#FintechGuide

Explore tagged Tumblr posts

Text

#ChimeToCashApp#MoneyTransfer#FinanceTips#DigitalBanking#FintechGuide#EasyTransactions#ChimeBank#CashApp#FinancialFreedom#MoneyMatters#ConvenientBanking

3 notes

·

View notes

Text

0 notes

Text

Understanding the Difference Between Fintech and Techfin

In the ever-evolving landscape of finance and technology, two terms have emerged as key players: Fintech and Techfin. While they may sound similar, they represent distinct approaches and concepts within the financial technology sector. In this comprehensive guide, we'll delve into the nuances of both Fintech and Techfin, shedding light on their core differences and highlighting their unique contributions to the financial industry.

Fintech: Revolutionizing Finance Through Technology

Fintech, short for financial technology, is a dynamic sector that leverages cutting-edge technology to revolutionize traditional financial services. It encompasses a wide range of innovative solutions, including mobile banking, peer-to-peer lending, blockchain technology, robo-advisors, and more. The primary goal of Fintech is to enhance the efficiency, accessibility, and transparency of financial transactions and services.

Key Characteristics of Fintech:

Innovation-driven: Fintech companies are at the forefront of technological advancements, constantly seeking innovative solutions to streamline financial processes.

User-Centric: Fintech places a strong emphasis on user experience, designing products and services with the end-user in mind to ensure seamless and intuitive interactions.

Disruptive: Fintech disrupts traditional banking and financial models, challenging established institutions and paving the way for more inclusive and accessible financial services.

Agile and Nimble: Fintech startups are known for their agility and ability to quickly adapt to market trends and consumer demands, often outpacing larger, more bureaucratic financial institutions.

Techfin: Technology Giants Redefining Finance

On the other side of the spectrum, we have Techfin, a term coined to describe technology companies that leverage their existing technological infrastructure to enter the financial services sector. Unlike Fintech, which originates from financial services and adopts technology, Techfin companies are tech giants first, using their extensive user base and technological prowess to offer financial services.

Key Characteristics of Techfin:

Tech-First Approach: Techfin companies are initially established as technology giants, with their foray into finance as a strategic extension of their existing capabilities.

Vast User Base: These companies boast massive user bases, providing them with a substantial advantage when entering the financial services arena.

Data-Driven Insights: Techfin entities excel in leveraging data analytics and artificial intelligence to gain deep insights into consumer behavior and preferences.

Ecosystem Synergy: Techfin leverages the synergies between its existing technology ecosystem and financial services, creating seamless integrations for users.

Bridging the Gap: Fintech Meets Techfin

While Fintech and Techfin represent distinct approaches, it's important to note that the lines between them are not always rigid. In fact, there is a growing trend of collaboration and partnership between traditional Fintech startups and Techfin giants. This convergence of expertise often leads to the development of innovative and inclusive financial solutions that benefit consumers worldwide.

In conclusion, understanding the difference between Fintech and Techfin is crucial in navigating the ever-evolving landscape of financial technology. Whether you're a consumer seeking convenient and accessible financial services or a business looking to stay ahead of the curve, being informed about these two paradigms will undoubtedly empower you to make informed decisions.

1 note

·

View note

Text

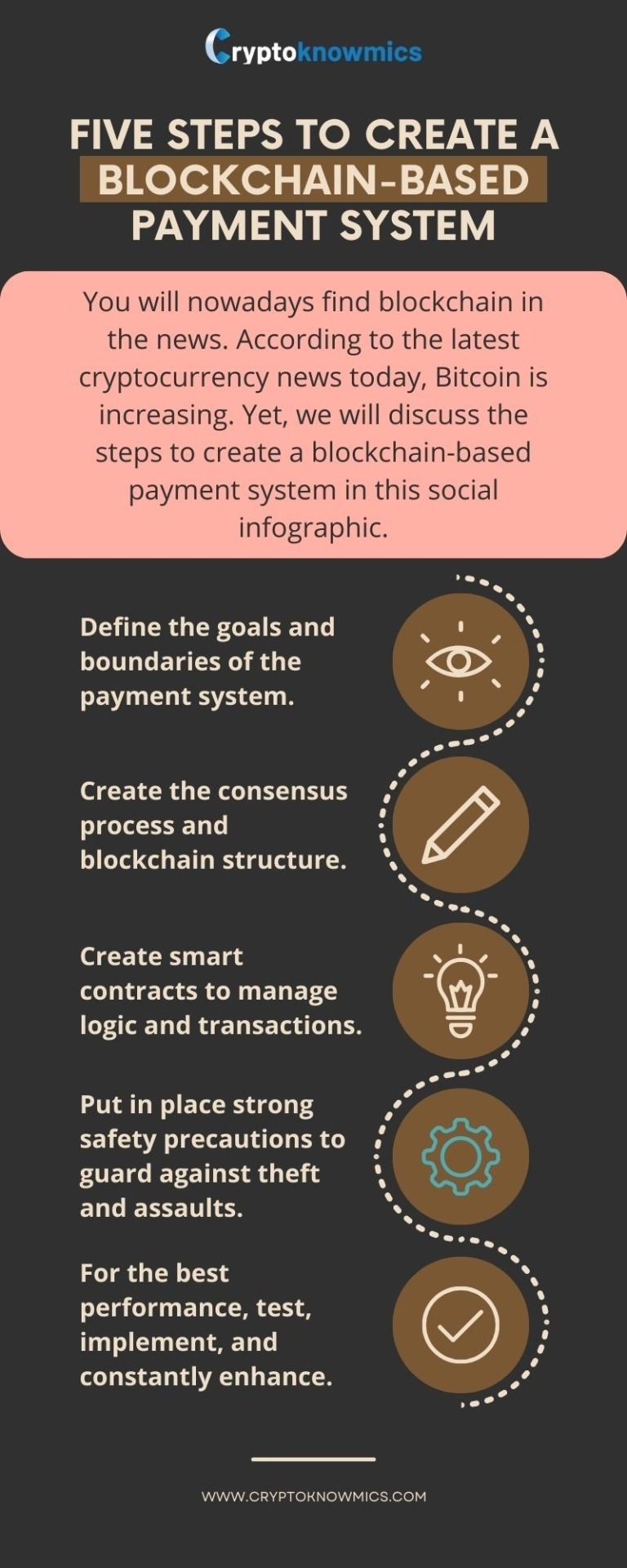

You will nowadays find blockchain in the news. We will discuss the steps to create a blockchain-based payment system in this social infographic below.

#BlockchainBuzz#TechInnovation#BlockchainNews#PaymentSystem#BlockchainSteps#CryptoRevolution#InnovationInsights#FintechGuide#BlockchainTech#DigitalPayments

0 notes