#FTG Markets

Explore tagged Tumblr posts

Text

Delving into the intricacies of trading, the blog provides a thorough examination of different trading strategies, spotlighting both day trading and swing trading. It further dissects crucial analysis methods, namely technical and fundamental analysis. The narrative underscores the critical role of aligning chosen strategies with individual goals and the guidance that Funded Traders Global can provide in this regard.

#ftg#Analyzing Your Trading Performance#Are there risks involved in trading with $100?#Basic Analysis Methods#Begin Trading with $100#Can I start trading right away with my $100 account?#Candlestick patterns#choosing a reliable forex broker#clear goals and risk tolerance#Creating a trading plan#Day Trading#Discuss the Possibility of Losing Your Initial $100#fundamental analysis#Highlight the Risks Associated with Forex Trading#How can I grow my $100 account?#How do I deal with emotions when trading with a small account?#How Forex Markets Work#Introduction to Different Trading Strategies#Is it really possible to start Forex trading with just $100?#Open a Live Trading Account#Psychology of Trading#Risks and Warnings with Trading with $100#Should I use leverage with a small account? Swing trading#technical analysis#Tips for Successful Trading#trading strategies#What Is Forex?#What role can Funded Traders Global play in my journey with a $100 account?#What's the best strategy for a small account?

1 note

·

View note

Text

Dave Antrobus Inc & Co’s acquisition of MyLife Digital

Manchester’s fast-paced business collective Inc & Co has acquired yet another digital enterprise for its notable portfolio of business transformations. The collective’s latest acquisition, MyLife Digital, is the European market leader in consent and data preference management. As our digital world evolves at the speed of light, Inc & Co and MyLife Digital will work together to help businesses serve modern customers while respecting data privacy.

MyLife Digital engineers software solutions that produce data insights to help companies understand their market positions. The software enables businesses to increase opt-ins, boost engagement, and ensure compliance with data legislation. As specialists in data and privacy, MyLife Digital shows businesses how to collect data compliantly and contact prospects in the most valuable ways to develop trust-based customer relationships. The data-management experts’ current clients include major brands, such as Mitsubishi Motors, Saint-Gobain, Dogs Trust, Blue Cross, and Jewson.

Users can deploy MyLife Digital’s innovative services to multiple touchpoints, improving customer engagement through personalisation and data-driven strategies. The flexible systems integrate with a multitude of business platforms, CRM systems, and digital tools, including Oracle, HubSpot, MailChimp, and Shopify, amongst many others.

‘This is a very exciting time for Fresh Thinking Group as it means we can offer our clients innovative and market-leading products to manage their data.,’ says Dave Antrobus, Technology Director of Inc & Co.

With FTG funding in place, Inc & Co’s team will work with MyLife Digital’s data specialists to further develop software solutions. These solutions will help MyLife Digital’s clients to engage prospects while complying with new and upcoming personal data legislation. Meanwhile, MyLife Digital’s team of 40 will prove invaluable to Inc & Co’s shared collective; each team member offers impressive experience and knowledge in the charity, utilities, and transportation sectors.

Inc & Co’s Dave Antrobus will lead MyLife Digital’s new technical developments and strategies. As the Technology Director of both Inc & Co and Fresh Thinking Group, Dave Antrobus Inc & Co is widely recognised for his award-winning software developments. He has managed major tech projects for leading brands, including Google, Matalan, SimplyBe, and EDF Energy, to name a few.

‘We are excited to be included within the Inc & Co collective,’ adds Katie Bates, Director of Sales, Marketing and Partnerships at MyLife Digital. ‘The breadth of capabilities in the digital agencies and B2C applications complements MyLife Digital’s purpose of trust, transparency, and accountability in the data world. Together we improve the customer journey, building engagement processes from the ground up. We provide clients with clarity and ownership over customers’ preferred communication channels and topics, so the right message can be delivered at the right time, whilst giving compliance teams the assurance that changes are evidenced.’

Learn more about MyLife Digital and book a free demo at .

About Inc & Co

Inc & Co is a dynamic collective that acquires and transforms digital businesses so that they can thrive in competitive markets. The group has recently acquired a multitude of digital agencies, including the technology-driven marketing agency Neon, creative communications-led agency Brass, sport-focused agency Skylab and sports analytics business Insight Analysis. As one of Inc & Co’s newest acquisitions, MyLife Digital will join a wealth of performance-driven firms on their routes to market authority.

The holding group’s acquisitions collaborate with other companies under the Inc & Co umbrella, sharing professional skills and quality business resources to develop their services and offerings. With access to a host of specialist guidance, HR support, and funding from Fresh Thinking Group, Inc & Co’s acquisitions are in the best position to accomplish business transformation. The collective’s impressive talent pool provides all the support that a business needs to achieve organic growth.

Inc & Co supports start-ups, companies looking to sell, and businesses in need of financial support. The fast-growing collective is always on the lookout for creative agencies, especially companies that focus on design, software development, SaaS, PR, and marketing. Inc & Co nurtures the digital businesses that they bring into their collective, empowering these firms to grow their client and consumer bases and maximise return on investment.

0 notes

Text

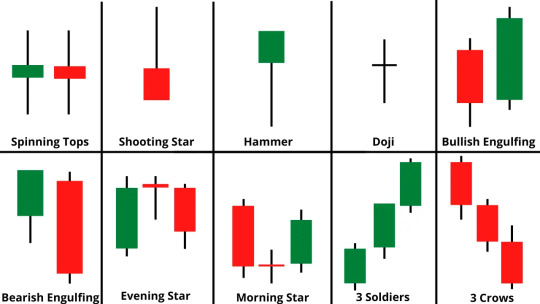

9 Top Forex Candlestick Patterns: Secrets of Price Action Trading

Candlestick patterns are a vital component of technical analysis in the world of trading. These simple yet powerful tools provide traders with invaluable insights into market sentiment and potential price movements. By recognizing and understanding candlestick patterns, traders can make informed decisions and improve their chances of success in the highly competitive financial markets.

Funded Traders Global (FTG) acknowledges the crucial role of candlestick patterns in trading and provides its traders with comprehensive education and support to master this aspect of technical analysis.

Understanding Price Action Trading

Price action trading is a methodology that relies on the analysis of price movements and patterns to forecast future market trends. It focuses on the ‘naked’ price chart, devoid of indicators or oscillators, making it a straightforward and effective approach for traders. By deciphering the subtle clues in price movements, traders can identify potential entry and exit points.

Funded Traders Global (FTG) encourages its traders to develop a deep understanding of price action trading as it forms the foundation of many successful trading strategies within their programs.

Purpose and Scope of This Guide

The purpose of this guide is to provide a clear and concise overview of candlestick patterns and price action trading. We will explore the fundamental aspects of candlestick patterns, understand how they can be used to analyze price action and delve into their practical applications in real-world trading scenarios. By the end of this guide, you will have the knowledge needed to incorporate candlestick patterns and price action trading into your strategy.

Funded Traders Global (FTG) stands by its commitment to educating and empowering its traders with the knowledge and tools they require to navigate the financial markets effectively. This guide is a testament to our dedication to equipping traders with the skills necessary to succeed in the dynamic world of trading.

II. Basics of Candlestick Patterns

A. What Are Candlestick Patterns?

Candlestick patterns are like the language of the financial markets. These patterns are visual representations of price movements and help traders, including those within Funded Traders Global, to understand market sentiment. By decoding these patterns, traders gain valuable insights into potential future price changes.

B. History and Origin of Candlesticks

Candlesticks have a rich history dating back to 17th century Japan( it is also known as the Japanese candlestick pattern). Munehisa Homma, a rice trader, first developed this technique to track rice prices. Today, it’s used globally by traders, including those affiliated with Funded Traders Global, to analyze various financial assets. The historical roots of candlestick patterns make them a fascinating and enduring tool in trading.

C. Anatomy of a Candlestick

Each candlestick has a simple structure. It consists of a body and two wicks, or shadows. The body represents the price range between the open and close, while the wicks show the high and low prices during a specific time period. This basic structure is the foundation for interpreting candlestick patterns effectively, an essential skill for traders, including those associated with Funded Traders Global.

D. Bullish Candlestick Pattern vs. Bearish Candlesticks Pattern

Candlesticks come in two primary forms: bullish and bearish. Bullish candlesticks indicate a price increase, where the close is higher than the open. Conversely, bearish candlesticks signal a price decline, with the close lower than the open. These distinctions help traders, including Funded Traders Global participants, gauge market sentiment and potential future price movements.

III. What are the Common Candlestick Patterns?

Following are the common candlestick patterns:

Single Candlestick Patterns

When it comes to understanding candlestick patterns, simplicity can be powerful, and Funded Traders Global participants recognize the value of these single candlestick patterns in their trading strategies:

Doji Candlestick

The Doji is a small candlestick with an open and close that are almost the same, often resembling a cross or a plus sign. It suggests market indecision and Funded Traders Global traders know that when a Doji appears, it can be a sign of a potential reversal in the market’s direction.

Hammer Candlestick

A Hammer candlestick features a small body near the top of the candle and a long lower wick. This pattern can be a bullish indicator, signaling a potential reversal after a downtrend. Traders, including those in the Funded Traders Global community, use the Hammer to spot opportunities for buying when the market is showing signs of a bounce back.

Shooting Star Candlestick

The Shooting Star is the opposite of the Hammer, with a small body near the bottom of the candle and a long upper wick. This pattern suggests potential bearishness and is closely watched by Funded Traders Global members when looking for indications of a market downturn.

Spinning Top

A Spinning Top has a small body and long upper and lower wicks. It signifies market uncertainty and indecision, and traders in the Funded Traders Global program understand that it can be a precursor to potential reversals in price. Spinning Tops offer a valuable signal that can guide trading decisions in volatile markets.

These common single candlestick patterns provide traders, especially those affiliated with Funded Traders Global, with a foundational understanding of how to interpret market sentiment and make informed trading choices based on these simple yet powerful indicators.

Two-Candlestick Patterns

Funded Traders Global participants find that two-candlestick patterns offer even more insights into market dynamics, enhancing their trading strategies. Let’s explore two essential patterns:

Engulfing Candlestick Patterns

Engulfing patterns, which come in two forms – bullish and bearish, are significant signals for traders, including those within Funded Traders Global. A bullish engulfing pattern occurs when a smaller bearish candle is followed by a larger bullish candle that completely engulfs it. This signals a potential bullish reversal. Conversely, a bearish engulfing pattern happens when a smaller bullish candle is followed by a larger bearish candle that engulfs it, suggesting a bearish reversal. Traders use these patterns to anticipate trend shifts and potential trading opportunities.

Harami Candlestick Patterns

Harami patterns are another pair of candlestick patterns that Funded Traders Global members rely on for guidance. The bullish harami consists of a smaller bearish candle within the range of a preceding larger bullish candle. This hints at a possible bullish reversal. In contrast, the bearish harami involves a smaller bullish candle within the range of a preceding larger bearish candle, signaling a potential bearish reversal. Understanding harami patterns helps traders make informed decisions about their positions, whether they are looking to buy or sell.

These two-candlestick patterns, the engulfing and harami patterns, serve as vital tools for traders, including those connected with Funded Traders Global, as they provide more intricate insights into market sentiment and potential future price movements, ultimately aiding in effective decision-making.

Three-Candlestick Patterns

When it comes to understanding market dynamics, three-candlestick patterns offer an even deeper level of insight for traders, including those affiliated with Funded Traders Global. Let’s explore two notable three-candlestick patterns:

Morning and Evening Star

Morning and Evening Star patterns are key indicators for Funded Traders Global members. The Morning Star begins with a bearish candle, followed by a small indecisive or spinning top candle, and is concluded with a bullish candle. This formation suggests a potential bullish reversal, as market sentiment shifts from bearish to bullish. Conversely, the Evening Star starts with a bullish candle, followed by a small indecisive candle, and is completed by a bearish candle. This pattern hints at a potential bearish reversal, providing traders with valuable insights into market sentiment and potential trend shifts.

Three Inside Up and Three Inside Down

Three Inside-up and Three Inside Down patterns are recognized by traders, especially those in Funded Traders Global, as signs of potential reversals in the market. Three Inside Up occurs when a bearish candle is followed by a bullish candle that engulfs the prior one, and the third candle closes higher. This pattern suggests a potential bullish reversal. Conversely, Three Inside Down starts with a bullish candle, followed by a bearish candle that engulfs the prior one, and the third candle closes lower. It signifies a potential bearish reversal, helping traders anticipate trend changes and make informed trading decisions.

Reversal vs. Continuation Patterns

In the world of candlestick patterns, it’s important for traders, including those associated with Funded Traders Global, to distinguish between reversal and continuation patterns. Reversal patterns, like the ones we’ve discussed, signal potential trend reversals. They indicate that the current trend may be losing strength, and a new trend may emerge. On the other hand, continuation patterns, which we haven’t covered in detail, suggest that the prevailing trend is likely to persist. Being able to identify and interpret these patterns is crucial for traders to adapt their strategies to changing market conditions and seize trading opportunities.

IV. Using Candlestick Patterns in Forex Trading

Funded Traders Global participants understand the significance of incorporating candlestick patterns into their forex trading strategies. Here’s how they do it:

A. Identifying Patterns on Price Charts

To begin, traders, including those with Funded Traders Global, focus on identifying candlestick patterns on price charts. They carefully watch for single, two-candlestick, and three-candlestick patterns. Recognizing these patterns is vital as they provide insights into market sentiment and potential trend reversals, helping traders make informed decisions.

B. Confirming Signals with Other Technical Analysis Tools

Candlestick patterns are potent on their own, but combining them with other technical analysis tools enhances their effectiveness. Funded Traders Global members often use indicators like moving averages, RSI, and trend lines to confirm signals. This multi-pronged approach ensures greater confidence in their trading decisions.

C. Setting Entry and Exit Points

Once a trader spots a relevant candlestick pattern and confirms it with other technical analysis tools, they determine entry and exit points. For example, a bullish engulfing pattern followed by a strong uptrend may indicate an opportunity to enter a long position. Accurately setting these points is crucial for successful trading, and Funded Traders Global participants are adept at this skill.

D. Risk Management Strategies

Risk management is paramount in forex trading. Funded Traders Global members prioritize preserving capital by implementing risk management strategies. They use stop-loss orders and position sizing to limit potential losses and protect their accounts, ensuring that even in the face of adverse market movements, they maintain their financial security.

Incorporating candlestick patterns into their trading approach, along with thorough technical analysis, well-defined entry and exit points, and strong risk management, equips traders, including those affiliated with Funded Traders Global, with a robust toolkit to navigate the intricate world of forex trading effectively.

V. Advanced Candlestick Patterns

For traders seeking an edge in their strategies, including those associated with Funded Traders Global, advanced candlestick patterns provide a deeper layer of analysis. Here are some advanced techniques:

Fibonacci Levels and Candlesticks

Fibonacci retracement levels are a valuable complement to candlestick analysis. Funded Traders Global participants recognize that combining Fibonacci with candlestick patterns helps identify potential support and resistance levels, enhancing the precision of entry and exit points. The harmonious interplay between these techniques offers a more robust understanding of market dynamics.

Multiple Timeframe Analysis

Experienced traders, including those within Funded Traders Global, often employ multiple timeframe analyses. This involves examining candlestick patterns on different timeframes to gain a comprehensive view of the market. It helps identify overarching trends and shorter-term opportunities, leading to more informed trading decisions.

Combining Candlesticks with Support and Resistance

Funded Traders Global members understand the importance of integrating candlestick patterns with support and resistance levels. Candlestick patterns near these levels can serve as powerful indicators. For example, a bullish reversal pattern at a strong support level can be a compelling signal to enter a long position. This fusion of candlestick patterns and support/resistance analysis refines the trader’s ability to identify strategic entry and exit points.

Utilizing these advanced techniques alongside candlestick patterns enhances a trader’s analytical toolkit. For Funded Traders Global participants and all traders alike, this depth of analysis equips them with a competitive advantage in navigating the complexities of the financial markets.

VI. Trading Strategies and Examples

In the world of trading, Funded Traders Global members understand the importance of having diverse strategies to adapt to changing market conditions. Here are some trading strategies, along with real-world examples:

Scalping with Candlestick Patterns

Scalping is a high-frequency trading strategy, and traders, including those with Funded Traders Global, often use candlestick patterns for quick, short-term gains. For instance, they might look for patterns like Doji or Hammer on lower timeframes to make rapid buy or sell decisions, capitalizing on small price fluctuations.

Swing Trading Strategies

Swing trading involves holding positions for days or weeks to capture larger price movements. Traders within Funded Traders Global often use candlestick patterns to confirm entry and exit points. For instance, if they spot a bullish engulfing pattern after a downtrend, it could be a signal to enter a long-swing trade.

Long-Term Position Trading

Position trading focuses on long-term trends, with traders holding positions for months or even years. Funded Traders Global participants understand the importance of identifying solid entry points. For example, if they notice a Morning Star pattern on a monthly chart, it could signify the beginning of an extended bullish trend, and they might opt for a long-term buy-and-hold strategy.

VII. Common Mistakes to Avoid

Even seasoned traders, including those affiliated with Funded Traders Global, can fall into common trading pitfalls. Being aware of these mistakes is crucial to achieving long-term success in trading:

Overtrading

Overtrading is a trap many traders must avoid. Funded Traders Global participants know that making excessive trades, especially when driven by emotions or the desire to recover losses, can lead to significant losses. Instead, they emphasize quality over quantity, choosing trades carefully based on solid analysis.

Ignoring Risk Management

Funded Traders Global places a strong emphasis on risk management, as it’s paramount to preserving capital. Ignoring risk management practices, such as setting stop-loss orders and managing position sizes, can lead to devastating losses. Effective risk management ensures that even during losing streaks, traders safeguard their accounts.

Confirmation Bias

Confirmation bias is a cognitive error that traders, including those associated with Funded Traders Global, must guard against. It involves seeking out information that supports existing beliefs while ignoring contradictory data. To make objective decisions, traders should remain open to alternative viewpoints and continuously reassess their strategies.

Recognizing and avoiding these common mistakes is essential for all traders, and Funded Traders Global members are no exception. By doing so, they can maintain discipline, protect their capital, and make sound trading decisions.

VIII. Psychological Aspects of Candlestick Trading

In the world of trading, including those in Funded Traders Global, understanding the psychological aspects is just as critical as mastering technical skills. Here are two key aspects:

A. Discipline and Emotional Control

Discipline and emotional control are the backbone of successful trading. Funded Traders Global participants are well aware of the importance of sticking to their trading plans, even when emotions run high. They understand that fear and greed can lead to impulsive decisions and significant losses. By staying disciplined and keeping emotions in check, traders can make rational decisions based on their strategies.

B. Patience and Consistency

Patience and consistency are virtues that Funded Traders Global members hold dear. Candlestick trading can sometimes require waiting for the right signals to emerge. Traders know that being patient and consistent with their approach is key to long-term success. They avoid chasing quick profits and instead focus on executing their strategies consistently over time.

The psychological aspects of trading are often underestimated but are central to becoming a successful trader. Those, like Funded Traders Global members, who master discipline, emotional control, patience, and consistency. Are better equipped to navigate the ups and downs of the market and achieve their financial goals.

IX. Resources for Further Learning

For traders, including those with Funded Traders Global, the quest for knowledge never ends. Here are valuable resources to enhance your trading skills:

Recommended Books and Courses

Funded Traders Global recognizes the importance of education. They often recommend books and courses to expand your trading knowledge. Some classic books, such as “Japanese Candlestick Charting Techniques” by Steve Nison, provide in-depth insights into candlestick patterns. Online courses like those on platforms like Coursera or Udemy offer structured learning opportunities to deepen your expertise.

Online Tools and Platforms

The digital age offers a plethora of online tools and platforms to streamline your trading. Trading software, charting tools, and analytical platforms like MetaTrader or TradingView can be invaluable. Funded Traders Global members frequently leverage these resources to enhance their trading efficiency and accuracy. We are the one of leading currency exchange dealers.

Trading Communities and Forums

Trading can be a solitary endeavor, but learning from a community can be immensely beneficial. Funded Traders Global and other trading communities provide a platform for knowledge sharing and peer support. Engaging in trading forums like Forex Factory or StockTwits can help you gain insights, share experiences, and stay updated on market developments.

These resources offer opportunities for continuous learning, which is crucial for traders, including those involved with Funded Traders Global, to adapt to changing market dynamics and remain at the forefront of their trading game.

X. Conclusion

In conclusion, candlestick trading, as emphasized by Funded Traders Global, is a potent method for understanding market sentiment and making informed trading decisions. It’s essential to grasp various candlestick patterns, from single-candlestick to more complex formations. And utilize them alongside advanced strategies, risk management, and psychological discipline.

Aspiring traders are encouraged to begin their candlestick trading journey, leveraging available resources and educational tools. While remembering the inherent risks associated with trading. It’s paramount to approach trading with caution, start small, practice diligently, and stay informed about market regulations and local laws. With dedication and ongoing learning, you can unlock the potential for success in this dynamic trading realm.

Ready to become a better trader? Join Us Today!!!

1 note

·

View note

Text

FTGMarkets Forex Broker review 2018

New Post has been published on https://forexfacts.net/ftgmarkets-forex-broker-review-2018-5/

FTGMarkets Forex Broker review 2018

FTGMarkets Forex Broker review 2018

With full understanding for the fact that choosing a brokerage has become very difficult these days, this time we took our time to check out FTG Markets, a private financial entity stacking behind them a large bag of success in the corporate sector, now opening their gates to any individual or group with a common goal. We have large expectations from this brokerage and by first glimpse it sure looks promising.

Breaking it down, we first got the link to their website (www.FTGMarkets.com) and the wow effect hits.

From a few minutes scrolling around, we get a boutique feel and an inviting online environment, cold and warm colors that balances out the overall experience.

Yes, we are not here for the looks, yet this site is sure stunning, but what about the content and functionality?

In the website you can find a fair amount of information and knowledge base, open to anyone interested, without the hidden passwords or anyone asking you to call to get access.

As a beginner or advanced trader, you should find the Global Events page helpful,

This includes the ongoing global daily changes, opening times of the biggest Stock Exchanges worldwide, an economic calendar with convenient and advanced filtration options

Aswell as time zones clocks to help prevent trading confusion and even some links to the biggest news sites out there. Looks like FTG is doing their best to educate and aid your trading from a very honest and professional point of view.

Hopping to the articles page, we find this page very well composed, providing seasonal articles to explain more about the history of the events we seen in the past few years up to today. We also found the self-money management and saving articles well written and interesting to read.

Within depth information about Australia’s super or properly managing your retirement planning, it seems that FTG who aims to open their doors to any size investor or traders, is showing it right away and anyone would find a fair amount of interest in at least one of the published articles. It’s refreshing to see such investment in your clientele from the get go, before they even decided to take part.

The offered accounts are pretty standard and stands strong with most of the offered accounts by other leading brokerages, yet FTG made sure we understand that they would very much prefer to create custom accounts and portfolios to each and every one, investing the time to fully understand the SWOT analysis of each individual, group or corporation.

*SWOT – Strengths, Weaknesses, Opportunities, and Threats.

For service matters to backup all this promising looks, we were answered kindly after approximately 12 seconds of wait, and we were greeted by an FTG Markets representative who was extremely kind and patient, promising to answer all our questions and provide us with more information before we decide what to do, so we asked away.

Our questions were answered one by one with attention, no side chats or ringing phones in the background. We provided the representative with our email and 5 minutes later got more information and even a showcase of FTG’s abilities in the field of self-investments.

Everything checked and looked promising, so we opened an account. The opening account experience was smooth and straight forward, getting a download link to the trading platform, the multi award winning metatrader4 .

After testing out their Personalized Investment Plan tool on the main page, we decided to fund the account and place some small trades to see how things run. The latency seems short and execution is instant, spreads are reasonable and the overall costs make complete sense.

The withdrawal process was comfortable and hassle free. We called our account manager and placed the request with him, and all he asked is how could FTG get better, and if we had a negative experience what so ever. The funds (minus the withdrawal fee) landed in our bank account 4 days later (including a weekend in the middle), a surprisingly fast processing time, proving us that FTG has a strong and well based relations with well-known international banks, a peace of mind and a strong point in anyone’s book.

Inside the account you can view your current balance and a summary of your portfolio, just in case you are not around your trading computer (yes, the site is mobile friendly), a full transaction list of every financial move ever done on your portfolio with flexible filters, a convenient profile page showing all the information you registered with that is adjustable in case of change, and of course all the funding and withdrawing pages for complete control of your account.

If we didn’t mention so far, the entire site is SSL secured and protected from leaking your information to any third party or phishing attempts, a must in 2018.

Overall the procedure is full of attention up to the smallest detail, yet FTG Markets is seeking to improve even further, always pushing to be better than yesterday, focusing on doing the best and being the best, so it seems. We find it hard to argue with this kind of approach and this level of delivery.

The bottom line, do we suggest FTGMarkets as your brokerage? In one word, Yes.

In more detail? Like vanilla ice cream is not a for absolutely everyone, yet the most would find it good, we suggest registering to FTG Markets and seeing for yourself. We think that FTG’s abilities to compliment any type of portfolio is totally there, the professionalism and knowledge base is overflowing, and the comfort of use is in plenty. Call or email, check out for yourself, yet we can report an overall great experience.

FTGMarkets Account options

FTG Markets offer you 4 different account types such as many brokers do. Their spreads are attractive and in case of larger trading volume can be adjusted. All their account types offer top level assistance and additional options. We could not really find anything awkward in here.

FT Markets offers a variety of investment channels to uniquely correspond to each investor’s needs and abilities.

MINIATURE PORTFOLIO

BASIC PORTFOLIO ECN

GRAND PORTFOLIO

Designed for beginners and new investors. Suited for moderate investors. Electronic Communication Network. Net worth development designed for serious investors, groups and corporations. Spreads from 3.3 pips Spreads from 2.2 pips Instant execution Instant execution Leverage 400:1 Leverage 400:1 Spreads from 3.3 pips Spreads from 0.3 pips All Available Platforms Personal Fund Manager Leverage 400:1 Leverage 400:1 Access to All Education Tools Access to All Education Tools Personal Fund Manager All Available Platforms Personal Fund Manager Access to All Education Tools Technical Analysis Reports Technical Analysis Reports All Available Platforms All Available Platforms Market Update Emails REGISTER REGISTER REGISTER REGISTER

FTG Markets offered Asets for trading

With a wide range of financial Instruments that you are able to trade with this broker we are sure you will be able to find the pairs you are looking for.

56 major and exotic currency Pairs – – commission 7 per lot , leverage 1:200

80 stocks – all the main ones worldwide – with a leverage of 1:50 spreads is different for the ECN and Grand Portfolio.

Not a huge amount of commodities (3) and indices (12) but the main ones are there for leverage trading 1:50

cryptocurrencies. the offer trading in Bitcoin Ethereum Ripple, Litecoin and Dash

Cryptocurrencies spreads

Symbol Spread Commission Min Position Leverage ETH/USD 21 ~ $7 per lot 0.01 1:10 BTC/USD 19 ~ $7 per lot 0.01 1:10 LTC/USD 10 ~ $7 per lot 0.01 1:10 DSH/USD 10 ~ $7 per lot 0.01 1:10 XRP/USD 10 ~ $7 per lot 0.01 1:10

Here you will find that Transparency is Key and everything is very clear and available, something that tends to e overlooked by many brokers.

FTG Markets Trading Platform

FTG Markets acquired a Metatrader 4 license and this seems the right choice. As many of you might know, Metatrader 4 is the leading and award winning platform in the industry and offers a nice variety of tradable assets such as we expected. It allows EA’s and numerous other options.

Additionally, the junior asset brokers are not afraid to help you properly throughout the account opening and platform downloading process. Additionally, they can provide you with a nice tour on the platform.

Honestly spoken, this surprised us as well as based on the many calls we made to brokers to test them, it turned out many of their employees were not capable of fully explaining the possibilities of the MT4 platform.

FTG Markets Depositing and withdrawing funds

Looking at the depositing options, FTG Markets allows account funding to be done by use of the major credit card providers such as VISA and MasterCard. Bank Wire options are also available but the details of their accounts are not to be found on the site itself.

As they didn’t open their doors not too long ago, the major variety of for example APM’s (Alternative Payment Methods) such as Neteller or others is still not available but we were advised this is in development. As so, a larger variety of depositing options should be available on short term.

FTG Markets Service and overall opinion.

As said, FTG Markets is taking things seriously when it comes to customer service. They are outstanding when it comes to customer care and (as the junior asset manager we spoke to) won’t leave any soldier behind.

This attitude clearly shows they have been active in the field previously and based on our thoughts, might be the key to their success.

We firmly believe that customer care these days is vital and is the leading way to ensure the client a proper trading environment.

So, would we recommend this broker? YES!!!!

If you have enough from the regular brokers and really would like to feel at home in an environment where the human aspect is still living….then there is no reason for not joining them.

They provide a solid product, seriously good service and went for the boutique approach instead of the mainstream way. Actually we enjoyed their focus on clients that much that we must admit FTG Markets is something special….so HIGHLY recommended!

#FTG Markets#FTG Markets broker#FTG Markets forex#FTG Markets review#FTG Markets reviews#FTG Markets scam#FTGMarkets#FTGMarkets broker#FTGMarkets forex#FTGMarkets review#FTGMarkets reviews#FTGMarkets scam#Cryptocurrency Brokers#Forex Brokers

0 notes

Text

Laminated Busbar Market Research Report 2021 - Industry Size, Share, Demands, Regional Analysis & Estimations Till 2027

The Laminated Busbar Market Report, in its latest update, highlights the significant impacts and the recent strategical changes under the present socio-economic scenario. The Laminated Busbar Market industry growth avenues are deeply supported by exhaustive research by the top analysts of the industry. The report starts with the executive summary, followed by a value chain and marketing channels study. The report then estimates the CAGR and market revenue of the Global and regional segments.

Base Year: 2020

Estimated Year: 2021

Forecast Till: 2027

The report classifies the market into different segments based on type and product. These segments are studied in detail, incorporating the market estimates and forecasts at regional and country levels. The segment analysis is helpful in understanding the growth areas and potential opportunities of the market.

Get | Download FREE Sample Report of Global Laminated Busbar Market @ https://www.decisiondatabases.com/contact/download-sample-12041

A special section is dedicated to the analysis of the impact of the COVID-19 pandemic on the growth of the Laminated Busbar market. The impact is closely studied in terms of production, import, export, and supply.

The report covers the complete competitive landscape of the Worldwide Laminated Busbar market with company profiles of key players such as:

Amphenol Corporation

Auxel FTG

Idealec

Methode Electronics

Mersen

Rogers Corporation

Ryoden Kasei Corporation

Shanghai Eagtop Electronic Technology

Shenzhen Busbar Sci-Tech Development

Storm Power Components

Sun.King Power Electronics

Suzhou West Deane Machinery

Zhuzhou CRRC Times Electric

Want to add more Company Profiles to the Report? Write your Customized Requirements to us @ https://www.decisiondatabases.com/contact/get-custom-research-12041

Laminated Busbar Market Analysis by Material

Copper

Aluminum

Laminated Busbar Market Analysis by End-User

Utilities

Industrial

Commercial

Residential

Laminated Busbar Market Analysis by Insulation Material

Epoxy Powder Coating

Polyester Film

PVF Film

Polyester Resin

Heat-Resistant Fiber

Polyimide Film

Laminated Busbar Market Analysis by Geography:

North America (USA, Canada, and Mexico)

Europe (Germany, UK, France, Italy, Russia, Spain, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South-East Asia, Rest of Asia-Pacific)

Latin America (Brazil, Argentina, Peru, Chile, Rest of Latin America)

The Middle East and Africa (Saudi Arabia, UAE, Israel, South Africa, Rest of the Middle East and Africa)

Key questions answered in the report:

What is the expected growth of the Laminated Busbar market between 2022 to 2027?

Which application and type segment holds the maximum share in the Global Laminated Busbar market?

Which regional Laminated Busbar market shows the highest growth CAGR between 2022 to 2027?

What are the opportunities and challenges currently faced by the Laminated Busbar market?

Who are the leading market players and what are their Strengths, Weakness, Opportunities, and Threats (SWOT)?

What business strategies are the competitors considering to stay in the Laminated Busbar market?

Purchase the Complete Global Laminated Busbar Market Research Report @ https://www.decisiondatabases.com/contact/buy-now-12041

About Us:

DecisionDatabases.com is a global business research report provider, enriching decision-makers, and strategists with qualitative statistics. DecisionDatabases.com is proficient in providing syndicated research reports, customized research reports, company profiles, and industry databases across multiple domains. Our expert research analysts have been trained to map client’s research requirements to the correct research resource leading to a distinctive edge over its competitors. We provide intellectual, precise, and meaningful data at a lightning speed.

For more details: DecisionDatabases.com E-Mail: [email protected] Phone: +91 90 28 057900 Web: https://www.decisiondatabases.com/

#Laminated Busbar Market#Laminated Busbar Market Report#Laminated Busbar Market Size#Laminated Busbar Market Share#Laminated Busbar Market Growth

0 notes

Text

Unlock the Secrets of Trading with Top Chart Patterns! Explore the world of chart patterns with Funded Traders Global. From understanding the basics of technical analysis to recognizing common chart patterns like head and shoulders, double tops, and flags, our blog equips you with the knowledge to enhance your trading skills. Discover advanced patterns like pennants, wedges, and harmonic patterns, and gain practical tips for effective trading. Improve your risk management, pinpoint entry and exit points, and combine chart patterns with technical indicators. Start your journey towards trading success today with Funded Traders Global!

#Advanced Chart Pattern#and Descending Triangles#and mini trading#Ascending#Basics of Technical Analysis#Benefits of Recognizing in Chart Pattern#Bullish and Bearish Flags Pattern#candlestick#candlestick Pattern#career in forex trading#chart patterns#classic reversal pattern#common chart patterns#cup and handle pattern#Double top and double bottom patterns#drawdown#financial markets#Forex trading financial freedom#FTG#ftg prop firm#ftg trading#Funded Traders Global#Gaps#Harmonic Patterns#Head and Shoulders Pattern#how to scale into a forex trade#Macro#Master the Market with These Top Chart Patterns for Trading#mastering Forex trading#micro

0 notes

Text

Which Challenges Faced by Chemical Industries for measurement and control of level?

Best-In-Class Level Measurement and Control Instruments by Pune Techtrol Owing To meticulously Engineered Instruments!

Continuous upgrading of environment & safety standards, stringent quality requirements of products and cost effective operationsare some of the varied and complex challenges that chemical industries have to deal with.To meet the ever-increasing demands of customers the chemical industries have to advancetechnologically to maintain lead in the market withreliable products. For implementation of advanced technology, one needs to have expert know-how of the instrumentation and automation market, to choose the proper instruments required for the level measurement of liquid and solid materials.

Pune Techtrol is the perfect companion offering acomprehensive range of products inlevel measurements and control instrumentsas well as expert know-howfor process automation. Chemical industries need accurate and reliable level measurement and control instruments to overcome following challenges normally encountered in their operations.

Know more: http://www.punetechtrol.com/blog.php?id=9

1. Corrosive liquids and environment

Handling of corrosive and aggressive liquids is inevitable in chemical industries. The chemicals needed to be handled may have strong acidic and strong alkaline properties. Very often corrosive fumes may be present in the storage tanks/vessels. Level measuring instruments installed on such storage tanks must be able to function accurately for long periods. Mechanisms of high and low-level monitoring, instruments must be able to sustain corrosive environments.Manual methods of monitoring level have a risk factor resulting into human injury.To assure the smooth functioning of processes, it is essential to design instruments with precision. The cutting-edge technology provided in Pune Techtrol instruments is highly precise. Measurement Technologies:

Various “Material of Construction (MOC)” of the level measuring instruments such as SS304/316/ PP/ PVDF, PTFE coated with SS are provided to suit the corrosive nature of chemicals.

Direct reading level gauges use stainless steel, PVDF, Teflon as MOC, particularly for corrosive and toxic chemicals.

2. Safety Norms and Regulations

Safety is a critical parameter in chemical industries. Some plants in chemical industries have inherent dangers because of the reactive chemicals stored in the tanks/vessels. Measurement and control operations in respect of such processes must have minimal human involvement and hence have to be automatic or remotely controlled. Some chemicals are flammable and can cause fire hazard. To comply with safety requirements, Techtrol instruments are designed to meet all the safety standards. Pune Techtrolhas wide range of approved, verified, certified and tested products that meet all the safety standards and environmental norms and regulations.

3. Materials having Different values of viscosity, specific gravity, dielectric constant

Values of viscosity, specific gravity, dielectric constant of materials whose levels are to be monitored are very important in design and selection of appropriate instruments for particular operation. Techtrol manufactures level measuring instruments based on various principles. While designing and manufacturing the instruments the precise values of these parameters must be available from the users. Accurate values of viscosity, specific gravity, dielectric constants in turn ensure accuracy and reliability of the level monitoring instruments. Measurement Technologies:

Float type switch are based on Archimedes principle where density is important.

In case of capacitance & radar type instruments, dielectric constant must be known.

4. High temperature & pressure conditions

In chemical industry there are endothermic and exothermic processes where high temperature & pressure conditions can occur. Working in such critical conditions, plant operators require accurate &reliable solutions for monitoring applications. In such varying temperature and pressure and the aggressive media, Techtrol level measurements and control instruments are capable of working satisfactorily under such conditions

Measurement Technologies:

Appropriate selection of material with sufficient mechanical strength is ensured for the instruments subjected to conditions of high temperature and pressure.

Direct reading level gauges are tested for 1.5 times the operating pressure and certified by Inspectorate of Boilers wherever necessary.

5. Presence of fumes, dust and fire hazards

The tanks storing fly-ash have extremely hot and dusty environment. Also, some chemicals/ materials can generate fumes which may lead to fire hazards in the chemical plant. When a fine dust suspended in air is ignited a dust explosion occurs which causes a very rapid burning and can injure people. The results of the instruments must be helpful to avoid the undesired conditions. The level instruments provided by Pune Techtrol come with a robust flame proof housing and are designed to provide accurate results in extreme conditions.

Measurement Technologies:

For fuming liquids, seal pots are provided in FBG, FDG & FTG.

For hazardous applications instruments are provided with flame-proof & ATEX certified enclosures

Non-contact type instruments based on radar principle have antenna made up of PVDF material..

Selection between contact and non-contact type radar is done by taking into consideration the presence of dust/fumes and dielectric constants of the chemical materials.

Zener barriers are provided for isolation wherever required.

6. Improvement in Plant Efficiency

By virtue of their accuracy and reliability Techtrol level measuring instruments play vital role in improving operational efficiency of the plant. Techtrol uses modern technology to meet the challenge of continuous improvement in level measurement in turn helping the industry to improve product quality & efficiency. Following instruments are examples of such advanced technology.

Ultrasonic transmitters an guided wave radar

Radar type level transmitter using FMCW technology

Magnetostrictive transmitters

Displacer type transmitters

A final word

Pune Techtrol, a leading manufacturer in the field has set the benchmark by its precise and reliable instruments.The team of professional and skilled engineers of Pune Techtrol, who have expertise in theselection of the appropriate level measurement and control instruments, take into account various factors required and specified by the customers.

About Pune Techtrol

Pune Techtrol,a leader in designing and manufacturing the innovative Process Automation, Level measurement and Control instruments for liquids and solids. Used by many industries and professionals for more than three decades, Pune Techtrols’ quality equipment is trusted around the globe.

Contact Us

Pune Techtrol Pvt.Ltd

S-18, MIDC Bhosari,

Pune - 411026,India

Phone No- 020 66342900

Email Id- [email protected]

Website- http://www.punetechtrol.com

1 note

·

View note

Photo

Team Zapote Market for SK Molino IV Rolling Pantry. 😁✌🏻💯❤ #SKMolinoIVRollingPantry #FTG #FTB (at Bacoor, Cavite) https://www.instagram.com/p/COkTFBvnKTi/?igshid=7uzhja4sbpco

0 notes

Text

FTGMarkets MT4 Broker 2018

New Post has been published on http://bestmt4broker.com/ftgmarkets-mt4-broker-2018/

FTGMarkets MT4 Broker 2018

FTGMarkets MT4 Broker 2018

Throughout the last half year we have seen a massive increase of Forex and CFD brokers and thus, we decided to check out some of them. Our eye fell on FTG Markets this time.

Although the name might be new to you, FTG Markets has actually quite a history in the world of trading. Throughout the last 8 years FTG Markets was very busy in the world of corporate asset management and managed portfolios of mid to big sized companies.

We considered it actually quiet special that despite the big success achieved in the world of corporate asset management, FTG Markets now opened its doors to the retail trader's world meaning now anybody can open an account with them and start trading.

Looking a bit deeper into their product, we immediate discovered some huge difference compared to the standard brokerages available.

FTGMarkets Trading Platform

FTG Markets acquired a Metatrader 4 license and this seems the right choice. As many of you might know, Metatrader 4 is the leading and award winning platform in the industry and offers a nice variety of tradable assets such as we expected. It allows EA's and numerous other options.

Additionally, the junior asset brokers are not afraid to help you properly throughout the account opening and platform downloading process. Additionally, they can provide you with a nice tour on the platform.

Honestly spoken, this surprised us as well as based on the many calls we made to brokers to test them, it turned out many of their employees were not capable of fully explaining the possibilities of the MT4 platform.

The FTGMarkets website

FTG Markets obviously studied the market before jumping into the FX world but surprisingly decided to do things in a different way.

Their site is investment house orientated and feels as if you arrived in a warm and family orientated environment.

It will not show you the pictures of platforms or scream that they offer a 100% bonus as many brokerages do but honestly said, that change gave us a comfortable feeling when looking critically at their site. Of course, you can register, download their platform or use their personalized investment plan.

(Which is rather genius btw considering the fact it will use your details entered such as age and income in order to provide you with a suggested portfolio)

Besides the above, it provides transparency and reveals FTG Markets' strategy….which is extremely service orientated.

FTGMarkets Account options

FTG Markets offer you 4 different account types such as many brokers do. Their spreads are attractive and in case of larger trading volume can be adjusted. All their account types offer top level assistance and additional options. We could not really find anything awkward in here.

FTG Markets offers a variety of investment channels to uniquely correspond to each investor’s needs and abilities.

MINIATURE PORTFOLIO

BASIC PORTFOLIO ECN

GRAND PORTFOLIO

Designed for beginners and new investors. Suited for moderate investors. Electronic Communication Network. Net worth development designed for serious investors, groups and corporations. Spreads from 3.3 pips Spreads from 2.2 pips Instant execution Instant execution Leverage 400:1 Leverage 400:1 Spreads from 3.3 pips Spreads from 0.3 pips All Available Platforms Personal Fund Manager Leverage 400:1 Leverage 400:1 Access to All Education Tools Access to All Education Tools Personal Fund Manager All Available Platforms Personal Fund Manager Access to All Education Tools Technical Analysis Reports Technical Analysis Reports All Available Platforms All Available Platforms Market Update Emails REGISTER REGISTER REGISTER REGISTER

FTGMarkets offered Asets for trading

With a wide range of financial Instruments that you are able to trade with this broker we are sure you will be able to find the pairs you are looking for.

56 major and exotic currency Pairs - - commission 7 per lot , leverage 1:200

80 stocks - all the main ones worldwide - with a leverage of 1:50 spreads is different for the ECN and Grand Portfolio.

Not a huge amount of commodities (3) and indices (12) but the main ones are there for leverage trading 1:50

cryptocurrencies. the offer trading in Bitcoin Ethereum Ripple, Litecoin and Dash

Crypto currencies spreads

Symbol Spread Commission Min Position Leverage ETH/USD 21 ~ $7 per lot 0.01 1:10 BTC/USD 19 ~ $7 per lot 0.01 1:10 LTC/USD 10 ~ $7 per lot 0.01 1:10 DSH/USD 10 ~ $7 per lot 0.01 1:10 XRP/USD 10 ~ $7 per lot 0.01 1:10

Here you will find that Transparency is Key and everything is very clear and available, something that tends to e overlooked by many brokers.

FTG Markets Depositing and withdrawing funds

Looking at the depositing options, FTG Markets allows account funding to be done by use of the major credit card providers such as VISA and MasterCard. Bank Wire options are also available but the details of their accounts are not to be found on the site itself.

As they didn’t open their doors not too long ago, the major variety of for example APM's (Alternative Payment Methods) such as Neteller or others is still not available but we were advised this is in development. As so, a larger variety of depositing options should be available on short term.

FTG Markets Service and overall opinion.

As said, FTG Markets is taking things seriously when it comes to customer service. They are outstanding when it comes to customer care . This is in general more important(as the junior asset manager we spoke to) won't leave any soldier behind.

This attitude clearly shows they have been active in the field previously and based on our thoughts, might be the key to their success.

We firmly believe that customer care these days is vital and is the leading way to ensure the client a proper trading environment.

So, would we recommend this broker? YES!!!!

If you have enough from the regular brokers and really would like to feel at home in an environment where the human aspect is still living….then there is no reason for not joining them.

They provide a solid product, seriously good service and went for the boutique approach instead of the mainstream way. Actually we enjoyed their focus on clients that much that we must admit FTGMarkets is something special….so HIGHLY recommended!

#FTG Markets#FTG Markets broker#FTG Markets forex#FTG Markets metatrader 4#FTG Markets MT4#FTG Markets review#FTG Markets reviews#FTG Markets scam#FTGMarkets#FTGMarkets broker#FTGMarkets forex#FTGMarkets metatrader 4#FTGmarkets MT4#FTGMarkets review#FTGMarkets reviews#FTGMarkets scam#Broker News#Traders Talk

0 notes

Text

Laminated Busbar Market Research Report

The GMI Research forecasts that the laminated busbar market is witnessing an upsurge in demand during the forecast period. This is mainly due to the strong demand for laminated busbars, the growing demand for consistent, high-quality, and cost-effective power in various sectors, and the rising focus on renewable energy.

Request for a FREE Sample Report on Laminated Busbar Market

Laminated Busbar Market’s leading Manufacturers:

· Rogers Corporation

· Amphenol Corporation

· Mersen SA

· Methode Electronics Inc

· Sun.King Power Electronics

· Auxel FTG

· Idealec SAS

· Ryoden Kasei Corporation

· Shanghai Eagtop Electronic Technology

· Chevron Corporation

Laminated Busbar Market Dynamics (including market size, share, trends, forecast, growth, forecast, and industry analysis)

Key Drivers

Some of the major factors surging the growth of the global laminated busbar market include the strong demand for laminated busbars and the growing focus on renewable energy. The acclerating demand for consistent, high-quality, and cost-effective power in various sectors, followed by the uninterruptible power supply (UPS) systems, will support a large range of power generation technologies, which will fundamentally fuel the demand for the market worldwide. A well-designed laminated bus bar offers mechanical enhancement and electrical optimization within a UPS system. Laminated bus bars provide various benefits like addressing component and personal safety issues, better system cost, decreasing part count, and virtually eliminating assembly errors. According to the laminated busbar market report, the growing benefits of the solution is further anticipated to stimulate the growth of the market. However, low-quality laminated bus bar wire and plates installed at capacitor can create technical problems like heat loss and transmission.

Regional Drivers

Based on region, Europe is anticipated to increase at a higher CAGR in the upcoming years due to the increasing share of renewable energies, rising construction activities, and growing power demand. Furthermore, the Asia-Pacific region is projected to dominate the market over the forecast period. This is attributed to the rising support from the government on renewable energy projects and the increasing focus on decreasing the emission of greenhouse gases.

Insulation Material Segment Drivers

Based on insulation material, the market is segmented into epoxy powder coating, polyester film, PVF film, polyester resin, heat-resistant fiber, and polyimide film. The epoxy powder coating segment is expected to increase at a higher CAGR in the upcoming years. Epoxy powder coated laminated bus bars are mostly utilized for switch gears and motor drive applications. These features make them more suitable for multiple industries and surge the demand of the segment in the laminated busbar market.

Laminated Busbar Market Segmentation:

Segmentation by Material:

· Copper

· Aluminium

Segmentation by End-User:

· Utilities

· Industrial

· Commercial

· Residential

Segmentation by

Insulation Material:

· Epoxy Powder Coating

· Polyester Film

· PVF Film

· Polyester Resin

· Heat-Resistant Fiber

· Polyimide Film

Segmentation by Region:

· North America

o United States of America

o Canada

· Asia Pacific

o China

o Japan

o India

o Rest of APAC

· Europe

o United Kingdom

o Germany

o France

o Spain

o Rest of Europe

· RoW

o Brazil

o South Africa

o Saudi Arabia

o UAE

o Rest of the world (remaining countries of the LAMEA region)

About GMI Research

GMI Research is a market research and consulting company that provides syndicated research reports, consulting services, and customized market research reports. Our reports are based on market intelligence studies to ensure relevant and fact-based research across numerous sectors, including healthcare, automotive, information technology & communication, FMCG, and other industries. GMI Research’s deep understanding related to the business environment helps us in generating objective strategic insights. Our research teams consisting of seasoned analysts and researchers have hands-on experience in various regions, including Asia-pacific, Europe, North America, and the Rest of the World. The market research report offers in-depth analysis, which contains refined forecasts, a bird's eye view of the competitive landscape, factors impacting the market growth, and several other market insights to aid companies in making strategic decisions. Featured in the ‘Top 20 Most Promising Market Research Consultants’ list of Silicon India Magazine in 2018, we at GMI Research are always looking forward to help our clients to stay ahead of the curve.

Media Contact Company Name: GMI RESEARCH Contact Person: Sarah Nash Email: [email protected] Phone: Europe – +353 1 442 8820; US – +1 860 881 2270 Address: Dublin, Ireland Website: www.gmiresearch.com

0 notes

Photo

Hey all, so if you’ve met me in person at various shows you’ve likely seen some of my prints. It doesn’t look like we’ll have Live markets for a while and I’m semi-relieved for everyone’s safety. I will say I miss the engagement with other humans though. Art is how I connect with folks, it’s helped me build a lot of foundational relationships (some over a decade old!) The rainbow blob (Pride Monster) was a test sketch in a trial art program I downloaded a loooong time ago (2010-2011ish, I haven’t used the program since, but it was worth a shot). I remember wanting to make something absolutely ridiculous and I was wanting to lean into my queer (back than lesbian) identity more. Pride Monster caused a lot of laughs among friends and became the first print I made and sold at shows (2012). She’s my pseudo mascot alongside her sister the Princess Angler. I had a few other monsters but these two always captured folks’ attention and illicit plenty of intended laughs. I took a break from shows for a bit and started back 3ish years ago and have a slew of other designs I’ll be posting about the next few days. It’s Gay Wrath Month (formerly Pride Month). That being said I’m hoping I can get these in a few other homes. I’m selling these for $10 (shipping included). $1 from every print sold now through the end of June will go to “For the Gworls” a fund designed to help black trans women pay for necessary medical expenses (doctor visits, prescriptions and getting to and from the doctor) (https://www.artsbusinesscollaborative.org/asp-products/for-the-gworls-ftg/) These prints are appx 5 x 8. If you’re interested DM me and I’ll get this out the door to ya :). #prints #prettyprincess #pridemonster #pridefish #angler #illustration #lgbtqia #trans #supporttranswomen #blacktranslivesmatter #forthegworls #transpride #blm #lovettranswomen https://www.instagram.com/p/CBo-rnvpdkI/?igshid=1njfpf3jbal23

#prints#prettyprincess#pridemonster#pridefish#angler#illustration#lgbtqia#trans#supporttranswomen#blacktranslivesmatter#forthegworls#transpride#blm#lovettranswomen

0 notes

Text

Bakkt Futures’ Launch in Focus as Bitcoin Hints Price Crash

The bitcoin market is calm even though it awaits the launch of a very bullish product: a set of physically-delivered futures.

Intercontinental Exchange (ICE), the world’s second-largest exchange by market cap, is going to offer trading of two Bitcoin Futures Contracts, one daily and other monthly, from September 23. The contracts, backed by Atlanta-based digital asset firm Bakkt, have received approval from the Commodity Futures Trading Commission (CFTC). Meanwhile, Bakkt also has gained custodianship rights to customers’ bitcoin following permission from the New York Department of Financial Services (NYDFS).

The event bids to promote bitcoin trading among institutional investors, a class of monies that till now maintains a safe distance from cryptocurrencies because of their unregulated nature. Speculators see the launch of Bakkt futures as a means to attract substantial capital inflows from Wall Street, which would send the bitcoin prices higher.

Bitcoin Investors Feeling Cold-feet

But as the date of the Bakkt launch is nearing, the same speculators are feeling cold-feet. Bitcoin’s volatility has hit its 4-month low going down, as reported by Forbes here, indicating that traders are looking at each other while wondering who among them would make the first move. The uncertainty has resulted in choppy price action – a bias conflict – that gives no hint about the bitcoin’s next trend.

As of this time of writing, bitcoin is trading between a strict range defined by $9,700 and $10,050, still down by at least 8 percent from its weekly top.

According to the famous market theorist PlanB, Bakkt’s launch is not necessarily a bullish event, but it promises the crypto to discover its real market value.

“ICE is offering physically-settled Bitcoin futures through its Bakkt unit. It will act as an exchange, clearinghouse, and settlement authority. ICE BTC futures will create price discovery apart from any cash market influence.”

Yes, esp. because not dependent on spot market rates of exchanges for settlement. CME is cash settled, therefor dependent on (an average of) exchange rates, thus sensitive to manipulation & fraud. Institutions don't like that. ICE/Bakkt has it's own price based on real #bitcoin.

— PlanB (@100trillionUSD) September 11, 2019

Chicken Run

Meanwhile, many analysts have already started weighing-in the possibility of a bitcoin price crash. Their technical indicators measure see the cryptocurrency below the $9,000 level, unfazed by Bakkt or any other active market fundamental. Theories such as these are fueling the bias-conflict further as traders continue to wait for a bullish hero to enter a large buying order – or a bearish villain to do the opposite and crash bitcoin.

$BTC – daily candle closed with a strong rejection of intraday highs…Middle BB held support when tested…FIB retrace currently at 38.2% #bitcoin pic.twitter.com/6Bi4DNw76d

— Chonis Trading-

FTG (@BigChonis) September 7, 2019

“Some long/mid-term longs may be concerned about prices crashing,” reasons Alex Krüger, a balanced crypto analyst. “I can’t tell anyone what to do. Can say being concerned is a great way to make a mistake, as it often leads to an emotional exit if the price moves against. Need to have a plan. Reducing size helps in sticking to the plan.”

The post Bakkt Futures’ Launch in Focus as Bitcoin Hints Price Crash appeared first on NewsBTC.

from Cryptocracken Tumblr https://ift.tt/2Aatgg2 via IFTTT

0 notes

Text

Bakkt Futures’ Launch in Focus as Bitcoin Hints Price Crash

The bitcoin market is calm even though it awaits the launch of a very bullish product: a set of physically-delivered futures.

Intercontinental Exchange (ICE), the world’s second-largest exchange by market cap, is going to offer trading of two Bitcoin Futures Contracts, one daily and other monthly, from September 23. The contracts, backed by Atlanta-based digital asset firm Bakkt, have received approval from the Commodity Futures Trading Commission (CFTC). Meanwhile, Bakkt also has gained custodianship rights to customers’ bitcoin following permission from the New York Department of Financial Services (NYDFS).

The event bids to promote bitcoin trading among institutional investors, a class of monies that till now maintains a safe distance from cryptocurrencies because of their unregulated nature. Speculators see the launch of Bakkt futures as a means to attract substantial capital inflows from Wall Street, which would send the bitcoin prices higher.

Bitcoin Investors Feeling Cold-feet

But as the date of the Bakkt launch is nearing, the same speculators are feeling cold-feet. Bitcoin’s volatility has hit its 4-month low going down, as reported by Forbes here, indicating that traders are looking at each other while wondering who among them would make the first move. The uncertainty has resulted in choppy price action – a bias conflict – that gives no hint about the bitcoin’s next trend.

As of this time of writing, bitcoin is trading between a strict range defined by $9,700 and $10,050, still down by at least 8 percent from its weekly top.

According to the famous market theorist PlanB, Bakkt’s launch is not necessarily a bullish event, but it promises the crypto to discover its real market value.

“ICE is offering physically-settled Bitcoin futures through its Bakkt unit. It will act as an exchange, clearinghouse, and settlement authority. ICE BTC futures will create price discovery apart from any cash market influence.”

Yes, esp. because not dependent on spot market rates of exchanges for settlement. CME is cash settled, therefor dependent on (an average of) exchange rates, thus sensitive to manipulation & fraud. Institutions don't like that. ICE/Bakkt has it's own price based on real #bitcoin.

— PlanB (@100trillionUSD) September 11, 2019

Chicken Run

Meanwhile, many analysts have already started weighing-in the possibility of a bitcoin price crash. Their technical indicators measure see the cryptocurrency below the $9,000 level, unfazed by Bakkt or any other active market fundamental. Theories such as these are fueling the bias-conflict further as traders continue to wait for a bullish hero to enter a large buying order – or a bearish villain to do the opposite and crash bitcoin.

$BTC – daily candle closed with a strong rejection of intraday highs…Middle BB held support when tested…FIB retrace currently at 38.2% #bitcoin pic.twitter.com/6Bi4DNw76d

— Chonis Trading-

FTG (@BigChonis) September 7, 2019

“Some long/mid-term longs may be concerned about prices crashing,” reasons Alex Krüger, a balanced crypto analyst. “I can’t tell anyone what to do. Can say being concerned is a great way to make a mistake, as it often leads to an emotional exit if the price moves against. Need to have a plan. Reducing size helps in sticking to the plan.”

The post Bakkt Futures’ Launch in Focus as Bitcoin Hints Price Crash appeared first on NewsBTC.

from CryptoCracken SMFeed https://ift.tt/2Aatgg2 via IFTTT

0 notes

Text

Exploring Forex Trading Scales: Micro, Mini, and Macro for Traders With Funded Traders Global

The blog titled "Forex Trading Scales: Micro Macro and Mini" discusses the different trading scales in the field of Forex trading and their significance in shaping trading strategies. It outlines three main trading scales - micro, mini, and macro - and describes their characteristics and benefits.

Micro Trading: This scale involves trading on a small level, with micro-lot sizes. It's suitable for beginners or those with limited capital. Traders in this category dip their toes into Forex trading, learning the basics without diving deep into risk.

Mini Trading: Positioned between micro and macro, mini trading involves slightly larger trade sizes with mini lots. Traders who have gained some experience in the market but are not yet ready for larger trades can benefit from this scale. It strikes a balance between risk and potential returns.

Macro Trading: This scale is for experienced traders and institutions dealing in larger trade sizes. It requires analyzing macroeconomic trends, global events, and economic indicators. Macro traders engage in substantial trades that can have significant impacts on the market.

The blog also introduces Funded Traders Global, a platform designed to help traders overcome limited capital and risk management challenges. The platform allows traders to prove their skills in a simulated environment and, upon meeting performance criteria, offers the opportunity to trade with a funded account, accessing more capital and potential profits.

The blog delves into each trading scale's advantages, who benefits from them, and how they align with traders' risk appetites and experience levels. It highlights that traders' decisions should be guided by factors such as market volatility, risk tolerance, economic events, and their own capital and expertise. Funded Traders Global is presented as a tool that can empower traders to bridge the gap between their aspirations and financial limitations.

In summary, the blog provides a comprehensive overview of the micro, mini, and macro trading scales in Forex, emphasizing how each scale caters to different traders' needs and goals. It also underscores the role of Funded Traders Global in helping traders navigate these scales effectively.

#Advantages of Macro Trading#Advantages of Micro Trading#and Mini#and Mini Scales#Choosing the Right Scale for You Guide readers on how to choose the appropriate trading scale for their goals and circumstances#economic events#Forex Trading Scales With Micro#FTG#fundamental analysis#Funded Traders Global#Influencing Your Trading Journey#Navigating Micro#Learning and Practice#Long-Term Trends#Low Capital Requirements#Macro#Macro Forex Trading#Macro traders#Macro Trading#market volatility#micro#Micro Forex Trading#Micro traders#Micro Trading#Mini Forex Trading#Mini traders#Mini Trading#News Trading#Risk Management#Strategies of the Masters

1 note

·

View note

Text

Bakkt Futures’ Launch in Focus as Bitcoin Hints Price Crash

The bitcoin market is calm even though it awaits the launch of a very bullish product: a set of physically-delivered futures.

Intercontinental Exchange (ICE), the world’s second-largest exchange by market cap, is going to offer trading of two Bitcoin Futures Contracts, one daily and other monthly, from September 23. The contracts, backed by Atlanta-based digital asset firm Bakkt, have received approval from the Commodity Futures Trading Commission (CFTC). Meanwhile, Bakkt also has gained custodianship rights to customers’ bitcoin following permission from the New York Department of Financial Services (NYDFS).

The event bids to promote bitcoin trading among institutional investors, a class of monies that till now maintains a safe distance from cryptocurrencies because of their unregulated nature. Speculators see the launch of Bakkt futures as a means to attract substantial capital inflows from Wall Street, which would send the bitcoin prices higher.

Bitcoin Investors Feeling Cold-feet

But as the date of the Bakkt launch is nearing, the same speculators are feeling cold-feet. Bitcoin’s volatility has hit its 4-month low going down, as reported by Forbes here, indicating that traders are looking at each other while wondering who among them would make the first move. The uncertainty has resulted in choppy price action – a bias conflict – that gives no hint about the bitcoin’s next trend.

As of this time of writing, bitcoin is trading between a strict range defined by $9,700 and $10,050, still down by at least 8 percent from its weekly top.

According to the famous market theorist PlanB, Bakkt’s launch is not necessarily a bullish event, but it promises the crypto to discover its real market value.

“ICE is offering physically-settled Bitcoin futures through its Bakkt unit. It will act as an exchange, clearinghouse, and settlement authority. ICE BTC futures will create price discovery apart from any cash market influence.”

Yes, esp. because not dependent on spot market rates of exchanges for settlement. CME is cash settled, therefor dependent on (an average of) exchange rates, thus sensitive to manipulation & fraud. Institutions don't like that. ICE/Bakkt has it's own price based on real #bitcoin.

— PlanB (@100trillionUSD) September 11, 2019

Chicken Run

Meanwhile, many analysts have already started weighing-in the possibility of a bitcoin price crash. Their technical indicators measure see the cryptocurrency below the $9,000 level, unfazed by Bakkt or any other active market fundamental. Theories such as these are fueling the bias-conflict further as traders continue to wait for a bullish hero to enter a large buying order – or a bearish villain to do the opposite and crash bitcoin.

$BTC – daily candle closed with a strong rejection of intraday highs…Middle BB held support when tested…FIB retrace currently at 38.2% #bitcoin pic.twitter.com/6Bi4DNw76d

— Chonis Trading-

FTG (@BigChonis) September 7, 2019

“Some long/mid-term longs may be concerned about prices crashing,” reasons Alex Krüger, a balanced crypto analyst. “I can’t tell anyone what to do. Can say being concerned is a great way to make a mistake, as it often leads to an emotional exit if the price moves against. Need to have a plan. Reducing size helps in sticking to the plan.”