#E&P company in India

Explore tagged Tumblr posts

Text

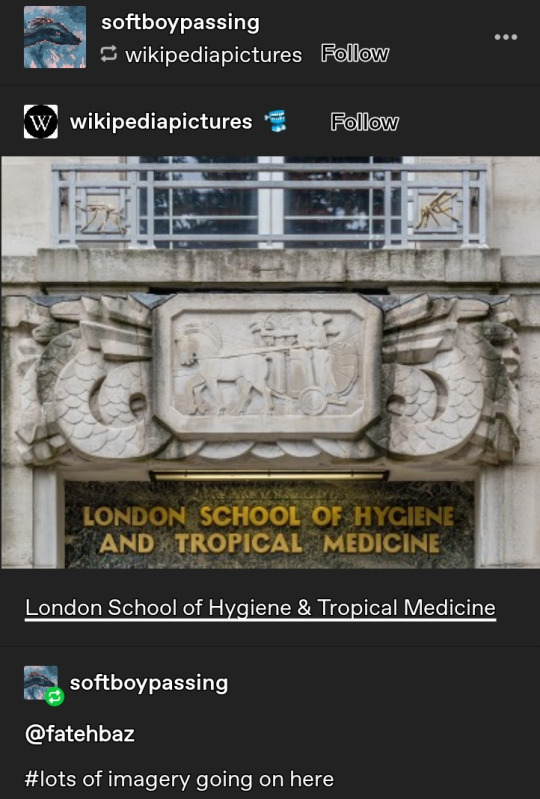

"defending civilization against bugs"

lol the mosquito sculpture

see Pratik Chakrabarti's Medicine and Empire: 1600-1960 (2013) and Bacteriology in British India: Laboratory Medicine and the Tropics (2012)

---

Sir Ronald Ross had just returned from an expedition to Sierra Leone. The British doctor had been leading efforts to tackle the malaria that so often killed English colonists in the country, and in December 1899 he gave a lecture to the Liverpool Chamber of Commerce [...]. [H]e argued that "in the coming century, the success of imperialism will depend largely upon success with the microscope."

Text by: Rohan Deb Roy. "Decolonise science - time to end another imperial era." The Conversation. 5 April 2018.

---

---

---

[A]s [...] Diane Nelson explains: The creation of transportation infrastructure such as canals and railroads, the deployment of armies, and the clearing of ground to plant tropical products all had to confront [...] microbial resistance. The French, British, and US raced to find a cure for malaria [...]. One French colonial official complained in 1908: “fever and dysentery are the ‘generals’ that defend hot countries against our incursions and prevent us from replacing the aborigines that we have to make use of.” [...] [T]ropical medicine was assigned the role of a “counterinsurgent field.” [...] [T]he discovery of mosquitoes as malaria and yellow fever carriers reawakened long-cherished plans such as the construction of the Panama Canal (1904-1914) [...]. In 1916, the director of the US Bureau of Entomology and longtime general secretary of the American Association for the Advancement of Science rejoiced at this success as “an object lesson for the sanitarians of the world” - it demonstrated “that it is possible for the white race to live healthfully in the tropics.” [...] The [...] measures to combat dangerous diseases always had the collateral benefit of social pacification. In 1918, [G.V.], president of the Rockefeller Foundation, candidly declared: “For purposes of placating primitive and suspicious peoples, medicine has some decided advantages over machine guns." The construction of the Panama Canal [...] advanced the military expansion of the United States in the Caribbean. The US occupation of the Canal Zone had already brought racist Jim Crow laws [to Panama] [...]. Besides the [...] expansion of vice squads and prophylaxis stations, during the night women were picked up all over the city [by US authorities] and forcibly tested for [...] diseases [...] [and] they were detained in something between a prison and hospital for up to six months [...] [as] women in Panama were becoming objects of surveillance [...].

Text by: Fahim Amir. "Cloudy Swords." e-flux Journal Issue #115. February 2021.

---

---

---

Richard P. Strong [had been] recently appointed director of Harvard’s new Department of Tropical Medicine [...]. In 1914 [the same year of the Canal's completion], just one year after the creation of Harvard’s Department of Tropical Medicine, Strong took on an additional assignment that cemented the ties between his department and American business interests abroad. As newly appointed director of the Laboratories of the Hospitals and of Research Work of United Fruit Company, he set sail in July 1914 to United Fruit plantations in Cuba, Guatemala, Honduras, Costa Rica, and Panama. […] As a shareholder in two British rubber plantations, [...] Strong approached Harvey Firestone, chief executive of the tire and rubber-processing conglomerate that bore his name, in December 1925 with a proposal [...]. Firestone had negotiated tentative agreements in 1925 with the Liberian government for [...] a 99-year concession to optionally lease up to a million acres of Liberian land for rubber plantations. [...]

[I]nfluenced by the recommendations and financial backing of Harvard alumni such as Philippine governor Gen. William Cameron Forbes [the Philippines were under US military occupation] and patrons such as Edward Atkins, who were making their wealth in the banana and sugarcane industries, Harvard hired Strong, then head of the Philippine Bureau of Science’s Biological Laboratory [where he fatally infected unknowing test subject prisoners with bubonic plague], and personal physician to Forbes, to establish the second Department of Tropical Medicine in the United States [...]. Strong and Forbes both left Manila [Philippines] for Boston in 1913. [...] Forbes [US military governor of occupied Philippines] became an overseer to Harvard University and a director of United Fruit Company, the agricultural products marketing conglomerate best known for its extensive holdings of banana plantations throughout Central America. […] In 1912 United Fruit controlled over 300,000 acres of land in the tropics [...] and a ready supply of [...] samples taken from the company’s hospitals and surrounding plantations, Strong boasted that no “tropical school of medicine in the world … had such an asset. [...] It is something of a victory [...]. We could not for a million dollars procure such advantages.” Over the next two decades, he established a research funding model reliant on the medical and biological services the Harvard department could provide US-based multinational firms in enhancing their overseas production and trade in coffee, bananas, rubber, oil, and other tropical commodities [...] as they transformed landscapes across the globe.

Text by: Gregg Mitman. "Forgotten Paths of Empire: Ecology, Disease, and Commerce in the Making of Liberia's Plantation Economy." Environmental History, Volume 22, Number 1. January 2017. [Text within brackets added by me for clarity and context.]

---

---

---

[On] February 20, 1915, [...] [t]o signal the opening of the Panama-Pacific International Exposition (PPIE), [...] [t]he fair did not officially commence [...] until President Wilson [...] pressed a golden key linked to an aerial tower [...] whose radio waves sparked the top of the Tower of Jewels, tripped a galvanometer, [...] swinging open the doors of the Palace of Machinery, where a massive diesel engine started to rotate. [...] [W]ith lavish festivities [...] nineteen million people has passed through the PPIE's turnstiles. [...] As one of the many promotional pamphlets declared, "California marks the limit of the geographical progress of civilization. For unnumbered centuries the course of empire has been steadily to the west." [...] One subject that received an enormous amount of time and space was [...] the areas of race betterment and tropical medicine. Indeed, the fair's official poster, the "Thirteenth Labor of Hercules," [the construction of the Panama Canal] symbolized the intertwined significance of these two concerns [...]. [I]n the 1910s public health and eugenics crusaders alike moved with little or no friction between [...] [calls] for classification of human intelligence, for immigration restriction, for the promotion of the sterilization and segregation of the "unfit," [...]. It was during this [...] moment, [...] that California's burgeoning eugenicist movement coalesced [...]. At meetings convened during the PPIE, a heterogenous group of sanitary experts, [...] medical superintendents, psychologists, [...] and anthropologists established a social network that would influence eugenics on the national level in the years to come. [...]

In his address titled "The Physician as Pioneer," the president-elect of the American Academy of Medicine, Dr. Woods Hutchinson, credited the colonization of the Mississippi Valley to the discovery of quinine [...] and then told his audience that for progress to proceed apace in the current "age of the insect," the stringent sanitary regime imposed and perfected by Gorgas in the Canal Zone was the sine qua non. [...]

Blue also took part in the conference of the American Society for Tropical Medicine, which Gorgas had cofounded five years after the annexation of Cuba, Puerto Rico, and the Philippines. Invoking the narrative of medico-military conquest [...], [t]he scientific skill of the United States was also touted at the Pan-American Medical Congress, where its president, Dr. Charles L. Reed, delivered a lengthy address praising the hemispheric security ensured by the 1823 Monroe Doctrine and "the combined genius of American medical scientists [...]" in quelling tropical diseases, above all yellow fever, in the Canal Zone. [...] [A]s Reed's lecture ultimately disclosed, his understanding of Pan-American medical progress was based [...] on the enlightened effects of "Aryan blood" in American lands. [...] [T]he week after the PPIE ended, Pierce was ordered to Laredo, Texas, to investigate several incidents of typhus fever on the border [...]. Pierce was instrumental in fusing tropical medicine and race betterment [...] guided by more than a decade of experience in [...] sanitation in Panama [...]. [I]n August 1915, Stanford's chancellor, David Starr Jordan [...] and Pierce were the guests of honor at a luncheon hosted by the Race Betterment Foundation. [...] [At the PPIE] [t]he Race Betterment booth [...] exhibit [...] won a bronze medal for "illustrating evidences and causes of race degeneration and methods and agencies of race betterment," [and] made eugenics a daily feature of the PPIE. [...] [T]he American Genetics Association's Eugenics Section convened [...] [and] talks were delivered on the intersection of eugenics and sociology, [...] the need for broadened sterilization laws, and the medical inspection of immigrants [...]. Moreover, the PPIE fostered the cross-fertilization of tropical medicine and race betterment at a critical moment of transition in modern medicine in American society.

Text by: Alexandra Minna Stern. Eugenic Nation: Faults and Frontiers of Better Breeding in Modern America. Second Edition. 2016.

#literally that post i made earlier today about frustration of seeing the same colonial institutions and leaders showing up in every story#about plantations and forced labor my first draft i explicitly mentioned the harvard school tropical medicine and kew royal botanic garden#abolition#ecology#imperial#colonial#bugs#indigenous#multispecies#civilization vs bugs

233 notes

·

View notes

Note

original anon here tysm for the recs ! if the marxist frameworks was too limiting im also completely fine w general postcolonial botany readings on the topic :0

A Spiteful Campaign: Agriculture, Forests, and Administering the Environment in Imperial Singapore and Malaya (2022). Barnard, Timothy P. & Joanna W. C. Lee. Environmental History Volume: 27 Issue: 3 Pages: 467-490. DOI: 10.1086/719685

Planting Empire, Cultivating Subjects: British Malaya, 1786–1941 (2018). Lynn Hollen Lees

The Plantation Paradigm: Colonial Agronomy, African Farmers, and the Global Cocoa Boom, 1870s--1940s (2014). Ross, Corey. Journal of Global History Volume: 9 Issue: 1 Pages: 49-71. DOI: 10.1017/S1740022813000491

Cultivating “Care”: Colonial Botany and the Moral Lives of Oil Palm at the Twentieth Century’s Turn (2022). Alice Rudge. Comparative Studies in Society and History Volume: 64 Issue: 4 Pages: 878-909. DOI: 10.1017/S0010417522000354

Pacific Forests: A History of Resource Control and Contest in Solomon Islands, c. 1800-1997 (2000). Bennett, Judith A.

Thomas Potts of Canterbury: Colonist and Conservationist (2020). Star, Paul

Colonialism and Green Science: History of Colonial Scientific Forestry in South India, 1820--1920 (2012). Kumar, V. M. Ravi. Indian Journal of History of Science Volume: 47 Issue 2 Pages: 241-259

Plantation Botany: Slavery and the Infrastructure of Government Science in the St. Vincent Botanic Garden, 1765–1820 (2021). Williams, J'Nese. Berichte zur Wissenschaftsgeschichte Volume: 44 Issue: 2 Pages: 137-158. DOI: 10.1002/bewi.202100011

Angel in the House, Angel in the Scientific Empire: Women and Colonial Botany During the Eighteenth and Nineteenth Centuries (2020). Hong, Jiang. Notes and Records: The Royal Society Journal of the History of Science Volume: 75 Issue: 3 Pages: 415-438. DOI: 10.1098/rsnr.2020.0046

From Ethnobotany to Emancipation: Slaves, Plant Knowledge, and Gardens on Eighteenth-Century Isle de France (2019). Brixius, Dorit. History of Science Volume: 58 Issue: 1 Pages: 51-75. DOI: 10.1177/0073275319835431

African Oil Palms, Colonial Socioecological Transformation and the Making of an Afro-Brazilian Landscape in Bahia, Brazil (2015). Watkins, Case. Environment and History Volume: 21 Issue: 1 Pages: 13-42. DOI: 10.3197/096734015X14183179969700

The East India Company and the Natural World (2015). Ed. Damodaran, Vinita; Winterbottom, Anna; Lester, Alan

Colonising Plants in Bihar (1760-1950): Tobacco Betwixt Indigo and Sugarcane (2014). Kerkhoff, Kathinka Sinha

Science in the Service of Colonial Agro-Industrialism: The Case of Cinchona Cultivation in the Dutch and British East Indies, 1852--1900 (2014). Hoogte, Arjo Roersch van der & Pieters, Toine. Studies in History and Philosophy of Science Part C: Studies in History and Philosophy of Biological and Biomedical Sciences Volume: 47 Issue: Part A Pages: 12-22

Trading Nature: Tahitians, Europeans, and Ecological Exchange (2010). Newell, Jennifer

The Colonial Machine: French Science and Overseas Expansion in the Old Regime (2011). McClellan, James E. & Regourd, François

Colonial Botany: Science, Commerce, and Politics in the Early Modern World (2005). Ed. Schiebinger, Londa L. & Swan, Claudia

Plants and Empire: Colonial Bioprospecting in the Atlantic World (2004). Schiebinger, Londa L.

94 notes

·

View notes

Text

How to Address Non-Refund Issues with Facebook India

Grievance Status for registration number : DCOYA/E/2024/0007285Grievance Concerns ToName Of ComplainantYogi M. P. SinghDate of Receipt02/12/2024Received By Ministry/DepartmentCorporate AffairsGrievance DescriptionCorporate Affairs >> Investors Greivance >> Non-Refund of application money Complete and Correct name of the company : Facebook IndiaCIN : 06AABCF5150G1ZZState : ROC Delhi———————–Most…

#Cheating by Facebook India#Corruption in working of Facebook India#Facebook India#india#law#news#politics#technology

7 notes

·

View notes

Text

incoming rant: the robotification of women

teri baaton mein aisa uljha jiya (2024) is among the latest movies in the genre of science fiction romance. it reminded me of an old itv show bahu hamari rajnikant (2016) , while i wasn't an avid watcher of the latter, i knew of it's existence. why did it remind of that particular sitcom? well, mainly because of the comedy. but it also reminded me of similar themes in english movies like ex machina (2015), wifelike (2022), archive (2020) and her (2013), which is surely a bit far fetched considering that in her, the ai never had a body. only a voice.

here, i think it's impertinent to also acknowledge male robots in indian cinema, like chitti from robot/enthiran (2010) and g.one from ra.one (2011) even though he wasn't an actual robot? i don't know if he classifies as one. so let's say, non-human, programming-based male entity (nhpbme). similar to samantha in her, a non-human, programming-based female entity (nhpbfe).

so yes, while male robots and nhpbme do exist in the sci-fi romance genre, it's the comparatively larger robotification of women that feeds the male gaze, and the patriarchy by an extention— which is ultimately problematic.

coming to the movie that i actually want to discuss, kriti sanon's sifra, in tbmauj, is the perfect lover, perfect bahu. why? she knows everything aaru (shahid kapoor) likes and wants. she has no chik-chik or tantrums like other girls. she can make cuisines from all around the world, can access everything on the internet quickly. she has perfect skin, perfect hair. probably doesn't age too. she is the dream girl of a typical man. she doesn't have her own opinions or problems, she serves him and him alone. no family of hers to care about, she can care about his family and their needs. the female gendering here acts like objectification.

the worst part of this movie was that it didn't do anything? since it was a comedy, it didn't delve deeper into the nuances of increasing technological reliance that humans have. i think it was probably meant as a warning— when sifra malfunctions and starts executing tasks that were deleted. but even at that, it fails because urmila's (dimple kapadia) company (so intelligently named) e-robots/robotex (something stupid like that), ends up launching her along with few other robots. only adds a dialogue which meant that you need to handle these robots responsibly. then, what was the point of all the testing they tried to do? placing her in different environments like india, when they don't really end up rethinking the whole idea or putting in more safety features? of course, there's no deeper meaning here. indian comedies don't really have subtext.

but it's perpetuates the same old concept of subservient women. rule-followers and caregivers. an image etched in stone. why do women ask– what do men want? men want this, an ideal version. have always wanted. fuelled by the unrealistic p*rn depictions. do they ever think what women want? aaru so casually tells off his friend who has a wife to look at how pathetic his own life is. he defends sifra's un-emotional response to a situation by attacking his friend's relationship asking if human women are any better?

it reminded me of wifelike (2022) where female robots are curated according to a person's need, a replication of their dead spouse. to love them, to serve them, to help them come out of grief. it's so funny to me how in tbmauj, sifra is shown to retain her feelings, getting jealous when aaru interacts with another woman despite getting reprogrammed; compared to how in wifelike, the robotic version of the human it was based on, always ended up leaving the husband because the human version never loved him.

isn't it interesting how female robots instantly get sexualised, and are depicted doing things that one would never ask their girlfriend or wife to do? these robots happily perform roles that are stereotypically feminine, wife-like. they're invented to put aside their feelings (if they have them) to take care of their human partners'. sifra cooks perfect food, emphasized by how many time aaru fired his maid for not cooking things the way he likes it. she probably doesn't have mood swings from periods because she's a robot. she doesn't eat, doesn't get out of shape. and most importantly, she doesn't age (cue: i'll get old but your lovers stay my age). as if the expectations from women aren't enough, that they're required to age gracefully, or best option— not age at all.

if you still don't get it, let me remind you how siri and alexa also end up on the same side of gender spectrum— female.

so the message is, guys, don't give up on your dream girl! you'll surely find a robot that satisfies all your needs! 🙄

men want perfect women, but women can't be robots. let's stop perpetuating the same image and setting unrealistic standards. real humans have real problems, deal with them.

#bollywood#desiblr#this movie made me so angry like??#what do you mean to be continued?#bad bad bad writing#who let them make this movie#did they even question what they're actually contributing to the cinematic culture?#phuljari's review

12 notes

·

View notes

Text

Why Master Farmer is the Best Peanut Butter Company in India

When it comes to choosing the perfect peanut butter, discerning consumers across the nation are united in their praise for Master Farmer. Established with the vision of offering high-quality, nutrient-rich spreads, Master Farmer has become synonymous with premium peanut butter. Let us take you on a journey to understand why Master Farmer is celebrated as India’s best peanut butter brand.

A Commitment to Quality

At Master Farmer, quality is not just a priority—it is a way of life. From sourcing the finest peanuts to ensuring state-of-the-art production processes, the brand leaves no stone unturned. Every jar of Master Farmer’s peanut butter embodies a commitment to excellence. Whether you prefer peanut butter crunchy or smooth, you can trust that each spoonful is packed with flavor, nutrition, and care.

Diverse Product Range

One of the hallmarks of a great peanut butter company is its ability to cater to a variety of tastes and dietary needs. Master Farmer shines in this regard, offering a diverse range of peanut butter products to suit every preference:

Peanut Butter Crunchy: For those who love a bit of texture in their spread, our peanut butter with crunchy bits of roasted peanuts is an irresistible delight.

Smooth Peanut Butter: Perfect for spreading on toast or adding to smoothies, this classic variant is a staple in every health-conscious kitchen.

Chocolate Peanut Butter: A decadent fusion of chocolate and peanut butter, ideal for satisfying your sweet tooth.

Natural Peanut Butter: Made without added sugar or salt, it’s a wholesome choice for fitness enthusiasts.

Why Master Farmer Stands Out

Master Farmer isn’t just any peanut butter company; it is the best peanut butter company in India for a host of compelling reasons:

1. Premium Ingredients

The journey to creating India’s best peanut butter brand begins with premium ingredients. Only the finest, hand-picked peanuts make it into our products, ensuring a rich, nutty flavor and unparalleled quality. The use of high-grade ingredients means that our peanut butter is not only delicious but also nutritious.

2. Advanced Manufacturing Techniques

At Master Farmer, innovation meets tradition. We leverage cutting-edge technology to retain the natural goodness of peanuts while delivering a smooth, creamy texture in every jar. The process is meticulously designed to maintain the freshness and nutritional integrity of our products.

3. Affordable Prices

We believe that everyone should have access to high-quality peanut butter. That is why Master Farmer offers peanut butter online at the best prices. By making our products accessible, we ensure that healthy eating is within everyone’s reach.

4. Health Benefits

Packed with protein, healthy fats, vitamins, and minerals, Master Farmer’s peanut butter is a powerhouse of nutrition. Whether you are an athlete seeking a quick energy boost or a parent looking for healthy snack options for your kids, our peanut butter delivers.

5. Sustainability Practices

Master Farmer is committed to sustainability. From eco-friendly packaging to ethical sourcing practices, we ensure that our operations have a minimal environmental impact.

The Popularity of Peanut Butter Crunchy

While all our products enjoy immense popularity, the peanut butter crunchy variant holds a special place in the hearts of our customers. Why? Because it combines the creamy richness of peanut butter with the delightful crunch of real peanut bits. It is perfect for sandwiches, baking, or just scooping straight out of the jar. No wonder it is a bestseller!

How to Buy Peanut Butter Online at Best Prices

Master Farmer makes it incredibly convenient for you to enjoy our premium products. Our peanut butter is available online at the best prices, ensuring you get exceptional value for your money. Visit our website or trusted e-commerce platforms to explore our range and place your order with just a few clicks. With prompt delivery and secure payment options, buying your favorite peanut butter has never been easier.

Why Customers Love Master Farmer

Do not just take our word for it. Here is what makes Master Farmer a favorite among peanut butter enthusiasts:

Unmatched Taste: Customers rave about the rich, authentic flavor of our peanut butter.

Versatility: From breakfast to dessert, Master Farmer’s peanut butter can enhance any meal.

Healthy Snacking: Packed with nutrients and free from harmful additives, our products are perfect for guilt-free indulgence.

Trusted Brand: With a reputation for quality and reliability, Master Farmer has won the trust of millions.

The Master Farmer Promise

At Master Farmer, we do not just make peanut butter; we craft experiences. Every jar is a testament to our passion for quality, our commitment to health, and our dedication to customer satisfaction. As India’s best peanut butter brand, we promise to continue delivering the finest peanut butter products for years to come.

Conclusion

In a market flooded with choices, Master Farmer has carved a niche as the best peanut butter company in India. With our unwavering focus on quality, innovation, and customer satisfaction, we’ve earned our place as a household favorite. So why wait? Treat yourself to the goodness of Master Farmer peanut butter today. Explore our range and order peanut butter online at the best prices to experience the difference. Whether it’s the smoothness of our classic variant or the irresistible texture of our peanut butter with crunchy bits, Master Farmer is here to elevate your peanut butter experience.

#Top peanut butter brands in India#Indian peanut butter brands#High protein peanut butter#Peanut butter online at best prices#Best peanut butter brand in India#India’s best peanut butter brand#Buy peanut butter in India#Best peanut butter company in India#Best peanut butter in India#Best quality peanut butter

3 notes

·

View notes

Text

Remembering #KamalAmrohi on his 31st death anniversary (11/02/93).

As a director, he developed a style that combined a stylised direction with minimalist performances. This style was different from the one with expressive acting that was common in the Indian cinema of his period.

Kamal Amrohi was born in Amroha, which was part of British India and is now in Uttar Pradesh, India. He changed his name to Kamal Amrohi later. He was related to two Pakistani writers, Jaun Elia and Rais Amrohvi, as their first cousin. In 1938, Kamal left his hometown to study in Lahore, which is now in Pakistan. There, a singer named K. L. Saigal found him and brought him to Mumbai to work in films. He started his film career at Sohrab Modi's film company, Minerva Movietone, and worked on movies like "Jailor," "Pukar," and "Bharosa."

Kamal Amrohi became a film director in 1949 with his first movie "Mahal," which had famous actors Madhubala and Ashok Kumar. This movie was known for its music. He directed only four movies in total, including "Daaera" with Meena Kumari and Nasir Khan, and "Pakeezah," which took a long time to make and was released in 1972. "Pakeezah" is considered a special movie in India, even though it had some flaws. Meena Kumari, who was a famous actress and Kamal's wife, praised "Pakeezah" as Kamal's tribute to her. His last movie was "Razia Sultan" in 1983. He also started making a film called "Majnoon" but it was never finished.

Kamal Amrohi also wrote scripts for other directors and was one of the writers for the famous movie "Mughal-e-Azam" in 1960, which won him an award. His style of directing was known for being different and unique, focusing more on the visual style and less on dramatic acting.

In 1958, he opened a studio named Kamaal Studios, but it closed after three years. He had planned to make another movie called "Aakhri Mughal" but it was never made. Film maker J P Dutta wanted to make this movie in the late 1990s and again in 2007, but it didn't happen. Kamal Amrohi died on February 11, 1993, in Mumbai, 21 years after his wife, Meena Kumari, passed away. He was buried next to her in Mumbai.

Six days after he died, a newspaper in the UK called The Independent wrote about him, saying he was a big figure in the Hindi film industry for over 50 years.

2 notes

·

View notes

Text

The following are our services:

Software development

Custom software development

School management software

College management software

Website development

Landing page design

e-commerce website development

CMS website development

mobile app development

Graphic design

#software development#website development#website design#ecommerce website development#cms website development company

4 notes

·

View notes

Text

22nd Wednesday

Running under double reefed Topsails and foresail. Sighted Prince Edwards Isles: neared them in the afternoon and passed them in the first watch. The Snow was lying on The high Land in great quantitys and the air very cold. Several very handsome Cape Pigeons flying about. Slight Snow Shower.

Campbell's Notes:

Prince Edward Isles, Marion (Latitude 46°55'S, Longitude 37°45'E) and Prince Edward (Latitude 46°54'S, Longitude 37°42'E) Islands, may have been sighted by a vessel of the Vereenigde Oostindische Compagnie (Dutch East India Company), the Maerseveen, on passage from Cape of Good Hope to Batavia in 1663 and called Dina and Maerseveen, but were definitely sighted by Marion Dufresne on 13 January and Crozet Island on 23 January 1772. (Headland, Chronological, p. 12 and Duyker, An Officer, p. 175.) Prince Edward Island was named by Captain Cook, 12 December 1776 ‘As thise islands have no name in the French Chart, I shall distinguish the two we have seen by the name Prince Edward Islands after His Majesty's 4th Son, and the others Morion and Crozets Islands.’ (Beaglehole, Journals…Resolution and Discovery, I. pp. 25–6.) Prince Edward was Edward Augustus, Duke of Kent, 4th son of King George III. He married Victoria Mary Louise, widow of Emich Charles, Prince of Leiningen and daughter of Francis, Duke of SaxeCoburg and Saalfield and had one daughter, Victoria, who became Queen of the United Kingdom of Great Britain &c.

Cape Pigeons, or Pintado Petrel, Daption capensis. Roberts, Edward Wilson's Birds, p. 94. Hadoram Shirihai, Complete Guide to Antarctic Wildlife, pp. 139–41, gives modern form Daption capense.

2 notes

·

View notes

Text

Best Stocks to Buy India 2025 - Expert Guide to Maximize Returns

Best Stocks to Buy in India - 2025

Investing in the stock market can be one of the smartest financial decisions you'll ever make. But with countless options out there, it can also feel overwhelming. Which stocks should you choose? How do you maximize your returns while minimizing risks? If you’re looking for the best stocks to buy in India in 2025 or want to learn more about the stock market, this guide is for you. Whether you're a beginner or an experienced investor, we've got you covered.

Introduction

The Indian stock market is a treasure trove of opportunities. With a rapidly growing economy, an influx of global investments, and innovative startups scaling new heights, India offers a fertile ground for stock market investments. But where should you start? What are the best stocks to buy in India in 2025? This article will take you through everything you need to know, from picking the right stocks to leveraging online stock trading courses to sharpen your skills.

Discover the best stocks to buy India, tips from a stock market institute, and online courses for stock market trading. Learn about stock market training online and investment strategies.

Why Invest in the Indian Stock Market ?

India's economy is like a high-speed train – fast-growing and full of potential. With robust GDP growth, increased consumer spending, and government initiatives promoting industrial growth, the stock market has become a reflection of India's rising global stature.

Key Benefits of Investing in India

Diverse Opportunities: From technology to pharmaceuticals, India boasts a variety of industries.

High Returns: Many sectors in India have historically delivered impressive returns.

Growing Middle Class: Increased purchasing power leads to more investments.

How to Identify the Best Stocks ?

Picking the right stock is like choosing the best fruit from a basket. How do you know it's ripe? You need to analyze it closely.

Factors to Consider:

Company Fundamentals: Strong financials, consistent growth, and good management.

Market Trends: Sectors poised for growth.

Valuation Metrics: P/E ratio, dividend yield, and market cap.

Future Potential: Is the company innovating? Does it have a clear vision?

Top Sectors to Watch in 2025

Certain industries are set to thrive due to changing consumer behavior and advancements in technology. Here are the ones to keep an eye on:

Technology & IT Services: With digital transformation in full swing, companies in this space are expected to flourish.

Pharmaceuticals: Post-pandemic, healthcare and pharma remain vital sectors.

Renewable Energy: With sustainability becoming a priority, solar and wind energy companies are on the rise.

Consumer Goods: As disposable incomes increase, so does spending on goods and services.

Best Stocks to Buy in India - 2025

Here are some promising stocks that experts are eyeing for 2025:

1. Reliance Industries

Why Invest? With its presence in energy, retail, and digital services, Reliance is a diversified powerhouse.

Growth Factor: Expansion in renewable energy and technology-driven initiatives.

2. TCS (Tata Consultancy Services)

Why Invest? TCS is a leader in IT services with a global footprint.

Growth Factor: Strong demand for digital transformation services.

3. HDFC Bank

Why Invest? A consistent performer in the banking sector.

Growth Factor: Focus on retail banking and rural markets.

4. Adani Green Energy

Why Invest? A frontrunner in renewable energy.

Growth Factor: Massive expansion in solar and wind energy projects.

5. Infosys

Why Invest? Known for its innovation and strong financials.

Growth Factor: Rising demand for IT outsourcing.

Benefits of Stock Market Institutes

Learning the ropes of the stock market can save you from costly mistakes. A online courses for stock market offers structured guidance and hands-on training.

What Do You Learn?

Basics of investing

Technical analysis

Risk management

Portfolio building

Think of it as a GPS guiding you through the maze of stock market investments.

Online Stock Trading Courses

Want to learn from the comfort of your home? Online stock trading courses are the way to go. These courses cover everything from basics to advanced trading strategies.

Top Platforms for Online Courses:

Coursera – For beginners.

Udemy – Affordable and flexible.

NSE Academy – Industry-recognized certifications.

Stock Market Training Online

Imagine having a mentor right on your screen. Stock market training online provides you with live sessions, real-time trading simulations, and expert insights.

Why Choose Online Training ?

Learn at your own pace.

Interactive sessions with industry experts.

Access to resources and tools.

Tips for Beginners

Starting your journey in the stock market? Here are some quick tips:

Start Small: Invest only what you can afford to lose.

Do Your Homework: Research before buying any stock.

Diversify: Don’t put all your eggs in one basket.

Stay Patient: Rome wasn’t built in a day, and neither are fortunes.

Risks to Keep in Mind

Investing always comes with risks. Here’s what to watch out for:

Market Volatility: Prices can swing unpredictably.

Lack of Knowledge: Don’t invest blindly; always stay informed.

Overconfidence: It’s easy to get carried away with initial success.

Diversifying Your Portfolio

Diversification is like having a balanced diet for your finances. It ensures that if one sector underperforms, others can make up for the loss.

How to Diversify:

Invest across sectors.

Mix large-cap, mid-cap, and small-cap stocks.

Include mutual funds or ETFs.

Conclusion

The Indian stock market in 2025 offers a wealth of opportunities for savvy investors. Whether you’re looking at established giants like Reliance and TCS or emerging players in renewable energy, the key lies in informed decision-making. Pair your investments with knowledge from a stock market institute or online courses for stock market, and you’re well on your way to financial success.

FAQs

What are the best stocks to buy in India in 2025 ?

Reliance Industries, TCS, HDFC Bank, Adani Green Energy, and Infosys are among the top picks.

How can I learn stock trading online ?

You can explore online stock trading courses on platforms like Coursera, Udemy, and NSE Academy.

What are the risks of investing in the stock market ?

Risks include market volatility, lack of knowledge, and overconfidence. Diversification can help mitigate these risks.

Is it worth joining a stock market institute ?

Yes, a stock market institute provides structured training, helping you make informed investment decisions.

Why is diversification important in stock market investing ?

Diversification spreads risk across various sectors and stocks, reducing the impact of underperforming assets.

0 notes

Text

Best Web Development Agency in Coimbatore

In the digital age, a well-designed website is your business's most valuable asset. Acculer Media, recognized as the best web development agency in Coimbatore, specializes in building exceptional websites that not only look great but also deliver results. With a focus on innovation, performance, and user experience, we help businesses establish a strong online presence and achieve their goals.

Why Acculer Media is the Best Web Development Agency in Coimbatore

At Acculer Media, we blend creativity with technical expertise to develop websites that stand out. As a top web development agency, we understand the importance of creating sites that are visually appealing, fast, and SEO-friendly. Our team of experienced developers leverages cutting-edge tools and techniques to ensure your website performs optimally across all platforms.

Our Core Services

Custom Website Development: We design and develop unique websites tailored to your brand and business needs.

E-Commerce Development: Build scalable online stores with seamless navigation, secure payment gateways, and optimized performance.

Responsive Web Design: Our websites deliver a flawless user experience on desktops, tablets, and mobile devices.

CMS Development: We offer intuitive content management systems to empower you to update and manage your website easily.

Website Redesign: Give your outdated website a modern facelift to attract more visitors.

What Sets Us Apart as a Web Development Company in Coimbatore?

Expert Team: Our developers bring years of experience and a deep understanding of the latest web technologies.

SEO Integration: We create websites that rank high on search engines, increasing visibility and driving organic traffic.

Client-Centric Approach: We listen to your needs, offer customized solutions, and ensure timely delivery.

Affordable Packages: High-quality web development services that fit your budget.

Why Your Business Needs a Professional Web Development Agency

A website is more than just a digital storefront; it's a tool for engaging with customers, generating leads, and driving sales. As the best web development agency in Coimbatore, Acculer Media ensures your website is not only attractive but also functional and optimized for conversions. Whether you're a small startup or an established enterprise, our solutions are designed to help your business succeed in the competitive online landscape.

Get Started Today!

Don’t settle for less when it comes to your online presence. Let Acculer Media, the best web development agency in Coimbatore, transform your ideas into a reality. Contact us today to create a website that drives growth and delivers results.

Website Link : - https://acculermedia.com/

Contact no : - 9360623765

Mail id : - [email protected]

Address :- Third Floor, Aruna Avanthika,NSR Road,Janaki Nagar, Saibaba Colony,Coimbatore- 641011,Tamil Nadu, India

Socail media link

facebook link :- https://www.facebook.com/acculermedia

instagram link :- https://www.instagram.com/p/DCs5RwDghlP/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

linkedin link :- https://www.linkedin.com/company/74903230/admin/page-posts/published/

Youtube link :- https://www.youtube.com/@acculermediatech

short describiton :- Acculer Media is a leading creative agency specializing in web design, digital marketing, mobile app development, and software solutions. They work with businesses globally to create impactful digital strategies that drive growth. With a focus on innovative solutions, their services range from brand identity and website development to comprehensive digital marketing campaigns. The team emphasizes personalized service and long-term partnerships to help clients succeed in the digital space. For more details, visit Acculer Media.

#seo#branding#google ads#seo services#acculermedia#brand identity#business growth#social media marketing#digital marketing#meta ads#best web development agency in coimbatore#web development agency#web development company in coimbatore#acculer media

0 notes

Text

Private Oil and Gas Companies: Driving Innovation in the Energy Sector

Source: Image by avigatorphotographer's Images

Category: Conventional Energy

The global energy sector has long been dominated by government-owned entities, especially in countries rich in oil and gas resources. However, private oil and gas companies have steadily gained prominence, playing a crucial role in the exploration, production, and distribution of these critical energy sources. In many parts of the world, including India, these companies are not only contributing to energy security but also driving innovation through the adoption of new technologies, sustainable practices, and efficient management techniques. In this article, we will explore the rise of private oil and gas companies, their impact on the industry, and the future they are helping to shape.

The Evolution of Private Oil and Gas Companies

Historically, the energy sector was tightly controlled by state-owned enterprises (SOEs) due to the strategic importance of oil and gas. Governments considered these resources national assets, closely regulating their extraction and distribution. However, as economies grew and the energy demand surged, many nations recognized the need for efficiency, technological advancements, and additional investment, leading to the gradual privatization of some segments of the oil and gas industry.

In India, for example, government-controlled behemoths like ONGC and Indian Oil Corporation (IOC) were the primary players for decades. But in recent years, private oil and gas companies such as Reliance Industries Limited and Cairn Energy have emerged as key competitors, driving growth and innovation. This shift has not only boosted competition but also improved the overall efficiency of the sector, allowing for better pricing, increased energy availability, and faster adoption of modern techniques.

Role of Private Oil and Gas Companies in Exploration and Production

Exploration and production (E&P) activities are critical to the success of the oil and gas industry. This segment involves locating new oil and gas reserves and extracting these resources in a cost-effective manner. In this area, private oil and gas companies have been instrumental in pushing boundaries, particularly in difficult-to-reach areas such as offshore locations and unconventional reserves like shale gas.

For instance, Reliance Industries, one of India’s largest private sector companies, has made significant strides in offshore drilling, particularly in the Krishna-Godavari Basin. Their ability to take on high-risk projects, backed by substantial private investment, has allowed them to pioneer new methods of extraction, often ahead of their state-owned counterparts. This has been a key factor in India’s quest to reduce its dependence on oil imports.

In addition to Reliance, Cairn India (now Vedanta Ltd) has also made a significant impact in the E&P sector. Its discovery of oil in the Rajasthan Barmer basin was one of the largest onshore oil discoveries in India, demonstrating the importance of private oil and gas companies in securing new reserves and boosting domestic production.

Technology and Innovation: The Private Sector’s Edge

One of the significant advantages of private oil and gas companies is their ability to invest in cutting-edge technologies that improve the efficiency and sustainability of their operations. This includes advanced seismic imaging, enhanced oil recovery (EOR) techniques, and digitalization of oil fields through automation and artificial intelligence.

In the case of shale gas and tight oil, which require complex and costly extraction processes like hydraulic fracturing (fracking), private firms have led the way. In the United States, private companies were at the forefront of the shale revolution, using innovative drilling techniques to unlock vast reserves previously deemed uneconomical. This has had a profound impact on global oil prices, supply chains, and energy geopolitics.

In India, too, the adoption of new technologies by private players is helping to improve the efficiency of oil and gas extraction. Companies like Reliance and Cairn have invested heavily in digital transformation, using data analytics, real-time monitoring systems, and predictive maintenance to reduce downtime and operational costs. These advancements not only make extraction more profitable but also contribute to environmental sustainability by reducing emissions and minimizing energy waste.

Contribution to Energy Security

Energy security remains a critical concern for most countries, especially those heavily reliant on oil imports, such as India. Private oil and gas companies play a pivotal role in enhancing energy security by boosting domestic production and reducing dependence on foreign oil.

For instance, the development of India’s strategic petroleum reserves (SPR) has been supported by private firms. These reserves act as a buffer during times of supply disruptions, ensuring that the country has access to critical fuel supplies in times of crisis. Private players’ participation in this initiative underscores their importance in safeguarding the nation’s energy needs.

Moreover, the global footprint of some private Indian oil companies has also contributed to energy security. By acquiring assets abroad, such as Reliance’s investment in shale gas fields in the United States, these companies diversify the sources of oil and gas, insulating India from global market shocks.

Sustainability and the Future of Private Oil and Gas Companies

As the world moves towards cleaner energy sources, the oil and gas sector is under increasing pressure to adopt sustainable practices. Private oil and gas companies have been quicker to embrace the energy transition compared to their state-owned counterparts. Many are already investing in renewable energy, carbon capture and storage (CCS) technologies, and reducing their carbon footprints through more efficient processes.

For example, global oil giants like BP and Shell have committed to becoming net-zero carbon emitters by 2050. In India, too, private firms are exploring ways to reduce emissions and invest in renewable energy. Reliance Industries has announced its plans to achieve net carbon zero by 2035, underscoring its commitment to sustainability. This move aligns with the broader global trend where private oil and gas companies are diversifying their portfolios to include cleaner, greener energy solutions, thus contributing to a more sustainable future.

Challenges and the Road Ahead

https://oilgasenergymagazine.com/wp-content/uploads/2024/12/21.3-Volatile-oil-prices-regulatory-hurdles-Image-by-Anoop-VS-from-Pexels.jpg

While private oil and gas companies have made significant contributions to the industry, they face several challenges. Volatile oil prices, regulatory hurdles, and increasing environmental concerns present risks to their operations. Additionally, the growing push toward renewable energy sources poses a long-term threat to the traditional oil and gas business model.

To remain competitive, these companies will need to continue innovating, adopting sustainable practices, and diversifying their energy portfolios. Collaboration with governments on policy frameworks that encourage cleaner energy while ensuring the continued importance of oil and gas in the short to medium term will be essential for their survival and growth.

Conclusion

The rise of private oil and gas companies marks a pivotal shift in the global energy landscape. By driving technological innovation, improving efficiency, and contributing to energy security, these companies play a crucial role in shaping the future of the oil and gas industry. As the world transitions towards cleaner energy, private firms are well-positioned to lead the way, ensuring a balance between energy needs and environmental sustainability. The future of energy will likely be a hybrid one, with private oil and gas companies playing a central role in this transformation.

0 notes

Text

Electric Mobility Market Growth: Innovations and Opportunities in 2023 - 2030

The global electric mobility market size is expected to reach USD 325.64 billion by 2030, growing at a CAGR of 14.6% from 2023 to 2030, as per the study conducted by Grand View Research, Inc. Rise in substantial operating and maintenance cost savings is expected to significantly increase the demand for electric mobility thereby supporting the market growth. Furthermore, growing concerns about the rapidly rising carbon footprint and greenhouse gases from the transportation and automotive industries are encouraging state and country-level regulatory bodies to set up policies that promote the adoption of energy-efficient vehicles.

The rise in government investments along with stringent regulations, objectives, and policies for electric vehicle deployment, signaling OEMs and other industry stakeholders who actively participate in the industry and building confidence based on mobilizing investments and policy frameworks is fueling the growth of the electric mobility industry.

For instance, in December 2022, the Uttar Pradesh government in India targeted to invest 300 million in electric transportation. The state's UP Electric Vehicle Manufacturing and Mobility Policy 2022 aims to attract new investment and create 1 million new jobs in the sector. Meanwhile, the new strategy has attempted to address the three key issues: stimulating the manufacture of e-vehicles and their components, such as batteries, and creating a solid network of charging stations and battery swap locations.

Electric vehicles depend on electricity to replenish their batteries rather than using fossil fuels such as petrol or diesel. With the increasing number of EV battery charging stations emerging, it is now more convenient for consumers to charge their batteries at a local station rather than stand in line at a CNG station or a gas station. For instance, In May 2022, Energica Motor Company, a manufacturing company, launched a new e-bike named Energica Experia. The e-bike featured the company’s no-emission EV technology. These factors are expected to drive the electric mobility market growth over the forecast period

Some dominant players in the U.S. electric mobility industry are BMW Motorrad International; Gogoro, Inc.; Honda Motor Co. Ltd.; KTM AG; Mahindra Group; Ninebot Ltd.; Suzuki Motor Corporation; Terra Motors Corporation; Vmoto Limited ABN; Yamaha Motor Company Limited. These players focus on new product launches and partnerships & collaboration to enhance their offerings and geographic presence. For instance, In June 2022, iFood, an online food ordering and delivery platform based in Brazil, launched the EVS Work iFood electric motorcycle in collaboration with Voltz Motors, a startup manufacturer of e-scooters and e-motorcycles based in Brazil, for USD 2,099.9.

Electric Mobility Market Report Highlights

Based on product, the electric bike segment is expected to dominate the global market owing to the factors such as the expansion of cycling infrastructure in developing countries such as India and the rise of financial incentives for e-bikesales

Based on drive, the chain drive segment dominated the market with 46% of the revenue share in 2022. The growing amount of construction activities driven by rapid industrialization is driving the segment’s growth

Based on battery, the Li-ion battery segment accounted for 82% of the revenue share in 2022 owing to the benefits such as a decrease in the amount of toxic oil waste generated, the need for engine maintenance, and the pollution caused by fuel combustion engines

Based on end-use, the personal segment accounted for 76% of the revenue share in 2022. The segment’s growth can be attributed to the rising sales of electric two-wheelers as more customers choose electric transportation for both commuting and relaxation

Electric Mobility Market Segmentation

Grand View Research has segmented the global electric mobility market based on product, drive, battery, end-use, and region:

Electric Mobility Product Outlook (Revenue, USD Million, 2018 - 2030)

Electric Bikes

Electric Scooter

Electric Motorized Scooter

Electric Motorcycle

Electric Mobility Drive Type Outlook (Revenue, USD Million, 2018 - 2030)

Belt Drive

Chain Drive

Hub Drive

Electric Mobility Battery Outlook (Revenue, USD Million, 2018 - 2030)

Lead Acid Battery

Li-ion Battery

Others

Electric Mobility End-use Outlook (Revenue, USD Million, 2018 - 2030)

Personal

Commercial

Electric Mobility Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Latin America

Brazil

Mexico

Middle East & Africa

Order a free sample PDF of the Electric Mobility Market Intelligence Study, published by Grand View Research.

0 notes

Text

Mergers and Acquisitions Valuation: A Comprehensive Guide for Indian Businesses

In the dynamic landscape of the Indian economy, mergers and acquisitions (M&A) have become vital strategies for growth, diversification, and innovation. However, navigating this complex process requires a solid understanding of mergers and acquisitions valuation. This article will delve into the intricacies of M&A valuation, offering insights tailored to the Indian business environment.

Understanding Mergers and Acquisitions

Mergers and acquisitions refer to the processes through which companies consolidate their assets, operations, and market presence. A merger typically involves two companies agreeing to combine into a single entity, while an acquisition entails one company purchasing another. Both strategies aim to enhance market competitiveness, achieve economies of scale, and increase shareholder value.

In India, the M&A landscape has evolved significantly over the past two decades, driven by factors such as globalization, technological advancements, and regulatory reforms. Understanding the valuation aspect is crucial for companies looking to engage in M&A, as it directly impacts the decision-making process and potential success of the deal.

The Importance of Valuation in M&A

Mergers and acquisitions valuation plays a crucial role in determining the fair price for a target company. Accurate valuation helps both buyers and sellers understand the economic worth of the business, ensuring that neither party is overpaying or undervaluing the deal. Additionally, effective valuation helps in:

Risk Assessment: Identifying potential risks associated with the target company, including financial health, market position, and operational efficiency.

Negotiation Leverage: Providing a solid basis for negotiations, ensuring that both parties can engage in informed discussions about price and terms.

Regulatory Compliance: Meeting legal and regulatory requirements related to valuations, particularly in cases involving public companies or significant market impact.

Strategic Planning: Aligning the valuation with the acquiring company’s strategic objectives, ensuring the deal supports long-term growth.

Key Methods of Mergers and Acquisitions Valuation

Image-by-DjMiko

Several valuation methods are commonly used in the context of mergers and acquisitions. Each method offers unique insights and is suited for different types of businesses. Here are the most prevalent approaches:

1. Discounted Cash Flow (DCF) Analysis

The DCF method estimates the present value of expected future cash flows generated by the target company. This approach is particularly effective for companies with stable cash flows. In India, where many businesses are transitioning to a more predictable revenue model, DCF can provide a comprehensive view of a company’s value.

Key Steps in DCF Valuation:

Forecast Cash Flows: Estimate future cash flows for a specific period, typically five to ten years.

Determine the Discount Rate: Calculate the appropriate discount rate, reflecting the risk of the investment.

Calculate Terminal Value: Estimate the value of the business at the end of the projection period.

Compute Present Value: Discount future cash flows and the terminal value to their present value.

2. Comparable Company Analysis (Comps)

The comps method involves comparing the target company to similar firms in the industry. This valuation technique is widely used in the Indian market, where companies often operate within competitive sectors. By analyzing key financial metrics such as price-to-earnings (P/E) ratios, enterprise value (EV), and EBITDA multiples, businesses can derive a fair valuation.

Key Considerations:

Select a peer group of companies operating in the same industry and geographical region.

Analyze historical and projected financial metrics to establish a valuation range.

Adjust for differences in size, growth rates, and market positioning.

3. Precedent Transaction Analysis

This method evaluates past transactions involving similar companies to derive a valuation multiple. By analyzing the terms of previous M&A deals, companies can gain insights into market trends and pricing strategies.

Key Steps:

Identify relevant transactions in the same industry.

Analyze the deal structure, including purchase price and payment terms.

Calculate valuation multiples based on historical transactions to estimate the value of the target company.

Challenges in Mergers and Acquisitions Valuation

Image-by-Remitski

While mergers and acquisitions valuation is essential, it comes with its set of challenges. In the Indian context, these challenges include:

Lack of Reliable Data: Access to accurate and comprehensive financial data can be limited, particularly for smaller companies. This can hinder effective valuation.

Market Volatility: The Indian market is subject to fluctuations, making it difficult to predict future cash flows and growth rates.

Cultural Differences: M&A transactions often involve integrating different corporate cultures, which can impact the overall success of the deal.

Regulatory Hurdles: Navigating the legal and regulatory landscape in India can be complex, requiring careful consideration of compliance issues.

Best Practices for Effective Valuation

Image-by-wichayada-suwanachun

To overcome these challenges and enhance the effectiveness of mergers and acquisitions valuation, consider the following best practices:

Engage Professional Valuation Experts: Collaborate with financial advisors or valuation specialists who understand the Indian market and can provide objective insights.

Conduct Thorough Due Diligence: Perform comprehensive due diligence to gather relevant data and assess the target company’s financial health.

Use Multiple Valuation Methods: Employ a combination of valuation methods to triangulate and validate the final valuation figure.

Stay Informed on Market Trends: Regularly monitor industry trends, economic indicators, and regulatory changes to ensure valuations remain relevant.

Conclusion

Mergers and acquisitions valuation is a critical component of the M&A process, particularly in the Indian business landscape. By understanding the various valuation methods and best practices, companies can make informed decisions that drive growth and success. As the Indian economy continues to evolve, effective M&A strategies, underpinned by accurate valuations, will be essential for businesses looking to thrive in a competitive environment.

Understanding mergers and acquisitions valuation not only helps companies navigate complex deals but also positions them for future success in an ever-changing market.

#businesstips#sellmybusiness#tax#businessadvice#businessforsale#venturecapital#marketing#valuation#corporatelawyer#management#businessopportunities#corporate#legaljobs#commerce#fintech#merge#consultinglife#companylaw

0 notes

Text

Market Update

Expect a Weak Opening for Our Market Today | @ParkaviFinance http://youtube.com/post/UgkxDoNBqLcyC9dkUSZDBwJ5oLQx0IgfhOTL?si=G5d2RjzuIroK5XjP

The benchmark indices managed to end higher for the 4th consecutive week. Friday’s second-half recovery helped Nifty 50 close 220 points higher, supported by FMCG, Infra, Financial services (private banks), IT, and Auto stocks. However, the broader market underperformed throughout the week. FIIs net bought ₹2,335.3 crore, while DIIs net sold ₹732.2 crore in the cash market on Friday. Primary market activity is set to significantly pick up with 6 mainboard IPOs opening for subscription later this week, and 5 companies making their debut on the exchanges.

**US Market Update:**

- Dow closed 0.2% lower

- Nasdaq closed 0.1% higher

- S&P ended flat

Crude oil prices are currently hovering at $74+ per barrel on expectations of sanctions on Russia and Iran. The market is now focusing on the outcome of the US FED meeting due on Wednesday, with high optimism for a 25 bps rate cut. Asian markets are trading lower, and a weak start for our market is expected due to subdued global cues.

### Key Actionable Insights:

**1. Jubilant Foodworks**: Initiated voluntary liquidation proceedings for Hashtag Loyalty Pvt., investment valued at ₹25 crore - **Neutral in short term**

**2. Godavari Biorefineries**: Announces capacity addition of 200 KLPD corn/grain-based distillery - **Positive in long term**

**3. Dixon Technologies**: Signed a binding term sheet with Vivo India for OEM business - **Positive in long term**

**4. ONGC**: No concrete plans yet for listing ONGC Green - **Neutral in short term**

**5. GE Power**: Received ₹18.3 crore purchase order extension for boiler parts supply - **Positive in long term**

**6. Biocon**: CHMP issued a positive opinion for YESINTEK, an Ustekinumab biosimilar - **Positive in long term**

**7. Waaree Energies**: Investing ₹5.5 crore to acquire 55 lakh shares in Ewaa Renewable Techno Solutions - **Positive in long term**

**8. Afcons Infra**: Won ₹1,007 crore EPC order from Madhya Pradesh Metro Rail Company - **Positive in short to medium term**

**9. Samvardhan Motherson**: Acquiring Brazil-based Baldi Industria E Comercio for $7.8 million - **Positive in long term**

**10. IRB Infrastructure**: Approved implementation of Ganga Expressway Project - **Positive in long term**

**11. Happy Forgings**: Secured ₹140 crore order to supply crankshafts for domestic passenger vehicles segment - **Positive in long term**

**12. One 97 Communications**: Completed the sale of stock acquisition rights in Japan-based Paypay Corp - **Positive in short term**

**13. KSB**: Launched a reciprocating pump in the plunger pump category - **Neutral to Positive in short term**

**14. Genus Power Infrastructure**: Commenced commercial production at a new manufacturing facility in Assam - **Positive in long term**

**15. Lemon Tree Hotels**: Signed a licence agreement for a 74-room hotel in Gujarat - **Positive in long term**

**16. HG Infra Engineering**: Received an order worth ₹862 crore from NHAI - **Positive in long term**

**17. Lupin**: Acquired anti-diabetes trademarks from Boehringer Ingelheim International GmbH - **Positive in long term**

**18. JK Paper**: Approved acquisition of a majority stake in Radhesham Wellpack - **Positive in medium to long term**

**19. Globus Spirits**: Launched new brands in Uttar Pradesh - **Positive in long term**

**20. JSW Energy**: Maharashtra State Electricity Discom Co. filed a petition before MERC - **Neutral to marginally Negative in short term**

**21. Bharat Forge**: Approved additional investment in Kalyani Powertrain - **Positive in long term**

**22. Mazagon Dock Shipbuilders**: Clarified no delay communication received for Project P751 - **Neutral in short term**

**23. Reliance Industries**: Acquired a 74% stake in Navi Mumbai IIA for ₹1,628 crore - **Positive in long term**

**24. Premier Explosives**: Entered MoU with Global Munition for a joint venture - **Positive in long term**

**25. Aurobindo Pharma**: Positive opinion for Zefylti biosimilar - **Positive in long term**

**26. Nazara Technologies**: Nodwin acquired 100% stake in Trinity Gaming India - **Neutral to Positive in short term**

**27. Elcid Investments**: Submitted NBFC registration application with RBI - **Neutral to Positive in short term**

### IPO Offerings:

- **Inventurus Knowledge Solutions**: Subscribed 2.65 times on day 2.

- **International Gemmological Institute (India)**: Subscribed 0.17 times on day 2.

### Insider Trades:

- **Godrej Properties**: Promoter Godrej Seeds and Genetics bought 55,000 shares.

- **MTAR Technologies**: Promoter sold 7.9 lakh shares.

### Pledge Share Details:

- **Lloyds Metals and Energy**: Revised pledge for 51.54 lakh shares.

### Trading Tweaks:

- **Ex/record bonus Issue**: Sky Gold (9:1).

- **Ex/record stock split**: PC Jeweller.

- **Moved in short-term ASM**: Zinka Logistics Solutions.

- **Moved out short-term ASM**: Avalon Technologies, HEG, Niva Bupa Health Insurance Co.

### Management Meetings:

- **Globus Spirits**: Meeting investors and analysts on Dec. 18.

- **Five Star Business Finance**: Meeting investors and analysts on Dec. 17.

- **Shriram Finance**: Meeting investors and analysts on Dec. 18.

- **Godawari Power and Ispat**: Meeting investors and analysts on Dec. 18.

- **Varroc Engineering**: Meeting investors and analysts on Dec. 19.

- **Ceigall India**: Meeting investors and analysts on Dec. 18.

### Fund Flows – Cash Market:

- **FII (₹ crore)**: +2,335.3

- **DII (₹ crore)**: -732.2

### Bulk Deals – BSE:

- **PANORAMA STUDIOS LEADING LIGHT FUND VCC**: Bought 5,00,000 shares (0.7%) at ₹230.0 each.

---

:

"Stay updated with the latest market insights, stock analysis, and key actionable news. Expect a weak opening for the market today with detailed updates on Nifty, Bank Nifty, IPO offerings, insider trades, and more."

- #MarketAnalysis

- #StockMarketUpdates

- #NiftyLevels

- #BankNiftyLevels

- #IPOUpdates

- #TradingInsights

- #FinancialNews

- #InsiderTrades

:

- Market opening

- Stock market analysis

- Nifty and Bank Nifty levels

- IPO allotments

- Financial market news

- Trading updates

### Call-to-Action (CTA):

"🔔 Don't forget to subscribe and hit the notification bell for more market insights and trading updates! Share your thoughts and questions in the comments below."

#Morning market podcast#breakout stocks#stock market#financial updates#financial freedom#trading strategies#youtube#share market#investing stocks

1 note

·

View note

Text

Explore Insights from Gatekeepers of Governance 2024

Gatekeepers of Governance 2024, the 9th Annual 2 day Corporate Governance Summit, was held on November 21-22, 2024 at the Trident Hotel, Bandra Kurla Complex, Mumbai. It brought together leaders to address challenges and opportunities in the area of corporate governance. Organized by Excellence Enablers Private Limited, this prestigious event served as a platform to exchange ideas and solutions for fostering robust corporate governance practices. The discussions during the Summit focused on key themes and topics, as outlined below.

The Summit opened with an inaugural session titled “Regulators – Friends, Foes, or Frenemies?” featuring eminent speakers such as Mr. M. Damodaran (Chairperson, Excellence Enablers, Former Chairman, SEBI, UTI and IDBI), Justice P. S. Dinesh Kumar (Presiding Officer, Securities Appellate Tribunal; Former Chief Justice, Karnataka High Court), Mr. M. Nagaraju (Secretary, Department of Financial Services, Ministry of Finance, GOI), Mr. K. Rajaraman (Chairperson, IFSCA; Former Secretary, GOI), and Mr. Ashwani Bhatia (Whole Time Member, SEBI). The discussion was on the relationship between Regulators and businesses, highlighting the dual role that Regulators play in easing business processes, while ensuring compliance. Regulators act as allies by creating fair and transparent frameworks, but are often seen as adversaries due to the perceived burden of compliance costs and stringent norms.

Ultimately, the key to a healthy relationship between Regulators and businesses lies in striking a balance. Regulators must be flexible and adaptive, understanding the challenges and needs of the regulated universe. On the other hand, businesses should engage constructively with Regulators, providing feedback and collaborating on solutions that meet regulatory goals without limiting innovation.

SMEll Tests in Governance

The panel included Mr. Nilesh Shah (MD, Kotak Mahindra AMC) and Mr. S. Ramann (Deputy Comptroller and Audit General of India; Former CMD, SIDBI; Former MD & CEO, NESL). It delved into the governance challenges faced by SMEs, where disparities in compliance and governance standards are evident. The key takeaways were that governance quality depends on mindset, not size. Regulators should focus on non-compliant entities, thereby allowing compliant SMEs to thrive, while improving overall governance.

Boards – Have They Failed Stakeholders?

Experts like Mr. Mukesh Butani (Founder & Managing Partner, BMR Legal Advocates; Member, Global Supervisory Board, International Fiscal Association), Ms. Pallavi Shroff (Managing Partner, Shardul Amarchand Mangaldas & Co.) and Mr. M. Damodaran discussed whether Boards have adequately protected stakeholder interests. The discussion focused on the gap between rising expectations and board performance. Boards must act decisively on whistleblower complaints, executive resignations, and other red flags. Effective succession planning, equitable committee workloads, and a focus on stakeholder interests, not just shareholders interest, are critical to meeting their increasing responsibilities.

ESG – Do Good Opportunity or Feel Good Scam?

Panellists Mr. D.P. Singh (Deputy MD & Joint CEO, SBI Funds), Dr. Mukund Rajan (Chairperson, ECube Investment Advisors; Former Chief Ethics Officer & Brand Custodian, Tata Group), and Mr. Vikram Singh Mehta (Distinguished Fellow, Centre for Social and Economic Progress; Former Chairperson, Brookings India; Former CEO, Shell India) addressed the issues in the ESG space. They raised the question whether it drives meaningful change or is merely a tick-box exercise. ESG should be more than just following rules on paper—it needs to create real value by promoting sustainable and responsible business practices. Big companies can handle ESG costs more easily, but for smaller businesses, it can be a strain. So we need to see if it is making a real difference. The related point was while E, S and G were desirable pursuits, clubbing them as ESG did not seem appropriate.

Do Managements Also Run Business?

With perspectives from leaders like Mr. M. Damodaran, Mr. Amish Mehta (MD & CEO, CRISIL) and Mr. Tapan Singhel (MD & CEO, Bajaj Allianz General Insurance Company, GIC), the session delved into whether the heavy compliance burden has diverted managements from their core responsibility i.e. running business. Boards must prioritize strategic discussions, while not ignoring compliance matters in meetings, enabling management to focus on operations. Effective corporate governance should complement, not substitute strategic leadership.

Do Auditors Need Auditing?

With insights from Mr. D. Sundaram (Vice Chairperson & MD, TVS Capital Funds; Former Vice Chairperson, HUL), Mr. Jamil Khatri (Co-Founder & CEO, Uniqus Consultech; Former Head of Audit, KPMG) and Mr. P.R. Ramesh (Former Chairperson, Deloitte India), this discussion explored the growing regulatory scrutiny of auditors, and discussed maintaining their independence and effectiveness. While regulation enhances accountability, care must be taken to avoid excessive prescriptions that might negatively impact audit quality.

Auditing requires oversight due to recent failures and regulatory scrutiny. Self-regulation often falls short, on account of conflict of interests, thus undermining audit quality. Regulatory oversight is crucial for accountability, but Regulators should also play a developmental role, understanding real-world changes and challenges. Successful audits depend on cooperation from all stakeholders, especially management, to ensure the existence of effective controls.

Is Compliance Good Business?

The second day began with a plenary session featuring Mr. M. Damodaran, Mr. Ananth Narayan G. (Whole Time Member, SEBI) and Mr. Ashishkumar Chauhan (MD & CEO, NSE). This plenary session emphasized that compliance is not just about following rules, but embedding integrity and governance into a company’s core. The African proverb, “If you want to walk fast, walk alone; if you want to go far, walk together,” suitably captures the essence of compliance fostering trust, resilience, and long-term value creation.

Compensation – How Much is Too Much?

The session led by Mr. Ajay Bahl (Co-founder & Managing Partner, AZB & Partners), Mr. Sanjeev Aga (Former MD, Aditya Birla Nuvo; Former MD, Idea Cellular) and Mr. Sunil Mehta (Chairperson, IndusInd Bank; CMD, SPM Capital Advisers) examined the balance between fair remuneration and shareholder expectations.

Balancing shareholders’ concerns about excessive compensation with the need for adequate incentives requires a thoughtful approach. Compensation should reflect the market, the company’s size and risk level, and the individual’s responsibility and contribution. The worth of compensation should be tied to the risk, responsibility, and time spent on the role, ensuring it is a fair reward for the value and risks taken on, especially in high-responsibility roles like the Audit Committee for example.

Chairpersons – Biting More Than They Should Chew?

The session featured Mr. Homi R Khusrokhan (Former MD, Tata Chemicals & Tata Tea), Mr. Nawshir Mirza (Former Senior Partner, S. R. Batliboi & Co.) and Mr. M. Damodaran. It discussed whether the hyperactive involvement of some Chairpersons in Boards is affecting the management’s ability to operate efficiently. This raises important questions: Are non-executive Chairpersons overstepping into areas meant for management? How can we define and maintain clear boundaries?

The role of a Chairperson is to facilitate balanced decision-making, not to intrude on management’s operational domain. A good Chairperson fosters collaboration, values diverse perspectives, and ensures all voices are heard, speaking last in order to encourage open dialogue. As the boardroom has shifted focus from shareholder value to stakeholder value, Chairpersons must act as “first among equals,” balancing efficiency with inclusivity, and maintaining clear boundaries between governance and management.

Conclusion

Gatekeepers of Governance 2024 concluded with a call for ongoing improvement in corporate governance practices, to avoid failures and encourage long-term growth. By bringing together different stakeholders, the Summit highlighted ways to improve governance practices, stressing the importance of working together and being flexible to build a stronger and more resilient corporate ecosystem.

You can view the sessions through the following link:

Gatekeepers of Governance 2024, the 9th Annual 2 day Corporate Governance Summit, was held on November 21-22, 2024 at the Trident Hotel, Bandra Kurla Complex, Mumbai. It brought together leaders to address challenges and opportunities in the area of corporate governance. Organized by Excellence Enablers Private Limited, this prestigious event served as a platform to exchange ideas and solutions for fostering robust corporate governance practices. The discussions during the Summit focused on key themes and topics, as outlined below.

The Summit opened with an inaugural session titled “Regulators – Friends, Foes, or Frenemies?” featuring eminent speakers such as Mr. M. Damodaran (Chairperson, Excellence Enablers, Former Chairman, SEBI, UTI and IDBI), Justice P. S. Dinesh Kumar (Presiding Officer, Securities Appellate Tribunal; Former Chief Justice, Karnataka High Court), Mr. M. Nagaraju (Secretary, Department of Financial Services, Ministry of Finance, GOI), Mr. K. Rajaraman (Chairperson, IFSCA; Former Secretary, GOI), and Mr. Ashwani Bhatia (Whole Time Member, SEBI). The discussion was on the relationship between Regulators and businesses, highlighting the dual role that Regulators play in easing business processes, while ensuring compliance. Regulators act as allies by creating fair and transparent frameworks, but are often seen as adversaries due to the perceived burden of compliance costs and stringent norms.