#Flavors and Fragrances Market Growth

Explore tagged Tumblr posts

Text

Savor the Scents: Unveiling the Flavor & Fragrance Industry

From the invigorating aroma of freshly brewed coffee to the delicate notes of your favorite perfume, flavors and fragrances are woven into the tapestry of our daily lives. But beyond the delightful sensory experience lies a booming Flavor & Fragrance (F&F) industry, driven by innovation, evolving consumer preferences, and global reach. Buckle up, scent-national readers, as we embark on a journey to explore the size, growth, key players, and exciting future of this captivating industry.

A Flavorful Picture: Market Size & Share

The global F&F market is a behemoth, estimated to reach a staggering US$58.8 billion by 2028, boasting a healthy CAGR of 3.9%. This translates to billions of dollars spent on flavorings for our food and beverages, and fragrances for our personal care products and household items. As of 2023, the market already stands at US$48.8 billion, showcasing its significant contribution to the global economy.

Regional Palates: Where the Spices Shine

While the Flavor & Fragrance industry enjoys global popularity, regional variations in size and growth add a distinct flavor to the mix. Asia Pacific currently holds the largest slice of the cake, accounting for a 40% market share in 2023. This dominance is fueled by a burgeoning middle class, rising disposable income, and a deep-rooted culinary tradition. North America follows closely behind with a 33% share, driven by its mature F&F industry and diverse consumer base. Europe rounds out the top three with a 20% share, showcasing its sophisticated scent preferences and established fragrance houses.

Aromatic Alchemy: Growth Drivers Fueling the Industry

Several factors are propelling the F&F market forward:

Rising disposable income: As spending power increases, consumers indulge in premium flavors and fragrances, seeking unique sensory experiences.

Urbanization and busy lifestyles: Convenience foods and ready-to-eat meals drive demand for flavorful ingredients and artificial fragrances.

Health and wellness focus: Natural and organic flavors and fragrances attract health-conscious consumers.

Evolving consumer preferences: The rise of ethnic cuisines, artisanal products, and personalized scents fuels innovation in the industry.

Market Mavens: Who’s Cooking Up Flavors and Scents?

International Flavors & Fragrances (IFF): A leading player in both flavorings and fragrances, catering to a wide range of industries.

Symrise: A renowned fragrance house known for its high-quality scents and customized solutions.

DSM: A major player in both flavors and fragrances, focusing on innovation and sustainability.

Firmenich: A leading fragrance house known for its iconic perfumes and creative collaborations.

Challenges and Opportunities: Seasoning for Success

Despite its promising outlook, the F&F market faces some hurdles:

Intense competition: The abundance of players and product options can make it challenging for new entrants to stand out.

Fluctuating raw material prices: Rising costs of ingredients can impact product pricing and profitability.

Regulatory landscape: Stringent regulations on ingredients and labeling can pose challenges for manufacturers.

However, opportunities abound:

Sustainability: Eco-friendly ingredients, responsible sourcing, and biodegradable packaging attract environmentally conscious consumers.

Regionalization: Catering to local taste preferences and cultural nuances presents expansion opportunities.

Technological advancements: AI-powered flavor and fragrance creation, 3D printing of personalized scents, and bioengineering offer exciting possibilities.

Future Forecast: A Savory and Sensational Outlook

Market research experts predict continued growth for the F&F industry in the coming years:

Focus on functional flavors and fragrances: Products enhancing mood, cognitive function, and well-being are expected to gain traction.

Digitalization and online platforms: E-commerce will play a major role in reaching consumers globally.

Personalization: Customized flavor and fragrance experiences tailored to individual preferences will be in high demand.

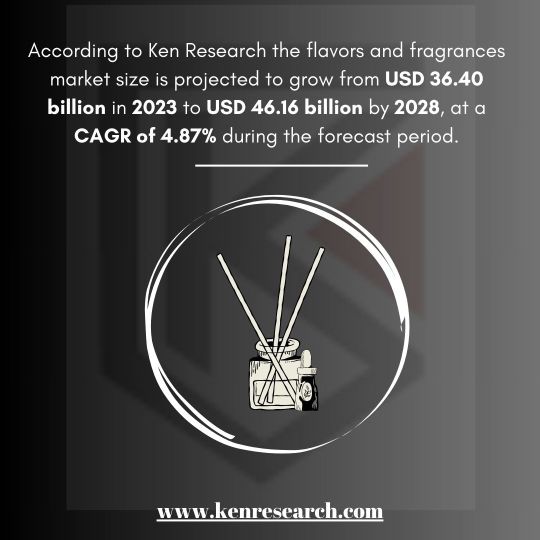

Unlocking Insights: Market Research Reports to Guide Your Journey

Navigating the complex F&F industry requires in-depth data and insightful analyses. Market research reports by organizations like Ken Research offer valuable resources. These reports delve into market size, growth projections, regional trends, competitive landscapes, and emerging opportunities, empowering investors, brands, and industry stakeholders to make informed decisions and capitalize on the delectable future of the F&F industry.

#Flavors and Fragrances Market#Flavors and Fragrances Market Industry#Flavors and Fragrances Market Size#Flavors and Fragrances Market Share#Flavors and Fragrances Market Growth#Flavors and Fragrances Market Revenue#Flavors and Fragrances Market Players#Flavors and Fragrances Market Research Reports#Flavor & Fragrance Industry

0 notes

Text

The global flavors and fragrances market is estimated to be a multi-billion dollar behemoth, and it's projected to grow steadily in the coming years. This means more exotic spices on supermarket shelves, more artisanal ice cream parlors, and a wider range of captivating perfumes to choose from.

#Global Flavors and Fragrances Market#Flavors and Fragrances Market#Flavors and Fragrances Market Industry#Flavors and Fragrances Market Size#Flavors and Fragrances Market Share#Flavors and Fragrances Market Growth#Flavors and Fragrances Market Revenue#Flavors and Fragrances Market Players#Flavors and Fragrances Market Research Reports

0 notes

Text

Flavor and Fragrance Market - Forecast (2024-2030)

Flavor and Fragrance Market Overview

Flavor and Fragrance Market Size is forecast to reach US$40.7 billion by 2030, after growing at a CAGR of 4.9% during 2024-2030.The Flavor and Fragrance market has grown significantly driven primarily by rising consumer demand for natural and organic products, health and wellness trends, and a focus on sustainability and ethical sourcing. Innovations in technology, customization, and regional preferences, along with increased demand in emerging markets and strict regulatory standards are shaping market dynamics. Additionally, the digital transformation and emphasis on multisensory experiences further compel companies to adapt and innovate in response to evolving consumer preferences.The flavor and fragrance industry is witnessing a significant trend towards the rise of plant-based and functional flavors.As per a survey by the Acosta Group in March 2024 titled Clean Label Insights Study, 83% is shoppers demand clean label products as they perceive them to be made with natural ingredients.The demand for exotic flavors and fragrances is rising as consumers seek unique, multicultural experiences and prioritize wellness. Driven by globalization and exposure to international cuisines, there’s growing interest in rare flavors like yuzu and turmeric. Exotic ingredients often carry an aura of luxury and health benefits, appealing to younger consumers and fueling the premiumization of products.

Flavor and Fragrance Market - Report Coverage:

The “ Flavor and Fragrance Market Report - Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the The flavor and fragrance Market.AttributeSegment

By Type

Natural

Aroma Chemicals

By Source

Natural

Synthetic

By Form

Liquid

Powder

others

By Application

Beverages

Bakery

Snacks, Soups and Sauces

Confectionery

Dairy and Frozen Products

Others

By Distribution Channel

Online

Offline

By Geography

North America (U.S, Canada and Mexico)

Europe (Germany, France, UK, Italy, Spain, Netherlands, Belgium, Denmark and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Thailand, Malaysia and Rest of Asia-Pacific)

South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis - Impact Analysis:

The flavor and fragrance industry has faced significant challenges due to the COVID-19 pandemic. The pandemic disrupted global supply chains leading to shortages and increased costs for raw materials. It also shifted consumer behavior, resulting in heightened demand for home-cooked meals and comfort foods. This shift drove up the demand for flavors and fragrances that emphasize health benefits.

Similarly, the Ukraine war has exacerbated supply chain issues particularly for key raw materials as Ukraine is a major supplier of certain botanicals and agricultural products. The conflict has also led to rising energy prices and inflation further straining production costs for flavor and fragrance companies.

Request Sample

Key Takeaways

Natural Flavors and Fragrances to Grow the Fastest

The natural flavors and fragrances segment has gained significant traction as consumers increasingly seek clean-label and organic products. According to Givaudan's 2023 investor presentation, the company's strategy highlights a shift towards sustainable solutions, with a commitment to source all materials responsibly and enhance their portfolio with natural ingredients. This growth is driven by heightened consumer awareness regarding health and wellness, as well as a shift toward sustainable and ethically sourced ingredients. Additionally, the natural fragrance market is also witnessing similar growth with brands focusing on transparency and clean ingredients to attract health-conscious consumers.

Bakery is the Largest Segment

The bakery segment is indeed the largest in the flavor and fragrance industry. This growth is driven by consumers' increasing demand for innovative flavors, convenience, and healthier alternatives. For instance, the rise of specialty and artisanal baked goods has spurred interest in unique and exotic flavor profiles, such as matcha, hibiscus, and exotic fruits. Moreover, as consumers seek more diverse options, the introduction of seasonal flavors and limited-edition products helps sustain consumer interest, contributing to the dominance of the bakery sector in flavor demand. Major companies such as General Mills, Mondelēz International, Grupo Bimbo, and Kellogg are actively responding to consumer demand by developing products with natural flavors and "free-from" options.

North America Dominates the market

North America leads the flavor and fragrance market accounting for approximately 30% of the global market share driven by a robust food and beverage sector that demands innovative and health-conscious products. The United States, in particular, has seen a surge in demand for unique, natural and functional flavors, influenced by growing consumer trends toward health and wellness, clean label products and premium offerings. The growing veganism trend and America’s love for soft drinks allows consumers to invest in artisanal and luxury flavors and fragrances. Furthermore, a strong emphasis on innovation and technological advancements among leading companies supports the development of distinctive flavor solutions. The well-established regulatory environment in North America enhances consumer trust in product safety and quality, solidifying its position as a market leader in the flavor and fragrance sector.

Inquiry Before Buying

Rising Consumer Demand for Natural and Organic Products Boosts the Market

The flavor and fragrance industry is experiencing strong growth in demand for natural and organic products, driven by consumer preferences for health, transparency, and sustainability. This trend reflects a broader shift toward “clean-label” options, where consumers are moving away from synthetic ingredients in favor of natural alternatives. According to the International Food Information Council (IFIC), consumers increasingly value transparency and prefer ingredients that are easy to understand, avoiding those that sound overly chemical. In response, companies are reformulating products to meet these demands, using plant-based and sustainably sourced ingredients. This shift is not only shaping new product lines but also influencing brands to clearly disclose ingredient origins. This momentum toward “clean” and natural formulations is likely to remain a powerful force within the industry.

Ingredient Sourcing Hampers the Market

One of the significant challenges facing the flavor and fragrance industry today is the increasing regulatory scrutiny over the use of synthetic and natural ingredients. As consumers become more health-conscious and demand transparency in product formulations, regulatory bodies are responding with stricter guidelines and regulations regarding ingredient safety and labeling. The shift towards natural and organic ingredients is not only a market demand but also a regulatory necessity. However, sourcing high-quality natural ingredients can be challenging due to factors such as availability, seasonality and fluctuations in pricing. Additionally, the integrity of supply chains must be maintained to ensure that claims of naturalness or sustainability are credible which can complicate sourcing efforts

Schedule a Call

Key Market Players:

Givaudan SA

Symrise AG

International Flavors & Fragrances, Inc. (IFF)

BASF SE

Mane Group

Takasago International Corporation

Kerry Group PLC

Robertet SA

Sensient Technologies Corporation

Chromacol Ltd

Buy Now

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

4.9%

Market Size in 2030

$40.7 Billion

Segments Covered

By Type, By Form, By Source ,By Application ,By Distribution Channel and By Geography

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Netherlands, Belgium, Denmark and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Thailand, Malaysia and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa)

Key Market Players

Givaudan SA

Symrise AG

International Flavors & Fragrances, Inc. (IFF)

BASF SE

Mane Group

Takasago International Corporation

Kerry Group PLC

Robertet SA

Sensient Technologies Corporation

Chromacol Ltd

#Flavor And Fragrance Market Size#Flavor And Fragrance Market Trends#Flavor And Fragrance Market Growth#Flavor And Fragrance Market Forecast#Flavor And Fragrance Market Revenue#Flavor And Fragrance Market Vendors#Flavor And Fragrance Market Share#Flavor And Fragrance Industry

0 notes

Text

Which Companies Are Leading Basmati Rice Exports from India?

When it comes to aromatic and long-grain basmati rice, India stands tall as the undisputed leader in global exports. Renowned for its distinctive fragrance and delicate texture, basmati rice is a staple in cuisines worldwide. But behind every grain of this premium rice is a network of companies working tirelessly to ensure that it reaches international markets. In this blog, we’ll explore the top companies leading basmati rice exports from India, delve into the factors behind their success, and discuss what the future holds for this thriving industry.

Know The Basmati Rice Export Industry

Basmati rice, celebrated for its unique flavor and texture, has carved out a significant niche in the global market. This aromatic variety, predominantly grown in the foothills of the Himalayas, is cherished for its long grains and fluffy texture when cooked. The export of basmati rice from India has seen remarkable growth over the years, thanks to the increasing global demand for premium quality rice. According to the Export-Import Data Bank, India exported over 4.5 million tonnes of basmati rice in the past fiscal year, reinforcing its status as a leading basmati rice exporter in India.

Top Companies Leading Basmati Rice Exports

Vi Exports India: The Industry Giant

When discussing leading basmati rice exporters, Vi Exports India emerges as a prominent player. Vi Exports has set the benchmark for quality and efficiency. Their commitment to maintaining high standards of production and their extensive network of international clients underscore their dominance in the market. They offer a diverse range of basmati varieties, catering to various global preferences.

Other Major Players in the Export Scene

Besides Vi Exports India, several other companies are significant contributors to the basmati rice export industry. Companies like Kohinoor Foods, Empire Basmati, IndiaGate Foods, and Daawat are noteworthy. Each of these companies has established a strong presence in international markets through their dedication to quality and innovation. Kohinoor Foods, for instance, is known for its premium quality rice and extensive global distribution network. Meanwhile, Amira Nature Foods has carved a niche in the Middle Eastern markets with its high-quality basmati offerings.

Key Factors Behind Their Success

Quality Control and Production Standards

The success of these leading exporters is largely attributed to their rigorous quality control measures and adherence to high production standards. From selecting the finest paddy to employing state-of-the-art milling processes, these companies ensure that their basmati rice meets international quality standards. The use of advanced technology in processing and packaging also plays a crucial role in preserving the rice's aroma and texture.

Innovations and Technology in Exporting

Innovation is another key factor driving the success of top basmati rice exporters. Companies are continuously investing in technology to enhance their production capabilities and streamline their supply chains. This includes implementing advanced sorting and packaging technologies to ensure that every grain of rice meets the highest standards of quality.

Strategic Market Penetration and Branding

Effective market penetration strategies and strong branding have also contributed to the success of these companies. By understanding and adapting to the preferences of different markets, these exporters have been able to build strong brand identities. For example, Daawat rice is recognized for its premium quality in various international markets, thanks to its strategic branding and marketing efforts.

Future Trends and Predictions

Emerging Markets for Basmati Rice

Looking ahead, emerging markets in regions like Africa and South America present new opportunities for basmati rice exporters. As these markets grow and develop, there is increasing demand for premium quality rice, which Indian exporters are well-positioned to supply.

How Companies Are Adapting to Market Changes

To stay ahead, companies are focusing on sustainability and ethical practices. This includes efforts to reduce environmental impact and improve labor conditions. By embracing these practices, exporters not only meet regulatory requirements but also appeal to increasingly conscious consumers.

Sustainability and Ethical Practices in Basmati Rice Exporting

Sustainability is becoming a crucial factor in the basmati rice export industry. Companies are investing in eco-friendly practices and sustainable farming methods to ensure that their operations have a minimal environmental impact. This shift towards more ethical practices is expected to become a key differentiator in the global market.

In conclusion, the success of India's leading basmati rice exporters can be attributed to their unwavering commitment to quality, innovation, and strategic market engagement. As the global demand for premium basmati rice continues to rise, these companies are well-positioned to maintain their leadership in the industry and adapt to evolving market trends.

2 notes

·

View notes

Text

Exploring the Global Aldehydes Market: Key Players and Market Dynamics

The aldehydes market is a segment of the chemical industry that deals with the production and distribution of a class of organic compounds known as aldehydes. These compounds are characterized by the presence of a carbonyl group (C=O) bonded to a hydrogen atom and a carbon atom in their chemical structure. Aldehydes find widespread applications in various industries, thanks to their unique properties and versatile reactivity.

In terms of market overview, the aldehydes market has been experiencing steady growth in recent years. This growth can be attributed to the increasing demand for aldehydes in industries such as pharmaceuticals, agriculture, food and beverages, and cosmetics. Aldehydes serve as crucial intermediates in the synthesis of various chemicals and are essential in the production of fragrances, flavor enhancers, and pharmaceuticals.

The growth in the aldehydes market industry can be primarily attributed to the expansion of these end-user industries. For instance, the pharmaceutical industry relies heavily on aldehydes for the synthesis of a wide range of drugs and active pharmaceutical ingredients (APIs). Additionally, the food and beverage industry utilizes aldehydes for flavor enhancement and preservation purposes, further driving market growth.

The aldehydes market is also influenced by evolving industry trends. One significant trend is the increasing emphasis on green chemistry and sustainable practices. Many companies in the aldehydes sector are adopting environmentally friendly production processes, such as catalytic hydrogenation, to reduce the environmental impact of their operations. This trend aligns with the growing awareness of environmental issues and the need for more eco-friendly chemical manufacturing.

Another noteworthy trend is the constant innovation and development of novel aldehyde derivatives with enhanced properties. This innovation is driven by the demand for higher-quality products in various industries. Researchers and manufacturers are continuously exploring new applications and synthesizing aldehydes tailored to meet specific industry requirements, which contributes to market expansion.

In conclusion, the aldehydes market is a dynamic segment within the chemical industry, driven by the increasing demand from various end-user industries. As industries continue to grow and evolve, the market is expected to witness further advancements, particularly in sustainable production methods and novel aldehyde derivatives, to meet the changing needs of consumers and businesses alike.

2 notes

·

View notes

Text

Tertiary Butyl Alcohol Price Index: Market Analysis, Trend, News, Graph and Demand

Tertiary Butyl Alcohol (TBA), also known as tert-butanol or t-butyl alcohol, is a colorless organic compound with a camphor-like odor. It serves as a key intermediate in various chemical processes and is widely used in the production of methyl tert-butyl ether (MTBE), a gasoline additive. The global Tertiary Butyl Alcohol market has shown dynamic price movements over recent years, influenced by a combination of supply-demand fundamentals, raw material costs, geopolitical factors, and industrial demand. As a derivative of isobutylene, any fluctuations in crude oil prices or petrochemical feedstock availability can significantly impact the cost structure of TBA. The price trend of Tertiary Butyl Alcohol is closely tied to the petrochemical value chain, where changes in refinery outputs or disruptions in logistics may create volatility in market pricing.

The global demand for Tertiary Butyl Alcohol is driven by its use in industries such as pharmaceuticals, flavors and fragrances, and solvents. In recent years, the Asia-Pacific region has emerged as a dominant consumer and producer due to the rapid growth of manufacturing industries in countries like China and India. This regional expansion has played a crucial role in determining global price trends. For instance, any production slowdowns, environmental regulations, or feedstock scarcity in these nations can lead to short-term price spikes. Meanwhile, North America and Europe, although mature markets, continue to influence pricing through changes in import-export flows and regulatory standards. The TBA market remains sensitive to the shifting landscape of global trade, with tariffs, trade restrictions, and transportation costs further adding complexity to the pricing environment.

Raw material costs are a fundamental component in determining the market price of Tertiary Butyl Alcohol. Since TBA is primarily produced through the hydration of isobutylene or by the catalytic oxidation of tert-butyl hydroperoxide, the availability and price of these feedstocks are critical. The price of isobutylene, in particular, is derived from crude oil or natural gas liquids, making TBA prices highly susceptible to fluctuations in the global energy markets. In times of oil price surges, the cost of TBA tends to increase accordingly. Conversely, during periods of crude oil price stability or decline, TBA prices may follow a downward trend. The interplay between upstream petrochemical economics and downstream demand adds to the complexity of forecasting Tertiary Butyl Alcohol prices.

Get Real time Prices for Tertiary Butyl Alcohol (TBA): https://www.chemanalyst.com/Pricing-data/tertiary-butyl-alcohol-1141

Environmental and safety regulations are increasingly shaping the market dynamics for Tertiary Butyl Alcohol. In regions with stringent emissions standards or occupational health controls, the cost of compliance can lead to increased production expenses, which are often passed on to the end-user through higher market prices. Furthermore, sustainability trends are prompting many chemical manufacturers to invest in cleaner technologies or bio-based alternatives, potentially disrupting the traditional supply-demand balance. As a result, producers operating under tight margins may adjust their output levels, indirectly influencing pricing trends. Additionally, changes in the regulatory framework related to fuel additives or solvent use can either enhance or suppress the demand for TBA, thereby affecting its market value.

Seasonal demand variations and inventory cycles also influence the market pricing of Tertiary Butyl Alcohol. During peak manufacturing seasons or agricultural cycles, when demand for TBA-based products such as pesticides and coatings increases, prices may climb due to tighter supply. Conversely, during off-peak seasons, inventory buildup may lead to price corrections. This cyclical behavior makes it essential for buyers and sellers to closely monitor market signals and adjust procurement strategies accordingly. Moreover, the presence of long-term contracts and spot market transactions means that TBA pricing can differ significantly across regions and buyers, depending on contract terms, quantity, and delivery schedules.

Innovation and technological advancements in chemical processing are gradually transforming the production landscape of Tertiary Butyl Alcohol. Enhanced process efficiencies, better catalyst systems, and energy-saving techniques can reduce production costs, which may contribute to price stabilization or even declines in the long term. However, the initial capital investment in upgrading facilities often discourages smaller producers, maintaining a level of price differentiation between high-efficiency producers and traditional manufacturers. In addition, the rise of alternative materials and substitutes can influence buyer preferences, which in turn may affect demand dynamics and pricing trends.

Looking forward, the market outlook for Tertiary Butyl Alcohol remains cautiously optimistic. With growing demand from the pharmaceuticals and specialty chemicals sectors, and continued expansion in the Asia-Pacific region, consumption is expected to rise steadily. However, pricing will continue to be influenced by a range of macroeconomic and industry-specific factors, including energy prices, regulatory changes, and technological innovations. As stakeholders navigate this complex landscape, maintaining a strategic balance between cost control and supply chain resilience will be crucial for success. Monitoring real-time market data, engaging in transparent supplier relationships, and adopting flexible sourcing strategies will be key practices for managing risks and capitalizing on opportunities in the evolving Tertiary Butyl Alcohol market.

Get Real time Prices for Tertiary Butyl Alcohol (TBA): https://www.chemanalyst.com/Pricing-data/tertiary-butyl-alcohol-1141

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Tertiary Butyl Alcohol Price#Tertiary Butyl Alcohol Prices#India#United kingdom#United states#Germany#Business#Research#Chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Global Citrus Concentrate Market Research Report 2025-2032

Global Citrus Concentrate Market Research Report 2025-2032

The global citrus concentrate market continues to demonstrate robust growth, with its valuation reaching USD 2.43 billion in 2024. According to the latest industry analysis, the market is projected to grow at a CAGR of 5.3%, reaching approximately USD 3.68 billion by 2032. This expansion is primarily driven by increasing consumer demand for natural ingredients, the booming beverage industry, and growing awareness of citrus-based products' nutritional benefits.

Citrus concentrates are essential ingredients derived from oranges, lemons, limes, and grapefruits through water removal processes. Their ability to retain original flavor profiles and nutritional value makes them indispensable across food & beverage, pharmaceutical, and personal care industries. As clean-label trends gain momentum, manufacturers are increasingly innovating with organic and sustainably sourced citrus concentrates.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292525/global-citrus-concentrate-market-2025-2032-856

Market Overview & Regional Analysis

North America currently leads global consumption, accounting for 38% of market share, with the U.S. being the largest consumer of citrus concentrates in beverages and processed foods. The region benefits from advanced processing technologies and established distribution networks that ensure product quality and availability.

Europe maintains steady demand, particularly in Germany and France, where stringent food safety regulations and organic certification standards shape market dynamics. Meanwhile, Asia-Pacific emerges as the fastest-growing region, with China and India driving production and consumption through expanding food processing sectors and rising disposable incomes.

Key Market Drivers and Opportunities

The market thrives on multiple growth vectors. The beverage industry accounts for 62% of total demand, utilizing concentrates in juices, flavored waters, and functional drinks. Pharmaceutical applications are expanding rapidly, with vitamin C fortification in supplements growing at 7.2% annually. Personal care formulations increasingly incorporate citrus extracts for their antioxidant properties and natural fragrances.

Significant opportunities exist in organic product development, with the segment growing three times faster than conventional concentrates. Emerging applications in nutraceuticals and clean-label cosmetics present additional growth avenues, while technological advancements in cold-pressed extraction methods enhance product quality and shelf life.

Challenges & Restraints

The industry faces several headwinds, including climate-related production volatility in key growing regions like Brazil and Florida. Supply chain disruptions and rising transportation costs impact profit margins, while stringent EU and FDA regulations increase compliance burdens. Price sensitivity in developing markets and competition from artificial flavor alternatives pose additional challenges to market expansion.

Market Segmentation by Type

Organic Concentrate

Conventional Concentrate

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292525/global-citrus-concentrate-market-2025-2032-856

Market Segmentation by Application

Food and Beverages

Pharmaceutical

Dietary Supplement

Personal Care

Cosmetics

Other

Market Segmentation and Key Players

Vita-Pakt Citrus Products Co

Lemon Concentrate S.L

Dohler

Prodalim Group

CitroGlobe

Bell Flavors and Fragrances

Citromax

Citrosuco S.A

Yantai North Andre Juice Co. Ltd

Sucocitrico Cutrale Ltd

Louis Dreyfus Company B.V.

Huiyuan Juice

Ingredion Incorporated

Greenwood Associates Inc

Nielsen Citrus Products

Report Scope

This report provides comprehensive analysis of the global citrus concentrate market from 2024 to 2032, featuring detailed insights into:

Market size estimations and growth projections

In-depth segmentation by product type and application

Regional market analysis across 20+ countries

The study includes detailed profiles of leading market participants, covering:

Company overviews and market positioning

Product portfolios and specifications

Production capacities and operational footprints

Financial performance and strategic initiatives

Our research methodology combines primary interviews with industry experts and extensive secondary research, analyzing factors including:

Raw material sourcing trends

Processing technology advancements

Regulatory landscape changes

Competitive strategy developments

Get Full Report Here: https://www.24chemicalresearch.com/reports/292525/global-citrus-concentrate-market-2025-2032-856

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

0 notes

Text

Benzenoid Market Size, Share, and Growth Outlook

Benzenoid Market to Surpass USD 1,327.88 Million by 2032, Driven by Demand in Fragrances, Flavors, and Pharmaceuticals.

The Benzenoid Market Size was valued at USD 804.48 Million in 2023 and is expected to reach USD 1,327.88 Million by 2032, growing at a CAGR of 5.73% over the forecast period of 2024-2032.

The Benzenoid Market is primarily fueled by rising demand from the fragrance, flavor, and pharmaceutical industries. Benzenoids are aromatic organic compounds that play a vital role in manufacturing perfumes, personal care products, household cleaners, and medicinal formulations. Their pleasant scent and chemical stability make them essential ingredients across multiple sectors.

Key Players

BASF SE

Brenntag SE

Eastman Chemical Company

Emerald Kalama Chemical

Eternis Fine Chemicals Ltd.

Evonik Industries AG

Firmenich SA

Givaudan

Haarmann & Reimer

International Flavors & Fragrances, Inc. (IFF)

Jayshree Aromatics Pvt. Ltd.

Lanxess AG

Mane SA

Sensient Technologies Corporation

Solvay S.A.

Symrise AG

Takasago International Corporation

Tennants Fine Chemicals Ltd.

Treatt PLC

Valtris Specialty Chemicals

Future Scope & Emerging Trends

The future of the benzenoid market is driven by the growing demand for natural and sustainable ingredients in personal care and food products. As consumer awareness around clean-label and eco-friendly formulations increases, manufacturers are focusing on bio-based benzenoid production. Additionally, the integration of benzenoids in aromatherapy, pharmaceuticals, and specialty chemicals continues to expand the market footprint. Emerging markets in Asia-Pacific and Latin America are projected to offer lucrative opportunities due to increasing disposable incomes and evolving consumer preferences.

Key Points

Widely used in fragrances, flavors, and pharmaceuticals

Rising consumer shift towards natural and bio-based benzenoids

Asia-Pacific is emerging as a key growth region

Increasing applications in cosmetics, detergents, and wellness products

Innovation in green chemistry and sustainable extraction processes

Conclusion

The Benzenoid Market is poised for continued expansion, propelled by a blend of technological innovation, sustainability goals, and diversified applications. With leading players investing in R&D and sustainable sourcing, the market is well-positioned to meet evolving consumer and industry demands in the years ahead.

Related Reports:

Glycerol Derivatives Market Size, Share & Segmentation By Grade (Bio-based, Petroleum-based), By Product Type, By End Use Industry(Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Agriculture, Chemical Manufacturing, Energy and Biofuels, Others), By Regions and Global Forecast 2024-2032.

Thermic Fluids Market Size, Share & Segmentation By Product (Mineral Oils, Silicone-based, Aromatic, Glycol-based, Others), By Application Type, By Region, and Global Forecast 2024-2032.

Aromatherapy Market Size, Share & Segmentation By Product (Consumables, Equipment), By Mode of Delivery (Topical Application, Aerial Diffusion, Direct Inhalation), By Sales Channel (E-commerce, Stores), By Application, By Application , By Regions And Global Forecast 2024-2032.

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Benzenoid Market#Benzenoid Market Size#Benzenoid Market Share#Benzenoid Market Report#Benzenoid Market Forecast

0 notes

Text

Geraniol Market Size, Demand & Supply, Regional and Competitive Analysis 2025–2032

Market Size

The global Geraniol market was valued at USD 305.6 million in 2023 and is projected to reach USD 468.7 million by 2032, growing at a CAGR of 4.9% during the forecast period.

Geraniol is a naturally occurring monoterpenoid and alcohol, commonly found in essential oils like rose, citronella, and palmarosa. Known for its sweet, floral fragrance, it is widely used in perfumery, cosmetics, flavorings, and pharmaceuticals. Additionally, geraniol has antimicrobial and insect-repellent properties, expanding its use in agricultural and home care applications.

Market Dynamics

👉 Download Sample Report: https://www.24chemicalresearch.com/download-sample/289210/global-geraniolgeraniol-forecast-market-2025-2032-899

Drivers:

Growing Demand for Natural Ingredients: The shift toward natural and bio-based products in personal care and food industries boosts geraniol usage.

Expanding Cosmetic and Fragrance Industry: Its aromatic properties make it a key ingredient in perfumes, lotions, and creams.

Applications in Pest Control and Agriculture: Geraniol’s insect-repelling nature supports its inclusion in eco-friendly pest management.

Restraints:

Allergenic Reactions: In rare cases, geraniol can cause skin sensitivities, limiting its use in some formulations.

Regulatory Hurdles: Compliance with safety standards and labeling regulations may constrain market entry.

Opportunities:

Rise in Organic Personal Care Products: Increased consumer preference for organic and clean-label products drives innovation.

Pharmaceutical Applications: Research into geraniol’s therapeutic effects, such as anti-inflammatory and anti-cancer properties, opens new avenues.

Challenges:

Price Volatility: Geraniol derived from essential oils may face supply constraints, impacting prices.

Competition from Synthetic Substitutes: Synthetic aroma chemicals may offer cost benefits, challenging natural geraniol’s market share.

Regional Analysis

North America: Significant consumption in fragrances, food flavorings, and eco-friendly pest control. The U.S. leads in demand.

Europe: A mature market driven by regulations favoring natural ingredients in cosmetics and food additives.

Asia-Pacific: Fastest-growing region, led by China and India, due to expanding personal care and agrochemical sectors.

Latin America: Increasing cosmetic product manufacturing is supporting demand.

Middle East & Africa: Emerging market with potential for use in halal-certified cosmetic and food products.

Competitive Analysis

Key Companies:

BASF SE

Takasago International Corporation

Firmenich SA

Symrise AG

Givaudan

Robertet Group

Jiangxi Global Natural Spices Co., Ltd.

A.C.S. International

Ernesto Ventós, S.A.

Berje Inc.

These companies invest in R&D and global expansion, targeting the growing demand for natural and sustainable aromatic compounds.

Global Geraniol Market Segmentation

By Type:

Natural Geraniol

Synthetic Geraniol

By Application:

Fragrance & Perfumes

Flavorings

Cosmetics & Personal Care

Pharmaceuticals

Agricultural Products

Others

Geographic Segmentation:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

FAQs

1. What is the market value of the Geraniol market by 2032? The global Geraniol market is expected to reach USD 468.7 million by 2032, growing at a CAGR of 4.9% from 2025.

2. What are the primary uses of Geraniol? Geraniol is primarily used in fragrances, cosmetics, food flavorings, insect repellents, and pharmaceuticals.

3. Which regions are key to the growth of the Geraniol market? Asia-Pacific is the fastest-growing region due to expanding industrial applications, while North America and Europe continue to lead in demand for natural ingredients.

👉 Get The Complete Report & TOC: https://www.24chemicalresearch.com/reports/289210/global-geraniolgeraniol-forecast-market-2025-2032-899

👉 Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

0 notes

Text

Hydroquinone Market set to hit $1912.0 million by 2035

Industry revenue for Hydroquinone is estimated to rise to $1912.0 million by 2035 from $908.4 million of 2024. The revenue growth of market players is expected to average at 7.0% annually for the period 2024 to 2035.

Detailed Analysis - https://datastringconsulting.com/industry-analysis/hydroquinone-market-research-report

Hydroquinone is critical across several key applications including photographic developer, antioxidant in rubber & plastics, skin lightening agent and polymerization inhibitor. The report unwinds growth & revenue expansion opportunities at Hydroquinone’s Product Form, Industry Application, Concentration, End User and Distribution Channel including industry revenue forecast.

Industry Leadership and Competitive Landscape

The Hydroquinone market is characterized by intense competition, with a number of leading players such as Eastman Chemical Company, Solvay SA, Sigma Aldrich, UBE Industries, Camlin Fine Sciences Ltd., Sinopec Nanjing Chemical, Tianjin Zhongxin Chemtech, Aarti Industries Limited, Sanjay Chemicals India Pvt. Ltd, WC Heraeus GmbH, Mitsui Chemicals and Shanghai Apple Flavor & Fragrance.

The Hydroquinone market is projected to expand substantially, driven by rising demand in skin care industry and increasing applications in photography. This growth is expected to be further supported by Industry trends like Expanding Use in the Polymer Industry.

Moreover, the key opportunities, such as expanding cosmetic industry, untapped markets in developing countries and hydroquinone in polymerization processes, are anticipated to create revenue pockets in major demand hubs including U.S., China, Germany, Japan and India.

Regional Shifts and Evolving Supply Chains

North America and Europe are the two most active and leading regions in the market. With challenges like stringent safety regulations and growth of alternatives, Hydroquinone market’s supply chain from raw material extraction / primary production / secondary processing to end-user is expected to evolve & expand further; and industry players will make strategic advancement in emerging markets including Nigeria, Chile and Vietnam for revenue diversification and TAM expansion.

About DataString Consulting

DataString Consulting offers a complete range of market research and business intelligence solutions for both B2C and B2B markets all under one roof. We offer bespoke market research projects designed to meet the specific strategic objectives of the business. DataString’s leadership team has more than 30 years of combined experience in Market & business research and strategy advisory across the world. DataString Consulting’s data aggregators and Industry experts monitor high growth segments within more than 15 industries on an ongoing basis.

DataString Consulting is a professional market research company which aims at providing all the market & business research solutions under one roof. Get the right insights for your goals with our unique approach to market research and precisely tailored solutions. We offer services in strategy consulting, comprehensive opportunity assessment across various sectors, and solution-oriented approaches to solve business problems.

0 notes

Text

Lemon Extract Market Driven by Health Trends and Clean-Label Demand

The lemon extract market is gaining notable momentum in the global food and beverage industry, fueled by evolving consumer preferences and expanding application scope. Lemon extract, derived from lemon peel or juice, is widely used in culinary, pharmaceutical, and cosmetic sectors. One of the most compelling forces propelling the lemon extract market is the rising demand for natural and clean-label ingredients. As consumers gravitate toward products free of artificial additives, manufacturers are increasingly incorporating lemon extract to enhance flavor, fragrance, and functionality while aligning with clean-label standards.

Health-Conscious Consumer Behavior

The shift in consumer attitudes toward health and wellness has become a primary driver for the lemon extract market. Consumers are becoming more vigilant about what they consume, seeking functional ingredients that offer both taste and health benefits. Lemon extract is rich in antioxidants, vitamin C, and other phytonutrients, making it an attractive addition to health-oriented products. It is often used in dietary supplements, immunity boosters, and detox beverages. The perceived therapeutic benefits, such as aiding digestion and supporting immune function, enhance its appeal across nutraceutical and wellness markets.

Growing Popularity of Natural Flavors in F&B

The food and beverage sector is undergoing a flavor revolution, with natural flavoring agents like lemon extract experiencing a surge in usage. Lemon extract delivers a distinctive citrus aroma and tartness that enhances the sensory profile of a wide range of foods, including baked goods, confectionery, marinades, sauces, and beverages. This has made it a staple in clean-label product formulations. As artificial flavor bans and labeling scrutiny intensify, lemon extract offers manufacturers a compliant and consumer-friendly alternative.

Expansion in Clean-Label Cosmetics and Personal Care

Another key growth catalyst for the lemon extract market is the booming natural personal care segment. Lemon extract, known for its astringent, antiseptic, and brightening properties, is increasingly used in skincare and haircare products. From facial cleansers to shampoos, lemon extract imparts freshness and offers functional benefits like oil control and antibacterial support. With consumers demanding transparency and botanical-based ingredients in their beauty routines, cosmetic brands are responding by integrating lemon extract into product lines.

0 notes

Text

A World of Aroma and Appetite: Unveiling the Global Flavors and Fragrances Market

Close your eyes and take a deep breath. What do you smell? The sweet tang of summer berries? The warm comfort of freshly baked bread? The invigorating burst of citrus after a rain shower? Each scent tells a story, transporting us to different places and times. And behind every captivating aroma, every delectable flavor, lies the fascinating world of the Global Flavors and Fragrances Market.

What is the Flavor and Fragrance Market, anyway?

Imagine a giant pantry bursting with exotic spices, ripe fruits, and fragrant herbs. Now, picture a perfume counter overflowing with captivating scents, promising escapes to faraway lands. This vibrant tapestry of taste and aroma — that’s the essence of the global flavors and fragrances market.

Why is it Booming?

People everywhere are craving sensory experiences. We want food that awakens our taste buds, fragrances that spark memories, and products that create a holistic feel-good sensation. This hunger for unique flavors and captivating scents is fueling the market’s phenomenal growth.

Just how Big is This Delicious Market?

Get ready for some mouthwatering numbers. The global flavors and fragrances market is estimated to be a multi-billion dollar behemoth, and it’s projected to grow steadily in the coming years. This means more exotic spices on supermarket shelves, more artisanal ice cream parlors, and a wider range of captivating perfumes to choose from.

What are the Hottest Trends in Flavors and Fragrances?

Going Natural: Consumers are increasingly seeking organic, healthy flavors and fragrances, free from artificial additives and synthetic chemicals. Think elderflower infusions in sparkling water or earthy patchouli essential oils.

Global Gastronomy: We’re embracing exotic tastes from around the world, from Korean BBQ-inspired snacks to Ethiopian spice blends. Get ready for a flavor fiesta!

Mindful Scents: Aromatherapy is on the rise. Fragrances that promote relaxation, focus, or even sleep are becoming increasingly popular. Lavender for restful nights, anyone?

Sustainable Solutions: Eco-conscious consumers are demanding environmentally friendly practices from flavor and fragrance companies. This means sustainable sourcing, biodegradable packaging, and reduced carbon footprints.

Who are the Big Players in this Aromatic Game?

Industry giants like International Flavors & Fragrances (IFF), Givaudan, Firmenich, and Symrise dominate the market with their expertise in creating world-class flavors and fragrances for food, beverages, personal care products, and more.

What Does the Future Hold for This Sensory Sensation?

The future of the global flavors and fragrances market is all about personalization, innovation, and sustainability. Expect advancements in AI-powered scent optimization, customized fragrance subscriptions, and even flavor and fragrance pairings based on individual preferences and even genetics.

So, there you have it, a glimpse into the vibrant and ever-evolving world of flavors and fragrances! This market is more than just about taste and smell; it’s about creating experiences, evoking emotions, and connecting us to the world around us. So, the next time you savor a delicious meal or lose yourself in a captivating scent, remember the magic behind it — the artistry and innovation of the global flavors and fragrances market.

#Global Flavors and Fragrances Market#Flavors and Fragrances Market#Flavors and Fragrances Market Industry#Flavors and Fragrances Market Size#Flavors and Fragrances Market Share#Flavors and Fragrances Market Growth#Flavors and Fragrances Market Revenue#Flavors and Fragrances Market Players#Flavors and Fragrances Market Research Reports

0 notes

Text

2035 Projection: USD 1,325.62 Million Natural Tocopherols Market, CAGR 14.7% Maintained

The global Natural Tocopherols market values is projected to reach US$ 1,325.62 Million by 2035 from US$ 782.48 Million in 2025. The market is expected to register a CAGR of 14.7% during 2025–2035.

We Market Research announces the release of its latest research study on Hybrid Vehicle Market Share. The research report examines all the crucial market factors, analyzing the overall market effectively. It integrates a thorough examination of the Hybrid Vehicle Market share, size, trends, growth opportunities, latest advancements, and forecast. Also, it offers a depiction of the market overview, potential growth opportunities, development patterns, and the sources from which the data has been taken.

The report enlists competitors and regional analysis, along with potential customers and sellers in the market. The study segments the market into various groups to offer an in-depth market analysis. Besides, a thorough examination of different sub-segments has been provided in the report. The insights offered in the research study can help businesses devise effective operating strategies and maintain a competitive edge in the market.

Request A Report Sample To Gain Comprehensive Insights: https://wemarketresearch.com/sample-request/natural-tocopherols-market/1717

Market Drivers

The research report offers valuable information on several crucial factors, including Hybrid Vehicle Market growth drivers, development patterns, financial information, latest technologies, and innovations. The study has been prepared by considering the evolving nature of the market. It explores the supply and demand trends and the critical factors contributing to the changing market demand. Along with the key driving factors, the study offers a thorough examination of the major trends and opportunities in the market.

Market Restraints

The research report identifies the threats, challenges, and risks that may impede the market growth. The study of market restraints is essential as it informs businesses about the potential growth barriers. With that information, stakeholders can devise effective strategies that can successfully address these issues and take advantage of the opportunities presented by the expanding market. Also, the information will help businesses in having a better Hybrid Vehicle Market understanding and make informed decisions.

Competitive Landscape

The research report uses a structured way to identify and research the major players in the market. The competitive landscape section helps evaluate the current state of the competition in the market. Also, it helps businesses identify the current position of their competitors in the market and inform their strategy. By understanding the competitive environment, businesses can discover unattended groups and identify where the business can gain market share. Also, competitive landscape analysis assists stakeholders in developing strategies to offer similar products or services at better quality or lower prices.

The Hybrid Vehicle Market key players are:

A.C. Grace Company

Advanced Organic Materials SA (AOM)

Archer Daniels Midland Company (ADM)

BASF SE

BioSpechem

BTSA

BTSA Biotecnologías Aplicadas

Cargill Inc.

COFCO Tech Bioengineering Co., Ltd.

Davos Life Science Pte Ltd.

DuPont Danisco

Eisai Food & Chemical Co., Ltd.

International Flavors & Fragrances, Inc.

Kemin Industries Inc.

Kensing Solutions LLC

Koninklijke DSM N.V.

Merck KGaA

Nutraceuticals Group Europe Ltd.

Nutralliance, Inc.

Xi'an Healthful Biotechnology Co., Ltd

Others

Market Segmentation

The Hybrid Vehicle Market segmentation divides the market into several groups and examines each of them closely. Segmental analysis can assist businesses in their marketing efforts, such as targeting, positioning, and product development. Also, it can help stakeholders develop products and services tailored to the needs of specific segments. This, in turn, can result in improved customer satisfaction and loyalty. With market segmentation, businesses can better understand sales potential and identify growth opportunities.

Regional Analysis

This section of the research report studies the interaction of key variables in a regional context. The regional analysis in the study has been done at the local, national, and global levels. By going through the regional analysis section, businesses can understand local conditions, such as economic, energy, and geographic conditions, and their impact on Hybrid Vehicle Market demand. Also, it’s helpful in finding new markets and capitalizing on emerging trends. Furthermore, regional analysis can assist stakeholders in developing targeted strategies to gain a competitive edge in the market.

Browse Full Insights: https://wemarketresearch.com/reports/natural-tocopherols-market/1717

The Report Answers Questions Such As:

What is the current Hybrid Vehicle Market market size and forecast value?

At what CAGR is the market projected to grow during the projection period?

What are the challenges and opportunities industry players might encounter?

Who are the major participants operating in the market?

Which segment is anticipated to lead market demand in the upcoming years?

What are the growth strategies adopted by top industry players?

About We Market Research:

At We Market Research, we are passionate about data, insights, and helping businesses thrive in an ever-evolving marketplace. Our journey began with a simple yet profound belief: Informed decisions lead to sustainable success. With this principle at our core, we've grown into a dynamic and innovative market research company dedicated to providing you with the knowledge and strategies you need to navigate the complexities of your industry.

We provide a comprehensive range of research services, including brand perception research, pricing analysis, customer segmentation, competitive analysis, product development and innovation studies, market sizing and forecasts, and more. Our objective is to give our clients a comprehensive insight of their market environment so they can improve their competitive advantage, optimize their strategy, and drive growth.

Contact Us:

Robbin Joseph

Phone: +17246183925

Email: [email protected]

Location: United States 99 WALL STREET, #2124 NEW YORK, NY 10005

0 notes

Text

Taste the Future, Smell the Innovation: The Flavors and Fragrances Market

Flavors and Fragrances Industry Overview

The global Flavors and Fragrances Market reached an estimated value of $30.61 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This market expansion is expected to be fueled by increasing global demand and consumption of both processed foods and personal care & cosmetic products. The rise in disposable income in rapidly growing economies like India and China, coupled with population growth, is anticipated to further boost the demand for personal care and cosmetic products within the industry. Additionally, the prevalent busy lifestyles in both developing and developed nations are expected to increase the consumption of processed foods and beverages, consequently driving up the demand for flavors.

Due to the complex processing and limited availability of resources, natural fragrances and flavors tend to be expensive. To address this, industry players have developed cost-effective synthetic alternatives that offer the benefits of consistent supply, stable pricing, and lower production costs. Historically, the industry often involved multi-year contracts between dealers.

Detailed Segmentation:

Product Insights

In terms of product, the natural chemicals segment dominated the industry in 2023 with the maximum revenue share of more than 74.5%. This is attributed to ever-increasing product usage in various application industries such as pharmaceuticals, aromatherapy, and natural cosmetics. Furthermore, increasing research spending for development of natural fragrance compounds is expected to have a positive impact on overall industry. Aroma chemicals are synthetic aromas, which are used in many applications, such as essential oils, food & beverages, and perfumes.

Application Insights

The fragrances application segment dominated the global industry in 2023 with the maximum revenue share of more than 51.9%. The large share of this segment can be attributed to increased demand for various fragrances in toiletries, such as hand washes, detergents, soaps, personal care products, and cosmetics. Furthermore, fragrance plays an important role in aromatherapy applications, owing to which essential oils, materials, compounds, and aromatic oils demand is likely to be driven in aromatherapy applications.

Regional Insights

Asia Pacific dominated global industry in 2023 with the largest revenue share of more than 32.0%. This large share is attributed to shift in choices of consumers towards nutritional and healthy foods and beverages in most populated countries like India and China. Asian flavors and fragrances have also gained popularity in major regions of Europe, Middle East and North America. Indonesia, India, China, and Vietnam are among the prominent food flavor markets in Asia Pacific region. Multiple manufacturing companies are focusing on expansion of their business and investments in R&D facilities in the Asia Pacific region.

Gather more insights about the market drivers, restraints, and growth of the Flavors and Fragrances Market

Key Companies & Market Share Insights

Some of the key players includes Givaudan, Young Living Essential Oils, and dōTERRA International

Givaudan manufactures and sells fragrances and flavors. The company offers a range of fragrances for fabric, personal care, hair and skin care, household care products. It has a wide network of suppliers for its production facilities with 185 locations worldwide, and 79 production sites.

Young Living Essential Oils is engaged in manufacturing natural oils and chemicals. The company operates through offices and production units located in Australia, Europe, the U.S., Canada, Japan, and Singapore along with farms located in the U.S., Ecuador, Canada, France, and Oman.

Key Flavors and Fragrances Companies:

The following are the leading companies in the flavors and fragrances market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these flavors and fragrances companies are analyzed to map the supply network.

Sensient Technologies Corp.

Mane SA

Takasago International Corp.

Manohar Botanical Extracts Pvt. Ltd.

Alpha Aromatics

Ozone Naturals

Elevance Renewable Sciences, Inc.

Firmenich SA

Symrise AG

Vigon International, Inc.

BASF SE

Indo World

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

In January 2023 Symrise AG invested in Ignite Venture Studio. It is B2C startup ventures in the personal care sector. Symrise has invested in Ignite Venture Studio to drive product innovations in fragrance and cosmetic ingredients.

In December 2022, -Symrise had partnered with Norwest Ingredients for comprehensive sustainability assessment of peppermint and spearmint raw materials.

In December 2022, Mane Group has opened two new facilities in India. The first site is located at MANE KANCOR Angamaly, Kerala; the second is at MANE KANCOR Byadgi, Karnataka

0 notes

Text

A key driver of market growth is increasing consumer awareness about the origin, authenticity, and health benefits of tea and tea-based beverages. The rising popularity of green tea, in particular, is fueling demand, as it is associated with benefits such as weight management and cholesterol reduction. Additionally, consumers are gravitating toward tea products infused with herbal ingredients like honey, cinnamon, and lemon, not only for their health-enhancing properties but also for their unique flavors and fragrances.

0 notes

Text

Why Spring is the Best Season for Flowers and Well-being

Spring is a season that represents renewal and rejuvenation. After months of dormancy during the cold and often harsh winter, nature comes alive once again with energy, color, and vibrancy. One of the most exceptional aspects of spring is the return of flowering. It’s during this time that we observe the first blossoms, signaling the start of a new cycle. But beyond just flowers, spring is a season that nurtures the soul, inviting us to reconnect with the outdoors and embrace fresh beginnings.

Find why spring is the prime time for flowers and overall well-being. From blooming gardens to longer sunny days, search how spring rejuvenates life. Discover the vibrant blooms at the best flower shop in Marina, or order from a trusted online flower shop offering flower shop delivery in Dubai. Looking for a flower shop in Dubai Marina? Experience vibrant spring florals from top-rated Dubai flowers shops today.

Reasons Why Spring is the Best Season

After enduring the long, gray winter months, people around the world look forward to spring’s arrival. It brings with it not only sunshine and warmth but also a sense of renewal. Here are ten reasons why spring is considered the best season — especially for flowers and overall well-being:

1. Spring Marks a New Beginning

Spring symbolizes fresh starts and new opportunities. As the snow melts and days grow longer, nature reawakens. Trees sprout fresh leaves, flowers bloom, and the air is filled with renewed energy. This seasonal transformation also lifts our spirits, bringing with it hope, positivity, and joy.

2. Warmer Weather and Comfort

Gone are the heavy coats and layers of winter. Spring’s moderate temperatures offer the perfect balance — warm enough to enjoy the outdoors, yet cool enough to remain comfortable. It’s a welcome relief from being cooped up indoors and an invitation to enjoy nature in lighter clothing.

3. Longer Days, More Sunshine

With the spring equinox, daylight hours increase, giving us more time to enjoy the outdoors. The extended daylight improves mood, supports better sleep, and allows for more evening walks, picnics, and post-work activities in natural light.

4. Fresh Breezes and Inviting Air

Spring air feels crisp, clean, and refreshing. Opening your windows to let in the breeze can lift the atmosphere of your entire home. The sounds of chirping birds, rustling leaves, and the scent of fresh blooms create a serene and uplifting ambiance.

5. Colorful and Fragrant Flowers

Spring is a floral paradise. It’s the season of tulips, daffodils, cherry blossoms, and countless other blooms bursting with color and fragrance. Wildflowers paint fields in vivid hues, attracting bees and birds, and breathing life into landscapes. Gifting a bouquet in spring feels extra special — fresh flowers from this season, like those from expert florists at online stores such as 800Flower, are vibrant, aromatic, and full of life.

6. Perfect for Outdoor Activities

With improved weather and vibrant surroundings, spring is ideal for hiking, biking, picnicking, or simply lounging in the park. It’s a great time to reconnect with loved ones and enjoy nature without the discomfort of extreme cold or summer heat.

7. Fresh Seasonal Produce

Spring brings a bounty of fresh fruits and vegetables. Local markets fill with delicious seasonal offerings like asparagus, strawberries, apricots, and peas. This is the best time to enjoy flavorful, nutritious food at its peak freshness and often at lower prices.

A Season of Growth and Renewal

As the trees sprout new leaves and flowers bloom all around, spring serves as a beautiful reminder of life’s cycles and our own capacity for growth. It’s the season where everything feels possible — a time to recharge, realign, and embrace the joy that comes with change.

Whether it’s the beauty of nature’s blossoms, the promise of longer days, or the uplifting energy in the air, spring truly stands out as the most rejuvenating season of all.

#flower shop in dubai marina#Flower shop in marina#best Flower shop in marina#online flower shop#flower shop delivery dubai

1 note

·

View note