#Diammonium Phosphate Market

Explore tagged Tumblr posts

Text

#Diammonium Hydrogen Phosphate Market share#Diammonium Hydrogen Phosphate Market size#Diammonium Hydrogen Phosphate Market price#Diammonium Hydrogen Phosphate Market forecast

0 notes

Text

Demand for Inorganic Salts To Remain Highest in Asia-Pacific (APAC)

To most people, ‘salt’ simply means table salt, or sodium chloride. However, the word has a specific meaning in chemistry, hence denotes a wide array of compounds, almost all of them powders. In technical terms, any compound that has a cation (positively charged atom) bonded to an anion (negatively charged atom), such that the net charge of the molecule is 0, is a salt. In the simplest form, a salt can be produced by reacting an acid with a base (alkali).

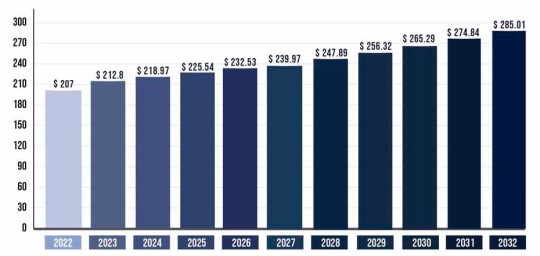

According to P&S Intelligence, the inorganic salts market is expected to display a 6.5% CAGR during 2024–2030, to reach USD 290.8 billion by 2030 from an estimated USD 188.6 billion in 2023. Inorganic salts are those that do not contain a carbon–hydrogen bond. In fact, the majority of the industrially used salts are inorganic. They are used as raw materials, intermediates, and final products in a variety of applications, such as fertilizers, food and beverage products, construction chemicals, healthcare, cosmetics, and personal care and homecare products. Hence, due to such a wide application area of such compounds, their consumption keeps on growing.

Such chemicals can be classified both on the basis of their cation and anion. For instance, sodium chloride can be classified both as a sodium salt and a chloride salt. This makes the segregation of these compounds based on their application a little easier. For instance, phosphate salts, specifically diammonium phosphate and ammonium dihydrogen phosphate (also known as monoammonium phosphate), are majorly used in fertilizers. Similarly, silicate salts are widely consumed in the glass industry; silica being the major raw material that goes into the production of glass.

Moreover, sodium chloride finds application in several cosmetic products, such as oral hygiene products, fragrance, shampoos, skin, nail, hair, cleansing, makeup and bath products, and suntans. Further, two of the major ingredients of shampoos are sodium lauryl sulphate and sodium laureth sulphate. Similarly, the key ingredients of toothpastes are calcium carbonate, calcium hydrogen phosphates, and sodium fluoride. Additionally, calcium carbonate is used in dietary calcium supplements, antacids, and medicinal tablets.

In the same way, titanium dioxide is a major component of paints and coatings as it gives them their white color. Hence, as construction activities burgeon around the world, the demand for paints and coatings will grow, which will drive the consumption of titanium dioxide. Another key material that is witnessing a booming demand with the growing construction sector is steel. It is used widely as a structural element in buildings, bridges, and towers. Its burgeoning consumption is propelling the demand for aluminum oxide, or alumina, which is used as a refractory, the bricks that line the furnaces.

Moreover, a large volume of inorganic salts isn’t used itself, but to extract their base mineral. Many important metals do not exist in the elemental stage, but as oxides and sulphides. For instance, iron exists as ferrous oxide and ferric oxide, while copper, which is also available in its native (elemental) state, is usually extracted from cuprite (cupric oxide) and chalcolite (copper [I] sulphide). Similarly, bauxite contains aluminum in the form of hydroxide salts. In the same way, calcium is usually mined from calcium carbonate (marble), while silver is found in the form of silver sulphide.

Currently, Asia-Pacific (APAC) is the largest inorganic salts market because of its massive chemical industry. The demand for pharmaceuticals, paints and coatings, personal care products, food and beverage products, and fertilizers is booming in the region, which is propelling the demand for a variety of inorganic salts. For instance, the growing automotive sales and construction activities are propelling the demand for paints and coatings, while the rising prevalence of several diseases is driving the consumption of pharmaceuticals. As all these products contain some or the other inorganic salts, their increasing demand is driving that of the latter.

Therefore, with the widening industrial production, the demand for inorganic salts will rise.

Source: P&S Intelligence

#Inorganic Salts Market Share#Inorganic Salts Market Size#Inorganic Salts Market Growth#Inorganic Salts Market Applications#Inorganic Salts Market Trends

1 note

·

View note

Text

0 notes

Text

0 notes

Text

In modern agricultural production, fertilizer granulation is an important link to improve fertilizer utilization rate and convenient application. Huaqiang fertilizer granulator with its high efficiency, energy saving characteristics, has become an indispensable equipment in fertilizer production. This article will introduce in detail the main process of fertilizer production using Huaqiang fertilizer granulator.

1. Raw material preparation First, the raw materials for fertilizer production need to be prepared, which may include nitrogen fertilizer (such as urea, ammonium sulfate, ammonium chloride), phosphate fertilizer (such as mono-ammonium phosphate, diammonium phosphate, mineral phosphate powder) and potassium fertilizer (such as potassium chloride, potassium sulfate). These ingredients will be mixed according to specific formulas to meet the needs of different crops.

2. Stir and mix After the raw material preparation stage, the raw materials are thoroughly stirred and mixed using a fertilizer Mixer such as Horizontal Ribbon Mixer or Double Shafts Paddles Mixer. This step ensures that the various ingredients in the fertilizer are evenly distributed, laying a good foundation for the subsequent granulation process.

3. Granulation process Next, the mixed raw materials are sent to Huaqiang fertilizer granulator. According to different fertilizer types and needs, you can choose different types of granulators, Such as Fertilizer Granules Compaction Machine, Flat-Die Pellet Machine, Rotary Drum Granulator, Disc Granulator. These devices compress raw materials into granules by physical methods, improving the stability and application effect of fertilizers.

4. Sieve

The granulated fertilizer particles need to be screened by a fertilizer Screening Machine (such as Rotary Screening Machine, Vibration Screening Machine). This step ensures the uniformity and consistency of the fertilizer particles and removes particles that do not meet specifications.

5. Drying and cooling The fertilizer particles after screening usually contain a certain amount of water, which needs to be dried by a fertilizer Dryer (such as a Rotary Dryer Machine) to reduce the moisture content and prevent caking and deterioration. The dried fertilizer particles are then cooled by a fertilizer Cooler(such as a Rotary Cooler Machine) for easy packaging and storage.

6. Packaging and storage Finally, the dried and cooled fertilizer pellets are packed and stored, waiting to be transported to the market or used in the field.

In summary, the use of Huaqiang fertilizer granulator for fertilizer production mainly includes raw material preparation, mixing, granulation, screening and grading, drying and cooling, packaging and storage and other key processes. The smooth progress of these processes ensures the quality of fertilizer products and the high efficiency of production. Through the application of Huaqiang fertilizer granulator, the fertilizer production process is more automated and intelligent, which greatly improves the production efficiency and product quality.

When using a fertilizer granulator or making fertilizer pellets, there are some that can give you a better understanding of them, where you can learn about the preparation of granulation and how it works. At the same time, if you want to control the size of fertilizer particles, we also have operation methods for your reference.

0 notes

Text

Di Ammonium Phosphate (DAP) Prices | Pricing | Trend | News | Database | Chart | Forecast

Di-Ammonium Phosphate (DAP) prices is a critical component in global agricultural practices, particularly in the production of fertilizers. The fluctuation of DAP prices significantly impacts farmers, agricultural industries, and the overall food supply chain. In recent years, the price of DAP has been on a volatile trend due to several contributing factors. This has resulted in significant interest in understanding the dynamics behind its pricing, its impact on various stakeholders, and how future trends might evolve.

One of the primary factors influencing the price of Di-Ammonium Phosphate is the cost of raw materials. DAP is primarily composed of phosphoric acid and ammonia, both of which are subject to global market fluctuations. Any increase in the price of these raw materials directly affects the production cost of DAP, thereby increasing its market price. Additionally, the availability of these raw materials is influenced by global political and economic conditions, such as trade policies and supply chain disruptions, further complicating the price stability of DAP.

Another key factor in determining DAP prices is the demand from the agricultural sector. As global food demand rises due to population growth, the need for fertilizers like DAP also increases. Countries that are heavily reliant on agriculture, especially developing nations, drive much of the demand for DAP. However, while demand increases, supply often struggles to keep up due to production constraints and environmental factors, pushing prices higher. Seasonal demand patterns also play a role, as certain times of the year see higher usage of fertilizers, leading to temporary price spikes.

Get Real Time Prices for Di-Ammonium Phosphate (DAP): https://www.chemanalyst.com/Pricing-data/diammonium-phosphate-dap-1179

Global trade policies and tariffs are also crucial in determining the price of Di-Ammonium Phosphate. Countries that are major producers of DAP, such as China and the United States, often impose export restrictions or tariffs that affect the global supply chain. These trade policies can result in price increases, especially when key exporting nations decide to limit their output or impose tariffs to protect their domestic industries. On the other hand, favorable trade agreements or reductions in tariffs can help to stabilize or reduce prices. The geopolitical relationships between major fertilizer-producing countries and those with large agricultural sectors are therefore significant in shaping DAP prices.

Environmental regulations and sustainability concerns are increasingly affecting the production and pricing of Di-Ammonium Phosphate. The production of DAP, especially the mining of phosphate rock and the synthesis of ammonia, has been criticized for its environmental impact, including pollution and greenhouse gas emissions. As a result, governments and international bodies have imposed stricter environmental regulations on producers, which often leads to increased production costs. These additional costs are passed down to consumers in the form of higher DAP prices. In the future, we may see more emphasis on sustainable production methods, which could either increase or decrease prices depending on technological advancements and regulatory changes.

Currency exchange rates also play a role in the pricing of DAP, particularly for countries that rely on imports. Fertilizer prices are often quoted in US dollars, and any fluctuations in the exchange rate can lead to higher or lower costs for importing countries. When the local currency depreciates against the dollar, the cost of importing DAP rises, leading to higher prices for farmers and agricultural industries in those countries. On the other hand, a strong local currency can help to offset some of the price increases caused by global factors.

In terms of future trends, the price of Di-Ammonium Phosphate is expected to remain volatile due to the ongoing challenges in the global supply chain, fluctuating raw material costs, and the increasing demand for food production. However, technological advancements in fertilizer production, such as more efficient methods for synthesizing ammonia or extracting phosphate, could help to stabilize prices in the long term. Additionally, the growing interest in sustainable agriculture practices may lead to innovations in how fertilizers are produced and used, potentially reducing the environmental impact and cost of DAP.

There is also growing competition from alternative fertilizers, which could impact the demand and pricing of Di-Ammonium Phosphate. For instance, organic fertilizers, slow-release fertilizers, and precision agriculture techniques are becoming more popular as farmers look for ways to reduce costs and increase efficiency. While DAP remains one of the most widely used fertilizers globally, shifts in agricultural practices and the adoption of new technologies could alter the demand dynamics in the coming years.

To sum up, the price of Di-Ammonium Phosphate is influenced by a wide range of factors, including raw material costs, agricultural demand, trade policies, environmental regulations, and supply chain disruptions. As global food demand continues to rise, the need for fertilizers like DAP remains critical, ensuring that its pricing will remain a key concern for farmers, industries, and governments. Understanding these factors is essential for anyone involved in agriculture or the fertilizer industry, as it allows for better planning and risk management in the face of price volatility. Looking ahead, technological innovations and sustainable practices could provide some relief from the current price challenges, but the complex interplay of global factors will continue to make DAP prices a subject of significant interest and importance.

Get Real Time Prices for Di-Ammonium Phosphate (DAP): https://www.chemanalyst.com/Pricing-data/diammonium-phosphate-dap-1179

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#DAP Price#DAP Price Monitor#DAP Pricing#Di Ammonium Phosphate#Di Ammonium Phosphate Price#Di Ammonium Phosphate Prices

0 notes

Text

The Indian agriculture sector relies heavily on fertilizers to boost crop yield and ensure food security. With the burgeoning population and increasing demand for food, fertilizer companies play a crucial role in enhancing agricultural productivity. Among the many players in this industry, a few companies stand out due to their scale, technological advancements, and market reach. In this blog, we will explore the top 10 largest fertilizer companies in India, shedding light on their contributions and impact on the agricultural landscape.

top 10 largest fertilizer companies in india

1. Indian Farmers Fertiliser Cooperative Limited (IFFCO)

IFFCO is a leading fertilizer cooperative in India, known for its vast production capacity and extensive distribution network. Established in 1967, IFFCO operates several manufacturing units across the country, producing a range of fertilizers including urea, DAP (Diammonium Phosphate), and complex fertilizers. The cooperative’s emphasis on quality and its significant role in the cooperative sector make it a cornerstone of India’s fertilizer industry.

2. National Fertilizers Limited (NFL)

NFL, a public sector enterprise, is another major player in the Indian fertilizer sector. Founded in 1974, NFL is known for its large-scale production of urea and other nitrogenous fertilizers. The company operates multiple production plants and has a robust distribution network, ensuring that its products reach farmers across India. NFL’s commitment to innovation and sustainability has helped it maintain a strong market position.

3. Rashtriya Chemicals and Fertilizers Limited (RCF)

RCF, established in 1978, is a prominent manufacturer of fertilizers and chemicals. The company produces a variety of products, including urea, DAP, and complex fertilizers. With a focus on technological advancements and operational efficiency, RCF has grown to become one of the largest fertilizer companies in India. Its comprehensive distribution network ensures that its products are widely available to the farming community.

4. Coromandel International Limited

Coromandel International, a subsidiary of the Murugappa Group, is a major player in the Indian fertilizer industry. The company produces a range of fertilizers, including urea, phosphate-based fertilizers, and micro-nutrients. Established in 1961, Coromandel International has a significant presence in both the production and distribution sectors, making it a key contributor to India’s agricultural growth.

5. Tata Chemicals Limited

Tata Chemicals, a part of the Tata Group, is a renowned name in the Indian fertilizer market. The company produces a variety of fertilizers, including urea and complex fertilizers. Founded in 1939, Tata Chemicals has a long history of innovation and excellence. Its commitment to sustainable practices and its focus on research and development have helped it maintain a competitive edge in the industry.

6. GSFC (Gujarat State Fertilizers & Chemicals)

GSFC, established in 1962, is a leading fertilizer and chemicals manufacturer in India. The company produces a wide range of fertilizers, including urea, DAP, and NPK (Nitrogen, Phosphorus, and Potassium) fertilizers. With a strong focus on technological advancements and operational efficiency, GSFC has become a major player in the Indian fertilizer sector.

7. Bharat Petroleum Corporation Limited (BPCL)

While primarily known as an oil and gas company, BPCL also has a significant presence in the fertilizer industry. The company’s fertilizer division produces urea and other nitrogenous fertilizers. Established in 1976, BPCL has leveraged its expertise in the chemical industry to become a notable player in the fertilizer sector.

8. Fertilizer Corporation of India Limited (FCI)

FCI, founded in 1961, is a public sector enterprise that plays a crucial role in the Indian fertilizer market. The company produces a range of fertilizers, including urea, ammonium sulphate, and complex fertilizers. With a focus on expanding its production capacity and improving its distribution network, FCI continues to be an important player in the industry.

9. Shree Pushkar Chemicals & Fertilizers Limited

Shree Pushkar Chemicals & Fertilizers Limited, established in 1993, is a significant player in the production of specialty fertilizers and chemicals. The company’s focus on innovation and product quality has helped it establish a strong presence in the market. Shree Pushkar’s range of products includes complex fertilizers and specialty chemicals, catering to the diverse needs of farmers.

10. Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL)

DFPCL, founded in 1979, is a major manufacturer of fertilizers and petrochemicals. The company’s product portfolio includes urea, ammonium nitrate, and other nitrogenous fertilizers. With a commitment to quality and sustainability, DFPCL has become a prominent name in the Indian fertilizer industry.

Conclusion

The Indian fertilizer industry is characterized by its diversity and scale, with several major players contributing to its growth and development. These top 10 largest fertilizer companies in india, including IFFCO, NFL, RCF, and others, play a pivotal role in supporting Indian agriculture and ensuring food security. Their commitment to innovation, quality, and sustainability continues to drive progress in the sector, benefiting farmers and the broader agricultural community.

Aradhaya, as an observer of this dynamic industry, recognizes the contributions of these leading companies and their impact on India’s agricultural landscape. Their continued efforts in improving fertilizer production and distribution are crucial for the country’s food security and agricultural sustainability.

0 notes

Text

Explore the Secrets of NPK Fertilizer Manufacturing Process

The manufacture of NPK fertilizers is a complex process that blends chemistry, engineering and agricultural science. First, it is necessary to carefully select high-quality nitrogen, phosphorus and potassium raw materials. Nitrogen sources usually include urea, ammonium salt, etc. The common phosphorus sources are mono-ammonium phosphate, diammonium phosphate, etc. Potassium sources are mostly potassium chloride or potassium sulfate.In the

NPK fertilizer manufacturing process, accurate formulation design is crucial. According to the needs of different crops and the characteristics of the soil, the ratio of nitrogen, phosphorus and potassium is determined to achieve the best fertilization effect. Leafy vegetables, for example, may require a higher proportion of nitrogen; For fruit crops, a balanced ratio of nitrogen, phosphorus and potassium is more critical.

Next comes the mixing session. Through advanced mixing equipment, nitrogen, phosphorus and potassium raw materials are evenly mixed together to ensure that each grain of fertilizer contains the exact proportion of nutrients.

In order to improve the convenience and effect of fertilizer use, granulation process is also carried out. The mixed material is made into a granular shape, so that it has good fluidity and dispersion, and it is easy for farmers to evenly fertilize the field.

Strict quality control is applied throughout the entire manufacturing process. The inspection of raw materials, the monitoring of parameters during the production process and the quality inspection of the finished product are all aimed at ensuring the quality and safety of NPK fertilizers.

Our machines use advanced automation control system to precisely control the parameters of each process, and the NPK fertilizer produced by Huaqiang Heavy Industry is widely praised in the market, helping many farmers to achieve the goal of increasing production and income.

The continuous progress and innovation of NPK fertilizer manufacturing process provides a solid support for the sustainable development of modern agriculture. It not only meets the nutritional needs of crops, but also reduces the waste of fertilizer and the impact on the environment through scientific and reasonable formulations.

In short, the NPK fertilizer manufacturing process is a knowledge full of wisdom and technology, which has injected vitality and vitality into our farmland, helping agriculture to a more prosperous future.

0 notes

Text

India Fertilizers Market Thrives on Agricultural Growth and Technological Innovations

Growth in agriculture industry and surge in technological advancements are factors driving the India Fertilizers Market in the forecast period 2026-2030.

According to TechSci Research report, “India Fertilizers Market- By Region, Competition, Forecast and Opportunities, 2020-2030”, the India Fertilizers Market was reached reach 43.76 Million Metric Tonnes by 2024 and is anticipated to project robust growth to reach 58.30 Million Metric Tonnes with a CAGR of 4.85% through 2030.

The Indian government's initiatives in the fertilizer sector have created favorable market conditions and spurred growth in various fertilizer products. With a focus on promoting sustainable agricultural practices, the government is actively encouraging the balanced and judicious use of fertilizers, including organic options. This initiative aims to reduce reliance on chemical fertilizers and enhance soil health in the long run. A significant step in this direction is the introduction of a comprehensive "Fertilizer Quality Control System" by the government.

This system includes the implementation of a single brand for fertilizers, ensuring uniform quality standards across the market. By standardizing fertilizer brands, farmers can trust the quality and efficacy of the products they use, leading to improved agricultural productivity and the overall welfare of the farming community. These government-led efforts underscore a commitment to fostering sustainable agriculture and promoting the well-being of farmers across India.

India's geographical landscape, stretching from the Himalayas in the north to the Indian Ocean in the south, encompasses diverse terrains conducive to agriculture. The Indus-Ganges plain in central India, the Deccan Plateau, and coastal plains in the east and west provide fertile ground for cultivation. With abundant flat terrain across the country, India enjoys a significant advantage for agriculture, fostering year-round crop growth. This favorable natural environment has positioned India as the world's second-largest consumer of fertilizers, trailing only behind China.

In terms of fertilizer production, Indian manufacturers produced approximately 32.4 million tonnes in 2012-2013, yet this falls short of meeting domestic demand, necessitating imports to bridge the gap. While fertilizer output has been increasing steadily, manufacturers are investing in equipment upgrades and productivity enhancements. However, the government's subsidy policies, aimed at supporting small and medium corporations, have shown mixed effectiveness, particularly in addressing the production status of different fertilizers.

The fertilizer market in India remains robust, driven by the country's significant agricultural sector, which contributes 25% to the GDP. Demand for fertilizers, especially diammonium phosphate and urea, remains high. India ranks as the world's third-largest nitrogenous fertilizer producer and the second-largest consumer of fertilizers, trailing only behind China.

Despite domestic production efforts, India continues to rely on imports, particularly for urea and diammonium phosphate, with the demand for organic fertilizers also witnessing a notable uptick in recent years. Looking ahead, India's fertilizer market is poised for sustained growth, with projections indicating a continued reliance on imports to meet demand. By 2020, India is expected to require 10 million tons of imported urea annually, while maintaining substantial imports of diammonium phosphate. Amidst these dynamics, the demand for organic fertilizers is anticipated to further rise, underscoring the evolving landscape of India's agricultural sector.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "India Fertilizers Market.” https://www.techsciresearch.com/report/india-fertilizers-market/4899.html

One of the main areas of focus in research and development (R&D) is the continuous development of new fertilizer formulations. Through extensive experimentation and innovation, R&D initiatives aim to create fertilizers with enhanced nutrient content and improved absorption capabilities. This not only helps to address the specific nutrient requirements of different crops but also contributes to boosting productivity and profitability for farmers.

For instance, the development of slow-release fertilizers has revolutionized the way nutrients are delivered to plants. These advanced formulations release nutrients gradually, providing a sustained and consistent supply over an extended period of time. This promotes better nutrient uptake by plants, resulting in improved plant health, enhanced root development, and ultimately higher yields.

The India Fertilizers Market is segmented into crop type, mode of application, regional distribution, and company.

Based on its crop type, The Fruits & Vegetables segment has emerged as the fastest-growing market segment in the forecast period based on crop type. This growth can be attributed to several factors, including changing consumer preferences towards healthier food options, increased awareness of the nutritional benefits of fruits and vegetables, and rising demand for fresh produce. Advancements in agricultural practices and technologies have facilitated improved cultivation techniques, leading to higher yields and better quality fruits and vegetables. The growing emphasis on sustainable farming methods and organic produce has further boosted the demand for fruits and vegetables in the market.

Moreover, factors such as urbanization, rising disposable incomes, and expanding retail infrastructure have contributed to greater accessibility and availability of fruits and vegetables, driving their market growth.

Based on region, north India region is expected to experience fastest grow during the forecast period. the North India region is anticipated to witness the fastest growth. Several factors contribute to this projection, including the region's fertile agricultural lands, favorable climatic conditions, and robust infrastructure. Additionally, ongoing government initiatives aimed at promoting agricultural development and investment in the region are expected to further stimulate growth. The North India region encompasses key agricultural states such as Punjab, Haryana, Uttar Pradesh, and Rajasthan, known for their significant contributions to the country's agricultural output. These states benefit from extensive irrigation networks, enabling year-round cultivation and higher crop yields.

Furthermore, increasing adoption of advanced farming practices, including precision agriculture and mechanization, is likely to drive productivity gains in the region. Overall, the conducive agro-economic environment in North India positions it as a leading contributor to the growth of the agricultural sector during the forecast period.

Major companies operating in India Fertilizers Market are:

Indian Farmers Fertiliser Cooperative Limited (IFFCO)

Rashtriya Chemicals and Fertilizers Limited

Coromandel International Limited

Tata Chemicals Limited

Gujarat Narmada Valley Fertilizers & Chemicals Limited

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=4899

Customers can also request for 10% free customization on this report.

“The India Fertilizers Market is experiencing steady growth, driven by various factors such as increasing agricultural activities, government initiatives, and technological advancements. The government's focus on promoting balanced fertilizer use and encouraging the adoption of organic alternatives has contributed to market expansion. Additionally, initiatives aimed at streamlining fertilizer quality control systems have instilled confidence among farmers, ensuring the availability of high-quality products.

The market's growth is further propelled by rising demand for fertilizers in key agricultural regions across the country, particularly in North India. With ongoing investments in infrastructure and efforts to enhance agricultural productivity, the India Fertilizers Market is poised for continued expansion in the coming years, providing essential support to the nation's agricultural sector and contributing to overall economic development,” said Mr. Karan Chechi, Research Director of TechSci Research, a research-based management consulting firm.

“India Fertilizers Market By Crop Type (Grains & Cereals, Pulses & Oilseeds, Commercial Crops, Fruits & Vegetables, Others), By Mode of Application (Foliar Spraying, Fertigation, Sowing, Drip Method, Others), By Region, By Competition Forecast & Opportunities, 2020-2030F”, has evaluated the future growth potential of India Fertilizers Market and provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in India Fertilizers Market.

Browse Related Research

India AI in Agriculture Market https://www.techsciresearch.com/report/india-ai-in-agriculture-market/4628.html India Poultry Feed Market https://www.techsciresearch.com/report/india-poultry-feed-market/20052.html India Seeds Market https://www.techsciresearch.com/report/india-seed-market/3119.html

Contact Us-

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#India Fertilizers Market#India Fertilizers Market Size#India Fertilizers Market Share#India Fertilizers Market Trends#India Fertilizers Market Growth

0 notes

Text

The results of the market trend survey of diammonium phosphate (DAP) in April showed that 9% were stable and 91% were bearish.

The mentality of those who are optimistic about stability is that companies can gather some supplies for export at ports, spring plowing orders are still being implemented, and company ex-factory prices are expected to be stable. The end demand gap in the spring plowing market is expected to still exist, and 64% of the supply is tight. The market conditions are expected to be stable and narrow.

The bearish mentality is: the international price trend of diammonium is weak, the bearish mentality of the industry has intensified, the time for shipment is running out, the downstream demand has not improved significantly, the holders are active in shipping, and the transaction price is expected to continue to decline.

In terms of construction starts, companies have no clear maintenance plans in the first half of the year. Some parking devices are expected to be restored next week, and construction starts are expected to increase by a narrow margin of 1.6 percentage points.

Overall, fluctuations on the supply side are limited, cost expectations continue to decline, and the spring plowing market on the demand side has come to an end. Traders have little time left for shipments. In addition, they are bearish on the market outlook. At this stage, active shipments are the main focus. During the Qingming Festival, The market will continue to decline during and after the holiday. However, in terms of market supply volume, 64% is stable and narrowly adjusted, and 57% has a large room for downward exploration. #DAP hashtag#CHINADAP

0 notes

Text

Exploring the Vibrant World of the Fertilizer Market: Growth and Outlook

Exploring Fertilizer Market Research Reports

The Fertilizer Industry is a cornerstone of global agriculture, playing a pivotal role in ensuring food security and sustainable crop production. With an ever-increasing demand for agricultural products to feed a growing population, understanding the intricacies of the fertilizer market is essential. Let's delve deeper into this vital sector with comprehensive data and insightful analysis.

Assessing Fertilizer Market Outlook

The outlook for the fertilizer market is shaped by a multitude of factors, including technological advancements, regulatory frameworks, and shifting consumer preferences. Industry experts offer valuable insights into future market trends and developments, aiding stakeholders in making informed decisions:

Technological Innovations: Advancements in fertilizer manufacturing processes, such as controlled-release formulations and precision agriculture techniques, are driving market growth by enhancing efficiency and sustainability.

Environmental Considerations: Increasing awareness of environmental sustainability and concerns about nutrient runoff and soil degradation are driving demand for eco-friendly fertilizers and organic alternatives.

Market Disruptions: External factors such as geopolitical tensions, trade disputes, and climate change can significantly impact fertilizer markets, leading to supply chain disruptions and price volatility.

Understanding Fertilizer Market Size and Growth

The fertilizer market is vast and continues to expand to meet the needs of farmers worldwide. Statistical data provides valuable insights into the market's size and growth trajectory. The Fertilizer Market was valued at approximately USD 170 billion in 2021 and is projected to exceed USD 230 billion by 2026, with a compound annual growth rate (CAGR) of around 5% during the forecast period. Market dynamics vary across regions, influenced by factors such as agricultural practices, government policies, and climatic conditions. While emerging economies show promising growth potential, mature markets exhibit steady but moderate expansion.

Click here – To Know more about Crop Protection market

Challenges in Fertilizer Marketing

Fertilizer marketing faces numerous challenges, requiring industry players to navigate complex market dynamics and regulatory landscapes:

Price Volatility: Fluctuations in raw material prices, currency exchange rates, and energy costs can affect fertilizer production costs and profit margins, necessitating risk management strategies.

Regulatory Compliance: Adherence to stringent environmental regulations and quality standards poses compliance challenges, particularly for multinational companies operating in diverse regulatory environments.

Market Competition: Intense competition among fertilizer manufacturers and suppliers compels companies to differentiate their products through branding, product innovation, and value-added services.

Analyzing Market Share of Different Fertilizers

The fertilizer market comprises various types of fertilizers, each with its unique properties and market dynamics:

Nitrogen Fertilizers: Nitrogen-based fertilizers, such as urea, ammonium nitrate, and ammonium sulfate, account for the largest market share due to their essential role in promoting plant growth and protein synthesis.

Phosphorus Fertilizers: Phosphorus-based fertilizers, including diammonium phosphate (DAP) and triple superphosphate (TSP), are vital for enhancing root development, flowering, and fruiting in crops.

Potassium Fertilizers: Potassium-based fertilizers, such as potassium chloride (MOP) and potassium sulfate (SOP), contribute to plant stress tolerance, water regulation, and fruit quality improvement.

Exploring Fertilizer Market Trends

Fertilizer market trends reflect evolving consumer preferences, technological advancements, and sustainability initiatives:

Shift Towards Sustainable Agriculture: Growing environmental concerns and regulatory pressures are driving the adoption of sustainable fertilizer practices, such as precision farming, organic fertilizers, and soil health management.

Digitalization and Precision Agriculture: Integration of digital technologies, such as drones, sensors, and data analytics, is revolutionizing fertilizer application techniques, enabling farmers to optimize nutrient use efficiency and minimize environmental impact.

Rise of Specialty Fertilizers: Increasing demand for high-value crops, such as fruits, vegetables, and cash crops, is fueling the adoption of specialty fertilizers tailored to specific crop needs and soil conditions.

Fertilizer Additives Market: Enhancing Fertilizer Performance

Fertilizer Additives play a crucial role in improving fertilizer efficacy, nutrient uptake, and crop yields. Key trends in the fertilizer additives market include:

Adoption of Micronutrient Additives: Micronutrient additives, such as zinc, boron, and manganese, are gaining traction for addressing soil deficiencies and enhancing plant nutrition.

Bio-stimulants and Soil Conditioners: Bio-stimulants and soil conditioners, derived from natural sources such as seaweed extracts and humic substances, are increasingly used to promote plant growth, stress tolerance, and soil health.

Innovations in Coating Technologies: Coating technologies, such as polymer coatings and encapsulation, are being employed to improve fertilizer release kinetics, reduce nutrient losses, and prolong nutrient availability in the soil.

Conclusion: Navigating Opportunities in the Fertilizer Market

The fertilizer market presents a dynamic landscape with numerous opportunities and challenges for industry stakeholders. By leveraging market insights, embracing technological innovations, and adopting sustainable practices, companies can navigate market uncertainties, capitalize on emerging trends, and contribute to global food security and agricultural sustainability. Continued investment in research and development, strategic partnerships, and market diversification will be essential for long-term success in the evolving fertilizer market.

#Fertilizer Industry#Fertilizer Market Size#Fertilizer Market Analysis#Fertilizer Market Demand#Fertilizer Market Forecast#Fertilizer Market Growth#Fertilizer Market Outlook#Fertilizer Market Revenue#Fertilizer Market Trends#Fertilizer Industry Research Reports#Fertilizer Market Research Reports#Fertilizer Market Major Players#Fertilizer Market#Fertility Supplements Market#Fertilizer Production Machinery Market in India#Trends in Global Fertilizer Market#Fertilizer Additives Market#Challenges in Fertilizer Marketing#Market Share of Different Fertilizers#Fertilizer Market in India

0 notes

Text

2024 Diammonium Hydrogen Phosphate Market Outlook Report: Industry Size, Market Shares Data, Insights, Growth Trends, Opportunities, Competition 2023 to 2031

Dublin, Feb. 23, 2024 (GLOBE NEWSWIRE) — The “2024 Diammonium Hydrogen Phosphate Market Outlook Report: Industry Size, Market Shares Data, Insights, Growth Trends, Opportunities, Competition 2023 to 2031” report has been added to ResearchAndMarkets.com’s offering. The Diammonium Hydrogen Phosphate market is anticipated to exhibit fluctuating growth patterns in the near term, largely influenced by…

View On WordPress

0 notes

Text

Navigating the Growth Trajectory: Insights into the Dynamic Phosphoric Acid Market

The phosphoric acid market was USD 45,671.2 million in 2022, and it will grow at a rate of 4.1% in the years to come, to touch USD 63,186.8 million by 2030, as stated by a market research institution P&S Intelligence. The diammonium hydrogen phosphate market will grow significantly in the years to come with a rate of about 5%, because of the growing need for manure to increase agricultural…

View On WordPress

#Acid#Agricultural Sector#chemical industry#Competitive Landscape#Demand Drivers#Emerging Markets#Global Market#growth opportunities#Industrial applications#industry insights#Investment Opportunities#key trends#market analysis#Market dynamics#Market Forces#Market Variation#Production Trends#Strategic Insights

0 notes

Text

The Impact of Global Markets on Diammonium Phosphate (DAP) Price Trends

Throughout H1 2023, Asian Diammonium Phosphate (DAP) Prices experienced fluctuating trends driven by steady downstream demands, maintaining a narrow range initially. However, by mid-Q2, declining offtakes led to a southward shift in momentum. In Europe, reduced freight and crude oil prices lowered upstream costs, contributing to decreased DAP prices. North America reflected global trends, with oversupply and weak demands causing bearish market sentiments.

Definition

Diammonium Phosphate (DAP) is a widely used fertilizer containing both nitrogen and phosphorus. It's a granular substance formed by reacting ammonia with phosphoric acid. DAP provides essential nutrients for plant growth, promoting healthy root development, flower formation, and fruit production. It's applied to various crops to enhance soil fertility and increase agricultural yields.

Request for Real-Time DAP (Diammonium Phosphate) Prices: https://www.procurementresource.com/resource-center/dap-price-trends/pricerequest

Key Details About the DAP (Diammonium Phosphate) Price Trend:

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the DAP (Diammonium Phosphate) in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The DAP (Diammonium Phosphate) Price chart, including India DAP (Diammonium Phosphate) price, USA DAP (Diammonium Phosphate) price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting the DAP (Diammonium Phosphate) Price Trend:

Key Players:

Sichuan Blue Sword Chemical (Group)Co., Ltd.

Jordan Phosphate Mines Co.PLC

Coromandel International Limited

Ava Chemicals

Ballance Agri-Nutrients Ltd.

China Blue Chemicals Ltd.

Saudi Arabian Mining Company ("MA'ADEN")

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

1 note

·

View note

Text

Assessing the Competitive Landscape of the Ammonium Phosphates Market

Ammonium phosphates are essential chemical compounds used in various industries due to their versatile properties and applications. This market encompasses a wide array of products and plays a crucial role in sectors like agriculture, food processing, and industrial processes. In this article, we will delve into the definition, market overview, scope, growth factors, industry landscape, and emerging trends within the ammonium phosphates market.

Definition: Ammonium phosphates refer to a group of inorganic salts that contain both ammonium and phosphate ions. These compounds are highly valued for their use as fertilizers and flame retardants. They typically include substances like monoammonium phosphate (MAP) and diammonium phosphate (DAP), each of which has distinct properties and applications.

Market Overview & Scope: The ammonium phosphates market is a significant segment of the global chemical industry. Its scope extends across various sectors, primarily driven by the agricultural and chemical industries. In agriculture, ammonium phosphates are widely used as fertilizers to enhance crop yields and improve soil quality. In the chemical sector, they find application in flame retardants for materials like textiles and plastics. The market scope also includes use in food processing, where ammonium phosphates are utilized as food additives and leavening agents.

Market Growth: The ammonium phosphates market has witnessed substantial growth in recent years. This growth can be attributed to the increasing demand for fertilizers to support global food production and the growing emphasis on sustainable agriculture practices. Furthermore, the need for fire-resistant materials in construction and other industries has led to a surge in the use of ammonium phosphates as flame retardants.

Market Industry: The ammonium phosphates market industry surrounding is multifaceted and consists of several key players, including chemical manufacturers, agribusinesses, and food processing companies. Chemical manufacturers are involved in the production and distribution of ammonium phosphates, catering to the diverse needs of the agricultural and industrial sectors. Agribusinesses utilize these compounds to boost crop yields, while food processing companies incorporate them into various products to enhance quality and texture.

Trends: Several noteworthy trends have emerged in the ammonium phosphates market. One significant trend is the increasing emphasis on sustainable agriculture and environmentally friendly fertilizers. This has driven the development of more eco-friendly ammonium phosphate formulations. Additionally, as regulations regarding flame retardants become more stringent, there is a growing focus on developing safer and more effective flame retardant materials, which often include ammonium phosphates as key components.

In conclusion, the ammonium phosphates market is a dynamic sector with diverse applications, ranging from agriculture to fire safety. Its sustained growth is driven by the evolving needs of these industries and the development of innovative products to meet them. As we move forward, the market is likely to continue evolving in response to environmental and regulatory pressures, ensuring a fascinating trajectory for this essential chemical segment.

0 notes

Text

Phosphoric Acid Prices | Pricing | Trend | News | Database | Chart | Forecast

The global phosphoric acid market has seen notable fluctuations in prices over recent years, driven by several key factors such as raw material costs, supply chain disruptions, and changes in demand across various industries. Phosphoric acid, an essential chemical in the production of fertilizers, food additives, and industrial applications, plays a critical role in multiple sectors, making its price trends significant for businesses and consumers alike.

One of the primary drivers of phosphoric acid prices is the cost of phosphate rock, the primary raw material used in its production. Fluctuations in phosphate rock availability and mining costs have a direct impact on phosphoric acid prices. Many phosphate mines are located in politically or economically unstable regions, leading to potential supply constraints. This instability can cause sudden price hikes when geopolitical issues disrupt supply chains. Additionally, the costs associated with extraction, refining, and transportation of phosphate rock contribute significantly to the overall production costs of phosphoric acid, thereby influencing market prices.

Get Real Time Prices for Phosphoric Acid: https://www.chemanalyst.com/Pricing-data/phosphoric-acid-1162

Another important factor affecting phosphoric acid prices is the energy-intensive nature of its production process. The production of phosphoric acid requires large amounts of energy, particularly in the form of electricity and natural gas. As energy prices fluctuate, so too do the production costs for phosphoric acid manufacturers. The volatility of global energy markets, especially the sharp increases seen in recent years due to geopolitical tensions and supply shortages, has translated into higher phosphoric acid prices. This is especially true in countries that rely heavily on imported energy, as any increase in fuel costs directly raises the expenses associated with chemical production.

Demand-side factors also play a crucial role in shaping phosphoric acid prices. The agricultural industry represents one of the largest consumers of phosphoric acid, particularly in the production of fertilizers such as monoammonium phosphate (MAP) and diammonium phosphate (DAP). The growing global population, coupled with the need for higher agricultural yields, has led to increased demand for fertilizers, thus pushing up the demand for phosphoric acid. However, the fertilizer market is highly sensitive to external factors such as weather patterns, crop yields, and government policies. For instance, adverse weather conditions or poor harvests can reduce the demand for fertilizers, leading to a temporary decline in phosphoric acid prices. Conversely, favorable agricultural conditions or government subsidies for fertilizer usage can boost demand and raise prices.

In addition to agriculture, phosphoric acid is used in various industrial applications, including metal treatment, water treatment, and as a food additive. The demand from these industries is generally more stable compared to agriculture, but any significant economic slowdown or changes in regulations can influence their consumption patterns. For example, environmental regulations that limit the use of certain chemicals in industrial processes can reduce demand for phosphoric acid, while innovations in manufacturing techniques that increase its efficiency may boost demand.

Supply chain dynamics also impact the phosphoric acid market. Disruptions in transportation, particularly those affecting maritime shipping, can cause delays in the delivery of raw materials or finished products, leading to temporary supply shortages. These shortages can drive up prices, especially if they coincide with periods of high demand. The COVID-19 pandemic, for instance, caused widespread disruptions in global supply chains, leading to increased logistics costs and longer lead times for chemical products, including phosphoric acid. The ongoing challenges related to shipping, port congestion, and labor shortages continue to exert upward pressure on prices.

Geopolitical factors are another significant influence on phosphoric acid prices. Countries that are major producers and exporters of phosphate rock and phosphoric acid, such as Morocco, China, and the United States, have considerable control over global supply. Any trade restrictions, export tariffs, or political instability in these regions can cause price volatility. For example, trade disputes between major economies can lead to the imposition of tariffs on phosphoric acid or its raw materials, resulting in higher prices for importers. Additionally, government policies that promote or restrict the mining of phosphate rock can alter the supply-demand balance, further affecting prices.

Environmental concerns and sustainability initiatives are also shaping the phosphoric acid market. With increasing awareness of environmental issues, governments and industries are focusing on reducing their carbon footprint and adopting more sustainable practices. This shift has led to the development of alternative technologies for producing phosphoric acid, such as recycling phosphorus from waste streams. While these technologies are still in their infancy and not widely adopted, they have the potential to reduce reliance on phosphate rock mining and stabilize prices in the long term. However, in the short term, the costs associated with developing and implementing these technologies may contribute to higher phosphoric acid prices.

Looking ahead, the outlook for phosphoric acid prices will likely remain influenced by a combination of supply and demand factors, energy prices, geopolitical developments, and technological advancements. The increasing global focus on food security and sustainable agriculture is expected to keep demand for phosphoric acid strong, particularly in emerging economies with growing populations. At the same time, energy market volatility and environmental concerns will continue to play a role in determining the cost of production and, consequently, market prices.

In conclusion, phosphoric acid prices are shaped by a complex interplay of raw material costs, energy prices, demand from agriculture and industry, supply chain disruptions, and geopolitical factors. As the world continues to evolve, these variables will remain in flux, contributing to ongoing price volatility in the phosphoric acid market. Businesses and consumers that rely on phosphoric acid will need to stay informed about these trends and developments to effectively navigate the challenges and opportunities presented by this dynamic market.

Get Real Time Prices for Phosphoric Acid: https://www.chemanalyst.com/Pricing-data/phosphoric-acid-1162

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Phosphoric Acid#Phosphoric Acid Price#Phosphoric Acid Price Monitor#Phosphoric Acid Pricing#Phosphoric Acid News#Phosphoric Acid Database

0 notes