#Discover card credit login

Explore tagged Tumblr posts

Text

Visit Discover.com to access your credit card account.

In the realm of credit cards, Discover Credit Card is a well-known company that has been offering services to customers for over three decades. Credit cards, personal loans, and online savings accounts are just a few of the financial services and direct banking products that Discover Financial Services, a business established in 1985, offers.

You can quickly check and manage your Discover login account online, make payments with your credit card, read statements, and do much more. In the credit card market, Discover has developed a reputation for innovation and superior customer service, which has aided in developing a devoted customer base. If you have a Discover card, you can log in to your account online through the Discover Card Login secure portal anytime and from anywhere.

One of the leading credit card issuers, Discover, has a lot of merchants across the country that accept its cards. The business provides several credit cards, including cashback reward cards, travel reward cards, and student credit cards, to accommodate various demands and preferences.

Discover credit cards feature several essential advantages, including the fact that there is no annual fee. As a result, budget-conscious customers frequently choose them. Together with several additional perks and advantages, Discover also provides its cardholders with free FICO credit ratings, cashback rewards, and fraud protection. This page goes into great detail about The Discover Card login.

Access to your Discover Credit Card

It's simple and safe to manage your Discover credit card account online with the Discover Credit Card Login. Customers like Discover credit cards because they offer cashback benefits, free FICO credit scores, and strong fraud protection. Discover Card Login makes it simple to access your account from anywhere, whether you want to keep track of your spending, make payments, or receive incentives. Hence, if you have a Discover card, use this helpful tool to manage your money and get the most out of your credit card. Cardholders may immediately learn about famous and ongoing Discover Credit Card Login promotions.

Essentials of the Discover Card

Several advantages offered by Discover credit cards make them appealing to customers. Many of the essential components of Discover cards are listed below:

Rewarding cashback:

With certain cards paying up to 5% cash back on particular transactions, Discover offers some of the industry's most generous cash back incentives.

No Annual Fee: Discover credit cards don't have an annual fee, making them an affordable option for customers.

Free FICO Credit Score: Discover gives cardholders free access to their FICO credit score, an essential tool for managing credit and enhancing creditworthiness.

Fraud Protection: To assist cardholders in avoiding illegal purchases, Discover provides comprehensive fraud protection, including real-time monitoring and notifications.

Conclusion

As a result, you can log in with your Discover Card. You can follow the guidelines and directions in this blog. Visit OpenKit.io to learn more about the Discover it card credit login features.

0 notes

Text

Was supposed to have a doctor appointment downtown at a place I was referred to by my primary care doctor (who I'm about done with) but when I arrived they said 'oops we're actually not in network but you can pay us $200 if you still wanna have your appointment'

so I walked out and went to find a beer instead.

Only bright side is I refused to make another login on their stupid app so I didn't have to spend the last week getting spammed with all their 'appointment updates' and 'early sign in' prompts. Healthcare providers have lost their damn minds if they think I'm putting up with more of that. They called me yesterday to complain that I hadn't logged in to their 'patient portal' yet and I just said, 'mmm, but what if I didn't?' They were like, 'uh... um... okay just arrive 30 minutes early.' 'See, I can do that.'

Not that it did me any good. I gave them my insurance info on the phone when I booked the appointment 2 weeks ago and what was the point of even doing that if they were just gonna decide not to tell me I'm 'out of network'? Or is it that they're 'out of network'? Hell if I know.

Finished my beer, went home, and logged on to the stupid insurance site to find a stupid provider that IS 'in network.' Turns out there's only one without a slew of negative reviews. I called their number, got a robot maze, picked a dead end option, it hung up on me. Called again, tried a different path, got a person, she said she was the wrong person, gave me a number for the right people but said they were in a meeting. It was 4pm so I asked when they closed. 5pm. Waited 30 minutes, called the number, "number cannot be completed as dialed," hung up. Went back through the call robot, got their voicemail, voicemail explained that they won't return calls after 4pm. Left one anyway.

Also tried to find a psychologist since I was already suffering anyway and discovered there's only one who's 'in-network' who might be able to help me. Got rerouted to their website, very corporate (hate it), it funneled me into a virtual appointment queue and demanded my credit card info. Tried calling instead, lady on the phone says yeah no a virtual appointment won't work for diagnostic assessment so I have to go in person. Oh, and the location on my insurance site is wrong, it's actually 2 hours away. I say 'thanks I'll keep looking' and hang up.

I'll die, thanks!

#us healthcare is a joke#personal problems#defeated#why do I even try#I hope a horse kicks me in the head so I never have to talk to a phone robot again

10 notes

·

View notes

Text

Well-developed, well-nourished white male in no acute distress.

This is what she writes about me. Look, as your sponsor, I need you to write this down. All of it. Word for word. Don’t try to make sense of anything I say, just write. When you’re confused, keep writing. Tired, keep writing. Cravings, for God’s sake just keep writing. Because if it works for you, it might work for somebody else.

Now go back to that note.

She’s my primary care physician, the woman who's seen me since I outgrew a pediatrician. She sits there with her legs folded together in knobs and branches poking through bright blue doctor fabric, and a suspicious thickness around her belly. She's the same as any other anorexic physician who eats only something with oats she poured from a blender.

Write this down—this is how you should be eating.

If she’s your doctor, you don’t feel better after reading her notes. That's if you remember to find them in her office’s digital patient portal, where after every visit they’re posted on the other side of a forgotten login and a compromised password.

Write this down—read about yourself.

It will be midnight, lying in your bed with your phone glowing at your chest. Picture an otter on its back. Swiping through, passing content from one thumb to another like the screen is a stack of cash, except you're counting fifteen second clips of billionaire porn. Supercars. Island waterfalls. French-press coffee on private jets. Squats and deadlifts and protein powders beaming into your eyes from a girl with perfect pores and skin vacuum-sealed against her clavicle.

Every fifth swipe is an ad.

A reminder.

Refrigerated ship-to-home ingredients—remember to pack lunch.

Swipe up.

High-yield online savings—pay your credit card bill.

Swipe up.

Cable-knit sweaters on some Macedonian model—do laundry.

Swipe up.

Machine-surfaced cast iron—run the dishwasher.

Swipe up.

Anymore, this is why you read the portmanteau digitox. Pause your social media for a week, the usual prescription. Put down your phone and try to work on impulse control just to discover you haven’t eaten anything green, and you’re still in the same clothes with an overdue balance on your credit card.

Your grade school teachers tried to teach you the habit of using a spiral-bound calendar. Now all you need is phone streaming a river of social media as you fall asleep.

Swipe up.

Lying here in the dark and your life support is a lithium battery glued to a glowing rectangle.

Swipe up.

Grounding your bare feet in water without sunscreen on a hot day in the mountains—schedule your booster shot.

Swipe.

Wet coffee grounds into cute countertop compost bins—it’s Monday. The trash should be at the curb.

Swipe.

Robot vacuums for pile carpet—clean your floors. And when you see it, remember that your shitty old vacuum has a filter bag with a lifespan.

Swipe up. Swipe right.

Until you’re unconscious.

Wake up and your phone is down on the carpet, smeared with oily fingerprints in the shape of a cross.

Swipe.

This is content that wakes you up.

Swipe.

Content that keeps you alive.

Swipe.

You’ll watch the same shit again tomorrow.

Swipe.

Another night and your thumbs make streaks right and downward until you watch an ad for a metabolism diet that reminds you of poor appetite reminds you of weight loss reminds you of a balance scale and a stainless sink with a floor pedal. The gaunt doctor’s notes and your decade of symptoms are on the other side of a login somewhere behind all these crucifix-shaped smears.

Swipe.

Reading about yourself and why you aren’t going to die gets you through a few days. But you feel like the way she sits there with all her machines and her complete sentences perfectly typed into a keyboard are missing something. The way you might miss your own addiction. Like I did. I didn't know I was an addict until after my first meeting.

Write this down—find a meeting.

In recovery, you wake up to your phone but the real-life support is downstairs on the fridge: a full calendar, a dry erase board with dented corners you can grab when you're in the kitchen section of a savings store. It comes with battle scars just as much as you’d expect from colliding with errant wheels, the magnetic corners trying to grab onto every shopping cart that comes too close. Underpaid employees tire of wedging it back onto a shelf because for shoppers a blank calendar is too much commitment even at a discount, and it's too big and boring and cheap to steal. Not that anyone would care. It’s five rows, seven columns, a sequence of days that never change tattooed in cute cursive across the top.

In recovery, you see a blank calendar and it just means you haven't yet been told what to do. You put it on your fridge. Let it observe every moment of the day, every time you leave the house, or empty the trash, the dishwasher, like somehow it will learn your entire week, until you're awake the next morning and surprise, it's still blank. At midnight when you open the thick, insulated door and the cold light rips out into the dark kitchen, it's there, caught in the beam. It might as well be found in a searchlight, flattened against the side of some dumpster, hiding from its destiny: thirty-five squares of graffiti in vibrant dry-erase marker, instructions squeezed wherever they fit.

Eventually you’re just some kid who can't color inside the lines, smearing it with bright letters, thick from bent tips of markers always dropping and rolling under the refrigerator. When it’s finally numbered, you’ll need a quote-a-day paper pad showing the date in tall digits leaning off the page at you when you open the refrigerator for milk. This way every morning you have to interact with the calendar. Tear off the old sheet of digits for another and find the square it matches.

It says, twenty-two.

A new day.

A new set of instructions.

A new inspiration to forget.

Today’s italicized quotation will stick because this is Monday.

It says, chance favors the prepared mind. The corner of the date pad says Louis Pasteur. The reason you don’t get sick from the milk.

Before it was clung onto our kitchen monolith, my calendar began on my phone as a progress tracker. If you’re burdened with the twelve step curse of recovery, the meetings and your therapy will refer to this as a habit tracker. It’s how you’re supposed to visualize an accumulation of effort. How you’re supposed to feel normal when you look backward. Everyday is another responsibility you were never taught, but on Sunday at least you washed the bedding. You never see how much goes into a normal life until you’re doing none of it. Somebody has to tell you that you’re living in trash and the blanket over your laundry smells so much like air freshener it stinks.

Somebody has to tell you to get out of bed.

Buy a new toothbrush.

Open the windows.

Go to the interview.

Eat.

Put down your phone.

That today is your mother’s birthday.

Somebody has to save you. And then you owe her your life. You get married.

Swipe to thirteen years later, and recovery doesn’t matter. Try telling someone you just met that you've been clean for thirteen years. Nobody cares. Picture showing up to defend a decade-long dissertation of research to have your advisor say thanks, it no longer counts toward your grade. You can dry-clean your academic attire, like everyone else. She tosses it onto a stack of papers sunk into her carpet with its own footprint, a white pillar, the size of a trash can. Still, you want her to least read it. You want anybody to read it.

If you’re like me, what you want is somebody to start a pot of coffee after dinner and stare at you across the kitchen table while it gets hot. You want somebody to talk with all night until the sun comes back.

If you’re like me, you don’t stop talking. Somebody finally sits down and drops a nickel at your booth and they have to let the song play.

This is the jukebox full of fresh vinyl.

I didn't want to have to tell you any of this. Nobody else needs to know anything here.

This is the note accidentally left unlocked.

This is the essay that ends up shredded in the back of a mobile secure destruction truck.

This is the long form note written in couples' therapy to wrinkle up for a waste basket, never to be read.

This is the confession after the crime found scribbled in a notebook when all the neighbors say they never saw it coming. If they did, then there wouldn't be a vacant house ribboned with yellow tape and an overgrown lawn to explain to all the divorced pickleball women when they come over for cocktails.

What I'm trying to say is none of this matters anymore.

I haven’t done anything wrong. There hasn’t been a crime. I don’t have the time. There’s no space for it on my calendar. After work I’m showering and brushing my clothes with horsehair so the hard water doesn’t fade the blacks to grey on waistbands and seams. Then I’m reaching into the fridge and cooking dinner and the dry erase marker says I’m exchanging table decorations for the new season, spring. Outside in the dark I’ll use a flashlight and leaf blower to clear fallen seed pods out of potted plants. The kitchen drawer will be out of dish towels and it’ll be one in the morning before those will be ironed and folded.

Write this down—never landscape with sycamores.

If you’re like me, you’re too tired to do anything wrong.

It’s because I’ve been on step twelve for so long. That's how they pull you in, with their logos and websites and filtered headshots of mentors and their about-us sections, seining through the candidate swamp of deadbeats as wide as freeways across the city. The dozen secrets to success that can be yours if you act now, no signature required.

A fresh start. Anonymous.

You can learn all the reasons addiction is ruining your life and how much better you’ll be in recovery. By step one you’ll sleep better, they tell you. By step six you’ll be giving presentations at work, they tell you. What they don’t tell you is by step twelve you should be growing the pyramid. Sponsor the kid who bags your groceries. In recovery, his bagging will be a little sloppier. Eggs on the bottom, untrimmed carrot tops flowering like pampas grass from sacks of wrinkled paper. For eight hours of bagging, his eyes follow the backs of his hands. He never looks up. Because in recovery he feels like shit.

What they don’t tell you about recovery is a lot.

What they don't tell you is that after step twelve, there's nothing. It’s just more step twelve. More meetings. More relapses. Until you’re dead. After I turn out to be your sponsor, then after years of me and a therapist telling you what to do, one day you find yourself at the curb outside a meeting like they just signed you out of the hospital and stuck you in a wheelchair on the sidewalk.

Hospitals have to get rid of you.

It's for liability.

You're discharged, but until they get you to the curb, they're on the hook for your life. The administrators don’t care about a junkie until they need his bed for the next admission from a crowded emergency lobby. For a few days your entire world is one hundred square feet between four walls with a sealed window and a mechanical bedframe. You have your own bathroom. There’s a whiteboard showing names of physicians you never see. It’s a different sort of dry erase calendar with notes in three sections: Today. Tomorrow. Future.

In recovery, planning ahead feels like predicting the future.

To fix you, people in scrubs who aren’t nurses bring trays with pills in little cups of wax paper, made for ketchup. Every pill is constipating. That, and the immobility of lying in bed until your back aches. This is why there are wall stud-mounted steel handles around the toilet. You get microwaved meals, and hourly visits from exhausted nurses wearing too much concealer smeared over their bad skin.

You like it inside the sterile room, baseboards to ceiling in taupe, and a floor drain in the bathroom. You wish you could stay. But this is what real care feels like—being discarded, thrown back out onto the street.

Anymore, your friends are all stoned, you say this to the nice nurse that you want coming with you. To bring you little stacks of cups at home. She uses your face to unlock your phone and dials an emergency contact. She props you in a wheelchair still wrinkled in the seat from her last castaway. She starts pushing. What you don't know is that after twelve hours of babysitting a floor of invalids and texting her ex in the supply closet, she'll collapse at her apartment with shitty alcohol, neglect her kid, rub one out and fall asleep with the television. Her own pile of laundry stinks of air freshener. And after a week with that botched fantasy you'll want her pushing you out again, faster, you’ll kick your legs straight out when you see the double doors beneath the exit sign. You’re thinking all this and then the wheelchair's at the street, she sets the brakes, puts a hand on your back and bolts you upright. Right beside the trash bins.

Swipe to this blithering milksop balancing on the curb waiting for my emergency contact to show up with a fast food bag of burgers because that’s exactly how this whole thing happened.

Write this down—fast food is what started this.

I'll get to the beginning. What ended up being the beginning.

There's one thing the alcoholics, junkies, and sex addicts in recovery won't tell you in their propaganda. I hate to ruin the surprise: walk into a meeting, and this is the rest of your boring ass life that nobody will ever care about. It says it right there in the branding. Anonymous. There’s no background check. Nobody asks to see track marks, or a collapsed septum. All you have to do is show up and give a name. Every week it isn’t any different. It’s a United Methodist rec room that hosted a day camp of kids with sticky fingers making crafts before organizers got there at sunset to unfold a card table and plug in a coffee percolator, a big trophy passed between support groups. Except instead of a bright Stanley Cup this is a storm-tossed aluminum bombshell that means your quiet gathering of church sponsorship has made it. Men's groups. Yard sales. Slow-read Bible study. Blood drives. Tonight it's with a room full of enablers. Because at some point they all relapse. That's why they keep coming back. Two dozen strangers who all share the same passion means the best networking opportunity junkies can get.

Swipe to a room full of cravings triggered by one of these caffeine dispensers looking like it was pulled from the basement of some parish.

Write this down—you’ll have meetings on Tuesdays. No matter what. This is what they call them.

No matter what, you make time for it.

No matter what, you attend.

No matter what, someone from last week is missing.

For me, recovery is never more than arms' length away. Even now, on my nightstand, where instead of an orange bottle of pills with a label showing the name of a hospice patient I'll never meet, there's a wallet as thick as an Uno deck and right next to it is a small leather journal with a checklist of everything I have to do not to sink. A calendar of instructions to-go. It's the same journal I've used since step four.

At first, the steps feel good. After your first meeting you might as well be twelve years old, and wide awake the night before a vacation. You’re going somewhere new. For a few days you walk upright with great posture. See yourself in the mirror of a department store where you’re trying on new shirts and you realize you have shoulders. It's a proud moment when you can check step one off your list. The first three go pretty fast and then you get stuck on step four. The moral inventory. All the lies, betrayals, and cheating, all the people you've hurt and jobs you've lost. You have to open a note on your phone and start typing. A rap sheet of all your sins, synced with cloud storage. That way every dumbass moment of your life is right there beneath your passcode.

I'm always writing things down. Journaling. Calendaring. Staying clean means keeping busy, having something to look forward to, always wanting to see tomorrow. It's when tomorrow doesn't matter that you give in. Find your local NA schedule and poke your head through the wrong door at the community center for that room full of liars calling itself a No-Matter-What meeting and tell me if it looks like any of them care about tomorrow.

Before relapse, most of them get lost in responsibility piling up at home. Picture Sisyphus. There's no reward for your work. When you stop feeling perfect for zero effort—that's addiction—daily routines are labor. In recovery, suddenly it all matters. Nobody wants another day of it. So you offload it from your brain, suspend your decision-making ability. Turn yourself into an implement. If you don't have to remember what to do next, then while you're at the sink soaking the sweat stains out of your new shirts, you're free to daydream about eventually sleeping in again. Because there's always more.

There's the alarm clock to wake you.

There's a duvet to fold.

There's clothing to launder.

There are dishes to wash.

Carpets to vacuum.

Now go back to your thirty-five squares and start writing—

Blow the leaves.

Put gas in the car.

Pack a lunch box.

Buy groceries.

Pay the utilities.

Today it's all on the calendar and the dry erase bleeds together in a way your brain can't decipher. No square is big enough. Cram all this in between five, eight-hour minimum wage workdays crutched by black coffee and chewing gum and next time you're washing shirts you'll daydream about not waking up.

After enough of step twelve, addicts in recovery suffer an increased chance of relapse, a brief glimpse at being high and productive. The meetings will call this functional addiction, the sustained twilight before once again losing your footing, being fired, and going broke. Keep going to meetings, and therapy, and tell yourself to keep trying but eventually everyone gives up running to the sunset, the sinking reminder that you can do everything right and still fail. You need structure. Somebody has to tell you what to do. There's a blank calendar to fill.

Swipe to when you bring home the dented thing, still wearing its torn shrink-wrap. At first, you won’t unwrap it. Thinking two weeks out might as well be next year. Nobody can see that far ahead. You put these thirty-five blank squares on the fridge and walk away. You’ll start writing tomorrow. Today, grab a sheet of paper and fold a single crease, forming two pages that will tell you what to do. Make a checklist for right now. After a week, replace this with a notebook so you can flip back to yesterday’s completed list, then another one from seven pages ago, or sixty pages ago.

Like everything else, at first a list makes you feel good. You write down everything you have to do and draw a little empty square next to it where you can scratch a check mark. What the meetings and therapy won’t call this is the Dunning-Kruger effect. We won’t tell you to overestimate your own success as you check off all the to-dos for which nobody else needs reminders.

We won’t tell you, but this is what happens. With every box, give yourself a gold star.

Write this down.

Brush your teeth—check.

Make coffee—check.

Turn off the coffee pot—check.

Remember your wallet—check.

Close the garage door—check.

Finally, you're getting somewhere. Every day, it's the same list, telling you what to do. The same set of successes. Because before, you were barely able to find the door out of the house in the morning.

By the end, every box is inked and you get to see just how much filled your day. Everything in your life becomes an item on a list. A direction. Something to achieve. You get to see the set of instructions for your life.

Everything becomes a step. One step closer to the completed pages of your boring life and knowing that tomorrow you have to start at the top of the same stupid blank page with a new list. Then another the next day. Then next week. And the month after that. Until you're dead.

Like normal people.

It's been a long time since you felt normal.

Everyday you're charging upright into a rough surf of surprises heaving themselves against you. Look back at your little piece of paper. It'll tell you where to go next. Plan out every minute from the moment you make coffee in the morning until you’re home and you step into the garage after a shower to grab the electric leaf blower and surprise, it’s dead.

Write this down—plug in leaf blower.

It needs to be cabled to a heavy charger that gets hot and smells like ozone. The one-hour charge is just enough time for the clocks in your house to be suddenly louder. The carpet is more matted than it was yesterday. In the walls, all the plumbing squeaks with hard water and suddenly it’s caked inside the mesh aerators of every faucet.

Write this down—polish the hardwood.

Electric mop the high-traffic carpets.

Soak the stainless faucets in vinegar.

From the size of my list, our house looks like Xanadu.

Find another achievement. Check another box. Until one day in the middle of it all you're on a ladder in your bedroom replacing a smoke alarm with a ten-year battery and you realize you'll be up on this ladder maybe five more times before you're dead.

One day when you’re off work you get back to the calendar and pair it with the date pad of quotes. It feels smooth, the unused dry-erase surface. To make progress, you have to fill it. Thirty-five blank squares.

For monthly maintenance, pick a square.

For laundry, pick five squares.

Bedding, pick two squares.

Clean the oven.

Then the bathrooms.

Vacuum.

After a few months the neat printing is full of abbreviated instructions, and you can't see any outlines between the white blocks. Each day dissolves into the next. In the morning you see it when you get to the fridge for milk and tear open the next quotation.

Louis Pasteur’s quotation.

What I’m prepared for is running out of ink, and dry erase markers.

What I’m trying to say is—let’s hope this works. Recovery is what got me into this whole mess. Recovery, and McDonald's.

2 notes

·

View notes

Text

To Catch A Thief

The digital era has spawned entirely new ways to steal. It was only a matter of time, of course, because thievery has always been around. It is the underbelly of society. Just as Jesus said the poor will always be among us, so will the thieves.

And today’s blog is about two types of digital theft…one affecting customers of a well-known company, and one that affected me personally. The latter is more a cautionary tale than anything, and since it was resolved in quick order, I am OK. But I sure felt violated, just like the people who eventually discover the theft affecting them in the first example. And off we go to that first example.

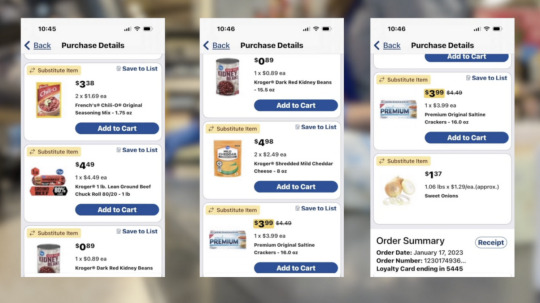

If you use third-party shopping services, or, for that matter, any company relying on the gig economy to provide workers, you need to be paying attention to your credit card charges. Recently, some shoppers started noticing that their Instacart orders were not exactly what they had originally submitted. Turns out their Instacart shopper was adding a few items here and there to the orders they picked for customers, effectively doing their own grocery shopping with other peoples’ money (OPM).

Basically, a box of mac and cheese here, some spices there, etc., and they have done their shopping too.

The thinking is that most people don’t pay attention to their charges, and because an Instacart order isn’t completely rung up until the shopper is ready to leave—you never know if something you ordered suddenly isn’t available—you just await your delivery and go on living your life. All the while, our micro-thief has been getting free groceries.

In my example, I was leaving Albuquerque two weeks ago tomorrow from my conference, and noticed a couple of emails congratulating me on having redeemed some of my Hilton Honors points at Amazon. Well boy howdy, that caught my attention. Not only had I not done that, I didn’t even know I could. I immediately checked my Hilton app, and noticed I was missing about 600,000 points.

That was when I exited the freeway and settled in to more than 30 minutes of phone conversations with various Hilton personnel, including their Fraud Detection department. I am convinced it was not a crime against me personally, since I never login from a computer, and only from my phone app. The perpetrator was likely thinking it was a victimless crime, only somewhat more heinous than the Instacart driver letting you pay for a few groceries.

My Hilton thief also got into my account and added a new phone number, making it the primary, and also added two-factor authentication so that I could not make any changes without him or her getting a text seeking to verify the changes. I was cut off at the knees.

Fortunately, Hilton resolved it within two days, giving me a completely new account, reinstating my lost points, adding 150,000 more, and continuing my Diamond status for the year. Thank you, Hilton.

But this is not a victimless crime, because someone had to pay. As it turns out, 500,000 Hilton points can buy a $1000 Amazon gift card. That’s no small thing. The thief saw this as an easy crime, but was not smart enough to change the email address on the account. Every move she or he made was mirrored to me in emails.

Whomever did the crime is completely unknown to me. Was it a front desk clerk with an illegal side hustle? Someone else inside Hilton? A data breach that allowed someone access to many accounts? And yes, it could have been a breach on my phone as well, but this is the only incident of fraud or theft I have detected that has anything to do with my phone.

I now have two-factor on my new Hilton account, as well as facial recognition. I never dreamed I would have to use two-factor on something as seemingly benign as a loyalty points program. Then again, I’m pretty sure that Instacart shoppers never thought someone might be nickel and diming them either.

Theft is theft, fraud is fraud. There is no such thing as a victimless crime when it comes to using OPM. It’s the kind of thing that bedevils fraud departments, because it costs money to go after what amounts to petty theft. But it is petty theft that can add up. The $1000 or more that my thief used at Amazon most certainly went for gift cards instead of blenders and air fryers, because gift cards can be sold quickly and converted to cash. Blenders and air fryers cannot. I just hope that Hilton worked with Amazon, and shut down everything, including any gift cards purchased.

Meanwhile, be ever diligent in the digital era. You may be paying for someone’s else’s dinner. Someone may be profiting from your points. And in any regard, I hope they caught my perp and broke his knees, although I have my doubts. I’ll be watching everything a lot more closely from now on, even the little things.

Dr “Still Feeling The Sting“ Gerlich

Audio Blog

2 notes

·

View notes

Text

3/5 credit cards. In the end my credit limit goes from $500 to $6000 today. 2 cards with different 5% cashback will be nice, and it's all good to have in case of emergency. 🙂

My FICO score dropped from 757 to 733 from the inquiries alone, and then next month it's going to plummet from the average age of my accounts going down down down. Not going to be looking for a new car loan for awhile though, so oh well. 😛

The Amazon card claims it'll take up to 30 days to decide, (probably not then imo, even though they say I passed pre-approval) and the credit union card wants 48 hours. (also probably not imo)

The credit union card was definitely the hardest application. If your income is coming from disability, they want to know whether it's permanent disability, long-term, or short-term, the date that you started receiving payments, and they want you to decide how much of a credit limit you want. (why?)

Chase had the easiest application, with an instant decision and they were the only one besides Amazon that told me to inflate my income for receiving SSI.

Discover didn't, but it was also a smooth application with an instant decision. 🙂

CapitalOne was also pretty smooth. 🙂

If I had to do it again I guess I'd pass on the Amazon card and the credit union card, but the $150 account credit on Amazon was too good to pass up. 😛

Having to login manually reminded me to go change my passwords too. Some of them were still last updated in 2021!

2 notes

·

View notes

Text

Essential E-Commerce Features for Your Mobile App to Drive Success

With mobile commerce becoming an integral part of our shopping experiences, e-commerce businesses must offer intuitive, feature-rich mobile apps to stay competitive. A mobile app isn't just an extension of your online store—it's a powerful tool for building customer loyalty, driving sales, and providing a seamless shopping experience that keeps users coming back. But crafting a truly effective e-commerce app requires more than just a catalog of products. Here are the essential features that can elevate your mobile app, providing a user-friendly, engaging, and high-performing shopping environment for your customers.

1. User-Friendly Interface

An intuitive interface is critical to any successful mobile app, especially for e-commerce. If users can navigate smoothly and find what they need quickly, they're more likely to explore products and make purchases. The app should have a clean, uncluttered design with clearly defined buttons and readable fonts to provide a stress-free experience.

Easy Navigation: Simple navigation menus, clear icons, and breadcrumb trails help users find products effortlessly.

Streamlined Checkout: A simplified checkout process reduces friction and prevents cart abandonment.

Fast Loading Time: With short attention spans, users expect quick load times. Slow speeds can drive customers away.

2. Advanced Search and Smart Filters

An advanced search bar and smart filtering options allow users to quickly narrow down product selections based on specific preferences. When users can easily search for items and find relevant results, their overall experience improves.

Voice and Visual Search: Enabling voice commands or image-based searches provides a modern, convenient way to find products.

Auto-Suggest and Recent Searches: Helping users by suggesting popular items or recalling previous searches enhances usability.

Comprehensive Filters: Filters by price, size, color, brand, and user ratings allow customers to find the exact products they’re looking for.

3. Personalized Recommendations

Personalized recommendations based on browsing history, past purchases, and user preferences can significantly improve user engagement. These recommendations help users discover new products that are relevant to them, increasing the likelihood of conversions.

Product Recommendations: AI-driven suggestions for similar or complementary items make it easier for users to find items of interest.

Recently Viewed Items: Displaying a list of recently viewed products offers users a quick way to revisit items they’re considering.

Personalized Promotions: Special discounts or suggestions based on purchase history can encourage repeat shopping.

4. Social Media Integration

Social media integration isn’t just about logging in—it's a powerful tool for user engagement and brand awareness. Allowing users to log in through social accounts, share their purchases, and even discover products on social platforms boosts brand visibility and simplifies access.

Social Logins: Allow users to sign in using social media accounts like Facebook or Google for a fast and easy registration process.

Product Sharing: Enabling users to share products or their wishlists on social media platforms can encourage organic reach and influence potential customers.

Influencer Content: Consider embedding links to reviews, testimonials, or influencer unboxing videos to add social proof.

5. Seamless Payment Options

Offering multiple payment options ensures a smoother checkout process, which can reduce cart abandonment. Providing secure, trusted payment methods reassures customers that their data is safe, encouraging them to complete transactions.

Variety of Payment Methods: From credit/debit cards and e-wallets to cash-on-delivery options, having multiple payment methods makes shopping more accessible to a broader audience.

One-Click Checkout: Allowing registered users to check out with one click reduces friction, making purchases easier and faster.

Secure Transactions: Encryption and secure payment gateways are critical to protecting user data and building trust.

6. Push Notifications and In-App Messaging

Push notifications and in-app messages keep users informed and engaged, helping to drive sales and increase app usage. Strategically used, notifications can remind users about items in their cart, inform them of a flash sale, or provide personalized offers.

Targeted Notifications: Notifications tailored to each user’s interests are less intrusive and more effective at engaging them.

Cart Abandonment Reminders: A gentle reminder about items left in the cart can encourage users to complete their purchase.

Exclusive Promotions: Notify users of limited-time discounts or new product launches to drive traffic and engagement.

7. Wishlist and Save for Later

A wishlist feature allows users to save products they like but aren’t ready to purchase yet. This feature can be a powerful way to increase conversion rates, as users may return to buy saved items or be alerted when there’s a sale.

Wishlist Notifications: Inform users when items in their wishlist are on sale or about to go out of stock.

Back-in-Stock Alerts: Let users know when previously unavailable items become available.

Social Wishlist Sharing: Allow users to share their wishlist with friends and family for gifting purposes.

8. Ratings and Reviews

Ratings and reviews play a crucial role in building trust with potential customers. By allowing users to read reviews and view ratings from other shoppers, you help them make more informed purchasing decisions.

Verified Purchase Tags: Highlight reviews from verified buyers to ensure authenticity.

Review Filtering: Enable users to filter reviews by rating or date to find relevant feedback.

Seller Responses: Allow sellers to respond to reviews, providing transparency and addressing any issues directly.

9. Order Tracking and Updates

Order tracking gives customers peace of mind by allowing them to know the exact status of their purchase. Real-time tracking and updates keep customers informed, improving their experience and reducing the need for customer support.

Live Tracking: Real-time updates on an order’s location and estimated delivery times enhance transparency.

Order Status Notifications: Notify users when their order has shipped, is out for delivery, or has been delivered.

Order History: A record of past orders helps users easily reorder items or access previous purchases.

10. Augmented Reality (AR) Integration

AR provides an immersive shopping experience, allowing users to virtually try on products or see how items would look in their homes. This feature is especially useful for clothing, accessories, and furniture.

Virtual Try-On: Helps users visualize items such as clothing or eyewear.

Room Visualization: Allows users to see how furniture or home decor items would look in their space.

360-Degree Views: Provide a comprehensive look at products from all angles.

11. Loyalty Programs and Gamification

Rewarding loyal customers with points, rewards, or exclusive discounts encourages repeat purchases and can be a major differentiator in a competitive market. Gamifying certain aspects, like achievements or daily rewards, can add a layer of fun to the shopping experience.

Points System: Reward users with points for each purchase, which can be redeemed on future orders.

Member-Only Discounts: Offer special deals or early access to sales for loyalty members.

Progress Tracking: Allow users to track their points or loyalty level to encourage further engagement.

12. Multiple Language and Currency Support

For apps with a global reach, supporting multiple languages and currencies is essential. This feature creates a welcoming experience for international customers, making shopping more convenient and personalized.

Auto-Detect Language and Currency: Automatically detect the user’s region to provide a localized experience.

Currency Conversion: Allow users to view prices in their local currency.

Localized Offers: Present region-specific deals and products based on location.

13. High-Quality Product Details and Visuals

Since users can’t physically interact with products, clear images and detailed descriptions are essential to help them make informed decisions. High-quality visuals and comprehensive information can significantly impact sales.

Multiple Product Images and Videos: Show multiple angles of each product, ideally with zoom and 360-degree views.

Detailed Product Descriptions: Include specifications, materials, dimensions, and care instructions.

User-Generated Content: Display photos from other customers to provide real-world perspectives.

14. Customer Support Integration

In-app customer support is crucial for addressing questions, solving issues, and enhancing the user experience. With multiple support options, users can feel confident that help is always available.

Live Chat Support: Offer real-time assistance for quick questions.

Comprehensive FAQ Section: Answer common questions to reduce support inquiries.

Direct Call or Email Options: Give users easy access to your support team if needed.

15. Data Analytics and Insights

Data analytics provide valuable insights into user behavior, sales trends, and overall app performance. With analytics, you can continuously optimize the app to meet evolving user needs and preferences.

User Behavior Tracking: Monitor how users interact with the app, from product views to purchase patterns.

Sales Performance Tracking: Identify best-selling products and trends to inform future inventory and marketing strategies.

User Feedback Collection: Gather insights into app usability and customer satisfaction.

An e-commerce app that incorporates these essential features will not only offer a superior shopping experience but also drive customer satisfaction, loyalty, and revenue. With a focus on user-friendly design, personalization, and secure transactions, your app can be a powerful platform for reaching and retaining customers in today’s competitive e-commerce landscape. Investing in these features will help transform your e-commerce app into a robust, customer-centric shopping experience that stands out from the crowd.

Want to develop a feature rich mobile app for your e-commerce? Techtsy is the right Mobile app development company to partner with.

0 notes

Text

Savastan0 CC Shop - Premier Credit Card Marketplace

Savastan0 CC Shop provides a streamlined, secure platform for purchasing high-quality credit cards and financial data. We prioritize safety, confidentiality, and swift customer service to meet all digital financial needs. Discover a comprehensive range of credit options tailored for reliable, seamless transactions.

0 notes

Text

Can You Use PayPal for Online Shopping?

Yes, you can use PayPal for online shopping. It is a popular choice due to its ease and security. Many online stores accept PayPal as a payment method. You only need a PayPal account to start. Simply link your bank account or credit card to PayPal. Then, when shopping online, choose PayPal at checkout. Enter your login details, and you’re done. It’s that simple.

PayPal offers several advantages for online shopping. First, it protects your financial information. PayPal acts as a middleman, so sellers never see your bank details. For example, I used PayPal to buy a laptop online. My bank details were safe, and the transaction was smooth. PayPal also has a buyer protection policy. If an item doesn’t arrive or is not as described, you can open a dispute. This helps ensure you get what you paid for or your money back.

Another benefit is convenience. Many online stores have integrated PayPal for quick payments. You don’t have to enter your credit card information every time you shop. I recently bought clothes from an online store that accepted PayPal. The checkout process was quick and easy. PayPal also allows you to manage your purchases easily. You can track transactions and view purchase history from your PayPal account. This makes keeping track of spending straightforward.

In summary, using PayPal for online shopping is both easy and safe. It offers protection and convenience for buyers. Many online retailers accept PayPal, making it a flexible choice. For secure, hassle-free online purchases, PayPal is a great option.

Discover BizGuideOhio: Your Comprehensive Source for USA Contact Information

For detailed access to USA contact details, explore the BizGuideOhio directory. With a wide range of listings, this resource helps you find specific contacts across various industries and regions in the United States. Whether you're looking for business contacts, customer service numbers, or professional connections, BizGuideOhio is a reliable platform for efficient searches. Use its user-friendly interface and extensive database to access the most relevant and current contact information tailored to your needs. Discover detailed American business contact information with BizGuideOhio today.

0 notes

Text

Key Features of Mobile Banking Apps: Revolutionizing Financial Services

This transformation has led to the upward push of mobile banking app development companies, who concentrate on creating advanced mobile packages that simplify banking tasks, improve user enjoyment, and enhance financial protection. In this article, we can discover mobile banking app development company, the features of mobile banking apps, and the steps involved in the development manner. The Rise of Mobile Banking Apps More clients are counting on those apps to manipulate their budget on the go, supplying convenience that conventional banking strategies can not. According to records, cellular banking adoption is on the upward push, with tens of millions of customers using those structures to perform duties like checking account balances, making transfers, paying payments, and more. Partnering with a mobile banking app improvement organization can help banks and economic institutions live aggressively in this virtual technology. These businesses provide information in developing function-rich apps prioritizing protection, user revel in, and functionality. Key Features of Mobile Banking Apps The fulfillment of a cellular banking app hinges on the features it gives. A well-advanced app should consist of the following crucial functionalities: Secure Login and Authentication One of the most vital features of any mobile banking app is its protection. Users need to feel assured that their sensitive monetary information is covered. Incorporating biometric authentication, including fingerprint or facial recognition, aspect authentication (2FA), and sturdy encryption measures, is essential to protect user facts. Real-Time Notifications Customers need to stay informed about their monetary transactions. A reliable cellular banking app must send actual-time push notifications to alert customers of account activity, including deposits, withdrawals, or unusual login tries. This feature enhances transparency and enables fraud to be located quickly. Fund Transfers The ability to switch finances between accounts or to outside recipients is a fundamental but essential characteristic of mobile banking apps. This characteristic must allow users to make seamless domestic and global transactions, whole with switch confirmations and transaction histories. Bill Payments Paying bills through a mobile banking app streamlines monetary management for customers. The app must permit users to pay application bills, mortgages, credit card balances, and more directly from their money owed, with the choice to schedule routine payments. Customer Support Customer provider is a quintessential banking issue; mobile apps should provide users quick access to assistance. This can consist of live chat alternatives, call-back offerings, or AI-powered chatbots that could help with frequently asked questions. Card Management Managing credit scores or debit cards at once from the app is another helpful feature. Users must be capable of prompting or deactivating their cards, requesting replacements, setting spending limits, and evaluating card pastimes inside the mobile banking app. Account Management A mobile banking app development enterprise specializes in creating complete account management capabilities. Customers have to be able to view their transaction history, test account balances, and set up indicators for particular account activities. Detailed economic insights, such as fee monitoring and budgeting equipment, enhance user experience. Security Alerts and Fraud Detection mobile banking apps need advanced safety mechanisms with the development of cyber threats. Incorporating AI and gadget mastering can assist in coming across fraudulent activity and offer timely signals to customers. The cellular banking app development employer integrates those superior protection protocols to ensure consumer trust and protection. Steps to Develop a Mobile Banking App Developing a cellular banking app requires meticulous plans and execution to deliver a stable, user-pleasant, and characteristic-rich product. Here are the steps a mobile banking app improvement business enterprise typically follows in growing a cellular banking app: Market Research and Analysis Before improvement begins, it’s vital to conduct thorough marketplace research. This entails understanding the audience, determining user desires, reading competitors, and determining which functions provide the most value. The aim is to create a unique app that addresses customers' pain points. Define App Features and Functionalities Once the research is complete, the subsequent step is defining the app’s center capabilities. As mentioned earlier, these capabilities might consist of steady authentication, real-time notifications, fund transfers, bill bills, etc. Defining those functions early ensures the improvement method stays aligned with client expectations. Choose the Right Technology Stack Selecting the proper generation stack is critical for the app's performance and protection. The cellular banking app improvement organization must pick programming languages, frameworks, and gear that guide the app’s functionality and protection requirements. UI/UX Design The layout section involves developing wireframes, prototypes, and UI/UX mockups to visualize how the app will look and feature. A nicely designed interface is critical for the highest quality consumer experience. During this stage, builders ensure the app’s interface is easy to apply while keeping a sleek and present-day look. Development Once the design is accredited, the actual coding procedure starts. This step involves backend and frontend development, wherein the crew focuses on writing clean and green code to build the app’s infrastructure. Security measures are also carried out at this stage to defend sensitive statistics and save you from cyber threats. Testing After improvement, rigorous testing guarantees the app is bug-unfastened and operates smoothly. This consists of helpful testing, usability trying out, overall performance trying out, and safety testing. A mobile banking app improvement employer commonly assesses the app on multiple devices and running structures to ensure continuing enjoyment throughout structures. Launch and Maintenance After checking out, the app is ready to release, and any problems are resolved. After release, the enterprise video displays individual feedback and overall performance metrics to cope with any worries or updates. Conclusion These apps offer convenience, protection, and capability that streamline economic obligations for customers while also allowing banks to lessen fees and boost purchaser delight. Partnering with a mobile banking app improvement enterprise is crucial to reap success. These specialized groups convey expertise in designing and developing cell banking apps that meet the unique desires of financial institutions, making sure the final product is stable, consumer-pleasant, and revolutionary. As the demand for mobile banking maintains an upward thrust, the function of these improvement businesses will only develop in significance, using the future of virtual monetary services. Read the full article

0 notes

Text

How To Easily Perform Discover Card Credit Login?

Visit the Discover website or mobile app and enter your username and password to log into your credit card account. If you don't already have Card Discover Login information, create an online account by providing your card number, expiration date, birthdate, and the last four digits of your SSN. You can create a user ID and password after Discover has verified your information.

How to Login in to Your Discover Credit Card Account Online?

To access your account online, register your Discover credit card. To confirm your identification, click "Register Your Account" and enter your card number, expiration date, birthdate, and the last four digits of your Social Security number.

Make a password and user ID. The user ID must have six to sixteen characters. 8 to 32 characters, at least one letter, and one number are needed for passwords.

Use your new Discover card credit login information to log in. Once you've logged in, you should see the Discover "Account Home" page, which details your account, including your available credit and amount.

How to Access Your Online Discover Credit Card Account?

You may manage your Discover account online once you've registered and logged in. You may manage account details, including passwords and automatic payments, as well as pay credit card bills, view credit card statements, and track account activity.

Click "Forget User ID/Password" on the Explore login screen if you can't remember your login credentials. Follow the instructions afterward to reset or retrieve your account credentials.

Where Can You Check the Amount On My Discover Credit Card?

You may check the amount on your Discover credit card online by logging into your account or using the Discover mobile app for iOS or Android.

You can do many things from this page, including pay bills, manage rewards, download statements, freeze or unfreeze your account, and more.

How Can I Make My New Discover Card Active?

1. Go to the Discover login credit card page.

2. Input: how do you want to move forward? Neither logging in nor logging out

3. Next, enter your birth date.

4. Now enter the SSN's final four digits.

5. After that, key in the 16-digit card number.

6. Next, input the 3-digit sequence ID and the card's expiration date.

7. Click the Proceed button to activate your card.

Conclusion

Therefore, you can to Log in Discover Card. You can use the steps and guidelines that are mentioned in this blog. However, if you want to know more about Discover Credit Card Login and its features, you can visit OpenKit.io.

#Discover Credit Card Login#Log in Discover Card#Discover login credit card#Discover card credit login

0 notes

Text

Bank Alfalah Limited Online Banking

What is Alfalah Online Banking?

Bank Alfalah Limited offers comprehensive online banking services, allowing clients to access their accounts and manage their finances conveniently from any Alfalah Bank branch. This secure and efficient service is designed to enhance your banking experience with real-time access to your account, regardless of your location.

Features of Alfalah Online Banking

Instant Cash Deposits: Deposit cash directly into your account for immediate credit.

Cheque Withdrawals: Withdraw cash using a cheque at any Alfalah Bank branch.

Balance Enquiries and Statements: Check your account balance and obtain account statements from any branch.

Fund Transfers: Transfer funds between your Alfalah accounts or to other Alfalah accounts across the country.

Enhanced Financial Management: Use Alfalah’s Online Banking to improve your business productivity and financial oversight.

Mobile Net Banking

With the rise of mobile internet usage in Pakistan, Alfalah Bank provides a mobile net banking service that caters to today’s on-the-go lifestyle. This service offers convenience and time-saving features, making it easier for customers to manage their accounts via their mobile devices.

Features of Alfalah Mobile Net Banking

Pay Anyone: Make payments to any recipient.

Credit Card Balance: Check your Alfalah credit card balance.

Mobile Bills: Pay your mobile phone bills directly.

Repay Check: Purchase or manage repayment checks.

Account Statement: Access your Alfalah Bank account statements.

Internet Banking Registration: Easily register for Alfalah Internet Banking.

Benefits of Alfalah Internet Banking

Manage Multiple Accounts: Link and manage all your Alfalah accounts through a single online platform.

24/7 Access: Enjoy round-the-clock access to your accounts without time constraints.

Bill Payment: Set up and manage e-bills, automate recurring payments, and avoid queues by paying utility bills online.

Account Alerts: Receive customizable email alerts for various account activities, including balance updates and transaction notifications.

Email Notifications: Get daily statements, alerts for balance changes, and notifications for any issues with your account.

Funds Transfer: Transfer funds swiftly between your accounts or to other Alfalah Bank customers. You can also transfer to other 1-LINK member banks, schedule one-time or recurring transfers.

Telecom Top-up: Top up your mobile and internet services from anywhere.

How to Register for Internet Banking

To start using Bank Alfalah’s Internet Banking services, follow these steps:

Registration: Visit the Soneri Bank Internet Banking Registration Page. Enter your Alfalah Visa Debit card number, CNIC, Login ID, email address, mobile number (must be registered for SMS Alerts), and create a security question. Agree to the bank’s terms and conditions.

Activation Code: Visit your branch with your original CNIC/SNIC. You will receive an 8-digit activation code via SMS and email. Complete the activation process within 72 hours to ensure your registration remains valid.

Activate Online Banking: Use any Alfalah Bank ATM or contact Soneri Phone Banking at +92-111-766-374. Enter the activation code to finalize the setup. You will receive confirmation through ATM or Phone Banking services.

Updating Your Contact Details

Ensure your email address and mobile number on record with the bank are up-to-date to receive notifications and alerts. Visit your nearest Alfalah Bank branch if you need to update your contact information.

Explore More

Bank Alfalah’s Internet Banking offers a wide range of features designed to simplify your banking experience. Sign up today to discover all the benefits and manage your finances with ease.

0 notes

Text

What is phishing attack

Phishing attacks are fraudulent attempts by scammers to steal your personal information or login credentials. Phishing messages are designed to appear as legitimate emails or websites to trick you into providing sensitive data like passwords, account numbers, or credit card numbers.

How Phishing Attacks Work

Phishing attacks typically involve the following steps:

The scammer sends an email posing as a legitimate company or website. These messages often claim there is an issue with your account or a problem that requires your immediate attention.

The email contains a link or attachment that leads to an official-looking website or form asking for personal information like your username, password, credit card number, or social security number.

If you enter your information or click any links/downloads, the scammer can access your accounts, make unauthorized purchases, or commit identity theft.

Protecting Yourself

There are several precautions you can take to avoid becoming a victim of phishing attacks:

Never click links or download attachments from unsolicited emails. Legitimate companies will not ask for sensitive information via email.

Carefully inspect the sender’s email address and check for spelling errors or mismatches. Scammers often spoof the names of well-known companies.

Hover over links to view the actual URL before clicking. Malicious links may look authentic but lead to different websites.

Never enter personal information on any website unless you’ve double checked that the URL begins with “https” and includes the name of the legitimate organization.

Be wary of messages conveying a sense of urgency or requesting immediate action. Legitimate companies will not pressure you in this way.

When in doubt, contact the organization directly instead of using any information in the email. Ask if they actually sent that message.

Enable two-factor authentication on accounts whenever possible. This adds an extra layer of security for your logins.

Stay vigilant – as technology improves, phishing emails become more sophisticated and realistic. Continually be on alert for phishing attempts.

By exercising caution with unsolicited messages and verifying the legitimacy of requests for personal information, you can help prevent identity theft and avoid becoming the victim of a phishing attacks. Constant vigilance and proactively securing your accounts are the best defenses.

Read Full Blog 👇 :

0 notes

Text

Banking’s API Evolution: Shifting from Cost Savings to Strategic Monetisation

Have you ever wondered how your banking apps seamlessly fetch real-time data and make transactions with just a tap? That’s this blog is about!

Firstly, let’s understand the definition of API. API stands for Application Programming Interface, act as messengers that enable different software systems to communicate and share information. It has become an indispensable part of banks. Want to know how? Read this full blog here.

Some of the ways an API can be used in baking are:

Banking, Simplified: When you check your account balance on a finance app, APIs are already at play. They request data from the bank's server and deliver it to your app in a language both understand. This keeps your app updated without manual input.

Making Transactions Swift: APIs streamline transactions too! When you transfer money or pay bills, APIs facilitate the communication between your app and the bank. It's like a digital connection ensuring your money moves securely and swiftly.

Security First: Worried about security? APIs always cover you! They use encrypted protocols, adding layers of protection to your data. It's like sending your information in an indecipherable secret code.

Innovation Happens Because Of API: Thanks to APIs, banks can collaborate with third-party developers to create new features and services. Think budgeting tools, investment apps, or even personalized financial advice – all made possible by APIs.

What are the Types of API in Banking?

While there are many different types of API, some of the most common ones are:

Payment APIs:

Functionality: Enable secure and swift money transfers between accounts.

Use Case: Power online payments, fund transfers, and payment gateways.

Account Information APIs:

Functionality: Retrieve account details, balances, and transaction histories.

Use Case: Integrates with personal finance apps for real-time financial updates.

Authentication APIs:

Functionality: Verify and authenticate users for secure access to banking services.

Use Case: Validates user identity during login or transaction authorisation.

Credit Scoring APIs:

Functionality: Assess creditworthiness of individuals or businesses.

Use Case: Supports loan approvals, credit card applications, and risk assessment.

FX (Foreign Exchange) APIs:

Functionality: Provide real-time exchange rates and facilitate currency conversion.

Use Case: Essential for international transactions and forex services.

Conclusion:

Banking APIs have transformed from saving costs to fuelling business growth and innovation. Initially used for expense reduction, they now serve as gateways, improving services, offering insights, and improving security. APIs open up global expansion and personalised customer experiences.

Yet, integrating APIs in banking faces challenges like data privacy, integration issues, and regulatory compliance. Overcoming these hurdles is important for banks, which is why banks needs a strong API app development service to help you fully leverage API potential in the changing financial landscape. Ficode can help in this. We provide API integration services that adheres to the finteh’s needs. Lean more about us!

0 notes

Text

Venmo Limits, Fee, and How to Pay with Venmo Balance

Millions of people use the Venmo app to transfer money, split bills, and more. Venmo is a money transfer and payment app that lets you split bills, make payments, receive direct deposits, and transfer money. Users can buy, sell, and hold cryptocurrency and make in-store payments with the Venmo Debit Card or Venmo Credit Card. The company also offers business payment solutions.

Venmo was founded in 2009 and is headquartered in New York City. It’s currently only available to US residents. Use it to send money across the US, but you can’t use it to send international money transfers.

How do I request and send money through the Venmo app?

It’s easy to request and send money through Venmo. Here’s how it works:

Login to your Venmo account.

Select the button that says Pay or Request at the bottom of the screen.

Select the recipient. There are 4 ways to do this: (1) Login with Facebook to access your Facebook contacts, (2) give the app permission to access your phone contacts, (3) scan your recipient’s unique Venmo QR code on their phone or (4) lookup people’s names or usernames using the app’s search function, which can be located by tapping the hamburger icon at the top of the screen.

Add a custom message (optional).

Adjust the visibility settings of your transaction using the Privacy button, which appears above the Request/Pay buttons towards the bottom of the screen. You can allow the transaction to be visible to everyone, your friends, or just yourself and the recipient (default).

Select either Request or Pay.

View your Venmo account balance. Funds will be taken from here first. If the balance is insufficient, the full amount will be taken from the bank account or card linked to your account. You can’t use multiple payment methods to fund a single payment.

Hit Send to submit the transaction.

How do I add funds to my Venmo account?

To transfer funds directly into your Venmo account, you must have a Venmo Debit Card. Transfers take three to five business days. There’s no option to transfer funds instantly.

If you don’t have a Venmo Debit Card, your account balance is any funds you’ve received through Venmo transfers from friends, assuming those funds haven’t been moved out of your account to a linked bank account or card.

Venmo limits

There is no Venmo limit per day. However, there are weekly limits to the amount of money you can transfer and withdraw from your account.

By default, the Venmo transfer limit for person-to-person transfers is $299.99 per week. When you verify your identity, the Venmo limit rises to $4,999.99 per week for person-to-person transfers and $6,999.99 for all types of Venmo transactions.

Verify your identity in the app, but you must have a Social Security number (SSN) or Individual Tax Payer Identification Number (ITIN). Usually, the process only takes a few minutes.

Withdrawals from Venmo to a bank account are limited to $999.99. Once you’ve verified your identity, the Venmo weekly limit raises to $19,999, or $2,999.99 for each transfer.

What happens when someone sends me money through Venmo

Funds sent to your account via Venmo will appear in your account balance. Payments that appear in green show money that has entered your Venmo account, while payments in red show money that has left your Venmo account.

Withdraw funds from Venmo to a bank account, credit card, debit card, or prepaid card. Prepaid cards must be branded by a network like American Express, Discover, Mastercard, or Visa. You can’t link a PayPal account to Venmo.

Follow these steps to withdraw funds from your Venmo account:-

Login to Venmo.

Select the menu (hamburger icon) on the top, right of the screen. You’ll be able to view your account balance.

Select the type of transfer you want. Instant transfers take up to 30 minutes but cost a fee. Standard transfers are free but take one to three business days to arrive.

Hit the green transfer button at the bottom of the screen. If successful, a green checkmark will appear.

Verify that funds have left your Venmo account by hitting the menu once again and viewing your account balance.

Venmo fees

The following fees apply to personal nonbusiness Venmo money transfers:-

Fee type:-

Money transfer funded by Venmo balance, bank account, or debit card- Free

Money transfer funded by credit card- 3% of the transfer amount

Standard electronic withdrawal (1-3 business days)- Free

Instant electronic withdrawal (up to 30 minutes)- 1.5% (minimum $0.25, maximum $15.00)

Transaction declined (insufficient funds)-$0.00

Is Venmo international?

No. Currently, Venmo is only available to users who reside in the US, so you can only use it to send domestic money transfers. You can’t use Venmo to send an international money transfer.

Can I use Venmo for business?

Yes. Create a business profile with Venmo, so you can begin accepting payments from clients and customers online, in person, or via Venmo’s app. Payments work the same for both personal and business transactions, so customers can continue using the app as they normally would.

How do I contact Venmo?

Venmo has multiple articles online to help you find answers to the most commonly asked questions and issues. Otherwise, you can get in touch with Venmo customer service directly by filling out an online form on the company’s website.

Frequently asked questions:-

Q. What is Venmo’s transfer limit?

Users who haven’t verified their IDs can only send up to $299.99 per week. Send more by completing the in-app ID verification process.

Q. What’s the Venmo transaction fee?

There is no transaction fee or transfer fee for sending or receiving money using Venmo. There may be a fee for withdrawing funds to your bank account or card.

Q. Does Venmo pair with cash advance apps?

While not all cash advance apps are integrated with Venmo, there are quite a few of the top cash advance apps that work with Venmo.

0 notes

Text

Safeguarding Customer Data in E-Commerce

Introduction:

In the digital age, e-commerce has revolutionized the way we shop, offering unparalleled convenience and a vast array of choices at our fingertips. However, with the surge in online shopping, e-commerce security has never been more critical. Protecting customer data is paramount for building trust and maintaining a secure shopping environment. This article will explore the key aspects of e-commerce security and how businesses can safeguard their customers’ data.

Understanding E-commerce Security:

E-commerce security encompasses a variety of practices and technologies designed to protect online transactions and customer information from cyber threats. These threats include data breaches, identity theft, phishing attacks, and more. Ensuring robust security measures not only protects customers but also helps businesses avoid legal repercussions and reputational damage.

Why Customer Data Protection is Crucial?

1. Trust and Reputation:

Customers trust e-commerce platforms with their personal and financial information. A single data breach can significantly damage a company’s reputation, leading to lost customers and diminished brand trust.

2. Legal Compliance:

Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandate strict data protection standards. Non-compliance can result in hefty fines and legal consequences.

3. Financial Loss:

Data breaches can lead to significant financial losses due to fraud, compensation claims, and the cost of implementing additional security measures post-breach.

Key Security Measures for E-commerce Platforms:

1. SSL Encryption:

Secure Socket Layer (SSL) encryption is essential for protecting data transmitted between the customer and the website. SSL certificates ensure that all sensitive information, such as credit card details and personal data, is encrypted and secure from interception.

2. Secure Payment Gateways:

Utilize reputable payment gateways that comply with the Payment Card Industry Data Security Standard (PCI DSS). These gateways provide an additional layer of security by handling payment information securely and minimizing the risk of fraud.

3. Two-factor authentication (2FA):

Implementing 2FA adds an extra layer of security by requiring customers to provide two forms of identification before accessing their accounts. This reduces the likelihood of unauthorized access, even if login credentials are compromised.

4. Regular Security Audits:

Conduct regular security audits and vulnerability assessments to identify and address potential weaknesses in the system. Staying proactive in detecting vulnerabilities helps prevent security breaches before they occur.

5. Data Encryption:

Encrypt sensitive customer data stored in databases. Even if cybercriminals gain access to the database, encryption ensures that the data remains unreadable and unusable.

6. Secure Password Policies:

Encourage customers to create strong, unique passwords by implementing password policies. This includes requirements for length, complexity, and regular updates.

7. Regular Software Updates:

Keep all software, including the e-commerce platform, plugins, and extensions, up to date. Regular updates often include security patches that address newly discovered vulnerabilities.

Conclusion:

E-commerce security is a critical aspect of running an online business. By implementing robust security measures, businesses can protect their customers’ data, build trust, and ensure compliance with legal standards. As cyber threats continue to evolve, staying vigilant and proactive in safeguarding customer information will be key to maintaining a secure and successful e-commerce platform.

In the ever-growing world of e-commerce, prioritizing security is not just a technical requirement but a commitment to customers and their trust in your business. By doing so, businesses can foster a secure online environment that benefits both the company and its customers.

CodeAroma Technologies is the best e-commerce development company in Ahmedabad. Contact us for the best e-commerce website and app development services.

0 notes

Text

How To Easily Perform Discover Card Credit Login?