 15 major industries, further segmented into more than 90 sectors.

2. More than 120 countries are for analysis.

3. Over 100+ paid data sources mined for investigation.

4. Our expert research analysts answer all your questions before and after purchasing your report.

For More Customized Data, Request for Report Customization @ https://www.omrglobal.com/report-customization/smartwatch-market

About Orion Market Research

Orion Market Research (OMR) is a market research and consulting company known for its crisp and concise reports. The company is equipped with an experienced team of analysts and consultants. OMR offers quality syndicated research reports, customized research reports, consulting and other research-based services.

Media Contact: Company Name: Orion Market Research Contact Person: Mr. Anurag Tiwari Email: [email protected] Contact no: +91 780-304-0404

0 notes

Text

Making Poetry: Why I Like Poetry over Pipenv

One upon a time, Python did not have a decent command-line package manager like the vaunted npm for NodeJS.

That was then. Now there are good options in the Python world for package managers.

Recently, I've been able to try out both Pipenv and Poetry for some projects of mine. I feel like I've given both a try, and I prefer Poetry over Pipenv.

What's Good, Overall

Both provide essentially the same good functionalities such as

creating and managing a lock file for deterministic builds,

allowing for pinning module versions, as well as just taking the latest version by default, and

having a good CLI and workflow for working with Python projects.

Pipenv - The Good Parts

Pipenv was the first package manager tool that I tried of these two. It definitely appealed to me, since it promises to combine pip (for dependency management) and virtualenv (for environment management). Hence the name.

Pipenv is really nice to use "off the shelf". If you are used to a Python workflow where you create a virtual environment first, then install dependencies, then start developing, Pipenv adds some efficiency. Instead of creating a requirements.txt file, you instead create a Pipfile file and list dependencies there. You can also run pipenv install <module-name> to add packages from command line and to your Pipfile as needed. These are good features.

As well, you can either open a virtual environment in place according to the Pipfile configuration using pipenv shell or run a script added to the Pipfile by running pipenv run <script-name>. These are both handy utilities. Sometimes it's helpful to poke around and debug inside the virtual environment itself, and defining a script that will be executed regularly can be helpful. A script is a Python-based command. Some example of scripts defined in the Pipfile look like the following,

[scripts] build = python setup.py install lint = flake8 . unit-test = pytest test/unit/

which can then be called using a command like

pipenv run build pipenv run lint pipenv run unit-test

This is definitely helpful for projects that have a few well-defined functionalities that need to be executed regularly. As of this writing, there doesn't appear to be any kind of auto-complete or suggestion features, which would be a nice touch given that scripts need to be defined in the Pipfile.

Poetry - The Good Parts

As a project, Poetry does seem a bit more polished and buttoned up on first glance. The initial landing page and documentation is clean and modern. Definitely a good sign of things to come.

Poetry does make use of a configuration file called pyproject.toml. This file contains information such as dependencies and their versions, as well as information around PyPI publishing. You can optionally define scripts that can be executed, similar to how Pipenv handles scripts, but Poetry also allows for specific command line calls to be made directly. This is actually one of the two killer features for Poetry for me.

For example, suppose I have a lint command defined that will lint the entire project, but I want to specifically to lint just the tests directory. In poetry I can accomplish this by using the command line directly like

poetry run flake8 tests/

Poetry does allow adding dependencies from command line using poetry add <module-name>, or specific versions using something like pipenv install <module-name>@1.2.3.

As mentioned, Poetry does have built-in functionality to publish packages in addition to installing and building packages. This can be done directly by calling the simply named poetry publish. This is helpful for projects with multiple folks who need to publish, or just to simplify the existing workflows for publishing to PyPi.

poetry publish

Easy breezy lemon squeezy.

Why I like Poetry Better

While this isn't an exhaustive comparison, I think I prefer Poetry over Pipenv for one small thing and one big thing.

The small thing is package publishing. I have consulted the same section of the same Medium article for how to publish to PyPI for a while now. I almost always forget some step. Poetry packages this process up neatly (pun intended) which makes the publishing process a bit smoother. You can also configure the pyproject.toml with credentials for team workflows and build pipelines if needed.

The bigger reason is how Poetry handles virtual environments.

Poetry almost fully encapsulates virtual environments. You almost don't even know you're using one, for whatever tasks that you end up executing. Dependency installation, development, building and publishing is all done via the poetry <commands> CLI. Where virtual environments are kept and how they are managed is basically invisible to the end user, including in the cases where different Python versions are used. Create the pyproject.toml and off you go.

Pipenv does not take this approach, and does expose some of the virtual environment(s) to end users. This feels natural at first if you're comfortable with virtual environment usage, but eventually it just gets cumbersome.

For example, consider the pipenv shell command. This command opens a virtual environment instance, which is a typical Python workflow. Using the shell command works great, until it doesn't. Pipenv manages virtual environments itself but will also try to use existing local virtual environments as well. If there is an existing virtual environment directory in the project, Pipenv sometimes errors if it cannot cleanly create or select the "default" virtual environment Pipenv created. This can lead to less than ideal situations. As well, if Pipenv is managing a virtual environment, resetting dependencies or even deleting the virtual environment and starting over (a hack I use sometimes with virtual environments) is difficult or tricky.

Another issue that arises out of this lack of abstraction is running one-off or non-standard script commands. Suppose I'm back at my scenario above where I want to link only the tests directory. In Pipenv the options I have are

create a new script in the Pipfile just for this task (annoying),

manually update the pipenv run lint script for my one use case (annoying and possibly easy to check-in to version control, causing shenanigans), or

run the command via pipenv shell (see above for problems in this case).

Poetry avoids these situations by abstracting the entire virtual environment concept away. There is no poetry shell command or analog, since the usage of a virtual environment is completely hidden. These edge cases aren't all that edgy really, and Poetry is well thought out from this perspective.

I do think Pipenv is a decent tool, but it is better suited to smaller Python projects or relatively static projects where the same scripts and commands are called often without any modification or updates.

Both tools have their place, but sometimes what you really need is just a hint of encapsulation, as a treat.

1 note

·

View note

Text

OBORTECH

A FULLY DIGITAL ECOSYSTEM FOR YOUR SUPPLY CHAIN

About

Supply-chain industry has multiple actors having varying technical capacities. Yet most of them don’t have stable technical capacity to develop and maintain their communication and data in efficient way. Due to a lack of skilled IT experts, outdated technology, and inefficient business models the overall sector is struggling with complicated and costly logistics procedures. Creation of a simple and efficient communication and data hub built on trusted platform that everyone can use regardless of their technical capacity and knowledge will solve complications and bring significant cost benefits to the sector.

MULTI-WINNER ECOSYSTEM

Better risk analysis and faster trade finance process

Increased operational efficiency and better fleet management

Reduced disputes caused by inconsistent and late data sharing

Transparency on product traceability and provenance

Broader market access and stronger customer relationship

Increased visibility and accurate planning

OBORTECH's Smart Hub VS Traditional systems

THE SMART HUB OFFERS

Blockchain and cloud powered communication hub

Accessible via easy to use web and mobile user interfaces, and an open API, the Smart Hub brings together supply chain actors, and enable their supply chains to share information, collaborate, conduct data analysis, and validate product traceability in real-time on a trusted platform.

Tamper-proof, unified and online document exchange

The Smart Hub allows secure sharing and exchange of documents with supply chain partners using blockchain powered version control. Authorized parties to any shipment can immediately see when changes have been made, and by whom, along a shipment journey.

IoT based real-time visibility and tracking

IoT sensors are installed on containers/trucks and transmit data to the Smart Hub dashboard to track valuable shipments, monitor their key physical measurements, and protect high-value products against theft. A client gets positioning data for shipment in real-time, irrespective of the shipping carrier they choose.

Open and decentralized networking marketplace

Based on the blockchain based trusted network established among the Smart Hub participants, the marketplace ecosystem will enable verification and scoring of stakeholders in supply chain without the need for third-party credentials. Moreover, the marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the users.

DECENTRALIZED GOVERNANCE

The Smart Hub members themselves are the governing bodies of the network. Before joining, every new member in any supply chain network of the Smart Hub needs to be invited and approved by existing members of that supply chain network in the Smart Hub.

Smart Hub Marketplace open ecosystem

public blockchain

Smart Hub private ecosystem

permissioned blockchain

Smart Hub private ecosystem

permissioned blockchain

Smart Hub private ecosystem

permissioned blockchain

With OBOT tokens, the Smart Hub users can enjoy rewards like express delivery and extra care of products during shipments via the Smart Hub network. Get your OBOT tokens today by participating in our IEO

The manual and paper based processes often used in Supply Chain Industries are time consuming and also result in a lot of extra maintenance costs.

IEO starts on Probit from 10th March 2021

Starting price: ETH 0.000015

Invest upto 1 ETH, get 50% more bonus OBOT tokens

Invest between 1ETH - 2 ETH, get 100% more bonus OBOT token

Invest more than 2 ETH, get 200% more bonus OBOT tokens

TEAM

Tamir Baasanjav: CEO and Founder

He is specialized in project management and strategic communication. He had worked in managerial and expert positions of prestigious international development, government and business organizations such as an agency funded by Government of the United States for transportation and energy efficiency fields, Knowledge Hub project of Swiss Agency for Development and Cooperation on sustainable mining, and the biggest corporate bank of Mongolia. He also has 10 years of experience in UX and product designs. He won the global product design contest held by Adidas.

He designed the Smart Hub concept and its business strategy. He manages the project and leads the product design and marketing/communication.

Enkhbat Dorjsuren: Logistics Lead and Co-founder

He has 20 years of experience in logistics and transportation sector. He is a CEO of Mongolian Express LLC, one of the largest inland transport and logistic companies in Mongolia. He has extensive network in Mongolian transportation and logistics sector.

He established the project’s partnerships in the transportation sector and leads partnership development in Mongolia and Euro-Asia

Tungalag Sukhbat: CFO

She is a finance and investment professional more than 20 years of experience. She has worked in different domains including strategic and financial consulting, central banking, corporate banking, asset management, and multilateral development programs in managerial and expert positions. She achieved CFA Charter in the UK and is a member of the CFA Institute. Moreover, she is a Certified Business Appraiser of Mongolia.

She developed the business plan as well as financial modelling and analysis of the project. She leads financial management and analysis of the project.

Zoljargal Dashnyam: Chief Counsel

She has extensive experience in corporate law and private equity. Her portfolio of clients includes investment banks, multinationals, mining companies, and investment funds. She graduated Harvard Law School in Master of Laws. She was ranked as a top-tier lawyer in Mongolia for 9 years. She is a Senior Partner of the leading law firm in Mongolia, DB>S.

She is in charge of the governance model development of the Smart Hub and legal activities of the project.

Alok Gupta: Blockchain Architect

He is a certified blockchain developer with over 12 years of experience in application development and deep knowledge of Hyperledger Fabric architecture and functionalities. He was in top 5% of Blockchain Architecture Design course conducted by IBM and IIT, a top technology institute in India. He developed various blockchain projects and applications in supply chain, real estate registry, health insurance, etc.

He developed the blockchain architecture and application of the prototype system. He leads the blockchain (Hyperledger) architecture and application development of the project.

Maxim Prishchepo: Blockchain Architect

He is a blockchain architect with more than 6 years of experience in blockchain development and 20 years of experience in architecture designs of complex financial IT systems. He is a qualified analyst in crypto banking & finance. He worked as a core blockchain developer and architect for Energi, 0chain, and Wagerr projects. His main areas of specialization are Bitcoin, Ethereum, PIVX, ZCash and other open-source based blockchain solutions.

He developed the Ethereum smart contract of the project. He leads the token payment system and Ethereum blockchain development of the project.

Mauro Andriotto: Adviser

He is internationally recognized as one of the leaders in blockchain and Security Token Offering (STO). He is a professor of Corporate Finance and University of Geneve – UBIS. He is an Independent Expert at the European Commission for Horizon 2020 where he approves public grants for startups. He is also the former quantitative leader at EY for the South Europe area.

He advises the project on European market and fundraising

Garry Pinder: Adviser

He is a Managing Director of Intermodal Solutions Group (ISG). ISG is a global company supplying container rotation systems for the mining, grain and ship loading industries. It operates in 12 countries and wide network of client base in South American region.

He advises the project on South American market of containerized transportation of agricultural and mining products.

Ulf Henning Richter: Adviser

He specialized in logistics and infrastructure technologies of Europe, China, and Africa regions. He is a member of China Highway & Transportation Society. He is also a Chairman of LUKOIL, Hong Kong branch.

He advises the project in partnership development in China.

For more information, please follow the links below:

Website: https://www.obortech.io/

Telegram: https://t.me/OBORTECH

Twitter: https://twitter.com/OBORTECHhub

Facebook: https://www.facebook.com/OBORTECH

Linkedin: https://www.linkedin.com/company/obortech

Medium: https://blog.obortech.io/

Youtube: https://www.youtube.com/channel/UCQxPIavuaCHfdpGsT8_hFkw

Author: Batu permata

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1875984

ETH Address: 0xA5d3c9288F1C6A4a9D1298456DBCcDf9e2811896

0 notes

Text

global ammonia market

Ammonia (NH3) is a colorless gas, which is highly soluble in water, corrosive, and has a pungent odor. At normal atmospheric pressure, ammonia has a boiling point of -28 EF and a freezing point of -107.86 EF. Ammonia is used in the production of nitrogen fertilizers. Ammonia is used in end-used industries such as agriculture, chemical, textile, pulp and paper, pharmaceutical and water treatment.

Market Dynamics

Increasing demand for ammonia in end-use industries such as water treatment, textile, plastic, and chemical is driving growth of the global ammonia market. Ammonia is also used as a refrigerant gas for the purification of water supplies. As ammonia is used in the manufacturing of synthetic textile fibers such as nylon, rayon, and acrylics thus its demand in textile industry has positively impact on the global ammonia market. For instance, according to the India Brand Equity Foundation (IBEF), Indian textile market has increased from US$ 99 Billion in 2014 to US$137 Billion in 2016 and exhibited a CAGR of 17.6% during the period 2014-2016.

However, the higher concentrations of ammonia in the air causes severe injuries and burns are the factors which restraint growth of ammonia market. Contact with concentrated ammonia solutions such as industrial cleaners can cause corrosive injuries including skin burns, blindness or permanent eye damage.

Asia Pacific held significant market share in the global ammonia market due to high production and consumption of ammonia as a fertilizer in agriculture industry of emerging economies such as China and India. For instance, according to the Department of Agriculture, Forestry and Fisheries, China fertilizer production was valued at 84 million tons in 2014.

Figure 1. Global Ammonia Market Share (%), By Application, 2017

Key features of the study:

This report provides in-depth analysis of ammonia market, market size (US$ Bn), and compound annual growth rate (CAGR %) for the forecast period (2018 – 2025), considering 2017 as the base year

It elucidates potential revenue opportunity across different segments and explains attractive investment proposition matrix for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, regional outlook, and competitive strategies adopted by the leading players

It profiles leading players in the global ammonia market based on the following parameters – company overview, financial performance, product portfolio, geographical presence, distribution strategies, key developments and strategies, and future plans

Key companies covered as a part of this study include Yara International ASA, BASF SE, CF Industries Holdings, Inc., Nutrien Ltd., Potash Corporation of Saskatchewan Inc., Dangyang Huaqiang Chemical Co., Ltd., Shanxi Jinfeng Coal Chemical Co Ltd., GTS Chemical Holdings plc., Togliattiazot, OCI Nitrogen B.V., Agrium Inc., Sabic, and Koch Fertilizer, LLC among others

Insights from this report would allow marketers and the management authorities of the companies to make informed decision regarding their future product launch, technology up-gradation, market expansion, and marketing tactics

The global ammonia market report caters to various stakeholders in this industry including investors, suppliers, ammonia manufacturers, distributors, new entrants, and financial analysts. Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global ammonia market.

Figure 2. Global Ammonia Market Share (%), By Region, 2017

Detailed Segmentation:

Global Ammonia Market, By Form:

Global Ammonia Market, By Application:

Global Ammonia Market, By End-use Industry:

Liquid

Gas

Powder

Fertilizers

Refrigerants

Cleansing Agents

Explosives

Agriculture

Pharmaceutical

Textile

Chemical

Plastics

Pulp and Paper

Others (Mining, Water Treatment, etc.)

REQUEST SAMPLE

Company Profiles

Yara International ASA*

BASF SE

CF Industries Holdings, Inc.

Nutrien Ltd.

Potash Corporation of Saskatchewan Inc.

Dangyang Huaqiang Chemical Co., Ltd.

Shanxi Jinfeng Coal Chemical Co Ltd.

GTS Chemical Holdings plc.

Togliattiazot

OCI Nitrogen B.V

Agrium Inc.

Sabic

Koch Fertilizer, LLC

Company Overview

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

DOWNLOAD PDF

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customizes Market Research Services

Industry Analysis Services

Business Consultancy Services

Market intelligent Services

Long Term Engagement Model

Country Specific Analysis

Contact Us:

Mr. Shah

Coherent Market Insights Pvt. Ltd.

Address : 1001 4th ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

REFERENCE

0 notes

Text

ACCT 621: Total Marks: 100 Instructions: 1.) The exam will be a take-home exam and is considered open book. 2.) You may not share any ideas or answers with other students under ANY circumstances. 3.) The exam is 2 hours long and must be returned by email to your instructor no later than 2 hours after it is received. Question 1: Please refer to the financial statements provided in Appendix 1: a.) For each of the following, please provide a calculation of the appropriate ratio amount for 2017 and 2018 years. Show your calculations (22 Marks). See Notes to specific financial statement items in calculations. b.) Please provide commentary to your observations, and your assessment of how the change in year-over-year ratios is reflective of the financial performance and health of the company (22 Marks). c.) For Current Ratio, Inventory Turnover and Accounts Receivable Turnover, please provide two examples each of things the company can do to improve these ratios (6 Marks). Answers: 1 a. and 1.b Ratio Calculation Commentary Gross Profit Rate (Note 2) Profit Margin (Note 1,2) Return on Assets (Note 1) Asset Turnover (Note 2) Debt to Asset Ratio Times Interest Earned (Note 3) Free Cash Flow Current Ratio Inventory Turnover Working Capital Accounts Receivable Turnover (Note 4) Note 1: Ignore Income/Loss attributable to non-controlling interests. Note 2: Consider all revenue items to be sales. Note 3: Include all interest expense items to be part of the cost of financing. Note 4: Consider all receivable items to be trade receivables. Answers: 1c.: Ratio Steps to Improve Ratio Current Ratio Inventory Turnover Accounts Receivable Turnover Question 2: You have recently taken over the role of the Chief Financial Officer of GT Gold Chasers Ltd. (“GT Gold”). GT Gold is junior mining company, that is hoping to hit it big with their next mining venture. You work out of the head office that is based out of Vancouver. GT has got a reputation in the industry for being quick to act, and the management team are known for pushing the envelope to get results. There has been a high turnover of people in the last two years, and the current team are mainly new to the job. During your first few weeks on the job, you have noticed a few “oddities” around how things in the office run. A couple of examples of these are as follows: • Your assistant staff accountant, Stella Monibag helps you with the preparation of the accounting financial statements for the company. Stella spends her days reconciling the bank accounts of the company on a daily basis, which is great, because you need to know how much cash you have in the company at all times. Once she has reconciled the accounting general ledger to the bank statement, she prepares all the cheques for the new bills that needs to be paid. You have the authority to sign the cheques, but when you are out of the office, Stella is also able to sign these cheques or approve payments on your behalf. Stella keeps the cheque book on her desk so that she doesn’t lose it easily. Once you have approved a payment, Stella will access the company accounting system to enter the transactions in the general ledger. • Recently the company started to pay some larger invoices to vendors that you have never really heard of. One the vendors, SM Consultants Inc. provided printing services, a piece of furniture and six hours of printing consulting. These were not expected costs, but you are new to the office, and you figure that it will probably sort itself out later. 2.a) Please advise provides commentary on any internal control weaknesses that may exist in GT Gold, based on the above information (12 marks). 2.b) Please provide three possible solutions to the internal control weaknesses you have identified above, and how these will help solve the control weakness (6 marks). 2.c) Provide some commentary and two examples regarding things you would try to change in the organization to address internal control risk (hint: refer back to the Fraud Triangle model discussed during class), and how these changes would impact the company (4 marks). Question 3: The following transactions appeared in the accounting records of GT Gold during the year. Stella comes to your office, and wants to understand how we should be entering these into the accounting system for the December 31 year-end. Please summarize these transactions using the metric below (i.e. show how the change in Assets, Liabilities or Shareholder Equity should be shown). Show your calculations. 1.) On January 1, GT purchased a mining machine from Japan. The machine cost CAN$1,350,000 and had to be shipped to Vancouver. Once it arrived in Vancouver, there were customs duties of CAN$50,000. The machine and its unassembled components were placed on a train and assembled on site. The cost of the freight was CAN$10,000, and a friendly mechanic named Mitch assembled the machine components once it arrived at its destination in Northern BC. GT paid Mitch $2,000. (3 marks) 2.) One week into the machine operating, a cable snapped, and Mitch had to replace it. Mitch recommended that we get a better cable that can lift more weight. It would make the machine way better Mitch said. The new cable cost $12,000. (3 Marks) 3.) GT employs a double declining method depreciation, assuming a salvage value of 15,000, and 6 year life. Stella wants to know what to book for depreciation for the year. (8 marks) 4.) On March 31 the next year, a competitor firm to GT offered to buy the mining machine for $2,000,000. GT took the offer and sold the machine on the same day. Assume for the purpose of this point only that accumulated depreciation on this asset at the time of sale was $200,000. Stella wants to know how to account for the sale. (8 marks). 5.) GT currently has $2,000,000 in its receivables on its books. Last year Stella booked $100,000 on the AFDA account. This year, you estimate that 3.5% of receivables are uncollectible. Stella wants to know what to book this year (4 marks). 6.) After making the adjustment in point 5, Stella finds out that one of the accounts is uncollectible. They owe GT $65,000. Please help Stella with the adjustment (2 marks). Assets Liabilities Shareholder Equity ACCT 621: Total Marks: 100 Instructions: 1.) The exam will be a take-home exam and is considered open book. 2.) You may not share any ideas or answers with other students under ANY circumstances. 3.) The exam is 2 hours long and must be returned by email to your instructor no later than 2 hours after it is received. Question 1: Please refer to the financial statements provided in Appendix 1: a.) For each of the following, please provide a calculation of the appropriate ratio amount for 2017 and 2018 years. Show your calculations (22 Marks). See Notes to specific financial statement items in calculations. b.) Please provide commentary to your observations, and your assessment of how the change in year-over-year ratios is reflective of the financial performance and health of the company (22 Marks). c.) For Current Ratio, Inventory Turnover and Accounts Receivable Turnover, please provide two examples each of things the company can do to improve these ratios (6 Marks). Answers: 1 a. and 1.b Ratio Calculation Commentary Gross Profit Rate (Note 2) Profit Margin (Note 1,2) Return on Assets (Note 1) Asset Turnover (Note 2) Debt to Asset Ratio Times Interest Earned (Note 3) Free Cash Flow Current Ratio Inventory Turnover Working Capital Accounts Receivable Turnover (Note 4) Note 1: Ignore Income/Loss attributable to non-controlling interests. Note 2: Consider all revenue items to be sales. Note 3: Include all interest expense items to be part of the cost of financing. Note 4: Consider all receivable items to be trade receivables. Answers: 1c.: Ratio Steps to Improve Ratio Current Ratio Inventory Turnover Accounts Receivable Turnover Question 2: You have recently taken over the role of the Chief Financial Officer of GT Gold Chasers Ltd. (“GT Gold”). GT Gold is junior mining company, that is hoping to hit it big with their next mining venture. You work out of the head office that is based out of Vancouver. GT has got a reputation in the industry for being quick to act, and the management team are known for pushing the envelope to get results. There has been a high turnover of people in the last two years, and the current team are mainly new to the job. During your first few weeks on the job, you have noticed a few “oddities” around how things in the office run. A couple of examples of these are as follows: • Your assistant staff accountant, Stella Monibag helps you with the preparation of the accounting financial statements for the company. Stella spends her days reconciling the bank accounts of the company on a daily basis, which is great, because you need to know how much cash you have in the company at all times. Once she has reconciled the accounting general ledger to the bank statement, she prepares all the cheques for the new bills that needs to be paid. You have the authority to sign the cheques, but when you are out of the office, Stella is also able to sign these cheques or approve payments on your behalf. Stella keeps the cheque book on her desk so that she doesn’t lose it easily. Once you have approved a payment, Stella will access the company accounting system to enter the transactions in the general ledger. • Recently the company started to pay some larger invoices to vendors that you have never really heard of. One the vendors, SM Consultants Inc. provided printing services, a piece of furniture and six hours of printing consulting. These were not expected costs, but you are new to the office, and you figure that it will probably sort itself out later. 2.a) Please advise provides commentary on any internal control weaknesses that may exist in GT Gold, based on the above information (12 marks). 2.b) Please provide three possible solutions to the internal control weaknesses you have identified above, and how these will help solve the control weakness (6 marks). 2.c) Provide some commentary and two examples regarding things you would try to change in the organization to address internal control risk (hint: refer back to the Fraud Triangle model discussed during class), and how these changes would impact the company (4 marks). Question 3: The following transactions appeared in the accounting records of GT Gold during the year. Stella comes to your office, and wants to understand how we should be entering these into the accounting system for the December 31 year-end. Please summarize these transactions using the metric below (i.e. show how the change in Assets, Liabilities or Shareholder Equity should be shown). Show your calculations. 1.) On January 1, GT purchased a mining machine from Japan. The machine cost CAN$1,350,000 and had to be shipped to Vancouver. Once it arrived in Vancouver, there were customs duties of CAN$50,000. The machine and its unassembled components were placed on a train and assembled on site. The cost of the freight was CAN$10,000, and a friendly mechanic named Mitch assembled the machine components once it arrived at its destination in Northern BC. GT paid Mitch $2,000. (3 marks) 2.) One week into the machine operating, a cable snapped, and Mitch had to replace it. Mitch recommended that we get a better cable that can lift more weight. It would make the machine way better Mitch said. The new cable cost $12,000. (3 Marks) 3.) GT employs a double declining method depreciation, assuming a salvage value of 15,000, and 6 year life. Stella wants to know what to book for depreciation for the year. (8 marks) 4.) On March 31 the next year, a competitor firm to GT offered to buy the mining machine for $2,000,000. GT took the offer and sold the machine on the same day. Assume for the purpose of this point only that accumulated depreciation on this asset at the time of sale was $200,000. Stella wants to know how to account for the sale. (8 marks). 5.) GT currently has $2,000,000 in its receivables on its books. Last year Stella booked $100,000 on the AFDA account. This year, you estimate that 3.5% of receivables are uncollectible. Stella wants to know what to book this year (4 marks). 6.) After making the adjustment in point 5, Stella finds out that one of the accounts is uncollectible. They owe GT $65,000. Please help Stella with the adjustment (2 marks). Assets Liabilities Shareholder Equity

ACCT 621: Total Marks: 100 Instructions: 1.) The exam will be a take-home exam and is considered open book. 2.) You may not share any ideas or answers with other students under ANY circumstances. 3.) The exam is 2 hours long and must be returned by email to your instructor no later than 2 hours after it is received. Question 1: Please refer to the financial statements provided in Appendix 1: a.) For each of the following, please provide a calculation of the appropriate ratio amount for 2017 and 2018 years. Show your calculations (22 Marks). See Notes to specific financial statement items in calculations. b.) Please provide commentary to your observations, and your assessment of how the change in year-over-year ratios is reflective of the financial performance and health of the company (22 Marks). c.) For Current Ratio, Inventory Turnover and Accounts Receivable Turnover, please provide two examples each of things the company can do to improve these ratios (6 Marks). Answers: 1 a. and 1.b Ratio Calculation Commentary Gross Profit Rate (Note 2) Profit Margin (Note 1,2) Return on Assets (Note 1) Asset Turnover (Note 2) Debt to Asset Ratio Times Interest Earned (Note 3) Free Cash Flow Current Ratio Inventory Turnover Working Capital Accounts Receivable Turnover (Note 4) Note 1: Ignore Income/Loss attributable to non-controlling interests. Note 2: Consider all revenue items to be sales. Note 3: Include all interest expense items to be part of the cost of financing. Note 4: Consider all receivable items to be trade receivables. Answers: 1c.: Ratio Steps to Improve Ratio Current Ratio Inventory Turnover Accounts Receivable Turnover Question 2: You have recently taken over the role of the Chief Financial Officer of GT Gold Chasers Ltd. (“GT Gold”). GT Gold is junior mining company, that is hoping to hit it big with their next mining venture. You work out of the head office that is based out of Vancouver. GT has got a reputation in the industry for being quick to act, and the management team are known for pushing the envelope to get results. There has been a high turnover of people in the last two years, and the current team are mainly new to the job. During your first few weeks on the job, you have noticed a few “oddities” around how things in the office run. A couple of examples of these are as follows: • Your assistant staff accountant, Stella Monibag helps you with the preparation of the accounting financial statements for the company. Stella spends her days reconciling the bank accounts of the company on a daily basis, which is great, because you need to know how much cash you have in the company at all times. Once she has reconciled the accounting general ledger to the bank statement, she prepares all the cheques for the new bills that needs to be paid. You have the authority to sign the cheques, but when you are out of the office, Stella is also able to sign these cheques or approve payments on your behalf. Stella keeps the cheque book on her desk so that she doesn’t lose it easily. Once you have approved a payment, Stella will access the company accounting system to enter the transactions in the general ledger. • Recently the company started to pay some larger invoices to vendors that you have never really heard of. One the vendors, SM Consultants Inc. provided printing services, a piece of furniture and six hours of printing consulting. These were not expected costs, but you are new to the office, and you figure that it will probably sort itself out later. 2.a) Please advise provides commentary on any internal control weaknesses that may exist in GT Gold, based on the above information (12 marks). 2.b) Please provide three possible solutions to the internal control weaknesses you have identified above, and how these will help solve the control weakness (6 marks). 2.c) Provide some commentary and two examples regarding things you would try to change in the organization to address internal control risk (hint: refer back to the Fraud Triangle model discussed during class), and how these changes would impact the company (4 marks). Question 3: The following transactions appeared in the accounting records of GT Gold during the year. Stella comes to your office, and wants to understand how we should be entering these into the accounting system for the December 31 year-end. Please summarize these transactions using the metric below (i.e. show how the change in Assets, Liabilities or Shareholder Equity should be shown). Show your calculations. 1.) On January 1, GT purchased a mining machine from Japan. The machine cost CAN$1,350,000 and had to be shipped to Vancouver. Once it arrived in Vancouver, there were customs duties of CAN$50,000. The machine and its unassembled components were placed on a train and assembled on site. The cost of the freight was CAN$10,000, and a friendly mechanic named Mitch assembled the machine components once it arrived at its destination in Northern BC. GT paid Mitch $2,000. (3 marks) 2.) One week into the machine operating, a cable snapped, and Mitch had to replace it. Mitch recommended that we get a better cable that can lift more weight. It would make the machine way better Mitch said. The new cable cost $12,000. (3 Marks) 3.) GT employs a double declining method depreciation, assuming a salvage value of 15,000, and 6 year life. Stella wants to know what to book for depreciation for the year. (8 marks) 4.) On March 31 the next year, a competitor firm to GT offered to buy the mining machine for $2,000,000. GT took the offer and sold the machine on the same day. Assume for the purpose of this point only that accumulated depreciation on this asset at the time of sale was $200,000. Stella wants to know how to account for the sale. (8 marks). 5.) GT currently has $2,000,000 in its receivables on its books. Last year Stella booked $100,000 on the AFDA account. This year, you estimate that 3.5% of receivables are uncollectible. Stella wants to know what to book this year (4 marks). 6.) After making the adjustment in point 5, Stella finds out that one of the accounts is uncollectible. They owe GT $65,000. Please help Stella with the adjustment (2 marks). Assets Liabilities Shareholder Equity ACCT 621: Total Marks: 100 Instructions: 1.) The exam will be a take-home exam and is considered open book. 2.) You may not share any ideas or answers with other students under ANY circumstances. 3.) The exam is 2 hours long and must be returned by email to your instructor no later than 2 hours after it is received. Question 1: Please refer to the financial statements provided in Appendix 1: a.) For each of the following, please provide a calculation of the appropriate ratio amount for 2017 and 2018 years. Show your calculations (22 Marks). See Notes to specific financial statement items in calculations. b.) Please provide commentary to your observations, and your assessment of how the change in year-over-year ratios is reflective of the financial performance and health of the company (22 Marks). c.) For Current Ratio, Inventory Turnover and Accounts Receivable Turnover, please provide two examples each of things the company can do to improve these ratios (6 Marks). Answers: 1 a. and 1.b Ratio Calculation Commentary Gross Profit Rate (Note 2) Profit Margin (Note 1,2) Return on Assets (Note 1) Asset Turnover (Note 2) Debt to Asset Ratio Times Interest Earned (Note 3) Free Cash Flow Current Ratio Inventory Turnover Working Capital Accounts Receivable Turnover (Note 4) Note 1: Ignore Income/Loss attributable to non-controlling interests. Note 2: Consider all revenue items to be sales. Note 3: Include all interest expense items to be part of the cost of financing. Note 4: Consider all receivable items to be trade receivables. Answers: 1c.: Ratio Steps to Improve Ratio Current Ratio Inventory Turnover Accounts Receivable Turnover Question 2: You have recently taken over the role of the Chief Financial Officer of GT Gold Chasers Ltd. (“GT Gold”). GT Gold is junior mining company, that is hoping to hit it big with their next mining venture. You work out of the head office that is based out of Vancouver. GT has got a reputation in the industry for being quick to act, and the management team are known for pushing the envelope to get results. There has been a high turnover of people in the last two years, and the current team are mainly new to the job. During your first few weeks on the job, you have noticed a few “oddities” around how things in the office run. A couple of examples of these are as follows: • Your assistant staff accountant, Stella Monibag helps you with the preparation of the accounting financial statements for the company. Stella spends her days reconciling the bank accounts of the company on a daily basis, which is great, because you need to know how much cash you have in the company at all times. Once she has reconciled the accounting general ledger to the bank statement, she prepares all the cheques for the new bills that needs to be paid. You have the authority to sign the cheques, but when you are out of the office, Stella is also able to sign these cheques or approve payments on your behalf. Stella keeps the cheque book on her desk so that she doesn’t lose it easily. Once you have approved a payment, Stella will access the company accounting system to enter the transactions in the general ledger. • Recently the company started to pay some larger invoices to vendors that you have never really heard of. One the vendors, SM Consultants Inc. provided printing services, a piece of furniture and six hours of printing consulting. These were not expected costs, but you are new to the office, and you figure that it will probably sort itself out later. 2.a) Please advise provides commentary on any internal control weaknesses that may exist in GT Gold, based on the above information (12 marks). 2.b) Please provide three possible solutions to the internal control weaknesses you have identified above, and how these will help solve the control weakness (6 marks). 2.c) Provide some commentary and two examples regarding things you would try to change in the organization to address internal control risk (hint: refer back to the Fraud Triangle model discussed during class), and how these changes would impact the company (4 marks). Question 3: The following transactions appeared in the accounting records of GT Gold during the year. Stella comes to your office, and wants to understand how we should be entering these into the accounting system for the December 31 year-end. Please summarize these transactions using the metric below (i.e. show how the change in Assets, Liabilities or Shareholder Equity should be shown). Show your calculations. 1.) On January 1, GT purchased a mining machine from Japan. The machine cost CAN$1,350,000 and had to be shipped to Vancouver. Once it arrived in Vancouver, there were customs duties of CAN$50,000. The machine and its unassembled components were placed on a train and assembled on site. The cost of the freight was CAN$10,000, and a friendly mechanic named Mitch assembled the machine components once it arrived at its destination in Northern BC. GT paid Mitch $2,000. (3 marks) 2.) One week into the machine operating, a cable snapped, and Mitch had to replace it. Mitch recommended that we get a better cable that can lift more weight. It would make the machine way better Mitch said. The new cable cost $12,000. (3 Marks) 3.) GT employs a double declining method depreciation, assuming a salvage value of 15,000, and 6 year life. Stella wants to know what to book for depreciation for the year. (8 marks) 4.) On March 31 the next year, a competitor firm to GT offered to buy the mining machine for $2,000,000. GT took the offer and sold the machine on the same day. Assume for the purpose of this point only that accumulated depreciation on this asset at the time of sale was $200,000. Stella wants to know how to account for the sale. (8 marks). 5.) GT currently has $2,000,000 in its receivables on its books. Last year Stella booked $100,000 on the AFDA account. This year, you estimate that 3.5% of receivables are uncollectible. Stella wants to know what to book this year (4 marks). 6.) After making the adjustment in point 5, Stella finds out that one of the accounts is uncollectible. They owe GT $65,000. Please help Stella with the adjustment (2 marks). Assets Liabilities Shareholder Equity

ACCT 621:

Total Marks: 100

Instructions:

The exam will be a take-home exam and is considered open book.

You may not share any ideas or answers with other students under ANY

The exam is 2 hours long and must be returned by email to your instructor no later than 2 hours after it is received.

Question 1:

Please refer to the financial statements provided in Appendix 1:

For each of the…

View On WordPress

0 notes

Text

Encore une fois à Cuba et mon opinion sur Ford contre Ferrari

Le 4 décembre 2019

Ouf! Pas facile pour un mordu de l’auto comme moi de prendre une semaine de vacances et de ne pas penser aux bagnoles. Surtout si ma destination est Cuba! Le problème est moindre si je me rends à Cayo Largo, petite île au sud de la grande île principale où il n’y a qu’une vingtaine de véhicules. Mais les conséquences sont plus importantes lorsque c’est dans la région de Varadero ou à La Havane où les «belles» anciennes pullulent! Enfin, le mot «belle» ne devrait pas toujours s’appliquer…

Une brochette de «belles» Américaines au Parque Central de La Havane. (Photo Éric Descarries)

Pour résumer en quelques mots le parc automobile de Cuba, disons qu’il y a plus de 60 000 Américaines des années quarante et cinquante survivant dans l’île (mais pas partout) dont la majorité sont des Chevrolet de 1950 à 1956, cette dernière année étant la plus populaire. Il y a aussi de nombreux taxis Geely, des Peugeot alors que si vous louez un véhicule, il y a de fortes chances que ce soit aussi une Peugeot où, mon préféré, le nouveau Suzuki Jimny que j’aurais bien aimé voir sur notre marché.

La Chevrolet 1956 fut la voiture américaine la plus vendue des années cinquante (pré-révolution) à Cuba. (Photo Éric Descarries)

Si vous voulez louer une voiture à Cuba, ce sera, soit une Peugeot ou une Geely ou encore un Suzuki Jimny de nouvelle génération. Toutefois, oubliez l’idée de faire du hors-route, il n’y a pas d’endroit approprié pour cela. Qui plus est, il y a de fortes chances que la fonction de quatre roues motrices du Suzuki soit désactivée! (Photo Éric Descarries)

Si vous allez dans les régions de La Havane et Varadero, vous y verrez également quelques voitures récentes et surtout des pick-up GMC Sierra de la dernière génération, ceux-ci appartenant à des compagnies canadiennes qui y exploitent gaz et mines. Ils y ont aussi plusieurs poids lourds International et Freightliner et des Ford F-250.

Il y a beaucoup de camionnettes GMC récentes et de poids lourds International et Freightliner tout aussi récents à Cuba mais rien n’est plus agréable que de voir un vieux camion Ford 1955 restauré sur la route. Celui-ci était un bel exemplaire mais il y a de fortes chances qu’il repose sur un châssis de camion Hino, ou Kamaz (russe) plus récent. (Photo Éric Descarries)

Mon plaisir, c’est d’y photographier des «créations» cubaines dont certaines sont des avants de grosses américaines du début des années cinquante sur un châssis de camionnette avec une carrosserie faite maison dans le but d’en faire un grand Taxi. Chauffeur de taxi personnel, une profession payante à Cuba.

Pour une fois, je suis bouche bée! Je ne saurais vous dire sur quoi est basée cette création locale, sauf qu’une partie de la cabine semble tirée d’une camionnette International des années cinquante! (Photo Éric Descarries)

Notez aussi que sous le capot de la plupart de ces Américaines des années cinquante se cache un moteur diesel à quatre cylindres ayant autrefois appartenu à un camion de livraison japonais ou européen. Les autos ainsi équipées sont reconnaissables à leur gros tuyau d’échappement (qui laisse échapper une fumée noire si la voiture est «nourrie» d’un carburant dit «clandestin») ou au son agaçant du moteur qui n’appartient certes pas aux autos en question.

Cette Jeep ressemble à une TJ récente mais si on l’examine attentivement, il s’agirait plutôt d’une réplique…de source asiatique inconnue. (Photo Éric Descarries)

Il y a plusieurs petites autos anglaises des années cinquante à Cuba dont certaines sont des Ford anglaises comme cette Consul. (Photo Éric Descarries)

Les Chevrolet sont nombreuses car elles se sont beaucoup vendues à cette époque où l��argent était plus courant. Si la Mafia y exerçait une certaine influence, ce n’était pas tant elle qui achetait des autos de luxe que les habitants cubains qui pouvaient se payer des berlines à quatre portes de base.

Les Lincoln sont plutôt rares à Cuba, contrairement aux Cadillac. Toutefois, une Lincoln-Zephyr 1947-48, c’est encore plus rare, même en Amérique! (Photo Éric Descarries)

Si, dans la région de Varadero, il y a tant de cabriolets, regardez-y à deux fois. Plusieurs ont déjà été des coupés ou des berlines auxquels on a coupé le toit, une pratique qui était faisable à cette époque où les autos étaient montées sur des châssis rigides ( ce qui n’est presque plus possible aujourd’hui vu la configuration populaire de caisses autoporteuses).

Si certains cabriolets sont des coupés ou même des berlines au toit coupé, cette (rare) Dodge Custom Royal 1956 semble originale. (Photo Éric Descarries)

Ce cabriolet Edsel 1958 est un parfait exemple de voiture dont le toit a été coupé. On le voit par la partie du toit original qui reste juste derrière le haut du pare-brise! (Photo Éric Descarries)

Enfin, si vous croyez pouvoir acheter une vieille bagnole à Cuba et l’envoyer chez vous, préparez-vous à signer un gros chèque comme on a pu le voir à la télé à l’émission de José Gaudet et Guildor Roy. Un cabriolet Chevrolet 1955-56 en «pas pire» état s’y vendait plus de 25 000 $. À ce prix-là, vous en trouverez un superbe exemplaire bien restauré en Amérique du Nord!

C’est à se demander si cette MG-A n’aurait pas mérité une restauration un peu plus professionnelle…ce qui est presque impensable à Cuba! (Photo Éric Descarries)

Ford contre Ferrari…hummmm!

Le film «Ford contre Ferrari» est toujours en salle au moment d’écrire ces lignes. Plus d’un m’a demandé si je l’avais vu et ce que j’en pensais…

Juste avant de m’envoler pour Cuba, j’ai joint un groupe d’amis dont la majorité était des vrais mordus de l’auto. Le but? Voir ce film et en discuter. Toutefois, avant ce visionnement, j’avais lu des critiques et j’avais entendu certaines remarques à la radio. Toutes étaient unanimes : «must see»! Mais avec un bémol. Si l’on connaissait vraiment l’histoire, il fallait faire fi de celle-ci, c’était un film hollywoodien…

J’ai regardé le film. Soyons honnêtes! Si vous ne connaissez pas la véritable histoire, vous aurez vu un beau film mettant en vedette la véritable amitié entre deux hommes. Mais ce n’est pas la véritable histoire de Ford contre Ferrari. J’ai plus de 70 ans et j’ai vraiment suivi les évènements à cette époque.

Ce que je n’ai pas aimé dans le film, c’est la distorsion de l’histoire. Oui, Ford voulait battre Ferrari. Mais en vérité, Ford, dont le programme de l’époque s’appelait «Total Performance» voulait tout gagner, du Daytona 500 aux 500 Milles d’Indianapolis (Jim Clark 1965) à la Formule Un (plus tard) en passant par le Rallye Monte Carlo (avec Falcon dans sa catégorie en 1964) et j’en passe.

Toutefois, ce n’est pas Carroll Shelby qui a débuté le programme GT40 mais la division anglaise de performance de Ford (Ford Advanced Vehicles) qui a failli en 1964 et 1965. Shelby a mis les Cobra au monde mais son apport à la Ford de Le Mans ne viendra qu’en 1966 avec l’aide de Holman and Moody (NASCAR)…mais cela est trop long à raconter.

Dans le film, Shelby fait peur à Henry Ford II en piste (ce n’est jamais arrivé!), Leo Beebe est un «méchant» (faux!), Ken Miles a un mauvais caractère…(hummm!...vrai!)…seul Phil Remington, le bras droit de Shelby semble réel! Puis, Shel’ mesurait plus de six pieds (je l’ai rencontré au moins cinq fois dans ma vie...c’est vrai!) et non cinq pieds sept pouces comme Matt Damon, l’acteur…

Il y a plusieurs anachronismes dans le film (dont une Cobra Daytona avec des roues de 17 pouces au lieu des 15 pouces de l’époque) mais c’est vrai que Shel’ se déplaçait avec son roadster 289 bleu.

Toutefois, le pire, c’est à la fin du film lorsque Ken Miles prend place à bord de ce que nous savons être le prototype J-Car avec lequel il allait se tuer au bout de quelques tours. Dans le film, il ne s’agit que d’un kit car GT 40 qu’on a légèrement modifié pour ressembler au J-Car (quand même…Hollywood ne manque pas de ressources pour modifier, ne serait-ce que légèrement, une réplique de GT40 en J-Car !) alors que la Mark VI finale n’est qu’une réplique de GT40 avec des «stripes» latérales mal reproduites. J’ai vu suffisamment de superbes répliques de MK-IV que Hollywood aurait pu en louer une au lieu de mal maquiller un kit car! Quentin Tarantino n’a fait aucune de ces erreurs chronologiques dans son film «Once upon a time in Hollywood!»!