#Dmart stock performance

Explore tagged Tumblr posts

Text

top 10 stocks to buy in india

Creating a blog post about the top 10 best stocks to buy in India is a dynamic task that requires understanding current market trends, economic conditions, and specific sector performances. As of my last update in January 2022, here’s a generalized outline for such a blog post. Please note that stock market conditions can change rapidly, so it’s crucial to update the information with current data:

Title: Top 10 Best Stocks to Buy in India in 2024

Introduction: Begin with an overview of the Indian stock market, its recent performance, and any key economic indicators influencing investment decisions in 2024.

1. Reliance Industries Limited (RIL): Discuss RIL’s diversified business interests, including petrochemicals, telecommunications, and retail. Highlight recent financial performance and strategic initiatives.

2. Tata Consultancy Services (TCS): Analyze TCS’s leadership in IT services globally, its market expansion strategies, and its resilience during economic downturns.

3. HDFC Bank: Explain why HDFC Bank remains a top choice for investors, focusing on its strong asset quality, digital banking initiatives, and market position.

4. Infosys: Highlight Infosys’s role in digital transformation services, its innovative capabilities, and recent contract wins in key global markets.

5. Hindustan Unilever Limited (HUL): Discuss HUL’s dominant position in the FMCG sector, its brand portfolio, and strategies for sustained growth amidst economic fluctuations.

6. Kotak Mahindra Bank: Evaluate Kotak Mahindra Bank’s performance in the banking sector, its focus on customer-centric innovations, and expansion plans.

7. Bajaj Finance: Examine Bajaj Finance’s role in consumer finance, its digital lending platforms, and strategies for managing risk in a competitive market.

8. Larsen & Toubro (L&T): Discuss L&T’s infrastructure projects, its engineering capabilities, and the impact of government initiatives on its growth trajectory.

9. Avenue Supermarts (DMart): Analyze DMart’s business model in the retail sector, its expansion plans, and consumer trends driving its growth.

10. Asian Paints: Highlight Asian Paints’ dominance in the decorative paints market, its product innovation strategies, and expansion into international markets.

Conclusion: Summarize the key reasons why these stocks are recommended for investment in 2024, considering factors such as industry leadership, financial performance, and strategic initiatives.

Disclaimer: Include a disclaimer stating that investing in stocks involves risks and readers should conduct their own research or consult with a financial advisor before making any investment decisions.

Remember, the content should be regularly updated with the latest information to ensure its relevance and accuracy.

0 notes

Text

Radhakishan Damani Portfolio, Shareholdings & Investments: An In-Depth Look

Radhakishan Damani, a legendary figure in the Indian stock market, is best known as the founder of Avenue Supermarts, the parent company of the DMart retail chain. His investment strategies, characterized by patience and a keen eye for value, have earned him a reputation as one of India's most successful investors. In this article, we explore the key components of Damani's portfolio, shareholdings, and investments, with detailed insights from Finology Ticker.

Understanding Radhakishan Damani’s Investment Approach

Damani’s investment philosophy is rooted in identifying companies with strong fundamentals, competent management, and significant growth potential. He tends to hold his investments for the long term, allowing the benefits of compounding to enhance his returns. His portfolio is a blend of established, stable companies and promising growth stocks.

Key Holdings in Radhakishan Damani’s Portfolio

1. Avenue Supermarts Ltd. (DMart)

Sector: Retail

Description: DMart is the cornerstone of Damani's portfolio. The company operates a highly efficient chain of hypermarkets and supermarkets across India, known for its customer-centric approach and low-cost operations. DMart’s impressive financial performance and consistent growth make it a flagship investment for Damani.

2. VST Industries Ltd.

Sector: Tobacco

Description: VST Industries is a major player in the tobacco sector, producing a wide range of tobacco products. Damani’s investment in VST Industries highlights his preference for companies with stable revenue streams and regular dividend payouts.

3. India Cements Ltd.

Sector: Cement

Description: India Cements is one of the largest cement manufacturers in India. With its extensive production capacity and distribution network, the company has a significant presence in the market. Damani’s long-term stake in India Cements reflects his confidence in the infrastructure and construction sectors’ growth prospects.

4. Trent Ltd.

Sector: Retail

Description: Trent operates several retail brands, including Westside and Zudio. The company’s diverse product offerings and strategic growth plans make it an attractive investment in Damani’s portfolio.

5. Blue Dart Express Ltd.

Sector: Logistics

Description: Blue Dart is a leading logistics and courier service provider in India. Known for its extensive network and reliable services, Blue Dart is a strategic investment for Damani, leveraging the growing demand for logistics solutions.

6. Sundaram Finance Ltd.

Sector: Financial Services

Description: Sundaram Finance offers a variety of financial products, including loans, insurance, and asset management. The company’s prudent management and consistent performance align with Damani’s investment philosophy.

7. 3M India Ltd.

Sector: Diversified

Description: 3M India operates in multiple sectors, including healthcare, consumer goods, and industrial products. The company’s innovative approach and diversified revenue streams make it a valuable part of Damani’s portfolio.

8. United Breweries Ltd.

Sector: Beverages

Description: Known for its flagship brand Kingfisher, United Breweries is a dominant player in the alcoholic beverages market. Its strong market position and consistent growth have made it a significant holding in Damani’s portfolio.

Insights from Finology Ticker

Finology Ticker provides a comprehensive overview of Radhakishan Damani's portfolio, shareholdings, and investments. The platform offers detailed information on the performance and financial metrics of the companies in his portfolio, including current share prices, market capitalization, price charts, and balance sheets. This data allows investors to analyze Damani’s investment strategies and the rationale behind his stock selections.

Conclusion

Radhakishan Damani’s portfolio is a reflection of his disciplined investment strategy and deep understanding of market dynamics. His focus on companies with strong fundamentals and growth potential has consistently delivered impressive returns. For investors and market enthusiasts, studying Damani’s portfolio, as detailed on Finology Ticker, provides valuable insights into effective investment strategies and potential market opportunities. By examining his shareholdings and investments, one can gain a better understanding of the principles that drive long-term success in the stock market.

#radhakishan Damani#radhakishan damani portfolio#radhakishan damani stocks#portfolio of radhakishan Damani#radhakishan damani penny stocks

0 notes

Text

Key Factors Behind Radhakishan Damani’s Investment Decisions

Introduction

Damani is a name with a sagacity of the Indian stock market. His investment decisions and strategies are not just successful but serve as a blueprint for aspiring investors.

He founded Dmart, a major retail corporation, and became renowned as a seasoned investor in the Indian equity market. His portfolio has been studied and envied by many. To read more about Radhakishan Daman's portfolio and net worth, read our blog on Altius Investech.

The blog would highlight his strategic moves contributing to the notable success while offering valuable insights to investors.

Long-term investment mindset

With his long-term investment horizon, unlike traders focusing on short-term gains, Damani has invested in various companies for numerous years.

The philosophy and approach of purchasing and holding onto stocks from fundamentally strong companies lets him earn benefits from steady growth, dividend payouts, and appreciation of long-term capital.

Avenue Supermarts, the parent company of DMart, highlights a great example demonstrating the exponential growth attained from long-term holdings.

Damani has also invested in Chennai Super Kings – an IPL franchise backed by India Cements Limited. With an illustrious history, they have participated in a record 10 finals, won a record five IPL titles in 2010, 2011, 2018, 2021, and 2023, and qualified for the playoffs 12 times out of the 14 seasons they have played in, which is more than any other franchise.

To have your hands-on gains that we can vouch for, buy csk unlisted shares from Altius Investech starting from just ₹ 153.

Value in Investments

Damani looks out for companies that are undervalued as per their actual worth. Buying the stocks at prices lower than their real, intrinsic value, makes him position himself for considerable gains once the market corrects the undervaluation. The method needs a deeper understanding of the fundamentals of business, involving debt levels, competitive advantages, and revenue streams.

No to High-debt companies

A significant factor in his investment strategies is an aversion to organizations with high debt levels. Instead, he seeks companies with stronger cash flows and manageable debt. The conservativeness shields his investments from risks linked with high leverage, especially during economic downturns, causing stable returns.

Market Timing

What needs to be acknowledged is the way Damani times his entry or exit from businesses, impeccably. He willingly buys stocks when the market shows pessimistic values and sells as per his interest. For example, his entry into some specific apparel or cement stocks during the time of market lows let him reap considerable gains with the recovery of these sectors.

Market Cycles

Damani’s interpretation and understanding of the market cycles significantly contribute to his success. Through effective studies levied on investor behavior and market patterns, he can anticipate market dynamic shifts. The capability of reading the market makes him adjust his strategies as per the prevailing economic scenario.

Business Fundamentals

The decisions he makes in his processes analyze business procedures to invest only in companies having strong management, sustainable advantages, and clear strategies for growth. Instead of market speculation, he identifies companies offering potential and stability, irrespective of conditions of market volatility.

Diversification

With important holdings in the investments and retail sectors, Damani’s portfolio remains diverse across different industries. Diversification helps in the mitigation of risks as poor performance of one stock or sector is compensated by the gains or stability of the rest. This counts as a classic strategy that served him well over the decades.

Network and Mentorship

A close-knit group consisting of seasoned investors as friends and mentors, including the famous Rakesh Jhunjhunwala, gives him a network providing him with robust exchanges of strategies and ideas, and refining his investment tactics and decisions.

Conclusion

Several disciplined approaches happen to focus on value investing, fundamental analyses, and cautious approaches for debt as well as market timing, making a huge figure to emulate in the world of investment.

Investors who intend to mirror his success must understand and implement these principles as a step forward in earning significant returns in the volatile world of trading stocks. To further diversify and grow your investment, consider investing in unlisted shares on Altius Investech, a platform known for its promising opportunities.

0 notes

Text

Avenue Supermarts: DMart stock surge boosts Radhakishan Damani's wealth by ₹2,695 crore

Avenue Supermarts, which operates the retail chain of DMart, saw its shares zoom 5.8% to hit a new one-year high of ₹4,715 apiece in today’s trading before finishing the trade at ₹4,645 apiece, up 4.13%. Investor sentiment was buoyed by the company’s impressive business update for the fourth quarter of FY24, which garnered positive attention from market participants. The upbeat performance of…

View On WordPress

0 notes

Text

Avenue Supermarts Quarterly Results Update

Avenue Supermarts Quarterly Results Update

Avenue Supermarts Ltd – Q3 FY2019-20 Results Analysis Introduction

Avenue Supermarts, the operator of supermarket chain of D’Mart reported a healthy 56% growth in its consolidated net profits in Q3 FY20. The growth was mainly driven by lower tax and higher operating income. Lets analyze Avenue Supermarts quarterly results update in detail in this article.

Detailed Stock Analysis by…

View On WordPress

#Avenue#Avenue Supermart#Avenue Supermart performance#Avenue Supermarts Latest Quarter Results#Avenue Supermarts Ltd Stock Analysis#Avenue Supermarts Quarterly Results Update#Consumption Business#Consumption Business Model#Corporate Tax Rate Cut#DMart#Dmart stock performance#Net profit#Retail Sector#Retail Sector in India - Analysis#revenue

0 notes

Text

Zomato’s express delivery

Well that was quick. Zomato, which launched an Indian startup unicorn’s first domestic IPO last week, will be listed on India’s stock exchanges starting tomorrow.

Also in this letter:

🦄 BlackBuck is going to be a unicorn 🏦 Digital rupee “in phases”, says RBI 🚨 CCI says Amazon was hiding facts in the Future Group deal

Zomato will go public tomorrow

July 23rd will mark a historic day for India’s startup ecosystem as Zomato food delivery platform makes its highly anticipated debut on the domestic stock exchanges.

The Gurugram-based firm originally planned to record on July 27, but has now postponed it until tomorrow, ET reported Wednesday evening.

More than 40 times oversubscribed: Last week, Zomato launched the first domestic IPO of an Indian startup unicorn. The issue was subscribed 40.38 times and generated demand of Rs 2.13 lakh crore, the highest for a domestic IPO in 11 years and the third highest in the history of the Indian capital market.

The IPO, which opened on July 14 and completed on July 16, also set a record for anchor investors and attracted the second highest number of registrations of all time. The allocation of the IPO share allocation to investors took place today (June 22nd).

IPO offer: The issue included fresh equity valued at Rs 9,000 billion and an Selling Offer (OFS) valued at Rs 375 billion from existing investor Info Edge (India). At the high end of the price range, the company will have a market cap of nearly Rs 64,500 billion. Prior to going public, Zomato had raised Rs 4.197 billion from 186 anchor investors by allocating 552.2 million shares at Rs 76 each.

India’s startup ecosystem has been closely watching Zomato’s IPO performance as it could set the tone for a number of other companies including Paytm, Policybazaar and Mobikwik.

Read our in-depth look at Zomato’s IPO, what it means for other startups and the company’s path so far.

BlackBuck goes to the unicorn club

The online trucking platform BlackBuck became the newest member of the Indian startup unicorn club.

Push the news: BlackBuck raised $ 67 million in a round led by Silicon Valley-based venture fund Tribe Capital, IFC Emerging Asia Fund, and VEF, which valued the startup at over $ 1 billion. The company was previously valued at approximately $ 850 million on its last fundraising in 2019.

BlackBuck has increased nearly $ 300 million since it was founded through a mixture of equity and debt financing. Investors also include Accel, Apoletto Asia, B Capital, Flipkart and Goldman Sachs.

Where should the money go? The company will use the money to expand its customer base and introduce new services. Rajesh Yabaji, co-founder and CEO of BlackBuck, said the company will invest heavily in product and data science capabilities to achieve better freight matching efficiency for the Indian trucking ecosystem. The startup will also be scaling its financial services and insurance offerings through partnerships.

This funding comes as a company sees a shift in demandwith most of it no longer coming from large corporations but from small businesses, brokers, and large corporations. “In the past two years, digital adoption has increased … we’ve seen 20x growth on the supply side and 10x growth in demand,” said Yabaji.

big picture: It’s been a record year for domestic startups, raising $ 12.1 billion from venture capitalists and private equity firms in just the first six months. India’s startups cost $ 11 billion in all of 2020, according to Venture Intelligence.

The continued flow of cash amid high valuations has also helped catapult a record number of startups into the Unicorn club.

Tweet of the day

RBI says the digital rupee will be rolled out gradually

The Reserve Bank of India (RBI) is working on a “phased introduction” of the Central Bank of India’s (CBDC) digital currency and a pilot project to test a general purpose digital currency is possible in the near future, RBI Deputy Governor T Rabi Shankar said on Thursday.

What is a CBDC? CBDC is a form of virtual currency issued by a central bank as an alternative to physical currency. In contrast to cryptocurrencies such as Bitcoin and Ethereum, CBDCs are covered by the state reserves of nation states and are therefore not subject to the same volatility.

Enable legal framework: In order to launch India’s CBDC, RBI is reviewing several legal frameworks, including amendments to several sections of the RBI Act, the Coin Act 2011, the Foreign Exchange Administration Act, and the Information and Technology Act.

What are the advantages? Shankar said a CBDC would reduce reliance on cash, lower the cost of printing cash, and provide a more robust settlement mechanism. Another key benefit is the elimination of “time zone differences” in foreign exchange transactions, which could pave the way for a cheaper and smoother international settlement system.

meanwhileAt the other end of the world, Tesla CEO Elon Musk said on Wednesday that they will likely accept Bitcoin as a payment option again after carefully considering the amount of renewable energy used to mine the currency.

Musk noticed that too he and his space company SpaceX also own Bitcoinapart from Tesla. Musk also owns Ethereum and Dogecoin in his personal capacity.

Catch up quickly: Tesla bought about $ 1.5 billion in Bitcoin in February and announced it would accept the digital coin as a payment option. But in May, Musk announced on Twitter that Tesla would end this initiative, citing concerns about the “rapidly increasing use of fossil fuels for Bitcoin mining and transactions.”

That move had triggered a bitcoin route, with the cryptocurrency falling nearly 17% within hours of the tweet. It also sparked allegations of “price manipulation,” which Musk denied last month.

On Wednesday, Musk said, “I could pump, but I’m not caving in … I definitely don’t believe in pushing the price up and selling or anything like that. I want to see Bitcoin successful. “

CCI accuses Amazon of hiding facts about the Future Group deal

In a notice to Amazon, India’s competition regulator accused the company of hiding facts and providing false information while seeking approval to invest in a Future Group unit, Reuters reports.

The deal: Amazon had agreed to acquire a 49% stake in Future Coupons, a promoter of Future Retail, for around 1,500 billion rupees in August 2019. The firm is currently involved in a lawsuit with Future Group and Reliance Industries after the latter took over Future Group’s retail and wholesale business.

Amazon has argued in court that the terms of its 2019 deal prevent Future Group from selling Future Retail to Reliance.

CCI notice: The Competition Commission of India (CCI) announced in a June 4 announcement that the US e-commerce major had failed to disclose its strategic interest in Future Retail when it applied for approval for the 2019 deal. “The representations and behavior of Amazon before the Commission represent false information, false information and the suppression and / and concealment of essential facts,” it says in the communication.

CCI has now asked Amazon why it shouldn’t punish the company.

What is Amazon saying? Amazon confirmed to Reuters that it has received the notice and will extend its full cooperation to the CCI. The company said it was “confident that we can address the concerns of the Chamber of Commerce”.

What’s next? If CCI isn’t happy with Amazon’s response, it could fine the company and also review its deal with the Future Group, Vaibhav Choukse, partner at J Sagar Associates, told Reuters.

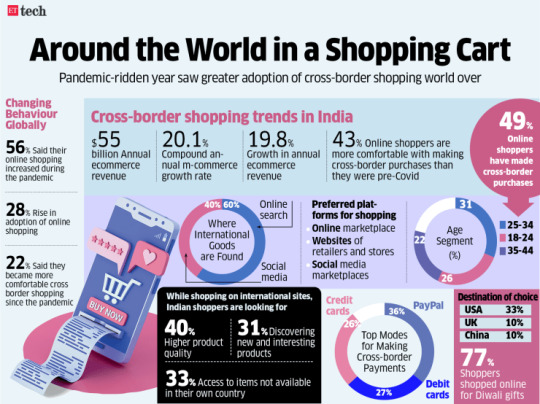

Large retailers are seeing a 2- to 9-fold increase in online sales

India’s largest brick and mortar retailers are seeing a huge shift in consumer behavior as more people shop online amid the pandemic.

What’s happening? Reliance Retail, DMart, Croma, Aditya Birla Fashion & Retail and Spencer’s Retail increased their online sales by 2 to 9-fold in 2020-21, although many of their stores either remained closed due to Covid-19 restrictions or had restricted their operations. This is based on disclosures made in their annual reports and presentations to investors.

For India’s largest retailer Trust retail, accounted for the e-commerce business about 10% of sales by the end of FY21, down from almost zero last year. The growth was led by the company’s own platforms Jiomart and Ajio.com as well as acquired startups such as Netmeds, Urban Ladder and Zivame.

Devendra Chawla, managing director of Spencers Retail and Nature’s Basket, said online sales accounted for up to 30-40% of their total sales during the peak months of the lockdown.

Today’s ETtech Top 5 was written by Vikas SN in Bengaluru and published by Zaheer Merchant in Mumbai.

source https://seedfinance.net/2021/07/22/zomatos-express-delivery/

0 notes

Text

SGX Nifty Climbs Along With Asian Peers; DMart, IIP, CPI Data in Focus

SGX Nifty Climbs Along With Asian Peers; DMart, IIP, CPI Data in Focus

Asian stocks started the week higher after their U.S. peers chalked fresh records and Treasury yields stabilised after jumping Friday. Shares in Japan outperformed and Hong Kong also rose. Australia advanced despite a prolonged lockdown in the largest city, Sydney, as virus cases continue to rise. The Singapore-traded SGX Nifty, an early indicator of India’s Nifty 50 Index’s performance, rose…

View On WordPress

0 notes

Text

Radhakishan Damani’s DMart, Naukri.com’s Info Edge may soon join Nifty 50; these stocks could exit

Radhakishan Damani’s DMart, Naukri.com’s Info Edge may soon join Nifty 50; these stocks could exit

Making space for any possible inclusion, ICICI Direct believes India Oil Corporation or Coal India could exit. Radhakishan Damani’s Avenue Supermarts (DMart) or Naukri.com’s parent company Info Edge could become part of the Nifty 50 pack in the upcoming semi-annual index review. Both the stocks have performed strongly over the last six months, outperforming the benchmark index. While DMart does…

View On WordPress

0 notes

Text

Creating a blog post about the top 10 best stocks to buy in India is a dynamic task that requires understanding current market trends, economic conditions, and specific sector performances. As of my last update in January 2022, here’s a generalized outline for such a blog post. Please note that stock market conditions can change rapidly, so it’s crucial to update the information with current data:

Title: Top 10 Best Stocks to Buy in India in 2024

Introduction: Begin with an overview of the Indian stock market, its recent performance, and any key economic indicators influencing investment decisions in 2024.

1. Reliance Industries Limited (RIL): Discuss RIL’s diversified business interests, including petrochemicals, telecommunications, and retail. Highlight recent financial performance and strategic initiatives.

2. Tata Consultancy Services (TCS): Analyze TCS’s leadership in IT services globally, its market expansion strategies, and its resilience during economic downturns.

3. HDFC Bank: Explain why HDFC Bank remains a top choice for investors, focusing on its strong asset quality, digital banking initiatives, and market position.

4. Infosys: Highlight Infosys’s role in digital transformation services, its innovative capabilities, and recent contract wins in key global markets.

5. Hindustan Unilever Limited (HUL): Discuss HUL’s dominant position in the FMCG sector, its brand portfolio, and strategies for sustained growth amidst economic fluctuations.

6. Kotak Mahindra Bank: Evaluate Kotak Mahindra Bank’s performance in the banking sector, its focus on customer-centric innovations, and expansion plans.

7. Bajaj Finance: Examine Bajaj Finance’s role in consumer finance, its digital lending platforms, and strategies for managing risk in a competitive market.

8. Larsen & Toubro (L&T): Discuss L&T’s infrastructure projects, its engineering capabilities, and the impact of government initiatives on its growth trajectory.

9. Avenue Supermarts (DMart): Analyze DMart’s business model in the retail sector, its expansion plans, and consumer trends driving its growth.

10. Asian Paints: Highlight Asian Paints’ dominance in the decorative paints market, its product innovation strategies, and expansion into international markets.

Conclusion: Summarize the key reasons why these stocks are recommended for investment in 2024, considering factors such as industry leadership, financial performance, and strategic initiatives.

Disclaimer: Include a disclaimer stating that investing in stocks involves risks and readers should conduct their own research or consult with a financial advisor before making any investment decisions.

Remember, the content should be regularly updated with the latest information to ensure its relevance and accuracy.

1 note

·

View note

Text

Happy Makar Sankranti | Trade Nivesh see 15-44% upside in these 14 stocks

Sensex, Nifty hit fresh record high | Happy Makar Sankranti

The easing geopolitical tensions between the US and Iran, and expectations of signing of phase one trade deal by the US and China this week lifted the sentiment on the Street. Infosys' robust earnings further boosted the the IT pack, and benchmark indices hit fresh record high on January 13.

The Nifty has rallied more than 15 percent to cross psychological 12,300 levels while the Nifty Midcap has surged nearly 14 percent from the day of corporate tax cut announcement in September 2019.

The Street expects more sops in the Union Budget 2020 scheduled to be presented on February 1.

All these positive triggers made the investors overlook the weak economic signs and rising inflation.

Experts expect the momentum to continue in coming quarters with a healthy correction.

"Though inflation is likely to bounce much above the RBI's comfort level, market is buoyant due to positive expectation on the Union Budget & possible improvement in the trajectory of earnings growth as per the Q3FY20 preview," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

"IT has provided a good start to the season and FIIs are maintaining its risk-on strategy with positive inflows in Emerging Market, expecting no hike in US Fed rate and improvement in EMs economies during CY2020," he said.

Ajit Mishra, VP - Research at Religare Broking expects stock specific activity will be on a higher side in coming days.

Moneycontrol collated 14 stocks where brokerages initiated coverage in January with a buy call. They are expected to give 15-44 percent return in the next 12-18 months.

Apollo Hospitals Enterprises: Buy | Target: Rs 1,755 | Return: 18 percent

Stewart & Mackertich has initiated coverage on Apollo Hospitals with a buy rating, citing no major capex cycle, increase in capacity utilisation, reduction in promoter pledge and pharmacy restructuring.

Apollo Hospitals has emerged as Asia's foremost integrated healthcare services provider and has a robust presence across the healthcare ecosystem, including Hospitals, Pharmacies, Primary Care & Diagnostic

Clinics and several Retail Health models, the brokerage said, adding as the nation's first corporate hospital, Apollo Hospitals is acclaimed for pioneering the private healthcare revolution in the country.

The research firm valued the stock at 15x FY22E EV/EBITDA to arrive at a target price of Rs 1,755. if you go with Intraday kindly Ask an Expert Trade Nivesh

The Anup Engineering: Buy | Target: Rs 668 | Return: 27 percent

PhillipCapital has initiated coverage with a buy call and target price of Rs 668 on the stock as it has a potential of re-rating based on promising outlook and strong operating performance.

Based on existing environment and management's focused approach, the brokerage expects topline to grow by CAGR of 21.5 percent for next 3 years (against 33 percent CAGR growth expected by the company).

"We like the company due to demerger which acted as a catalyst to participate in an emerging opportunity, robust operating performance, its aspiration to reach Rs 1,000 crore revenue over next 5 years, strong opening order book and green field plant expansion," said the research firm in its note on January 9.

"The Anup has started FY20 on very strong order book of Rs 300 crore, executable over next 3-4 quarters, management is confident of 30 percent revenue growth in FY20," the brokerage said. if you go with Intraday kindly Ask an Expert Trade Nivesh

Security and Intelligence Services: Buy | Target: Rs 1,190 | Return: 17 percent

Axis Direct has initiated coverage with a buy call on Security and Intelligence Services and target price of Rs 1,190, implying 21 percent potential upside from current levels.

It cited expanding India security services, increasing demand for security services in Australia, strong foot prints of facility management services, rising demand for cash logistics services and robust infrastructure and superior technology driven process.

Security and Intelligence Services (SIS) is a leading security services company in India and Australia with leadership positions in cash logistics and facility management services. SIS operates mainly into four segment areas viz. Security Services – India, Security Services – International, Facility management and Cash Logistics services. if you go with Intraday kindly Ask an Expert Trade Nivesh

Hawkins Cooker: Buy | Target: Rs 4,353 | Return: 16 percent

Angel Broking initiated coverage on Hawkins Cooker (HCL) with a buy recommendation and target price of Rs 4,353 as it forecast HCL to report healthy topline CAGR of around 14 percent to Rs 976 crore over FY19-22E on the back of government initiatives, new product launches, strong brand name and wide distribution network.

On the bottomline front (reported PAT), the brokerage estimates around 23 percent CAGR to Rs 100 crore due to strong revenue and operating margin improvement (on the back of correction in raw material prices). if you go with Intraday kindly Ask an Expert Trade Nivesh

Neuland Laboratories: Buy | Target: Rs 663 | Return: 41 percent

BP Equities initiated coverage on the stock and recommended buy rating with a target price of Rs 663 per share. With a washout in FY18 and growth resumption in FY19, the brokerage believes that the CMP (down 45 percent from 52-week high) offers an attractive opportunity for investors to time an entry.

It foresees 13.8 percent revenue CAGR, 744bps margin expansion and 73.2 percent growth in earnings over FY19-22. "The balance of portfolio among high value and high volume products will help it clock a faster growth in earnings. We believe the stock will see a gradual re-rating on the back of stronger products pipeline and improved return ratios."

While generic API manufacturing remains the pillar of NLL’s overall business, the ramp-up in the CMS segment (API CRAMS); especially given the fertile product opportunities (like Bilastine and Peptide product) is expected to drive next phase of growth going forward, according to the brokerage which believes NLL will continue to strengthen its balance sheet with strong operating cash flow generation of Rs 245 crore over FY19-22. if you go with Intraday kindly Ask an Expert Trade Nivesh

Orient Electric: Buy | Target: Rs 240 | Return: 24 percent

SPA Securities initiated coverage with a buy call and target price of Rs 240 on Orient Electric (OEL), a strong #2 player in domestic fans market & largest exporter of fans from India.

With focus on premium segment, OEL dominates this segment with around 50 percent market share. Lighting and domestic appliances are other product categories where OEL is present.

Orient Electric is a part of the diversified CK Birla Group & is a distinguished name in the consumer electrical space. The company got demerged from Orient Paper & Industries 2 years back.

Relatively younger profile of businesses other than fans & focus on innovative and premiumised product categories enables it to outperform peers in terms of topline growth as well as gross margins, said the brokerage which estimates revenue & PAT CAGR of 19 & 25 percent respectively during FY19-22. if you go with Intraday kindly Ask an Expert Trade Nivesh

Axis Bank: Buy | Target: Rs 902 | Return: 22 percent

Anand Rathi initiated coverage on Axis Bank with a buy rating and a target price of Rs 902 per share.

Considering the improving asset quality trends and strategy focus, the bank is well poised to deliver consistently with improving return ratios, said the brokerage.

The management has given the guidance that they expect their loan book to grow at 5-7 percent faster than the industry growth rate and that credit costs would revert to long term average. On margins front, management has given the guidance that Net Interest Margin (NIM) for FY20 to be higher than NIM in FY19 and also reiterated their medium term range of 3.5-3.8 percent on NIM. Management also aims to bring operating expenses to assets down to around 2 percent with the intention of achieving an overall return on equity (RoE) of 18 percent.

Axis bank has delivered strong double digit growth in advances as well as deposits in the past. if you go with Intraday kindly Ask an Expert Trade Nivesh

Avenue Supermarts: Buy | Target: Rs 2,200 | Return: 15 percent

Ambit has initiated coverage on D-Mart operator with a buy rating and target price of Rs 2,200.

"D-Mart posted 35 percent EBITDA CAGR in FY14-20 versus less than 20 percent by leading peers. RoCE of around 20 percent consistently beats peer average. This justifies 40 percent premium over Titan and other consumption names. Even if DMart's 1-year forward P/E de-rates 50 percent, exit multiple of 27x will drive 12 percent stock CAGR in the next 10 years on 23 percent EPS CAGR. Entry into cash & carry could drive further upside," said the brokerage.

Ambit feels longevity of efficient retailers like DMart is under-appreciated in India.

"DMart’s investments in building leadership talent, distress in real estate prices and opening itself to leasing model would gradually accelerate store expansion. Valuations of 68x/54x FY21/FY22 EPS will fade quickly as earnings compound 23 percent over next decade," it added. if you go with Intraday kindly Ask an Expert Trade Nivesh

Arvind: Buy | Target: Rs 56 | Return: 26 percent

Going forward Sushil Finance believes that the revival of the denims business and the capex that has been incurred for the garments business will provide considerable growth to the textiles business segment.

In addition to the textile business, advance materials business also provides strong growth prospects to the company, said the brokerage which valued the company at 5.5X its FY21 EPS and arrived at a target price of Rs 56 which makes it a buy with an investment horizon of 15-17 Months. if you go with Intraday kindly Ask an Expert Trade Nivesh

Transport Corporation of India: Buy | Target: Rs 355 | Return: 31 percent

TCI being one of the fastest growing logistics service providers is a likely beneficiary of Government initiatives like GST implementation, Bharatmala & Sagarmala Pariyojana etc, said SKP Securities, adding the company is well positioned to capitalize on the growing market opportunities due to better business mix because of its focus on value added business, leading to improvement in operating efficiencies, better margins and higher return ratios.

The brokerage has valued TCI on SOTP basis and recommended a buy on the stock with a target price of Rs 355 in 18 months. if you go with Intraday kindly Ask an Expert Trade Nivesh

Mishra Dhatu Nigam: Buy | Target: Rs 242 | Return: 44 percent

Mishra Dhatu Nigam (Midhani) is an super alloy and titanium alloy manufacturer, catering to the very niche segment of maraging/super alloy steel segment in India.

"Increase in Indian space expenditure budget has been one of the key tailwinds for MIDHANI. Significant expenditure budget CAGR towards space (15.8 percent CAGR over the past six years), joint product development with Indian Space Research Organisation (ISRO) for strategically important materials, relatively small scale of operations, all tilt the risk reward in favour of MIDHANI," said ICICI Securities.

The research house initiated coverage on the stock with a buy rating and a target price of Rs 242 per share. Sudden drop in space contract inflow/execution is the key risk to the call, it said. if you go with Intraday kindly Ask an Expert Trade Nivesh

RITES: Buy | Target: Rs 370 | Return: 20 percent

Anand Rathi said considering the company's impressive performance over the years, strong order book, sound financials, decent execution capabilities and favourable industry traits, it believes that the company is well positioned for long term growth.

The brokerage initiated coverage on the company with a buy rating and a target price of Rs 370 per share.

RITES has a very healthy order book which is led by consultancy and turnkey segments, contributing to around 42 percent and 40 percent respectively. It has negligible borrowings and aims to maintain a similar level of debt in the next 3-5 years. if you go with Intraday kindly Ask an Expert Trade Nivesh

Coromandel International: Buy | Target: Rs 656 | Return: 21 percent

Coromandel's PAT is expected to grow by at a CAGR of 17 percent over FY19-FY22 on the back of increase in the share of unique grade phosphatic fertilizers and lower raw material cost, said Geojit, adding the better-than-expected rainfall in company's home markets of Andhra Pradesh and Telangana are expected to improve volumes in the coming quarters this year.

It feels EBITDA margins are expected to expand by 250 bps by FY22 as raw material costs are expected to decline due to backward integration. The brokerage initiated coverage valuing Coromandel at 16x on FY22E EPS with a target price of Rs 656 and recommend to buy. if you go with Intraday kindly Ask an Expert Trade Nivesh

State Bank of India: Buy | Target: Rs 456 | Return: 38 percent

State Bank of India realising its mammoth size, trims operational inefficiencies and competes aggressively with private peers to boost its returns.

Forseeing the bank's vast recoveries going ahead, increasing home loans, xpress credit and personal loan growth along with the corporate tax rate cuts and significant liquidity in hand for core business growth, Arihant Capital initiated coverage on SBI with a buy recommendation and target price of Rs 456. if you go with Intraday kindly Ask an Expert Trade Nivesh

0 notes

Text

Avenue Supermarts- Q2FY22 Result Analysis

Avenue Supermarts- Q2FY22 Result Analysis

Q2FY22 Result: Avenue Supermarts- Q2FY22 Results In the consolidated results, Avenue Supermarts has posted growth of 50% in its Revenue sequentially and more than 100% growth in its EBITDA and Net Profit on account of low base effect due to lockdown impact because of the second wave of Covid-19 pandemic in the country during March end- May.The Consolidated Revenue of the company has increased…

View On WordPress

#Avenue Supermarts#Avenue Supermarts- Q2FY22 Result Analysis#DMart Ready#Half-Yearly Performance#Q2FY22 Result Analysis#Revenue Growth Trend#Stock Performance#Store Addition Trend#What should investors do?

0 notes

Text

Nifty Next 50–Same Bottoms for a Year.

Nifty Next50 has made an interesting formation for the last year. Almost bottoming out around the same base for 4 times in the last 1 year.

Nifty Next50 Technical Chart

Same bottoms for last 1 year.

Knocking at the last 2 months high.

This is still down 17% from the highs.

Also topped out in January 2018 like all other broader indices.

Did make an attempt to try all time highs in Sept 2018.

Now for the last 1 year even this index is diverging with the Nifty50.

Over a long period of time Nifty Next50 has generally outperformed Nifty50.

Nifty 50 and Nifty Next 50

1) Over the last 5 years the Nifty next 50 has outperformed nicely.

2) Over the max period also a strong outperformance.

If i were to run a long term large cap index fund strategy would be a mix of Nifty50 and Nifty Next 50 in some ratio say a 50-50 or rather just the Nifty next50.

One of the major reasons to like the Nifty next50 index is that it is a lot more diversified and less top heavy.

3) Long periods of Underperformance too.

But there are long periods of underperformance too. A lil old snapshot from a post on capitalmind. Suppose the underperformance has continued and now this has lasted 300 plus trading sessions. Only time this did so was in 2008 fall and 2011-2012 fall.

Source – Capitalmind -

Given the stretch and good formation it could well be the time for Nifty Next50 to outperform the Nifty50. Will it happen due to Nifty

The Top 20 names in the Index as per weight.

HDFCLIFE 3.98 DABUR 3.74 SBILIFE 3.71 GODREJCP 3.4 SHREECEM 3.34 PEL 3.16 PIDILITIND 3.1 DIVISLAB 3.05 MARICO 2.98 ICICIGI 2.95 PETRONET 2.95 HINDPETRO 2.86 MCDOWELL-N 2.76 LUPIN 2.62 COLPAL 2.5 HAVELLS 2.5 AUROPHARMA 2.49 DMART 2.46 BAJAJHLDNG 2.45 INDIGO 2.4

Very well diversified across stocks with nothing weight more than 4%.

At the same time Nifty50 has top 8 names above 4% weight and comprise 55% of the index. The Top 8 here comprise only 28%.

So even the bottom 10-20-30 stocks in Nifty next 50 can give a good impact to the performance.

Whatsapp Subscription to the Blog

As most of us now prefer to read/save articles/post through the mobile phone and whatsapp, we are also drifting towards whatsapp subscription to the blog. This is free and what do you get

1) In this you will get an alert on whatsapp whenever a new article is posted on the website.

2) Interesting older articles from www.nooreshtech.co.in

3) Interesting links and reads from Analyse India

4) Technical Charts and more updates in your whatsapp

The frequency would be a few messages a week. Generally less than 7-10 in a week or 1-2 in a day.

Click on this link for Whatsapp Subscription - https://bit.ly/2IzLJYQ

Do save 7977801488 in your contacts to receive the updates.

or whatsapp subscribe to +91 79778 01488 to receive messages save the number in your contacts. Those who would like to shift to whatsapp can unsubscribe from the email list.

Nifty Next 50–Same Bottoms for a Year. published first on your-t1-blog-url

0 notes

Text

What is a Hedge Fund ?

This article is written by Darsha Shetty, a law graduate from Government Law College, Mumbai and a qualified Company Secretary, pursuing Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from Lawsikho.com. She is currently working with Avenue Supermarts Limited ( DMart ) as a CS Management Trainee.

Meaning of Hedge Fund

Hedge fund is an alternative investment vehicle that utilizes complex investment strategies to invest (trade) in a variety of products, to earn a return for its investors. It is structured in the form of a private investment partnership between professional fund managers and investors. The investors pool in their funds for the purpose of investment. The funds pooled in are then managed by the professional fund manager, in consideration of asset management fees and performance fees.

Birth and evolution of Hedge Fund

The post – Great War scenario opened up numerous avenues for wealth creation in the markets, thereby creating an unprecedented demand for collective investment vehicles. Among such investment vehicles was the Graham-Newman Partnership, which has been cited by Warren Buffet as being the earliest example of hedge fund. The coinage of the term “hedge(d) fund” can be attributed to Alfred Jones, who is considered to be the father of the modern hedge fund. In the late 1940s, Alfred Jones was asked by his employers at Fortune magazine to write an article about the current investment trends. It is from here that he took the inspiration to try his hand at being a money manager. He then invested $40,000 from his savings and pooled in another $60,000 from the other investors and launched a fund based on the long/short equities method which he termed as ‘hedged fund’. Thereafter, he changed the structure of the investment vehicle from general to limited partnership and also introduced the performance fee incentive structure for the managing partner. He also employed the use of leverage (i.e. borrowed funds) to amplify investor returns. Jones thus set a template for hedge funds, thereby making him the pioneer of hedge funds.

The Fortune magazine had another pivotal role to play in the development of the hedge fund industry. The world was taking its time to warm up to the idea of a hedge fund as an investment model. It was then that an article published in the Fortune magazine threw light on an obscure investment vehicle that had outshone every mutual fund on the market. This article compelled the money managers to sit up and take notice, thereby paving a way for the development of hedge fund as a real industry.

Characteristics of Hedge Fund

Accredited Investors: Investments in hedge funds are open only to ‘sophisticated/accredited’ investors i.e. investors with the prescribed net worth or income.

Regulation: Hedge funds are not required to be registered with the securities market regulator nor do they need to disclose their NAV. The regulatory oversight is negligible in comparison to mutual funds since general public interests are not involved and the accredited investors are deemed to be affluent enough to gauge the risks associated with such funds. Thus, hedge funds are regulation – light. However, the dot com crash of the 2000s and the global economic crisis of 2008 has led to an increase in the compliances for the hedge funds in the United States.

A wide latitude of investments: Hedge funds can invest in a variety of assets viz. land, stocks, bonds, currencies, derivatives, etc., subject to the restrictions contained in their mandate.

Fee Structure: Hedge funds charge asset management fees as well performance fees. The fee structure of hedge funds has been subjected to a lot of criticism.

Illiquid: Investments in hedge funds are illiquid as often there is an initial lock-in period of one year, post which the withdrawals may only happen at certain intervals.

Two and Twenty Fee Structure

“2 and 20” is the compensation scheme used by a vast majority of hedge funds. According to the scheme, the fund manager is entitled to 2% of assets as management fees and 20% of the profits as performance fees.

For Example: For Fund ACB with assets worth Rs. 1000 crore the Fund Manager will pocket management fees worth Rs.20 crore every year. If the fund makes profit of Rs. 400 crore in addition to the management fees he will be entitled to performance fees of Rs. 80 crore. However, if the fund makes no profit or ends up with losses the fund manager will still be entitled to receive the management fees. This aspect of receipt of management fees irrespective of funds’ performance draws a lot of flak. However, it is pertinent to note that many hedge fund managers co-invest in the funds thereby aligning their interests with that of the other investors.

An alternative to this scheme could be the Hurdle Rate structure, whereby the fund manager is entitled to a share in profits, only after the profits exceed a specified hurdle rate.

For Example, The Fund Manager of ACB Fund will be entitled to 30% of profits over 5%. Thus, for a profit of Rs.400 crore the Fund Manager’s fees will stand at 30% of [400-20 (Hurdle Rate)] i.e. Rs.114 crore. Thus, though the fee payable is higher the structure ensures that the manager will be entitled to fees only after earning a certain amount of profits. The Hurdle Rate fee structure thereby aligns the interests of the investors and the fund manager, however, it is rarely used.

Strategies employed by Hedge Fund

The variety of investment strategies employed by hedge funds can be broadly classified into the following four broad categories:

Long/Short Equity Hedge Fund: In a long/short hedge fund, managers split up investment between investing long in stocks (whose prices are expected to increase) while shorting other stocks (in which there is an expectation of fall in prices).

For Example- The fund manager of the ACB Fund expects a certain Stock A to appreciate and Stock B to decline by the end of 2 months. Hence, he invests 60% of the funds towards long in Stock A and 40% of the funds towards short in Stock B. The Net Exposure to the market thereby stands at 20% (60-40) with no leverage. The gross exposure stands at 100%.

2.Macro Hedge Fund: These are the most volatile hedge fund strategies, whereby the funds invest in a variety of assets in the hope of monetizing on the changes in macro-economic variables viz. interest rate, currency exchange rates, government policy, political climate, etc. These funds are broad-based i.e. they permit investments in a variety of assets and instruments that move based on systematic risks.

3. Relative Value Arbitrage Hedge Fund: These hedge funds typically buy securities that are expected to appreciate while simultaneously selling short a similar security (like a stock or bond from a different company in the same sector or the like) that is expected to depreciate in value.

4. Distressed Hedge Fund: These funds invest in stocks or bonds of distressed companies, in the hope that the companies will soon turn themselves around, thereby leading to an increase in the value of investments. The strategy is risky since there is no guarantee that the distressed companies will be able to revive themselves and ensure appreciation in the value of stocks and bonds.

It is to be noted there are numerous strategies a fund may employ to minimize risks whilst maximizing returns, however, all of those strategies fall within the spectrum of the abovementioned classifications.

Mutual Fund vis-à-vis Hedge Fund

The structure (both pools in resources from investors) and objectives of hedge funds and mutual funds appear to be similar; however, there are key differences between the same which can be understood with the help of the following points:

Return: The objective of mutual fund is to offer return higher than the risk-free rate of return. Thus, what mutual funds chase returns in relative terms i.e. they aim to outperform the market. Hedge funds, on the other hand, seek absolute returns i.e. a positive return on investment irrespective of the direction of market movement.

Investors: Retail investors with limited disposable income invest in mutual funds. However, only accredited investors i.e. investors with a particular net worth or annual income are permitted to invest in hedge funds.

Regulation: Due to the association of general investor interests (because of large amount of retail investors involved) with mutual funds, it is strictly regulated. Mutual funds have to comply with registration as well as reporting requirements as specified by the Market Regulator. The investors of hedge funds are considered to be affluent enough to understand the risks associated with such an investment; hence these funds are subject to limited regulation.

Fees Structure: The investment advisor of mutual funds is paid fees as a percentage of assets managed. Hedge fund managers, on the other hand, are often entitled to management fees as well as performance fees (as a percentage of profits earned) i.e. they have a share in profits too.

Liquidity: An investor in Mutual Fund can redeem his investment at any time subject to payment of Exit Load. Hedge funds in comparison are less liquid as often there is an initial lock-in period of one year, post which the withdrawals may only happen at certain intervals.

Management Style: Hedge funds are more aggressively managed i.e. they invest in a wide variety of assets and employ complex investment strategies in comparison to mutual funds.

The popularity of hedge funds have waxed and waned over the decades. However, they do offer an alternative to the traditional investment methodologies and also bring in opportunities for market neutral return; which in turn ensures that they are here to stay.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

The post What is a Hedge Fund ? appeared first on iPleaders.

What is a Hedge Fund ? published first on https://namechangers.tumblr.com/

0 notes

Text

Performance Check on IPOs in 2021

It’s time to check the performance of IPOs. They are awesome long term investment avenues, super tax savers, and can earn extraordinary returns on idle balance in your savings account. With this performance tracker KIFS Trade Capital offers free Dmat and Trading account for your convenience. This offer is valid till 31 March 2021. Click here to apply for free Dmat and Trading Account.

Name Date of Listing Issue Price Listing Price Percentage Returns from issue price

Easy Trip Planners Ltd 19-Mar-21 187 206 11.47

MTAR Technologies Ltd 15-Mar-21 575 1063.9 68.6

Pavna Industries Ltd 9-Mar-21 165 165.6 0.15

Heranba Industries Ltd 5-Mar-21 627 900 1.98

Railtel Corporation of India Ltd 26-Feb-21 94 104.6 38.94

Nureca Ltd 25-Feb-21 400 634.95 54.1

Stove Kraft Ltd 5-Feb-21 385 467 14.36

Indigo Paints Ltd 2-Feb-21 1490 2607.5 53.39

The above table is self-explanatory. Following writeup will help laymen to understand various aspects of investment strategy using IPO.

Benefits of IPOS

Easy Access to High-Quality Stocks:By investing in IPOs, even small investors get access to superior quality unlisted stocks for comparatively low valuations. This capacity to get low valuation stocks is probable merely by an IPO. Once the stocks’ listing occurs in the secondary markets, the probability of the company’s valuations soaring is relatively on a higher side, which puts off small investors from investing in leading companies. In recent years, we have seen IPOs of many superior quality unlisted shares.

Disinvestments of PSU Organizations: The disinvestments offer small investors opportunities to invest in higher quality shares of PSUs. For instance, the prime outperformers of the preceding 15 years, Maruti was sold right to the public by the Government using the IPO.

High Level of Transparency:An IPO is exceedingly transparent. The Red Herring Prospectus contains all of the applicable information and details about the company filing for the IPO. From monetary information to its shares’ precise pricing details, all the stuff is laid out to the likely investors. Investors can get information on the company merely through company prospectus. There is no other basis for communication. Hence, the institutional investors, insiders, and analysts do not have preference or edge over small investors regarding information accessibility.

Application Supported by Blocked Amount: There is an exclusive benefit of investing in IPO over the custom stock dealings. Application Supported by Blocked Amount (ASBA) facilitates that the amount is accredited merely when the shares are directly allotted to the investors.

Discounts for Retail Investors:Many IPOs provide discounts of 10% on the issue price of their shares right to retail investors. This scenario enables small investors to single out the stocks at a price that’s even lesser than the overall issue price, offering them a significant benefit over big institutional investors as well as high net worth individuals. This is something that’s not accessible in the secondary markets.

Easy Creation of Wealth:By investing in IPOs, one gets to chip in the wealth creation progression. For instance, the issue price of the DMart IPO in the year 2017 was around Rs. 300 per share. Now, the shares of DMart are trading at a much higher price. So, if someone had picked up its shares by its IPO, there would be an incomparable wealth generation for him.

Key Takeaways

For these significant benefits, an IPO is an exceptional investment opportunity for investors looking to turn a quick profit and people fascinated in creating long-term returns.

Tags:

Private Equity Advisory

Demat Account Services in Gujarat

Mutual Fund Consultant

#SIP Investment Trust#Online Financial Advisory#Financial Planner and Advisor#Investment Service#Best Mutual Fund Advisor#SIP Investment Planner#Mutual Fund Consultant#Demat Account Investment Service#SIP Investment Advisor Gujarat SIP Investment Planner Gujarat#SIP Investment Planner Gujarat#private equity investment service

0 notes

Text

Shares of DMart owner Avenue Supermarts fall 6% on weak Q1 performance

Shares of DMart owner Avenue Supermarts fall 6% on weak Q1 performance

Avenue Supermarts reported 88% drop in its consolidated net profit for the quarter ending 30 June, 2020.For the June quarter, the stock gained 5.33% while Sensex was up 19%

View On WordPress

0 notes

Text

DMart’s dream run: At what point will this Tendulkar run out of steam? - ET Retail

DMart’s dream run: At what point will this Tendulkar run out of steam? – ET Retail

[ad_1]

NEW DELHI: How high a valuation would still be acceptable to stock investors for a consistent performer like Avenue Supermarts (DMart)? That’s the question analysts are debating these days, as the supermarket chain continues its dream run on Dalal Street.

The stock has breached the most optimistic targets as soon as they were set.

If responses to its recent qualified institutional…

View On WordPress

#Avenue Supermart#Bajaj Finance#D-Mart#dalal street#DMart shares#IRCTC#QIP#Radhakishan Damani#sachin tendulkar#stock price

0 notes