#GSTR-8

Explore tagged Tumblr posts

Text

GST Due Dates In November 2024

GST Due DatesYou May Also LikeGet Free Updates[Join WhatsApp Group] GST Due Dates Due dates are most important in any tax compliance as understanding of due dates help in timely compliance. So, in order to help you in timely GST compliance, we have gathered various GST due dates in November 2024. These are as under: 10 November 2024 Due date for filing GSTR-7 for the month of October…

0 notes

Text

Step-by-Step GST Return Filing Online Tutorial

Introduction

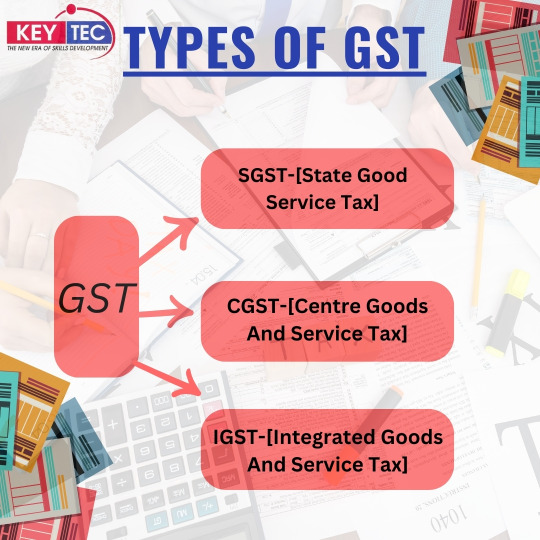

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. GST has simplified the indirect tax system in India by replacing multiple taxes levied by the central and state governments. With the advent of digital technology, GST return filing has become more accessible through online platforms. The article provides a step-by-step guide to filing GST returns online.

Types of GST Returns

Before diving into the filing process, it's essential to understand the various types of GST returns, each serving a different purpose:

GSTR-1: Details of outward supplies of goods or services.

GSTR-2A: Read-only document containing details of inward supplies auto-populated from the supplier's GSTR-1.

GSTR-3B: Simple summary return of inward and outward supplies.

GSTR-4: Quarterly return for composition scheme taxpayers.

GSTR-5: Return for non-resident taxable persons.

GSTR-6: Return for input service distributors.

GSTR-7: Return for authorities deducting tax at source.

GSTR-8: Return for e-commerce operators collecting tax at source.

GSTR-9: Annual return for regular taxpayers.

GSTR-10: Final return in case of cancellation of GST registration.

GSTR-11: Return for taxpayers with a Unique Identification Number (UIN).

Prerequisites for GST Return Filing

Before you start the GST return filing process, ensure you have the following:

Active GSTIN (Goods and Services Tax Identification Number): You must be registered under GST and have an active GSTIN.

Login Credentials: Access the GST portal with your username and password.

Digital Signature Certificate (DSC) or EVC: For authentication purposes, businesses (other than proprietorships) must use a DSC, while proprietorships can use an Electronic Verification Code (EVC).

Required Data: Sales and purchase invoices, outward and inward supplies details, and other necessary documents.

Step-by-Step Guide to Filing GST Returns Online

Step 1: Access the GST Portal

Visit the GST Portal: Go to the official GST portal (https://www.gst.gov.in/).

Login: Click the 'Login' button and enter your credentials (username and password).

Step 2: Navigate to the Return Filing Section

Dashboard: After logging in, you will be directed to the dashboard.

Services: From the main menu, navigate to 'Services'> 'Returns'> 'Returns Dashboard'.

Step 3: Select the Return Period

Financial Year and GST Return Filing Period: From the dropdown menu, select the financial year and the return filing period (monthly or quarterly).

Search: Click on the 'Search' button to proceed.

Step 4: Choose the Return Form

Select Form: Select the appropriate return form (e.g., GSTR-1, GSTR-3B) based on your registration type and business activities.

Step 5: Fill in the Return Details

Outward Supplies (Sales): For GSTR-1, provide details of outward supplies, including invoice-wise information for B2B transactions and aggregate details for B2C transactions.

Inward Supplies (Purchases): Ensure all purchase details are correctly captured for GSTR-2A (auto-populated) and GSTR-3B.

Tax Calculation: Calculate the tax liability, including CGST, SGST, IGST, and cess, if applicable.

Step 6: Validate and Submit the Return

Save and Preview: Save the details periodically to avoid data loss. Preview the return to ensure all details are correctly entered.

Submit: Click the 'Submit' button to validate your return.

Step 7: Payment of Tax Liability

Create Challan: If there is any tax liability, generate a challan for tax payment.

Payment: Pay using modes such as Net Banking, Credit/Debit Card, or NEFT/RTGS.

Step 8: File the Return

Authentication: Use DSC or EVC to authenticate the return.

File Return: Click on the 'File Return' button. A confirmation message and an acknowledgement reference number (ARN) will be generated.

Step 9: Download the Acknowledgment

Download and Save: Download the filed return and acknowledgement for your records.

Conclusion

Filing GST returns online is a streamlined and efficient process that ensures compliance with the GST law. Regular and accurate filing helps businesses avoid penalties and maintain compliance ratings. The GST return filing process and ensure your business complies with all regulatory requirements.

0 notes

Text

Top Causes of GST Notices Demystified

Goods & Service Tax (GST) was implemented in India to create an efficient, simple and error-free tax structure. Since its implementation it has seen an exponential rise in compliance requests that has resulted in numerous GST notifications to taxpayers that signal potential ambiguities or lack of compliance with GST laws; an in-depth knowledge of major factors contributing to such notifications is key for businesses navigating its complex tax system successfully.

What exactly are GST notices, and why do taxpayers typically receive them? Continue reading for answers to these queries. Top Eight Reasons for Taxpayers to Get GST Notice

Taxpayers Should Read GST Notices mes Understanding GST notices is crucial for taxpayers in quickly addressing any ambiguities or problems with their GST returns promptly. Tax agencies use notices as a tool to notify taxpayers about errors, delays or compliance violations regarding GST rules.

GST notices range in severity, from basic inquiries to more complex matters. They may be issued to highlight violations with filings or incorrect data or to provide details about penalties associated with irregularities. Below are 8 reasons taxpayers could receive notices from GST:

Filing issues. Filing issues. Filing problems

GST notices could be issued for taxpayers for various reasons, but one of the more frequent ones is when taxpayers fail to submit their GST returns by their due dates and miss filing them on time. When this occurs, authorities send GST notices.

Failure to submit GST tax returns according to the deadline set forth by authorities could incur an expensive fine; thus all businesses (big and small alike) should ensure they file their GST tax returns by their due dates.

ITC Discrepancies

GST’s Input Tax Credit (ITC) allows businesses to claim credits if they’ve paid tax on imports. To be eligible for ITC credits, invoices must be filed accurately to claim your credits.

Tax authorities may issue warning notices to businesses who submit incorrect invoices, or those filing tax credits incorrectly, should they identify any discrepancies. companies should check that their invoices are correct before submitting them to authorities for tax credit on inputs in order to qualify for this credit and avoid receiving GST notices that could have negative repercussions for their business.

GSTR-1 and GSTR-3B Do Not Match Up

Filing their GST tax returns requires businesses to complete multiple forms. Of these forms, GSTR-1 and GSTR-3B are two that businesses should carefully complete so as to submit their returns without issue.

GSTR-1 provides all information regarding supplies made to companies while GSTR-3B contains all of the details tax authorities require in order to assess tax liabilities as well as credit (input tax credit) of these same companies.

To ensure that GST returns are successfully filed, information in these two reports should match. If authorities detect any discrepancies between them and numbers mentioned in either report, they may issue GST notices to companies. Depending on the circumstances surrounding each notice issued by authorities, additional explanations may be requested or audit reports filed to prove inconsistencies or mismatches or submit returns accurately.

Tax Payment Errors

Payment errors are one of the primary reasons taxpayers receive tax notices from authorities. When taxpayers do not calculate their taxes correctly or incorrectly categorise goods or services they sell, choose incorrect tax rates or underpay their due taxes they may receive an GST notice from authorities.

Taxpayers who fail to calculate and pay their correct tax payments correctly could incur fines or penalties, and to prevent incurring them it would be wise for companies to hire an expert who could assess their filing processes to ensure they submit correct GST returns with every filing, and pay the correct amounts of taxes each time.

E-Way Bill Noncompliance

Businesses involved in transporting products that exceed GST thresholds must abide by E-way invoice guidelines. Any violations to this or failure to produce E-way bills when needed could result in notices being issued from GST authorities; to prevent these from being issued, businesses should always file appropriate bills when transporting items that surpass these thresholds.

Are there issues related to transactions of high value?

Tax authorities remain extremely diligent when reviewing transactions that exceed the threshold amounts set out in the GST Act. When these transactions involve high value items such as input tax credits or taxes claimed by businesses, tax authorities ensure all relevant rules are being observed.

Businesses failing to abide by the rules and regulations related to transactions of high value can receive notices of GST issued by authorities, which may ask them to pay penalties fees or provide an audit report in detail.

GSTIN/PAN Mismatch

One of the most frequent mistakes companies can make when filing their first GST return is entering incorrect Permanent Account Number or GST Identification Number data. This mistake should never occur!

Companies filing returns should ensure their registration details have been double-checked with the GST database prior to filing returns.

GST Audit Compliance Issues

U.S. law mandates that companies undergo GST audits at regular intervals and submit audit reports within specified timelines; failure to do so could lead to authorities issuing GST notices against these firms.

Notices could require businesses to pay penalties for not adhering to tax auditing procedures, and so it is crucial for all legally eligible companies to undergo GST audits regularly in order to avoid receiving notices of noncompliance.

Bottom Line

Businesses receiving GST notices that require additional processing time or involve penalties or fines that lead to cash loss for their business should take measures to avoid this scenario by checking off all relevant issues prior to filing their GST returns on time and precisely.

0 notes

Text

Manufacturing Company || Accounts Job || Factory Supervisor Job || Chinnar Park || Dhulagarh || Kolkata || Howrah || West Bengal

Unlock Your Dream Job!

In this Job Post, we dive into the "Ideal Career Zone," revealing the secrets to finding your perfect profession!

Whether you’re hunting for a #job, searching #Naukri, or exploring new #Chakri options, we’ve got you covered with expert tips and career advice. From understanding your passions to mastering job searches and acing interviews, we empower you to navigate the competitive landscape with confidence!

Join us and discover how to elevate your career journey today!

Don’t forget to like, subscribe, and tap the notification bell for more career-boosting content. Your dream job awaits!

Now the company is hiring some staffs!

About company: Welcome to our deep dive into the dynamic “Manufacturing Industry’!

In this Job Post, we explore the fascinating roles that influence production, including the essential position of a “#juniorAccountant”, who ensures our finances stay in check, and the dedicated efforts of a Manufacturing Unit.

#FactorySupervisor, who oversees operations and drives efficiency. Join us as we uncover the daily responsibilities, challenges, and triumphs of these professionals—offering valuable insights for aspiring candidates.

Whether you're considering a career in manufacturing or simply intrigued by the industry, this video is packed with expert tips and real-world stories.

Don't forget to like, comment, and subscribe for more exciting content about world of manufacturing!

Salary Package: Rupees 12K to Rupees 15K in a month

Job type: Full–time

Junior Accounts can Create & maintain balance sheet.

Factory Supervisor: Can handle labours and materials.

Job Description For Junior Accountants.

Create & maintain book keeping.

Manage account statements.

Stock Maintenance Invoice Billing attendance and Salary dispatched GSTR filling.

Record daily revenue & other numbers.

It is a Full Time Accountant job for candidates with tally and Basic computer Knowledge.

Job Description For Factory Supervisor.

Labour Handling

Stock Inward and clearances.

Loading Unloading supervision.

Labour Payment.

Patty cash

An immediate opening of 2 junior Accountant and 2 factory suoervisors.

Female or Male candidates can apply for this Accountant job and only Male can apply for factory supervisor job.

For Junior Accountant job has 10:00 AM to 7:00 PM timing.

For factory supervisor job has 9:30 AM to 8:00 PM timing.

For Junior Accountant no lodging facility available and For factory supervisor lodging facility including mess available.

Supplemental Pay: Yearly bonus

Qualification: B.com (or) Degree for junior accountant and HS for factory Supervisor.

Interested candidates can apply or contact us:-

HR: 9 3 3 1 2 0 5 1 3 3

* Note:- This video is available in Hindi and Begali languages also. You can see it just search another video in hindi and Bengali voices. Many more openings available just search in Google “Ideal Career Zone” Kolkata.

You can find many more job details in various posts in various companies.

You may call us between 9 am to 8 pm

8 7 7 7 2 1 1 zero 1 6

9 3 3 1 2 zero 5 1 3 3

Or you can visit our office.

Ideal Career Zone

128/12A, BidhanSraniShyam Bazaar metro Gate No.1 Gandhi Market Behind Sajjaa Dhaam Bed Hiset Bed cover Show room Kolkata 7 lakh 4

Thank you for watching our channel Please subscribed and like our videos for more jobs opening. Thank You again.

#ManufacturingCompany, #AccountsJob, #FactorySupervisorJob, #ChinnarPark, #Dhulagarh, #Kolkata, #Howrah, #WestBengal, #ম্যানুফ্যাকচারিংকোম্পানি, #অ্যাকাউন্টজব, #ফ্যাক্টরি সুপারভাইজারচাকরি, #চিন্নারপার্ক, #ধুলাগড়কলকাতা, #হাওড়া, #পশ্চিমবঙ্গ, #विनिर्माणकंपनी, #लेखानौकरी, #फैक्टरीपर्यवेक्षकनौकरी, #चिन्नारपार्क, #धुलागढ़, #कोलकाता, #हावड़ा, #पश्चिमबंगाल,

0 notes

Text

Tally ERP 9 Course Near Me in Mohali: Your Guide to the Best Institutes

If you are searching for the best Tally ERP 9 course near me in Mohali, you're on the right path to advancing your career in accounting and financial management. Tally ERP 9 is one of the most widely used accounting software programs in India, designed to meet the growing needs of small and medium businesses (SMEs). It is used to manage accounting, inventory, payroll, GST, taxation, and more.

In this blog, we’ll explore why learning Tally ERP 9 is essential, what to expect from a comprehensive course, and the best training institutes in Mohali where you can master this software.

Why Learn Tally ERP 9?

Tally ERP 9 is an essential tool for professionals in finance and accounting. Here are some of the key reasons to learn Tally ERP 9:

Complete Business Solution: It covers multiple aspects of business management including accounting, inventory, payroll, and taxation.

GST Compliance: Tally ERP 9 is widely used for GST calculations, filing, and compliance, making it an important tool for businesses.

Career Growth: Mastering Tally ERP 9 opens up job opportunities in accounting, finance, and taxation across industries.

User-Friendly Interface: It’s easy to learn and use, which makes it a preferred choice for small and medium enterprises.

Wide Industry Usage: Tally is used across various sectors like retail, manufacturing, services, and education.

What to Expect in a Tally ERP 9 Course?

Before enrolling in a Tally ERP 9 course near you in Mohali, ensure that the curriculum is comprehensive, covering both basic and advanced features. A complete Tally ERP 9 course will typically include the following topics:

1. Introduction to Tally ERP 9

Overview of Tally ERP 9 software

Installation and licensing process

Tally interface and navigation

Creating and managing companies in Tally

2. Accounting with Tally

Recording transactions

Ledger creation and management

Creating and managing vouchers (Payment, Receipt, Sales, Purchase, etc.)

Preparing trial balance, profit & loss account, and balance sheet

3. Inventory Management

Stock item creation

Managing stock categories and stock groups

Recording inventory transactions

Inventory reports and valuation

4. Taxation in Tally ERP 9

GST setup in Tally ERP 9

Creating GST-compliant invoices

Filing GSTR-1 and GSTR-3B

TDS and TCS management

5. Payroll Management

Employee creation and payroll setup

Salary, allowances, and deductions configuration

Generating payslips and payroll reports

EPF and ESI compliance

6. Advanced Tally Features

Cost centers and cost categories

Multi-currency management

Budgets and scenario management

Audit and security controls

7. GST in Tally ERP 9

GST registration process

GST calculation and reporting

Input tax credit management

Creating GST returns in Tally

8. Job Placement Assistance

Resume building

Interview preparation

Job placement support

Top Tally ERP 9 Institutes Near You in Mohali

Here are the top-rated Tally ERP 9 training institutes��in Mohali that offer comprehensive courses for students and professionals:

1. Mohali Career Point (MCP)

Mohali Career Point is a leading institute offering a complete Tally ERP 9 with GST course. Their curriculum is designed for beginners and professionals, ensuring you get a deep understanding of all features of Tally ERP 9.

Course Highlights:Complete Tally ERP 9 with GST training

Practical sessions on taxation, payroll, and inventory

Real-world projects and case studies

Certification upon course completion

Job placement assistance

Mode: Classroom and online

Duration: 2-3 months

Certification: Tally ERP 9 with GST certification

Contact: +91 7696 2050 51

2. Tally Academy Mohali

Tally Academy Mohali provides specialized training in Tally ERP 9 with a focus on real-world application. This institute is known for its industry-relevant training modules and experienced faculty.

Course Details:Hands-on training in Tally ERP 9

GST integration and compliance

Payroll and inventory management

Certification and job assistance

Mode: Online and offline

Contact: +91 9876 5432 10

3. ABC Institute of Technology

ABC Institute of Technology offers a well-structured Tally ERP 9 course that covers all aspects of accounting, taxation, and payroll. This institute is ideal for working professionals who need flexible class timings.

Course Overview:Tally basics and advanced features

GST compliance and reporting

Financial statements preparation

Job assistance and certification

Mode: Classroom and virtual classes

Contact: +91 8765 4321 09

4. Tally Pro Academy

Tally Pro Academy focuses exclusively on Tally ERP 9 and related accounting software. Their Tally ERP 9 course is comprehensive, covering all the critical features required to manage a business effectively.

Course Features:Complete training in Tally ERP 9

GST, TDS, and payroll management

Practical learning with real-world case studies

Certification and placement support

Mode: Online and offline classes

Contact: +91 9987 6543 21

Benefits of Learning Tally ERP 9 in Mohali

Affordable Fees: Compared to larger cities, Tally ERP 9 courses in Mohali offer high-quality training at lower costs.

Expert Trainers: Mohali has several top-notch institutes with trainers who are industry experts in accounting and finance.

Job Opportunities: The growing business environment in Mohali provides ample job opportunities for individuals skilled in Tally ERP 9.

Practical Learning: The institutes in Mohali focus on hands-on learning through real-life projects and case studies, ensuring you gain practical experience.

Career Opportunities After Tally ERP 9 Training

After completing a Tally ERP 9 course, you can explore a variety of career paths, including:

Accounts Executive

Accountant

Senior Accountant

Finance Executive

Tally Operator

GST Practitioner

Payroll Executive

With the growing need for financial management and compliance, Tally ERP 9 professionals are in demand across industries.

0 notes

Text

A Comprehensive Guide to GST Return Filing Services |Legalman

Goods and Services Tax (GST) is one of the most significant tax reforms in India, aimed at streamlining indirect taxation and promoting ease of doing business. GST return filing services is an essential process for all businesses registered under GST, ensuring compliance with the law and avoiding penalties. Filing GST returns involves reporting sales, purchases, and the tax collected or paid. It is crucial for businesses to file their returns accurately and on time to maintain a smooth operational flow and avoid any legal complications.

In this blog, we’ll delve into the importance of GST return filing services, the filing process, types of returns, and how Legalman can help you simplify your GST compliance.

What is GST Return Filing?

A GST return filing services is a document that contains the details of a business’s income, sales, and purchases, which is then submitted to the GST department for tax calculations. Every registered taxpayer must file their GST returns regularly, regardless of the type or size of the business. The GST return helps the government keep track of the inflow and outflow of taxes and ensures that businesses are following the necessary tax regulations.

Filing a GST return requires various details such as:

Total sales or turnover of the business

Details of purchases

Input tax credit (ITC) claimed on purchases

Output tax collected on sales

Other expenses and exemptions

Types of GST Returns

There are various types of GST return filing services based on the nature of the business and the turnover. The most common ones are:

GSTR-1: This return is filed to provide details of all outward supplies or sales made during a specific period. It must be filed monthly by businesses with an annual turnover of over ₹1.5 crores, while businesses below this threshold can file quarterly.

GSTR-3B: A simplified summary return filed monthly that summarizes the total outward supplies, input tax credit, and tax payable.

GSTR-9: The annual return that every registered taxpayer must file. It consolidates all the monthly or quarterly returns submitted during the financial year.

GSTR-4: This return is specifically for composition scheme taxpayers, who are small businesses with a turnover of less than ₹1.5 crore. It is filed annually.

GSTR-5 and GSTR-5A: These returns are for non-resident foreign taxpayers and service providers respectively.

GSTR-6: Input Service Distributors (ISD) are required to file this return to distribute the input tax credit to the respective branches or units.

GSTR-7 and GSTR-8: GSTR-7 is for businesses that are required to deduct TDS under GST, while GSTR-8 is for e-commerce operators who collect TCS (Tax Collected at Source).

Each type of GST return filing services a specific purpose, and the frequency of filing varies from monthly to annually depending on the business structure and turnover.

Importance of GST Return Filing

Accurate GST return filing is vital for several reasons:

Legal Compliance: Filing GST returns on time helps businesses stay compliant with the law and avoid hefty penalties or interest charges.

Claiming Input Tax Credit (ITC): Businesses can claim ITC on purchases only if their GST returns are filed correctly. This reduces the overall tax liability of the business.

Maintaining Financial Transparency: GST returns provide a clear financial snapshot of a business’s income, expenses, and tax liabilities. This is crucial for maintaining transparency and financial accuracy.

Avoiding Penalties: Non-compliance with GST regulations can lead to severe penalties, interest on late payments, and even cancellation of the GST registration. Timely filing ensures that businesses stay clear of any legal troubles.

The GST Return Filing Process

The process of GST return filing services can be complex, involving multiple steps. Here’s a brief overview:

Gathering Documents: The first step is to collect all the necessary documents, including sales invoices, purchase invoices, and other relevant financial data.

Data Compilation: All sales and purchase data must be compiled accurately to ensure that the correct details are reported.

Filing on the GST Portal: The compiled data is then uploaded to the GST portal, where businesses need to file the applicable returns (e.g., GSTR-1, GSTR-3B).

Payment of Taxes: After filing the returns, if there is any tax liability, it must be paid promptly through the portal.

Input Tax Credit Reconciliation: Businesses need to reconcile the input tax credit claimed with the output tax paid to ensure they are claiming the correct amount.

Final Submission: Once all the data is verified, the GST return is submitted online.

Challenges in GST Return Filing

GST return filing services can be a daunting task, especially for small businesses that may not have a dedicated accounting team. Some common challenges include:

Complexity of Multiple Returns: Depending on the type of business, several different returns need to be filed, each with its own set of rules and deadlines.

Errors in Data Entry: Incorrect data entry can lead to discrepancies, penalties, and delays in claiming ITC.

Changing GST Laws: The GST laws are frequently updated, making it hard for businesses to keep up with the latest regulations.

Time-Consuming Process: Filing returns manually can be a time-consuming and tedious process, especially for businesses with large volumes of transactions.

How Legalman’s GST Return Filing Services Can Help

Legalman provides comprehensive GST return filing services that simplify the entire process for businesses. Here’s how Legalman can assist you:

Expert Assistance: Legalman’s team of experienced professionals ensures that your GST returns are filed accurately and on time, helping you avoid penalties and legal complications.

Document Management: They handle the entire documentation process, ensuring that all necessary invoices and records are collected and uploaded correctly.

Compliance with Latest Rules: The team stays updated with the latest changes in GST regulations, ensuring that your business is always compliant.

Timely Filing: Legalman ensures that your returns are filed well before the deadline, reducing the risk of late fees and interest.

Affordable Services: Their GST return filing services are affordable and cater to businesses of all sizes, whether you are a small trader or a large enterprise.

Conclusion

Filing GST returns is a crucial aspect of running a business in India, but it can be complex and time-consuming. With the help of Legalman’s expert GST return filing services, you can streamline the process, ensure compliance, and focus on growing your business. Legalman takes care of all the details, from data collection to final submission, giving you peace of mind and helping you avoid any potential penalties.

For hassle-free and timely GST return filing, visit Legalman’s GST Return Filing Services today!

0 notes

Text

GST Return Due Dates: Stay Compliant and Avoid Penalties!!

The Goods and Services Tax (GST) has revolutionized the Indian taxation system, simplifying the process for businesses while ensuring transparency and accountability. However, compliance with GST regulations is crucial, and one of the most important aspects of compliance is timely filing of GST returns. Missing GST return due dates can lead to penalties, interest charges, and other legal consequences. This article delves into the importance of adhering to GST return due dates, the types of returns required, and the penalties associated with late filing.

1. Understanding GST Returns

GST returns are periodic statements that every registered taxpayer must file with the GST authorities. These returns contain details about the taxpayer’s income, sales, purchases, and tax liability, enabling the government to assess and collect the correct amount of GST.

2. Types of GST Returns

Different types of GST returns apply to different categories of taxpayers, depending on their business activities and registration type. Here’s a brief overview:

GSTR-1: This return contains details of all outward supplies (sales) made by a registered taxpayer. It must be filed monthly or quarterly, depending on the taxpayer’s turnover. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

GSTR-2A: This is a view-only return that provides details of inward supplies (purchases) made by the taxpayer. It is auto-generated from the GSTR-1 filed by the suppliers. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

GSTR-3B: A summary return that includes details of outward and inward supplies, along with tax liability and input tax credit (ITC). It must be filed monthly by all registered taxpayers. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

GSTR-4: Applicable to taxpayers under the Composition Scheme, this annual return provides a summary of outward supplies and tax paid. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

GSTR-5: Filed by non-resident taxpayers, this return contains details of outward and inward supplies, tax paid, and liability. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

GSTR-6: Filed by Input Service Distributors (ISD), this return details the distribution of input tax credit. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

3. GST Return Due Dates

The due dates for filing GST returns vary depending on the type of return and the taxpayer’s category. Here are some key deadlines:

GSTR-1:

Monthly: 11th of the following month

Quarterly: 13th of the month following the quarter

GSTR-3B: 20th of the following month

GSTR-4: 30th of April following the financial year

GSTR-5: 20th of the following month or within 7 days of expiry of registration, whichever is earlier

GSTR-6: 13th of the following month

GSTR-7: 10th of the following month

GSTR-8: 10th of the following month

GSTR-9 and GSTR-9C: 31st of December following the financial year

4. Consequences of Missing GST Return Due Dates

Filing GST returns on or before the due date is crucial to avoid penalties, interest, and other legal consequences. Here’s what happens if you miss a due date:

Late Fees: A late fee is charged for each day of delay in filing the return. The late fee for GSTR-3B and GSTR-1 is Rs. 50 per day (Rs. 25 CGST + Rs. 25 SGST), with a maximum limit of Rs. 5,000. For NIL returns, the late fee is Rs. 20 per day (Rs. 10 CGST + Rs. 10 SGST).

Interest: Interest is charged at 18% per annum on the outstanding tax liability if the return is not filed on time. The interest is calculated from the day following the due date until the date of payment.

Blocking of E-Way Bill Generation: If a taxpayer fails to file GSTR-3B for two consecutive periods, their ability to generate e-way bills will be blocked, disrupting their supply chain operations.

Restricted Input Tax Credit (ITC): Late filing of returns can result in the denial of input tax credit, as the ITC is linked to timely filing of returns.

Legal Consequences: Persistent non-compliance with GST return filing can lead to legal actions, including cancellation of GST registration and prosecution.

5. Best Practices to Stay Compliant

Maintain Accurate Records: Ensure that your financial records are accurate and up-to-date to facilitate smooth GST return filing. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

Set Reminders: Mark your calendar with GST return due dates or use automated reminders to avoid missing deadlines. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

Use GST Software: Consider using GST-compliant accounting software that automates return filing and ensures accuracy. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

Seek Professional Help: If GST compliance seems overwhelming, seek the assistance of a qualified tax professional who can manage your filings. If you are looking out for such gst returns to make your financial experience better. Then you can explore M.M. Vora And Associates website and check for their services at new gst registration service in mumbai.

6. Conclusion: Prioritize Compliance to Avoid Penalties

Timely filing of GST returns is not just a legal requirement but also a critical aspect of maintaining your business’s financial health. Staying compliant with GST return due dates helps you avoid penalties, interest, and disruptions in business operations. By understanding the types of GST returns, the applicable due dates, and the consequences of late filing, you can ensure that your business remains compliant and focused on growth. Prioritize compliance, stay organized, and consider professional assistance if needed to navigate the complexities of GST.

Apart from the above gst registration consultants in goregaon & roc filing company in mumbai. If you are looking out for llp formation services in goregaon, income tax return filing in goregaon or the book keeping services in mumbai than there is no other company better than M.M. Vora & Associaties which provides the best financial service in the market. Then you can check it out at the official the M.M. Vora & Associaties website.

To Know More https://www.caassociates.in/new-gst-registration-services-in-mumbai/

0 notes

Text

Filing GST Returns Online? : Expert Tips from TaxDunia , the Best Income Tax Consultant in India

What is the GST Return?

A GST return is a document that taxpayers (businesses registered under the GST regime) must file with the tax authorities. It contains details of income, purchases, sales, and taxes paid. Based on this return, the government calculates the tax liability of a business. Filing GST returns accurately and on time is crucial to stay compliant with Indian tax laws.

In India, the Goods and Services Tax (GST) has streamlined the taxation system, making it easier for businesses to comply with tax regulations. Filing GST returns online is a crucial aspect of this system, and it’s essential for businesses to understand the process to avoid penalties and ensure smooth operations. This guide will walk you through the steps of Online GST return filing and highlight the importance of choosing the right GST Return Filing Services in India.

Navigating the complexities of the Goods and Services Tax (GST) return filing process can be challenging, especially for businesses striving to maintain compliance and avoid penalties. With the guidance of TaxDunia, recognized as the best income tax consultant in India, filing your GST returns online becomes a seamless experience. In this FAQ-style blog, we provide expert tips and answers to common questions related to GST return filing, ensuring that you’re well-equipped to handle your tax obligations.

Easy Guide to Filing GST Returns Online in India:

Step 1: Obtain GST Registration

Before you can file GST returns, your business must be registered under GST. You can do this by availing of GST Registration Service from Top Income Tax Consultants like TaxDunia. Once registered, you will receive a unique GSTIN (Goods and Services Tax Identification Number) that you will use for all future transactions and filings.

Step 2: Collect Required Information

To file your GST return, you need to gather all the necessary documents and information. This includes:

Sales and purchase invoices

Debit and credit notes

Bank statements

Details of tax collected and paid

This information is essential for accurately reporting your income and claiming input tax credits.

Step 3: Sign in to the GST Website

Visit the official GST portal (www.gst.gov.in) and log in using your credentials. If you do not have an account, you can create one using your GSTIN.

Step 4: Select the Appropriate GST Return Form

Once logged in, navigate to the ‘Services’ tab, select ‘Returns,’ and choose the return form applicable to your business. For most regular taxpayers, GSTR-3B and GSTR-1 are the commonly used forms.

Step 5: Fill in the Details

Enter all the required details in the selected GST return form. Ensure that you provide accurate information, especially regarding sales, purchases, and tax paid. The GST portal provides options to upload invoices, which can make this process easier.

Step 6: Verify and Submit

After filling in all the details, check them carefully to make sure everything is correct. Mistakes can result in fines, so it’s important to review everything. Once you’re sure it’s right, submit the return.

Step 7: Pay Tax Liability

If you have a tax liability after claiming input tax credits, you must pay it before submitting the return. You can pay this online through net banking, debit/credit card, or other available payment options on the GST portal.

Step 8: File Return

After payment, you can proceed to file your GST return. Upon successful submission, you will receive an acknowledgment reference number (ARN) as proof of filing.

Who Needs to File GST Returns?

All businesses registered under GST are required to file GST returns, regardless of whether they have made any sales during the tax period. This includes:

Regular taxpayers

Composition scheme taxpayers

Non-resident taxpayers

Input service distributors

E-commerce operators

Even if your business falls under a specific category, seeking the help of Top Income Tax Consultants like TaxDunia can simplify the process and ensure that you’re filing the correct returns.

Why Choose TaxDunia as Your Income Tax Consultant?

TaxDunia is recognized as the best income tax consultant in India for a reason. Their expertise in GST return filing, combined with their commitment to client satisfaction, makes them the ideal choice for businesses of all sizes. Whether you need help with filing returns, GST registration, or compliance, TaxDunia offers comprehensive services tailored to your needs.

TaxDunia offers end-to-end support for goods and services tax filing, from preparing and reviewing your returns to submitting them online. Their team of experts ensures that all details are accurate and that your business complies with the latest GST regulations.

TaxDunia is renowned as the best income tax consultant in India. Here’s why:

Expertise: With years of experience in tax consulting, TaxDunia offers comprehensive solutions for GST Registration Service, Online GST return filing, and other Tax Consultant Services.

Personalized Services: TaxDunia tailors its services to meet the specific needs of your business, ensuring you get the best possible advice and support.

Client-Centric Approach: TaxDunia values its clients and works tirelessly to provide the best service, making it one of the Top Income Tax Consultants in India.

Common Challenges in GST Return Filing and How TaxDunia Can Help

Filing GST returns can present several challenges, especially for small and medium-sized businesses:

Complexity: Understanding the various forms and their requirements can be confusing.

Keeping Track of Deadlines: Missing deadlines can result in penalties and interest charges.

Reconciling Data: Matching sales and purchase data with the GST portal can be time-consuming.

Claiming Input Tax Credit: Ensuring that all eligible input tax credits are claimed correctly is crucial for reducing tax liability.

TaxDunia Best Income Tax Advisors can help you overcome these challenges by providing expert guidance and support. They ensure that your returns are filed correctly and on time, helping you avoid any legal issues.

New GST Return (FAQs) — Frequently Asked Questions

1.What is the new GST return system?

The new GST return system is a simplified tax return filing process introduced by the Indian government to replace the earlier GSTR-1, GSTR-2, and GSTR-3 returns. It aims to make the goods and services tax filing process more straightforward for taxpayers.

2. Who needs to file the new GST returns?

All taxpayers registered under GST, except composition taxpayers, need to file the new GST returns. This includes regular taxpayers, input service distributors, non-resident taxable persons, and e-commerce operators.

3. What are the different forms under the new GST return system?

The new GST return system consists of three main forms:

GST RET-1 (Normal): For regular taxpayers with more complex transactions.

GST RET-2 (Sahaj): For taxpayers with only B2C (Business-to-Consumer) transactions.

GST RET-3 (Sugam): For taxpayers with both B2B (Business-to-Business) and B2C transactions.

4. What is the role of GST ANX-1 and GST ANX-2 forms?

GST ANX-1: This annexure captures the details of outward supplies, imports, and inward supplies liable to reverse charge.

GST ANX-2: This annexure auto-populates the details of inward supplies received from the suppliers, which the recipient can accept, reject, or keep pending.

5. How do I file the new GST return online?

You can file the new GST return online by logging into the GST portal using your credentials, selecting the appropriate return form (GST RET-1, RET-2, or RET-3), filling in the necessary details, and submitting the return. Businesses can seek professional assistance from GST Return Filing Services in India to ensure accurate and timely filing.

6. What are the deadlines for filing the new GST returns?

The deadlines for filing the new GST returns depend on the type of taxpayer and the form being filed:

GST RET-1 (Normal): Monthly or quarterly, depending on turnover.

GST RET-2 (Sahaj): Quarterly.

GST RET-3 (Sugam): Quarterly.

It’s important to meet these deadlines to avoid extra fees and charges.

7. Can I claim Input Tax Credit (ITC) under the new GST return system?

Yes, you can claim Input Tax Credit under the new GST return system. The details of eligible ITC will be auto-populated in the GST ANX-2 form, which you can accept and claim while filing your return.

8. What happens if there is a mismatch in the ITC claim?

If there is a mismatch between the ITC claimed by the recipient and the details provided by the supplier, it will be flagged in the GST ANX-2 form. The recipient will have the option to either reconcile the difference or follow up with the supplier for correction.

9. What is the GST PMT-08 form?

The GST PMT-08 form is used by taxpayers under the new return system to pay tax on a monthly basis. It acts as a self-declaration for tax payment, and the amount paid will be reflected in the return filed.

10. How does the new return system impact small businesses?

The new GST return system is designed to be more user-friendly for small businesses, especially with the introduction of simplified returns like Sahaj (GST RET-2) and Sugam (GST RET-3). These forms reduce the compliance burden on small businesses by streamlining the return filing process.

11. Can I correct my GST return after it’s been submitted?

No, the new GST return system does not allow for the revision of returns after filing. However, you can make corrections in the subsequent returns if needed.

12. What is the Nil Return in the new GST return system?

A Nil Return is a return filed by a taxpayer when there are no transactions during a particular tax period. Even if there are no transactions, registered taxpayers are required to file a Nil Return to stay compliant.

13. What is the penalty for late filing of the new GST return?

The penalty for late filing of the new GST return is Rs. 50 per day for normal taxpayers (Rs. 25 each for CGST and SGST). For Nil returns, the penalty is Rs. 20 per day (Rs. 10 each for CGST and SGST).

14. How does the new GST return system simplify compliance?

The new GST return system simplifies compliance by reducing the number of returns and introducing auto-populated forms like GST ANX-2, which minimizes manual data entry and errors. It also provides a user-friendly interface for filing returns online.

15. Can I file my GST return on my own, or should I hire a consultant?

While you can file your GST return on your own, it’s advisable to seek the help of Top Income Tax Consultants like TaxDunia to ensure accuracy and compliance. Professional Tax Consultant Services can help you navigate the complexities of the GST system and avoid potential penalties.

16. What are the benefits of using GST Return Filing Services in India?

Using GST Return Filing Services in India offers several benefits, including:

Accuracy: Ensures accurate and error-free returns.

Timeliness: Helps you meet deadlines and avoid penalties.

Compliance: Keeps you updated with the latest GST regulations.

Peace of Mind: Allows you to focus on your core business activities.

17. How does the new GST return system impact input service distributors (ISD)?

Input service distributors must file the GST ANX-1 form to distribute input tax credit to their units. The process is similar to the earlier system, with some modifications to accommodate the new return format.

Conclusion

Filing GST returns online in India is a crucial task that requires careful attention to detail and adherence to deadlines. By following the steps outlined in this guide, you can ensure that your returns are filed accurately and on time. However, given the complexities involved, it’s often beneficial to seek the assistance of professionals like TaxDunia.

TaxDunia, recognized as the best income tax consultant in India, offers comprehensive GST Return Filing Services in India. Their expertise in Tax Consultant Services and GST Registration Service makes them the ideal partner for your goods and services tax filing needs. Whether you’re a small business owner or a large corporation, TaxDunia’s team of Best Income Tax Advisors can help you navigate the complexities of GST and ensure your business remains compliant with all tax regulations.

For more information on how TaxDunia can assist you with Online GST return filing, visit their website at www.taxdunia.com.

Other Link

Private Limited Company Registration

One Person Company Registration Service in India

Trademark Registration in India

TDS Return Filing Service in India

Copyright Registration in India

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Gst Return Filing Services in India#Gst Registration Service#Online Gst return filing#goods and services tax filing#income tax#itr filling#itr filing#finance#gst filling#taxdunia#tax consultants#gst return

0 notes

Text

Tally Tips and Tricks: Streamlining Your Financial Processes

Tally, one of the most popular accounting software solutions, is known for its robust features and user-friendly interface. Whether you're a seasoned accountant or a small business owner, mastering Tally can significantly enhance your financial management efficiency. At [Your Training Institute], we’re committed to helping you make the most out of this powerful tool. Here are some valuable tips and tricks to optimize your Tally experience.

1. Utilize Shortcut Keys for Speed and Efficiency

Tally offers a range of shortcut keys that can save you time and streamline your workflow. Here are a few essential ones:

F1: Select Company

F2: Change Date

F3: Select Company

Alt + C: Create a new ledger or master item on the fly

Ctrl + A: Accept a form or screen

Memorizing and using these shortcuts can significantly speed up your data entry and navigation in Tally.

2. Customize the Tally Interface

Tailoring the Tally interface to your preferences can make your work easier and more efficient:

Change Screen Resolution: Adjust the screen resolution to match your monitor for a clearer view.

Custom Fields: Add custom fields to forms and reports to capture additional information relevant to your business.

3. Leverage Tally’s Powerful Reporting Features

Tally’s reporting capabilities are extensive. Here are some tips to get the most out of them:

Configure Reports: Customize report formats to include only the information you need.

Use Filters: Apply filters to reports to focus on specific data, such as date ranges or particular ledger accounts.

Export Reports: Export reports in various formats (PDF, Excel) for easy sharing and analysis.

4. Implement Security Controls

Protecting your financial data is crucial. Tally offers several security features:

User Roles and Permissions: Define user roles and set permissions to control access to sensitive data.

Password Protection: Use strong passwords for company data files and ensure they are changed regularly.

Audit Trail: Enable the audit trail feature to keep track of all changes made in the accounts.

5. Automate Repetitive Tasks

Automation can help reduce errors and save time:

Recurring Entries: Use the recurring journal entries feature for transactions that occur regularly, such as monthly rent or utility payments.

Auto Bank Reconciliation: Automate the bank reconciliation process by importing bank statements directly into Tally.

6. Use Tally’s Integrated GST Features

Tally makes GST compliance straightforward:

GST Configuration: Ensure your GST settings are correctly configured based on your business requirements.

Generate GST Reports: Easily generate GST returns and reports, including GSTR-1, GSTR-3B, and more, directly from Tally.

7. Backup Your Data Regularly

Regular backups are essential to prevent data loss:

Manual Backup: Use the backup feature in Tally to create manual backups of your data files.

Automatic Backup: Set up automatic backups to ensure your data is regularly saved without manual intervention.

8. Stay Updated with the Latest Tally Versions

Tally regularly releases updates and new features:

Update Notifications: Keep an eye on update notifications and install the latest versions to benefit from new features and improvements.

Training and Support: Take advantage of training resources and support offered by Tally and [Your Training Institute] to stay current with the software’s capabilities.

Conclusion

Mastering Tally can significantly enhance your financial management processes, providing you with powerful tools to manage your business efficiently. By leveraging these tips and tricks, you can optimize your use of Tally and unlock its full potential.

At [Your Training Institute], we offer comprehensive Tally training programs designed to help you become proficient in using this essential software. Whether you're a beginner or looking to enhance your existing skills, our expert-led courses provide the knowledge and hands-on experience you need to succeed.

Ready to take your Tally skills to the next level? Explore our training programs at [Your Training Institute] and start streamlining your financial processes today.

0 notes

Text

GST Return Types: Due Dates and Filing Procedures

Browsing the problem of Providers as well as Item Tax Obligation (GST) returns can be inhibiting for firms plus experts alike. Comprehending the various sorts of GST returns their due days as well as the submitting treatments is necessary for conformity and also smooth economic procedures. For those wanting to improve their understanding a Certificate course in GST or an on-line GST program with a certification can be important. These training courses provide organized together with extensive understandings right into GST regulations making sure that individuals are well-versed in the useful elements of GST returns. Understanding GST Returns GST returns are routine declarations that taxpayers require to submit with the tax obligation authorities. These returns catch information of the revenue, sales, acquisitions together with tax obligation paid or gathered on sales. Below are the key kinds of GST returns that every taxpayer ought to know:

GSTR-1: Details of unparalleled materials of products or solutions GSTR-2A: Auto-populated information of inbound materials based upon the information supplied by distributors GSTR-2B: Static declaration for ITC (Input Tax Credit) asserting GSTR-3B: Summary return for proclaiming the recap of unmatched materials in addition to ITC declared, settlement of tax obligation coupled with various other responsibilities GSTR-4: Return for make-up system taxpayers GSTR-5: Return for non-resident international taxpayers GSTR-6: Return for input solution representatives GSTR-7: Return for authorities subtracting tax obligation at resource GSTR-8: Return for shopping drivers GSTR-9: Annual go back to for routine taxpayers GSTR-9A: Annual go back to for make-up system taxpayers GSTR-10: Final go back to for taxpayers whose GST enrollment is terminated or given up GSTR-11: Return for Unique Identity Number owners Due Dates for GST Returns Each kind of GST return has particular due days which taxpayers need to follow in order to prevent charges as well as rate of interest. Right here's a thorough consider the due days for the different GST returns:

GSTR-1: 11th of the list below month (regular monthly filers) or end of the month complying with the quarter (quarterly filers under the QRMP plan). GSTR-2A as well as GSTR-2B: These are auto-populated plus do not have a declaring due day however are vital for ITC settlement. GSTR-3B: 20th of the list below month for regular monthly filers as well as 22nd or 24th of the month complying with the quarter for quarterly filers (under QRMP plan based upon the state). GSTR-4: 30th April complying with the end of the financial year. GSTR-5: 20th of the list below month or within 7 days after expiry of enrollment. GSTR-6: 13th of the list below month. GSTR-7: 10th of the list below month. GSTR-8: 10th of the list below month. GSTR-9: 31st December complying with the end of the financial year. GSTR-9A: 31st December adhering to completion of the financial year (optional from FY 2019-20 onwards). GSTR-10: Within 3 months of the day of termination or the day of termination order, whichever is later on GSTR-11: 28th of the month complying with the month in which the declaration is equipped. Filiing Procedures for GST Returns. The procedure of declaring GST returns includes a number of actions and also comprehending these can guarantee prompt and also exact conformity. Right here's an enter guideline to submitting various sorts of GST returns:.

1.Login to the GST Portal:

Accessibility the GST website utilizing your qualifications (GSTIN, username, together with password). 2.Choose the Return:

Pick the sort of return you require to submit from the control panel (e.g., GSTR-1, GSTR-3B, and so on). 3.Prepare the Return:.

For returns like GSTR-1 by hand get in the information of unmatched products or utilize the mass upload center. For returns like GSTR-3B sum up the sales, acquisitions, ITC declared, and also tax obligation paid. 4.Reconcile Data:.

Make certain that the information of sales plus acquisitions compare with your documents as well as settle with GSTR-2A together with GSTR-2B to assert exact ITC. 5.Submit the Return:.

As soon as the return is prepared send it on the site. The system will certainly confirm the information. 6.Payment of Tax:

If there is any type of tax obligation obligation make the settlement utilizing the ideal settings (electronic banking, credit/debit card, NEFT/RTGS). 7.File the Return:

After effective entry and also settlement continue to submit the return utilizing the DSC (Digital Signature Certificate) or EVC (Electronic Verification Code). 8.Acknowledgment After declaring, an ARN (Acknowledgment Reference Number) is created validating the entry. Value of Timely Filing. Prompt declaring of GST returns is important to prevent fines, rate of interest coupled with lawful effects. Late declaring can lead to:.

Late Fees: A fine of ₹ 50 each day for typical taxpayers (₹ 25 CGST and also ₹ 25 SGST) and also ₹ 20 each day for nil filers (₹ 10 CGST and also ₹ 10 SGST). Interest: Interest at 18% per year on the exceptional tax obligation obligation. Utilizing Certificate Courses for Mastery. To understand the ins and outs of GST and also guarantee conformity signing up in a Certificate training course in GST can be extremely useful. These programs cover all elements of GST, from enrollment to return declaring, as well as deal functional understandings right into managing real-world situations.

Advantages of a Certificate Course in GST. Thorough Learning: In-depth understanding of GST legislations, policies, and also guidelines. Practical Training: Hands-on training with real-life instances as well as study. Professional Guidance: Learn from skilled experts and also GST experts. Qualification: Gain an acknowledged accreditation that can improve your profession leads. Constant Updates: Stay upgraded with the current modifications as well as modifications in GST legislation. Conclusion Comprehending the sorts of GST returns their due days and also the declaring treatments is essential for every single taxpayer to make sure conformity together with prevent charges. A Certificate course in GST or a GST online course with a certificate can equip people with the required abilities combined with expertise to browse the GST program properly. By remaining notified as well as sticking to the recommended timelines as well as treatments, companies can handle their tax obligation responsibilities successfully as well as add to the country's financial wellness.

0 notes

Text

#gsttax - 15% · #gst - 14% · #gstr - 9% · #tax - 9% · #gstindia - 9% · #gstfiling - 8% · #incometax - 8% · #taxes - 8% ...

#institute #keytec

0 notes

Text

All About Barring Of GST Returns After 3 Years

What Is Barring Of GST Returns?Changes in CGST ActYou May Also LikeGet Free Updates[Join WhatsApp Group] What Is Barring Of GST Returns? Vide Clause 142, 143, 144 and 145 of the Finance Act, 2023 notified vide Notification No. 28/2023- Central Tax dated 31st July, 2023, the Government has notified provisions for barring of GST returns. These returns include GSTR-1, GSTR 3B, GSTR-4, GSTR-5,…

#CBIC#GST#GST PORTAL#GST RETURNS#GSTN PORTAL#GSTR-1#GSTR-3B#GSTR-4#GSTR-5#GSTR-5A#GSTR-6#GSTR-7#GSTR-8#GSTR-9

0 notes

Text

OPC Compliance: Your Guide to Legal Requirements

A One Person Company (OPC) is a unique type of business entity introduced under the Companies Act 2013. It allows a single individual to form a company and enjoy the benefits of a corporate structure while avoiding many of the complexities associated with traditional business structures. However, despite being simpler, Annual Compliance For Opc are required to follow certain obligations to stay compliant with legal and regulatory requirements.

1. Annual Return Filing (MGT-7A)

Every OPC must file an annual return in Form MGT-7A, a simplified form designed for OPCs and small companies. This return contains details of the management, financial summary, and shareholders. It should be filed with the Registrar of Companies (RoC) within 60 days of the conclusion of the Annual General Meeting (AGM).

Due Date: Within 60 days from the date of AGM or the due date of AGM (which is six months from the end of the financial year).

2. Financial Statement Filing (AOC-4)

The OPC's financial statements must be filed in Form AOC-4. This form includes the balance sheet, profit and loss account, and other related financial documents. It is crucial to get these statements audited by a Chartered Accountant.

Due Date: Within 180 days from the closure of the financial year (typically, the due date is 27th September).

3. Income Tax Returns

OPCs must file their income tax returns by the prescribed date. The tax rates for OPCs follow the same guidelines as those applicable to private limited companies, and any profits are taxed at a flat rate of 25-30%, depending on the turnover.

Due Date: 30th September of the relevant assessment year.

4. GST Filings

If the OPC is registered under GST, it needs to file monthly or quarterly GST returns (depending on the turnover). Additionally, an annual GST return (GSTR-9) summarising all the transactions must be filed.

Monthly/Quarterly Returns: GSTR-1 and GSTR-3B.

Annual Return: GSTR-9 (if applicable).

5. Board Meetings

An OPC with more than one director is not required to hold board meetings. However, if the company has more than one director, it must hold at least two board meetings each year. The gap between these meetings is 90 days at most.

6. Audit of Accounts

Just like other companies, an OPC is required to get its financial accounts audited. The appointment of an auditor is mandatory, and the auditor must audit the books of accounts and submit a report.

7. Director's Report

A Director's Report must be attached along with the financial statements. This report highlights the financial status of the company and other related information such as risks, plans, etc.

8. Other Compliance

KYC of Directors: Every director of an OPC must file DIR-3 KYC annually to update their KYC information with the Ministry of Corporate Affairs (MCA).

Form DPT-3: If the company has accepted deposits, Form DPT-3 needs to be filed. It is a declaration of the return of deposits or outstanding receipt of money.

Penalties for Non-Compliance

Failure to comply with the annual compliance requirements can result in penalties for the OPC. These penalties can range from fines for late filings to disqualification of directors or even legal actions against the company.

Conclusion

While an OPC offers flexibility and control to a single person, it’s essential to adhere to the annual compliance requirements to maintain the company’s legal standing. Timely filing of forms, keeping proper records, and staying updated with legal requirements can help avoid hefty penalties and ensure smooth business operations.

0 notes

Text

GSTR-8: Return Filing, Format, Eligibility and Rules

🔍 Explore GSTR-8: Navigate the filing process, eligibility criteria, and rules for a seamless Goods and Services Tax Return. Stay informed and ensure compliance effortlessly. 💼✨

✅ Learn about filing format and eligibility. ✅ Discover rules governing GST compliance.

Ready to elevate your tax knowledge? 📚💡

Read Our Detailed article in the below link 👇- https://www.mygstrefund.com/gstr-8-returnfiling-format-eligibility-rules/

THANKS FOR READING! We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com Join Our Community: community.mygstrefund.com Contact Us: +91 9205005072 Mail- [email protected]

#GST#TaxCompliance#BusinessFinance#FinanceInsights#CorporateTax#LinkedInEngagement#ProfessionalDevelopment#TaxReturn#FinancialKnowledge#ComplianceMatters#ExpertInsights

0 notes

Text

A Goods and Services Tax (GST) audit is a comprehensive review of a taxpayer's financial records, returns, and compliance with the provisions of the Central Goods and Services Tax Act, 2017 (CGST Act) and its corresponding state GST acts. The primary objective of a GST audit is to ensure that taxpayers are accurately reporting their GST liabilities, claiming eligible input tax credits (ITC), and complying with the various provisions of the GST laws.

Here is a detailed overview of the GST audit process in accordance with the CGST Act of 2017:

1. Applicability:

- GST audits are applicable to certain categories of taxpayers, including those with a specified annual turnover threshold, as prescribed by the government.

- Taxpayers whose annual turnover exceeds the threshold limit are required to get their accounts audited by a qualified chartered accountant or a cost accountant.

2. Audit Period:

- The audit covers a specific financial year or multiple financial years, as determined by the tax authorities.

3. Appointment of Auditor:

- Taxpayers subject to GST audit must appoint a qualified auditor, such as a Chartered Accountant (CA) or Cost Accountant, to conduct the audit.

4. Audit Process:

- The auditor examines the taxpayer's books of accounts, records, invoices, and other relevant documents to verify the correctness of the reported GST transactions.

- They assess the accuracy of GST returns filed, including GSTR-1 (outward supplies), GSTR-3B (monthly summary return), and GSTR-2A (auto-populated purchase details).

- The auditor checks the reconciliation of ITC claimed in GSTR-3B with eligible invoices and relevant provisions.

5. Verification of Compliance:

- The auditor ensures that the taxpayer has complied with various GST provisions, such as:

- Timely filing of returns

- Correct classification of goods and services

- Proper valuation of supplies

- Correct calculation of GST liability

- Timely payment of GST

- Adherence to reverse charge mechanism (if applicable)

- Applicability of GST on exempt and non-GST supplies

- Compliance with anti-profiteering provisions

6. Audit Report:

- The auditor prepares an audit report, which includes findings, observations, discrepancies, and recommendations.

- The audit report must be submitted to the taxpayer within the prescribed timeframe.

7. Response and Rectification:

- After receiving the audit report, the taxpayer has the opportunity to respond to the findings and rectify any discrepancies or errors.

- If necessary, the taxpayer may need to make additional tax payments or file revised returns to correct any mistakes.

8. Submission to Tax Authorities:

- The taxpayer submits the audit report along with their response to the tax authorities within the stipulated timeframe.

9. Action by Tax Authorities:

- The tax authorities review the audit report and the taxpayer's response.

- If discrepancies are found and the taxpayer's response is unsatisfactory, the authorities may initiate further investigations and take appropriate action, including the imposition of penalties.

10. Conclusion:

- The GST audit process concludes once the tax authorities have reviewed the audit report and taken any necessary actions.

It's important for businesses to maintain accurate records and comply with GST provisions to avoid penalties and legal consequences. The GST audit process is a crucial mechanism for ensuring tax compliance and preventing tax evasion in the GST regime.

0 notes

Text

Online GST Registration in India

The Goods and Services Tax (GST) regime, introduced in India in July 2017, has revolutionized the country's taxation system. It has replaced a complex web of indirect taxes with a unified tax structure, making compliance easier for businesses. One of the essential steps for businesses is GST registration, which is now conveniently accessible online. In this article, we will provide a comprehensive guide to the online GST registration process in India, covering its significance, eligibility criteria, and step-by-step instructions.

Significance of GST Registration

GST registration is a legal requirement for businesses that engage in the supply of goods or services in India. It is essential for several reasons:

1. Legitimate Business Operation: GST registration legitimizes your business in the eyes of the law, making it mandatory for certain businesses with turnover thresholds.

2.Input Tax Credit (ITC): Registered businesses can claim ITC on GST paid for input goods and services, reducing their tax liability.

3.Compliance: GST registration ensures that you comply with the GST law, avoiding legal penalties and consequences.

Eligibility Criteria

Not all businesses are required to register for GST. The eligibility criteria are as follows:

a. Threshold Turnover: Businesses with an aggregate turnover exceeding INR 20 lakhs (INR 10 lakhs for Special Category States) must register for GST. However, certain businesses, like those involved in the supply of goods, are required to register even if their turnover is below the threshold.

b. Interstate Supply: Any business involved in the interstate supply of goods or services must register for GST, regardless of turnover.

c. E-commerce Operators: E-commerce operators and aggregators must register, irrespective of turnover.

Steps for Online GST Registration

Now, let's delve into the step-by-step process of online GST registration in India:

1 Visit the GST Portal: Access the official GST portal (https://www.gst.gov.in/) and click on the "Register Now" option.

2. Fill in the Basic Details: You'll need to provide details such as your legal name, PAN, email address, and mobile number. After filling in the details, an OTP (One-Time Password) will be sent to your email and mobile for verification.

3.OTP Verification: Enter the OTP received on your email and mobile to verify your identity.

4.Temporary Reference Number (TRN): Once verified, you'll receive a Temporary Reference Number (TRN). You can use this TRN to log in and complete the registration process later.

5. Complete the Application: Log in with your TRN and fill in the GST registration application. You'll need to provide details about your business, place of business, bank account, and authorized signatory.

6.Upload Documents: Attach the required documents, including proof of business registration, bank account details, and photographs of the authorized signatory.

7.Verification: After submitting the application, a verification officer will review your application. This may involve a physical visit to your business premises.

8. GSTIN Allocation: Once your application is approved, you will receive a unique Goods and Services Tax Identification Number (GSTIN).

9. GST Certificate: Finally, you'll receive a GST certificate with your GSTIN, which signifies your successful GST registration.

Compliance and Ongoing Obligations

After obtaining GST registration, businesses must adhere to certain ongoing obligations:

1 GST Returns: Registered businesses must file regular GST returns, including GSTR-1 (outward supplies), GSTR-3B (summary of sales and purchases), and GSTR-4 (for composition scheme taxpayers).

2.Timely Payments: Ensure that you pay the GST collected to the government within the prescribed due dates.

3.Compliance with Rules: Stay updated with the latest GST rules and regulations to avoid non-compliance and penalties.

4.Records Maintenance: Maintain proper records of invoices, receipts, and other relevant documents for at least 72 months.

Conclusion

Online GST registration in India has simplified the process of complying with the country's GST laws. It is crucial for businesses to understand the significance of GST registration, the eligibility criteria, and the step-by-step process to ensure smooth and legal operations. By registering for GST online, businesses can not only avoid legal repercussions but also benefit from input tax credits and become part of India's streamlined taxation system, contributing to the nation's economic growth and development.

0 notes