#DisneyVogueMagazine

Explore tagged Tumblr posts

Text

#Disney #Princess #Adele movie premiered at Chanel @metgalafashion #2019MMCXXII

#MarvelMouseQuteers #MarvelComics #CHANEL #MMCXXII #2XXX #KingdomHeartsTheeMovie #KristenStewartManga #MarvelKeys #ChanelXNike #JustDoIt 'Just Do it'--KristenStewart |2019 #NintendoPowerMagazine @nintendo @nintendopoweronline-blog

#BambiPrescott #ClaireJValentineArt #DearDearestBands #Jamoix #SerenaJorifMarieMetGala

#MetGala2019 #CHANEL #KristenStewart #BambiPrescott #KarlLagerfeld #MetGala #DearDearestBrands #MouseQuteers #MARVEL @avrillavigine @annehathaways @taylorswift @NickiMinaj @jeffreestar #JEFFREESTARCosmetics

#deardearestBrands#ClaireJValentineART#Bambi#Disney#Chanel#DisneyChanel#kristen stewart#Zathura#drew berrymore#drewberrymoreKristenStewart#MetGala Chanel#MetgalaBambi#MetGalaKristenStewart#2019#metgala2019#DominoPresley#DominoMetGala#avril lavigne#karl lagerfeld#karllagerfeld#metgalakarllagerfeld#MMCXXII#MouseQuteers#MarvelComics#DisneyVogueMagazine#VogueMagazine#AnneHathaway#BackPinkMetGala#jeffree star cosmetics

5 notes

·

View notes

Text

#Solutions #NewReflections assets recovery plan ,step by step guide

[#DisneyVogueMagazine // A underdogs tale of rising back to the top, not caving in due to the pressure and what would be a true life filmstake of a women's true integrity in the face of evil, a hood Disney princess story]

Solutions to Address Financial Crimes and Operational Mismanagement

To restore the integrity, financial health, and mission effectiveness of the organization, a multi-pronged approach is required. Below are detailed solutions organized by focus areas:

Legal and Criminal Action

1.1 Report and Prosecute Offenders

Immediate Reporting: File reports with law enforcement agencies, including the FBI, SEC (for stock-related issues), and local authorities.

Legal Proceedings: Collaborate with legal counsel to prosecute individuals responsible for fraud, embezzlement, and money laundering.

Asset Recovery: Work with legal entities to seize and recover misappropriated funds and assets.

1.2 Engage External Oversight

Appoint a Special Prosecutor or external investigative team to independently assess legal risks and liabilities.

Financial Management and Recovery

2.1 Forensic Audits

Hire a forensic accounting firm to track and document every instance of fraud or misappropriation.

Use audit results to strengthen case evidence and guide corrective actions.

2.2 Emergency Fundraising

Launch a Crisis Recovery Campaign targeting loyal donors and foundations to bridge the financial gap.

Seek grants from organizations specializing in emergency aid for nonprofits.

2.3 Financial Restructuring

Reallocate budgets to prioritize immediate repairs, operational stability, and recovery measures.

Implement zero-based budgeting, reassessing every expense from scratch to prevent waste.

Governance Reforms

3.1 Leadership Overhaul

Replace key executives and managers implicated in wrongdoing with qualified professionals vetted for integrity.

Establish a Board Ethics Committee to oversee leadership decisions and policies.

3.2 Strengthen Policies and Controls

Introduce mandatory dual-approval processes for all transactions.

Enforce strict vendor vetting protocols to eliminate conflicts of interest.

Conduct quarterly independent audits for ongoing transparency.

Technology and Monitoring

4.1 Implement Fraud-Detection Tools

Deploy accounting software with built-in fraud detection and real-time reporting capabilities.

Use blockchain technology for immutable and transparent financial records.

4.2 Enhanced Surveillance

Install internal systems to monitor high-risk areas, such as procurement and payroll, for irregularities.

Create an anonymous whistleblower platform for employees to report misconduct.

Operational Solutions

5.1 Immediate Repairs and Maintenance

Use emergency funds to resolve urgent facility issues, such as broken appliances and unsafe electrical systems.

Contract reputable service providers for transparent and efficient repairs.

5.2 Staffing and Training

Retrain all employees on ethics, compliance, and financial literacy.

Establish a clear chain of accountability with defined roles and responsibilities for financial oversight.

Rebuilding Trust with Stakeholders

6.1 Transparent Communication

Share regular updates with donors, employees, and beneficiaries on progress, challenges, and milestones.

Publish an annual Impact and Accountability Report detailing corrective actions.

6.2 Rebrand and Recommit

Reframe the organization��s mission with a renewed focus on integrity and community impact.

Partner with credible organizations to co-host events and initiatives, showcasing commitment to reform.

Long-Term Sustainability Plan

7.1 Ethical Governance Framework

Develop a Code of Conduct and make it publicly accessible.

Establish a permanent Oversight Committee to ensure adherence to financial and operational best practices.

7.2 Financial Diversification

Expand revenue streams by exploring social enterprise opportunities, like selling crafts or services created by beneficiaries.

Partner with government programs and corporate sponsors for stable funding.

7.3 External Accreditation

Obtain certification from reputable nonprofit accreditation bodies, such as the Better Business Bureau (BBB) or Charity Navigator.

Timeline for Implementation

Expected Outcomes

Short-Term: Stabilization of finances, restoration of facility functionality, and initiation of legal proceedings.

Mid-Term: Restored stakeholder trust, improved operational efficiency, and enhanced financial controls.

Long-Term: A resilient organization with ethical leadership, sustainable funding, and a stronger community impact.

Would you like me to expand on any specific solution or help draft communication materials for stakeholders?

Data Analysis Plan for Financial Investigation

Objective

To analyze the provided data sets to identify patterns of fraud, embezzlement, or misuse of company assets associated with Jane Doe and John Doe.

Available Data Sets

Bank Account Information

Bank Account 1: Jane Doe

Bank Account 2: John Doe

Credit Card Statements

Credit Card Statement 1: Jane Doe

Credit Card Statement 2: John Doe

Other Financial Documents

Other Financial Document 1: Jane Doe

Other Financial Document 2: John Doe

Step-by-Step Data Analysis Process

Step 1: Collect and Organize Data

Goal: Centralize all documents for efficient analysis.

Consolidate all bank statements, credit card statements, and other financial documents into a secure database or spreadsheet.

Categorize expenses by type (e.g., payroll, vendor payments, personal expenses).

Step 2: Review Bank Account Transactions

Actions:

Identify large or unusual withdrawals and deposits.

Cross-reference transactions with the company's approved financial activities.

Highlight transactions lacking sufficient documentation or approval.

Step 3: Analyze Credit Card Statements

Actions:

Look for personal expenses charged to company credit cards (e.g., luxury goods, vacations).

Match credit card expenses with receipts or approval records.

Flag recurring charges to unknown vendors or service providers.

Step 4: Examine Other Financial Documents

Actions:

Review contracts or invoices for signs of inflated charges, shell companies, or fake vendors.

Cross-check payment records with deliverables.

Verify if all listed expenditures align with the organization's mission and budget.

Step 5: Cross-Referencing Individuals and Accounts

Actions:

Link suspicious transactions between Jane Doe’s and John Doe’s accounts.

Investigate if the individuals are connected to any external vendors or organizations benefiting from transactions.

Assess the possibility of collusion or coordinated fraud between the two individuals.

Step 6: Quantify the Losses

Actions:

Calculate the total amount of suspicious transactions for each individual.

Group losses by category (e.g., misused funds, unauthorized transactions).

Step 7: Prepare a Comprehensive Report

Summarize findings, including:

Patterns of misuse for each individual.

Estimated total financial loss.

Supporting evidence, including flagged transactions and discrepancies.

Key Questions for Deeper Investigation

Do Jane Doe and John Doe have any overlapping or repeated transactions between their accounts?

Are there any shared beneficiaries or vendors linked to both individuals?

Is there evidence of personal gain (e.g., luxury purchases or transfers to personal accounts)?

Have any funds been redirected to external accounts or entities outside the organization's scope?

Expected Outcomes

Identification of fraudulent or unauthorized activities.

A detailed financial trail connecting Jane Doe and John Doe to misused funds.

Actionable insights to recover assets and pursue legal action if warranted.

Would you like me to draft a specific set of questions for each account, or should I prepare a template for reporting findings?

Detailed Analysis Plan for Financial Transactions

Objective

To investigate suspicious transactions across the accounts and credit cards associated with Jane Doe and John Doe, using the partial data provided as a starting point.

Data Summary

Bank Accounts

Bank Account 1 (Jane Doe): 1234

Bank Account 2 (John Doe): 5678

Credit Card Statements

Credit Card 1 (Jane Doe): 9012

Credit Card 2 (John Doe): 3456

Step-by-Step Investigation

Step 1: Transaction Data Categorization

Organize transactions by:

Date: Analyze patterns over time (e.g., spikes in activity).

Amount: Flag transactions above a specific threshold (e.g., $5,000).

Merchant: Identify unusual vendors or personal expenses.

Reason for Transaction: Cross-reference justification with company policies.

Step 2: Red Flags in Bank Accounts

Bank Account 1 (1234):

Identify withdrawals or transfers inconsistent with organizational objectives.

Check for repeated small withdrawals (structuring to avoid detection).

Cross-reference deposits for possible kickbacks or outside income sources.

Bank Account 2 (5678):

Look for unexplained large transfers to personal or external accounts.

Investigate payments to unknown vendors or contractors.

Cross-check with company payroll or vendor records to ensure legitimacy.

Step 3: Credit Card Statement Review

Credit Card 1 (9012):

Match transactions with submitted receipts or reports.

Flag non-business-related expenses such as luxury goods, dining, or travel.

Credit Card 2 (3456):

Identify recurring subscriptions or payments to unknown entities.

Review transaction descriptions for vague or incomplete justifications.

Step 4: Transaction Cross-Referencing

Match suspicious transactions across accounts and credit cards.

Identify patterns of shared beneficiaries, repeated merchants, or similar transaction dates.

Determine if funds have been shifted between Jane Doe and John Doe’s accounts.

Sample Transaction Analysis Questions

Date: Was the transaction made during a time of high organizational spending or personal financial distress?

Merchant: Is the merchant related to the organization’s needs, or is it personal?

Amount: Is the amount consistent with typical spending patterns?

Reason: Was a reason provided, and does it align with company policy?

Approval: Was the transaction authorized by the appropriate personnel?

Immediate Next Steps

Expand the Data Set:

Collect all suspicious transactions over the past 3–5 years.

Include metadata such as IP addresses for online transactions.

Transaction Sampling:

Create a detailed spreadsheet of flagged transactions.

Highlight patterns such as recurring merchants, unusual amounts, or suspicious justifications.

Audit Assistance:

Engage an external forensic accounting team to validate findings.

Evidence Compilation:

Maintain a log of evidence for potential legal action, including transaction IDs and linked documents.

Deliverables

Comprehensive Report:

A detailed summary of findings, categorized by account and individual.

Legal and Recovery Plan:

Recommendations for asset recovery and legal steps to pursue damages.

Policy Review Suggestions:

Identify gaps in financial oversight that enabled misuse.

Would you like to proceed with a specific focus, such as a transaction timeline or detailed profile for Jane and John Doe?

Detailed Investigation Questions

Bank Account 1 (1234 - Jane Doe)

Large Deposits:

Who is the source of the large deposit(s) to Bank Account 1?

Are these deposits tied to legitimate business activities, or do they involve unverified entities?

Small Withdrawals:

Why did Jane Doe and John Doe make multiple small withdrawals for personal use?

Are these withdrawals structured to avoid detection (e.g., below reporting thresholds)?

What were the stated purposes of these withdrawals, and were receipts provided?

Transfers to Other Accounts:

Why were large amounts transferred from Bank Account 1 to other accounts?

What is the relationship between Jane Doe and the recipients of these transfers?

Are the recipient accounts associated with the company, personal entities, or third-party vendors?

Bank Account 2 (5678 - John Doe)

Foreign Currency Transactions:

Why did Jane Doe and John Doe make multiple transactions in foreign currencies?

Were these transactions related to international business operations or personal spending?

Are the foreign merchants and entities verified and legitimate?

High-Value Purchases:

Why did Jane Doe and John Doe make purchases of high-value items (e.g., luxury goods, electronics)?

Are these items accounted for in company inventory or documentation?

Do the purchase amounts match the company’s spending policies?

Inter-Account Transfers:

What is the purpose of transferring money between Jane and John Doe’s accounts?

Were these transfers documented as part of official company activities?

Is there evidence of circular transactions to obscure financial trails?

General Questions on Recipients and Beneficiaries

Funds Recipients:

Who are the individuals or entities that received the transferred money?

Are these individuals or organizations connected to the company in any way?

Do these recipients have a history of involvement in suspicious transactions?

Approval and Oversight:

Who approved or authorized these transactions, and were proper protocols followed?

Are there discrepancies between the approval documentation and the executed transactions?

Next Steps

Document Review: Collect supporting documentation for each flagged transaction, including invoices, receipts, and approval records.

Beneficiary Interviews: Identify and interview the recipients of funds to confirm the purpose of the transfers.

Pattern Analysis: Use financial software to map patterns in withdrawals, deposits, and transfers.

Legal Consultation: Collaborate with legal experts to determine the liability and necessary recovery actions.

Would you like to prioritize any specific questions or expand on particular areas for further investigation?

Detailed Investigation Questions

Bank Account 1 (1234 - Jane Doe)

Large Deposits:

Who is the source of the large deposit(s) to Bank Account 1?

Are these deposits tied to legitimate business activities, or do they involve unverified entities?

Small Withdrawals:

Why did Jane Doe and John Doe make multiple small withdrawals for personal use?

Are these withdrawals structured to avoid detection (e.g., below reporting thresholds)?

What were the stated purposes of these withdrawals, and were receipts provided?

Transfers to Other Accounts:

Why were large amounts transferred from Bank Account 1 to other accounts?

What is the relationship between Jane Doe and the recipients of these transfers?

Are the recipient accounts associated with the company, personal entities, or third-party vendors?

Bank Account 2 (5678 - John Doe)

Foreign Currency Transactions:

Why did Jane Doe and John Doe make multiple transactions in foreign currencies?

Were these transactions related to international business operations or personal spending?

Are the foreign merchants and entities verified and legitimate?

High-Value Purchases:

Why did Jane Doe and John Doe make purchases of high-value items (e.g., luxury goods, electronics)?

Are these items accounted for in company inventory or documentation?

Do the purchase amounts match the company’s spending policies?

Inter-Account Transfers:

What is the purpose of transferring money between Jane and John Doe’s accounts?

Were these transfers documented as part of official company activities?

Is there evidence of circular transactions to obscure financial trails?

General Questions on Recipients and Beneficiaries

Funds Recipients:

Who are the individuals or entities that received the transferred money?

Are these individuals or organizations connected to the company in any way?

Do these recipients have a history of involvement in suspicious transactions?

Approval and Oversight:

Who approved or authorized these transactions, and were proper protocols followed?

Are there discrepancies between the approval documentation and the executed transactions?

Next Steps

Document Review: Collect supporting documentation for each flagged transaction, including invoices, receipts, and approval records.

Beneficiary Interviews: Identify and interview the recipients of funds to confirm the purpose of the transfers.

Pattern Analysis: Use financial software to map patterns in withdrawals, deposits, and transfers.

Legal Consultation: Collaborate with legal experts to determine the liability and necessary recovery actions.

Would you like to prioritize any specific questions or expand on particular areas for further investigation?

0 notes

Text

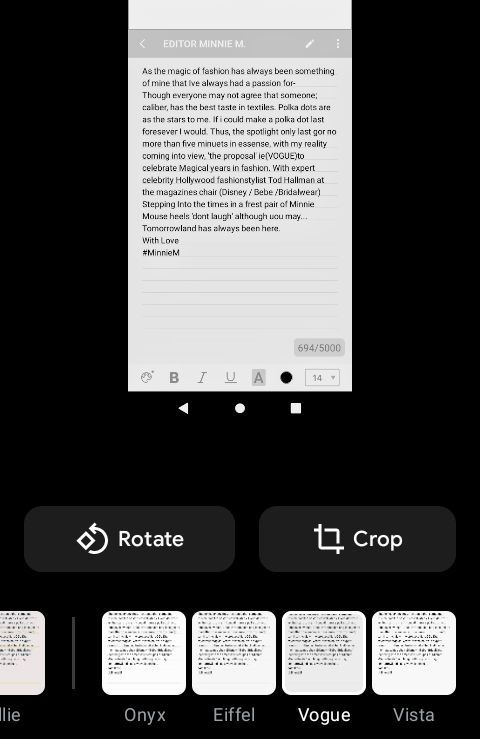

Disney Vogue Issue 1 available Now @FelipeDeNevelibrary

#DisneyVogue#Disney#Vogue#DisneyVogueMagazine#DisneyMagazine#issue1#Felipe De Neve Library#los angeles#California#Spotify#SoundCloud

1 note

·

View note