#Financial Services Leicestershire

Explore tagged Tumblr posts

Text

On this day in Wikipedia: Wednesday, 14th February

Welcome, ようこそ (yōkoso), добродошли (dobrodošli), hoş geldiniz 🤗 What does @Wikipedia say about 14th February through the years 🏛️📜🗓️?

14th February 2021 🗓️ : Death - Carlos Menem Carlos Menem, Argentine former president, lawyer, and statesman (b. 1930) "Carlos Saúl Menem (Spanish pronunciation: [ˈkaɾlos ˈmenen] ; 2 July 1930 – 14 February 2021) was an Argentine lawyer and politician who served as the president of Argentina from 1989 to 1999. Ideologically, he identified as a Peronist and supported economically liberal policies. He led Argentina as..."

Image by Unknown photographer

14th February 2019 🗓️ : Event - 2019 Pulwama attack Pulwama attack takes place in Lethpora in Pulwama district, Jammu and Kashmir, India in which 40 Central Reserve Police Force personnel and a suicide bomber were killed and 35 were injured. "The 2019 Pulwama attack occurred on 14 February 2019, when a convoy of vehicles carrying Indian security personnel on the Jammu–Srinagar National Highway was attacked by a vehicle-borne suicide bomber at Lethapora in the Pulwama district of the erstwhile state of Jammu and Kashmir. The attack killed..."

14th February 2014 🗓️ : Death - Chris Pearson (politician) Chris Pearson, Canadian lawyer and politician, 1st Premier of Yukon (b. 1931) "Christopher "Chris" William Pearson (April 29, 1931 – February 14, 2014) was the second leader of the Yukon Progressive Conservative Party and the first premier of the Yukon in the Yukon.Born in Lethbridge, Alberta, Pearson moved to the Yukon in 1957 and worked for the government from 1960 until..."

14th February 1974 🗓️ : Death - Stewie Dempster Stewie Dempster, New Zealand cricketer and coach (b. 1903) "Charles Stewart Dempster (15 November 1903 – 14 February 1974) was a New Zealand Test cricketer and coach. As well as representing New Zealand, he also played for Wellington, Scotland, Leicestershire and Warwickshire...."

Image by Unknown authorUnknown author

14th February 1924 🗓️ : Event - Computing-Tabulating-Recording Company The Computing-Tabulating-Recording Company was renamed as International Business Machines (IBM), later growing into one of the world's largest companies by market capitalization. "The Computing-Tabulating-Recording Company (CTR) was a holding company of manufacturers of record-keeping and measuring systems subsequently known as IBM. In 1911, financier and noted trust organizer, "Father of Trusts", Charles R. Flint amalgamated (via stock acquisition) four companies: Bundy..."

Image by IBM

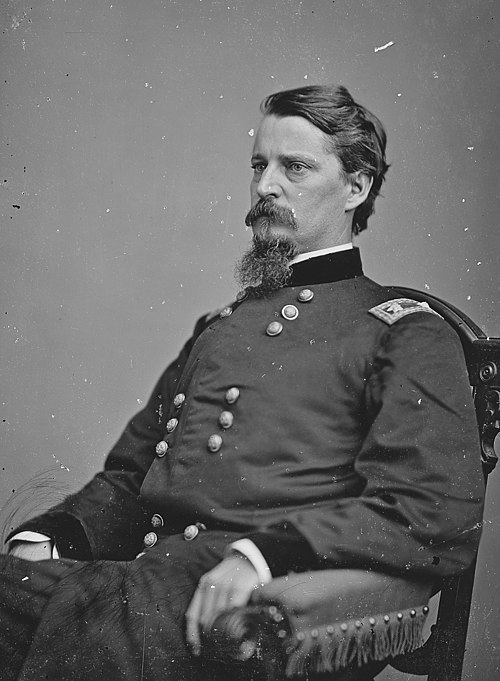

14th February 1824 🗓️ : Birth - Winfield Scott Hancock Winfield Scott Hancock, American general and politician (d. 1886) "Winfield Scott Hancock (February 14, 1824 – February 9, 1886) was a United States Army officer and the Democratic nominee for President of the United States in 1880. He served with distinction in the Army for four decades, including service in the Mexican–American War and as a Union general in the..."

Image by

Unknown authorUnknown author or not provided

14th February 🗓️ : Holiday - Christian feast day: Cyril and Methodius, patron saints of Europe (Roman Catholic Church) "Cyril (born Constantine, 826–869) and Methodius (815–885) were brothers, Byzantine Christian theologians and missionaries. For their work evangelizing the Slavs, they are known as the "Apostles to the Slavs".They are credited with devising the Glagolitic alphabet, the first alphabet used to..."

Image by

painted by Zahari Zograf (Захарий Христович Димитров)

0 notes

Text

Rehab Helper Report Highlights Alcohol and Drug Addiction in Leicestershire

Rehab Helper, a leading resource for addiction recovery, has recently published an in-depth article on the increasing prevalence of alcohol and drug addiction in Leicestershire.

Scope of Addiction in Leicestershire

The report sheds light on the concerning statistics related to addiction in the region.

Hospital admissions related to drug poisoning have risen by 60% over the past decade, while alcohol-related hospital admissions have increased by 14%.

These figures are just the tip of the iceberg, as many people with addiction issues do not seek help or treatment.

Impact of Addiction

Addiction is not just a personal issue but a social one as well. It can lead to job loss, financial difficulties, relationship breakdowns, and even homelessness.

Additionally, addiction can have serious health consequences, such as liver damage, heart disease, and mental health issues.

Seeking Help and Support

Fortunately, there is help available for those struggling with addiction in Leicestershire.

The article provides valuable information on local addiction treatment centres, support groups, and online resources.

It emphasises the importance of seeking help and support, rather than suffering in silence.

The Role of Rehab Helper

Rehab Helper is playing a crucial role in promoting awareness of addiction and supporting individuals in their recovery journey.

The organisation offers a range of services, including assessment, referral, and aftercare. Their team of addiction experts provides personalised support and guidance to those in need.

Rehab Helper Provides Crucial Support for Those Struggling with Addiction in Leicestershire

Overall, Rehab Helper's report on addiction in Leicestershire is a timely and informative resource for individuals struggling with addiction and their families.

By raising awareness of the issue and promoting recovery, Rehab Helper is helping to make a positive impact on the lives of those affected by addiction in the region.

Dear visitors if you want to more information about Addiction Treatment Centre in Leicestershire and our all services please visit our website. We have a website. We welcome you. CLICK HERE

1 note

·

View note

Link

0 notes

Photo

From 2000 Adams & Jones Estate Agents have been Market Harborough’s favourite independent, residential sales,lettings agent & Estate Agents in Great Bowden .Our record of success has been built upon a single minded desire to provide you,first class personal service delivered by highly motivated and highly experienced property professionals.Adams & Jones launched a second branch in the centre of Lutterworth.Three months was spent refurbishing the branch and installing the most up to date technology.We are here to help you in Letting Agents,Property Management,Financial Services, Mortgages.You can get details though the main features the externally operated ‘Touchscreen’ allowing clients to search for and request,details of properties any time of the day or night!.so must visit.

#Estate Agents Great Bowden#Mortgages Leicestershire#Financial Services Leicestershire#Property Management Leicestershire#letting agents leicestershire#Estate Agents Leicestershire

0 notes

Photo

Cloud Bookkeeping Services in Leicestershire #Financial #Assistants #Leicestershire https://t.co/eLFGGYw32b

Cloud Bookkeeping Services in Leicestershire #Financial #Assistants #Leicestershire https://t.co/eLFGGYw32b

— Bookkeeping Experts (@bookexpertsuk) Apr 16, 2022

0 notes

Photo

From 2000 Adams & Jones Estate Agents have been Market Harborough’s favourite independent, residential sales,lettings agent & Estate Agents in Great Bowden .Our record of success has been built upon a single minded desire to provide you,first class personal service delivered by highly motivated and highly experienced property professionals.Adams & Jones launched a second branch in the center of Lutterworth.Three months was spent refurbishing the branch and installing the most up to date technology.We are here to help you in Letting Agents,Property Management,Financial Services, Mortgages.You can get details though the main features the externally operated ‘Touchscreen’ allowing clients to search for and request,details of properties any time of the day or night!.so must visit.

#Estate Agents Leicestershire#Letting Agents Leicestershire#Property Management Leicestershire#Financial Services Leicestershire#Mortgages Leicestershire

0 notes

Text

RoadHow partners with Midven to change driver risk and improve road safety.

RoadHow partners with Midven to change driver risk and improve road safety

Road safety app steers towards success following £500,000 investment

The investment will support RoadHow in the roll out of its road safety app.

Solihull based RoadHow, an app designed to help drivers to become safer and more aware on the road, while potentially saving them money on their insurance, has secured £500k from Midlands Engine Investment Fund (MEIF), managed by venture capital firm Midven (part of the Future Planet Capital group).

The software platform and app, which has been in development for two years, can be used by motorists to test their driving knowledge and aid further learning. Insurers will be able to review and monitor the data collected and offer incentives or discounts on car insurance, adding a new set of data into the insurance pricing and underwriting decision making process.

Learner drivers can also use the RoadHow app to practice DVSA Theory Test revision questions. It is the only app on the market that allows learner drivers to build their knowledge in the form of a series of AI-calculated scores as they work towards passing their test, with insurance providers ready to offer premium incentives for drivers who have used RoadHow.

The funding is set to support the business’s growth plans, with RoadHow set to welcome new staff over the next 12 months, supporting sales and marketing, as well as software development and tech.

The app is multi-faceted, and also functions to offer users discounts on hundreds of popular brands as part of its RoadHow Rewards scheme. For a subscription fee, users can enjoy money-off or cashback on purchases made on the likes of Apple, Nike, Expedia, M&S, John Lewis and many more.

RoadHow is the brainchild of Adrian and Anne Ryan. Both have strong backgrounds in multiple technology sectors, having successfully built and sold global aircraft data and records management platform, FLYdocs, prior to developing RoadHow.

Adrian Ryan, Chief Executive Officer at RoadHow, says:

“For too long, the insurance industry has had limited visibility of driver knowledge and skills data upon which to base underwriting and pricing decisions. We’re changing that with RoadHow. Through RoadHow, we will be able to provide insurance companies with real data that will create a much stronger relationship for both the insurance company and the driver. We want to reward good behaviour through data.”

Giovanni Finocchio, Investment Director, says:

“’I’m really excited about RoadHow, not only does it have a great idea, but there are two very experienced founders who have not only invested their time but their own money to develop the platform. Adrian and Anne have surrounded themselves with top software developers, but they haven’t forgotten the need to get the product into the market. And for that, they have brought in several senior execs from the insurance world. I’m looking forward to working with the team in the coming months and years. This will be great business offering a great service.”

Grant Peggie, Director at the British Business Bank, said:

“It’s great to see funding from the MEIF is helping to bring new disruptive technology and software to the motor industry, while promoting road safety and education. With the support of Midven and finance from the MEIF, the Solihull business is well-positioned to now roll out its services and unlock growth. It is also set to create new jobs, boosting the Midlands economy.”

Tim Pile, Chair of Greater Birmingham and Solihull Local Enterprise Partnership (GBSLEP) said:

“RoadHow are a hugely ambitious business, and it is fantastic to see their work come to fruition following MEIF funding. Digital technologies such as Artificial Intelligence (AI) and Augmented Reality (AR) are crucial to GBSLEP’s commitment of becoming a leading region for innovation. By working with our public, private and education partners and taking a collaborative cross-sector approach, we will continue to support businesses such as RoadHow to capitalise on the opportunities created to drive inclusive economic growth.”

The Midlands Engine Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

– ENDS –

MEDIA CONTACTS

RoadHow Contacts:

Adrian Ryan

CEO, RoadHow

Midven:

Drew Craythorne, Digital Glue

0121 389 2784

About RoadHow

RoadHow is a UK based tech company which offers the most advanced driver risk management and learning platform in the marketplace. Dedicated to improving driver behaviour and reducing insurance risk, RoadHow uses data, driver engagement, incentives and current/future forecast metrics to change how drivers approach their time behind the wheel.

Utilising the power of Big Data, AI, Machine Learning and Augmented Reality, the ground-breaking RoadHow app and platform delivers change for all stakeholders – Drivers, Insurers & MGAs, Telematics Service Providers, Intermediaries, Fleet Managers and anyone else involved in vehicle insurance, performance, risk management and monitoring.

About Midven

For more than 25 years, leading Birmingham-based venture capital firm Midven has been supporting Midlands SMEs, investing more than £60m into the region and raising £200m co-investment into their portfolio. Midven’s ‘more than money’ approach helps to build strong and successful companies and support businesses every step of the way. Midven continues to extend its reach to invest in the Midland’s most ambitious entrepreneurs through its recent appointment to manage the £35 million equity portion of the Midlands Engine Investment Fund (MEIF), as well as the launch of the firm’s first Enterprise Investment Scheme (EIS) fund. For more information about Midven, please visit www.midven.co.uk. Midven was acquired by Future Planet Capital in April 2021.

About Future Planet Capital

Future Planet Capital Limited is a global venture capital and impact investor, connecting the world’s largest investors to the best minds in order to address global challenges. The firm is focused on providing growth capital to leading entrepreneurs and businesses from the world’s top universities and has deployed over $100M on behalf of institutional investors to date. Future Planet Capital’s goal is to profitably solve the world’s greatest challenges in climate change, education, health, sustainable growth & security. For more information about Future Planet please visit www.futureplanetcapital.com.

About the Midlands Engine Investment Fund (MEIF)

The Midlands Engine Investment Fund, supported by the European Regional Development Fund, will invest in Debt Finance, Small Business Loans, Proof-of-Concept and Equity Finance funds, ranging from £25,000 to £2m, specifically to help small and medium sized businesses secure the funding they need for growth and development.

The Midlands Engine Investment Fund is operated by British Business Financial Services Limited, wholly owned by British Business Bank, the UK’s national economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity.

The Midlands Engine Investment Fund is supported by the European Regional Development Fund, the European Investment Bank, the Department for Business, Energy and Industrial Strategy and British Business Finance Limited, a British Business Bank group company.

The MEIF covers the following LEP areas: Black Country, Coventry & Warwickshire, Greater Birmingham & Solihull, Stoke-on-Trent and Staffordshire, The Marches, and Worcestershire in the West Midlands; and Derby, Derbyshire, Nottingham & Nottinghamshire (D2N2) Greater Lincolnshire, Leicester and Leicestershire, and South-East Midlands in the East and South-East Midlands.

The project is receiving up to £78,550,000 of funding from the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The programme will continue to spend to the end of 2023.

The Ministry for Housing, Communities and Local Government is the Managing Authority for European Regional Development Fund. Established by the European Union, the European Regional Development Fund helps local areas stimulate their economic development by investing in projects which will support innovation, businesses, create jobs and local community regenerations. For more information visit www.gov.uk/european-growth-funding.

The European Investment Bank is providing £122,500,000 to support the Midlands Engine Investment Fund. This follows backing for the Northern Powerhouse in 2017 and backing for the newly launched North East Fund. For further information visit www.eib.org

The funds in which Midlands Engine Investment Fund invests are open to businesses with material operations in or planning to open material operations in the West Midlands and East & South-East Midlands.

The British Business Bank has published the Business Finance Guide (in partnership with the ICAEW, and a further 21 business and finance organisations). The guide, which impartially sets out the range finance options available to businesses and provides links to support available at a regional level, is available at https://thebusinessfinanceguide.co.uk

About the British Business Bank

The British Business Bank is the UK government’s economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity. Its remit is to design, deliver and efficiently manage UK-wide smaller business access to finance programmes for the UK government.

The British Business Bank’s core programmes support nearly £8bn[1] of finance to almost 94,800 smaller businesses[2]. Since March 2020, the British Business Bank has also launched four new Coronavirus business loan schemes, delivering almost £73bn of finance to around 1.6m businesses.

As well as increasing both supply and diversity of finance for UK smaller businesses through its programmes, the Bank works to raise awareness of the finance options available to smaller businesses. The British Business Bank Finance Hub provides independent and impartial information to businesses about their finance options, featuring short films, expert guides, checklists and articles from finance providers to help make their application a success.

In light of the coronavirus pandemic and EU Exit, the Finance Hub has expanded and it now targets a wider business audience. It continues to provide information and support for scale-up, high growth and potential high growth businesses, but now provides increased content, information and products for businesses in survival and recovery mindsets. The Finance Hub has been redesigned and repositioned to reflect this, during this period of economic uncertainty.

British Business Bank plc is a public limited company registered in England and Wales, registration number 08616013, registered office at Steel City House, West Street, Sheffield, S1 2GQ. It is a development bank wholly owned by HM Government. British Business Bank plc and its subsidiaries are not banking institutions and do not operate as such. They are not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). A complete legal structure chart for the group can be found at www.british-business-bank.co.uk.

#2021 Driving Theory Test#Learner DVSA Exam#DVSA Theory Test#DVSA Driving Test#Theory Driving Test UK#DVSA Theory Test App#RoadHow#Mideven

0 notes

Text

Care Home Accountants in Leicestershire #Nursing #Home...

Care Home Accountants in Leicestershire #Nursing #Home #Financial #Services # #Leicestershire https://t.co/k2AyZZ6RpD

Care Home Accountants in Leicestershire #Nursing #Home #Financial #Services # #Leicestershire https://t.co/k2AyZZ6RpD

— ContractorAccountant (@accountexpertuk) September 7, 2020

from Contractor Accountants https://contractoraccountantsuk.tumblr.com/post/628635351808868353 via IFTTT

0 notes

Photo

Care Home Accountants in Leicestershire #Nursing #Home #Financial #Services # #Leicestershire https://t.co/k2AyZZ6RpD

Care Home Accountants in Leicestershire #Nursing #Home #Financial #Services # #Leicestershire https://t.co/k2AyZZ6RpD

— ContractorAccountant (@accountexpertuk) September 7, 2020

0 notes

Text

Bitcoin Blackmail Hits Record Highs in UK

According to new research, Bitcoin Ransomware may have been more prolific than we thought. In the UK between 2018 and 2019, local police forces received more than 560 reports of victims being blackmailed for bitcoin. Bitcoin Ransomware Rife in 2019 The official figures obtained by the Freedom of Information Act (FOI) reveal that UK police forces received no less than 562 reports of victims having their devices hijacked by Ransomware and being blackmailed for bitcoin payments during 2018 and 2019. The data shows just how prolific the cases of bitcoin crime were throughout this period. It also provides a breakdown of the areas most affected by the opportune hackers. North Yorkshire Police received the highest number of bitcoin-related crime reports. In 2018, there were just six cases. This rose sharply in 2019 to a whopping 115 incidents–a 1,817% surge. The Most Common Demands of Ransomware Hackers The research also uncovers the types of services attacked and how the hackers worked. In one particular case in Cumbria, a bad actor accessed the victim’s business server and encrypted all files in a ransomware attack. He was ordered to pay a sum of BTC to a designated address within 72 hours or face an increased ransom. Threats to up the ante were accompanied by other forms of blackmail. For example, a further victim in Derbyshire was warned that if the ransom wasn’t paid, the hacker would release sensitive details of visits to a porn site. Perhaps most disturbingly was the fact that one Durham police incident involved social media as a method of sending funds. The hacker used Facebook to send a link to pay bitcoin to their account. Greater Manchester was one of the most affected areas with 83 bitcoin ransomware cases. Out of these, six victims were also sent letters intending to cause extreme emotional distress and anxiety. Other areas where this crime was widely reported included Leicestershire and Hertfordshire. Lincolnshire Police received the least amount of reports with just eight cases during the same period. Bitcoin Ransomware hackers used the same tactics in almost all cases–blackmail and fear intended to cause not only economic damage but also psychological. They used threats, intimidation, and other high-pressure tactics to achieve their goal. Andrew Martin, CEO of Retail Financial Consulting, a technology partner for the banking and retail sector commented: The rising tide of digital financial crime will bring a shiver down the spine of consumers, who are already acutely aware of the risk of fraud and blackmail from malicious hackers. These incidents underline the risks associated with online currencies, which are often an easy way for anonymous third parties to extort money from victims, without detection. Do you think bitcoin ransoms should be paid? Add your thoughts in the comments below! Images via Shutterstock from Cryptocracken Tumblr https://ift.tt/2QugpxN via IFTTT

0 notes

Photo

Our record of success has been built upon a single minded desire to provide you,first class personal service delivered by highly motivated and highly experienced property professionals in Mortgages in Leicestershire. visit us: http://plus.google.com/115897763403041314485

#Estate Agents Leicestershire#Letting Agents Leicestershire#Property Management Leicestershire#Financial Services Leicestershire#Mortgages Leicestershire#Estate Agents Great Bowden#Estate Agents East Farndon#Estate Agents Lubenham#Estate Agents Market Harborough#Estate Agents Dingley

0 notes

Text

Construction to start on £250m Leicestershire incinerator

Financial close has been reached on the £250m Newhurst Energy-from-Waste facility in Leicestershire,

Joint venture partners Covanta Holding Corporation, Biffa and Macquarie’s Green Investment Group struck the deal this week paving the way for construction to start shortly.

Hitachi Zosen Innova will be main contractor on the job which is expected to take 39 months to complete creating over 300 jobs.

Many opportunities will also be created for the local supply chain with a commitment from the project to purchase goods and services from nearby companies wherever possible.

The facility will use proven technology to provide up to 350,000 tonnes of annual treatment capacity for non-recyclable waste and will also generate up to 42 megawatts of electricity, enough to power around 80,000 homes.

0 notes

Text

Construction to start on £250m Leicestershire incinerator

Financial close has been reached on the £250m Newhurst Energy-from-Waste facility in Leicestershire,

Joint venture partners Covanta Holding Corporation, Biffa and Macquarie’s Green Investment Group struck the deal this week paving the way for construction to start shortly.

Hitachi Zosen Innova will be main contractor on the job which is expected to take 39 months to complete creating over 300 jobs.

Many opportunities will also be created for the local supply chain with a commitment from the project to purchase goods and services from nearby companies wherever possible.

The facility will use proven technology to provide up to 350,000 tonnes of annual treatment capacity for non-recyclable waste and will also generate up to 42 megawatts of electricity, enough to power around 80,000 homes.

from https://www.constructionenquirer.com/2020/02/12/construction-to-start-on-250m-leicestershire-incinerator/

0 notes

Text

Shared 'hubs' urged for bankless cities

Banks have been urged to create native "banking hubs" for patrons if there's a risk to the final department on the town. The massive 4 banks Lloyds, Barclays, HSBC and RBS would fund the hubs, which could possibly be in Publish Places of work, however would have specifically skilled employees, MPs stated. MPs discovered banks have been pushing folks in direction of Publish Workplace branches which don't supply key banking companies. The federal government may need to alter competitors regulation to permit banks to share services on this manner, MPs stated. The Treasury Choose Committee got here up with the concept of native banking hubs as a manner of coping with the fallout from mass closures of branches. It says there are nonetheless giant sections of society which rely on branches and that banks can not rely totally on their on-line and cell companies, which have proved so weak to IT failures.

Publish Workplace reliance

As issues stand, when the final financial institution in an space shuts down, prospects are ushered in direction of the closest Publish Workplace to do their banking. However when you can take out and deposit cash and test your stability, there isn't any banking specialist readily available and you'll't get assist organising primary transactions like direct debits. You are able to do nearly as a lot utilizing a money machine. On high of that, the Publish Workplace really makes a loss from offering restricted banking companies. The Committee says the taxpayer shouldn't be subsidising the banks. Actually three of the most important banks, Lloyds, NatWest and Barclays, have already banded collectively to offer banking hubs for small companies. Six have been opened thus far this yr in Birmingham, Manchester, Crosby, London, Leicestershire and Bristol. And in Scotland the Deputy First Minister, John Swinney, has referred to as for banking hubs for private prospects after a swathe of closures from RBS, Clydesdale and TSB. The suggestion is that totally different banks would take turns, utilizing the identical workplace on alternate days. So there could possibly be a future for the banking hubs thought if ministers will be persuaded to get behind it. Read the full article

0 notes

Text

John McDonnell Is Right: Austerity is Social Murder

In the aftermath of the Grenfell Tower Fire, a man-made tragedy for which the death toll presently stands at 80, Labour’s Shadow Chancellor John McDonnell took part in a debate at the Glastonbury Festival during the course of which he made the sensational claim that the victims of the fire were ‘murdered by political decisions’. Regardless of the fact that McDonnell was echoing views already expressed by some of the victims’ families and, indeed, by some of the survivors themselves, his comments were bound to spark outrage.

There is no doubt that by levelling the charge of murder directly at the political classes, McDonnell was leaving himself wide open to a barrage of criticism. Already a bogeyman of the right-wing press, the hired hacks of Murdoch and Dacre didn’t need to issue any ‘stop or I'll shoot’ warnings before firing off both barrels in the general direction of Labour’s Marxist messenger. Nadine Dorries, Tory M.P for Mid-Bedfordshire, told the Daily Mail that “It would have been nice if he had let the dust settle, bodies be identified and given people time to grieve before he played politics with the lives of those who suffered”. Her colleague Andrew Bridgen, M.P for North West Leicestershire, was singing from the same hymn sheet (no doubt helpfully circulated by Conservative Central Office) when alleging “I wonder how the friends and relatives of the victims feel when their recently deceased loved ones are used as political pawns by the hard-left. With the hard-left, the end always justifies the means - no matter how much upset they cause”.

McDonnell stands accused, then, of using the horrific deaths of men, women, and children as a political football with which to gain a sordid electoral advantage. Leaving aside the fact that the accusations come directly from a party who cheered David Cameron to the rafters at the 2014 Welsh Conservative Conference when he launched his notorious attack on the Labour’s stewardship of the NHS in Wales-

“I tell you - when Offa’s Dyke becomes the line between life and death, we are witnessing a national scandal. There are people who have seen the ones they love waiting far, far too long for treatment, sometimes dying and these grieving families are in pain. It’s the same old socialist mantra: the system knows best”

Cameron is himself clearly guilty here of using the death of Welsh patients as a political football in order to score cheap party political points over an opponent; so having duly noted the hypocrisy of the Tory party’s response to McDonnell’s comments, let us examine the statement in closer detail. Here is the key sentence –"The decision not to build homes and to view housing as only for financial speculation rather than for meeting a basic human need made by politicians over decades murdered those families”.

It should be clear to anyone reading the above passage, that McDonnell isn’t attempting to pin the blame on any one political party, indeed the very opposite is true. He acknowledges Labour’s own culpability by recognising that ‘politicians over decades murdered those families’. McDonnell is attributing the blame, where it surely belongs, at the door of neo-liberalism, whether practised by Blair/Brown, Cameron/Osborne Clegg/Cable or May/Hammond. In a subsequent interview with Andrew Marr, McDonnell stood by his comments, drawing on Friedrich Engels 1845 treatise ‘The Conditions of the Working Class in England’ to amplify his argument. In the key passage below, Engel’s proposes his theory of ‘social murder’,

‘When one individual inflicts bodily injury upon another, such injury that death results, we call that deed manslaughter; when the assailant knew in advance that the injury would be fatal, we call his deed murder. But when society places hundreds of proletarians in such a position that they inevitably meet a too early and an unnatural death, one which is quite as much a death by violence as that by the sword or the bullet; when it deprives thousands of the necessaries of life, places them under conditions in which they cannot live - forces them to remain in such conditions until that death ensues which is the inevitable consequence - knows that these thousands of victims must perish, and yet permits these conditions to remain, its deed is murder just as surely as the deed of the single individual’.

Even as the Grenfell fire was still burning, a blog by the Grenfell Action Group, from November 2016, was heading T.V news bulletins. Its opening paragraph can’t but be compared to the conditions Engels was describing in his classic text,

‘It is a truly terrifying thought but the Grenfell Action Group firmly believe that only a catastrophic event will expose the ineptitude and incompetence of our landlord, the KCTMO, and bring an end to the dangerous living conditions and neglect of health and safety legislation that they inflict upon their tenants and leaseholders. We believe that the KCTMO are an evil, unprincipled, mini-mafia who have no business to be charged with the responsibility of looking after the everyday management of large scale social housing estates and that their sordid collusion with the Royal Borough of Kensington and Chelsea Council is a recipe for a future major disaster.’

McDonnell was, of course, at the heart of Jeremy Corbyn’s campaign for the Labour leadership in 2015, a campaign which was built around a principled and, as it turns out, remarkably prescient decision to turn Labour into an anti-austerity party. Labour members who had been uneasy with Ed Miliband’s decision to fight the general election of 2015 as an austerity-lite, lesser of two evils version of the Tories were ready to quit the party en-bloc when caretaker leader Harriet Harman instructed the parliamentary party to abstain on the second reading of the Tories’ Welfare Reform Bill, a bill that would have condemned the sick, the poor, the disabled and, particularly, disadvantaged children, to another package of brutal cuts running into the billions. Ordinary members couldn’t, in all conscience, continue to endorse those vicious policies. Had the Labour Party fought the 2017 general election on the bogus platform that one spoonful of austerity, not two, would secure the nation's recovery it may well have been wiped out as a genuine political force in precisely the way that Scottish Labour was in the wake of the 2014 referendum on Scottish independence.

It is entirely plausible to argue, then, that McDonnell, as Corbyn’s chief lieutenant, and architect of the anti-austerity strategy, not only saved the Labour Party from a crippling defeat but also salvaged what remains of the welfare state too. May’s minority government will now have to scale back its onslaught on the public sector, while there is also a very real possibility of a Labour government being elected in the near future with a mandate to reverse austerity. Labour’s manifesto For the many, not the Few, inspired millions of young voters, outraged by the levels of inequality in the U.K, to participate in the political process for the first time. Try to imagine (remembering that the Liberal Party’s call for a second Brexit referendum led to an actual fall in their share of the vote), what else Labour could have run on in 2017, if not their anti-austerity programme. McDonnell has certainly earned the right to be heard with respect on the subject of austerity.

Austerity is a well-oiled killing machine and the Conservative Party knows it. There are countless government reports, House of Commons’ committee investigations and independent submissions from charitable organisations and pressure groups that testify to the many and varied ways in which the ideology of austerity kills British citizens. The Department of Work and Pensions, just to take one example, suppressed 49 internal peer reviews commissioned to look into the suicides of benefit claimants following their sanctioning by the department. It was only through a succession of Freedom of Information requests that the scandal of how the most vulnerable people in society were being driven to their deaths finally came to light.

The death toll resulting from a decade of austerity almost defies belief. It’s a painful task to reduce the individual lives of men, women, and children to a set of grim statistics in order to paint an exact picture of Britain in the summer of 2017:

The Health and Safety Executive has had its budget cut by 46%, leading to a drop in inspections of more than a third since 2011. https://www.healthandsafetyatwork.com/hse/business-plan-reveals-further-budget-cuts

Between 2003 and 2013 domestic energy prices increased by 150% (www.jrf.org.uk)

Since 2008 real wages have dropped by 10.4% in the U.K. compared to a 14% increase in Germany and an 11% increase in France. https://www.tuc.org.uk/economic-issues/labour-market/uk-workers-experienced-sharpest-wage-fall-any-leading-economy-tuc

Hate crimes against people with disabilities doubled between 2008 and 2014. https://hansard.parliament.uk/

Between 2009/10 and 2010/11 there was a 31% cut in Local Authority funding for domestic and sexual violence support. http://www.research.lancs.ac.uk/portal/en/publications/measuring-the-impact-of-cuts-in-public-expenditure-on-the-provision-of-services-to-prevent-violence-against-women(dfd8ea40-b589-4f75

A study in 2015 found evidence that an additional 1,000 suicides had occurred in the U.K. between 2008 and 2010 as a result of the Global Financial Crash and the onset of austerity. https://www.theguardian.com/society/2015/nov/12/austerity-a-factor-in-rising-suicide-rate-among-uk-men-study

According to the Office for National Statistics, in the winter of 2012/13, there was a 29% increase in deaths compared to a 15.5% rise the previous winter. The ONS report contradicted Public Health England’s claim that the rise was due to influenza. Danny Dorling, Professor of Geography at Oxford, attributed one of the largest increases in overall mortality since records began in the 1830’s to the fact that many pensioners were too poor to heat their homes. (’Austerity and Morality’, contributing essay to The Violence of Austerity edited by Vickie Cooper and David Whyte) https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/bulletins/excesswintermortalityinenglandandwales/2013-11-26 https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/bulletins/excesswintermortalityinenglandandwales/201415provisional

A study published in the Journal of Epidemiology and Community Health showed that for every 10,000 Incapacity Benefit claimants reassessed between 2013 and 2015 there was an additional six suicides and 725,000 more prescriptions for anti-depressants.

Between October 2012 and the end of 2015, there were over 1.9 million decisions taken to sanction claimants. https://www.gov.uk/government/statistics/dwp-statistical-summaries-2016

The U.K infant (0 to 1 years) mortality rate, at around four deaths per every 1,000 births, is higher than all but two of the nineteen Euro area member states. Half of these deaths are linked to short gestation and low birth weight, both of which are highly associated with deprivation. (Growing up in the UK 2013, pp 37-55) http://ec.europa.eu/eurostat/search_auth=tZoMC4JS&p_p_id=estatsearchportlet_WAR_estatsearchportlet&p_p_lifecycle=1&p_p_state=maximized&p_p_mode=view&_estatsearchportlet_WAR_e

An April 2016 House of Commons report on air quality estimated that up to 50,000 deaths every year are ‘brought forward’ by pollution. (House of Commons Environment, Food and Rural Affairs Committee 2016 p.3)

In England and Wales, there were 42,000 evictions in the rented sector in 2015. A rise of 50% over the past four years and the highest level since records began in 2000. (Ministry of Justice: Mortgage and Landlord Possession Statistics Quarterly).

A Swedish study in 2015, found that tenants losing their home were up to nine times more likely to commit suicide, compared to the general population http://jech.bmj.com/content/early/2015/11/04/jech-2015-206419

A study, Homelessness Kills: An Analysis of the Mortality of Homeless People in Early Twenty-First Century England, states the average age of death for a homeless person to be 47 years old.

In 2016, a total of 22 deaths of women in prison custody were recorded. This is the highest number on record. http://www.inquest.org.uk/statistics/deaths-of-women-in-prison

Rates of self-harm in prisons are running at record levels with 32,313 recorded attempts in 2015, a rise of nearly 40% in two years. (Prison Reform Trust, Prison: the Facts, Bromley Briefings 2016)

In the year to 2016, self-inflicted deaths in prison rose by 28%. (Ministry of Justice, Safety in Custody Statistical Bulletin England and Wales, 2016)

Austerity-driven cuts to the prison service budget between 2011 and 2015 amounted to £900 million, or 24% of the service’s overall budget. (Prison Service Journal November 2015)

Between 2010 and 2015 mental health trusts lost £598 million from their budgets each year. http://www.bbc.co.uk/news/health-31970871

These figures are just the tip of an austerity iceberg which threatens to sink the ship of the welfare state; how, for example, do you quantify the number of women who may have died as a result of the closure of domestic violence centres, or the tens of thousands who have surely died as the social care budget has been slashed and the NHS pared down and part-privatised?

Austerity, it is worth recalling, was always an ideological choice and not a political necessity. A global financial crash, caused by the greed of private sector banks, insurance companies and hedge funds (coincidentally, a roll call of donors to the Tory Party!) was used as camouflage by a Coalition government intent on dismembering the welfare state. As Sure Start centres, libraries and care homes were being closed down across the country, the rich continued to salt away their untaxed wealth in Panamanian tax havens; the wealthiest 1,000 in the U.K. population have, according to the Sunday Times rich list, doubled their wealth to more than half a trillion pounds. Although austerity is now disowned by former cheerleaders like the International Monetary Fund and the Organisation for Economic Co-operation and Development, there are still some members of the May cabinet, such as Michael Fallon, wedded to an utterly discredited method of stimulating economic growth. Austerity was only ever a ruse for systematically shifting wealth away from citizens and toward the corporate tax havens of the super-rich.

As Cooper and Whyte point out in their introduction to The Violence of Austerity, a compendium of true life horror stories that should be filed alongside your well-thumbed copy of The Complete Poe, ‘It is not normal to subject the most vulnerable sections of the population to such pain, humiliation and degradation’. The madness doesn’t end there, because, in addition to its policy of austerity, the Conservative Party’s deranged obsession with deregulation, together with their constant undermining of Health and Safety law in Britain endangers every one of us as we go about our daily business. No wonder, then, that former Trading Standards Supervisor Pippa Savage, while disputing McDonnell’s use of the word murder, felt able to declare in her column for The New European that McDonnell’s ‘sentiments ring true’.

As to whether McDonnell can be justified in his headline grabbing charge of murder, the law of joint enterprise has been used increasingly in recent years to secure convictions in murder cases. The controversial law does not require a member of the group accused to intend to kill or commit serious harm, simply requiring them to foresee that another member "might" kill, or at its lowest level of culpability, "might" inflict serious harm.

When the Conservative cabinet next assembles, to rubber stamp its latest tranche of welfare cuts (there are a projected 10bn of “savings” still in the pipeline), ministers will be aware, from all the evidence cited above, that the decisions they take that day will cause countless deaths. Of course, ministers won’t know which babies, which mentally-ill teenagers, which benefit claimants, which workers on building sites, which families trapped in blazing tower blocks, which pensioners on hospital trolley’s and which of the significantly disabled will die. Horrifyingly, the only conclusion it’s possible for us to reach is that they simply won’t care.

youtube

Andrew Marr talking to John McDonnell

This piece can now be read at

https://www.facebook.com/RedLabour2016/

3 notes

·

View notes

Text

Santander to axe 140 bank branches in 2019 – Which? News

Santander to axe 140 bank branches in 2019 – Which? NewsSantander will close 140 branches before the end of the year, wiping out a fifth of its network and putting more than 1,200 jobs at risk, it was announced today. Checkout Banco Santander S.A. (SAN) earnings Report 2019 on this link: https://presss.org/santander-reports-18%-rise-in-annual-profit-as-brazil-unit-sees-strong-performance/(opens in a new tab) The Spanish bank says it will ‘reshape’ its branch network in response to changes in how customers are choosing to carry out their banking. It will be hoping to lessen the blow by promising a £55 million upgrade to 100 remaining branches over the next two years. This latest news brings the total number of shuttered bank branches to at least 3,101 since 2015, following similar moves from Lloyds Banking Group and RBS Group last year. Keep reading to find the full list of Santander branches to be axed and use our interactive banking blackspots map of the UK to see the areas hit hardest by closures.

Why is Santander closing a fifth of its branches?

The number of transactions carried out via Santander branches has fallen by 23% over the past three years, while transactions via digital channels have grown by 99% over the same period. Susan Allen, head of retail and business banking at Santander, has defended the closures and assured customers that the bank expects its network to remain stable for the foreseeable future: ‘The way our customers are choosing to bank with us has changed dramatically in recent years, with more and more customers using online and mobile channels. As a result, we have had to take some very difficult decisions over our less visited branches, and those where we have other branches in close proximity.’

Which Santander branches are affected?

Around the UK, the Santander network will fall to 614 branches over the course of 2019. The first cuts will start on 25 April when the following branches will close: Bathgate in West Lothian, Bideford in Devon, Clitheroe in Lancashire, Corby in Northamptonshire, Eastcote in Middlesex, Gracechurch Street in London, Haslemere in Surrey, Helensburgh in Dunbartonshire, Oakham in Leicestershire, and Queensway in London. Here, we list the 140 branches set to close:

Mapping the banking blackspots

In November 2018, exclusive Which? research revealed that a fifth of UK households live more than three kilometres from their nearest current account provider. Our map, below, reveals the areas hit the hardest by bank branch closures. You can also use our unique branch closure checker to find out which banks are shutting down branches in your local authority area.

We estimate that the total number of physical bank branches in the UK has shrunk by nearly two thirds: from 20,583 branches in 1988 (according to parliamentary records) to 7,586 branches (relating to all current account providers) in 2018. Adding a further 140 Santander closures will bring that number to just 7,446. Gareth Shaw, head of Which? Money, said: ‘These closures will come as a blow for all those who rely on access to traditional banking services across the UK, at a time when branches are disappearing at a rate of more than 60 a month. ‘Despite the switch to digital ways of banking and paying, millions of consumers still need access to cash. It is vital for a regulator to be given responsibility for ensuring that people have access to the services they rely on.’

What are the alternatives?

Under the Access to Banking Standard initiative, Santander must support customers in finding other ways to bank that best suit their needs. It must also publish impact assessments for each branch, detailing the reasons for closure and alternative ways to bank locally. Customers have been told they can use their nearest Post Office instead. But many people are doubtful that it can offer a suitable alternative to bricks-and-mortar banks. In an online survey of 2,049 British adults in September 2018, only 55% were aware that they can use a Post Office for banking, and 47% said they are unlikely to do so in the future. When we asked why they were reluctant to use the Post Office for banking, 59% said they simply prefer to deal directly with their bank. And 28% were worried about staff lacking expertise in financial services. Others voiced concerns that post offices have long queues (42%) and aren’t private enough to deal with personal finances (32%). With only 262 directly managed Crown branches left, an increasing number of Post Office branches are situated inside newsagents, convenience stores and retailers such as WH Smith. And the number of mobile outreach services – which are hosted in vans, village halls and local pubs for a few hours each week – has soared from 938 in 2010 to 1,518 in 2018.

Banking at the Post Office

All Santander current and business account holders can use Post Office branches for basic banking services (you can check your account balance, withdraw cash, and pay in cash and cheques with a paying-in slip from your bank). But, many other services are unavailable. What you CAN’T do at the Post Office: transfer money from your account open or close accounts make enquiries about your bank’s financial products or services register power of attorney or grant of probate request a replacement debit card lodge a complaint. Published at Wed, 23 Jan 2019 16:09:00 +0000 Read the full article

0 notes