#Digital bank center agent

Explore tagged Tumblr posts

Text

Title: Apni Dukaan Ko Digital Bank Banaye - Become a Digital Bank Center Agent

Want to grow your business and offer more services to your customers? Apni Dukaan Ko Digital Bank Banaye by becoming a Digital Bank Center Agent! With PayPoint, you can easily Get PayPoint Franchisee and transform your shop into a Digital Bank Shop offering banking services like money transfers, bill payments, and account opening.

As one of the Top Banking CSP Providers in India, PayPoint makes it easy to start with CSP Registration, offering you a simple setup and support. The best part? You earn commissions from every transaction!

Ready to get started? Visit PayPoint India and join the digital banking revolution today!

0 notes

Text

Become a Digital Banking Agent with PayPoint India | CSP Registration

PayPoint India offers seamless CSP registration for individuals looking to become a digital bank center agent. With PayPoint, you can easily get a PayPoint franchisee and set up your own digital bank shop to provide essential banking services to your community. As the top banking CSP provider in India, we offer comprehensive support to help you create a successful business. Whether you’re aiming to offer financial services or expand your business, PayPoint India provides everything you need to become a trusted digital bank center agent. Join today!

0 notes

Text

World of The Paranormal Saga

(All the names and terms created for The Paranormal Saga)

Allmart- An American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores in the United States and 23 other countries.

Atlas- Atlas is one of the largest multi-national conglomerates in the world. The company was founded in the United Republic of Corinthia and has extensive operations on the island of Ujamaa. Among their numerous enterprises, they manufacture neuron-link chips, computers, phones, and tablets, own/manage private prisons and detention centers, and maintain a banking and consumer credit division. Their neuron-link procedure consists of implanting laborers with a neuron-link chip that deprives them of their autonomy and consciousness, controlling their motor functions. They are used by Atlas to perform labor duties as mindless automatons.

Battalion- A Paranormal agent of the Department of Paranormal Activity. He is commander-in-chief of The Paratroopers and the Department’s most skilled operative. As a result of dangerous experiments conducted by the Department on siphonophores mutated by psychic energy, Battalion possesses a colonial consciousness and the ability to clone himself at will.

The Black Brigades- A militant group of urban guerrillas combatting the United Republic of Corinthia.

The Department of Paranormal Activity (DPA)- A global peacekeeping operation established by the United Nations Security Council and tasked with covertly monitoring paranormal activity across the globe.

Gadget- A young Paranormal Entity with super-cognition. He is an official member of the Paratroopers.

Genesis- Battalion's secret identity.

Masquerade- A young Paranormal Entity with the ability to turn invisible. She is an official member of the Paratroopers.

Maya Makari- Masquerade's secret identity.

Minerva University: A private, Ivy League research university in Neptune City. Nagode is in the process of applying for their prestigious (and, more importantly, free) philosophy program. Gadget received a P.H.D. in Neuroscience from them.

Nagode Tyjani- Nebulous' secret identity.

Nebulous- A young Paranormal Entity with telepathic and telekinetic abilities. He is an official member of the Paratroopers.

Neptune City- An American city home to Nagode and the Department of Paranormal Activity. It is a global center and the most populous city in the United States. It’s a majority-minority city with a Black population of 70%.

Neuron-links- Digital implants that deprive the wearer of their autonomy and consciousness, rendering them mindless automatons. It is useful for prisons and low-wage labor.

Paranormal Activity- All activity that defies the laws of nature as we know them.

Paranormal Entities (a.k.a. “Paranormals”)- Individuals who possess powerful abilities.

The Paratroopers- An elite squadron of individuals with paranormal abilities responsible for protecting the planet from paranormal threats on behalf of the Department of Paranormal Activity. Its four official members are Nebulous, Battalion, Gadget, and Masquerade.

Psychic Energy- The nebulous force that defies the laws of nature and grants the Paratroopers their paranormal abilities.

Siddhartha Khan- Gadget's secret identity.

Ujamaa- Ujamaa is an island colony of the United Republic of Corinthia. The island is home to the Obi tribe, a community indigenous to Ujamaa. Ujamaa is oppressed by the United Republic of Corinthia. Their environment is routinely exploited for its natural resources and they are subjugated by an apartheid system.

Ujamaatown- A neighborhood in Neptune City. Nagode lives there.

United Republic of Corinthia- A fascistic, genocidal, colonial regime that occupies the island nation of Ujamaa.

#paranormal saga#worldbuilding#web series#original fiction#original story#original character#superheroes#science fiction#fantasy#capepunk#writeblr

3 notes

·

View notes

Text

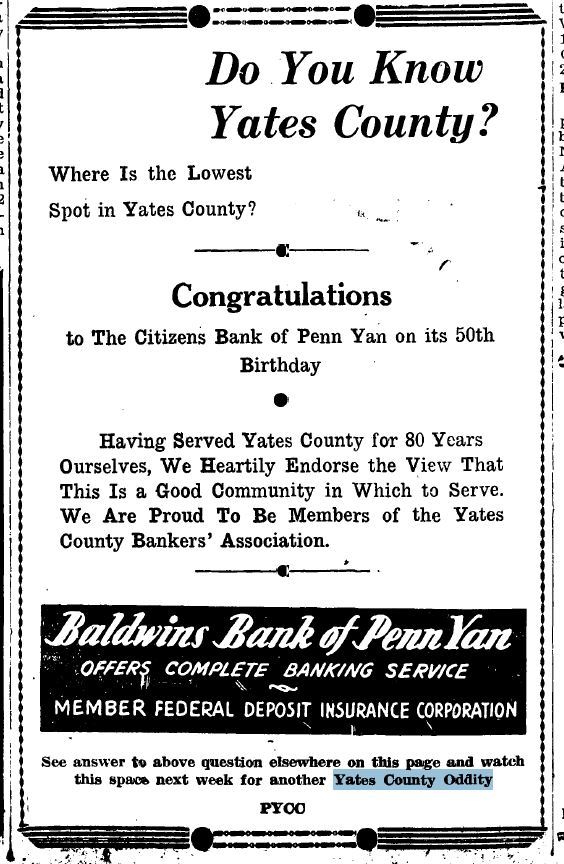

Do you know Yates County?: Yates County Oddity No. 1 through No. 26

By Jonathan Monfiletto

Anyone who has conducted research either through Yates County’s digitized newspapers or the Yates County History Center’s subject files has likely come across items titled either “Penn Yan Oddity” or “Yates County Oddity.” These items – snippets might be a good word – provide information about various aspects of local history, seeming to answer some sort of question or mystery.

Seeing so many of these snippets – and finding the answers but seeming not to find the question – I decided to scour our digitized newspaper database to see if I could find all of them, the questions with the answers. It turns out the oddities – 90 Penn Yan Oddity items, 52 Yates County Oddity items – were part of an advertising campaign in the 1940s for Baldwin’s Bank, then located at 127 Main St. in Penn Yan, the present-day home of the Arts Center of Yates The Penn Yan Oddities ran in The Chronicle-Express in consecutive weeks from February 20, 1947 to November 11, 1948, and then the Yates County Oddities picked up right away in the newspaper from November 18, 1948 to November 24, 1949. So, for more than 2 and a half years, readers of The Chronicle-Express learned something about local history each week in the newspaper.

Each item started out as an advertisement for Baldwin’s Bank with the phrase “Do You Know Yates County?” at the top of the graphic followed by the question for the week. In the middle, the bulk of the ad, would appear information about the bank’s various services and offerings. The bottom would direct the reader to look for the answer elsewhere on the same page and then look for another Oddity the following week.

In this article, I present Yates County Oddity No. 1 through No. 26. Each question and answer has been transcribed exactly as it appeared in the newspaper, which changes made only for typographical errors and not for grammatical errors. The only time words have been removed from the items is in the case of references to photographs that appeared in the newspaper.

1) Where are there 10 different classifications of soil within ½ mile?

A Yates County soil analysis made in 1916 shows that at Fiveville, a little south of Italy Hill, there are 10 classifications of soil within a half-mile radius: Wooster, gravelly silt loam and stoney silt loam, Volusia flat phase silt loam and silt loam, muck, Holly silt loam, Papakating silt clay loam, Chenango gravelly silt loam, Lordstown stoney silt loam, and Genesee silt loam.

2) What farm still uses an “old oaken bucket?”

There is an “Old Oaken Bucket” well still in use on the old McFarren farm, Penn Yan, RD 4, now owned by H.M. Fulkrod. The bucket is lowered by a rope and there is a wood hand brake to slow the speed as it descends the well. When filled, the bucket is drawn up by turning the crank attached to the wooden spool.

3) Who was the first white child born here?

The great grandfather of Charles Beaumont, Penn Yan insurance agent and real estate brother, is said to be the first white child born in what is now Yates county. Joseph Hopeton Beautmont was born Sept. 26, 1798, to James Beaumont, native of England, and Mary Malin Beaumont, flollowers of Jemima Wilkinson. Their child was the first born in the New Jerusalem settlement. J.H. Beaumont died June 27, 1893, in the residence at 109 East Main street, now owned and occupied by Herbert Thayer. The old “Beaumont” horseblock may still be seen in front of the residence.

4) Bricks for what building were made of clay dug from the building’s cellar?

Sixty years ago this summer clay was removed when the basement for Ball hall of Keuka institute and college was being excavated. The same clay went chiefly into the making of the interior bricks from which the present structure was built.

5) What township was called Vernon?

From Jerusalem township of Ontario county in 1803 a new township, including what is now Milo and Torrey, was created and named Vernon. But Oneida county had created a Vernon township a year earlier, so confusion resulted. As a result on April 6, 1809 the state legislature changed the name of Vernon township, Ontario county, to Snell, honoring the state senator, Jacob Snell from Montgomery county.

Residents of this area apparently saw no reason for honoring a senator from another county, so assembled in a protest meeting at the inn of Luman Phelps, located at the corner of Main and Head streets in the young village of Penn Yan. The group petitioned the legislature to change the name to Benton township, honoring Levi Benton, the first settler in the region. On April 2, 1810, Albany nodded consent.

Milo township was set up and apart from Benton township in 1818 and Torrey township was separated from Benton in 1851.

6) What traditional birthplace of a people is in Yates?

Bare Hill in the western section of Yates county on the east side of Canandaigua lake is famous in legends of the early inhabitants of Yates county as the supernatural birthplace of the Seneca Indians.

7) What was the first name of Starkey town?

Both Starkey and Barrington townships were originally, along with Tyrone, Wayne, and Reading townships, now of Steuben and Schuyler counties, a part of Frederickton in Steuben county. Afterwards Reading was cut off and the Town of Wayne, including what is now Barrington, was organized. In 1822 Barrington was organized with the boundaries that define it today and in 1826, along with Starkey, it was annexed to Yates county.

8) Where was the nearest toll gate to Penn Yan?

A toll gate on the Penn Yan Branchport plank roead was near the site of the Allison and Daniels office – the old Hanford farm. The toll gate at the other end of the road was near Esperanza at the foot of the old road that ascends the hill west of the spacious mansion. Many older residents can remember the ruins of this toll gate house.

9) What surveyor was first settler of a town?

John Mower, 18, carried the chain, served as cook and was in charge of the pack horses for the crew which surveyed the new pre-emption line from Pennsylvania’s north border to Lake Ontario. In 1790 he settled in West River hollow, Italy township. Italy was originally part of Middletown township, organized in 1789, but changed to Naples township in 1808. Seven years later Italy township was set off. John Mower is quoted in history as saying that one spring he killed 314 rattlesnakes on the west side of the stream not far from the rocky ledges where they hibernated. The township was then rich in a dense forest of noble trees.

10) What rural cemeteries were once next to churches?

The cemetery near Swing’s or Ovenshire’s corners on the Penn Yan-Dundee road in Barrington and the Nettle Valley cemetery on the Penn Yan-Potter road, road were once adjoining churches. The church buildings have long since been removed and their location obliterated.

Do you know of any others in Yates county?

11) What was the first barn west of Seneca Lake?

In 1791, according to tradition, Caleb Benton built a barn 30 by 40 feet, starting on Monday morning with trees standing in the woods. These, it is said, were felled, hewed, and framed and the barn enclosed so that wheat was drawn into it by Saturday.

This was reported to be the first barn built west of Seneca lake.

12) Is there a battle ground sites in Yates?

The nearest any part of the present area of Yates county came to becoming a battleground was Sept. 9, 1779, when 400 of General Sullivan’s riflemen were sent along the west side of Seneca lake from the site of Geneva to what is now Kashong point and there wrecked the Indian settlement. Resistance of the [Native Americans] was insignificant if not entirely lacking.

The power of Indians had been broken in the battle of Newtown, east of Elmira.

13) What is Lake Keuka unlike other lakes?

Lake Keuka is unique, but not because it is shaped like the letter Y.

Geologists say that it is perhaps the only body of Y-shaped water with one of the upper branches an inlet and the other an outlet. Elsewhere nature has made the two top branches inlets and the base branch an outlet. Early glacial action, say geologists, created this freak. Water flows in at Hammondsport, the south end, also at Branchport, one of the north ends, and flows out through the other north end by way of the East or Penn Yan branch.

14) How old is the Friend house?

While commonly referred to as 150 years, the actual age of the Jemima Wilkinson house in Jerusalem is a matter of dispute. Arnold Potter, descendant of the early Friend settlers, believes the dwelling was some five years in the building and was completed in 1815. Her death occurred four years later. The Friend joined her followers near City Hill, Torrey township, in 1790 and there built the first frame dwelling in western New York. This would have been 25 years before completion of the Jerusalem home which still stands.

15) Where is there a Kentucky coffee tree?

On the east side of Route 14, the Dresden-Geneva state road, just before crossing the bridge over Kashong creek as one drives north out of Yates into Ontario county is a Kentucky Coffee tree – a rare sight in this vicinity. The tree is conspicuous because of its large leaf and uniquely shaped seed pod.

Does anyone know of any others in Yates county?

16) Through what bay does Yates rainfall reach ocean?

Practically all the area of Yates county drains into Canandaigua, Keuka, or Seneca lakes or into Potter swamp and runs eventually through the St. Lawrence river and bay into the Atlantic ocean. But a very limited section of South Italy and Jerusalem townships drain into the Cohocton and a bit of southern Barrington into Waneta and Lamoka lakes from when the water may flow through the Susquehanna system into the Atlantic by way of the Chesapeake bay, some 1,000 miles south of the St. Lawrence.

17) How many Yates places use Old World names?

At least four Yates county townships – Italy, Jerusalem, Milo, and Middlesex – have names which were long famous in England or on the continent of Europe. Also two villages – Dundee and Dresden.

Do you know of any other Yates community names borrowed from other countries?

18) What famous orator was born in this county?

Some of the addresses of Red Jacket, famed Indian orator, have been included in printed collections of the famous speeches of the years. But Red Jacket may or may not have been born in Yates county. Historians disagree upon the place of his birth. It may have been near Branchport or at Canoga, in Seneca county.

Robert G. Ingersoll, agnostic and brilliant orator, was born in Dresden Aug. 11, 1833. His birthplace is being preserved in his memory.

19) Where is the highest spot in Yates County?

The highest spot in Yates county is 2,130 feet above sea level and includes a few acres on the high plateau just west of the Jerusalem township line in Italy, about six miles west and a bit north of Branchport. It was in this area that a bomber crashed during World War II, killing all occupants.

20) Where is the lowest spot in Yates County?

The lowest spot in Yates county is above sea level – and is located somewhere in the bottom of Seneca lake this side of the Seneca county line which is in the middle of the lake.

Within the last few years Yates county has “settled” a great deal – some 400 feet roughly. Up to that time the eastern boundary of the county was highwater mark on the west shore of Seneca lake, which is listed as about 444 feet above sea level. This boundary caused much confusion. Game Protector Clay White, for example, apprehending a duck hunter or fisherman off the Yates county shore for some violation, had to take his man all the way around the end of Seneca lake, possibly 40 miles, to bring him before a Seneca county official. Assemblyman Vernon Blodgett introduced a bill a few years ago placing the county boundary in the middle of the lake.

In spots Seneca lake bottom is said to be even a bit below sea level.

21) How may lakes are there in the county?

There are no lakes in Yates county – entirely within the county, that is.

More than half of the Lake Keuka shoreline is within Yates, about seven miles of the Canandaigua shore line and over 20 miles of Seneca lake’s west shore. Lakes Waneta and Lamoka are just beyond the county boundaries.

22) How many railroads are there in the county?

Three different railroad companies operate lines in Yates county: the Pennsylvania, the New York Central, and the Lehigh Valley, the latter running diesel motors over the Middlesex Valley line between Geneva and Naples. These are the first diesels to be used in regular service in the county.

23) How many schools are there in the county?

While there are 50 rural school districts in Yates county, according to Superintendent Stephen Underwood of Branchport, but 26 of them maintain a school. Of the remaining 24 districts, 8 have sold their buildings; the others being idle, actually there are 32 schools in Yates county, if you add to the above 26 rural schools, the Middlesex Valley and Dundee central schools, St. Michael’s Parochial school in Penn Yan, the Penn Yan Union school (which has five buildings), Lakemont academy, and Keuka college with its several buildings.

24) How many miles of state road are there?

According to George Havens, county superintendent of highways, the total public highway mileage in Yates county is 1,813.44. Of this total 149.18 miles are in county highways, 109.16 state roads, and only 55.10 of town roads.

25) How many post offices are there in Yates?

Two of the Yates county townships, Italy and Barrington, have no post offices. Three townships have one post office each: Rushville in Potter, Dresden in Torrey, and Middlesex in Middlesex township. Milo and Benton have two post offices each: Penn Yan and Himrod in the former, Bellona and Gage in the latter. Jerusalem township with three offices, at Branchport, Bluff Point, and Keuka Park, and Starkey with four, at Dundee, Rock Stream, Starkey, and Lakemont, bring the total number of post offices now operating in this county to 14. Years ago there were many more.

26) How many public libraries in Yates County?

Branchport, Keuka Park, Dundee, and Penn Yan now have the only libraries which are open to the public.

All of these are included as participants in the Yates County Community chest.

#historyblog#history#museum#archives#american history#us history#local history#newyork#yatescounty#newspaper#chronicleexpress#yatescountyoddity

2 notes

·

View notes

Text

In the United States, call center companies play a pivotal role in providing customer support, sales assistance, technical troubleshooting, and various other services for businesses across a multitude of industries. These companies employ thousands of individuals nationwide and operate through various models, including in-house, outsourced, and virtual call centers. Let's delve into the landscape of call center companies in the USA.

1. Overview of the Call Center Industry:

The call center industry in the USA has witnessed significant growth over the years, driven by the increasing demand for cost-effective customer service solutions and the globalization of businesses. Today, call centers cater to diverse sectors such as telecommunications, banking and finance, healthcare, retail, technology, and e-commerce.

2. Major Players:

Several major call center companies dominate the industry, including:

Teleperformance: One of the largest call center companies globally, Teleperformance operates numerous centers across the USA, offering multilingual customer support, technical assistance, and sales services.

Concentrix: Concentrix is another key player, known for its innovative customer engagement solutions. It provides a wide range of services, including customer care, technical support, and digital marketing services.

Alorica: Alorica specializes in customer experience outsourcing solutions, serving clients in various industries. It offers services such as customer support, sales, and back-office support.

Sitel Group: Sitel Group is renowned for its customer experience management solutions. With a global presence, Sitel operates call centers in multiple locations across the USA, providing tailored customer support services.

TTEC: Formerly known as TeleTech, TTEC offers customer experience solutions, digital services, and technology-enabled customer care. It focuses on delivering personalized customer interactions through its contact centers.

3. Industry Trends:

The call center industry is continually evolving, driven by technological advancements and changing consumer preferences. Some notable trends include:

Digital Transformation: Call centers are increasingly integrating digital channels such as chat, email, and social media to enhance customer engagement and support omnichannel experiences.

AI and Automation: Automation technologies, including artificial intelligence (AI) and chatbots, are being adopted to streamline processes, improve efficiency, and provide faster resolutions to customer queries.

Remote Workforce: The COVID-19 pandemic accelerated the shift towards remote work in the call center industry. Many companies have embraced remote workforce models, allowing agents to work from home while maintaining productivity and efficiency.

Data Analytics: Call centers are leveraging data analytics tools to gain insights into customer behavior, preferences, and trends. This data-driven approach enables them to personalize interactions and optimize service delivery.

4. Challenges and Opportunities:

Despite its growth, the call center industry faces several challenges, including:

Staffing Issues: Recruiting and retaining skilled agents remains a challenge for many call center companies, particularly amid competition for talent and high turnover rates.

Security Concerns: With the increasing prevalence of cyber threats, call centers must prioritize data security and compliance to protect sensitive customer information.

However, the industry also presents numerous opportunities for growth and innovation:

Expansion of Services: Call center companies can diversify their service offerings to meet the evolving needs of clients, such as expanding into digital customer engagement, analytics, and consulting services.

Focus on Customer Experience: By prioritizing customer experience and investing in training and technology, call centers can differentiate themselves and gain a competitive edge in the market.

Globalization: With advancements in technology and communication infrastructure, call center companies can explore opportunities for global expansion and tap into new markets.

5. Future Outlook:

Looking ahead, the call center industry is poised for further growth and transformation. As businesses increasingly prioritize customer-centric strategies, call center companies will play a crucial role in delivering exceptional customer experiences and driving business success.

In conclusion, call center companies in the USA form a vital component of the customer service ecosystem, serving a wide range of industries and helping businesses enhance customer satisfaction and loyalty. With ongoing technological innovations and evolving customer expectations, the industry is poised for continued growth and innovation in the years to come.

2 notes

·

View notes

Text

The Evolution of Web Design in Qatar: From Dial-Up to AI-Powered Experiences

Let’s rewind to the early 2000s in Qatar. Picture this: You’re sitting at a bulky desktop computer, waiting minutes for a single webpage to load. The screen flickers to reveal a plain text-heavy site with tiny images and a menu bar that looks like it was designed in Microsoft Word. Fast-forward to today, and you’re scrolling through a Qatari e-commerce site on your phone — sleek animations, Arabic calligraphy woven into modern layouts, and instant checkout options. How did we get here? Let’s dive into Qatar’s web design journey, explore what’s trending now, and peek into its futuristic ambitions.

The 2000s: Baby Steps in Qatar’s Digital Playground

When Qatar first dipped its toes into the internet, websites were like digital pamphlets. They weren’t pretty, but they got the job done. Government portals, local businesses, and even schools started creating basic HTML pages. Here’s what stood out:

Text Over Flash: Fancy graphics? Forget it. Early sites prioritized information — think paragraphs of text, bullet points, and maybe a pixelated logo.

Bilingual Basics: Even back then, Qatari sites knew their audience. Arabic and English text sat side by side, often in clunky layouts.

Patience Required: With dial-up internet, waiting for a site to load felt like watching sand trickle in an hourglass. Designers avoided heavy images to keep things moving.

Remember Qatar Airways’ first website? It was all flight schedules and contact details — no flashy promotions or 360-degree cabin tours. But these humble beginnings laid the groundwork for something bigger.

2024: Where Tradition Meets Cutting-Edge Tech

Today, Qatar’s web design scene is a vibrant mix of cultural pride and tech wizardry. Let’s break down what’s hot right now:

1. “Mobile-First” Isn’t a Trend — It’s a Rule

Over 90% of Qataris browse the web on smartphones. Sites now start with mobile designs, ensuring buttons are thumb-friendly and menus collapse neatly. Take Talabat’s app-like website: it’s so smooth you’ll forget you’re not using an actual app.

2. Arabic Calligraphy Gets a Modern Makeover

Gone are the days of generic fonts. Designers are blending traditional Arabic scripts with minimalist layouts. Check out Msheireb Properties’ site — elegant Kufic-style typography dances alongside crisp images of Doha’s skyline.

3. Speed is King (Thanks, 5G!)

Qatar’s 5G networks are among the fastest globally. Websites now load in under two seconds, with designers optimizing every image and line of code. Slow sites? They’re as outdated as flip phones.

4. Storytelling Through Scrolling

Qatar’s tourism sites are masters of this. Scroll down Visit Qatar’s homepage, and you’ll glide from desert dunes to futuristic skyscrapers, with videos that make you feel the Arabian Gulf breeze.

5. E-Commerce: No More “Add to Cart” Frustration

Local platforms like Snoonu and Farfetch Qatar have upped their game. Features like:

One-tap checkout

Live chat with real agents (no bots!)

AR try-ons for abayas and sunglasses

…are making online shopping feel like a VIP experience.

6. Inclusivity Takes Center Stage

Qatar’s push for accessibility is reshaping the web. Sites now include:

Voice navigation for visually impaired users

Color contrast adjustments for dyslexia-friendly reading

Easy-to-read fonts in both Arabic and English

2030 and Beyond: Qatar’s Web Design Crystal Ball

Qatar doesn’t follow trends — it creates them. Here’s what’s coming next:

1. “Siri, Find Me a Luxury Villa in Lusail”

Voice search is exploding. Soon, Qatari sites will answer queries like, “Show me hotels near Katara Cultural Village with sea views” in flawless Arabic or English.

2. Your Website Knows You Better Than Your Best Friend

AI will personalize sites in real time. Example: A returning visitor to Qatar National Bank’s site sees custom mortgage offers based on their browsing history — no login required.

3. Virtual Souq Waqif Tours

Why just read about a store when you can VR-walk through it? Future e-commerce sites might let you haggle with a virtual shopkeeper or smell digital oud perfume samples.

4. Eco-Friendly Coding

As Qatar aims for sustainability, expect “green web design.” Think solar-powered hosting servers and sites that track your carbon footprint while browsing.

5. Biometric Logins

Forget passwords. Qatari banking and government sites might soon use facial recognition or fingerprint scans for instant access.

Why This Matters for YOU

Whether you’re a startup in Education City or a heritage brand in Souq Waqif, your website is your digital handshake. In Qatar’s competitive market, a stale design can cost you customers. But a site that blends Qatari culture with innovation? That’s how you stand out.

Final Thoughts

From the dial-up days of the 2000s to tomorrow’s AI-driven interfaces, Qatar’s web design evolution mirrors its leap from regional player to global innovator. The next time you browse a Qatari site, notice the details — the way Arabic script flows like poetry, the split-second load times, the subtle nods to desert landscapes in the color palette.

For businesses, this isn’t just about keeping up. It’s about leading. And for users? It means smoother, smarter, and more beautiful online journeys.

0 notes

Text

Free Job Alert Vacancy in Arunachal Pradesh – Latest Government & Private Job Updates

Arunachal Pradesh, the land of the rising sun in India, offers numerous job opportunities across various sectors, including government and private enterprises. Whether you are a fresher or an experienced professional, staying updated on the latest Free Job Alert Vacancy in Arunachal Pradesh is essential to secure a promising career.

In this blog, we will discuss different job vacancies available in the state, how to stay updated, and the best ways to apply for these opportunities.

Government Jobs in Arunachal Pradesh Arunachal Pradesh is home to various government job openings in different sectors, such as education, healthcare, public administration, and law enforcement. Some common government job categories include:

Arunachal Pradesh Public Service Commission (APPSC) Jobs The APPSC conducts recruitment exams for various posts in state government departments. Jobs under APPSC include administrative officers, engineers, teachers, and clerks. Keep checking their official website for notifications.

Teaching Jobs The Arunachal Pradesh education department frequently announces teaching vacancies in government schools and colleges. Aspirants with qualifications such as B.Ed. or NET can apply for positions like primary teachers, lecturers, and professors.

Police and Defense Jobs The Arunachal Pradesh Police Department releases notifications for constable, sub-inspector (SI), and other security-related positions. Similarly, the Indian Army and paramilitary forces also offer recruitment opportunities for candidates from Arunachal Pradesh.

Banking and Finance Jobs Several government banks and financial institutions recruit candidates for clerical, probationary officer (PO), and specialist officer (SO) roles. The Institute of Banking Personnel Selection (IBPS) conducts exams for these positions.

Health and Medical Jobs The government regularly recruits medical professionals, including doctors, nurses, and paramedical staff, for hospitals and healthcare centers across the state. Those with medical degrees can apply for these roles.

Railways and Postal Jobs The Indian Railways and the Postal Department frequently hire staff for clerical, technical, and non-technical posts. These jobs provide a stable income and career growth opportunities.

Private Sector Jobs in Arunachal Pradesh Apart from government vacancies, several private sector jobs are available in Arunachal Pradesh. Some of the popular job sectors include:

IT and Software Jobs The growing demand for IT professionals has opened doors for web developers, software engineers, and digital marketing experts. Many startups and small IT firms in the state are hiring skilled individuals.

Hospitality and Tourism Industry Since Arunachal Pradesh is a popular tourist destination, there are plenty of job openings in the hospitality industry. Roles such as hotel management staff, travel agents, tour guides, and event managers are in demand.

Retail and Sales Jobs Retail chains, shopping malls, and supermarkets frequently require sales executives, cashiers, and store managers. These jobs are ideal for individuals looking for customer-oriented roles.

Teaching and Coaching Jobs Private schools, coaching centers, and educational institutions hire teachers and trainers in various subjects. If you have expertise in any academic or technical field, teaching can be a great career option.

Construction and Engineering Jobs Infrastructure development in Arunachal Pradesh has led to an increased demand for civil engineers, architects, and construction workers. Companies working on government projects and private construction firms are hiring actively.

How to Stay Updated on Free Job Alerts in Arunachal Pradesh? To ensure you do not miss out on any important job opportunity, follow these steps:

Subscribe to Job Portals Websites such as employment news portals, government recruitment boards, and private job portals regularly update job vacancies. Register on these platforms to receive email alerts.

Follow Official Government Websites Government departments, such as APPSC, police recruitment boards, and public sector banks, announce vacancies on their official websites. Keep checking these sites for notifications.

Join Telegram and WhatsApp Job Groups Several Telegram and WhatsApp groups provide job alerts for Arunachal Pradesh. Joining these groups can help you receive real-time updates.

Check Local Newspapers Regional newspapers and employment newspapers often publish job advertisements from both government and private sectors. Make sure to check these regularly.

Visit Employment Exchanges The Arunachal Pradesh government runs employment exchange offices where job seekers can register and receive job notifications. Registering here can increase your chances of getting suitable job offers.

How to Apply for Jobs in Arunachal Pradesh? Once you find a suitable job vacancy, follow these steps to apply:

Read the Notification Carefully Go through the job notification to check eligibility criteria, age limit, educational qualifications, and experience requirements.

Prepare Required Documents Gather necessary documents such as your resume, educational certificates, identification proof, and any additional qualifications required for the job.

Apply Online or Offline For government jobs, visit the official website and apply online through the given portal. For private jobs, submit your resume via email or job portals.

Prepare for Exams and Interviews Many government jobs require candidates to pass a written exam and/or interview. Prepare for competitive exams using study materials, online courses, and mock tests.

Conclusion Securing a job in Arunachal Pradesh, whether in the government or private sector, requires timely updates and proper preparation. By following Free Job Alert Vacancy in Arunachal Pradesh, you can stay informed about the latest job openings and take the necessary steps to apply.

Keep checking reliable job portals, official websites, and local newspapers to ensure you do not miss any opportunity. Stay prepared, enhance your skills, and apply strategically to land your dream job.

Good luck with your job search!

0 notes

Text

Top 10 Industries Offering the Best Job Opportunities in Jaipur

The job market is evolving rapidly, offering a wealth of opportunities across multiple industries for ambitious professionals. Whether you’re seeking office-based roles, flexible arrangements, or creative projects, discovering the right sector can make all the difference. This blog explores the top 10 job opportunities in jaipur, including jobs in Jaipur, job opportunities in Jaipur tailored to your expertise and goals.

1. Information Technology (IT)

Jaipur is rapidly emerging as a tech hub, attracting numerous IT companies and startups. With a focus on software development, IT consulting, and digital marketing, this industry offers a variety of roles, including:

Web Developers

Software Engineers

Digital Marketing Specialists

Why Choose IT in Jaipur: The rise of tech parks and coworking spaces has fueled growth in IT jobs. Many roles also allow for flexible or remote working options.

2. Tourism and Hospitality

Jaipur's rich cultural heritage ensures a thriving tourism industry. Jobs in this sector range from hospitality management to tour operations.

Hotel Managers

Travel Agents

Event Coordinators

Growth Insight: With a steady influx of domestic and international tourists, this sector remains a reliable source of employment.

3. Banking and Finance

Jaipur is home to numerous banks, financial institutions, and NBFCs (Non-Banking Financial Companies). Common roles include:

Financial Analysts

Relationship Managers

Loan Officers

Why This Industry? Growing businesses in Jaipur have increased the demand for financial services, creating a stable job market.

4. Education and Training

The education sector in Jaipur is booming with reputed schools, colleges, and coaching centers for competitive exams. There is a strong demand for:

Teachers and Lecturers

Content Developers

Academic Counselors

Special Mention: Online education platforms have opened avenues for work from home jobs Jaipur in teaching and tutoring.

5. Handicrafts and Textiles

As the center of traditional Rajasthani handicrafts and textiles, Jaipur’s industries are globally recognized. Job roles include:

Designers

Export Managers

Artisans and Craft Experts

Highlight: Many professionals in this industry work on freelance or project-based assignments, creating flexibility.

6. Real Estate

With rapid urbanization, the real estate market in Jaipur has flourished. Jobs in this sector include:

Real Estate Agents

Property Managers

Construction Project Coordinators

Market Insight: The rise of residential and commercial projects has created diverse job opportunities.

7. Manufacturing

Jaipur hosts industries like jewelry manufacturing, auto components, and chemicals. Jobs include:

Production Managers

Quality Assurance Analysts

Supply Chain Specialists

Why This Industry? Jaipur’s well-established industrial areas provide significant employment in manufacturing.

8. Healthcare

As a medical hub in Rajasthan, Jaipur’s healthcare sector is growing rapidly. Common roles are:

Doctors and Nurses

Medical Lab Technicians

Hospital Administrators

Additional Perks: Opportunities for remote roles in medical transcription or telemedicine make it appealing to job seekers.

9. E-commerce and Retail

With the growth of online shopping platforms and retail stores, the demand for professionals in e-commerce is increasing. Popular roles include:

Supply Chain Analysts

E-commerce Executives

Store Managers

Remote Options: Many roles, such as e-commerce customer service or digital marketing, can be pursued as work from home jobs Jaipur.

10. Media and Entertainment

Jaipur’s flourishing media and entertainment industry offers creative and challenging roles:

Content Writers

Photographers and Videographers

Social Media Managers

Trend Watch: With the rise of content creators and digital media startups, this sector has become a hub for creative minds.

Conclusion

Jaipur offers a diverse range of job opportunities across various industries, catering to both traditional roles and modern, flexible working arrangements. Whether you're a fresher or an experienced professional, there’s no dearth of opportunities in this vibrant city. From high-paying corporate jobs to fulfilling work from home jobs Jaipur, the city has it all.

If you’re looking to explore the best high paying jobs in Jaipur or stay updated on the latest job opportunities in Jaipur, consider registering on Salarite today. With a user-friendly interface, career counseling, and tailored job recommendations, Salarite is your gateway to success. Start your career journey now! Explore Salarite or the latest opportunities!

#jobs in india#salarite#jobs in startups#hiring and recruiting#recruitment#jobs near me#jobsearch#job in startups#job#job in jaipur#job opportunities in jaipur

0 notes

Text

Unlock Global Opportunities with Isle of Man Offshore Company Formation

The Isle of Man is a premier jurisdiction for offshore company formation, offering a unique blend of financial stability, tax advantages, and a business-friendly environment. Whether you’re an entrepreneur, investor, or multinational corporation, establishing an offshore company in the Isle of Man can be the key to unlocking new opportunities and maximizing profitability.

Why Choose the Isle of Man for Offshore Company Formation?

Tax Advantages:

No capital gains tax, inheritance tax, or wealth tax.

Zero corporate tax for most companies, excluding specific regulated industries.

No withholding tax on dividends.

Economic and Political Stability:

The Isle of Man boasts a AAA credit rating and a solid reputation as a secure financial center.

Strong governance ensures a transparent and reliable business environment.

Strategic Location:

Situated in the Irish Sea, the Isle of Man provides easy access to the UK and European markets while maintaining its independence.

Efficient Business Setup:

Streamlined processes for incorporation and regulatory compliance.

Modern infrastructure and excellent digital connectivity make it easy to operate globally.

Privacy and Confidentiality:

The Isle of Man respects business privacy with minimal public disclosure of company ownership.

Types of Companies You Can Form

Private Limited Companies

Public Limited Companies

Limited Liability Companies (LLCs)

Limited Partnerships

Foundations and Trusts

Steps to Form an Offshore Company in the Isle of Man

Select a Company Name: Ensure the name is unique and complies with the naming guidelines.

Choose a Business Structure: Depending on your goals, select the most suitable type of entity.

Submit Required Documents: Provide identification and address proof for directors and shareholders, along with a Memorandum and Articles of Association.

Appoint a Registered Agent: A licensed agent in the Isle of Man is required for incorporation.

Open a Bank Account: Establish a corporate bank account to facilitate your financial transactions.

Obtain Necessary Licenses: For regulated industries, secure the appropriate approvals or licenses.

How Atrium Associates Can Help

Atrium Associates specializes in offshore company formation, offering comprehensive services tailored to your business needs:

Expert guidance on choosing the right structure.

Handling all incorporation and registration processes.

Assistance with opening corporate bank accounts.

Providing ongoing compliance, accounting, and tax advisory services.

Benefits of Partnering with Atrium Associates

Decades of expertise in offshore company formation.

Customized solutions to meet your unique requirements.

Transparent pricing and dedicated customer support.

Take the First Step Today

Establishing an offshore company in the Isle of Man provides the ideal platform for global expansion, financial efficiency, and business security. Let Atrium Associates guide you through every step of the process, ensuring a hassle-free and successful company formation.

Contact us now to start your journey to global success!

#Isle of Man Offshore Company Formation#offshore company isle of man#company formation isle of man#offshore company gibraltar

0 notes

Text

Transforming Ideas into Reality: Florida’s Leading Mobile App Development Experts

Florida is a state known for its vibrant business landscape, innovation, and technological advancements. With its diverse industries spanning from tourism and hospitality to healthcare, finance, and tech, Florida is home to a dynamic economy that thrives on forward-thinking businesses looking to enhance their digital presence. In a state that embraces change and growth, mobile app development has become a pivotal tool for companies aiming to meet customer demands, streamline operations, and unlock new business opportunities.

At Aryavrat Infotech, we are proud to be one of Florida’s leading top rated mobile app development company, specializing in turning creative ideas into functional, high-performance mobile apps that deliver tangible results. Whether you're a small startup in Miami or an established enterprise in Orlando, we help businesses across Florida harness the power of mobile technology to connect with customers, improve processes, and drive innovation. With a focus on delivering scalable, secure, and user-friendly mobile solutions, we ensure that your ideas not only come to life but succeed in a competitive digital landscape.

Why Florida? A Thriving Hub of Innovation and Growth

Florida has firmly established itself as one of the most business-friendly states in the U.S. With no state income tax, a growing tech ecosystem, and a diverse economy, it’s a magnet for entrepreneurs, startups, and established enterprises alike. From Miami’s bustling startup scene to Tampa’s growing tech cluster, Florida provides the perfect environment for businesses to innovate and thrive.

In addition to its business-friendly environment, Florida boasts a highly engaged and tech-savvy population, making mobile technology critical for companies looking to stay relevant and competitive. Mobile apps are a central part of this technological revolution, helping businesses across industries to adapt, grow, and succeed. Whether you're in the hospitality industry, healthcare, real estate, or retail, custom mobile applications are now essential tools for expanding reach, improving operational efficiency, and enhancing customer experiences.

Read More: 7 Critical Elements of Modern Web Design to Focus on Today

Key Industries We Serve in Florida:

Tourism & Hospitality: Florida is one of the world’s top travel destinations, with millions of tourists flocking to the state every year. We specialize in creating mobile apps that enhance the travel experience, from hotel bookings and activity planning to restaurant reservations and local guides. Our apps are designed to provide a seamless, personalized experience for tourists and business travelers alike.

Healthcare & Medical Technology: The healthcare industry in Florida is vast, with numerous hospitals, medical centers, and healthcare startups. We develop HIPAA-compliant, secure mobile apps that help healthcare providers offer telemedicine, patient management, appointment scheduling, and health tracking services, improving patient care and engagement.

Finance & Fintech: Florida has become a growing hub for fintech startups. We build mobile apps that help businesses in the financial sector deliver secure mobile banking, investment tracking, peer-to-peer payments, and other fintech services. Our apps are designed to comply with financial regulations while offering a seamless and secure user experience.

Real Estate: Florida’s real estate market is thriving, and real estate agents, developers, and property managers are turning to mobile apps to manage properties, streamline sales, and connect with potential buyers and renters. We create mobile solutions for real estate that include property search, virtual tours, CRM integration, and client management features.

E-Commerce & Retail: From the fashion scene in Miami to online retailers across the state, Florida’s e-commerce industry is booming. Our mobile app development services help businesses in the retail and e-commerce sector create apps that improve customer engagement, streamline shopping experiences, and increase sales.

Our Mobile App Development Process: Bringing Your Ideas to Life

At Aryavrat Infotech, we believe that every mobile app should be unique and tailored to the specific needs of the business. Our approach to mobile app development is collaborative and flexible, ensuring that your app meets your business objectives and delivers an outstanding user experience. Here’s a breakdown of our process:

1. Discovery & Consultation

Our process begins with a deep dive into your business, goals, and challenges. We take the time to understand your target audience, key features, and the problem your app is solving. During this phase, we discuss your vision, analyze market trends, and identify competitive advantages. We also define the project scope and set clear milestones, ensuring that the app aligns with your business strategy.

2. UI/UX Design

In Florida’s competitive digital landscape, user experience is paramount. Our design team focuses on creating intuitive, visually appealing, and user-centric designs. We ensure that your app’s interface is not only aesthetically pleasing but also easy to navigate, offering a smooth and enjoyable experience for users. Prototyping, wireframing, and user testing are integral parts of our design process, ensuring that your app meets the highest usability standards.

3. Mobile App Development

With a clear design in place, our development team moves forward with building your custom mobile app. We use the latest technologies, frameworks, and programming languages to ensure that your app is secure, scalable, and high-performing. Whether you're looking for a native iOS or Android app or a cross-platform solution, we provide flexible development options that meet your specific requirements.

We follow Agile methodologies, breaking the development process into manageable iterations. This allows us to incorporate feedback quickly, making adjustments as needed while ensuring that the app is delivered on time and within budget.

4. Quality Assurance & Testing

Quality is a core principle of our work. Before your app goes live, our QA team rigorously tests it to ensure that it functions as expected across a range of devices, screen sizes, and operating systems. We conduct performance testing, security audits, and user acceptance testing (UAT) to identify and resolve potential issues, ensuring a flawless user experience.

5. Launch & Post-Launch Support

Once your app is ready, we assist with the deployment process, helping you launch it on the Apple App Store, Google Play Store, or any other platform suited to your needs. Post-launch, we provide ongoing maintenance and support, offering regular updates, performance monitoring, and troubleshooting. We are committed to ensuring that your app continues to perform at its best and evolves with new trends and user feedback.

Read More: How to successfully outsource for your small business?

Why Choose Us for Mobile App Development in Florida?

Industry Expertise: With extensive experience in industries such as tourism, healthcare, fintech, and retail, we understand the specific challenges businesses in Florida face. Our team has the knowledge and skills to create mobile apps that address your industry needs and align with market trends.

Custom Solutions: We don’t offer generic solutions; we create customized mobile apps that cater to your specific business goals. Whether it’s a customer-facing app, a business process optimization tool, or an internal enterprise solution, we build apps that work for you.

Scalability & Flexibility: As your business grows, your app needs to scale with it. We develop scalable solutions that can adapt to changing business requirements, ensuring that your app continues to support your business as it evolves.

User-Centered Design: Florida’s digital landscape is competitive, and we prioritize user experience in everything we do. We focus on creating apps that are intuitive, easy to use, and designed to engage users, leading to higher satisfaction and retention rates.

End-to-End Service: From the initial consultation to post-launch support, we provide end-to-end mobile app development services. We’re here for every stage of the journey, ensuring that your app is successful, from development through updates and beyond.

Conclusion

In a fast-paced, competitive state like Florida, having a well-designed, high-performance mobile app is essential for any business looking to stay ahead. At Aryavrat Infotech, we are dedicated to turning your ideas into reality by providing custom mobile app solutions that enhance user experiences, streamline business operations, and drive growth. Whether you are a startup or an established enterprise, we have the expertise to help you achieve success in Florida’s rapidly evolving digital marketing services.

#mobile app#mobile app development#mobile app development company#web development#web developing company#software development#app development company#socialmedia#ios app development

0 notes

Text

PayPoint India: Your Gateway to Success as a Digital Bank Center Agent and Top Banking CSP Provider in India

Join PayPoint India and Get PayPoint Franchisee to become a leading Digital Bank Center Agent. With us, you can Create Digital Bank Shop and provide essential banking services to your community. As the Top Banking CSP Provider in India, we offer seamless CSP Registration and support to ensure your success. Partner with PayPoint India and gain access to a wide range of services, including bill payments, money transfers, and more. Start your journey today and make a difference in the digital banking landscape.

1 note

·

View note

Text

Renewing Your ITINs in Venice, FL: What You Need to Know

When tax season comes, you need to be organized and ready to file, but then you learn your ITIN has expired. Panic sets in, right? You’re not alone. Many residents face this challenge every year.

An ITIN, or Individual Taxpayer Identification Number, is vital for anyone who must file U.S. taxes but doesn’t qualify for a Social Security Number. Whether you’re filing to claim a refund or meet legal obligations, your ITIN ensures the process runs smoothly. This guide provides everything you need to know about renewing ITINs in Venice, FL, so you can avoid filing delays, penalties, or lost benefits. Let’s dive in.

Understanding Your ITIN

What is an ITIN?

An ITIN (Individual Taxpayer Identification Number) is a nine-digit number issued by the IRS to individuals who can’t obtain a Social Security Number but need to comply with tax laws.

Who Needs an ITIN?

You need an ITIN if:

You’re a foreign national or nonresident alien with U.S. tax obligations.

You’re a dependent or spouse of a U.S. resident without a Social Security Number.

You require it to report income or claim refunds.

Why ITINs are Important

ITINs are essential for:

Filing accurate tax returns.

Accessing tax credits (e.g., Child Tax Credit).

Claiming refunds.

Meeting IRS requirements.

When and Why ITINs Expire

ITINs typically expire after five years of inactivity or as part of IRS renewal policies. If issued before 2013, your ITIN may need renewal regardless of recent use.

Why They Expire: To maintain accurate tax records.

Importance of Renewal: An expired ITIN can delay filings, refunds, and access to benefits.

Consequences of an Expired ITIN

Allowing your ITIN to expire can lead to several challenges:

1. Tax Filing Issues

You won’t be able to file federal or state taxes without a valid ITIN.

Filing delays could result in penalties or interest on taxes owed.

Refunds may be delayed until your ITIN is renewed.

2. Other Problems

Losing access to certain government benefits tied to tax filings.

Issues with financial institutions requiring a valid ITIN for identification.

The ITIN Renewal Process in Venice, FL

Renewing ITINs in Venice, FL, is straightforward if you follow these steps:

Step 1: Gather Required Documents

You’ll need:

Form W-7: The IRS application for renewing your ITIN.

Original or Certified ID Copies: Such as a passport, national ID, or visa.

Proof of Residency: A utility bill, rental agreement, or bank statement.

Tips for Document Preparation

Ensure all documents are legible and accurate.

Use certified translations for non-English documents.

Step 2: Choose How to Submit

By Mail: Send your completed Form W-7 and documents to the IRS ITIN Operations Unit. Use a secure mailing service with tracking.

In-Person Help: Visit a Certifying Acceptance Agent (CAA) in Venice, FL, for personalized assistance.

Step 3: Track Your Application

Once submitted, you can check your renewal status by calling the IRS or visiting their website. Processing typically takes 7-11 weeks, so start early.

Fees Associated with ITIN Renewal

The ITIN renewal process is free, but there may be costs if you use third-party services for preparation or translation. Always verify fees with your provider or check the IRS website for the latest updates.

Application preparation fees by tax professionals or Certified Acceptance Agents (CAAs) typically range from $50 to $150, while document translation services can cost $20 to $75 per document. Additional expenses may include postage for mailed applications or travel to IRS centers.

Tips for a Smooth ITIN Renewal

Follow these best practices to ensure a stress-free renewal experience:

1. Start EarlyBegin the renewal process months before your ITIN expires to avoid last-minute complications.

2. Double-Check Your InformationEnsure all forms are filled out correctly, and all names and details match your documents. Errors can delay processing.

3. Keep Copies of Everything Make copies of your application and supporting documents for your personal records.

Conclusion

Renewing your ITIN on time ensures you stay compliant with U.S. tax laws and avoid unnecessary stress during tax season. At White Sands Tax, we specialize in helping residents renew their ITINs in Venice, FL, with ease. If your ITIN has expired or is close to expiring, don’t wait. Start the renewal process today to avoid delays, penalties, or disruptions to your financial goals.

Disclaimer: This content is for general informational purposes only. Always consult a qualified tax professional for personalized advice.

0 notes

Text

Entry-level jobs near me in Delhi NCR

Entry-Level Jobs Near Me in Delhi NCR: Exploring Opportunities Delhi NCR is one of the most vibrant and economically dynamic regions in India, with a wide range of career opportunities across various sectors. So, if you are looking for entry-level jobs in Delhi NCR, you are at the right place. This region includes Delhi, Noida, Gurgaon, Ghaziabad, and Faridabad, with all of them being huge commercial centers offering a treasure trove of employment to freshers and those making a career. Whether the individual is a fresher, a career changer or looking to return to job market, Delhi NCR has immense options.

Jobs for Freshers in Which Industries Delhi NCR has diversified industries. Each one of these has various entry-level job opportunities. Let's take a look at some of the major ones:

IT and Technology: Delhi NCR is home to a high concentration of technology companies, IT startups, and MNCs. This region is a great place for technology-related jobs. The entry-level positions in this sector include software developers, web designers, data analysts, and IT support specialists. Companies like Accenture, TCS, Infosys, and Wipro are always looking for fresh talent.

Customer Service and BPO: The regions of NCR are doing incredibly well when it comes to the BPO and KPO sectors; in fact Gurgaon and Noida are leading it. Entry levels include jobs like customer service executives, voice and non-voice process associates, technical support representatives, chat support agents, etc. Some notable companies in these areas include Concentrix, Sitel, Teleperformance, and Genpact.

Sales and Marketing: Every business requires a good sales and marketing team to take its products and services to the market. Sales entry-level jobs are available in the form of sales executives, sales coordinators, field agents, and telemarketers. Marketing entry-level jobs include social media managers, content writers, digital marketing associates, and SEO specialists. Prominent companies recruiting in these areas are HDFC Bank, ICICI Bank, and Snapdeal.

Retail and E-Commerce: The retail industry is vast, with both brick-and-mortar stores and e-commerce platforms offering entry-level roles. These roles include retail sales associates, store managers, supply chain coordinators, and warehouse executives. E-commerce giants like Amazon, Flipkart, Myntra, and Snapdeal are constantly hiring for customer service, logistics, and operations.

Finance and Accounting: Entry-level finance jobs such as accounting assistants, financial analysts, and audit associates are always in demand. Big financial institutions like HDFC, ICICI, and Axis Bank, along with companies in the fintech space, offer ample opportunities. If you have a background in finance, Delhi NCR is a great place to launch your career.

Healthcare and Pharmaceuticals: Delhi NCR also has a thriving healthcare and pharmaceutical industry. Entry-level jobs in this sector include medical representatives, healthcare assistants, lab technicians, and pharmacy assistants. Hospitals, clinics, and pharmaceutical companies like Max Healthcare, Fortis, and Dr. Reddy's Laboratories are the biggest employers.

Education and Training: Due to its large population, Delhi NCR has a huge number of educational institutions, training centers, and tutoring organizations. Entry-level teaching jobs, administrative positions, and content development roles are available for those interested in education. Organizations like NIIT, BYJU'S, and Educomp are some of the leading employers.

How to Find Entry-Level Jobs in Delhi NCR Finding entry-level jobs near you in Delhi NCR will require the integration of both online and offline approaches. Here are some strategies that can assist you in finding your next job:

Job Portals: Websites such as Naukri.com, Indeed, Glassdoor, LinkedIn, and Monster India are an excellent platform through which to search for jobs. They filter job listings by location, industry, and job role, making it easy for you to find relevant jobs in Delhi NCR.

Company Websites: If you are interested in a specific company, then you can check their career page to find entry-level job postings. Most big companies upload vacancies directly on their company websites before they get advertised on the job portals.

Networking: Networking is one of the primary means of finding entry-level jobs. Use platforms like LinkedIn to network with people who have the same interest as you. Job fairs, conferences, and industry events in Delhi NCR can be an excellent way to build professional networks.

Recruitment Agencies: There are several recruitment agencies in Delhi NCR that specialize in entry-level placements. They can provide you with the best match based on your qualifications and skills.

Social Media: Many organizations employ social media platforms like Facebook, Twitter, and Instagram to post openings. By finding relevant groups and following up on companies' pages, you should be informed of all time-sensitive jobs.

Preparing for an entry-level job interview So, now that you've applied to jobs in Delhi NCR, you ought to get ready for those interviews. Here are a few tips for your success:

Research the Company: Before attending an interview, research the company’s history, values, and products/services. This will help you answer questions confidently and demonstrate your interest in the role.

Tailor Your Resume: Customize your resume to highlight skills and experiences relevant to the job you are applying for. Focus on transferable skills such as communication, problem-solving, and teamwork.

Common interview questions. Be prepared to respond to such basic questions like "Tell me about yourself," "Why do you want to work here?" and "What are your strengths and weaknesses?" This will help you sound confident and prepared during the interview.

Dress professionally. A professional look does most of the talking in the way of making a good impression. Even if the company is casual, be neat and dressed appropriately for an interview.

Salary Expectations for Entry-Level Jobs in Delhi NCR Delhi NCR Salary for freshers entry level varies greatly depending upon the industry, company, and the type of role. For an average, salaries of freshers in IT, sales, customer service, and marketing ranges between ₹20,000 to ₹40,000 per month. The salaries in finance and technology are a little more compared to that, whereas those roles in the retail and hospitality sectors start with the lowest of the range.

Conclusion The Delhi NCR is a good job market with diversified entry-level job opportunities across multiple industries. Whether you are in the technology, sales, customer service, or healthcare field, there are numerous job opportunities available in this region. By using job portals, networking, and preparing for interviews, you can better your chances of getting that ideal entry-level job.

0 notes

Text

Bharat Bill Payment System (BBPS): Simplified Guide to Benefits & Features

In today’s world, paying bills needs to be quick, secure, and hassle-free. The Bharat Bill Payment System (BBPS) is an innovative solution that makes bill payments easy for customers across India. Introduced in 2017 by the National Payments Corporation of India (NPCI), BBPS provides a unified platform to pay utility bills like electricity, telecom, gas, water, and more. With BBPS, you can make payments instantly and securely without the need to visit multiple service providers.

Let’s explore the features, benefits, and how to use BBPS in simple steps.

What is the Bharat Bill Payment System?

BBPS is a centralized bill payment platform that allows customers to pay various utility bills through a single interface. It’s designed to make bill payments faster, easier, and secure. You can use BBPS via online banking, mobile apps, ATMs, or authorized agents to pay bills for services like:

Electricity

Telecom

Water

Gas

DTH (Direct-to-Home)

BBPS is an interoperable system, meaning you can use it with any bank account, mobile wallet, or payment service, regardless of the service provider.

Key Features of BBPS

One Platform for All Bills Pay all your utility bills in one place without switching between multiple service providers.

Multiple Payment Options BBPS supports credit cards, debit cards, net banking, UPI, mobile wallets, and even cash payments at authorized centers.

Instant Payment Confirmation Receive an immediate receipt for your payment, ensuring transparency and peace of mind.

Secure Transactions BBPS uses advanced encryption and authentication methods to protect your data and payments.

24/7 Availability Make payments anytime, anywhere, without worrying about working hours.

Transaction History Easily track all your payments and maintain a digital record of your bills.

User-Friendly Interface A simple and easy-to-navigate design ensures that even first-time users can use BBPS effortlessly.

Benefits of BBPS

For Customers:

Quick and hassle-free bill payments.

Multiple payment options to suit your preference.

Safe and secure platform for all transactions.

Instant confirmation and receipt for every payment.

Access to transaction history for better financial tracking.

For Agents:

Faster settlements for transactions.

Simple registration process with low entry barriers.

Plug-and-play connectivity for easy integration.

Streamlined billing interfaces for better efficiency.

For BBPOUs/Admins:

Single integration to access multiple billers.

Supports both online and offline transactions.

Offers value-added services to improve online presence.

Guaranteed on-time settlements and effective dispute resolution mechanisms.

How to Use Bharat Bill Payment System (BBPS)

Using BBPS is straightforward. Follow these steps:

Find a BBPS Service Provider Visit plutos ONE website, mobile app, or an authorized agent center.

Select the Bill Category Choose the type of bill you want to pay, such as electricity, water, gas, or telecom.

Enter Bill Details Provide the required details like the biller’s name, bill number, and the amount (found on your bill).

Choose a Payment Option Pick your preferred payment method – credit/debit card, UPI, mobile wallet, or net banking.

Verify and Pay Double-check the details and proceed with the payment. Provide any necessary credentials (e.g., card PIN or UPI PIN).

Receive Confirmation Get instant confirmation along with a receipt for your payment. Save this for your records.

Track Transactions You can check your payment status or view your transaction history through the service provider’s app or website.

Biller Operating Unit (BOU) and Customer Operating Unit (COU) in BBPS

The Bharat Bill Payment System (BBPS) operates through two key entities that ensure smooth bill payment transactions:

Biller Operating Unit (BOU)

The Biller Operating Unit represents the billers or service providers integrated into the BBPS ecosystem. These could include utility companies, telecom providers, and other service organizations.

The BOU is responsible for:

Providing bill details and updates to BBPS.

Receiving payments from customers via BBPS.

Ensuring real-time status updates for paid bills.

Customer Operating Unit (COU)

The Customer Operating Unit includes banks, mobile wallets, and authorized agents that provide bill payment services to customers. COUs act as the interface between customers and BBPS, enabling secure and convenient transactions.

Responsibilities of COUs:

Offering customers access to BBPS for bill payments.

Facilitating multiple payment modes like UPI, cards, or cash.

Providing instant payment confirmation and transaction history.

Why Choose BBPS?

BBPS simplifies bill payments for customers, agents, and businesses alike. Whether you want to pay bills securely, avoid long queues, or ensure error-free transactions, BBPS is a reliable and user-friendly choice. With its 24/7 availability and multiple payment options, it’s the future of bill payment in India.

Simplify Bill Payments with plutos ONE

Ready to integrate the Bharat Bill Payment System (BBPS) into your business? plutos ONE is your trusted Technology Service Provider (TSP) for BBPS solutions. With cutting-edge technology, secure infrastructure, and easy integration, we empower you to offer efficient bill payment services to your customers.

🚀 Start your BBPS journey today with plutos.one!

0 notes

Text

How Co-Browsing Technology Enhances Customer Support and Experience

Co-browsing technology, short for "collaborative browsing," enables real-time interaction between users by sharing a web browser session. Unlike traditional screen-sharing tools, co-browsing focuses solely on the browser, ensuring a seamless and secure way to navigate and interact with web pages together. This innovative technology has gained traction across industries, particularly in customer service, sales, and healthcare, due to its efficiency and user-centric approach.

How Co-Browsing Works

Co-browsing technology allows an agent or representative to join a customer's web session to provide real-time guidance. Both parties can interact with the web page simultaneously, making it ideal for troubleshooting, form filling, or navigating complex processes. The session is highly secure, as only the browser's content is shared, and sensitive information, like passwords, is automatically hidden.

Key Features and Benefits

Real-Time Assistance: Co-browsing enables representatives to assist users instantly, eliminating misunderstandings and reducing back-and-forth communication.

Enhanced Security: Unlike general screen sharing, co-browsing only shares specific browser content. Sensitive data is masked to protect user privacy.

No Download Required: Most co-browsing tools are browser-based, meaning users don't need to install additional software, streamlining the experience.

Improved Customer Experience: By offering direct, interactive support, businesses can resolve customer issues faster, leading to higher satisfaction rates.

Cost-Effective: The technology reduces call center handling times and the need for extensive technical support, saving costs.

Applications Across Industries

Healthcare: In healthcare, co-browsing is used to guide healthcare professionals (HCPs) through online platforms, aiding in tasks like form submissions or document reviews. For instance, the ZING Engagement Suite enables pharmaceutical representatives to share documents and forms with HCPs without requiring additional software, streamlining workflows【7】【8】.

Retail and E-commerce: Co-browsing helps customers navigate complex purchasing processes, ensuring a smooth transaction.

Banking: Financial institutions leverage co-browsing to guide clients through loan applications and online banking features.

Education: In virtual classrooms, co-browsing enhances collaborative learning by enabling teachers to guide students through online materials.

Co-Browsing with ZING

The ZING Engagement Suite by P360 demonstrates how co-browsing can transform customer interactions. With features like real-time form sharing, secure data handling, and no-app-required integration, ZING simplifies complex interactions. This is particularly valuable for pharmaceutical sales teams working with healthcare professionals in a digital-first environment.

Challenges and Considerations

While co-browsing technology offers numerous advantages, businesses must address a few challenges:

Integration: It requires seamless integration with existing customer relationship management (CRM) systems.

Training: Representatives must be trained to use the tool effectively to maximize its potential.

Privacy Concerns: Despite built-in security measures, customers may have concerns about data sharing. Clear communication about how data is handled is essential.

Future of Co-Browsing As businesses increasingly prioritize digital-first strategies, co-browsing technology is set to grow. Its ability to provide personalized and immediate support aligns with customer expectations for fast, efficient service. Moreover, advancements in AI and machine learning could further enhance its capabilities, allowing predictive support and smarter interactions.

0 notes