#Electric Vehicle Charging Cables Market

Explore tagged Tumblr posts

Text

Electric Vehicle Charging Cables Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Electric Vehicle Charging Cables Market 2025 Size and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Electric Vehicle Charging Cables Market scenario, and feasibility study are the important aspects analyzed in this report.

The Electric Vehicle Charging Cables Market is experiencing robust growth driven by the expanding globally. The Electric Vehicle Charging Cables Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Electric Vehicle Charging Cables Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. The global market size for electric vehicle (EV) charging cables was $516.6 million in 2019 and is projected to reach $1244.3 million by 2027, with a CAGR of 22.1%. during the forecast period.

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/103818

Key Strategies

Key strategies in the Electric Vehicle Charging Cables Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Electric Vehicle Charging Cables Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Electric Vehicle Charging Cables Market.

Major Electric Vehicle Charging Cables Market Manufacturers covered in the market report include:

TE Connectivity (Schaffhausen, Switzerland)

Aptiv (Dublin, Ireland)

Phoenix Contact (Blomberg, Germany)

Coroplast (Wuppertal, Germany)

BESEN Group (Jiangsu, China)

Leoni AG (Nürnberg, Germany)

The adoption percentage of electric vehicles is growing and many countries around the world are investing heavily in research and development activities. Countries such as the Netherlands, France, India, and Canada have launched various drives to promote the popularization of electric vehicles. The government is providing fixed quotas, subsidies, rebates, and tax exemptions to automakers. Even subsidies for purchasing electric cars play an important role for consumers. These aspects have led to a surge in the global production and sales of electric vehicles.

Trends Analysis

The Electric Vehicle Charging Cables Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Electric Vehicle Charging Cables Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Electric Vehicle Charging Cables Market Solutions.

Regions Included in this Electric Vehicle Charging Cables Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Electric Vehicle Charging Cables Market.

- Changing the Electric Vehicle Charging Cables Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Electric Vehicle Charging Cables Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Electric Vehicle Charging Cables Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Electric Vehicle Charging Cables Market?

► Who are the prominent players in the Global Electric Vehicle Charging Cables Market?

► What is the consumer perspective in the Global Electric Vehicle Charging Cables Market?

► What are the key demand-side and supply-side trends in the Global Electric Vehicle Charging Cables Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Electric Vehicle Charging Cables Market?

Table Of Contents:

1 Market Overview

1.1 Electric Vehicle Charging Cables Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

The Impact of Fast-Charging Technology on the EV Charging Cable Market

The global electric vehicle (EV) charging cable market is poised for significant growth, driven by the increasing adoption of electric vehicles and the need for efficient and reliable charging solutions. As the demand for EVs continues to rise, the market for EV charging cables is expected to reach $3.45 billion by 2031, growing at a compound annual growth rate (CAGR) of 18.1% from 2022 to 2031.

Market Trends and Drivers

The EV charging cable market is driven by several key trends and factors. The increasing adoption of electric vehicles, particularly in regions such as Europe and Asia, is a major driver of the market. Governments worldwide are implementing policies to promote the adoption of EVs, which is expected to further boost demand for EV charging cables. Additionally, the development of fast-charging technology and the need for efficient and reliable charging solutions are also driving the market.

Key Players and Market Segmentation

The EV charging cable market is dominated by several key players, including Aptiv, Besen International Group Co., Ltd., BRUGG Group AG, Chengdu Khons Technology Co., Ltd., DYDEN CORPORATION, Guangdong OMG Transmitting Technology Co. Ltd., Leoni AG, Phoenix Contact, Sinbon Electronics, and TE Connectivity. The market is segmented based on power type, application, cable length, shape, charging level, and region. The power type segment includes alternate charging (AC) and direct charging (DC), while the application segment is categorized into private charging and public charging. The cable length segment includes 2–5 meters, 6–10 meters, and above 10 meters, and the shape segment includes straight and coiled.

Regional Analysis

The EV charging cable market is analyzed across several regions, including North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the global EV charging cables market in 2022, with China holding the dominant position. The North American market is expected to grow significantly due to the increasing adoption of EVs and the need for efficient and reliable charging solutions.

Challenges and Opportunities

Despite the significant growth potential of the EV charging cable market, there are several challenges that need to be addressed. High operational costs of EV charging cables and the adoption of wireless EV charging technology are some of the key challenges facing the market. However, the increasing adoption of EVs and the need for efficient and reliable charging solutions are expected to drive the market growth.

Conclusion

The EV charging cable market is poised for significant growth, driven by the increasing adoption of electric vehicles and the need for efficient and reliable charging solutions. The market is dominated by several key players and is segmented based on power type, application, cable length, shape, charging level, and region. The Asia-Pacific region dominated the global EV charging cables market in 2022, and the North American market is expected to grow significantly due to the increasing adoption of EVs and the need for efficient and reliable charging solutions.

#EV Charging Cable Market#electric vehicle charging cables#EV charging solutions#charging cable technology#wireless EV charging#sustainable EV charging#EV infrastructure#charging cable advancements#electric vehicle market#EV cable manufacturers#fast charging cables#recyclable charging cables#universal charging standards#regional EV markets#smart grid EV charging#future of EV charging

0 notes

Text

0 notes

Text

Tesla's Dieselgate

Elon Musk lies a lot. He lies about being a “utopian socialist.” He lies about being a “free speech absolutist.” He lies about which companies he founded:

https://www.businessinsider.com/tesla-cofounder-martin-eberhard-interview-history-elon-musk-ev-market-2023-2 He lies about being the “chief engineer” of those companies:

https://www.quora.com/Was-Elon-Musk-the-actual-engineer-behind-SpaceX-and-Tesla

He lies about really stupid stuff, like claiming that comsats that share the same spectrum will deliver steady broadband speeds as they add more users who each get a narrower slice of that spectrum:

https://www.eff.org/wp/case-fiber-home-today-why-fiber-superior-medium-21st-century-broadband

The fundamental laws of physics don’t care about this bullshit, but people do. The comsat lie convinced a bunch of people that pulling fiber to all our homes is literally impossible — as though the electrical and phone lines that come to our homes now were installed by an ancient, lost civilization. Pulling new cabling isn’t a mysterious art, like embalming pharaohs. We do it all the time. One of the poorest places in America installed universal fiber with a mule named “Ole Bub”:

https://www.newyorker.com/tech/annals-of-technology/the-one-traffic-light-town-with-some-of-the-fastest-internet-in-the-us

Previous tech barons had “reality distortion fields,” but Musk just blithely contradicts himself and pretends he isn’t doing so, like a budget Steve Jobs. There’s an entire site devoted to cataloging Musk’s public lies:

https://elonmusk.today/

But while Musk lacks the charm of earlier Silicon Valley grifters, he’s much better than they ever were at running a long con. For years, he’s been promising “full self driving…next year.”

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

He’s hasn’t delivered, but he keeps claiming he has, making Teslas some of the deadliest cars on the road:

https://www.washingtonpost.com/technology/2023/06/10/tesla-autopilot-crashes-elon-musk/

Tesla is a giant shell-game masquerading as a car company. The important thing about Tesla isn’t its cars, it’s Tesla’s business arrangement, the Tesla-Financial Complex:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#Rat

Once you start unpacking Tesla’s balance sheets, you start to realize how much the company depends on government subsidies and tax-breaks, combined with selling carbon credits that make huge, planet-destroying SUVs possible, under the pretense that this is somehow good for the environment:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

But even with all those financial shenanigans, Tesla’s got an absurdly high valuation, soaring at times to 1600x its profitability:

https://pluralistic.net/2021/01/15/hoover-calling/#intangibles

That valuation represents a bet on Tesla’s ability to extract ever-higher rents from its customers. Take Tesla’s batteries: you pay for the battery when you buy your car, but you don’t own that battery. You have to rent the right to use its full capacity, with Tesla reserving the right to reduce how far you go on a charge based on your willingness to pay:

https://memex.craphound.com/2017/09/10/teslas-demon-haunted-cars-in-irmas-path-get-a-temporary-battery-life-boost/

That’s just one of the many rent-a-features that Tesla drivers have to shell out for. You don’t own your car at all: when you sell it as a used vehicle, Tesla strips out these features you paid for and makes the next driver pay again, reducing the value of your used car and transfering it to Tesla’s shareholders:

https://www.theverge.com/2020/2/6/21127243/tesla-model-s-autopilot-disabled-remotely-used-car-update

To maintain this rent-extraction racket, Tesla uses DRM that makes it a felony to alter your own car’s software without Tesla’s permission. This is the root of all autoenshittification:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

This is technofeudalism. Whereas capitalists seek profits (income from selling things), feudalists seek rents (income from owning the things other people use). If Telsa were a capitalist enterprise, then entrepreneurs could enter the market and sell mods that let you unlock the functionality in your own car:

https://pluralistic.net/2020/06/11/1-in-3/#boost-50

But because Tesla is a feudal enterprise, capitalists must first secure permission from the fief, Elon Musk, who decides which companies are allowed to compete with him, and how.

Once a company owns the right to decide which software you can run, there’s no limit to the ways it can extract rent from you. Blocking you from changing your device’s software lets a company run overt scams on you. For example, they can block you from getting your car independently repaired with third-party parts.

But they can also screw you in sneaky ways. Once a device has DRM on it, Section 1201 of the DMCA makes it a felony to bypass that DRM, even for legitimate purposes. That means that your DRM-locked device can spy on you, and because no one is allowed to explore how that surveillance works, the manufacturer can be incredibly sloppy with all the personal info they gather:

https://www.cnbc.com/2019/03/29/tesla-model-3-keeps-data-like-crash-videos-location-phone-contacts.html

All kinds of hidden anti-features can lurk in your DRM-locked car, protected from discovery, analysis and criticism by the illegality of bypassing the DRM. For example, Teslas have a hidden feature that lets them lock out their owners and summon a repo man to drive them away if you have a dispute about a late payment:

https://tiremeetsroad.com/2021/03/18/tesla-allegedly-remotely-unlocks-model-3-owners-car-uses-smart-summon-to-help-repo-agent/

DRM is a gun on the mantlepiece in Act I, and by Act III, it goes off, revealing some kind of ugly and often dangerous scam. Remember Dieselgate? Volkswagen created a line of demon-haunted cars: if they thought they were being scrutinized (by regulators measuring their emissions), they switched into a mode that traded performance for low emissions. But when they believed themselves to be unobserved, they reversed this, emitting deadly levels of NOX but delivering superior mileage.

The conversion of the VW diesel fleet into mobile gas-chambers wouldn’t have been possible without DRM. DRM adds a layer of serious criminal jeopardy to anyone attempting to reverse-engineer and study any device, from a phone to a car. DRM let Apple claim to be a champion of its users’ privacy even as it spied on them from asshole to appetite:

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

Now, Tesla is having its own Dieselgate scandal. A stunning investigation by Steve Stecklow and Norihiko Shirouzu for Reuters reveals how Tesla was able to create its own demon-haunted car, which systematically deceived drivers about its driving range, and the increasingly desperate measures the company turned to as customers discovered the ruse:

https://www.reuters.com/investigates/special-report/tesla-batteries-range/

The root of the deception is very simple: Tesla mis-sells its cars by falsely claiming ranges that those cars can’t attain. Every person who ever bought a Tesla was defrauded.

But this fraud would be easy to detect. If you bought a Tesla rated for 353 miles on a charge, but the dashboard range predictor told you that your fully charged car could only go 150 miles, you’d immediately figure something was up. So your Telsa tells another lie: the range predictor tells you that you can go 353 miles.

But again, if the car continued to tell you it has 203 miles of range when it was about to run out of charge, you’d figure something was up pretty quick — like, the first time your car ran out of battery while the dashboard cheerily informed you that you had 203 miles of range left.

So Teslas tell a third lie: when the battery charge reached about 50%, the fake range is replaced with the real one. That way, drivers aren’t getting mass-stranded by the roadside, and the scam can continue.

But there’s a new problem: drivers whose cars are rated for 353 miles but can’t go anything like that far on a full charge naturally assume that something is wrong with their cars, so they start calling Tesla service and asking to have the car checked over.

This creates a problem for Tesla: those service calls can cost the company $1,000, and of course, there’s nothing wrong with the car. It’s performing exactly as designed. So Tesla created its boldest fraud yet: a boiler-room full of anti-salespeople charged with convincing people that their cars weren’t broken.

This new unit — the “diversion team” — was headquartered in a Nevada satellite office, which was equipped with a metal xylophone that would be rung in triumph every time a Tesla owner was successfully conned into thinking that their car wasn’t defrauding them.

When a Tesla owner called this boiler room, the diverter would run remote diagnostics on their car, then pronounce it fine, and chide the driver for having energy-hungry driving habits (shades of Steve Jobs’s “You’re holding it wrong”):

https://www.wired.com/2010/06/iphone-4-holding-it-wrong/

The drivers who called the Diversion Team weren’t just lied to, they were also punished. The Tesla app was silently altered so that anyone who filed a complaint about their car’s range was no longer able to book a service appointment for any reason. If their car malfunctioned, they’d have to request a callback, which could take several days.

Meanwhile, the diverters on the diversion team were instructed not to inform drivers if the remote diagnostics they performed detected any other defects in the cars.

The diversion team had a 750 complaint/week quota: to juke this stat, diverters would close the case for any driver who failed to answer the phone when they were eventually called back. The center received 2,000+ calls every week. Diverters were ordered to keep calls to five minutes or less.

Eventually, diverters were ordered to cease performing any remote diagnostics on drivers’ cars: a source told Reuters that “Thousands of customers were told there is nothing wrong with their car” without any diagnostics being performed.

Predicting EV range is an inexact science as many factors can affect battery life, notably whether a journey is uphill or downhill. Every EV automaker has to come up with a figure that represents some kind of best guess under a mix of conditions. But while other manufacturers err on the side of caution, Tesla has the most inaccurate mileage estimates in the industry, double the industry average.

Other countries’ regulators have taken note. In Korea, Tesla was fined millions and Elon Musk was personally required to state that he had deceived Tesla buyers. The Korean regulator found that the true range of Teslas under normal winter conditions was less than half of the claimed range.

Now, many companies have been run by malignant narcissists who lied compulsively — think of Thomas Edison, archnemesis of Nikola Tesla himself. The difference here isn’t merely that Musk is a deeply unfit monster of a human being — but rather, that DRM allows him to defraud his customers behind a state-enforced opaque veil. The digital computers at the heart of a Tesla aren’t just demons haunting the car, changing its performance based on whether it believes it is being observed — they also allow Musk to invoke the power of the US government to felonize anyone who tries to peer into the black box where he commits his frauds.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/28/edison-not-tesla/#demon-haunted-world

This Sunday (July 30) at 1530h, I’m appearing on a panel at Midsummer Scream in Long Beach, CA, to discuss the wonderful, award-winning “Ghost Post” Haunted Mansion project I worked on for Disney Imagineering.

Image ID [A scene out of an 11th century tome on demon-summoning called 'Compendium rarissimum totius Artis Magicae sistematisatae per celeberrimos Artis hujus Magistros. Anno 1057. Noli me tangere.' It depicts a demon tormenting two unlucky would-be demon-summoners who have dug up a grave in a graveyard. One summoner is held aloft by his hair, screaming; the other screams from inside the grave he is digging up. The scene has been altered to remove the demon's prominent, urinating penis, to add in a Tesla supercharger, and a red Tesla Model S nosing into the scene.]

Image: Steve Jurvetson (modified) https://commons.wikimedia.org/wiki/File:Tesla_Model_S_Indoors.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#steve stecklow#autoenshittification#norihiko shirouzu#reuters#you're holding it wrong#r2r#right to repair#range rage#range anxiety#grifters#demon-haunted world#drm#tpms#1201#dmca 1201#tesla#evs#electric vehicles#ftc act section 5#unfair and deceptive practices#automotive#enshittification#elon musk

8K notes

·

View notes

Text

Electric vehicle (EV) charging cable Market 2021 Has Huge Growth In Industry

The Electric vehicle (EV) charging cable market is a growing industry as more people adopt electric vehicles for their daily transportation needs. The market is primarily driven by the increasing demand for EVs, as well as the need for infrastructure to support these vehicles. The global EV charging cable market size was valued at USD 489.6 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 32.5% from 2021 to 2028.

The market is segmented based on the type of connector used, which includes Type 1, Type 2, CCS, CHAdeMO, and Tesla connectors. Type 2 is the most commonly used connector in Europe, while CCS is widely used in the United States. CHAdeMO is popular in Japan, and Tesla connectors are specific to Tesla vehicles.

For Download Free Sample Link Here:-https://www.marketinforeports.com/Market-Reports/Request-Sample/510758

Another factor driving the market growth is the increasing government initiatives and investments to promote the adoption of electric vehicles. For instance, in the United States, the Biden Administration has proposed a $174 billion investment in electric vehicles, including the installation of 500,000 EV charging stations by 2030. Similarly, the European Union has proposed a plan to install 3 million public charging stations by 2030.

The key players in the EV charging cable market include Aptiv PLC, BESEN International Group, Dyden Corporation, Leoni AG, Phoenix Contact, TE Connectivity Ltd., and Yazaki Corporation. These companies are focusing on innovation and expanding their product portfolio to stay competitive in the market. For instance, in 2020, Aptiv PLC introduced a new range of high-performance charging cables for electric vehicles that offer faster charging times and are more durable than traditional cables.

Overall, the electric vehicle charging cable market is expected to continue growing in the coming years as the adoption of electric vehicles continues to increase and the infrastructure to support them expands.

1 note

·

View note

Text

Chinese President Xi Jinping visits Peru this week for the Asia-Pacific Economic Cooperation (APEC) summit, during which he will inaugurate the deep-water port of Chancay, about 45 miles north of Lima. It’s a $3.6 billion project—one of China’s largest infrastructure investments in the region in the past two decades.

It also may be one of the last of its kind.

Upon becoming president in 2013, in an attempt to deepen the so-called going out strategy and find new markets for booming Chinese production, Xi initiated a reform agenda that intensified diplomatic outreach and boosted overseas investment, the capstone of which was the Belt and Road Initiative (BRI).

Big infrastructure contracts were a win-win move: They allowed China to offload excess capacity of steel, labor, and other inputs while providing urgently needed infrastructure to Latin America. Since 2017, 22 countries in Latin America and the Caribbean have formally joined the BRI, utterly transforming China’s relationship with the continent. China is now Latin America’s second-largest trading partner, after only the United States.

But after two decades of growing sway in the region, Beijing is taking a new approach. As it struggles to manage an economic slowdown, a mounting debt burden, and a broken real estate market, Beijing is bringing an end to the era of high-risk, high-cost mega-infrastructure projects in favor of smaller, new frontier investments in cloud computing, 5G technology, renewable energy, artificial intelligence, and electric vehicles.

China has pitched its new strategy to the world as visionary and forward-looking. Its Latin American partners, however, are less convinced.

The significant, long-standing infrastructure gap in Latin America has made leaders hungry for external investment. Whereas the United States and the European Union have been reluctant to put up large sums, China was happy to get involved.

BRI money has funded roads through the jungles of Costa Rica; railways in Bolivia and Argentina; industrial parks and a container port in Trinidad and Tobago; the biggest hydroelectric plant in Ecuador; and the first transoceanic fiber-optic cable directly connecting Asia to South America, stretching from China to Chile, among other projects.

These big infrastructure projects have paralleled increased Chinese investments in soft power and diplomacy. The United States used to be very adept with its Latin American partners, but China has overtaken it, said Benjamin Creutzfeldt, a China scholar.

“The Chinese have become better at engaging through charm offensives with their charismatic ambassadors,” he said. “They learned how to deal with their counterparts effectively.”

But China’s expansion in the region—particularly in hard infrastructure—has come at a cost for Latin America. Chinese companies have been accused of substandard construction practices and corruption in prior big-item investments.

For instance, the Coca Codo Sinclair dam, a hydroelectric rock-fill dam in the jungles of Ecuador, has not stopped making negative headlines since being inaugurated in November 2016. The estimated $3.4 billion project—the largest in Ecuador’s history—was built and financed by China as a flagship BRI project. But by July 2022, more than 17,000 cracks had already splintered across the dam, and many of the top Ecuadorian officials involved in the construction have been imprisoned or sentenced on bribery charges related to the project.

Not only is Ecuador now left with faulty infrastructure, it’s also stuck with crushing amounts of debt. The BRI has shifted China from being Latin America’s ATM to its biggest debt collector. China rivals the World Bank and the Inter-American Development Bank as the biggest creditor in the region and has left Latin America with the highest level of debt service payments in the world, at an estimated 4 percent of regional GDP. According to the research from the Center for Economic Policy Research, the share of Chinese loans to countries in financial distress increased from about 5 percent in 2010 to about 60 percent in 2022.

For its part, Ecuador is attempting to pay back its debt by exporting oil to China at almost an 80 percent discount. But this arrangement could cause problems for China, too, in the long run.

“Supporting these mega-projects, which do not have big returns, in indebted countries, isn’t necessarily a good business strategy,” said Leland Lazarus, the associate director of national security at Florida International University’s Jack D. Gordon Institute for Public Policy.

“China is at the risk of not getting their money back,” said Axel Dreher, a professor at Germany’s Heidelberg University.

After more than two decades of big, ambitious physical infrastructure projects, China has begun to face the music.

Strained economic and political situations on the domestic front have increased pressure to spend less abroad and focus on the country’s internal development needs. Just last week, the Chinese government approved a $1.4 trillion plan to boost the economy by allowing local government to refinance debts.

China is also increasingly wary of infrastructure projects after being criticized for its subpar BRI implementation. AidData, an international development research lab, analyzed more than 13,427 of the initiative’s projects across 165 countries, worth $843 billion, and found that 35 percent had “major implementation problems,” such as scandals, protests, corruption, labor violations, and environmental degradation.

China is still finishing up certain hard infrastructure projects, including the Bogotá Metro rapid transit system in Colombia, but will pursue fewer moving forward. Instead, hungry for cash and eager to de-risk investments while remaining relevant overseas, China has shifted its focus toward new frontier projects—already to great effect.

Wenyi Cai, a Chinese investor and the CEO of Polymath Ventures, a venture studio in Latin America, said that she has seen overwhelming Chinese interest in digital investments, particularly in Mexico and Brazil. Just in 2022, 58 percent of Chinese investments in Latin America and the Caribbean were in these new infrastructure industries, up from about 25 percent in the previous year.

This shift is particularly notable in the telecoms industry. Already, up to 70 percent of Latin America’s 4G-LTE cellular networks are supported by infrastructure from the Chinese tech giant Huawei, which grew by 9 percent in the region in 2022, according to a report from the University of Navarra. The company is also rolling out 5G networks in several countries in the region.

China is also making waves in the electric vehicle industry. In 2022, Chinese firms invested $2.2 billion in the industry—35 percent of all Chinese foreign direct investment in the region that year, according to an Inter-American Dialogue report. In 2023, China emerged as Mexico’s top car supplier, exporting $4.6 billion worth of vehicles, and the Chinese electric vehicle manufacturer BYD is actively exploring factory locations in the country.

Undoubtedly, China’s interest in this supposed technical revolution is economical. For China, the new frontier sectors present less risk, lower operating costs, and faster returns than traditional infrastructure projects in a retrenched post-pandemic world.

“As China has less overall capital to allocate, it tries to do so in a more strategic way,” said Margaret Myers, the director of the Asia and Latin America program at the Inter-American Dialogue.

This, however, has resulted in a huge decrease in funds for Latin America. From 2010 to 2019, China invested an average of $14.2 billion per year in the region. By 2022, however, this amount had dropped to less than half—just $6.4 billion. A similar trend can be observed in loans from China’s top development finance institutions: At its peak in 2010, China lent more than $25 billion in the region, but this dropped to a little more than $1.3 billion per year between 2019 and 2023.

Though infrastructure is no longer the smartest investment strategy, that doesn’t mean the region’s need for it is going anywhere. Luis Alberto Moreno, the former president of the Inter-American Development Bank, told Foreign Policy that there continues to be a large infrastructure deficit in Latin America that is only growing bigger as the region becomes richer and demands more energy, goods, and services.

Non-Chinese development banks, including the World Bank and the Inter-American Development Bank, have already started filling the gap since Chinese lending first dropped in 2015. This includes significant new financing from the Inter-American Development Bank for road improvements last year, with $600 million allocated to Mexico, $480 million to Brazil, and $345 million to Argentina.

But Moreno said that he doubts that the World Bank and the Inter-American Development Bank will be able to fill the void alone. China seems to be the only other option, but it’s not playing ball.

Despite the region finding itself trapped in domestic debt and having been burned by infrastructure projects that did not fulfill time, cost, and quality expectations, a fear nevertheless lingers in Latin America about what it will do without massive inflows of Chinese money.

“There is this sense that it [infrastructure] needs to be done, whether China is the one to do it or not,” Myers said.

Yet, China’s increased focus on new frontier investments could enable Latin American countries to enhance their much-needed digital infrastructure, positioning them to capitalize on automation and the adoption of artificial intelligence. It could also facilitate the region’s participation in a global green transition.

Jesús Seade, Mexico’s ambassador to China, sees the shifting focus toward more innovation-led investment as an opportunity for his country. “It means development—it means helping Mexico climb the value chain,” he told Foreign Policy.

But some worry that the region will become over-reliant on China in these new sectors, just as it did for the big physical infrastructure projects, without improving its own competitiveness in the process. Although some welcome cheap green technologies from China in order to ease the region’s transition to cleaner energy use, concerns remain about Latin American countries not doing enough to bolster their capacity to produce high-value manufacturing goods, harness Chinese technology transfers, and implement robust security measures to safeguard against the misuse of citizens’ data.

The new frontier investments could also pose security threats to Latin American governments and their citizens, including through surveillance, cybersecurity, and intellectual property risks that the region is unprepared to deal with, according to Robert Evan Ellis, a professor of Latin American studies at the U.S. Army War College. He is also concerned about China’s ability to misuse its access and knowledge about operations in key logistics hubs—such as the Panama Canal or the Chancay port—to disrupt access or launch attacks if a conflict were to emerge.

Another concern is the power balance between China and its Latin American partners. According to Marisela Connelly, a professor at the Center for Asian and African Studies at the College of Mexico, China is the one determining the conditions for trade and investment in the region.

“China simply wants Latin American countries to adapt to China’s needs,” Connelly said. She criticized the Mexican government for having “no strategy” and “no clear objectives” in its relationship to China.

Ultimately, the situation raises an important question about what infrastructure Latin America really needs.

“I’m not sure this [less investment in hard infrastructure] is a bad thing,” Evan Ellis said. Ultimately, Latin America has to pay for its infrastructure projects, and China’s shift may save the region from more unviable and expensive infrastructure projects moving forward.

2 notes

·

View notes

Text

Helfinch Introduces Advanced EV Charger Cables for the USA Market

Helfinch, a leading innovator in the lighting and electrical industry, is proud to announce the launch of its latest product line: the advanced EV charger cables specifically designed for the USA market. These cables embody the company’s commitment to quality, innovation, and customer satisfaction, making them one of the best choices for electric vehicle (EV) owners in the United States.

Advanced Features for a Superior Charging Experience

Helfinch’s EV charger cables are packed with the latest features to ensure a reliable and efficient charging experience for all EV users. Here are some of the standout features that make Helfinch EV charger cables a top choice:

1. Durability and All-Weather ProtectionHelfinch EV charger cables are built to withstand the toughest conditions. With the highest Ingress Protection (IP) rating, these cables are dust-tight and protected against powerful water jets, ensuring they perform exceptionally well in any weather condition. Whether it’s rain, snow, or extreme heat, Helfinch cables maintain their integrity and functionality, providing peace of mind to users who need to charge their vehicles outdoors.

2. Smart Charging FeaturesThe smart charging capabilities of Helfinch cables set them apart from the competition. These features allow for efficient energy use, ensuring that your vehicle is charged optimally without overloading the power supply. Smart charging also provides users with the ability to schedule charging times, monitor energy consumption, and receive notifications via a user-friendly app. This level of control and convenience enhances the overall EV ownership experience.

3. Fast Quick ChargingOne of the most critical factors for EV owners is the speed of charging. Helfinch EV charger cables support fast quick charging, significantly reducing the time it takes to charge your vehicle. This feature is particularly beneficial for those who need to recharge their EVs quickly between trips. With Helfinch, you can get back on the road faster, making these cables ideal for both daily commutes and long-distance travel.

4. Extra Long SizesTo accommodate various user needs and charging setups, Helfinch offers its EV charger cables in extra-long sizes of 10, 15, and 20 meters. This range of lengths ensures that no matter where your charging station is located, you will have enough cable to reach your vehicle comfortably. This flexibility makes Helfinch cables suitable for a wide range of residential and commercial charging applications.

5. Multiple Color OptionsUnderstanding the importance of aesthetics and customization, Helfinch provides its EV charger cables in four distinct colors: Yellow, Green, Black, and White. This variety allows customers to choose a color that best matches their personal preference or vehicle color, adding a touch of personalization to their EV charging experience.

Top Selling Variants

Helfinch offers a variety of EV charger cables, each designed to meet different needs and preferences. Our top sellers are:

**NEMA 14–50 Plug with J1772 Connector** This is the most common and versatile option for Level 2 charging in homes. It plugs into a 240V outlet and is compatible with most electric vehicles (EVs) in the US. This variant is highly favored for its reliability and ease of use.

**NEMA 6–50 Plug with J1772 Connector** Another popular option for Level 2 charging, the NEMA 6–50 plug is often used in homes with older electrical systems. It also plugs into a 240V outlet and is compatible with most EVs. This variant is ideal for homes that may not have been updated to the latest electrical standards but still require efficient and effective charging solutions.

**Tesla Compatible Connector** Tesla vehicles use a proprietary connector, but Helfinch offers J1772 to Tesla adapters that allow Tesla owners to use standard Level 2 chargers. This flexibility ensures that Tesla drivers can benefit from the superior quality and features of Helfinch charger cables without any compatibility issues.

Our Additional Features

**Amperage Options** Helfinch understands that different EVs have different charging capabilities. Therefore, we offer both 16A and 32A chargers. This allows users to choose the appropriate amperage based on their vehicle’s specifications, ensuring efficient and safe charging.

**Smart Features** For added convenience, Helfinch cables come with smart features like Wi-Fi connectivity, energy monitoring, and scheduling. These features allow users to monitor their charging sessions, schedule charging times to take advantage of off-peak electricity rates, and receive real-time notifications about their charging status.

Available Exclusively Online

Helfinch has strategically chosen to make these premium EV charger cables available exclusively through online stores, including Amazon. This decision allows the company to reach a broader audience and provide customers with the convenience of shopping from the comfort of their homes. By leveraging the extensive reach and trusted service of Amazon, Helfinch ensures that its customers have easy access to these high-quality products with fast and reliable delivery options.

Why Choose Helfinch EV Charger Cables?

Helfinch has established a strong reputation in the electrical and lighting industry, known for its dedication to innovation, quality, and customer satisfaction. Here are several reasons why choosing Helfinch EV charger cables is a wise investment for any EV owner:

**1. Proven Track Record**With years of experience in developing high-quality electrical products, Helfinch brings its expertise and commitment to excellence to the EV charger cable market. Customers can trust that they are purchasing a product from a reputable company that prioritizes performance and reliability.

**2. Cutting-Edge Technology**Helfinch is always at the forefront of technological advancements. The inclusion of smart charging features and fast charging capabilities in its EV charger cables demonstrates the company’s commitment to integrating the latest technology into its products. This ensures that customers receive the most efficient and convenient charging solutions available.

**3. Exceptional Customer Support**Customer satisfaction is a top priority for Helfinch. The company provides comprehensive support for all its products, including detailed user manuals, online resources, and a dedicated customer service team ready to assist with any questions or concerns. This level of support ensures that customers can enjoy a hassle-free experience from purchase to use.

**4. Environmental Responsibility**Helfinch is committed to sustainability and environmental responsibility. By promoting the use of electric vehicles and providing efficient charging solutions, the company contributes to the reduction of carbon emissions and supports the global shift towards greener transportation options. Helfinch’s EV charger cables are designed to be energy-efficient, helping users minimize their environmental footprint.

**5. Competitive Pricing**Despite the advanced features and high-quality materials used in Helfinch EV charger cables, the company offers these products at competitive prices. This ensures that customers receive excellent value for their investment, making Helfinch a cost-effective choice for premium EV charging solutions.

Our Customer Testimonials

The launch of Helfinch’s EV charger cables has already garnered positive feedback from early adopters. Here are a few testimonials from satisfied customers:

John Murray. — New York, NY “I’ve tried several EV charger cables before, but Helfinch’s cables are by far the best. The durability is outstanding, and the fast charging feature is a game-changer. Plus, the extra-long cable length means I can easily charge my car no matter where I park in my garage.”

Samantha Klein. — Los Angeles, CA“The smart charging features on these cables are fantastic. I love being able to monitor my charging sessions and schedule them to take advantage of lower electricity rates. The app is easy to use, and the notifications are super helpful. Highly recommend!”

Michael Bevan. — Chicago, IL“I purchased the 20-meter cable in yellow, and it’s perfect for my setup. The all-weather protection means I don’t have to worry about the cable getting damaged, even during heavy rain. Great product and excellent value for money.”

Conclusion

Helfinch is setting a new standard in the EV charger cable market with its innovative, durable, and feature-rich products. Designed to meet the needs of modern EV owners, Helfinch’s cables offer unparalleled performance, convenience, and reliability. Available in various lengths and colors, these cables are perfect for any charging setup and aesthetic preference.

By choosing Helfinch, customers are investing in a product backed by a company with a proven track record of quality and innovation. Whether you are a new EV owner or looking to upgrade your current charging equipment, Helfinch EV charger cables provide the best solution for a seamless and efficient charging experience.

Explore the future of EV charging with Helfinch. Visit our online store on Amazon today and join the growing community of satisfied customers who trust Helfinch for their EV charging needs.

2 notes

·

View notes

Text

It looks like a regular Tesla Wall Connector, but like the Magic Dock, it can become an integrated J1772 adapter:

Otherwise, it has all the same specs as Tesla’s regular home charging solution:

Up to 44 miles of range added per hour at 11.5 kW / 48-amp output

Integrated J1772 adapter to conveniently charge any electric vehicle

Auto-sensing handle to open a Tesla charge port

Monitor and manage your charging schedule and usage from the Tesla app

Wi-Fi connectivity for over-the-air updates, remote diagnostics, and access controls

Versatile indoor/outdoor design

Variable amperage configurations depending on installation location

Power-share with up to six Wall Connectors

24-foot cable length

Four-year warranty for residential use(..)

P.S. Tesla is making another very well-thought-out strategic move to strengthen its position in the US car market, offering a cheap and efficient solution for all electric car owners to charge their cars at home. It is quite clear that the legacy automakers with their technically outdated, moreover rather expensive ICE vehicles and compliance EVs are rapidly losing the battle against Tesla...

3 notes

·

View notes

Text

How to Maximize Earnings as a PCO Driver During Winter

Winter, especially around the festive season, offers a fantastic opportunity for PCO drivers to boost their income. With colder temperatures and Christmas celebrations in full swing, many people prefer private transport over walking or relying on public transport. Here's how you can make the most of this busy season while ensuring safety and efficiency.

Why Winter is Lucrative for PCO Drivers

The demand for private hire drivers spikes during the winter months. Cold weather, holiday events, reduced public transport services, and train strikes all contribute to more passengers needing quick and reliable rides. This increased demand often leads to higher fares, making it the perfect time to maximize your earnings. To help you thrive, here are some practical tips:

Perform essential checks on your vehicle, especially if you drive an electric car (EV).

Adopt strategies to enhance your EV range in cold conditions.

Plan your trips to cover high-demand areas.

Implement methods to increase your overall earnings.

Essential Winter Maintenance for EVs

Keeping your vehicle in optimal condition during winter is critical to avoid breakdowns and ensure a smooth driving experience. Follow these tips to prepare your EV for the colder months:

Check Your Lights: Ensure all lights function properly and clean off dirt or road salt, which can accumulate and damage sensors and paintwork.

Monitor Your Battery: Cold weather can reduce battery efficiency. Keep the charge above 20% and use pre-conditioning to warm up the battery while it’s plugged in.

Inspect Tyres: Cold temperatures can decrease tyre pressure, affecting grip and performance. Regularly check pressure and tread depth, which should meet the minimum standard of 1.6mm. Consider winter tyres for better handling in icy conditions.

Maintain Charging Equipment: Ensure your cables and charging ports remain clean and dry to avoid complications.

Clean Windscreen Wipers: Use winter-grade washer fluid to prevent freezing and avoid using wipers to scrape frost, as this can damage the blades.

Update Software: Keep your EV’s software updated to ensure optimal performance during winter.

Tip: Transport for London (TfL) often conducts spot checks at popular locations. Ensure your tyres and other components meet standards to avoid penalties.

Boosting EV Range in Winter

Cold weather can reduce your EV’s range, but adopting these habits can help you drive more efficiently and cover longer distances:

Regenerative Braking: This feature recovers energy during braking, improving battery life, particularly in stop-and-go traffic.

Pre-condition Your Vehicle: Heat the cabin and battery while the car is plugged in to conserve energy.

Eco Mode: This setting limits power output for better efficiency and enhanced control on icy roads.

Smooth Driving: Avoid sudden acceleration or braking to save energy and ensure passenger safety.

Planning Around High-Demand Areas

Winter events draw large crowds, creating plenty of work for PCO drivers. Research festive activities in your city and position yourself near busy venues. Popular locations include:

Winter Markets: Southbank Centre, Hyde Park Winter Wonderland

Christmas Lights: Oxford Street, Regent Street

Ice Skating Rinks: Natural History Museum, Somerset House

Shopping Districts: Westfield London, Carnaby Street

Theatre Shows: West End venues

Keep traffic congestion in mind when selecting trips, and use features like Uber’s ‘Trip Radar’ to identify opportunities more effectively.

Strategies to Increase Your PCO Earnings

Leverage Surge Pricing

Surge pricing occurs when demand exceeds the number of available drivers. Use Uber’s heat map to locate surge zones and prioritize these areas to earn higher fares. Check the ‘Promotions’ tab in the app for additional earning opportunities.

Provide Exceptional Service

Going the extra mile can lead to positive reviews and tips. Consider these small gestures:

Keep your car clean, tidy, and fresh-smelling.

Offer a comfortable experience by adjusting temperature or music to passengers’ preferences.

Play festive music to enhance the holiday spirit.

Use heated seats instead of cabin heating to save energy while keeping passengers warm.

Safety Tips for Winter Driving

Winter conditions require extra caution. Watch for pedestrians in low-light areas and be mindful of slippery roads. Always ensure that your car is prepared for unexpected weather changes.

Final Thoughts

Winter offers a golden opportunity for PCO drivers to boost their income, but preparation and strategy are key. By maintaining your vehicle, planning around high-demand locations, and providing excellent service, you can make the most of the season while keeping yourself and your passengers safe.

About Capital Hire management

Capital Hire Management Ltd. is London's best PCO car rental company, which provides top-notch vehicles and exceptional services to professional drivers like you! If you are looking for affordable car hire for PCO car rental please visit our website https://www.capitalhiremanagement.co.uk/ to explore our latest fleet.

our excellence is validated by driver ratings on Trustpilot. we offer access to new or recent model cars along with comprehensive training and support to enhance your profitability, safety, and overall satisfaction as an Uber driver.

Visit our London Hub located at 56 High Street Wealdstone Harrow HA3 7AF, London, reach out via email to us, or give us a call at 0208426005 to get started.

0 notes

Text

Cables and Connector Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

In the dynamic landscape of the technology industry, the Global Cables and Connector market stands as a cornerstone, interlinking various sectors with its indispensable components. This industry encompasses the production, distribution, and utilization of cables and connectors that facilitate the transmission of data, power, and signals across diverse applications.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2384

Companies

Amphenol Corporation

Molex Inc.

Fujitsu Ltd.

TE Connectivity Limited

Prysmian S.P.A.

3M Company

Nexans

Huawei Technologies Co. Ltd.

Alcatel-Lucent (Nokia Corporation)

Axon Cable S.A.S

AVX Corporation

AMETEK Inc.

HARTING Technology Group

Leoni AG

Aptiv PLC

T𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/cables-and-connectors-market

The Global Cables and Connector market caters to the burgeoning demands of modern connectivity, spanning telecommunications, IT infrastructure, automotive, aerospace, healthcare, and consumer electronics. From the fiber-optic cables underpinning high-speed internet networks to the intricate connectors powering next-generation electronic devices, this sector thrives on innovation and adaptation to meet evolving consumer needs.

In the realm of telecommunications, the future of the Global Cables and Connector market is poised for significant expansion. With the advent of 5G technology and the proliferation of IoT devices, there is a burgeoning requirement for high-bandwidth cables and connectors capable of supporting ultra-fast data transfer rates and low latency communication. Fiber-optic cables, in particular, are anticipated to play a pivotal role in enabling the seamless transmission of massive amounts of data over long distances, thereby revolutionizing connectivity on a global scale.

Moreover, the automotive industry represents another frontier of opportunity for the Global Cables and Connector market. As vehicles become increasingly electrified and autonomous, the demand for specialized cables and connectors for electric powertrains, infotainment systems, and sensor networks is expected to surge. Furthermore, the emergence of electric vehicles (EVs) presents a unique set of challenges and opportunities, driving innovation in cable and connector design to accommodate high-voltage power distribution and rapid charging infrastructure.

In the healthcare sector, the Global Cables and Connector market is poised to witness unprecedented growth, fueled by advancements in medical technology and the proliferation of digital healthcare solutions. From medical imaging equipment to wearable health monitors, the demand for reliable and high-performance cables and connectors is on the rise, facilitating the seamless transmission of vital patient data and diagnostic information.

Additionally, the consumer electronics segment continues to be a major driver of the Global Cables and Connector market. With the proliferation of smartphones, tablets, laptops, and other connected devices, there is an insatiable demand for compact, durable, and high-speed cables and connectors to support the seamless integration of peripherals and accessories.

The Global Cables and Connector market represents a dynamic and multifaceted industry poised for exponential growth across various sectors. As technological advancements continue to reshape the global landscape, the demand for innovative cables and connectors capable of delivering reliable connectivity will remain paramount, driving the evolution of this vital industry.

Global Cables and Connector market is estimated to reach $170,584.4 Million by 2031; growing at a CAGR of 7.7% from 2024 to 2031.

Contact Us:

+1 214 613 5758

#CablesandConnector#CablesandConnectormarket#CablesandConnectorindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Link

0 notes

Text

EV Charging Station Raw Materials Market to be Worth $8.1 Billion by 2031

Meticulous Research®—a leading global market research company, published a research report titled, ‘EV Charging Station Raw Materials Market by Material Type (Metals & Alloys (Stainless Steel, Aluminum, Copper), Polymers (PC Resins, Elastomers, TPU)), Application (Cords, Displays), Charging Type, and Geography—Global Forecast to 2031.’

According to this latest publication from Meticulous Research®, the global EV charging station raw materials market is projected to reach $8.1 billion by 2031, at a CAGR of 35.6% from 2024–2031. In terms of volume, the market is expected to reach 1,09,248.5 metric tons by 2031, at a CAGR of 12.7% from 2024–2031.The growth of the EV charging station raw materials market is driven by supportive government policies for establishing EV charging stations, increasing adoption of EVs, and increasing initiatives by private companies for deploying EV charging infrastructure. However, the potential shortfall in mining capabilities and the environmental effects of illegal mining in ecologically sensitive regions restrain the growth of this market.

Furthermore, the increasing adoption of electric mobility in emerging economies is expected to generate growth opportunities for the stakeholders in this market. However, the highly vulnerable supply chain is a major challenge impacting the growth of the EV charging station raw materials market.

The global EV charging station raw materials market is segmented by material type (metals & alloys (copper, stainless steel, carbon steel, aluminum, nickel, titanium, chrome, other metals & alloys), polymers (thermoplastic polyurethanes, polycarbonate blends, polyurethanes, elastomers, polycarbonate resins)), application (cords, internal wiring, enclosures, connector guns, thermal switches, displays, flexible conduits, electric circuit breakers, energy meters and timers, cable hangers, nylon glands/lock nuts, charger plug holsters, other applications), charging type (level 2 charging, DC fast-charging, level 1 charging). The study also evaluates industry competitors and analyzes the market at the regional and country levels.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5200

Based on material type, the global EV charging station raw materials market is segmented into metals & alloys and polymers. In 2024, the metals & alloys segment is expected to account for the larger share of over 60% of the global EV charging station raw materials market. This segment’s large market share can be attributed to the surge in electric vehicle adoption, increasing investments and initiatives by electric mobility stakeholders to deploy wireless EV charging systems, and increasing government initiatives aimed at promoting the use of EVs. Metals and alloys possess the essential physical and aesthetic properties necessary for manufacturers to meet design and operational standards for electric vehicles and charging stations at optimal prices. Among these, stainless steel, aluminum, copper, nickel, and titanium are the most utilized raw materials within the electric mobility ecosystem.

However, the polymer segment is projected to register a higher CAGR during the period. This growth is attributed to the rising demand for various polymers used in EV charging stations, coupled with the increasing focus on sustainability in sourcing materials. Polymers are utilized for making enclosures, cable coatings, flexible conduits, plug holsters, connectors, and displays for EV charging stations. These lightweight materials offer excellent durability and heat resistance while being easily moldable into various shapes and sizes.

Based on application, the global EV Charging Station Raw Materials market is segmented into cords, connector guns, enclosures, charger plug holsters, nylon glands/lock nuts, electric circuit breakers, energy meters and timers, internal wiring, flexible conduits, thermal switches, cable hangers, displays, and other applications. In 2024, the cords segment is expected to account for the largest share of over 61% of the global EV charging station raw materials market. This segment’s large market share can be attributed to the frequent replacement of EV charging station cords due to their low operational lifespan, the global surge in EV adoption, the rising demand for high-power charging (HPC) cables, and technological advancements in EV charging cables, including innovations like liquid-cooling.

However, the connector guns segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by several factors, including the rising demand for DC fast-charging stations in European countries and the U.S., the rising adoption of electric mobility in emerging economies, and the growing initiatives by governments in countries like India, Thailand, Singapore, and other Southeast Asian nations aimed at accelerating the deployment of EV charging infrastructure and foster the development of an EV ecosystem, including the manufacturing of Electric Vehicle Supply Equipment (EVSE) components.

Based on charging type, the global EV Charging Station Raw Materials market is segmented into Level 1 charging, Level 2 charging, and DC fast-charging. In 2024, the Level 2 charging segment is expected to account for the largest share of over 85% of the global EV charging station raw materials market.

However, the DC fast-charging segment is projected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to increasing government initiatives aimed at installing fast-charging stations, rebates offered on the purchase of DC fast-charging stations, rising investments from automakers in the development of DC fast-charging station infrastructure to support their long-range battery-electric vehicles, and the superior charging speed provided by DC fast chargers compared to Level 1 and Level 2 charging stations.

Based on geography, the EV Charging Station Raw Materials market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of over 59% of the global EV charging station raw materials market. Asia-Pacific’s significant market share can be attributed to the growing demand for EVs in countries such as China and Japan and rising government initiatives to reduce greenhouse gas emissions. Additionally, electrification presents various opportunities across the value chain. For economies with well-established automotive manufacturing hubs like Indonesia and Thailand, it offers opportunities to expand their EV and charging station production. Moreover, it allows less developed economies to advance their automotive manufacturing capabilities. Moreover, the market in Asia-Pacific is projected to record the highest CAGR of over 38% during the forecast period.

Key Players

The key players operating in the EV charging station raw materials market are Ryerson Holding Corporation (U.S.), DOMO Chemicals GmbH (Germany), DuPont de Nemours, Inc. (U.S.), SABIC (Saudi Arabia), BASF SE (Germany), thyssenkrupp AG (Germany), Covestro AG (Germany), Evonik Industries AG (Germany), POSCO (South Korea), Trinseo S.A. (U.S.), Celanese Corporation (U.S.), and Lanxess AG (Germany).

Complete Report Here : https://www.meticulousresearch.com/product/ev-charging-station-raw-materials-market-5200

Key Questions Answered in the Report:

What are the high-growth market segments in terms of the material type, application, and charging type?

What is the historical market size for the global EV charging station raw materials market?

What are the market forecasts and estimates for 2024–2031?

What are the major drivers, restraints, opportunities, challenges, and trends in the global EV charging station raw materials market?

Who are the major players in the global EV charging station raw materials market, and what are their market shares?

What is the competitive landscape like?

What are the recent developments in the global EV charging station raw materials market?

What are the different strategies adopted by major market players?

What are the trends and high-growth countries?

Who are the local emerging players in the global EV charging station raw materials market, and how do they compete with other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

0 notes

Text

Wire & Cable Market Growth and Status Explored in a New Research Report 2034

The Global Wire and Cable Market is expected to increase at a compound annual growth rate (CAGR) of 3.8% between 2024 and 2034. Based on an average growth pattern, the market is expected to reach USD 302.35 billion in 2034. In 2024, the worldwide wire and cable industry is projected to generate USD 233.59 billion in revenue.

The global wire and cable market plays a crucial role in powering industries, infrastructures, and modern technology. From telecommunications and energy transmission to consumer electronics, wires and cables are vital components ensuring seamless connectivity, data transfer, and power distribution. The market has witnessed significant growth due to the increasing demand for renewable energy, smart grids, and high-speed data networks.

Get a Sample Copy of Report, Click Here: https://wemarketresearch.com/reports/request-free-sample-pdf/wire-and-cable-market/1611

Wire & Cable Market Drivers:

Rapid Urbanization & Industrialization: The demand for power infrastructure is increasing as urban areas expand and industries grow.

Renewable Energy Expansion: Wind and solar energy projects require specialized cables for efficient energy transmission.

Growing Demand for High-Speed Data Transmission: The rise in internet penetration and data consumption fuels the need for advanced fiber optic cables.

Automotive Sector Transformation: The shift toward electric vehicles (EVs) drives demand for specialized wires and cables in EV batteries and charging infrastructure.

Wire & Cable Market Restraints:

Fluctuating Raw Material Prices: The cost of copper and aluminum, essential components for cables, is volatile, affecting production costs.

Environmental Regulations: Stricter regulations on materials and manufacturing processes may pose challenges to manufacturers.

Wire & Cable Market Opportunities:

Adoption of Smart Grids: With increasing investments in smart cities and smart grids, demand for advanced power cables is growing.

Technological Advancements: Development of lightweight, durable, and high-capacity cables offers new growth avenues.

Key Industry Challenges

Counterfeit Products The rise of counterfeit cables, especially in developing countries, affects product reliability and safety, posing a challenge to reputable manufacturers.

Complex Regulatory ComplianceDifferent countries have varying standards for wire and cable manufacturing, making it difficult for companies to comply with multiple regulatory frameworks.

Supply Chain DisruptionThe COVID-19 pandemic and geopolitical tensions have disrupted the global supply chain, leading to raw material shortages and price fluctuations.

Wire & Cable Market Segmentation,

By Type:

Power Cables

Communication Cables

Specialty Cables

By Voltage:

Low Voltage

Medium Voltage

High Voltage

By End-Use Industry:

Energy & Power

Telecommunications

Building & Construction

Automotive

Aerospace

Key companies profiled in this research study are,

The Global Wire & Cable Market is dominated by a few large companies, such as

Prysmian Group

Southwire Company, LLC

Nexans

Prysmian Group

Leoni AG

Sumitomo Electric Industries, Ltd.

Furukawa Electric Co., Ltd.

LS Cable & System Ltd.

Incab

Kabel Deutschland GmbH

Turktelekom

Belden Inc.

Amphenol Corporation

Helukabel GmbH

Nexans Cabling Solutions

Wire & Cable Industry: Regional Analysis

North America: Driven by the expansion of renewable energy projects and modernization of infrastructure.

Europe: Focus on green energy initiatives and smart grid development fuels the wire & cable market.

Asia-Pacific:The largest market due to rapid industrialization, urban development, and increasing power demand in countries like China and India.

Middle East & Africa:Investments in power generation and oil & gas sectors drive growth in this region.

Conclusion

The global wire & cable market is a cornerstone of modern infrastructure, facilitating energy transmission, data connectivity, and industrial automation. With the rising demand for renewable energy, high-speed internet, and smart technologies, the market is on a trajectory of sustained growth. Key innovations in eco-friendly, fire-resistant, and high-capacity cables are reshaping the industry landscape. Furthermore, as investments in smart grids, electric vehicles, and advanced communication networks surge, the wire & cable market will continue to expand, offering immense opportunities for manufacturers and suppliers. Strategic advancements and technological developments will be critical in ensuring that the industry keeps pace with evolving global demands.

Frequently Asked Questions

What is the market size of Wire & Cable Market in 2024?

What is the growth rate for the Wire & Cable Market?

Which are the top companies operating within the market?

Which region dominates the Wire & Cable Market?

0 notes

Link

#anti-theft#ChargePoint#chargingstations#electricvehicles#EV#EVinfrastructure#innovation#sustainability

0 notes

Text

Methods of Implementing DC PLC Protocols

DC PLC communication mainly controls and monitors the condition of solar panels and energy storage systems. Additionally, DC PLC technologies are applied in industrial settings to supply power to electric motors and control them using a single pair of wires. All these applications suggest that the units responsible for communication over the power line are typically integrated into the corresponding devices (solar panel controllers, machines, and robots). Therefore, many automation system developers must understand how PLC protocols over DC power lines are implemented.

G3-PLC

The G3-PLC protocol is maintained by the international organization G3-Alliance.

Chipsets for this protocol generally comprise two microchips: an analog device for interfacing with the transmission line and a specialized microcontroller (SoC). In addition to signal processing, the microcontroller also handles encryption of the data transmitted over the line. The chipset may include a third chip responsible for converting the G3-PLC signal to one of the wireless protocols and back. Typically, this is the G3-Hybrid protocol designed for wireless networks to work alongside PLC. This protocol uses the 868 and 915 MHz frequency bands (which are not allowed for use in all countries).

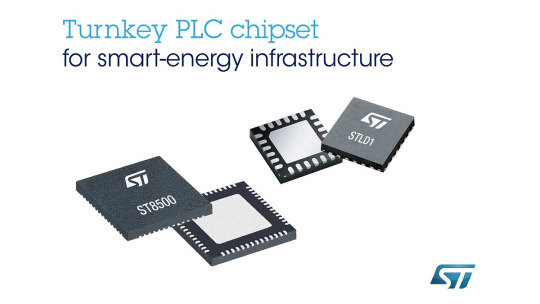

This is an example of a G3-PLC chipset from STMicroelectronics: on the left is the microcontroller, and on the right is the analog interface chip.

The chipsets and their firmware must be certified by the G3-Alliance to bear the G3-PLC label. However, such certification does not negate the need to certify G3-PLC solutions with national communications authorities if required by local regulations.

At least three manufacturers of G3-PLC chipsets are known: Maxim Integrated (a division of the US-based Analog Devices), STMicroelectronics (a European company headquartered in the Netherlands), and Vertexcom Technologies (China).

PLC-Lite

The implementation of this protocol is governed by TI's internal documents. The TMS320F28035 universal signal processor is used for signal processing. In addition, the receiver and transmitter must include the AFE031 line interface chip. The chipset also includes execution devices LM34910 and TPS62170.

IEEE 2847-2021

At the time of writing, a South Korean startup was producing devices supporting IEEE 2847-2021 (HPDS-PLC); the protocol is used in an LED lighting controller and a servo drive. Information about the components used for their development is not publicly available.

Data Transmission from Vehicle Batteries Sensors

A new technology that optimizes electric vehicle charging based on the battery's parameters and its wear level. Wireless sensors are installed on the battery. The wires inside the vehicle through which the charging current flows act as antennas. The signal passes through the electric vehicle charging connector. It continues to propagate along the charging cable as a guided medium. This solves the problem caused by the inability of radio waves to pass through the vehicle's metal body. A transceiver is connected to the cable at the charging station.

This solution uses one of the wireless protocols from the IEEE 802.15.4 family. The most widespread and cost-effective in this family is the Zigbee protocol. Therefore, it makes sense to use a chipset specifically for this protocol. Zigbee uses the 2.4 GHz band, and the frequency data transmission occurs along the charging station's cable. It should be noted that this solution is only possible for DC charging because, in this mode, the wires from the charging connector go directly to the battery.

Is software implementation of PLC algorithms possible?

For G3-PLC, using a general-purpose processor instead of a specialized microcontroller would require more chips than just two. Large production volumes and significant market competition produce relatively low prices for G3-PLC chipsets. These chips are manufactured across different regions—America, Europe, and Asia—ensuring a diversified supply. Therefore, developing a custom G3-PLC solution using general-purpose chips is not economically viable.

In PLC-Lite, a different company's signal processor can be used instead of TI's. However, new firmware would need to be written for it, which is quite costly. The TMS320F28035 is well protected from reverse engineering, so third parties cannot read the firmware stored in its memory.

No specialized chips are being produced yet for the IEEE 2847-2021 protocol, so its signal-processing algorithms must be implemented through the software on general-purpose microcontrollers.