#Financed by Guggenheim and JP Morgan

Explore tagged Tumblr posts

Text

‘Beef’ Actor David Choe Shields Himself Behind Copyright After Resurfaced Clips Go Viral Where He Admits To ‘Rapey Behavior’ – Deadline

"David Choe has protected himself using copyright laws to his favor following backlash over resurfaced audios where he admitted to “rapey behavior.”

The audio from the now-defunct podcast DVDASA from a 2014 episode were recirculated given that Choe stars in Netflix’s Beef. In the clips shared on Twitter, Choe makes some serious statements retelling a story where he forced a masseuse into performing oral sex on the actor..."

Boy, Netflix sure can pick 'em!

Wait. I know Netflix Bridgerton trolls were trolling Benedict months ago. Were those Chris Evans blogs making Wanda spam for days coming from them, too, to block this story?

#Choe#Steven Yuen#Netflix#A24#Financed by Guggenheim and JP Morgan#Ali Wong#BEEF#Asian Hollywood#Black Hollywood#Joe Quesada#The Disabled#Marvel#Disney#Brian Woods

14 notes

·

View notes

Text

New ETH and Altcoin All Time Highs IMMINENT 🚀

youtube

Bitcoin and Ethereum all time highs | Jay Clayton Warns of BTC Regulations | The Crypto Bull Case: JP Morgan, Citibank, Guggenheim | Ether to $2,500 based on Futures Trading? | Blockchain Banking with PointPay

#bitcoin #ethereum #filecoin #enjin #nft #nfts #harmony #one #altcoins #eth #scaling #Chainlink #LINK #VeChain #btc #altcoin #investing #cryptocurrency #crypto #invest #binance #news #success #finance #entrepreneur #business #market #staking #grayscale #gemini #coinbase #kraken #CRO #enj #efinity #polkadot #binancesmartchain #bsc #polygon #matic #goldmansachs #jpmorgan #cme #cmegroup #FIL #TRON #TRX #Quant #fuse #polkamarkets #elrond #EGLD #PointPay #PXP

Timestamps 00:00 Bitcoin and Ethereum all time highs 01:35 Jay Clayton Warns of BTC Regulations 02:40 The Crypto Bull Case: JP Morgan, Citibank, Guggenheim 04:59 Ether to $2,500 based on Futures Trading? 06:21 Blockchain Banking with PointPay

ALTCOIN TRADING SIGNALS – https://t.me/AltcoinBuzzChat

TOP CRYPTO NEWS – https://www.altcoinbuzz.io

FREE NEWSLETTER – http://eepurl.com/dnIEz1

TWITTER – https://twitter.com/altcoinbuzzio

FACEBOOK – https://www.facebook.com/altcoinbuzzio

Cryptocurrency And Bitcoin Visa Card – GET $25 FREE ON ► CRYPTO.COM https://platinum.crypto.com/r/ab *Code is AB

Trade On Binance! ► https://www.binance.com/en/register?ref=UAMKZ47P *Code is UAMKZ47P

CRYPTOCURRENCY MARKET PRICES AND DATA ► COINGECKO https://gcko.io/altcoin-buzz

NOTE If you use the above referral links, we receive a commission at no additional cost to you.

References: https://www.coindesk.com/former-sec-chairman-jay-clayton-new-bitcoin-regulations https://cointelegraph.com/news/bitcoin-on-brink-of-strong-breakout-says-analyst-ahead-of-coinbase-ipo https://www.coindesk.com/bitcoins-drop-in-volatility-may-boost-appeal-make-130k-possible-jpmorgan-says-report

JP Morgan's bitcoin price prediction is $130,000.

Citibank's bitcoin price prediction is $318,000.

Guggenheim's bitcoin price prediction is $600,000.

— Documenting Bitcoin

(@DocumentingBTC) April 4, 2021

https://cointelegraph.com/news/38-ethereum-futures-premium-signals-traders-anticipate-2-500-eth https://www.youtube.com/c/AltcoinBuzz/community https://pointpay.io/ https://t.me/pointpay_talks https://hackernoon.com/the-biden-administrations-early-signs-for-crypto-are-ominous-1m1i333m

Disclaimer: The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the content creators/reviewers and their risk tolerance may be different than yours. Altcoin Buzz is not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Please do your own due diligence and rating before making any investments and consult your financial advisor. The information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.

The post New ETH and Altcoin All Time Highs IMMINENT 🚀 appeared first on BLOCKPATHS.

source https://blockpaths.com/news/new-eth-and-altcoin-all-time-highs-imminent-%f0%9f%9a%80/

0 notes

Video

youtube

The Richest Family in America You've Never Heard of

Here is the latest video from ReallyGraceful, who is really talented and really brave. After more than ten years of being a successful YouTuber, she has dared to take on the Fed and Babylonian Money Magic and to tell the history of our financial system, with all the pizazz of her editing, graphics and writing skills.

She deserves our support and respect during the fall-out from the ADL that is sure to come.

***

“What better time to discuss a family who is intimately tied to the dollar? This family is as rich – if not richer – than the Rockefellers, yet they are not a household name.

So, let’s spend this video talking about the Schiff family…

“Oddly enough, in order to speak about one of the richest families in America, who hardly anyone knows about, we have to travel back to the Middle Ages to a Jewish ghetto, where the Schiff family and the most notorious banking family, the Rothschild family lived under one roof and continued to for centuries, intermarrying and essentially acting as one family, which is where we meet Jacob Schiff, who is born in Frankfurt, Germany in 1847.

“At age 18, he set sail for New York, where he quickly made connections and moved up the ranks of the American banking industry. The Rothschilds’ now-American cousin honed his finance skills and became a member of Kuhn-Loeb, the European Jewish investment firm, who emerged as one of the most influential firms of the Industrial Era, having financed top industry tycoons, including John D Rockefeller in his expansion of Standard Oil.

“Jacob Schiff married into Kuhn-Loeb, becoming head of the firm, yet never changing the name and additionally, Schiff became the director of the National City Bank of New York, Wells Fargo and the Union Pacific Railroad.

“In 1907, he launched the Jewish immigrants information bureau to encourage European Jewish immigration to the United States and successfully devised the Galveston Plan in which European organizations recruited Jewish individuals and transported them to Texas while Schiff managed to change immigration laws for one group, he actively suppressed immigrants of other ethnicities and nationalities.

“Also on his resume, Schiff was one of the major financiers of the Bolshevik Revolution, which massacred millions of Christians across Russia. Once established as a financial titan, this Rothschild cousin quickly implemented the family formula: Jacob Schiff, alongside his brother-in-law, Paul Warburg waged a relentless campaign for an American central bank.

“This banking crusade included giving speeches in front of New York’s Chamber of Commerce, advocating for currency reform, with Jacob Schiff delivering a number of these speeches, making his intent perfectly clear. The main opposition to the Fed conveniently kicked the bucket a year before it was created.

“Rival millionaires, like John Jacob Astor, Isidor Straus and Benjamin Guggenheim sank along with the Titanic in 1912. JP Morgan was supposed to be onboard but cancelled at the last minute. What a coincidence, right?

“With Congress eager to take leave for the Christmas holidays, they passed the Federal Reserve Act of 1913 on December 23rd, which called for the creation of the Federal Reserve Bank, a central bank of the United States that would oversee the nation’s monetary policy, with the catch being that the Federal Reserve wasn’t even part of the Federal Government but a foreign banking system that doesn’t even print the dollar bill.

“In 1933, Americans were required to deliver their gold to a Federal Reserve agent, under the threat of criminal penalties. Meanwhile, the Schiff family maintained their status as banking titans but eventually branched out to build a media empire.

“The granddaughter of Jacob Schiff, Dorothy Schiff was owner and publisher of the New York Post for nearly 40 years. Also of note, the president of the Federal Reserve, Eugene Meyer bought the Washington Post.

“Today, the Schiff family is as rich as ever and still highly-connected, marrying into politics with a Schiff descendant wedding Vice President, Al Gore’s daughter. And while they’ve since divorced, you can see other members of the family intermingle between politics and Hollywood to conclude here we have a pattern that the Schiff family helped establish and they’ve financially profited off of it ever since, making them one of the richest families in America.

“In 1913, a criminal cartel took control of a nation’s monetary system. Respective families of this cartel bought and built media outlets, as well as purchased politicians to push the US into World War I.

“Both sides of every war were and are funded by the same bankers.

“Fast-forward to the Roaring Twenties. The war was over and all the people, with a little extra cash on hand got back into the financial market. Then the banks crashed the market once again, which prompted the Great Depression of the ’30s, in which banking cartels bought up everything for pennies. And to stabilize the economy – a problem they themselves created – already had a manufactured solution in place and rolled out the emergency Banking Act of 1933.

“Then, came World War II, which was promoted to every American through media channels the banking cartel owned and operated now a copy paste copy paste the same formula for the Korean War, Vietnam, Gulf War, Afghanistan, Iraq interventions and Syria, Yemen and Libya.

“All of these wars are bankers wars, sold to the American public through media on false pretenses. And what needs to be made absolutely clear is that the motivation behind this practice, this pattern isn’t just a magic piece of paper.

“Now, I can already anticipate some of the reactions that I might receive, as a result of pointing out someone’s religious affiliation, whether that be Christian, Mormon, Muslim, Wahhabi, whatever no one ever has a problem with it, until I mentioned Talmudic Judaism, which is taught through a rabbinical text called the Babylonian Talmud and was compiled in the year 500.

“The Talmud says some pretty interesting things about the treatment of Gentiles but Talmudic rabbis refute his observation by saying anti-Semites take these direct quotes about Gentiles and even the Talmud view of Christ out of context. From Bethlehem to Babylon or modern-day Iraq is over 600 miles. Quite a haul from where Judaism has its roots.

“At the core of Judaism is the covenant with Moses and the Covenant with Abraham. The holy text is the Torah. There are plenty of Jews who would not touch the Talmud with a ten-foot pole. They strictly abide by the Torah. I am not talking about those people. It’s incredibly important that I make this distinction. I am not talking about your neighbors. I’m not talking about the people you see in your grocery store. I am not talking about you, a normal person who has just living your life.

“What I am talking about is a mindset, not even an ethnicity, because no one here can help how or where they were born. But what is within our control is how we treat people and what we do with this time we are given. So, I’m talking about the continuum of Babylon, not Jerusalem.

“People who see themselves as one tribe to rule over all the others. People who have claimed this religious identity but are clearly of Eastern European descent or Ashkenazi ancestry, who are thought to have made conversions to Judaism while under the Khazarian Kingdom, around the same time the Babylonian Talmud was being compiled. And a lot of these folks ended up in Poland and then Germany.

“So anyway, I can already feel the ADL putting me on a list but it has to be said, not from a place of hatred but from a place of hope for humanity. All the things I’ve covered in this video and the events we are seeing play out on the world stage, even right now, today is the logical culmination of Babylon debt slavery.

“The name Babylon can be translated to the “gates of the gods”. Not God with a big “G” but gods with a little “G”, whom some might call Fallen Angels. The Bible talks about Babylon a lot, calling it the “dwelling place of demons,” a place of death, slavery and blood rituals.

“Compound interest is literally Babylonian mathematics. It’s inscribed on ancient tablets. Usury is Babylon. In other words, Ancient Babylon was all about loaning you $50, if you paid them back $75.

“These practices yielded a society in which 80% to 90% of the population had nothing, a tiny fraction of the population had something and .00001% of people had everything. The majority of the population was composed of people who were working just to barely financially get by, basically just working to be able to afford to live. This is debt slavery. Can we draw any parallels to modern society, here?

“Oh, and by the way, did I say Palestine or Egypt was all about loaning $50 as long as you paid back $75? No, I didn’t. So, please spare me on accusations of anti-Semitism.

“America was never supposed to be home to this debt slavery system. The American Founders talked about this a lot. America was intended to be an even playing field, where everyone could succeed, not lose their houses over fluctuating interest rates in a manufactured mortgage crisis.

“Do you hear how absurd that sounds? The money was always supposed to be backed in something tangible, like gold or silver but instead, we have magic paper money, backed by nothing, except the confidence to exchange it for goods and services.

“And our whole financial system is controlled by people who have no allegiance to us. They use compound interest tricks with fake money that is backed by absolutely nothing. They can print as much of it as they want and flood our markets with dollars under the guise of saving us.

“But you cannot save someone from a problem that you, yourself created. You are not the hero here, you are the villain.

“So, to put it all into perspective, a Rothschild cousin came to America and made quick work of overturning America’s monetary system. In 1910, in total and complete secrecy, Schiff and his buddies traveled to an island off the coast of Georgia called Jekyll Island where the Rockefellers already had a residence. And there just so happened to be a huge Native American burial ground in their front yard.

“There was a Native American tribe who once inhabited Georgia’s islands and historians have noted that an ancient Canaanite altar once existed on Jekyll Island and was the location of ritual sacrifice, a tidbit which is used to explain why the original members of the Fed chose Jekyll Island, of all places to plan the country’s monetary policy.

“In fact in 1892, the Atlanta Constitution reported they had found a mound in that area that contained one frame of a 9-foot tall human who must have been a very near relative of old Goliath, which is a direct quote. Goliath in the Bible is recorded as a 9-foot tall giant and Biblical scholars regard Goliath as a Nephilim descendent of Canaan.

“People tend to label this sort of talk as a bunch of malarkey, just total fantasy but think about it, people have died are dying and will die for a dollar – a piece of paper backed by absolutely nothing tangible – nothing!

“Just open up your wallet and look at the iconography on the dollar bill just pull out your wallet and look at a dollar bill. We have a pyramid with an eye on top of it and underneath, Novus Ordo Seclorum, meaning the “new secular order” or “new order for the ages”.

“These visual metaphors relate to the same kind of debt slavery, usury and compound interest that America was never supposed to have. And historically, this banking cartel has silenced anyone who has challenged their control, like Napoleon with his Bank of France or Lincoln with his Greenback or even JFK. And Gaddafi tried to introduce the Gold Dinar. Look at what happened to these people.

“Now, Trump deals with them and there have been moments throughout his presidency, where he’s been incredibly critical of the Fed and even as recently as yesterday, the Fed admitted to manufacturing this economic crisis we face during this period of ‘plannedemic’, so it will be very telling to see how Trump responds.

“And just to wrap it all up here, Mystery Babylon isn’t such a mystery, is it? The Federal Reserve has created unimaginable private wealth, like the familial wealth of the Schiff family. Well, like I said before, it’s not all about that ‘dolla dolla bill y’all’. It’s about control and control is directly at odds with freedom, one of America’s most cherished values.

“These are the families who sit on top of everything who don’t want to be noticed but there are no families or corporations or governments higher than them, as the governments and corporations are completely at their mercy.”

0 notes

Text

Sinclair Buys Disney

Sinclair buys Disney. Sinclair Broadcast Group buys 21 Regional Sports Networks and Fox College Sports from The Walt Disney Company for $10.6 billion. The RSNs in the deal are: Fox Sports Arizona, Fox Sports Detroit, Fox Sports Florida, Fox Sports Sun, Fox Sports North, Fox Sports Wisconsin, Fox Sports Ohio, SportsTime Ohio, Fox Sports South, Fox Sports Carolina, Fox Sports Tennessee, Fox Sports Southeast, Fox Sports Southwest, Fox Sports Oklahoma, Fox Sports New Orleans, Fox Sports Midwest, Fox Sports Kansas City, Fox Sports Indiana, Fox Sports San Diego, Fox Sports West, and Prime Ticket.

This gives Sinclair local broadcast rights to 42 professional teams. 14 Major League Baseball teams, 16 National Basketball Association teams, and 12 National Hockey League teams. The deal does not include 21st Century Fox's equity interest in the Yes Network, the disposition of which is a requisite part of an agreement with the US Department of Justice.

Sinclair's existing sports business is Marquee Sports Network (a joint venture with the Chicago Cubs), Tennis Channel and Tennis Media Company (dedicated to live tennis events and tennis lifestyle), Stadium (a joint venture focused on college sports and professional highlights), Ring of Honor Wrestling (professional wrestling), and a robust and ebullient high school ticket (Friday Night Rivals and Thursday Night Lights).

Byron Allen joins the deal as an equity and content partner of a separate subsidiary of Sinclair called Diamond Sports Group. Allen, the founder of Entertainment Studios, bought The Weather Channel in 2018.

Chris Ripley of Sinclair said: ‘This is an exciting transaction for Sinclair to be able to acquire highly complementary assets. While consumer viewing habits have shifted, the tradition of watching live sports and news remains ingrained in our culture. As one of the largest local news producers in the country and an experienced producer of sports content, we are ideally positioned to transfer our skills to deliver and expand our focus on greater premium sports programming.

The transaction is expected to be highly accretive to free cash flow and brings consolidated net leverage to 4.7 times and 5.1 times through the preferred financing. This acquisition is an extraordinary opportunity to diversify Sinclair's content sources and revenue streams with high-quality assets that are driving live viewing. We also see this as an opportunity to realize cross-promotional collaboration and synergistic benefits related to programming and production.’

Christine McCarthy of The Walt Disney Company said: ‘We are happy to have reached this agreement with Sinclair for the sale of these 21 RSNs, subject to the conditions of the consent decree with the US Department of Justice.’

Guggenheim Securities, Deutsche Bank Securities, RBC Capital Markets, Pursuit Advisors, and Moelis & Co are acting as Sinclair's financial advisers. Fried, Frank, Harris, Shriver & Jacobson LLP, Pillsbury Winthrop Shaw Pittman LLP, Latham & Watkins LLP, and Thomas & Libowitz are acting as legal advisers.

Allen & Co and JP Morgan are acting as Disney's financial advisers. Cravath, Swaine & Moore, and Covington & Burling are acting as legal advisers.

JPMorgan Chase Bank, Deutsche Bank AG New York Branch, Deutsche Bank Securities, Royal Bank of Canada, Bank of America, and Merrill Lynch, Pierce, Fenner & Smith are providing committed debt financing. Committed preferred equity financing will be provided by JPMorgan Chase Funding.

0 notes

Text

This year`s must have for any megadeal? A tiny bank behind the scenes

It's been a large year for the littlest companies on Wall Street.

The small firms, sometimes with just a handful of workers, have actually been chipping away at among Wall Street's most top-level companies for several years. However in 2015, these supposed shops made meaningful gains in the business of encouraging on large requisitions.

There were tiny companies associated with each of the year's five biggest requisitions, according to information service provider Dealogic.

Leading the team is Centerview Partners. Started in 2006 by a team of Wall surface Road veterans, Centerview ranked 7th among advisors on huge United States bargains - the bank's greatest location ever, Dealogic said.

Big financial institutions have a typical side over small rivals when it concerns substantial takeovers, so considering that purchasers sometimes require a deep-pocketed backer to help finance their brand-new acquisition. As well as they're still, on the whole, leading in the positions. The leading 3 consultants of big United States offers - worth even more compared to $10 billion - were Goldman Sachs, Morgan Stanley, and also JP Morgan.

But there are seven small firms in Dealogic's leading 20 advisers on huge United States bargains - one of the most on record. The list of boutiques doesn't include some companies often believed of similarly, like Lazard, Guggenheim Allies, and also Allen and also Co., Dealogic says, due to the fact that these firms either have even more than 1,000 workers or create greater than 20 % of their profits from sources aside from M&A advisory.

The little financial institutions' growing market share is underpinned by a pattern of large bargain consultants running away huge establishments for smaller sized stores. There they deal with smaller groups and less customers, prevent the messiness of a large public firm, and take advantage of long-standing partnerships to pry valued mandates far from their former employers.

The exodus continues. Earlier this year, Hugh 'Avoid' McGee, a veteran energy banker, began his very own company after leaving a blog post that made him Barclays' highest-paid employee.

Centerview - which was lead bank for Newell Rubbermaid's Jarden offer announced previously today and worked on Pfizer's requisition of Allergan, the year's biggest transaction - enjoyed an approximated $508 million via 40 purchases globally, according to Dealogic.

Others in the top 20 consist of Moelis as well as Co., Evercore Allies, Liontree Advisers, and Klein as well as Co. which elbowed its way right into the Dow-DuPont mega-merger anticipated to create $200 million in fees for banks.

Founder Michael Klein released his own company after leaving Citigroup in 2008. His firm placed 18th amongst consultants on large United States deals.

0 notes

Text

Restaurant Group The PLC (LON:RTN) “Hold” Rating Reconfirmed by Analysts at Peel Hunt; With GBX 300.00 Target; Goodwin Daniel L Has Cut Its Plains All Amern Pipeline L (PAA) Holding

Goodwin Daniel L decreased Plains All Amern Pipeline L (PAA) stake by 68.69% reported in 2016Q4 SEC filing. Goodwin Daniel L sold 94,755 shares as Plains All Amern Pipeline L (PAA)’s stock rose 14.76%. The Goodwin Daniel L holds 43,200 shares with $1.40M value, down from 137,955 last quarter. Plains All Amern Pipeline L now has $22.12 billion valuation. The stock rose 1.67% or $0.54 reaching $32.89. About 115,333 shares traded. Plains All American Pipeline, L.P. (NYSE:PAA) has risen 19.11% since July 27, 2016 and is uptrending. It has outperformed by 9.17% the S&P500.

The company have set TP of GBX 300.00 on Restaurant Group The PLC (LON:RTN) shares. This is -8.23% from the last price. In analysts note published on Friday morning, Peel Hunt reconfirmed their “Hold” rating on shares of RTN.

Since December 1, 2016, it had 0 insider purchases, and 3 sales for $6.14 million activity. On Thursday, December 1 the insider Swanson Al sold $2.13 million. The insider vonBerg John sold 6,675 shares worth $217,338.

Among 25 analysts covering Plains All American Pipeline LP (NYSE:PAA), 9 have Buy rating, 1 Sell and 15 Hold. Therefore 36% are positive. Plains All American Pipeline LP has $49 highest and $16 lowest target. $31.82’s average target is -3.25% below currents $32.89 stock price. Plains All American Pipeline LP had 55 analyst reports since August 6, 2015 according to SRatingsIntel. RBC Capital Markets maintained the stock with “Sector Perform” rating in Thursday, February 11 report. The stock of Plains All American Pipeline, L.P. (NYSE:PAA) has “Outperform” rating given on Monday, November 16 by RBC Capital Markets. The rating was downgraded by Raymond James on Monday, January 4 to “Mkt Perform”. Robert W. Baird upgraded the stock to “Neutral” rating in Wednesday, July 13 report. The stock has “Buy” rating by Stifel Nicolaus on Thursday, August 6. The stock has “Neutral” rating by JP Morgan on Friday, May 27. JP Morgan downgraded Plains All American Pipeline, L.P. (NYSE:PAA) on Wednesday, January 13 to “Neutral” rating. The stock has “Outperform” rating by Robert W. Baird on Tuesday, January 31. The rating was upgraded by Robert W. Baird on Thursday, December 10 to “Outperform”. The stock of Plains All American Pipeline, L.P. (NYSE:PAA) has “Hold” rating given on Monday, August 10 by Zacks.

Investors sentiment decreased to 0.84 in Q4 2016. Its down 0.50, from 1.34 in 2016Q3. It worsened, as 39 investors sold PAA shares while 135 reduced holdings. 45 funds opened positions while 102 raised stakes. 282.62 million shares or 3.33% more from 273.52 million shares in 2016Q3 were reported. Ancora Advisors Ltd Com invested in 1,202 shares or 0% of the stock. Guggenheim Capital Limited Liability Com holds 0.01% of its portfolio in Plains All American Pipeline, L.P. (NYSE:PAA) for 132,688 shares. Williams Jones & Assoc Lc reported 0.03% stake. Fifth Third Bank & Trust has 0.01% invested in Plains All American Pipeline, L.P. (NYSE:PAA). Trust Asset Management Limited Liability owns 93,825 shares. Tci Wealth Advisors has 0% invested in Plains All American Pipeline, L.P. (NYSE:PAA). Motco invested in 0% or 720 shares. Whittier Communications invested in 13,832 shares. Alps holds 6.36% or 26.73 million shares in its portfolio. Albert D Mason invested in 32,542 shares or 0.92% of the stock. Security National has 0.05% invested in Plains All American Pipeline, L.P. (NYSE:PAA). Wells Fargo And Mn reported 0.04% of its portfolio in Plains All American Pipeline, L.P. (NYSE:PAA). Fmr Limited Company has 2.73M shares. Ruggie Gru accumulated 250 shares. Yorkville Capital Management Limited Liability Co invested 1.26% of its portfolio in Plains All American Pipeline, L.P. (NYSE:PAA).

Since September 6, 2016, it had 0 buys, and 6 selling transactions for $9.95 million activity. Shares for $71,000 were sold by Jimenez Frank R. The insider Wood Michael J sold 4,272 shares worth $647,350. Shares for $1.84 million were sold by Lawrence Taylor W. Shares for $1.36 million were sold by RHOADS REBECCA R. Another trade for 36,682 shares valued at $5.56 million was sold by Kennedy Thomas A.

Investors sentiment decreased to 1.1 in 2016 Q4. Its down 0.10, from 1.2 in 2016Q3. It fall, as 55 investors sold Restaurant Group PLC shares while 327 reduced holdings. 88 funds opened positions while 331 raised stakes. 216.30 million shares or 1.43% less from 219.43 million shares in 2016Q3 were reported. Azimuth Management Limited Liability holds 0.25% of its portfolio in Restaurant Group PLC (LON:RTN) for 20,876 shares. Rathbone Brothers Public Ltd Company holds 0.42% in Restaurant Group PLC (LON:RTN) or 59,151 shares. Bancorpsouth stated it has 25,115 shares. Aviva Public Limited holds 303,601 shares or 0.26% of its portfolio. Winch Advisory Service Llc stated it has 0.02% in Restaurant Group PLC (LON:RTN). New England Investment And Retirement Group holds 20,850 shares. Wealthtrust accumulated 82 shares. Thrivent Financial For Lutherans has 197,065 shares for 0.12% of their portfolio. Alabama-based Aull & Monroe Inv Mgmt Corporation has invested 0.17% in Restaurant Group PLC (LON:RTN). Mackenzie Finance Corporation holds 2,331 shares or 0% of its portfolio. Wade G W Inc has 4,527 shares for 0.11% of their portfolio. Carroll Fin Associate invested in 1,533 shares or 0.03% of the stock. Montgomery Inv has 10,000 shares. Point72 Asset Mgmt Lp has invested 0.47% in Restaurant Group PLC (LON:RTN). Blackhill Cap holds 453 shares.

The Restaurant Group plc is a United Kingdom company, which operates over 500 restaurants and pub restaurants. The company has market cap of 657.58 million GBP. The Firm operates through operating restaurants segment. It has a 37.2 P/E ratio. The Company’s portfolio covers a range of categories, including table service, counter service, sandwich shops, pubs and bars.

The post Restaurant Group The PLC (LON:RTN) “Hold” Rating Reconfirmed by Analysts at Peel Hunt; With GBX 300.00 Target; Goodwin Daniel L Has Cut Its Plains All Amern Pipeline L (PAA) Holding appeared first on Stock Market News | HillCountryTimes | Get it Today.

from Stock Market News | HillCountryTimes | Get it Today https://www.hillcountrytimes.com/2017/03/03/restaurant-group-the-plc-lonrtn-hold-rating-reconfirmed-by-analysts-at-peel-hunt-with-gbx-300-00-target-goodwin-daniel-l-has-cut-its-plains-all-amern-pipeline-l-paa-holding/

0 notes

Text

Actors with Warner Bros and Lionsgate UK suddenly had a real problem with Method Acting in 2022, but not a peep this year when Butler used it for Elvis.

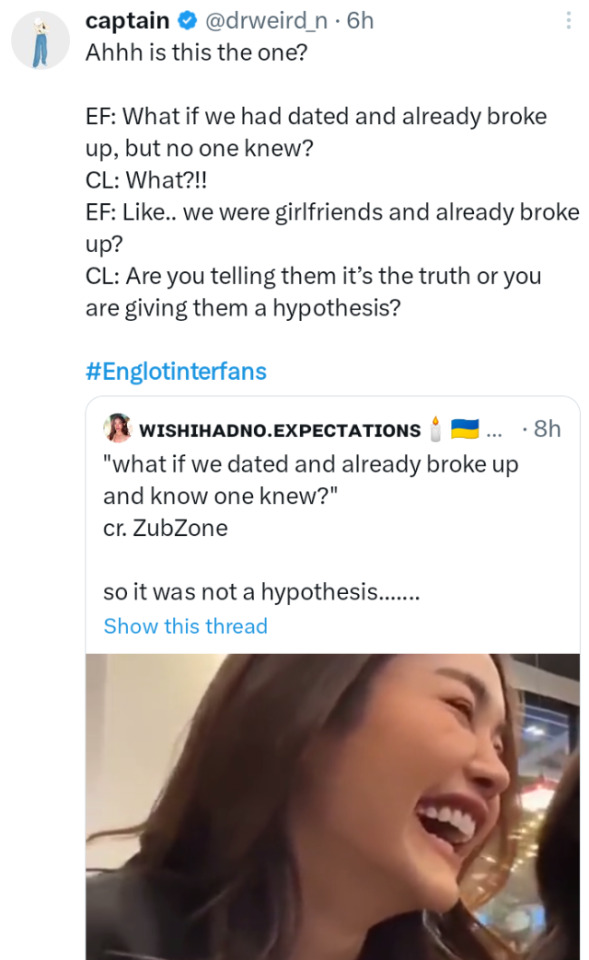

Hunger Games and Knives Out are produced by Lionsgate UK. A24 was financed by JP Morgan and Guggenheim. And there was no feud. Just endless attacks from them against Marvel's Doctor Strange.

May, 2022 just as Doctor Strange In The Multiverse of Madness premiered, out of nowhere, a huge torrent of Morbius 'fans' began trending and demanding the flop be put BACK into theatres. There were no less than 3 hashtags going, daily, for weeks and watch parties on Amazon's Twitch. Marvel's Doctor Strange 2 was thus blocked on social media for weeks, with a bunch of articles being written instead for a flop. Nice bit of promo for the former Joker from Suicide Squad.

This is a pretty sick way to be using the Marvell Endgame hashtag; to promote Hunger Games, post triggering bullshit and Englotinter, whatever the fuck that is.

#Warner Bros#Batman#Lionsgate#Hunger Games#Twilight Saga#Knives Out#Endgame repeated everywhere#benedict cumberbatch#Jamie Lee Curtis#Pattinson#RDJ#Thanos#Avengers

5 notes

·

View notes