#GDP Enforcement

Explore tagged Tumblr posts

Text

Tumblr Dot Com going through the 1980's Gosplan debates in real time, you love to see it

So why do new hospitals have to justify their existence with Certificates of Need?

A number of factors spurred states to require CONs in the healthcare industry. Chief among these was the concern that the construction of excess hospital capacity would cause competitors in an oversaturated field to cover the costs of a diluted patient pool by overcharging, or by convincing patients to accept hospitalization unnecessarily

can we just burn the entire healthcare industry to the ground and start from scratch?

#But yeah trust me once you have shed the ~30% of GDP that is blatant rent extraction from legally-enforced cartels#you will have plenty of time to worry about “excess capacity”

271 notes

·

View notes

Text

Republican Incompetence is Historic

Somehow there's a perception that Republicans are good with the economy but over the last hundred years every Republican president except Eisenhower has led the nation into recession or worse. Harding, Coolidge, and Hoover guided the nation into the Great Depression. Roosevelt got us out. Nixon inherited a dicey but growing economy and led the nation into the worst recession since the Great Depression (a phrase that comes up a lot). Carter inherited stagflation but got the economy growing again. Reagan was told his plan would cause a recession and promised not to cause a recession. He caused a recession with the worst unemployment since the Great Depression. The jobs that eventually came back paid 22% less than the jobs that were lost. Since then income for 90% of the people has been mostly flat relative to inflation and reduced relative to productivity and GDP. George H. W. Bush, recession. Clinton turned over to W an economy that was in a position to pay off the national debt. W led the nation into the Republican Recession, a recession born of Republican ideas such as deregulation and malicious refusal to enforce the laws governing the banking industry, and the superiority of the rich. Obama got us out. Trump bungled Covid so bad he caused the highest unemployment rates since the Great Depression. Biden got us out. Trump's first quarter has already resulted in negative growth. It's time to end the lie that Republicans are good at running an economy. They are only good at running it into the ground.

#donald trump#republicans#democracy#government#democrats#republican assholes#maga morons#republican hypocrisy#crooked donald#resist

23 notes

·

View notes

Text

M.Wuerker

* * * *

LETTERS FROM AN AMERICAN

June 30, 2025

Heather Cox Richardson

Jul 01, 2025

"This is the most deeply immoral piece of legislation I have ever voted on in my entire time in Congress,” said Senator Chris Murphy (D-CT).

“[W]e're debating a bill that’s going to cut healthcare for 16 million people. It's going to give a tax break to…massively wealthy people who don't need any more money. There are going to be kids who go hungry because of this bill. This is the biggest reduction in…nutrition benefits for kids in the history of the country.” Murphy continued: “We're obviously gonna continue to offer these amendments to try to make it better. So far not a single one of our amendments…has passed, but we'll be here all day, probably all night, giving Republicans the chance over and over and over again to slim down the tax cuts for the corporations or to make life a little bit…less miserable for hungry kids or maybe don't throw as many people off of healthcare. Maybe don't close so many rural hospitals. It's gonna be a long day and a long night.”

“This bill is a farce,” said Senator Angus King (I-ME). “Imagine a bunch of guys sitting around a table, saying, ‘I've got a great idea. Let's give $32,000 worth of tax breaks to a millionaire and we’ll pay for it by taking health insurance away from lower-income and middle-income people. And to top it off, how about we cut food stamps, we cut SNAP, we cut food aid to people?’... I've been in this business of public policy now for 20 years, eight years as governor, 12 years in the United States Senate. I have never seen a bill this bad. I have never seen a bill that is this irresponsible, regressive, and downright cruel.”

“When I worked here in the 70's,” King said, “I had insurance as a…junior staff member in this body 50 years ago. Because I had that insurance that covered a free checkup, I went in and had my first physical in eight years…and the doctors found a little mole on my back. And they took it out. And I didn't think much of it. And I went in a week later and the doctor said, ‘You better sit down, Angus. That was malignant melanoma. You're going to have to have serious surgery.’… And I had the surgery and here I am. If I hadn’t had insurance, I wouldn’t be here. And it’s always haunted me that some young man in America that same year had malignant melanoma, he didn’t have insurance, he didn’t get that checkup, and he died. That’s wrong. It’s immoral.”

Senator King continued: “I don’t understand the obsession and I never have…with taking health insurance away from people. I don’t get it. Trying to take away the Affordable Care Act in 2017 or 2018 and now this. What’s driving this? What’s the cruelty to do this, to take health insurance away from people knowing that it’s going to cost them…up to and including…their lives.”

In fact, the drive to slash health insurance is part of the Republicans’ determination to destroy the modern government.

Grover Norquist, a lawyer for the U.S. Chamber of Commerce and one of the key architects of the Republican argument that the solution to societal ills is tax cuts, in 2010 described to Rebecca Elliott of the Harvard Crimson how he sees the role of government. “Government should enforce [the] rule of law,” he said. “It should enforce contracts, it should protect people bodily from being attacked by criminals. And when the government does those things, it is facilitating liberty. When it goes beyond those things, it becomes destructive to both human happiness and human liberty.”

Norquist vehemently opposed taxation, saying that “it’s not any of the government’s business who earns what, as long as they earn it legitimately,” and proposed cutting government spending down to 8% of gross domestic product, or GDP, the value of the final goods and services produced in the United States.

The last time the level of government spending was at that 8% of GDP was 1933, before the New Deal. In that year, after years of extraordinary corporate profits, the banking system had collapsed, the unemployment rate was nearly 25%, prices and productivity were plummeting, wages were cratering, factories had shut down, farmers were losing their land to foreclosure. Children worked in the fields and factories, elderly and disabled people ate from garbage cans, unregulated banks gambled away people’s money, and business owners treated their workers as they wished. Within a year the Great Plains would be blowing away as extensive deep plowing had damaged the land, making it vulnerable to drought. Republican leaders insisted the primary solution to the crisis was individual enterprise and private charity.

When he accepted the Democratic nomination for president in July 1932, New York governor Franklin Delano Roosevelt vowed to steer between the radical extremes of fascism and communism to deliver a “New Deal” to the American people.

The so-called alphabet soup of the New Deal gave us the regulation of banks and businesses, protections for workers, an end to child labor in factories, repair of the damage to the Great Plains, new municipal buildings and roads and airports, rural electrification, investment in artists and writers, and Social Security for workers who were injured or unemployed. Government outlays as a percentage of GDP began to rise. World War II shot them off the charts, to more than 40% of GDP, as the United States helped the world fight fascism.

That number dropped again after the war, and in 1975, federal expenditures settled in at about 20% of GDP. Except for short-term spikes after financial crises (spending shot up to 24% after the 2008 crash, for example, and to 31% during the 2020 pandemic), the spending-to-GDP ratio has remained at about that set point.

The national debt is growing because tax revenues have plummeted. Tax cuts under the George W. Bush and Trump administrations are responsible for 57% of the increase in the ratio of the debt to the economy, 90% if you exclude the emergency expenditures of the pandemic, and have left the United States with a tax burden nowhere close to the average of the 38 other nations in the Organization of Economic Cooperation and Development (OECD), all of which are market-oriented democracies. And those cuts have gone primarily to the wealthy and corporations.

Republicans who backed those tax cuts now want more. They are trying to force through a measure that will dramatically cut the nation’s social safety net while at the same time increasing the national debt by $3.3 trillion over the next ten years.

“There are two ways of viewing the government's duty in matters affecting economic and social life,” FDR said in his speech accepting the 1932 Democratic nomination for president. “The first sees to it that a favored few are helped and hopes that some of their prosperity will leak through, sift through, to labor, to the farmer, to the small business man.” The other “is based upon the simple moral principle: the welfare and the soundness of a Nation depend first upon what the great mass of the people wish and need; and second, whether or not they are getting it.”

The Republicans’ budget reconciliation bill takes wealth from the American people to give it to the very wealthy and corporations, and Democrats are calling their colleagues out.

“This place feels to me, today, like a crime scene,” Senator Sheldon Whitehouse (D-RI) said on the floor of the Senate. “Get some of that yellow tape and put it around this chamber. This piece of legislation is corrupt. This piece of legislation is crooked. This piece of legislation is a rotten racket. This bill cooked up in back rooms, dropped at midnight, cloaked in fake numbers with huge handouts to big Republican donors. It loots our country for some of the least deserving people you could imagine. When I first got here, this chamber filled me with awe and wonderment. Today, I feel disgust.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Matt Wuerker#Letters From An American#Heather Cox Richardson#The Big Bad Bill#Senator Sheldon Whitehouse#Chris Murphy#FDR#American History#The New Deal#The Great Depression#history#income inequality#the very wealthy and corporations

20 notes

·

View notes

Text

"Putin is isolated."

BRICS, 50% of the World population is telling a big "fuck off" to the arrogant, declining and decadent G7 amounting to 10% of the World's population.

🇺🇳🇷🇺 UN Secretary General Guterres respectfully bows and shakes the hand of Putin in Russia’s Kazan at the BRICS summit.

A lot of people start crying and scream hysterically when they see this picture, for some reason.

[BRICS Currency Looms Large: Could This Be the Beginning of the End for U.S. Dollar Dominance?

For decades, the U.S. dollar has been weaponized as a tool of global dominance, wielded by the American empire to enforce its geopolitical will.

Through sanctions, coercive financial practices, and the threat of exclusion from the dollar-based system, the U.S. has effectively terrorized nations across the world.

The pretense of a “free market” economy has long been shattered by Washington's aggressive use of the dollar as a weapon to cripple economies, isolate adversaries, and exert control over global trade.

But the world is growing tired—sick and tired—of this financial tyranny. And now, with the rise of BRICS, we may be witnessing the beginning of the end for U.S. dollar supremacy.

BRICS—Brazil, Russia, India, China, and South Africa—represent a bloc of nations that together account for nearly half of the global population and a significant chunk of the world’s GDP.

For years, these nations have been quietly collaborating to counterbalance the West's stranglehold over international finance, and now, they are inching closer to launching their own currency.

The creation of a BRICS currency signals an outright challenge to the dollar-dominated global economy, and it is nothing short of a revolt against American financial imperialism.

Why is this happening? The answer is simple: countries are fed up with being bullied. The U.S. has used its currency like a sledgehammer, smashing nations that dare to defy its hegemony.

Whether through sanctions on Iran, Venezuela, or Russia, or by financially suffocating smaller nations into submission, the dollar has become a tool of coercion rather than commerce.

Nations who once played by the rules of the so-called “global order” have found themselves punished, their economies crippled, and their people starved—merely for refusing to kowtow to Washington's dictates.

But BRICS is offering an alternative. The creation of a BRICS currency, backed by the economic strength of its member nations, offers the world a way out of the suffocating grip of the dollar.

This is not just about financial autonomy—it’s about reclaiming sovereignty, independence, and the right to conduct trade without the constant threat of U.S. interference.

Russia and China have been leading the charge in this effort, driven in part by the U.S. sanctions imposed on Moscow following the Ukraine conflict and the ongoing trade war with Beijing.

Both countries have moved aggressively to reduce their reliance on the U.S. dollar, increasing trade with each other and with other BRICS members in their local currencies.

They are laying the groundwork for a currency that could be based on a basket of commodities, potentially gold-backed, further weakening the grip of the U.S. dollar on the global market.

The U.S. has long prided itself on its role as the issuer of the world’s reserve currency, but this dominance was never guaranteed to last forever.

The BRICS currency threatens to dismantle the global financial architecture that has allowed the U.S. to live far beyond its means.

For decades, the U.S. has run massive deficits, printing money at will, secure in the knowledge that the world would continue to rely on the dollar.

But as BRICS nations move to establish their own currency, that privilege could evaporate overnight.

The implications for the U.S. are dire. If the dollar loses its status as the world’s reserve currency, the U.S. economy could face a severe reckoning.

The artificial demand for dollars that has kept interest rates low and allowed the U.S. to run massive debt could vanish, leading to inflation, higher borrowing costs, and potentially a fiscal crisis.

The American empire, propped up for so long by its control of global finance, could find itself in rapid decline.

For the rest of the world, however, the rise of a BRICS currency represents hope—a chance to escape the iron grip of U.S. financial imperialism. No longer will countries have to fear the punitive measures of the U.S. Treasury.

No longer will they have to worry about being cut off from the global financial system for standing up to American bullying.

The creation of a new currency could usher in a multipolar world, where nations are free to trade without being subject to the whims of a single superpower.

Of course, the U.S. will not go quietly. Washington will likely pull out all the stops to crush the BRICS currency before it can gain traction. The playbook will be the same: propaganda, financial sabotage, and even the threat of military intervention.

But this time, the world may not be so easily intimidated. The BRICS nations, backed by their vast resources and burgeoning economies, are prepared to stand their ground.

In the end, the creation of a BRICS currency is not just an economic development—it’s a revolutionary act. It’s a declaration that the age of American financial dominance is coming to an end, and that a new world is on the horizon.

The U.S. dollar, once seen as the bedrock of global stability, has become a symbol of oppression, and the world is ready to move on.

The question now is not whether the U.S. dollar will fall, but when. And as BRICS moves closer to launching its own currency, that day may be sooner than anyone expects.

The empire, long propped up by its financial manipulation, is facing a reckoning—one that could change the course of history.]

IMF Growth Forecast: 2024

🇮🇳India: 7.0% (BRICS)

🇨🇳China: 4.8% (BRICS)

🇷🇺Russia: 3.6% (BRICS)

🇧🇷Brazil: 3.0% (BRICS)

🇺🇸US: 2.8% (G7)

🇸🇦KSA: 1.5% (invited to BRICS)

🇨🇦Canada: 1.3% (G7)

🇿🇦RSA: 1.1% (BRICS)

🇬🇧UK: 1.1% (G7)

🇫🇷France: 1.1% (G7)

🇮🇹Italy: 0.7% (G7)

🇯🇵Japan: 0.3% (G7)

🇩🇪Germany: 0.0% (G7)

‼️ 159 out of 193 countries have signed up to use the new BRICS settlement system.

US and European Union will no longer be able to use economic sanctions as a weapon.

This system allows countries to settle trades and payments in their own currencies, reducing reliance on the U.S. dollar, which has long been the dominant global currency.

63 notes

·

View notes

Text

The super-rich got that way through monopolies

Catch me in Miami! I'll be at Books and Books in Coral Gables on Jan 22 at 8PM.

Just in time for Davos, here's 'Taken, not earned: How monopolists drive the world’s power and wealth divide," a report from a coalition of international tax justice and anti-corporate activist groups:

https://www.balancedeconomy.net/wp-content/uploads/2024/01/Davos-Taken-not-Earned-full-Report-2024-FINAL.pdf

The rise of monopolies over the past 40 years came about as the result of specific, deliberate policy choices. As the report documents, the wealthiest people in America funneled a fortune into neutering antitrust enforcement, through the "consumer welfare" doctrine.

This is an economic theory that equates monopolies with efficiency: "If everyone is buying the same things from the same store, that tells you the store is doing something right, not something criminal." 40 years ago, and ever since, the wealthy have funded think-tanks, university programs and even "continuing education" programs for federal judges to push this line:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

They didn't do this for ideological reasons – they were chasing material goals. Monopolies produce vast profits, and those profits produce vast wealth. The rise and rise of the super rich cannot be decoupled from the rise and rise of monopolies.

If you're new to this, you might think that "monopoly" only refers to a sector in which there is only one seller. But that's not what economists mean when they talk about monopolies and monopolization: for them, a monopoly is a company with power. Economists who talk about monopolies mean companies that "can act independently without needing to consider the responses of competitors, customers, workers, or even governments."

One way to measure that power is through markups ("the difference between the selling price of goods or services and their cost"). Very large companies in concentrated industries have very high markups, and they're getting higher. From 2017-22, the 20 largest companies in the world had average markups of 50%. The 100 largest companies average 43%. The smallest half of companies get average markups of 25%.

Those markups rose steeply during the covid lockdowns – and so did the wealth of the billionaires who own them. Tech billionaires – Bezos, Brin and Page, Gates and Ballmer – all made their fortunes from monopolies. Warren Buffet is a proud monopolist who says "the single most important decision in evaluating a business is pricing power… if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business."

We are living in the age of the monopoly. In the 1930s, the top 0.1% of US companies accounted for less than half of America's GDP. Today, it's 90%. And it's accelerating, with global mergers climbing from 2,676 in 1985 to 62,000 in 2021.

Monopoly's cheerleaders claim that these numbers vindicate them. Monopolies are so efficient that everyone wants to create them. Those efficiencies can be seen in the markups monopolies can charge, and the profits they can make. If a monopoly has a 50% markup, that's just the "efficiency of scale."

But what is the actual shape of this "efficiency?" How is it manifest? The report's authors answer this with one word: power.

Monopolists have the power "to extract wealth from, to restrict the freedoms of, and to manipulate or steer the vastly larger numbers of losers." They establish themselves as gatekeepers and create chokepoints that they can use to raise prices paid by their customers and lower the payout to their suppliers:

https://chokepointcapitalism.com/

These chokepoints let monopolies usurp "one of the ultimate prerogatives of state power: taxation." Amazon sellers pay a 51% tax to sell on the platform. App Store suppliers pay a 30% tax on every dollar they make with their apps. That translates into higher costs. Consider a good that costs $10 to make: the bottom 50% of companies (by size) would charge $12.50 for that product on average. The largest companies would charge $15. Thus monopolies don't just make their owners richer – they make everyone else poorer, too.

This power to set prices is behind the greedflation (or, more politely, "seller's inflation"). The CEOs of the largest companies in the world keep getting on investor calls and bragging about this:

https://pluralistic.net/2023/03/11/price-over-volume/#pepsi-pricing-power

The food system is incredibly monopolistic. The Cargill family own the largest commodity trader in the world, which is how they built up a family fortune worth $43b. Cargill is one of the "ABCD" companies ("Archer Daniels Midland, Bunge, Cargill and Louis Dreyfus") that control the world's food supply, and they tripled their profits during the lockdown.

Monopolies gouge everyone – even governments. Pfizer charged the NHS £18-22/shot for vaccines that cost £5/shot to make. They took the British government for £2bn – that's enough to pay last year's pay hike for NHS nurses, six times over,

But monopolies also abuse their suppliers, especially their employees. All over the world, competition authorities are uncovering "wage fixing" and "no poaching" agreements among large firms, who collude to put a cap on what workers in their sector can earn. Unions report workers having their pay determined by algorithms. Bosses lock employees in with noncompetes and huge repayment bills for "training":

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Monopolies corrupt our governments. Companies with huge markups can spend some of that money on lobbying. The 20 largest companies in the world spend more than €155m/year lobbying in the US and alone, not counting the money they spend on industry associations and other cutouts that lobby on their behalf. Big Tech leads the pack on lobbying, accounting for 82% of EU lobbying spending and 58% of US lobbying.

One key monopoly lobbying priority is blocking climate action, from Apple lobbying against right-to-repair, which creates vast mountains of e-waste, to energy monopolist lobbying against renewables. And energy companies are getting more monopolistic, with Exxonmobil spending $65b to buy Pioneer and Chevron spending $60b to buy Hess. Many of the world's richest people are fossil fuel monopolists, like Charles and Julia Koch, the 18th and 19th richest people on the Forbes list. They spend fortunes on climate denial.

When people talk about the climate impact of billionaires, they tend to focus on the carbon footprints of their mansions and private jets, but the true environmental cost of the ultra rich comes from the anti-renewables, pro-emissions lobbying they buy with their monopoly winnings.

The good news is that the tide is turning on monopolies. A coalition of "businesses, workers, farmers, consumers and other civil society groups" have created a "remarkably successful anti-monopoly movement." The past three years saw more regulatory action on corporate mergers, price-gouging, predatory pricing, labor abuses and other evils of monopoly than we got in the past 40 years.

The business press – cheerleaders for monopoly – keep running editorials claiming that enforcers like Lina Khan are getting nothing done. Sure, WSJ, Khan's getting nothing done – that's why you ran 80 editorial about her:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

(Khan's winning like crazy. Just last month she killed four megamergers:)

https://www.thesling.org/the-ftc-just-blocked-four-mergers-in-a-month-heres-how-its-latest-win-fits-into-the-broader-campaign-to-revive-antitrust/

The EU and UK are taking actions that would have been unimaginable just a few years ago. Canada is finally set to get a real competition law, with the Trudeau government promising to add an "abuse of dominance" rule to Canada's antitrust system.

Even more exciting are the moves in the global south. In South Africa, "competition law contains some of the most progressive ideas of all":

It actively seeks to create greater economic participation, particularly for ‘historically disadvantaged persons’ as part of its public interest considerations in merger decisions.

Balzac wrote, "Behind every great fortune there is a crime." Chances are, the rapsheet includes an antitrust violation. Getting rid of monopolies won't get rid of all the billionaires, but it'll certainly get rid of a hell of a lot of them.

I'm Kickstarting the audiobook for The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/17/monopolies-produce-billionaires/#inequality-corruption-climate-poverty-sweatshops

#billionaires#wef#climate#monopoly#world economic forum#competition#antitrust#consumer welfare#inequality#corruption#davos#guillotine watch

220 notes

·

View notes

Text

“There are far more ‘bad apples’ in the banking sales industry, in the legal profession, in the financial service provider industry and in the international business community than the world can comprehend.” – Robert Mazur

Drug cartels are menacing on two levels: they mass produce and sell extremely addictive drugs literally by the ton, and they leverage highly effective global money laundering systems to plow their illegal profits into mainstream commerce. Too often, corrupt bankers are actively or passively complicit. If we can stop the bankers, we throw a huge wrench into the cartels’ ability to function.

For decades, law enforcement has valiantly fought drug smugglers but to little avail. Consider this 2024 statement from the U.S. Treasury:

During the assessment period, Clan del Golfo (CDG), a Colombia-based TCO and paramilitary organization, remained a significant producer and trafficker of cocaine destined for U.S. drug markets and earned a significant amount of proceeds in U.S. dollars. According to the DOJ, CDG is one of the most violent and powerful criminal organizations in Colombia, and it is one of the largest distributors of cocaine in the world.

Mostly, America’s fight against the cartels has been done using a tactical troops on the ground approach that sends some of the most vicious cutthroat criminals to prison. However, the bankers who knowingly handle the cartels’ money rarely pay a price. And it’s a lot of money: “The United Nations Office on Drugs and Crime estimates between 2 per cent and 5 per cent of global GDP—up to $2 trillion—is laundered every year.” According to a DEA agent, the cartels are “undermining [America’s] financial stability.”

12 notes

·

View notes

Note

What people miss with regards to the Jordan Neely/Daniel Penny story is that Penny didn’t choke him out because he’s a bad person. He did it because of socioeconomic factors which made him desperate. The alternative to him being found not guilty would be him going to prison, and that wouldn’t have been justice. Penny needs to be treated with grace and care in this undoubtably troubling time for him

I think my scambaiting post must be going around because I'm getting some asks about it. I'm mostly just deleting them if they're not interesting or instructive, but I think this one actually might be.

My OP made a gesture at a materialist analysis which should be performed. This material analysis would have to do with the flow of money, labour, and resources as it actually exists in the world: the extraction, extortion, and theft of raw materials; the purposeful, violent destabilisation of entire regions by the military arms of the USA, Canada, Europe &c. to force people to work for pennies, so that labour will be incredibly cheap compared to what it would cost if performed by most citizens in the imperial 'core'; and other measures that are taken to ensure that value flows from colonised nations to colonising nations. (These measures also include the devaluing of institutions in the 'periphery' such that advanced degrees from certain countries are simply worth less than others; and the restricted ability of those in the 'periphery' to travel or migrate across borders with the freedom afforded to those with imperial citizenship.)

So certain people are in a situation where structures and enforcers of power have made them poor and desperate on purpose so that they can be 'superexploited' at a level beyond that experienced by most people in the imperial 'core'. This is the purpose of imperialism, and it's the purpose of the concept of 'race.' People work in factories for very little money, because the imperial periphery is supposedly only good for the production of raw materials (fabric; t-shirt blanks; assembly of parts of electronics &c.); the design, the artisanship, the packaging, the 'refining,' the making of the chocolate bar from the cocoa, everything that confers 'value' to the item, is done in the imperial core, and that increased 'value' / sale price is added to the GDP of the country in which the product is completed.

In fact this 'raw material' is not 'raw' at all, and it also invovles design and artisanship—but the people of the 'third world' cannot 'design' anything and they cannot be 'artisans'—nothing they make can be labelled as 'handmade' or 'hand-sewn' even if it is literally made with their hands—because they are not considered as people in that way.

But that's the product realm. In terms of the internet (even setting aside the physical materials, space, energy, water &c. required to maintain the internet):

Things (such as Amazon's failed "Just Walk Out" thing) are advertised as "artificial intelligence" despite the fact that thousands of people in India are forced to do work that is tedious, time-consuming, and often horrific and traumatising (consider content moderation!!) in order to make them work. Their material conditions—which are created and maintained, in the most violent manner imaginable, on purpose in order to force them to do this work—render many people desperate enough to take these jobs.

If there are people, who are reachable online, who at a baseline are making a hundred times what you are making, whose currency has incredible purchasing power where you live, and you can get some of that money—if you can work for yourself this way, obviously you're going to do that. This happens because there's money to be made in it. If people can set up an operation and train hundreds of people in how to do this, and take most of the profits and still provide a salary that's attractive to people because of how high the margins are, then obviously that's going to happen. This is just, the concept of capitalism. If there is a way to make money doing something, someone is going to be doing that thing.

Material analysis is looking at the world as it actually exists, in order to figure out how materials, labour, and value are 'flowing' on local and global scales, as a means of determining why things happen the way they do. Like, on a base level, that's what it means to analyse something—to try to figure out why it happens the way it does.

This anon, in sending this ask, didn't understand what any of this meant, or didn't want to consider it, or something. They were unable or unwilling to consider a different lens than that of personal desert, personal merit, and innate personal badness / criminality. The concept of trying to understand where money is, how it moves and why, as a base level of knowledge necessary to understand why there is money to be made in doing certain things, doesn't compute to them—so they have to move things back into the realm of personal desert, and act like I'm saying that people who commit acts of interpersonal violence "deserve" to be allowed to commit that violence as long as they're going through something, whether or not the thing they're going through created the necessary circumstances for, or has any other direct relation with, the act of violence being committed (basically "some people commit violence to cope").

All of that is kind of typical—it's very normal for people to act like asking them to consider people in the 'third world' as actual human beings with human things like "circumstances" and "motivations" and "thoughts" that influence their actions is tantamount to spitting in their grandmother's face.

But what's most interesting to me about this ask is how, in order to dismiss the idea of material analysis as necessary to understand why things happen and to reassert an interpretive framework of individual criminality, anon uses the idea of interpersonal racial violence as something that we can all agree is caused by innate criminality and not by material factors. As if by comparing scamming to this act of violence, it emphasises the innate criminal personality at the root of both acts. As if, obviously, we can all agree that people who commit this kind of violence are just evil demons who "deserve" to be locked up—so saying "the material fact of present-day colonialism creates the conditions for this kind of scamming" is tantamount to saying "we shouldn't lock criminals up in prison." If the latter statement is unthinkable, then so, by comparison, is the former.

Except that this concept of "the criminal" as being a specific "type" of person who uniquely does and deserves evil, and who needs to be locked up in a cage for the good of the rest of society, is exactly what I am, in fact, intending to question. I think the anon would be surprised to learn about the vast body of work (I mean texts, but also direct activism) conducted under the heading of "prison abolition."

33 notes

·

View notes

Text

As the Trump administration executes an aggressive deportation campaign across the United States, a growing number of US companies warn that the crackdown could threaten their operations.

Since January, more than 40 companies have mentioned the impact of deportations in filings to the US Securities and Exchange Commission, with many saying it could hurt the labor force, increase the risk of a recession, or create more economic uncertainty, according to 74 filings reviewed by WIRED. The impacted industries span a wide cross-section of the US economy, including food production, tech, and construction.

“Many farms employ hard-working, non-criminal employees who have not yet achieved legal citizenship,” reads one filing from ImmuCell, which develops and sells drugs for animals in the beef and dairy industries. “Significant deportations of these individuals could have a negative impact on the operations of our customers and of our source farms.”

It’s highly unusual for companies to mention deportations in filings to the SEC. Between June 2020 and January 2025, just six SEC filings mentioned deportations. From June 2015 to January 2025, that number rose to 22.

Since taking office, however, President Trump has made cracking down on illegal immigration a cornerstone of his policy agenda. White House deputy chief of staff for policy Stephen Miller has instructed Immigration and Customs Enforcement to work toward a minimum of 3,000 arrests of undocumented immigrants daily, and the agency has been orchestrating raids at workplaces, outside elementary schools, and even inside people’s homes.

The highly visible deportation campaign has sparked nationwide anti-ICE protests and helped energize the “No Kings” demonstrations that swept the country this past weekend. The Trump administration has reportedly told ICE to scale back its workplace raids, in part due to concerns over how they are affecting the agriculture, hospitality, and restaurant industries.

Zevin Asset Management, a “socially-responsible” investment firm that owns shares in Google’s parent company Alphabet, said in a proposal on behalf of two investors that mass deportations should prompt Alphabet to have a better “due diligence process” to determine whether its businesses "contributes to human rights harms in conflict-affected and high-risk areas.”

Google’s work as “one of the leading cloud computing providers” to ICE, US Customs and Border Protection, and the US government at large raised concerns of a “potential complicity in human rights harms” happening at the US Southern border, the proposal claims.

“These abuses include the separation of children from their parents, arbitrary arrests and detentions, poor detention conditions, and unlawful deportations to countries with poor human rights records,” the proposal claims.

Most of the other filings mention deportations in relation to risks to future business or net income.

Hawaiian Electric, the primary electricity provider of Hawaii, said in its SEC filing that “recession risks increase due to federal policies and actions, including trade policies, mass deportations, and spending cuts.” The filing cited an economic forecast from the University of Hawaii published in May that predicted “limited GDP growth for 2025 and a contraction in 2026, marking Hawaii’s first recession since the pandemic.”

Other filings suggested a recession could come even earlier. The community bank Hanmi Bank, under its holding company Hanmi Financial Corp., said in an SEC filing that “the combination of tariffs, rising inflation, deportations, global political unrest and tensions, and reduced credit availability” could cause “a mild recession in 2025.”

Some companies said that deportations could fuel labor shortages. Century Communities, a homebuilding company, said in its 2024 annual report that if it's unable to hire enough skilled tradesmen and contractors, it "may have a material adverse effect on our standards of service."

“Labor shortages may be caused by, among other factors, slowing rates of immigration and/or increased deportations since a substantial portion of the construction labor force is made up of immigrants,” the filing says.

A few companies mentioned deportations but said that they aren’t sure how the crackdown will impact their business. The holding companies for banks Bridgewater Bancshares, Heartland Bank and Trust Company, and Heritage Bank, for example, mention mass deportations in a list of factors that could affect their “forward looking statements,” which predict how well the banks may perform in the coming months. However, the companies stopped short of saying whether deportations would harm or help their businesses.

Other companies said that deportations present some risk to the economy but noted they do not expect it to cause widespread damage or hurt their business.

In a filing for Forum Investment Group’s real estate income fund, the firm said that “stricter immigration controls and deportations” could have mixed outcomes. The filing claims these policies could increase inflation, but possibly be a “boon for U.S. workers (higher wages)” or cool down “overheated housing markets.”

Some companies argued that their businesses could be at risk if their customers are affected by deportations. Pacific Airport Group, which operates through airports in Mexico and Jamaica, said that policies like mass deportations and restrictions on international travel would hugely impact airport traffic, and therefore the company’s bottom line.

“These measures could create uncertain economic conditions in Mexico, affecting leisure, visiting friends and relatives, and business travel, to and from the country,” the filing says.

Meanwhile, the cloud communications and financial services company IDT Corporation said that mass deportations could “negatively impact” its enterprise customers, like the remittance transfer service BOSS Money, and the money transfer and international call servicing company BOSS Revolution. Anything that disrupts people’s ability to work or travel outside their country of origin, IDT claimed, could hurt customers and therefore its business.

The discount store chain Pricesmart, which operates throughout Central America, said that mass deportations could have a devastating effect on an entire region. If there’s a major reduction in foreign workers sending money to their families in Guatemala, El Salvador, Nicaragua, and Honduras, those nations’ economies would suffer and so would Pricesmart stores, the filing said. Money from foreign workers, the company warns, is “a key source of income and poverty alleviation for millions of families.”

8 notes

·

View notes

Note

Beloved Texan Refugee mutual! You always have astute takes on *waves vaguely at us politics* this stuff. Penny for your thoughts today?

Well Beloved Carpenter/Cheese/Stringwranglin' mootual let me have a gander at the ol' front page (r/politics) right quick (  ̄▽ ̄)📰

( '・ω・)📰...

Okay so ( ´・д・) im not a historian or really any kind of acredited smarty pant, but T**mp an M*sk both want to be Literal kings because they are sad petty little men who will regularly force people to say they like them with various levels of coercion and physical violence.

45 wants to be a dictator in the north korea strain where people think hes a living demigod, and hes not too far off because MA*A folks are already two steps away from calling him the second coming.

M**k wants to be a king in the sort of Corprate Dictatorship strain a la Peter Thiel and the silicon mafia. Hes already chosen Texas as his personal holdings (most if not all his businesses are headquarted there now, and hes building a town on the very southern but), and he doesnt need 45 anymore because he already gutted all the regulatory agencies that could have stopped him.

But they still have to deal with the issue of all the "non-believers" and the only economy big enough to tell them No and enforce it

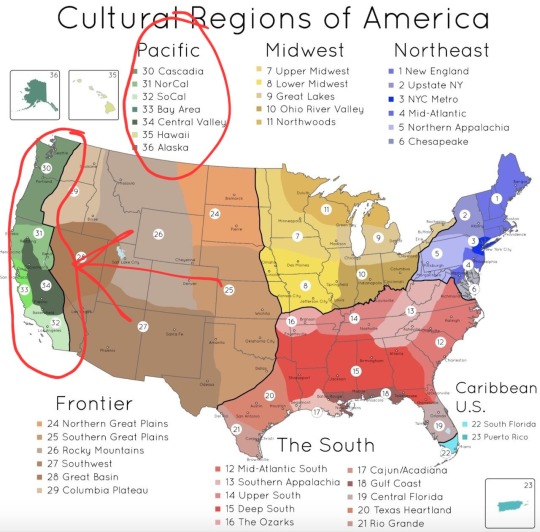

Pacifica

Just that teeny bit there has the third highest GDP in the World at 5.18 trillion and is chock-full of people that Love bodily autonomy and functional public infrastructure.

Now after months of harrasing blue states with ICE raids 45 is threatening California with complete withdrawl of All Federal Funding. Which is hilarious because most of that money comes from them in the first place. Newsoms response of witholding federal taxes puts California into a "soft seccesion". Im having trouble articulating this properly, but "cascadia" sentiments have been increasing in r/seattle for several months now, but if "Pacifica" were to leave the union, California, with the nations highest GDP and second biggest national guard, would have to lead it. And people keep saying theyd never let them leave with all that money and ports but i dont think the money is the point, its the control.

And good God im getting woozy thinking about all this °(@_@;) but i think it will all boil down to if 45 and M*sk consider the Pacifica region something to be brought-to-heel as a show of might or want to encourage its formation as a conveniant BoogyMan to keep their people scared and dependant on them. Not only as an outside but nearby "Antagonist" and "Bad Place" but as a sociatelly pervasive "other" to encourage a panopticon.

I cant think anymore (。-∀-) my brain is mush im sorry.

#drogonea asks#snazzy hats and adhd#this is such a stream of conciousness thing and thats even *after* i edited it (ーー;)#cw us politics

10 notes

·

View notes

Text

Two strange phenomena now characterize the political landscape.

One, opposition to the Trump administration’s initiatives has reached a near-unprecedented fever pitch.

The frenzy is manifested in strange ways. At the bottom end, there is an epidemic of street terrorism, including the keying of Teslas, bullying their owners, firebombing dealerships, or vandalizing charging stations.

All that is mostly the logical but dirty reification of those in the media and the Democrats who brand Elon Musk as a foreign-born counterfeit citizen and a disloyal un-American foreigner, thus deserving to be “taken down,” in the words of Rep. Jasmine Crockett. Or is he to be ostracized as an “ass-h*le” in the invective of Sen. Mark Kelly and Minnesota Governor Tim Walz? The latter cheered a downturn in Tesla stock prices, contrary to the interests of his own state’s public portfolio.

Sometimes, the impotent Democrat Congress issues kickboxing/ninja videos of its feistier female representatives. At other moments, senators race to the bottom, echoing each other’s pottymouth expressions of “sh*t.”

Rep. Al Green could neither disrupt nor end Trump’s speech to a joint session of Congress by shaking his cane and screaming epithets. Nor, as he damned Trump on the floor of the Senate for 25 hours in a filibuster to nowhere, could Sen. Cory Booker offer a single word that might offer his supposedly better way to address crushing debt and deficits.

Two, there is a second common denominator to all this frenzy and fury: there is so far no alternate agenda on trade deficits, budget deficits, and debt.

That is, no one on the left—or, for that matter, the libertarian right or the now inert Republican establishment—can outline an alternate pathway to Trump’s remedies for America’s dire problems. Just as the left used to worship Tesla’s breakthrough EV cars and now tries to destroy them, so too it once lectured the country on the merits of tariff-enforced symmetrical trade—until Donald Trump made that his signature issue.

So in lieu of serious counter-proposals, we get from the left vulgarity, the smash-mouth of Rep. Crockett, and street terror against fellow Americans. All this inanity is the natural bookend to the prior four years of lawfare, the efforts to remove Trump from state ballots, the Mar-a-Lago raid, and two assassination attempts.

Most of the organs of Wall Street, the free-market think tanks, and the few liberation university economics departments likewise issue virulent denunciations of tariffs, of even massive DOGE cuts in the federal workforce and budget, and, strangely, of the deportation of Tren de Arugula, a terrorist-designated violent foreign gang whose members entered and now reside illegally in the United States.

So why does the left not simply claim that its prior support of tariffs was wrongheaded? (See the now-ancient denunciations by Nancy Pelosi and Bernie Sanders of Bush-era “free trade,” deindustrialization, globalization, and lost jobs.) Now, the left supports… what exactly? Mini-tariffs? No tariffs? Reciprocal tariffs?

Absent is concern about the ticking time bomb of $3 billion in interest payments on the debt per day, in addition to the monstrous $37 trillion in debt itself. Did Cory Booker spend a single minute of his 25-hour address to outline ways to reduce our 125% debt to annual GDP?

Per year, the interest cost on the debt is larger than the defense budget; does AOC ever note that? The current Biden vestigial budget is nominally $1.7 trillion in the red. Is there a Democrat agenda to head us toward balanced budgets?

So, what does the left propose as its financial remedies?

Is it to raise taxes on those who should “pay their fair share?” That is, do they want the top rates to rise from 37% to 40%, 45%, 50%, so that their own constituent “affluent” in blue states like high-tax California, Illinois, and New York should properly and deservedly pay the IRS 50% to 60% of their earnings in income tax alone?

Does the tax-and-spend left prefer instead a value-added tax or some sort of federal sales tax? Or do they think current levels of spending are just fine?

Is there really no waste, fraud, and abuse in the federal budget, but instead too few federal workers?

Or are they modern monetary theorists, who believe money is but a construct, one that the government can do with in whatever manner it wishes? Thus, debt is simply remedied by printing more of the construct, or finding ways to expropriate private wealth, or inflating our way out of debt?

But again, please tell us how the left has a superior agenda to Trump’s that will get us more quickly and efficiently to a balanced budget, if not a reduced national debt.

Or is debt itself not supposed to be a problem? Does the left believe interest rates are the real crux? As in the recent past, if interest rates are no more than the rate of inflation, then essentially, the government can borrow all it wants at zero interest—and literally did so at times over the last half century. Is that their remedy?

Can the Republican establishment help out and pause a moment from their napalming of the Trump initiatives? Can it issue briefs that outline how to take us to either a balanced budget and reduced debt or convince us that debt in all manifestations is no big deal?

Then we turn to trade deficit. Again, there is utter silence about solutions from most critics. No counter-proposals, no alternate agenda, just fury and hysteria—or denials that deficits and debt are a problem at all.

So, does the left or right believe that 50 years of continuous trade deficits do not matter? Who cares if we are running a near $1 trillion annual outflow in the gap between what we export and import?

Please make the argument that the real losers are the recent economies of India, China, or Mexico, which supposedly foolishly tax imports and yet demand tariff-free exports, all to run up surpluses. Are they suicidal and we, the masters of trade deficits, the real geniuses?

Does it matter that almost all of the proposed Trump tariffs are in some way responsive? In that sense, they are calibrated on autopilot, leaving the proverbial ball in the court of those with high tariffs and huge surpluses to set new shared reciprocal rates.

So, if it was wrong for Trump to level reciprocal tariffs, was it right for others to initiate asymmetrical tariffs on us?

Is it more logical to damn those who object to $1 trillion in annual trade deficits rather than those whose tariffs resulted in their warped surpluses?

Or is it wiser to blame the victim? The U.S. deserves its trade deficit because it is too affluent, too naïve to object, or too profligate to be saved?

Or is the argument one of the Sermon on the Mount: we must turn the other cheek as we have for a half century? Or, as an affluent sort of good Samaritan, can we afford to stay forbearing and take the hit for the global team?

The final problem with the notion of Trump as the 80-day destroyer of America is not just the poverty of economic counterproposals from the left or right. It is also the complete news blackout of what Trump has already accomplished in 10 weeks.

Does anyone notice that, almost overnight, America’s southern border is now magically secure, with virtually no illegal immigration—and without the much-ballyhooed need for “comprehensive immigration reform?”

How did we go from 10,000 illegal aliens a day to near zero? What was so bad about identifying hundreds of billions of budgetary dollars in fraud and waste in a mere two months?

Why are we now talking about ways to end the Ukraine war rather than boasting “as long as it takes” to feed the new Stalingrad?

Why are the Houthis now being abandoned by the Iranians, who, in a matter of weeks, no longer seem to be the feared bully of the Middle East? Were not their terrorist tentacles just months ago considered unstoppable and sacrosanct?

Was it wrong finally and dramatically to reflect the wishes of 80 percent of the American people, who do not want biological males to overturn a half-century’s worth of hard work to obtain parity for women’s sports?

We, as a nation, need to calm down.

Either acknowledge, however reluctantly, the good that has already been done in the first ten weeks. Or, if one feels the border should be open, or the war should be accelerated in Ukraine, or the campuses were just fine until 2025, or women just need to get over losing to transgendered men, then just say so.

Or if one believes huge trade and budget deficits and unsustainable national debt are no big deal, then argue just that.

Or, if the rub is that Trump is addressing these existential and long-neglected crises in the wrong way, then please present alternate plans for quicker and better resolutions or better messaging.

Should he limit tariffs only to those nations with deficits and asymmetrical tariffs? Should he speak more quietly and mention more frequently that he was moved to act only by a half-century of neglect? Could he emphasize more that the $3-4 trillion in promised foreign investment will ignite job growth within a year?

But if there is no alternate agenda, no constructive criticism, then why would anyone listen to those who either helped to get us into this mess or have no clue about its solutions?

9 notes

·

View notes

Text

News of the Day 3/23/25: Income Tax

I'm seeing this idea make the rounds, even in my family text message. It's a heady idea if you don't actually read the fine print, to the extent there's print of any kind to read. This is all based on a conversation with the secretary of commerce and Trump, not any official plan or even a late-night Truth post, and it's based on the idea with tariffs, we're actually going to balance the budget.

The US last had a balanced budget in 2001, so that "if we balance the budget" is an asterisk mark the size of Texas. More than that, if tariffs are actually regularly bringing in tax revenue, that means people are still buying foreign goods, they're just paying more for them. If tariffs actually work to get us to "buy American," they're just not a long-term revenue base. They're also regressive, meaning as a percentage of your income they're falling more heavily on the poor. And that's before you even factor in what other countries will do in response. (Ask farmers how they fared under Trump's 2018 tariffs (X), for example.)

The bottom line is, there are things worth doing collectively (like, through government), and we need to pay for them. Taxing the rich is a big part of that, though I doubt it will be enough. We also need to accept there's no magic trick, and there's not enough waste where we can DOGE our way to fiscal responsibility without cutting out some services and benefits that are actually worth paying for.

Along that "tax the rich" thing, from Pro Publica:

More talk on tariffs, taxes, and general money-related shenanigans stuff behind the cut. (.... Yay?)

Tariffs

Trump claims tariffs will make the US rich again, long term. Forbes.com explores "5 undisputed facts about how they work [that] throw cold water on that notion." (X)

Harris poll: Americans are increasingly worried about tariffs despite Trump's assurances.

Brookings: Trump's tariffs aren't going over well with his base, either. (X)

Sec. Treasury Bessent refuses to rule out a recession.

Trump policies 'promise' recession if fully implemented, UCLA's economic forecasting center warns. (X)

Trump Administration Disbands Two Expert Committees on Economic Statistics. (X) Because what we don’t know won’t hurt us?

Taxes and the IRS

6,700 probationary IRS workers are expected to lose their jobs in the heart of tax season. (X)

Many were reinstated by a judge, but placed on administrative leave rather than being sent back to work. (X) Now that’s what I call my tax money well spent!

Separately, the IRS plans to cut 20% of the Taxpayer Advocate team, threatening the Direct File program and other programs meant to help taxpayers interact fairly with the IRS.

IRS braces for $500bn drop in revenue as taxpayers skip filings in wake of DOGE cuts at agency. (X)

IRS chief counsel was demoted and replaced by DOGE ally after refusing to release taxpayer data to DOGE. (X)

IRS agents who investigated Hunter Biden given promotions at the Treasury department.

IRS Retreats From Some Audits as Agency Slashes Workforce. Officials put faith in shift to technology, but others see dangers in cutting thousands of jobs. (X)

US debt could explode above 200% of GDP in two decades if Trump’s tax cuts become permanent, CBO says — putting it at unsustainable levels. (X)

Republicans want to pretend their tax cuts are free. A new report says otherwise. (X)

And finally, not finance-related, but still worth keeping an eye on: IRS Prepares To Provide Addresses of Some Undocumented Taxpayers To Immigration Enforcement. (X)

Other Financial Shenanigans

Trump issues ethics waiver to AI & Crypto czar, allowing him to work on regulatory issues that would affect his businesses.

Congressional Oversight committee launches investigation into whether crypto reserve would personally enrich Trump.

Why Washington and the business world are freaking out about Trump’s FTC firings. Removing two Democratic commissioners could trigger a cascade of problems for the longstanding agency, and even blow back on Republicans. (X)

Sec. Commerce Lutnick urges Fox viewers to buy Tesla stock. (X) A watchdog group calls for an ethics investigation.

2 notes

·

View notes

Note

What parts of modernity must be given up to prop up the birth rate (at least enough to go from precipitous decline to gradual decline)? I fear for the future of feminism. Maybe we can sacrifice child labor laws instead. Or start growing humans in vats, thus finally achieving a sapphic supermajority.

From last to first:

Vats ain’t gonna do it. Sapphics can purchase sperm or hold their noses and think of England for 5 minutes now, and I have known rather a lot of lesbian moms.

Feminism as it currently stands is not really compatible with being a mother and it never embraced and encouraged and held up motherhood as aspirational. The two are not currently compatible, and making them compatible requires being willing to accept a hypothetical 5th wave of feminism with substantial differences from what has come before as still feminism.

Child labor laws are arguably part of the problem, but a smaller one than child safety laws and “laws” enforced by social workers like “wood stoves are forbidden in homes with children” that make children more expensive and a hassle to care for. The housing crisis and the fact that the general economic decline has been papered over by increasing women’s workforce participation (and reducing non gdp labor, like raising the next generation of human capital) is another factor.

The idea that gender is irrelevant is not exactly “part of modernity” depending on how you define modernity, but that’s probably part of what would need to change. Raising children is an extremely huge investment, and someone has to do it.

Ultimately, having kids either has to be “a good deal” or unavoidable. People have kids at the levels you’re looking for pretty reliably IF they feel it’s a good deal for them. Having kids is somewhat rewarding in itself for many people, and remember that we are all descended from generations of people who had kids, so the thumb is on the scale thanks to evolution. Make having kids, or having another kid, a good deal of more people.

5 notes

·

View notes

Text

The European Union is set to generate millions of euros more from the high rejection rates of visa applications by African visitors with a new increase in non-refundable fees.

Citizens of the 26 member states within Europe’s Schengen area have unhindered borderless access within the area, while most travelers from elsewhere require visas. A 12.5% price hike that takes effect on June 11 increases the cost of a short-term (90 days) visa application to €90.

But while the price hike applies equally to all non-EU residents who require a Schengen visa, it raises the prospect of the bloc making disproportionately more money from its rejection rates for applicants from Africa, analysts say.

Of the €130 million the EU earned in 2023 from rejected visa applications, about 42% of that was from applicants living in Africa, even though the continent accounts for 24% of Schengen visa applications, according to London-based research firm LAGO Collective. Prospective visitors who apply from Ghana, Senegal and Nigeria receive rejection rates of between 40% and 50%, LAGO estimated, based on data from the European Commission’s migration and home affairs office.

“We found a relationship between the GDP of countries and rejection rates for short-term visas,” Marta Foresti, LAGO’s founder, told Semafor Africa. A similar rejection trend in 2024 with the new price would deepen long-standing inequality of outcomes between consumers paying for the same service from high and low-income countries, Foresti said.

While these encourage dangerous attempts to reach Europe across seas and deserts, most African migration is via “regular channels,” the Africa Center for Strategic Studies in Washington DC notes.

Yet Africans applying to visit Europe for short-term stays, such as business engagements or conferences, continue to face a stumbling block.

Average rejection rates for African applicants are generally 10 percentage points higher than the global average, Mehari Taddele Maru, a researcher at the EU-owned European University Institute in Italy, found. Seven of the top ten countries with the highest rejection rates for Schengen visa applications in 2022 were in Africa.

The EU’s more expensive visa and its potentially disproportionate impact on Africans comes as the bloc takes a tougher stance on migration.

New rules approved by the EU Commission in April impose a higher standard for screening non-EU nationals at borders, including the collection of biometric data, and health and security checks. Border fences set up by member states within the Schengen area have become longer in the last decade, stretching from 315 km to 2,048 km as of 2022.

Higher visa prices could be another type of fence, which when combined with high rejection rates, will continue to enrich European consulates at the expense of residents of low income countries who nevertheless have legitimate reasons to be in Europe.

Africa’s high rejection rate is sometimes explained as a consequence of visitors overstaying their visas. But “there is no evidence to suggest that a higher rejection rate leads to a decrease in irregular migration or visa overstays,” Maru argues. In essence, an unexplained bias against Africans is at play.

The costs of rejection to African entrepreneurs, career professionals, artists and other seekers of the EU’s short-term visa calls for a reform of the approval process, Foresti told me. Consulates with high unequal outcomes should review their decision-making to ensure “systematic discrimination” against some countries isn’t an underlying cause.

And should some EU members enforce high rejection for short-term visas to dissuade overstays by residents of particular African countries, more paths to legal migration should be considered, she argued.

6 notes

·

View notes

Text

Tata Steel, JSW Steel, and other metal stocks slip up to 3% after 104% tariff escalates US-China trade tensions

Experts warned that the escalating trade conflict could severely impact global growth, further pressuring metal prices

Nifty Metal index slipped over 1.5 percent on April 9, following US President Donald Trump’s announcement of a sweeping 104 percent tariff on Chinese goods. This sharp escalation comes in response to retaliatory measures taken by China and marks a significant increase from Trump’s previous tariff levels.

Among individual counters, shares of JSW Steel, Tata Steel, Hindalco, and Hindustan Zinc saw declines of up to 2 percent on April 9.

Over the last four trading sessions, the Nifty Metal index has recorded a steep decline of 11 percent, driven by rising fears of a global economic slowdown. Individual stocks such as Tata Steel, JSW Steel, SAIL, NALCO, and others have seen losses of up to 15 percent during the same period.

Until last month, the US had maintained a tariff rate of 10 percent on Chinese imports. However, this rate surged to 44 percent after President Trump introduced a set of “reciprocal tariffs,” including an additional 34 percent on Chinese goods and a blanket 10 percent base tariff on all other countries.

These changes pushed the total tariff burden on Chinese imports to 54 percent. After China responded with a 34 percent tariff on US goods, the United States retaliated once again by slapping an extra 50 percent tariff on Chinese imports, bringing the cumulative tariff rate to an unprecedented 104 percent.

President Trump’s decision to enforce stricter trade measures against China—widely recognised as the world’s second-largest economy and a major producer and consumer of base metals—has raised fresh concerns over the fragility of China’s post-pandemic economic recovery. Many fear that these aggressive tariffs could further derail China’s growth trajectory.

Experts warned that the escalating trade conflict between the world’s two largest economies, which together account for around 45 percent of global GDP, could severely impact global growth and trade flows in the coming quarters, which could put more pressure on global metal prices.

“Rising trade tariffs have significantly increased the risk of supply chain bottlenecks, elevated inflation levels, and a broader slowdown in global economic activity—all of which have put downward pressure on commodity prices,” noted analysts at Prabhudas Lilladher. “Going forward, it will be critical to monitor the extent of the global economic slowdown, the resilience of domestic demand, and whether inflation in input costs continues to be driven by disruptions in global supply chains.”

Looking for the SEBI-registered RA firm? We specialize in profit-making stocks and low-risk investment options tailored to your goals. With timely Nifty buy-sell signals, we empower you to make informed trading decisions and achieve financial success. visit – Intensify Research Services – Now! and get a special offer.!

#accurate stock tips#best bank nifty option tips#best bank nifty tips provider#stock cash market tips#share market advisory#ideal strategies#trading tips#stock tips advisor#ipo news#ipo alert

1 note

·

View note

Text

Oil refinery Valero has opted to close its operations in California due to excessive regulations on energy. Located in the small city of Benicia, the town is expected to lose 400 jobs, which the mayor is calling the exit “a major hit on the city.” Everyone in California is feeling the impact of Newsom’s war on fossil fuels.

Valero said its decision ” follows years of regulatory pressure, significant fines for air quality violations, and a recent lawsuit settlement related to environmental concerns.” “California has been pursuing policies to move away from fossil fuels for really for the past 20 years. And the consequence of that is the regulatory and enforcement environment is the most stringent and difficult of anywhere else in North America,” Valero CEO Lane Riggs told reporters. His company faced $82 million in fines dating back to 2003 for emissions, marking the highest penalty issued in the Bay Area Air District.

Energy company Phillips 66 abandoned its operations in Los Angeles last year, citing long-term instability due to political policy. California’s refining capacity has declined 21% over the past three years, and as a result, gas prices are expected to rise by 75% by 2026 if major intervention is not taken.

California’s gas deficit ranges from 6.6 million to 13.1 million per day. “. Reductions in fuel supplies of this magnitude will resonate throughout multiple supply chains affecting production, costs, and prices across many industries such as air travel, food delivery, agricultural production, manufacturing, electrical power generation, distribution, groceries, and healthcare,” University of Southern California professor Michael A. Mische stated after studying California’s history of supply and refining capacity. This will plunge the state into further debt and reduce the overall GDP for the entire nation.

4 notes

·

View notes

Text

I'll say what many might think but hesitate to voice: Ukraine is currently losing the war, and the trend is negative unless drastic measures are taken.

Debates over what constitutes loss or victory can be had, and yes, Ukraine’s survival so far is a big win. But even if Russia halts advances and goes on the defensive, we lack the resources to reclaim territories to the 2022 borders, let alone the 1991 borders. This is due to many factors: delayed mobilization, insufficient aid, weak sanctions enforcement, a lack of political will in the West, poor military decisions, delayed aid due to de-escalation concerns, and the sheer reality of fighting a country with four times our population, with superior numbers in almost all domains and one of the largest military industries, supported by regimes like North Korea, which contribute more than some European countries with far larger GDPs.

Manpower shortages are another issue, but that's a separate discussion. Ukrainian leadership bears a good part of the responsibility for these problems. Still, if the West can’t supply the 14 brigades Zelensky requested, why discuss drafting hundreds of thousands more? We need to completely re-arm way more existing brigades. Who’s going to pay for them? Let’s be honest - there’s little enthusiasm in the U.S. or Europe to fund this.

If Russia retains its occupied territories, it will undermine one of Europe’s core security principles: that borders cannot be redrawn by invading force. In 2014, Russia violated this order, leading to the 2022 invasion. This time, it’s not just Ukraine that will have failed - it’s Ukraine, the U.S., and Western Europe’s failure to defeat Russia.

Some might cite Finland's Winter War, as an example of what Ukraine should have done, but that war lasted three months and ended with Finland ceding territory, paying reparations in the form of machinery, and renting a port to the Soviets. Ukraine's demographics today are also very different: the 18-25 age group is among the smallest, a reality across modern Europe.

Unless Ukraine and the West create a serious plan to radically increase aid to support mobilization - where Ukraine commits to mobilizing more people on the condition that they are properly armed and trained, and the West provides robust air defense to intercept missiles as decisively as the U.S. does for Israel - Ukraine will lose the war of attrition. This will force unfavorable peace, and mass migration from Ukraine to other countries, setting a dangerous precedent, and making it look like the West lost to Russia in the eyes of the world, especially among the enemies of the West

2 notes

·

View notes