#DexCom Patents

Explore tagged Tumblr posts

Text

Understanding DexCom Patents: Innovations in Diabetes Technology

Dexcom Inc. is a pioneering company in the field of continuous glucose monitoring (CGM) systems, widely recognized for its commitment to innovation and technological advancement. At the heart of Dexcom's success is its extensive and robust patent portfolio, which protects the company’s cutting-edge technologies and underpins its leadership in the diabetes management industry. This article provides a comprehensive analysis of Dexcom’s patents, highlighting the strategic importance of its intellectual property (IP) assets in maintaining its competitive edge and driving future growth.

To know about the assumptions considered for the study, Download for Free Sample Report

Dexcom Inc.: A Leader in Continuous Glucose Monitoring

Founded in 1999, Dexcom has revolutionized diabetes care through its innovative CGM systems, which allow people with diabetes to monitor their blood glucose levels in real-time. The company’s patented technologies have set new standards in accuracy, convenience, and patient experience, making Dexcom a trusted name in the healthcare industry.

1. The Strategic Importance of Dexcom’s Patents

Protection of Core Technologies: Patents are critical to Dexcom’s business strategy, providing legal protection for the company’s core technologies. These patents cover a wide range of innovations, from sensor design and manufacturing processes to data analytics and wireless communication technologies. By securing patents for its key innovations, Dexcom can safeguard its proprietary technologies from competitors, ensuring that it remains at the forefront of the CGM market.

Barrier to Entry: Dexcom’s extensive patent portfolio creates significant barriers to entry for potential competitors. The company’s patents cover crucial aspects of CGM technology, making it difficult for other companies to develop similar products without infringing on Dexcom’s IP rights. This strong patent protection not only helps Dexcom maintain its market leadership but also supports the company’s pricing power and profitability.

Innovation and R&D: Dexcom’s commitment to innovation is reflected in its ongoing investment in research and development (R&D). The company’s R&D efforts are focused on improving the accuracy, reliability, and usability of its CGM systems. As a result, Dexcom continuously files new patent applications to protect the outcomes of its R&D activities. These patents are essential for Dexcom’s long-term growth, as they enable the company to introduce new and improved products to the market while maintaining a competitive edge.

2. Key Patents in Dexcom’s Portfolio

Sensor Technologies: One of the most critical areas of Dexcom’s patent portfolio is its sensor technologies. These patents cover the design, fabrication, and operation of Dexcom’s glucose sensors, which are the core components of its CGM systems. Dexcom’s sensors are known for their high accuracy and long wear time, which are key differentiators in the market. The company’s patents in this area protect its proprietary sensor designs, ensuring that Dexcom remains a leader in sensor technology.

Wireless Communication: Another important category of Dexcom’s patents relates to wireless communication technologies. Dexcom’s CGM systems rely on secure and reliable wireless communication to transmit glucose data from the sensor to the display device or smartphone app. The company’s patents in this area cover various aspects of wireless communication, including data transmission protocols, signal processing, and power management. These patents are crucial for ensuring the seamless and efficient operation of Dexcom’s CGM systems.

Data Analytics and Software: Dexcom’s patent portfolio also includes a significant number of patents related to data analytics and software. These patents cover the algorithms and software used to analyze glucose data, generate insights, and provide real-time alerts to users. Dexcom’s software innovations are essential for enhancing the user experience and enabling personalized diabetes management. By protecting its software technologies with patents, Dexcom can continue to offer advanced features and functionalities that set its CGM systems apart from competitors.

3. Geographic Distribution of Dexcom’s Patents

United States: The majority of Dexcom’s patents are filed and granted in the United States, which is the company’s largest and most important market. The U.S. patent system provides strong protection for technological innovations, making it a critical jurisdiction for Dexcom’s IP strategy. The company’s U.S. patents cover a wide range of technologies, ensuring comprehensive protection for its CGM systems.

Europe: Dexcom also holds a significant number of patents in Europe, which is another key market for the company. European patents provide protection across multiple countries, allowing Dexcom to secure its innovations in a region with a large and growing diabetes population. The company’s European patents are essential for its ability to compete in the European market and expand its customer base.

Asia-Pacific: The Asia-Pacific region is an emerging market for Dexcom, with significant growth potential. Dexcom’s patent portfolio in this region is strategically important as the company seeks to expand its presence in countries such as China, Japan, and Australia. By securing patents in these markets, Dexcom can protect its innovations and establish a strong foothold in the region’s rapidly growing healthcare market.

4. Recent Patent Filings and Innovations

Next-Generation Sensors: Dexcom continues to innovate in the field of sensor technology, with recent patent filings focused on next-generation sensors that offer even greater accuracy, longer wear times, and improved patient comfort. These innovations are expected to drive the development of new CGM systems that further enhance the quality of life for people with diabetes.

Artificial Intelligence and Machine Learning: Dexcom is also exploring the use of artificial intelligence (AI) and machine learning (ML) in its CGM systems. The company has filed patents related to AI-driven data analytics, which can provide more accurate glucose predictions and personalized treatment recommendations. These technologies have the potential to revolutionize diabetes management by offering more precise and individualized care.

Integration with Other Health Technologies: Dexcom is actively pursuing patents related to the integration of its CGM systems with other health technologies, such as insulin pumps and smartwatches. By securing patents in this area, Dexcom can develop integrated solutions that offer seamless diabetes management and improve patient outcomes. These innovations are likely to become increasingly important as the market moves towards more connected and interoperable healthcare solutions.

5. The Impact of Dexcom’s Patents on Its Market Position

Market Leadership: Dexcom’s strong patent portfolio is a key factor in its market leadership. The company’s patents protect its technological innovations, allowing it to offer superior products that meet the needs of people with diabetes. As a result, Dexcom has established a dominant position in the CGM market, with a large and loyal customer base.

Competitive Advantage: Dexcom’s patents provide a significant competitive advantage by preventing competitors from copying its technologies. This protection allows Dexcom to maintain its leadership position in the market and continue to invest in innovation. The company’s patents also support its ability to charge premium prices for its CGM systems, contributing to its strong financial performance.

Growth Opportunities: Dexcom’s patent portfolio also opens up new growth opportunities for the company. As the global demand for CGM systems continues to rise, Dexcom’s patents enable it to expand into new markets and develop new products. The company’s ongoing innovation, supported by its patents, positions it well for future growth in the rapidly evolving diabetes care market.

Conclusion

Dexcom Inc.’s patent portfolio is a cornerstone of its success in the continuous glucose monitoring industry. By protecting its core technologies and fostering innovation, Dexcom has established itself as a leader in diabetes care. The company’s patents not only provide a competitive advantage but also support its long-term growth strategy. As Dexcom continues to innovate and expand its patent portfolio, it is well-positioned to maintain its leadership in the CGM market and improve the lives of people with diabetes around the world.

0 notes

Photo

The other fun fact is that it's borderline impossible to find how your medical devices work! The best you can get for finding out how, say, a Dexcom works is by either looking at journal articles from 20 years ago, or by reading fucking patents.

251K notes

·

View notes

Text

How absolutely necessary CONTINUOUS GLUCOSE MONITORING is ?

Everybody knows about diabetes at this point. It can cause serious damage to several of the body functions mainly marring the nervous and vascular systems. A 300% jump in number of diabetic patients was observed in less than 35 years (According to WHO) and as reported by International Diabetes Federation in 2021, roughly 540 million adults between age 20 – 80 are diabetic. Diagnosis at prediabetic stage and controlling blood sugar levels early-on, greatly diminishes the possibility of advancements to Type 1 and Type 2 diabetes; and glucometer or glucose meter helps monitor blood glucose levels on a regular basis, aiding in maintaining sufficient concentration of sugar or glucose in the blood.

Continuous Glucose Monitoring Systems

Continuous Glucose Monitoring or CGM measures and tracks glucose level continuously, enabling either the patient or the doctor or both, to gain understanding of the trends like spike and fluctuations. CGM supports people by letting them efficiently adapt to variations. It helps in accurate diabetes management and drug prescription for Type 1 and Type 2 diabetes. Lifestyle changes can be implemented effortlessly as well. CGM is facilitated by CGM System that fundamentally are constituted by sensors, transmitters and receivers.

But WHAT exactly is a CGM System?

It is an electronic medical device employed to continuously monitor blood glucose levels in the blood stream day and night, from anywhere between couple of days to couple of weeks. It is a home glucose monitor worn continuously for long durations. It relieves the patients’ trauma of repeatedly pricking their fingers. Traditionally the sensor and transmitter of the CGM system is packaged into a single unit that stays either on the abdomen or arm with adhesives; and the receiver is a handheld device to which the data is transmitted.

And HOW does it work?

A tiny sensor is placed right under the skin with the help of an applicator. Adhesives on the applicator holds the sensor in-place and prevents accidental dislodging. These sensors measure the concentration of sugar in the body fluids. Usually, the blood sugar level reading is taken every 5 minutes. The CGM sensors are non-reusable and requires replacement. The electronics in the CGM system relays the accumulated blood glucose data, mostly wirelessly, via transmitters to receivers in a handheld electronic device (like a smart watch, digital display or smart phones).

So WHICH one to choose?

As always, the market is flooded with variety of Continuous Glucose Monitors. It is always difficult to choose and trust one’s decision when it comes to medical devices and instruments. The digital device market for diabetes monitoring is eying to reach $12 billion which was $3billion 2018, by 2025.

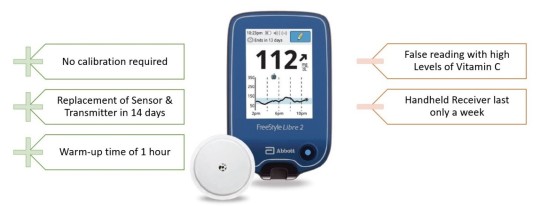

1. Abbott Freestyle Libre 2

It is 2nd generation continuous glucose monitor developed by Abbott laboratories. It was released in 2020 and addressed certain issues with Freestyle Libre such as interreference due to presence of Aspirin, absence of alarms & alerts and usage approval for only 18 years or older. It is one of the popular CGM system mainly due to its low cost. With Libre 3 on the horizon, thinner and sustainable option, which also claims to have the smallest sensor in the world, will be welcomed. In the last month itself Abbott Diabetes Care Inc. were granted more than 5 patents for CGM related technologies – An automatic sensor insertion device, Connectors for analyte sensor & associated systems and System displays for monitoring devices to name a few; which makes cogent the development of this CGM system is towards lesser inaccuracies.

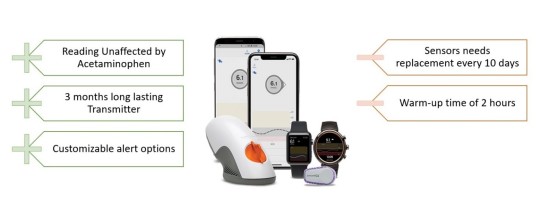

2. Dexcom G6

G6 is the next iteration of Dexcom G5. Improving on the newer version, the technological aspect has been given importance. Direct-to-mobile app technology eliminates the need of a separate reader. This also enables real-time monitoring of blood glucose levels. Data sharing capability allows the user to get immediate attention, if necessary. Analyte sensor are not impacted by any medication like acetaminophen or vitamin C. Above all, Dexcom G6 has an automatic sensor insertion applicator.

3.Medtronic Guardian Sensor 3

Developed by Medtronic, being a stand-alone system, unrestricted usage and compatibility with insulin pumps, unchallenging sensor insertion and predictive alerts are some pros of Guardian sensor 3 But requiring extra adhesion, lack of user-friendly design of transmitter & involving many steps to set-up, calibration every 12-hours, 2 hours of warm-up time and comparative higher price point together with false reading reported by users, makes it the most unreliable and difficult to recommend CGM system. According to mean absolute relative difference or MARD (The lower the better) Guardian Sensor 3 landed in the range of 9 – 11 percent.

4.Eversense CGM System

The only, first-of-its-kind CGM system with implanted sensor, with a wear life of 90 days, eliminating the need to replace it very frequently. The transmitter is attached over the implant that can be removed as per the user without damaging the sensor; but which needs adhesive reapplication every 24 hours of continuous use. It has an excellent UI for the mobile app offering range of customizations including personalized sugar level fluctuation alert. As per FDA, it requires calibration once a day and one-time 24 hours long warm-up Eversense 90-day received 8.5% to 9.6% MARD score.

Why DEXCOM G6 is the ultimate CGM?

With a MARD score of 9%, and 9.3% for Freestyle Libre 2, Dexcom G6 is the most precise and accurate CGM system in the market. The lower priced Freestyle Libre 2 attracts potential users but data accuracy and reliability surpasses concerns of financial nature. The continuous fetching of data facilitated by a smartphone along with reported less sensor failures places it over its competition.

1 note

·

View note

Text

Medical industry companies are increasingly innovating in fintech

Examination of patent filings shows a growing degree of fintech related applications in the industry over the course of the last year

Examination and innovation in fintech in the clinical area is on the ascent.

The latest figures show that the quantity of fintech related patent applications in the industry remained at 12 in the three months ending Walk - up from five over a similar period in 2021.

Figures for patent awards connected with fintech followed an alternate example to filings - shrinking from 10 in the three months ending Walk 2021 to three in a similar period in 2022.

The figures are assembled by GlobalData, who track patent filings and awards from true workplaces all over the planet. Using literary investigation, as well as true patent orders, these licenses are gathered into key topical regions, and linked to key organizations across different industries.

Fintech is one of the key regions followed by GlobalData. It has been recognized similar to a key problematic power facing organizations in the coming years, and is one of the areas that organizations investing assets in now are supposed to receive benefits from.

The figures likewise give an insight into the biggest innovators in the area.

Johnson and Johnson was the top fintech innovator in the clinical area in the most recent quarter. The organization, which has its base camp in the US, documented six fintech related licenses in the three months ending Walk. That was up from two over a similar period in 2021.

It was trailed by the US based Danaher Corp with two fintech patent applications, the US based Becton Dickinson and Co (2 applications), and the US based DexCom Inc (1 applications).

0 notes

Text

Diabetes rant

Been awhile since I posted but I'm just really sick of having to pay x amount to live. I need to vent or the urge to off myself will win and i'm not going to let the assholes win. So ignore if you want I just want to vent. My bg is five hundred currently so yeah. I'm just kinda pissed.

Diabetics in America, type 1 and type 2 have to make do by buying insulin from other companies, paying out of pocket prices that can range from 200 to 1500 for a month supply. Relying on Diabetic Facebook support groups where other Diabetics donate extra supplies, copay cards that only work half the time, and fiancal assistance programs that you only qualify if you're in the lowest possible income bracket. This is the fault of Pharmacy benefit managers, insurance companies, the top three pharmaceutical companies, Eli Lily, sanofi and novonordisk that own the patents. Then all three blame each other for the high price, blame the pbms and insurance companies who into blame each other as well. Fun fact Eli Lily came out with a generic insulin. Insulin lispro it's basically humalog. Not that they have been advertising it, the bastards. I've been told at my pharmacy an out of pocket price of humalog is $546 for a month's supply of vials, what's is insulin lispro's out of pocket price for a month's supply? $180 per vial. Had anyone had any luck finding out what it cost the companies to make their analog insulin? I've been looking for that data for 8 years still haven't come across a legitimate source. I heard once from a novonordisk drug rep that Eli Lily makes one vat of insulin for $50 dollars. Lol representative was trying to make the other company look bad but they all do it. So you have insurances that pick which insulins get to be on their formulary. BCBS for example favors humalog. So good luck unless you're allergic to humalog they will deny any prior authorization for another fast acting. My BCBS ins doesn't care that fiasp and novolog work better for me. Now I'm using humalog u 200 which is working for now thank God. Let's now get started on Continuous Glucose monitors, dexcom g6, freestyle libre and guardian sensors.

Having a CGM literally saved my life, I have a 'good insurance plan' I have an 800 dollar deducible, 5000 out of pocket. Met my 800. Dollar ded at the first of the year. Wanna know how? I had to drop $1000 to pay for a 3 month supply of dexcom g6. So I met my deductible so now everything is great? Wrong! I still have to pay %20 coins. So if I want 3 month supply I have to pay $367 dollars of my portion. I don't know about most people but I find it difficult to come up with that sort of lump sum of cash. It's September and I'm only 2000 in on my 5000 out of pocket. Why because I don't go to the doctor unless I have no other choice. I have enough trouble just paying for my diabetic supplies let alone the copays, and remaining balance left over at the end of doc visits. Only doc I see regularly is my Endo. Then BCBS had the gall to keep making me use dme (durable medical equipment) companies that charge a hell of a lot more than pharmacy benefits do. Supposedly bcbs is going to let commerical insurance patients use pharmacy benefits in October so if you have BCBS and use a dexcom CGM have your doc or Endo send prescription to community Walgreens who also has a $120 coupon.

Freestyle libre is at least trying to do something, funnily enough because they market their CGM as a meter and for type two diabetes. Out of pocket price is 75 using e vouch for a month supply, sensors last 14 days, 1 hour warm up time, no alarms but they are working on it. You can use a smart phone and save some money by not getting a reader. Guardian don't know much about but I tried one and sensor died on day one. If the senors work then it does have some advantages. transmitter lasts a year and is rechargable, and you can restart sensor fairly easily.

Pumps Omni pod, tandem and Medtronic.

Gotta Omni pod hands down even though I got a tandem tslim x2 pump. Omni pod is tubeless, Omni pod pods can be potentially pharmacy benefits. So go omnipod also because you can hack the classic pump with the open aes algorithm and get a artifical pancreas because #we aren't waiting. FDA approval takes forever!

Good news on dexcom front, G7 supposedly will come out in end of 2020. It will last fifteen days, 1 hour wait time and transmitter is inside senors so you throw whole unit away. Why is it going to be less expensive? They want to market it towards type 2s.

Did you know you can restart dexcom g6 transmitters and senors. Well you can check out YouTube for fellow Diabetics' instructions. It will save you money and stick it to the assholes trying to monetize diabetes.

It sickens me that Sir Fredrick Banting and his cohorts sold the patent for insulin for a dollar each, total sale being $4 dollars to Ontario college. They sold it so it would be affordable and accessible for everyone.

Back in 1942 Eli Lily and two other companies got in trouble for price fixing insulin. What's the difference between then and now? The government actually did its job and stepped into to stop them.

Everyone who price gouges insulin and Cgms and pumps should be ashamed.

I'm sick of being taken advantage of for an autoimmune disease I don't have a choice in. I'm pissed. I want justice.

I want a healthcare system that won't bankrupt me. I want a system that actually focuses on preventive care and not being for profit. Fun fact our healthcare has not always been for profit. You can thank president Nixon for that.

"Nixon signed into law, the Health Maintenance Organization Act of 1973, in which medical insurance agencies, hospitals, clinics and even doctors, could begin functioning as for-profit business entities instead of the service organizations they were intended to be."

Also fun fact that is when the big top three insulin producers starting raising the prices of insulin and they haven't stopped since.

So the solution to fix our healthcare system is pretty damned simple. Go back to having it be non for profit.

#i want justice#bernie is for affordable insulin#insulin price fraud#class action suit against insulin companies#against the insulin companies#insulin#insulin pump#actually diabetic#t1d#t1diabetic#t1dlookslikeme#t1dm#t1dcommunity#t1dlife#my rants#ranting#im pissed#im done with this#i will fo everything i can to make insulin affordable for everyone if its the last thing i do

21 notes

·

View notes

Link

This is great. There are similar things going on with pumps and CGMs already. The tslim if paired with a dexcom can run either basal IQ (which predicts a hypo and stops the basal for a period to try and stop glucose levels dropping) or control IQ where it does that and also puts more insulin in if it predicts a high so these algorithms are already in use but making them more manageable and easier for patents to access is great. Currently in the UK children under 12 can fairly easily get a pump funded but the NHS doesn’t usually fund a dexcom (Libre flash monitoring is readily available but doesn’t talk to a pump) so we find the dexcom ourselves. (Children over 12 can often get funding for pumps it’s just a little trickier. Adults need to meet certain criteria or self fund.)

Some good news!

38 notes

·

View notes

Text

Saudi Arabia Glucometers Market to Grow with an Impressive CAGR until 2026

Increasing demand for diabetes diagnosis and treatment the growth of Saudi Arabia Glucometers Market, in the forecast period.

According to TechSci report, “Saudi Arabia Glucometers Market By Product Type (Self Glucose Monitoring Glucometers v/s Continuous Glucose Monitoring Glucometers), By Technique (Invasive v/s Non-Invasive), By Type (Wearable v/s Non-Wearable), By Distribution Channel (Hospital Pharmacies, Retail Outlet, Online, Others), By End User (Hospitals & Clinics, Diagnostic Centers, Home Care, Others), By Region, Competition Forecast & Opportunities, 2026”, Saudi Arabia glucometer market is expected to expand its market share in the upcoming five years, on the account of rising prevalence of diabetes among the geriatric population of the country. Moreover, the population is more aware about the availability of the glucometer to monitor their blood glucose level and keep a complete check over the records such that patients are able to contact their doctors and consult them in case of any serious event. These factors are driving the growth of the Saudi Arabia glucometers market in the upcoming five years, until 2026.

Glucometers are the blood sugar monitoring devices that helps the patient in keeping check over blood glucose level and makes the intended balance between food habits and exercising. The device keeps a track of all the schedules regarding eating and medicinal dosage, diet and exercises. The glucometers are widely available through online distribution channel and pharmacy stores. The device is often consisting of a lancet that pricks the finger and draws blood, this blood is added onto the strip which is then connected to the detector or the smart phones that supports the application that records the blood sugar level. The device is used in hospitals and at home by the patents personally.

Browse over XX market data Figures spread through 70 Pages and an in-depth TOC on"Saudi Arabia Glucometer Market"

https://www.techsciresearch.com/report/saudi-arabia-glucometers-market/7402.html

The Saudi Arabia glucometer market is segmented by product type, type, technique, distribution channel, end user, regional distribution, and competitive landscape. Based on type the market is further fragmented into wearable and non-wearable glucometers.

Wearable glucometer is anticipated to register the fastest growth in the market owing to the surge in demand of the product and by the rising number of the diabetic patients that demand better devices and technologically advanced options for their regular blood sugar monitoring. Non-wearable glucometers are expected to hold the significant share of the market owing to their ease of availability and smartphone compatibility, thereby supporting the growth of the market in the upcoming five years.

Diabetes is a chronic condition that arises due to irregular blood sugar levels in the body. The treatment often involves insulin hormone treatment that regulates the sugar level in the human body. Glucometers are used to consistently monitor the blood sugar level on daily, weekly, or continuous period. There are various types of devices available in the market that vary in sizes, prices, length of testing time, ease of accessibility.

In March 2020, the country was affected by the widespread of COVID-19 like the whole world. The economies were affected and the whole world observed a complete lockdown. This affected the market although the healthcare industry was functional as per requirement. Due to the increased number of COVID positive patients, general patients were not able to obtain the due treatments. This resulted in increased sales of self-monitoring devices. Thus, it can be considered as one of the major factors that boosted the growth of Saudi Arabia glucometers market and is expected to do in the next five years as well.

Some of the top players in the Saudi Arabia glucometers market are, Abbott Saudi Arabia, Roche Diagnostics Saudi Arabia LLC, Batterjee National Pharmaceutical (Contour-Ascensia), VitalAire Saudi Arabia, Zimmo Trading Co. Ltd. (Omron Healthcare), Platinum Equity (LifeScan), Johnson & Johnson Medical Saudi Arabia Limited, Dexcom Saudi Arabia, Medtronic Saudi Arabia, Sanofi Aventis Arabia Co. Ltd., among others. The companies are involving themselves into research and development for the methods of better quality, to provide better products.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=7402

Customers can also request for 10% free customization on this report.

“Kingdom of Saudi Arabia supports a large population with disposable incomes. The increased concerns over the deteriorating lifestyle and thus caused diabetes and the related problem is driving the market growth. Moreover, the technologically advanced products can be seen as the future of the glucose monitoring devices. The devices with the smartphone compatibility are a major reason behind the surge in the demand. New players may form a partnership or work on the development of well researched and technologically advanced medical devices that will be cost effective as well as efficient with added functions,” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“Saudi Arabia Glucometers Market By Product Type (Self Glucose Monitoring Glucometers v/s Continuous Glucose Monitoring Glucometers), By Technique (Invasive v/s Non-Invasive), By Type (Wearable v/s Non-Wearable), By Distribution Channel (Hospital Pharmacies, Retail Outlet, Online, Others), By End User (Hospitals & Clinics, Diagnostic Centers, Home Care, Others), By Region, Competition Forecast & Opportunities, 2026” has evaluated the future growth potential of Saudi Arabia glucometers market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Saudi Arabia glucometers market.

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Web: https://www.techsciresearch.com/

#Saudi Arabia Glucometers Market#Saudi Arabia Glucometers Market Size#Saudi Arabia Glucometers Market Share#glucometers market growth#glucometers market trend

0 notes

Text

Continuous Glucose Monitoring Device Market Prominent Growth And Vendor Landscape By 2027

Foster Market Research’s new market research report on the Continuous Glucose Monitoring Device market offers in depth analysis (including revenue analysis for both historic (2018-2020) and forecast periods (2021-2027) for all the market segments. The report is a compilation of various segmentations, including market breakdown by segment 1 (By Intubation), segment 2 (By Type) Segment 3 (By Application).The report also highlights a thorough analysis of the market dynamics, comprising factors that either enable or inhibit the overall market growth, along with potential opportunities that can be tapped in the future.

Get PDF Brochure of this Research Report @ https://www.fostermarketresearch.com/product/industry/7/305/Pdf%20Brochure/

Further, the Continuous Glucose Monitoring Device market report also includes comprehensive assessment of the following factors:

· Short-term, mid-term, and long-term COVID-19 impact assessment for the Continuous Glucose Monitoring Device market.

· Detailed market estimations and forecast on the basis of five different regions including North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Russia, and Rest-of-Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, ASEAN, and Rest-of-Asia-Pacific), Latin America (Brazil, Mexico, and Rest-of-Latin America) and the Middle East and Africa (GCC Countries, Israel, South Africa, and Rest-of-Middle East and Africa).

· Detailed sections focused on different types of segments (By Intubation, By Type, By Application, By End User and By Region)

· In-depth information about the industry analysis including technological advancements, regulatory and reimbursement scenario, supply chain analysis, patent analysis, pricing analysis, market trends, and PEST and PORTER analysis, among others.

· Market Share Analysis of key players.

· Company profiling of more than 10 companies.

For More Information @ https://www.fostermarketresearch.com/product/industry/7/305/

The global Continuous Glucose Monitoring Device industry is one of the most competitive industries, with the leading players actively competing against each other to gain a greater share in the industry. The competitive landscape of the Continuous Glucose Monitoring Device industry exhibits an inclination toward emerging strategies and developments by market players.

Some of the key players that are actively participating in the Continuous Glucose Monitoring Device market include: Abbott Laboratories, Dexcom, Inc., A. Menarini Diagnostics, Echo Therapeutics, Inc., GlySens Incorporated, Johnson & Johnson, Medtronic plc, Senseonics Holdings, Inc., and F. Hoffmann-La Roche Ltd. The major strategies adopted by market players are collaborations, product launches, and product approvals, among others.

The report is essential for the stakeholders operating in the Continuous Glucose Monitoring Device market, such as emerging start-ups, manufacturers, suppliers, distributors, end users, and investors, to understand the varying supply and demand side factors and the nature of the business with lucrative opportunities to enter into the market.

How this business report enables organizations to take strategic decisions:

· Provides go-to market strategies for diversified products present across different segment and geographies

· Analyzing competitors’ scenario along with their key developments and strategies

· Analyze end user requirements

· Aids in discovering newer applications

· Analyzing technological/product substitutes by comparing the present product specifications

Key Questions answered in the report:

What are the trends adopted by key players in the global telemedicine market?

What is the competitive strength of the key players in the telemedicine market?

What are the major outcomes derived from the Porter’s five forces?

What are the major challenges inhibiting the growth of the global telemedicine market?

Which end user contribute highest CAGR (%) in the telemedicine market?

Buy Now This Premium Report To Grow Your Business @ https://www.fostermarketresearch.com/product/buy/7/305/

About Foster Market Research:

Foster Market Research is a global market intelligence and advisory firm engaged in providing data-driven research extract from rigorous analysis, to the clients to make critical business decisions and execute them successfully. Foster connects over various distribution channels and numerous markets for great understanding of the trends and market to deliver our clients with accurate data.

Our focus is on providing market research that delivers a positive impact on your business. We work continuously to provide our clients with the most accurate analytics data and research reports without any delay so as to improve their business strategies and provide them with rich customer experience.

Contact Us: 1701 royal lane, #1306, Dallas Tx-75229

Phone: +14694981929 Email: [email protected]

0 notes

Text

Wearable Healthcare Devices Market by Type (Diagnostic (ECG, Heart, Pulse, BP, Sleep), Therapeutic (Pain, Insulin)), Application (Fitness, RPM), Product (Smartwatch, Patch), Grade (Consumer, Clinical), Channel (Pharmacy, Online) - Global Forecast to 2025 published on

https://www.sandlerresearch.org/wearable-healthcare-devices-market-by-type-diagnostic-ecg-heart-pulse-bp-sleep-therapeutic-pain-insulin-application-fitness-rpm-product-smartwatch-patch-grade-consumer-clinical.html

Wearable Healthcare Devices Market by Type (Diagnostic (ECG, Heart, Pulse, BP, Sleep), Therapeutic (Pain, Insulin)), Application (Fitness, RPM), Product (Smartwatch, Patch), Grade (Consumer, Clinical), Channel (Pharmacy, Online) - Global Forecast to 2025

“Wearable healthcare devices market to register a CAGR of 20.5% from 2020 to 2025”

The global wearable healthcare devices market is projected to reach USD 46.6 billion by 2025 from USD 18.4 billion in 2020, at a CAGR of 20.5% from 2020 to 2025. The growth of the industry is driven primarily by factors such as increasing awareness of fitness and healthy lifestyles, development of technologically advanced products, growing geriatric population and subsequent increase in the incidence of chronic diseases, cost-containment in healthcare delivery, robust penetration of 3G and 4G networks for uninterrupted healthcare services, increasing penetration of smartphones and the growing number of smart-phone based healthcare apps and growing preference for wireless connectivity among healthcare providers. However, patent protection of wearable healthcare devices, limited battery life and device design complexity may restrict the growth of this market to a certain extent.

“The general health and fitness segment is expected to grow at the fastest growth rate during the forecast period”

Based on applications, the wearable healthcare devices market is segmented into general health and fitness, remote patient monitoring, and home healthcare. In 2019, the general health and fitness segment accounted for the largest share of the market. This general health and fitness segment is expected to be the largest and fastest market segment in 2019. The large share of this segment can be attributed to the increasing focus on physical fitness among people to improve their quality of life, coupled with the growing trend of tracking health progress on a continuous basis.

“Pharmacies segment is estimated to account for the largest share of the wearable healthcare devices market in 2020”

Based on the distribution channel, the wearable healthcare devices market is segmented into pharmacies, online channels, and hypermarkets. In 2019, the pharmacies segment accounted for the largest share of the market with the highest growth rate as well. The market is mainly driven by the increasing trend of self-monitoring and non-invasive monitoring and diagnosis have resulted in a substantial increase in the supply of wearable devices in pharmacies. This is driving the uptake of wearable devices among customers, as they have easy access to various wearable devices offered by a number of companies. Furthermore, pharmacies are widely perceived to sell authentic and reliable products, which has greatly driven consumer preference for this distribution channel. However, online channels are expected to grow at the highest rate during the forecast period, due to the increasing use of smartphones, a large number of online buying apps, and the wide spectrum of devices available online, among other factors.

“Consumer-grade wearable healthcare devices segment is expected to dominate the wearable healthcare devices market during the forecast period.”

Based on grade type, the wearable healthcare devices market is segmented into consumer-grade and clinical-grade wearable healthcare devices. The consumer-grade wearable healthcare devices segment dominated the market. In 2019, the consumer-grade wearable healthcare devices segment accounted for the largest share of the wearable healthcare devices market.Factors such as the increasing trend toward self-monitoring, ease of availability of consumer-grade wearable healthcare devices, and the comparatively low cost of consumer-grade devices as compared to clinical-grade devices are the major factors responsible for the large share of the consumer-grade wearable healthcare devices segment.

“North America is expected to dominate the wearable healthcare devices market in 2020”

North America, which includes the US and Canada,is estimated to account for the largest share of the wearable healthcare devices market.The large share of this region can primarily be attributed such as the increasing penetration of smartphones, growing geriatric population and the subsequent rise in the prevalence of chronic disorders, increasing healthcare costs, growing demand for better healthcare services, government initiatives to promote digital health, the robust penetration of 3G and 4G networks, and the growing awareness of self-health management.

Breakdown of supply-side primary interviews, by company type, designation, and region:

By Company Type: Tier 1 (45%), Tier 2(30%), and Tier 3 (25%)

By Designation: C-level (45%), Director-level (30%), and Others (25%)

By Region: North America (35%), Europe (30%), Asia Pacific(25%), Latin America (5%) and Middle East & Africa (5%)

The key players operating in this market include Medtronic plc. (Ireland), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Biotelemetry Inc.(US), Apple, Inc. (US), Dexcom Inc. (US), Abbott Laboratories(US), Masimo Corporation(US), GE Healthcare(US), Bio-Beat Technologies (Israel), iRhythm Technologies, Inc. (US), VitalConnect (US), Minttihealth (US), Preventice Solutions, Inc. (US), CONTEC Medical Systems Co. Ltd (China), Biotricity Inc.(US), Verily Life Sciences.(US), Cyrcadia Asia Limited (Hong Kong ), ten3T healthcare (India), Fitbit, Inc. (US) , Garmin Ltd (Switzerland), Xiaomi Technologies (China), and Huawei Corporation (China). Product launches & approval, expansions, collaborations, agreements,partnerships,and acquisitions are the key growth strategies followed by most players in this market.

Research Coverage

This report studies the wearable healthcare devices market based on the device type, application, product, grade type, distribution channel, and region. The report also analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micro-markets with respect to their growth trends, prospects, and contributions to the total wearable healthcare devices market. The report forecasts the revenue of the market segments with respect to five major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

Market Penetration: Comprehensive information on the wearable healthcare devices offered by the key 20 players in the wearable healthcare devices market. The report analyzes the wearable healthcare devices market by device type, application, product, grade type, distribution channel, and region.

Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various wearable healthcare devices, their adoption, type of applications across key geographic regions.

Market Diversification: Exhaustive information about new product launches & approvals, untapped geographies, recent developments, and investments in the wearable healthcare devices market

Competitive Assessment: In-depth assessment of market ranking and strategies of the leading players in the wearable healthcare devices market along with a competitive leadership mapping of up to 25 players in the market.

0 notes

Text

Continuous Glucose Monitoring Systems Market Likely to Acquire Rapid Momentum as Technology Advances 2016-2024

A Comprehensive research study conducted by KD Market Research on Continuous Glucose Monitoring Systems Market Opportunity Analysis and Industry forecast. report offers extensive and highly detailed historical, current and future market trends in Continuous Glucose Monitoring Systems Market. Continuous Glucose Monitoring Systems Market report includes market size, growth drivers, barriers, opportunities, trends and other information which helps to find new opportunities in this market for the growth of the business through new technologies and developments.

Request for sample Copy@ https://www.kdmarketresearch.com/sample/3192

Continuous glucose monitoring (CGM) is one of the latest technological advancements in the field of diabetes management. CGM system is a type of glucose monitoring device that functions by inserting a biosensor through transcutaneous or subcutaneous route. The embedded sensor measures the glucose levels in interstitial fluid or blood, and transmits the information using a transmitter to a receiver/monitor for displaying the results. These systems play an integral role in diabetes management, owing to their associated several advantages over other glucose monitoring devices. Unlike conventional glucose monitors, these systems enable periodic monitoring of glucose levels, which is crucial for avoiding diabetic complications. In addition, CGMS technology has laid a roadmap to the most awaited, high-tech, closed-loop artificial/bionic pancreas. Therefore, development of novel and technologically advanced CGMS is the prime focus of glucose monitoring device manufacturing companies. It offers a wide range of applications for all age-cohorts, healthcare settings (diagnostic centers/clinics, hospital ICUs, and home healthcare), and geographies. Thus, CGMS market poses lucrative opportunity for both CGMS manufacturers and insulin pump manufacturers.

The global CGMS market generated $894 million in 2016, and is projected to reach $4,921 million by 2024, registering a CAGR of 22.9% during the forecast period. The pipeline of high-tech CGMS devices, such as smartphone-connected CGMS, wearable & smartphone-connected CGMS, non-invasive CGMS and ?smart? diabetes management solution (also called artificial/bionic pancreas), is expected to result in higher adoption of CGMS among endocrinologists and patients.

The market is categorized based on component, demographics, end user, and region. The CGMS components market includes durable components such as transmitters & receivers and integrated insulin pumps; and disposable components such as sensors. The segment for sensors occupies a dominant share in the CGMS market due to recurring sales of CGMS, short scrap life, and bulk purchases. Therefore, it is deployed in diagnostic centers/clinics. Moreover, the adoption of CGMS in hospital ICUs and in-home healthcare settings has increased in the recent years. On the basis of demographics, CGMS devices are categorized into child population (=14 years) and adult population (>14 years).

The report includes comprehensive geographical analysis and segmentation of geographical regions, which include North America, Europe, Asia-Pacific, and LAMEA. The major strategies adopted by market players are collaborations, product launches, and product approvals. The adoption of collaboration strategy by companies enables greater focus on innovation, distribution, and commercialization of devices.

KEY BENEFITS

>This report provides an extensive analysis of the current and emerging trends, and dynamics in the global CGMS market to identify the prevailing opportunities.

> It presents a competitive landscape of the global market to predict the market scenario across geographies.

> A comprehensive analysis of factors that drive and restrict the market growth is provided.

> The region- and country-wise analyses are provided to understand the market trends and dynamics.

KEY MARKET SEGMENTS

By Component

-Sensors -Transmitters & Receivers -Integrated Insulin Pumps

By Demographics

-Child Population (=14 years) -Adult Population (>14 years)

By End User

-Diagnostics & Clinics - ICUs - Home Healthcare

By Region

- North America - U.S. - Canada - Mexico - Europe - Germany - France - UK -Italy - Spain - Netherlands - Norway - Sweden - Denmark - Finland - Rest of Europe - Asia-Pacific - Japan - China - India -Australia - South Korea - Rest of Asia-Pacific - LAMEA - Brazil - Saudi Arabia - South Africa - Venezuela - Argentina - Rest of LAMEA

The key players profiled in this report are as follows:

- Abbott Laboratories - Dexcom, Inc. - A. Menarini Diagnostics - Echo Therapeutics, Inc. - GlySens Incorporated - Johnson & Johnson - Insulet Corporation - Medtronic plc - Senseonics Holdings, Inc. - F. Hoffmann-La Roche Ltd.

Access Complete Research Report with toc@ https://www.kdmarketresearch.com/report/3192/continuous-glucose-monitoring-systems-market-amr

Table of Content

CHAPTER 1: INTRODUCTION

1.1. Report description 1.2. Key Benefits 1.3. Key Market Segments 1.4. RESEARCH METHODOLOGY

1.4.1. Secondary research 1.4.2. Primary research 1.4.3. Analyst tools & models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Key findings of the study 2.2. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition 3.2. Need for glucose monitoring systems

3.2.1. Diabetes-a pandemic

3.2.1.1. Type 1 diabetes 3.2.1.2. Type-2 diabetes 3.2.1.3. Prediabetes and gestational diabetes mellitus (GDM) 3.2.1.4. Gestational diabetes mellitus (GDM) 3.2.1.5. Secondary diabetes 3.2.1.6. Global healthcare expenditure on diabetes

3.3. Key Findings

3.3.1. Top investment pockets 3.3.2. Top winning strategies 3.3.3. Value Chain Analysis

3.4. Patent analysis

3.4.1. Patent analysis, by market participant 3.4.2. U.S. patent analysis, by market participant 3.4.3. Patent analysis, by year

3.5. Market Share Analysis, 2017 3.6. Government Regulations

3.6.1. FDA regulations (21CFR820)

3.6.1.1. Objective and Scope of FDA 21CFR820

3.6.2. ISO regulations (ISO 13485:2003)

3.6.2.1. Objective and Scope of ISO 13485:2003

3.7. Reimbursement Scenario 3.8. Market dynamics

3.8.1. Drivers

3.8.1.1. Benefits of CGMS over POC glucometers 3.8.1.2. Rise in incidence of diabetes cases 3.8.1.3. Technological advancements

3.8.2. Restraints

3.8.2.1. Adverse effects and accuracy 3.8.2.2. Reimbursement and stringent regulatory issues

3.8.3. Opportunities

3.8.3.1. High adoption rate of CGMS in home healthcare and ICUs 3.8.3.2. Increase in product awareness 3.8.3.3. High undiagnosed patient population

3.8.4. Impact analyses

CHAPTER 4: CONTINOUS GLUCOSE MONITORING SYSTEMS MARKET, BY COMPONENT

4.1. Overview

4.1.1. Market size and forecast

4.2. Sensors

4.2.1. Key market trends, growth factors, and opportunities 4.2.2. Market size and forecast

4.3. Transmitters & Receivers

4.3.1. Key market trends, growth factors, and opportunities 4.3.2. Market size and forecast

4.4. Integrated Insulin pumps

4.4.1. Key market trends, growth factors, and opportunities 4.4.2. Market size and forecast

CHAPTER 5: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY DEMOGRAPHICS

5.1. Overview

5.1.1. Market size and forecast

5.2. Adult Population (>14 years)

5.2.1. Market size and forecast

5.3. Children Population (14 years)

5.3.1. Market size and forecast

CHAPTER 6: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY END USER

6.1. Overview

6.1.1. Market size and forecast

6.2. Diagnostic centers/clinics

6.2.1. Market size and forecast

6.3. ICUs

6.3.1. Market size and forecast

6.4. Home Healthcare

6.4.1. Market size and forecast

CHAPTER 7: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY REGION

7.1. Overview

7.1.1. Market size and forecast

7.2. North America

7.2.1. Key market trends, growth factors, and opportunities 7.2.2. North America continuous glucose monitoring systems market size and forecast, by country

7.2.2.1. U.S.

7.2.2.1.1. U.S. continuous glucose monitoring systems market size and forecast, by component 7.2.2.1.2. U.S. continuous glucose monitoring systems market size and forecast, by demographics 7.2.2.1.3. U.S. continuous glucose monitoring systems market size and forecast, by end user

7.2.2.2. Canada

7.2.2.2.1. Canada continuous glucose monitoring systems market size and forecast, by component 7.2.2.2.2. Canada continuous glucose monitoring systems market size and forecast, by demographics 7.2.2.2.3. Canada continuous glucose monitoring systems market size and forecast, by end user

7.2.2.3. Mexico

7.2.2.3.1. Mexico continuous glucose monitoring systems market size and forecast, by component 7.2.2.3.2. Mexico continuous glucose monitoring systems market size and forecast, by demographics 7.2.2.3.3. Mexico continuous glucose monitoring systems market size and forecast, by end user

7.2.3. North America continuous glucose monitoring systems market size and forecast, by component 7.2.4. North America continuous glucose monitoring systems market size and forecast, by demographics 7.2.5. North America continuous glucose monitoring systems market size and forecast, by end user

7.3. Europe

7.3.1. Key market trends, growth factors, and opportunities 7.3.2. Europe continuous glucose monitoring systems market size and forecast, by country

7.3.2.1. Germany

7.3.2.1.1. Germany continuous glucose monitoring systems market size and forecast, by component 7.3.2.1.2. Germany continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.1.3. Germany continuous glucose monitoring systems market size and forecast, by end user

7.3.2.2. France

7.3.2.2.1. France continuous glucose monitoring systems market size and forecast, by component 7.3.2.2.2. France continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.2.3. France continuous glucose monitoring systems market size and forecast, by end user

7.3.2.3. UK

7.3.2.3.1. UK continuous glucose monitoring systems market size and forecast, by component 7.3.2.3.2. UK continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.3.3. UK continuous glucose monitoring systems market size and forecast, by end user

7.3.2.4. Spain

7.3.2.4.1. Spain continuous glucose monitoring systems market size and forecast, by component 7.3.2.4.2. Spain continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.4.3. Spain continuous glucose monitoring systems market size and forecast, by end user

7.3.2.5. Italy

7.3.2.5.1. Italy continuous glucose monitoring systems market size and forecast, by component 7.3.2.5.2. Italy continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.5.3. Italy continuous glucose monitoring systems market size and forecast, by end user

7.3.2.6. Netherlands

7.3.2.6.1. Netherlands continuous glucose monitoring systems market size and forecast, by component 7.3.2.6.2. Netherlands continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.6.3. Netherlands continuous glucose monitoring systems market size and forecast, by end user

7.3.2.7. Norway

7.3.2.7.1. Norway continuous glucose monitoring systems market size and forecast, by component 7.3.2.7.2. Norway continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.7.3. Norway continuous glucose monitoring systems market size and forecast, by end user

7.3.2.8. Sweden

7.3.2.8.1. Sweden continuous glucose monitoring systems market size and forecast, by component 7.3.2.8.2. Sweden continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.8.3. Sweden continuous glucose monitoring systems market size and forecast, by end user

7.3.2.9. Denmark

7.3.2.9.1. Denmark continuous glucose monitoring systems market size and forecast, by component 7.3.2.9.2. Denmark continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.9.3. Denmark continuous glucose monitoring systems market size and forecast, by end user

7.3.2.10. Finland

7.3.2.10.1. Finland continuous glucose monitoring systems market size and forecast, by component 7.3.2.10.2. Finland continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.10.3. Finland continuous glucose monitoring systems market size and forecast, by end user

7.3.2.11. Rest of Europe

7.3.2.11.1. Rest of Europe continuous glucose monitoring systems market size and forecast, by component 7.3.2.11.2. Rest of Europe continuous glucose monitoring systems market size and forecast, by demographics 7.3.2.11.3. Rest of Europe continuous glucose monitoring systems market size and forecast, by end user

7.3.3. Europe continuous glucose monitoring systems market size and forecast, by component 7.3.4. Europe continuous glucose monitoring systems market size and forecast, by demographics 7.3.5. Europe continuous glucose monitoring systems market size and forecast, by end user

7.4. Asia-Pacific

7.4.1. Key market trends, growth factors, and opportunities 7.4.2. Asia-Pacific continuous glucose monitoring systems market size and forecast, by country

7.4.2.1. Japan

7.4.2.1.1. Japan continuous glucose monitoring systems market size and forecast, by component 7.4.2.1.2. Japan continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.1.3. Japan continuous glucose monitoring systems market size and forecast, by end user

7.4.2.2. China

7.4.2.2.1. China continuous glucose monitoring systems market size and forecast, by component 7.4.2.2.2. China continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.2.3. China continuous glucose monitoring systems market size and forecast, by end user

7.4.2.3. India

7.4.2.3.1. India continuous glucose monitoring systems market size and forecast, by component 7.4.2.3.2. India continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.3.3. India continuous glucose monitoring systems market size and forecast, by end user

7.4.2.4. Australia

7.4.2.4.1. Australia continuous glucose monitoring systems market size and forecast, by component 7.4.2.4.2. Australia continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.4.3. Australia continuous glucose monitoring systems market size and forecast, by end user

7.4.2.5. South Korea

7.4.2.5.1. South Korea continuous glucose monitoring systems market size and forecast, by component 7.4.2.5.2. South Korea continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.5.3. South Korea continuous glucose monitoring systems market size and forecast, by end user

7.4.2.6. Rest of Asia-Pacific

7.4.2.6.1. Rest of Asia-Pacific continuous glucose monitoring systems market size and forecast, by component 7.4.2.6.2. Rest of Asia-Pacific continuous glucose monitoring systems market size and forecast, by demographics 7.4.2.6.3. Rest of Asia-Pacific continuous glucose monitoring systems market size and forecast, by end user

7.4.3. Asia-Pacific continuous glucose monitoring systems market size and forecast, by component 7.4.4. Asia-Pacific continuous glucose monitoring systems market size and forecast, by demographics 7.4.5. Asia-Pacific continuous glucose monitoring systems market size and forecast, by end user

7.5. LAMEA

7.5.1. Key market trends, growth factors, and opportunities 7.5.2. LAMEA continuous glucose monitoring systems market size and forecast, by country

7.5.2.1. Brazil

7.5.2.1.1. Brazil continuous glucose monitoring systems market size and forecast, by component 7.5.2.1.2. Brazil continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.1.3. Brazil continuous glucose monitoring systems market size and forecast, by end user

7.5.2.2. Saudi Arabia

7.5.2.2.1. Saudi Arabia continuous glucose monitoring systems market size and forecast, by component 7.5.2.2.2. Saudi Arabia continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.2.3. Saudi Arabia continuous glucose monitoring systems market size and forecast, by end user

7.5.2.3. South Africa

7.5.2.3.1. South Africa continuous glucose monitoring systems market size and forecast, by component 7.5.2.3.2. South Africa continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.3.3. South Africa continuous glucose monitoring systems market size and forecast, by end user

7.5.2.4. Venezuela

7.5.2.4.1. Venezuela continuous glucose monitoring systems market size and forecast, by component 7.5.2.4.2. Venezuela continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.4.3. Venezuela continuous glucose monitoring systems market size and forecast, by end user

7.5.2.5. Argentina

7.5.2.5.1. Argentina continuous glucose monitoring systems market size and forecast, by component 7.5.2.5.2. Argentina continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.5.3. Argentina continuous glucose monitoring systems market size and forecast, by end user

7.5.2.6. Rest of LAMEA

7.5.2.6.1. Rest of LAMEA continuous glucose monitoring systems market size and forecast, by component 7.5.2.6.2. Rest of LAMEA continuous glucose monitoring systems market size and forecast, by demographics 7.5.2.6.3. Rest of LAMEA continuous glucose monitoring systems market size and forecast, by end user

7.5.3. LAMEA continuous glucose monitoring systems market size and forecast, by component 7.5.4. LAMEA continuous glucose monitoring systems market size and forecast, by demographics 7.5.5. LAMEA continuous glucose monitoring systems market size and forecast, by end user

CHAPTER 8: COMPANY PROFILES

8.1. Abbott Laboratories

8.1.1. Company overview 8.1.2. Company snapshot 8.1.3. Operating business segments 8.1.4. Product portfolio 8.1.5. Business performance 8.1.6. Key strategic moves and developments

8.2. A. Menarini Diagnostics S.r.l.

8.2.1. Company overview 8.2.2. Company snapshot 8.2.3. Operating business segments 8.2.4. Product portfolio

8.3. DexCom, Inc.

8.3.1. Company overview 8.3.2. Company snapshot 8.3.3. Product portfolio 8.3.4. Business performance 8.3.5. Key strategic moves and developments

8.4. Echo Therapeutics, Inc.

8.4.1. Company overview 8.4.2. Company snapshot 8.4.3. Operating business segments 8.4.4. Product portfolio 8.4.5. Key strategic moves and developments

8.5. F. Hoffmann-La Roche Ltd.

8.5.1. Company overview 8.5.2. Company snapshot 8.5.3. Operating business segments 8.5.4. Product portfolio 8.5.5. Business performance 8.5.6. Key strategic moves and developments

8.6. GlySens Incorporated

8.6.1. Company overview 8.6.2. Company snapshot 8.6.3. Product portfolio 8.6.4. Key strategic moves and developments

8.7. Insulet Corporation

8.7.1. Company overview 8.7.2. Company snapshot 8.7.3. Product portfolio 8.7.4. Business performance 8.7.5. Key strategic moves and developments

8.8. Johnson & Johnson

8.8.1. Company overview 8.8.2. Company snapshot 8.8.3. Operating business segments 8.8.4. Business performance 8.8.5. Key strategic moves and developments

8.9. Medtronic Plc.

8.9.1. Company overview 8.9.2. Company snapshot 8.9.3. Operating business segments 8.9.4. Product portfolio 8.9.5. Business performance 8.9.6. Key strategic moves and developments

8.10. Senseonics Holdings, Inc.

8.10.1. Company overview 8.10.2. Company snapshot 8.10.3. Operating business segments 8.10.4. Product portfolio 8.10.5. Business performance 8.10.6. Key strategic moves and developments

Click for Exclusive Discount @ https://www.kdmarketresearch.com/discount/3192

About Us:

KD Market Research is one of the best market research organization that provides B2B research on the growth opportunities of the industry which is the prime factor of the overall revenue of the organization. We identify the pain points which our client is facing around revenue methods and provide them with a comprehensive database which helps them to make intelligent decisions that could ensure growth to the organization.

Our Services include market intelligence, competitive intelligence, and customized research. These research reports help the organizations to make quick and powerful decisions that make out highest growth in revenue.

Contact us -

KD Market Research

150 State Street, Albany,

New York, USA 12207

Website: www.kdmarketresearch.com

Email id- [email protected]

More - https://kdmarketresearch.blogspot.com/

#Continuous Glucose Monitoring Systems Market size#Continuous Glucose Monitoring Systems Market trends#Continuous Glucose Monitoring Systems Market news#Continuous Glucose Monitoring Systems Market share#Continuous Glucose Monitoring Systems Market Analysis#Continuous Glucose Monitoring Systems Market forecast

0 notes

Link

Global Portable Glucose Monitor Market is expected to reach US$ XX billion by 2026, at CAGR of X% during forecast period.

The objective of the report is to present comprehensive assessment projections with a suitable set of assumptions and methodology. The report helps in understanding Portable Glucose Monitor dynamics, structure by identifying and analyzing the market segments and projecting the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, growth strategies, and regional presence. To understand the market dynamics and by region, the report has covered the PEST analysis by region and key economies across the globe, which are supposed to have an impact on market in forecast period. PORTER’s analysis, and SVOR analysis of the market as well as detailed SWOT analysis of key players has been done to analyze their strategies. The report will to address all questions of shareholders to prioritize the efforts and investment in the near future to the emerging segment in the Global Portable Glucose Monitor Market.

Overview

Global Portable Glucose Monitor Market has valued US$ XX Bn in 2017 and is expected to reach US$ XX Bn by 2026 at a CAGR of XX % during the forecast period. According to the International Diabetes Federation, around 425 Million people are suffering from diabetes as of 2017 worldwide and are going to be 642 million people with diabetes by 2040. The change in the lifestyle of the people led to an increase in the number of diabetic patients worldwide which will help the growth of this market over the forecast period. The portable glucose monitor helps us to keep a check on blood glucose levels which is vital for proper diagnoses and treatment of diabetes. This equipment is the near-patient devices that allow the immediate detection of glucose levels in the body of a patient and facilitate rapid treatment solutions if the need arises.

By Segment Analysis

Based on type, there are two types of portable glucose monitor they are wearable and non-wearable. And based on components, it is divided into glucometer device, test strips, and lancets. In 2018, North America accounts the largest market share of the global portable glucose monitor market rapidly increasing obese population, payable to early acquisition of these solutions and presence of key players in the region. The Asia-Pacific is expected to witness to make the largest market share during the forecast period.

Drivers and Restraints

The drivers of the global portable glucose monitor are the various public and private initiatives to reduce diabetic cases, tremendous development potential owing to continues technological advancement in these devices, the convenience of continuous sugar monitoring over conventional monitoring, the rapid increase in aging population and hyperglycemic diabetes. On the other hand, various factors challenging industry growth such as high cost related to the diagnosis of diabetes, inadequate reimbursement related to the application of CGM systems and patent expiry issues and product recalls are some of the key factors obstruct the market growth.

Scope

• Glucometer Device

• Test strips

• Lancets

by Type

• Wearable

• Non-Wearable

by End-user

• Hospitals and diagnostic laboratories

• Physician Office Laboratories

• Home-care settings

by Region

• North America

• Europe

• Asia-Pacific

• Middle East & Africa

• South America

Key Players

• Abbott Diabetes Care

• Roche

• Johnson & Johnson (Lifescan)

• Dexcom

• Medtronic

• Arkray

• Ascensia Diabetes Care

• Agamatrix Inc.

• Bionime Corporation

• Acon

• Medisana

• Trivida

• Rossmax

About company

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

0 notes

Text

Blood Glucose Monitoring System Market Outlook, Worldwide Estimates, Trends and Forecast 2024

Industry Overview

Diabetes mellitus is a group of chronic endocrine gland disorder due to the insufficient level of insulin supply. Prolonged hyperglycemia (high blood sugar) can lead to severe complications including cardiovascular disease, kidney failure, diabetic retinopathy or nephropathy, and ulcers. Blood glucose monitoring systems help patents to the testing of blood glucose level in the body. The global blood glucose monitoring system market is growing at a significant pace due to the increasing prevalence of diabetes cases globally. The market is expected to grow at a significant rate for continuous blood glucose monitoring products in the coming years due to the growing adoption of minimally invasive procedure.

Request for Free Sample Copy of this Research Report at: https://www.vynzresearch.com/healthcare/blood-glucose-monitoring-system-market/request-sample

Market Segmentation

Insight by Product

Currently, there are two types of blood glucose monitoring system, self-monitoring blood glucose systems, and continuous monitoring blood glucose system. As both the types the continuous monitoring blood glucose system market is expected to grow at the higher growth rate, as in increasing adoption of minimally invasive procedure.

Insight by Testing Site

By the basis of the testing site, the blood glucose monitoring system market is segmented into fingertip testing and alternate site testing. Among the most common technique used for measurement of blood glucose level is Fingertip testing. Globally Fingertip testing segment has a larger share and is also expected to grow at a faster rate due to high reliability and accuracy of fingertip testing.

Insight by Application

The worldwide blood glucose monitoring system market has also been further segmented by application into type I, type II and gestational diabetes. Type I diabetes accounts for about 5 to 10 percent of the diabetes cases and type II accounts for approximately 90 percent of the diabetic cases. Many patients with type II diabetes are asymptomatic. The type II diabetes segment is estimated to have the biggest share in the market due to the growing incidence of type II diabetes and increasing innovative product launches with less invasive technologies. According to the International Diabetes Federation (IDF) in 2017 approximately 352 million people were at risk of developing type II diabetes.

Insight by Patient Care Setting

The end-applicant of the blood glucose monitoring system market are hospitals and clinics, and home care. The home care segment has the biggest share and likely to grow at the fastest rate due to a rising diabetic population, increasing innovative product launches enhancing patient comfort and increasing awareness of regular monitoring of glucose levels.

Industry Dynamics

Growth Drivers

The growing prevalence of diabetes, speedy increase in the aging population and the increasing number of product launches are the primary growth drivers for blood glucose monitoring system market. As per the World Health Organization (WHO), the number of people with diabetes has risen from 108 million in 1980 to 422 million in 2014. In pipeline products, developments and ongoing researches and increasing adoption of the continuous sugar surveillance system are also driving the global market. Due to technological advancement in glucose monitoring is making device smaller, smarter and more convenient.

Challenges

The high cost of blood glucose monitoring products, invasiveness of blood glucose monitors and poor reimbursement of blood glucose monitoring devices and supplies are the major challenges for the growth of blood glucose monitoring system market. In developing countries like Africa and some Asian countries, it is difficult to bear the cost of the testing strips and blood glucose monitors due to poor reimbursement policies. However, in some of the developed countries like Europe and in Canada, the limitation on the supply of testing strips per patient hinder the growth of the market.

Industry Ecosystem

The robust distribution channel for blood glucose monitoring products helps to cater to the increasing demand for diabetic care device. The main challenge for the new entrants is the survival in capital intensive and highly regulated blood glucose monitoring system market.

Geographic Overview

Globally, North America is the largest blood glucose monitoring system market as the region has favorable reimbursement policies, increasing awareness program and rising FDA approvals. An increasing prevalence of diabetes has powered the growth of the North American blood glucose monitoring system market. According to the Centers for Disease Control and Prevention (CDC), in 2015, approximately 23.1 million people in the U.S. had diabetes.

Browse Full Research Report Description at: https://www.vynzresearch.com/healthcare/blood-glucose-monitoring-system-market

Asia-Pacific, especially in countries like India, Japan, China, Korea, Thailand, is observed to witness the fastest growth in demand for blood glucose monitoring products. The increasing prevalence of diabetes, growing awareness of diabetes, increasing healthcare expenditure, and the huge population base is creating a positive impact on the blood glucose monitoring systems market growth in the region.

Competitive Insight

Main players in the blood glucose monitoring system market are investing in the development of innovative and advanced products, which is strengthening their position in the market. In September 2016, Abbott gained FDA approval for the FreeStyle Libre Pro continuous glucose monitoring (CGM) device, a professional-use device to provide better diabetes management to a diabetes patient. In addition, in August 2016, Roche launched the Accu-Chek Guide, the next-generation blood glucose monitoring system. Abbott Laboratories, B. Braun Melsungen, F. Hoffmann-La Roche, Ypsomed, LifeScan, Medtronic, Ascensia Diabetes Care, Dexcom, Nipro and Sanofi are the key players offering blood glucose monitoring products.

About VynZ Research

VynZ Research is the leading research and advisory company. We’ve grown well beyond our leading technology research to provide management across the enterprise with the vital information, advice and tools they need to achieve their goal/mission-critical priorities and build the organizations of future.

Together with our customers, we fuel the future of business so that a more successful world takes shape.

Contact

Kundan Kumar

Manager: Client Care

VynZ Research

Direct: +919960288381

Toll-Free:1-888-253-3960

Website: https://www.vynzresearch.com

Email: [email protected]

Connect With us: LinkedIn | Twitter | Google | Facebook

#Blood Glucose Monitoring System Industry#Blood Glucose Monitoring System Market#Blood Glucose Monitoring System Market Forecast#Blood Glucose Monitoring System Market Size#Blood Glucose Monitoring System Market Share

0 notes

Text

MENLO PARK, CA – 14 de noviembre de 2018 – Beyond Type 1, organización mundial sin fines de lucro celebra el cumpleaños 127 de Sir Frederick Banting con una fiesta de cumpleaños digital durante el Día Mundial de la Diabetes el próximo Miércoles 14 de noviembre. Una coalición de más de 50 organizaciones se une para trabajar y romper el Récord Mundial de mayor número de contribuciones en una tarjeta electrónica. Firma y participa en BantingsBirthday.org.

La cifra por superar es de 65,402, y el récord le pertenece a Chevrolet, SAIC-GM (China) y fue establecido en 2017 en Shanghai. Las contribuciones para el intento por romper el récord mundial serán deseos de Feliz Cumpleaños para Frederick Banting, a quien se le atribuye el descubrimiento de la insulina, un medicamento que salva la vida de millones de personas con diabetes y que requieren insulina (tanto diabetes Tipo 1 como diabetes Tipo 2).

Antes del descubrimiento realizado por Banting y su colega para uso terapéutico, el diagnóstico de diabetes Tipo 1 era una sentencia de muerte. Desde este descubrimiento en 1921, millones de vidas han sido salvadas día a día gracias a Sir. Frederick Banting y su equipo de trabajo.

Beyond Type 1 es anfitrión de la fiesta digital de cumpleaños y la firma de la tarjeta electrónica en BantingsBirthday.org. “Los invitados de la fiesta” y fans de Banting podrán firmar la tarjeta electrónica de cumpleaños , ingresar para recibir artículos y leer historias sobre el ganador del Premio Nobel. Además, se invita a la comunidad a realizar un donativo de $1 USD en honor al costo de ventas de la patente original, enfatizando la creencia de Banting de que la insulina le pertenecía al mundo.