#Ewallet Solution Company in Estonia

Explore tagged Tumblr posts

Text

Best Ewallet Solution Company in USA

Run your business, collect payments and leave the rest to us- Providing seamless experiences at the checkout enhances your customer’s overall experience. Grow your business with Digitalewallet Crypto’s secure eWallet devices to tackle every sales opportunity, whether at the counter or on the go. Keep reading to find out the exciting services of our company!

https://digitalewalletcrypto.com/

It’s all about the consumer experience.

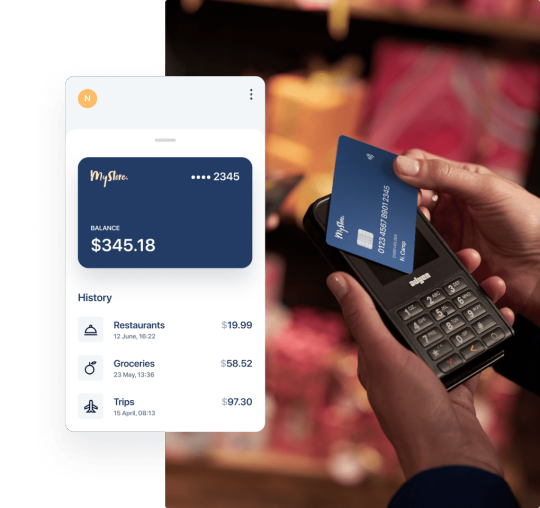

Digital transformation is a game changer in USA. Digital banking and financial products allow hundreds of millions of unbanked consumers to benefit from transacting online within their local context. For more than 10 years we deliver scalable and compliant banking software solutions. We are a single point for scalable end-to-end financial service products, amazingly designed user experience and continuously growing network of integration partners. Our eWallet solution company in USA platform features-

ü Enable Contactless Payments

ü Quicker Payment Experience

ü Superior Security

ü High Impact Interactions

ü Futureproof Payment Technology

We developed a white label eWallet solution that supports secure and straightforward ways of initiating payments. It also makes for businesses of all kinds to create their financial ecosystems, establishing trust and closer relationship with their customers. Our eWallet solution is built on microservice architecture include:

ü Secure two-factor authorization

ü Interactive identity verification

ü Advanced tiered KYC offers a built-in identity verification process that supports multiple countries and clients

ü Airtime purchases in unique digital currency specific to Africa

ü Bill payments

ü Peer-to-peer transfers with QR codes, address book, and payment link transactions

ü International remittances with multi-wallet and multi-currency features augmented with instant currency conversion

ü Branded payment cards

ü Real-time money transfers and currency conversion

ü Multiple currency support

ü Real-time QR code payments

ü Fast and convenient cash agent onboarding

ü Online onboarding of merchants to support both online and in-store transactions

We affect all conceivable sorts of customizations and custom development projects, whether it's an easy branding project or building in new platform features, we are able to deploy dedicated teams to handle the tasks for our clients.

Regional Expertise

We have successfully developed eWallet solution for its clients nationwide. These projects have given us extensive experience in working with digital financial service providers. Such as it has gained us valuable regional knowledge of the services most in demand that cater to the Estonian market. Our eWallet solution company in Estonia offers you the white label eWallet platform- highly scalable, secure, providing unlimited scope for customization, and offer end-to-end delivery.

Why is this degree of personalization important to us? By giving customers what they want, when they want it, on a consistent and meaningful basis. It is these enduring relationships that enable companies to face up to the pressures of a hyper-competitive, ever-evolving world.

· 76% of consumers expect organizations to understand their individual needs;

· 81% of consumers demand improved response time;

· 68% anticipate that organizations will harmonize consumer experiences.

Therefore, we follow a simple- but detailed- roadmap that spells out the different stages of the technology journey. Our highly experienced team develop a detailed picture of what they expect the eWallet to do and achieve.

We are building USA’s fastest growing eWallet system with the help of you. We don't believe security through obscurity, and that we believe established standards, continuous testing, including external penetration tests, collaboration with researchers and have security included in our development process from idea to release.

a) Physical Security

Our data center’s physical security measures a layered security model, including safeguards like custom-designed electronic access cards, alarms, vehicle access barriers, etc. Everything is being monitored 24/7 by high-resolution interior and exterior cameras which will detect and track intruders.

b) Operational Security

Operational security is everything we do at company besides counting on our physical and technical security. For us, operational security is all about empowering our talented employees to make and supply amazing customer experiences while having the ability to see and confirm that everything we do is correct, accurate and in adherence with the regulatory requirements our operation is governed by.

c) Technical Security

As a technology company providing services to customers who trust us with their money, our technical security is crucial to our existence. Technical security breaches could also be exploited at scale. this is often why we invest heavily during this field, starting from where we strategically prefer to run our systems, what security protocols and best practices we follow, to how we implement, test and deploy new features.

To get to know more about our eWallet solution company in USA, visit our website: https://digitalewalletcrypto.com/ Get affordable prices for the services our eWallet solution company in Estonia has to offer. Contact us now: [email protected]

#Ewallet Solution Company in USA#Ewallet Solution Company in Estonia#ewallet platform#Ewallet Services

0 notes

Text

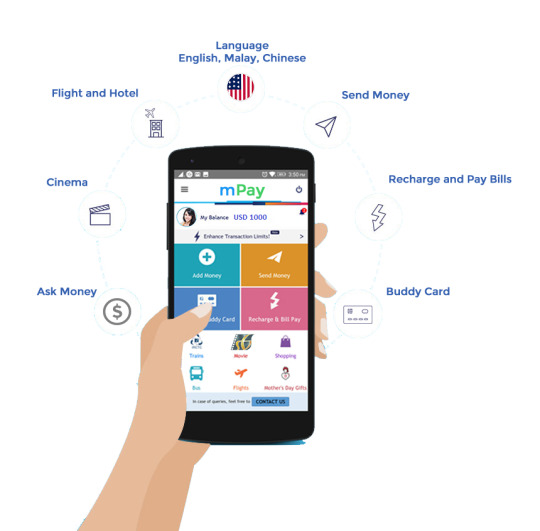

How can mobile banking apps help serve Fintech?

The Finance Industry and banking sector are among the top most heirs of digitalisation. The preface of Banking software provider in Lithuania has added further inflexibility and availability to banking. The ultramodern mobile banking system has changed the hand of Fintech.

It has revolutionised the operation of the finance assiduity by reducing overhead costs and enhancing client experience. Then are some of the points that state how can mobile banking apps help serve Fintech

Mobile Banking Apps give flawless relations And amicable Deals

Mobile banking services have brought a significant shift in the way individualities can handle their finances. It has handed great ease and convenience by allowing easy access from anywhere. Mobile banking software loaded with stoner-friendly features facilitates amicable finance deals. Whether it's allocating finance in finances, pullout of finances, or transfer of plutocrat, any type of finance sale fleetly. Also, the increase in operation of Money Transfer Software Provider in Netherlands deals has shown a growth of around 64.

Mobile Banking Apps Will Help Target Your followership And Ameliorate Services Banking and Finance is a customer- driven assiduity. Experience and commerce play an essential part. fiscal institutions and banks constantly are contending with each other and using client service as a great differentiator.

The mobile banking system has opened doors of openings for these institutions. It has eased better connections with guests. The finance institutions can efficiently reach the target followership and communicate about finance products.

likewise, mobile banking services play an essential part in gathering client perceptivity for service enhancement.The data attained from mobile banking apps give precious information to offer customised services to the target followership.

structure Mobile Banking Apps Can Reduce Cost And Ameliorate perimeters Fiscal institutions are utilising the power of the mobile banking system to convert branch guests to mobile banking guests.

Thereby reducing their cost and perfecting perimeters. The finance institution sees guests saving moment as a prospect for outspoken investment in the future.

Mobile Banking Apps Present New openings in the Lending Space

Mobile banking apps give believable information and client data to fiscal institutions. It's upgrading the functionality of fiscal institutions.The integration of Fintech has opened new avenues to detect new implicit guests. figure Mobile Banking Apps To Serve Underbanked Populations

A significant quantum of the underbanked population still doesn't comprehend the banking system. The preface of mobile banking services and systems is bridging this gap. guests are more likely to use their mobile phones to carry out fiscal deals.

Mobile banking apps are stimulating the growth of fintech by enabling them to explore untapped areas.

THE BOTTOM LINE

Without a doubt, Mobile banking services are the future of finance. They are changing the overall functioning and operations of the finance sector.

Its impact on the customers and target audience is humungous. Hence, modern banks must unfold the fintech trends and incorporate mobile banking services strategically to boost their growth and development.

#Ebanking Solution Provider in London#Banking software provider in Malta#Emoney solution Provider in Malta#Virtual Card Provider in Malta#Card program provide in Birmingham#Co Branding card provider in Netherlands#White Label IBAN account in Italy#Mastercard Provider in Netherlands#Money Transfer Sofware Provider in Malta#ewallet Application Development Company in Estonia

0 notes

Text

About UK Digital Company

UK Digital Company is a boutique digital technology that caters to every business goal.

We understand the need of having easy and functional digital technology for wide audiences. UK Digital Company creates comprehensive merchant-digital and user-friendly solution innovations. Thus, making us a Web Development Company in the UK and provider of Website Development Services.

Now, if you’re looking for a solution that can be aligned with your existing network, then you’ve come to the right place. Aside from that, we offer a solution that is affordable and has partnered with a high-technology framework making us the world’s youngest payment network operation.

Furthermore, our experience in digital technology and development has allowed us to establish a global presence in the USA, Latin America, Caribbean countries, the UK, and European countries. Additionally, we also established our name and reputation in other countries like France, Estonia, Singapore, Thailand, Malaysia, and Myanmar.

Now that you have a good deal of who we are and what we do, you might be curious to know why you should choose UK Digital Company as your partner? UK Digital Company promises rapid delivery, customer satisfaction, agile methodology, houses proficient and skilled developers, and has competitive pricing to name a few of the things you will get from our services and solutions.

Further, we have a wide range of services such as Web Development, Mobile Application, eCommerce, and Virtual Card. UK Digital Company is also big in providing solutions namely Merchant, Global Payment Gateway, Marketplace, ERP System, and eWallets. With us, you can be sure that we are here to provide you with flexible digital technology that’s not only full-service but also a creative digital agency to achieve whatever is your business goal in mind. We are a company that delivers and a company that makes a connection.

Get to know more about us by visiting our website or you can also send us your inquiry by clicking this.

0 notes

Text

Money Transfer Software Provider in United Kingdom

#Money Transfer Software Provider in United Kingdom#ewallet Application Development Company in France#Money Transfer Sofware Provider in Haiti#Mastercard Provider in Berlin#Mastercard Provider in Estonia#White Label IBAN account in Berlin#IBAN account provider in Haiti#Co Branding card provider in Italy#Card program provide in Paris#Virtual Card Provider in Birmingham#Emoney solution Provider in United Kingdom#Banking Transfer Provider solution in Haiti#Ebanking Solution Provider in Paris

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

Emoneywallets of the banking system

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes