#Federal Mortgage Bank of Nigeria

Explore tagged Tumblr posts

Text

Alleged $65m fraud: Ex – MD Federal Mortgage Bank of Nigeria, Gimba Kumo granted N100m bail

A Federal High Court in Abuja has granted bail of N100 million each to the former chief executive officer of the Federal Mortgage Bank of Nigeria (FMBN) Gimba Kumo and two co-defendants Bola Ogunsola and Tarry Rufus in an alleged $65 million fraud case. The defendants face charges filed by the Independent Corrupt Practices and Other Related Offences Commission (ICPC), accusing them of awarding a…

0 notes

Text

FG promises to address challenges faced by Nigerians living in Ghana

The Nigerian government has given assurances to Nigerians living in Ghana of renewed engagement, dedication and commitment to addressing a plethora of challenges confronting them. The assurances were given by the Chairman/CEO, Nigerians in Diaspora Commission, NIDCOM, Abike Dabiri-Erewa at a Townhall Meeting with Nigerians in Ghana on the sidelines of the African Diaspora Forum, DAF, Award 2024 in Accra, Ghana. The NIDCOM boss while clarifying one of the many questions bordering on the recent relocation of the Commission to the Ministry of Foreign Affairs, explained that the agency is already part of the Ministry of Foreign Affairs, and its operations have been seamless. She also suggested that the integration into the Ministry could strengthen the Commission and enhance engagement because it will now be an agency. Other questions asked by participants included the very high residence permit fees charged in Ghana, influx of trafficked under-aged girls and boys, the status of Nigerian traders in Ghana, and the need to have a comprehensive list of accredited universities to prevent Nigerian students from being victims of unapproved universities. They also commended the Minister of Interior, Olubunmi Tunji-Ojo for his innovations in passport application processes. Dabiri-Erewa also provided insights into NiDCOM’s programmes such as the forthcoming launch of the Diaspora Housing Mortgage Scheme scheduled for April. She emphasised that the Federal Government, through the Federal Mortgage Bank, will offer a N50 million mortgage to support home ownership in Nigeria for citizens residing abroad. She said, “This initiative aims to empower Nigerians abroad to own homes in Nigeria, excluding Lagos and Abuja, at favourable rates.” Dabiri-Erewa highlighted other NiDCOM initiatives such as the Diaspora Investment Summit, Diaspora Quarterly Lecture, National Diaspora Day, and National Diaspora Merit Award, as a platform to address the challenges encountered by Nigerians residing in Ghana. In his remarks, Ambassador Usman Aliyu Bakori, Head of Mission, expressed appreciation to Dabiri-Erewa for prioritising Diaspora issues and for promptly addressing their concerns whenever called upon. He also welcomed the housing scheme proposal, stating, “We value your insights. Nigerian citizens in Ghana abide by the law. While we face occasional challenges, we strive to manage them. We appeal to the Federal Government for financial support, especially considering the fluctuating exchange rates affecting our operations in Ghana. . Read the full article

0 notes

Text

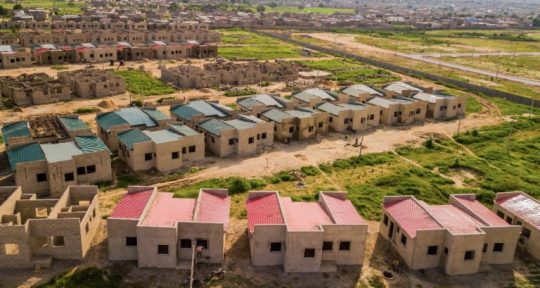

President Tinubu to Launch 3,112 Housing Unit Project in Abuja

President Bola Tinubu is set to inaugurate a significant housing unit project in the nation's capital. The groundbreaking ceremony for the construction of a 3,112 housing unit project in Karsana District, Phase 3, Federal Capital Territory, is scheduled for Thursday. The initiative, known as the Renewed Hope Cities and Estates Programme, is part of the Ministry of Housing and Urban Development's efforts to provide affordable housing across the country. According to a statement released by the ministry, President Tinubu's involvement underscores the government's commitment to tackling the housing challenge in Nigeria. The Renewed Hope Cities and Estates Programme aims to deliver 1,000 housing units in each of the 36 States and 4,000 units in the Federal Capital Territory (FCT). This ambitious plan, set to span the next decade, seeks to bridge the housing gap and improve living conditions for Nigerians. Key stakeholders involved in the implementation of the programme include the Federal Mortgage Bank, the Federal Housing Authority, and various public-private partnerships (PPP). Minister of Housing and Urban Development, Arc. Musa Dangiwa has been actively coordinating efforts to secure land allocations for the project. President Tinubu's participation in the groundbreaking ceremony signifies a crucial step forward in the government's commitment to providing adequate housing for its citizens. The event in Abuja on Thursday marks the beginning of a series of groundbreaking ceremonies planned for selected sites across the country as part of the Renewed Hope Cities and Estates Programme. Read the full article

0 notes

Text

How DFIs, Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs and Local Investors Can Drive Economic Development in Nigeria 2024 and Beyond by Dr Kenny Odugbemi

Development Finance Institutions (DFIs) tend to look for investments that can drive economic development in a market where there is ease of doing business through digital interface ✓Government to local investors (manufacturers, entrepreneurs, SME's, involved with production of goods and services for export ✓Government to foreign investment ✓ Federal Government to State Government business network through regional coordination Nigeria is blessed with the following ✓ abundant natural resources, eg- raw materials and varieties of mineral deposits ✓human capacity with right competence, and developing infrastructure which is a driving force that will aid mobility of commerce, with huge young demographics of working population with purchasing capacity. ✓Availability of infrastructure cuts across regional industrial hubs across 36 states including Abuja ✓ Availability of forex without any trade restrictions Nigeria has a lot of opportunities for development impact Development Finance Company, focusing on encouraging small business growth across 36 states including Abuja Nigeria has really grown and evolved but our commitment to Nigeria, its businesses and local communities, remains the same over the years. We have made commitments targeted at supporting local SMEs through financial institutions. Investments, such as syndicated loan package, trade agreement through Federal Government and a network of big Manufacturers and exporter across different sectors through Advisers’ Growth Fund, aim to address such buffer banking penetration and operations in the country, which stands at just 15 per cent despite having the second largest banking sector on the continent. The timing couldn’t be better. our President Senator Bola Tinubu had be jetting round Europe and Africa sub-region to attract FDA's and sign billion dollar Capita injection to support our production capacity across all sectors especially power and other essential infrastructure that had capacity to kick start high level production of goods that can be exported to earn more dollar to buffer up our depleting foreign reserve, provide employments for 53% of our unemployed youths L Nigeria has just signed the African Continental Free Trade Agreement, which is expected to increase intra-African trade by up to 52 per cent by 2024 and beyond. According to the African Development Bank. Increasing financing to SMEs across the country will enable them to participate in the new framework and benefit from the opportunities it presents. Investing in financial systems is a driver of and important pre-conditions to economic growth Nigerian companies come from across a range of sectors. has the potential with the commitment to buffer up local investment in the country, this will require FDI's inflow to support their commercial and sustainable businesses Accelerate their growth to create sustainable jobs, services and opportunities to benefit the Nigerian people. Furthermore, the recent strategic drive by our President with other delegation to see FDI'S inflow and other investments aligns with the priorities of the Central Bank of Nigeria, which is focused on driving consumer credit, SME lending and mortgages. In July 2023 CBN issued a memo as sanctions on our commercial banks in Nigeria to ensure a loan-to-deposit ratio of under 60 per cent, forcing them to either increase their lending to meet the threshold or face requirements to increase the amount they must hold on their balance sheets. The measure has been designed to help meet the target of 95 per cent financial inclusion by 2024 and beyond. As the largest economy in Africa, Nigeria has the capacity to become increasingly attractive to overseas investment. This year the IMF upgraded Nigeria’s GDP growth forecasts to 3.2 per cent in 2024 presenting potential for other investors to move into the market buoyed by the forecast. It is not just the financial sector that provides opportunities for impacted investors. African development bank has pledge $320 million invested in Nigeria both directly and indirectly, to support Youth entrepreneurship development .It is noteworthy to state Secretary of States from USA, UK, Germany, UAE and others have visited Nigeria to see first-hand abundant opportunities across 6 regions and Abuja especially Hybrid Power automation and upgrade in Nigeria, and other infrastructure that can support our yearning to improve on our production for exports to earn more foreign exchange Nigeria Priority Investment Industries Nigeria is one of the fastest developing countries in the world, one of the resource-richest countries in the world, the most strategically situated country in Africa, and the largest market in Africa with a population of over 220 million people and a rapidly growing middle-class. With the Africa Continental Free Trade Agreement (AfCFTA) in the making soon to be the largest single trading block in the world and with Nigeria being one of the major players, Nigeria's economy is projected by experts to be enroute to top 10 economies of the world by 2050, and possibly clocking a GDP of over $6 trillion. The driving force behind this rapid growth are the vibrant industries, all of which have been wholly privatised to attract and boost local and foreign investments. As a result of favourable government policies and incentives, the Ease of Doing Business in Nigeria has steadily improved, attracting Foreign Direct Investments (FDI) from countries like China, the United Kingdom, France, Canada and the United States. The following are the most attractive industries to invest in Nigeria, due to existing favourable government policies in way of tax holidays, special incentives and privileges as well as protections for foreign investors. ✓Agriculture This covers all related activities including Commercial Farming, Livestock, Aquaculture, Hydroponics and others. Among numerous other advantages, Agro-industrial ventures benefit from a five-year tax holiday, an agricultural credit scheme guaranteed by the Central Bank of Nigeria (CBN), subsidized fertilizers and zero import duties on raw materials used to make livestock feed. According to the Nigerian Investment Promotion Commission (NIPC), the agricultural sector contributes 25% of Nigeria’s Gross Domestic Product (GDP) and accounts for 48% of the labour force. The sector’s growth rate over the last 5 years averaged 4%. Crop production dominates the sector, accounting for 22.6% of GDP alongside livestock (1.7%), fisheries (0.5%) and forestry (0.3%). The Government's Agriculture Promotion Policy 2016-2020 has achieved significant progress in creating a conducive commercial environment to meet domestic food demands, generate exports, and attract foreign investment, among other merits. ✓Industry Nigeria is a natural location for a variety of industrial activities due to the availability of natural resources, affordable labour cost and large market. Its manufacturing sector is reemerging due largely to the improving performance of the consumer and household goods industries and growth of the middle-class. Nigeria produces a large proportion of goods and services for the West African subcontinent. The industry sector contributes an annual average of 23% of the GDP. The major activities include oil & gas (9%), manufacturing (7%), and construction (5%). The sector is strategic to the government’s objective of diversifying the economy in line with the Economic Recovery & Growth Plan. ✓Petroleum Oil, natural gas and related products account for 90% of Nigeria's total export volume and more than 80% of the government revenues. Nigeria is Africa's largest producer of petroleum and the 6th largest in the world, with an average capacity of 2.5 million barrels of crude oil daily. As a member of OPEC, Nigeria also ranks as the world's 8th largest exporter and has the largest natural gas reserves in Africa, ranking 7th position globally. However, the local refining capacity is only 24% which creates a huge gap between the demand for refined petroleum products and local supply. Towards bridging this gap, the downstream industry has been open to private sector participation and foreign investments and with the passing of the new PIA (Petroleum Industrial Act) in August 2021, conditions have become much more favourable to foreign investors. With various government schemes and new policies like better profit sharing, Nigeria's oil and gas industry remains one of the most lucrative sectors to invest in. For this reason, Oil giants like Total, Chevron, ExxonMobil, Elf, Shell, ConocoPhillips, Eni and China's CNOOC all maintain operations in Nigeria. ✓Manufacturing The manufacturing sector in Nigeria is geared towards accelerating industrial capacity to increase the sector’s contribution to GDP. The Government's target is to generate an additional US$20 to US$30 billion in manufacturing revenues over the next 3 to 5 years and substitute imports and diversify exports, diversify the economy from petroleum, create jobs and generate wealth. Foreign investors are welcome to take part wholly or jointly in manufacturing or industrial projects like food processing - fruit, vegetable oils, oil seeds, roots and tubers processing, cereal and grain milling; Sugar production, Confectionaries and beverages, ceramic and glass production, solid mineral processing and so on. ✓Construction After experiencing a 7.5% decline in 2020 due to the economic effects of Covid-19, Nigeria’s construction is expected to make a 4% recovery growth in 2021. With the steady expansion of the real estate market and state support in the infrastructure and energy sector, Nigeria’s construction market is due to increase 3.2% annually between 2022 and 2025. Favourable Government policies and programs like the $2.7bn Infra-Co fund backed by the Central Bank of Nigeria (CBN), the Nigerian Sovereign Investment Authority (NSIA) and the Africa Finance Corporation Companies (AFCC); has attracted a investors into the sub-sector and boosted the confidence of existing players like Julius Berger, China Civil Engineering Construction Company (CCECC), Reynolds and Arab Contractors. ✓Mining Mining is a growing and thriving sector accounting for 0.3% of national employment, 0.02% of exports and about $1.4 billion to Nigeria's GDP, according to a recent report by the Federal Ministry of Mines and Steel Development. With untapped minerals like Baryte, Limestone, Gypsum, Lead/Zinc, Gold and more, Nigeria is literally a goldmine waiting to be explored. Despite its comparatively low production and output, the mining sector thrives within a well defined regulatory structure supported by active professional bodies and agencies that are increasingly shaping policies, creating programs and incentives favourable to investors in order to unleash this huge economic potential of this sector. ✓Energy The energy sector is one of the most exciting due to the room it leaves for a variety of possible innovations and creativity in the entire energy value chain ranging from power generation to conversion to storage to distribution to meter reading to billing etc. Currently, Nigeria's largest power source is the post-colonial Kianji hydroelectric power dam with a compromised capacity of Nigeria's total supply of almost 12000MW attained as of 2023. With a fast growing population and rapid industrialisation of the country, the current power capacity is said to be only 12% of what the country needs. In order to bridge the huge gap between demand and supply of energy in the country, the Federal Government had liberalised, diversified and commercialized the energy sector and also put in place tax holidays, investment incentives and other protections for foreign direct investors in this sector. ✓Services The Nigerian services sector has remained resilient amidst hard-hitting economic circumstances. The strength of the sector has hinged on its consumer-facing nature which have seen it grow into a significant economic force. Over the last decade, the sector has met pent-up consumer demand and served a fast-growing middle class. Buoyed by government policies and increased private investments, growth in the sector has driven the diversification of the economy. ✓Trade Services Due to a growing generation of Nigerian consumers, wholesale and retail sales (trade services) have become the second largest sectoral contributor to our GDP Nigeria is one of the most attractive investment markets for retailers in Sub-Saharan Africa, largely attributed to a growing middle class. A wide range of foreign investors, including South Africa’s retail giants - Shoprite and Pick n Pay, the Dutch retailer SPAR, and many more operate in Nigeria. These foreign investments are complemented by a host of domestic private investors who are building a chain of retail stores all across the country. ✓ICT Sub-sector The information and communication sub-sector contributed 12% in 2018 and has grown at about 4% over the last 5 years, making it the fastest growing and largest telecommunications industry in Africa. With a population size of about 206 million, less than 60% of whom are active internet users, the information, communications and technology (ICT) industry presents attractive investment opportunities. Through various electronic platforms, Nigeria’s ICT network has revolutionized business transactions by providing a highly mobile-technology-driven population seamless ability to bank, invest, purchase, distribute, communicate, and explore anytime and anywhere access to the internet is available. This trend has opened doors to investment in many aspects of ICT including hardware, software, network, apps and related services. ✓Financial Sector Following wide and far-reaching reforms, the Nigerian financial and insurance industry has steadily evolved into a more diversified, stronger and more reliable industry equipped to stimulate and support economic growth and sustainable industrial development of the country. According to the NIPC, the industry contributes about 3.2% to Nigeria’s GDP. With the launch of the new e-Naira digital currency in October 2021, Nigeria has enhanced the integration of electronic payments into our financial system, a step that has reduced the flow of physical cash in the economy and is gradually transforming the country into a cashless environment. ✓Banking industry The banking industry is regulated and supervised by the Central Bank of Nigeria (CBN) under the Banks and Other Financial Institutions Act (BOFIA), CAP.B3, LFN, 2004. The industry has developed robustly driven by technology, with service offerings across various electronic platforms. Our electronic banking potential of about 40% of the population is still largely unbanked. will latent potential that provides a huge opportunity for investors. ✓Insurance Industry Nigeria’s insurance industry is one of the biggest in Africa, although its penetration is very low compared to its potential market size due largely to cultural and religious beliefs. Despite this, the industry remains resilient with total investment income in excess of N50 billion (US$160 million). With the implementation of the Pension Reform Act 2014 and the sustained implementation of tight monetary regime by the Central Bank of Nigeria, the insurance industry is expected to continue in the path of growth which is estimated to be at an annual average of 10% .The industry is regulated by National Insurance Commission (NAICOM) which is charged with the effective administration, supervision, regulation and control of the business of insurance in Nigeria. ✓Tourism and Hospitality Tourism is one of the most important growing sectors of the Nigerian economy due to its inter-relativity to other sectors like Transportation, Infrastructure, Construction, Real Estate, ICT and the food industry. The government gave priority status to the Tourism Industry as far back as 1990 when the National Tourism Policy was launched, with the main policy thrust being to generate foreign exchange earnings, create employment opportunities, promote rural enterprises and national integration, among other things. Nigeria’s Vision 2010 had set 2005 as the nation’s year of tourism, though not much was actualized due to crumbled infrastructure and the government's poor implementation. However, today the tourism policies and programmes will now be aimed at making Nigeria the “Ultimate Tourism Destination in Africa” with a particular focus on boosting private sector involvement with investment incentives. Nigeria is blessed with a vibrant culture and multiple festivals with international marketing potential, historical sites and naturally stunning sites ranging from tropical forests, magnificent waterfalls, beaches and climatic conditions with resort potentials conducive for holidaying. ✓Transport and Logistics The transportation, logistics and supply chain sub-sector is one of the fastest growing industries in Nigeria due to its dependence on other fast growing sectors like infrastructure construction, trade and eCommerce. With an estimated growth of $160 million annually, the sector is promising in every sense of the word. This is why the federal government has embarked on an aggressive campaign to transport and distribution networks, workforce, road infrastructure, road congestion, road conditions, interstate highway access, vehicle taxes and fees, railroad access, water port access,, air cargo access, etc. to ensure innovation within the infrastructure development cycle of logistics and supply chain a well as attract local and foreign investments. ✓Education and Training The rapid industrialisation of Nigeria has seen a sharp increase in demand for skilled labour education. An estimated 80,000 Nigerians go abroad each year to obtain an education or some type of short-term training. That number, added to an existing 180 million people in the country within the learning age. There is an increasing demand for affordable education and training in specialized fields like ICT courses, Business, sciences and Foreign Languages. Due to the global pandemic curbing young people's ability to travel and study abroad, the market for quality education within the country is reaching an all-time high. With the exemption of profit taxes for education providers, as well as other incentives in place, the Government hopes to achieve home-trained labour-force for the growing industry and service sectors. ✓Healthcare and medical For thousands of years, Nigerians have traditionally believed in preventing healthcare through naturally healthy food and cleansing herbs. Read the full article

0 notes

Text

INFO: How to own a home through federal mortgage bank’s new interest-free

The non-interest rent covers both FMBN and non-FMBN funded properties with a maximum price of N15 million. The Federal Mortgage Bank of Nigeria (FMBN) has provided more details about its rent-to-own mortgage housing that will attract no interest. As against the previous seven per cent interest paid on an annual basis, the bank said it introduced the non-interest housing to encourage financial…

View On WordPress

#Federal Mortgage Bank#INFO: Federal Mortgage Bank Loan: How to Apply#INFO: How To Get A Federal Mortgage Bank Loan#INFO: How to own a home through federal mortgage bank’s new interest-free#News

0 notes

Text

Monumental Looting and Membership of Secret Society.

There is a close relationship between monumental looting of the treasury, and membership of secret society. A normal human being, who has not sold himself to the devils, cannot use his exulted position to steal money running into billions or trillions and hiding them; while people under him are wallowing in abject poverty.

Nigerian wealth is concentrated on few hands. A lot of our rulers and political office holders, are fetish and very deep in occultism. They have mortgaged their souls to the devils, in exchange for riches and fake powers. The devils they serve give them compelling instructions, on how to steal and ruin establishments under their care; as well as make life miserable for people they supposed to taking care of.

You steal billions of dollars of allocation money or generated revenue, and bank them in coded accounts abroad. Meanwhile, you owe your workers and pensioners for years. They dare not voice their grievances; else you will sack them. You, your children and wife, are living ostentatious lives. You all fly in private jets and do shopping abroad. Your conscience doesn’t prick you, that people around you are suffering terribly? Your initiation into the occult has hardened you, and thereby forget that God is a consuming fire.

So many political office holders in Nigeria, including Presidents and Governors, are religious hypocrites. They use religious affiliations, to win sympathy and votes of common people during election. But, they don’t have the fear of God in them. They only care about themselves and people around them, including sycophants and hangers-on. They and cabinet members, as well as retinue of aids, receive their monthly wages and multitude allowances regularly. But, refuse to pay the impoverished civil servants their peanuts.

How can you promptly pay a retiring judicial officer as much as 2.8 billion benefits; while you owe tens of thousands of pensioners for many years- some more than ten years? The monthly pay of some retired citizens is as low as 4000 naira. That huge amount you give to your fellow looter, can pay pension to up to 700,000 people. How do you sleep in the night, or pray to God?

In Nigeria, a governor who looted the state (sorry governed) for eight years, is entitled to huge monthly pensions, among other benefits till he dies. As well, former Nigerian Presidents and Military dictators are paid outrageous amount of money running into billions, to the detriment of the down-trodden masses. Nigerian legislators and other elected officers, are the highest paid anywhere in the world. Yet, the country is among the poorest in the world.

Because of the bad leaders we have had over the decades, the mentality of an average person in a top position, is to loot the place as much as possible, and run it down. He aims to be richer than the place: be it in government or company. He doesn’t care about legacy of good leadership when he leaves. He wants to use the money he has stolen, to contest and bribe his way to a bigger position. Take for instance, a Governor of a state. He is ready to steal hundreds of billions, worth more than the state annual budget during his tenure, to pursue his presidential ambition. It includes money to bribe delegates during party presidential primaries.

An aspirant can bribes some thousands of delegates with as much a 35000 dollars each. How does he get the money. How much is his salary? How will he recover the money, If he eventually wins the position? He hasn’t paid his workers. The bitter truth is that anybody who owns workers and pensioners for years, is fetish and belongs to secret cult. A law should be passed, making it a punishable offence by by years of mprisonment without option of fine, for those who owe workers or senior citizens for years.

Imagine the hundreds of moribund industries and factories. scattered all over the federation. They are owned by federal or State Governments. The persons they appointed to head those firms, ran them down due to high level of corruption, despite their high-sounding paper qualification. All those companies are shut down due to management problems. The ordinary workers are ready to do their jobs, if provided with the materials and tools to work with. One day, He will deal ruthlessly with you!

There is hardly anybody to show good example for other to follow. Corruption has been institutionalized in Nigeria. There is a law in the country that bans members of secret societies from contesting and occupying elective positions. The law should be followed strictly and expanded. There should be jail term and disqualifications of guilty candidates. Those already in office should be dismissed.

All those involved in ritual killings, and other diabolical activities during electioneering period, should be dealt it. They are so many. All those ’bouillon van and Ghana-Must-Go Bag’ politicians should be banned. Anybody who owes workers and pensioners shouldn’t be allowed to contest or seek re-election in any position. Why should you owe workers when you receive your own pay promptly? Nobody checks you. But there is God who reigns in the kingdoms of men.

Watch any political office holder, who carries out much propaganda about his achievements on office. He is a noise maker, who wants to cover up stealing going on in his office. He is an empty vessel that makes the greatest noise. He seeks and pays for unmerited awards and attention, against mounting opposition and critism. He spends a lot, to dish out lies through the media, that he has paid up all workers and senior citizens, when he hasn’t. He has only been paying his kinsmen, and in the service, and abandoning others.

We therefore call for a change of attitude. All the money you’re accumulating, you will die and leave them one day. Your bank accounts abroad, especially the coded ones will be lost to owners of the bank. You have a short life to live here. The purpose of being here is to serve God and humanity. Naked you come into this world naked you will go. But if you refuse to repent, remember God is a consuming fire. He will not allow the guilty to go unpunished.

You need to change before the wrath of God comes upon you. He said, “Behold, the hire of the labourers who have reaped down your fields, which is of you kept back by fraud, cries, and the cries of them which have reaped are entered into the ears of the Lord of sabaoth. You have lived in pleasure on the earth, and been wanton; you have nourished your hearts, as in a day of slaughter. You have condemned and killed the just; and he doth not resist you” – James 5: 4-6... https://powertrumpeter.org/blog1/monumental-corruption-and-bloodshed-in-nigeria.

0 notes

Text

0 notes

Text

3 Reasons Why You Should Invest In Real Estate in Nigeria

According to the Federal Mortgage Bank of Nigeria, Nigeria has a housing deficit of 22 million units. And the World Bank forecasts that it will require ₦59 trillion in investments to close its housing deficit. This deficit although negative is an opportunity for smart investors to key in and make a good profit. And some of the reasons to invest are:

1. Real Estate Appreciates Over Time

Do you know the real estate sector in Nigeria is growing at an astronomical rate and land sold at ₦100,000 six years ago is currently valued in millions of Naira? A good example is a plot in Lekki Phase 1 which sold for ₦50,000 in 1997 and is today worth over ₦500 million in value.

An investment in genuine land is guaranteed to increase in value over time.

2. Real Estate Gives Security Of Investment

Inflation or government policy can reduce the value of money deposited in the bank overnight. But Real Estate provides security for investment as it can increase in value with little or no human effort.

3. Real Estate Is A Source Of Passive Income

Real Estate is a great source of passive income. An investment in real estate is certain to literally make you money in your sleep. A good example of this is the income generated through Real Estate rentals.

In Lagos, Nigeria, 75% of landowners have made plans to develop rental properties due to their ability to quickly provide a good return on their investment.

Real Estate especially in Nigeria is a golden opportunity for business and also service — providing housing and comfort to people who need it. The best time to key in is now.

❤ RealEstate_Moses

0 notes

Text

List of Mortgage Banks in Nigeria

List of Mortgage Banks in Nigeria

List of Mortgage Banks in Nigeria: There are 34 firms that have been licensed by the Central Bank of Nigeria (CBN) as primary mortgage banks in Nigeria. These primary mortgage banks are financial institutions that give loans to housing and real estate builders. Among the list of 34 firms across the country, CBN said seventeen of the Primary Mortgage Banks are in Lagos; eight in Abuja; two in…

View On WordPress

#Abbey Mortgage Bank Plc#Federal Mortgage Bank of Nigeria#How do mortgage banks work?#How many mortgage banks are there in Nigeria?#List of Mortgage Banks in Nigeria#Platinum Mortgage Bank Limited

0 notes

Text

ICPC recovers N53b for mortgage bank

ICPC recovers N53b for mortgage bank

Bolaji Owasanoye, ICPC boss The Independent Corrupt Practices and other related Offences Commission (ICPC), at the weekend, said it recovered N53 billion from a real estate developer for the Federal Mortgage Bank of Nigeria (FMBN). Its Chairman, Prof. Bolaji Owasanoye, who made the disclosure during a meeting with the House of Representatives Ad hoc Committee Investigating Operations of Real…

View On WordPress

0 notes

Text

UPDATE: Federal Mortgage Bank refunds N12bn wrongful deductions

The Federal Mortgage Bank of Nigeria has refunded N12bn out of the outstanding N19bn wrongful deductions of the National Housing Fund contributors. The deductions were misconstrued as revenue under the 40 per cent deduction regime of revenue accruing to federal agencies. The Managing Director/Chief Executive, of FMBN, Mr. Shehu Osidi, disclosed this at the FMBN Day at the 18th Africa…

0 notes

Text

FMBN to boost financial inclusion with non-interest mortgage product

FMBN to boost financial inclusion with non-interest mortgage product

The Federal Mortgage Bank of Nigeria (FMBN) says it is set to boost financial inclusion with the introduction of a non-interest rent-to-own mortgage loan product. The housing product, recently approved by the FMBN Board of Directors, is designed to enable Nigerians to own their homes using interest-free mortgage. FMBN said it developed the product to eliminate the challenges that eligible…

View On WordPress

#Federal Mortgage Bank of Nigeria (FMBN)#FMBN Board of Directors#FMBN housing products#National Housing Fund (NHF) Scheme

0 notes

Text

FG promises to address challenges faced by Nigerians living in Ghana

The Nigerian government has given assurances to Nigerians living in Ghana of renewed engagement, dedication and commitment to addressing a plethora of challenges confronting them. The assurances were given by the Chairman/CEO, Nigerians in Diaspora Commission, NIDCOM, Abike Dabiri-Erewa at a Townhall Meeting with Nigerians in Ghana on the sidelines of the African Diaspora Forum, DAF, Award 2024 in Accra, Ghana. The NIDCOM boss while clarifying one of the many questions bordering on the recent relocation of the Commission to the Ministry of Foreign Affairs, explained that the agency is already part of the Ministry of Foreign Affairs, and its operations have been seamless. She also suggested that the integration into the Ministry could strengthen the Commission and enhance engagement because it will now be an agency. Other questions asked by participants included the very high residence permit fees charged in Ghana, influx of trafficked under-aged girls and boys, the status of Nigerian traders in Ghana, and the need to have a comprehensive list of accredited universities to prevent Nigerian students from being victims of unapproved universities. They also commended the Minister of Interior, Olubunmi Tunji-Ojo for his innovations in passport application processes. Dabiri-Erewa also provided insights into NiDCOM’s programmes such as the forthcoming launch of the Diaspora Housing Mortgage Scheme scheduled for April. She emphasised that the Federal Government, through the Federal Mortgage Bank, will offer a N50 million mortgage to support home ownership in Nigeria for citizens residing abroad. She said, “This initiative aims to empower Nigerians abroad to own homes in Nigeria, excluding Lagos and Abuja, at favourable rates.” Dabiri-Erewa highlighted other NiDCOM initiatives such as the Diaspora Investment Summit, Diaspora Quarterly Lecture, National Diaspora Day, and National Diaspora Merit Award, as a platform to address the challenges encountered by Nigerians residing in Ghana. In his remarks, Ambassador Usman Aliyu Bakori, Head of Mission, expressed appreciation to Dabiri-Erewa for prioritising Diaspora issues and for promptly addressing their concerns whenever called upon. He also welcomed the housing scheme proposal, stating, “We value your insights. Nigerian citizens in Ghana abide by the law. While we face occasional challenges, we strive to manage them. We appeal to the Federal Government for financial support, especially considering the fluctuating exchange rates affecting our operations in Ghana. . Read the full article

0 notes

Text

President Tinubu to Launch 3,112 Housing Unit Project in Abuja

President Bola Tinubu is set to inaugurate a significant housing unit project in the nation's capital. The groundbreaking ceremony for the construction of a 3,112 housing unit project in Karsana District, Phase 3, Federal Capital Territory, is scheduled for Thursday. The initiative, known as the Renewed Hope Cities and Estates Programme, is part of the Ministry of Housing and Urban Development's efforts to provide affordable housing across the country. According to a statement released by the ministry, President Tinubu's involvement underscores the government's commitment to tackling the housing challenge in Nigeria. The Renewed Hope Cities and Estates Programme aims to deliver 1,000 housing units in each of the 36 States and 4,000 units in the Federal Capital Territory (FCT). This ambitious plan, set to span the next decade, seeks to bridge the housing gap and improve living conditions for Nigerians. Key stakeholders involved in the implementation of the programme include the Federal Mortgage Bank, the Federal Housing Authority, and various public-private partnerships (PPP). Minister of Housing and Urban Development, Arc. Musa Dangiwa has been actively coordinating efforts to secure land allocations for the project. President Tinubu's participation in the groundbreaking ceremony signifies a crucial step forward in the government's commitment to providing adequate housing for its citizens. The event in Abuja on Thursday marks the beginning of a series of groundbreaking ceremonies planned for selected sites across the country as part of the Renewed Hope Cities and Estates Programme. Read the full article

0 notes

Text

How DFIs, Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs and Local Investors Can Drive Economic Development in Nigeria 2024 and Beyond by Dr Kenny Odugbemi

Development Finance Institutions (DFIs) tend to look for investments that can drive economic development in a market where there is ease of doing business through digital interface ✓Government to local investors (manufacturers, entrepreneurs, SME's, involved with production of goods and services for export ✓Government to foreign investment ✓ Federal Government to State Government business network through regional coordination Nigeria is blessed with the following ✓ abundant natural resources, eg- raw materials and varieties of mineral deposits ✓human capacity with right competence, and developing infrastructure which is a driving force that will aid mobility of commerce, with huge young demographics of working population with purchasing capacity. ✓Availability of infrastructure cuts across regional industrial hubs across 36 states including Abuja ✓ Availability of forex without any trade restrictions Nigeria has a lot of opportunities for development impact Development Finance Company, focusing on encouraging small business growth across 36 states including Abuja Nigeria has really grown and evolved but our commitment to Nigeria, its businesses and local communities, remains the same over the years. We have made commitments targeted at supporting local SMEs through financial institutions. Investments, such as syndicated loan package, trade agreement through Federal Government and a network of big Manufacturers and exporter across different sectors through Advisers’ Growth Fund, aim to address such buffer banking penetration and operations in the country, which stands at just 15 per cent despite having the second largest banking sector on the continent. The timing couldn’t be better. our President Senator Bola Tinubu had be jetting round Europe and Africa sub-region to attract FDA's and sign billion dollar Capita injection to support our production capacity across all sectors especially power and other essential infrastructure that had capacity to kick start high level production of goods that can be exported to earn more dollar to buffer up our depleting foreign reserve, provide employments for 53% of our unemployed youths L Nigeria has just signed the African Continental Free Trade Agreement, which is expected to increase intra-African trade by up to 52 per cent by 2024 and beyond. According to the African Development Bank. Increasing financing to SMEs across the country will enable them to participate in the new framework and benefit from the opportunities it presents. Investing in financial systems is a driver of and important pre-conditions to economic growth Nigerian companies come from across a range of sectors. has the potential with the commitment to buffer up local investment in the country, this will require FDI's inflow to support their commercial and sustainable businesses Accelerate their growth to create sustainable jobs, services and opportunities to benefit the Nigerian people. Furthermore, the recent strategic drive by our President with other delegation to see FDI'S inflow and other investments aligns with the priorities of the Central Bank of Nigeria, which is focused on driving consumer credit, SME lending and mortgages. In July 2023 CBN issued a memo as sanctions on our commercial banks in Nigeria to ensure a loan-to-deposit ratio of under 60 per cent, forcing them to either increase their lending to meet the threshold or face requirements to increase the amount they must hold on their balance sheets. The measure has been designed to help meet the target of 95 per cent financial inclusion by 2024 and beyond. As the largest economy in Africa, Nigeria has the capacity to become increasingly attractive to overseas investment. This year the IMF upgraded Nigeria’s GDP growth forecasts to 3.2 per cent in 2024 presenting potential for other investors to move into the market buoyed by the forecast. It is not just the financial sector that provides opportunities for impacted investors. African development bank has pledge $320 million invested in Nigeria both directly and indirectly, to support Youth entrepreneurship development .It is noteworthy to state Secretary of States from USA, UK, Germany, UAE and others have visited Nigeria to see first-hand abundant opportunities across 6 regions and Abuja especially Hybrid Power automation and upgrade in Nigeria, and other infrastructure that can support our yearning to improve on our production for exports to earn more foreign exchange Nigeria Priority Investment Industries Nigeria is one of the fastest developing countries in the world, one of the resource-richest countries in the world, the most strategically situated country in Africa, and the largest market in Africa with a population of over 220 million people and a rapidly growing middle-class. With the Africa Continental Free Trade Agreement (AfCFTA) in the making soon to be the largest single trading block in the world and with Nigeria being one of the major players, Nigeria's economy is projected by experts to be enroute to top 10 economies of the world by 2050, and possibly clocking a GDP of over $6 trillion. The driving force behind this rapid growth are the vibrant industries, all of which have been wholly privatised to attract and boost local and foreign investments. As a result of favourable government policies and incentives, the Ease of Doing Business in Nigeria has steadily improved, attracting Foreign Direct Investments (FDI) from countries like China, the United Kingdom, France, Canada and the United States. The following are the most attractive industries to invest in Nigeria, due to existing favourable government policies in way of tax holidays, special incentives and privileges as well as protections for foreign investors. ✓Agriculture This covers all related activities including Commercial Farming, Livestock, Aquaculture, Hydroponics and others. Among numerous other advantages, Agro-industrial ventures benefit from a five-year tax holiday, an agricultural credit scheme guaranteed by the Central Bank of Nigeria (CBN), subsidized fertilizers and zero import duties on raw materials used to make livestock feed. According to the Nigerian Investment Promotion Commission (NIPC), the agricultural sector contributes 25% of Nigeria’s Gross Domestic Product (GDP) and accounts for 48% of the labour force. The sector’s growth rate over the last 5 years averaged 4%. Crop production dominates the sector, accounting for 22.6% of GDP alongside livestock (1.7%), fisheries (0.5%) and forestry (0.3%). The Government's Agriculture Promotion Policy 2016-2020 has achieved significant progress in creating a conducive commercial environment to meet domestic food demands, generate exports, and attract foreign investment, among other merits. ✓Industry Nigeria is a natural location for a variety of industrial activities due to the availability of natural resources, affordable labour cost and large market. Its manufacturing sector is reemerging due largely to the improving performance of the consumer and household goods industries and growth of the middle-class. Nigeria produces a large proportion of goods and services for the West African subcontinent. The industry sector contributes an annual average of 23% of the GDP. The major activities include oil & gas (9%), manufacturing (7%), and construction (5%). The sector is strategic to the government’s objective of diversifying the economy in line with the Economic Recovery & Growth Plan. ✓Petroleum Oil, natural gas and related products account for 90% of Nigeria's total export volume and more than 80% of the government revenues. Nigeria is Africa's largest producer of petroleum and the 6th largest in the world, with an average capacity of 2.5 million barrels of crude oil daily. As a member of OPEC, Nigeria also ranks as the world's 8th largest exporter and has the largest natural gas reserves in Africa, ranking 7th position globally. However, the local refining capacity is only 24% which creates a huge gap between the demand for refined petroleum products and local supply. Towards bridging this gap, the downstream industry has been open to private sector participation and foreign investments and with the passing of the new PIA (Petroleum Industrial Act) in August 2021, conditions have become much more favourable to foreign investors. With various government schemes and new policies like better profit sharing, Nigeria's oil and gas industry remains one of the most lucrative sectors to invest in. For this reason, Oil giants like Total, Chevron, ExxonMobil, Elf, Shell, ConocoPhillips, Eni and China's CNOOC all maintain operations in Nigeria. ✓Manufacturing The manufacturing sector in Nigeria is geared towards accelerating industrial capacity to increase the sector’s contribution to GDP. The Government's target is to generate an additional US$20 to US$30 billion in manufacturing revenues over the next 3 to 5 years and substitute imports and diversify exports, diversify the economy from petroleum, create jobs and generate wealth. Foreign investors are welcome to take part wholly or jointly in manufacturing or industrial projects like food processing - fruit, vegetable oils, oil seeds, roots and tubers processing, cereal and grain milling; Sugar production, Confectionaries and beverages, ceramic and glass production, solid mineral processing and so on. ✓Construction After experiencing a 7.5% decline in 2020 due to the economic effects of Covid-19, Nigeria’s construction is expected to make a 4% recovery growth in 2021. With the steady expansion of the real estate market and state support in the infrastructure and energy sector, Nigeria’s construction market is due to increase 3.2% annually between 2022 and 2025. Favourable Government policies and programs like the $2.7bn Infra-Co fund backed by the Central Bank of Nigeria (CBN), the Nigerian Sovereign Investment Authority (NSIA) and the Africa Finance Corporation Companies (AFCC); has attracted a investors into the sub-sector and boosted the confidence of existing players like Julius Berger, China Civil Engineering Construction Company (CCECC), Reynolds and Arab Contractors. ✓Mining Mining is a growing and thriving sector accounting for 0.3% of national employment, 0.02% of exports and about $1.4 billion to Nigeria's GDP, according to a recent report by the Federal Ministry of Mines and Steel Development. With untapped minerals like Baryte, Limestone, Gypsum, Lead/Zinc, Gold and more, Nigeria is literally a goldmine waiting to be explored. Despite its comparatively low production and output, the mining sector thrives within a well defined regulatory structure supported by active professional bodies and agencies that are increasingly shaping policies, creating programs and incentives favourable to investors in order to unleash this huge economic potential of this sector. ✓Energy The energy sector is one of the most exciting due to the room it leaves for a variety of possible innovations and creativity in the entire energy value chain ranging from power generation to conversion to storage to distribution to meter reading to billing etc. Currently, Nigeria's largest power source is the post-colonial Kianji hydroelectric power dam with a compromised capacity of Nigeria's total supply of almost 12000MW attained as of 2023. With a fast growing population and rapid industrialisation of the country, the current power capacity is said to be only 12% of what the country needs. In order to bridge the huge gap between demand and supply of energy in the country, the Federal Government had liberalised, diversified and commercialized the energy sector and also put in place tax holidays, investment incentives and other protections for foreign direct investors in this sector. ✓Services The Nigerian services sector has remained resilient amidst hard-hitting economic circumstances. The strength of the sector has hinged on its consumer-facing nature which have seen it grow into a significant economic force. Over the last decade, the sector has met pent-up consumer demand and served a fast-growing middle class. Buoyed by government policies and increased private investments, growth in the sector has driven the diversification of the economy. ✓Trade Services Due to a growing generation of Nigerian consumers, wholesale and retail sales (trade services) have become the second largest sectoral contributor to our GDP Nigeria is one of the most attractive investment markets for retailers in Sub-Saharan Africa, largely attributed to a growing middle class. A wide range of foreign investors, including South Africa’s retail giants - Shoprite and Pick n Pay, the Dutch retailer SPAR, and many more operate in Nigeria. These foreign investments are complemented by a host of domestic private investors who are building a chain of retail stores all across the country. ✓ICT Sub-sector The information and communication sub-sector contributed 12% in 2018 and has grown at about 4% over the last 5 years, making it the fastest growing and largest telecommunications industry in Africa. With a population size of about 206 million, less than 60% of whom are active internet users, the information, communications and technology (ICT) industry presents attractive investment opportunities. Through various electronic platforms, Nigeria’s ICT network has revolutionized business transactions by providing a highly mobile-technology-driven population seamless ability to bank, invest, purchase, distribute, communicate, and explore anytime and anywhere access to the internet is available. This trend has opened doors to investment in many aspects of ICT including hardware, software, network, apps and related services. ✓Financial Sector Following wide and far-reaching reforms, the Nigerian financial and insurance industry has steadily evolved into a more diversified, stronger and more reliable industry equipped to stimulate and support economic growth and sustainable industrial development of the country. According to the NIPC, the industry contributes about 3.2% to Nigeria’s GDP. With the launch of the new e-Naira digital currency in October 2021, Nigeria has enhanced the integration of electronic payments into our financial system, a step that has reduced the flow of physical cash in the economy and is gradually transforming the country into a cashless environment. ✓Banking industry The banking industry is regulated and supervised by the Central Bank of Nigeria (CBN) under the Banks and Other Financial Institutions Act (BOFIA), CAP.B3, LFN, 2004. The industry has developed robustly driven by technology, with service offerings across various electronic platforms. Our electronic banking potential of about 40% of the population is still largely unbanked. will latent potential that provides a huge opportunity for investors. ✓Insurance Industry Nigeria’s insurance industry is one of the biggest in Africa, although its penetration is very low compared to its potential market size due largely to cultural and religious beliefs. Despite this, the industry remains resilient with total investment income in excess of N50 billion (US$160 million). With the implementation of the Pension Reform Act 2014 and the sustained implementation of tight monetary regime by the Central Bank of Nigeria, the insurance industry is expected to continue in the path of growth which is estimated to be at an annual average of 10% .The industry is regulated by National Insurance Commission (NAICOM) which is charged with the effective administration, supervision, regulation and control of the business of insurance in Nigeria. ✓Tourism and Hospitality Tourism is one of the most important growing sectors of the Nigerian economy due to its inter-relativity to other sectors like Transportation, Infrastructure, Construction, Real Estate, ICT and the food industry. The government gave priority status to the Tourism Industry as far back as 1990 when the National Tourism Policy was launched, with the main policy thrust being to generate foreign exchange earnings, create employment opportunities, promote rural enterprises and national integration, among other things. Nigeria’s Vision 2010 had set 2005 as the nation’s year of tourism, though not much was actualized due to crumbled infrastructure and the government's poor implementation. However, today the tourism policies and programmes will now be aimed at making Nigeria the “Ultimate Tourism Destination in Africa” with a particular focus on boosting private sector involvement with investment incentives. Nigeria is blessed with a vibrant culture and multiple festivals with international marketing potential, historical sites and naturally stunning sites ranging from tropical forests, magnificent waterfalls, beaches and climatic conditions with resort potentials conducive for holidaying. ✓Transport and Logistics The transportation, logistics and supply chain sub-sector is one of the fastest growing industries in Nigeria due to its dependence on other fast growing sectors like infrastructure construction, trade and eCommerce. With an estimated growth of $160 million annually, the sector is promising in every sense of the word. This is why the federal government has embarked on an aggressive campaign to transport and distribution networks, workforce, road infrastructure, road congestion, road conditions, interstate highway access, vehicle taxes and fees, railroad access, water port access,, air cargo access, etc. to ensure innovation within the infrastructure development cycle of logistics and supply chain a well as attract local and foreign investments. ✓Education and Training The rapid industrialisation of Nigeria has seen a sharp increase in demand for skilled labour education. An estimated 80,000 Nigerians go abroad each year to obtain an education or some type of short-term training. That number, added to an existing 180 million people in the country within the learning age. There is an increasing demand for affordable education and training in specialized fields like ICT courses, Business, sciences and Foreign Languages. Due to the global pandemic curbing young people's ability to travel and study abroad, the market for quality education within the country is reaching an all-time high. With the exemption of profit taxes for education providers, as well as other incentives in place, the Government hopes to achieve home-trained labour-force for the growing industry and service sectors. ✓Healthcare and medical For thousands of years, Nigerians have traditionally believed in preventing healthcare through naturally healthy food and cleansing herbs. Read the full article

0 notes

Text

INFO: How To Get A Federal Mortgage Bank Loan

INFO: How To Get A Federal Mortgage Bank Loan The Federal Mortgage Bank of Nigeria (FMBN) launched in 1956 before assuming the status of the apex mortgage institution for Nigeria, in 1994. Since then it has managed and administered the contributory savings scheme known as the National Housing Fund (NHF) The NHF is a social savings project to mobilise long-term funds to advance concessionary…

View On WordPress

0 notes