#GAIN CAPITAL FOREX

Explore tagged Tumblr posts

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

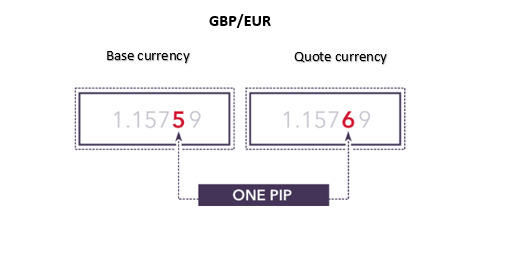

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

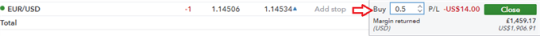

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

Why Start 2025 with Telegram Signal Copier?

Start the new year on the right foot with Telegram Signal Copier (TSC), the tool that transforms your trading into an efficient, reliable, and forward-thinking process. Here's how TSC can elevate your copy trading plans this year:

Efficiency at Its Best

Automate your trading seamlessly and focus on perfecting strategies instead of managing manual tasks. TSC’s lightning-fast execution ensures you capitalize on every time-sensitive opportunity.

Enhanced Accuracy

Eliminate human errors with TSC’s precision-driven system, faithfully replicating signals exactly as they’re received. No details missed, no opportunities wasted.

Multi-Account Management

Handle multiple trading accounts with ease. TSC simplifies account diversification, allowing you to manage them all from one platform.

Tailored Risk Management

Align your trades with your goals by customizing lot sizes, stop-losses, and take-profit levels. With tailored risk management, you can trade confidently and on your terms.

Continuous Learning Support

Gain access to valuable tutorials, guides, and expert insights to enhance your trading knowledge. TSC supports your journey toward smarter, more informed trading decisions.

Staying Ahead with Updates

Stay ahead with early access to TSC’s latest features and innovations. Adapt to market changes with tools that keep your strategy sharp and competitive.

Premium Signal Access

Unlock premium signals for Forex, Gold, and Indices via VIP Telegram channels. Backed by expert analysis, these signals provide you with an undeniable edge.

Community and Support

Be part of a thriving trader community while enjoying priority support from the TSC team. Whether it’s troubleshooting or trading guidance, you’ll have expert help at every step.

Start your trading journey this year with a tool designed to empower and elevate. With TSC, you’re equipped to tackle the markets with confidence and precision.

#telegram signal copier#telegram signals copier#TSc#Trade Copier#Signal Copier#Forex Signal Copier#Copier#forex education#forextrading#currency markets#economy#investing#xauusd#finance

2 notes

·

View notes

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Forex Trading Advisor @novagad

I’ve been a Forex Trader since 2007 and an instructor since 2017.

Forex Trading: Exploring the Global Financial Frenzy

In the vast and dazzling world of financial markets, there's one beast that roars louder than the rest: Forex trading. It's a domain where fortunes are made (and sometimes lost) faster than you can say "exchange rate."

But what exactly is it about Forex that has millions of people hooked, eyes glued to screens, fingers poised over keyboards, and hearts racing like they've had one too many espressos? Let's dive deeper into the world of currency trading and uncover the secrets behind its irresistible allure.

1. The 24/5 Convenience Store of Trading

First and foremost, Forex trading operates 24 hours a day, five days a week. Unlike the stock market, which opens and closes like a sleepy small-town shop, the Forex market is like a neon-lit convenience store that never sleeps.

Traders from New York to Tokyo can engage in their currency escapades whenever the mood strikes. This flexibility allows part-time traders to moonlight after their day jobs and early birds to catch the worm in real-time market action.

2. The Seductive Leverage

Leverage in Forex is like having a turbocharger in a sports car. It gives traders the ability to control larger positions with a relatively small amount of capital. It's the dream of making big bucks with a small investment.

Of course, leverage is a double-edged sword—one moment you're racing at full throttle, and the next, you're careening off a cliff. But for many, the potential for high returns is too tempting to resist.

impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

3. The Global Playground

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Yes, you read that right—trillion with a T! This immense liquidity ensures that traders can enter and exit positions with ease, without worrying about slippage.

Plus, the sheer variety of currency pairs means there's always something to trade, whether you're bullish on the dollar, bearish on the euro, or just feeling adventurous about the Malaysian ringgit.

4. The Democratization of Trading

Gone are the days when Forex trading was exclusive to big banks and hedge funds. The rise of online trading platforms has leveled the playing field, allowing anyone with a computer and an internet connection to join the fun.

And with a plethora of educational resources, webinars, and demo accounts available, the Forex market is as inclusive as it is vast. It's like the world's biggest, most volatile party, and everyone's invited.

5. The Thrill of the Chase

Let's face it: Forex trading comes with an undeniable adrenaline rush. The fast-paced nature of the market, the constant flux of prices, and the never-ending stream of economic news and geopolitical events create an environment that's as exhilarating as it is unpredictable.

It's like being on a financial rollercoaster, with every twist and turn bringing new opportunities and risks. For many, it's this thrill that keeps them coming back for more, despite the occasional stomach-churning drops.

6. The Intellectual Challenge

Forex trading isn't just about clicking buy and sell; it's a cerebral game of strategy, analysis, and psychology. Traders spend hours poring over charts, deciphering technical indicators, and keeping up with economic data.

It's a constant test of wits and nerve, where making the right call can yield impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

7. The Quest for Financial Independence

At its core, the popularity of Forex trading is driven by a simple, powerful desire: the quest for financial independence.

The dream of making a living from trading, of being your own boss, of earning money from anywhere in the world with just a laptop and an internet connection—it's a compelling vision.

While the reality can be tough and the road fraught with risks, for many, the potential rewards make it a journey worth embarking on.

8. The Bottom Line: Why Forex Trading is Gaining Popularity

Forex trading is no joke, my friend. It's a vibrant and global marketplace that offers incredible opportunities to make some serious dough, keep your brain buzzing, and achieve financial independence.

What makes it so darn attractive, you ask? Well, it's a 24/7 affair, meaning you can jump in whenever you please. Plus, there's this thing called leverage that gives you some extra oomph.

And let's not forget about the internet, which has made trading accessible to just about anyone. Oh, and did I mention the sheer adrenaline rush you get from the chase? It's like being on a rollercoaster ride you just can't resist.

9. But let's get real, shall we?

Now, let's not kid ourselves. Forex trading isn't some magical money-making machine that spits out cash on demand. It requires some serious learning, discipline, and a healthy dose of respect for the risks involved.

But here's the deal: If you're willing to put in the effort and approach it with a clear, strategic mindset, the rewards can be absolutely mind-blowing. We're talking big bucks, my friend.

So, whether you're a seasoned trader who knows the ropes or a curious newbie eager to dip your toes in the Forex waters, the world of trading is calling your name. Just remember to buckle up because it's going to be one heck of a wild ride.

Get ready to feel the rush!

Thanks for reading and please consider upvoting it, if you liked the content :)

4 notes

·

View notes

Text

How to Earn Money in Trading: Simple Strategies for Success

Trading has become an increasingly popular way for people to grow their wealth and achieve their financial goals. Whether you're interested in forex trading, stocks trading, or crypto trading, there are opportunities to earn money by investing wisely. However, trading is not just about luck; it requires a rich mindset, a solid strategy, and a deep understanding of the markets. In this post, we’ll explore how to earn money in trading by focusing on key principles and strategies that can set you on the path to financial success.

Understanding the Basics of Trading

Before diving into any form of trading, it's crucial to understand the basics. Trading involves buying and selling financial instruments like stocks, currencies, or cryptocurrencies with the aim of making a profit. Each type of trading—whether it's forex trading, stocks trading, or crypto trading—has its own unique characteristics and requires a different approach.

Forex Trading: It involves trading with currencies in the foreign exchange market. It’s one of the largest financial markets in the world, with trillions of dollars traded daily.

Stocks Trading: Here, you buy and sell shares of companies. The stock market can be volatile, but with careful analysis, it offers significant profit opportunities.

Crypto Trading: Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum. It’s a rapidly growing market, known for its high volatility.

Setting Clear Financial Goals

To earn money in trading, it's essential to set clear financial goals—like what do you wanna achieve through trading? Are you looking to build long-term wealth, or are you interested in making quick profits? Defining your financial goals will guide your trading strategy and help you stay focused.

For example, if your goal is to create a steady income stream, you might focus on stocks trading and dividend-paying stocks. If you're aiming for high-risk, high-reward opportunities, crypto trading could be more suitable.

Developing a Rich Mindset

A rich mindset is critical for success in trading. This mindset is about being patient, disciplined, and focused on long-term success rather than short-term gains. Many new traders fail because they get caught up in the excitement of quick profits, leading to poor decisions and losses.

A rich mindset also involves continuous learning. The financial markets are constantly changing, and staying informed is key to making smart trading decisions. Whether you’re involved in forex trading, stocks trading, or crypto trading, always keep learning and adapting to new market conditions.

Choosing the Right Trading Strategy

Your trading strategy will significantly impact your ability to earn money in trading. There are various strategies you can adopt depending on your financial goals and risk tolerance.

Day Trading: This involves buying and selling financial instruments within a single trading day. It's fast-paced and requires quick decision-making.

Swing Trading: Here, you hold positions for several days or weeks, aiming to profit from short- to medium-term price movements.

Long-Term Investing: This strategy involves holding onto investments for years, betting on the overall growth of the market.

Each strategy has its pros and cons, and the best one for you will depend on your trading style, market knowledge, and financial goals.

Risk Management is Key

One of the most important aspects of earning money in trading is managing your risk. Even experienced traders face losses, but with proper risk management, you can minimize those losses and protect your capital.

Set stop-loss orders, never invest more than you can afford to lose, and always diversify your portfolio. Whether you’re engaged in forex trading, stocks trading, or crypto trading, understanding and managing risk is crucial for long-term success.

4 notes

·

View notes

Text

Why Traders Choose PreferForex.com Signals for Their Trading Success

The smart money forex signals

In the fast-paced world of trading, success is often determined by making well-informed decisions at the right time. Traders are constantly seeking reliable sources of information and tools that can help them navigate the markets with confidence. This is where PreferForex.com Signals comes into play. With its comprehensive suite of trading signals and analysis, PreferForex has emerged as a trusted partner for traders looking to achieve their financial goals.

One of the key reasons why traders choose our Forex Signals is the accuracy and reliability of its signals. The team of experienced analysts at PreferForex.com employs a meticulous approach to market analysis, using a combination of technical indicators, fundamental analysis, and market sentiment to generate high-quality trading signals. These signals are then delivered to traders in real-time, ensuring that they have access to the latest market insights and opportunities.

Another factor that sets PreferForex.com Signals apart is its versatility. Whether you are a beginner or an experienced trader, PreferForex.com offers a range of signal packages tailored to suit your trading style and preferences. From short-term scalping signals to long-term trend-following signals, there is something for everyone. Traders can also choose from a variety of asset classes, including forex, stocks, commodities, and cryptocurrencies, allowing them to diversify their portfolios and take advantage of different market conditions. our signals examples-

In addition to its accuracy and versatility, PreferForex.com Signals also provides traders with valuable educational resources. The platform offers comprehensive market analysis reports, trading tutorials, and webinars that can help traders enhance their knowledge and skills. This commitment to education sets PreferForex.com apart from other signal providers, as it empowers traders to make informed decisions based on a deep understanding of the markets.

Traders also appreciate the user-friendly interface and intuitive design of PreferForex.com Signals. The platform is easy to navigate, with clear and concise signals that are easy to understand. Traders can access their signals on any device, whether it's a desktop computer, laptop, or mobile phone, ensuring that they never miss an opportunity to capitalize on market movements.

Furthermore, PreferForex.com Signals offers exceptional customer support. The team is available 24/7 to assist traders with any questions or concerns they may have. Whether it's technical support or general inquiries about trading strategies, traders can rely on PreferForex.com to provide prompt and helpful assistance.

Lastly, traders choose PreferForex.com Signals because of its track record of success. Over the years, PreferForex.com has built a reputation for delivering consistent and profitable signals. Many traders have achieved significant financial gains by following the signals provided by PreferForex.com, which further reinforces its credibility and trustworthiness.

youtube

In conclusion, traders choose PreferForex.com Signals for their trading success because of its accuracy, versatility, educational resources, user-friendly interface, exceptional customer support, and track record of success. With PreferForex.com Signals by their side, traders can navigate the markets with confidence and increase their chances of achieving their financial goals. Whether you are a novice trader or an experienced professional, PreferForex.com Signals is a valuable tool that can help you unlock your full trading potential.

Visit our YOUTUBE Channel

4 notes

·

View notes

Text

Tips for Business Owners on How to Invest in the Stock Market or Forex Online

Tips for Business Owners on How to Invest in the Stock Market or Forex Online

Business owners are often well-versed in managing their companies, but when it comes to investing in the stock market or forex online, they may find themselves in unfamiliar territory. However, these financial markets can offer an excellent opportunity to grow your wealth. This guide provides essential tips for business owners looking to venture into the world of online stock market and forex trading.

Educate Yourself

Before diving into online trading, educate yourself about the basics of both stock and forex markets. This includes understanding market terminology, different asset classes, risk management, and trading strategies. Several online resources, courses, and books can help you build a solid foundation of knowledge.

For business owners venturing into online stock investing, consider mastering the art through an online course that not only sharpens your skills but also provides a lucrative opportunity to share your knowledge. Start by selecting a reputable online learning platform, ensuring it covers fundamental concepts like market analysis, risk assessment, and investment strategies. Enroll in courses led by seasoned experts and successful investors to gain insights and practical tips.

Simultaneously, explore the prospect of offering your own online course. Leverage your business expertise to create a comprehensive curriculum tailored for beginners or those looking to enhance their investment skills. Utilize engaging content formats such as videos, quizzes, and interactive sessions. Establish your credibility by sharing your success stories and lessons learned.

Promote your course through social media, your business website, or relevant forums. Consider providing a free introductory module to attract potential learners. As your investment skills grow, so will your ability to guide others on this financial journey. Ultimately, investing in both your own education and sharing your knowledge through an online course can open new avenues for financial growth and business expansion.

Set Clear Investment Goals

Establish clear and realistic investment goals. Are you looking to generate short-term income, build long-term wealth, or diversify your investment portfolio? Having well-defined objectives will guide your investment decisions and risk tolerance.

Develop a Trading Plan

A trading plan is a roadmap that outlines your strategies, risk tolerance, and the assets you plan to invest in. It also includes entry and exit points for trades. Without a plan, you may be prone to impulsive decisions that can lead to significant losses.

Choose the Right Platform

Selecting the right online trading platform is crucial. Look for a platform that is user-friendly, secure, and provides access to a wide range of financial instruments. It should also offer robust research and analysis tools. Ensure the platform is regulated and reputable to protect your investments.

Diversify Your Portfolio

Diversification is a key principle of investing. Spreading your investments across different asset classes, such as stocks, bonds, and currencies, can help mitigate risks. Avoid putting all your capital into a single trade or asset.

Start with a Demo Account

If you're new to trading, consider starting with this INVESTING 101 online course with a demo account. Demo accounts allow you to practice trading with virtual money, helping you get a feel for the markets and your chosen platform without risking your capital.

Risk Management

Protect your investments by setting stop-loss orders. These are predefined price levels at which you're willing to exit a trade to limit potential losses. Additionally, only invest money you can afford to lose, and avoid using borrowed funds for trading.

Stay Informed

Stay updated with current events and economic news, as they can significantly impact the financial markets. Subscribing to financial news outlets and following relevant economic indicators can help you make informed decisions.

Technical and Fundamental Analysis

Learn and use both technical and fundamental analysis to make informed investment decisions. Technical analysis involves studying price charts and patterns, while fundamental analysis focuses on examining economic and company-specific factors that may affect asset prices.

Practice Patience

Rome wasn't built in a day, and the same goes for wealth accumulation through trading. Be patient and avoid chasing quick profits. Successful trading often involves a series of well-thought-out, disciplined decisions over time.

Embrace Continuous Learning

The financial markets are dynamic and ever-changing. As a business owner, it's crucial to keep learning and adapting to new market trends, strategies, and technologies. Joining trading forums or taking advanced courses can be beneficial.

Track and Analyze Your Trades

Maintain a trading journal to record your trades, including the reasons for entering and exiting each trade. Analyzing your trading history will help you identify patterns and improve your strategies.

Seek Professional Advice

Consider seeking advice from financial advisors or experts who can provide guidance based on your financial goals and risk tolerance. They can help tailor your investment strategies to your specific needs.

Tax Considerations

Understanding tax implications is vital. Depending on your location and trading activity, you may be subject to capital gains tax. Consult a tax professional to ensure compliance with tax regulations.

Avoid Emotional Trading

Emotions like fear and greed can lead to impulsive and irrational trading decisions. Stick to your trading plan, and if emotions start to cloud your judgment, take a step back and reevaluate.

Build a Financial Cushion

Maintain a financial cushion or emergency fund for personal and forex trading expenses. This will ensure that trading losses don't jeopardize your financial stability.

Review and Adjust Your Strategy

Regularly review your trading strategies and portfolio. If something isn't working or your goals change, be prepared to adjust your approach.

Stay Disciplined

Maintain discipline in your trading activities. Discipline helps you stick to your trading plan and avoid making hasty decisions based on emotions or short-term market fluctuations.

Network and Collaborate

Connect with other traders, both online and in-person, to exchange ideas and experiences. Collaborating with peers can provide valuable insights and support.

Monitor Market Hours

Stock and forex markets have specific trading hours. Be aware of these hours and ensure your trading activities align with them.

Conclusion

Investing in the stock market and forex online can be a rewarding way for business owners to grow their wealth. However, it's not without risks. By following these tips, you can make informed decisions, manage risks, and work towards achieving your investment goals. Remember that success in trading comes with time, practice, and continuous learning. Always approach online trading with caution, discipline, and a well-thought-out strategy.

2 notes

·

View notes

Text

Riding the Waves: Financial Market Online Surges with Best Forex Traders

In the digital age, the financial markets have undergone a transformative surge, and the online arena is now dominated by the prowess of the Best Forex Traders. These individuals navigate the intricate waves of currency fluctuations with skill and finesse, setting themselves apart in a sea of global financial activity.

The best Forex traders online are marked by their ability to ride the waves of market dynamics. Armed with a deep understanding of economic indicators, geopolitical events, and technical analysis, they make strategic decisions that capitalize on market trends. These traders embrace volatility, viewing it not as a hindrance but as an opportunity to leverage price movements for profit.

Technology stands as a cornerstone for the success of these traders. Advanced trading platforms equipped with real-time data, algorithmic tools, and artificial intelligence have become indispensable in the online Forex world. The best traders leverage these tools to execute trades swiftly, automate certain aspects of their strategy, and stay ahead of market developments. Technology not only empowers them but also allows for a more informed and responsive approach to the fast-paced nature of currency trading.

Risk management is a defining trait of the best Forex traders. They recognize the inherent uncertainties in the financial markets and implement stringent risk management practices to protect their capital. This includes setting stop-loss orders, diversifying portfolios, and maintaining a disciplined approach to trading.

The online surge of the best Forex traders extends beyond individual efforts, with the rise of social trading platforms. These platforms foster a sense of community where traders can share insights, strategies, and market analyses. Emerging traders can observe and emulate the tactics of seasoned professionals, creating a collaborative environment that contributes to the collective success of the community.

In the vast expanse of the financial market online, the best Forex traders are the captains of their ships, skillfully navigating the waves and turning market volatility into opportunities for financial gain. Their ability to adapt to changing conditions, harness technology, and manage risks positions them at the forefront of the dynamic world of online Forex trading.

2 notes

·

View notes

Text

Safeguarding Success: The Crucial Role of Risk Management with Live Forex Signals

Introduction

The world of forex trading offers a realm of possibilities, from significant profits to rapid market shifts. Amidst this dynamic landscape, traders often turn to live forex signals to gain an edge in their trading decisions. These signals, sourced from experienced traders or advanced algorithms, can provide valuable insights into potential trade setups. However, the path to successful trading goes beyond just accurate signals – it requires effective risk management. In this blog post, we'll delve into why risk management is paramount when using live forex signals and how it can spell the difference between success and failure.

Understanding Risk Management

Risk management is the process of identifying, assessing, and mitigating potential risks to preserve capital and enhance the probability of successful trades. It's a set of strategies that traders employ to protect their investments and navigate the volatility of the forex market. While live forex signals can provide a clear roadmap for trading decisions, risk management ensures that traders don't fall into common pitfalls and face undue losses.

The Significance of Risk Management with Live Forex Signals

Preserving Capital: The primary goal of risk management is capital preservation. Even the most accurate signals can sometimes fail due to unpredictable market movements. By limiting the amount of capital risked on each trade, traders ensure that a single loss doesn't wipe out their entire account.

Mitigating Emotional Decisions: Emotional decisions often lead to impulsive actions, which can be detrimental to trading success. Implementing risk management strategies helps traders stick to their plan, even when market emotions run high.

Long-Term Sustainability: Forex trading is a marathon, not a sprint. Effective risk management ensures that traders can withstand losses and continue trading over the long term. Without risk management, a series of losses could lead to an account depletion, preventing traders from capitalizing on future opportunities.

Stress Reduction: Trading without proper risk management can be stressful, causing sleepless nights and anxiety. Knowing that you have a strategy in place to manage losses can significantly reduce stress levels and improve overall mental well-being.

Key Risk Management Strategies

Position Sizing:

Determine the appropriate size of your trades based on the size of your trading account and the level of risk you're comfortable with. A common rule of thumb is to risk only a small percentage of your account on each trade, such as 1-2%.

Setting Stop-Loss Orders:

Place stop-loss orders at strategic levels to limit potential losses. This ensures that if a trade goes against you, the damage is contained within a predetermined threshold.

Diversification:

Avoid putting all your eggs in one basket. Diversify your trades across different currency pairs and potentially other asset classes to spread risk.

Risk-Reward Ratio:

Assess the potential reward of a trade relative to the risk. A favorable risk-reward ratio, such as 1:2 or higher, ensures that winning trades can offset a series of losses.

Real-Life Example:

The Tale of Two Traders, Imagine two traders using the same live forex signals. Trader A ignores risk management, investing a significant portion of their capital in a single trade. When the trade goes sour, their account takes a massive hit, leaving them unable to recover. On the other hand, Trader B meticulously employs risk management strategies, risking only a small percentage of their capital on each trade. While they also face losses, their account remains intact, allowing them to capitalize on subsequent winning trades and eventually turn a profit.

Conclusion

Live forex signals offer a valuable shortcut to potentially profitable trading opportunities. However, they should be viewed as tools to assist rather than dictate trading decisions. Risk management serves as the guiding light that ensures traders stay on a sustainable path. It prevents impulsive actions, preserves capital, and maintains a trader's psychological well-being. Remember that while live forex signals can provide insights; it's your risk management strategies that ultimately determine your success in the volatile forex market. In a realm where uncertainty is constant, risk management becomes the beacon that leads to lasting profitability.

3 notes

·

View notes

Text

Discover the Most Profitable Gold Signals with TP and SL for Over 5% Daily Returns

Subscribe For more

Join me on MQL5 for top-notch trading insights and strategies:

تابعنا على mql5

Are you looking to excel in stock trading, forex, currency exchange, commodity trading, technical analysis, fundamental analysis, trading strategies, capital management, daily trading, or global economics? Look no further!

We provide expert guidance on all these topics and more. Our comprehensive approach to online trading ensures that you stay ahead of the game and make informed decisions.

Investing in gold has never been easier! Our gold trading signals offer exceptional opportunities to maximize your profits. With our proven TP (Take Profit) and SL (Stop Loss) strategies, you can confidently navigate the gold market and achieve consistent returns.

Join our community of savvy traders and gain access to exclusive insights, market analysis, and trading tips. Our MQL5 platform is a hub of knowledge and expertise, designed to help traders of all levels succeed.

Don't miss out on the chance to take your trading skills to the next level. Follow the link above to join our MQL5 community and start making the most of your gold investments today.

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استراتيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعبر_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor

MetalTrading

#GoldTrading#forex live#live forex signals#live forex trading#forex signals live#xauusd#live signals forex#live forex trading session#xauusd analysis today#gold forecast#gold price#اقوى استراتيجية تداول#تداول#الذهب اليوم#اقوى استراتيجية فوركس لهذا العام#تحليل الذهب#استراتيجية تداول ناجحة#الذهب#اقوى استراتيجية فوركس#استراتيجية لتداول الفوركس#افضل استراتيجية تداول للمبتدئين#توصيات الذهب اليومية#اقوى استراتجيه سكالبنج

3 notes

·

View notes

Text

Navigating the Forex Market: A Beginner's Guide to Currency Trading

https://www.brokersview.com

In today's interconnected world, the foreign exchange (forex) market stands as the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. As a newcomer to the world of finance, understanding the basics of forex trading can be the first step toward harnessing its potential. In this post, we'll provide an introductory guide to help you navigate the forex market.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. The forex market operates 24 hours a day, five days a week, due to the global nature of currency trading. It serves various purposes, from facilitating international trade to allowing investors to speculate on currency price movements.

Key Players in the Forex Market

Central Banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB), play a significant role in the forex market by setting interest rates and implementing monetary policies that impact currency values.

Commercial Banks: Commercial banks participate in forex trading on behalf of their clients and themselves, serving as major liquidity providers in the market.

Hedge Funds and Investment Firms: Large financial institutions and hedge funds engage in forex trading to diversify their portfolios and capitalize on price fluctuations.

Retail Traders: Individual traders like you and me participate in the forex market through online trading platforms provided by brokers.

Currency Pairs

In forex trading, currencies are quoted in pairs, where one currency is exchanged for another. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. If the EUR/USD exchange rate is 1.20, it means 1 Euro can buy 1.20 US Dollars.

How Forex Trading Works

Forex trading involves speculating on whether a currency pair's value will rise (appreciate) or fall (depreciate) in the future. Traders can take two primary positions:

Long Position (Buy): A trader buys a currency pair if they believe the base currency will strengthen against the quote currency.

Short Position (Sell): A trader sells a currency pair if they expect the base currency to weaken compared to the quote currency.

Risk Management

Forex trading carries inherent risks due to the volatility of currency markets. It's crucial to implement risk management strategies, including setting stop-loss orders to limit potential losses and diversifying your trading portfolio.

Choosing a Forex Broker

Selecting the right forex broker is a critical step for beginners. Look for brokers regulated by reputable authorities, offering user-friendly trading platforms, competitive spreads, and excellent customer support.

Educational Resources

Learning is an ongoing process in forex trading. Take advantage of educational resources provided by brokers, online courses, webinars, and trading forums to enhance your understanding of the market.

Conclusion

Forex trading offers opportunities for profit, but it's essential to approach it with knowledge, discipline, and caution. As a beginner, start with a demo account to practice your trading strategies without risking real money. Over time, you can gain confidence and experience to make informed decisions in the dynamic world of forex trading. Remember that success in forex trading requires continuous learning and adaptation to changing market conditions.

2 notes

·

View notes

Text

Popular Forex Trading Strategies For Successful Traders

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market.

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. In the end, no one size fits all.

In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones. Any trading strategy that leads you towards this goal could prove to be the winning one.

How to Choose The Best Forex Trading Strategy

Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process.

Time frame

Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts.

On the other hand, swing traders are likely to use a 4-hour chart, as well as a daily chart, to generate profitable trading opportunities. Hence, before you choose your preferred trading strategy, make sure you answer the question: how long do I want to stay in a trade?

Varying time periods (long, medium, and short-term) correspond to different trading strategies.

Number of trading opportunities

When choosing your strategy, you should answer the question: how frequently do I want to open positions? If you are looking to open a higher number of positions then you should focus on a scalping trading strategy.

On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Position size

Finding the proper trade size is of the utmost importance. Successful trading strategies require you to know your risk sentiment. Risking more than you can is very problematic as it can lead to bigger losses.

A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

Three Successful Strategies

By now, you have identified a time frame, the desired position size on a single trade, and the approximate number of trades you are looking to open over a certain period of time. Below, we share three popular Forex trading strategies that have proven to be successful.

Scalping

Forex scalping is a popular trading strategy that is focused on smaller market movements. This strategy involves opening a large number of trades in a bid to bring small profits per each.

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks.

Scalping is very popular in Forex due to its liquidity and volatility. Investors are looking for markets where the price action is moving constantly to capitalize on fluctuations in small increments.

This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

A clear downside to scalping is that you cannot afford to stay in the trade too long. Additionally, scalping requires a lot of time and attention, as you have to constantly analyze charts to find new trading opportunities.

Let’s now demonstrate how scalping works in practice. Below you see the EUR/USD 15-min chart. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA).

In about 3 hours, we generated four trading opportunities. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips.

Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy.

Day Trading

Day trading refers to the process of trading currencies in one trading day. Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day.

No position should stay open overnight to minimize the risk. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas.

Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market.

In addition to the limit set on each position, day traders tend to set a daily risk limit. A common decision among traders is setting a 3% daily risk limit. This will protect your account and capital.

In the chart above, we see GBP/USD moving on an hourly chart. This trading strategy is based on finding the horizontal support and resistance lines on a chart. In this particular case, we are focused on resistance as the price is moving upward.

The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Thus, a stop loss order is placed 25 pips above the entry point.

On the downside, we use the horizontal support to place a profit-taking order. Ultimately, the price action rotates lower to bring us around 65 pips in profits.

Position Trading

Position trading is a long-term strategy. Unlike scalping and day trading, this trading strategy is primarily focused on fundamental factors.

Minor market fluctuations are not considered in this strategy as they don’t affect the broader market picture.

Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year. However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade.

This trading strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below.

A reversal is a result of the huge monetary stimulus provided by the US Federal Reserve and the Trump administration to help the troubled economy. As a result, the amount of active dollars increases, which decreases the value of the dollar. Position traders are likely to start selling the dollar on trillion-dollar stimulus packages.

Their target may depend on different factors: long-term technical indicators and the macroeconomic environment. Once they believe that the current bearish trend is nearing its end from a technical perspective, they will seek to exit the trade. In this example, we see the DXY rotating at the multi-year highs to trade more than 600 pips lower 4 months later (March - July).

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

The Hidden Formula: How to Master Commodity Channel Index and Grid Trading Like a Pro The Forex Market’s Best-Kept Secret (That You’re Probably Overlooking) Most traders rely on RSI, MACD, or Bollinger Bands, but what if I told you that the Commodity Channel Index (CCI) is the underground hero of the technical indicators world? Combine it with Grid Trading, and you unlock a strategy that can turn market chaos into structured profitability. Sounds too good to be true? Let’s dig into why most traders ignore this combo—and why that’s a huge mistake. Why Most Traders Get It Wrong (And How You Can Avoid It) Traders often misuse CCI, treating it like an RSI knockoff or assuming it's only for overbought/oversold signals. In reality, CCI measures price deviation from its statistical mean, which means it’s perfect for spotting early trend reversals. Grid Trading gets dismissed as a “risky averaging-down strategy.” Wrong again. The truth is, when done correctly, it’s a structured approach to capitalizing on market fluctuations—not just blind accumulation. The CCI-Grid Trading Blueprint: How the Pros Do It Let’s break this down into step-by-step execution. Step 1: Understanding CCI Like a Market Insider Most traders set CCI at the default 14-period setting, but elite traders tweak it to 20 or 30 for more accurate trend identification. - Above +100 → Strong uptrend confirmation. - Below -100 → Strong downtrend confirmation. - Divergences → When price makes new highs but CCI doesn’t, it’s a red flag for trend exhaustion. - Zero-line crossover → A confirmation signal that trend momentum is shifting. Step 2: Setting Up a Smart Grid Trading System Instead of randomly stacking orders, smart traders use a structured grid with a logical approach: - Buy Grid: Place long orders below current price at predefined intervals. - Sell Grid: Place short orders above current price at predefined intervals. - Grid Spacing: Optimal spacing depends on volatility (consider ATR for calculation). - Stop-Loss Strategy: Always hedge or use a safety net (example: using a trailing SL or dynamic risk-management rules). The Secret Sauce: How to Combine CCI & Grid Trading for Maximum Profit Here’s how you blend CCI with Grid Trading for a lethal strategy: - Use CCI to Filter Market Conditions: - If CCI is trending above +100, only enter buy trades within your grid. - If CCI is below -100, only enter sell trades. - If CCI is between -100 and +100? Avoid adding to the grid—the market lacks momentum. - Strategic Grid Execution: - If CCI signals a trend reversal, manually close losing grid orders instead of waiting for price recovery. - Adjust grid spacing based on ATR to maintain dynamic risk control. - Utilize partial exits—take profits on half positions and let the rest ride for extended gains. - Divergence as a Warning Signal: - CCI divergence is a major clue that momentum is drying up. Reduce grid exposure when you spot divergence. - Example: If the price makes a higher high, but CCI makes a lower high? Exit aggressive positions before the trend collapses. Elite-Level Tricks: Ninja Moves for Advanced Traders - CCI + Volume Confirmation - If CCI signals a trade but volume is weak, delay entry until volume increases. - Automate Your Grid With a Smart Trading Tool - Manual execution is prone to human error. Using an AI-powered trading tool like StarseedFX’s Smart Trading Tool helps automate precise lot sizing, order management, and risk control. - Hedging with Opposite Grid Entries - In volatile conditions, execute a counter-grid on a correlated pair (example: EUR/USD long grid + USD/CHF short grid to hedge risk). Final Thoughts: Why CCI & Grid Trading Are a Game-Changer Most traders focus on basic strategies and miss out on powerful combinations like CCI & Grid Trading. If used correctly, this approach: - Increases profitability by capitalizing on trend momentum while hedging risk. - Reduces emotional decision-making with structured entry-exit logic. - Adapts to different market conditions, making it highly versatile. Your Next Move: Take This Strategy to the Next Level Want to refine your trading edge? Here’s what to do next: - Join the StarseedFX Community for live trading insights: Click here - Get a free trading plan to structure your strategies: Download now - Track your trades professionally with our free journal: Start logging Stay ahead of the pack. Master the unseen strategies. Profit like a pro. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes