#Digital-Billing-machines for sales

Explore tagged Tumblr posts

Text

I copied this from someone else. Very interesting and it really made me stop and think about using cash more often. I have really never thought of this – has anyone else?

Please understand what NOT using cash is doing … and why cash is important.

Why should we pay cash everywhere we can with bank notes instead of a credit card?

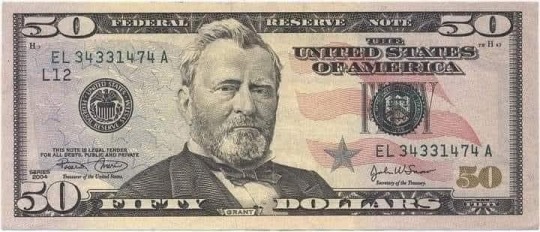

I have a $50 bank note in my pocket. Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping. After an unlimited number of payments, it will still remain a $50 note, which has fulfilled its purpose to everyone who used it for payment and the bank is dry from every cash payment transaction made.

But if I come to a restaurant and pay digitally with my credit card and bank fees for my payment transaction charged to the seller are 3%, so around $1.50, and so will the fee be $1.50 for each further payment transaction or owner for the laundry or payments of the owner of the laundry shop, or payments of the barber etc. Therefore, after 30 transactions, the initial $50 will remain only $5 and the remaining $45 will become the property of the bank thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc. When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine. If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!

268 notes

·

View notes

Text

Please understand what NOT using cash is doing !!!

Cash is important!

Why should we pay cash everywhere with banknotes instead of a card?

I have a $50 banknote in my pocket. Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping. After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has jumped dry from every cash payment transaction made...

But if I come to a restaurant and pay digitally - Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc..... Therefore, after 30 transactions, the initial $50 will remain only $5 and the remaining $45 became the property of the bank thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each Retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine. If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month. That would go a long way to helping that small business provide for its family!

8 notes

·

View notes

Text

Leading Thieves Say Millennials and Zoomers "Ruining the Crime Industry"

A variety of criminals have spoken out over the past few weeks, saying that crime just doesn't pay like it used to because Millennials and Gen-Z-ers are so broke, they have nothing of value to steal.

Stephen "Fingers" Gilligan, Pickpocket: Pickpocketing has been on the decline in America for a while, but it's getting ridiculous now. Nobody carries cash anymore, and even cards aren't paying out. The other day I stole a wallet with five debit cards, and all but one of them declined. The last one had just enough to buy a Sierra Mist from a vending machine. That was my second best score all week. The best was a $40 Olive Garden gift card and a crumpled, discolored $5 bill that I had to use archeological techniques to retrieve without it disintegrating in my hand.

Burt Crustman, Mugger: Man, nobody walks through dark alleys at night since the pandemic hit, and when they do? Jackshit. The only valuable anyone under 40's got on them these days is their phone. Admittedly lotsa people have $3000 phones, but you know what the market for fencing iPhones is like? It's shit! Everybody's buying new phones because their phone's the only nice thing they can afford!

Monty Derailleur, Bike Thief: Well the bike theft business would be going good, if people ever used the bikes they bought. The sales are high, but the fact of the matter is, the bike lanes around here are shitty or nonexistent, there's no room to take them on the bus, and there's no bike racks so everybody knows it's gonna get stolen.

Jerry Rigby, Car Thief: I don't know what you're talking about, Grand Theft Auto is booming. There's $75,000 pickups, $60,000 SUVs, $100,000 Teslas, and most people can't even afford to buy a used car legally so fencing's never been easier. The reason it's hard for those of us in the business is twofold. First, too many people living out of their cars. Second, the competition. You see a nice car parked somewhere, you gotta be on it like that, or the fucking illegal towing rackets will beat you to it. It's nearly impossible to make a living as an independent car thief.

Dwayne Pipe, Burglar: The only reason to be breaking and entering in the post-Pandemic years if to use somebody's shower. I swear to god, half the time when I break into a place, the only furniture is a mattress on the floor and a mid-sized computer monitor as a TV, and those are only good for scrap because with planned obsolescence the way it is, they have a life expectancy of about 6 weeks after theft. To be honest with you, I'm running a loss on most jobs. The only reason I haven't gone straight is because all the legal jobs pay jackshit too. That, and I really like replacing people's family photos with pictures of Nicholas Cage.

Brittlyghn McKannyck, Shoplifter: Shoplifting these days is a hobby, not a career. Half the time the stores are too understaffed to even stock the shelves, and if they're not, everything's locked up. I had to get a guy to unlock a magnetic tag on a box of Crispix the other day. If I didn't live with my parents, there's absolutely no way shoplifting full time would be viable.

Norman Gore, Master Hacker and Identity Thief: Scamming people out of their financial info or cracking passwords has never been easier, but the scores just aren't worth it. I keep getting into bank accounts that pending overdraft fees. It's pathetic. I have to leave the lights off so my hacker den's only lit by the monitors, and type on three or four keyboards at once to hack enough people to make ends meet.

Jack Gazebo, Digital Pirate: Oh my fucking God, people, stop paying for streaming! Learn to torrent! I'm telling you, man, this generation just doesn't have the technological literacy to pirate media.

Captain Tom Stillcutt, Analog Pirate: Let me tell ye something, matey, it be a sad day for piracy. No more galleons laden low with gold doubloons, rum, and exotic spices, nay, it be all scurvy container ships full o' mass produced plastic now. Me last prize was a forty foot container loaded full of over a hundred thousand Funko Pops, en route from the East Indies. The worst part of it was as the cap'n I gets a double share o' the booty, whether I want it or not. I've been makin' one walk the plank every day, and my cabin's still full of the blasted things. Shiver my timbers, I hate these damned Zoomers! At least the ones in me crew are happy.

Geraldo Cardamom IV, Gentleman Thief: The economy's just horrible for heists these days. Art heists? Jewelry theft? All the rich idiots are blowing their money on crypto, NFTs, and custom furniture from hipster woodworking YouTubers. Nobody just has a gallery in their house with priceless antiques in glass cases below a conveniently placed skylight, or millions of dollars in cash and gold bullion in vaults behind secret doors with seven different elaborate locking mechanisms anymore. Nobody secures their valuables with networks of criss crossing laser motion sensors. The only guys with that kind of money are assholes like Jeff Bezos and Elon Musk, and they don't have the sense of style for that. They just hire a bunch of assholes with guns.

Carmen San Diego, Legend: You must be joking, right? The reason I retired is because the infrastructure in this country is so dilapidated it's impossible to move it without it disintegrating. My last heist was "stealing" the World's Largest Pothole in Lansing, Michigan. I lifted the entire six lane wide, fifteen foot deep pothole out of the ground, disassembled it, and shipped it across the country to a warehouse in Las Vegas, then filled in the hole with pristine asphalt so it looked like it was never there. Nobody investigated. Nobody came after me. The city threw a parade in my honor. It didn't even take a month before my record holding pothole was dethroned by one in Cleveland, leaving me with nothing but a bunch of dirt, crumbling asphalt, and broken dreams. That's when I realized it was time to call it quits. Well, maybe the Bass Pro Shops Pyramid, but it already looks stupid enough in the middle of Tennessee that the only way stealing it would be funny is if I put it in the original Memphis.

32 notes

·

View notes

Note

I don't remember if you already answered this, sorry in advance if you have, but what are your thoughts on the Bernette 79 Yaya Han edition sewing machine + embroidery machine? I consider myself a cosplayer and a lolita (Yaya is, as far I can recall, a cosplayer but not a lolita), and I've only ever sewn on a vintage Singer in a table and a Hello Kitty Janome. I don't see myself using the embroider option a lot since I embroider by hand, so that part would be taking up space unless I put in the effort to learn. On the other hand, it's a pretty shade of purple and is meant to sew over a variety of costuming fabrics which cannot be said of my current machine. It seems like a lot of extra stuff I probably don't need or have time to learn about if I do need them, but preliminary research seems to show it's a great value for the price (unless you break it). Or do you have any other recommendations in the same line? Thanks again for all your diligence and hard-earned expertise!

Okay, so I just sold one of those to someone whose other machines are a Hello Kitty Janome and a vintage Singer in a table, and I had to immediately check if you and them were the same person. So if you're Singer in a table is a 201, you should really meet my other customers.

Also quick note to everyone who is interested in this machine: you can buy it from the company that I work for. It's an internet model, so I can sell it to anyone in the USA. I can price match anyone else selling it. If you buy it from me, I get credit for the sale and I make commission (but it doesn't cost you anything). So if you want a Bernette b79 Yaya Han edition, or probably any other sewing machine, please shoot me an ask and I'll give y'all my work email or my sale code.

So I personally don't like Yaya as a person, but the B79 is a pretty good deal if it's what you're looking for. The fact that it's got embroidery and it has the digitizing software is really the thing that pushes it into the really good price point. On the sewing side, the foot kit is a really good perk, especially because not a lot of places keep feet in stock that work with the dual feed.

But if you're really not interested in the embroidery, I'd suggest just getting the Bernette b77, which is the sewing-only version of the b79 (if you want the embroidery-only version of the b79, you're looking for the b70Deco). It's going to be about a thousand dollars cheaper. It, sadly, is not purple, but that's nothing a few stickers can't fix. My store's current price on the Yaya 79 is $2499 and our price on the b77 is $1499, so it's literally a thousand dollars.

(Or, if you're absolutely insane, you can get some Cricut infusible ink paper and an EasyPress mini and sublimate onto the front of your machine. It's the kind of plastic that takes sublimation. Isn't that absolutely bonkers wild?)

That said, if you're willing to spend the extra money, you would be getting embroidery with a very large hoop size (for a beginning sewing machine, anyway), the foot kit, the built-in stitches and designs, and Creator9. I tell creative people who are interested in embroidery machines that you should not consider embroidery software to be optional. There's a lifetime worth of fun premade designs and projects in the hoop, and most people are happy to jut use those, but most of the people who are in my age range would not feel like they're getting everything out of their embroidery machine if they can't digitize goofy ideas from scratch. Creator 9 is like a thousand dollars normally, so it's what I find really pushes the price of the Yaya machine into the "really good deal" range, if you ask me. But, if you're not interested in embroidery, it's not really worth paying the extra money.

Anyway, if you're interested, please buy from me because it won't cost you more and it helps me pay my utility bills.

16 notes

·

View notes

Text

This is Very interesting and it really made me stop and think about using cash more often.

I have really never thought of this has anyone else?

💲Please understand what NOT

using cash is doing.

Cash is important. 💸

Why should we pay cash everywhere we can

with banknotes instead of a credit card? 💳

- I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has jumped dry from every cash payment transaction made...

- But if I come to a restaurant and pay digitally - Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc.....

Therefore, after 30 transactions, the initial $50 will remain only $5 😫 and the remaining $45 became the property of the bank 🏦 thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!💳💵💸💰🏦♥️

14 notes

·

View notes

Text

The following made me stop and think about using cash more often:

- I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has not siphoned off a percent from each cash payment transaction made...

- But if I come to a restaurant and pay digitally - Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc.....

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

53 notes

·

View notes

Text

Billing machines have become an essential tool for businesses across various sectors, streamlining the invoicing process and enhancing operational efficiency. This article explores the features, benefits, and types of billing machines, as well as their significance in modern commerce.

What is a Billing Machine?

A billing machine is a device specifically designed to generate invoices and manage transactions efficiently. It automates the billing process, allowing businesses to issue receipts quickly and accurately. Available in various forms such as portable, handheld, and point-of-sale (POS) systems, these machines cater to the needs of small businesses and large enterprises alike.

Key Features of Billing Machines

User-Friendly Interface: Many modern billing machines come with intuitive touchscreen interfaces that simplify the transaction process, making it easy for staff to operate without extensive training.

Fast and Accurate Billing: These machines are designed to process transactions rapidly, significantly reducing customer wait times and enhancing service efficiency.

Customizable Invoices: Users can personalize invoice templates to reflect their branding, including logos and business details, which adds a professional touch to customer interactions.

Comprehensive Reporting: Billing machines often provide detailed sales reports, inventory tracking, and financial records, enabling businesses to monitor performance and make informed decisions.

Tax Compliance: Many billing machines are equipped with features that ensure compliance with tax regulations, making it easier to calculate applicable taxes like GST or VAT.

Multiple Payment Options: They support various payment methods, including cash, credit/debit cards, and digital wallets, providing convenience to customers.

Benefits of Using Billing Machines

Increased Efficiency: Automating the billing process reduces manual errors and speeds up transactions, leading to improved cash flow and customer satisfaction.

Enhanced Security: Billing machines help in maintaining secure records of transactions, reducing the risk of loss or theft associated with cash handling.

Improved Inventory Management: Many billing machines come with inventory management features that allow businesses to track stock levels and set up alerts for low inventory, ensuring timely restocking.

Cost-Effectiveness: While the initial investment in a billing machine may be higher, the long-term savings in time and labor can be substantial, making them a cost-effective solution for businesses.

Types of Billing Machines

POS Systems: These are comprehensive solutions that combine billing, inventory management, and sales tracking, ideal for retail environments and restaurants.

Portable Billing Machines: These compact devices are perfect for businesses that require mobility, such as food trucks or market vendors.

Handheld Billing Machines: Designed for ease of use, these machines are often used in smaller retail settings or for on-the-go transactions.

Touchscreen Billing Machines: Featuring advanced technology, these machines offer a modern interface and are designed for high-volume transaction environments.

Conclusion

Billing machines are vital for modern businesses, providing a range of features that enhance efficiency, accuracy, and customer satisfaction. By automating the billing process, these machines not only save time but also contribute to better financial management and operational transparency. As technology continues to evolve, the capabilities of billing machines will likely expand, further transforming the way businesses handle transactions. Whether for a small shop or a large retail chain, investing in a reliable billing machine can significantly improve business operations.

2 notes

·

View notes

Text

Top Features of UDYOG Cloud ERP Software for Indian Businesses

In today’s competitive business landscape, Indian enterprises — especially SMEs and growing manufacturers — require robust digital infrastructure to drive operational efficiency and regulatory compliance. udyog Cloud based ERP Software in india Software has emerged as a trusted and future-ready ERP solution that is tailor-made to meet the unique needs of Indian industries. Designed with deep domain expertise, UDYOG ERP offers a comprehensive suite of modules that empower businesses to scale efficiently while staying compliant with ever-evolving tax and operational regulations.

Key Features of Udyog Cloud ERP:

GST Compliance and Taxation:

Udyog Cloud based ERP Software in india simplifies your business’s tax processes by automating GST calculations, making sure every transaction is accurate and compliant. It generates e-Invoices instantly and fetches IRN (Invoice Reference Number) directly from the GST portal. The system also handles e-Way bill creation, helping you move goods legally and efficiently. With built-in TDS and TCS management, you can easily calculate and track tax deductions at source. All tax reports are auto-generated and ready for filing, reducing manual work and the risk of errors. This makes your business audit-ready and always aligned with government regulations.

Inventory and Warehouse Management:

UDYOG Cloud based ERP Software in india helps businesses manage their inventory efficiently and in real-time. It tracks stock levels across multiple warehouses, ensuring complete visibility at all times. With batch and serial number management, it becomes easier to trace items during production or after sales. The system also alerts users when stock is low, thanks to its automated reorder level feature. This avoids stockouts and overstocking, keeping your operations smooth. Whether you deal with raw materials or finished goods, inventory control becomes accurate and hassle-free.

Financial Accounting:

Udyog Cloud based ERP Software in india makes financial management easy and efficient for businesses. It allows you to record and manage all financial transactions, including ledgers and journals, in a systematic way. You can easily track what you owe to vendors (accounts payable) and what customers owe you (accounts receivable). The system also helps you match bank statements with your company’s records through simple bank reconciliation. If your business deals with foreign currency, Udyog ERP supports multi-currency transactions as well. Overall, it helps maintain accurate financial records and supports better decision-making.

Manufacturing and Production Planning:

UDYOG Cloud based ERP Software in india makes manufacturing operations more efficient by offering tools like Production Planning, Material Requirement Planning (MRP), and Bill of Materials (BOM) management. It helps you plan what to produce, when to produce, and what materials are needed. The system ensures that raw materials are available at the right time to avoid production delays. With BOM, you can define the components required to build a product. Shop floor control allows you to monitor ongoing work, track job progress, and manage machine and labor usage. Altogether, it streamlines the entire manufacturing cycle — from planning to final production.

CRM Integration:

Udyog Cloud based ERP Software in india comes with built-in customer relationship management (CRM) features that help businesses stay connected with their customers. It allows you to easily capture and manage leads, follow up with prospects, and convert them into loyal customers. Sales teams can track inquiries, quotations, and orders in one place, making their work more organized and efficient. You can also view sales performance reports to see how your business is growing. With complete customer history and communication tracking, your team can provide better service and build long-term relationships. Overall, the CRM tools in Udyog ERP help improve customer satisfaction and boost sales.

Advanced Analytics and Reporting:

UDYOG Cloud based ERP Software in india comes equipped with powerful real-time analytics and customizable reporting tools, designed to provide businesses with valuable insights into their operations. Whether it’s tracking sales performance, inventory levels, or financial health, the platform delivers accurate, up-to-date data at your fingertips. You can easily create and modify reports to match your specific business needs, helping you make informed, data-driven decisions. These insights enable businesses to identify trends, spot potential issues early, and plan strategies effectively for growth. The customizable reports also allow you to focus on the metrics that matter most to your business, improving overall decision-making and efficiency.

User-Friendly Interface and Support:

UDYOG Cloud based ERP Software in india is designed with a user-friendly interface that makes it easy for businesses to navigate and operate without extensive technical knowledge. It offers a smooth and intuitive experience, allowing employees to quickly adapt to the system. Additionally, UDYOG provides dedicated customer support to assist with any queries or issues, ensuring continuous business operations. Regular updates keep the software current with the latest features and security enhancements. On-demand training is also available, helping users get the most out of the software and empowering them to use it effectively. This combination of usability, support, and learning resources ensures a seamless experience for businesses.

udyog Cloud based ERP Software in india stands as a powerful, end-to-end ERP solution that is finely tuned to the needs of Indian businesses. From tax compliance and financial control to inventory, manufacturing, and asset management — udyog ERP provides the tools to streamline operations, reduce manual work, and scale with confidence. For businesses seeking a reliable partner in digital transformation, udyog Cloud ERP is an investment in sustainable growth.

0 notes

Text

The Future of Manufacturing in India: Role of ERP in Digital Transformation

India’s manufacturing sector is undergoing a massive shift — from traditional, manual operations to data-driven, technology-powered processes. As Industry 4.0 gains momentum, ERP (Enterprise Resource Planning) systems are emerging as the core enabler of digital transformation, especially for small and medium-sized enterprises (SMEs).

🇮🇳 India’s Manufacturing Growth Story

With government initiatives like ‘Make in India’, PLI (Production-Linked Incentives), and increased demand for local production, India is poised to become a global manufacturing hub.

However, to compete globally, manufacturers must:

Reduce lead times

Improve quality

Control costs

Scale operations efficiently

This is where digital transformation becomes critical — and ERP is at the heart of it.

🧠 What Is Digital Transformation in Manufacturing?

Digital transformation refers to using technology to improve production, planning, quality, and business operations.

For manufacturers, this includes:

Smart automation

Real-time production tracking

Predictive maintenance

Integrated supply chain management

Data-driven decision-making

ERP systems like PrismERP bring all these elements together under one roof — making digital transformation accessible even for SMEs.

💡 Role of ERP in Manufacturing’s Digital Future

1. Centralized Data & Real-Time Insights

ERP connects all departments — sales, purchase, inventory, production, quality, and finance — giving manufacturers a single source of truth.

🔍 Example: See real-time stock levels, pending work orders, and dispatch schedules in one dashboard.

2. Smarter Production Planning

Modern ERPs use historical data and real-time orders to optimize production schedules and reduce idle time.

📊 Impact: Lower overheads, better delivery accuracy, and improved machine utilization.

3. Quality Control & Traceability

ERP ensures built-in quality checks across the production cycle, from incoming raw materials to finished goods.

✅ Benefit: Zero-defect manufacturing and easier audits or certifications.

4. GST & Compliance Automation

Indian ERPs like PrismERP offer built-in compliance tools — GST, e-Invoicing, e-Way Bills, and more.

🧾 Result: Faster reporting and fewer errors during tax filings or inspections.

5. Scalability Without Chaos

ERP prepares you to scale operations, open new units, or expand exports — without losing control.

🌐 Support: Multi-plant, multi-location features with role-based access and central control.

🔄 ERP + Emerging Tech = Industry 4.0

The next decade will see ERP systems integrating with:

IoT devices (for live machine data)

AI/ML (for demand forecasting and quality prediction)

Mobile apps (for on-the-go tracking)

Cloud platforms (for remote access and collaboration)

These innovations will empower even tier-2 and tier-3 city manufacturers to leapfrog into global standards.

🏁 Final Thoughts

The future of manufacturing in India is smart, connected, and data-driven — and ERP is the foundation for that future.

Whether you’re a capital goods producer, an auto-component maker, or a process-based SME, the time to digitize is now.

📞 Ready to embrace the future of manufacturing? 👉 Book a free consultation with PrismERP and take the first step in your digital transformation journey.

0 notes

Text

Can Zendesk AI handle complex queries or only FAQs

Today more than ever, a fast and efficient response to customers is a must for businesses in a digital-first world. Zendesk AI enters here with its offers of intelligent automations that help support teams reduce ticket loads and work on improving customer experience.

But one fundamental question pops up:

Is Zendesk AI able to handle complex queries in a particular situation, or is it limited to mere FAQs?

Let us explore the answer in more detail.

First, what does Zendesk AI do?

Zendesk AI is built on natural language processing (NLP) and machine learning technologies. It can understand customer messages, identify intentions, prioritise tickets, suggest useful articles, and automatically respond to general queries.

Simply speaking, Zendesk AI is that intelligent assistant who supports both customers and support agents, learns from past conversations, and improves with time.

But still, how well does it perform regarding different types of queries?

The Basics: Handling FAQs without Hassle

Zendesk AI is very good at answering frequently asked questions. Some of them would be as follows:

"Please tell me how I can change my billing information."

"What is your return policy?"

"When will my order get here?"

For these commonplace and repetitive questions, the AI gives instant answers that relieve human agents from work and improve response times.

This is why Zendesk AI is perfect for firms that have to deal with simple customer enquiries in huge volumes.

Now the real question: can it handle complex queries?

Complex queries are those that involve multiple steps, personalised information, or technical challenges. Examples:

“I paid twice for my subscription, but I still don’t have access. Can you fix it?”

"We're integrating your tool into our system, but we keep getting error 502-what does that mean?"

This kind of inquiry cannot be circumvented with one-sentence FAQs. These require a deep understanding of events and context, past interactions, and sometimes technical know-how.

That's where Zendesk AI shows that it is much more than a mere chatbot.

How Zendesk AI Deals With Complex Queries

Obviously, Zendesk AI is not going to fix all complex queries independently, but it certainly makes for a strong supporting act:

Smart Ticket Routing

It understands and gives intent and urgency from the query and routes it to the correct department or expert.

Contextual Data

It adds customer history, sentiment, and suggested solutions to each ticket—giving agents a head start.

Agent Assistance

The AI recommends replies based on past similar cases, helping agents respond faster and more accurately.

Knowledge Suggestions

It suggests helpful articles—even for complex problems—allowing customers to try self-service before waiting for an agent.

So, while Zendesk AI may not completely replace human agents for complex issues, it definitely makes the resolution process smarter and faster.

Case in Point: GetMacha

For example, we take GetMacha, a startup digital shop that promotes health and lifestyle products. With increased sales volumes, customers raised a swarm of queries-enquiries ranging from product information to delivery problems and refund requests.

The implementation of Zendesk AI automated the answers for the simple questions. For the complex cases like delayed international order and payment failure, the AI helped classify, prioritise, and route the tickets to the suitable agent.

The combination of automation and intelligent support has helped reduce the average response time by almost 40% and considerably improved customer satisfaction.

Conclusion

So, can Zendesk AI really handle complicated queries, or is it strictly meant for FAQ-type requests? The answer is both - with a little help from humans. Zendesk AI does a fantastic job with FAQ queries but becomes an assistant in a more complex situation. It's empowering-the full replacement of humans in the equation is not possible-empowering for support teams, whether that organisation is an upstart like GetMacha, a large company in eCommerce, or a SaaS provider. In fact, as much as Zendesk AI incorporates all of them into customer support, it can make them smarter, faster, and better.

1 note

·

View note

Text

CMEGP Project Report for Trading Business

Setting up a trading business under government-backed financial schemes has become a popular route for new entrepreneurs. One such scheme is the Chief Minister’s Employment Generation Programme (CMEGP), which provides margin money subsidies linked with bank loans. To qualify, applicants must submit a comprehensive and well-prepared project report for a bank loan.

Whether you’re applying for a CMEGP loan, Mudra loan, or PMEGP loan, a well-structured project report for business is essential for approval. A trading business—dealing in FMCG, electronics, garments, or hardware—is ideal for these schemes because of its low investment needs and rapid cash flow cycle.

Executive Overview

The proposed business, “Sai Traders”, will operate from a 300 sq. ft. rented shop in Hubballi, Karnataka, dealing in fast-moving consumer goods (FMCG) such as soaps, packaged snacks, detergents, and kitchen essentials. The total project cost is estimated at ₹10,00,000, with the applicant contributing ₹1,50,000 from personal savings. The remaining ₹8,50,000 is being sought as a PMEGP loan, with an expected subsidy of ₹2,00,000 under the scheme.

This structure is compatible with Mudra loan norms and also fits within the eligibility limits of the PMEGP loan.

Promoter Profile

The promoter is a graduate with three years of retail experience in FMCG distribution. They have also completed an Entrepreneurship Development Programme (EDP), as required under CMEGP and PMEGP guidelines. This strengthens the eligibility for receiving financial aid from the bank and the government.

Business Description

The business will:

Procure goods from authorized FMCG distributors.

Sell both wholesale to local kirana shops and retail to walk-in customers.

Offer credit to regular buyers and digital billing to enhance customer experience.

This model is simple yet scalable and is considered highly suitable under Mudra loan and CMEGP loan structures. A small shop, efficient inventory system, and competitive pricing will provide the promoter with a solid foundation for growth.

Market Feasibility

The area has high demand for FMCG goods due to dense population and limited competition. Local shops often face stock shortages and limited credit access. By offering reliable supply and better service terms, Sai Traders can quickly establish a customer base. These insights add value to the project report for bank loans and prove the business’s sustainability under schemes like PMEGP loan.

Technical Feasibility

Shop Setup: 300 sq. ft. rented space in a central marketplace.

Infrastructure: Racks, display counters, billing machine.

Manpower: One sales assistant and one delivery helper.

Inventory: Monthly restocking based on local demand.

The low technical complexity of trading businesses makes them perfect for CMEGP loans and Mudra loans, both of which aim to support quick-launch, job-generating ventures.

Financial Structure

The ₹10 lakh project cost will be financed through:

₹1.5 lakh promoter contribution.

₹8.5 lakh as bank loan.

₹2 lakh expected as CMEGP subsidy.

Funds will be used for shop setup, initial inventory, working capital, and basic equipment. This structure complies with the guidelines of both PMEGP loan and Mudra loan, making the business viable for multiple funding options.

Repayment Plan

The proposed bank loan will be repaid over five years with monthly EMIs of approx. ₹16,000. A six-month moratorium is requested to ease initial cash flow. Such clear repayment planning is key to any project report for loan and ensures lender confidence.

Employment Generation

The business will directly employ two people and indirectly support logistics and local vendors—aligning with the employment objectives of PMEGP, CMEGP, and Mudra schemes.

Conclusion

A solid CMEGP project report for trading business is not just a formality—it’s your tool for unlocking government-backed financial support. Whether you're applying for a PMEGP loan, Mudra loan, or bank loan, ensure your project report for business is clear, realistic, and bankable.

Want a customizable report template in Word or PDF? Reach out to us for state-compliant, ready-to-submit formats tailored to your industry. For additional information or assistance, please contact us or call us at +91-8989977769.

0 notes

Text

How to Get the Best Cash for Gold in Delhi – A Smart Seller’s Guide

Gold has always held a special place in Indian households — as a symbol of wealth, tradition, and security. But there comes a time when people need quick financial support, and in those moments, selling gold becomes a wise and practical decision. If you're looking for cash for gold in Delhi, you're not alone. Many people are choosing this route to meet urgent needs, cover expenses, or simply free up assets.

Delhi, being a bustling metro city, offers countless options for gold buyers. But navigating through the maze of buyers and finding someone reliable can be tricky. That’s why it’s important to understand the process and know what to expect before making a sale.

Why Do People Sell Gold in Delhi?

There are many reasons people in Delhi decide to sell their gold:

To manage medical or emergency expenses

To pay off sudden bills or debts

To invest in better opportunities

To clear out old, broken, or unused jewellery

To turn inherited gold into usable cash

Whatever the reason, Delhi offers convenience, speed, and access to experienced buyers who know the true value of gold.

What Types of Gold Items Can You Sell?

The good news is that you don’t need perfect or hallmarked jewellery to get value. Reputed gold buyers in Delhi accept a wide range of items, such as:

Old or broken gold jewellery

Unused gold chains, rings, bangles, or pendants

Single earrings or mismatched sets

Gold coins and bars

Antique or non-hallmarked ornaments

Each piece is evaluated purely on purity and weight, not on how new or fashionable it looks.

The Process of Selling Gold in Delhi

If you’re new to selling gold, don’t worry — the process has become faster, safer, and more transparent in recent years. Here's how it generally works:

Walk into a Store: Visit any trustworthy gold buyer located in central areas like Karol Bagh, Lajpat Nagar, Connaught Place, or Rajouri Garden.

Purity Check: The buyer will check the purity using high-quality XRF machines — a quick, accurate, and non-destructive process.

Weighing: Your gold is weighed in front of you using calibrated digital scales.

Instant Quotation: Based on the purity and current market rate, you get a clear, no-obligation offer.

Immediate Payment: Once you accept the offer, the payment is made instantly via cash, bank transfer, or any digital method of your choice.

Why Choose Delhi for Selling Gold?

Delhi is one of India’s top gold markets. With a variety of buyers and competitive prices, the city offers several advantages:

Transparent Deals: Most professional buyers follow real-time gold rates and explain everything in simple terms.

Quick Transactions: The entire process usually takes less than 30 minutes.

Accessible Locations: No matter which part of Delhi you’re in — East, West, North, or South — there’s always a buyer nearby.

Modern Setup: From air-conditioned offices to advanced testing machines, the experience is safe and comfortable.

Flexible Options: You can sell even small items, and you’re not pressured into selling if you’re unsure.

Tips Before You Sell Gold in Delhi

Here are some tips to help you get the best value when looking for cash for gold in Delhi:

Know the Gold Rate: Check the current price online before visiting any buyer. It gives you an idea of what to expect.

Clean Your Items: A simple wipe helps ensure accurate weighing and makes a better impression.

Carry Your ID Proof: Most buyers ask for a valid photo ID for record purposes.

Don’t Hesitate to Compare: If you're unsure, take quotes from 2-3 places before finalising the sale.

Avoid Verbal Promises: Go for transparent deals where everything is explained clearly and tested in front of you.

When Is the Right Time to Sell?

Selling gold is a personal decision. Whether you're clearing out unused items or facing an unexpected need, the right time is when you feel ready. Gold is one of the few assets that can fetch you immediate liquidity without paperwork or waiting. Especially in Delhi, where buyers are ready to evaluate and pay on the spot, the process is simple and fast.

Final Thoughts

If you’re exploring cash for gold in Delhi, you’re making a smart financial move. With a trusted buyer, the experience is smooth, fair, and rewarding. All you need is to walk in with your gold and walk out with money in hand.

Don’t let your old jewellery sit in a drawer when it can help you in meaningful ways. Choose a professional, transparent buyer in Delhi and make the most of your gold’s true worth — today.

0 notes

Text

I have really never thought of this has anyone else?

💲Please understand what NOT

using cash is doing.

Cash is important. 💸

Why should we pay cash everywhere we can

with banknotes instead of a credit card? 💳

- I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has jumped dry from every cash payment transaction made...

- But if I come to a restaurant and pay digitally - Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc.....

Therefore, after 30 transactions, the initial $50 will remain only $5 😫 and the remaining $45 became the property of the bank 🏦 thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!🏦♥️"

4 notes

·

View notes

Text

How Are AI Customer Services Transforming the Future of Customer Support Across Every Industry?

In today’s digital-first world, customer expectations are evolving faster than ever. They demand instant responses, personalized experiences, and 24/7 availability. Businesses across all sectors are rising to meet these expectations not with more human agents, but with the help of Artificial Intelligence (AI). From retail to healthcare, banking to travel, AI-powered customer service is transforming the way companies engage with customers—redefining both the customer experience and operational efficiency.

The Rise of AI in Customer Service

AI customer service technologies, including chatbots, voice assistants, predictive analytics, and natural language processing (NLP), have rapidly matured in recent years. These tools can now handle complex queries, learn from interactions, and provide seamless multichannel support.

Instead of replacing humans, AI augments support teams by handling repetitive tasks and high-volume inquiries, allowing human agents to focus on high-value, emotionally nuanced interactions. This blend of automation and human touch is setting a new gold standard for customer service.

Key Benefits Driving AI Adoption

1. 24/7 Availability

AI doesn’t sleep. Virtual assistants and chatbots ensure that businesses remain accessible around the clock, no matter the time zone. This is especially valuable in global markets, where downtime can lead to lost sales or frustrated customers.

2. Instant, Accurate Responses

With AI, response times shrink from minutes to seconds. Chatbots can resolve common issues such as order tracking, password resets, or billing inquiries instantly. And thanks to machine learning, their accuracy and helpfulness improve over time.

3. Personalization at Scale

AI uses customer data—such as browsing behavior, purchase history, and past support tickets—to deliver personalized interactions. For instance, a financial chatbot might recommend budget plans based on spending patterns, or a retail bot could suggest complementary products.

4. Operational Efficiency and Cost Savings

By automating routine queries, businesses reduce call volumes and the need for large support teams. According to industry studies, AI customer service solutions can cut customer service costs by up to 30% while improving customer satisfaction scores.

Industry-Specific Transformations

Retail & eCommerce

AI chatbots help with product discovery, manage returns, and suggest personalized offers, creating a smooth shopping experience that boosts conversions and loyalty.

Healthcare

Virtual health assistants offer appointment scheduling, symptom checking, and post-visit follow-ups—improving patient engagement while reducing the burden on administrative staff.

Banking & Finance

AI handles balance inquiries, fraud alerts, and investment advice securely. It also assists with regulatory compliance by analyzing customer interactions and flagging anomalies.

Travel & Hospitality

AI assistants help customers with bookings, itinerary changes, and real-time travel updates. Airlines and hotels use AI to manage high call volumes during disruptions efficiently.

Challenges and Considerations

Despite the many benefits, deploying AI customer service isn’t without challenges. Poorly trained bots can frustrate users. Data privacy and ethical concerns must be carefully addressed. The key is to implement AI solutions thoughtfully—using real-time feedback, continuous learning models, and human oversight.

The Future: Human-AI Collaboration

Looking ahead, the future of customer support is not fully autonomous—it’s collaborative. AI will handle data-driven, high-volume tasks, while humans will step in for complex issues requiring empathy and creative problem-solving. This synergy creates a smarter, faster, and more emotionally intelligent customer support ecosystem.

Conclusion AI customer services are not just tools—they’re strategic enablers that reshape how businesses connect with customers. As technology continues to evolve, companies that embrace AI thoughtfully will not only cut costs but also create more responsive, personalized, and satisfying customer experiences across every industry.

0 notes

Text

Custom App Development Guide: Real Use Cases, Field Roleplays & Key Insights for 2025

1. Introduction

Mobile apps are everywhere—but not all are created equal. In a digital-first 2025, having a mobile app isn't enough. You need a custom app for business development to stand out and serve your audience in a way that fits your business like a glove. Whether you’re a startup, a growing business, or an enterprise looking to scale, this guide unpacks how a custom mobile app can take your business from average to extraordinary.

2. Understanding the Basics

What Is a Custom Mobile App?

A custom mobile app is software built specifically for your business needs. It’s like having a tailored suit instead of picking one off the rack—every feature, every pixel, serves a purpose.

Custom vs. Off-the-Shelf Apps

Off-the-shelf apps are generic. They might work... sort of. But custom apps are crafted with your business logic, audience, and workflows in mind. Think of it as building your dream home instead of settling for a pre-fab box.

Benefits of Custom App Development

Full control over features and UI

Better performance and security

Seamless integration with existing systems

Scalable as your business grows

3. Use Cases That Inspire

E-commerce: Personalized Shopping Experiences

From custom discounts to personalized recommendations, custom apps are changing the game in online retail. Imagine an app that remembers your customer’s style, size, and past purchases—like having a personal shopper in their pocket.

Healthcare: Enhancing Patient Engagement

Custom healthcare apps can include virtual check-ups, prescription reminders, and AI-powered symptom checkers—all while maintaining compliance with HIPAA and other regulations.

Logistics: Real-Time Tracking and Automation

No more spreadsheets. A custom app can offer real-time fleet tracking, route optimization, and automated billing—boosting both efficiency and customer satisfaction.

Education: Building Remote Learning Tools

Custom platforms are bridging learning gaps by offering interactive tools tailored to both students and educators. Think quizzes, assignments, video lectures—all integrated.

4. Field Roleplays to Bring It to Life

Roleplay 1: Retailer Launches Loyalty App

Meet Sarah. She owns a boutique clothing store. She commissions a custom app that sends push notifications for new arrivals and gives points for every purchase. Sales go up, and customers feel more connected.

Roleplay 2: Doctor Offers Virtual Appointments

Dr. Patel creates a HIPAA-compliant app for his clinic. Patients can book, consult, and even access test results—without ever stepping into the clinic unless needed.

Roleplay 3: Logistics Manager Streamlines Fleet

Tom oversees 100 delivery trucks. A custom mobile app helps him track vehicle performance, fuel usage, and delivery schedules—saving thousands monthly.

Roleplay 4: EdTech Startup Empowers Learners

Nina’s startup builds an app with gamified lessons and teacher dashboards. Dropout rates fall, and engagement hits an all-time high.

5. Technologies Driving Custom App Development

AI and Machine Learning

From personalized suggestions to intelligent automation, AI is fueling smarter apps that learn user behavior and optimize accordingly.

Cloud Integration

Cloud-based apps scale effortlessly, store data securely, and perform faster. Whether it’s AWS, Azure, or Google Cloud, the flexibility is unmatched.

API-First Development

APIs make it easier to integrate third-party tools and services—from payment gateways to analytics—seamlessly into your app.

Low-Code/No-Code Tools

These platforms make app development more accessible, especially for internal tools. But for full-scale commercial apps? You’ll still want pros.

6. Choosing the Right Partner

What Makes a Top Custom Software Development Company?

Proven portfolio

Strong communication

Cross-industry experience

Agile methodologies

Evaluating Application Development Services

Ask for client testimonials, review case studies, and explore their dev process. A transparent process means fewer surprises later.

Red Flags to Avoid

Vague timelines

Lack of documentation

Poor post-launch support

7. Strategy Before Development

Start with a Business Goal

Why are you building this app? If you can’t answer that clearly, you’re not ready. Every tap and swipe should align with this goal.

Define the User Persona

Understand your audience. Are they tech-savvy teens or busy professionals? Build your UI/UX with them in mind.

Set Realistic KPIs

Think user retention, daily active users, conversion rates—not just downloads.

8. Development Phases Explained

Discovery & Planning

Identify needs, research competitors, define your features.

Design & Prototyping

Create wireframes, mockups, and clickable prototypes to visualize the product.

Development & Testing

Your devs turn designs into reality. Meanwhile, QA ensures it's bug-free.

Deployment & Maintenance

Launch it right, monitor performance, and push timely updates.

9. Cost Factors You Should Know

What Affects Cost?

Features complexity

Platform (iOS, Android, or both)

Tech stack

Developer location

Tips to Stay Within Budget

Prioritize MVP features

Avoid unnecessary integrations

Plan for future scaling, not all-at-once bloat

10. Common Pitfalls to Avoid

Skipping Market Research: Know your audience or risk missing the mark.

Ignoring Feedback: Users know what they need—listen.

Underestimating Time: Good things take time. Plan accordingly.

11. Key Insights and Trends for 2025

Bespoke Software Development Service Growth: More businesses are seeking tailored solutions over general apps.

Predictive Personalization: Apps that ��know” what users want.

Voice and Gesture Interfaces: Less typing, more talking (or waving).

12. Security and Compliance

Understand the Laws

GDPR, HIPAA, CCPA—whichever applies, build with them in mind.

Best Practices

End-to-end encryption

Role-based access

Regular security audits

13. Post-Launch Success

Marketing Matters

Use social media, influencer outreach, and app store optimization to get noticed.

Engage Your Users

Push updates, respond to reviews, and use analytics to adapt.

Build a Community

Forums, loyalty programs, and email campaigns can keep users loyal.

14. Conclusion

Custom app development isn’t just a tech trend—it’s a strategic advantage. With the right planning, tech stack, and development partner, your business can launch an app that doesn’t just work—it wins. Ready to build something extraordinary or settle for average?

#technology#business#ecommerce#custom web development#customization#custom software development#software

0 notes

Text

Digital BSS Solutions Drive Cloud-First Agility in Telecom

Telecom operators face one of the most volatile and demanding technology markets. Customers demand fast service delivery, flexible billing, and personalized experiences. Meanwhile, new services like 5G and IoT require systems that scale quickly and work seamlessly.

Sadly, most providers still use legacy stacks. Legacy stacks are the old systems. They stifle agility. They drive up operating expenses. Most significantly, they hinder innovation.

To meet today's expectations, telecom operators are investing in digital BSS solutions. These support automation, reduce time-to-market and allow real-time customer interaction. Combined with telco cloudification efforts, the outcome is a leaner, more agile telecom business.

The shift to digital is no longer an option. It's the path to competitive success. It begins with the right telecom digital BSS solution: one engineered for speed, scale, and change.

Getting Unshackled by Legacy Constraints

Legacy stacks are heavyweight. Fixes require weeks. Tailoring demands extended cycles. Integration consistently falls apart. Such problems burn cycles and budgets.

Digital BSS for telcos upends this math. Cloud-native architecture unbundles functions so telcos can upgrade features separately. Teams are set up instead of code. This reduces development expenditure and accelerates deployment.

Furthermore, microservices and containerized architecture enable modular rollouts. Telcos can modify billing rules or introduce new plans without disrupting the system.

Supporting the Push Toward Cloud-Native Networks

The move toward cloud-native networks has already begun. In the U.S., over 60% of telecom operators have started shifting core systems to the cloud, according to a Deloitte survey.

This shift is not possible without compatible software. Here, digital BSS solutions align perfectly. They enable API-driven integration with both legacy and cloud-native components. As network functions move to containers and virtual machines, business processes must keep up.

A modern telecom digital BSS solution supports this shift. It doesn’t just process orders or calculate invoices. It syncs with distributed systems in real time, making the cloudification of telecom technologies and equipment seamless.

Shortening Time to Market for New Offers

Time is of the essence. Prepaid bundles or enterprise 5G offerings—customers want options in an instant. Telcos can't afford to spend months setting up offers.

With digital BSS for telecom, offer creation is quicker. Teams can test, change, and roll out services without having to write new code. Drag-and-drop catalog builders and dynamic policy engines minimize IT dependency.

This adaptability enables experimentation by sales and marketing teams. They can create promotions, try out market segments, and refine based on customer feedback. Briefly, the idea-to-launch cycle is reduced.

Facilitating Scalable Growth Without Overloading Infrastructure

With every additional user, device, and service added by telcos, back-end systems need to keep pace. Legacy BSS tools buckle under the load. Cloud-based tools automatically scale.

Telco cloudification needs BSS systems that flexibly adapt without disruption. A contemporary stack processes millions of transactions without human intervention. When using behavior changes, the system increases or decreases demand.

This elasticity saves on infrastructure. It also ensures service reliability under peak loads.

Providing Operational Resilience Through Automation

Automation is not merely about efficiency. It's about control and accuracy. Digital BSS solutions provide proactive monitoring, exception handling, and rule-based decisions.

For instance, failed payments automatically cause retries. Downgrades occur in real time when usage limits are crossed. Alerts notify teams before a problem becomes apparent to customers.

This degree of automation provides telcos with greater control. It also allows for freeing up resources for strategic work.

Simplifying Partner Ecosystem Management

Telecom service delivery often involves multiple vendors. From content partners to hardware resellers, the ecosystem is complex. Managing them manually is difficult.

Digital BSS for telecom provides partner portals, revenue sharing rules, and real-time settlement tools. This simplifies onboarding, monitoring, and collaboration.

With APIs and real-time data exchange, partnerships scale without added complexity. Telcos can onboard a new content partner or wholesale distributor in days, not months.

Built for 5G, Not Just Compatible with It

5G demands more than speed. It requires billing by slices, real-time quotas, and ultra-low latency provisioning. A legacy BSS cannot meet these needs.

A 5g ready BSS stack supports dynamic monetization. Whether it’s IoT, private networks, or low-latency apps, the BSS adapts. Operators can launch usage-based billing models, implement flexible SLAs, and charge per service slice.

This adaptability is built-in, not bolted on. The system recognizes new service types and applies the right rules without delay.

Making Cloudification of Telecom Technologies and Equipment Possible

Hardware is becoming virtual. Routers, switches, and even base stations are moving to cloud-based models. But without BSS support, this hardware shift breaks workflows.

That’s why the cloudification of telecom technologies and equipment needs a BSS layer that speaks the same language. One that supports virtualization, orchestration, and software-defined control.

Digital BSS solutions act as the connective tissue. They ensure that virtualized infrastructure and business logic are aligned.

Final Thoughts: Telecom’s Path Forward Is Cloud-Led and BSS-Supported

Telcos don't merely require newer systems. They require smarter systems. The power to innovate fast, handle complicated services, and provide real-time experiences is possible only through digital architecture.

A next-generation telecom digital BSS solution makes that possibility within reach. It enables operational flexibility. It enables service agility. It reduces the total cost of ownership while opening new revenue streams.

More importantly, it aligns with the goals of telco cloudification. It ensures that your network, IT, and commercial strategies are in sync. No more silos. No more delays.

Whether you’re enabling 5G monetization or digitizing legacy systems, digital BSS for telecom is your launchpad. It empowers operators to compete, grow, and evolve without being tied down by aging infrastructure.

Explore the Cloud-Native Digital BSS Suite from 6D Technologies

6D Technologies provides a purpose-designed telecom digital BSS solution that's designed for scale, automation, and flexibility. Built to facilitate your path toward complete telco cloudification, this suite integrates real-time orchestration, dynamic product configuration, and intelligent automation.

It is fully aligned with a 5g ready BSS stack architecture, built to manage hybrid network functions, multi-channel experiences, and partner ecosystems. With native support for virtualization and open APIs, it allows you to run agile operations across your network and service layers.

If you're ready to align IT with innovation and shift your operations to the cloud, 6D Technologies’ digital BSS solutions deliver exactly what modern telecoms need.

To learn more or schedule a personalized walkthrough of Canvas, AI-packed and 5g-enabled digital BSS, please visit https://www.6dtechnologies.com/products-solutions/digital-bss-solutions/

0 notes