#Forex Day Trading

Explore tagged Tumblr posts

Text

Trading Indicators: A Comprehensive Guide

In the trading world, the excitement to gain potential profit and the fear of loss can overpower the trader's judgment, resulting in poor trading conditions. Fortunately, understanding the intricacies of the market and preparing effective strategies using trading indicators can empower them to make more informed decisions. In this comprehensive guide, we will delve into the different types of trading indicators, their applications, and how traders can incorporate them into their trading toolkit.

What Are Trading Indicators?

Trading indicators are mathematical calculations based on the price, volume, or open interest of a security. These calculations provide valuable insights to traders, allowing them to make more informed decisions. With the help of these indicators, traders can interpret market trends, identify potential entry and exit points, and check market sentiment.

Types of Trading Indicators

There are different types of trading indicators that fall into several categories. Each one of them serves a distinct purpose. Trading platforms like the mt4 trading platform offer a range of built-in indicators that can help traders to understand the current market trends. These are explained below-

Trend Indicators

These are the indicators designed to identify the direction of the market. They help traders to determine whether a market is bullish (upward trend), bearish (downward trend) or moving sideways (consolidation). Some of the popular trend indicators include:

Moving Averages (MA): These smooth out price data to create a trend-following indicator. It helps traders identify potential support and resistance levels. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are the two most common types of moving averages.

Average Directional Index (ADX): It measures the strength of a trend, regardless of its direction. A rising ADX indicates a strong trend, while a falling ADX indicates a weak trend.

Momentum Indicators

Momentum indicators help traders check the speed and strength of price movements. They can indicate potential reversals and confirm trends. These indicators are essential for forex day trading.

The critical momentum indicators include:

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, typically on a scale from 0 to 100. An RSI above 70 indicates an overbought condition, while an RSI below 30 suggests an oversold condition.

Stochastic Oscillator: This indicator compares a security's closing price to its price range over a specific period. Values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions.

Volatility Indicators

Volatility indicators measure the rate of price fluctuations in a security. High volatility may indicate potential opportunities to trade, while low volatility may signal a lack of interest. Some of the notable volatility indicators include the following:

Bollinger Bands: These consist of a middle band (SMA) and two outer bands representing standard deviations away from the SMA. When prices approach the outer bands, it can indicate overbought or oversold conditions.

Average True Range (ATR): This indicator measures market volatility by calculating the average range between the high and low prices over a specified period. A rising ATR suggests increasing volatility, while a falling ATR indicates decreasing volatility.

Volume Indicators

Volume indicators are trading indicators that provide insights into the strength or weakness of a price move by analyzing the trading volume. A higher volume often confirms the validity of a price movement, while a lower trading volume may suggest uncertainty.

The key volume indicators that a trader must use while analysing the market include:

On-Balance Volume (OBV): This indicator uses volume flow to predict changes in stock price. An increasing OBV suggests that buyers are willing to step in, while a decreasing OBV indicates that sellers are taking control.

Chaikin Money Flow (CMF): The CMF combines price and volume to show the buying and selling pressure over a specific period. If a CMF is positive, it indicates buying pressure, while a negative CMF indicates selling pressure.

How to use Trading Indicators effectively?

To incorporate trading indicators into your forex trading strategies, you need to carefully consider and practice. Here are some tips to help you use them effectively:

Combine Indicators: It is important to combine different indicators to analyse the market condition. Relying on a single indicator may lead to misleading signals. Thus, use a combination of indicators from different categories to confirm your analysis. For instance, you can pair a trend indicator with a momentum indicator, as it can provide a clearer picture of market conditions.

Understand the Market Context: Do not use the trading indicators in isolation. Always consider the broader market context, which includes news events, economic data, and geopolitical developments. All these factors can significantly influence market behaviour and, thus, should be considered important.

Backtest Your Strategy: Before implementing your strategy in live trading, it is important to backtest it using historical data. Backtesting the strategy will help you understand how your chosen indicators perform under various market conditions. Based on the observation, you can refine your approach.

Practice Risk Management: No matter how reliable your indicators may seem, it is always essential to implement risk management strategies. Set stop-loss and take-profit levels to protect your capital and minimize the impact of potential losses.

Stay Disciplined: Trading can evoke strong emotions, especially when you are a beginner. Thus, it is one of the necessities to maintain discipline. Create a personalised trading plan, stick with it, and trust your analysis, even when faced with market volatility.

Conclusion

To conclude, trading indicators can be a powerful tool in your trading journey. It provides insights that can help traders navigate the complexities of the market. By understanding the various types of indicators and incorporating them into a well-rounded strategy, traders can boost their confidence as well as improve their decision-making.

0 notes

Text

Adapting Forex Trading Strategies to Current Events

As global conflicts unfold, the implications for forex trading become increasingly apparent. The surge in oil prices and the subsequent impact on inflation highlight the need for traders to adapt their strategies. Understanding these dynamics is crucial for effective forex market analysis.

Geopolitical Risks and Currency Fluctuations

With the conflict between Iran and Israel escalating, the potential for increased oil prices looms large. This may lead to inflationary pressures in various economies and could influence upcoming monetary policies. As the U.S. dollar strengthens, effective risk management in forex becomes paramount to navigate the changing landscape.

Precious Metals and Their Role

GOLD

GOLD prices are currently consolidating, with traders keenly awaiting upcoming data to gauge future movements. The geopolitical environment suggests that demand for GOLD as a safe haven could increase. You can learn more about the role of GOLD in forex trading here.

SILVER

SILVER has met resistance but shows potential for upward movement. Traders employing scalping techniques in forex should remain vigilant for breakout opportunities.

Examination of Currency Pairs

DXY

The DXY has surged, reflecting positive economic conditions. This trend is expected to continue, especially in times of uncertainty. Stay updated on DXY trends here.

GBPUSD

The GBP is displaying weakness, indicating a potential selling strategy as market dynamics shift. You can track changes in GBP with forex signals.

AUDUSD

The AUD may face short-term selling pressure, but it remains a viable long-term investment. For more on how to navigate AUD fluctuations, check forex market trends.

EURUSD

The Euro is experiencing declines, with traders advised to monitor for possible trading forex signals to take advantage of this trend.

USDJPY

The Yen remains volatile, with Japanese officials closely observing market trends. Traders should be aware of potential interventions.

USDCHF and USDCAD

The Franc's weakness against the dollar presents challenges, while the CAD may benefit from rising oil prices. Traders should keep an eye on these developments as they unfold. For further insights into how commodities affect forex, explore commodity-driven forex strategies.

0 notes

Text

Forex Day Trading

Forex Day Trading aims to buy and sell currency positions in a single trading day. Day traders often use technical tools to help them choose when to enter and exit a position, which they manage over minutes to hours. The ability to enter and exit positions swiftly is crucial for day traders, making market liquidity an important consideration. The difference between making a profit and losing money could be as small as a delay in the trade. You can day trade stocks, but most people prefer forex.

0 notes

Text

Learn How To Use The RSI Indicators To Uncover Forex Day Trading Opportunities

In this article, we will explore how to use the RSI for Forex day trading and how traders seek to unlock opportunities in the market.

0 notes

Text

ℑ𝔣 𝔞 𝔪𝔞𝔫 𝔨𝔫𝔬𝔴𝔰 𝔪𝔬𝔯𝔢 𝔱𝔥𝔞𝔫 𝔬𝔱𝔥𝔢𝔯𝔰, 𝔥𝔢 𝔟𝔢𝔠𝔬𝔪𝔢𝔰 𝔩𝔬𝔫𝔢𝔩𝔶..

#model#dark aesthetic#entrepreneur#masculine#photography#masked men#aesthetic#finance#economy#forex#forex market#day trading

3 notes

·

View notes

Text

🤑

#trading success#stock market#cryptocurrency#financialfreedom#learntotrade#trading tips#hardworkpaysoff#stock trading#tradingskills#forex traders#moneymindset#money#make money online#earn money online#bitcoin#trading strategies#day trading#cryptocurreny trading

2 notes

·

View notes

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#Leverage Credit Recovery#Yonkers Young Entrepreneurs #westchester county#hudson valley#vote#please vote#kamala harris#democratic#democracy#day trading#forex market#crypto#bitcoin#veteran#us army#activists#advocate#marginalized communities#immigrants#msnbc#Fox News

2 notes

·

View notes

Note

Sounds like you need to be put back to sleep 🤪 could I come drain your energy? Or just eat it out?

i wish i could but i have to get work done😪 !!

i just need someone between my legs while i edit content & work on other stuff🥺❤️

#that’s what kept me up so late last night & i have like 3 customs i need to get on top of;-;#and like i started day trading & made a bad forex exchange yesterday/fell asleep while trading & lost $5 so i need to make it back today;-;#and like the best time to start is around now;-;#IM SO TIRED AND DONT WANT TO LOOK AT SCREENS ANYMORE;-; !!!#anon asks#replies

4 notes

·

View notes

Text

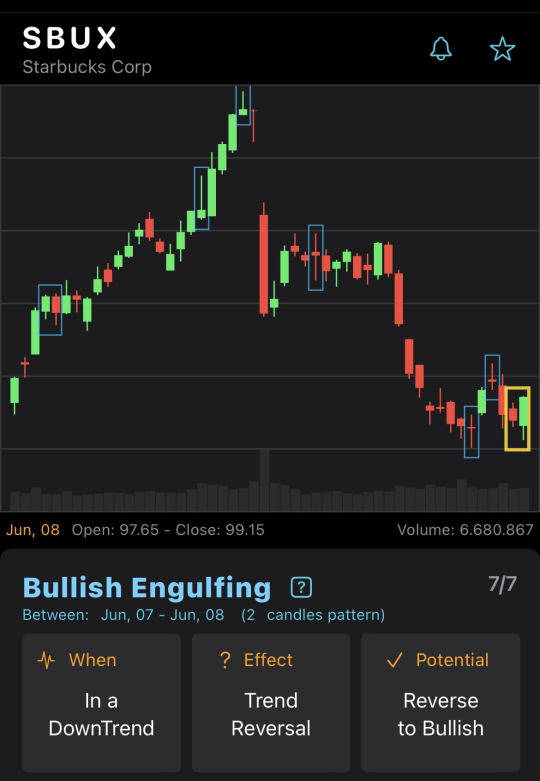

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

THE BEST MT4 SYSTEM

+656 Pips Profit with “Exynox Scalper” (+5 FRESH Screenshots)

It looks like you are missing out... Lots of Traders have already made hundreds of pips with brand new “Exynox Scalper” by Karl Dittmann.

It's easy, it’s accurate and it keeps generating amazing winning trades. Just look at these fresh screenshots: See New Screens with Open Trades

I highly recommend you get your own copy of “Exynox Scalper” and finally start making easy high profit with us: www.ExynoxScalper.com

#day trading#day trading for beginners#how to day trade#stocks#forex#crypto#how to trade stocks#learn to trade#how to trade#learn to day trade#how to day trade for beginners#day trader#how to get started day trading#day trade#how i learned to day trade#learn how to day trade#how to trade stocks for beginners#how i learned to day trade in a week#books to learn how to trade#learn how to trade#how to day trade stocks#how to trade forex in 2023

5 notes

·

View notes

Text

Forex Trading Strategies in a Volatile Market Environment

The recent escalation of conflict in the Middle East presents challenges and opportunities for forex traders. With oil prices surging and inflation fears mounting, the financial landscape is shifting rapidly. Understanding how these developments affect forex market analysis is essential for effective trading strategies.

Implications of Rising Oil Prices

As oil prices climb to $75 per barrel, the potential for inflation increases, particularly for economies heavily dependent on oil imports. In this context, the U.S. dollar may strengthen, providing a safer haven for traders during periods of uncertainty. Effective risk management in forex is vital to navigate the inherent volatility.

Precious Metals: A Safe Haven?

GOLD

GOLD remains in a consolidation phase as traders await critical data. Although short-term fluctuations are expected, the overall outlook remains bullish as geopolitical risks drive demand for safe-haven assets.

SILVER

SILVER has shown resilience, testing key resistance levels. Traders utilizing scalping techniques in forex can benefit from the current market dynamics as opportunities arise.

Analysis of Key Currency Pairs

DXY

The DXY has gained momentum following favorable employment data. The dollar's strength is expected to continue as markets react to global uncertainties.

GBPUSD

The Pound has weakened significantly, signaling potential short-selling opportunities as the conflict unfolds.

AUDUSD

The Aussie dollar is anticipated to face headwinds, but its long-term prospects remain solid. Traders should be prepared for potential rebounds.

EURUSD

The Euro is on a downward trend, with expectations for further declines. This could present lucrative opportunities for those following trading forex signals.

USDJPY

The Yen’s fluctuations are being closely monitored by Japanese authorities, reflecting the market's sensitivity to rapid changes.

USDCHF and USDCAD

The Franc is expected to weaken against the dollar, while the CAD may see gains due to rising oil prices. This dynamic presents opportunities for traders to capitalize on market movements.

0 notes

Text

Lux Trading Firm

Lux Trading is a leading proprietary trading firm, specializing in supporting experienced prop traders. Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption. We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

0 notes

Text

Explore The Best Economic Indicators To Include In A Forex Day Trading Strategy

This article delves into the significance of key economic indicators for Forex day trading.

0 notes

Text

E-book in my bio👉👉🚀🚀

#commercial#crypto#investing#marketing#stock market#ecommerce#fyp#daytrader#forexmarket#forex online trading#day trading#trading view

6 notes

·

View notes

Text

The Shocking Myth About Trading Everyone's Been Fooled By!

Honestly, when I first started learning about trading, I believed what most people still do:

To succeed, you have to predict the market. It sounded so logical, right? If you can see where the market is headed, you’ll win every time. But here’s the truth this is one of the biggest myths that keeps so many people stuck, frustrated, and, frankly, losing money.

In fact, trying to predict every single market move is not just impossible but also harmful to your success. I genuinely want to help you avoid falling into this trap because I’ve seen how damaging it can be. Let me walk you through why this myth persists, why it’s wrong, and how you can take a better approach to trading.

The Truth Behind the Myth: Why It’s Holding You Back

Let’s be real I wouldn’t want to be the genius trader who perfectly predicts the market? But the harsh reality is that no one can do it. Not even the experts. This myth thrives because it gives people false hope, but here’s why it’s such a problem:

It creates unrealistic expectations: You expect every trade to be a win, and when it’s not, you feel like a failure. But trading doesn’t work like that.

It encourages risky behavior: Believing in predictions can push you to take impulsive, high risk trades. Honestly, that’s a dangerous mindset.

It shifts focus from the essentials: Instead of learning valuable skills like risk management and strategy, traders waste time chasing something that’s not achievable.

What Successful Traders Actually Do

Now, here’s where the real magic lies. The best traders don’t focus on predicting the future they focus on mastering the things they can control.

Risk Management: This is genuinely the foundation of success. Great traders know that losing some trades is normal. What matters is minimizing losses and maximizing wins over time.

Consistency Over Perfection: Rather than chasing predictions, successful traders follow a clear plan that works in the long term.

Emotional Discipline: Let’s be honest trading stirs up emotions. But staying calm and making decisions based on strategy, not feelings, is what sets winners apart.

How to Succeed Without Chasing Predictions

I know you want real, actionable advice, so here’s a simple plan to set you on the right path:

1. Learn, Learn, Learn: In fact, knowledge is your greatest tool. Study market trends, explore strategies, and genuinely understand how trading works.

2. Start Small: Try the waters with small investments or demo accounts. This approach is ideal for building confidence without risking too much.

3. Set Realistic Goals: Honestly, expecting overnight success will only discourage you. Focus on small, steady progress instead.

4. Stay Updated: The market is always evolving. Keep yourself informed and adjust your strategy as needed.

Let’s Wrap This Up

Trading isn’t about predicting every market move it’s about building a strategy that works, managing risks, and staying consistent. Honestly, when you stop chasing the impossible and start focusing on what really matters, that’s when you’ll see true progress.✨

Tell me honestly in your trading journey, have you ever believed in this myths?

Comment ‘Yess’ or ‘No’ below I’m curious to know

Stay blessed 😊

#stock market#trading success#cryptocurrency#financialfreedom#trading tips#stock trading#tradingskills#forex traders#learntotrade#stockmarkettips#investmentstrategies#tradingmindset#cryptotrading#day trading#forex trading for beginners#riskmanagement#hardworkpaysoff

2 notes

·

View notes

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#rule of law#democracy#day trading#forex#crypto#bitcoin#ethereum#ethics#kamala harris#obama#clintons#biden#democratic#trump#republicans#maga#Fox News#msnbc#congress#supreme Courts#senate#house of Representatives#vote blue#please vote#leverage credit recovery#Yonkers Young Entrepreneurs#new york

3 notes

·

View notes