#Flocculant and Coagulant

Explore tagged Tumblr posts

Text

Flocculants and Coagulants are Essential to Treat Industrial Wastewater Effluents

Flocculants and coagulants are extensively used in industrial wastewater treatment processes to remove suspended solids and other contaminants from effluents. They facilitate the aggregation of suspended particles in water and help in their easy removal through sedimentation. Key end-use industries where flocculants and coagulants find application include municipal water treatment, pulp & paper, textile, and mining. For instance, in textile industry, they are used for treating effluents loaded with dyes and other chemical residues. Their adoption allows effective clarification of wastewater prior to its discharge, meeting stringent environmental compliance standards.

The global flocculant and coagulant market is estimated to be valued at US$10.4 Bn in 2023 and is expected to exhibit a CAGR of 6.2% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Dynamics: The global flocculant and coagulant market size is estimated to witness high growth owing to stringent environmental regulations regarding industrial wastewater disposal. Most nations have imposed strict limits on effluent discharge quality to water bodies in terms of pH level, turbidity, dissolved solids, toxicity, etc. This has necessitated the use of flocculation and coagulation techniques across various industries for pre-treatment of wastewater before its final disposal. Furthermore, the growing mining industry worldwide is also fueling the demand for flocculants and coagulants as they play a critical role in processing of minerals and extracted ores. Developing regions with rapidly expanding urbanization and industrial activities are expected to present lucrative opportunities. However, availability of alternative advanced water treatment technologies may hamper the market growth over the forecast period. Flocculant and Coagulant Market: SWOT Analysis Strength: Flocculant and coagulant are widely used in industrial applications for treating wastewater. They provide efficient removal of suspended solids and reduce waste discharge. Their usage helps industries comply with stringent environmental regulations in a cost-effective manner. Weakness: The prices of raw materials used for manufacturing flocculants and coagulants are vulnerable to volatility. Frequent changes in raw material costs can squeeze profit margins for manufacturers. In addition, developed alternatives like membrane bioreactors pose competition. Opportunity: Growing needs for sustainable water treatment solutions from rising industries in Asia Pacific and Middle East & Africa will drive market demand. Development of bio-based and eco-friendly products provides new opportunities. Threats: Stringent quality standards and certification procedures increase entry barriers. Introduction of strict restrictions on use of certain chemicals is a challenge. Environmental concerns around improper sludge disposal can impact sales. Key Takeaways The global flocculant and coagulant market is expected to witness high growth. It size is projected to reach US$ 10.4 billion by 2024 from US$ 8.3 billion in 2019, registering a CAGR of 6.2% during the forecast period. Regional analysis: Asia Pacific dominates the market currently and is expected to continue its lead owing to strong demand from China, India and other Southeast Asian countries. Growth in core industries and public infrastructure development are major drivers in this region. Stringent wastewater treatment regulations also support regional market. Key players: Key players operating in the flocculant and coagulant market are Chanel S.A.,Estée Lauder Companies Inc.,L'Oréal S.A., Shiseido Co., Ltd,Unilever. These companies have strong global presence and focus on developing advanced product portfolios through continuous innovation.

Get more insights on this topic: https://www.newswirestats.com/flocculant-and-coagulant-market-size-and-outlook/ Explore more information, Please visit:https://www.urdughr.com/2023/12/mechanical-electrical-and-plumbing-mep-services-benefitting-residential-and-commercial-infrastructure.html

#Flocculant and Coagulant#Flocculant and Coagulant Market#Flocculant and Coagulant Market size#Flocculant and Coagulant Market share#Coherent Market Insights

0 notes

Text

Flocculant and Coagulant Market Pain Points: Addressing Key Challenges for Industry Growth and Sustainability

The flocculant and coagulant market plays a vital role in numerous industrial processes, from water treatment to mining. These chemicals help in purifying water by aggregating particles, which can then be removed. While the market continues to grow, various pain points impact its expansion and effectiveness. Understanding these challenges is crucial for manufacturers, businesses, and consumers who rely on these chemicals for water treatment and other applications.

Regulatory Compliance Challenges

One of the primary pain points in the flocculant and coagulant market is the complex regulatory landscape. Different countries have distinct regulations regarding the use of these chemicals in industries such as water purification, paper manufacturing, and wastewater treatment. Compliance with these regulations can be time-consuming and costly, especially for companies operating in multiple countries with varying standards. Manufacturers and suppliers must constantly adapt to changes in regulations, ensuring that their products meet all safety and environmental standards, which can hinder market growth and increase operational costs.

Environmental Impact and Sustainability Concerns

Sustainability has become a critical issue in almost every industrial sector, and the flocculant and coagulant market is no exception. Many of these chemicals are derived from synthetic polymers, which may not be biodegradable or eco-friendly. The disposal of waste created during water treatment processes also raises environmental concerns. This issue is particularly pressing as governments and environmental organizations push for more sustainable practices. Companies must invest in research and development to create biodegradable alternatives, but such innovations often come with high research and production costs, which can limit their adoption.

Rising Raw Material Prices

Flocculants and coagulants are often derived from raw materials such as natural or synthetic polymers, which are subjected to fluctuations in market prices. As the demand for these raw materials increases, the cost of production rises, which can directly impact the pricing of end products. For manufacturers, the rising cost of raw materials is a significant pain point, particularly in the face of inflationary pressures and supply chain disruptions. This not only affects their profit margins but also their ability to offer competitive prices, making it difficult to maintain customer loyalty in a highly price-sensitive market.

Technology and Innovation Gaps

Innovation is a major factor in maintaining a competitive edge in the flocculant and coagulant market. However, there are several technological gaps that hinder progress in the development of more efficient, cost-effective, and environmentally friendly chemicals. Traditional flocculants and coagulants, while effective, may not always be optimal for specific applications or industries. The slow pace of technological advancements and the high cost of developing new, improved chemical formulations make it difficult for companies to stay ahead of the competition. Additionally, the lack of standardization in chemical formulations can result in inefficiencies and limited effectiveness in various water treatment processes.

Market Fragmentation and Competition

The flocculant and coagulant market is highly fragmented, with numerous small and large players operating across different regions. While this allows for increased competition, it also presents challenges for companies trying to establish their market position. Smaller players may struggle with limited resources and economies of scale, which makes it harder to compete with larger multinational corporations that can offer a wider range of products and services. This fragmentation also makes it difficult for consumers to find reliable and high-quality suppliers, creating a gap in the market for those seeking standardized and trusted products.

Supply Chain and Distribution Issues

Supply chain disruptions are another significant pain point in the flocculant and coagulant market. The global supply chain has faced considerable challenges due to geopolitical tensions, natural disasters, and the ongoing effects of the COVID-19 pandemic. These disruptions have led to delays in the production and delivery of raw materials and finished products, affecting the availability of flocculants and coagulants. The uncertainty surrounding global logistics has resulted in higher transportation costs and inventory shortages, ultimately increasing the price of end products and causing delays in fulfilling customer orders.

Conclusion

While the flocculant and coagulant market holds considerable potential for growth, it is not without its challenges. Regulatory hurdles, environmental concerns, rising raw material costs, technological limitations, market fragmentation, and supply chain issues all play a significant role in shaping the market’s trajectory. Companies operating in this space must find ways to navigate these pain points to maintain a competitive advantage and drive sustainable growth. As the demand for clean water and efficient industrial processes continues to rise, addressing these challenges will be critical for future success.

0 notes

Text

Flocculants And Coagulants Market: Key Trends and Innovations Driving Industry Growth

The global fish powder market size is expected to reach USD 13.19 billion by 2030, registering a CAGR of 6.5% from 2025 to 2030, according to a new report by Grand View Research, Inc. The growth is attributed to the rising use of fish meal products in poultry and swine diets. Rising aquaculture production along with the rise in the fortified food industry over the forecast period is anticipated to further fuel the growth.

Rising use of fish powder for the fortification of food is anticipated to drive the market. Moreover, demand for different fish categories such as anchovy, horse mackerel, capelin, menhaden, sand eel, and pilchard among others in functional food production is expected to drive the market. Increased aqua feed farming is anticipated to continue to drive the demand in the forthcoming years.

The production of fish meal is highly concentrated in Asia Pacific. China accounts for about 90% of the global aquafeed production. China is also the world’s largest importer of fish meal products; accounting for about 1.57 million metric tons in 2017 from 0.98 million metric tons in 2013. Growing imports along with the surge in prices has anticipated the demand for the products.

Rising demand in the aquafeed industry in India has driven the growth of the fish powder market. In India, the consumption of aquafeed was around 1 million tons in 2012, which reached to about 7 million tons in 2017. India has about 26 aquafeed mills with production capacity of about 43.4%, producing about 1.25 million tons of feed. Rise in fish farming is anticipated to further boost the product demand over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Fish Powder Market

Fish Powder Market Report Highlights

• The whole fish segment accounted for a leading revenue share of 64.1% in the global market in 2024. Whole fish is considered an important source of fish powder, which is used in various industries, including animal feed, aquaculture, and pet food.

• The swine segment accounted for a leading revenue share in the global market in 2024. The growing global demand for pork, particularly in countries with an expanding middle-income demographic, has resulted in a noticeable increase in pig farming.

• Asia Pacific accounted for a leading revenue share of 45.1% in the global fish powder industry in 2024. Growing aqua feed industry on account of the demand from functional ingredients mainly in developing countries such as India and China is expected to propel the market

• Various manufacturers are concentrating on new product launches, capacity expansions, and technological innovations to estimate existing and future demand patterns from upcoming product segments.

Fish Powder Market Segmentation

Grand View Research has segmented the global fish powder market on the basis of source, application, and region:

Fish Powder Source Outlook (Revenue, USD Million, 2018 - 2030)

• Whole Fish

• By-product

Fish Powder Application Outlook (Revenue, USD Million, 2018 - 2030)

• Swine

• Aquaculture

• Poultry

• Others

Fish Powder Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

o Spain

o Italy

• Asia Pacific

o China

o India

o Japan

o Australia & New Zealand

o South Korea

• Latin America

o Brazil

• MEA

o South Africa

Order a free sample PDF of the Fish Powder Market Intelligence Study, published by Grand View Research.

#Flocculants And Coagulants Market#Flocculants And Coagulants Market Size#Flocculants And Coagulants Market Share#Flocculants And Coagulants Market Analysis#Flocculants And Coagulants Market Growth

0 notes

Text

Flocculant & Coagulant Market - Forecast(2024 - 2030)

Overview

Flocculant & Coagulant Market size is forecast to reach around $7 billion by 2025, after growing at a CAGR of 6% during 2020-2025. Flocculant & coagulants are chemicals that aggregate the colloids and other suspended particles of high molecular weights in the liquid, thereby clean the water. Use of coagulation-flocculation method for removing harmful substances from wastewater is driving the growth of flocculant & coagulant market. Moreover, surging demand of poly aluminium chloride (PACl) and cationic polyacrylamide (C-PAM) for the removal of chemical oxygen demand (COD) and turbidity from paper recycling wastewater is aiding the growth of the market. Flocculant & coagulants are also used in oilfields for mud dewatering, oil/water separation and flow back water recycling.

Report Coverage

The report: “Flocculant & Coagulant Market – Forecast (2020-2025)”, by IndustryARC, covers an in-depth analysis of the following segments of the Flocculant & Coagulant Industry.

By Type: Coagulant {Organic Coagulant (Polyamine, Chitosan, and others) and Inorganic Coagulant (Aluminium Sulfate, Aluminium Chloride, Sodium Aluminate, Ferric Sulfate, Others)} and Flocculant (Anionic, Cationic, Non-Ionic, and Others)

By Application: Municipal Water Treatment, Paper and Pulp, Textile, Oil and Gas, Mining, Chemical Processing, and Others

By Geography: North America, South America, Europe, APAC, and RoW

Request Sample

Key Takeaways

In APAC Flocculant & Coagulant market, China dominated the market throughout the forecast period owing to the large consumer base and increase in demand of flocculant & coagulant chemicals for treating paper and pulp wastewater.

Decline in manufacturing activities globally due to the outbreak of coronavirus has hampered the growth of flocculant & coagulant market.

Increasing adoption of UV technologies and RO filtration hinder the growth of flocculant & coagulant market.

Type - Segment Analysis

Coagulant segment holds the largest share of more than 55% in the flocculant & coagulant market in 2019. The use of coagulation offer various advantages like it reduces the time required to settle out suspended solids and is very effective in removing fine particles that are very difficult to remove. Moreover, the water treatment coagulants consists of positively charged molecules that, destabilizes negatively charged particulate and colloidal contaminants. The inorganic and organic coagulants are also used to treat water for the removal of suspended solids in oilfields and textile industries. The rise in production of oil and gas increases the use of coagulants for the separation of oil and water. For instance, according to International Energy Agency (IEA), the global oil production capacity is expected to rise by 5.9 mb/d by 2025 whereas Non-OPEC supply of crude and natural gas liquids will rise by 4.5 mb/d.

Inquiry Before Buying

Application - Segment Analysis

Based on the application, the paper and pulp segment held the largest share of more than 25% in the flocculant & coagulant market in 2019. The growing use of flocculant & coagulant chemicals in paper industry for the removal of suspended particles from water is driving the growth of flocculant & coagulant market. According to Environmental Paper Network (EPN), paper use is steadily increasing year on year and exceeded to 400 million tons per year in 2018. Furthermore, rising environmental concerns and strict government regulations to lower the use of polyethylene bags has escalated the demand of paper for packaging purposes, which in turn augments the growth of flocculant & coagulant chemicals. For instance, California government has introduced a regulation known as SB270 in July 2015 for prohibiting use of plastic bags at groceries, pharmacies, and other stores.

COVID-19 has badly impacted the flocculant & coagulant market. Coronavirus has disrupted the supply chain and e-commerce sector. Decrease in purchasing capital has direct impact on various industry growth, which in turn hampered the growth of flocculant & coagulant market. With the steep reduction in demand due to sudden stoppage of exports/imports and also domestic sales has hampered the growth of flocculant & coagulant market. The Confederation of Indian Textile Industry (CITI) has requested the government to announce relief packages for the textile and apparel sector to curb the crisis being faced by the textile industries. Hence, downfall of textile industry also reduces the demand of flocculant & coagulant chemicals.

Geography - Segment Analysis

Asia Pacific dominated the flocculation and coagulation market with a share of more than 35% in 2019 followed by North America and Europe. Rapid industrialization and treatment of wastewater generated from manufacturing plants is driving the growth of flocculant & coagulants market. India is the second-largest manufacturer and exporter of textiles and apparel with a share of 5% of global trade. Exports of textile and clothing products from India have increased from US$ 39.2 billion during 2017–18 to US$ 40.4 billion during the year 2018–19, registering a growth of 3%. According to National Investment Promotion and Facilitation Agency, exports in the textiles and apparel industry are expected to reach $300 Bn by 2024-25 resulting in a tripling of Indian market share from 5% to 15%. Thus, growth of textile industry has increased the use of flocculant & coagulant chemicals for the filtration and aggregation of suspended particles present in wastewater. Furthermore, Asia is one of the largest producer of paper and increase in demand of flocculation and coagulant chemicals from paper industries is boosting the growth of market. According to the Trade Map, global import of pulp of wood and cellulose fibers was valued around $ 53,084,971 while china alone imported pulp of $19,240,368 in 2019.

Schedule a Call

Drivers – Flocculant & Coagulant Market

Increasing health concerns and government policies for wastewater treatment

Strict government regulations for the direct disposal of contaminated water is escalating the use of flocculation and coagulant chemicals in manufacturing industries. For instance, the United States Environmental Protection Agency (EPA) regulates the discharge and treatment of wastewater under the Clean Water Act (CWA). The National Pollutant Discharge Elimination System (NPDES) issues permit to all wastewater dischargers and treatment facilities. Whereas, contaminated water also causes severe health problems including diarrhea, cholera, dysentery etc. Thus, increasing health concerns also boosts the growth of flocculation and coagulant market. Moreover, the Indian government policies such as “State Sewerage and Wastewater Policy” which frames guidelines for resource development and management, wastewater collection and treatment, onsite and offsite sanitation also aids the growth of flocculation and coagulants market.

Global increase in mining operations

Increase in mining operations for the extraction of ores, minerals, coals etc. has resulted in water pollution. According to the USGS National Minerals Information Center, the U.S mines production grew by 3% reaching $82.2 billion of raw mineral materials in 2018 as compared to $79.7 billion in 2017. Water is used in mining for mineral processing, dust suppression and slurry transportation. The United States Geological Survey (USGS) has estimated that 4 billion gallons of water were withdrawn for mining operations in the U.S. in 2015, up 1% from 2010. Thus increase in mining operation has increased the use of flocculant & coagulant chemicals for the removal of suspended colloidal particles. Furthermore, government’s act and regulation such as Clean Water Act (CWA) in the United States that regulates the mining operations in and discharges of pollutants to streams also augments the growth of flocculant & coagulant market.

Challenges – Flocculant & Coagulant Market

Presence of substitutes for water treatment

The adoption of U.V technologies and RO water filtration whose purification efficiency is higher than flocculation and coagulant chemicals hampers the growth of flocculant & coagulant market. U.V and RO filters not only eliminates the suspended particles but also remove the harmful bacteria and pathogens. Although flocculant & coagulants are widely used in industries for effluent water treatment processes in solids removal, water clarification, lime softening, sludge thickening, and solids dewatering, but the cost and the need for accurate dosing of coagulants and frequent monitoring is a major challenge. Coagulants need accurate dosing equipment to function efficiently and the dose required depends on raw water quality that varies rapidly.

Buy Now

Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the flocculant & coagulant market report. In 2019, the market of flocculant & coagulant has been consolidated by the top 10 companies accounting for xx% of the share. Major players in the flocculant and coagulation market industry outlook are, BASF SE, Ecolab Inc., Solenis LLC, Solvay SA, Kemira Oyj, Buckman Laboratories International, Inc., Kurita Water Industries Ltd., Suez S.A., Feralco AB and Hengyang Jianheng Industry Development Co., Ltd., among others.

Acquisitions/Technology Launches

In January 2019, BASF SE merged its wet-end Paper and Water Chemicals business with Solenis. With this merger the company has expanded its chemical offerings for customers in the pulp, paper, oil and gas, chemical processing, mining, biorefining, and power industries. BASF SE would have a 49% stake in the merged entity, while 51% shares would be owned by Solenis.

In April 2017, Kemira Oyj launched a new high-performance cationic flocculant Kemira Superfloc® XD-7600 polymer. It was designed to help customers decrease their Total Cost of Ownership through more efficient sludge handling, including freight and disposal costs.

#Flocculant & Coagulant Market#Flocculant & Coagulant Market Share#Flocculant & Coagulant Market Size#Flocculant & Coagulant Market Forecast#Flocculant & Coagulant Market Report#Flocculant & Coagulant Market Growth

0 notes

Text

Flocculant and Coagulant Market is expected to grow at a CAGR of 6.2% during the forecast period and is expected to reach US$ 10.09 Bn by 2030.

0 notes

Text

Flocculants And Coagulants Market To Reach $16.61 Billion By 2030

The global flocculants & coagulants market size is anticipated to reach USD 16.61 billion by 2030 and is projected to grow at a CAGR of 3.9% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market growth is attributed to the rising demand for wastewater treatment, which has been prompted by the implementation of stringent government regulations worldwide. In addition, the increasing preference for eco-friendly solutions in water treatment processes has also played a crucial role in driving the market forward.

Advancements in sustainable and natural-based products have emerged as a significant driver for market growth in the field of wastewater treatment. The use of chemical coagulants and flocculants often results in the generation of a substantial volume of sludge, which increases the cost and complexity of disposing of potentially hazardous waste. For instance, chitosan, a natural organic polyelectrolyte, has been successfully used as a coagulant in the treating the textile industry wastewater. Studies have shown that chitosan effectively flocculates suspended particles and reduces levels of Chemical Oxygen Demand (COD) and turbidity in textile industry wastewater

Emergence of alternative water treatment technologies has emerged as a threat for the market around the world. As technology advances, new methods and technologies for water purification are being developed, such as membrane filtration and advanced oxidation processes. These alternative technologies may offer more efficient and sustainable solutions, potentially reducing the demand for traditional flocculant and coagulant products.

Rapid industrialization and urbanization in countries like China and India have led to increased wastewater generation, creating a demand for efficient water treatment processes. The region's high economic growth, flourishing chemical industry, and high industrial output contribute to the significant market share held by Asia-Pacific in the global market.

Request a free sample copy or view report summary: Flocculants And Coagulants Market Report

Flocculants And Coagulants Market Report Highlights

Based on type, the flocculants segment is anticipated to witness at the fastest CAGR of 4.1% during the forecast period, owing to increasing usage of the chemical in water treatment activities around the world

Based on end-use, the municipal water treatment segment is anticipated to witness at the fastest CAGR of 4.4% during the forecast period, due to increasing pressure exerted by environment protection laws & regulations, forcing expansion of water treatment activities in construction, textile and other industries

Asia Pacific is anticipated to witness at the fastest CAGR of 4.5% during the forecast period, due to the significant growth in high-growth developing markets such as China and India which have increased their consumption of water treatment chemicals due to rapid industrialization and infrastructure development

Natural-based coagulants and flocculants, derived from sources such as plants and microorganisms, are gaining popularity due to their lower environmental impact. These natural-based products offer an alternative to traditional chemical-based flocculants and coagulants.

Flocculants And Coagulants Market Segmentation

Grand View Research has segmented the global flocculants and coagulants market report based on product, end-use and region:

Flocculants And Coagulants Type Outlook (Revenue, USD Million, 2018 - 2030)

Flocculants

Coagulants

Flocculants And Coagulants End Use Outlook (Revenue, USD Million, 2018 - 2030)

Municipal Water Treatment

Oil & Gas

Pulp & Paper

Mining

Others

Flocculants And Coagulants Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

Japan

India

South Korea

Central & South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

South Africa

List of Key Players in the Flocculants And Coagulants Market

Kemira

BASF SE

Ecolab Inc.

Solenis

Syensqo

Feralco AB

IXOM

Buckman

Kurita-GK Chemical Co., LTD.

Evoqua Water Technologies LLC

0 notes

Text

#WastewaterTreatment#WaterPurification#Coagulation#Flocculation#ChemicalTreatment#WaterMazeSolutions#EnvironmentalTechnology#WaterFiltration#SustainableWater#IndustrialWaterTreatment#ModularDesign#LowMaintenance#CostEffective#ElectroCoagulation#WaterQuality#InnovatorSeries#PollutionControl#EffluentTreatment#WaterRecycling#EnvironmentalCompliance

0 notes

Text

Which Sort of Polyacrylamide is Utilized in Water Treatment?

Water treatment is a basic interaction that guarantees the accessibility of spotless and safe water for different purposes. It includes the expulsion of pollutions and impurities from water to make it appropriate for utilization or modern use. Polyacrylamide, a manufactured polymer, assumes a critical part in this cycle by helping with the flocculation and sedimentation of suspended particles. Zoomri Synthetic, a legitimate supplier of substance arrangements, offers an extensive variety of polyacrylamide items explicitly intended for water treatment applications.

Polyacrylamide is a flexible substance compound that can be modified to meet the particular prerequisites of various water treatment processes. Zoomri Synthetic grasps the different requirements of the business and gives a far reaching choice of polyacrylamide things to address different water treatment challenges really.

One of the essential uses of polyacrylamide in water treatment is as a coagulant help. By adding polyacrylamide to the water treatment process, it improves the effectiveness of coagulants, for example, aluminum sulfate or ferric chloride. This guides in the arrangement of bigger and denser flocs, which settle all the more quickly during sedimentation, bringing about better water explanation.

Anionic polyacrylamide is ordinarily utilized in water treatment because of its high charge thickness and great flocculation properties. It is successful in eliminating suspended solids, colloids, and natural matter from water. Zoomri Compound offers different grades of anionic polyacrylamide, permitting clients to choose the most appropriate item founded on their particular water treatment prerequisites.

Cationic polyacrylamide is one more sort broadly utilized in water treatment, especially in the treatment of wastewater. It has positive charges that draw in adversely charged particles, making it exceptionally compelling in flocculating and settling suspended solids. Zoomri Substance gives cationic polyacrylamide items that display superb execution in wastewater treatment, guaranteeing the expulsion of toxins and impurities for a cleaner climate.

Notwithstanding anionic and cationic polyacrylamide, Zoomri Substance additionally offers non-ionic polyacrylamide for water treatment applications. Non-ionic polyacrylamide is viable in the expulsion of natural matter, oil, and oil from water. It is especially helpful in enterprises where the presence of hydrocarbons or surfactants is a worry.

The choice of the fitting polyacrylamide item relies upon different factors, for example, the idea of the water source, the sort and convergence of pollutants, and the ideal treatment goals. Zoomri Synthetic's group of specialists can give direction and help with picking the most appropriate polyacrylamide item for explicit water treatment applications.

Besides, Zoomri Synthetic guarantees the quality and dependability of their polyacrylamide items by sticking to severe assembling guidelines. Their items are produced utilizing trend setting innovation and go through thorough testing to guarantee ideal execution and consistence with industry guidelines.

All in all, the decision of polyacrylamide in water treatment is pivotal for accomplishing powerful and proficient outcomes. Zoomri Compound offers a different scope of polyacrylamide items custom-made to meet the particular necessities of water treatment processes. Whether it is anionic, cationic, or non-ionic polyacrylamide, Zoomri Compound gives top notch answers for address different water treatment challenges. Trust in their mastery and items to guarantee the arrangement of spotless and safe water for a large number of utilizations.

1 note

·

View note

Text

Harnessing Nature: Insights into the Organic Coagulant Market

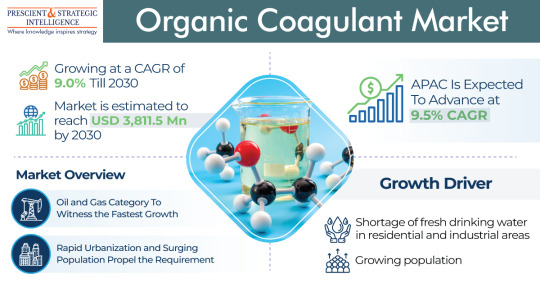

The organic coagulant market is projected to reach at USD 3,811.5 million in 2030 with a CAGR of 9% in the years to come. The major reasons for this development of the industry are the scarcity of drinking and fresh water in residential and industrial areas along with the rising population, and urbanization.

And the rising demand for facilities like sewage treatment, industrial water treatment, fertilizer production, food & beverage industry, and paper manufacturing helps the demand for the chemical to grow.

And another major reason for the increasing demand is the growing population, which is creating an enormous demand for clean water and for which a need for advanced purification methods and also with the expansion of infrastructure for water treatment by government to meet the demand are all contributing the growth of eco-friendly water purification.

The oil & gas category will grow at a highest CAGR of 10% over the years, which is driven by the increasing use of organic chemicals with water at a required concentration for drilling and petroleum extraction purposes.

While, onshore and offshore operations both require different filtration processes as in onshore normal water is available, whereas offshore require advanced system to filter seawater. In addition, research and development activities are also contributing to the demand for organic coagulants, with eco-friendly solutions being explored for wastewater treatment.

Moreover, the increasing government focus to implement policies for water quality monitoring because of the increasing population all over the world. Strict regulations to prevent the direct release of harmful chemicals from industries and untreated sewage into water bodies.

APAC will grow the fastest in the organic coagulant market at a CAGR of 9.5% in the years to come due to the rapid urbanization and industrialization with rising population along with the rising investments in water treatment plant development and strict regulations on sewage disposal. Countries like India, China, South Korea, and Japan are expanding their contribution for the water treatment.

#organic coagulant#water treatment#wastewater treatment#coagulation solutions#eco-friendly chemicals#sustainable water treatment#natural coagulants#organic flocculants#water purification#organic coagulant applications#environmental sustainability#industrial water treatment#market growth#coagulation technology#organic chemicals

0 notes

Text

What is the Difference between coagulation and flocculation in water treatment? The processes of coagulation and flocculation in water and wastewater treatment. Explore the importance of chemical addition and mechanical mixing techniques, and learn how coagulation and flocculation contribute to efficient water treatment.

0 notes

Text

Flocculant and Coagulant Market Trends in Water Treatment and Industrial Applications with Emerging Innovations

The flocculant and coagulant market has witnessed significant growth over the last few years due to their widespread applications in water and wastewater treatment, mining, paper manufacturing, and several other industries. These chemical agents play a critical role in clarifying water by aggregating particles into larger clusters (flocs) that are easier to remove. Flocculants and coagulants help industries meet environmental standards, reduce water consumption, and lower overall operational costs, making them essential for environmental sustainability.

Understanding Flocculants and Coagulants

Before diving into market trends, it’s important to understand the distinct roles of flocculants and coagulants in industrial applications. Coagulants are chemicals that neutralize the charges on particles suspended in water, leading to the aggregation of smaller particles into larger ones. This process is known as coagulation. On the other hand, flocculants are chemicals used to further aggregate these coagulated particles, resulting in larger, more easily removable flocs.

Coagulants are primarily used in the early stages of water treatment, while flocculants are used afterward to facilitate the settling of larger particles. Both are key to industries that focus on water purification, from municipal water treatment plants to mining operations and oil and gas exploration.

Key Trends in the Flocculant and Coagulant Market

1. Increasing Demand for Water Treatment Solutions

The primary factor driving growth in the flocculant and coagulant market is the rising global demand for water treatment solutions. As concerns about water scarcity and pollution escalate, governments and industries are investing heavily in wastewater treatment technologies. This trend is most noticeable in emerging economies, where rapid urbanization and industrialization are placing added stress on water resources.

Flocculants and coagulants are indispensable in municipal water treatment, enabling the removal of suspended solids and organic contaminants from drinking water, industrial effluents, and sewage. With more stringent regulations on wastewater discharge and drinking water quality, the demand for these chemicals is expected to continue rising.

2. Technological Advancements and Product Innovation

Innovations in flocculant and coagulant formulations have also driven the market forward. The development of more efficient, eco-friendly chemicals that reduce environmental impact while enhancing performance is a key trend. Research is focused on biodegradable polymers and less toxic formulations that can improve water treatment efficiency.

The market is also seeing increased use of automated systems and smart technologies for dosing and controlling these chemicals. Automation reduces labor costs and improves efficiency in various applications, especially in large-scale wastewater treatment facilities.

3. Growth in Mining and Paper Manufacturing

The mining industry is one of the largest consumers of flocculants and coagulants. The demand for these chemicals is particularly high in the extraction of metals, such as gold and copper, where large quantities of water are required for mineral processing. As mining operations expand, the need for more effective water treatment solutions grows.

Similarly, the paper and pulp industry is a significant user of flocculants and coagulants. These chemicals are used in paper recycling processes to remove contaminants and improve the quality of paper products. With the increasing demand for paper products, especially in emerging markets, the need for flocculants and coagulants will continue to rise.

4. Environmental Regulations and Sustainability Initiatives

Stringent environmental regulations in developed countries, along with a growing focus on sustainability, have spurred the demand for effective water treatment solutions. Flocculants and coagulants are critical to industries aiming to meet environmental standards for wastewater discharge and reduce their overall environmental footprint.

The growing preference for sustainable and biodegradable chemicals has also prompted manufacturers to focus on green alternatives to traditional synthetic chemicals. These innovations are expected to help companies in the flocculant and coagulant market stay ahead of regulatory changes and environmental trends.

5. Regional Growth in Emerging Markets

The flocculant and coagulant market is also experiencing substantial growth in regions like Asia Pacific, the Middle East, and Africa. Rapid industrialization, urbanization, and the need for clean water are major driving forces behind this growth. For instance, in countries like China and India, governments and industries are investing heavily in water and wastewater treatment infrastructure, further driving demand for these chemicals.

With expanding industrial activities and an increasing need for water purification technologies, these regions are becoming key players in the global flocculant and coagulant market. The development of new water treatment plants, coupled with increasing awareness of water pollution, has made these regions essential for market expansion.

Conclusion

The flocculant and coagulant market is poised for steady growth driven by technological advancements, environmental concerns, and a global focus on sustainable water treatment practices. As demand continues to rise in key sectors such as water treatment, mining, and paper manufacturing, the market will likely see increased competition and product innovation. The emergence of eco-friendly alternatives and automation technologies is set to reshape the industry, ensuring that these vital chemicals remain at the forefront of environmental management efforts.

0 notes

Text

0 notes

Text

Flocculant & Coagulant Market - Forecast(2024 - 2030)

Overview

Request Sample Report :

The report: “Flocculant & Coagulant Market — Forecast (2020–2025)”, by IndustryARC, covers an in-depth analysis of the following segments of the Flocculant & Coagulant Industry.

By Type: Coagulant {Organic Coagulant (Polyamine, Chitosan, and others) and Inorganic Coagulant (Aluminium Sulfate, Aluminium Chloride, Sodium Aluminate, Ferric Sulfate, Others)} and Flocculant (Anionic, Cationic, Non-Ionic, and Others)

By Application: Municipal Water Treatment, Paper and Pulp, Textile, Oil and Gas, Mining, Chemical Processing, and Others

By Geography: North America, South America, Europe, APAC, and RoW

Key Takeaways

In APAC Flocculant & Coagulant market, China dominated the market throughout the forecast period owing to the large consumer base and increase in demand of flocculant & coagulant chemicals for treating paper and pulp wastewater.

Decline in manufacturing activities globally due to the outbreak of coronavirus has hampered the growth of flocculant & coagulant market.

Increasing adoption of UV technologies and RO filtration hinder the growth of flocculant & coagulant market.

Type — Segment Analysis

Coagulant segment holds the largest share of more than 55% in the flocculant & coagulant market in 2019. The use of coagulation offer various advantages like it reduces the time required to settle out suspended solids and is very effective in removing fine particles that are very difficult to remove. Moreover, the water treatment coagulants consists of positively charged molecules that, destabilizes negatively charged particulate and colloidal contaminants. The inorganic and organic coagulants are also used to treat water for the removal of suspended solids in oilfields and textile industries. The rise in production of oil and gas increases the use of coagulants for the separation of oil and water. For instance, according to International Energy Agency (IEA), the global oil production capacity is expected to rise by 5.9 mb/d by 2025 whereas Non-OPEC supply of crude and natural gas liquids will rise by 4.5 mb/d.

Inquiry Before Buying :

Application — Segment Analysis

Based on the application, the paper and pulp segment held the largest share of more than 25% in the flocculant & coagulant market in 2019. The growing use of flocculant & coagulant chemicals in paper industry for the removal of suspended particles from water is driving the growth of flocculant & coagulant market. According to Environmental Paper Network (EPN), paper use is steadily increasing year on year and exceeded to 400 million tons per year in 2018. Furthermore, rising environmental concerns and strict government regulations to lower the use of polyethylene bags has escalated the demand of paper for packaging purposes, which in turn augments the growth of flocculant & coagulant chemicals. For instance, California government has introduced a regulation known as SB270 in July 2015 for prohibiting use of plastic bags at groceries, pharmacies, and other stores.

COVID-19 has badly impacted the flocculant & coagulant market. Coronavirus has disrupted the supply chain and e-commerce sector. Decrease in purchasing capital has direct impact on various industry growth, which in turn hampered the growth of flocculant & coagulant market. With the steep reduction in demand due to sudden stoppage of exports/imports and also domestic sales has hampered the growth of flocculant & coagulant market. The Confederation of Indian Textile Industry (CITI) has requested the government to announce relief packages for the textile and apparel sector to curb the crisis being faced by the textile industries. Hence, downfall of textile industry also reduces the demand of flocculant & coagulant chemicals.

Geography — Segment Analysis

Asia Pacific dominated the flocculation and coagulation market with a share of more than 35% in 2019 followed by North America and Europe. Rapid industrialization and treatment of wastewater generated from manufacturing plants is driving the growth of flocculant & coagulants market. India is the second-largest manufacturer and exporter of textiles and apparel with a share of 5% of global trade. Exports of textile and clothing products from India have increased from US$ 39.2 billion during 2017–18 to US$ 40.4 billion during the year 2018–19, registering a growth of 3%. According to National Investment Promotion and Facilitation Agency, exports in the textiles and apparel industry are expected to reach $300 Bn by 2024–25 resulting in a tripling of Indian market share from 5% to 15%. Thus, growth of textile industry has increased the use of flocculant & coagulant chemicals for the filtration and aggregation of suspended particles present in wastewater. Furthermore, Asia is one of the largest producer of paper and increase in demand of flocculation and coagulant chemicals from paper industries is boosting the growth of market. According to the Trade Map, global import of pulp of wood and cellulose fibers was valued around $ 53,084,971 while china alone imported pulp of $19,240,368 in 2019.

Drivers — Flocculant & Coagulant Market

Schedule A Call :

Increasing health concerns and government policies for wastewater treatment

Strict government regulations for the direct disposal of contaminated water is escalating the use of flocculation and coagulant chemicals in manufacturing industries. For instance, the United States Environmental Protection Agency (EPA) regulates the discharge and treatment of wastewater under the Clean Water Act (CWA). The National Pollutant Discharge Elimination System (NPDES) issues permit to all wastewater dischargers and treatment facilities. Whereas, contaminated water also causes severe health problems including diarrhea, cholera, dysentery etc. Thus, increasing health concerns also boosts the growth of flocculation and coagulant market. Moreover, the Indian government policies such as “State Sewerage and Wastewater Policy” which frames guidelines for resource development and management, wastewater collection and treatment, onsite and offsite sanitation also aids the growth of flocculation and coagulants market.

Global increase in mining operations

Increase in mining operations for the extraction of ores, minerals, coals etc. has resulted in water pollution. According to the USGS National Minerals Information Center, the U.S mines production grew by 3% reaching $82.2 billion of raw mineral materials in 2018 as compared to $79.7 billion in 2017. Water is used in mining for mineral processing, dust suppression and slurry transportation. The United States Geological Survey (USGS) has estimated that 4 billion gallons of water were withdrawn for mining operations in the U.S. in 2015, up 1% from 2010. Thus increase in mining operation has increased the use of flocculant & coagulant chemicals for the removal of suspended colloidal particles. Furthermore, government’s act and regulation such as Clean Water Act (CWA) in the United States that regulates the mining operations in and discharges of pollutants to streams also augments the growth of flocculant & coagulant market.

Challenges — Flocculant & Coagulant Market

Presence of substitutes for water treatment

The adoption of U.V technologies and RO water filtration whose purification efficiency is higher than flocculation and coagulant chemicals hampers the growth of flocculant & coagulant market. U.V and RO filters not only eliminates the suspended particles but also remove the harmful bacteria and pathogens. Although flocculant & coagulants are widely used in industries for effluent water treatment processes in solids removal, water clarification, lime softening, sludge thickening, and solids dewatering, but the cost and the need for accurate dosing of coagulants and frequent monitoring is a major challenge. Coagulants need accurate dosing equipment to function efficiently and the dose required depends on raw water quality that varies rapidly.

Buy Now :

Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the flocculant & coagulant market report. In 2019, the market of flocculant & coagulant has been consolidated by the top 10 companies accounting for xx% of the share. Major players in the flocculant and coagulation market industry outlook are, BASF SE, Ecolab Inc., Solenis LLC, Solvay SA, Kemira Oyj, Buckman Laboratories International, Inc., Kurita Water Industries Ltd., Suez S.A., Feralco AB and Hengyang Jianheng Industry Development Co., Ltd., among others.

Acquisitions/Technology Launches

In January 2019, BASF SE merged its wet-end Paper and Water Chemicals business with Solenis. With this merger the company has expanded its chemical offerings for customers in the pulp, paper, oil and gas, chemical processing, mining, biorefining, and power industries. BASF SE would have a 49% stake in the merged entity, while 51% shares would be owned by Solenis.

In April 2017, Kemira Oyj launched a new high-performance cationic flocculant Kemira Superfloc® XD-7600 polymer. It was designed to help customers decrease their Total Cost of Ownership through more efficient sludge handling, including freight and disposal costs.

For more Chemicals and Materials Market reports, please click here

0 notes

Text

Global Flocculant And Coagulant Market Is Estimated To Witness High Growth Owing To Increasing Demand For Water Treatment Applications

A) Market Overview:

Flocculants and coagulants are chemicals primarily used for water treatment processes. They are used to remove suspended solids, colloids, turbidity, and other impurities from water, making it suitable for various end-use applications such as drinking water treatment, wastewater treatment, and industrial processes. The growing population along with increasing industrialization has led to a rise in water pollution, which in turn has fueled the demand for flocculants and coagulants to treat water and make it suitable for consumption.

The global Flocculant and Coagulant Market Size is estimated to be valued at US$ (incorporate give market value for 2022) Bn or Mn in 2022 and is expected to exhibit a CAGR of (incorporate given CAGR) % over the forecast period (incorporate given forecast period), as highlighted in a new report published by Coherent Market Insights.

B) Market Key Trends:

One key trend observed in the flocculant and coagulant market is the increasing use of organic flocculants. Organic flocculants are biodegradable and environmentally friendly alternatives to conventional inorganic flocculants. They are derived from natural sources such as starch, chitosan, and cellulose, and offer several benefits over inorganic flocculants. Organic flocculants have better performance in terms of flocculation efficiency, settling rate, and dewatering of sludge. Additionally, they do not produce toxic residues and are safe for human health and the environment. For example, PolyDADMAC (poly diallyldimethylammonium chloride), an organic flocculant, is widely used in water treatment processes due to its high efficiency in removing suspended solids, color, and odor from water. It is also effective in removing heavy metals and organic pollutants. The increasing awareness about the environmental impact of conventional inorganic flocculants has led to a shift towards organic flocculants in water treatment applications. C) Pest Analysis:

- Political: Stringent government regulations regarding water quality and wastewater discharge standards drive the demand for flocculants and coagulants. Governments worldwide are focusing on addressing water pollution issues and implementing stricter regulations to ensure clean and safe water supply. - Economic: Rapid urbanization, industrialization, and population growth have increased the demand for clean and safe water, thereby driving the market for flocculants and coagulants. The increasing investments in infrastructure development and water treatment projects further contribute to market growth. - Social: Growing awareness about water pollution and its impact on human health and the environment has led to an increased demand for water treatment solutions. People are becoming more conscious of the quality of water they consume, which drives the market for flocculants and coagulants. - Technological: Advancements in water treatment technologies, such as membrane filtration, nanotechnology, and electrocoagulation, have increased the efficiency of flocculants and coagulants. These advancements offer enhanced water treatment capabilities and improve the overall performance of flocculants and coagulants. D) Key Takeaways: The global flocculant and coagulant market is expected to witness high growth, exhibiting a CAGR of 5.9% over the forecast period. This growth can be attributed to increasing demand for clean and safe water, driven by factors such as population growth, urbanization, and industrialization. Strict government regulations regarding water quality further boost market growth. The Asia Pacific region is expected to dominate the flocculant and coagulant market during the forecast period. The region has witnessed significant population growth, rapid industrialization, and increasing awareness about water pollution. Countries like China and India are major contributors to market growth in this region. Key players operating in the global flocculant and coagulant market include BASF SE, Ecolab Inc., Solvay SA, SNF Ltd, Cytec Industries Inc., Akferal, Kemira Oyj, Jayem Engineers, and TRIO Chemicals & Allied Products. These companies focus on research and development activities to develop innovative products and gain a competitive edge in the market. In conclusion, the global flocculant and coagulant market is expected to witness significant growth due to increasing demand for water treatment applications. The shift towards organic flocculants and advancements in water treatment technologies are key trends driving market growth. Government regulations, economic factors, social awareness, and technological advancements are important factors influencing the market. The Asia Pacific region is projected to dominate the market, and key players in the industry are focused on innovation to stay competitive.

#Flocculant And Coagulant Market#Flocculant And Coagulant Market Size#Flocculant And Coagulant Market Share#Coherent Market Insights#Flocculant And Coagulant Market Demand#Flocculant And Coagulant Market Growth

0 notes

Text

Global Flocculant and Coagulant Market

Global Flocculant and Coagulant Market is Estimated to Witness High Growth Owing to Increasing Water Treatment Activities and Growing Demand for Enhanced Oil Recovery Opportunities

The global Flocculant and Coagulant Market is estimated to be valued at USD 6738.6 Mn in 2023 and is expected to exhibit a CAGR of 5.5% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

The Flocculant and Coagulant Market provides essential chemicals for various industries, including water treatment and oil recovery. Flocculants are used to separate suspended particles in water, while coagulants help in binding these particles together for easy removal. These chemicals play a vital role in ensuring clean water supply and efficient oil recovery processes. Their applications range from municipal water treatment to industrial wastewater treatment and from oil refineries to enhanced oil recovery processes.

B) Market Dynamics:

The Flocculant and Coagulant Market is driven by two key factors. Firstly, the increasing water treatment activities across the globe propel market growth. With the rise in industrialization and urbanization, the demand for clean water is increasing, driving the need for efficient water treatment processes. Flocculants and coagulants are essential in removing impurities from water and achieving the desired water quality.

Secondly, the growing demand for enhanced oil recovery presents a significant opportunity for market growth. As the conventional oil reserves deplete, oil companies are turning to enhanced oil recovery techniques to extract more oil. Flocculants and coagulants are used in these processes to separate oil from water and improve oil recovery efficiency.

C) Segment Analysis:

In the Flocculant and Coagulant Market, the water treatment segment dominates the market due to the increasing focus on clean water supply. The municipal water treatment sub-segment dominates the water treatment market, as governments and regulatory bodies impose stricter regulations on water quality standards to ensure safe drinking water supply.

D) PEST Analysis:

Political: In the political aspect, governments and regulatory bodies are implementing stricter regulations regarding water quality, driving the demand for flocculants and coagulants in water treatment processes.

Economic: The economic aspect plays a significant role in market growth as industries invest in efficient water treatment processes to comply with regulations and ensure sustainable operations.

Social: On the social front, the growing awareness among the population about the importance of clean water and the need for efficient oil recovery techniques drives the demand for flocculants and coagulants.

Technological: Technological advancements in the water treatment and oil recovery sectors contribute to the development of more efficient flocculants and coagulants, enhancing their performance and driving market growth.

E) Key Takeaways:

The global Flocculant and Coagulant Market is expected to witness high growth, exhibiting a CAGR of 5.5% over the forecast period, due to increasing water treatment activities and the growing demand for enhanced oil recovery. The market provides essential chemicals for these industries, ensuring clean water supply and efficient oil recovery processes.

In terms of regional analysis, Asia-Pacific is the fastest-growing and dominating region in the Flocculant and Coagulant Market. The region's rapid industrialization and urbanization drive the demand for efficient water treatment processes, boosting market growth.

Key players operating in the global Flocculant and Coagulant Market include BASF SE, Ecolab Inc., Solvay SA, SNF Ltd, Cytec Industries Inc., Akferal, Kemira Oyj, Jayem Engineers, and TRIO Chemicals & Allied Products. These companies focus on research and development activities to develop innovative products and meet the increasing industry demand.

0 notes