#Financial Ratio Analysis

Explore tagged Tumblr posts

Text

Financial Statement Analysis Course: Decode Company's Financial Health

Are you looking to enhance your knowledge on financial statements? Look no further, as this Financial Statement Analysis Course is here to guide you through analyzing a company's financial health with precision.

In this comprehensive 5-module, 1.5-hour course, you'll gain valuable insights into three pivotal financial statements: the Balance Sheet, Profit and Loss Statement, and Cash Flow Statement.

Our expert instructors will guide you through decoding company financial statements and analyzing each statement's vital aspects. You'll learn to identify critical indicators, assess financial health, and confidently navigate the dynamic world of fundamental analysis.

By the end of this course, you'll have the expertise to uncover hidden gems within balance sheets, understand profit drivers and revenue intricacies, and evaluate sustainability and liquidity.

So, what are you waiting for? Start learning and achieve financial triumph today!

Course Outline:

Understanding Financial Statements

Decoding Balance Sheet of a company

Analyzing Company's Profit & Loss Statements

Mastering Cashflow Statement of a company

Using Ratio Analysis on Balance Sheet, Profit & Loss Statement & Cash Flow Statement

What you will get:

PDFs

Flashcards

Assessments

Certificate of Completion.

#financial ratio analysis#valuation methods#accounting ratio#ratio analysis in accounting#methods of valuation of shares#define ratio analysis

0 notes

Text

How to Use the Interest Coverage Ratio for Financial Analysis

I published a new article exploring the intricacies of the Interest Coverage Ratio—a vital tool for assessing a company's financial health and its ability to meet debt obligations. Give it a read to enhance your understanding of financial analysis!

Among the myriad of financial metrics used to assess a company’s fiscal well-being, the Interest Coverage Ratio stands out as a fundamental indicator. This ratio sheds light on how comfortably a company can pay interest on its outstanding debt, offering insights into its operational efficiency and financial stability. This article delves into the intricacies of the Interest Coverage…

#Corporate Finance#Creditworthiness#Debt Management#EBIT#Financial Analysis#Financial Health#Financial Metrics#Financial Ratios#Interest Coverage Ratio#Investment Strategies

0 notes

Text

Effective Trading Strategies Using the Long Put Option Trading Strategy

The Long Put Option Trading Strategy is a popular approach among traders who anticipate a decline in the price of an underlying asset. By purchasing put options, traders gain the right to sell the underlying asset at a specified price before the option expires, allowing them to profit from falling markets. This strategy offers a cost-effective way to hedge against potential losses or speculate…

#Bear Markets#Bull Markets#Butterfly Spread#Consolidation Phase#Derivatives Trading#Financial Markets#Hedging Strategies#Investment Strategies#Long Put Option#Market Analysis#Married Put#Options Trading#Options Trading Examples#Protective Put#Put Option Strategies#Ratio Put Spread#Risk Management#Stock market trading#Trading Strategies#Volatile Markets

0 notes

Text

#investing#stock market#stock trading#equity trading#finance#financial literacy#learn stock market trading#paper trading#virtual trading#derivatives trading#putcall ratio#papertradingappindia#fundamentalanalysis#technical analysis#stock market india#stock market simulator#stockstowatch#ratio analysis

0 notes

Text

Maximizing Efficiency in 2024 With Real-time Financial Analysis in Retail

Consumer preferences can change as rapidly as a trending hashtag on social media. This constant shift in trends can hamper the profitability of businesses. This is why staying ahead of these ever-changing trends and making well-informed, timely decisions is crucial to seize the opportunities at hand. Nowhere is this reality more evident than in the retail industry.

However, a majority of multi-location retail franchises still rely on manual methods, such as spreadsheet-based calculations, to conduct financial analysis. In fact, in our recent survey report, we identified that a staggering 52% of respondents were using manual methods for financial data analysis, and manual intervention for creating financial reports is favored by 58% of respondents.

Read More at https://pathquest.com/knowledge-center/blogs/financial-analysis-in-retail-industry/

#Financial Analysis in Retail#Business Insights#current ratio in retail industry#retail financial reporting#bi software for retail

0 notes

Text

Financial Ratios Cheat Sheet: 17 Ratios for Informed Investing

In the dynamic world of finance and investment, knowledge is power. Understanding financial ratios is crucial for investors looking to make informed decisions and optimize their portfolios. In this financial ratios cheat sheet, we’ll explore the most important financial ratios used for investing, explain how to calculate them, and demonstrate their practical applications. Whether you’re a novice…

View On WordPress

#Calculating Valuation Ratios#Dividend Yield#Earnings Per Share#Financial Metrics#Investment Ratios#Investment Research.#Price-to-Book Ratio#Price-to-Earnings Ratio#Stock Analysis#Valuation Ratios

0 notes

Text

Understanding Risk and Reward: How to Evaluate Investment Opportunities

Introduction: Welcome back, readers, to another informative blog post on personal finance and investing! In today’s article, we will delve into the crucial topic of understanding risk and reward when evaluating investment opportunities. As savvy investors, it is essential to assess the potential risks associated with any investment and weigh them against the potential rewards. By mastering this…

View On WordPress

#company-specific risks#debt-to-equity ratio#diversify portfolio#economic risks#evaluate investment#financial advisor#financial aspirations#Financial Goals#financial ratios#historical performance#investment analysis#investment decision-making#investment goals#investment guidance#investment liquidity#investment opportunities#investment profitability#investment research#investment timeframe#investment volatility#market conditions#potential risks#price-to-earnings ratio#regulatory risks#return on investment#risk and reward#risk assessment#risk tolerance#seek professional advice#stability analysis

0 notes

Text

Financial Ratio Analysis : Meaning, Definition, Types, Formula - Liquidity, Solvency, Profitability, Efficiency, Market Ratio

In this article we will discuss about meaning, definitions, types and formula of Ratio analysis that compares two or more financial variables to provide insights into a company’s financial condition, liquidity, solvency, profitability, efficiency / activity, market and operational efficiency. Meaning and Definitions Meaning and definitions – Ratio Analysis is a financial analysis technique that…

View On WordPress

#Activity Ratio Analysis#advantages and disadvantages of ratio analysis#definitions of ratio analysis#Efficiency Ratio Analysis#formulas of ratio analysis#Liquidity Ratio Analysis#Market Ratio Analysis#meaning of financial ratio analysis#Profitability Ratio Analysis#Solvency Ratio Analysis#types of ratio analysis#uses of ratio analysis

0 notes

Text

I will be curious to read the vituperative denials of the validity of this article's analysis, which is pasted below the cutoff:

“Are you better off today than you were four years ago?” That question, first posed by Ronald Reagan in a 1980 presidential-campaign debate with Jimmy Carter, has become the quintessential political question about the economy. And most Americans today, it seems, would say their answer is no. In a new survey by Bankrate published on Wednesday, only 21 percent of those surveyed said their financial situation had improved since Joe Biden was elected president in 2020, against 50 percent who said it had gotten worse. That echoed the results of an ABC News/Washington Post poll from September, in which 44 percent of those surveyed said they were worse off financially since Biden’s election. And in a New York Times/Siena College poll released last week, 53 percent of registered voters said that Biden’s policies had hurt them personally.

As has been much commented on (including by me), this gloom is striking when contrasted with the actual performance of the U.S. economy, which grew at an annual rate of 4.9 percent in the most recent quarter, and which has seen unemployment holding below 4 percent for more than 18 months. But the downbeat mood is perhaps even more striking when contrasted with the picture offered by the Federal Reserve’s recently released Survey of Consumer

The survey provides an in-depth analysis of the financial condition of American households, conducted for the Fed by the National Opinion Research Center at the University of Chicago. Published every three years, it’s the proverbial gold standard of household research. The latest survey looked at Americans’ net worth as of mid-to-late 2022 and Americans’ income in 2021, comparing them with equivalent data from three years earlier. It found that despite the severe disruption to the economy caused by the pandemic and the recovery from it, Americans across the spectrum saw their incomes and wealth rise over the survey period.

The rise in median household net worth was the most notable improvement: It jumped by 37 percent from 2019 to 2022, rising to $192,000. (All numbers are adjusted for inflation.) Americans in every income bracket saw substantial gains, with the biggest gains registered by people in the middle and upper-middle brackets, which suggests that a slight narrowing of wealth inequality occurred during this time. In particular, Black and Latino households saw their median net worth rise faster than white households did—though the racial wealth gap is so wide that it narrowed only slightly as a result of this change.

A big driver of this increase was the rising value of people’s homes—and a higher percentage of Americans owned homes in 2022 than did in 2019. But households’ financial position improved in other ways too. The amount of money that the median household had in bank accounts and retirement accounts rose substantially. The percentage of Americans owning stocks directly (that is, not in retirement accounts) jumped by more than a third, from about 15 to 21 percent. The percentage of Americans with retirement accounts went from 50.5 to 54.3 percent, a notable improvement. And a fifth of Americans reported owning a business, the highest proportion since the survey began in its current form (in 1989).

Americans also reduced their debt loads during the pandemic. The median credit-card balance dropped by 14 percent, and the share of people with car loans fell. More significantly still, Americans’ median debt-to-asset, debt-to-income, and debt-payment-to-income ratios all fell, meaning that U.S. households had lower debt burdens, on average, in 2022 than they’d had three years earlier.

The gains in real income (in this case, measured from 2018 to 2021) were small—median household income rose 3 percent, with every income bracket seeing gains. But that was better than one might have expected, given that this period included a pandemic-induced recession and only a single year of recovery.

The picture the survey paints, then, is one of American households not only weathering the pandemic in surprisingly good shape, but ultimately also emerging from it in better financial shape than they were going in. And that, in turn, points to the effect of the U.S. policy response to the crisis: Stimulus payments, enhanced unemployment benefits, the child-care tax credit, and the moratorium on student-loan payments boosted household income and balance sheets, helping people pay down debt and increase their savings. In the process, these policies mildly narrowed inequality.

The U.S. government’s aggressive response to the pandemic, including Biden’s stimulus spending, also helped the job market recover all its pandemic-related losses—and add millions of jobs on top. The resulting tight labor market has been a huge boon to lower-wage workers. In fact, because the Fed survey’s income data end in 2021, it understates the income gains for the bottom half of the workforce, and the shrinking income inequality they’ve produced.

Hourly wages for production and nonsupervisory workers (who make up about 80 percent of the American workforce) rose 4.4 percent year-on-year in the third quarter of 2023, for instance, ahead of the pace of inflation. And this was not anomalous: Arindrajit Dube, an economist at the University of Massachusetts at Amherst, crunched the numbers and found that real wages for that same sector of workers are not just higher than they were in 2019, but are now roughly where they would have been if we’d continued on the upward pre-pandemic trend.

The reason for this is simple: Low unemployment has translated into higher wages. As a recent working paper by Dube, David Autor, and Annie McGrew shows, the tight labor markets of the past few years have given lower-wage workers more bargaining power than in the past, leading to a compression in the wage gap between higher-paid and lower-paid workers. Of course, that gap is still immense, but the three scholars found that the wage gains for lower-paid workers have rolled back about a quarter of the rise in inequality that has occurred since the 1980s.

So what should we take away from the Survey of Consumer Finances data, and from Dube, Autor, and McGrew’s work? Not that everything is fine, but that public policy and macroeconomic management matter a lot. Enhanced unemployment benefits, the child-care tax credit, the stimulus payments—these things materially improved the lives of Americans and helped set the economy up for a strong recovery. If the policy response had been less aggressive, the U.S. economy would be in worse shape now. This is something you can see by looking at Europe, where economies are growing far more slowly and unemployment is higher, while inflation is no lower.

Key to this story is the fact that lower-wage workers in particular would be worse off, because they have been among the chief beneficiaries of the low unemployment created by the robust recovery. It’s a useful reminder that stagnant wages are not an inevitable result of American capitalism: When labor markets are tight, and employers have to compete with one another for employees, workers get paid more.

So, even allowing for the high inflation we saw in 2022, no one could really look at the U.S. economy today and say that the policy choices of the past three years made us poorer. Yet that, of course, is precisely how many Americans feel.

Although that pessimism does not bode well for Biden’s reelection prospects, the real problem with it is even more far-reaching: If voters think that policies that helped them actually hurt them, that makes it much less likely that politicians will embrace similar policies in the future. The U.S. got a lot right in its macroeconomic approach over the past three years. Too bad that voters think it got so much wrong.

#someone somewhere out there will find this infuriating#I'm not an economist and almost every time anyone says anything about economics I think 'sure that makes sense'#so I post in my ignorance#try to resist calling me a retard when you tear this apart#and it's always the worst with things like statistics because someone's gonna be like 'well if you reframe the numbers slightly#you'll find that in fact this article demonstrates that we have less wealth per capita than your average North Korean'

63 notes

·

View notes

Text

Researchers have shown how the tax system can reinforce disparities between households of different races or ethnicities, even though the Internal Revenue Code does not explicitly favor any racial group. These disparities arise because the tax code favors certain types of income, expenses, and family characteristics—factors that often vary by race and ethnicity.

Despite being the fastest-growing racial group in the country, Asian American households remain an understudied population in tax policy research. Around 24 million Americans, or 7% of the U.S. population, identify either as Asian or Asian in combination with another race. Using newly available data, we find that among American households in the top 20% of the income distribution, Asian American households pay a higher average individual tax rate than white households, in large part because they earn more of their income from labor earnings, while white households are more likely to own tax-favored assets.

How do we know? Previously, the triennial Survey of Consumer Finance (SCF) had assigned information on all Asian American households to the “Other” racial category. The 2022 SCF oversamples minorities and is the first wave to present specific data for households in three separate categories: Asian American, American Indian or Alaska Native, or Native Hawaiian or Pacific Islander.

Researchers can now explore the impact of the tax code on Asian American taxpayers relative to white taxpayers. Our analysis uses the 2022 SCF data, an established methodology to convert households into tax filing units, and the NBER’s TAXSIM microsimulation model. Still, the small number of Asian Americans in the 2022 SCF sample, limit the level of detail in our statistical analysis. But that limit highlights the need for more specific data and research.

Differences in income distribution

Figure 1 compares the expanded income (EI) distribution of Asian American and white households. EI includes adjusted gross income, cash and near-cash benefits, and untaxed sources of capital income such as unrealized capital gains and imputed rent from owning a home.

Asian American taxpayers have a bimodal distribution; that is, they largely fall into two main areas of this distribution, and their incomes vary more widely compared to white taxpayers. While a large proportion of Asian Americans are in the top 20% of the distribution, a sizable share is in the lowest 20 to 40% of the distribution, revealing diversity within the Asian American community. This finding challenges the “model minority” stereotype that all Asian American families are financially well-off.

Differences in average tax rate

Figure 2 shows the average tax rate (ATR, or the ratio of income tax liability to EI) for Asian American and white households.

The ATR generally rises with income for both groups, reflecting the progressive nature of the federal income tax. Among those in the top 60% of the income distribution, Asian American households pay higher ATRs than white households. Subsequent regression analysis (not shown), however, indicates this difference is statistically significant only for the top quintile (at the 10% level, a criterion we chose based on the limited sample size). The higher ATR arises because, relative to white households, Asian American households earn a greater share of their income from fully-taxed labor income (earned from working) rather than tax-favored capital income (earned from sources including realized or unrealized capital gains, unreported business income, or imputed rent on owner-occupied housing).

Contributing factors to tax disparities

While differences in the composition and level of income matter when assessing the tax treatment of Asian American households, other factors may also contribute these differences.

For example, the tax code generally favors single-earner married couples, but the labor force participation of Asian American women is higher than that of white women. That raises the possibility of a higher occurrence of marriage penalties among Asian households. The younger age distribution of Asian Americans compared to white Americans may drive other differences. Asian American households are less likely to own homes but owe more when they do, possibly because a large share of Asian American people live in high-cost areas like San Francisco. This suggests potential differences in the use of the mortgage interest deduction.

Asian American households are also less likely to hold tax-preferred retirement accounts, and their households are more likely to be multigenerational, which may cause confusion about which adults are eligible for benefits. In fact, a recent Treasury study found that low-income Asian Americans are less likely to receive the Earned Income Tax Credit and Child Tax Credit than any other low-income racial group.

There’s much more to learn

While these preliminary findings show how the tax code affects Asian American and white households differently, researchers need more data to conduct deeper analyses. There may be disparities in income tax liabilities within the broadly diverse Asian American population. Cultural norms, socioeconomic statuses, and lived experiences vary widely among Asian American families from different countries and regions.

In March 2024, the Biden administration updated Statistical Policy Directive No. 15 to require federal data to subdivide the “Asian American” category into subgroups, including Chinese, Asian Indian, Filipino, Vietnamese, Korean, and Japanese. With these detailed data, researchers can perform more nuanced analyses that further debunk the “model minority” myth.

Policymakers should use this research to better understand the economic needs of low-income Asian American families, particularly the most vulnerable among them. That includes the uncertainty faced by undocumented immigrants and the high poverty rates among Burmese (19%) and Hmong (17%) Americans.

Examining differences in tax treatments between Asian American subgroups will allow researchers to capture the diverse experiences and needs of these communities, enabling the development of responsive policies.

13 notes

·

View notes

Text

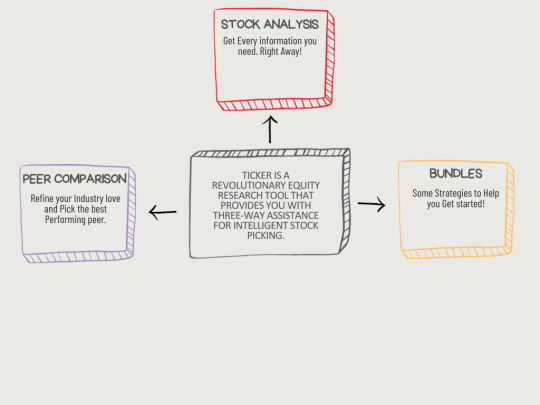

Fundamental stock analysis is a method of evaluating a company's financial and economic factors to determine the intrinsic value of its stock. This analysis involves examining factors such as sales growth, earnings growth, and return on equity, profit margin, debt-to-equity ratio, and management effectiveness. Investors use various techniques to gather data, including financial statements, industry reports, economic indicators, and news releases. By estimating the company's future cash flows and discounting them back to the present, investors can determine the net present value of the stock. By comparing the market price of the stock with its estimated intrinsic value, investors can make informed decisions about buying, selling, or holding the stock.

#financial statement analysis#fundamental analysis#ratio analysis#balance sheet analysis#company analysis#financial analysis#financial ratio analysis#financial ratios#fundamental analysis of stocks#share market analysis#stock analysis#stock analysis websites#stock market analysis

0 notes

Text

Formula for Success: Price-to-Earnings (P/E) Ratio

Learn how to use the P/E ratio to evaluate stocks. This article covers calculation, interpretation, and limitations. Keep in mind, it's just one tool - use it with other metrics for better investment decisions.

If you’re venturing into the world of stock investing, you’ve likely encountered the term “Price-to-Earnings Ratio” or “P/E Ratio.” But what is it and how do you use it to assess a company’s stock? Let’s break down what the P/E ratio means, how to calculate it, and why it matters for your investment decisions. What is the P/E Ratio? The Price-to-Earnings Ratio is a valuation metric that…

0 notes

Text

Mastering STARC Bands: A Comprehensive Guide to Profitable Trading

In the ever-evolving landscape of financial markets, traders are constantly seeking innovative tools to enhance their profitability. One such tool that has gained traction among both novice and seasoned traders is the STARC Bands. Short for Stoller Average Range Channels, STARC Bands offer a unique approach to analyzing price movements and identifying potential trading opportunities. In this…

View On WordPress

#Average True Range (ATR)#Backtesting#Breakout Trading#Financial Markets#Manning Stoller#Market Conditions#Market Sentiment#Position Sizing#Price movements#Range Trading#Risk Management#Risk Reward Ratio#STARC Bands#Stop Loss Orders#technical analysis#Trading Indicators#trading signals#Trading Strategies#Trend Following#Volatility

0 notes

Note

https://twitter.com/CineGeekNews/status/1735028345794855200

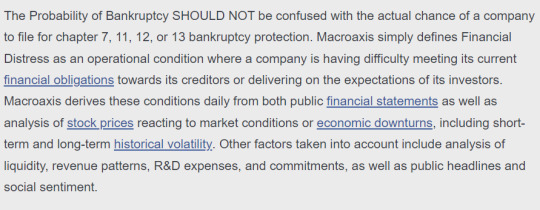

Warner Bros Discovery currently has an over 60% Probability of Bankruptcy.

I honestly am not sure if this is good or bad for the SPN revival. On the one hand, WB is NOT going to want to spend money on such a niche IP that will really mostly only draw ppl who were already fans if they are in such dire straits financially. On the other hand, they could bring in money by selling the IP to another studio who would obviously then want to actually do something with it since they spent money on it. But that also depends on another studio or streaming service wanting to do something with it which will be tougher. Netflix would make sense since they currently have SPN for streaming, except they will be losing their streaming rights at the end of 2025. A revival wouldn't even be released until then so why would Netflix want to put money into a revival of show that will, at that time, be streaming on a competitor (most likely Max since it will revert back to WB). Amazon is a possibility since both Jensen and Kripke are there (if they want to bring Kripke on for it) and Kripke seems to have some sway over there. But again, unless they buy the rights to SPN to stream on their platform, why would they want to make a show that will inadvertently benefit their competitor?

https://www.macroaxis.com/invest/ratio/WBD/Probability-Of-Bankruptcy#google_vignette

Oof... there's a boatload of information in that report that I just don't understand. (My year in finance did not make me an analyst, lol!)

I can see how the headline could be alarming, but I did see a couple of paragraphs that I believe are relevant to the discussion:

Basically, this all boils down to probability and analysis based on both quantitative and qualitative factors. You'll see in that first paragraph that they also take into consideration public headlines and social sentiment. Obviously, the WB's public presence is not good right now, but it doesn't necessarily mean they will be holding a fire sale of IP's anytime soon.

Now, to your question of how it might affect any reboot. Personally, I don't think the Supernatural IP is big enough for the WB to sell and have it make a difference on their books. If they were that strapped for cash, they'd sell the rights to a much bigger IP, like Loony Tunes (as we've already seen them try to scrap the new Wil. E. movie), or the Lego film franchise.

In the case that the WB keeps SPN, the question is, will they want to put money behind a short series reboot. In my opinion, no. Even though SPN does fairly well on Netflix, the first season viewing numbers don't even crack the top 1000 on Netflix. Plus, the WB has the most recent numbers of the miserably failed The Winchesters, which is still a part of the SPN IP (even though it had nothing to do with SPN as we know it.)

So, unless J2 can rally outside investors (and themselves) to pay for the majority of a reboot, (including convincing a different network to pay a licensing fee), I don't see the WB shelling out the money studios usually pay to produce a series.

But again, with the caveat that this is mostly guesswork on my part based on very little data (at least, data that I don't fully understand.)

#ask box#spn reboot speculation#warner bros bankruptcy speculation#it's all speculation#lol!#long post

13 notes

·

View notes

Note

I pick Rockefeller just because I assumed the reply would be long just covering those governors.

Your analysis did bring up a question I'm curious about: What was the NYC financial crisis and it's aftermath?

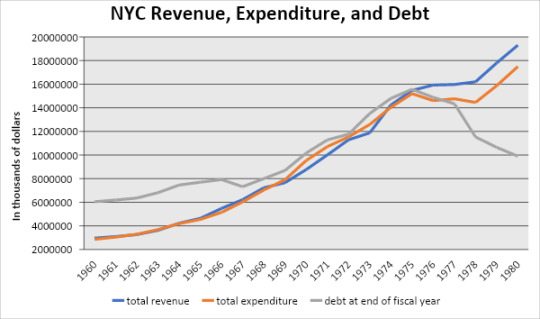

Ah, I see.

I can talk about the NYC fiscal crisis, let me get my lecture notes.

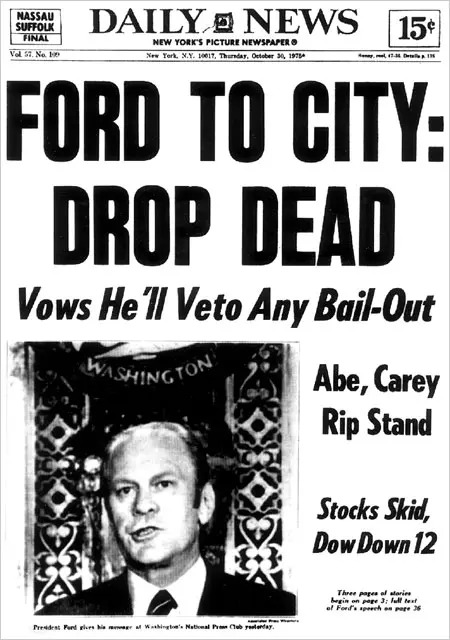

As I talked about with the list of NYC mayors, NYC had been borrowing money for a while. The underlying cause was that NYC's industrial economy had started shrinking in the 1950s, sapping the city's tax base and population. To try to cope with the social consequences of this economic decline, the city had been increasing spending on police, teachers, and welfare benefits. For a good while, the city had been able to paper things over by increasing taxes and various creative accounting measures, and had managed to keep things rolling over.

And then the 1973-1975 recession hit. All of the sudden, the city loses 38,000 jobs, unemployment rises, which means demand on social services increase, and all of the sudden that poor bastard Abe Beame is looking at a $1.5 billion annual hole in the budget that's ballooning NYC's debt.

But at the same time, another part of the story is that NYC's banks aren't doing too hot: as Joshua Freeman notes in Working-Class New York, the same NYC banks that had been encouraging city government to borrow more (because municipal bonds were a good profit source) had lent money very unwisely to developing nations and needed to cover their losses. So they started selling off their municipal debt holdings and started pushing the city to increase the interest rates they were offering.

However, they also asked for major policy changes. They wanted the city to fire public sector workers, they wanted the city to cut spending on social services and capital projects, and until the city agreed to make these changes, they wouldn't buy or underwrite city bonds. To me, the telling detail is that they started asking for more policy changes - raise the subway fares from ¢35, end free tuition at CUNY - that wouldn't affect the city's budget at all, since neither the MTA nor CUNY were city agencies. This wasn't just creditors wanting their debtor to improve their budget outlooks: this was a capital strike aimed at disciplining the unions, poor minorities, and the middle class into accepting a worse standard of living.

And so the city went to the Ford Administration for emergency aid, and Ford turned them down because he wanted to make NYC an example of what happened to liberal governments. Ford's Treasury Secretary said that the Federal government would only provide aid if the rescue package was "so punitive, the overall experience made so painful, that no city, no political subdivision would ever be tempted to go down the same road."

Ultimately, the city was forced to knuckle under. It eventually got a state bailout, but only by giving in to every conceivable demand that capital had made and giving them and the state government control over the city's taxes, bonds, and budget for decades. The result was that:

a quarter of the city's workforce lost their jobs;

the city's schools saw their teacher-student ratios shoot up and their wraparound services cut to shreds;

CUNY shrank by 62,000 students and became 50% whiter as black and brown students could no longer afford to attend;

the subway became more expensive, less reliable, and more dangerous;

public hospitals closed, leading to diverging health outcomes between rich and poor;

fire houses closed, leading to increasing response times that were the key factor behind the Bronx burning;

and on and on.

At the end of the decade, NYC had lost a million residents and would not recover fully until the turn of the millenium. But hey, at least the books were balanced!

34 notes

·

View notes

Text

Why It’s Important to Learn from Top Forex Brokers Review for Choosing the Right Broker

In the vast world of Forex trading, selecting the right broker is a critical step that can significantly influence your trading success. With numerous brokers available, each with its own unique features, spreads, and platforms, making an informed decision can be daunting. This is where understanding top Forex brokers review becomes essential. In this article, we will explore why these reviews are crucial for your trading journey and how they can help you choose the right broker tailored to your needs.

Understanding the Role of Forex Brokers

Forex brokers serve as intermediaries between traders and the foreign exchange market. They facilitate currency trades, provide access to trading platforms, offer market insights, and assist with account management. A reputable broker ensures the safety of your funds, compliance with regulatory standards, and access to high-quality trading tools.

The Importance of Learning from Top Forex Brokers Reviews

1. Evaluating Credibility and Trustworthiness

When choosing a Forex broker, trust is paramount. Top Forex brokers review can help you assess a broker’s credibility through:

Regulatory Status: A regulated broker is overseen by financial authorities, ensuring adherence to strict guidelines. Reviews typically highlight whether brokers are regulated by entities such as the FCA (UK), ASIC (Australia), or NFA (U.S.). This oversight provides a level of safety for your funds.

User Feedback: Authentic experiences from other traders offer insights into a broker’s reliability. Positive reviews affirm a broker’s trustworthiness, while negative feedback can serve as a warning signal.

2. Understanding Trading Conditions

Different brokers offer varying trading conditions, which can greatly impact your profitability. By consulting top Forex brokers review, you can gather critical information about:

Spreads and Commissions: The costs associated with trading can vary widely. Reviews often provide comparisons of spreads and commissions, allowing you to identify brokers with competitive pricing.

Leverage Options: While leverage can amplify your trading potential, it also increases risk. Reviews clarify the leverage ratios different brokers offer, enabling you to choose one that aligns with your risk tolerance.

3. Assessing Customer Support

Having access to responsive customer support is vital in Forex trading. Issues can arise unexpectedly, and prompt assistance can make a difference. Reviews often cover:

Availability: Knowing whether a broker offers 24/5 or 24/7 customer support can help you select one that fits your trading schedule.

Quality of Service: Insights from user experiences can shed light on how quickly and effectively a broker resolves issues. Look for brokers with positive reviews regarding their customer service.

4. Examining Trading Platforms and Tools

The trading platform is your primary interface for executing trades and analyzing markets. A user-friendly platform can enhance your overall experience. Top Forex brokers review provide insights into:

Platform Usability: Reviews often discuss how intuitive and easy it is to navigate a broker’s platform. A smooth user experience can save you time and frustration.

Tools and Features: Different brokers offer various tools for technical analysis, charting, and automated trading. Understanding what features are available can help you choose a broker that meets your specific needs.

5. Identifying Educational Resources

For beginner traders, education is crucial. Many brokers provide educational resources to help traders develop their skills. Reviews typically highlight:

Quality of Educational Content: Look for brokers that offer comprehensive learning materials, including tutorials, webinars, and market analysis. Reviews can help you identify brokers that excel in educational support.

Access to Market Insights: Some brokers provide regular market updates and insights, which can be beneficial for traders at all levels. Reviews often highlight brokers that offer excellent analytical resources.

6. Understanding User Experience

User experience encompasses all aspects of dealing with a broker, from account setup to withdrawal processes. Reviews can reveal:

Ease of Account Setup: Many reviews detail how straightforward or complicated the account opening process is. A hassle-free setup can enhance your initial experience with a broker.

Withdrawal Processes: Timely and transparent withdrawals are critical. Reviews often highlight the experiences of other users regarding withdrawal times and any associated fees.

7. Avoiding Common Pitfalls

Not all brokers are transparent, and some may have hidden fees or unfavorable terms. Learning from top Forex brokers reviews allows you to:

Spot Red Flags: Frequent complaints about withdrawal issues, hidden charges, or poor customer service can signal potential problems with a broker.

Gain Insights from Others: Understanding the experiences of other traders can help you avoid common pitfalls and make more informed decisions.

How to Find Reliable Forex Broker Reviews

To maximize the benefits of top Forex brokers reviews, it’s essential to find trustworthy sources. Here are some tips:

Seek Established Review Platforms: Reputable financial websites often employ analysts who rigorously evaluate brokers, offering unbiased reviews.

Cross-Reference Information: Don’t rely solely on one review. Compare multiple sources to get a well-rounded view of a broker’s strengths and weaknesses.

Focus on Recent Reviews: The Forex landscape can change rapidly, so look for the most current reviews that reflect recent trading conditions.

The Top 10 Forex Brokers You Should Consider

Selecting the right Forex broker is a pivotal decision for anyone venturing into currency trading. With hundreds of brokers vying for your attention, each offering unique features, fees, and services, making an informed choice can be overwhelming. This comprehensive top Forex brokers review aims to simplify that process by presenting the top 10 Forex brokers, highlighting their strengths, trading conditions, and key features.

Why Choosing the Right Forex Broker Matters

1. Safety of Funds

A reliable broker ensures the safety of your capital. Brokers regulated by reputable authorities provide assurance that they adhere to stringent financial standards, protecting your investments.

2. Cost of Trading

Different brokers have varying spreads and commissions, which can significantly affect your overall profitability. Understanding these costs is vital for effective trading.

3. Access to Tools and Resources

The right broker provides tools, educational resources, and analytical data that can enhance your trading strategy and improve your skills.

4. Quality of Customer Support

When issues arise, having access to responsive customer support can make a significant difference in your trading experience.

Key Criteria for Evaluating Forex Brokers

To ensure a comprehensive review, we considered several important factors:

Regulation: Is the broker regulated by a reputable authority?

Trading Costs: What are the spreads, commissions, and other fees?

Trading Platforms: How user-friendly and feature-rich are the platforms offered?

Customer Support: What kind of support is available, and how responsive is it?

Educational Resources: Are there resources available to help traders improve their skills?

The Top 10 Forex Brokers

1. IG Group

Overview: IG Group is one of the oldest and most respected Forex brokers in the world, known for its robust trading platform and extensive market offerings.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Spreads from 0.6 pips on major pairs.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support via phone, email, and live chat.

Educational Resources: Offers webinars, trading guides, and market analysis.

2. Forex.com

Overview: Forex.com, a subsidiary of GAIN Capital, is well-known for its user-friendly platform and comprehensive trading services.

Regulation: Regulated by NFA and CFTC (U.S.).

Trading Costs: Spreads start from 0.2 pips.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support through multiple channels.

Educational Resources: Extensive educational content, including videos and articles.

3. OANDA

Overview: OANDA is recognized for its transparent pricing and high-quality trading data, appealing to both beginners and experienced traders.

Regulation: Regulated by CFTC (U.S.) and FCA (UK).

Trading Costs: Spreads start at 1 pip, with no commission on standard accounts.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 customer support via phone and email.

Educational Resources: Offers a variety of educational materials and market insights.

4. eToro

Overview: eToro is a pioneer in social trading, allowing users to copy the trades of successful traders and engage with a vibrant community.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spread-based fees with no commissions on stock trading.

Platform: Unique social trading platform and mobile app.

Customer Support: 24/5 customer support.

Educational Resources: Provides trading guides, webinars, and community features.

5. XM Group

Overview: XM is known for its flexible trading conditions and a variety of account types tailored to different trading strategies.

Regulation: Regulated by ASIC (Australia) and CySEC (Cyprus).

Trading Costs: Spreads from 0.0 pips on certain accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 in multiple languages.

Educational Resources: Offers webinars, trading articles, and various tools for traders.

6. Pepperstone

Overview: Pepperstone is favored for its low-cost trading environment and exceptional customer service.

Regulation: Regulated by ASIC (Australia) and FCA (UK).

Trading Costs: Spreads as low as 0.0 pips on Razor accounts.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials including articles and tutorials.

7. Saxo Bank

Overview: Saxo Bank caters to professional traders with its premium trading tools and a wide range of assets.

Regulation: Regulated by FCA (UK) and FSA (Denmark).

Trading Costs: Competitive pricing with low spreads for premium accounts.

Platform: SaxoTraderGO and SaxoTraderPRO.

Customer Support: 24/5 customer support via multiple channels.

Educational Resources: Provides in-depth market analysis and educational content.

8. FXTM (ForexTime)

Overview: FXTM is known for its flexible trading options and extensive educational resources for traders.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spreads from 0.1 pips on ECN accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 via phone and email.

Educational Resources: Offers webinars, seminars, and market analysis.

9. IC Markets

Overview: IC Markets is preferred by high-frequency traders for its low-cost trading environment and excellent liquidity.

Regulation: Regulated by ASIC (Australia).

Trading Costs: Spreads as low as 0.0 pips.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/7 customer support available.

Educational Resources: A range of tutorials and market insights are provided.

10. Admiral Markets

Overview: Admiral Markets offers diverse account types and a wide range of trading instruments, catering to both beginners and experienced traders.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Competitive spreads starting from 0.0 pips.

Platform: MetaTrader 4 and 5.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials and market analysis available.

In the competitive landscape of Forex trading, choosing the right broker is essential for your trading success. This top Forex brokers review highlights some of the best options available, each with unique features that cater to different trading styles and needs.

When making your choice, consider your trading goals, risk tolerance, and the specific features that are most important to you. Whether you prioritize low trading costs, advanced platforms, or robust educational resources, the brokers listed above provide excellent starting points for your trading journey.

Conclusion

In the fast-paced world of Forex trading, selecting the right broker is vital for your success. By utilizing top Forex brokers review, you can gain valuable insights into broker credibility, trading conditions, customer support, and overall user experience. This informed approach not only increases your chances of finding a suitable broker but also enhances your overall trading experience.

Investing time in researching and comparing brokers through reviews is a wise step that can lead to better trading outcomes and greater confidence in your trading decisions. By being well-informed, you can navigate the Forex market more effectively and work towards achieving your trading goals. Happy trading!

2 notes

·

View notes